Post COVID-19 Recovery and 2050 Climate Change Targets: Changing the Emphasis from Promotion of Renewables to Mandated Curtailment of Fossil Fuels in the EU Policies

Abstract

:1. Introduction

1.1. The Impact of the COVID-19 Pandemic on Climate Change

1.2. The Impact of the COVID-19 Pandemic on Energy and Fossil Fuels

2. Scope of Work

3. Methodology and Structure of the Article

4. Fossil Fuels Perspectives in Selected Economies

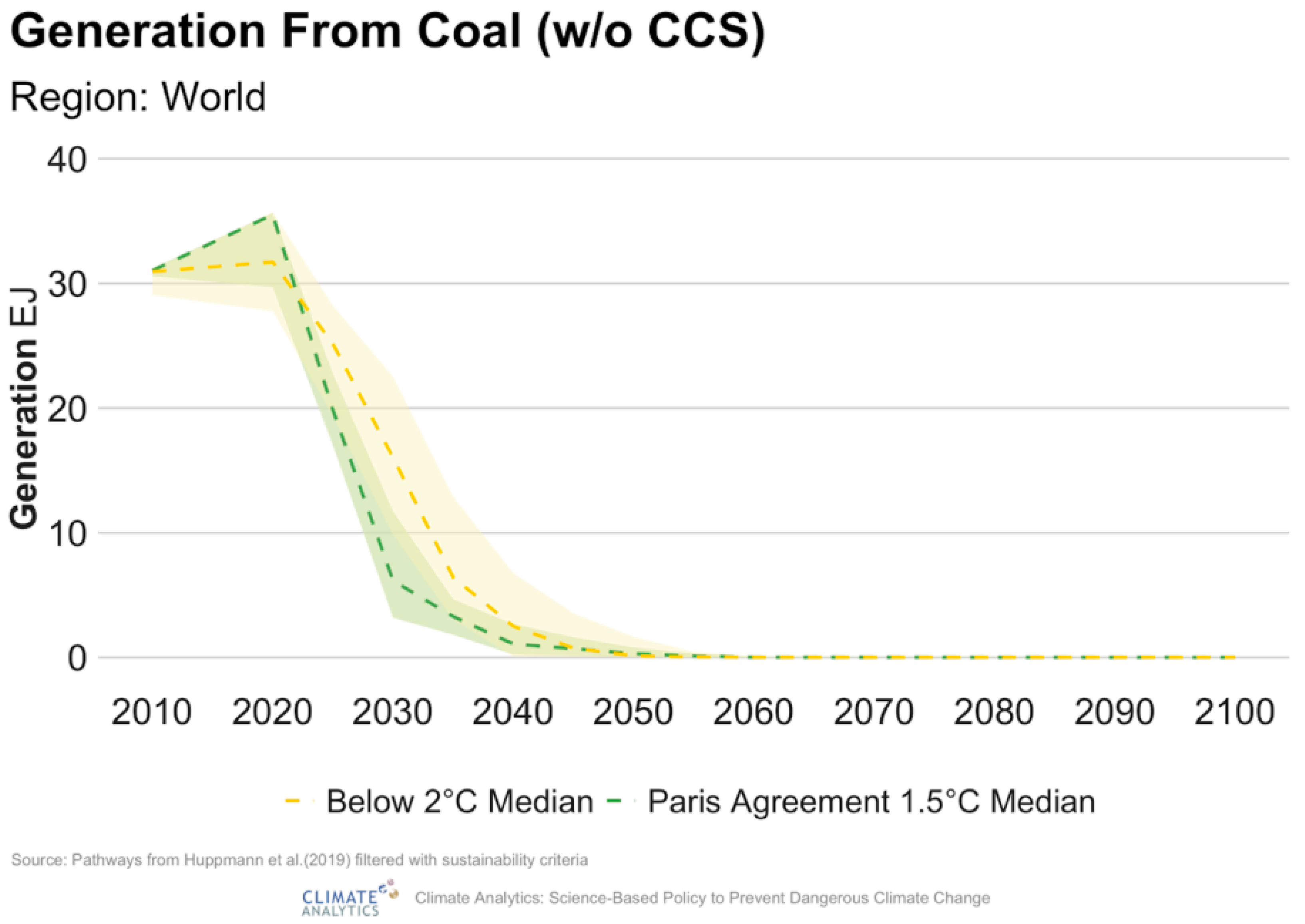

4.1. Coal Perspectives

4.1.1. Coal Perspectives in the US

4.1.2. Coal Perspectives in the European Union

4.1.3. Coal Perspectives in Canada

4.1.4. Coal Perspectives in Australia

4.1.5. Coal Perspectives in Japan

4.1.6. Summary of Perspectives for Coal

4.2. Oil Perspectives

4.2.1. Oil Perspectives by the European Majors

4.2.2. Oil Perspectives by the US Majors

4.2.3. Oil Perspectives by Other Majors

4.3. Natural Gas Perspectives

4.3.1. Natural Gas Perspectives in the US

4.3.2. Natural Gas Perspectives in the EU

- using low-cost green electricity to produce renewable hydrogen that can be used as such or subsequently converted to renewable methane,

- using waste streams, agricultural residues and sustainable energy crops to produce biomethane, and,

- using natural gas combined with CCS (such as methane pyrolysis) to produce so called “blue” hydrogen.

4.4. Overall Effects of the 1st COVID-19 Pandemic Wave on the Energy Industry

- Production of natural gas decreased by 2.8% compared to May 2019.

- Imports (entries) of natural gas was 11.6% lower on a year-on-year basis, and total OECD exports (exits) decreased by 5.9% in the same period.

- Gross consumption of natural gas experienced a decrease of 7.7% in May 2020 on a year-on year basis.

5. Further Considerations

5.1. Subsidies for Fossil Energy

5.2. New Investments in Fossil Fuels

5.3. Decarbonizing Oil and Gas Operations

5.3.1. Complexity and Costs for CCS

5.3.2. Costs for Renewable Hydrogen

5.4. Fossils Losing Market to the Benefit of Renewables in the Chemical Industry Too

5.5. Civil Society vs. Fossil Industry

5.6. How Far Will the Fossil Industry Be Committed in Meeting Its P2050 Obligations?

6. The Necessity for Disruptive Policies to Meet the PA2050 Objectives

6.1. Disruptive Innovation and Waves of Innovation

6.2. Current Policies in the US

6.3. California

6.4. Hawaii

6.5. China

6.6. New Zealand

6.7. The European Union

6.8. Other Countries

7. Discussion

8. The Way Forward for the European Union

8.1. Legislation to Curtail Fossil as of 2025

8.1.1. First Leg of the Roadmap Continuing the REDII until 2035

8.1.2. Second Leg of the Roadmap, New Legislation for the Curtailment of Fossil

- The legislation should mandate market operators to gradually but steadily reduce the use of carbon based on the trajectory of Figure 15. The same approach has been applied for advanced biofuels under REDII.

- Annual targets and reporting obligations should be developed for the all carbon majors. The EC has experience in developing individual targets for Member States; therefore, it should be in position to do the same for the carbon majors.

- EU carbon majors should apply the same rules for their global operations.

- Non-EU carbon majors should not be allowed to operate anymore in the EU if they do not apply the same rules in the EU as well as in their global operations.

- Heavy penalties should be imposed to those carbon operators that fail to reach their annual target.

- The net-zero-carbon legislation should be in place by 2025 and remain operational till 2050. The EU should regularly examine how to further improve it and enforce it via revisions when and where appropriate.

- The Member States should have the responsibility to ensure that market operators in their territory implement the legislation.

8.2. Is the Proposed Legislative Action Compatible with International Law?

8.3. Will Member States Support the New Legislation for the Curtailment of Fossil?

8.4. Is There a Role for the European Civil Society?

8.5. Which Opportunities for the European Fossil Carbon Industry?

8.6. Can the Stability of the Energy System Be Ensured While Keeping the Impact on Energy Costs Reasonable?

9. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- NASA Earth Observatory. Airborne nitrogen dioxide plummets over Chiba, January 1–February 25. 2020. Available online: https://earthobservatory.nasa.gov/images/146362/airborne-nitrogen-dioxide-plummets-over-china (accessed on 17 February 2021).

- Liu, F.; Wang, M.; Zheng, M. Effects of COVID-19 lockdown on global air quality and health. Sci. Total Environ. 2021, 755, 142533. [Google Scholar] [CrossRef] [PubMed]

- He, G.; Pan, Y.; Tanaka, T. The short-term impacts of COVID-19 lockdown on urban air pollution in China. Nat. Sustain. 2020, 3, 1005–1011. [Google Scholar] [CrossRef]

- European Environmental Agency. Briefing 5 November 2020, Covid-19 and Europe’s Environment: Impacts of a Global Pandemic. Available online: https://www.eea.europa.eu/post-corona-planet/covid-19-and-europes-environment (accessed on 5 February 2021).

- IATA. Air Passenger Market Analysis, July 2020, Limited Recovery Continues to Be Driven by Domectic Markets. Available online: https://www.iata.org/en/iata-repository/publications/economic-reports/air-passenger-monthly-analysis---july-2020/ (accessed on 5 February 2021).

- International Energy Agency. COVID19—Exploring the Impacts of the COVID19 Pandemic on Global Energy Markets, Energy Resilience, and Climate Change, April 2020. Available online: https://www.iea.org/topics/Covid19 (accessed on 15 April 2020).

- Chiaramonti, D.; Maniatis, K. Security of Supply, Strategic Storage and Covid19: Which Lessons Learnt for Renewable and Recycled Carbon Fuels, and Their Future Role in Decarbonizing Transport. Appl. Energy 2020, 271, 115216. [Google Scholar] [CrossRef]

- Eurelectric. Impact of COVID 19 on Customers and Society—Recommendations from the European Power Sector. March 2020. Available online: https://cdn.eurelectric.org/media/4313/impact_of_covid_19_on_customers_and_society-2020-030-0216-01-e-h-E7E407BA.pdf (accessed on 20 May 2020).

- The World Bank. A Shock Like No Other: Coronavirus Rattles Commodity Markets, 23 April 2020. Available online: https://www.worldbank.org/en/news/feature/2020/04/23/coronavirus-shakes-commodity-markets?cid=prospects_tt_cmo_en_ext (accessed on 7 July 2020).

- US Energy Information Administration. Available online: https://www.eia.gov/todayinenergy/detail.php?id=46596#:~:text=The%20U.S.%20Energy%20Information%20Administration,that%20dates%20back%20to%201980 (accessed on 1 February 2021).

- CNBC. WTI Crude. December 2020. Available online: https://www.cnbc.com/quotes/[email protected] (accessed on 26 October 2020).

- RadioFreeEurope, RadioLiberty. A Negative Oil Price? What in the World Is Happening. 21 April 2020. Available online: https://www.rferl.org/a/a-negative-oil-price-what-in-the-world-is-happening-/30568505.html (accessed on 19 February 2021).

- IPCC. Special Report; Global Warming of 1.5 °C, Summary for Policy Makers. 2018. Available online: https://www.ipcc.ch/sr15/chapter/spm/ (accessed on 26 October 2020).

- Sadik-Zada, E.R.; Loewenstein, W. Drivers of CO2-Emissions in Fossil Fuel Abundant Settings: (Pooled) Mean Group and Nonparametric Panel Analyses. Energies 2020, 13, 3956. [Google Scholar] [CrossRef]

- Gatto, A.; Loewenstein, W.; Sadik-Zada, E.R. An extensive data set on energy, economy, environmental pollution and institutional quality in the petroleum-reliant developing and transition economies. Data Br. 2021, 106766. [Google Scholar] [CrossRef]

- United Nations. Climate Change. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 18 May 2020).

- REN21. Renewables 2019, Global Status Report. Available online: https://www.ren21.net/wp-content/uploads/2019Maygsr_2020_full_report_en.pdf (accessed on 5 February 2021).

- United Nations. Economic and Social Council, E/2019/68. 8 May 2019. Available online: https://undocs.org/E/2019/68 (accessed on 22 May 2020).

- Moyer, J.D.; Hedden, S. Are we on the right path to achieve the sustainable development goals? World Dev. 2020, 127, 104749. [Google Scholar] [CrossRef]

- Friedlingstein, P. Global Carbon Budget 2020. Earth Syst. Sci. Data 2020, 12, 3269–3340. [Google Scholar] [CrossRef]

- Grasso, M. Oily politics: A critical assessment of the oil and gas industry’s contribution to climate change. Energy Res. Soc. Sci. 2019, 50, 106–115. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R.; Loewenstein, W.; Hasanli, Y. Production Linkages and Employment Effects of the Petroleum Windfalls: An Input-output Analysis of Azerbaijani Economy. Int. J. Econ. Financ. 2019, 9, 225–233. [Google Scholar]

- McKinsey Company. The Future Is Now: How Oil and Gas Companies Can Decarbonise. 7 January 2020. Available online: https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-future-is-now-how-oil-and-gas-companies-can-decarbonize (accessed on 29 October 2020).

- JRC Technical Reports. Kanellopoulos, K. Scenario Analysis of Accelerated Coal Phase-out by 2030. Available online: https://publications.jrc.ec.europa.eu/repository/bitstream/JRC111438/acd_in_metis_final.pdf (accessed on 26 October 2020).

- Climate Transparency. Managing the Phase-Out of Coal a Comparison of Actions in G20 Countries. May 2019. Available online: https://www.climate-transparency.org/wp-content/uploads/2019-June-CT-Managing-the-phase-out-of-coal-DIGITAL.pdf (accessed on 11 January 2021).

- Climate Analytics. Global and Regional Coal Phase-Out Requirements of the Paris Agreement: Insights from the IPCC Special Report on 1.5 °C. September 2019. Available online: https://climateanalytics.org/publications/2019/coal-phase-out-insights-from-the-ipcc-special-report-on-15c-and-global-trends-since-2015/ (accessed on 11 January 2021).

- Institute for Energy Economics and Fianancial Analysis; Buckley, T. Over 100 Global Financial Institutions Are Exiting Coal, With More to Come, IEEFA. 2019. Available online: https://ieefa.org/wp-content/uploads/2019/02/IEEFA-Report_100-and-counting_Coal-Exit_Feb-2019.pdf (accessed on 11 January 2021).

- Norges Bank Investment Management. Available online: https://www.nbim.no/en/the-fund/responsible-investment/exclusion-of-companies/ (accessed on 29 May 2020).

- European Investment Bank. Press Release. 14 November 2019. Available online: https://www.eib.org/en/press/all/2019-313-eu-bank-launches-ambitious-new-climate-strategy-and-energy-lending-policy (accessed on 8 January 2021).

- BNP Paribas. Available online: https://group.bnpparibas/en/press-release/bnp-paribas-announces-timeframe-complete-coal-exit-raises-financing-targets-renewable-energies (accessed on 16 June 2020).

- Deutsche Bank. Press Release. Available online: https://www.db.com/newsroom_news/2020/deutsche-bank-to-end-global-business-activities-in-coal-mining-by-2025-en-11650.htm (accessed on 25 August 2020).

- Deutsche Bank. Environmental and Social Policy Framework. July 2020. Available online: https://www.db.com/cr/en/docs/DB-ES-Policy-Framework-English.pdf (accessed on 8 January 2021).

- U.S. Energy Information Administration. Short-Term Energy Outlook, Forecast Highlights. May 2020. Available online: https://www.eia.gov/outlooks/steo/archives/May20.pdf (accessed on 29 May 2020).

- Great River Energy. Available online: https://greatriverenergy.com/major-power-supply-changes-to-reduce-costs-to-member-owner-cooperatives/ (accessed on 22 June 2020).

- Platte River Power Authority. Available online: https://www.prpa.org/media-releases/platte-river-to-retire-rawhide-unit-1-by-2030/ (accessed on 22 June 2020).

- Tucson Electric Power Company. 2020 Integrated Resource Plan. 26 June 2020. Available online: https://www.tep.com/wp-content/uploads/TEP-2020-Integrated-Resource-Plan-Lo-Res.pdf (accessed on 5 July 2020).

- Green Tech Madia. Available online: https://www.greentechmedia.com/articles/read/two-more-western-utilities-move-to-close-coal-plants-early-shift-to-renewables-and-storage (accessed on 5 July 2020).

- International Energy Agency. Available online: https://www.iea.org/commentaries/fading-fast-in-the-us-and-europe-coal-still-reigns-in-asia (accessed on 16 June 2020).

- International Energy Agency. Annual Total and per Capita Electricity Generation in Asia and the EU28, Paris. Available online: https://www.iea.org/data-and-statistics/charts/annual-total-left-and-per-capita-right-electricity-generation-in-asia-and-the-eu28 (accessed on 16 June 2020).

- Stockholm Exergi. Available online: https://www.stockholmexergi.se/nyheter/kvv6/ (accessed on 16 June 2020).

- Energy Central. Available online: https://energycentral.com/news/austria-phases-out-coal-closure-verbunds-246-mw-mellach-plant (accessed on 16 June 2020).

- Urgenda Foundation. Available online: https://www.urgenda.nl/en/themas/climate-case/ (accessed on 16 June 2020).

- Iberdrola. Press Release. 10 November 2017. Available online: https://www.iberdrola.com/press-room/news/detail/iberdrola-announces-complete-closure-coal-fired-power-capacity (accessed on 10 January 2021).

- Endesa. Press Release. 27 December 2019. Available online: https://www.endesa.com/en/press/press-room/news/energy-transition/renewable-energies/endesa-submits-the-application-to-close-both-the-as-pontes-and-carboneras-power-plants (accessed on 11 January 2021).

- Endesa. Press Release. 8 July 2019. Available online: https://www.endesa.com/en/projects/all-projects/energy-transition/futur-e/futur-e-model-circular-economy (accessed on 12 January 2021).

- Government of Canada. Environment and Climate Change Canada. 12 December 2018. Available online: https://www.canada.ca/en/environment-climate-change/news/2018Decembercanadas-coal-power-phase-out-reaches-another-milestone.html (accessed on 11 January 2021).

- European Commission. Platform for Coal regions in Transition, European Union. 2019. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/task_force_on_just_transition_for_canadian_coal_power_workers_and_communities_-_platform_for_coal_regions_in_transition.pdf (accessed on 12 January 2021).

- The Canadian Encyclopedia. Coal in Canada. Available online: https://www.thecanadianencyclopedia.ca/en/article/coal (accessed on 11 January 2021).

- Alberta Government. Overview. Available online: https://www.alberta.ca/climate-coal-electricity.aspx (accessed on 15 July 2020).

- Burke, P.J.; Best, R.; Jotzo, F. Closures of coal-fired power stations in Australia: Local unemployment effects. Aust. J. Agric. Resour. Econ. 2019, 63, 142–165. [Google Scholar] [CrossRef] [Green Version]

- Australian Energy Market Operator. Integrated System Plan, for the National Electricity Market. July 2018. Available online: https://www.aemo.com.au/-,/media/Files/Electricity/NEM/Planning_and_Forecasting/ISP/2018/Integrated-System-Plan-2018_final.pdf (accessed on 11 January 2021).

- NIKKEI Asian Review. Press Release. 2 July 2020. Available online: https://asia.nikkei.com/Business/Energy/Japan-seeks-stoppage-of-100-inefficient-coal-plants-in-a-decade (accessed on 5 July 2020).

- Japan Strategic Energy Plan. 2018. Available online: https://www.enecho.meti.go.jp/en/category/others/basic_plan/5th/pdf/strategic_energy_plan.pdf (accessed on 11 January 2021).

- Carbon Brief. Available online: https://www.carbonbrief.org/mapped-worlds-coal-power-plants (accessed on 7 July 2020).

- Shearer, C.; Myllyvirta, L.; Yu, A.; Aitken, G.; Mathew-Shah, N.; Dallos, G.; Nace, T. Boom and Bust 2020, Tracking the Global Coal Plant Pipeline, Global Energy Monitor. March 2020. Available online: https://endcoal.org/wpcontent/uploads/2020/03/BoomAndBust_2020_English.pdf (accessed on 11 January 2021).

- Carbon Brief. Available online: https://www.carbonbrief.org/analysis-why-coal-use-must-plummet-this-decade-to-keep-global-warming-below-1-5c (accessed on 7 July 2020).

- OPEC. Available online: https://www.opec.org/opec_web/en/press_room/5882.htm (accessed on 7 July 2020).

- Oil Price. Oil Price Charts. Available online: https://oilprice.com/oil-price-charts (accessed on 7 July 2020).

- International Energy Agency. Oil Market Report. June 2020. Available online: https://www.iea.org/reports/oil-market-report-june-2020 (accessed on 11 January 2021).

- Repsol. Press Release. 2 December 2020. Available online: https://www.repsol.com/en/press-room/press-releases/2019/repsol-will-be-a-net-zero-emissions-company-by-2050.cshtml#:~:text=against%20climate%20change-,Repsol%20will%20be%20a%20net%20zero%20emissions%20company%20by%202050,to%20assume%20this%20ambitious%20goal (accessed on 11 January 2021).

- The Transition Pathway Initiative. Available online: https://www.transitionpathwayinitiative.org/ (accessed on 7 July 2020).

- British Petroleum. Press Release. 12 February 2020. Available online: https://www.bp.com/en/global/corporate/news-and-insights/press-releases/bernard-looney-announces-new-ambition-for-bp.html (accessed on 11 January 2021).

- British Petroleum. Press Release. 15 June 2020. Available online: https://www.bp.com/en/global/corporate/news-and-insights/press-releases/bp-revises-long-term-price-assumptions.html (accessed on 11 January 2021).

- ENI. Press Release. 28 February 2020. Available online: https://www.eni.com/en-IT/media/press-release/2020/02/long-term-strategic-plan-to-2050-and-action-plan-2020-2023.html (accessed on 11 January 2021).

- ENI. Press Release. 13 May 2020. Available online: https://www.eni.com/assets/documents/press-release/migrated/2020-enMayPress-release_Eni-for-2019.pdf (accessed on 12 January 2021).

- Shell. Press Release. Available online: https://www.shell.com/media/news-and-media-releases/2020/responsible-investment-annual-briefing-updates.html (accessed on 12 January 2021).

- Shell. Press Release. 16 April 2020. Available online: https://www.shell.com/investors/news-and-media-releases/investor-presentations/2020-investor-presentations/responsible-investment-annual-briefing-april-16-2020.html (accessed on 12 January 2021).

- Shell. Press Release. 30 June 2020. Available online: https://www.shell.com/media/news-and-media-releases/2020/shell-second-quarter-2020-update-note.html (accessed on 12 January 2021).

- Total. Press Release. 5 May 2020. Available online: https://www.total.com/media/news/total-adopts-new-climate-ambition-get-net-zero-2050#:~:text=Paris%20%E2%80%93%20Total%20announces%20today%20its,products%20used%20by%20its%20customers (accessed on 12 January 2021).

- Joint Statement between Total and Institutional Investors as Participants in Climate Action 100+. Available online: https://new-publications.total.com/05052020/pr/original-joint-statement-total-climate-action-100-plus.pdf (accessed on 12 January 2021).

- Climate Action 100+. Available online: http://www.climateaction100.org/ (accessed on 8 July 2020).

- Preem. Preem Progress Book, Sustainability Report 2019, The Target Is Set: Climate Neutral by 2045. Available online: https://www.preem.com/globalassets/om-preem/hallbarhet/hallbarhetsredovisning/preem_sustainability_report_2019_eng.pdf (accessed on 12 January 2021).

- Neste. Press Release. 12 March 2020. Available online: https://www.neste.com/releases-and-news/climate-change/neste-sets-ambitious-target-carbon-neutral-production-2035 (accessed on 12 January 2021).

- Neste. Press Release. 17 April 2019. Available online: https://www.neste.com/releases-and-news/climate-change/neste-sets-new-strategic-climate-targets-reduce-own-and-customers-emissions (accessed on 12 January 2021).

- Fuels Europe. Press Release. 15 June 2020. Available online: https://www.fuelseurope.eu/wp-content/uploads/FuelsEurope-Press-Release-Clean-Fuels-for-All-Final.pdf (accessed on 12 January 2021).

- ExxonMobil. 2020 Energy & Carbon Suymmary. Available online: https://corporate.exxonmobil.com/-/media/Global/Files/energy-and-carbon-summary/Energy-and-carbon-summary.pdf (accessed on 12 January 2021).

- Financial Times. 5 March 2020, ExxonMobil Dismisses Carbon Targets as a “Beauty” match. Available online: https://www.ft.com/content/6b785d00-5f23-11ea-b0ab-339c2307bcd4 (accessed on 12 January 2021).

- Chevron. Press Release. 3 October 2020. Available online: https://www.chevron.com/stories/chevron-sets-new-greenhouse-gas-reduction-goals#:~:text=press%20releaseChevron%20Sets%20New%20Greenhouse%20Gas%20Reduction%20Goals&text=The%20company%20intends%20to%20lower,percent%20from%202016%20to%202023 (accessed on 12 January 2021).

- Chevron. Climate Change Resilience, a Framework for Decision Making. Available online: https://www.chevron.com/-/media/shared-media/documents/climate-change-resilience.pdf (accessed on 12 January 2021).

- Oil and Gas Climate Initiative. Press Release. 16 July 2020. Available online: https://oilandgasclimateinitiative.com/carbon-intensity-target-pr/ (accessed on 12 January 2021).

- Oil and Gas Climate Initiative. Press Release. 23 September 2019. Available online: https://oilandgasclimateinitiative.com/oil-and-gas-climate-initiative-announces-progress-towards-methane-target-and-new-ccus-initiative-to-scale-up-actions-towards-climate-goals/ (accessed on 13 January 2021).

- Sadik-Zada, E.R.; Gatto, A. Energy Security Pathways in South East Europe: Diversification of the Natural Gas Supplies, Energy Transition, and Energy Futures. In From Economic to Energy Transition; Springer International Publishing: Cham, Switzerland, 2021; pp. 491–514. [Google Scholar] [CrossRef]

- US Environmental Protection Agency. Revision under Consideration for the 2018 GHGI: Abandoned Wells, Stakeholder Workshop 22 June 2017. Available online: https://www.epa.gov/sites/production/files/2017-06/documents/6.22.17_ghgi_stakeholder_workshop_2018_ghgi_revision_-_abandoned_wells.pdf (accessed on 13 January 2021).

- United States Government Accountability Office. GAO. Report to Congressional Requesters, Oil and Gas. September 2019. Available online: https://www.gao.gov/assets/710/701450.pdf (accessed on 13 January 2021).

- Böttner, C.; Haeckel, M.; Schmidt, M.; Berndt, C.; Vielstädte, L.; Kutsch, J.A.; Karstens, J.; Weiß, T. Greenhouse gas emissions from marine decommissioned hydrocarbon wells: Leakage detection, monitoring and mitigation strategies. Int. J. Greenh. Gas Control 2020, 100, 103119. [Google Scholar] [CrossRef]

- Vielstädte, L.; Karstens, J.; Haeckel, M.; Schmidt, M.; Linke, P.; Reimann, S.; Liebetrau, V.; McGinnis, D.F.; Wallmann, K. Quantification of methane emissions at abandoned gas wells in the Central North Sea. Mar. Pet. Geol. 2015, 68, 848–860. [Google Scholar] [CrossRef]

- IEA. Global Methane Emissions from Oil and Gas. 31 March 2020. Available online: https://www.iea.org/articles/global-methane-emissions-from-oil-and-gas (accessed on 1 August 2020).

- IEA. Methane Tracker 2020. March 2020. Available online: https://www.iea.org/reports/methane-tracker-2020 (accessed on 1 August 2020).

- Macrotrends. Natural Gas Prices. Available online: https://www.macrotrends.net/2478/natural-gas-prices-historical-chart (accessed on 15 July 2020).

- Chesapeake Energy Corporation. Press Release. 28 June 2020. Available online: http://www.chk.com/about/restructuring-information (accessed on 18 August 2020).

- Council of the European Union. General Secretariat of the Council, Smart Sector Integration: Promoting Clean Energy—Policy Debate, 13854/19 of 15 November 2019. Available online: https://data.consilium.europa.eu/doc/document/ST-13854-2019-INIT/en/pdf (accessed on 13 January 2021).

- Eurostat. Statistics Explained, Natural Gas Price Statistics. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Natural_gas_price_statistics (accessed on 15 July 2020).

- ECOFYS a Navigant Company. Gas for Climate, How Gas Can Help to Achieve the Paris Agreement Target in an Affordable Way. Available online: https://gasforclimate2050.eu/wp-content/uploads/2020/03/Ecofys-Gas-for-Climate-Report-Study-March18.pdf (accessed on 10 August 2020).

- Gas for Climate. A Path to 2050, Action Plan 2030 (Update 2019). Available online: https://gasforclimate2050.eu/wp-content/uploads/2020/03/Gas-for-Climate-Action-Plan-Update-2019.pdf (accessed on 10 August 2020).

- Gas for Climate. Gas Decarbonisation Pathways 2020–2050. Available online: https://gasforclimate2050.eu/sdm_downloads/2020-gas-decarbonisation-pathways-study/ (accessed on 10 August 2020).

- European Commission. Impact of the Use of the Biomethane and Hydrogen Potential on Trans-European Infrastructure. September 2019. Available online: https://op.europa.eu/en/publication-detail/-/publication/10e93b15-8b56-11ea-812f-01aa75ed71a1/language-en?WT.mc_id=Searchresult&WT.ria_c=37085&WT.ria_f=3608&WT.ria_ev=search (accessed on 13 January 2021).

- Trinomics. The Role of Trans-European Gas Infrastructure in the Light of the 2050 Ecarbonisation Targets. 2018. Available online: https://op.europa.eu/en/publication-detail/-/publication/1796ecd6-cb71-11e8-9424-01aa75ed71a1/language-en (accessed on 14 January 2021).

- IEA. Global Energy Review 2020. The Impacts of the Covid-19 Crisis on Global Energy Demand and CO2 Emissions. Available online: https://www.iea.org/reports/global-energy-review-2020 (accessed on 19 August 2020).

- IEA. IEA’s Monthly Oil Statistics, August 2020. Available online: https://www.iea.org/reports/monthly-oil-statistics (accessed on 14 January 2021).

- IEA. IEA’s Monthly Natural Gas Statistics. September 2020. Available online: https://iea.blob.core.windows.net/assets/6ae63a44-5270-4624-b049-30fc166281a9/Natgas.pdf?utm_campaign=IEA%20newsletters&utm_source=SendGrid&utm_medium=Email (accessed on 14 January 2021).

- Clean Technica. News 5 August 2020. Available online: https://cleantechnica.com/2020/08/05/covid-19-bankrupts-19-energy-oil-gas-companies/ (accessed on 18 August 2020).

- Reuters. Bonds News. 17 August 2020. Available online: https://www.reuters.com/article/chaparral-energy-bankruptcy/shale-driller-chaparral-energy-files-for-bankruptcy-due-to-pandemic-woes-idUSL4N2FJ0VN (accessed on 18 August 2020).

- Dominion Energy. Press Release. 5 July 2020, Dominion Energy and Duke Energy Cancel the Atlantic Coast Pipeline. Available online: https://news.dominionenergy.com/2020-07-05-Dominion-Energy-and-Duke-Energy-Cancel-the-Atlantic-Coast-Pipeline (accessed on 8 September 2020).

- Chevron. Press Release. 10 December 2019. Available online: https://www.chevron.com/stories/chevron-announces-20-billion-capital-and-exploratory-budget-for-2020 (accessed on 14 January 2021).

- Repsol. Press Release. 23 July 2020. Available online: https://www.repsol.com/en/press-room/press-releases/2020/repsol-posted-an-adjusted-net-income-of-189-million-euros-for-the-first-half-of-2020.cshtml (accessed on 14 January 2021).

- Total. Press Release. 29 July 2020. Available online: https://www.total.com/media/news/short-term-price-revision-and-climate-ambition-total-announces-exceptional-8-b-asset (accessed on 14 January 2021).

- ENI. Press Release. 30 July 2020. Available online: https://www.eni.com/en-IT/media/press-release/2020/07/eni-result-for-the-second-quarter-and-half-year-2020.html (accessed on 14 January 2021).

- Carbon Tracker. The Impair State: The Paris Agreement Starts to Impact oil & Gas Account Ting. Available online: https://carbontracker.org/reports/the-impair-state/ (accessed on 19 August 2020).

- Bloomberg Green. Press Release. 18 August 2020, The World’s Top Miner Broadens Plans to Exit Coal Operations. Available online: https://www.bloomberg.com/news/articles/2020-08-18/top-miner-bhp-shapes-for-greener-future-with-wider-coal-exit (accessed on 14 January 2021).

- International Monetary Fund. IMF Working Paper WP/19/89, Global Fossil Fuels Subsidies Remain Large: An Update Based on Country-Level Estimates. 2019. Available online: https://www.imf.org/en/Publications/WP/Issues/2019/05/02/Global-Fossil-Fuel-Subsidies-Remain-Large-An-Update-Based-on-Country-Level-Estimates-46509 (accessed on 14 January 2021).

- Energy Post. EU. 20 June 2020. Available online: https://energypost.eu/400bn-in-global-fossil-fuel-consumption-subsidies-twice-that-for-renewables/#:~:text=At%20over%20%24400bn%20in,of%20the%20global%20energy%20mix (accessed on 18 August 2020).

- IEA. 13 June 2019, Fossil Fuel Consumption Subsidies Bounced Back Strongly in 2018. Available online: https://www.iea.org/commentaries/fossil-fuel-consumption-subsidies-bounced-back-strongly-in-2018 (accessed on 14 January 2021).

- ExxonMobil. Press Release. 28 February 2019. Available online: https://corporate.exxonmobil.com/News/Newsroom/News-releases/2019/0228_ExxonMobil-makes-natural-gas-discovery-offshore-Cyprus (accessed on 14 January 2021).

- Financial Times. 21 August 2020. Available online: https://www.ft.com/content/3c3d1600-1001-4239-9f97-c65ec94e8ac5 (accessed on 14 January 2021).

- US Department of Interior. Press Release. 17 August 2020. Available online: https://www.doi.gov/pressreleases/secretary-bernhardt-signs-decision-implement-coastal-plain-oil-and-gas-leasing-program (accessed on 14 January 2021).

- Bloomberg Markets. 30 August 2020. Available online: https://www.bloomberg.com/news/articles/2020-08-30/saudi-aramco-said-it-has-discovered-two-new-oil-gas-fields (accessed on 14 January 2021).

- Wood Mackenzie. Covid-19 and Energy Demand. The Future of Energy after Covid-19: Three Scenarios. Available online: https://www.woodmac.com/news/feature/the-future-of-energy-after-covid-19-three-scenarios/ (accessed on 19 August 2020).

- Alova, G. A global analysis of the progress and failure of electric utilities to adapt their portfolios of power-generation assets to the energy transition. Nat. Energy 2020, 5, 920–927. [Google Scholar] [CrossRef]

- Investopedia. Upstream vs. Downstream Oil and Gas Production: An Overview, Updated 25/2/2020. Available online: https://www.investopedia.com/ask/answers/060215/what-difference-between-upstream-and-downstream-oil-and-gas-operations.asp (accessed on 21 August 2020).

- Canada Gazette. Part I. Ottawa, 19 March 2016, Department of Environment and Climate Change, Estimating Upstream GHG Emissions. Available online: http://www.gazette.gc.ca/rp-pr/p1/2016/2016-03-19/pdf/g1-15012.pdf (accessed on 22 August 2020).

- Government of Norway. CCS in Norway, Last Updated 8/1/2020. Available online: https://www.regjeringen.no/en/topics/energy/carbon-capture-and-storage/ccs-in-norway/id2601471/ (accessed on 24 August 2020).

- Equinor. Press Release. 15 May 2020. Available online: https://www.equinor.com/en/news/2020-05-northern-lights.html (accessed on 14 January 2021).

- European Commission. Welcome Europe, European Programme for Energy Recovery. Available online: https://www.welcomeurope.com/european-funds/eepr-european-energy-programme-recovery-734+634.html#tab=onglet_details (accessed on 24 August 2020).

- European Commission. New Entrants’ Reserve (NER 300). Available online: https://ec.europa.eu/clima/policies/innovation-fund/ner300_en (accessed on 24 August 2020).

- European Court of Auditors. Special report N°24/2018, Demonstrating Carbon Capture and Storage and Innovative Renewables at Commercial Scale in the EU: Intended Progress Not Achieved in the Past Decade. Available online: https://www.eca.europa.eu/en/Pages/DocItem.aspx?did=47082 (accessed on 14 January 2021).

- Global CCS Institute. Lawrence Irlam, Global Costs of Carbon Capture and Storage, 2017 Update. Available online: https://www.globalccsinstitute.com/archive/hub/publications/201688/global-ccs-cost-updatev4.pdf (accessed on 14 January 2021).

- IPCC. Carbon Dioxide Capture and Storage. Available online: https://www.ipcc.ch/site/assets/uploads/2018/03/srccs_wholereport-1.pdf (accessed on 25 October 2020).

- IPCC. Chapter 8, Cost and Economic Potential. Available online: https://www.ipcc.ch/site/assets/uploads/2018/03/srccs_chapter8-1.pdf (accessed on 25 October 2020).

- IEA. The Future of Hydrogen, Report Prepared by the IEA for the G20, Japan. June 2019. Available online: https://webstore.iea.org/download/direct/2803 (accessed on 14 January 2021).

- Glenk, G.; Reichelstein, S. Nature Energy. 2019, Volume 4, pp. 216–222. Available online: https://www.nature.com/articles/s41560-019-0326-1.epdf?sharing_token=FH2EkDRYD4hS09lP9thu8NRgN0jAjWel9jnR3ZoTv0OU43KAoIuibBlrlITvtH92h8qIYeEwidbVCPlEqotbnnYRLf51e5hwWCv5ksa6Ln64ppMqZmafHPzIWrnR8sUaZz4NC6Z86hupT1HUTgxbpBRKCaQijVwP6yhU8j4uS-pGPYNesXLHrdP-e_DJf5UuaIFQTiEJWMQEbpXAMdugR02QDf0Bq4xwpqD0JUlQVNRwF64Beom6L6F1RiZ9eRFpBBQsOYUOJ8Js7IfmdmzcGcxPGAVPJtCF3KSF6f-JAa95PzIKSs0c8jyUlcxipBzE&tracking_referrer=www.carbonbrief.org (accessed on 14 January 2021).

- IEA. The Clean Hydrogen Future Has Already Began, Commentary. 23 April 2019. Available online: https://www.iea.org/commentaries/the-clean-hydrogen-future-has-already-begun (accessed on 1 August 2020).

- Van Wijk, A.; Wouters, F.; Rachidi, S.; Ikken, B. A North Africa-Europe Hydrogen Manifesto, Dii Desert Energy. November 2019. Available online: https://dii-desertenergy.org/wp-content/uploads/2019/12/Dii-hydrogen-study-November-2019.pdf (accessed on 25 August 2020).

- Hydrogen Europe. Green Hydrogen Investment and Support Report, Hydrogen Europe’s input for a post COVID-19 recovery plan. Available online: https://hydrogeneurope.eu/sites/default/files/Hydrogen%20Europe_Green%20Hydrogen%20Recovery%20Report_final.pdf (accessed on 11 January 2021).

- Germany, Federal Ministry for the Environment. Nature Conservation and Nuclear Safety, International Climate Initiative, 26 June 2017, Green Hydrogen from Chile. Available online: https://www.international-climate-initiative.com/en/news/article/green_hydrogen_from_chile (accessed on 14 January 2021).

- Bloomberg NEF. Hydrogen Economy Outlook, Key Messages. 30 March 2020. Available online: https://data.bloomberglp.com/professional/sites/24/BNEF-Hydrogen-Economy-Outlook-Key-Messages-30-Mar-2020.pdf (accessed on 14 January 2021).

- SABIC. Press Release. 29 July 2020. Available online: https://www.sabic.com/en/news/24033-sabic-chemical-plant-to-become-world-s-first-of-its-kind-to-operate-on-100-renewable-power (accessed on 14 January 2021).

- Iberdrola. Press Release. 29 July 2020. Available online: https://www.iberdrola.com/press-room/news/detail/iberdrola-will-build-operate-world-s-largest-site-photovoltaic-self-consumption-system-sabic (accessed on 14 January 2021).

- Unilever. Press Release. 15 June 2020. Available online: https://www.unilever.co.uk/news/press-releases/2020/unilever-sets-out-new-actions-to-fight-climate-change-and-protect-and-regenerate-nature-to-preserve-resources-for-future-generations.html (accessed on 14 January 2021).

- Unilever. Press Release. 2 September 2020. Available online: https://www.unilever.com/news/press-releases/2020/unilever-to-invest-1-billion-to-eliminate-fossil-fuels-in-cleaning-products-by-2030.html (accessed on 14 January 2021).

- BBC News Business. Climate Change. Available online: https://www.bbc.com/news/business-53994319 (accessed on 14 January 2021).

- IEA. News, 5 October 2018, Petrochemicals Set to Be the Largest Driver of World Oil Demand, Latest IEA Analysis Finds. Available online: https://www.iea.org/news/petrochemicals-set-to-be-the-largest-driver-of-world-oil-demand-latest-iea-analysis-finds (accessed on 14 January 2021).

- US Department of Commerce, National Ocean Service. A Guide to Plastic in the Ocean, Last Updated 14 August 2020. Available online: https://oceanservice.noaa.gov/hazards/marinedebris/plastics-in-the-ocean.html (accessed on 6 September 2020).

- European Parliament. News, 24 October 2018, Plastic in the Ocean: The Facts, Effects and New EU Rules. Available online: https://www.europarl.europa.eu/news/en/headlines/society/20181005STO15110/plastic-in-the-ocean-the-facts-effects-and-new-eu-rules (accessed on 6 September 2020).

- D’Souza, J.M.; Windsor, F.M.; Santillo, D.; Ormerod, S.J. Food web transfer of plastics to an apex riverine predator. Glob. Chang. Biol. 2020, 26, 3846–3857. [Google Scholar] [CrossRef] [PubMed]

- United Nations. Africa Renewal. Save our Seas, Plastics Pose Biggest Threat to Oceans, by Musau, Z., May July 2017. Available online: https://www.un.org/africarenewal/magazine/may-july-2017/plastics-pose-biggest-threat-oceans (accessed on 6 September 2020).

- Carbon Tracker. Energy Transition, 4 September, 2020, The Future’s Not in Plastics: Why Plastics Demand Won’t Rescue the Oil Sector. Available online: https://carbontracker.org/reports/the-futures-not-in-plastics/ (accessed on 6 September 2020).

- Carbon Tracker. Energy Transition, 4 September, 2020, Oil Industry Betting Future on Shaky Plastics as World Battles Waste. Available online: https://carbontracker.org/oil-industry-betting-future-on-shaky-plastics-as-world-battles-waste/ (accessed on 6 September 2020).

- The New York Times. 28 February 2006. Available online: https://www.nytimes.com/2006February28/business/dupont-looking-to-displace-fossil-fuels-as-building-blocks-of.html (accessed on 14 January 2021).

- Shell. Energy Transition, Update to the 2016 Report. Available online: https://www.shell.com/energy-and-innovation/the-energy-future/shell-energy-transition-report/_jcr_content/par/toptasks.stream/1524757699226/3f2ad7f01e2181c302cdc453c5642c77acb48ca3/web-shell-energy-transition-report.pdf (accessed on 14 January 2021).

- IEA Bioenergy. Task 42, Biorefining in a Circular Economy. Available online: http://task42.ieabioenergy.com/ (accessed on 2 August 2020).

- Cheon, A.; Urpelainen, J. Activism and the Fossil Fuels Industry, 1st ed.; Routledge: Abingdon, UK, 2018. [Google Scholar] [CrossRef]

- Piggot, G. The influence of social movements on policies that constrain fossil fuel supply. Clim. Policy 2018, 18, 942–954. [Google Scholar] [CrossRef]

- Green, F. Anti-fossil fuel norms. Clim. Chang. 2018, 150, 103–116. [Google Scholar] [CrossRef] [Green Version]

- The Conversation. A Wake-up call: Why This Student Is Suing the Government over the Financial Risks of Climate Change. 27 July 2020. Available online: https://theconversation.com/a-wake-up-call-why-this-student-is-suing-the-government-over-the-financial-risks-of-climate-change-143359 (accessed on 10 September 2020).

- Federal Court of Australia. Notice of Filing, 22 July 2020, File Number VID482/2020, Kathleen O’Donnell v Commonwealth of Australia & ORS. Available online: http://blogs2.law.columbia.edu/climate-change-litigation/wp-content/uploads/sites/16/non-us-case-documents/2020/20200722_11843_complaint.pdf (accessed on 14 January 2021).

- Friends of the Irish Environment. Press Release. 14 August 2020, Landmark Supreme Court Environmental Judgement quashes the National Mitigation plan. Available online: https://www.friendsoftheirishenvironment.org/climate-case/17849-landmark-supreme-court-environmental-judgment-quashes-the-national-mitigation-plan (accessed on 14 January 2021).

- Hoboken, New Jersey Government. Press Release. 2 September 2020, Hoboken Becomes First NL City to Sue big Oil Companies, American Petroleum Institute for Climate Change Damages. Available online: https://www.hobokennj.gov/news/hoboken-sues-exxon-mobil-american-petroleum-institute-big-oil-companies#:~:text=Hoboken%20Mayor%20Ravi%20S.%20Bhalla,its%20devastating%20impact%20on%20Hoboken (accessed on 14 January 2021).

- Global Legal Action Network. Available online: https://www.glanlaw.org/ (accessed on 6 September 2020).

- Climate Home News. Six Portuguese Youth File Unprecedented Climate Lawsuit against 33 Countries. 3 September 2020. Available online: https://www.climatechangenews.com/2020/09/03/six-portuguese-youth-file-unprecedented-climate-lawsuit-33-countries/ (accessed on 14 January 2021).

- Delaware. Press Release. 10 September 2020, Delaware Sues Oil Companies for Lying about Their Products’ Effect on Climate Change. Available online: https://eu.delawareonline.com/story/news/2020/09/10/delaware-sues-exxon-chevron-and-bp-role-climate-change/3457202001/#:~:text=The%20Delaware%20attorney%20general%20on,and%20damaging%20the%20state’s%20environment (accessed on 14 January 2021).

- City of Charleston, South Dakota. Press Release. 9 September 2020, Charleston Sues 24 Fossil Fuel Companies for Costs of Surviving Climate Change, Lawsuit Details Decades of Industry Deception about Their Products’ Dangers. Available online: https://www.charleston-sc.gov/ArchiveCenter/ViewFile/Item/717 (accessed on 14 January 2021).

- The Hill. 20 States Sue EPA over Methane Emissions Standards Rollback. 14 September 2020. Available online: https://thehill.com/policy/energy-environment/516283-20-states-sue-epa-over-methane-emissions-standards-rollback (accessed on 15 September 2020).

- United Court of Appeals for the District of Columbia Circuit. Available online: https://oag.ca.gov/sites/default/files/CA%20v.%20Wheeler_Methane%20Rescission%20Petition%20for%20Review_To%20File.pdf (accessed on 14 January 2021).

- Burke, A.; Fishel, S. A coal elimination treaty 2030: Fast tracking climate change mitigation, global health and security. Earth Syst. Gov. 2020, 3, 100046. [Google Scholar] [CrossRef]

- Reuters. Big Oil’s Patchy Deals Record Cats Shadow over Green Makeover. 1 September 2020. Available online: https://uk.reuters.com/article/us-global-oilmajors-m-a-analysis/big-oils-patchy-deals-record-casts-shadow-over-green-makeover-idUKKBN25S3RS (accessed on 7 September 2020).

- CNN Business. 25 August 2020. Available online: https://edition.cnn.com/2020August25/investing/exxon-stock-dow-oil/index.html (accessed on 7 September 2020).

- Saxe Facts. Saxe D., 23 December 2019, Climate Damage: Will Fossil Fuel Producers Have to Pay? Part 1. Available online: https://www.saxefacts.com/climate-damage-will-fossil-fuel-producers-have-to-pay-part-1/ (accessed on 14 January 2021).

- Wikipedia. Disruptive Innovation. Available online: https://en.wikipedia.org/wiki/Disruptive_innovation (accessed on 6 September 2020).

- Andrew Hargadon. Disruptive Policy and Innovation. 30 September 2014. Available online: https://andrewhargadon.com/2014September30/disruptive-policy-and-innovation/#:~:text=In%20other%20words%2C%20anything%20that,they%20are%20disruptive.%5B2%5D (accessed on 6 September 2020).

- Newman, P. COVID, CITIES and CLIMATE: Historical Precedents and Potential Transitions for the New Economy. Urban Sci. 2020, 4, 32. [Google Scholar] [CrossRef]

- White House. Statement by President Trump on the Paris Climate Accord. 1 June 2017. Available online: https://www.whitehouse.gov/briefings-statements/statement-president-trump-paris-climate-accord/ (accessed on 8 September 2020).

- US Department of State. Press Release. 4 November 2019, Pompeo, M.R., On the U.S. Withdrawal from the Paris Agreement. Available online: https://www.state.gov/on-the-u-s-withdrawal-from-the-paris-agreement/ (accessed on 8 September 2020).

- US Environmental Protection Agency. EPA Issues Final Policy Amendments to the 2012 and 2016 New Source Performance Standards for the Oil and Natural Gas Industrty: Fact Sheet. 13 August 2020. Available online: https://www.epa.gov/sites/production/files/2020-08/documents/og_policy_amendments.fact_sheet._final_8.13.2020_.pdf (accessed on 8 September 2020).

- Politico. Energy, 17 August 2020, Trump Administration Approves Opening Arctic Refuge for Drilling. Available online: https://www.politico.com/news/2020August17/trump-administration-arctic-refuge-drilling-397006 (accessed on 8 September 2020).

- White House. Statement by President Trump on Environmental Accomplishments for the People of Florida, Jupiter, Florida. 8 September 2020. Available online: https://www.whitehouse.gov/briefings-statements/remarks-president-trump-environmental-accomplishments-people-florida-jupiter-fl/ (accessed on 9 September 2020).

- Reuters. Democrat Ocasio-Cortez to lead Biden Climate Change Panel with Kerry. 13 May 2020. Available online: https://www.reuters.com/article/us-usa-election-biden-climate/democrat-ocasio-cortez-to-lead-biden-climate-change-panel-with-kerry-idUSKBN22P0F8 (accessed on 8 September 2020).

- CERES. Press Release. 9 September 2020, Managing Climate Risk in the U.S. Financial System. Available online: https://www.ceres.org/news-center/press-releases/ceres-welcomes-climate-risk-report-subcommittee-cftc-calls-regulate (accessed on 9 September 2020).

- Report of the Climate-Related Market Risk Subcommittee. Market Risk Advisory Committee of the U.S. Commodity Futures Trading Commission, Managing Climate Risk in the US Financial System. Available online: https://www.cftc.gov/sites/default/files/2020-09/9-9-20%20Report%20of%20the%20Subcommittee%20on%20Climate-Related%20Market%20Risk%20-%20Managing%20Climate%20Risk%20in%20the%20U.S.%20Financial%20System%20for%20posting.pdf (accessed on 14 January 2021).

- State of California. Executive Department, Executive Order B-55-18 to Achieve Carbon Neutrality. Available online: https://www.ca.gov/archive/gov39/wp-content/uploads/2018September9.10.18-Executive-Order.pdf (accessed on 14 January 2021).

- California Air Resources Board. California’s 2017 Climate Change Scoping Plan. Available online: https://ww2.arb.ca.gov/sites/default/files/classic//cc/scopingplan/scoping_plan_2017.pdf?utm_medium=email&utm_source=govdelivery (accessed on 28 September 2020).

- Hawaii Public Radio. Press Release 4 June 2018, Carbon Net Neutrality Goal by 2045 Signed into Law. Available online: https://www.hawaiipublicradio.org/post/carbon-net-neutrality-goal-2045-signed-law#stream/0 (accessed on 14 January 2021).

- State of Hawaii. House of Representatives, Bill for an Act. Available online: https://www.capitol.hawaii.gov/session2018/bills/HB2182_CD1_.htm (accessed on 14 January 2021).

- European Council. Press Release. 14 September 2020. Available online: https://www.consilium.europa.eu/en/meetings/international-summit/2020/09/14/ (accessed on 14 January 2021).

- United Nations. UN News. 22 September 2020. Available online: https://news.un.org/en/story/2020September1073052 (accessed on 14 January 2021).

- Climate Action Tracker. Press Release. 23 September 2020. Available online: https://climateactiontracker.org/press/china-carbon-neutral-before-2060-would-lower-warming-projections-by-around-2-to-3-tenths-of-a-degree/ (accessed on 14 January 2021).

- EURACTIV. China to Launch Carbon Emission Trading Scheme Next Month. 6 January 2021. Available online: https://www.euractiv.com/section/emissions-trading-scheme/news/china-to-launch-carbon-emissions-trading-scheme-next-month/ (accessed on 11 January 2021).

- New Zealand Parliament. Climate Change Response (Zero Carbon) Amendment Bill. Available online: http://www.legislation.govt.nz/bill/government/2019/0136/latest/LMS183736.html (accessed on 28 September 2020).

- New Zealand Ministry for the Environment. Climate change, About New Zealand’s emissions reduction targets, revised 25 November 19. Available online: https://www.mfe.govt.nz/climate-change/climate-change-and-government/emissions-reduction-targets/about-our-emissions (accessed on 28 September 2020).

- Forestry New Zealand. About the 1 billion Trees Programme. Available online: https://www.mpi.govt.nz/funding-and-programmes/forestry/one-billion-trees-programme/about-the-one-billion-trees-programme (accessed on 28 September 2020).

- New Zealand Ministry for the Environment. New Zealand’s Greenhouse Gas Inventory 1990–2017, Fulfilling Reporting Requirements under the United Nations Framework Convention on Climate Change and the Kyoto Protocol, Volume 1, Chapters 1–15. Available online: https://www.mfe.govt.nz/sites/default/files/media/Climate%20Change/nz-greenhouse-gas-inventory-2019.pdf (accessed on 14 January 2021).

- UK Government. Department for Business, Energy & Industrial Strategy, Press Release. 27 June 2019. Available online: https://www.gov.uk/government/news/uk-becomes-first-major-economy-to-pass-net-zero-emissions-law (accessed on 14 January 2021).

- European Commission. Directive 2001/77/EC. On the Promotion of Electricity Produced from Renewable Energy Sources in the Internal Electricity Market. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32001L0077 (accessed on 23 September 2020).

- European Commission. Directive 2003/30/EC. 8 May 2003, On the Promotion of the Use of Biofuels or Other Renewable Fuels for Transport. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:32003L0030 (accessed on 23 September 2020).

- European Commission. Directive 2009/28/EC. On the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:32009L0028 (accessed on 23 September 2020).

- European Commission. Communication, A Policy Framework for Climate and Energy in the Period from 2020 to 2030, COM(2014) 15. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014DC0015&from=EN (accessed on 22 September 2020).

- European Commission. EU Emissions Trading System. Available online: https://ec.europa.eu/clima/policies/ets_en (accessed on 22 September 2020).

- European Commission. Communication, A European Strategy for Low-Emission Mobility, COM (2016) 501 Final. Available online: https://ec.europa.eu/transparency/regdoc/rep/1/2016/EN/1-2016-501-EN-F1-1.PDF (accessed on 22 September 2020).

- European Commission. Communication, Clean Energy for all Europeans. Available online: https://ec.europa.eu/energy/en/news/commission-proposes-new-rules-consumer-centred-clean-energy-transition (accessed on 28 October 2020).

- European Commission. COM (2016) 767 Final/2, of 23.2.2017, Directive of the European Parliament and of the Council on the Promotion of the Use of Renewable Energy Sources (Recast). Available online: http://ec.europa.eu/energy/sites/ener/files/documents/1_en_act_part1_v7_1.pdf (accessed on 28 October 2020).

- European Commission. Directive 2018/2001 of 21.12.2018, Directive of the European Parliament and of the Council on the promotion of the use of renewable energy sources (recast). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32018L2001 (accessed on 28 October 2020).

- European Commission. Communication, The European Green Deal, COM (2019) 640 Final. Available online: https://ec.europa.eu/info/sites/info/files/european-green-deal-communication_en.pdf (accessed on 28 October 2020).

- European Commission. Communication, Europe’s Moment: Repair and Prepare for the Next Generation, COM (2020) 456 Final, of 27.5.2020. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1590732521013&uri=COM:2020:456:FIN (accessed on 28 October 2020).

- European Commission. The pillars of the Next Generation EU. Available online: https://ec.europa.eu/info/live-work-travel-eu/health/coronavirus-response/recovery-plan-europe/pillars-next-generation-eu_en (accessed on 29 October 2020).

- European Council. Press Release. 23 October 2020, European Climate Law: Council reaches Agreement on Large Parts of the Proposal. Available online: https://www.consilium.europa.eu/en/press/press-releases/2020/10/23/european-climate-law-council-reaches-agreement-on-large-parts-of-the-proposal/ (accessed on 28 October 2020).

- European Commission. Press Release. 17 September 2020, State of the Union: Commission Raises Climate Ambition and Proposes 55% cut in Emissions by 2030. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_20_1599 (accessed on 29 October 2020).

- Euronews. 12 December 2020. Available online: https://www.euronews.com/2020December11eu27-leaders-agree-to-cut-greenhouse-gas-emissions-at-least-55-by-2030 (accessed on 14 January 2021).

- European Commission. Communication, Powering a Climate-Neutral Economy: An EU Strategy for Energy System Integration, of 8.7.2020, COM(2020) 299 final. Available online: https://ec.europa.eu/energy/sites/ener/files/energy_system_integration_strategy_.pdf (accessed on 28 October 2020).

- European Commission. Commission Staff Working Document, Impact Assessment, Accompanying the Document Stepping up Europe’s 2030 Climate Ambition—Investing in a Climate-Neutral Future for the Benefit of Our People, COM(2020) 301 final, of 17.9.2020. Available online: https://ec.europa.eu/clima/sites/clima/files/eu-climate-action/docs/impact_en.pdf (accessed on 28 October 2020).

- European Commission. 4 March 2020, COM(2020) 80 final, Proposal for a Regulation Establishing the Framework for Achieving Climate Neutrality and Amending Regulation (EU) 2018/1999 (European Climate Law). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52020PC0080 (accessed on 4 October 2020).

- Climate Home News. Press Release. 17 September 2020, Which Countries Have a Net Zero Carbon Goal. Available online: https://www.climatechangenews.com/2020/09/17/countries-net-zero-climate-goal/ (accessed on 27 September 2020).

- European Commission. COM(2018)773 Final of 28 November 2018, Communication from the European Commission, A Clean Planet for All A European Strategic Long-Term Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy. Available online: https://ec.europa.eu/transparency/regdoc/rep/1/2018/EN/COM-2018-773-F1-EN-MAIN-PART-1.PDF (accessed on 14 January 2021).

- European Environmental Agency. EEA Report 13/2020, Trends and Projections in Europe 2020. Available online: https://www.eea.europa.eu/publications/trends-and-projections-in-europe-2020#:~:text=EU%20on%20track%20to%20meet,2020%20climate%20and%20energy%20targets%2C (accessed on 14 January 2021).

- European Commission. Press Release. 18 December 2018, Commission Welcomes Political Agreement on Conclusion of the Clean Energy for All European Package. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_18_6870 (accessed on 4 October 2020).

- Bloomberg Green, 31 November 2020, New Energy Giants Are Renewable Companies: Iberdrola, Enel, NextEra, Orsted. Available online: https://www.bloomberg.com/graphics/2020-renewable-energy-supermajors/ (accessed on 4 February 2021).

- FuelCellsWorks, 1 December 2020, Repsol Goal to Be Leader in Renewable Hydrogen with Production Capacity at 1.2 GW by 2030. Available online: https://fuelcellsworks.com/news/repsol-goal-to-be-a-leader-in-renewable-hydrogen-with-production-capacity-at-1-2-gw-by-2030/ (accessed on 4 February 2021).

- Offshore wind.biz, 1 February 2021, BP Officially Enters Offshore Wind. Available online: https://www.offshorewind.biz/2021/02/01/bp-officially-enters-offshore-wind/ (accessed on 4 February 2021).

- The Brussels Times, 4 February 2021, 500km Electricity cable planned from Belgium to Denmark. Available online: https://www.brusselstimes.com/news/belgium-all-news/150424/500km-electricity-cable-planned-from-belgium-to-denmark/ (accessed on 4 February 2021).

- Greenfish, 2019, White Paper, Shaping Our Electrical Future: Moving towards an Integrated European Network. Available online: https://www.greenfish.eu/shaping-our-electrical-future-moving-towards-an-integrated-european-network (accessed on 4 February 2021).

- Singh, N. The European Interconnected Network: Case Study of Institutional Requirements for as Successful International Grid Interconnection, NAPSNet Special Reports. 5 October 2020. Available online: https://nautilus.org/napsnet/napsnet-special-reports/the-european-interconnected-network-case-study-of-institutional-requirements-for-a-successful-international-grid-interconnection/ (accessed on 4 February 2021).

- CNBC. Energy, 3 February 2021, Big Oil CEO Says Going Green “Will Have a Cost for Everybody”—And Governments Need to Explain That. Available online: https://www.cnbc.com/2021/02/03/oil-total-ceo-says-going-green-will-have-a-cost-for-everybody.html (accessed on 4 February 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maniatis, K.; Chiaramonti, D.; van den Heuvel, E. Post COVID-19 Recovery and 2050 Climate Change Targets: Changing the Emphasis from Promotion of Renewables to Mandated Curtailment of Fossil Fuels in the EU Policies. Energies 2021, 14, 1347. https://doi.org/10.3390/en14051347

Maniatis K, Chiaramonti D, van den Heuvel E. Post COVID-19 Recovery and 2050 Climate Change Targets: Changing the Emphasis from Promotion of Renewables to Mandated Curtailment of Fossil Fuels in the EU Policies. Energies. 2021; 14(5):1347. https://doi.org/10.3390/en14051347

Chicago/Turabian StyleManiatis, Kyriakos, David Chiaramonti, and Eric van den Heuvel. 2021. "Post COVID-19 Recovery and 2050 Climate Change Targets: Changing the Emphasis from Promotion of Renewables to Mandated Curtailment of Fossil Fuels in the EU Policies" Energies 14, no. 5: 1347. https://doi.org/10.3390/en14051347