Covid-19’s Impact on European Power Sectors: An Econometric Analysis

Abstract

:1. Introduction

2. Existing Literature Analyzing the Impact of the Covid-19 Crisis on the Energy Sector

3. Methodology and Data

4. Data Analysis, Results, and Discussion

4.1. Descriptive Analysis of Price and Load Developments

4.2. Econometric Analysis

4.2.1. Econometric Preliminaries

4.2.2. Effect of Covid-19 on Load: First Regression Analysis

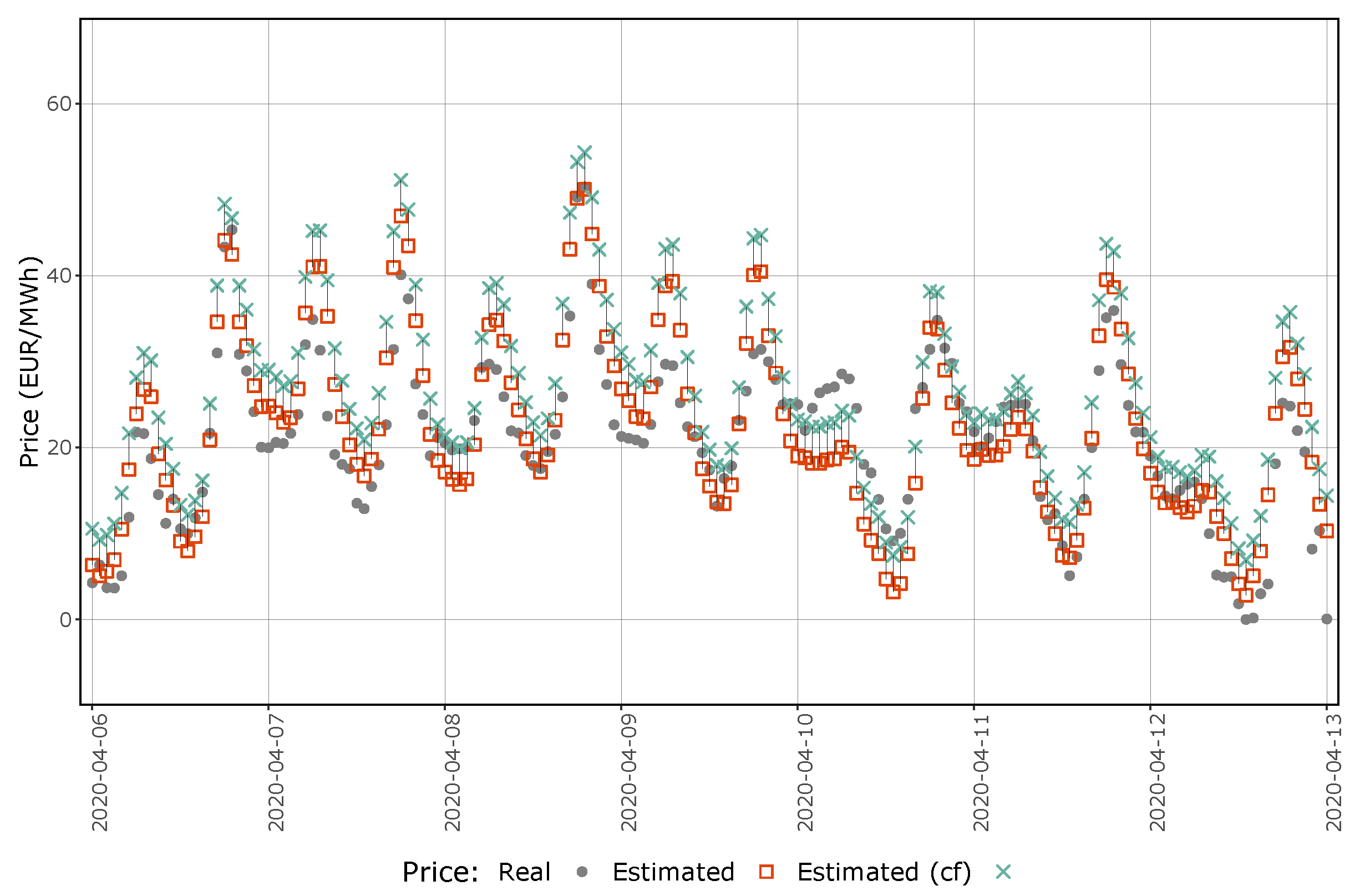

4.2.3. Effect of Reduced Load on Power Prices: Second Regression Analysis

4.3. Limitations of the Proposed Approach

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Dependent Variable: | ||||||

|---|---|---|---|---|---|---|

| Load Germany | Load France | Load Great Britain | ||||

| M2 | 422.194 | (340.876) | −2888.381 *** | (684.809) | 456.160 ** | (202.678) |

| M3 | −1922.561 *** | (381.430) | −9201.241 *** | (674.498) | −1012.213 *** | (226.877) |

| M4 | −5756.182 *** | (413.453) | −18,005.280 *** | (628.011) | −4582.063 *** | (226.007) |

| M5 | −7163.971 *** | (433.436) | −23,416.520 *** | (572.624) | −6562.748 *** | (210.444) |

| M6 | −6650.721 *** | (384.556) | −24,319.020 *** | (524.629) | −7558.618 *** | (200.347) |

| M7 | −6344.384 *** | (332.092) | −23,540.720 *** | (526.957) | −8165.849 *** | (204.330) |

| M8 | −6932.539 *** | (346.567) | −26,765.220 *** | (570.881) | −8207.455 *** | (198.625) |

| M9 | −6147.534 *** | (344.531) | −23,936.380 *** | (532.576) | −7686.319 *** | (199.070) |

| M10 | −4537.314 *** | (407.242) | −20,147.620 *** | (605.574) | −6135.953 *** | (204.812) |

| M11 | −957.744 ** | (392.039) | −9065.915 *** | (703.873) | −2338.358 *** | (233.750) |

| M12 | −2729.572 *** | (650.070) | −4258.198 *** | (724.622) | −2240.949 *** | (296.223) |

| H0 | −17,501.700 *** | (136.086) | −8279.654 *** | (105.358) | −12,620.410 *** | (78.424) |

| H1 | −17,834.260 *** | (132.249) | −10,217.430 *** | (105.724) | −13,465.900 *** | (73.917) |

| H2 | −17,260.640 *** | (124.682) | −11,730.220 *** | (96.245) | −14,442.040 *** | (70.230) |

| H3 | −15,467.900 *** | (107.851) | −11,360.250 *** | (88.869) | −15,037.21 0 *** | (68.327) |

| H4 | −11,332.950 *** | (101.137) | −8971.546 *** | (85.915) | −14,833.850 *** | (72.368) |

| H5 | −6455.908 *** | (96.711) | −5351.098 *** | (90.315) | −11,873.430 *** | (92.577) |

| H6 | −2621.457 *** | (90.459) | −2107.347 *** | (94.882) | −7111.801 *** | (99.300) |

| H7 | −604.753 *** | (73.903) | −139.798 * | (84.505) | −3297.327 *** | (86.484) |

| H8 | 816.413 *** | (61.583) | 843.981 *** | (67.017) | −1410.060 *** | (66.999) |

| H9 | 2085.811 *** | (55.466) | 1356.210 *** | (51.341) | −481.701 *** | (50.862) |

| H10 | 2197.305 *** | (42.290) | 2001.198 *** | (44.487) | 96.916 *** | (35.223) |

| H11 | 1276.913 *** | (32.008) | 1406.062 *** | (34.727) | 379.551 *** | (32.669) |

| H13 | −1121.775 *** | (31.062) | −1736.809 *** | (34.049) | −619.468 *** | (32.520) |

| H14 | −1978.539 *** | (39.318) | −3279.472 *** | (41.560) | −974.399 *** | (39.925) |

| H15 | −1857.239 *** | (51.425) | −3893.380 *** | (47.165) | −293.812 *** | (48.445) |

| H16 | −798.615 *** | (72.155) | −2470.932 *** | (55.956) | 1257.548 *** | (61.391) |

| H17 | −497.028 *** | (83.496) | −156.780 ** | (71.163) | 1966.567 *** | (74.715) |

| H18 | −1933.916 *** | (92.341) | −247.630 *** | (92.702) | 1464.667 *** | (79.155) |

| H19 | −4693.753 *** | (90.959) | −2121.782 *** | (79.541) | 191.572 *** | (72.975) |

| H20 | −7442.875 *** | (102.887) | −2612.972 *** | (74.414) | −1862.246 *** | (65.218) |

| H21 | −10,535.660 *** | (121.919) | −1907.874 *** | (82.858) | −4936.481 *** | (63.074) |

| H22 | −13,822.410 *** | (125.051) | −3585.080 *** | (93.476) | −8537.473 *** | (62.786) |

| H23 | −16,142.250 *** | (123.700) | −6376.530 *** | (97.984) | −11,655.790 *** | (67.817) |

| Y17 | 765.258 *** | (218.170) | 114.840 | (298.513) | −2729.682 *** | (120.104) |

| Y18 | 1507.393 *** | (222.966) | −562.954 * | (318.924) | −2383.713 *** | (121.124) |

| Y19 | 541.544 ** | (231.578) | −993.105 *** | (286.178) | −3132.017 *** | (128.941) |

| Y20 | −956.817 *** | (360.718) | −3896.747 *** | (397.956) | −4610.393 *** | (229.821) |

| Sun | 8166.436 *** | (197.964) | 5085.015 *** | (257.860) | 2742.593 *** | (119.157) |

| Tue | −3718.844 *** | (149.147) | −2253.437 *** | (242.741) | −674.786 *** | (120.558) |

| Wed | 7827.980 *** | (253.729) | 4449.022 *** | (299.856) | 2568.842 *** | (146.569) |

| Thu | 9533.097 *** | (211.792) | 5739.352 *** | (303.055) | 3156.884 *** | (131.226) |

| Fri | 9803.277 *** | (199.441) | 6012.438 *** | (300.013) | 3187.811 *** | (131.571) |

| Sat | 9399.969 *** | (213.165) | 5885.513 *** | (298.368) | 3134.739 *** | (134.830) |

| LD | −1291.138 | (944.069) | −5622.362 *** | (1236.838) | −2529.089 *** | (438.879) |

| C | −1.728 *** | (0.587) | 1.034 *** | (0.217) | −0.948 ** | (0.410) |

| C · LD | 1.105 | (0.675) | −0.940 * | (0.501) | 0.740 * | (0.432) |

| Const. | 59,648.090 *** | (358.467) | 69,702.430 *** | (576.102) | 44,583.620 *** | (200.996) |

| Adj. R2 | 0.8233 | 0.8420 | 0.8699 | |||

| Dependent Variable: | ||||||

|---|---|---|---|---|---|---|

| Price Germany | Price France | Price Great Britain | ||||

| Load | 0.952 *** | (0.059) | 1.075 *** | (0.042) | 1.039 *** | (0.087) |

| Biomass | −0.128 | (0.684) | −11.486 *** | (2.120) | −0.711 * | (0.429) |

| Lignite | 0.782 *** | (0.102) | ||||

| Gas | −0.138 | (0.138) | 0.752 *** | (0.116) | −0.095 | (0.078) |

| Hard coal | 0.109 | (0.078) | 1.201 *** | (0.354) | 1.065 *** | (0.171) |

| Oil | 7.379 *** | (1.355) | 18.509 *** | (2.485) | 128.143 | (95.971) |

| Pumped storage | 1.057 *** | (0.103) | 2.838 *** | (0.242) | 12.584 *** | (1.197) |

| Run of river | −6.125 *** | (0.611) | −3.283 *** | (0.201) | 3.771 *** | (1.191) |

| Reservoir | 1.574 | (1.798) | −0.545 * | (0.293) | ||

| Nuclear | −0.447 *** | (0.168) | −0.027 | (0.035) | −1.339 *** | (0.222) |

| Solar | −0.832 *** | (0.040) | −2.091 *** | (0.131) | −0.958 *** | (0.094) |

| Waste | 10.988 *** | (2.005) | 25.638 *** | (4.001) | ||

| Wind offshore | −0.313 ** | (0.122) | −1.867 *** | (0.184) | ||

| Wind onshore | −0.936 *** | (0.051) | −1.324 *** | (0.081) | −0.652 *** | (0.164) |

| M2 | −2.737 *** | (0.936) | 1.526 | (0.962) | −3.294 *** | (1.055) |

| M3 | −3.107 *** | (0.914) | 5.911 *** | (0.937) | −3.367 *** | (0.956) |

| M4 | −0.958 | (1.029) | 13.104 *** | (1.101) | 0.436 | (1.230) |

| M5 | 1.609 | (1.206) | 20.004 *** | (1.284) | 2.766 ** | (1.340) |

| M6 | 5.831 *** | (1.206) | 22.432 *** | (1.337) | 2.528 * | (1.389) |

| M7 | 7.511 *** | (1.081) | 20.290 *** | (1.256) | 4.909 *** | (1.357) |

| M8 | 6.891 *** | (1.064) | 21.307 *** | (1.362) | 5.798 *** | (1.310) |

| M9 | 5.769 *** | (1.018) | 18.755 *** | (1.397) | 10.191 *** | (2.078) |

| M10 | 4.037 *** | (1.096) | 21.558 *** | (1.281) | 7.827 *** | (1.390) |

| M11 | 3.185 *** | (0.942) | 16.734 *** | (1.365) | 9.363 *** | (1.721) |

| M12 | 3.278 *** | (1.064) | 9.148 *** | (0.997) | 6.213 *** | (1.128) |

| H0 | 1.280 | (0.789) | −3.987 *** | (0.566) | 8.743 *** | (1.010) |

| H1 | 0.529 | (0.792) | −4.412 *** | (0.591) | 7.900 *** | (1.067) |

| H2 | −0.288 | (0.762) | −4.781 *** | (0.615) | 6.252 *** | (1.131) |

| H3 | −0.938 | (0.694) | −4.408 *** | (0.609) | 5.822 *** | (1.170) |

| H4 | −0.828 | (0.547) | −2.362 *** | (0.577) | 7.304 *** | (1.157) |

| H5 | −0.113 | (0.412) | −0.184 | (0.510) | 9.439 *** | (0.951) |

| H6 | 1.182 *** | (0.306) | 1.364 *** | (0.432) | 7.009 *** | (0.639) |

| H7 | 1.565 *** | (0.249) | 1.609 *** | (0.335) | 5.853 *** | (0.463) |

| H8 | 1.542 *** | (0.213) | 1.477 *** | (0.242) | 6.864 *** | (0.390) |

| H9 | 1.491 *** | (0.215) | 2.034 *** | (0.177) | 5.488 *** | (0.300) |

| H10 | 1.246 *** | (0.187) | 1.315 *** | (0.141) | 3.505 *** | (0.204) |

| H11 | 0.567 *** | (0.126) | 0.557 *** | (0.105) | 1.765 *** | (0.133) |

| H13 | 0.139 | (0.123) | 0.152 | (0.117) | −1.464 *** | (0.116) |

| H14 | 0.127 | (0.195) | 0.998 *** | (0.196) | −1.646 *** | (0.171) |

| H15 | 0.564 ** | (0.255) | 2.665 *** | (0.282) | 1.061 *** | (0.252) |

| H16 | 1.059 *** | (0.316) | 4.811 *** | (0.357) | 6.622 *** | (0.402) |

| H17 | 1.248 *** | (0.363) | 6.919 *** | (0.931) | 15.466 *** | (1.032) |

| H18 | 0.745 ** | (0.377) | 3.620 *** | (0.526) | 13.262 *** | (0.620) |

| H19 | 0.283 | (0.409) | 2.339 *** | (0.482) | 6.757 *** | (0.547) |

| H20 | 0.438 | (0.474) | 0.959 * | (0.496) | 2.138 *** | (0.520) |

| H21 | 0.680 | (0.554) | −2.120 *** | (0.499) | 0.882 | (0.579) |

| H22 | 0.916 | (0.665) | −2.854 *** | (0.520) | 6.929 *** | (0.774) |

| H23 | 1.386 * | (0.746) | −3.068 *** | (0.547) | 8.480 *** | (0.946) |

| Y17 | 5.420 *** | (0.470) | 4.672 *** | (0.596) | 7.414 *** | (0.604) |

| Y18 | 14.275 *** | (0.607) | 18.036 *** | (0.601) | 22.484 *** | (1.001) |

| Y19 | 11.060 *** | (0.925) | 8.354 *** | (0.527) | 8.483 *** | (1.244) |

| Y20 | 7.367 *** | (1.264) | 5.286 *** | (0.611) | 0.052 | (1.552) |

| Sun | −1.955 *** | (0.550) | −0.242 | (0.431) | −1.472 *** | (0.469) |

| Tue | −1.079 ** | (0.488) | −2.546 *** | (0.407) | −0.860 * | (0.467) |

| Wed | −2.709 *** | (0.664) | −0.600 | (0.571) | −0.196 | (0.825) |

| Thu | −2.550 *** | (0.622) | −0.607 | (0.514) | −1.086 ** | (0.551) |

| Fri | −2.396 *** | (0.626) | −0.707 | (0.496) | −1.329 ** | (0.556) |

| Sat | −2.397 *** | (0.611) | −0.742 | (0.507) | −1.071 | (0.659) |

| Constant | −16.632 *** | (4.079) | −25.083 *** | (3.172) | 9.283 ** | (4.508) |

| Adjusted R | 0.7760 | 0.7298 | 0.4583 | |||

References

- Hauser, P.; Anke, C.; López, J.G.; Möst, D.; Scharf, H.; Schönheit, D.; Schreiber, S. Comparison to the 2008 Financial Crisis. In IAEE Energy Forum; International Association for Energy Economics: Cleveland, OH, USA, 2020; pp. 1–6. [Google Scholar]

- Anke, C.P. How renewable energy is changing the German energy system—A counterfactual approach. Zeitrschrift Für Energiewirtschaft 2019, 43, 85–100. [Google Scholar] [CrossRef]

- Weigt, H. Germany’s wind energy: The potential for fossil capacity replacement and cost saving. Appl. Energy 2009, 86, 1857–1863. [Google Scholar] [CrossRef] [Green Version]

- Diekmann, J.; Krewitt, W.; Musiol, F.; Nicolosi, M.; Ragwitz, M.; Sensfuß, F.; Weber, C.; Wissen, R.; Woll, O. Fachgespräch zum “Merit-Order-Effekt”. 2007. Available online: https://www.bmu.de/fileadmin/bmu-import/files/pdfs/allgemein/application/pdf/thesenpapier_meritordereffekt.pdf (accessed on 26 April 2018).

- Löschel, A.; Rübbelke, D.; Ströbele, W.; Pfaffenberger, W.; Heuterkes, M. Energiewirtschaft, 4th ed.; De Gruyter Oldenbourg: Berlin, Germany; Boston, MA, USA, 2020; p. 440. [Google Scholar] [CrossRef]

- Müller, T.; Möst, D. Demand Response Potential: Available when Needed? Energy Policy 2018, 115, 181–198. [Google Scholar] [CrossRef]

- European Network of Transmission System Operators for Electricity (ENTSO-E). ENTSO-E Transparency Platform. 2020. Available online: https://transparency.entsoe.eu (accessed on 5 November 2020).

- S&P Global. The Energy Transition and What It Means For European Power Prices And Producers: Midyear 2020 Update. 2020. Available online: https://www.spglobal.com/ratings/en/research/articles/200608-the-energy-transition-and-what-it-means-for-european-power-prices-and-producers-midyear-2020-update-11509932 (accessed on 22 February 2021).

- Bundesverband der Energie- und Wasserwirtschaft e. V. Fakten und Argumente Wirtschaftliche Auswirkungen der Corona-Epidemie auf die Energiewirtschaft. 2020. Available online: http://ewerk.rewi.hu-berlin.de/doc/corona/20200327_faktenargumente_auswirkungencorona_a8.pdf (accessed on 27 January 2021).

- International Energy Agency. World Energy Outlook 2020; World Energy Outlook, OECD: Paris, France, 2020. [Google Scholar] [CrossRef]

- International Energy Agency. Global Energy Review 2020; OECD: Paris, France, 2020. [Google Scholar] [CrossRef]

- Dorn, F.; Khailaie, S.; Stöckli, M.; Binder, S.; Lange, B.; Vanella, P.; Wollmershäuser, T.; Peichl, A.; Fuest, C.; Meyer-Hermann, M. Das gemeinsame Interesse von Gesundheit und Wirtschaft: Eine Szenarienrechnung zur Eindämmung der Corona- Pandemie|Veröffentlichung|ifo Institut. Ifo Schnelld. Digit. 2020, 6. Available online: https://www.ifo.de/publikationen/2020/article-journal/das-gemeinsame-interesse-von-gesundheit-und-wirtschaft (accessed on 3 November 2020).

- OIES. COVID-19 and The Energy Transition. Oxf. Energy Forum 2020. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2020/07/OEF123.pdf (accessed on 5 November 2020).

- Graf, C.; Quaglia, F.; Wolak, F.A. (Machine) learning from the COVID-19 lockdown about electricity market performance with a large share of renewables. J. Environ. Econ. Manag. 2021, 105, 102398. [Google Scholar] [CrossRef]

- Prol, J.L.; Sungmin, O. Impact of COVID-19 measures on short-term electricity consumption in the most affected EU countries and USA states. Iscience 2020, 23, 101639. [Google Scholar] [CrossRef]

- Cicala, S. Powering Work from Home. SSRN Electr. J. 2020. [Google Scholar] [CrossRef]

- Klobasa, M.; Höfling, H.; Stute, J.; George, J. Mittelfristprognose zur Deutschlandweiten Stromabgabe an Letztverbraucher für die Kalenderjahre 2021 bis 2025. Available online: https://www.netztransparenz.de/portals/1/Content/EEG-Umlage/EEG-Umlage%202021/2020-10-15%20Endbericht%20Fraunhofer%20ISI.pdf (accessed on 3 November 2020).

- Our World in Data. Coronavirus Pandemic (COVID-19). 2020. Available online: https://ourworldindata.org/coronavirus (accessed on 11 November 2020).

- European Central Bank. Euro Foreign Exchange Reference Rates. 2020. Available online: https://www.ecb.europa.eu/stats/policy_and_exchange_rates/euro_reference_exchange_rates/html/eurofxref-graph-gbp.en.html (accessed on 11 November 2020).

- Mantzos, L.; Wiesenthal, T.; Neuwahl, F.; Rózsai, M. The POTEnCIA. Central Scenario. An EU Energy Outlook to 2050; Publications Office of the European Union: Luxembourg, 2019. [Google Scholar] [CrossRef]

- Anke, C.P.; Schönheit, D. What caused 2019’s drop in German carbon emissions : Sustainable transition or short-term market developments? Zeitrschrift Für Energiewirtschaft 2020, 44, 275–284. [Google Scholar] [CrossRef]

- Icha, P.; Kuhs, G. Entwicklung der Spezifischen Kohlendioxid-Emissionen des Deutschen Strommix in den Jahren 1990–2019. 2020. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/1410/publikationen/2020-04-01_climate-change_13-2020_strommix_2020_fin.pdf (accessed on 27 January 2021).

- Hirth, L.; Mühlenpfordt, J.; Bulkeley, M. The ENTSO-E Transparency Platform—A review of Europe’s most ambitious electricity data platform. Appl. Energy 2018, 225, 1054–1067. [Google Scholar] [CrossRef]

| Area | Variable | Source | Unit | Time Resolution |

|---|---|---|---|---|

| Load, electricity generation per type | [7] | MW | Quarter-hours | |

| Germany | Day-ahead prices | [7] | €/MWh | Hours |

| Covid-19 cases | [18] | No. of cases | Days | |

| Load, electricity generation per type | [7] | MW | Hours | |

| France | Day-ahead prices | [7] | €/MWh | Hours |

| Covid-19 cases | [18] | No. of cases | Days | |

| Load, electricity generation per type | [7] | MW | Half-Hours | |

| Great- | Day-ahead prices | [7] | £/MWh | Hours |

| Britain | Covid-19 cases 1 | [18] | No. of cases | Days |

| Exchange rate | [19] | €/£ | Days |

| Statistic | N | Mean | St. Dev. | Min | Pctl(25) | Pctl(75) | Max |

|---|---|---|---|---|---|---|---|

| Load DE | 40,920 | 55,693.8 | 10,034.8 | 31,306.5 | 47,342.1 | 64,479.4 | 77,549.0 |

| Load FR | 40,854 | 53,315.7 | 11,758.3 | 29,398.0 | 44,257.5 | 61,501.0 | 94,492.0 |

| Load GB | 40,914 | 34,517.2 | 7790.6 | 511.0 | 28,574.0 | 40,195.5 | 56,478.5 |

| Price FR | 40,920 | 40.5 | 20.3 | −75.8 | 28.3 | 50.0 | 874.0 |

| Price GB (in EUR) | 40,920 | 50.7 | 23.0 | −38.8 | 39.0 | 59.6 | 1172.6 |

| Price DE | 40,920 | 34.8 | 17.1 | −130.1 | 25.9 | 44.0 | 163.5 |

| DE Biomass | 40,920 | 4547.5 | 550.3 | 0.0 | 4418.5 | 4785.9 | 5040.0 |

| DE Lignite | 40,920 | 12,995.2 | 3860.6 | 0.0 | 10,981.7 | 15,754.3 | 19,168.4 |

| DE Gas | 40,920 | 4423.9 | 2565.8 | 0.0 | 2370.8 | 6166.3 | 14,475.1 |

| DE Hard coal | 40,920 | 6798.6 | 4536.5 | 0.0 | 2720.8 | 10,224.2 | 19,143.2 |

| DE Oil | 40,920 | 320.4 | 189.3 | 0.0 | 195.7 | 439.4 | 3370.1 |

| DE Pumped storage | 40,920 | 1075.2 | 1230.0 | 0.0 | 198.9 | 1521.8 | 8217.4 |

| DE Run of river | 40,920 | 1715.9 | 419.1 | 0.0 | 1449.5 | 1956.5 | 2867.4 |

| DE Reservoir | 40,920 | 107.3 | 78.4 | 0.0 | 52.2 | 138.7 | 768.7 |

| DE Nuclear | 40,920 | 8079.8 | 1709.3 | 0.0 | 6698.3 | 9251.1 | 10,799.0 |

| DE Solar | 40,920 | 4634.0 | 7074.1 | 0.0 | 0.0 | 7455.3 | 32,947 |

| DE Waste | 40,920 | 364.7 | 120.5 | 0.0 | 319.9 | 472.6 | 568.0 |

| DE Wind offshore | 40,920 | 2155.0 | 1604.1 | 0.0 | 711.5 | 3349.8 | 6900.5 |

| DE Wind onshore | 40,920 | 9847.8 | 8224.8 | 0.0 | 3636.1 | 13,617.5 | 40,751.5 |

| FR Biomass | 40,920 | 339.6 | 91.8 | 0.0 | 292.0 | 344.0 | 665.0 |

| FR Gas | 40,920 | 3966.7 | 2471.8 | 0.0 | 2059 | 5859 | 9624 |

| FR Hard coal | 40,920 | 598.2 | 727.8 | 0.0 | 11.0 | 1058 | 2945 |

| FR Oil | 40,920 | 225.6 | 233.9 | 0.0 | 139.0 | 218.0 | 4278 |

| FR Pumped storage | 40,920 | 583.2 | 735.7 | 0.0 | 0.0 | 1038 | 3774 |

| FR Run of river | 40,920 | 4598.8 | 1605.8 | 0.0 | 3313 | 5934 | 11,430 |

| FR Reservoir | 40,920 | 1726.0 | 1057.7 | 0.0 | 937.0 | 2338 | 6143 |

| FR Nuclear | 40,920 | 42,163.6 | 8224.2 | 0.0 | 37,901 | 47,368.8 | 59,237 |

| FR Solar | 40,920 | 1157.5 | 1620.5 | 0.0 | 0.0 | 2079 | 7417 |

| FR Waste | 40,920 | 209.2 | 55.5 | 0.0 | 185.0 | 247.0 | 319.0 |

| FR Wind onshore | 40,920 | 3054.4 | 2377.7 | 0.0 | 1349 | 4026.2 | 12,976 |

| GB Biomass | 40,920 | 1145.0 | 1060.9 | 0.0 | 0.0 | 2083 | 3188 |

| GB Gas | 40,920 | 12,875.7 | 5397.9 | 0.0 | 8801.9 | 16,975.9 | 27,043.5 |

| GB Hard coal | 40,920 | 1752.3 | 2347.7 | 0.0 | 0.0 | 2414.0 | 14,658.0 |

| GB Oil | 40,920 | 0.00 | 0.3 | 0.0 | 0.0 | 0.0 | 52.0 |

| GB Pumped storage | 40,920 | 271.3 | 324.1 | 0.0 | 0.0 | 416.0 | 2180 |

| GB Run of river | 40,920 | 405.8 | 254.4 | 0.0 | 198.5 | 575.5 | 1402.5 |

| GB Nuclear | 40,920 | 6673.4 | 1329.8 | 0.0 | 6050.9 | 7587.1 | 8859.0 |

| GB Solar | 40,920 | 1240.7 | 1893.2 | 0.0 | 0.0 | 2015 | 9544 |

| GB Wind offshore | 40,920 | 1920.3 | 1433.0 | 0.0 | 751.6 | 2833.4 | 6423.1 |

| GB Wind onshore | 40,920 | 2702.7 | 1661.0 | 0.0 | 1314.0 | 3871.9 | 8340.4 |

| ActiveCases | 40,920 | 137.6 | 597.9 | 0.0 | 0.0 | 0.0 | 5121 |

| ActiveCases | 40,920 | 143.9 | 565.1 | 0.0 | 0.0 | 0.0 | 4243 |

| ActiveCases | 40,920 | 191.4 | 743.5 | 0.0 | 0.0 | 0.0 | 4725 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hauser, P.; Schönheit, D.; Scharf, H.; Anke, C.-P.; Möst, D. Covid-19’s Impact on European Power Sectors: An Econometric Analysis. Energies 2021, 14, 1639. https://doi.org/10.3390/en14061639

Hauser P, Schönheit D, Scharf H, Anke C-P, Möst D. Covid-19’s Impact on European Power Sectors: An Econometric Analysis. Energies. 2021; 14(6):1639. https://doi.org/10.3390/en14061639

Chicago/Turabian StyleHauser, Philipp, David Schönheit, Hendrik Scharf, Carl-Philipp Anke, and Dominik Möst. 2021. "Covid-19’s Impact on European Power Sectors: An Econometric Analysis" Energies 14, no. 6: 1639. https://doi.org/10.3390/en14061639