Penalty Electricity Price-Based Optimal Control for Distribution Networks

Abstract

1. Introduction

- We proposed a penalty electricity price mechanism calculated on the basis of the deviation between the actual net power consumption of each user and its optimal dispatching order. The purpose of the penalty electricity price is to guide each user to control its power consumption and generation behaviors in accordance with the optimal dispatching order.

- We developed an optimal control strategy of distribution networks based on the penalty electricity price according to the optimal object, and the implementation process of the control strategy was designed.

- We verified the proposed optimal control based on the penalty electricity price for distribution networks by taking the IEEE-33 node system as an example. The simulation results verified the effectiveness of the proposed penalty electricity price.

- We compared the proposed penalty electricity price mechanism with a credit electricity price by simulating in the IEEE33 node system to prove the advantages of the proposed penalty electricity price.

2. Problem of Traditional Real-Time Pricing

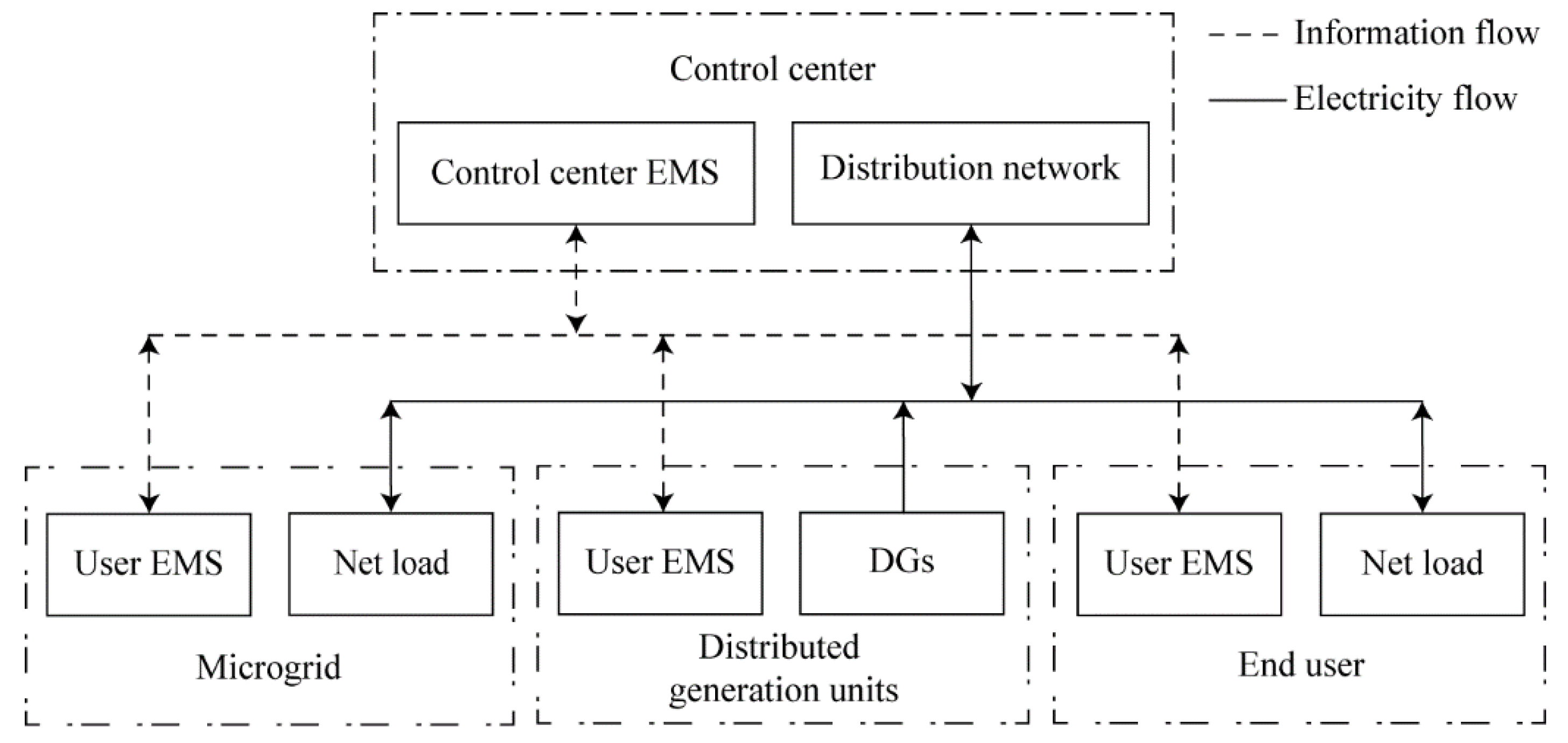

3. Energy Optimal Control System

4. Penalty Electricity Price-Based Optimal Control

4.1. Penalty Electricity Price Mechanism

4.2. Optimal Control for Control Center

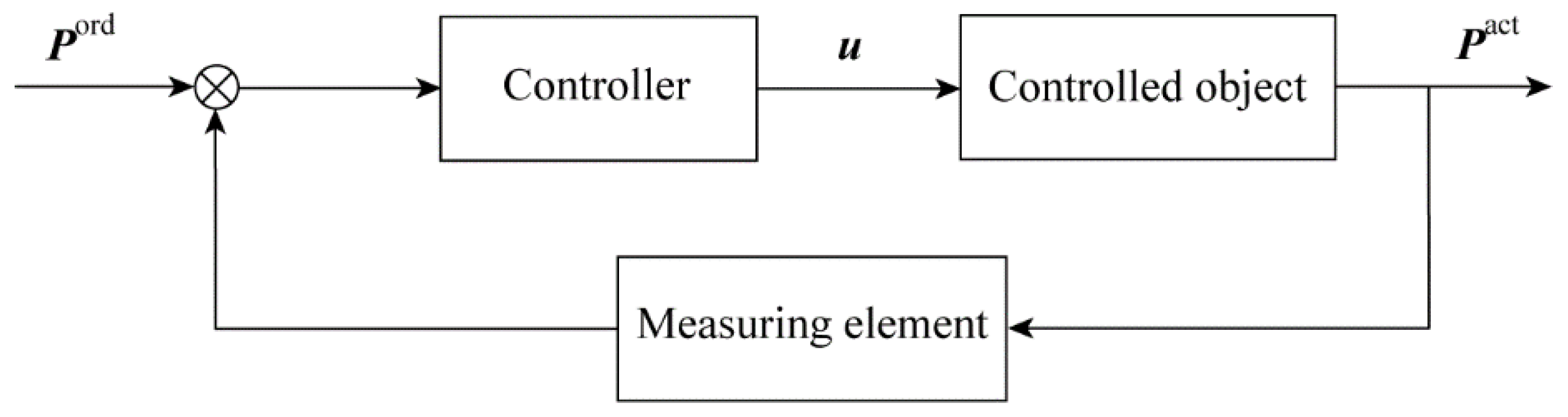

4.3. Optimal Control for Power User

4.4. Optimal Control Algorithm Based on Penalty Electricity Price

- Step 1: Power users made their day-ahead net power load forecast and reported them to the control center.

- Step 2: The control center formulated the day-ahead real-time pricing based on the net power load forecasts of all power users and communicated it to power users in the distribution network.

- Step 3: Power users developed their net power consumption plans over a day and reported them to the control center.

- Step 4: The control center formulated the optimal dispatching order for each power user according to user’s net power consumption plans and provided it to each power user.

- Step 5: The power user controlled its actual power consumption to meet its optimal dispatching order by changing its power consumption patterns and reported its actual power consumption to the control center.

- Step 6: The control center formulated penalty electricity price for each user according to the actual power consumption deviations and transmitted the bills to users.

5. Simulation and Discussion

5.1. Simulation Model of Distribution Networks

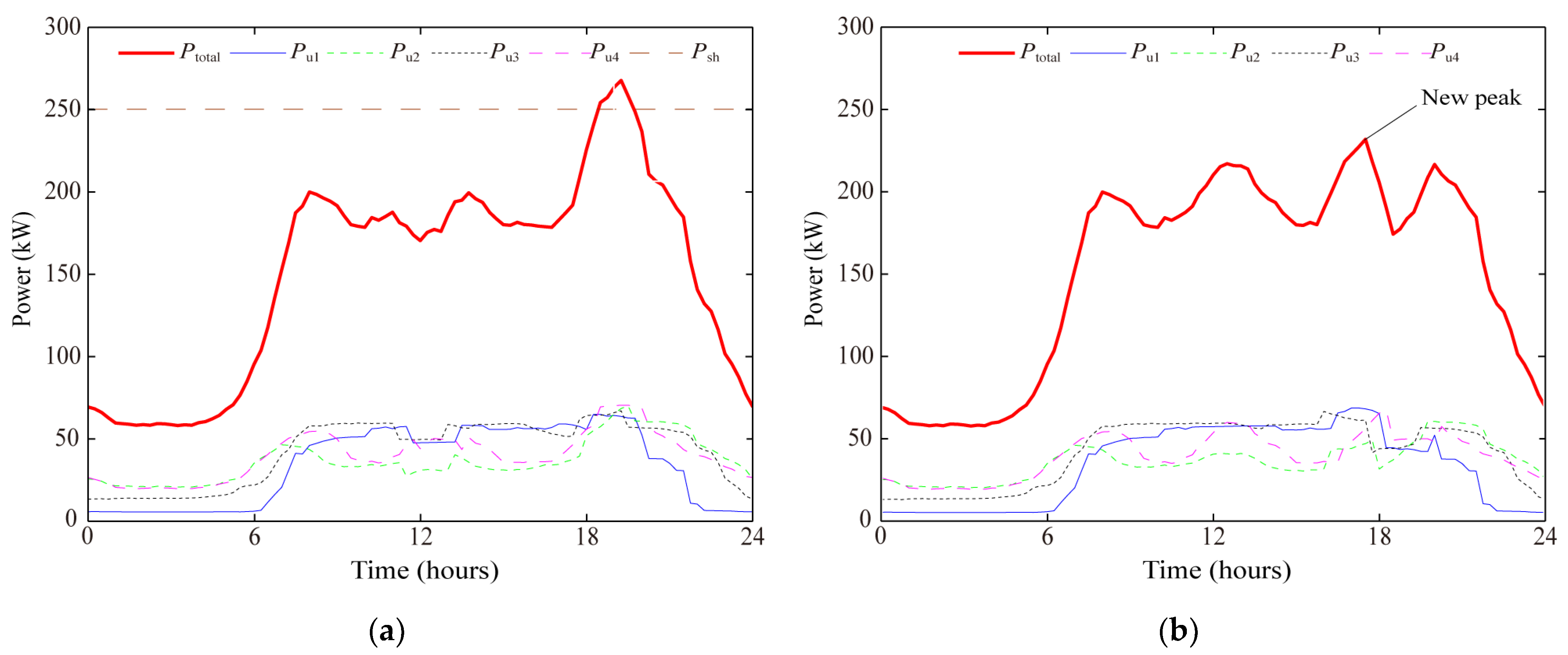

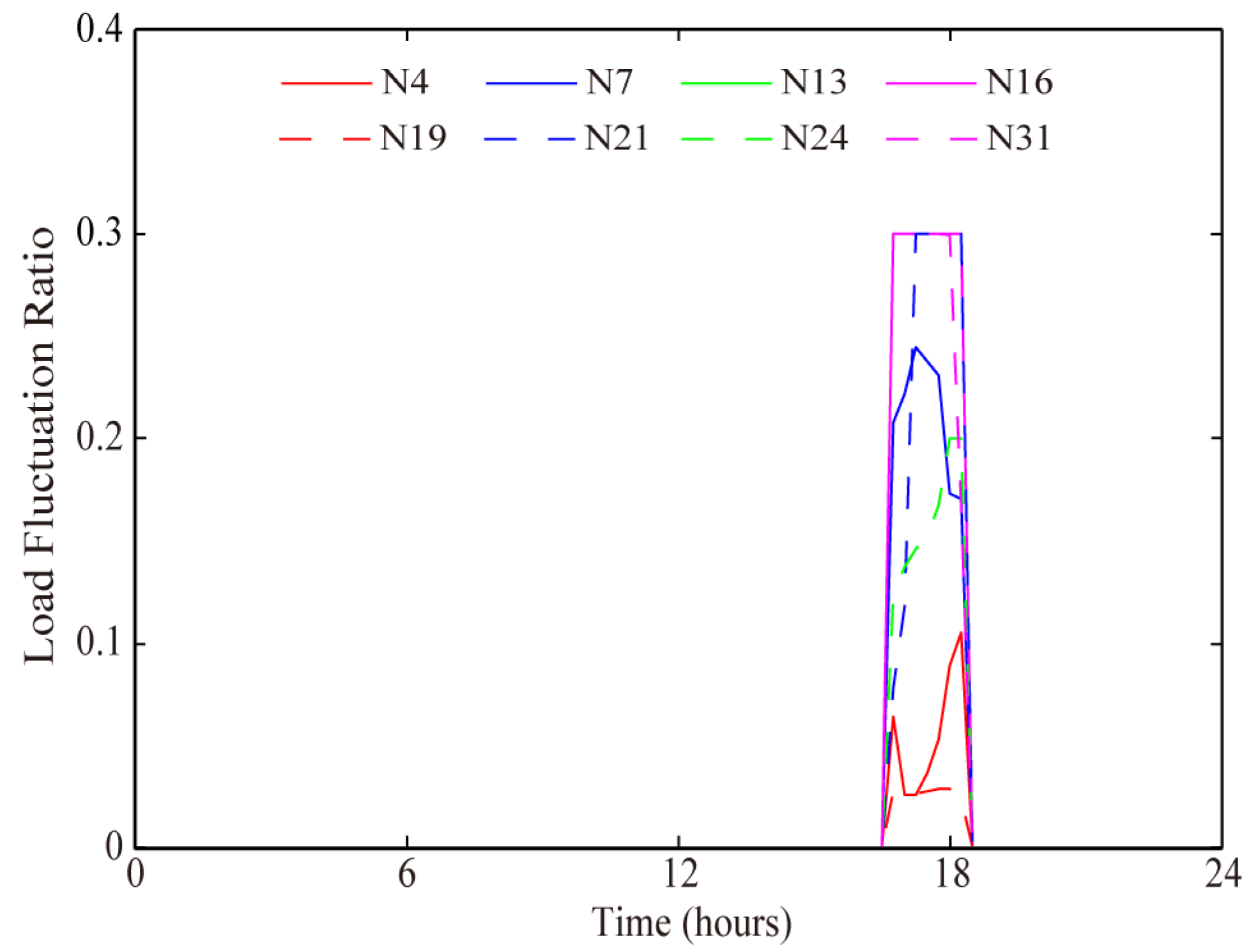

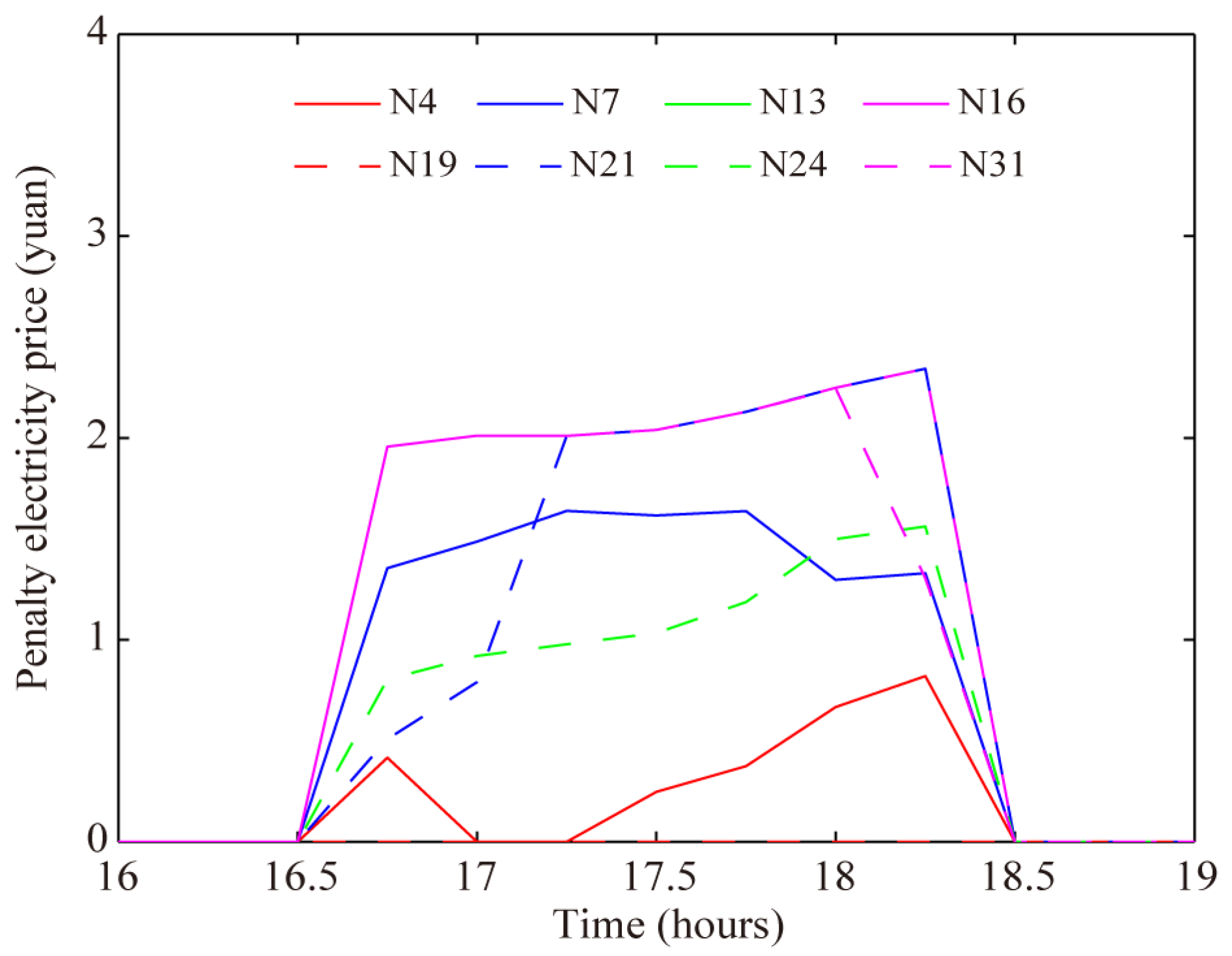

5.2. Simulation of Penalty Electricity Price

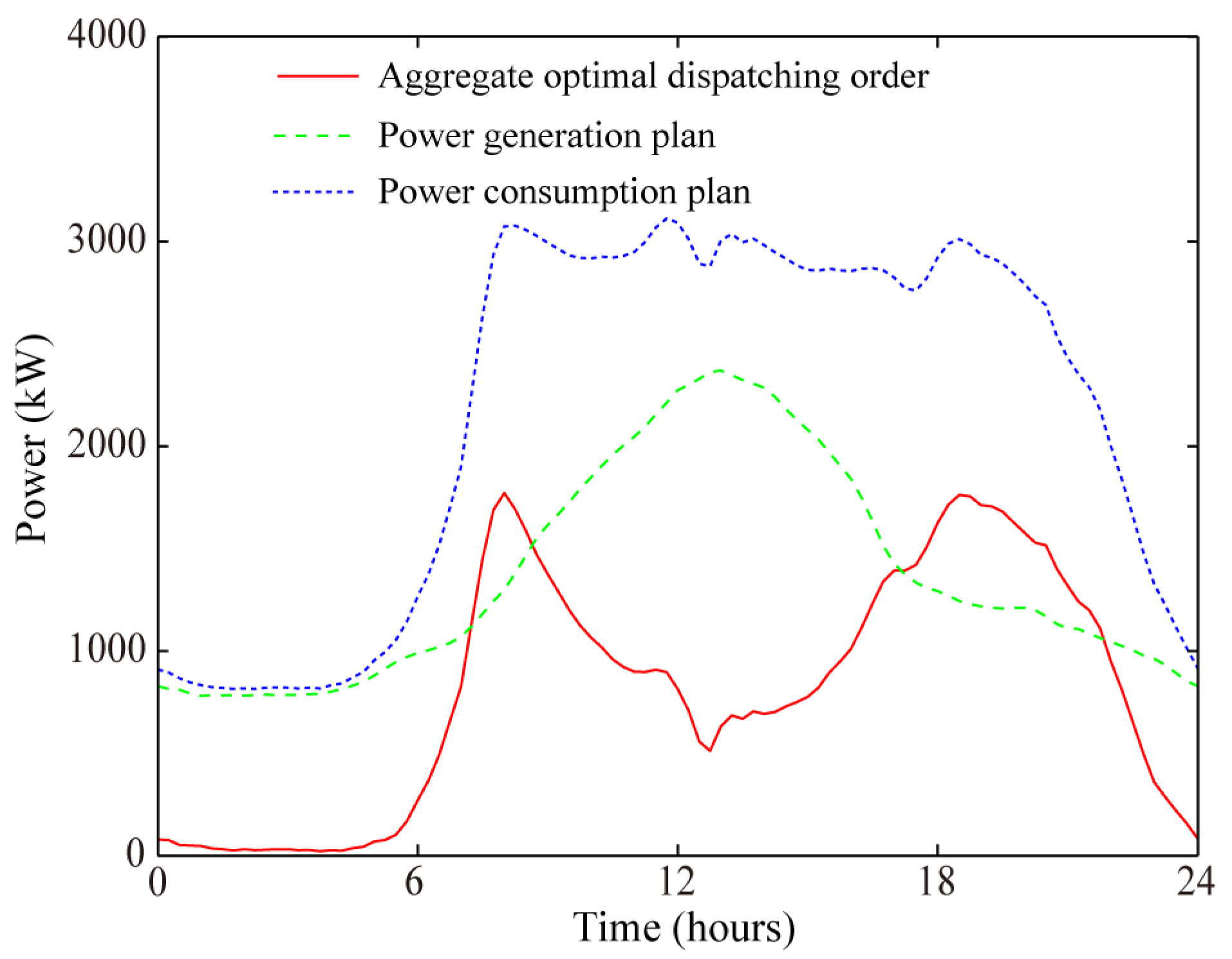

5.3. Simulation of Optimal Control

5.4. Comparison Between Penalty Electricity Price and Credit Electricity Price

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chen, G.; Li, M.; Xu, T.; Liu, M. Study on Technical Bottleneck of New Energy Development. Proc. CSEE 2017, 37, 20–27. [Google Scholar]

- Fu, Y.; Liao, J.; Li, Z.; Qian, X.; Tang, X. Day-Ahead Optimal Scheduling and Operating of Active Distribution Network Considering Violation Risk. Proc. CSEE 2017, 37, 6328–6338. [Google Scholar]

- Joseph, A.; Balachandra, P. Energy Internet, the Future Electricity System: Overview, Concept, Model Structure, and Mechanism. Energies 2020, 13, 4242. [Google Scholar] [CrossRef]

- Liu, Z. Research of Global Clean Energy Resource and Power Grid Interconnection. Proc. CSEE 2016, 36, 5103–5110. [Google Scholar]

- Cao, J.; Zhang, W.; Xiao, Z.; Hua, H. Reactive Power Optimization for Transient Voltage Stability in Energy Internet via Deep Reinforcement Learning Approach. Energies 2019, 12, 1556. [Google Scholar]

- Feng, C.; Liao, X. An Overview of ‘Energy + Internet’ in China. J. Clean. Prod. 2020, 258, 120630. [Google Scholar] [CrossRef]

- Lv, Z.; Kong, W.; Zhang, X.; Jiang, D.; Lv, H.; Lu, X. Intelligent Security Planning for Regional Distributed Energy Internet. IEEE Trans. Ind. Inform. 2020, 16, 3540–3547. [Google Scholar] [CrossRef]

- Wang, Z.; Perera, A.T.D. Integrated Platform to Design Robust Energy Internet. Appl. Energy 2020, 269, 114942. [Google Scholar] [CrossRef]

- Zapf, M.; Blenk, T.; Müller, A.C.; Pengg, H.; Mladenovic, I.; Weindl, C. Lifetime Assessment of PILC Cables with Regard to Thermal Aging Based on a Medium Voltage Distribution Network Benchmark and Representative Load Scenarios in the Course of the Expansion of Distributed Energy Resources. Energies 2021, 14, 494. [Google Scholar] [CrossRef]

- Csányi, G.M.; Tamus, Z.Á.; Varga, Á. Impact of Distributed Generation on the Thermal Ageing of Low Voltage Distribution Cables. In Technological Innovation for Smart Systems. DoCEIS 2017; Camarinha-Matos, L., Parreira-Rocha, M., Ramezani, J., Eds.; IFIP Advances in Information and Communication Technology; Springer: Cham, Switzerland, 2017; Volume 499, pp. 251–258. [Google Scholar]

- Csányi, G.M.; Bal, S.; Tamus, Z.Á. Dielectric Measurement Based Deducted Quantities to Track Repetitive, Short-Term Thermal Aging of Polyvinyl Chloride (PVC) Cable Insulation. Polymers 2020, 12, 2809. [Google Scholar] [CrossRef]

- Wei, B.; Han, X.; Wang, P.; Yu, H.; Guo, L. Temporally Coordinated Energy Management for AC/DC Hybrid Microgrid Considering Dynamic Conversion Efficiency of Bidirectional AC/DC Converter. IEEE Access 2020, 8, 70878–70889. [Google Scholar] [CrossRef]

- Villalón, A.; Rivera, M.; Salgueiro, Y.; Muñoz, J.; Dragičević, T.; Blaabjerg, F. Predictive Control for Microgrid Applications: A Review Study. Energies 2020, 13, 2454. [Google Scholar] [CrossRef]

- Sun, Q.; Teng, F.; Zhang, H. Energy Internet and Its Key Control Issues. Acta Autom. Sin. 2017, 43, 176–194. [Google Scholar]

- Dong, H.; Li, S.; Dong, H.; Tian, Z.; Hillmansen, S. Coordinated Scheduling Strategy for Distributed Generation Considering Uncertainties in Smart Grids. IEEE Access 2020, 8, 86171–86179. [Google Scholar] [CrossRef]

- Sun, Y.; Cai, Z.; Zhang, Z.; Guo, C.; Ma, G.; Han, Y. Coordinated Energy Scheduling of a Distributed Multi-Microgrid System Based on Multi-Agent Decisions. Energies 2020, 13, 4077. [Google Scholar] [CrossRef]

- Shi, X.; Wen, G.; Cao, J.; Yu, X. Model Predictive Power Dispatch and Control with Price-Elastic Load in Energy Internet. IEEE Trans. Ind. Inform. 2019, 15, 775–1787. [Google Scholar] [CrossRef]

- Lan, T.; Jermsittiparsert, K.; Alrashood, S.T.; Rezaei, M.; Al-Ghussain, L.; Mohamed, M.A. An Advanced Machine Learning Based Energy Management of Renewable Microgrids Considering Hybrid Electric Vehicles’ Charging Demand. Energies 2021, 14, 569. [Google Scholar]

- Zafar, R.; Ravishankar, J.; Fletcher, J.E.; Pota, H.R. Optimal Dispatch of Battery Energy Storage System Using Convex Relaxations in Unbalanced Distribution Grids. IEEE Trans. Ind. Inform. 2020, 16, 97–108. [Google Scholar] [CrossRef]

- Zhang, X.; Yang, J.; Wang, W.; Zhang, M.; Jing, T. Integrated Optimal Dispatch of a Rural Micro-Energy-Grid with Multi-Energy Stream Based on Model Predictive Control. Energies 2018, 11, 3439. [Google Scholar] [CrossRef]

- Muqeet, H.A.U.; Ahmad, A. Optimal Scheduling for Campus Prosumer Microgrid Considering Price Based Demand Response. IEEE Access 2020, 8, 71378–71394. [Google Scholar] [CrossRef]

- Alfaverh, F.; Denaï, M.; Sun, Y. Demand Response Strategy Based on Reinforcement Learning and Fuzzy Reasoning for Home Energy Management. IEEE Access 2020, 8, 39310–39321. [Google Scholar] [CrossRef]

- Dinh, H.T.; Yun, J.; Kim, D.M.; Lee, K.; Kim, D. A Home Energy Management System with Renewable Energy and Energy Storage Utilizing Main Grid and Electricity Selling. IEEE Access 2020, 8, 49436–49450. [Google Scholar] [CrossRef]

- Zhang, C.; Wang, S.; Zhao, Q. Distributed Economic MPC for LFC of Multi-Area Power System with Wind Power Plants in Power Market Environment. Int. J. Electr. Power Energy Syst. 2021, 126, 106548. [Google Scholar] [CrossRef]

- Hong, Y.; Taylar, J.V.; Fajardo, A.C. Locational Marginal Price Forecasting in a Day-Ahead Power Market Using Spatiotemporal Deep Learning Network. Sustain. Energy Grids Netw. 2020, 24, 100406. [Google Scholar] [CrossRef]

- Poyrazoglu, G. Determination of Price Zones during Transition from Uniform to Zonal Electricity Market: A Case Study for Turkey. Energies 2021, 14, 1014. [Google Scholar] [CrossRef]

- Zhang, Q.; Hu, Y.; Tan, W.; Lo, C.; Ding, Z. Dynamic Time-of-Use Pricing Strategy for Electric Vehicle Charging Considering User Aatisfaction Degree. Appl. Sci. 2020, 10, 3247. [Google Scholar] [CrossRef]

- Zhou, K.; Wei, S.; Yang, S. Time-of-Use Pricing Model Based on Power Supply Chain for User-Side Microgrid. Appl. Energy 2019, 248, 35–43. [Google Scholar] [CrossRef]

- Hung, Y.; Michailidis, G. Modeling and Optimization of Time-of-Use Electricity Pricing Systems. IEEE Trans. Smart Grid 2019, 10, 4116–4127. [Google Scholar] [CrossRef]

- Yao, L.; Hashim, F.H.; Lai, C. Dynamic Residential Energy Management for Real-Time Pricing. Energies 2020, 13, 2563. [Google Scholar] [CrossRef]

- Tao, L.; Gao, Y. Real-Time Pricing for Smart Grid with Distributed Energy and Storage: A Noncooperative Game Method Considering Spatially and Temporally Coupled Constraints. Int. J. Elect. Power Energy Syst. 2019, 115, 105487. [Google Scholar] [CrossRef]

- Zhang, K.; Hanif, S.; Hackl, C.M.; Hamacher, T. A Framework for Multi-Regional Real-Time Pricing in Distribution Grids. IEEE Trans. Smart Grid 2019, 10, 6826–6838. [Google Scholar] [CrossRef]

- Wang, H.; Gao, Y. Real-Time Pricing Method for Smart Grids Based on Complementarity Problem. J. Mod. Power Syst. Clean Energy 2019, 7, 1280–1293. [Google Scholar] [CrossRef]

- Rasheed, M.B.; Qureshi, M.A.; Javaid, N.; Alquthami, T. Dynamic Pricing Mechanism with the Integration of Renewable Energy Source in Smart Grid. IEEE Access 2020, 8, 16876–16892. [Google Scholar] [CrossRef]

- Baran, M.E.; Wu, F.F. Network Reconfiguration in Distribution Systems for Loss Reduction and Load Balancing. IEEE Trans. Power Deliver. 1989, 4, 1401–1407. [Google Scholar] [CrossRef]

- Sun, M.; Ji, J.; Ampimah, B.C. How to Implement Real-Time Pricing in China? A Solution Based on Power, Credit Mechanism. Appl. Energy 2018, 231, 1007–1018. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pang, Q.; Ye, L.; Gao, H.; Li, X.; Zheng, Y.; He, C. Penalty Electricity Price-Based Optimal Control for Distribution Networks. Energies 2021, 14, 1806. https://doi.org/10.3390/en14071806

Pang Q, Ye L, Gao H, Li X, Zheng Y, He C. Penalty Electricity Price-Based Optimal Control for Distribution Networks. Energies. 2021; 14(7):1806. https://doi.org/10.3390/en14071806

Chicago/Turabian StylePang, Qingle, Lin Ye, Houlei Gao, Xinian Li, Yang Zheng, and Chenbin He. 2021. "Penalty Electricity Price-Based Optimal Control for Distribution Networks" Energies 14, no. 7: 1806. https://doi.org/10.3390/en14071806

APA StylePang, Q., Ye, L., Gao, H., Li, X., Zheng, Y., & He, C. (2021). Penalty Electricity Price-Based Optimal Control for Distribution Networks. Energies, 14(7), 1806. https://doi.org/10.3390/en14071806