4.2. Economic Activities and Employment Opportunities in FARM communities

Mobilization of agricultural residues in farm communities as a feedstock to produce pellets will generate economic activities, mainly in the upstream ag-pellet logistics systems, including equipment manufacturing and dealership, field operations, storage and handling and transportation. These economic activities will create revenues for crop growers, custom harvest groups, transportation companies and equipment manufacturers and dealers.

The average annual revenues that can be potentially generated for three main players in the biomass logistics system, including crop growers, custom harvest groups and the transportation companies, are shown in

Figure 8. New incomes for crop growers include the sale of crop residues and the bale storage. Crop growers can use a portion of their farmlands to store bales for pellet plants, as there is limited land for pellet plants to store enough bales on-site for 1–2 weeks of operations. As shown in

Figure 8, on average, crop growers have the potential to generate about CAD 1.15 and CAD 0.28 million from annual sale of crop residues and bale storage in each region, respectively.

The average annual income from field operations including baling and bale collection and stacking for each region is estimated to be about CAD 1.62 million per year. This income can be earned either by local crop growers or custom harvest companies. Local growers can use the harvest equipment that they already own for harvesting and collecting hay or other biomass types if there is no conflict in the harvest seasons of their crops. Another player that can generate incomes is transportation companies, by providing bale handling and transportation services. The estimated annual income by transportation companies is about CAD 0.59 million in each region.

As shown in

Figure 9, total generated revenues in the biomass logistics system in all six case studies are estimated to be about CAD 21.80 million annually. Crop growers, custom harvest groups and transportation companies can potentially gain a share of 40%, 44% and 16% of the total annual generated revenues, respectively.

In addition to the potential new incomes for the logistics players, increasing demand for biomass will likely result in rising demands for logistics equipment. In each region under study, about 47 pieces of equipment will be needed including 12 square balers, 10 bale collectors, 17 tractors, 3 loaders and 5 trucks with flatbed trailers. The total economic value of these pieces of equipment, if assumed brand-new, is about CAD 9.30 million. Regardless of what portion of equipment demand is met through the existing fleet and/or the brand-new fleet, the utilization of this large number of logistics equipment will create jobs and wealth in the equipment manufacturing and dealership networks. In addition, this number of equipment fleet needs 30 operators to run them. These operators can make an income of over CAD 0.36 million by running the logistics equipment to harvest, collect, handle and transport crop residues to the pellet plant.

Overall, in all six case studies, it is estimated that 278 pieces of logistics equipment with a total economic value of CAD 55.81 million will be needed to meet the annual biomass demand of the six pellet plants. The logistics equipment fleet needs 176 local operators with a potential total annual income of about CAD 2.18 million.

4.4. Pellet Price at the Port of Delivery

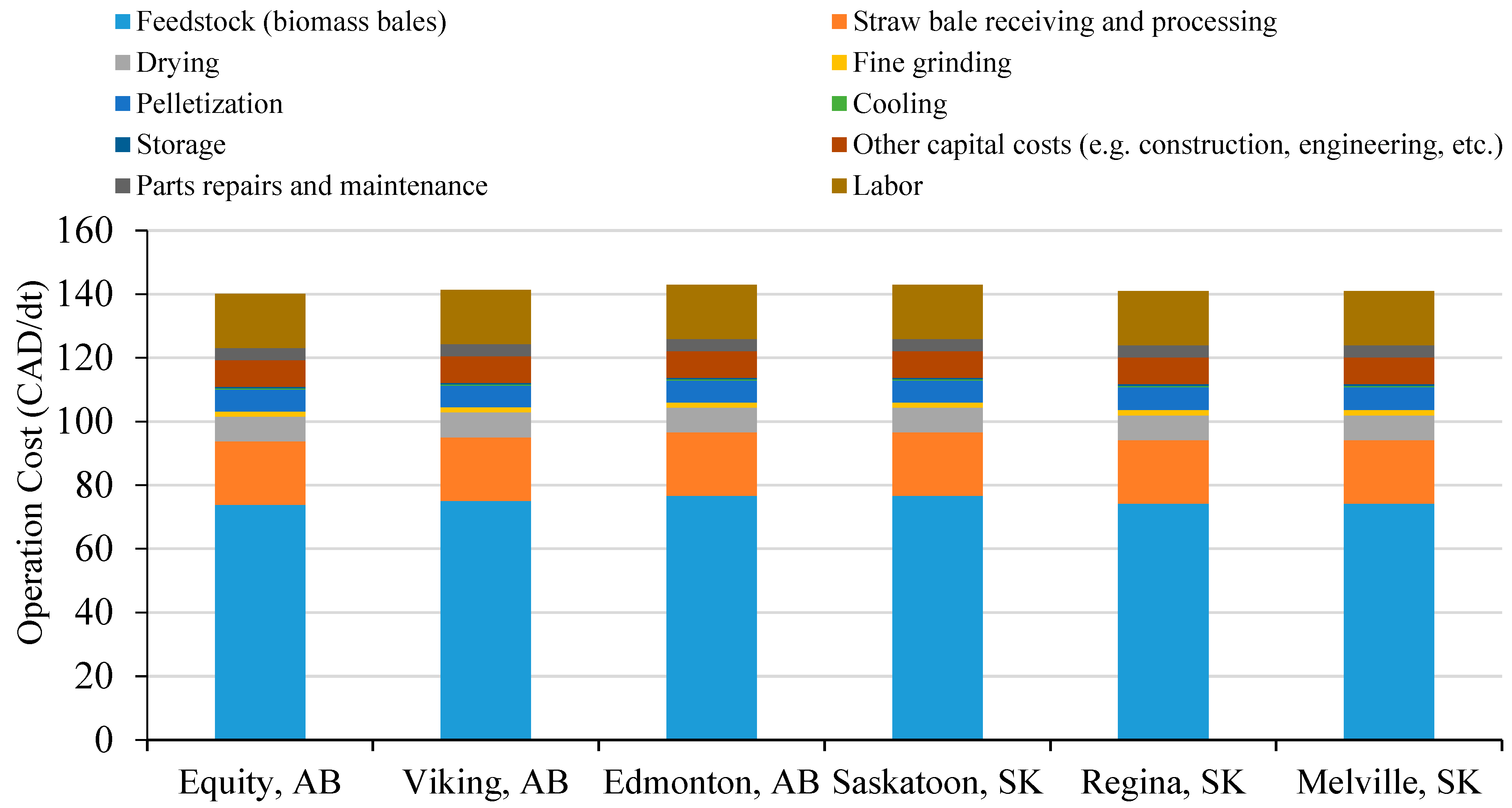

The ag-pellet production costs in

Figure 10 do not include the profit margin for the pellet producers. The minimum selling price (MESP) (CAD/tonne) is used in this study to estimate the ag-pellet price, including the profit margin. MESP of ag-pellet at the gate of the pellet plant was calculated for each region in order to obtain a net present value (NPV) of zero for a 15% internal rate of return (IRR) (before tax) on the full capital cost of CAD 5.75 million. As shown in

Table 3, the average MESP of ag-pellets is estimated to be CAD 150/tonne, assuming the average annual inflation rate of 1.57% and pellet price annual escalator of 2.5%, as shown in

Table A3 in the

Appendix A.

Table 4 shows the estimated rail transportation costs between the location of ag-pellet plants and the port terminal at the Port of Vancouver, given the transportation distances given in

Table 2. In addition to the transportation distance, type of railcar, demands for railcar in origin and destination points, the rail traffic on the rail routes between the origin and destination points and fuel cost impact the rail transportation cost. The estimated transportation costs in

Table 4 include all related fees, such as railcar rentals and insurance, railcar pull charge, fuel surcharge, and carbon tax charged on the use of fossil fuel to run the locomotives. The rail transport costs do not include additional capital investments in rail infrastructure that might be needed at the ag-pellet plants to connect to the rail mainlines.

Ag-pellets are stored in the port terminal until the arrival of an ocean vessel. Similar to wood pellets, ag-pellets are loaded directly from storage silos into the vessel cargo. The ocean vessel then ships and delivers the ag-pellets to one of the three major ports in the Netherlands (Rotterdam, Amsterdam and Antwerp, known as ARA).

Table 5 shows the breakdown of average ag-pellet price from the six locations in Alberta and Saskatchewan to ARA. The CIF ag-pellet price from the six ag-pellet plants to ARA is estimated to be in a range of CAD 260–290/tonne. There is a cost associated with currency risk that adds to the price of ag-pellets at the port of delivery to hedge this risk. Given the fluctuation in EUR/CAD in 2020 [

56], the estimated CIF ag-pellet price range could increase from CAD 260–290/tonne to CAD 274–305/tonne.

Most of the industrial pellets exchanged between North America and Western Europe are traded under long-term price contracts. The contract prices have varied between EUR 131–182/tonne (CAD 196–272/tonne), with an average price of EUR 143/tonne (CAD 214/tonne) over the period of 2012–2017 [

10]. The consideration of external shocks such as fluctuation in the exchange rate makes produced ag-pellets from the six locations more expensive than the historical price of wood pellets at the port of discharge over the period of 2012–2017, as shown in

Table 5. In case of the wood pellet price at EUR 131/tonne (lower bound of price range), the price of ag-pellets at the six locations are estimated to be 40–55% more expensive. Assuming the wood pellet price at EUR 182/tonne (upper bound of price range), the price of ag-pellets at the six locations is estimated to be 1–12% more expensive. Comparing with the average price of wood pellet at EUR 143/tonne, the price of ag-pellets at the six locations is estimated to be 29–42% more expensive.

Given the historical contract price of wood pellets in Western Canada, the supply chain costs of agricultural pellets need to be reduced to be able to supplement wood pellets in the growing global biomass demand for bioenergy production. There are several potential areas where the cost of ag-pellets can be reduced across its supply chain.

On the biomass supply side, more farmers involved as suppliers of agricultural residues to the pellet plant result in a smaller biomass supply area. Smaller biomass supply areas with high biomass availability can lead to the reduction in the operating costs of field operations and transportation. The distance and travel time of the field equipment including balers, bale collectors and loaders moving between crop fields during the harvest season would be reduced in a smaller supply area. This would improve their operational efficiency and lower their operating costs. In addition, smaller supply areas decrease the transportation distances between crop fields and the pellet plant. The ag-pellet plant should develop a biomass supply contract that encourages as many crop growers as possible to supply their crop residues to the pellet plant. As shown in

Figure 9, crop growers have the potential to generate an annual income of over CAD 8.5 million in the upstream biomass logistics system of ag-pellet production in the six locations under study.

On the ag-pellet production side, the optimal size of ag-pellet production capacity can contribute to the reduction of the costs associated with ag-pellet production and downstream operations. Large pellet plants can exploit the economics of scale and reduce the capital cost of ag-pellet production per tonne. In addition, larger pellet plants can transport larger quantities of ag-pellets using more railcars per trip to the port terminals. The faster the storage silos build up the ag-pellet inventories, the faster the ag-pellet plant can ship its product to global traders and buyers. This enables the ag-pellet plant to move toward a just-in time supply chain that can potentially reduce the inventory, handling, and rail and ocean transportation costs. However, the cost reduction in the production and distribution of ag-pellets should offset the potential increase in biomass delivered costs, as larger pellet plants need to secure their biomass from larger supply areas.

The optimal location of the ag-pellet plant with short transportation distance from port terminals can also contribute to the reduction of ag-pellet supply chain costs. As shown in

Table 5, about 18–26% of the price of the ag-pellets were estimated to be rail transportation costs from the pellet plant to the port terminals. In addition, the distance of the pellet plant from the market can also contribute to the reduction of ag-pellet delivery cost to end users. In this study, Western Europe was selected as the potential market, while the ag-pellets can be considered for the emerging markets such as Japan and South Korea, with shorter distances from the six pellet plants compared to Western Europe. Over 15% of the price of the ag-pellets was estimated to be shipping cost.

Another cost reduction potential is the drying operation at the pellet plant. Drying is usually a capital-intensive operation with a high operating cost. This operation requires the purchase and installation of several pieces of equipment and usually consumes a large amount of energy. As shown in

Figure 10, drying contributes about CAD 7/tonne to the pellet production cost. Depending on the type of agricultural biomass, the timing of the harvest and weather conditions as well as the biomass storage practices, the moisture content of delivered bales to the pellet plant can fall within an acceptable range that does not need drying or needs a low intensive drying operation. Field drying and various storage regimes (e.g., outdoors, outdoors and under tarp, under roof, and in airtight wrapping) have been studies in the literature to investigate their impacts on moisture content, dry matter loss and the self-heating of agricultural biomass [

58,

59,

60,

61]. A cost–benefit analysis can be considered in future studies to identify the least-cost scenario for drying agricultural biomass for a pellet plant, considering the initial moisture content of agricultural biomass in the field, weather conditions during the harvest season, the cost of the storage regime, and the drying cost of agricultural biomass at the pellet plant.

The supporting policies by local, provincial and federal governments can also contribute to the reduction of ag-pellet production costs, by providing financial programs such as tax relief/breaks, grants and loan guarantees to buy down the capital costs, compensation for depreciation of production and supply chain assets. Such financial programs can encourage investment in the establishment of pioneering ag-pellet plants. These financial programs can be justified by the significant potential of economic activities and employment generated in farm communities. As discussed in

Section 4.2, the establishment of six ag-pellet plants with a combined capacity of 30 tonnes/hr and a total estimated capital cost of CAD 34.5 million can lead to the generation of an annual income of CAD 21.7 million in farm communities and the employment of 176 operators who run the biomass logistics operations. It is noteworthy that such supporting programs and financial incentives must be in line with the terms of international agreements, such as the Comprehensive Economic and Trade Agreement (CETA), a free-trade agreement between Canada and the European Union.

However, it is noteworthy that the lower quality of agricultural biomass (high level of ash, nitrogen, sulfur, potassium and chlorine [

15,

17]) compared to woody biomass may require extra pre-processing operations, such as leaching, blending and binding agents at the pellet plant, to meet the national and international quality standards and requirements to be able to access the existing bioenergy markets. The possible additional steps at the pellet plant likely result in higher ag-pellet production cost. The need for pre-processing operations at the ag-pellet plants depend on the physical and chemical properties of agricultural biomass used in the production of ag-pellets and the quality specifications of the end users. The need for extra pre-processing operations and their impact on the ag-pellet cost and price can be investigated in future studies.