Revisiting Environmental Kuznets Curve in Relation to Economic Development and Energy Carbon Emission Efficiency: Evidence from Suzhou, China

Abstract

:1. Introduction

2. Literature Review

3. Methodology

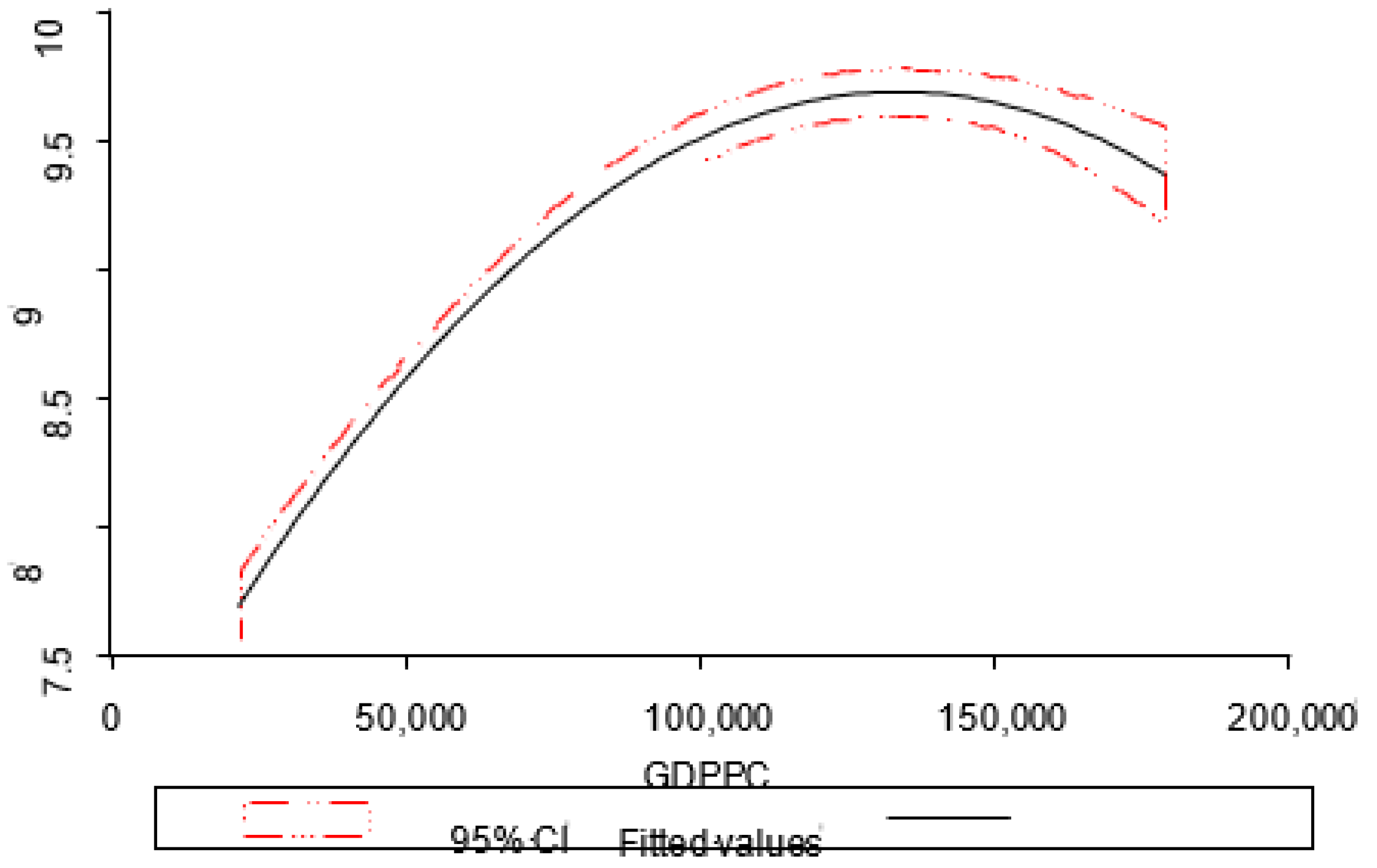

3.1. Establishment of the Empirical Model

3.2. Variable Selection and Data Sources

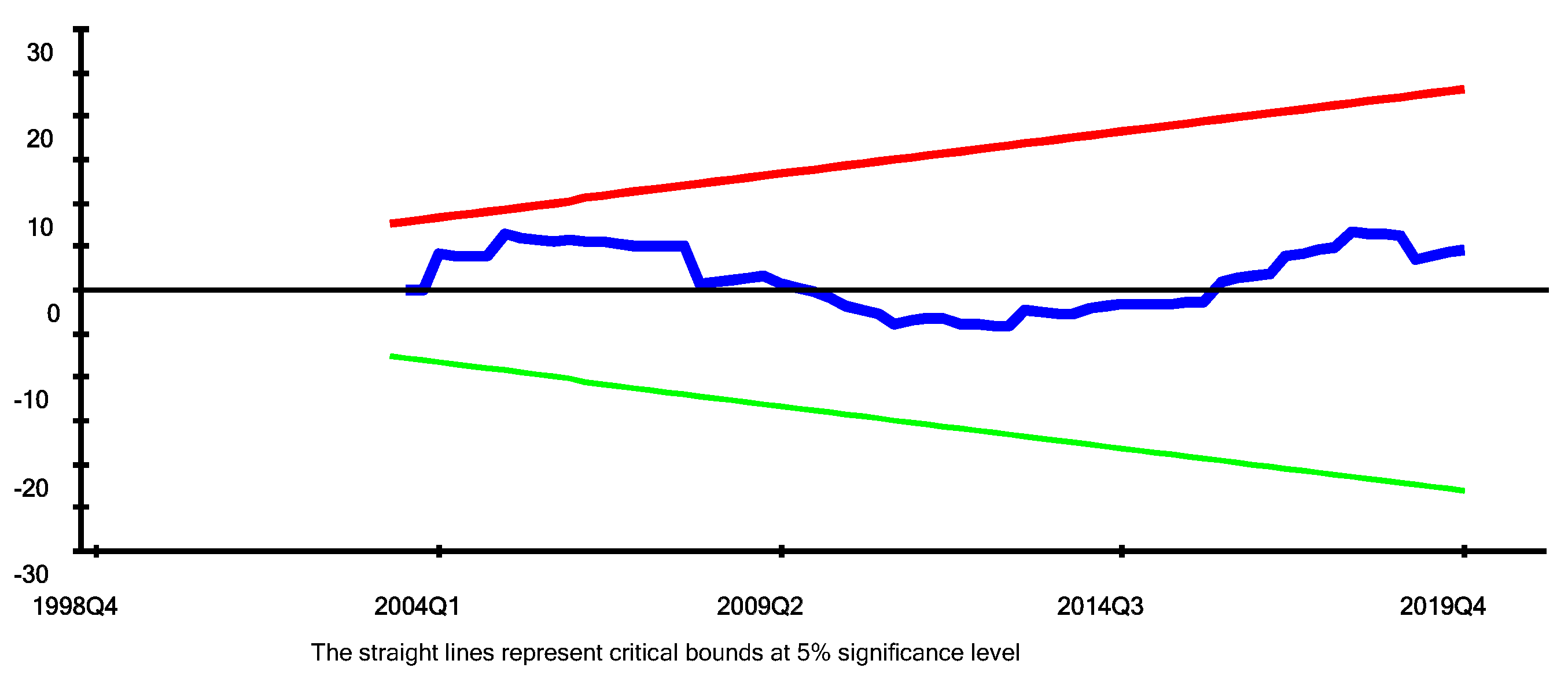

3.3. Standard Autograssive Distributed Lag Bounds Testing Approach to Cointegration

3.4. Asymmetric ARDL Model

4. Empirical Analysis

4.1. Unit Root Test

4.2. Empirical Findings from Standard ARDL Model

4.3. Empirical Findings from Asymmetric ARDL Model

5. Conclusions and Countermeasures

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Fan, J.-L.; Wang, Q.; Yu, S.; Hou, Y.-B.; Wei, Y.-M. The evolution of CO2 emissions in international trade for major economies: A perspective from the global supply chain. Mitig. Adapt. Strateg. Glob. Chang. 2017, 22, 1229–1248. [Google Scholar] [CrossRef]

- Nicholson-Cole, S.A. Representing climate change futures: A critique on the use of images for visual communication. Comput. Environ. Urban Syst. 2005, 29, 255–273. [Google Scholar] [CrossRef]

- Ang, J.B. CO2 emissions, research and technology transfer in China. Ecol. Econ. 2009, 68, 2658–2665. [Google Scholar] [CrossRef] [Green Version]

- Lu, J.; Vecchi, G.A.; Reichler, T. Correction to “Expansion of the Hadley cell under global warming”. Geophys. Res. Lett. 2007, 34, L14808. [Google Scholar] [CrossRef]

- Houghton, J.T.; Ding, Y.; Griggs, D.J.; Noguer, M.; van der Linden, P.J.; Dai, X.; Maskell, K.; Johnson, C. Climate Change 2001: The Scientific Basis; The Press Syndicate of the University of Cambridge: Cambridge, UK, 2001. [Google Scholar]

- Kind, V. Pedagogical content knowledge in science education: Perspectives and potential for progress. Stud. Sci. Educ. 2009, 45, 169–204. [Google Scholar] [CrossRef] [Green Version]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef] [Green Version]

- Lau, L.-S.; Choong, C.-K.; Ng, C.-F. Role of institutional quality on environmental Kuznets curve: A comparative study in developed and developing countries. In Advances in Pacific Basin Business, Economics and Finance; Emerald Publishing Limited: Bentley, UK, 2018. [Google Scholar]

- Sohag, K.; Kalugina, O.; Samargandi, N. Re-visiting environmental Kuznets curve: Role of scale, composite, and technology factors in OECD countries. Environ. Sci. Pollut. Res. 2019, 26, 27726–27737. [Google Scholar] [CrossRef] [PubMed]

- Zhao, X.; Burnett, J.W.; Fletcher, J.J. Spatial analysis of China province level CO2 emission intensity. Renew. Sustain. Energy Rev. 2014, 33, 1–10. [Google Scholar] [CrossRef] [Green Version]

- Omri, A. CO2 emissions, energy consumption and economic growth nexus in MENA countries: Evidence from simultaneous equations models. Energy Econ. 2013, 40, 657–664. [Google Scholar] [CrossRef] [Green Version]

- Sohag, K.; Al Mamun, M.; Uddin, G.S.; Ahmed, A.M. Sectoral output, energy use, and CO2 emission in middle-income countries. Environ. Sci. Pollut. Res. 2017, 24, 9754–9764. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Salahuddin, M.; Alam, K.; Ozturk, I.; Sohag, K. The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Rev. 2018, 81, 2002–2010. [Google Scholar] [CrossRef] [Green Version]

- Samargandi, N. Sector value addition, technology and CO2 emissions in Saudi Arabia. Renew. Sustain. Energy Rev. 2017, 78, 868–877. [Google Scholar] [CrossRef]

- Lotfalipour, M.R.; Falahi, M.A.; Ashena, M. Economic growth, CO2 emissions, and fossil fuels consumption in Iran. Energy 2010, 35, 5115–5120. [Google Scholar] [CrossRef]

- Ang, J.B. Financial development, liberalization and technological deepening. Eur. Econ. Rev. 2011, 55, 688–701. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. Modeling and forecasting the CO2 emissions, energy consumption, and economic growth in Brazil. Energy 2011, 36, 2450–2458. [Google Scholar] [CrossRef]

- Caviglia-Harris, J.L.; Chambers, D.; Kahn, J.R. Taking the “U” out of Kuznets: A comprehensive analysis of the EKC and environmental degradation. Ecol. Econ. 2009, 68, 1149–1159. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. CO2 emissions, energy consumption and economic growth in Turkey. Renew. Sustain. Energy Rev. 2010, 14, 3220–3225. [Google Scholar] [CrossRef]

- Ahmed, A.; Uddin, G.S.; Sohag, K. Biomass energy, technological progress and the environmental Kuznets curve: Evidence from selected European countries. Biomass Bioenergy 2016, 90, 202–208. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Adams, S. Renewable energy, nuclear energy, and environmental pollution: Accounting for political institutional quality in South Africa. Sci. Total Environ. 2018, 643, 1590–1601. [Google Scholar] [CrossRef]

- Saboori, B.; Sapri, M.; bin Baba, M. Economic growth, energy consumption and CO2 emissions in OECD (Organization for Economic Co-operation and Development)’s transport sector: A fully modified bi-directional relationship approach. Energy 2014, 66, 150–161. [Google Scholar] [CrossRef]

- Sephton, P.; Mann, J. Compelling evidence of an environmental Kuznets curve in the United Kingdom. Environ. Resour. Econ. 2016, 64, 301–315. [Google Scholar] [CrossRef]

- Ekins, P. The Kuznets curve for the environment and economic growth: Examining the evidence. Environ. Plan. A 1997, 29, 805–830. [Google Scholar] [CrossRef] [Green Version]

- Dietz, S.; Adger, W.N. Economic growth, biodiversity loss and conservation effort. J. Environ. Manag. 2003, 68, 23–35. [Google Scholar] [CrossRef]

- Roca, J.; Padilla, E.; Farré, M.; Galletto, V. Economic growth and atmospheric pollution in Spain: Discussing the environmental Kuznets curve hypothesis. Ecol. Econ. 2001, 39, 85–99. [Google Scholar] [CrossRef] [Green Version]

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Ahmed, S.; Alam, K.; Sohag, K.; Gow, J.; Rashid, A.; Akter, M. Renewable and non-renewable energy use and its relationship with economic growth in Myanmar. Environ. Sci. Pollut. Res. 2019, 26, 22812–22825. [Google Scholar] [CrossRef]

- Bella, G.; Massidda, C.; Mattana, P. The relationship among CO2 emissions, electricity power consumption and GDP in OECD countries. J. Policy Model. 2014, 36, 970–985. [Google Scholar] [CrossRef]

- Li, M.; Sun, H.; Agyeman, F.O.; Heydari, M.; Jameel, A.; Salah ud din Khan, H. Analysis of Potential Factors Influencing China’s Regional Sustainable Economic Growth. Appl. Sci. 2021, 11, 10832. [Google Scholar] [CrossRef]

- Alam, M.M.; Murad, M.W.; Noman, A.H.M.; Ozturk, I. Relationships among carbon emissions, economic growth, energy consumption and population growth: Testing Environmental Kuznets Curve hypothesis for Brazil, China, India and Indonesia. Ecol. Indic. 2016, 70, 466–479. [Google Scholar] [CrossRef]

- Alkhathlan, K.; Javid, M. Energy consumption, carbon emissions and economic growth in Saudi Arabia: An aggregate and disaggregate analysis. Energy Policy 2013, 62, 1525–1532. [Google Scholar] [CrossRef]

- Al Mamun, M.; Sohag, K.; Samargandi, N.; Yasmeen, F. Does remittance fuel labour productivity in Bangladesh? The application of an asymmetric non-linear ARDL approach. Appl. Econ. 2016, 48, 4861–4877. [Google Scholar] [CrossRef]

- Shan, Y.; Guan, D.; Liu, J.; Mi, Z.; Liu, Z.; Liu, J.; Schroeder, H.; Cai, B.; Chen, Y.; Shao, S. Methodology and applications of city level CO2 emission accounts in China. J. Clean. Prod. 2017, 161, 1215–1225. [Google Scholar] [CrossRef] [Green Version]

- Alcántara, V.; Padilla, E. Input–output subsystems and pollution: An application to the service sector and CO2 emissions in Spain. Ecol. Econ. 2009, 68, 905–914. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econom. J. Econom. Soc. 1991, 1551–1580. [Google Scholar] [CrossRef]

- Wang, K.-M. Modelling the nonlinear relationship between CO2 emissions from oil and economic growth. Econ. Model. 2012, 29, 1537–1547. [Google Scholar] [CrossRef]

- Wu, L.; Kaneko, S.; Matsuoka, S. Driving forces behind the stagnancy of China’s energy-related CO2 emissions from 1996 to 1999: The relative importance of structural change, intensity change and scale change. Energy Policy 2005, 33, 319–335. [Google Scholar] [CrossRef]

- Al Mamun, M.; Sohag, K.; Shahbaz, M.; Hammoudeh, S. Financial markets, innovations and cleaner energy production in OECD countries. Energy Econ. 2018, 72, 236–254. [Google Scholar] [CrossRef] [Green Version]

- Wagner, M. The carbon Kuznets curve: A cloudy picture emitted by bad econometrics? Resour. Energy Econ. 2008, 30, 388–408. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Watson, M.W. Vector autoregressions and cointegration. Handb. Econom. 1994, 4, 2843–2915. [Google Scholar]

- Frimpong Magnus, J.; Oteng-Abayie, E.F. Bounds testing approach: An examination of foreign direct investment, trade, and growth relationships. Am. J. Appl. Sci. 2006. Available online: https://ssrn.com/abstract=927169 (accessed on 10 October 2021).

- Sohag, K.; Taşkın, F.D.; Malik, M.N. Green economic growth, cleaner energy and militarization: Evidence from Turkey. Resour. Policy 2019, 63, 101407. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt; Springer: Berlin/Heidelberg, Germany, 2014; pp. 281–314. [Google Scholar]

- Najarzadeh, R.; Reed, M.; Tasan, M. Relationship between savings and economic growth. The case for Iran. J. Int. Bus. Econ. 2014, 2, 107–124. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M.H.; Shin, Y. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis. Available online: https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.153.3246&rep=rep1&type=pdf (accessed on 30 June 2021).

- Duffy, F.H.; Bartels, P.H.; Burchfiel, J.L. Significance probability mapping an aid in the topographic analysis of brain electrical activity. Electroencephalogr. Clin. Neurophysiol. 1981, 51, 455–462. [Google Scholar] [CrossRef]

| Variables | Levels | 1st Diff | Conclusion | Order of Integration |

|---|---|---|---|---|

| LnCo2E | −2.962 ** | −3.63 ** | Stationary | 1(0) |

| LnGDPPC | −2.275 | −4.931 *** | Non-Stationary | 1(1) |

| LnGDPPC2 | −2.28 | −3.42 * | Non-Stationary | 1(1) |

| LIPGDP | 2.95 ** | −3.23 ** | Stationary | 1(0) |

| LEU | −2.29 | −3.36 ** | Non-Stationary | 1(1) |

| LL | −1.12 | −5.80 *** | Non-stationary | 1(1) |

| LTO | −2.87 * | −4.46 *** | Stationary | 1(0) |

| Dependent Variable | F-Statistics | Outcome |

|---|---|---|

| Co2E (Co2E|LGDPPC, LGDPPC2, LL, LIPGDP, LEU, LTO) | 5.85 | Cointegration |

| LGDPPC (LGDPPC|Co2E, LGDPPC2, LL, LIPGDP, LEU, LTO) | 18.04 | Cointegration |

| LGDPPC2 (LGDPPC2|Co2E, LGDPPC, LL, LIPGDP, LEU, LTO) | 6.48 | Cointegration |

| LIPGDP (LIPGDP|Co2E, LGDPPC, LGDPPC2, LL, LEU, LTO) | 5.78 | Cointegration |

| LL (LL|Co2E, LGDPPC, LGDPPC2, LIPGDP, LEU, LTO) | 4.61 | Cointegration |

| LEU (LEU|Co2E, LGDPPC, LGDPPC2, LIPGDP, LL, LTO) | 19.96 | Cointegration |

| LTO (LEU|Co2E, LGDPPC, LGDPPC2, LIPGDP, LL, LEU) | 2.47 | No-Cointegration |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| LNCO2E(t−1) | −0.4824 *** | 0.1303 | −3.7010 | 0.0024 |

| LPCGDP(t−1) | 0.9042 ** | 0.3662 | 2.4687 | 0.0270 |

| LGDPPCSQ(t−1) | −0.1708 * | 0.0626 | −2.7278 | 0.0721 |

| LL(t−1) | −0.4829 | 1.8539 | −0.2604 | 0.7983 |

| LTO(t−1) | 0.4348 * | 0.1835 | 2.3695 | 0.0985 |

| LEU(t−1) | 0.3352 | 1.3515 | 0.2480 | 0.8077 |

| IPGDP(t−1) | 0.0397 *** | 0.0077 | 5.1234 | 0.0002 |

| Short-run coefficients | ||||

| ∆LGDPPC | 13.122 *** | 1.5839 | 8.2849 | 0.0001 |

| ∆LGDPPCSQ | −0.213 *** | 0.0128 | −16.6540 | 0.0000 |

| ∆LL | −0.213 *** | 0.0826 | −2.5863 | 0.0361 |

| ∆LTO | 0.699 *** | 0.0841 | 8.3060 | 0.0001 |

| ∆IPGDP | −0.044 *** | 0.0046 | −9.4121 | 0.0000 |

| ∆LEU | 1.942 *** | 0.2964 | 6.5545 | 0.0003 |

| CointEq(−1) * | −0.482 *** | 0.0372 | −12.9622 | 0.0000 |

| EC = LNCO2E − (−0.9042 * LPCGDP − 0.1708 * LGDPPCSQ − 0.4829 * LPOP + 0.4348 * LTO + 0.3352 * LEU + 0.0397 * IPGDP) | ||||

| R-squared | 0.83 | Adjusted R-squared | 0.75 | |

| Akaike info criterion | 28.41 | Schwarz criterion | 24.32 | |

| Durbin–Watson stat | 1.99 | F-Statistics: (6, 14) | 11.22 (0.00) | |

| Residual Sum of Squares | 0.383 | S.E. of Regression | 0.054295 | |

| Diagnostic tests | ||||

| Serial Correlation χ2(1) | 0.74 (0.979) | Functional Form χ2(1) | 0.55 (0.469) | |

| Normality χ2(2) | 0.96 (0.617) | Heteroscedasticity χ2(1) | 1.63 (0.217) | |

| Variables | Long-Run Effect [+] | Long-Run Effect [−] | ||||

| Coefficient | f-Statistics | p-Value | Coefficient | f-Statistics | p-Value | |

| LPCGDP | 8.488 | 24.6 | 0.001 | −0.296 | 0.0086 | 0.930 |

| LGDPPCSQ | −0.354 | 20.44 | 0.001 | 0.174 | 0.1385 | 0.717 |

| LL | −2.263 | 0.0167 | 0.900 | −0.903 | 0.6924 | 0.452 |

| LTO | 0.008 | 0.0001 | 0.992 | −0.461 | 0.1763 | 0.696 |

| LEU | 2.451 | 1.723 | 0.260 | 0.003 | 0.0401 | 0.845 |

| IPGDP | 0.250 | 4.451 | 0.068 | 0.040 | 0.2341 | 0.641 |

| Long-Run Asymmetry | Short-Run Asymmetry | |||||

| f-Statistics | p-Value | f-Statistics | p-Value | |||

| LPCGDP | 5.239 | 0.084 | 6.005 | 0.070 | ||

| LGDPPCSQ | 0.0596 | 0.812 | 1.04 | 0.332 | ||

| LL | 2.634 | 0.352 | 5.711 | 0.252 | ||

| LTO | 0.332 | 0.595 | 8.648 | 0.042 | ||

| LEU | 4.981 | 0.890 | 9.154 | 0.039 | ||

| IPGDP | 0.5556 | 0.497 | 5.026 | 0.088 | ||

| Cointegration Test Statistics | Model Diagnostics | |||||

| FPSS = 8.0734 (upper bound critical value = 4.05 at 5% level of significance) | Functional Form χ2(1) | 1.943 | 0.2013 | |||

| Heteroscedasticity χ2(1) | 0.3023 | 0.5825 | ||||

| TBDM = −4.0328 (upper bound critical value = 3.99 at 5% level of significance) | Normality χ2(2) | 0.4845 | 0.7849 | |||

| R2 | Adjusted R2 | Root MSE | ||||

| 0.8474 | 0.7101 | 0.05981 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wen, M.; Li, M.; Erum, N.; Hussain, A.; Xie, H.; ud din Khan, H.S. Revisiting Environmental Kuznets Curve in Relation to Economic Development and Energy Carbon Emission Efficiency: Evidence from Suzhou, China. Energies 2022, 15, 62. https://doi.org/10.3390/en15010062

Wen M, Li M, Erum N, Hussain A, Xie H, ud din Khan HS. Revisiting Environmental Kuznets Curve in Relation to Economic Development and Energy Carbon Emission Efficiency: Evidence from Suzhou, China. Energies. 2022; 15(1):62. https://doi.org/10.3390/en15010062

Chicago/Turabian StyleWen, Ming, Mingxing Li, Naila Erum, Abid Hussain, Haoyang Xie, and Hira Salah ud din Khan. 2022. "Revisiting Environmental Kuznets Curve in Relation to Economic Development and Energy Carbon Emission Efficiency: Evidence from Suzhou, China" Energies 15, no. 1: 62. https://doi.org/10.3390/en15010062

APA StyleWen, M., Li, M., Erum, N., Hussain, A., Xie, H., & ud din Khan, H. S. (2022). Revisiting Environmental Kuznets Curve in Relation to Economic Development and Energy Carbon Emission Efficiency: Evidence from Suzhou, China. Energies, 15(1), 62. https://doi.org/10.3390/en15010062