3.1. Model Design

Primiceri [

31] proposed a TVP-VAR model that allowed all parameters to change over time. Nakajima et al. [

32] introduced a TVP-VAR model with random volatility, and compared the robustness with other various VAR variant models. The results show that TVP-VAR had the best robustness. Therefore, their model has been widely used in dynamic linkage between structure shocks [

33]. Following the methodology of Nakajima, Kasuya and Watanabe [

32], we can write the model as follows:

Among them,

is a

observable endogenous vector.

is a

time-varying constant term vector;

is a

time varying coefficient vector; and

measures the unobservable impact vector with the covariance matrix

.

is expressed by the following equation:

. Among them, Matrix A has the matrix form of lower triangle:

is a symmetric matrix, and

= diag(

). We can covert

to vector

. Formula (1) can be converted into:

Among them,

, where

denotes the Kronecker product. The time-varying parameters obey the random walk process:

. Among them

, and we assume that

,

,

and

obey:

Among them,

is a three-dimensional unit array, and

,

and

are a positive definite matrix. In this paper, the Bayesian method is used to estimate the model. The posterior estimations of parameters are computed by the Markov chain Monte Carlo (MCMC) method. Before using the MCMC method for estimation, we need to set the initial value of the parameters. Let the average value

. Let the covariance matrix

. At the same time, it is assumed that the covariance matrix obeys the following gamma distribution:

Based on the practice of Kilian [

22], this paper constructs the SVAR model to decompose the oil price volatility:

Among them

,

and

represent the logarithmic difference of oil supply, demand and price, respectively.

represents the structural shock vector, representing oil supply shocks, total economic demand shocks and oil-specific demand shocks.

needs to be obtained by the residual vector of simplified SVAR

. Assuming that

is reversible, we can derive Equation (6):

Among them,

is regarded as the disturbance term of the simplified model, so that the simplified disturbance term

is the sum of the structural perturbation term

,

. To apply constraints to

, we can identify the SVAR model:

Among them, represents the disturbance of oil production, economic activity and oil price, which comes from the structural impact on the economic system . According to the requirements of the number of constraints imposed on the SVAR model, this model should impose three constraints. Equation (7) is the form of constraint: because the oil production cycle is long and cannot quickly respond to the change in demand, total economic demand and specific oil demand have no impact on oil production in the current period. Specific oil demand has no impact on global economic activities in the current period, whereas supply and total economic demand will have an impact on global economic activities in the current period. Supply shocks, economic aggregate demand shocks and oil-specific demand shock will have an impact on crude oil prices.

In order to measure the impact of different structural shocks on the panic index, our paper uses the PDL model to establish the response equation of the panic index:

Among them, let s be 1 to 3, and represent the sequence of structural shocks. For each structural shock, its current value and 1–12 period lagged values are taken as independent variables. represents the panic index growth rate series, and represents the value of all estimated parameters. Based on the growth rate of the panic index and structural shock vector, this paper calculates the response parameters of the panic index under structural shock.

In order to analyze the asymmetric impact of oil price volatility on panic index, we use the TARCH model proposed by Glosten et al. [

34] and Zakoian [

35], and set the conditional variance as:

Among them, is the dummy variable. If , then , otherwise . As long as , there exists asymmetric impacts. In Equation (9), the term is the asymmetric effect term. The value of depends on the square of the previous residual and conditional variance. When , it indicates that there is a leverage effect, that is, the asymmetric effect intensifies the fluctuation range. When , it indicates that the asymmetric effect reduces the fluctuation range.

3.2. Variable Description, Data Source and Data Preprocessing

The main variables in this paper include crude oil price, VIX index, return rate, global crude oil production and Baltic dry bulk index. The data sources are shown in

Table 1.

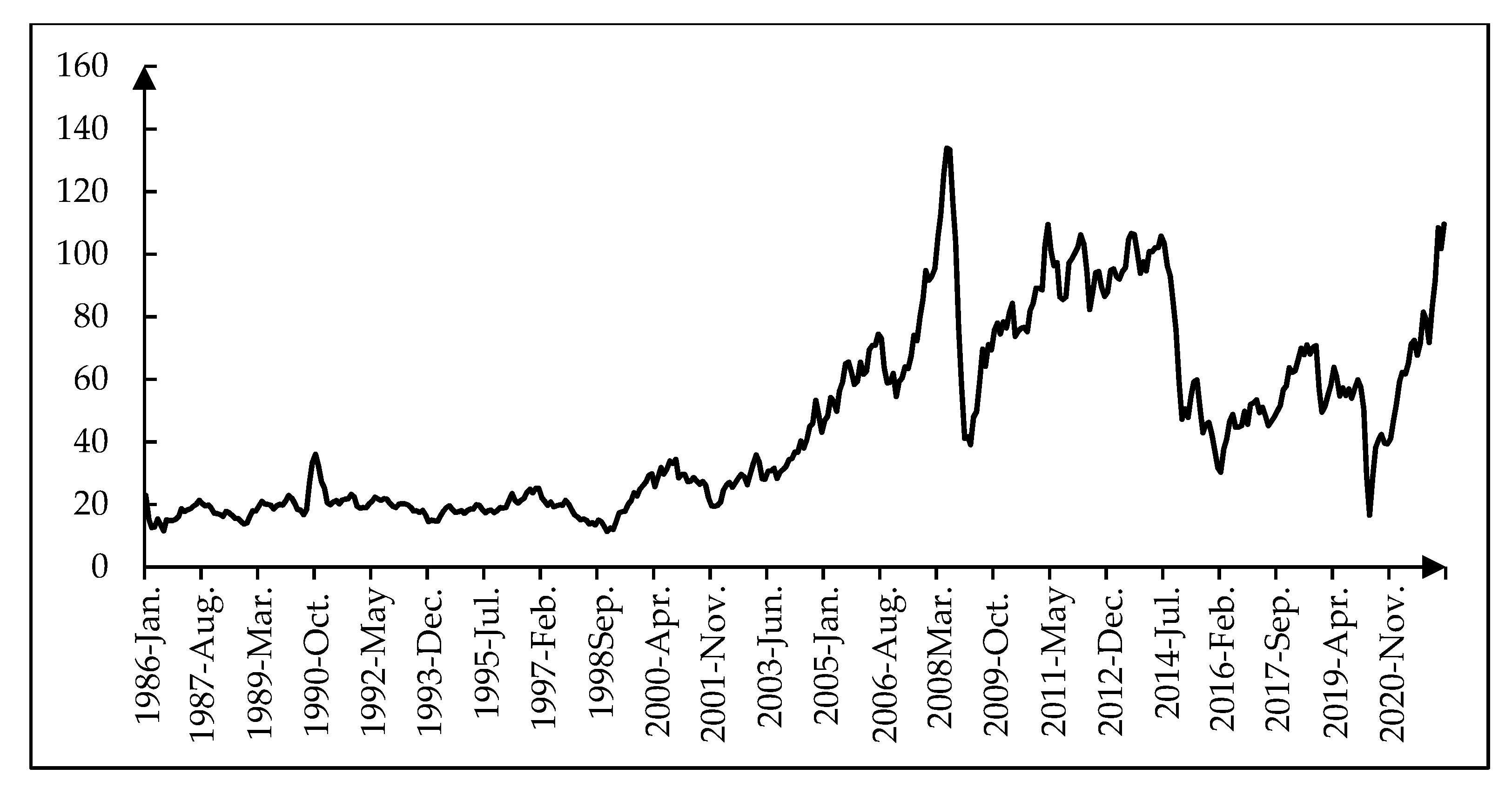

As is shown in

Table 1, the main variables in this paper include: (1) Crude oil price (ROP). This variable is obtained based on the nominal international crude oil price and the US CPI index after deducting inflation. The nominal crude oil price mainly uses the spot price of crude oil of West Texas Intermediate (WTI), and the data are mainly from the website of the U.S. Energy Information Administration (EIA). We choose the WTI crude oil spot price as the index to measure the world oil price because WTI is one of the most important global oil markets. WTI crude oil spot price and Futures Crude oil price are the basic commodities of the oil futures contract of the New York Mercantile Exchange [

36,

37]. We choose the US CPI from January 1990 as the deflator to eliminate the influence of price factors. (2) VIX index (VIX). This variable is the real-time volatility index compiled by the Chicago Options Exchange (CBOE), which can measure the implied volatility of S&P 500 index options and is usually used to measure investors’ panic. The VIX index is expressed as an annualized percentage and can roughly reflect the expected trend of the S&P 500 index in the next 30 days. Therefore, a high VIX index indicates that investors believe that the market will fluctuate violently in the forward or reverse direction. The VIX index will be depressed only when investors believe that there is no great risk of decline and a possibility of rise. The data come from the wind database. (3) Return rate (RET). This variable is the monthly return series of the S&P 500 index. The change in the return series causes the change in the VIX index. The data come from the NASDAQ data link. (4) Global crude oil production (PRO). This reflects the impact of various political changes, wars and monopoly activities, which cause fluctuations in crude oil prices. The data come from the website of the U.S. Energy Information Administration (EIA). (5) Baltic dry bulk index (BDI). As the activity of global economic activities affects oil demand and leads to oil price volatility, the more prosperous the economy is, the stronger the driving force behind the oil price rise is. The variables used to measure global economic activities in this paper need to be monthly data and can reflect the changes in total global economic demand. Some studies use the weighting of industrial added value of all countries to measure the total demand of global economic activities, but there are two major problems: first, the industrial structure of many countries has changed greatly in the past decade, and the change in the proportion of industry in GDP leads to a change in energy intensity, so it is easy to produce the problem of sequence instability; second, it is difficult for each country to calculate its contribution to the global economy more and more accurately. Therefore, based on Kilian’s method, this paper uses the Baltic dry bulk index (BDI) as an index to measure the degree of global economic activity. The data come from the wind database. Since the earliest time for which we can obtain the WTI crude oil price is October 2002, considering the data collection, the sample period of the above variables is from October 2002 to November 2021, with a total of 229 observations.

Before constructing the time series model, we need to test the stationarity of each series and select the optimal lag order of the model. The results are shown in

Table 2 and

Table 3. Specifically, we need to use the method of Dickey and Fuller [

38] to test whether the unit root exists.

According to

Table 2, the log difference sequence of ROP, VIX, PRO and BDI and the RET sequence are stable at the significance level of 1%. In order to avoid the problem of pseudo regression, the ADF unit root test is carried out on the studied sequences. It is found that the RET sequence is stable, while the ROP, VIX, PRO and BDI sequences are non-stationary. Therefore, the four sequences are processed by logarithmic difference, which is notated by dlnrop, dlnvix, dlnpro and dlnbdi. After processing, the ADF value of all sequences is less than the 5% critical value, which indicates that these sequences are stable; therefore, we can proceed to the next step of time series analysis.

According to

Table 3, the optimal lag order of the TVP-VAR model is 1. Specifically, before constructing the TVP-VAR model, it is necessary to determine the optimal lag order of the model. As can be seen from

Table 3, according to the minimum value criterion of AIC, the optimal lag order of the TVP-VAR model should be 2-lag with the minimum AIC value −6.446904, while according to the minimum value criterion of SC and HQ, the optimal lag order of the TVP-VAR model is 1-lag. Considering that the 1-lag order is selected by most criteria, we set the optimal lag order of our model to 1.