Carbon Dioxide and Greenhouse Gas Emissions: The Role of Monetary Policy, Fiscal Policy, and Institutional Quality

Abstract

:1. Introduction

2. Literature Review

2.1. Fiscal Policy, Institutions’ Quality, and Emissions Nexus

2.2. Monetary Policy and Emissions Nexus

3. Data and Methodology

3.1. The Model

3.2. The Data

3.3. Criteria Selection

3.4. Methodology

4. Results and Discussion

4.1. Unit-Root Tests

4.2. Core Model Results

4.3. Robustness Checks

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. The Ex-Post Error of the Presented Model

| Countries | Region | RMSE_CO2 2010–2019 | RMSE_GHG 2010–2019 | Countries | Region | RMSE_CO2 2010–2019 | RMSE_GHG 2010–2019 |

|---|---|---|---|---|---|---|---|

| Albania | ECA | 0.067382886 | 0.03301788 | Lebanon | MENA | 0.054202292 | 0.046566294 |

| Argentina | AME | 0.019900344 | 0.010318636 | Lesotho | SSA | 0.044579427 | 0.029825987 |

| Armenia | ECA | 0.060721941 | 0.041394116 | Lithuania | WE/EU | 0.044771674 | 0.026163937 |

| Australia | AP | 0.018246835 | 0.075811149 | Luxembourg | WE/EU | 0.037805764 | 0.033850666 |

| Austria | WE/EU | 0.049131252 | 0.036791485 | Malawi | SSA | 0.077106717 | 0.033445905 |

| Azerbaijan | ECA | 0.061979796 | 0.019042519 | Malaysia | AP | 0.039903121 | 0.031738382 |

| Bahamas | AME | 0.378335639 | 0.341553107 | Maldives | ECA | 0.089481813 | 0.033180157 |

| Bangladesh | ECA | 0.038122716 | 0.021578363 | Malta | WE/EU | 0.145656463 | 0.113526939 |

| Barbados | AME | 0.372690879 | 0.1884095 | Mauritius | SSA | 0.022417801 | 0.016568681 |

| Belarus | ECA | 0.03767692 | 0.024834989 | Mexico | AME | 0.019568676 | 0.016269018 |

| Belgium | WE/EU | 0.052125313 | 0.044346666 | Moldova | ECA | 0.060212043 | 0.037996263 |

| Belize | AME | 0.342934184 | 0.17433559 | Mongolia | AP | 0.041559449 | 0.047225262 |

| Bhutan | ECA | 0.139728602 | 0.047384896 | Mozambique | SSA | 0.102578662 | 0.035760501 |

| Botswana | SSA | 0.13926337 | 0.276901921 | Namibia | SSA | 0.034095341 | 0.178779007 |

| Brazil | AME | 0.050944877 | 0.028441743 | Netherlands | WE/EU | 0.044061681 | 0.036160471 |

| Bulgaria | WE/EU | 0.072133455 | 0.061822985 | New Zealand | WE/EU | 0.0293147 | 0.014315639 |

| Canada | AME | 0.010458947 | 0.010460739 | Nigeria | SSA | 0.077364583 | 0.03217938 |

| Chile | AME | 0.051258874 | 0.035925227 | Norway | WE/EU | 0.043830599 | 0.033440731 |

| China | AP | 0.036367037 | 0.026666117 | Oman | MENA | 0.043714152 | 0.046510699 |

| Colombia | AME | 0.047626035 | 0.018320081 | Pakistan | AP | 0.033804581 | 0.020428893 |

| Croatia | WE/EU | 0.031685186 | 0.029342018 | Pap. N. Guinea | AP | 0.060371591 | 0.034403498 |

| Cyprus | WE/EU | 0.03917971 | 0.033663646 | Peru | AME | 0.034929265 | 0.018221434 |

| Czech | WE/EU | 0.020015272 | 0.016515698 | Philippines | AP | 0.04372095 | 0.025036082 |

| Denmark | WE/EU | 0.064796113 | 0.051898743 | Poland | WE/EU | 0.030871095 | 0.023595434 |

| Egypt | MENA | 0.02214108 | 0.015192299 | Portugal | WE/EU | 0.057547811 | 0.039275104 |

| Estonia | WE/EU | 0.107374526 | 0.091909677 | Romania | WE/EU | 0.052158551 | 0.034214685 |

| Fiji | AP | 0.091095833 | 0.06734696 | Russia | ECA | 0.023751857 | 0.014168203 |

| Finland | WE/EU | 0.078742577 | 0.065952963 | Rwanda | SSA | 0.053966351 | 0.035595824 |

| France | WE/EU | 0.041089262 | 0.027014474 | Sierra Leone | SSA | 0.090140596 | 0.06433516 |

| Georgia | ECA | 0.080458473 | 0.038853446 | Singapore | AP | 0.022806392 | 0.015078584 |

| Germany | WE/EU | 0.035479327 | 0.026324881 | Slovakia | WE/EU | 0.043082658 | 0.035888532 |

| Greece | WE/EU | 0.029603828 | 0.021018621 | Slovenia | WE/EU | 0.040226402 | 0.033607897 |

| Guatemala | AME | 0.059974864 | 0.030646785 | Solomon Isl. | AME | 0.072707018 | 0.033293219 |

| Guyana | AME | 0.042829088 | 0.027827416 | South Africa | SSA | 0.031396338 | 0.027443708 |

| Hungary | WE/EU | 0.04169309 | 0.027283229 | Spain | WE/EU | 0.043295805 | 0.031747897 |

| Iceland | WE/EU | 0.037316879 | 0.028027022 | Sri Lanka | AME | 0.100822799 | 0.052903982 |

| India | AP | 0.029698023 | 0.019215774 | Sweden | WE/EU | 0.047167235 | 0.043867615 |

| Indonesia | AP | 0.059053567 | 0.033892302 | Switzerland | WE/EU | 0.048529953 | 0.040980981 |

| Ireland | WE/EU | 0.048579241 | 0.032883477 | Tanzania | SSA | 0.085766657 | 0.030844019 |

| Israel | MENA | 0.059403874 | 0.045627018 | Thailand | AP | 0.023220003 | 0.017828914 |

| Italy | WE/EU | 1.156147948 | 0.025281243 | Trin.-Tobago: | AME | 0.05538027 | 0.045719129 |

| Jamaica | AME | 0.067995337 | 0.056576397 | Uganda | SSA | 0.061945899 | 0.02154208 |

| Japan | AP | 0.02880699 | 0.028697721 | Ukraine | ECA | 0.075231676 | 0.061789416 |

| Jordan | MENA | 0.055647416 | 0.04185341 | Und. Kingdom | WE/EU | 0.044573151 | 0.040601213 |

| Kenya | SSA | 0.068859701 | 0.0284597 | United States | AME | 0.028784958 | 0.026540308 |

| Korea | AP | 0.022464644 | 0.023074612 | Vanuatu | AP | 0.149413826 | 0.027850795 |

| Kyrgyzstan | ECA | 0.123624633 | 0.073703631 | Zambia | SSA | 0.112116637 | 0.034822822 |

| Latvia | WE/EU | 0.032754115 | 0.047674643 |

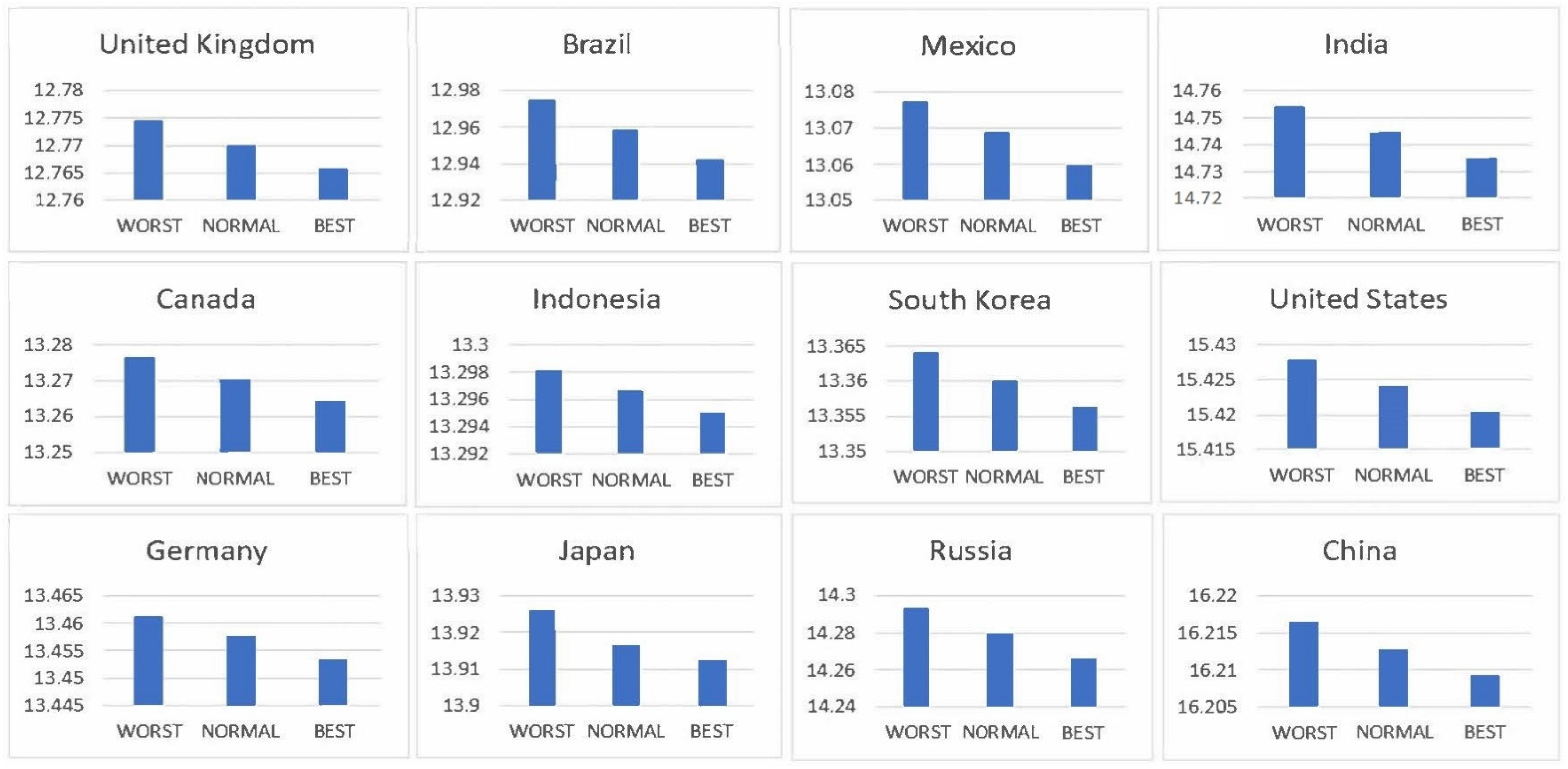

Appendix B. CO2 Emission Forecast Scenarios

(−0.0009026*GovEf) + (−0.0240855*M3gr) + (0.0189704*IRmm) + (−0.00214*CBT) +

(−0.0256864*CBI).

| Scenarios | Normal | Best | Worst |

|---|---|---|---|

| Brazil | −0.00773 | −0.02392 | 0.008448 |

| Canada | 0.009207 | 0.002995 | 0.015419 |

| China | 0.063882 | 0.060257 | 0.067507 |

| Germany | −0.01483 | −0.01878 | −0.01088 |

| India | 0.03939 | 0.030014 | 0.048767 |

| Indonesia | 0.020462 | 0.018885 | 0.022038 |

| Japan | −0.00015 | −0.00386 | 0.009519 |

| South Korea | 0.005247 | 0.001262 | 0.009232 |

| Mexico | 0.003653 | −0.00498 | 0.01229 |

| Russia | −0.0108 | −0.02401 | 0.002422 |

| United Kingdom | −0.02046 | −0.02476 | −0.01616 |

| United States | 0.00289 | −0.00085 | 0.006632 |

| Worst | Normal | Best | |

|---|---|---|---|

| Brazil | 12.97465 | 12.95847 | 12.94228 |

| Canada | 13.2765 | 13.27029 | 13.26408 |

| China | 16.21647 | 16.21284 | 16.20922 |

| Germany | 13.4615 | 13.45754 | 13.45359 |

| India | 14.75403 | 14.74465 | 14.73527 |

| Indonesia | 13.29817 | 13.29659 | 13.29502 |

| Japan | 13.92592 | 13.91625 | 13.91253 |

| South Korea | 13.36409 | 13.3601 | 13.35612 |

| Mexico | 13.07732 | 13.06868 | 13.06005 |

| Russia | 14.29264 | 14.27943 | 14.26621 |

| United Kingdom | 12.77436 | 12.77006 | 12.76576 |

| United States | 15.42783 | 15.42409 | 15.42035 |

References

- Arent, D.J.; Wise, A.; Gelman, R. The status and prospects of renewable energy for combating global warming. Energy Econ. 2011, 33, 584–593. [Google Scholar] [CrossRef]

- Solomon, B.D.; Krishna, K. The coming sustainable energy transition: History, strategies, and outlook. Energy Policy 2011, 39, 7422–7431. [Google Scholar] [CrossRef]

- Gielen, D.; Boshell, F.; Saygin, D.; Bazilian, M.D.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strategy Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- Pickl, M.J. The renewable energy strategies of oil majors–From oil to energy? Energy Strategy Rev. 2019, 26, 100370. [Google Scholar] [CrossRef]

- Spilimbergo, A.; Symansky, S.; Blanchard, O.; Cottarelli, C. Fiscal Policy for the Crisis. In CESifo Forum; IFO Institut für Wirtschaftsforschung an der Universität München: München, Germany, 2009; Volume 10, pp. 26–32. [Google Scholar]

- Rosenow, J.; Fawcett, T.; Eyre, N.; Oikonomou, V. Energy efficiency and the policy mix. Build. Res. Inf. 2016, 44, 562–574. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. CO2 emissions, energy usage, and output in Central America. Energy Policy 2009, 37, 3282–3286. [Google Scholar] [CrossRef]

- Price, L.; Wang, X.; Yun, J. The challenge of reducing energy consumption of the Top-1000 largest industrial enterprises in China. Energy Policy 2010, 38, 6485–6498. [Google Scholar] [CrossRef]

- Dokas, I.; Panagiotidis, M.; Papadamou, S.; Spyromitros, E. The Determinants of Energy and Electricity Consumption in Developed and Developing Countries: International Evidence. Energies 2022, 15, 2558. [Google Scholar] [CrossRef]

- Hallerberg, M.; Wolff, G.B. Fiscal institutions, fiscal policy and sovereign risk premia in EMU. Public Choice 2008, 136, 379–396. [Google Scholar] [CrossRef]

- Albuquerque, B. Fiscal institutions and public spending volatility in Europe. Econ. Model. 2011, 28, 2544–2559. [Google Scholar] [CrossRef] [Green Version]

- Frankel, J.A.; Vegh, C.A.; Vuletin, G. On graduation from fiscal procyclicality. J. Dev. Econ. 2013, 100, 32–47. [Google Scholar] [CrossRef] [Green Version]

- McManus, R.; Ozkan, F.G. On the consequences of pro-cyclical fiscal policy. Fisc. Stud. 2015, 36, 29–50. [Google Scholar] [CrossRef]

- Calderón, C.; Duncan, R.; Schmidt-Hebbel, K. Do good institutions promote countercyclical macroeconomic policies? Oxf. Bull. Econ. Stat. 2016, 78, 650–670. [Google Scholar] [CrossRef] [Green Version]

- Bergman, U.M.; Hutchison, M. Economic stabilization in the post-crisis world: Are fiscal rules the answer? J. Int. Money Financ. 2015, 52, 82–101. [Google Scholar] [CrossRef]

- Bergman, U.M.; Hutchison, M.M.; Jensen, S.E.H. Promoting sustainable public finances in the European Union: The role of fiscal rules and government efficiency. Eur. J. Political Econ. 2016, 44, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Dutt, K. Governance, institutions and the environment-income relationship: A cross-country study. Environ. Dev. Sustain. 2009, 11, 705–723. [Google Scholar] [CrossRef]

- Adams, S.; Klobodu, E.K.M. Urbanization, democracy, bureaucratic quality, and environmental degradation. J. Policy Model. 2017, 39, 1035–1051. [Google Scholar] [CrossRef]

- Hosseini, H.M.; Kaneko, S. Can environmental quality spread through institutions? Energy Policy 2013, 56, 312–321. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, B.; Wang, B. The moderating role of corruption between economic growth and CO2 emissions: Evidence from BRICS economies. Energy 2018, 148, 506–513. [Google Scholar] [CrossRef]

- Baloch, M.A.; Wang, B. Analyzing the role of governance in CO2 emissions mitigation: The BRICS experience. Struct. Change Econ. Dyn. 2019, 51, 119–125. [Google Scholar]

- Zakaria, M.; Bibi, S. Financial development and environment in South Asia: The role of institutional quality. Environ. Sci. Pollut. Res. 2019, 26, 7926–7937. [Google Scholar] [CrossRef]

- Campiglio, E.; Dafermos, Y.; Monnin, P.; Ryan-Collins, J.; Schotten, G.; Tanaka, M. Climate change challenges for central banks and financial regulators. Nat. Clim. Change 2018, 8, 462–468. [Google Scholar] [CrossRef]

- Monnin, P. Central Banks and the transition to a low-carbon economy. Counc. Econ. Policies Discuss. Note 2018, 1. [Google Scholar] [CrossRef]

- Durrani, A.; Rosmin, M.; Volz, U. The role of central banks in scaling up sustainable finance–what do monetary authorities in the Asia-Pacific region think? J. Sustain. Financ. Invest. 2020, 10, 92–112. [Google Scholar] [CrossRef]

- Campiglio, E. Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef] [Green Version]

- Polzin, F.; Sanders, M.; Täube, F. A diverse and resilient financial system for investments in the energy transition. Curr. Opin. Environ. Sustain. 2017, 28, 24–32. [Google Scholar] [CrossRef] [Green Version]

- Dafermos, Y.; Nikolaidi, M.; Galanis, G. Climate change, financial stability and monetary policy. Ecol. Econ. 2018, 152, 219–234. [Google Scholar] [CrossRef]

- Qingquan, J.; Khattak, S.I.; Ahmad, M.; Ping, L. A new approach to environmental sustainability: Assessing the impact of monetary policy on CO2 emissions in Asian economies. Sustain. Dev. 2020, 28, 1331–1346. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Ahmad, M.; Rehman, A.; Khan, M.K. Mitigations pathways towards sustainable development: Assessing the influence of fiscal and monetary policies on carbon emissions in BRICS economies. J. Clean. Prod. 2021, 292, 126035. [Google Scholar] [CrossRef]

- Noureen, S.; Iqbal, J.; Chishti, M.Z. Exploring the dynamic effects of shocks in monetary and fiscal policies on the environment of developing economies: Evidence from the CS-ARDL approach. Environ. Sci. Pollut. Res. 2022, 29, 45665–45682. [Google Scholar] [CrossRef]

- de Mendonça, H.F.; Simão Filho, J. Economic transparency and effectiveness of monetary policy. J. Econ. Stud. 2007, 34, 497–514. [Google Scholar] [CrossRef]

- Papadamou, S.; Sidiropoulos, M.; Spyromitros, E. Central bank transparency and the interest rate channel: Evidence from emerging economies. Econ. Model. 2015, 48, 167–174. [Google Scholar] [CrossRef]

- Weber, C.S. Central bank transparency and inflation (volatility)–new evidence. Int. Econ. Econ. Policy 2018, 15, 21–67. [Google Scholar] [CrossRef] [Green Version]

- Crowe, C.; Meade, E.E. Central bank independence and transparency: Evolution and effectiveness. Eur. J. Political Econ. 2008, 24, 763–777. [Google Scholar] [CrossRef] [Green Version]

- Arnone, M.; Romelli, D. Dynamic central bank independence indices and inflation rate: A new empirical exploration. J. Financ. Stab. 2013, 9, 385–398. [Google Scholar] [CrossRef]

- Halkos, G.E.; Paizanos, E.A. The effects of fiscal policy on CO2 emissions: Evidence from the USA. Energy Policy 2016, 88, 317–328. [Google Scholar] [CrossRef]

- López, R.; Palacios, A. Why has Europe become environmentally cleaner? Decomposing the roles of fiscal, trade and environmental policies. Environ. Resour. Econ. 2014, 58, 91–108. [Google Scholar] [CrossRef]

- Yuelan, P.; Akbar, M.W.; Hafeez, M.; Ahmad, M.; Zia, Z.; Ullah, S. The nexus of fiscal policy instruments and environmental degradation in China. Environ. Sci. Pollut. Res. 2019, 26, 28919–28932. [Google Scholar] [CrossRef]

- López, R.; Galinato, G.I.; Islam, A. Fiscal spending and the environment: Theory and empirics. J. Environ. Econ. Manag. 2011, 62, 180–198. [Google Scholar] [CrossRef]

- Congleton, R.D. Political institutions and pollution control. Rev. Econ. Stat. 1992, 74, 412–421. [Google Scholar] [CrossRef]

- Bernauer, T.; Koubi, V. Effects of political institutions on air quality. Ecol. Econ. 2009, 68, 1355–1365. [Google Scholar] [CrossRef]

- Ibrahim, M.H.; Law, S.H. Institutional Quality and CO2 Emission–Trade Relations: Evidence from Sub-Saharan Africa. S. Afr. J. Econ. 2016, 84, 323–340. [Google Scholar] [CrossRef]

- Abid, M. Impact of economic, financial, and institutional factors on CO2 emissions: Evidence from sub-Saharan Africa economies. Util. Policy 2016, 41, 85–94. [Google Scholar] [CrossRef]

- Solarin, S.A.; Al-Mulali, U.; Musah, I.; Ozturk, I. Investigating the pollution haven hypothesis in Ghana: An empirical investigation. Energy 2017, 124, 706–719. [Google Scholar] [CrossRef]

- Apergis, N.; Garćıa, C. Environmentalism in the EU-28 context: The impact of governance quality on environmental energy efficiency. Environ. Sci. Pollut. Res. 2019, 26, 37012–37025. [Google Scholar] [CrossRef] [Green Version]

- Ozturk, I.; Al-Mulali, U.; Solarin, S.A. The control of corruption and energy efficiency relationship: An empirical note. Environ. Sci. Pollut. Res. 2019, 26, 17277–17283. [Google Scholar] [CrossRef]

- Cansino, J.M.; Román-Collado, R.; Molina, J.C. Quality of institutions, technological progress, and pollution havens in Latin America. An analysis of the environmental Kuznets curve hypothesis. Sustainability 2019, 11, 3708. [Google Scholar] [CrossRef] [Green Version]

- Hunjra, A.I.; Tayachi, T.; Chani, M.I.; Verhoeven, P.; Mehmood, A. The moderating effect of institutional quality on the financial development and environmental quality nexus. Sustainability 2020, 12, 3805. [Google Scholar] [CrossRef]

- Ulucak, R. The pathway toward pollution mitigation: Does institutional quality make a difference? Bus. Strategy Environ. 2020, 29, 3571–3583. [Google Scholar]

- Khan, Z.; Ali, S.; Dong, K.; Li, R.Y.M. How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 2021, 94, 105060. [Google Scholar] [CrossRef]

- Liu, X.; Latif, K.; Latif, Z.; Li, N. Relationship between economic growth and CO2 emissions: Does governance matter? Environ. Sci. Pollut. Res. 2020, 27, 17221–17228. [Google Scholar] [CrossRef]

- Goel, R.K.; Herrala, R.; Mazhar, U. Institutional quality and environmental pollution: MENA countries versus the rest of the world. Econ. Syst. 2013, 37, 508–521. [Google Scholar] [CrossRef]

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Kaushal, L.A.; Pathak, N. The causal relationship among economic growth, financial development and trade openness in Indian economy. Int. J. Econ. Perspect. 2015, 9, 5–22. [Google Scholar]

- Matikainen, S.; Campiglio, E.; Zenghelis, D. The climate impact of quantitative easing. Policy Paper Grantham Research Institute on Climate Change and the Environment. Lond. Sch. Econ. Political Sci. 2017, 36. [Google Scholar] [CrossRef]

- Economides, G.; Xepapadeas, A. Monetary Policy under Climate Change (No. 7021). CESifo 2018. [Google Scholar] [CrossRef]

- Aslam, B.; Hu, J.; Majeed, M.T.; Andlib, Z.; Ullah, S. Asymmetric macroeconomic determinants of CO2 emission in China and policy approaches. Environ. Sci. Pollut. Res. 2021, 28, 41923–41936. [Google Scholar] [CrossRef]

- Chen, C.; Pan, D. The Optimal Mix of Monetary and Climate Policy; MPRA Working Paper No. 97718; MPRA: Munich, Germany, 2020. [Google Scholar]

- McKibbin, W.J.; Morris, A.C.; Panton, A.; Wilcoxen, P. Climate Change and Monetary Policy: Dealing with Disruption; Discussion Paper; Brookings Institution: Washington, DC, USA, 2017. [Google Scholar]

- Chan, Y.T. Are macroeconomic policies better in curbing air pollution than environmental policies? A DSGE approach with carbon-dependent fiscal and monetary policies. Energy Policy 2020, 141, 111454. [Google Scholar] [CrossRef]

- Hajdukovic, I. Interactions among macroeconomic policies, the energy market and environmental quality. Environ. Econ. Policy Stud. 2021, 23, 861–913. [Google Scholar] [CrossRef]

- Latief, R.; Lefen, L. Foreign direct investment in the power and energy sector, energy con-sumption, and economic growth: Empirical evidence from pakistan. Sustainability 2019, 11, 192. [Google Scholar] [CrossRef] [Green Version]

- Gregorio, J.D. The role of foreign direct investment and natural resources in economic development. In Multinationals and Foreign Investment in Economic Development; Palgrave Macmillan: London, UK, 2005; pp. 179–197. [Google Scholar]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. Governance matters IV: Governance indicators for 1996–2004. World Bank Policy Res. Work. Pap. Ser. 3630 2005. [Google Scholar] [CrossRef] [Green Version]

- Eichengreen’s Online Database. Available online: https://eml.berkeley.edu/~eichengr/data.shtml (accessed on 12 March 2022).

- Garriga’s Online Database. Available online: https://sites.google.com/site/carogarriga/cbi-data-1 (accessed on 15 March 2022).

- World Bank’s Website. Available online: https://info.worldbank.org/governance/wgi (accessed on 12 March 2022).

- World Development Indicators Database of the World Bank. Available online: https://databank.worldbank.org/home (accessed on 12 March 2022).

- Hafeez, M.; Yuan, C.; Khelfaoui, I.; Sultan Musaad, O.A.; Waqas Akbar, M.; Jie, L. Evaluating the energy consumption inequalities in the one belt and one road region: Implications for the environment. Energies 2019, 12, 1358. [Google Scholar] [CrossRef] [Green Version]

- Yan, X.; Crookes, R.J. Energy demand and emissions from road transportation vehicles in China. Prog. Energy Combust. Sci. 2010, 36, 651–676. [Google Scholar] [CrossRef]

- Rasoulinezhad, E.; Saboori, B. Panel estimation for renewable and non-renewable energy consumption, economic growth, CO2 emissions, the composite trade intensity, and financial openness of the commonwealth of independent states. Environ. Sci. Pollut. Res. 2018, 25, 17354–17370. [Google Scholar] [CrossRef]

- Akbar, M.; Hussain, A.; Akbar, A.; Ullah, I. The dynamic association between healthcare spending, CO2 emissions, and human development index in OECD countries: Evidence from panel VAR model. Environ. Dev. Sustain. 2021, 23, 10470–10489. [Google Scholar] [CrossRef]

- Omri, A.; Nguyen, D.K.; Rault, C. Causal interactions between CO2 emissions, FDI, and economic growth: Evidence from dynamic simultaneous-equation models. Econ. Model. 2014, 42, 382–389. [Google Scholar] [CrossRef] [Green Version]

- Zhang, C.; Zhou, X. Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sustain. Energy Rev. 2016, 58, 943–951. [Google Scholar] [CrossRef]

- Bayar, Y.; Diaconu, L.; Maxim, A. Financial development and CO2 emissions in post-transition European Union countries. Sustainability 2020, 1, 2640. [Google Scholar] [CrossRef] [Green Version]

- Isiksal, A.Z.; Samour, A.; Resatoglu, N.G. Testing the impact of real interest rate, income, and energy consumption on Turkey’s CO2 emissions. Environ. Sci. Pollut. Res. 2019, 26, 20219–20231. [Google Scholar] [CrossRef]

- Breitenfellner, A.; Pointner, W.; Schuberth, H. The potential contribution of central banks to green finance. Vierteljahrsh. Zur Wirtsch. 2019, 88, 55–71. [Google Scholar] [CrossRef]

- De Perthuis, C. Carbon markets regulation: The case for a CO2 central bank. Paris Dauphine Univ. Clim. Econ. Chair Inf. Debates Ser. 2011, 10. [Google Scholar]

- Dikau, S.; Ryan-Collins, J. Green Central Banking in Emerging Market an Developing Country Economies; New Economics Foundation: London, UK, 2017. [Google Scholar]

- Schoenmaker, D. Greening monetary policy. Clim. Policy 2021, 21, 581–592. [Google Scholar] [CrossRef]

- Fischer, S.; Alonso-Gamo, P.; Von Allmen, U.E. Economic developments in the West Bank and Gaza since Oslo. Econ. J. 2001, 111, 254–275. [Google Scholar] [CrossRef]

- Gani, A. The relationship between good governance and carbon dioxide emissions: Evidence from developing economies. J. Econ. Dev. 2012, 37, 77. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Choi, I. Unit root tests for panel data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification tests in econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef] [Green Version]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2010. [Google Scholar]

- Drukker, D.M. Testing for serial correlation in linear panel-data models. Stata J. 2003, 3, 168–177. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 4th ed.; Prentice Hall, Upper Saddle River: Hoboken, NJ, USA, 2000. [Google Scholar]

- Breusch, T.S.; Pagan, A.R. The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Driscoll, J.C.; Kraay, A.C. Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. Stat. 1998, 80, 549–560. [Google Scholar] [CrossRef]

- Greene, W. Econometric Analysis. Stern School of Business; New York University: New York, NY, USA, 2018. [Google Scholar]

- Keele, L.; Kelly, N.J. Dynamic models for dynamic theories: The ins and outs of lagged dependent variables. Political Anal. 2006, 14, 186–205. [Google Scholar] [CrossRef]

- Pedroni, P. Fully Modified OLS for heterogeneous cointegrated panels. In Nonstationary Panels 2001 Panel Cointegration, and Dynamic Panels; Emerald Group Publishing Limited: Bingley, UK, 2001. [Google Scholar]

- Arouri, M.E.H.; Youssef, A.B.; M’henni, H.; Rault, C. Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 2012, 45, 342–349. [Google Scholar] [CrossRef] [Green Version]

- Salahuddin, M.; Alam, K.; Ozturk, I. The effects of Internet usage and economic growth on CO2 emissions in OECD countries: A panel investigation. Renew. Sustain. Energy Rev. 2016, 62, 1226–1235. [Google Scholar] [CrossRef]

- Namahoro, J.P.; Wu, Q.; Zhou, N.; Xue, S. Impact of energy intensity, renewable energy, and economic growth on CO2 emissions: Evidence from Africa across regions and income levels. Renew. Sustain. Energy Rev. 2021, 147, 111233. [Google Scholar] [CrossRef]

- Birdsall, N.; Wheeler, D. Trade policy and industrial pollution in Latin America: Where are the pollution havens? J. Environ. Dev. 1993, 2, 137–149. [Google Scholar] [CrossRef]

- Zarsky, L. Havens, halos and spaghetti: Untangling the evidence about foreign direct investment and the environment. Foreign Direct Invest. Environ. 1999, 13, 47–74. [Google Scholar]

- Jensen, V. The pollution haven hypothesis and the industrial flight hypothesis: Some perspectives on theory and empirics. Cent. Dev. Environ. Work. Pap. 1996, 5. [Google Scholar]

- Omri, A.; Daly, S.; Rault, C.; Chaibi, A. Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ. 2015, 48, 242–252. [Google Scholar] [CrossRef] [Green Version]

- Maji, I.K.; Habibullah, M.S.; Saari, M.Y. Financial development and sectoral CO2 emissions in Malaysia. Environ. Sci. Pollut. Res. 2017, 24, 7160–7176. [Google Scholar] [CrossRef]

- Wang, H.; Dong, C.; Liu, Y. Beijing direct investment to its neighbors: A pollution haven or pollution halo effect? J. Clean. Prod. 2019, 239, 118062. [Google Scholar] [CrossRef]

- Box-Steffensmeier, J.M.; Freeman, J.R.; Hitt, M.P.; Pevehouse, J.C. Time Series Analysis for the Social Sciences; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Nguyen, D.K.; Huynh, T.L.D.; Nasir, M.A. Carbon emissions determinants and forecasting: Evidence from G6 countries. J. Environ. Manag. 2021, 285, 111988. [Google Scholar] [CrossRef] [PubMed]

- Bokde, N.D.; Tranberg, B.; Andresen, G.B. Short-term CO2 emissions forecasting based on decomposition approaches and its impact on electricity market scheduling. Appl. Energy 2021, 281, 116061. [Google Scholar] [CrossRef]

- Dong, F.; Wang, Y.; Su, B.; Hua, Y.; Zhang, Y. The process of peak CO2 emissions in developed economies: A perspective of industrialization and urbanization. Resour. Conserv. Recycl. 2019, 141, 61–75. [Google Scholar] [CrossRef]

- Akram, R.; Chen, F.; Khalid, F.; Ye, Z.; Majeed, M.T. Heterogeneous effects of energy efficiency and renewable energy on carbon emissions: Evidence from developing countries. J. Clean. Prod. 2020, 247, 119122. [Google Scholar] [CrossRef]

- Bayar, Y.; Sasmaz, M.U.; Ozkaya, M.H. Impact of trade and financial globalization on renewable energy in EU transition economies: A bootstrap panel granger causality test. Energies 2020, 14, 19. [Google Scholar] [CrossRef]

- Annicchiarico, B.; Di Dio, F. GHG emissions control and monetary policy. Environ. Resour. Econ. 2017, 67, 823–851. [Google Scholar] [CrossRef] [Green Version]

- Hayo, B. Inflation culture, central bank independence and price stability. Eur. J. Political Econ. 1998, 14, 241–263. [Google Scholar] [CrossRef]

- Garriga, A.C.; Rodriguez, C.M. More effective than we thought: Central bank independence and inflation in developing countries. Econ. Model. 2020, 85, 87–105. [Google Scholar] [CrossRef]

- McConnell, A.; Yanovski, B.; Lessmann, K. Central bank collateral as a green monetary policy instrument. Clim. Policy 2022, 22, 339–355. [Google Scholar] [CrossRef]

- Baltagi, B.H. (Ed.) Panel Data Econometrics: Theoretical Contributions and Empirical Applications; Emerald Group Publishing; Elsevier: Oxford, UK, 2006. [Google Scholar]

- Costantini, M.; Destefanis, S. Cointegration analysis for cross-sectionally dependent panels: The case of regional production functions. Econ. Model. 2009, 26, 320–327. [Google Scholar] [CrossRef]

- Helm, D.; Hepburn, C.; Mash, R. Credible carbon policy. Oxf. Rev. Econ. Policy 2003, 19, 438–450. [Google Scholar] [CrossRef]

- Zafar, M.W.; Shahbaz, M.; Hou, F.; Sinha, A. From nonrenewable to renewable energy and its impact on economic growth: The role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J. Clean. Prod. 2019, 212, 1166–1178. [Google Scholar]

- Eliet-Doillet, A.; Maino, A.G. Central Banks’ “Green Shift” and the Energy Transition; OIES: Oxford, UK, 2022. [Google Scholar]

- Abdullah, L.; Pauzi, H.M. Methods in forecasting carbon dioxide emissions: A decade review. J. Teknol. 2015, 75, 1. [Google Scholar] [CrossRef] [Green Version]

- Delarue, E.D.; Luickx, P.J.; D’haeseleer, W.D. The actual effect of wind power on overall electricity generation costs and CO2 emissions. Energy Convers. Manag. 2009, 50, 1450–1456. [Google Scholar] [CrossRef]

- Wang, J.; Yang, H.Z.; Lu, Z.B. Prospect of energy-related carbon dioxide emission in China based on scenario analysis. In Proceedings of the 2009 International Conference on Energy and Environment Technology, Guilin, China, 16–18 October 2009; Volume 3, pp. 90–93. [Google Scholar]

- Meng, M.; Jing, K.; Mander, S. Scenario analysis of CO2 emissions from China’s electric power industry. J. Clean. Prod. 2017, 142, 3101–3108. [Google Scholar] [CrossRef]

- Wang, S.; Zhao, Y.; Wiedmann, T. Carbon emissions embodied in China–Australia trade: A scenario analysis based on input–output analysis and panel regression models. J. Clean. Prod. 2019, 220, 721–731. [Google Scholar] [CrossRef]

- Samoilov, I.A.; Nakhutin, A.I. Estimation and medium-term forecasting of anthropogenic carbon dioxide and methane emission in Russia with statistical methods. Russ. Meteorol. Hydrol. 2009, 34, 348–353. [Google Scholar] [CrossRef]

| Author(s) | Countries | Timeframe | Method |

|---|---|---|---|

| Baloch and Wang [21] | BRICS | 1997–2017 | Driscoll-Kraay SE and DOLS |

| Chan [61] | 77 countries | 1980–2000 | E-DSGE with IRFs |

| Chishti et al. [30] | BRICS | 1985–2014 | OLS, FMOLS, DOLS |

| Dutt [17] | 94 countries | 1985–2000 | OLS (fixed effects panel) |

| Hajdukovic [62] | Switzerland and the UK | 1990–2016 | VAR |

| Halkos and Paizanos [37] | The USA | 1973–2013 | VAR |

| Hunjra et al. [49] | Pakistan, India, Sri Lanka, Nepal, and Bangladesh | 1984–2018 | Panel Regressions |

| Jalil and Feridun [54] | China | 1953–2006 | ARDL-ECM |

| Kaushal and Pathak [55] | India | 1991–2013 | VAR |

| Khan et al. [51] | Austria, Australia, Belgium, Canada, Germany, Spain, and Switzerland | 1990–2018 | CS-ARDL |

| Lopez and Palacios [38] | 12 European countries | 1995–2008 | Panel fixed effects-TVCE |

| Lopez et al. [40] | 38 countries | 1980–2005 | Panel fixed/random effects—FSE |

| Qingquan et al. [29] | 14 Asian countries | 1990–2014 | PFM-LS and PD-LS |

| Wang et al. [20] | BRICS | 1996–2005 | Panel Partial LS |

| Yuelan et al. [39] | China | 1980–2016 | ARDL |

| Zakaria and Bibi [22] | Bangladesh, India, Pakistan, Sri Lanka, and Nepal | 1984–2015 | 2SLS |

| Obs | Min | Max | Mean | Median | Standard Deviation | Variance | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|---|---|

| CO2Em | 2090 | 4.248495 | 16.14896 | 10.25784 | 10.52151 | 2.260729 | 5.110894 | −0.03519 | −0.38329 |

| GHGEm | 2090 | 5.991465 | 16.32959 | 10.88295 | 10.95492 | 2.006194 | 4.024813 | 0.058295 | −0.28004 |

| GDPgr | 2090 | −0.20599 | 0.345 | 0.036311 | 0.035741 | 0.038533 | 0.001485 | 0.177335 | 7.410194 |

| GovExp | 2090 | 0.009517 | 0.635793 | 0.270927 | 0.261278 | 0.104146 | 0.010846 | 0.299854 | −0.35547 |

| FDI | 2090 | −0.57605 | 4.490828 | 0.064115 | 0.031614 | 0.207597 | 0.043097 | 12.7532 | 209.4187 |

| GovEf | 2090 | 2.729246 | 7.436975 | 5.428397 | 5.284645 | 0.930047 | 0.864988 | 0.235591 | −1.08162 |

| M3gr | 2090 | −0.25551 | 0.877613 | 0.112545 | 0.083047 | 0.113249 | 0.012825 | 2.038833 | 7.073011 |

| IRmm | 2090 | −0.02955 | 0.776168 | 0.058411 | 0.04003 | 0.071292 | 0.005083 | 2.919285 | 14.91489 |

| CBT | 2090 | 1 | 14.5 | 7.293541 | 7.5 | 3.314904 | 10.98859 | −0.00462 | −1.13759 |

| CBI | 2090 | 0.12163 | 0.904 | 0.619382 | 0.6055 | 0.20082 | 0.040329 | −0.20415 | −1.20958 |

| IPS | ADF | |

|---|---|---|

| CO2Em | 3.1356 (0.9991) | 2.3560 (0.9908) |

| Δ.CO2Em | −21.9815 *** (0.0000) | −36.5351 *** (0.0000) |

| GHGEm | 3.2179 (0.9994) | 2.4274 (0.9924) |

| Δ.GHGEm | −22.3235 *** (0.0000) | −36.9910 *** (0.0000) |

| GDPgr | −15.9683 *** (0.0000) | −22.9885 *** (0.0000) |

| GovExp | −2.8428 ** (0.0022) | −3.4306 *** (0.0003) |

| FDI | −11.9641 *** (0.0000) | −15.9295 *** (0.0000) |

| M3gr | −14.2447 *** (0.0000) | −20.4868 *** (0.0000) |

| IRmm | −10.5815 *** (0.0000) | −15.5824 *** (0.0000) |

| Dependent ΔCO2 | Dependent ΔGHG | |||||||

|---|---|---|---|---|---|---|---|---|

| FE | RE | Driscoll–Kraay | GLS | FE | RE | Driscoll–Kraay | GLS | |

| GDPgr | 0.5010175 *** (0.000) | 0.520761 *** (0.000) | 0.520761 *** (0.000) | 0.520761 *** (0.000) | 0.3498996 *** (0.000) | 0.3473133 *** (0.000) | 0.3473133 *** (0.000) | 0.3473133 *** (0.000) |

| GovExp | −0.000325 (0.997) | −0.08832 ** (0.012) | −0.08832 *** (0.000) | −0.08832 ** (0.011) | −0.0105408 (0.852) | −0.0493751 ** (0.017) | −0.0493751 ** (0.009) | −0.0493751 ** (0.016) |

| FDI | 0.0051057 (0.753) | 0.0040655 (0.761) | 0.0040655 (0.426) | 0.0040655 (0.760) | 0.0052897 (0.580) | 0.0029454 (0.708) | 0.0029454 (0.405) | 0.0029454 (0.708) |

| GovEf | 0.0265612 * (0.077) | −0.0013416 (0.754) | −0.0013416 (0.801) | −0.0013416 (0.753) | 0.0055746 (0.529) | −0.0032147 (0.202) | −0.0032147 (0.206) | −0.0032147 (0.201) |

| M3gr | −0.0087763 (0.796) | −0.0244658 (0.403) | −0.0244658 (0.403) | −0.0244658 (0.402) | 0.0144446 (0.472) | −0.0043578 (0.801) | −0.0043578 (0.716) | −0.0043578 (0.800) |

| IRmm | 0.0118273 (0.862) | 0.022801 (0.612) | 0.022801 (0.387) | 0.022801 (0.611) | −0.0575196 (0.152) | −0.0297584 (0.261) | −0.0297584 (0.269) | −0.0297584 (0.260) |

| CBT | −0.0004853 (0.829) | −0.0020851 * (0.079) | −0.0020851 (0.115) | −0.0020851 * (0.078) | 0.0002092 (0.874) | −0.0008939 (0.201) | −0.0008939 (0.196) | −0.0008939 (0.200) |

| CBI | 0.0038791 (0.951) | −0.02508 (0.121) | −0.02508 ** (0.001) | −0.02508 (0.120) | 0.0173733 (0.639) | −0.0170345 * (0.074) | −0.0170345 ** (0.004) | −0.0170345 * (0.073) |

| constant | −0.145707 (0.115) | 0.0599537 ** (0.013) | 0.0599537 ** (0.006) | 0.0599537 ** (0.013) | −0.040503 (0.458) | 0.0480892 *** (0.001) | 0.0480892 *** (0.001) | 0.0480892 *** (0.001) |

| R2 | 0.0697 | 0.0529 | 0.0529 | 0.0303 | 0.0627 | 0.0627 | ||

| Hausman | 8.33 (0.4018) | 9.18 (0.3270) | ||||||

| Wooldridge | 5.194 ** (0.0249) | 14.934 *** (0.0002) | ||||||

| m-Wald | 1.7 × 105 *** (0.0000) | 54,895.34 *** (0.0000) | ||||||

| BP | 0.00 (1.0000) | 0.00 (1.0000) |

| REGION | RMSE_CO2 | RMSE_GHG |

|---|---|---|

| ECA | 0.075918761 | 0.046356371 |

| MENA | 0.08076882 | 0.041112596 |

| AP | 0.076740373 | 0.046469136 |

| AME | 0.075158505 | 0.046223406 |

| WE/EU | 0.077124186 | 0.04657374 |

| SSA | 0.068347786 | 0.040114951 |

| Dependent ΔCO2 | Dependent ΔGHG | |||||||

|---|---|---|---|---|---|---|---|---|

| FE | RE | Driscoll–Kraay | GLS | FE | RE | Driscoll–Kraay | GLS | |

| GDPgr | 0.6697974 ** (0.002) | 0.7537896 *** (0.000) | 0.7537896 *** (0.000) | 0.7537896 *** (0.000) | 0.5324164 *** (0.000) | 0.548746 *** (0.000) | 0.548746 *** (0.000) | 0.548746 *** (0.000) |

| GovExp | −0.0516406 (0.783) | −0.0784817 (0.151) | −0.0784817 * (0.062) | −0.0784817 (0.138) | −0.0277503 (0.568) | −0.0320581 ** (0.028) | −0.0320581 ** (0.046) | −0.0320581 ** (0.021) |

| FDI | −0.0226092 (0.671) | −0.018778 (0.687) | −0.018778 (0.279) | −0.018778 (0.687) | −0.0120243 (0.383) | −0.0137416 (0.261) | −0.0137416 (0.148) | −0.0137416 (0.255) |

| GovEf | 0.0321857 (0.251) | 0.004694 (0.486) | 0.004694 (0.634) | 0.004694 (0.475) | 0.0199485 ** (0.006) | −0.0043045 ** (0.016) | −0.0043045 ** (0.030) | −0.0043045 ** (0.009) |

| M3gr | −0.0112305 (0.876) | 0.0147909 (0.820) | 0.0147909 (0.651) | 0.0147909 (0.800) | −0.0057845 (0.757) | −0.0132487 (0.436) | −0.0132487 (0.290) | −0.0132487 (0.400) |

| IRmm | −0.0417223 (0.794) | 0.0606893 (0.404) | 0.0606893 (0.212) | 0.0606893 (0.384) | −0.0604342 (0.146) | 0.0057335 (0.767) | 0.0057335 (0.622) | 0.0057335 (0.716) |

| CBT | −0.0037583 (0.272) | −0.0022123 (0.278) | −0.0022123 (0.198) | −0.0022123 (0.275) | −0.0010417 (0.240) | −0.0010778 ** (0.046) | −0.0010778 (0.117) | −0.0010778 ** (0.037) |

| CBI | 0.0336716 (0.760) | −0.0089304 (0.707) | −0.0089304 (0.240) | −0.0089304 (0.696) | 0.0011826 (0.967) | −0.0083268 (0.189) | −0.0083268 * (0.090) | −0.0083268 * (0.058) |

| constant | −0.177093 (0.355) | −0.0011601 (0.980) | −0.0011601 (0.969) | −0.0011601 (0.969) | −0.1095789 ** (0.027) | 0.0409307 *** (0.001) | 0.0409307 ** (0.010) | 0.0409307 *** (0.000) |

| R2 | 0.0219 | 0.0510 | 0.0510 | 0.1515 | 0.2734 | 0.2734 | ||

| Hausman | 2.91 (0.9402) | 14.92 * (0.0608) | ||||||

| Wooldridge | 0.988 (0.3260) | 0.690 (0.4109) | ||||||

| m-Wald | 2.2 × 105 *** (0.0000) | 1273.95 *** (0.0000) | ||||||

| BP | 0.27 (0.3004) | 0.08 (0.4109) |

| Dependent ΔCO2 | Dependent ΔGHG | |||||||

|---|---|---|---|---|---|---|---|---|

| FE | RE | Driscoll–Kraay | GLS | FE | RE | Driscoll–Kraay | GLS | |

| GDPgr | 0.4546917 *** (0.000) | 0.4379928 *** (0.000) | 0.4379928 *** (0.000) | 0.4379928 *** (0.000) | 0.2964328 *** (0.000) | 0.2860754 *** (0.000) | 0.2860754 ** (0.003) | 0.2860754 *** (0.000) |

| GovExp | 0.0496961 (0.657) | −0.0991773 ** (0.046) | −0.0991773 ** (0.007) | −0.0991773 ** (0.045) | 0.017014 (0.846) | −0.0610739 (0.115) | −0.0610739 ** (0.035) | −0.0610739 (0.114) |

| FDI | 0.0075242 (0.652) | 0.001709 (0.902) | 0.001709 (0.694) | 0.001709 (0.901) | 0.0063487 (0.626) | 0.0039227 (0.717) | 0.0039227 (0.295) | 0.0039227 (0.716) |

| GovEf | 0.0176759 (0.324) | −0.0021711 (0.747) | −0.0021711 (0.781) | −0.0021711 (0.746) | −0.0058223 (0.677) | −0.0011362 (0.829) | −0.0011362 (0.861) | −0.0011362 (0.829) |

| M3gr | 0.0024391 (0.949) | −0.0301496 (0.351) | −0.0301496 (0.372) | −0.0301496 (0.349) | 0.0292892 (0.330) | 0.0025029 (0.921) | 0.0025029 (0.877) | 0.0025029 (0.921) |

| IRmm | 0.0354094 (0.632) | 0.0112998 (0.850) | 0.0112998 (0.797) | 0.0112998 (0.849) | −0.0490621 (0.396) | −0.0503946 (0.280) | −0.0503946 (0.317) | −0.0503946 (0.278) |

| CBT | 0.0032285 (0.299) | 0.0001181 (0.947) | 0.0001181 (0.926) | 0.0001181 (0.947) | 0.0023592 (0.330) | −0.0006313 (0.652) | −0.0006313 (0.536) | −0.0006313 (0.651) |

| CBI | −0.0132635 (0.861) | −0.0516529 ** (0.041) | −0.0516529 ** (0.003) | −0.0516529 ** (0.040) | 0.0272399 (0.645) | −0.0263021 (0.184) | −0.0263021 ** (0.048) | −0.0263021 (0.182) |

| constant | −0.1077269 (0.284) | 0.0776734 ** (0.020) | 0.0776734 ** (0.011) | 0.0776734 ** (0.019) | −0.0043257 (0.956) | 0.0469473 * (0.072) | 0.0469473 (0.108) | 0.0469473 * (0.071) |

| R2 | 0.1214 | 0.0482 | 0.0482 | 0.0584 | 0.0345 | 0.0345 | ||

| Hausman | 7.93 (0.4401) | 6.34 (0.6093) | ||||||

| Wooldridge | 4.613 ** (0.0365) | 14.828 *** (0.0003) | ||||||

| m-Wald | 13397.25 *** (0.0000) | 20262.14 *** (0.0000) | ||||||

| BP | 0.00 (1.0000) | 0.00 (1.0000) |

| Dependent ΔCO2 | Dependent ΔGHG | |

|---|---|---|

| FMOLS | FMOLS | |

| GDPgr | 0.5063472 *** (0.000) | 0.3362639 *** (0.000) |

| GovExp | −0.0890649 *** (0.000) | −0.0521193 ** (0.018) |

| FDI | 0.0047487 (0.299) | 0.0033989 (0.682) |

| GovEf | −0.0009026 (0.542) | −0.0027072 (0.313) |

| M3gr | −0.0240855 ** (0.016) | −0.0029406 (0.872) |

| IRmm | 0.0189704 (0.221) | −0.0297835 (0.289) |

| CBT | −0.00214 *** (0.000) | −0.0008483 (0.255) |

| CBI | −0.0256864 *** (0.000) | −0.0160313 (0.111) |

| constant | 0.0560095 *** (0.000) | 0.0457302 ** (0.004) |

| linear | 3.15 × 10−6 * (0.065) | 2.93 × 10−7 (0.925) |

| R2 | 0.02821 | 0.0180115 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bletsas, K.; Oikonomou, G.; Panagiotidis, M.; Spyromitros, E. Carbon Dioxide and Greenhouse Gas Emissions: The Role of Monetary Policy, Fiscal Policy, and Institutional Quality. Energies 2022, 15, 4733. https://doi.org/10.3390/en15134733

Bletsas K, Oikonomou G, Panagiotidis M, Spyromitros E. Carbon Dioxide and Greenhouse Gas Emissions: The Role of Monetary Policy, Fiscal Policy, and Institutional Quality. Energies. 2022; 15(13):4733. https://doi.org/10.3390/en15134733

Chicago/Turabian StyleBletsas, Konstantinos, Georgios Oikonomou, Minas Panagiotidis, and Eleftherios Spyromitros. 2022. "Carbon Dioxide and Greenhouse Gas Emissions: The Role of Monetary Policy, Fiscal Policy, and Institutional Quality" Energies 15, no. 13: 4733. https://doi.org/10.3390/en15134733

APA StyleBletsas, K., Oikonomou, G., Panagiotidis, M., & Spyromitros, E. (2022). Carbon Dioxide and Greenhouse Gas Emissions: The Role of Monetary Policy, Fiscal Policy, and Institutional Quality. Energies, 15(13), 4733. https://doi.org/10.3390/en15134733