Forecasting Crude Oil Consumption in Poland Based on LSTM Recurrent Neural Network

Abstract

:1. Introduction

- -

- the development of an innovative model based on LSTM artificial neural networks used to forecast oil demand;

- -

- according to the authors’ knowledge, this is the first study that uses deep learning methods to forecast the demand for crude oil on the Polish market;

- -

- this is the first study to confirm that LSTM artificial neural networks can be used to predict mal-numerical, non-stationary statistical datasets.

2. Geopolitical and Economic Foundations for the Functioning of the Energy-Resources Market

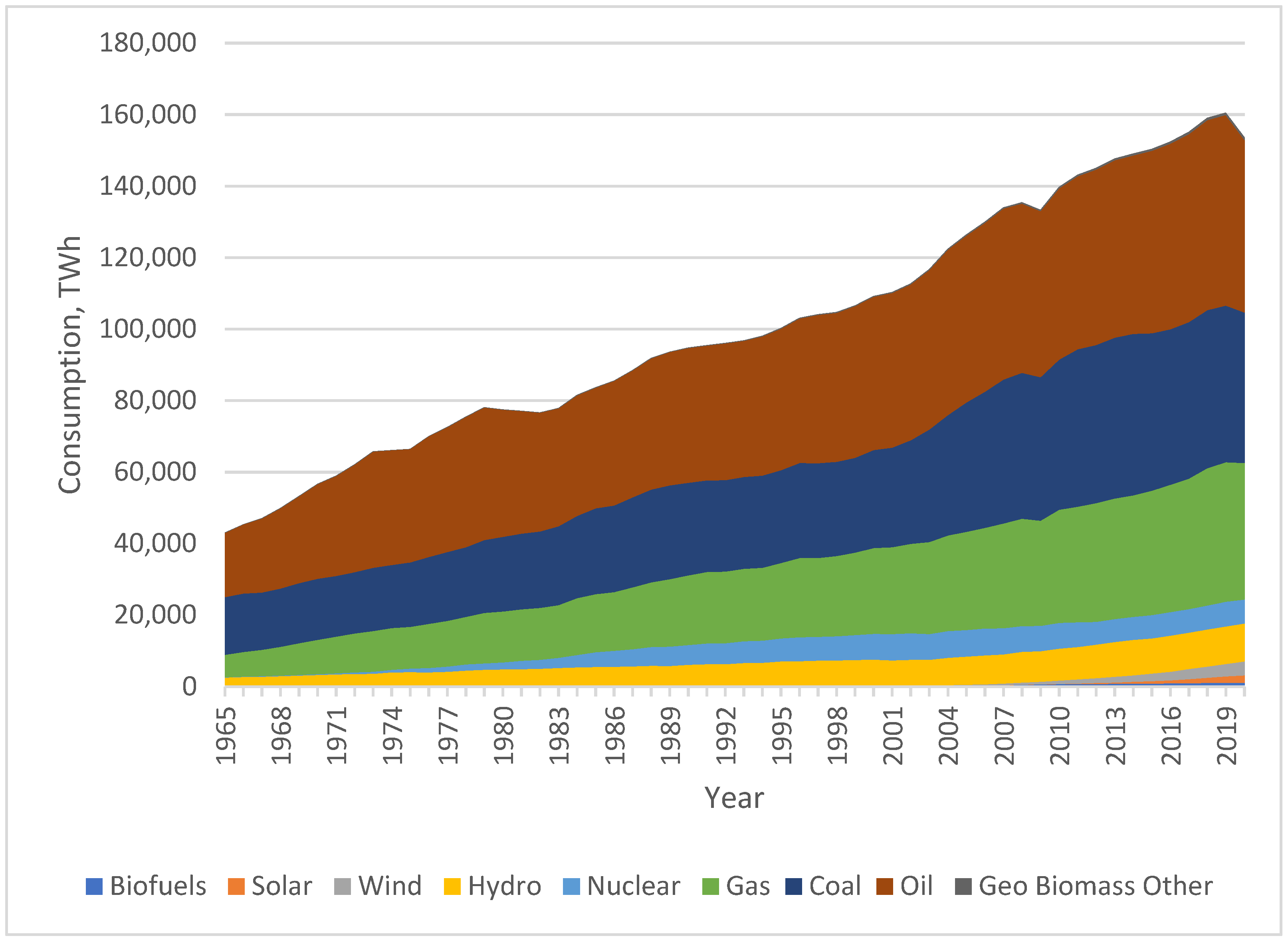

2.1. Primary Energy Supply

2.2. Crude Oil Market

- −

- The OPEC Reference Basket is the weighted average of crude oil types sourced from OPEC countries. The basket includes: Saharan Blend (Algeria), Minas (Indonesia), Iran Heavy (Iran), Basra Light (Iraq), Kuwait Export (Kuwait), Es Sider (Libya), Bonny Light (Nigeria), Qatar Marine (Qatar), Arab Light (Saudi Arabia), Murban (United Arab Emirates), and BCF 17 (Venezuela).

- −

- Dubai Fateh (Dubai Crude) is oil extracted from Dubai. Until June 2005, it was part of the OPEC basket. It is also used as a reference price for the export of raw materials to the Far East.

- −

- Ural oil is one of the four types of Russian oil. It is a mixture of deposits, mainly from Western Siberia, the Ural Mountains, and the Volga region, and is a reference point for establishing the export price of Russian crude oil. It is listed on the Russian stock exchange. The counterpart of Ural crude oil, listed on the New York Stock Exchange NYMEX, is Rebco crude oil (Russian Export Blend Crude Oil). Brent, WTI, and Dubai Fateh oil prices play a major role.

2.3. Poland’s Energy Structure

- −

- natural—the dominance of hard coal and lignite resources;

- −

- political—no long-term coherent vision of energy policy;

- −

- systemic—fully immature market economy;

- −

- external—participation in world trade and transport of energy carriers;

- −

- economic—relatively high prices, factors of electricity;

- −

- technical and technological—an extensive mining base of solid fuels and new technologies of fuel use.

3. Materials and Methods

- −

- correct estimation of model parameters;

- −

- applying the appropriate inference principle;

- −

- make the right starting assumptions.

4. Results and Discussion

- −

- training data:

- −

- test data:

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zinecker, M.; Doubravský, K.; Balcerzak, A.P.; Pietrzak, M.B.; Dohnal, M. The COVID-19 disease and policy response to mitigate the economic impact in the EU: An exploratory study based on qualitative trend analysis. Technol. Econ. Dev. Econ. 2021, 27, 742–762. [Google Scholar] [CrossRef]

- Prokop, V.; Kotkova Striteska, M.; Stejskal, J. Fostering Czech firms? innovation performance through efficient cooperation. Oecon. Copernic. 2021, 12, 671–700. [Google Scholar] [CrossRef]

- Markauskas, M.; Baliute, A. Technological progress spillover effect in Lithuanian manufacturing industry. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 783–806. [Google Scholar] [CrossRef]

- Nowak, P. Cooperation of enterprises in innovative activities on the example of Polish regions. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 839–857. [Google Scholar] [CrossRef]

- Andrijauskiene, M.; Dumciuviene, D.; Stundziene, A. EU framework programmes: Positive and negative effects on member states’ innovation performance. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 471–502. [Google Scholar] [CrossRef]

- Ključnikov, A.; Civelek, M.; Fialova, V.; Folvarčná, A. Organizational, local, and global innovativeness of family-owned SMEs depending on firm-individual level characteristics: Evidence from the Czech Republic. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 169–184. [Google Scholar] [CrossRef]

- Kotlebova, J.; Arendas, P.; Chovancova, B. Government expenditures in the support of technological innovations and impact on stock market and real economy: The empirical evidence from the US and Germany. Equilib. Q. J. Econ. Econ. Policy 2020, 15, 717–734. [Google Scholar] [CrossRef]

- Lin, M.-X.; Liou, H.M.; Chou, K.T. National Energy Transition Framework toward SDG7 with Legal Reforms and Policy Bundles: The Case of Taiwan and Its Comparison with Japan. Energies 2020, 13, 1387. [Google Scholar] [CrossRef] [Green Version]

- Pietrzak, M.B.; Igliński, B.; Kujawski, W.; Iwański, P. Energy transition in Poland—Assessment of the renewable energy sector. Energies 2021, 14, 2046. [Google Scholar] [CrossRef]

- Bluszcz, A. The emissivity and energy intensity in EU countries—Consequences for the Polish economy. In Proceedings of the Energy and Clean Technologies. Recycling, air Pollution and Climate Change, Sofia, Bulgaria, 1–7 July 2018; Volume 18, pp. 631–638. [Google Scholar]

- Bluszcz, A. European Economies in terms of energy dependence. Qual. Quan. 2017, 51, 1531–1548. [Google Scholar] [CrossRef] [Green Version]

- Strunz, S. The German energy transition as a regime shift. Ecol. Econ. 2014, 100, 150–158. [Google Scholar] [CrossRef] [Green Version]

- Shafique, M.; Azam, A.; Rafig, M.; Luo, X. Investigating the nexus among transport, economic growth and environmental degradation: Evidence from panel ARDL approach. Transp. Policy 2021, 109, 61–71. [Google Scholar] [CrossRef]

- Markandya, A.; Arto, I.; González-Eguino, M.; Román, M.V. Towards a green energy economy? Tracking the employment effects of low-carbon technologies in the European Union. Appl. Energy 2016, 179, 1342–1350. [Google Scholar] [CrossRef] [Green Version]

- Gielen, D.; Boshell, F.; Saygin, D.; Bazilian, M.D.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strat. Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- Ellabban, O.; Abu-Rub, H.; Blaabjerg, F. Renewable energy resources: Current status, future prospects and their enabling technology. Renew. Sustain. Energy Rev. 2014, 39, 748–764. [Google Scholar] [CrossRef]

- Balcerzak, A.P. Quality of Institutions in the European Union countries. Application of TOPSIS Based on Entropy Measure for Objective Weighting. Acta Polytech. Hung. 2020, 17, 101–122. [Google Scholar] [CrossRef]

- Gajdos, A.; Arendt, L.; Balcerzak, A.P.; Pietrzak, M.B. Future trends of labour market polarisation in Poland. Perspect. Trans. Bus. Econ. 2020, 19, 114–135. [Google Scholar]

- Dmytrów, K.; Bieszk-Stolorz, B. Comparison of changes in the labour markets of post-communist countries with other EU member states. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 741–764. [Google Scholar] [CrossRef]

- Svabova, L.; Tesarova, E.N.; Durica, M.; Strakova, L. Evaluation of the impacts of the COVID-19 pandemic on the development of the unemployment rate in Slovakia: Counterfactual before-after comparison. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 261–284. [Google Scholar] [CrossRef]

- Wosiek, M. Unemployment and new firm formation: Evidence from Polish industries at the regional level. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 765–782. [Google Scholar] [CrossRef]

- Matuszewska-Janica, A.; Witkowska, D. Differences between determinants of men and women monthly wages across fourteen European Union states. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 503–531. [Google Scholar] [CrossRef]

- Jankiewicz, M.; Pietrzak, M.B. Assesment of Trends in the Share of Expenditure on Services and Food in the Visegrad Group Member States. Int. J. Bus. Soc. 2020, 21, 977–996. [Google Scholar] [CrossRef]

- Piekut, M. Patterns of Energy Consumption in Polish One-Person Households. Energies 2020, 13, 5699. [Google Scholar] [CrossRef]

- Fragkos, P.; Paroussos, L. Employment creation in EU related to renewables expansion. Appl. Energy 2018, 230, 935–945. [Google Scholar] [CrossRef]

- Rollnik-Sadowska, E.; Dąbrowska, E. Cluster analysis of effectiveness of labour market policy in the European Union. Oecon. Copernic. 2018, 9, 143–158. [Google Scholar] [CrossRef]

- Chocholatá, M.; Furková, A. The analysis of employment rates in the context of spatial connectivity of the EU regions. Equilib. Quart. J. Econ. Econ. Policy 2018, 13, 181–213. [Google Scholar] [CrossRef]

- Manowska, A.; Rybak, A. An Analysis of Coal Products Sales with Reference to Environmental Regulations of the European Union. Energy and Fuels; Cracow University of Technology, Institute of Thermal Power Engineering: Cracow, Poland, 2018; Available online: https://www.semanticscholar.org/paper/An-analysis-of-sales-of-coal-products-with-to-of-Manowska-Rybak/42b5027332c801ebf4a17bdeee223cc8b4a49d13 (accessed on 1 July 2020).

- Azam, A.; Rafig, M.; Shafique, M.; Yuan, J. An empirical analysis of the non-linear effects of natural gas, nuclear energy, renewable energy and ICT-Trade in leading CO2 emitter countries: Policy towards CO2 mitigation and economic sustainability. J. Environ. Manag. 2021, 286, 112232. [Google Scholar] [CrossRef]

- Azam, A.; Rafig, M.; Shafique, M.; Yuan, J. Towards Achieving Environmental Sustainability: The Role of Nuclear Energy, Renewable Energy, and ICT in the Top-Five Carbon Emitting Countries. Energy Res. 2022, 9, 804706. [Google Scholar] [CrossRef]

- Shafique, M.; Azam, A.; Rafig, M.; Luo, X. Life cycle assessment of electric vehicles and internal combustion engine vehicles: A case study of Hong Kong. Res. Transp. Econ. 2022, 91, 101112. [Google Scholar] [CrossRef]

- Arabzadeh, V.; Mikkola, J.; Jasiūnas, J.; Lund, P.D. Deep decarbonization of urban energy systems through renewable energy and sector-coupling flexibility strategies. J. Environ. Manag. 2020, 260, 110090. [Google Scholar] [CrossRef]

- Sierpińska, M.; Bąk, P. Financial structure of mining sector companies during an economic slowdown. Arch. Min. Sci. 2020, 57, 1089–1100. [Google Scholar]

- Rybak, A.; Rybak, A. Possible strategies for hard coal mining in Poland as a result of production function analysis. Resour. Policy 2016, 50, 27–33. [Google Scholar] [CrossRef]

- Manowska, A.; Tobór-Osadnik, K.; Wyganowska, M. Economic and social aspects of restructuring Polish coal mining: Focusing on Poland and the EU. Resour. Policy 2017, 52, 192–200. [Google Scholar] [CrossRef]

- Jonek-Kowalska, I. Challenges for long-term industry restructuring in the Upper Silesian Basin. What has Polish coal mining achieved and failed from a twenty—Year perspective? Resour. Policy 2015, 44, 135–149. [Google Scholar] [CrossRef] [Green Version]

- Hąbek, P.; Wolniak, R. Assessing the quality of corporate social responsibility reports; the case of reporting practices in selected European Union member states. Qual. Quan. 2016, 50, 399–420. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Grabowska, S. Improvement of the heat treatment process in the industry 4.0 context. METAL 2018. In Proceedings of the 27th International Conference on Metallurgy and Materials, Brno, Czech Republic, 23–25 May 2018; pp. 1985–1990. [Google Scholar]

- Brzychczy, E. An overview of data mining and process mining applications in underground mining. Min. Eng. 2019, 21, 301–314. [Google Scholar] [CrossRef]

- Manowska, A. Forecast to determine a development strategy for the mining sector, Conference proceedings. In Ecology, Economics, Education and Legislation, Environmental Economics; STEF92 Technology: Sofia, Bulgaria, 2018; Volume 18, pp. 967–974. [Google Scholar]

- Bluszcz, A. Multidimensional comparative analysis as a tool for assessing the level of development of energy markets in selected European countries. In Proceedings of the World Multidisciplinary Earth Sciences Symposium WMESS, Prague, Czech Republic, 7–9 September 2020. [Google Scholar]

- Wang, Z.; Wang, Q.; Yang, X.; Xia, S.; Zheng, A.; Zeng, K.; Zhao, Z.; Li, H.; Sobek, S.; Werle, S. Comparative assessment of pretreatment options for biomass pyrolysis: Linking biomass compositions to resulting pyrolysis behaviors, kinetics, and product yields. Energy Fuels 2021, 35, 4. [Google Scholar] [CrossRef]

- Sukiennik, M.; Kowal, B. Analysis and Verification of Space for New Businesses in Raw Material Market—A Case Study of Poland. Energies 2022, 15, 3042. [Google Scholar] [CrossRef]

- Zinecker, M.; Skalická, M.; Balcerzak, A.P.; Pietrzak, M.B. Business angels in the Czech Republic: Characteristics and a classification with policy implications. Econ. Res.-Kenosha Istraživanja 2021, 35, 273–298. [Google Scholar] [CrossRef]

- Gorączkowska, J. Enterprise innovation in technology incubators and university business incubators in the context of Polish industry. Oecon. Copernic. 2020, 11, 799–817. [Google Scholar] [CrossRef]

- Zinecker, M.; Skalická, M.; Balcerzak, A.P.; Pietrzak, M.B. Identifying the impact of external environment on business angel activity. Econ. Res.-Ekon. Istraživanja 2021, 1–23. [Google Scholar] [CrossRef]

- Meluzín, T.; Zinecker, M.; Balcerzak, A.P.; Pietrzak, M.B.; Doubravský, K. Institutional Settings and their Impact on the IPO Activity: An Exploratory Study Based on Qualitative Modelling. Acta Polytech. Hung. 2021, 18, 215–235. [Google Scholar] [CrossRef]

- Meluzín, T.; Balcerzak, A.P.; Pietrzak, M.B.; Zinecker, M.; Doubravský, K. The impact of rumours related to political and macroeconomic uncertainty on IPO success: Evidence from a qualitative model. Transform. Bus. Econ. 2018, 2017, 148–169. [Google Scholar]

- Meluzín, T.; Zinecker, M.; Balcerzak, A.P.; Doubravský, K.; Pietrzak, M.B.; Dohnal, M. The timing of initial public offerings: Non-numerical model based on qualitative trends. J. Bus. Econ. Manag. 2018, 19, 63–79. [Google Scholar] [CrossRef] [Green Version]

- Meluzín, T.; Zinecker, M.; Balcerzak, A.P.; Pietrzak, M.B. Why do companies stay private? Determinants for IPO candidates to consider in Poland and the Czech Republic. East. Eur. Econ. 2018, 56, 471–503. [Google Scholar] [CrossRef]

- Carley, S.; Konisky, D.M. The justice and equity implications of the clean energy transition. Nat. Energy 2020, 5, 569–577. [Google Scholar] [CrossRef]

- Oehlmann, M.; Meyerhoff, J. Stated preferences towards renewable energy alternatives in Germany—Do the consequentiality of the survey and trust in institutions matter? J. Environ. Econ. Policy 2016, 6, 1–16. [Google Scholar] [CrossRef]

- Rogers, J.; Simmons, E.; Convery, I.; Weatherall, A. Public perceptions of opportunities for community-based renewable energy projects. Energy Policy 2008, 36, 4217–4226. [Google Scholar] [CrossRef] [Green Version]

- Zoellner, J.; Schweizer-Ries, P.; Wemheuer, C. Public acceptance of renewable energies: Results from case studies in Germany. Energy Policy 2008, 36, 4136–4141. [Google Scholar] [CrossRef]

- Hussain, H.I.; Szczepańska-Woszczyna, K.; Kamarudin, F.; Anwar, N.A.M.; Saudi, M.H.M. Unboxing the black box on the dimensions of social globalisation and the efficiency of microfinance institutions in Asia. Oecon. Copernic. 2021, 12, 557–592. [Google Scholar] [CrossRef]

- Bluszcz, A. Selected problems of Poland’s energy transformation in the light of the requirements of the European Green Deal. In Proceedings of the 7th World Multidisciplinary Earth Sciences Symposium (WMESS 2021), Prague, Czech Republic, 6–10 September 2021. [Google Scholar]

- Manowska, A. Forecasting of the share of renewable sources in the total final energy consumption for selected European Union countries. In Proceedings of the 7th World Multidisciplinary Earth Sciences Symposium (WMESS 2021), Prague, Czech Republic, 6–10 September 2021. [Google Scholar]

- Manowska, A. Analysis and forecasting of the primary energy consumption in Poland using deep learning. Inżynieria Miner. 2020, 21, 217–222. [Google Scholar] [CrossRef]

- Bluszcz, A.; Manowska, A. The use of hierarchical agglomeration methods in assessing the Polish energy market. Energies 2021, 14, 3958. [Google Scholar] [CrossRef]

- Ministerstwo Klimatu i Środowiska (Ministry of Assets). Polityka Energetyczna Polski do 2040 r (Poland’s Energy Policy until 2040). Available online: www.gov.pl (accessed on 15 November 2021).

- Hagen, R. How is the international price of a particular crude determined? OPEC Rev. 1994, 18, 145–158. [Google Scholar] [CrossRef]

- Stevens, P. The determination of oil prices 1945–1995. Energy Policy 1995, 23, 861–870. [Google Scholar] [CrossRef]

- Amin-Naseri, M.R.; Gharacheh, E.A. A hybrid artificial intelligence approach to monthly forecasting of crude oil price time, series. In Proceedings of the 10th International Conference on Engineering Applications of Neural Networks (CEUR-WS284), Salamanca, Spain, 10–12 June 2007; pp. 160–167. [Google Scholar]

- Cabedo, J.D.; Moya, I. Estimating oil price ‘Value at Risk’ using the historical simulation approach. Energy Econ. 2003, 25, 239–253. [Google Scholar] [CrossRef]

- Karakurt, I. Modelling and forecasting the oil consumptions of the BRICS-T countries. Energy 2021, 220, 119720. [Google Scholar] [CrossRef]

- Kang, S.H.; Kang, S.M.; Yoon, S.M. Forecasting volatility of crude oil markets. Energy Econ. 2009, 31, 119–125. [Google Scholar] [CrossRef]

- Wei, Y.; Wang, Y.; Huang, D. Forecasting crude oil market volatility: Further evidence using GARCH-class model. Energy Econ. 2010, 31, 1477–1484. [Google Scholar] [CrossRef]

- Zhang, Y.; Wahab, M.I.M.; Wang, Y. Forecasting crude oil market volatility using variable selection and common factor. Int. J. Forecast. 2022, in press. [Google Scholar] [CrossRef]

- Degiannakis, S.; Filis, G. Forecasting oil price realized volatility using information channels from other asset classes. J. Int. Money Financ. 2017, 76, 28–49. [Google Scholar] [CrossRef] [Green Version]

- Olkuski, T.; Szurlej, A.; Tora, B.; Karpiński, M. Polish energy security in the oil sector. E3S Web Conf. 2019, 108, 02015. [Google Scholar] [CrossRef]

- Kamyk, J.; Kot-Niewiadomska, A.; Galos, K. The criticality of crude oil for energy security: A case of Poland. Energy 2021, 220, 119707. [Google Scholar] [CrossRef]

- Olkuski, T.; Sikora, A.; Sikora, M.P.; Szurlej, A. The forecasted production, consumption, and net exports of energy resources in Poland. Energy Policy J. 2017, 20, 41–58. [Google Scholar]

- Krawczyk, A. Analysis of Energy Consumption for Heating in a Residential House in Poland. Energy Procedia 2016, 95, 216–222. [Google Scholar] [CrossRef] [Green Version]

- Skrodzka, W. Analysis of the Structure of Primary Energy Production in Poland Against the European Union. In Proceedings of the International Conference on European Integration, Ostrava, Czech Republic, 19–20 May 2016. [Google Scholar]

- Energy Information Administration, USA. 2021. Available online: www.eia.gov (accessed on 15 May 2022).

- World Energy Outlook 2022, IEA 2022. Available online: www.iea.org/topics/world-energy-outlook (accessed on 15 May 2022).

- BP. 2022. Available online: www.bp.com/en/global/corporate/investors/annual-report.html (accessed on 15 May 2022).

- Available online: https://yearbook.enerdata.net/crude-oil/world-production-statistics.html (accessed on 15 May 2022).

- World Oil Statistics—Worldometer. Available online: worldometers.info (accessed on 1 May 2022).

- Supply—Key World Energy Statistics 2021—Analysis—IEA. Available online: www.iea.org/reports/key-world-energy-statistics-2021/supply (accessed on 2 May 2022).

- Papież, M.; Śmiech, S. Modelowanie i Prognozowanie cen Surowców Energetycznych; Publishing House C.H.BECK: Warszawa, Poland, 2015. [Google Scholar]

- Prawo Energetyczne (Dz. U. z 2021 r. poz. 716, z zm.). Available online: www.infor.pl/akt-prawny/DZU.2021.109.0000716,ustawa-prawo-energetyczne.html (accessed on 3 May 2022).

- Krajowy Plan na Rzecz Energii i Klimatu na Lata 2021–2030 (KPEiK). Available online: www.gov.pl/web/klimat/projekt-krajowego-planu-na-rzecz-energii-i-klimatu-na-lata-2021-2030 (accessed on 2 May 2022).

- Kaliski, M.; Staśko, D. Bezpieczeństwo Energetyczne w Gospodarce Paliwowej Polski; Wydawnictwo Instytutu Surowcami Mineralnymi i Energią PAN: Kraków, Poland, 2006. [Google Scholar]

- Rybak, A.; Manowska, A. The forecast of coal sales taking the factors influencing the demand for hard coal into account. Resour. Manag. 2019, 35, 129–140. [Google Scholar]

- Cheong, C.W. Modeling and forecasting crude oil markets using ARCH-type models. Energy Policy 2009, 37, 2346–2355. [Google Scholar] [CrossRef]

- Wang, D.; Fang, T. Forecasting Crude Oil Prices with a WT-FNN Model. Energies 2022, 15, 1955. [Google Scholar] [CrossRef]

- Manowska, A. Using the LSTM network to forecast the demand for electricity in Poland. Appl. Sci. 2020, 10, 8455. [Google Scholar] [CrossRef]

- Manowska, A. Using the LSTM network to forecast the demand for hard coal. Miner. Resour. Manag. 2020, 36, 33–48. [Google Scholar]

- Manowska, A. Modeling of Changes in the Polish Energy Mix Structure Resulting from World Megatrends; Publishing House Silesian University of Technology: Gliwice, Poland, 2021; p. 191. [Google Scholar]

- Wu, B.; Wanga, L.; Wanga, S.; Zengb, Z. Forecasting the U.S. oil markets based on social media information during the COVID-19 pandemic. Energy 2021, 226, 1. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, Y. Forecasting crude oil futures market returns: A principal component analysis combination approach. Int. J. Forecast. 2022, in press. [Google Scholar] [CrossRef]

- Hamdi, E.; Aloui, C. Forecasting Crude Oil Price Using Artificial Neural Networks: A Literature Survey’. Econ. Bull. 2015, 35, 1339–1359. [Google Scholar]

- Anik, A.R.; Rahman, S. Commercial Energy Demand Forecasting in Bangladesh. Energies 2021, 14, 6394. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Kostenko, A.V. Minimum sample size requirements for seasonal forecasting models. Foresight 2007, 6, 12–15. [Google Scholar]

- Ingrassia, S.; Morlini, I. Neural network modeling for small datasets. Technometrics 2005, 47, 297–311. [Google Scholar] [CrossRef] [Green Version]

- Pasini, A. Artificial neural networks for small dataset analysis. J. Thorac. Dis. 2015, 7, 953. [Google Scholar]

- Del Real, A.J.; Dorado, F.; Durán, J. Energy Demand Forecasting Using Deep Learning: Applications for the French Grid. Energies 2020, 13, 2242. [Google Scholar] [CrossRef]

- Ma, R.; Zheng, X.; Wang, P.; Liu, H.; Zhang, C. The prediction and analysis of COVID-19 epidemic trend by combining LSTM and Markov method. Sci. Rep. 2021, 11, 17421. [Google Scholar] [CrossRef]

- Wu, X.; Liu, Z.; Yin, L.; Zheng, W.; Song, L.; Tain, J.; Yang, B.; Liu, S. A Haze Prediction Model in Chengdu Based on LSTM. Atmosphere 2021, 12, 1479. [Google Scholar] [CrossRef]

- Hochreiter, S.; Schmidhuber, J. Long short-term memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef]

- Zeliaś, A.; Wanat, S.; Pawełek, B. Prognozowanie Ekonomiczne; Publishing House PWN: Warszawa, Poland, 2008. [Google Scholar]

| Energy Resource [EJ] | 1990 | 2000 | 2010 | 2020 |

|---|---|---|---|---|

| Coal | 93 | 96.9 | 153 | 162.4 |

| Oil | 135.3 | 153.6 | 167.6 | 187.4 |

| Natural gas | 69.6 | 86.6 | 114.4 | 140.8 |

| Nuclear energy | 22 | 28.3 | 30.1 | 30.5 |

| Hydro | 7.7 | 9.4 | 12.4 | 12.5 |

| Biofuels and waste | 38.2 | 41.5 | 49.1 | 15.2 |

| Other | 1.8 | 2.6 | 4.7 | 16.5 |

| Total | 367.6 | 418.9 | 531.3 | 568 |

| Energy Resource [EJ] | 1990 | 2000 | 2010 | 2020 |

|---|---|---|---|---|

| Coal | 25% | 23% | 29% | 29% |

| Oil | 37% | 37% | 32% | 33% |

| Natural gas | 19% | 21% | 22% | 25% |

| Nuclear energy | 6% | 7% | 6% | 5% |

| Hydro | 2% | 2% | 2% | 3% |

| Biofuels and waste | 10% | 10% | 9% | 3% |

| Other | 0% | 1% | 1% | 3% |

| Autor(s) | Goal | Method |

|---|---|---|

| Wang et al. [87] | A new method of oil price forecasting | A combination of the FNN model and the stochastic time-effective function-WT-FNN |

| Wu et al. [91] | A new method of oil price forecasting | Social media information was used in convolutional neural network, which can finely reflect oil market factors and exogenous factors, such as conflicts and political instability. |

| Zhang et al. [92] | Predicted the predictability of market returns on oil futures | A principal component analysis (PCA) |

| Hamdi et al. [93] | They showed that the use of neural networks is the right choice due to the non-linear nature of crude oil prices | They compared traditional methods with econometric models and with artificial neural networks. |

| Anik et al. [94] | They forecasted the demand for primary energy, with particular emphasis on the demand for crude oil. | They used the Cobb–Douglas function for forecasting. |

| Manowska [88,89,90] | They analyzed the use of mathematical models to forecast fossil resources | In their works, they paid special attention to the non-stationarity of processes and the non-linear nature of their wear. They proposed the use of LSTM artificial neural net-works, which are highly effective in forecasting small-scale, non-linear data sets |

| Extended Dickey–Fuller test for the crude oil consumption process the significance of the delay from the order of 10 was tested for the AIC criterion sample size 51 Null hypothesis: unit root a = 1 exists; process I (1) |

| test with constant for an order delay of the 4th process (1-L) of the crude oil consumption series model: (1-L) y = b0 + (a − 1) ∗ y (−1) + … + e the estimated value of (a − 1) is: −0.0094344 Test statistic: tau_c (1) = −0.432418 asymptotic p-value = 0.9014 First-order residual autocorrelation: 0.002 delayed differences: F (4, 45) = 5.135 [0.0017] with a constant and a linear trend for the first-order process delay (1-L) of the crude oil consumption series model: (1-L) y = b0 + b1 ∗ t + (a − 1) ∗ y (−1) + … + e the estimated value of (a − 1) is: −0.164256 Test statistic: tau_ct (1) = −3.03071 asymptotic p-value = 0.1237 First order residual autocorrelation: −0.056 with a constant, linear trend and square trend for an order 2 (1-L) delay of the crude oil consumption series model: (1-L) y = b0 + b1 ∗ t + b2 ∗ t ^ 2 + (a − 1) ∗ y (−1) + … + e the estimated value of (a − 1) is: −0.206229 Test statistic: tau_ctt (1) = −3.3558 asymptotic p-value = 0.1539 First-order residual autocorrelation: 0.014 delayed differences: F (2, 47) = 9.160 [0.0004] |

| Measures | |

|---|---|

| Mean | 18.51 |

| Standard error | 0.92 |

| Median | 17.51 |

| Standard deviation | 6.74 |

| Sample variance | 45.42 |

| Kurtosis | −0.51 |

| Skewness | 0.09 |

| Range | 27.28 |

| Minimum | 5.54 |

| Maximum | 32.82 |

| Quantity | 55.00 |

| The largest | 32.82 |

| The smallest | 5.54 |

| Confidence level (95.0%) | 1.84 |

| Layer (Type) | Output Shape | Param |

|---|---|---|

| lstm (LSTM) | (None, 3, 3) | 60 |

| dropout (Dropout) | (None, 3, 3) | 0 |

| lstm_1 (LSTM) | (None, 1) | 20 |

| dense (Dense) | (None, 1) | 2 |

| A Recurrent Neural Network (LSTM) Implementation Using TensorFlow Library | |

|---|---|

| Loading and reading the data file | from google.colab import files uploaded = files.upload() df = pd.read_csv(io.BytesIO(uploaded[‘XXX.csv’])) df.head() |

| Function that sets the training vectors according (15) and (16) | def univariate_data(dataset, start_index, end_index, history_size, target_size): data = [] labels = [] start_index = start_index + history_size if end_index is None: end_index = len(dataset)-target_size for i in range(start_index, end_index): indices = range(i-history_size, i) Reshape data from (history_size,) to (history_size, 1) data.append(np.reshape(dataset[indices], (history_size, 1))) labels.append(dataset[i + target_size]) return np.array(data), np.array(labels) |

| The amount of historical data downloaded for training | tf.random.set_seed(13) uni_data = df[‘Crude Oil’] TRAIN_SPLIT = uni_data.shape [0]−1 uni_data.index = df[‘Year’] univariate_past_history = 3 univariate_future_target = 0 uni_data.head() print(TRAIN_SPLIT) uni_data.plot(subplots = True) uni_data1 = uni_data uni_data = uni_data.values |

| Network training | train_univariate = tf.data.Dataset.from_tensor_slices((x_train_uni, y_train_uni)) train_univariate = train_univariate.cache().shuffle(BUFFER_SIZE).batch(BATCH_SIZE).repeat() val_univariate = tf.data.Dataset.from_tensor_slices((x_val_uni, y_val_uni)) val_univariate = val_univariate.batch(BATCH_SIZE).repeat() simple_lstm_model = tf.keras.models.Sequential([ tf.keras.layers.LSTM(3, input_shape = (x_train_uni.shape [1],x_train_uni.shape [2]), return_sequences=True), tf.keras.layers.LSTM(1, input_shape = (x_train_uni.shape [1],x_train_uni.shape [2]), return_sequences=False), tf.keras.layers.Dropout(rate = 0.03), tf.keras.layers.LSTM(1,activation = ‘relu’), tf.keras.layers.Dropout(rate = 0.3), tf.keras.layers.Dense(1) ]) simple_lstm_model.compile(optimizer = ‘adam’, loss = ‘mae’) simple_lstm_model.fit(train_univariate, epochs = EPOCHS, steps_per_epoch = EVALUATION_INTERVAL, validation_data = val_univariate, validation_steps = 50, callbacks = [tensorboard_callback]) |

| Prediction for test data | result = [] print(“Model prediction on test data “) for i in range(x_train_uni.shape [0]): for j in range(univariate_past_history): x_val_uni [0,:,0] = x_train_uni[i,:,0] val_univariate = tf.data.Dataset.from_tensor_slices((x_val_uni, y_val_uni)) val_univariate = val_univariate.batch(BATCH_SIZE).repeat() x,y = val_univariate.take(2) predykcja = simple_lstm_model.predict(x [0]) wynik = np.append(wynik,predykcja [0]) print(predykcja [0]) pandaresalt = pd.DataFrame(resalt) pandaresalt.plot(subplots = True) uni_data2 = uni_data1[univariate_past_history:uni_data1.shape [0]−1] uni_data2.index = pandaresalt.index uni_data2.plot(subplots = True) |

| Proper prediction | print(“Proper prediction “) for k in range(35): for m in range(univariate_past_history−1): x_val_uni [0,m,0] = x_val_uni [0,m + 1,0] x_val_uni [0,univariate_past_history−1,0] = predykcja [0] val_univariate = tf.data.Dataset.from_tensor_slices((x_val_uni, y_val_uni)) val_univariate = val_univariate.batch(BATCH_SIZE).repeat() x,y = val_univariate.take(2) predykcja = simple_lstm_model.predict(x [0]) resalt = np.append(resalt,predykcja [0]) print(predykcja [0]) print(“Resalt “, i + 1, “forecasting”) pandawynik = pd.DataFrame(resalt) pandawynik.plot(subplots = True) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Manowska, A.; Bluszcz, A. Forecasting Crude Oil Consumption in Poland Based on LSTM Recurrent Neural Network. Energies 2022, 15, 4885. https://doi.org/10.3390/en15134885

Manowska A, Bluszcz A. Forecasting Crude Oil Consumption in Poland Based on LSTM Recurrent Neural Network. Energies. 2022; 15(13):4885. https://doi.org/10.3390/en15134885

Chicago/Turabian StyleManowska, Anna, and Anna Bluszcz. 2022. "Forecasting Crude Oil Consumption in Poland Based on LSTM Recurrent Neural Network" Energies 15, no. 13: 4885. https://doi.org/10.3390/en15134885

APA StyleManowska, A., & Bluszcz, A. (2022). Forecasting Crude Oil Consumption in Poland Based on LSTM Recurrent Neural Network. Energies, 15(13), 4885. https://doi.org/10.3390/en15134885