Conditional Dynamic Dependence and Risk Spillover between Crude Oil Prices and Foreign Exchange Rates: New Evidence from a Dynamic Factor Copula Model

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. Dynamic Dependence Model Based on Factor Copulas

3.1.1. Extraction of Common Factors

3.1.2. Marginal Distribution Model

3.1.3. Time-Varying Copula Dependent Parameter Model

3.2. Risk Spillover Measuring Model

4. Data and Summary Statistics

5. Analysis of Empirical Results

5.1. Model Estimations

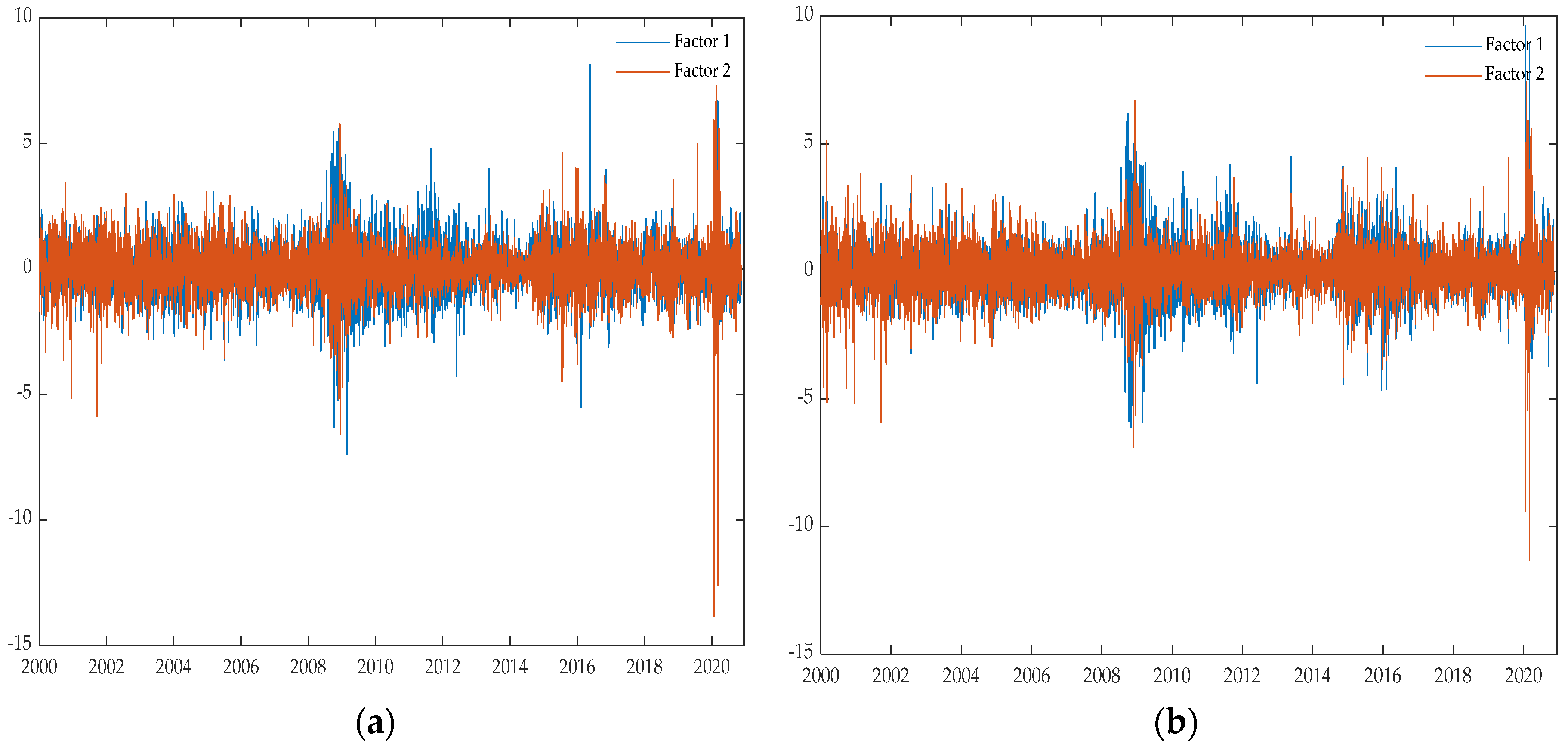

5.1.1. Extraction and Analysis of Common Factors

5.1.2. Estimation of Marginal Distribution

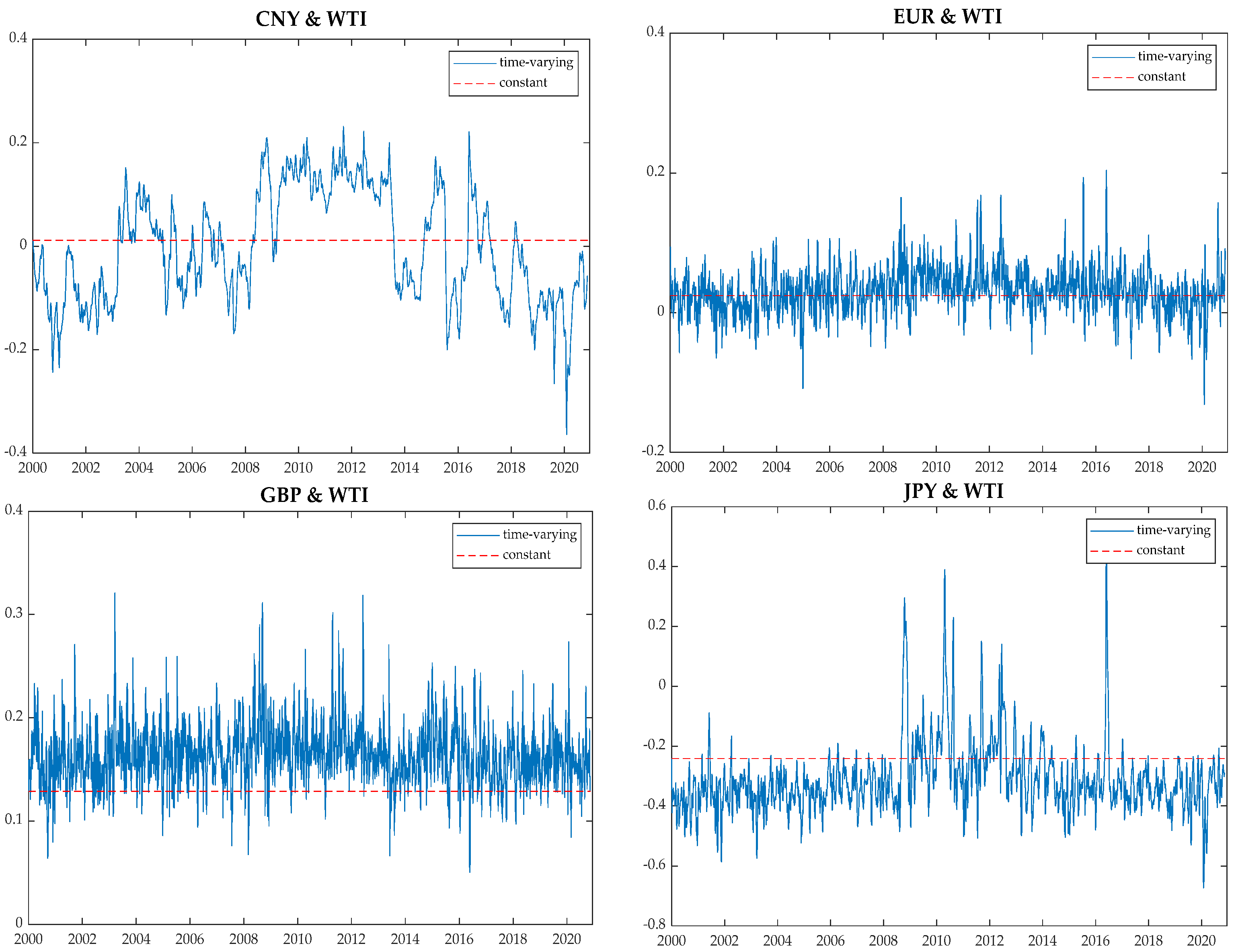

5.1.3. Estimation of Time-Varying Factor Copula Model

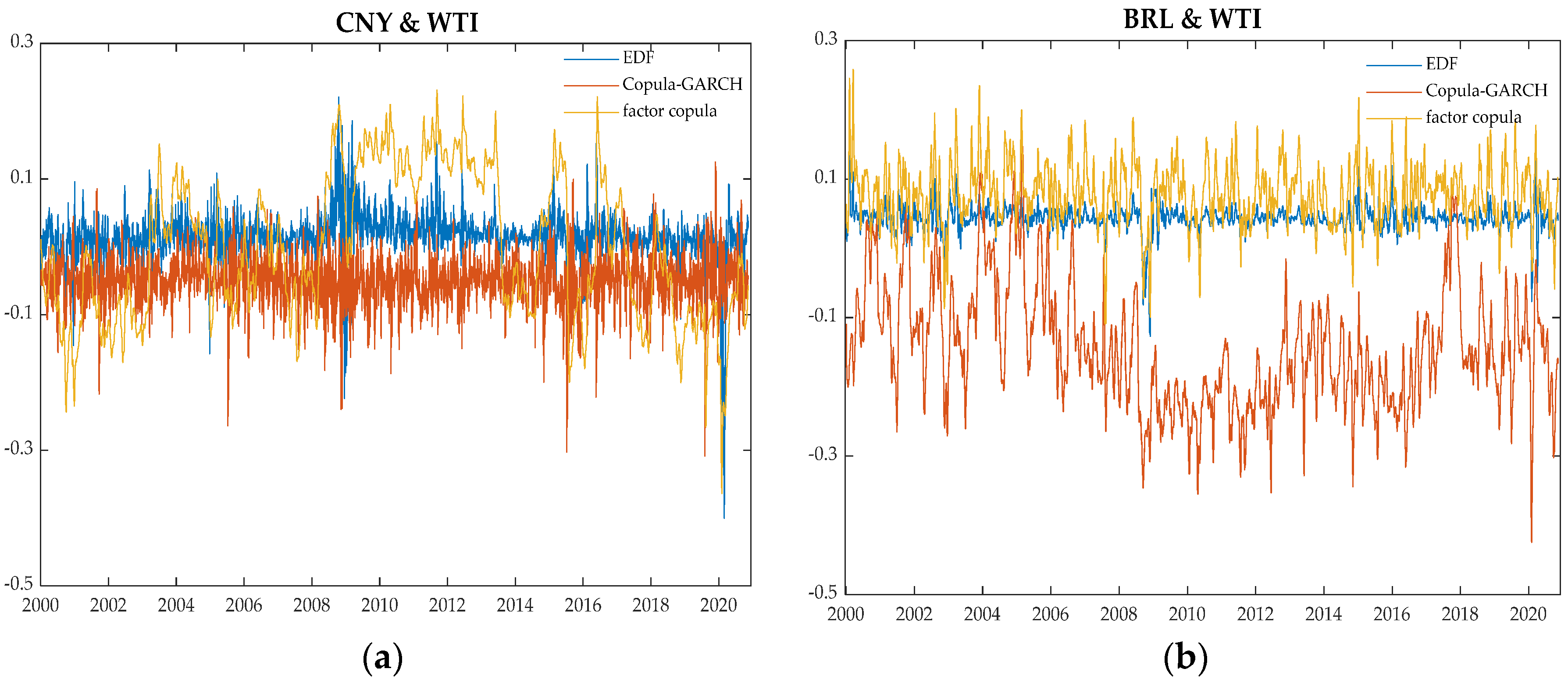

5.2. Comparison of Dynamic Conditional Dependence

5.2.1. Dynamic Dependence for Oil Importers

5.2.2. Dynamic Dependence for Oil Exporters

5.3. Analysis of Dynamic Risk Spillover

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Nikbakht, L. Oil prices and exchange rates: The case of OPEC. Bus. Intell. J. 2010, 3, 83–92. [Google Scholar]

- Beckmann, J.; Czudaj, R.L.; Arora, V. The relationship between oil prices and exchange rates: Revisiting theory and evidence. Energy Econ. 2020, 88, 104772. [Google Scholar] [CrossRef]

- Albulescu, C.T.; Ajmi, A.N. Oil price and US dollar exchange rate: Change detection of bi-directional causal impact. Energy Econ. 2021, 100, 105385. [Google Scholar] [CrossRef]

- Hussain, S.I.; Li, S. The dependence structure between Chinese and other major stock markets using extreme values and copulas. Int. Rev. Econ. Financ. 2018, 56, 421–437. [Google Scholar] [CrossRef]

- Hamdi, B.; Aloui, M.; Alqahtani, F.; Tiwari, A. Relationship between the oil price volatility and sectoral stock markets in oil-exporting economies: Evidence from wavelet nonlinear denoised based quantile and Granger-causality analysis. Energy Econ. 2019, 80, 536–552. [Google Scholar] [CrossRef]

- Granger, C.W.; Teräsvirta, T.; Patton, A.J. Common factors in conditional distributions for bivariate time series. J. Econ. 2006, 132, 43–57. [Google Scholar] [CrossRef]

- Huang, S.; An, H.; Lucey, B. How do dynamic responses of exchange rates to oil price shocks co-move? From a time-varying perspective. Energy Econ. 2020, 86, 104641. [Google Scholar] [CrossRef]

- Golub, S.S. Oil prices and exchange rates. Econ. J. 1983, 93, 576–593. [Google Scholar] [CrossRef]

- Yang, L.; Cai, X.J.; Hamori, S. Does the crude oil price influence the exchange rates of oil-importing and oil-exporting countries differently? A wavelet coherence analysis. Int. Rev. Econ. Financ. 2017, 49, 536–547. [Google Scholar] [CrossRef]

- Reboredo, J.C. Modelling oil price and exchange rate co-movements. J. Policy Model. 2012, 34, 419–440. [Google Scholar] [CrossRef]

- Ahmad, A.; Hernandez, R.M. Asymmetric adjustment between oil prices and exchange rates: Empirical evidence from major oil producers and consumers. J. Int. Financ. Mark. Inst. Money 2013, 27, 306–317. [Google Scholar] [CrossRef] [Green Version]

- Aloui, R.; Ben Aïssa, M.S.; Nguyen, D.K. Conditional dependence structure between oil prices and exchange rates: A copula-GARCH approach. J. Int. Money Financ. 2013, 32, 719–738. [Google Scholar] [CrossRef]

- Adrian, T.; Brunnermeier, M.K. CoVaR. Am. Econ. Rev. 2016, 106, 1705–1741. [Google Scholar] [CrossRef]

- Zhu, D.; Galbraith, J.W. Modeling and forecasting expected shortfall with the generalized asymmetric Student-t and asymmetric exponential power distributions. J. Empir. Financ. 2011, 18, 765–778. [Google Scholar] [CrossRef]

- Liu, B.-Y.; Ji, Q.; Fan, Y. Dynamic return-volatility dependence and risk measure of CoVaR in the oil market: A time-varying mixed copula model. Energy Econ. 2017, 68, 53–65. [Google Scholar] [CrossRef]

- Krupskii, P.; Joe, H. Factor copula models for multivariate data. J. Multivar. Anal. 2013, 120, 85–101. [Google Scholar] [CrossRef]

- Oh, D.H.; Patton, A.J. Modeling Dependence in High Dimensions with Factor Copulas. J. Bus. Econ. Stat. 2017, 35, 139–154. [Google Scholar] [CrossRef]

- Manner, H.; Manner, H.; Stark, F.; Stark, F.; Wied, D.; Wied, D. Testing for structural breaks in factor copula models. J. Econ. 2018, 208, 324–345. [Google Scholar] [CrossRef]

- Lin, B.; Su, T. Does oil price have similar effects on the exchange rates of BRICS? Int. Rev. Financ. Anal. 2020, 69, 101461. [Google Scholar] [CrossRef]

- Hussain, M.; Zebende, G.F.; Bashir, U.; Donghong, D. Oil price and exchange rate co-movements in Asian countries: Detrended cross-correlation approach. Phys. A Stat. Mech. Appl. 2017, 465, 338–346. [Google Scholar] [CrossRef]

- Tiwari, A.; Trabelsi, N.; Alqahtani, F.; Bachmeier, L. Modelling systemic risk and dependence structure between the prices of crude oil and exchange rates in BRICS economies: Evidence using quantile coherency and NGCoVaR approaches. Energy Econ. 2019, 81, 1011–1028. [Google Scholar] [CrossRef]

- Guo, R.; Ye, W. A model of dynamic tail dependence between crude oil prices and exchange rates. N. Am. J. Econ. Financ. 2021, 58, 101543. [Google Scholar] [CrossRef]

- Malik, F.; Umar, Z. Dynamic connectedness of oil price shocks and exchange rates. Energy Econ. 2019, 84, 104501. [Google Scholar] [CrossRef]

- Benedetto, F.; Mastroeni, L.; Quaresima, G.; Vellucci, P. Does OVX affect WTI and Brent oil spot variance? Evidence from an entropy analysis. Energy Econ. 2020, 89, 104815. [Google Scholar] [CrossRef]

- Fratzscher, M.; Schneider, D.; Van Robays, I. Oil Prices, Exchange Rates and Asset Prices. ECB Working Paper 2014, No. 1689. Available online: https://ssrn.com/abstract=2442276 (accessed on 1 July 2014).

- Ledoit, O.; Wolf, M. Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. J. Empir. Financ. 2003, 10, 603–621. [Google Scholar] [CrossRef] [Green Version]

- Zhang, H.; Jiao, F. Factor Copula Models and Their Application in Studying the Dependence of the Exchange Rate Returns. Int. Bus. Res. 2012, 5, 3. [Google Scholar] [CrossRef] [Green Version]

- Chen, Z.P.; Song, Z.X. Application of Copula function in coefficient estimation of multi-factor model. Syst. Eng. Theory Pract. 2013, 33, 2471–2478. (In Chinese) [Google Scholar]

- Song, Q.; Liu, J.; Sriboonchitta, S. Risk measurement of global stock markets: A factor copula-based GJR-GARCH approach. J. Physics: Conf. Ser. 2019, 1324, 012098. [Google Scholar] [CrossRef]

- Salisu, A.; Mobolaji, H. Modeling returns and volatility transmission between oil price and US–Nigeria exchange rate. Energy Econ. 2013, 39, 169–176. [Google Scholar] [CrossRef]

- Ding, Q.; Huang, J.; Chen, J. Dynamic and frequency-domain risk spillovers among oil, gold, and foreign exchange markets: Evidence from implied volatility. Energy Econ. 2021, 102, 105514. [Google Scholar] [CrossRef]

- He, F.; Ma, F.; Wang, Z.; Yang, B. Asymmetric volatility spillover between oil-importing and oil-exporting countries’ economic policy uncertainty and China’s energy sector. Int. Rev. Financ. Anal. 2021, 75, 101739. [Google Scholar] [CrossRef]

- Zhou, A.M.; Han, F. Research on risk spillover effect between stock market and foreign exchange market: Based on GARCH- time-varying Copula-CoVaR model. Int. Financ. Stud. 2017, 11, 54–64. (In Chinese) [Google Scholar]

- Lin, J.; Zhao, H. Research on the Risk Spillovers between Shanghai, Shenzhen and Hong Kong Stock Markets-Based on the Time Varying ΔCoVaR Model. System Eng. Theory Pract. 2020, 40, 1533–1544. (In Chinese) [Google Scholar]

- Chen, T.; Yu, X.L. Measurement of dynamic risk spillover effect in Sino-US cotton futures market: Based on DCC-GARCH-ΔCoVaR model. Pract. Underst. Math. 2021, 51, 282–292. (In Chinese) [Google Scholar]

- Zhao, R.B.; Tian, Y.X.; Tian, W. Measurement of asymmetric risk spillovers in Financ. markets based on GAS T-Copula model. Oper. Res. Manag. 2021, 30, 176–183. (In Chinese) [Google Scholar]

- Ji, Q.; Liu, B.-Y.; Fan, Y. Risk dependence of CoVaR and structural change between oil prices and exchange rates: A time-varying copula model. Energy Econ. 2018, 77, 80–92. [Google Scholar] [CrossRef]

- Patton, A.J. Modelling asymmetric exchange rate dependence. Int. Econ. Rev. 2006, 47, 527–556. [Google Scholar] [CrossRef]

- Yang, X.Y.; Zheng, Y.H. Application research of fund return dependence based on time-varying Copula model. Econ. Math. 2020, 37, 9–15. (In Chinese) [Google Scholar]

- Joe, H.; Xu, J.J. The Estimation Method of Inference Functions for Margins for Multivariate Models; Technical Report 166; Department of Statistics, University of British Columbia: Vancouver, BC, Canada, 1996; Available online: http://hdl.handle.net/2429/57078 (accessed on 1 October 1996).

- British Petroleum. Statistical Review of World Energy, British Pretoleum. 2021. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/xlsx/energy-economics/statistical-review/bp-stats-review-2021-all-data.xlsx (accessed on 29 June 2022).

- International Energy Agency (IEA). Oil Market Report-February 2022; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/oil-market-report-february-2022 (accessed on 1 February 2022).

- Liu, B.; Ji, Q.; Nguyen, D.K.; Fan, Y. Dynamic dependence and extreme risk comovement: The case of oil prices and exchange rates. Int. J. Financ. Econ. 2020, 26, 2612–2636. [Google Scholar] [CrossRef]

- Chen, S.-S.; Chen, H.-C. Oil prices and real exchange rates. Energy Econ. 2007, 29, 390–404. [Google Scholar] [CrossRef]

| Variable | Mean | Max. | Min. | Std. dev | Skew. | Kurt. | Jarque–Bera | Q (12) a | Q2 (12) | ARCH (12) b |

|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Original series. | ||||||||||

| CNY | −0.004 | 1.81 | −2.031 | 0.128 | −0.426 | 27.941 | 178,021.400 *** | 103.720 *** | 220.520 *** | 162.017 *** |

| EUR | −0.004 | 4.736 | −4.204 | 0.602 | 0.04 | 3.1 | 2188.842 *** | 24.339 ** | 625.100 *** | 344.356 *** |

| GBP | 0.003 | 8.312 | −4.474 | 0.594 | 0.497 | 10.48 | 25,243.100 *** | 39.829 *** | 563.070 *** | 311.139 *** |

| JPY | 0 | 3.71 | −4.61 | 0.616 | −0.261 | 4.04 | 3777.227 *** | 11.581 | 378.710 *** | 239.852 *** |

| INR | 0.009 | 3.251 | −3.063 | 0.378 | 0.277 | 7.126 | 11,637.190 *** | 69.426 *** | 2258.000 *** | 803.131 *** |

| ZAR | 0.015 | 9.807 | −8.523 | 1.0507 | 0.33 | 4.747 | 5231.493 *** | 20.072 * | 1377.000 *** | 657.387 *** |

| USDX | 0 | 2.495 | −3.252 | 0.49 | −0.079 | 1.761 | 711.502 *** | 8.003 | 768.050 *** | 657.387 *** |

| BRL | 0.0194 | 9.677 | −11.778 | 1.005 | 0.166 | 11.284 | 29,027.280 *** | 46.942 *** | 3010.600 *** | 1199.059 *** |

| CAD | −0.002 | 3.419 | −4.007 | 0.548 | 0.168 | 3.259 | 2443.361 *** | 36.003 *** | 4334.700 *** | 1162.439 *** |

| DZD | −0.012 | 5.602 | −6.811 | 0.643 | −0.928 | 37.143 | 266,863.300 *** | 168.630 *** | 992.770 *** | 695.574 *** |

| NGN | 0.024 | 26.904 | −7.71 | 0.703 | 13.511 | 472.793 | 50,542,830.000 *** | 51.394 *** | 34.115 *** | 33.436 *** |

| NOK | 0.001 | 6.35 | −6.458 | 0.756 | 0.142 | 5.209 | 6197.673 *** | 11.707 | 1102.500 *** | 490.434 *** |

| RUB | 0.018 | 14.268 | −15.523 | 0.774 | 0.476 | 63.075 | 906,613.200 *** | 118.430 *** | 2741.600 *** | 1808.544 *** |

| MXN | 0.013 | 8.114 | −5.96 | 0.695 | 0.753 | 11.844 | 32,470.530 *** | 24.268 * | 3488.500 *** | 1375.312 *** |

| WTI | 0.011 | 23.745 | −48.08 | 2.623 | −1.356 | 30.031 | 207,141.200 *** | 38.118 *** | 991.070 *** | 537.136 *** |

| Brent | 0.013 | 15.448 | −30.855 | 2.237 | −0.629 | 12.196 | 34,243.380 *** | 25.591 *** | 1017.300 *** | 536.196 *** |

| Panel B: Idiosyncratic factor series. | ||||||||||

| CNY | −0.005 | 2.284 | −1.767 | 0.305 | 0.097 | 2.236 | 1146.700 *** | 59.046 *** | 558.610 *** | 189.140 *** |

| EUR | −0.005 | 4.576 | −4.269 | 0.747 | −0.05 | 1.512 | 522.240 *** | 123.290 *** | 547.270 *** | 247.340 *** |

| GBP | 0.005 | 4.649 | −3.776 | 0.773 | −0.032 | 1.579 | 568.440 *** | 73.169 *** | 482.720 *** | 207.460 *** |

| JPY | 0 | 3.963 | −6.241 | 0.646 | −0.27 | 5.356 | 6600.600 *** | 16.635 | 823.640 *** | 307.280 *** |

| INR | 0.011 | 2.916 | −3.466 | 0.509 | −0.085 | 1.957 | 877.990 *** | 55.332 *** | 826.530 *** | 349.600 *** |

| ZAR | 0.02 | 9.328 | −10.199 | 1.051 | 0.339 | 5.081 | 5985.200 *** | 13.028 | 948.100 *** | 742.280 *** |

| USDX | −0.003 | 6.987 | −5.288 | 0.764 | 0.032 | 3.991 | 3627.100 *** | 92.181 *** | 335.220 *** | 161.680 *** |

| BRL | 0.024 | 9.144 | −11.555 | 1.005 | −0.042 | 10.413 | 24,699.000 *** | 65.344 *** | 971.200 *** | 1052.700 *** |

| CAD | −0.003 | 4.524 | −6.344 | 0.672 | −0.287 | 4.761 | 5237.500 *** | 49.359 *** | 862.790 *** | 287.600 *** |

| DZD | −0.016 | 6.119 | −6.061 | 0.671 | −0.344 | 5.807 | 7788.400 *** | 21.455 * | 1503.800 *** | 566.030 *** |

| NGN | 0.024 | 26.808 | −7.612 | 0.706 | 13.505 | 464.786 | 1146.700 *** | 59.046 *** | 33.882 *** | 189.140 *** |

| NOK | 0.002 | 8.339 | −6.518 | 0.825 | 0.163 | 8.123 | 15,051.000 *** | 41.560 *** | 1123.700 *** | 506.300 *** |

| RUB | 0.022 | 13.498 | −14.822 | 0.79 | 0.328 | 46.407 | 490,735.000 *** | 84.936 *** | 2594.000 *** | 1636.000 *** |

| MXN | 0.014 | 8.227 | −5.591 | 0.696 | 0.769 | 11.186 | 29,041.000 *** | 29.616 *** | 3366.100 *** | 1299.100 *** |

| WTI | 0.032 | 58.985 | −96.129 | 4.912 | −1.306 | 38.26 | 95,042.000 *** | 67.517 *** | 1301.700 *** | 723.770 *** |

| Brent | 0.037 | 27.675 | −51.841 | 3.966 | −0.506 | 10.192 | 1146.700 *** | 59.046 *** | 1128.700 *** | 189.140 *** |

| ϕ0 | ϕ1 | ω | α | β | ν | |

|---|---|---|---|---|---|---|

| CNY | −0.004 | 0.069 | 0.001 | 0.036 | 0.956 | 9.578 |

| (0.004) | (0.013) | (0.000) | (0.005) | (0.006) | (1.197) | |

| EUR | 0.003 | −0.145 | 0.010 | 0.052 | 0.931 | 11.918 |

| (0.009) | (0.014) | (0.003) | (0.008) | (0.013) | (1.791) | |

| GBP | 0.010 | 0.086 | 0.005 | 0.032 | 0.959 | 13.400 |

| (0.010) | (0.014) | (0.002) | (0.005) | (0.007) | (2.078) | |

| JPY | 0.012 | −0.042 | 0.006 | 0.055 | 0.929 | 7.245 |

| (0.010) | (0.015) | (0.002) | (0.008) | (0.011) | (0.705) | |

| INR | 0.012 | 0.084 | 0.005 | 0.047 | 0.933 | 11.559 |

| (0.007) | (0.014) | (0.001) | (0.007) | (0.011) | (1.676) | |

| USDX | 0.007 | −0.106 | 0.007 | 0.039 | 0.950 | 7.386 |

| (0.008) | (0.014) | (0.002) | (0.006) | (0.007) | (0.710) | |

| ZAR | −0.005 | - | 0.022 | 0.068 | 0.913 | 7.660 |

| (0.005) | (0.006) | (0.011) | (0.015) | (0.732) | ||

| BRL | 0.011 | −0.016 | 0.024 | 0.103 | 0.872 | 6.594 |

| (0.014) | (0.009) | (0.006) | (0.017) | (0.021) | (0.608) | |

| CAD | 0.002 | −0.061 | 0.007 | 0.050 | 0.934 | 7.375 |

| (0.005) | (0.014) | (0.002) | (0.009) | (0.013) | (0.697) | |

| DZD | −0.001 | 0.013 | 0.004 | 0.053 | 0.937 | 8.449 |

| (0.007) | (0.041) | (0.001) | (0.009) | (0.010) | (1.015) | |

| MXN | −0.011 | 0.004 | 0.005 | 0.094 | 0.896 | 7.394 |

| (0.018) | (0.051) | (0.002) | (0.017) | (0.018) | (0.774) | |

| NGN | 0.000 | −0.094 | 0.001 | 0.260 | 0.740 | 3.001 |

| (0.001) | (0.014) | (0.000) | (0.023) | (0.027) | (0.085) | |

| NOK | 0.011 | −0.059 | 0.015 | 0.072 | 0.904 | 8.533 |

| (0.025) | (0.014) | (0.006) | (0.019) | (0.027) | (1.073) | |

| RUB | 0.012 | −0.006 | 0.005 | 0.081 | 0.908 | 7.334 |

| (0.007) | (0.064) | (0.001) | (0.012) | (0.013) | (0.734) | |

| WTI | 0.153 | −0.039 | 0.325 | 0.074 | 0.910 | 5.448 |

| (0.040) | (0.014) | (0.072) | (0.009) | (0.010) | (0.419) | |

| Brent | 0.111 | −0.076 | 0.162 | 0.077 | 0.915 | 5.974 |

| (0.052) | (0.014) | (0.048) | (0.011) | (0.012) | (0.489) |

| Factor Copula Model | Copula–GARCH Model | |||

|---|---|---|---|---|

| Model | Kendall | AIC | Kendall | AIC |

| Panel 1: Exchange rate—WTI | ||||

| CNY-WTI | 0.011 | −176.903 | −0.036 | −62.258 |

| EUR-WTI | 0.024 | −72.748 | −0.066 | −140.11 |

| GBP-WTI | 0.129 | −264.46 | −0.094 | −201.655 |

| JPY-WTI | −0.242 | −1133.3 | 0.01 | −127.041 |

| INR-WTI | 0.236 | −842.88 | −0.029 | −32.531 |

| ZAR-WTI | 0.095 | −224.727 | −0.117 | −320.095 |

| USDX-WTI | 0.056 | −111.725 | −0.108 | −300.123 |

| BRL-WTI | 0.05 | −102.913 | −0.109 | −289.389 |

| CAD-WTI | 0.348 | −1939.5 | −0.215 | −817.4 |

| DZD-WTI | −0.069 | −573.459 | −0.077 | −178.663 |

| NGN-WTI | 0.136 | −632.674 | −0.01 | −17.863 |

| NOK-WTI | 0.056 | −106.164 | −0.149 | −444.214 |

| RUB-WTI | 0.083 | −300.759 | −0.132 | −410.775 |

| MXN-WTI | −0.048 | −72.053 | −0.024 | −33.459 |

| Panel 2: Exchange rate—Brent | ||||

| CNY-Brent | 0.006 | −110.192 | −0.03 | −45.76 |

| EUR-Brent | 0.014 | −37.238 | −0.063 | −19.279 |

| GBP-Brent | 0.112 | −301.756 | −0.091 | −194.035 |

| JPY-Brent | −0.246 | −608.996 | 0.017 | −128.334 |

| INR-Brent | 0.224 | −750.27 | −0.06 | −163.396 |

| ZAR-Brent | 0.114 | −248.937 | −0.106 | −281.554 |

| USDX-Brent | 0.044 | −78.4 | −0.102 | −272.35 |

| BRL-Brent | 0.051 | −96.537 | −0.103 | −224.636 |

| CAD-Brent | 0.347 | −1943.7 | −0.207 | −732.936 |

| DZD-Brent | −0.091 | −485.298 | −0.076 | −175.216 |

| NGN-Brent | 0.139 | −654.972 | −0.006 | −25.653 |

| NOK-Brent | 0.052 | −102.782 | −0.14 | −382.998 |

| RUB-Brent | 0.08 | −298.88 | −0.127 | −38.904 |

| MXN-Brent | −0.048 | −79.489 | −0.022 | −35.883 |

| Relative Magnitude of Risk Spillover from Exchange Rate Markets to Crude Oil Markets | Relative Magnitude of Risk Spillover from Crude Oil Markets to Exchange Rate Markets | ||||

|---|---|---|---|---|---|

| WTI | Brent | WTI | Brent | ||

| Oil-importing countries | CNY | 0.103% | 0.206% | −41.107% | 14.314% |

| EUR | 0.976% | 0.487% | 25.981% | 9.783% | |

| GBP | 5.123% | 4.969% | 146.462% | 108.772% | |

| JPY | −7.246% | −8.513% | −331.318% | −290.366% | |

| INR | 5.965% | 6.485% | 376.709% | 308.864% | |

| ZAR | 5.208% | 7.235% | 87.599% | 89.676% | |

| USDX | 2.121% | 2.143% | 63.091% | 47.112% | |

| Oil-exporting countries | BRL | 2.795% | 3.193% | 62.474% | 52.790% |

| CAD | 10.111% | 11.233% | 407.752% | 344.033% | |

| DZD | −1.363% | −2.299% | −132.248% | −122.832% | |

| NGN | 3.026% | 2.986% | 963.133% | 815.145% | |

| NOK | 2.432% | 2.602% | 67.167% | 55.305% | |

| RUB | 2.182% | 2.567% | 132.785% | 116.097% | |

| MXN | −1.822% | −1.845% | −82.683% | −62.630% | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, X.; Wu, X.; Zhou, Y. Conditional Dynamic Dependence and Risk Spillover between Crude Oil Prices and Foreign Exchange Rates: New Evidence from a Dynamic Factor Copula Model. Energies 2022, 15, 5220. https://doi.org/10.3390/en15145220

Wang X, Wu X, Zhou Y. Conditional Dynamic Dependence and Risk Spillover between Crude Oil Prices and Foreign Exchange Rates: New Evidence from a Dynamic Factor Copula Model. Energies. 2022; 15(14):5220. https://doi.org/10.3390/en15145220

Chicago/Turabian StyleWang, Xu, Xueyan Wu, and Yingying Zhou. 2022. "Conditional Dynamic Dependence and Risk Spillover between Crude Oil Prices and Foreign Exchange Rates: New Evidence from a Dynamic Factor Copula Model" Energies 15, no. 14: 5220. https://doi.org/10.3390/en15145220