Oil Prices and the Hydrocarbon Markets: A Review

Abstract

:1. Introduction

2. Transmission Channels between Oil and Hydrocarbon Prices

3. Empirical Models

3.1. Oil Price as an Exogenous Variable

3.2. Oil Price as an Endogenous Variable

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

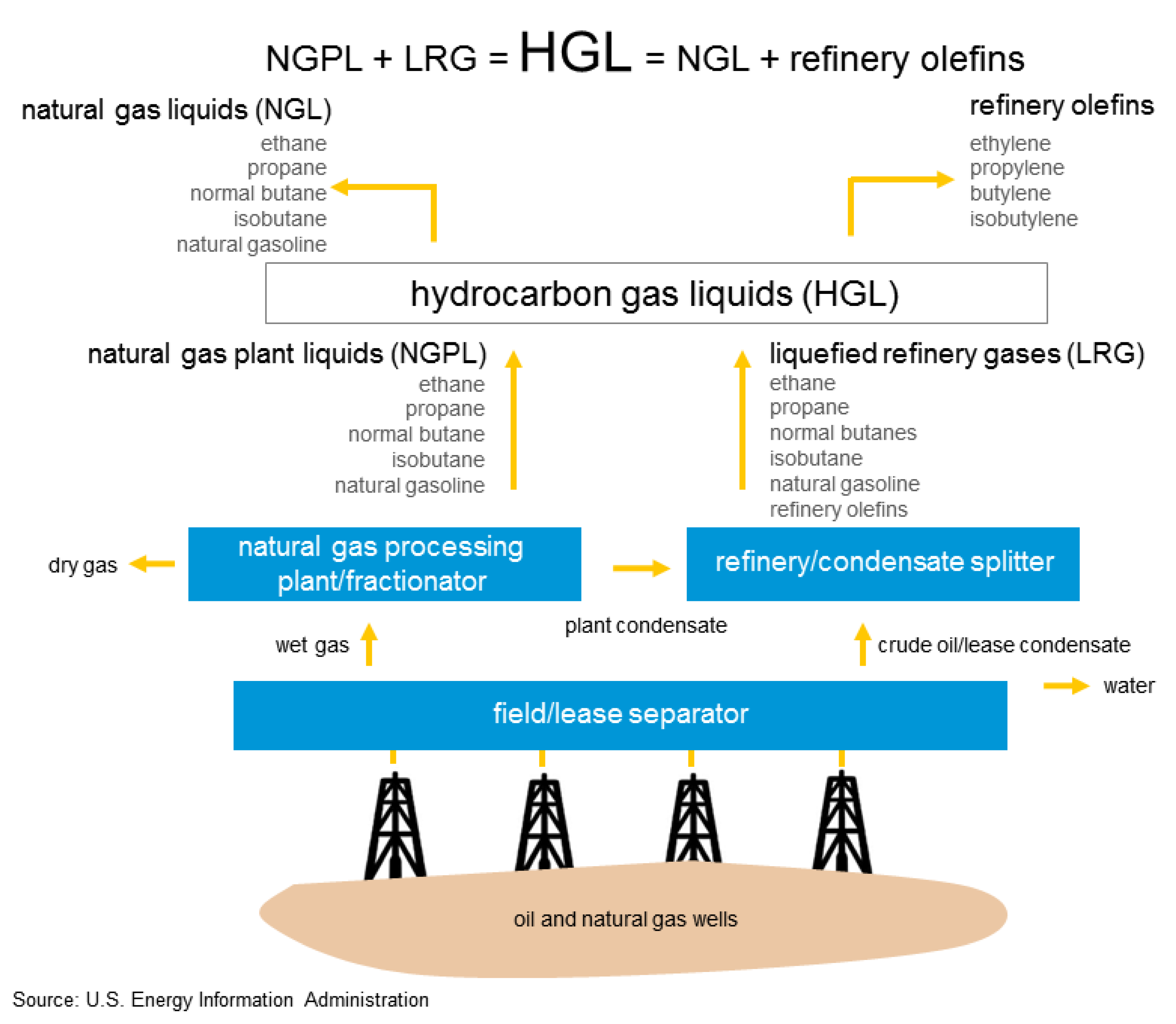

Abbreviations

| HGL | Hydrocarbon Gas Liquids |

| LPG | Liquefied Petroleum Gases |

| NGL | Natural Gas Liquids |

| VAR | Vector AutoRegressive |

References

- Jadidzadeh, A.; Serletis, A. How does the U.S. natural gas market react to demand and supply shocks in the crude oil market? Energy Econ. 2017, 63, 66–74. [Google Scholar] [CrossRef]

- Zavaleta, A.; Walls, W.; Rusco, F.W. Refining for export and the convergence of petroleum product prices. Energy Econ. 2015, 47, 206–214. [Google Scholar] [CrossRef]

- Pindyck, R.S. Volatility in natural gas and oil markets. J. Energy Dev. 2004, 3, 1–19. [Google Scholar]

- Oglend, A.; Lindbäck, M.E.; Osmundsen, P. Shale gas boom affecting the relationship between LPG and oil prices. Energy J. 2015, 36, 265–286. [Google Scholar] [CrossRef]

- Hartley, P.R.; MedlockIII, K.B.; Rosthal, J.E. The relationship of natural gas to oil prices. Energy J. 2008, 29, 47–65. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Jadidzadeh, A.; Serletis, A. Oil prices and the natural gas liquids markets. Green Financ. 2022, 4, 207–230. [Google Scholar] [CrossRef]

- Wamsley, R.K. Natural gas liquid allocations. Pet. Account. Financ. Manag. J. 2000, 19, 1–16. [Google Scholar]

- EIA. Hydrocarbon Gas Liquids (HGL): Recent Market Trends and Issues; Report; U.S. Energy Information Administration, U.S. Department of Energy: Washington, DC, USA, 2014. [Google Scholar]

- Rui, X.; Feng, L.; Feng, J. A gas-on-gas competition trading mechanism based on cooperative game models in China’s gas market. Energy Rep. 2020, 6, 365–377. [Google Scholar] [CrossRef]

- Wang, N.; You, W.; Peng, C. Heterogeneous risk spillovers from crude oil to regional natural gas markets: The role of the shale gas revolution. Energy Sources Part B Econ. Plan. Policy 2019, 14, 215–234. [Google Scholar] [CrossRef]

- Brown, S.P.A.; Yücel, M.K. What drives natural gas prices? Energy J. 2008, 29, 45–60. [Google Scholar] [CrossRef]

- Panagiotidis, T.; Rutledge, E. Oil and gas markets in the UK: Evidence from a cointegrating approach. Energy Econ. 2007, 29, 329–347. [Google Scholar] [CrossRef]

- Serletis, A.; Rangel-Ruiz, R. Testing for common features in North American energy markets. Energy Econ. 2004, 26, 401–414. [Google Scholar] [CrossRef]

- Serletis, A.; Herbert, J. The message in North American energy prices. Energy Econ. 1999, 21, 471–483. [Google Scholar] [CrossRef]

- Bachmeier, L.J.; Griffin, J.M. Testing for market integration crude oil, coal, and natural gas. Energy J. 2006, 27, 55–72. [Google Scholar] [CrossRef]

- Drachal, K. Comparison between Bayesian and information-theoretic model averaging: Fossil fuels prices example. Energy Econ. 2018, 74, 208–251. [Google Scholar] [CrossRef]

- Zhang, D.; Ji, Q. Further evidence on the debate of oil-gas price decoupling: A long memory approach. Energy Policy 2018, 113, 68–75. [Google Scholar] [CrossRef]

- Hailemariam, A.; Smyth, R. What drives volatility in natural gas prices? Energy Econ. 2019, 80, 731–742. [Google Scholar] [CrossRef]

- Yücel, M.K.; Guo, S. Fuel taxes and cointegration of energy prices. Contemp. Econ. Policy 1994, 12, 33–41. [Google Scholar] [CrossRef]

- Hou, C.; Nguyen, B.H. Understanding the U.S. natural gas market: A Markov switching VAR approach. Energy Econ. 2018, 75, 42–53. [Google Scholar] [CrossRef]

- Aruga, K. The U.S. shale gas revolution and its effect on international gas markets. J. Unconv. Oil Gas Resour. 2016, 14, 1–5. [Google Scholar] [CrossRef]

- Barcella, M.L. The Pricing of Gas; Oxford Energy Forum: Oxford, UK, 1999. [Google Scholar]

- Barton, A.; Vermeire, T.A.L. Gas price determination in liberalising markets: Lessons from the US and UK experience. In Proceedings of the British Institute of Energy Economics Annual Conference, Oxford, St. John’s College, 20–21September 1999. [Google Scholar]

- Heren, P. Removing the government from European gas. Energy Policy 1999, 27, 3–8. [Google Scholar] [CrossRef]

- Asche, F.; Osmundsen, P.; Sandsmark, M. The UK market for natural gas, oil and electricity: Are the prices decoupled? Energy J. 2006, 27, 27–40. [Google Scholar] [CrossRef]

- Batten, J.A.; Ciner, C.; Lucey, B.M. The dynamic linkages between crude oil and natural gas markets. Energy Econ. 2017, 62, 155–170. [Google Scholar] [CrossRef]

- Ji, Q.; Geng, J.B.; Tiwari, A.K. Information spillovers and connectedness networks in the oil and gas markets. Energy Econ. 2018, 75, 71–84. [Google Scholar] [CrossRef]

- Perifanis, T.; Dagoumas, A. Price and volatility spillovers between the U.S. crude oil and natural gas wholesale markets. Energies 2018, 11, 2757. [Google Scholar] [CrossRef]

- Zhu, F.; Zhu, Y.; Jin, X.; Luo, X. Do spillover effects between crude oil and natural gas markets disappear? Evidence from option markets. Financ. Res. Lett. 2018, 24, 25–33. [Google Scholar] [CrossRef]

- Li, X.; Sun, M.; Gao, C.; He, H. The spillover effects between natural gas and crude oil markets: The correlation network analysis based on multi-scale approach. Phys. A Stat. Mech. Its Appl. 2019, 524, 306–324. [Google Scholar] [CrossRef]

- Lovcha, Y.; Perez-Laborda, A. Dynamic frequency connectedness between oil and natural gas volatilities. Econ. Model. 2020, 84, 181–189. [Google Scholar] [CrossRef]

- Westgaard, S.; Faria, E.; Fleten, S.E. Price dynamics of natural gas components: Empirical evidence. J. Energy Mark. 2008, 1, 37–69. [Google Scholar] [CrossRef]

- Myklebust, J.; Tomasgard, A.; Westgaard, S. Forecasting gas component prices with multivariate structural time series models. OPEC Energy Rev. 2010, 34, 82–106. [Google Scholar] [CrossRef]

- Kilian, L. Oil Price Shocks: Causes and Consequences. Annu. Rev. Resour. Econ. 2014, 6, 133–154. [Google Scholar] [CrossRef] [Green Version]

- Herrera, A.M.; Karaki, M.B.; Rangaraju, S.K. Oil price shocks and U.S. economic activity. Energy Policy 2019, 129, 89–99. [Google Scholar] [CrossRef]

- Zamani, N. How the crude oil market affects the natural gas market? Demand and supply shocks. Int. J. Energy Econ. Policy 2016, 6, 217–221. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jadidzadeh, A.; Mirzababaei, M.; Serletis, A. Oil Prices and the Hydrocarbon Markets: A Review. Energies 2022, 15, 6192. https://doi.org/10.3390/en15176192

Jadidzadeh A, Mirzababaei M, Serletis A. Oil Prices and the Hydrocarbon Markets: A Review. Energies. 2022; 15(17):6192. https://doi.org/10.3390/en15176192

Chicago/Turabian StyleJadidzadeh, Ali, Mobin Mirzababaei, and Apostolos Serletis. 2022. "Oil Prices and the Hydrocarbon Markets: A Review" Energies 15, no. 17: 6192. https://doi.org/10.3390/en15176192

APA StyleJadidzadeh, A., Mirzababaei, M., & Serletis, A. (2022). Oil Prices and the Hydrocarbon Markets: A Review. Energies, 15(17), 6192. https://doi.org/10.3390/en15176192