1. Introduction

The efficient functioning of enterprises of the fuel and energy complex of Ukraine (including enterprises of production, storage, and transportation of natural gas) is the basis of energy security, protection of national interests, and the success of the country’s external integration processes. It is also a necessary condition for internal stabilization and development of the economy, that is, fully satisfying the population’s needs and social production in energy resources. Natural gas is increasingly seen as the most acceptable energy source for two reasons:

- (1)

improvement of gas production technologies;

- (2)

recognition of gas as the most „clean” type of fossil fuel (its combustion entails a minimum emission of carbon dioxide and is consistent with decarbonization goals).

However, today there are several challenges and threats to the functioning of the gas transportation system (GTS) of Ukraine, among which the greatest threat is dependence on Russian gas supplies. To reduce this threat, it is necessary to:

Make the most of internal traditional energy sources;

Increase the share of energy received from domestic renewable sources;

Diversify external suppliers of energy resources;

Use underground gas storage (UGS) facilities located on the country’s territory more efficiently.

To meet the domestic energy demand, Ukraine uses various sources: oil, natural gas, coal, nuclear energy, water, wind, sun, etc. The most demanded in Ukraine now are fossil resources—natural gas and coal. In 2020, primary energy production amounted to 57.0 million tons of oil equivalent, 5.7% less than the previous year. Nuclear energy (35.1%), natural gas (27.8%), and coal (22.4%) had the largest share in the structure of their own production. The total share of renewable energy (RE) sources was only 10.3%. Moreover, own production provided 66.0% of the total primary energy supply. In the structure of final consumption, the share of natural gas was the largest—27.6% [

1], which remains one of the main types of energy resources. Therefore, it is so important to study the gas transportation system of Ukraine, which includes gas pipelines and underground storage facilities.

Until recently, the gas pipelines of Slovakia, Poland, Hungary, Romania, and Bulgaria were set up so that gas could be transported in only one direction—from the supplier (Gazprom PJSC, Russia [

2]) to the consumer. For several years, these countries have built interstate gas pipelines (interconnectors), which were provided for by several EU documents, in particular, the Third Gas Directive. This made it possible to increase the security of gas supplies, including by purchasing gas on the „spot” market—gas „hubs”. The purpose of the interconnectors was to connect all European gas facilities, which made it possible to pump gas from any point in any direction. The necessary investments for transferring gas transmission systems to the reverse mode are small compared to constructing new gas pipelines [

3].

Imports of natural gas in 2020 amounted to 7.3 billion m

3, which is 38.2% less than in the previous year, with more than 4.4 billion m

3 Ukraine bought from Switzerland and Germany. Moreover, the volume of imports from Slovakia increased 6 times—up to 1.1 billion m

3. Since November 2015, Ukraine has not bought gas from Russia [

4]. For 10 months of 2021, Ukraine imported more than 2.5 billion m

3 of natural gas [

5].

To compensate for seasonal fluctuations in gas consumption, many countries accumulate gas reserves stored in underground storage facilities. In addition, UGS facilities ensure the reliability of gas supply in the event of an emergency in the GTS or an energy crisis (for example, the crisis associated with Russia’s aggression against Ukraine).

For gas storage, cavities are most often used, which remain after the extraction of gas and oil. There are general requirements for the construction of such facilities:

They should be located as close as possible to the route of the main gas pipeline;

Their placement should be close to the largest consumer groups;

the storage must be airtight (to avoid gas losses and prevent damage to the environment);

Gas pressure that meets the operating conditions of the gas transportation and distribution system must be created and maintained in the storage facility.

There are not many scientific publications containing research on the gas market in Ukraine, although they started to appear more often in connection with the Ukraine–Russia crisis that began in 2014. Goldthau and Boersma [

6] examined how this crisis influenced the energy market in political terms. The authors claim that “while the energy world is entering the next phase with a renewed emphasis on renewables and energy efficiency, and markets for energy becoming increasingly global and interconnected, a substantial number of politicians and foreign policy makers seem to be stuck in a Cold War paradigm”. However, as the events of recent months show, they were right. Skalamera [

7], in turn, believes that the gas factor (i.e., Ukraine’s leading role in the transit of Russian gas to Europe) was one of the most important factors in the aforementioned crisis of 2014. Van de Graaf and Colgan [

8] also devoted their research to this crisis, looking for answers to two questions: “How exactly did energy contribute to the crisis in the region? Can energy be wielded as a ‘weapon’ by Russia, the EU, or the US?” They stated that “Russian gas pricing played a crucial role as a context factor in igniting the Ukrainian crisis”, but that was not the only cause of the crisis. In turn, Lee [

9] returned in his research to the gas conflict between Russia and Ukraine in 2009, attempting to identify the causal mechanisms between their interdependence in the gas sphere and the gas conflict. The topic of the gas conflict in 2006–2009 and its impact on the energy security of European Union countries was also investigated by Rodríguez-Fernandez, Carvajal, and Ruiz-Gomez [

10]. The gas market in the context of the Russian-Ukrainian crisis was also the subject of research by Stulberg [

11], who examined strategic limitations in gas relations between Europe and Russia.

As the Ukrainian gas market underwent reform, Goncharuk and Storto [

12] compared it with the gas reform in Italy regarding natural gas distribution to end users. The authors stated that “both countries are low performing in terms of operators’ technical and scale efficiency, and there is room to design more efficient market configurations”. The study of the team of authors of the publication [

13] concerned “the assessment of the ability of the Ukrainian economy and individual industries to ensure, in the conditions of economic growth, a stable reduction in natural gas consumption and reduce dependence on its import” (assess the ability of the Ukrainian economy and its individual industries to ensure, in the conditions of economic growth, a stable reduction of natural gas consumption and to reduce dependence on its imports). However, since 24 February 2022, geopolitical conditions have changed drastically.

Yakovenko and Mišík [

14] studied the political discourse on transit and the role of natural gas in Ukraine and Slovakia in the context of energy security and compliance with the idea of the European Green Deal. Sauvageot [

15] examined the issues of energy security of the European Union in the context of its dependence on Russia as a gas supplier and Ukraine as the main transit country. The author also considered the issue of increasing LNG supplies as an alternative to gas delivered via pipelines.

Teichmann, Falker, and Sergi [

16], in turn, conducted a qualitative study of the impact of corruption in Ukraine on the extractive industries. The authors have proved that eliminating corruption is desirable for both governments and corporations. Bocse [

17] analyzed the impact of the unrest in Ukraine and Russia’s annexation of Crimea in 2014 on EU–US energy relations. The author stated that “strategic considerations played a more important role in thinking about energy security, not only in the EU but also in the US, and securitization characterizes the US response to the crisis”.

Alberini, Khymych, and Milan Scasný [

18] examined the price elasticity of demand for natural gas, using the example of Ukrainian households’ response to an increase in the price of this raw material. Such studies are important for determining the appropriate tariff policy in the country and for implementing reforms in the gas sector. Ukrainian households were also the subject of research for Goncharuk and Cirella [

19], who focused their attention on the impact of the government’s “gas tax” on the economic and social aspects of consumers’ lives. According to the authors, he “has significantly increased inflation, reduced domestic consumption, reduced profitability of local businesses, reduced the size of the middle class and increased stratification of society, concealed real income and escaladed a shadow economy and enhanced injustice and an outmigration of labor”. However, due to the dynamic changes taking place in the economy of Ukraine, including the gas sector, a researcher’s gap has arisen regarding the prospects for its development, including the use of underground gas storage.

On the other hand, there are many studies on the use of underground gas storage, but without reference to the Ukrainian gas market. Almeidaa et al. [

20] assessed the main barriers to developing underground natural gas storage facilities in Brazil. They indicated what conditions should be met for implementing UGS projects to become effective. The authors proved that “there is an important economic value associated with the storage of gas in periods of low power prices and its consumption in a period of high power prices”. Chen et al. [

21] proposed a viable variant model to analyze the optimal investment strategy for UGS in the context of the ongoing reform of the natural gas market in China. Yu et al. [

22] have developed an integrated methodology for assessing the reliability of gas supplies in a pipeline system involving underground gas storage.

Matar and Shabaneh [

23] assessed the geological and economic viability of UGS in Saudi Arabia “under different scenarios: with and without LNG imports allowed, and low and high domestic gas production”. Zhang et al. [

24] investigated the natural gas market and the possibilities of developing underground gas storage in China. They paid particular attention to the imbalance between supply and demand in the domestic gas market, resulting from both regional and seasonal differences, as well as imported gas supplies. The authors emphasized the unique role of UGS in solving the above problem. Skrzyński [

25] examined the role of UGS in the continuity of natural gas supplies to customers from the Visegrad Group countries (Poland, the Czech Republic, Hungary, and Slovakia). Syed and Lawryshyn [

26] developed a quantitative model to test the operational reliability risk of an underground gas storage facility.

Tongwen et al. [

27] focused on the technical issues of using UGS; namely, they proposed an integrated technology for constructing crude oil displacement tanks and underground gas storage. The authors described the advantages of this technology as well as technical connotations, rules for selecting a location, and the process of optimizing the operating parameters of gas storage facilities. Similarly, Thanh et al. [

28] presented the machine learning method “to develop a series of unique deliverability smart models for underground natural gas storage in different types of target formations” to help forecast the above-mentioned deliverability. The authors believe that this approach will contribute to cleaner production and the implementation of the principles of sustainable development. Sadeghi and Sedaee [

29] applied a mechanistic numerical simulation method to study the effects of molecular diffusion, operating conditions, and bed and rock properties on pillow gas replacement in conventional reservoirs. In the second article [

30], the authors focused on the problem of fractures in the mixing of cushion and working gases during underground gas storage. Zhang et al. [

31] focused on the issues of ensuring the safety and integrity of the UGS infrastructure, which is undoubtedly important for energy reliability. According to the authors, advanced monitoring and simulation of the risk management of underground gas storage may contribute to this.

The article aims to analyze the current state of UGS facilities in Ukraine, to study their role and potential for ensuring the reliable functioning of the European natural gas market, and to model possible scenarios for the use of Ukrainian underground gas storage facilities by the EU countries to increase the level of energy security. The relevance of the article is also due to the change in the conditions for the functioning of the European gas market, caused by the aggressive energy policy of the Russian Federation and the need to attract new alternative sources of gas supplies from other regions of the world, including through the use of LNG technologies. All of this will require a revision of the strategies for the formation of natural gas reserves and the balancing of the European gas market and, consequently, a more active and systematic involvement in the use of Ukrainian UGS facilities.

The article reviews the information available in the scientific literature and regulations, as well as on internet pages. PESTEL and SWOT analyses were applied to the processing of the collected information, which made it possible to formulate scenarios for developing the gas industry in Ukraine, in particular, the underground gas storage sector.

3. SWOT and PESTEL Analysis

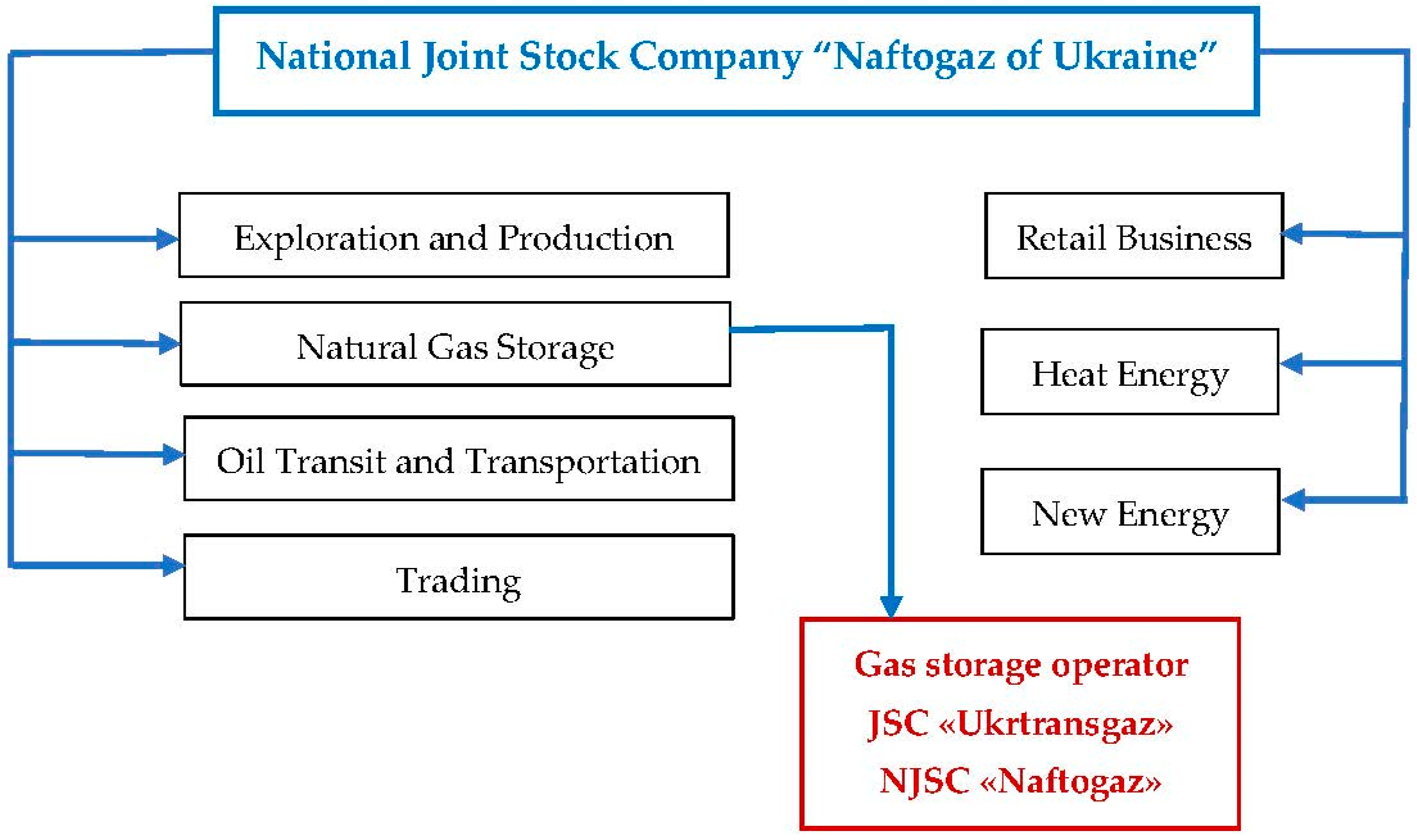

3.1. Environment of the Gas Storage Operator of Ukraine

The main task of the Gas Storage Operator of Ukraine is the effective management of underground gas storage facilities, accumulation of gas reserves necessary for the uninterrupted passage of heating seasons, as well as the development of the gas storage business with customers in Ukraine and abroad. Subdivisions of the Business Unit are part of JSC ”Ukrtransgaz”. The Business Unit manages 12 gas storage facilities located in mainland Ukraine. The portfolio also includes another underground storage facility located in the temporarily occupied territory of the Luhansk Region. The network of UGS facilities is an important element of the Ukrainian energy system. Their steady and uninterrupted operation is necessary for the passing heating seasons, operation of industrial enterprises, and fulfilling obligations towards foreign partners. Europe’s largest capacity and gas market reform create considerable opportunities for Ukrainian UGS facilities to attract foreign customers. This approach allows for commercializing available resources and reinforcing the country’s energy independence [

47].

Transformation processes in the economy of Ukraine and changes in the national strategy aimed at deepening European integration processes require studying the external environment in which business entities operate. The external environment can be divided into several levels:

When examining the operating environment of the gas storage operator of Ukraine, it is necessary to identify global factors in the hierarchy of levels of the external environment that will influence the formation of the strategy of the gas storage operator of Ukraine:

Situation in the global gas market;

Changes in the natural resource potential of the regions of the world;

Formation of the global communication and information space;

Ukraine’s access to this space;

International regulation of relations in the global gas market;

Development of transnational companies;

Aggravation of global and geopolitical problems.

Macroenvironment factors are related to the general conditions for the functioning of the national economy. At the same time, microenvironment factors are associated with the immediate environment of the enterprise (suppliers, buyers, competitors, and partners).

Figure 5 shows the interaction diagram of the three components of the external environment and the gas storage operator of Ukraine.

Figure 5.

Conceptual scheme of interaction between the components of the external environment and the Gas Storage Operator of Ukraine. Source: improved based on [

48,

49].

Figure 5.

Conceptual scheme of interaction between the components of the external environment and the Gas Storage Operator of Ukraine. Source: improved based on [

48,

49].

Until recently, the style of interaction between UGS facilities in Ukraine and global factors was reactive, but today it is acquiring the character of an analytical style. The same style is the optimal style of their interaction with macro factors since it is characterized by an attempt to adapt the elements of the external environment to their activities to mitigate or enhance their action. As for the micro factors, UGS facilities interact with the subjects of the near environment mainly in a proactive style, which is reflected in the ability to predict and prevent their action or even influence the surrounding economic entities and try to adapt their activities to achieve their goals. The result of a conscious and competent interaction of an enterprise with the external environment is the stability of its functionality and the possibility of future development. At the same time, ignoring or not being able to take into account the signals coming from the external environment can have a devastating effect on the enterprise and lead to its degradation.

Systematization of theoretical knowledge on the essence and composition of the external environment of enterprises, taking into account the peculiarities of the operation of UGS facilities in Ukraine, made it possible to decompose environmental factors, consider the establishments, organizations, and institutions through which the interaction between the external environment and UGS facilities is carried out, as well as identify the nature of such interaction.

Therefore, the question arises of choosing methods for assessing the influence of factors on the functioning of Ukrainian UGS facilities and the possibilities of using their capacities. In such cases, the tools and capabilities of expert research methods are usually used, using an individual or collective assessment of experts. Among the methods of individual expert assessment, the most common methods in practice are questionnaires, interviews, analytical, and written scripts. Among the collective expert methods, one can single out the Delphi method, matrix methods (PEST, SLEPT, STEEPLE, and SWOT analysis), and methods of collective generation of ideas (brainstorming). In our study, to form scenarios for the use of Ukrainian UGS facilities in the future, in the process of analyzing the UGS environment, we will apply PESTEL and SWOT analysis.

3.2. PESTEL and SWOT-Analysis of the Prospects for the Use of UGS Facilities in Ukraine

One of the common methods for assessing the environment to identify the strengths and weaknesses of an object while simultaneously identifying the opportunities and threats inherent in the external environment is the methodology for conducting a SWOT analysis. The essence of this analysis is the division of factors and phenomena that affect the functioning and development of enterprises into four categories: strengths, weaknesses, opportunities, and threats.

The preparation of a SWOT analysis is preceded by such stages of the strategic management process as an analysis of the internal and external environment. Analysis of the external environment allows one to identify both factors that are external opportunities for the enterprise and factors that can negatively affect it. Analysis of the internal environment is aimed at identifying the strengths and weaknesses of the company’s activities, which allows one to place values and make the best development strategy. This method can be used to determine the development prospects for business entities and industries, regions, or countries.

To assess the magnitude of the influence of the external environment on the possibilities of using Ukrainian UGS facilities and form scenarios for their use, we use PESTEL analysis, a matrix analysis method involving the study of components of the environment such as political, economic, socio-cultural, technological, legal, and environmental (natural factors, including geographic ones). PESTEL analysis will start by identifying trends for each component and assessing their potential impact on UGS facilities. The next step will be to predict the consequences of such an impact, allowing us to substantiate strategic hypotheses (scenarios). Based on these scenarios, UGS facilities in Ukraine will be able to build their own development strategies that provide various options for changes in the external environment.

4. PESTEL-Analysis

Let us consider the trends of changes among the components of the external environment and their possible impact on UGS facilities in Ukraine, divided into groups of factors:

Political;

Economic;

Social;

Technological;

Environmental;

Legal.

In each country, a group of political factors has a significant impact on the formation of the stability of the macro-environment of enterprises. Effective political actions and a stable political situation in the country create the appropriate foundation for the calm planning of economic activity. Above all, it allows one to create long-term investment strategies.

The constituent factors of the economic component reflect both the state of the economy as a whole and its individual aspects that affect this type of economic activity. In particular, important factors for UGS facilities in Ukraine are effective regulation of tariff formation for gas storage services, access to investment and credit resources, the level of state funding for programs to modernize UGS facilities, and state support for research and development in the oil and gas industry.

Among a significant number of factors of the social component, of great importance are the educational level of the population, the level of labor and intellectual migration, the level of quality and training of personnel, and personal attitudes to work and leisure. They reflect the social structure and social stratification of the population, as well as the presence of an economically active group of people within it. It is the social component that largely forms informal public institutions, the influence of which is reflected in the formation of common values, the level of education and skills of workers, manifestations of their creativity, etc.

The study of the factors of the technological component has an impact on the search for priority areas for the technical and technological renewal of facilities (in particular, UGS facilities in Ukraine), the intensification of innovation activities, the improvement of the mechanism of institutions for monitoring the quality and safety of services (including natural gas storage), the development of various levels of programs and projects in the scientific and technical industry. The constituent factors of the technological component are the presence in the country and access to advanced technologies, the technical and technological level of partner enterprises, equipment suppliers and other stakeholders, the development of information and communication technologies, the use of energy resources, etc.

Factors of the environmental component are determined by the characteristics of the ecological environment and the natural and geographical conditions of the location of economic facilities. Concerning UGS facilities in Ukraine, such factors are: the state of the environment and environmental safety; climatic conditions for the functioning of UGSF facilities and the complexity of passing routes that directly affect the operation parameters of UGSF facilities and the formation of final costs for natural gas transportation; degree of exploration and development of national oil and gas deposits, geographical location of UGS facilities by markets and sources of natural gas, which will influence the formation of scenarios for their use.

The factors of the legal component include transparency and stability of the national energy legislation, the level of adaptation of the regulatory and legal framework to European integration energy processes, legal support for standardization and certification of natural gas storage services, protection of intellectual property, transparency, and the possibility of obtaining licenses to carry out activities. The presence of legal institutions that are legally enshrined in laws, decrees, regulations, clarifications, nationwide concepts, and development strategies and their effective interaction and mutual agreement is a necessary condition for improving the efficiency of the function and development of UGS facilities and their successful European integration. These institutions are also mechanisms for controlling the quality and safety of natural gas storage services and eliminating shortcomings in their functioning as a subject of natural monopolies.

Let us consider in more detail the main environmental factors (in the context of individual components) and the nature of their interaction with UGS facilities in Ukraine (

Table 5).

The current situation in Ukraine and Europe testifies to a deep energy crisis, inability to ensure energy security, high dependence on the monopoly gas supplier (Russia), and lack of sufficient gas reserves in underground gas storage facilities (to ensure the alignment of seasonal fluctuations in gas consumption and prevent the consequences of a crisis that has arisen). The environmental factors that formed the crisis in the European energy market emphasized the competitiveness of Ukrainian UGS facilities and the need to use their capacities to maintain Europe’s energy security.

5. SWOT Analysis of Ukraine’s Competitive Position in the Field of Natural Gas Storage

Conducting a SWOT analysis includes such steps as assessing the factors of the internal environment and identifying and analyzing external opportunities and threats.

5.1. Strengths

UGS facilities in Ukraine create significant strategic opportunities for gas storage not only for the whole of Europe but for the whole world. They are the largest on the European continent and the third largest in the world, and in recent years have become a significant element of the EU energy balance. The active capacity of Ukrainian UGS facilities is approximately 20% of the total capacity of gas storage facilities in European countries. The total capacity of all gas storage on mainland Ukraine is 30.95 billion m

3 and is the largest in this part of the world. Ukraine has the biggest working storage capacity in Europe and amounts to a third of the combined storage capacity of the EU28 [

50]. Ukrainian gas storage facilities are the third largest in the world, after the US and Russia [

51].

As of September 1, 2021, the total active capacity of UGS facilities in European countries was about 138 billion m

3, of which 30.95 billion m

3 (i.e., 22.43%) was in Ukraine (

Table 6). More than 71% of all gas storage capacities are concentrated in six European countries—Ukraine, Germany, Italy, the Netherlands, France, and Austria. The latest GlobalData report “Underground Gas Storage Industry Outlook in Europe, North America, and Former Soviet Union (FSU) to 2025—Capacity and Capital Expenditure Outlook with Details of All Operating and Planned Storage Sites” shows that as of September 2021, 151 underground gas storage facilities were operating in Europe [

52].

Table 6.

Capacities of underground gas storage of European countries as of 1 September 2021.

Table 6.

Capacities of underground gas storage of European countries as of 1 September 2021.

| N° | Country | Storage Volume, Million m3 | The Share of Gas Storage Facilities in UGS in Europe,% |

|---|

| 1 | Ukraine | 30,950 | 22.43 |

| 2 | Germany | 21,881 | 15.86 |

| 3 | Italy | 18,904 | 13.70 |

| 4 | Netherlands | 13,748 | 9.96 |

| 5 | France | 12,640 | 9.16 |

| 6 | Austria | 9128 | 6.62 |

| 7 | Hungary | 6657 | 4.82 |

| 8 | Slovakia | 4068 | 2.95 |

| 9 | Czech Republic | 3441 | 2.49 |

| 10 | Poland | 3421 | 2.48 |

| 11 | Spain | 3274 | 2.37 |

| 12 | Romania | 3150 | 2.28 |

| 13 | Latvia | 2310 | 1.67 |

| 14 | Great Britain | 1115 | 0.81 |

| 15 | Denmark | 1000 | 0.72 |

| 16 | Belgium | 861 | 0.62 |

| 17 | Bulgaria | 599 | 0.43 |

| 18 | Croatia | 499 | 0.36 |

| 19 | Portugal | 341 | 0.25 |

| Total | 137,987 | 100.00 |

An additional strength of Ukrainian UGS facilities is their territorial location—about 80% of them are located near the western border of Ukraine. It is the significant active volume of UGS facilities in the Western region of Ukraine (located closest to other European countries), a wide range of possibilities for extracting natural gas from UGS facilities (providing extraordinary flexibility in gas flows), optimization of operating modes, and convenience of logistics processes that create a fairly profitable infrastructure for the use of Ukrainian underground storage facilities not only for storing operational and strategic gas reserves but also for its uninterrupted supply to European countries.

As of mid-January 2022, the number of customers using the services of Ukrainian UGS facilities was 1003, incl. 111 foreign companies from 27 countries located on three continents—Europe, North America, and Asia. Among them are companies from the Czech Republic, Switzerland, USA, Canada, United Arab Emirates, Hong Kong, and Singapore. The Gas storage operator provides gas storage services to both suppliers of this energy resource and its consumers. Daily operational information on the operation of gas storage facilities in Ukraine can be found on the transparency platform [

53], launched in 2015. Since 2014, similar data has also been published on the European Transparency Platform AGSI+ [

54]. Ukraine was the first country outside the EU to join the AGSI+ transparent data display system according to the standards of the Association of European Underground Gas Storage Operators (GSE) [

55].

Until June 2019, the gas storage operator of Ukraine created its own IT environment and a unified database (of process parameters), as well as set up its own dispatching system. Operational dispatching of UGS operation is currently carried out from Lviv, not far from several major storage facilities, where a central control room has been set up. In August 2019, an information platform was launched to interact with UGS customers, significantly increasing its efficiency. We are constantly working on expanding the functionality of the platform. To account for gas transferred between two operators, counting equipment installed at connection points is used. To improve the accuracy of gas metering, by 2023, equipping new metering units is planned [

55].

In November 2020, the gas storage operator of Ukraine introduced a new service that allowed banks to track transactions with natural gas in UGS facilities. Clients use this gas as collateral for loans [

56]. Since 21 May 2020, Ukrtransgaz customers have had the opportunity to submit separate nominations and renominations [

57] for volumes of natural gas submitted for injection and/or withdrawal to/from gas storage facilities using the short-haul service. The essence of the short-haul service is to issue trade notices identifying that the natural gas to be transferred has been supplied to the exit point in the gas storage or group of gas storage facilities under the terms of capacity use with restrictions. The new service is most in demand by Ukrainian and foreign gas traders who use Ukrainian UGS facilities for seasonal gas storage [

58]. Currently, Ukrtransgaz is implementing a program to prepare for the transition to gas accounting in energy units, scheduled for 1 May 2022. The advantages of gas storage facilities in Ukraine include competitive tariffs for the storage of natural gas, as shown in

Table 7 (as of 1 October 2021).

Table 7.

Comparison of gas storage tariffs in Ukraine and nearby EU countries.

Table 7.

Comparison of gas storage tariffs in Ukraine and nearby EU countries.

| Directions | Tariff for Short-Haul Transportation and Storage in the “Customs Warehouse” Mode (EUR/MWh) | Country | Storage Tariff

(EUR/MWh) |

|---|

| Annual | Lunar | The Day before |

|---|

Ukraine—Poland

Poland—Ukraine | 1.55 | 1.64 | 1.70 | Poland | 3.2–3.7 |

Ukraine—Hungary

Hungary—Ukraine | 1.52 | 1.60 | 1.66 | Hungary | 2.5 |

Ukraine—Slovakia

Slovakia—Ukraine | 1.47 | 1.55 | 1.61 | Slovakia | 2.2–2.9 |

Ukraine—Romania

Romania—Ukraine | 1.47 | 1.56 | 1.62 | Romania | 2.64 |

The proximity of Ukrainian UGS facilities to the border with the EU, favorable conditions, and competitive tariffs for storage and transportation of gas are several convincing arguments for gas traders from all over the world to choose these UGS facilities for storing their own natural gas reserves. This possibility is especially relevant during the period of instability in the gas market, which we are now witnessing in connection with Russia’s attack on Ukraine. These strengths form the strategic attractiveness and importance of Ukraine’s UGS facilities against the backdrop of growing demand for underground gas storage services.

5.2. Weaknesses

Weaknesses include the service life of UGS facilities and their associated technical condition, technological capabilities, and wear and tear of fixed assets. In general, the majority of gas compressor units (GCUs) in UGS facilities were put into operation in the 1970s and 1980s. Although the overall percentage of technical wear and tear is low (due to the short period of use of the main production equipment during the year), 102 gas compressor units (79.7% of their total number) have already been in operation for more than 30 years. More than 53% of gas compressor units have a service life of 31 to 40 years (68 out of 128). Most of them work at booster compressor stations (BCS) Dashava, BCS Opary-1, CS Kechyhivka, CS Solokha, and in some compressor shops (CC) CS Bohorodchany, CS Mryn, BCS Bilche-Volytsia. There is also a significant number of GPUs (34 in total) operated for more than 40 years, most of them installed at BCS Uhersko, CS Mryn, CS Olyshivka, and CS Krasnopopivka [

32] (

Figure 6).

Figure 6.

The structure of the fleet of gas-pumping units of the storage system according to the service life by the production departments of the UGS facilities. Source: [

32].

Figure 6.

The structure of the fleet of gas-pumping units of the storage system according to the service life by the production departments of the UGS facilities. Source: [

32].

The transparent display of information on UGS facilities in Ukraine (using the AGSI+ data display system according to the standards of the Association of European Underground Gas Storage Operators (GSE)) is an important component of Europe’s energy security. However, the full-scale entry of Ukrainian UGS facilities into the European gas market requires introducing digitalized information technologies. In particular, this concerns the processes of managing the client base of potential consumers of UGS services (both Ukrainian and foreign), the number of which is constantly growing. For example, in the 2020/2021 gas withdrawal season, the number of customers increased from 802 (as of 10 October 2020) to 901 (as of 30 April 2021). Over the past three years, from January 2019 to January 2022, the portfolio of customers of Ukrtransgaz services has more than doubled to 1003. And the number of non-resident companies in it has grown 8 times [

59].

The enterprises of the gas transmission system (gas transmission, gas distribution, and gas storage), due to the specifics of their operation, are also monopolized in the state form of ownership. This complicates the development of strategic mechanisms for managing them [

60]. In addition, the unpredictability of the state policy of Ukraine—in the field of gas storage and the formation of tariffs for the services of gas storing enterprises—complicates the work with potential customers. The problem is also the lack of investment attractiveness of the enterprise since UGS facilities are state-owned, and little funds are allocated from the budget for the renewal of fixed assets, which could increase the efficiency of these enterprises.

5.3. Opportunities

As already mentioned, most Ukrainian UGS facilities were created on the site of depleted fields. However, two of them—Chervonopartyzanske and Olyshivske—are based on aquifers [

61]. Although each Ukrainian gas storage is located at a distance of 3–3.5 thousand km from the main areas of natural gas production, they are all interconnected through a system of gas pipelines, creating favorable conditions for the redistribution of gas flows and meeting the needs of local and remote consumers. The Ukrainian GTS is also closely connected with the gas pipeline systems of neighboring European countries—Russia, Belarus, Poland, Slovakia, Hungary, Romania, and Moldova. Thus, it is integrated with the European gas network and is also a bridge between the gas-producing regions in Russia and Central Asia and consumers in Europe [

53]. In 2015, Ukraine proposed to Poland and Hungary that they use this powerful gas transmission hub, as well as the UGS facilities located next to it, as the basis of the Eastern European gas hub. On 19 January 2015, NJSC Naftogaz and the Polish Gaz-System SA signed an agreement to construct an interconnector. On 29 May 2015, JSC Ukrtransgaz (gas storage operator of Ukraine) and the Hungarian operator FGSZ signed an agreement to unite the cross-border gas pipelines of the two countries. Moreover, in March 2020, the United States announced that it was ready to create a hub for its liquefied gas in Ukraine, but with the spread of COVID-19, this idea was put on hold. Unfortunately, the war further pushed these plans into the future.

According to the estimates of leading Ukrainian non-governmental organizations and government agencies, with the support of European structures and experts, the energy balance of Europe will undergo significant changes by 2028. Renewable energy sources (including biogas, biomethane, hydrogen, and other “environmental gases”) and natural gas will significantly strengthen their positions. In Ukraine, the share of natural gas, according to the Energy Strategy of Ukraine until 2035, will not undergo significant changes, but the share of nuclear energy and renewable energy sources will increase significantly [

62].

Ukraine does not use all the capacities of its UGS facilities. From 2013–2018, Ukraine had about 15 billion m

3 of free capacity it could offer European consumers (

Figure 7).

Figure 7.

The level of filling, injection, and withdrawal of UGS of Ukraine in 2010–2021. Source: [

63].

Figure 7.

The level of filling, injection, and withdrawal of UGS of Ukraine in 2010–2021. Source: [

63].

In 2019, the maximum gas injection volume increased to 21.8 billion m

3, i.e., free capacity was 10 billion m

3. The record year was 2020, when the highest level in the last 10 years in terms of injection volumes (28.3 billion m

3) was reached. And a third of these stocks were created by foreign customers, most of whom were from EU countries [

63]. This fact is convincing evidence that the most important elements of Ukraine’s gas energy infrastructure are being successfully integrated into the energy space of the European Union. In addition, the gas storage operator of Ukraine is recognized as a reliable business partner in Europe, and Ukraine as a whole has significantly strengthened its position in its gas market.

In 2020, the gas storage operator and the GTS operator offered their customers a new service—storage of natural gas in the “Customs warehouse” mode and transportation of gas from entry/exit points to/from the GTS at interstate connections of UGS facilities at a reduced short-haul tariff. This provides special tariffs for transit transportation services, that is, for capacities with limited access to the Ukrainian VTP (the virtual trading point where natural gas is transferred) and the domestic market. Accordingly, in 2020, Ukrainian gas storage facilities received 6.1 billion m

3 of gas in the short-haul mode. The “Customs warehouse” service provides traders with the opportunity to store natural gas in 10 underground gas storage facilities in Ukraine for 1095 days without paying taxes and customs duties, subject to further transportation of natural gas from the territory of Ukraine or placing it in another customs regime. This service was introduced to the market back in 2017. In 2019, the customers of this service placed more than 8.1 billion m

3 of natural gas in the customs warehouse regime (more than 30% of the total volume of gas storage), of which natural gas of residents (10 customers) amounted to 6.1 billion m

3 (65%), and non-residents (19 customers)—2.0 billion m

3 (35%) (

Figure 8) [

63].

Figure 8.

Dynamics of the provision of the “Customs warehouse” service in 2017–2019. Source: [

54] (p. 93).

Figure 8.

Dynamics of the provision of the “Customs warehouse” service in 2017–2019. Source: [

54] (p. 93).

In 2021, the injection of natural gas into UGS facilities in Ukraine amounted to 3.59 billion m

3 (in 2020—16.8 billion m

3), and withdrawal—13.62 billion m

3 (in 2020—7.4 billion m

3). Thus, in 2021, the total gas withdrawal from storage facilities exceeded its injection by 10.03 billion m

3, while in 2020, injection exceeded the withdrawal by 9.4 billion m

3. In the 2020/2021 withdrawal season, gas reserves in Ukrainian UGS facilities were unusually high compared to the previous decade, thanks in large part to foreign customers of services who actively used gas storage facilities to store their own reserves [

64]. By the beginning of the 2021–2022 heating season, 19 billion m

3 of gas had been accumulated in Ukrainian UGS facilities. The Gas storage operator of Ukraine entered 2022 with gas reserves in UGS facilities at the level of 13.5 billion m

3 [

65].

The potential of Ukrainian UGS facilities is much higher, as is the role of Ukraine in the European energy space. This is not only about the rational and efficient use of existing natural gas storage capacities but also reasonable prerequisites for expanding the UGS network in Ukraine and increasing the total active volume of storage facilities at the expense of depleted gas fields.

5.4. Threats

There are several threats to companies providing natural gas storage services. The most important of these is the significant influence of the political and regulatory environment, by which we mean laws, government institutions, and pressure groups that put pressure on and restrict the activities of enterprises. Another type of restriction on business activities is licensing, since some of the activities of the gas storage operator JSC “Ukrtransgaz” are subject to state licensing. JSC “Ukrtransgaz” carries out its activities in the field of underground gas storage based on:

5 licenses of the National Commission of Ukraine (carrying out state regulation of energy and public utilities),

11 special permits of the State Service of Geology and Subsoil of Ukraine,

4 other permits.

These licenses and permits cover and regulate the activities of the gas storage operator and meet the requirements of the energy legislation of the European Union. At the same time, certain features require the continuation of work on harmonizing the energy legislation of Ukraine and the EU.

A characteristic feature of Ukraine is imperfect legislation, which also creates additional threats to the activities of market entities for underground gas storage services. After all, each enterprise must determine the permissible boundaries of economic activity, the boundaries of relationships with other entities, and methods for defending their interests.

In addition, the imperfection of the gas market and the incompleteness of structural reforms in the energy sector of Ukraine complicate their cooperation with European gas giants and pose a threat to the effective functioning of both UGS facilities and the GTS of Ukraine in the long term. At the same time, such threats are not critical and can be leveled quite easily by further improvement of the energy legislation of Ukraine. The need to create and operate a transparent gas market requires further reform of NJSC Naftogaz and its subsidiaries by turning them into a modern corporate business structure with a high level and quality of management.

The economic crisis, high inflation, rising unemployment, high-interest rates on loans in recent months, and now also the war (the worst that could befall the country and its inhabitants) have all negatively affected and will continue to affect the activities of underground gas storage companies in Ukraine.

The technological environment, which requires a separate systematic study in terms of limitations, trends, and opportunities for a particular enterprise, is of particular importance. Currently, Ukrainian gas storage facilities mainly use traditional technologies, which are quite reliable, but looking ahead, it is necessary to work now on the modernization of the gas industry in Ukraine.

During all 30 years of Ukraine’s independence, the government of the Russian Federation has used natural gas as an instrument of political blackmail and diktat. The GTS of Ukraine has been developing technological and economic interconnection with the GTS of Russia and European countries for a long time, serving as a means of intercontinental natural gas transit from its production areas (located mainly in Western Siberia of the Russian Federation) to end consumers in Europe. The gas crises of 2004–2005, 2009–2010, and 2021–2022 have become clear evidence of the use by the Russian Federation of its monopoly position in the European gas market for political pressure and blackmail. At the same time, Ukraine’s underground gas storage system also experienced a negative impact, as the reduction in the volume of Russian gas transit through the Ukrainian GTS reduced the level of workload and the use of Ukrainian UGS capacities to regulate seasonal fluctuations in gas consumption in European countries. Today, however, the biggest threat has been Russia’s invasion of Ukraine, the destruction of its infrastructure, and massacres of civilians. Concerning UGS facilities, this is fraught with a loss of control over gas storage facilities located in war zones.

However, the main gas storage facilities are located in the western part of the country and are under the control of Ukraine. On the other hand, the need has become clear for:

Refusal of European countries from the monopoly supply of natural gas from the Russian Federation;

Diversification of sources of supply;

Formation of large reserves of natural gas and its storage in UGS facilities.

An analysis of the development of the military conflict, and in fact, a full-scale war between Ukraine and the Russian Federation in the period from February to August 2022, testifies to the ability of Ukraine to defend its independence, and the aid of the countries of the European Union, the United States, and the United Kingdom allows us to draw an encouraging conclusion about a fairly quick end to hostilities, preservation of Ukraine’s independence, and rapid integration into the European community. Under these conditions, the use of the potential of Ukrainian UGS facilities to ensure the reliable functioning of the European gas market becomes especially attractive and promising.

5.5. SWOT Conclusions

Summing up the analysis,

Table 8 shows an extended SWOT matrix for underground gas storage facilities in Ukraine and, consequently, for Ukrainian companies engaged in underground gas storage in the context of identifying Ukraine’s competitive position in the European gas market.

As seen from the above SWOT analysis, Ukrainian UGS facilities have several competitive advantages, which can be used to win in foreign markets. These include:

Geographic location;

Well-developed transport communications;

Technical characteristics (a wide range of options for natural gas withdrawal from underground storage facilities, providing extraordinary flexibility of gas flows, optimization of operating modes, provision, and maintenance of reverse flows);

Favorable conditions and competitive tariffs, data transparency.

At the same time, the greatest advantages are the high capacity potential of UGS facilities in Ukraine and the high degree of compliance with contractual obligations for end users. However, most gas storages experience problems associated with the long service life of their production facilities. To ensure the competitiveness of Ukrainian UGS facilities, considerable attention should be paid to the construction, reconstruction, technical re-equipment, and overhaul of production facilities to ensure long-term performance. In addition, an insufficient number of qualified workers in the field of using the latest digital technologies leads certain consumers to be dissatisfied with the quality of service provision.

Clearly, political factors and the presence of monopolists in the market cannot be ignored, as evidenced by the events in the European natural gas market in the summer and autumn of 2021, as well as in March 2022. The events were accompanied by an astronomical increase in gas prices in spot markets and clearly demonstrated the vulnerabilities of the European energy security system (

Figure 9).

Figure 9.

Dutch TTF European natural gas price dynamics in 2021–2022 (EUR/MWh). Source: [

66].

Figure 9.

Dutch TTF European natural gas price dynamics in 2021–2022 (EUR/MWh). Source: [

66].

However, the shortcomings mentioned can be overcome and threats prevented. Ukraine has all the possibilities to do this. The gas storage operator of Ukraine has the opportunity to expand its activities (due to the high potential of the European sales market), but for this, it is necessary to use strengths and eliminate weaknesses, as well as closely monitor changes in the external environment.

6. The Role of UGS Facilities in Ensuring Energy Security in Europe

The growth of the role of Ukrainian UGS facilities in the European gas market significantly depends not only on the demand for gas storage services from foreign companies but also on the awareness at the state level of the importance of collective energy security manifested in energy policy regulations. An important role in this aspect is played by the problem of forming a single European energy space and its reliable and efficient function. At the same time, one should consider not only the availability and volume of storage facilities in different countries but also other infrastructure parameters, in particular their connection to existing gas pipelines, the development of pipeline networks, and their performance. All this ultimately creates opportunities for the rational use of storage capacities from the standpoint of national, regional, and European energy security.

To determine the role played by Ukrainian UGS facilities, we analyzed the available storage volumes in various European countries and domestic gas consumption in 2019 and 2020. We also assessed the level of UGS facilities supplying the internal needs of individual European countries (

Table 9).

Table 9.

Provision of underground storage facilities to the domestic needs of individual European countries.

Table 9.

Provision of underground storage facilities to the domestic needs of individual European countries.

| Country | Storage Volume, Billion m3 | Volume of Natural Gas Consumption, Billion m3 | Ratio of UGS Capacity for Domestic Needs |

|---|

| 2019 | 2020 | 2019 | 2020 |

|---|

| Ukraine | 30.950 | 28.3 | 29.3 | 1.094 | 1.056 |

| Germany | 21.881 | 88.7 | 86.5 | 0.247 | 0.253 |

| Italy | 18.904 | 70.8 | 67.7 | 0.267 | 0.279 |

| France | 12.640 | 43.7 | 40.7 | 0.289 | 0.311 |

| Netherlands | 13.748 | 37.0 | 36.6 | 0.372 | 0.376 |

| Austria | 9.128 | 8.9 | 8.5 | 1.026 | 1.074 |

| Hungary | 6.657 | 9.8 | 10.2 | 0.679 | 0.653 |

| Czech Republic | 3.441 | 8.3 | 8.5 | 0.415 | 0.405 |

| Poland | 3.421 | 20.9 | 21.6 | 0.164 | 0.158 |

| Spain | 3.274 | 36.0 | 32.4 | 0.091 | 0.101 |

| Romania | 3.150 | 10.7 | 11.3 | 0.294 | 0.279 |

| Great Britain | 1.115 | 77.3 | 72.5 | 0.014 | 0.015 |

| Belgium | 0.861 | 17.4 | 17.0 | 0.049 | 0.051 |

| Portugal | 0.341 | 6.1 | 6.0 | 0.056 | 0.057 |

Based on the data (

Table 9), we calculated the ratio of UGS capacities to meet gas consumption needs as the ratio of natural gas consumption to the active volume of gas storage facilities. We divided the results into five groups, characterizing the level of provision of each country with these capacities from the standpoint of internal energy security (

Table 10).

The level of supply of UGS capacities for domestic needs is an important component of the country’s energy security. If UGS capacities are less than 20% of the annual volume of gas consumption, then this level is considered critically low. The availability of UGS facilities at the level of 21–30% of annual consumption corresponds to a low level, 31–40% to an average level, 41–50% to a high level, and more than 50% to an ultra-high level. Next, we ranked the European countries (from

Table 9) according to the level of provision of domestic needs with underground gas storage facilities.

The results obtained allow for a more reasonable approach to creating strategies for improving the energy security of both individual European countries and the region. This approach contributes to the rationalization and optimization of the tasks of developing the network of underground gas storage facilities and allows minimizing the total costs of developing the UGS network from the standpoint of European energy security. Of course, this should take into account the peculiarities of the economic development of individual countries, the structure of gas consumption, the presence of industries with high gas consumption, and the possibility of alternative use of energy resources, including the replacement of natural gas with other energy resources, climatic conditions, environmental factors, the availability of pipeline infrastructure for cross-border movement of gas streams, etc.

7. Formation of Scenarios for the Use of UGS Facilities in Ukraine

Ukraine (according to the Association Agreement between Ukraine and the European Union [

68]) is actively implementing measures aimed at further integration with the European energy market, in particular, the gas market. Therefore, when planning the development of the Ukrainian gas storage system, it is necessary to take into account the prospects for the consumption of energy resources in the EU countries. According to experts, the forecast energy balance of Europe and Ukraine in 2028 will have the following structure (

Figure 10 and

Figure 11).

Figure 10.

Forecast of energy balance in 2028 (Europe). Source: [

55].

Figure 10.

Forecast of energy balance in 2028 (Europe). Source: [

55].

Figure 11.

Forecast of energy balance in 2028 (Ukraine). Source: [

55].

Figure 11.

Forecast of energy balance in 2028 (Ukraine). Source: [

55].

As we can see, both in Ukraine and in European countries, natural gas will continue to play a dominant role in the coming years (although the development of alternative energy sources will weaken its market position). Although forecasts up to 2050 may include a decrease in the share of gas in the global consumption of primary energy sources, they will remain significant in the future [

69,

70,

71]. In this regard, it is important to forecast the production and consumption of this energy resource in the coming decades.

Based on the studies, we will consider three scenarios for using UGS facilities in Ukraine: pessimistic; realistic; optimistic (

Figure 12,

Figure 13 and

Figure 14).

Considering the pessimistic scenario, which provides for a long-term energy crisis, a slow change in the energy infrastructure, and an increase in the monopoly supply of natural gas to Europe, we can predict its implementation within the next five years at least. As for the optimistic scenario, which provides for a complete renewal of the energy infrastructure, maximum demonopolization, and diversification of gas supply services, it is obvious that the implementation of such a scenario involves large investments, powerful scientific developments, and requires a significant period for implementation, in particular, in our opinion, not less than 10 years. A realistic scenario for the use of UGS capacities in Ukraine, in our opinion, can be implemented in the next 3–5 years. Obviously, the implementation of the individual components of the realistic scenario has already begun.

Given the current situation, a realistic scenario for using UGS facilities in Ukraine is more likely to materialize. However, in the longer term, Ukraine should prepare for alternative uses of gas storage facilities, in particular for hydrogen [

71] and carbon dioxide storage [

72], and to expand its offer of GTS services outside of Europe.

8. Conclusions and Prospects for Further Research

Underground gas storage is important for meeting domestic demand for natural gas. Facilities are used to compensate for the uneven consumption of gas in countries with a distinct change of seasons, as well as to level the risks of undersupply of gas of various natures (including technological, political, economic, and environmental) that may threaten the energy security of national markets. Ukraine belongs to the group of such countries.

In recent years, there have been significant changes in the functioning of Ukrainian UGS facilities, in particular:

Separation of the UGS operator from the gas transport operator;

Access of European countries to UGS facilities has been expanded and facilitated;

Natural gas storage regimes have been expanded;

Gas storage tariffs have been diversified;

Natural gas metering system has been improved.

However, in the future, it will be necessary to diversify the range of services, improve the quality of services already provided (including natural gas storage services), ensure the transparency of the activities of the underground gas storage operator, reduce the number of bureaucratic procedures, and eliminate the negative impact of monopolies that still operate in the gas market.

The studies prove the significant role of Ukrainian UGS facilities in ensuring the energy security of Europe. An important aspect of its improvement is regional cooperation aimed at increasing the level of energy security of countries that should unite in regional energy or exclusively gas clusters. The issue of forming a regional gas cluster, which could include Ukraine, Poland, Slovakia, Hungary, and some other countries interested in optimizing their energy balances, increasing the level of energy security and counteracting the gas expansion of the Russian Federation, deserves careful attention. The key infrastructure elements of such a gas cluster should be existing and potential underground gas storage facilities, an extensive gas transmission network, gas interconnector pipelines, LNG, and CNG terminals. In addition, gas storage facilities can be used to store hydrogen and carbon dioxide. The military invasion of Russia on the territory of Ukraine and the energy crisis caused by it will become an impetus for the development of hydrogen energy in European countries and the development of liquefied gas terminals, which will lead to demand for gas storage capacities in Ukraine.

As the study showed, UGS facilities in Ukraine have significant development opportunities, and the management of enterprises must use them correctly, utilizing their strengths. Of course, at the same time, there are many threats, but this requires effective management to foresee and avoid them in the future.

In further studies, we propose to deepen the study of the external environment of UGS facilities in Ukraine based on the already considered composition of factors within the political, economic, social, technological, and legal components; to determine the magnitude of the influence of each of the selected factors using the method of rating; to substantiate the reliability and consistency of the results of an expert survey using economic and mathematical criteria; and to carry out forecasting indicators of the functioning of UGS facilities in Ukraine. Our further studies will include: an analysis of the competitiveness of Ukrainian UGS facilities in the global gas market (taking into account macro-environment factors); identification of their role in the geopolitical aspect (taking into account global factors); forecasting demand for Ukrainian UGS services from foreign companies; analysis of alternative ways to use UGS facilities (in connection with the development of new achievements in science and technology).