Planning, Operation, and Design of Market-Based Virtual Power Plant Considering Uncertainty

Abstract

1. Introduction

1.1. Literature Review

1.2. Contributions and Study Layout

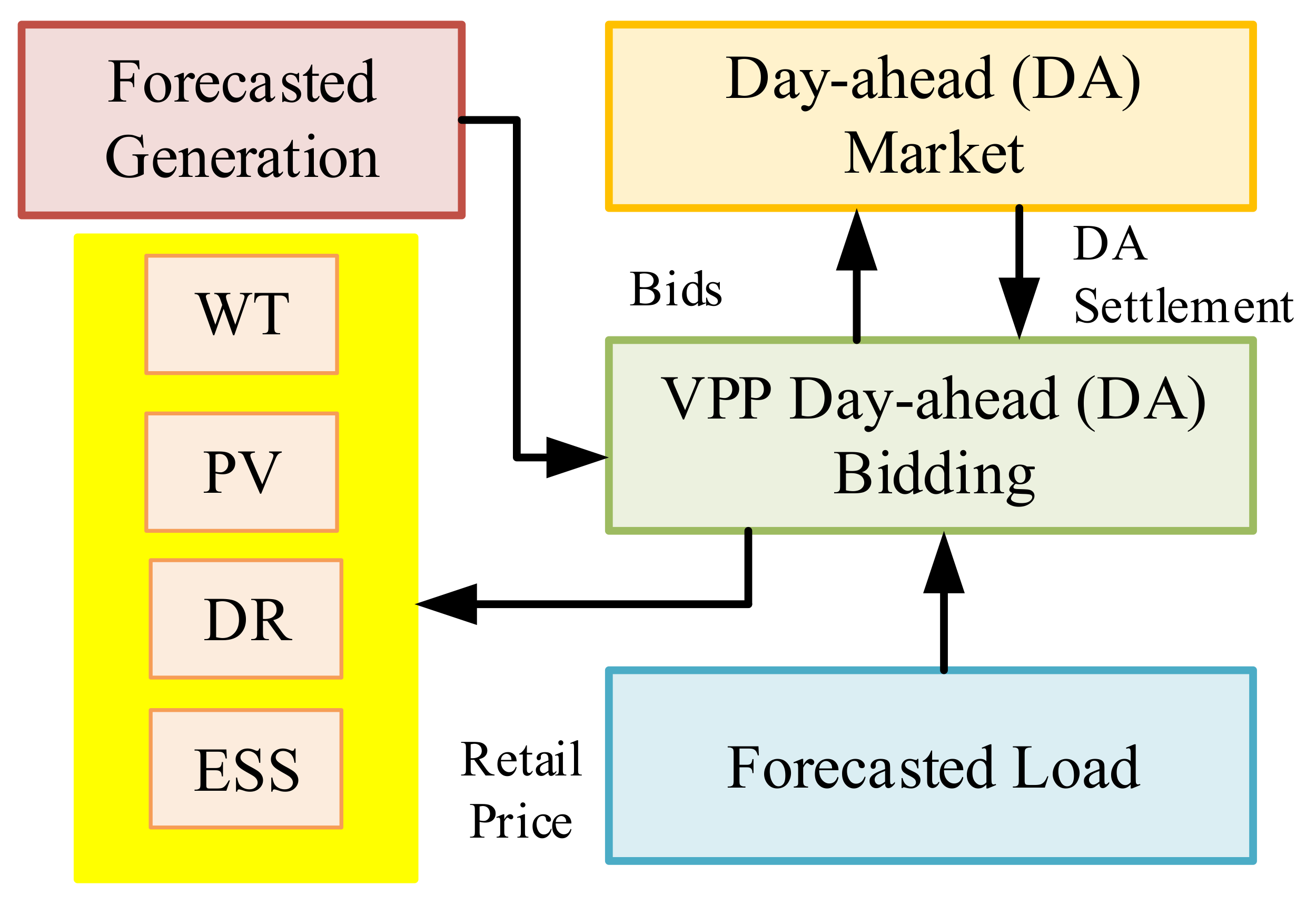

- To design a market trading mechanism for a VPP that trades in the day-ahead energy market with the integration of a DR program and ESS;

- To develop a market-based computationally efficient model for a VPP that operates in the day-ahead market;

- To perform a comparative analysis of a case study to demonstrate the effectiveness of the proposed strategy by thoroughly assessing the simulation results.

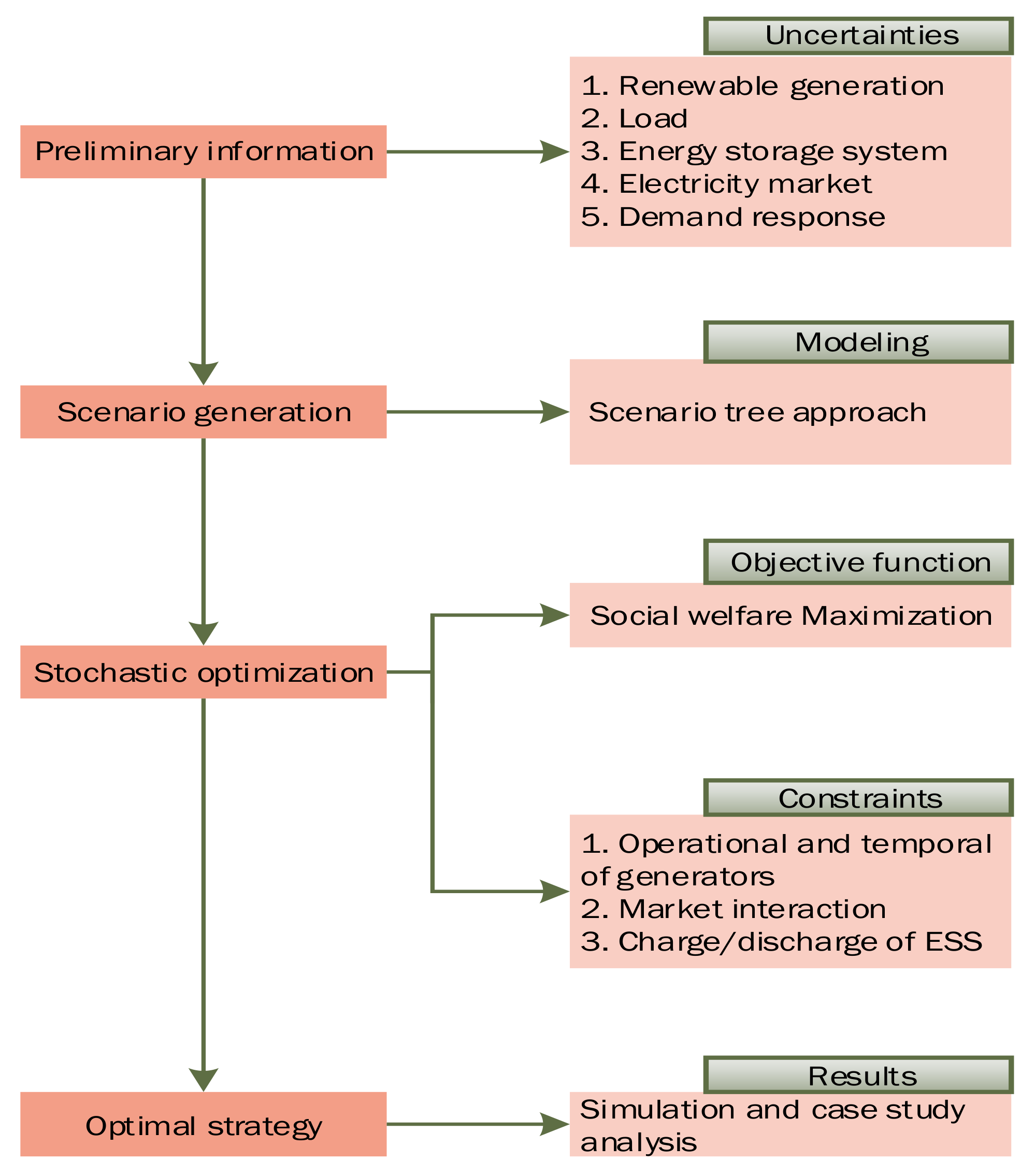

2. Methodology

3. Uncertainty Modeling

3.1. Wind Speed Modeling

3.2. Modeling of Solar Irradiance

3.3. Load Demand Uncertainty Modeling

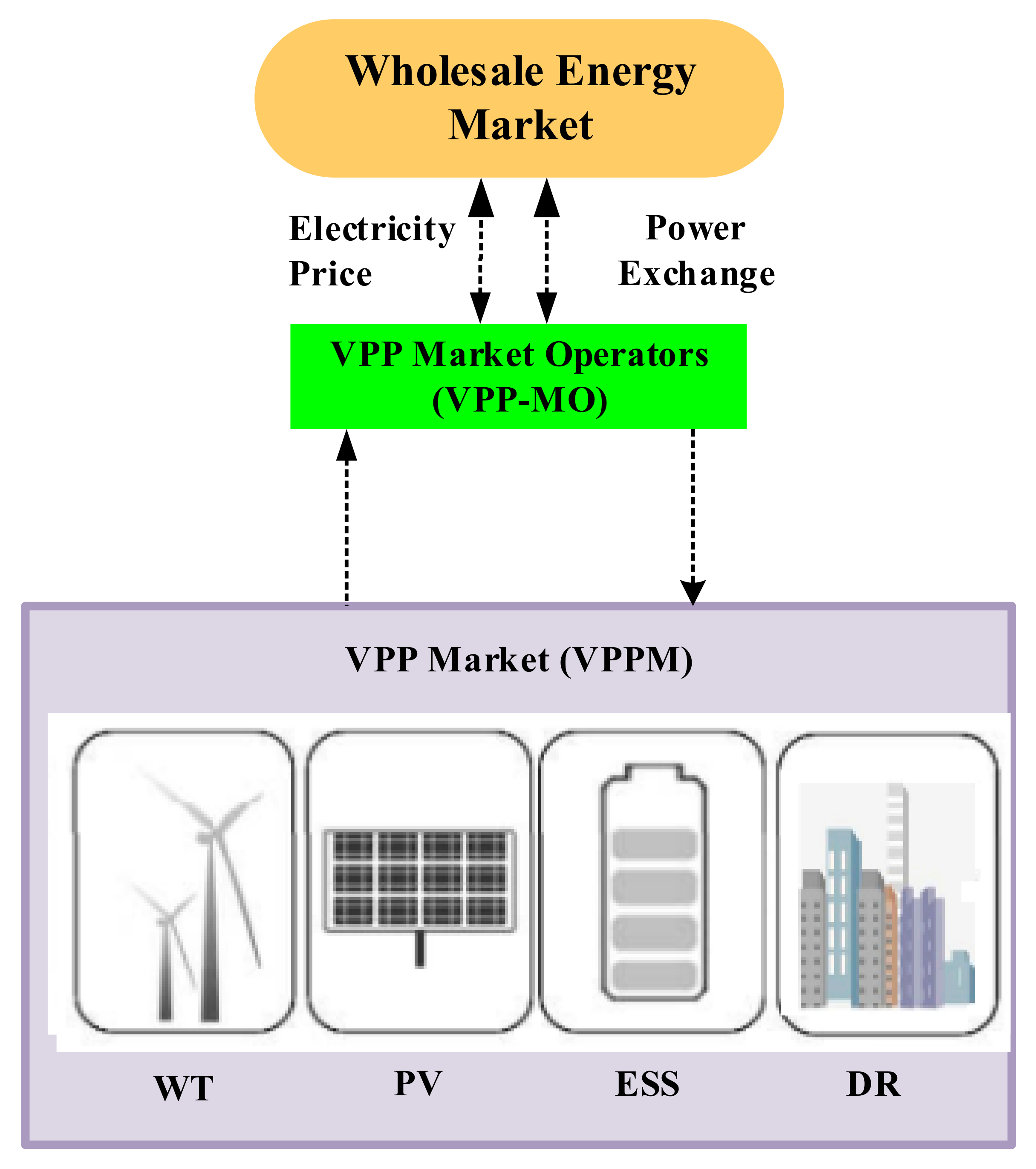

4. Proposed Market Model and Method Description

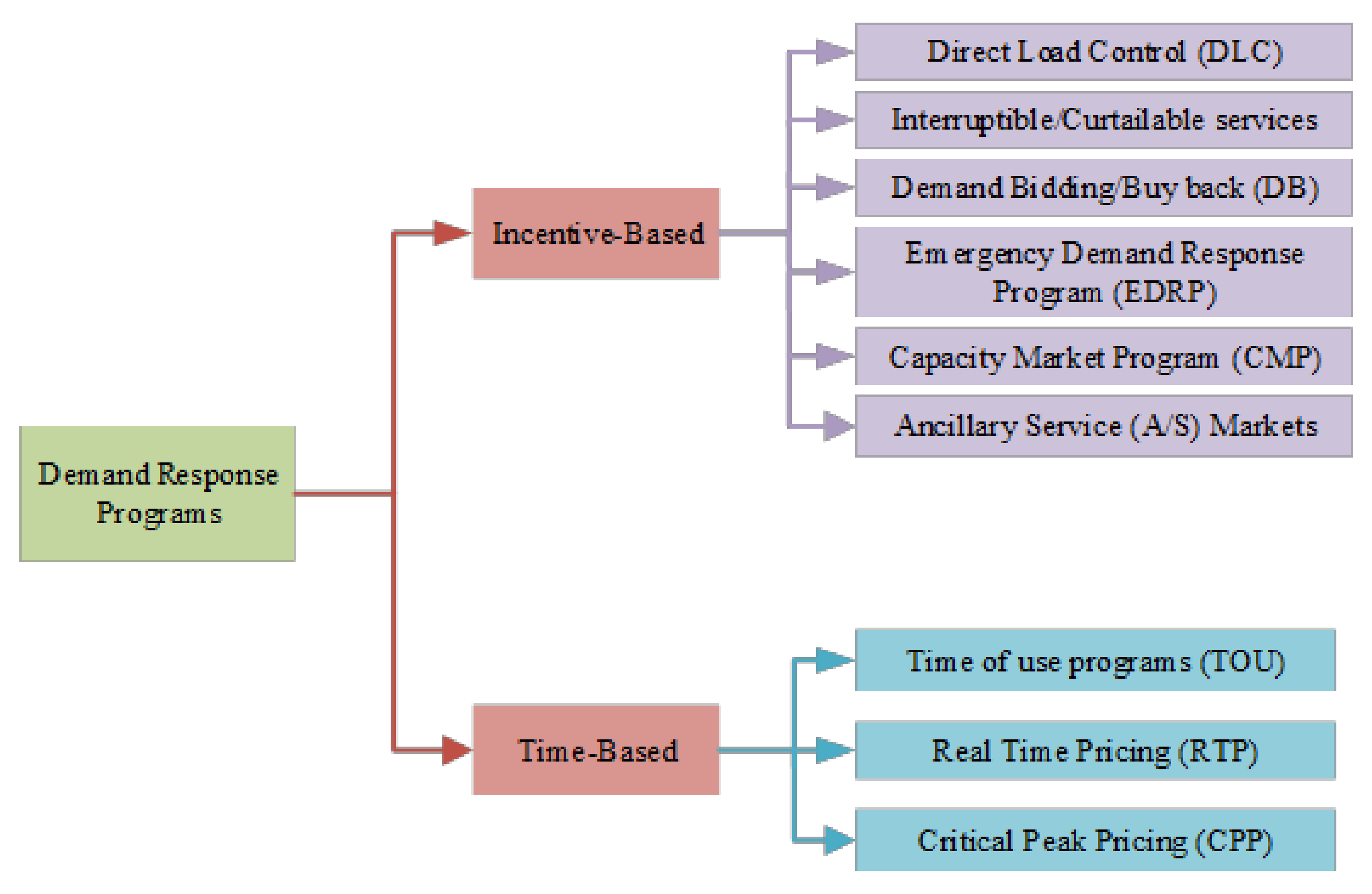

5. Demand Response Programs

5.1. Incentive-Based Programs

5.2. Time-Based Programs

6. Objective Function

6.1. Constraints

6.2. Case Study

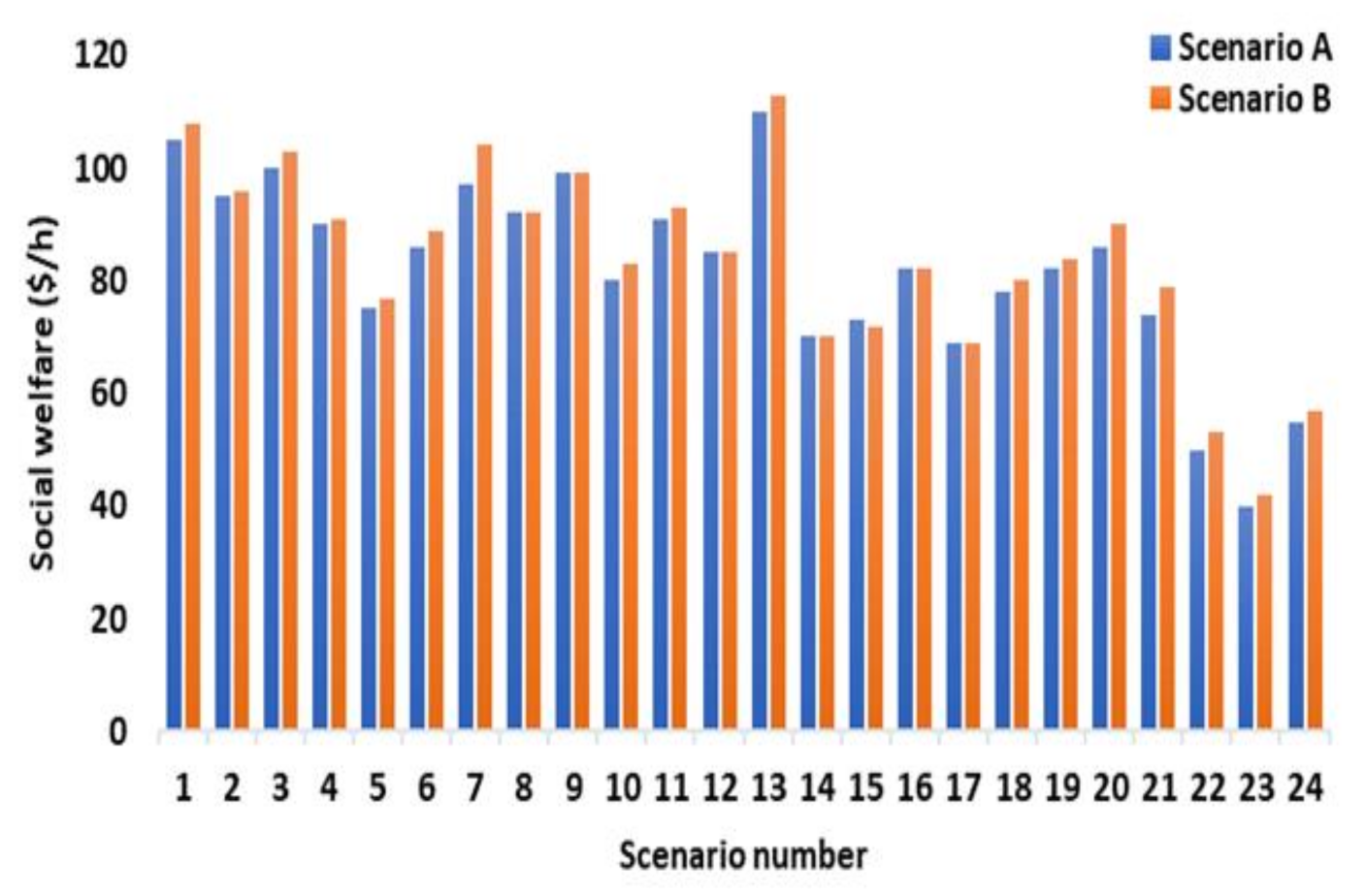

6.3. Simulation Results

7. Conclusions

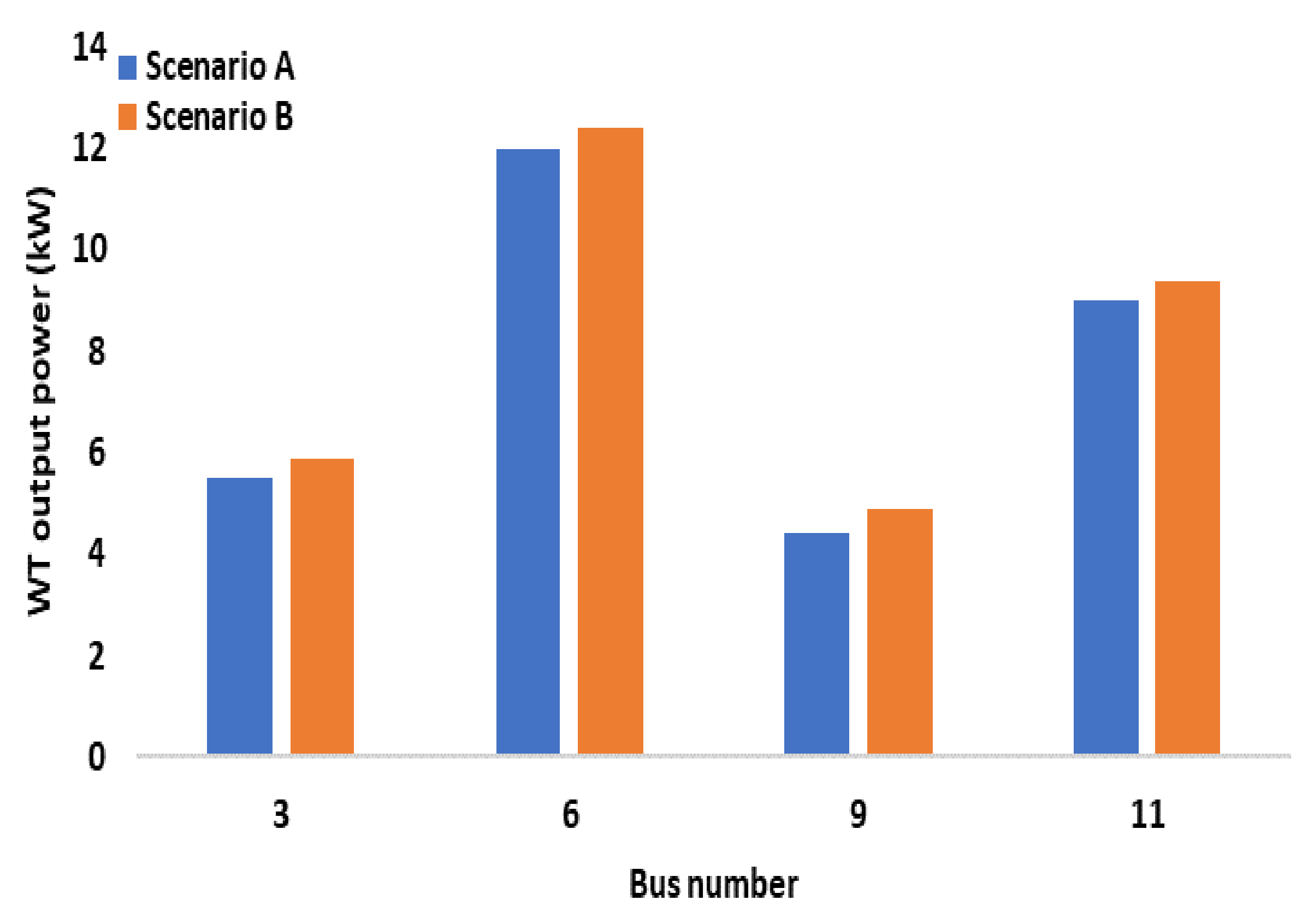

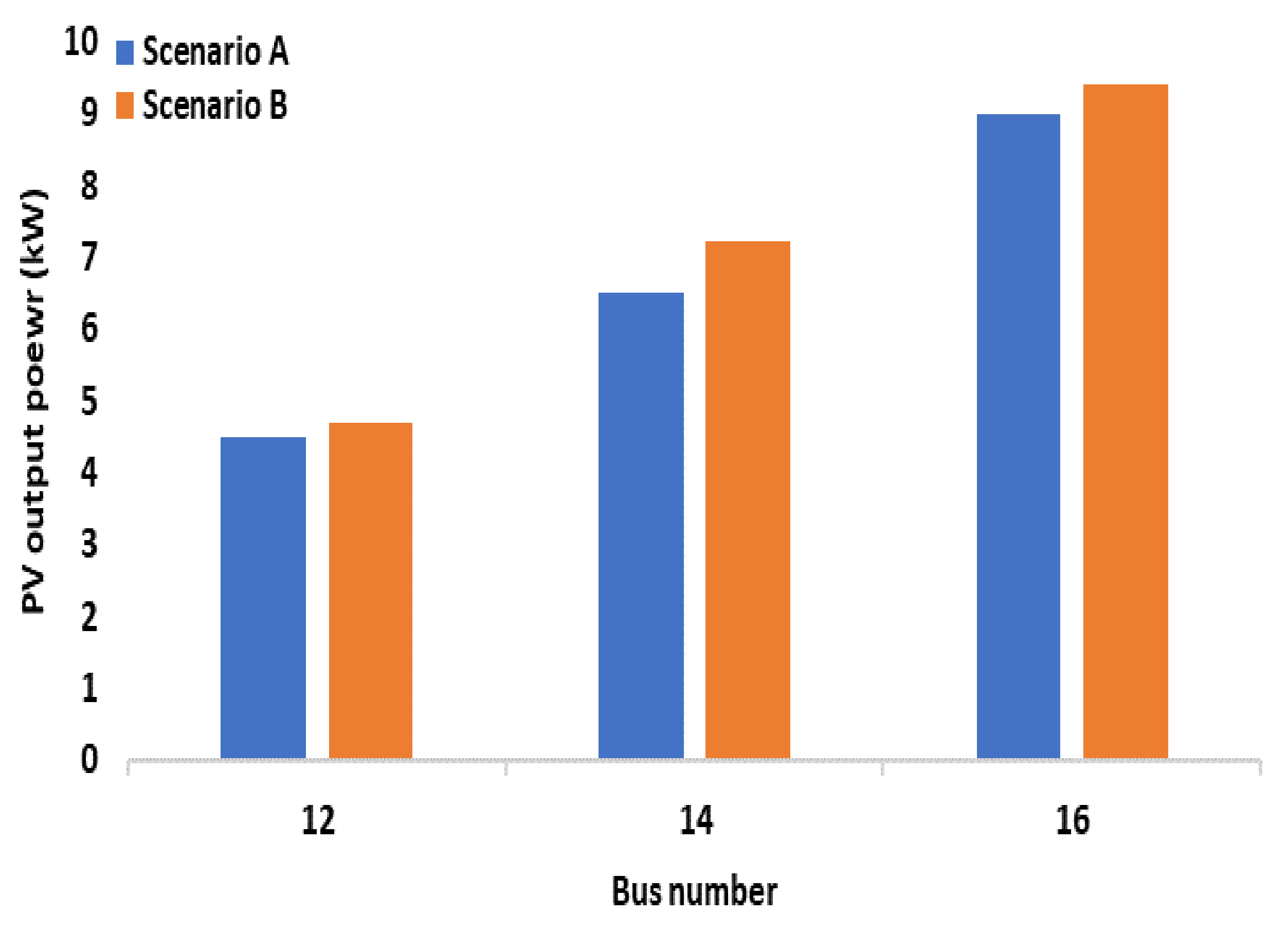

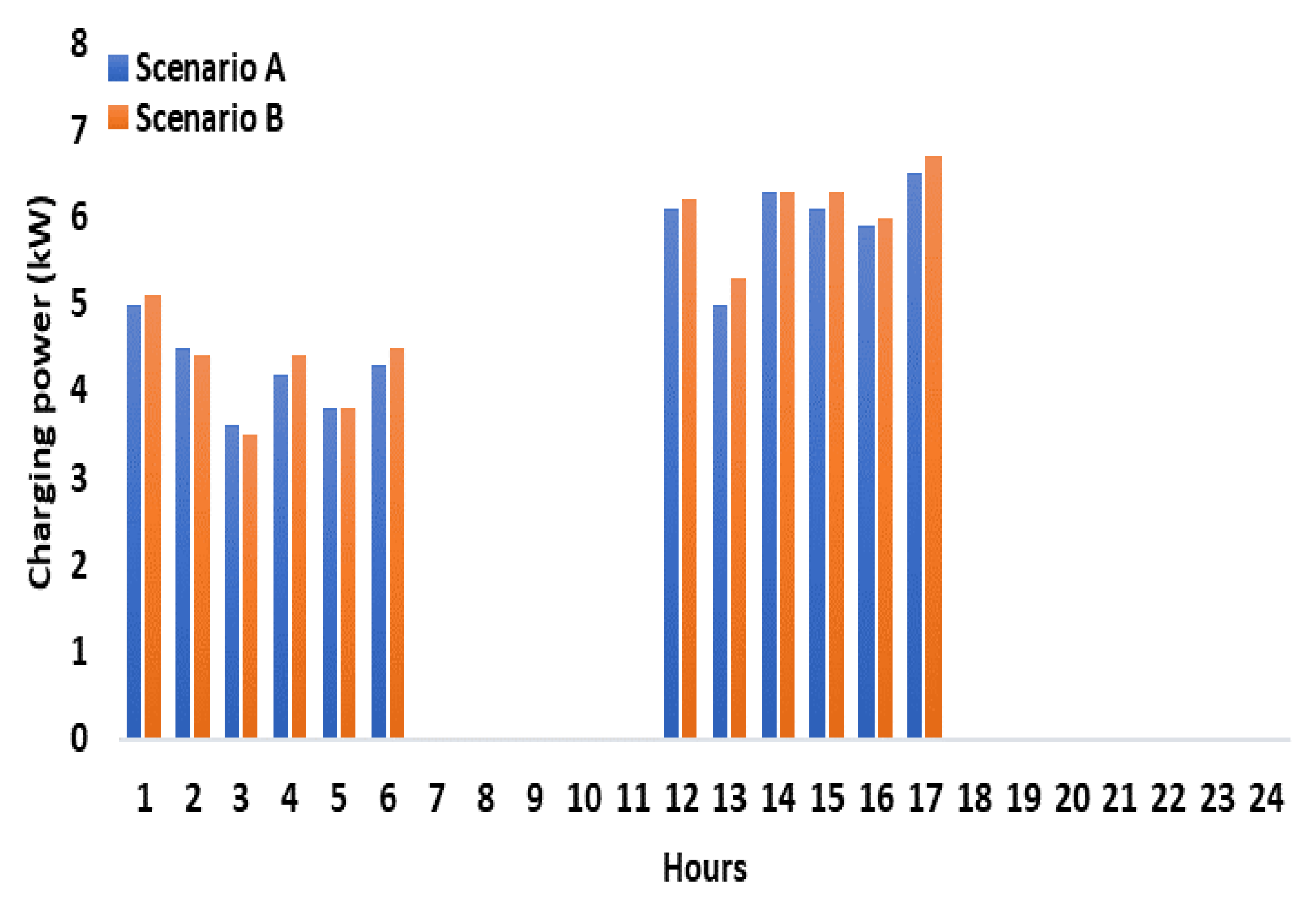

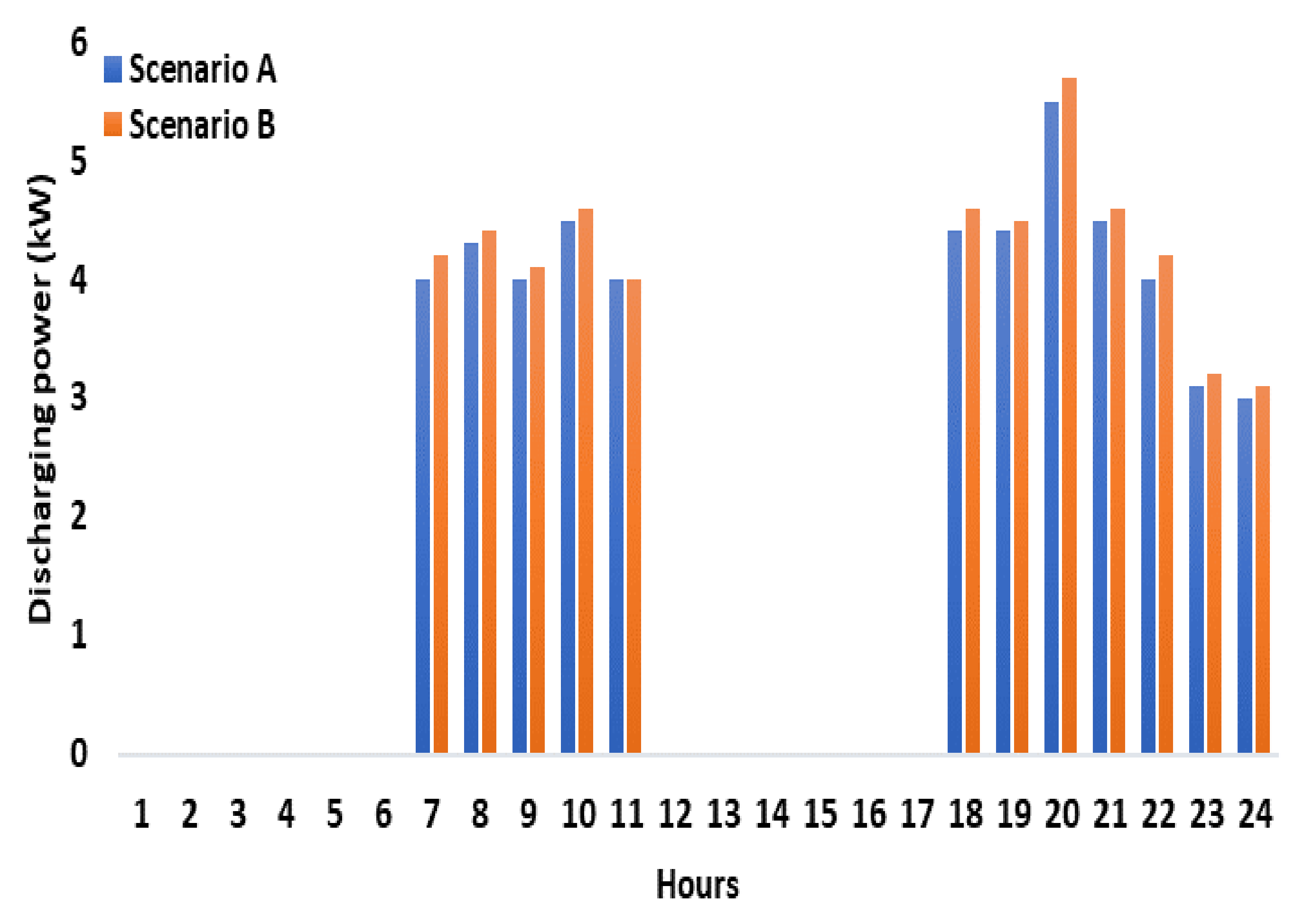

- The active power dispatch capacity of WT and PV at each candidate bus was improved by 3% in scenario B over the planning horizon, owing to the integration of the DR program in the proposed model.

- Similarly, the controllable loads participating in the DR program used in scenario B also improved social welfare of the VPP by 3%.

- The proposed approach could persuade end users to engage in the electricity market to ease peak-period load on the power grid; therefore, contributing to power system reliability.

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Ullah, Z.; Baseer, M. Operational planning and design of market-based virtual power plant with high penetration of renewable energy sources. Int. J. Renew. Energy Dev. 2022, 11, 620–629. [Google Scholar] [CrossRef]

- Naval, N.; Yusta, J.M. Virtual power plant models and electricity markets—A review. Renew. Sustain. Energy Rev. 2021, 149, 111393. [Google Scholar] [CrossRef]

- Ullah, Z.; Mirjat, N.H. Virtual power plant: State of the art providing energy flexibility to local distribution grids. In E3S Web of Conferences; EDP Sciences: Copenhagen, Denmark, 2021; Volume 231, p. 01002. [Google Scholar] [CrossRef]

- Wang, X.; Liu, Z.; Zhang, H.; Zhao, Y.; Shi, J.; Ding, H. A review on virtual power plant concept, application and challenges. In Proceedings of the 2019 IEEE Innovative Smart Grid Technologies-Asia (ISGT Asia), Chengdu, China, 21–24 May 2019; pp. 4328–4333. [Google Scholar] [CrossRef]

- Koza, E.; Öztürk, A. A Literature Review to Analyze the State of the Art of Virtual Power Plants in Context of Information Security. In Environmental Informatics; Springer: Cham, Switzerland, 2021; pp. 49–69. [Google Scholar] [CrossRef]

- Ullah, Z.; Mokryani, G.; Campean, F.; Hu, Y.F. Comprehensive review of VPPs planning, operation and scheduling considering the uncertainties related to renewable energy sources. IET Energy Syst. Integr. 2019, 1, 147–157. [Google Scholar] [CrossRef]

- Yan, Q.; Ai, X.; Li, J. Low-Carbon Economic Dispatch Based on a CCPP-P2G Virtual Power Plant Considering Carbon Trading and Green Certificates. Sustainability 2021, 13, 12423. [Google Scholar] [CrossRef]

- Bhuiyan, E.A.; Hossain, M.Z.; Muyeen, S.M.; Fahim, S.R.; Sarker, S.K.; Das, S.K. Towards next generation virtual power plant: Technology review and frameworks. Renew. Sustain. Energy Rev. 2021, 150, 111358. [Google Scholar] [CrossRef]

- Act, C.C. Climate Change Act 2008. 2008. Available online: http://www.legislation.gov.uk/ukpga/2008/27/contents (accessed on 13 November 2013).

- Rogelj, J.; Den Elzen, M.; Höhne, N.; Fransen, T.; Fekete, H.; Winkler, H.; Meinshausen, M. Paris Agreement climate proposals need a boost to keep warming well below 2 C. Nature 2016, 534, 631–639. [Google Scholar] [CrossRef] [PubMed]

- McKenna, K.; Keane, A. Residential load modeling of price-based demand response for network impact studies. IEEE Trans. Smart Grid 2015, 7, 2285–2294. [Google Scholar] [CrossRef]

- Ullah, Z.; Hassanin, H. Modeling, optimization, and analysis of a virtual power plant demand response mechanism for the internal electricity market considering the uncertainty of renewable energy sources. Energies 2022, 15, 5296. [Google Scholar] [CrossRef]

- Vahedipour-Dahraie, M.; Rashidizadeh-Kermani, H.; Anvari-Moghaddam, A.; Siano, P. risk-averse probabilistic framework for scheduling of virtual power plants considering demand response and uncertainties. Int. J. Electr. Power Energy Syst. 2020, 121, 106126. [Google Scholar] [CrossRef]

- Vahedipour-Dahraie, M.; Rashidizadeh-Kermani, H.; Shafie-Khah, M.; Catalão, J.P. Risk-Averse Optimal Energy and Reserve Scheduling for Virtual Power Plants Incorporating Demand Response Programs. IEEE Trans. Smart Grid 2020, 12, 1405–1415. [Google Scholar] [CrossRef]

- Ullah, Z.; Mirjat, N.H. Optimisation and management of virtual power plants energy mix trading model. Int. J. Renew. Energy Dev. 2022, 11, 83–94. [Google Scholar] [CrossRef]

- Ullah, Z.; Mirjat, N.H. Modelling and analysis of virtual power plants interactive operational characteristics in distribution systems. Energy Convers. Econ. 2022, 3, 11–19. [Google Scholar] [CrossRef]

- Liu, J.; Tang, H.; Xiang, Y.; Liu, J.; Zhang, L. Multi-stage market transaction method with participation of virtual power plants. Electr. Power Constr. 2017, 38, 137–144. [Google Scholar]

- Baseer, M.; Mokryani, G.; Zubo, R.H.; Cox, S. Planning of HMG with high penetration of renewable energy sources. IET Renew. Power Gener. 2019, 13, 1724–1730. [Google Scholar] [CrossRef]

- Lu, X.; Cheng, L. Day-Ahead Scheduling for Renewable Energy Generation Systems considering Concentrating Solar Power Plants. Math. Probl. Eng. 2021, 2021, 9488222. [Google Scholar] [CrossRef]

- Yu, S.; Wei, Z.; Sun, G.Q.; Sun, Y.H.; Wang, D. A bidding model for a virtual power plant considering uncertainties. Autom. Electr. Power Syst. 2014, 38, 43–49. [Google Scholar]

- Zhou, C.; Huang, G.; Chen, J. Planning of electric power systems considering virtual power plants with dispatchable loads included: An inexact two-stage stochastic linear programming model. Math. Probl. Eng. 2018, 2018, 7049329. [Google Scholar] [CrossRef]

- Aien, M.; Hajebrahimi, A.; Fotuhi-Firuzabad, M. A comprehensive review on uncertainty modeling techniques in power system studies. Renew. Sustain. Energy Rev. 2016, 57, 1077–1089. [Google Scholar] [CrossRef]

- Ullah, Z.; Baseer, M. Demand Response Strategy of a Virtual Power Plant for Internal Electricity Market. In Proceedings of the 2022 IEEE 10th International Conference on Smart Energy Grid Engineering (SEGE), Oshawa, ON, Canada, 10–12 August 2022; IEEE: New York, NY, USA, 2022; pp. 100–104. [Google Scholar] [CrossRef]

- Ahmed, S.A.; Mahammed, H.O. A statistical analysis of wind power density based on the Weibull and Ralyeigh models of “Penjwen Region” Sulaimani/Iraq. Jordan J. Mech. Ind. Eng. 2012, 6, 135–140. [Google Scholar] [CrossRef]

- Reddy, S.S.; Abhyankar, A.R.; Bijwe, P.R. Market clearing for a wind-thermal power system incorporating wind generation and load forecast uncertainties. In Proceedings of the 2012 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; IEEE: New York, NY, USA, 2012; pp. 1–8. [Google Scholar] [CrossRef]

- Jónsdóttir, G.M.; Milano, F. Modeling solar irradiance for short-term dynamic analysis of power systems. In Proceedings of the 2019 IEEE Power & Energy Society General Meeting (PESGM), Atlanta, GA, USA, 4–8 August 2019; IEEE: New York, NY, USA, 2019; pp. 1–5. [Google Scholar] [CrossRef]

- Moe, T.T.; Lin, K.M. Solar Irradiance and Power Output Modeling of Photovoltaic Module for Reliability Studies: Case Study of Mandalay Region; ICSTI: Mandalay, Maynmar, 2018; pp. 1–6. [Google Scholar]

- Reddy, S.S.; Panigrahi, B.K.; Kundu, R.; Mukherjee, R.; Debchoudhury, S. Energy and spinning reserve scheduling for a wind-thermal power system using CMA-ES with mean learning technique. Int. J. Electr. Power Energy Syst. 2013, 53, 113–122. [Google Scholar] [CrossRef]

- Montoya-Bueno, S.; Muñoz-Hernández, J.I.; Contreras, J. Uncertainty management of renewable distributed generation. J. Clean. Prod. 2016, 138, 103–118. [Google Scholar] [CrossRef]

- Widén, J. Correlations between large-scale solar and wind power in a future scenario for Sweden. IEEE Trans. Sustain. Energy 2011, 2, 177–184. [Google Scholar] [CrossRef]

- Reddy, S.S.; Bijwe, P.R.; Abhyankar, A.R. Joint energy and spinning reserve market clearing incorporating wind power and load forecast uncertainties. IEEE Syst. J. 2013, 9, 152–164. [Google Scholar] [CrossRef]

- Reddy, S.S.; Bijwe, P.R.; Abhyankar, A.R. Optimal posturing in day-ahead market clearing for uncertainties considering anticipated real-time adjustment costs. IEEE Syst. J. 2013, 9, 177–190. [Google Scholar] [CrossRef]

- Li, Y.; Zio, E. Uncertainty analysis of the adequacy assessment model of a distributed generation system. Renew. Energy 2012, 41, 235–244. [Google Scholar] [CrossRef]

- Ajoulabadi, A.; Gazijahani, F.S.; Najafi Ravadanegh, S. Risk-Constrained Intelligent Reconfiguration of Multi-Microgrid-Based Distribution Systems under Demand Response Exchange. In Demand Response Application in Smart Grids; Springer: Cham, Switzerland, 2020; pp. 119–145. [Google Scholar]

- Baringo, L.; Rahimiyan, M. Virtual Power Plants and Electricity Markets. In e-Book; Springer Nature: Cham, Switzerland, 2020. [Google Scholar]

- Soroudi, A. Power System Optimization Modeling in GAMS; Springer: Cham, Switzerland, 2017; Volume 78. [Google Scholar]

| Reference | RES Management | DR Model | ESS Model | Uncertainty Modeling | Power Market | SW |

|---|---|---|---|---|---|---|

| [11] | Yes | Yes | No | No | No | No |

| [12] | Yes | Yes | Yes | Yes | Yes | No |

| [13] | Yes | Yes | Yes | Yes | Yes | No |

| [14] | Yes | Yes | Yes | No | Yes | No |

| [15] | Yes | Yes | Yes | No | Yes | Yes |

| [16] | Yes | Yes | Yes | No | Yes | No |

| [17] | Yes | Yes | Yes | No | Yes | Yes |

| [18] | Yes | No | No | Yes | Yes | Yes |

| [19] | Yes | Yes | Yes | Yes | No | No |

| [20] | Yes | Yes | No | No | No | No |

| [21] | Yes | No | No | Yes | No | No |

| This paper | Yes | Yes | Yes | Yes | Yes | Yes |

| Scenario | |

|---|---|

| A | Without demand response |

| B | With demand response |

| Energy System | Busbar with Highest Active Power Dispatch | Busbar with Lowest Active Power Dispatch | Justification |

|---|---|---|---|

| WTs | Bus 6 | Bus 9 | Quantity of power dispatched by WTs at each bus was constrained by WT offer and bid prices, as well as the thermal limits of the lines |

| PVs | Bus 16 | Bus 12 | Amount of power dispatched by PVs at each bus was restricted by the offer and bid prices of PVs, as well as voltage limits at each bus |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ullah, Z.; Arshad; Hassanin, H.; Cugley, J.; Alawi, M.A. Planning, Operation, and Design of Market-Based Virtual Power Plant Considering Uncertainty. Energies 2022, 15, 7290. https://doi.org/10.3390/en15197290

Ullah Z, Arshad, Hassanin H, Cugley J, Alawi MA. Planning, Operation, and Design of Market-Based Virtual Power Plant Considering Uncertainty. Energies. 2022; 15(19):7290. https://doi.org/10.3390/en15197290

Chicago/Turabian StyleUllah, Zahid, Arshad, Hany Hassanin, James Cugley, and Mohammed Al Alawi. 2022. "Planning, Operation, and Design of Market-Based Virtual Power Plant Considering Uncertainty" Energies 15, no. 19: 7290. https://doi.org/10.3390/en15197290

APA StyleUllah, Z., Arshad, Hassanin, H., Cugley, J., & Alawi, M. A. (2022). Planning, Operation, and Design of Market-Based Virtual Power Plant Considering Uncertainty. Energies, 15(19), 7290. https://doi.org/10.3390/en15197290