Effects of Increased Renewable Energy Consumption on Electricity Prices: Evidence for Six South American Countries

Abstract

:1. Introduction

2. Literature Review and Empirical Evidence

3. Methodology

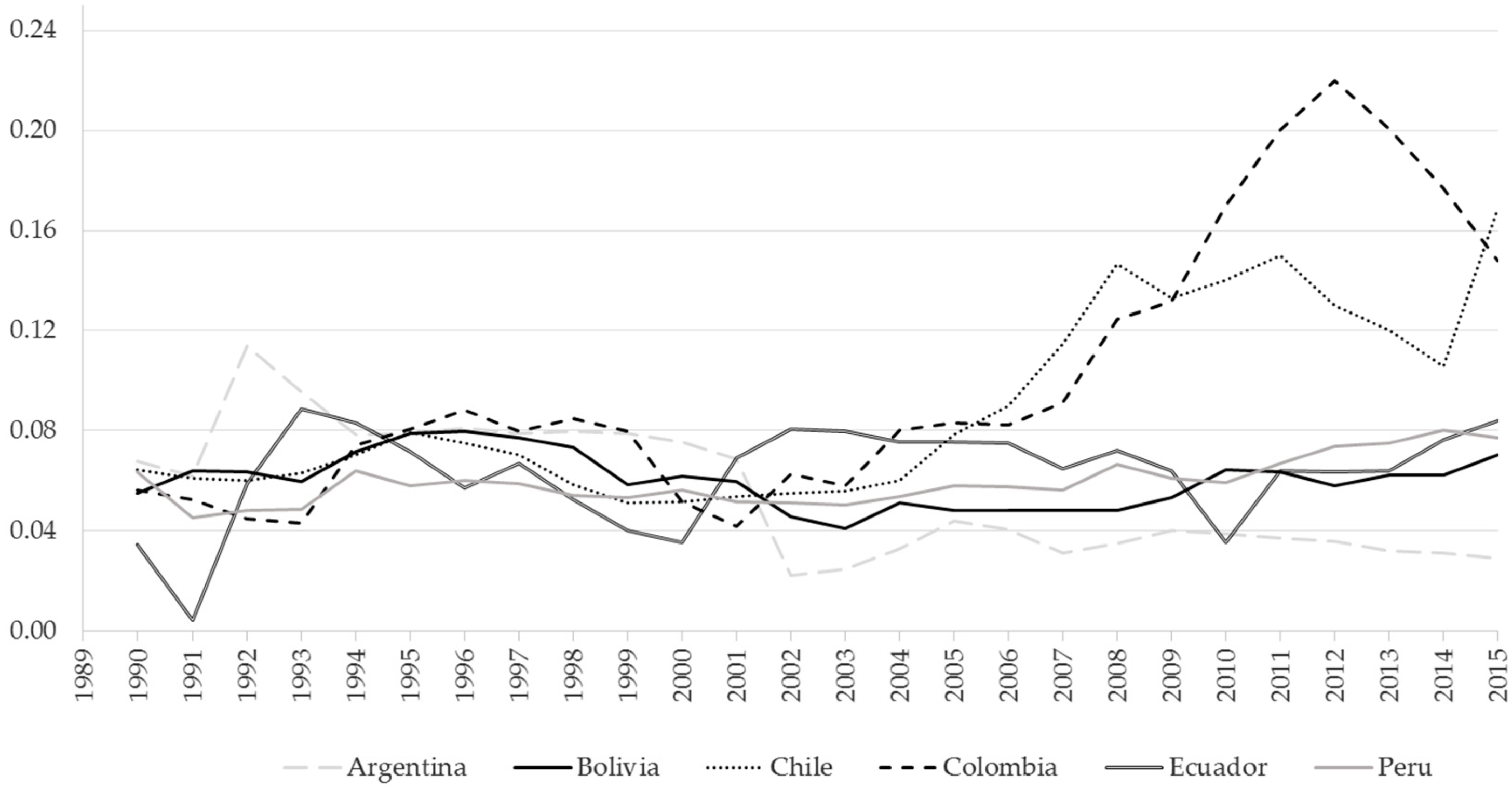

3.1. General Characterization of the State of Renewable Energies in the Study Countries during the Established Period (2000–2015)

3.2. Data on Energy Evolution in the Countries under Study by Sector

3.3. Econometric Methodology: Panel Models to Estimates

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Economic Commission for Latin America and the Caribbean (ECLAC). Statistical Yearbook of Latin America and the Caribbean; United Nations: Santiago, Chile, 2016; Available online: https://www.cepal.org/sites/default/files/publication/files/40972/S1601037_mu.pdf (accessed on 15 July 2021).

- International Energy Agency (IEA). 2020. Available online: https://www.iea.org (accessed on 15 July 2021).

- Moodys Investors Services. Moody’s. Latin America: Penetration of Renewables to Reach More than 70% Capacity within 20 Years; Moodys Investors Services: Sao Paulo, Brazil, 2019; Available online: https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1170171 (accessed on 15 July 2021).

- KPMG—International Cooperative. Crecimiento y Uso Eficiente de la Energía. Diagnóstico y Oportunidades Para la Argentina; KPMG Argentina: Buenos Aires, Argentina, 2015. [Google Scholar]

- KPMG—International Cooperative. Desarrollo de Energías Renovables: El Contexto Latinoamericano y el Caso Argentino. KPMG International; KPMG Argentina: Buenos Aires, Argentina, 2016; Available online: https://assets.kpmg/content/dam/kpmg/ar/pdf/kpmg-energias-renovables-en-latam-y-argentina.pdf (accessed on 15 July 2021).

- Stern, D.I. Energy use and economic growth in the USA, A multivariate approach. Energy Econ. 1993, 15, 137–150. [Google Scholar] [CrossRef]

- Toman, M.; Jenelkova, B. Introduction of Energy Economics, 2nd ed.; TTB Publication Limited: Washington, DC, USA, 2003. [Google Scholar]

- Stern, D.I.; Cleveland, C.J. Energy and Economic Growth; Rensselaer Working Paper in Economics No.0410; Rensselaer Polytechnic Institute: Troy, NY, USA, 2004. [Google Scholar]

- Ozturk, I.; Aslan, A.; Kalyoncu, H. Energy consumption and economic growth relationship: Evidence from panel data for low and middle-income countries. Energy Policy 2010, 38, 4422–4428. [Google Scholar] [CrossRef]

- Gómez, M.; Rodríguez, J.C. Electricity consumption and economic growth: The case of Mexico. Int. J. Soc. Behav. Educ. Manag. Eng. 2015, 9, 2803–2808. [Google Scholar]

- Bashier, A.A. Electricity consumption and economic growth in Jordan: Bounds testing cointegration approach. Eur. Sci. J. 2016, 12, 429–443. [Google Scholar] [CrossRef] [Green Version]

- Jensen, S.G.; Skytte, K. Simultaneous attainment of energy goals by means of green certificates and emission permits. Energy Policy 2003, 31, 63–71. [Google Scholar] [CrossRef]

- Amundsen, E.S.; Baldursson, F.M.; Mortensen, J.B. Price volatility and banking in green certificate markets. Environ. Resour. Econ. 2006, 35, 259–287. [Google Scholar] [CrossRef]

- Fischer, C. How Can Renewable Portfolio Standards Lower Electricity Prices. In Resources for the Future Discussion Paper; Resources for the Future: Washington, DC, USA, 2006. [Google Scholar]

- De Miera, G.S.; del Río González, P.; Vizcaíno, I. Analysing the impact of renewable electricity support schemes on power prices: The case of wind electricity in Spain. Energy Policy 2008, 36, 3345–3359. [Google Scholar] [CrossRef]

- Gelabert, L.; Labandeira, X.; Linares, P. An ex-post analysis of the effect of renewables and cogeneration on Spanish electricity prices. Energy Econ. 2011, 33, S59–S65. [Google Scholar] [CrossRef]

- Woo, C.K.; Horowitz, I.; Moore, J.; Pacheco, A. The impact of wind generation on the electricity spot-market price level and variance: The Texas experience. Energy Policy 2011, 39, 3939–3944. [Google Scholar] [CrossRef]

- Gerardi, W.; Nidras, P. Estimating the Impact of the RET on Retail Prices. 2013, pp. 1–20. Available online: http://docplayer.net/14210182-Estimating-the-impact-of-renewable-energy-generation-on-retail-prices.html (accessed on 15 July 2021).

- Labandeira, X.; Linares, P. Renewable Electricity Support in Spain: A Natural Policy Experiment. 2013. Available online: https://repositorio.comillas.edu/rest/bitstreams/18834/retrieve (accessed on 15 July 2021).

- Würzburg, K.; Labandeira, X.; Linares, P. Renewable generation and electricity prices: Taking stock and new evidence for Germany and Austria. Energy Econ. 2013, 40, S159–S171. [Google Scholar] [CrossRef] [Green Version]

- Ketterer, J.C. The impact of wind power generation on the electricity price in Germany. Energy Econ. 2014, 44, 270–280. [Google Scholar] [CrossRef] [Green Version]

- Clò, S.; Cataldi, A.; Zoppoli, P. The merit-order effect in the Italian power market: The impact of solar and wind generation on national wholesale electricity prices. Energy Policy 2015, 77, 79–88. [Google Scholar] [CrossRef]

- Dillig, M.; Jung, M.; Karl, J. The impact of renewables on electricity prices in Germany–An estimation based on historic spot prices in the years 2011–2013. Renew. Sustain. Energy Rev. 2016, 57, 7–15. [Google Scholar] [CrossRef]

- Rintamäki, T.; Siddiqui, A.S.; Salo, A. Does renewable energy generation decrease the volatility of electricity prices? An analysis of Denmark and Germany. Energy Econ. 2017, 62, 270–282. [Google Scholar] [CrossRef] [Green Version]

- Csereklyei, Z.; Qu, S.; Ancev, T. The effect of wind and solar power generation on wholesale electricity prices in Australia. Energy Policy 2019, 131, 358–369. [Google Scholar] [CrossRef]

- Kolb, S.; Dillig, M.; Plankenbühler, T.; Karl, J. The impact of renewables on electricity prices in Germany-An update for the years 2014–2018. Renew. Sustain. Energy Rev. 2020, 134, 110307. [Google Scholar] [CrossRef]

- Abrell, J.; Kosch, M.; Cross-country Spillovers of Renewable Energy Promotion—The Case of Germany. ZEW-Centre for European Economic Research Discussion Paper, (21-068). 2021. Available online: https://ssrn.com/abstract=3924904 (accessed on 15 July 2021).

- Timilsina, G.; Malla, S. Do Investments in Clean Technologies Reduce Production Costs? Insights from the Literature; Policy Research Working Paper, No. 9714; World Bank: Washington, DC, USA, 2021; Available online: https://openknowledge.worldbank.org/handle/10986/35885 (accessed on 15 July 2021).

- Levy Ferre, A.; Tejeda, J.A.; Di Chiara, L. Integración Eléctrica Regional: Oportunidades y Retos Que Enfrentan los Países de América Latina y el Caribe. 2019. Available online: https://publications.iadb.org/publications/spanish/document/Integraci%C3%B3n_el%C3%A9ctrica_regional_Oportunidades_y_retos_que_enfrentan_los_pa%C3%ADses_de_Am%C3%A9rica_Latina_y_el_Caribe_es.pdf (accessed on 15 July 2021).

- Linkohr, R. La política energética latinoamericana: Entre el Estado y el mercado. Rev. Nueva Soc. 2006, 204, 94–95. [Google Scholar]

- Abay Analistas Económicos y Sociales. El Impacto de las Energías Renovables en los hogares. 2014. Available online: http://archivo-es.greenpeace.org/espana/Global/espana/2014/Report/cambio-climatico/Informe%20ER%20Hogares.pdf (accessed on 15 July 2021).

- Sadorsky, P. Renewable energy consumption and income in emerging economies. Energy Policy 2009, 37, 4021–4028. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable energy consumption and economic growth: Evidence from a panel of OECD countries. Energy Policy 2010, 38, 656–660. [Google Scholar] [CrossRef]

- Griffa, B.; Marcó, L.; Goldstein, E. Producir electricidad con biomasa: Beneficios, experiencias y actualidad en Argentina. Rev. Fac. Cienc. Econ. 2017, 19, 67–79. Available online: https://pdfs.semanticscholar.org/da43/d9676765dad9047152220a3991347b02340b.pdf (accessed on 15 July 2021). [CrossRef]

- Recalde, M.Y.; Bouille, D.H.; Girardin, L.O. Limitaciones para el desarrollo de energías renovables en Argentina. Probl. Desarro. 2015, 46, 89–115. [Google Scholar]

- Oyarbide, J.F. Bioenergía en Bolivia. Fichas Sector Bolivia; NIPO: 114-20-022-X; ICEX, Oficina Económica y Comercial de España en La Paz: La Paz, Bolivia, 2020. [Google Scholar]

- Rojas Zurita, R.; Fernández Fuentes, M.; Orellana Lafuente, R. El desafío de las energías renovables para su inserción a mayor escala en el mercado eléctrico boliviano. Rev. Latinoam. Desarro. Econ. 2011, 15, 167–181. Available online: http://www.iisec.ucb.edu.bo/assets_iisec/publicacion/v9n15a05.pdf (accessed on 15 July 2021). [CrossRef]

- Cortés, S.; Londoño-Arango, A. Energías renovables en Colombia: Una aproximación desde la economía. Rev. Cienc. Estr. 2017, 25, 375–390. [Google Scholar]

- CONELEC. Plan Maestro de Electrificación 2013–2022. Volumen IV: Aspectos de Sustentabilidad y Sostenibilidad Social y Ambiental. 2013. Available online: https://www.regulacionelectrica.gob.ec/wp-content/uploads/downloads/2015/12/Vol4-Aspectos-de-sustentabilidad-y-sostenibilidad-social-y-ambiental.pdf (accessed on 15 July 2021).

- Mitma Ramírez, R.E. Análisis de la Regulación de Energías Renovables en el Perú. Derecho. Soc. 2015, 45, 167–176. Available online: https://revistas.pucp.edu.pe/index.php/derechoysociedad/article/view/15235 (accessed on 15 July 2021).

- OLADE—Organización Latinoamericana de Energía. Panorama Energético De América Latina y el Caribe. 2020. Available online: http://sielac.olade.org/WebForms/Reportes/SistemaDocumental.aspx?ss=7 (accessed on 15 July 2021).

- Contreras Lisperguer, R. Análisis de las Tarifas del Sector Eléctrico: Los Efectos del COVID-19 y la Integración Energética en los Casos de la Argentina, Chile, el Ecuador, México y el Uruguay; Serie Recursos Naturales y Desarrollo, N° 199 (LC/TS.2020/146); Comisión Económica para América Latina y el Caribe (CEPAL): Santiago, Chile, 2020. [Google Scholar]

- Nasirov, S.; Girard, A.; Peña, C.; Salazar, F.; Simon, F. Expansion of renewable energy in Chile: Analysis of the effects on employment. Energy 2021, 226, 120410. [Google Scholar] [CrossRef]

- Castelao Caruana, M.E. La energía renovable en Argentina como estrategia de política energética e industrial. Probl. Desarro. 2019, 50, 131–156. [Google Scholar] [CrossRef] [Green Version]

- World Bank. World Bank Open Data. Available online: https://databank.worldbank.org/home.aspx (accessed on 15 July 2021).

- OPEC. Organization of the Petroleum Exporting Countries. Available online: https://www.opec.org/opec_web/en/index.htm (accessed on 15 July 2021).

- Baltagui, B.H. Econometrics, 3rd ed.; Springer: Berlin, Germany, 2005. [Google Scholar]

- Baltagui, B.H. Econometric Analysis of Panel Data; Wiley and Sons: West Sussex, UK, 2008. [Google Scholar]

- Stock, J.H.; Watson, M.W.; Larrión, R.S. Introducción a la Econometría; Pearson Education S.A.: Madrid, Spain, 2012. [Google Scholar]

- Beck, N. Time-series–cross-section data: What have we learned in the past few years? Annu. Rev. Political Sci. 2001, 4, 271–293. [Google Scholar] [CrossRef] [Green Version]

- Mulder, M.; Scholtens, B. The impact of renewable energy on electricity prices in the Netherlands. Renew. Energy 2013, 57, 94–100. [Google Scholar] [CrossRef]

- Trujillo-Baute, E.; del Río, P.; Mir-Artigues, P. Analysing the impact of renewable energy regulation on retail electricity prices. Energy Policy 2018, 114, 153–164. [Google Scholar] [CrossRef] [Green Version]

- Chang, H.; Hsing, Y. The Demand for Residential Electricity: New Evidence on Time-Varying Elasticities. Appl. Econ. 1991, 23, 1251–1256. [Google Scholar] [CrossRef]

- Elkhaif, M.A.T. Estimating Disaggregated Price Elasticities in Industrial Energy Demand. Energy J. 1992, 13, 209–217. [Google Scholar]

- Woodland, A.D. A micro-Econometric Analysis of the Industrial Demand for Energy in NSW. Energy J. 1993, 14, 57–89. [Google Scholar] [CrossRef]

- Jones, C.T. A Dynamic Analysis of Interfuel Substitution in U.S. Industrial Energy Demand. J. Bus. Econ. Stat. 1995, 13, 459–465. [Google Scholar] [CrossRef]

- Filippini, M.; Pachauri, S. Elasticities of electricity demand in urban Indian households. Energy Policy 2004, 32, 429–436. [Google Scholar] [CrossRef] [Green Version]

- Holtedahl, P.; Joutz, F.L. Residential electricity demand in Taiwan. Energy Econ. 2004, 26, 201–224. [Google Scholar] [CrossRef]

- Chang, Y. The New Electricity Market of Singapore: Regulatory Framework, Market Power and Competition. Energy Policy 2007, 35, 403–412. [Google Scholar] [CrossRef]

- Brännlund, R.; Ghalwash, T.; Nordström, J. Increased energy efficiency and the rebound effect: Effects on consumption and emissions. Energy Econ. 2007, 29, 1–17. [Google Scholar] [CrossRef]

- Masike, K.; Vermeulen, C. The time-varying elasticity of South African electricity demand. Energy 2021, 238, 121984. [Google Scholar] [CrossRef]

- Jia, J.J.; Xu, J.H. Estimating residential electricity demand’s response to price policy and income dynamics in China. Energy Effic. 2021, 14, 1–23. [Google Scholar] [CrossRef]

- Reinaud, J.; CO2 Allowance & Electricity Price Interaction. Impact on Industry’s Electricity Purchasing Strategies in Europe. IEA Information Paper. 2007. Available online: https://www.boell.de/sites/default/files/assets/boell.de/images/download_de/oekologie/5.jr_price_interaction.pdf (accessed on 15 July 2021).

- Dong, S.; Li, H.; Wallin, F.; Avelin, A.; Zhang, Q.; Yu, Z. Volatility of electricity price in Denmark and Sweden. Energy Procedia 2019, 158, 4331–4337. [Google Scholar] [CrossRef]

- ECLAC—Economic Commission for Latin America and the Caribbean. La Economía del Cambio Climático en América Latina y el Caribe. Paradojas y Desafíos del Desarrollo Sostenible; Naciones Unidas: Santiago, Chile, 2014. [Google Scholar]

- ECLAC—Economic Commission for Latin America and the Caribbean. Medidas de Adaptación y Mitigación Frente al Cambio Climático en América Latina y el Caribe: Una Revisión General; Naciones Unidas: Santiago, Chile, 2015. [Google Scholar]

- ECLAC—Economic Commission for Latin America and the Caribbean. The Economics of Climate Change in Latin America and the Caribbean. Paradoxes and Challenges: Overview for 2014; Naciones Unidas: Santiago, Chile, 2015. [Google Scholar]

- Furió, D.; Chuliá, H. Price and volatility dynamics between electricity and fuel costs: Some evidence for Spain. Energy Econ. 2012, 34, 2058–2206. [Google Scholar] [CrossRef]

- Castagneto-Gissey, G.; Green, R. Exchange rates, oil prices and electricity spot prices: Empirical insights from European Union markets. J. Energy Mark. 2014, 7, 1–32. [Google Scholar] [CrossRef]

- Madaleno, M.; Moutinho, V.; Mota, J. Time relationships among electricity and fossil fuel prices: Industry and households in Europe. Int. J. Energy Econ. Policy 2015, 5, 525–533. [Google Scholar]

- Cheng, T.Y.; Weng, Y.C.; Syu, S.M. The asymmetric causal relationship research of electricity price, exchange rate and oil price-takes Taiwan area as an example. J. Stat. Manag. Syst. 2015, 18, 463–484. [Google Scholar] [CrossRef]

- Bitu, R.; Born, P. Tarifas de Energía Eléctrica: Aspectos Conceptuales y Metodológicos; Latin American Energy Organization (OLADE): Quito, Ecuador, 1993. [Google Scholar]

- IMF—International Monetary Fund. Perspectivas Económicas: Las Américas. Estudios Económicos y Financieros; IMF-International Monetary Fund: Washington, DC, USA, 2014; Available online: https://www.elibrary.imf.org/view/books/086/21108-9781484346129-es/21108-9781484346129-es-book.xml (accessed on 15 July 2021).

- FGV-Energía. Un Análisis Comparativo de la Transición Energética en América Latina y Europa; FGV-Energia: Rio de Janeiro, Brazil, 2016. Available online: https://www.kas.de/c/document_library/get_file?uuid=60691a11-3ba7-d739-5de6-06df4600f994&groupId=252038 (accessed on 20 July 2021).

| Model 1 | ||||

|---|---|---|---|---|

| Type | Variable | Symbol | Unit of Measure | Source |

| Dependent | Annual average price of electrical energy in the industrial sector | dollar per kilowatt-hour (US$/kWh) | Energy Information System of Latin America and the Caribbean (sieLAC) of the Latin American Energy Organization (OLADE) [41] | |

| Independent | Percentage of renewable energy over total consumption | Percentage of total (%) | International Energy Agency (IEA) [2] | |

| Gross domestic product | Dollars current prices (USD) | World Bank [45] | ||

| Carbon dioxide emissions | Kiloton (kt) | World Bank [45] | ||

| Average price of a barrel of oil | Dollars(USD) | Organization of Petroleum Exporting Countries [46] | ||

| Model 2 | ||||

| Dependent | Average annual price of electricity in the residential sector | dollar per kilowatt-hour (US$/kWh) | Energy Information System of Latin America and the Caribbean (sieLAC) of the Latin American Energy Organization (OLADE) [41] | |

| Independent | Same as model 1 | |||

| Model 3 | ||||

| Dependent | Annual average price of electricity in the commercial and services sector | dollar per kilowatt-hour (US$/kWh) | Energy Information System of Latin America and the Caribbean (sieLAC) of the Latin American Energy Organization (OLADE) [41] | |

| Independent | Same as model 1 | |||

| Variable | Mean | Std. Dev. | Min | Max | Observations | |

|---|---|---|---|---|---|---|

| Overall | −2.741812 | 0.4592363 | −5.480943 | −1.514507 | N = 156 | |

| Between | 0.2272935 | −3.003477 | −2.425311 | n = 6 | ||

| Within | 0.409351 | −5.355942 | −1.831008 | T = 26 | ||

| Overall | −2.513096 | 0.5441885 | −3.98939 | −1.463378 | N = 156 | |

| between | 0.2844461 | −2.833811 | −2.043433 | n = 6 | ||

| within | 0.4777881 | −4.142023 | −1.580299 | T = 26 | ||

| overall | −2.246817 | 0.4689988 | −3.396688 | −1.349365 | N = 156 | |

| between | 0.3203089 | −2.706969 | −1.781564 | n = 6 | ||

| within | 0.3659374 | −3.054188 | −1.499345 | T = 26 | ||

| overall | 24.56385 | 9.222533 | 7.609687 | 39.91311 | N = 156 | |

| between | 8.971631 | 10.17846 | 32.20002 | n = 6 | ||

| within | 4.188942 | 14.45114 | 35.91472 | T = 26 | ||

| overall | 24.97352 | 1.19305 | 22.30586 | 27.1114 | N = 156 | |

| between | 1.129406 | 23.11222 | 26.35039 | n = 6 | ||

| within | 0.5945969 | 23.81772 | 26.08108 | T = 26 | ||

| overall | 10.57603 | 0.8562257 | 8.644707 | 12.13399 | N = 156 | |

| between | 0.8839395 | 9.239812 | 11.84287 | n = 6 | ||

| within | 0.278922 | 9.98093 | 11.26 | T = 26 | ||

| overall | 3.634834 | 0.6538565 | 2.665838 | 4.60076 | N = 156 | |

| between | 0 | 3.634834 | 3.634834 | n = 6 | ||

| within | 0.6538565 | 2.665838 | 4.60076 | T = 26 |

| Statistical Tests | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Hausman test H0 difference in coefficients not systematic | chi2(4) = 268.64 Prob > chi2 = 0.0000 | chi2(4) = 3.97 Prob > chi2 = 0.4104 | chi2(4) = 4.54 Prob > chi2 = 0.3381 |

| Autocorrelation Wooldridge test H0: no first-order autocorrelation | F(1, 5) = 5.900 Prob > F = 0.0595 | F(1, 5) = 14.13 Prob > F = 0.0132 | F(1, 5) = 23.568 Prob > F = 0.0047 |

| Heteroscedasticity Modified Wald test for groupwise heteroscedasticity in fixed effect regression model H0: sigma(i)^2 = sigma^2 for all i | chi2 (6) = 85.66 Prob > chi2 = 0.0000 | ||

| Panel Groupwise Heteroscedasticity Tests Ho: Panel Homoscedasticity Ha: Panel Groupwise Heteroscedasticity | -Lagrange Multiplier LM Test = 1050.3227 p-Value > Chi2(5) 0.0000 -Likelihood Ratio LR Test = 17.7221 p-Value > Chi2(5) 0.0033 -Wald Test = 5031.2 p-Value > Chi2(6) 0.0000 | -Lagrange Multiplier LM Test = 738.1971 p-Value > Chi2(5) 0.0000 -Likelihood Ratio LR Test = 9.6947 p-Value > Chi2(5) 0.0844 -Wald Test = 1084.6311 p-Value > Chi2(6) 0.0000 |

| Model 1 (4) Industrial Sector | Model 2 (5) Residential Sector | Model 3 (6) Commercial and Services Sector | Model 4 Industrial Sector | Model 5 Residential Sector | Model 6 Commercial and Services Sector | |

|---|---|---|---|---|---|---|

FIXED | RANDOM | RANDOM | PCSE | PCSE | PCSE | |

| −0.006 | −0.021 ** | −0.004 | 0.003 | −0.004 * | 0.006 | |

| (−0.61) | (−2.82) | (−0.55) | (0.82) | (−2.03) | (1.00) | |

| 1.060 *** | 1.265 *** | 0.974 *** | 0.774 *** | 1.066 *** | 0.752 *** | |

| (9.21) | (12.01) | (9.71) | (6.98) | (8.07) | (6.13) | |

| −1.196 *** | −1.588 *** | −1.159 *** | −0.929 *** | −1.232 *** | − 0.915 *** | |

| −1.196 *** | −1.588 *** | −1.159 *** | −0.929 *** | −1.232 *** | − 0.915 *** | |

| (−4.79) | (−9.10) | (−6.68) | (−5.94) | (−6.32) | (−5.04) | |

| −0.302 *** | −0.181** | −0.261 *** | −0.131 * | −0.116 | −0.0541 | |

| (−4.16) | (−3.00) | (−4.50) | (−2.00) | (−1.55) | (−0.81) | |

| _cons | −15.31 *** | −16.12 *** | −13.26 *** | −11.85 *** | −15.60 *** | −11.32 *** |

| (−6.00) | (−10.09) | (−8.13) | (−11.17) | (−9.73) | (−7.63) | |

| sigma_u | 0.283 | 0.222 | 0.260 | |||

| sigma_e | 0.322 | 0.298 | 0.287 | |||

| Rho | 0.434 | 0.359 | 0.452 | 0.319 | 0.675 | 0.568 |

| R2 | 0.415 | 0.627 | 0.421 | |||

| N | 156 | 156 | 156 | 156 | 156 | 156 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Correa-Quezada, R.; Tituaña-Castillo, M.d.C.; del Río-Rama, M.d.l.C.; Álvarez-García, J. Effects of Increased Renewable Energy Consumption on Electricity Prices: Evidence for Six South American Countries. Energies 2022, 15, 620. https://doi.org/10.3390/en15020620

Correa-Quezada R, Tituaña-Castillo MdC, del Río-Rama MdlC, Álvarez-García J. Effects of Increased Renewable Energy Consumption on Electricity Prices: Evidence for Six South American Countries. Energies. 2022; 15(2):620. https://doi.org/10.3390/en15020620

Chicago/Turabian StyleCorrea-Quezada, Ronny, María del Cisne Tituaña-Castillo, María de la Cruz del Río-Rama, and José Álvarez-García. 2022. "Effects of Increased Renewable Energy Consumption on Electricity Prices: Evidence for Six South American Countries" Energies 15, no. 2: 620. https://doi.org/10.3390/en15020620