Possible Ways of Extending the Biogas Plants Lifespan after the Feed-In Tariff Expiration

Abstract

:1. Introduction

- guarantee secure and cost-effective energy supplies to EU members;

- build an integrated, interconnected, and digitalized energy market;

- spread the energy efficiency concept, enhance the energy performance of buildings and implement a power sector based on renewable energy sources (RES).

2. Literature Review

- Sector’s status. For example, Benato and Macor [19] provided an analysis of the Italian biogas sector’s trend of development by comparing current incentives to installment and operating costs. A similar investigation was conducted by Ferreira et al. [20] for Portugal, whereas Igliński et al. [21], Kim et al. [22] and Nevzorova [23] analyzed the Polish, Sud Korean, and Russian Federation biogas sectors. Contrary to other authors, Brémond et al. [24] presented a vision for the European biogas sector, whereas Kemausuor et al. [25] described and discussed barriers to biogas development in Africa.

- Biogas production maximization through the selection of the feedstock type and quantity. For example, Lee et al. [26] analyzed how the pretreatment and the share of organic wastes influence biogas production. Then, to maximize production, they optimized the mixture ratio. A similar study was conducted by Ghouali et al. [27], Song et al. [28] and Asadi and McPhedran [29], while Sarker et al. [30] investigated the critical parameters and their role in the design and operation of biogas production plants.

- Biogas engines’ performance improvement and emissions reduction. Several works have analyzed the use of biogas in Internal Combustion (IC) engines in combination with other fuels. The scope of such investigations is to reduce fuel consumption and emissions. For example, Nathan et al. [31], Barik and Murugan [32], and Yilmaz and Gumus [33] investigated the effects of adding biogas to diesel on IC engine performance and emissions, whereas Bui et al. [34], Benaissa et al. [35], and Sharma et al. [36] conducted a similar analysis but considering the enrichment of biogas with hydrogen. Contrary to others, Deheri et al. [37] focused their attention on reviewing the available literature on IC dual-fuel engines working with biogas and hydrogen. Finally, Macor and Benato [38,39,40] measured the biogas IC engine regulated and unregulated emissions, performed a risk and human health toxicity assessment and computed the cost to reduce the emissions’ toxicity on human health.

- Life Cycle Assessment (LCA). In this research field, there are researchers that conducted LCA analysis of the entire industrial scale co-digestion biogas plants (e.g., Bartocci et al. [41]) or others that focused on a specific bio-product; as an example, Rehl and Müller [42] analyzed the digestate. Reviews are numerous also. As an example, the review by Hijazi et al. [43] is centered on LCA for biogas production in Europe, while Aziz et al. [44] focused on Malaysia. Esteves et al. [45] reviewed the works dealing with LCA and manure for biogas production, and Starr et al. [46] focused on the LCA of biogas upgrading technologies.

- Economic aspects. O’Connor et al. [47] analyzed the economic feasibility of small-scale biogas plants located in Europe, and Trypolska et al. [48] performed a similar analysis but centered on agricultural biogas production by Ukrainian farms. Barbera et al. [49] explored the techno-economic feasibility of a micro-scale biogas plant integrated with microalgae cultivation for treating the organic part of the municipal waste. Winquist et al. [50] evaluated the business opportunities for the Finish market offered by biogas.

- Potential production. As an example, Sun et al. [51] firstly evaluated the potential production of biomethane from crop residues in China. Then, they analyzed how this fuel could contribute to the achievement of carbon neutrality. Zhu et al. [52] investigated the effects in different countries of promoting biomethane production by upgrading from agricultural biogas. Xue et al. [53] compared the European with the Chinese experience in the biomethane sector and the potential of their acquired knowledge exchange. Dale et al. [54] analyzed how to expand biomethane production sustainably and considered its potential impacts in different countries. There are also some contributions in the literature dealing with the estimation of the biomethane potential for transport purposes (see, e.g., Argalis and Vegere [55]) and studies that specifically focused on the design of strategies and support policies to boost biomethane production (see, e.g., Schmid et al. [56]).

- Upgrading technologies. This is a really hot topic, because there is an urgent need for efficient and cost-effective technologies for upgrading biogas into biomethane. In fact, several review papers in the literature address this issue. As an example, Rodero et al. [57] presented a review of biogas’ purification-and-upgrading technologies. In addition, Khan et al. [58] focused on the available technologies for direct biomethane use, and Angelidaki et al. [59] provided an analysis of the currently available technologies and investigated the emerging ones. By contrast, Zhao et al. [60] concentrated their attention on the recent technological advancements in biogas upgrading. Ahmed et al. [61] reviewed upgrading technologies and examined their utilization and related economic aspects. The latter issue is also addressed by Lombardi and Francini [62]. Nonetheless, in their work, the attention is posed on both economic and environmental concerns and drivers. Differently from the others, Kapoor et al. [63] and Golmakani et al. [64] analyzed the future perspectives of biogas upgrading. Nevertherless, Golmakani et al. [64], to clarify the current situation and suggest a future outlook, expanded the study to biogas cleaning and biomethane utilization, computing the global warming potential of various biogas upgrading technologies.

- Economic and socioeconomic aspects. Apart from the economic analyses conducted on biogas upgrading technologies, it is important to highlight that there are studies that compare the profitability of (i) biogas upgrading with its use for electricity generation (see, e.g., Budzianowski and Budzianowska [65]), (ii) biomethane grid injection with biomethane liquefaction (e.g., Ref. [66]), and (iii) biomethane production conditional to the presence or the absence of incentive schemes (e.g., Ref. [67]). There are also investigations devoted to assessing the economic viability of biogas–biomethane from animal residues supply chain (e.g., Ref. [68]) or focused on the socioeconomics of biomethane use in the transport sector (e.g., Ref. [69]).

- Life Cycle Assessment. The studies embeddable in this research branch are numerous. They range from LCA of biomethane [70] to comparison based on LCA analysis of biowaste-to-biomethane and biowaste-to-energy [71]. There are also investigations focused on analyzing from the LCA perspective (i) the upgrading of biogas into biomethane [72], (ii) the production of biomethane from lignocellulosic biomass [73], or (iii) microalgae grown in municipal wastewater [74].

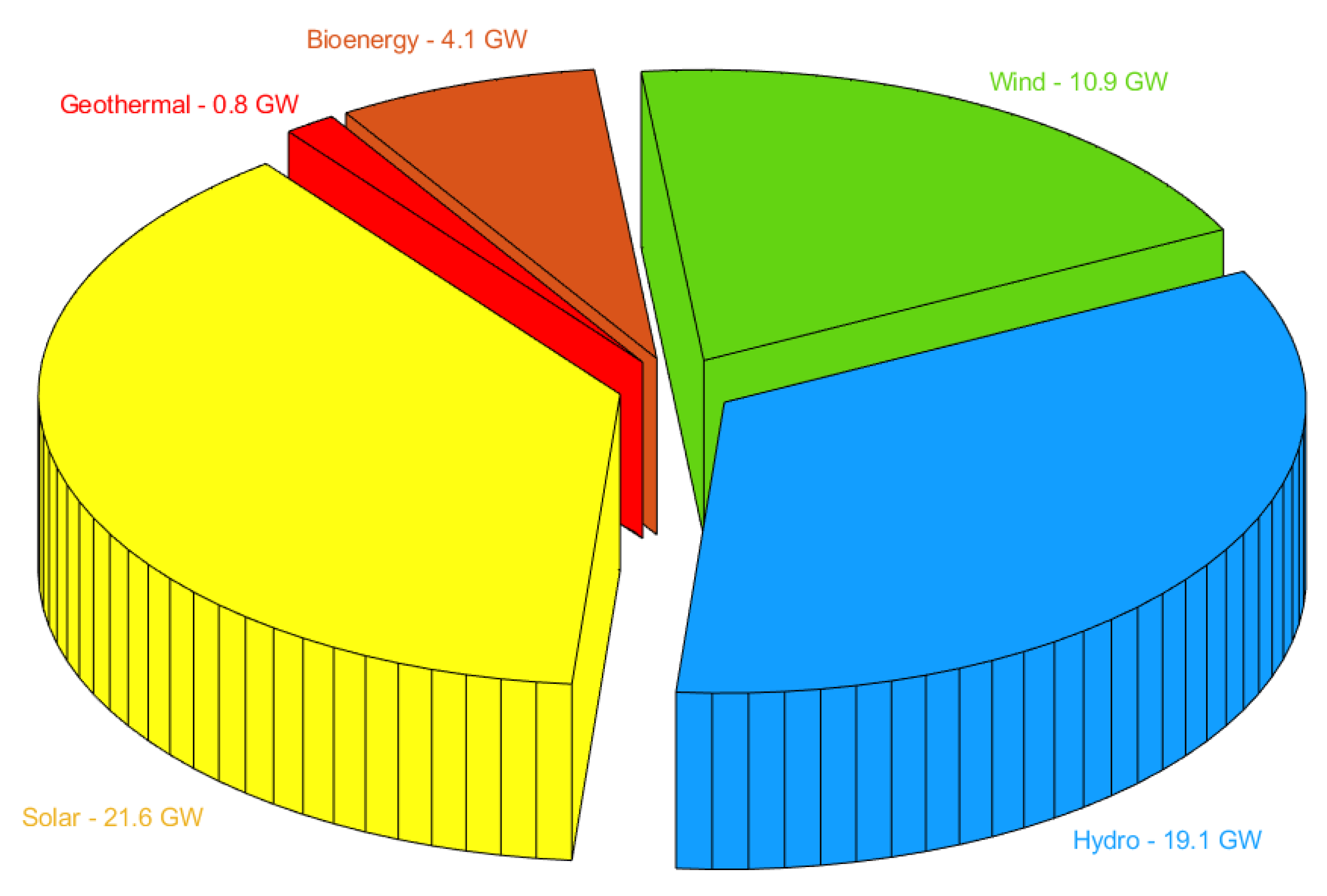

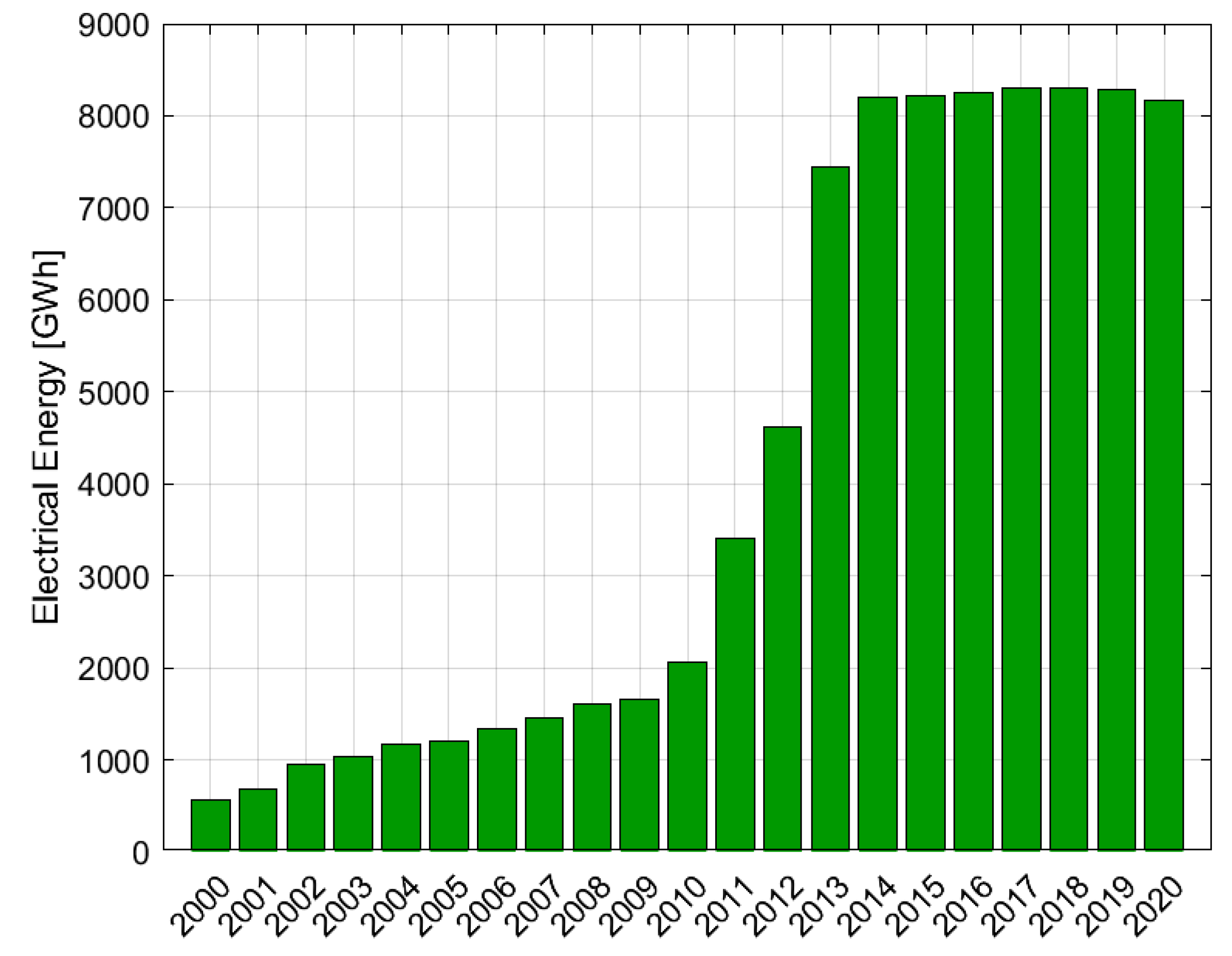

3. The Biogas Sector in the Italian Renewable Energy Context: Trend, Legislation and Subsidies

- a PV plant of 50 MWp design power occupies approximately 95–105 hectares and costs 60–65 M€ [83]. The replacement of energy production from biogas plants, potentially switched off in 2027–2028, would require an investment cost of about 650–700 M€ and an area of about 1100–1200 hectares. The latter is a decent amount of land hard to find in Italy, especially considering that PV power should increase from 23 to 52 GWp by 2030 to comply with national climate targets.

- Biogas production is programmable and predictable, wheras PV production is intermittent and depend on seasonality. Indeed, a biogas plant can operate for over 8000 h per year. By contrast, PV power plants function for approximately 1200–1250 h annually.

- To make PV energy production more flexible and increase self-consumed energy quotas, storage units are necessary. Storage increases investment costs and may generate management issues.

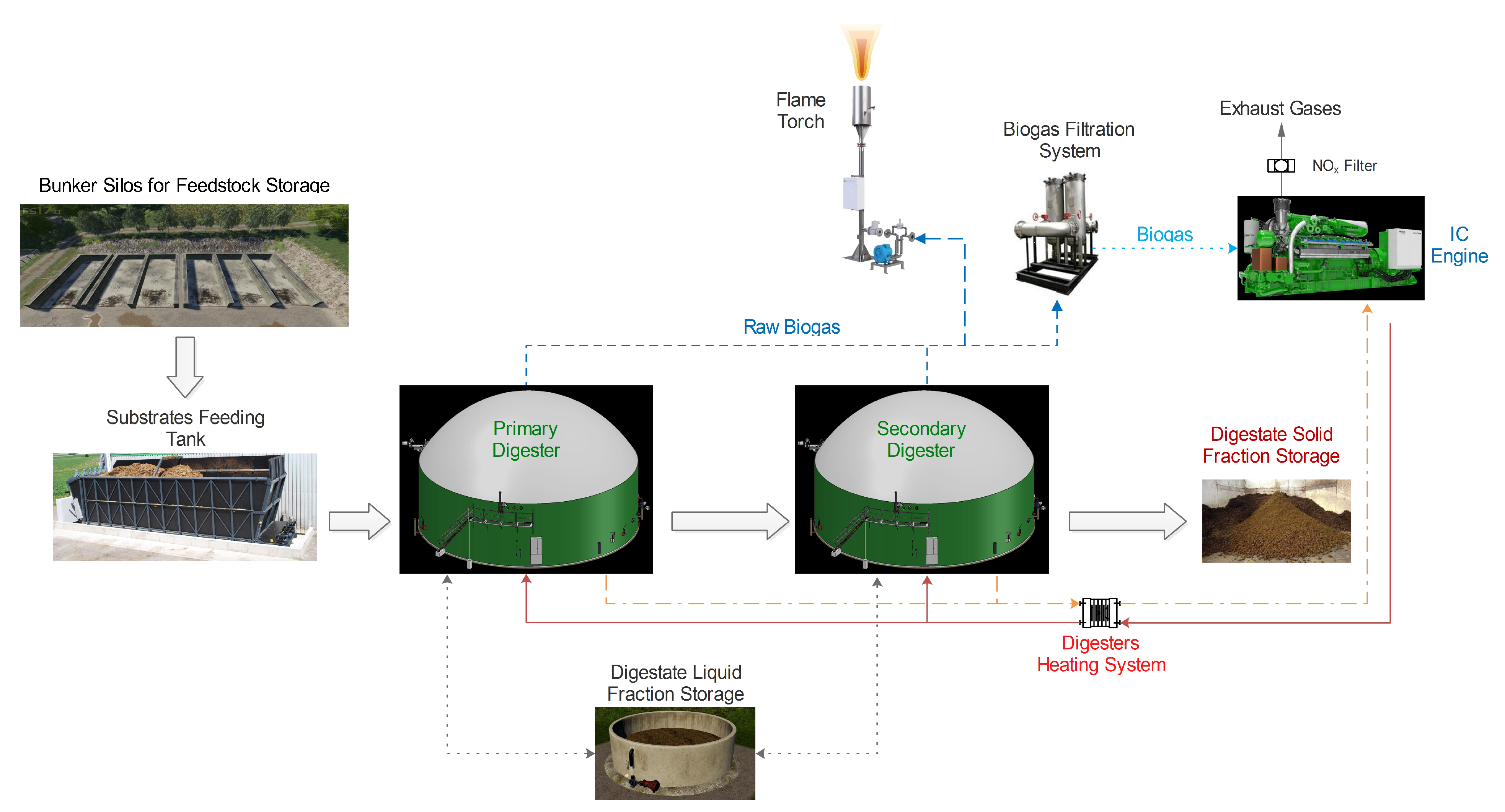

4. Plant Structure

- Hot water or steam that can be directly delivered to a thermal user;

- Hot water used as heat source for an organic Rankine cycle turbogenerator. In this case, the ORC presents a design power of 70 kWel and, to obtain the maximum incentive possible, the engine is operated at 929 kWel instead of 999 kWel. This configuration is adopted to reduce the engine biogas consumption and, subsequently, the feedstock quantity (up to 10%). However, as demonstrated by Benato and Macor [84], the direct recovery of the exhaust gases heat content operated at full load allows the installation of an ORC with a design power up to 137.8 kWel. The ORC installation, in turn, guarantees an additional “green” electricity production without consuming the land. In addition, waste heat recovery reduces thermal pollution and permits cutting emissions per unit of generated electricity.

5. Materials and Methods

- Investment costs. According to an analysis conducted on the 20 plants monitored by the authors, the investment costs range from 4 M to 5 M€, depending on the feedstock used as the production input. The surveyed costs are in line with Ref. [19] and Ref. [86]. In detail, the investment costs of the plant under investigation amounted to 4.8 M€.

- Operating costs. Operating costs vary according to the plant’s operating time, the cost of the feedstock and its harvesting. They include input costs, the opportunity cost of digestate, labor costs, maintenance and insurance costs [85,86,87]. Based on the market analysis the authors conducted and the survey they administered to plants’ owners and managers, the feedstock production costs range from 1.0 to 1.2 M€, depending on the digester diet. The plant under observation co-digestes maize silage, pig sewage and chicken dung, and it exhibits annual average costs equal to 1.2 M€. Operating and ordinary maintenance costs amount amount to about 180 k€ per year. This is a standard cost observed in the set of monitored production units and is in line with results by D’Alpaos [85], Barbera et al. [86] and Benato and Macor [19]. The results of the analysis conducted on the 20 monitored plants show that estimated annual labor costs are equal to 19.5 k€. Indeed, there is usually a significant integration between the operation of the plant and livestock farming. The estimated annual costs for digestate disposal are about 80 k€. This estimate falls in the range of estimates provided in the literature [19,85].

- Revenues. As to revenues and their estimate, some comments are in order. Revenues vary linearly with produced electricity. Nonetheless, it is worth noting that plants that started operation in 2012, according to the Budget Act of 2008 [78] and in the ARG/elt 296 1/09 [79], will benefit from the government incentive scheme until 2027 (i.e., for 15 years). During this timespan, revenues coincide with the generous FiT set by the Italian government that corresponds to 280 € for any MWh of electricity produced. After the phasing out of the current incentive scheme, the plant’s owner has the opportunity to feed electricity into the grid at the current market price. In accordance with recent contributions in the literature focusing on the Italian electricity market [88,89,90], the authors assume the Single National Price (PUN) as a proxy for the electricity price. The PUN is set in the Italian Power Exchange and calculated as the average of hourly prices in the different market zones into which the Italian electricity market is divided into. The price of electricity is stochastic, and to estimate the underlying discrete-time stochastic process, PUN hourly prices in the time period April 2004–May 2020 [91] are considered and processed according to Menoncin [92] for forecasting future energy prices. The main assumption in considering the time series of past energy prices for price forecasts resides is that the stochastic process underlying the price dynamics is Markovian (i.e., memory less). In fact, it can be demonstrated that the PUN evolves over time according to a Geometric Brownian Motion [88,90,93].

6. Results and Discussion

- Scenario 1 (SC-1) represents the existing situation in which the plant started operating in 2012, it will be receiving the FiT (i.e., 280 € MWh−1) for 15 years, and it will be switched off in 2027. In 2019, the IC-engine was repowered, and the cost paid was equal to 275 k€. In this scenario, as revenues are of a deterministic nature thanks to the FiTs, the investment is low risk, and consequently, the discount rate is assumed as a risk-free discount rate, i.e., r = 3%. In 2012, the plants’ owner based his/her decision to invest on the project’s NPV, which is significantly positive:

- Scenario 2 (SC-2). In this scenario, SC-1 conditions will persist until 2027. Nonetheless, in 2028, the plant’s owner has to decide whether to maintain in operation the plant until 2042 and then shut down the plant and cease operation. To prolong operation and continue to produce electricity, the plant’s owner would pay an estimated additional cost of 675 k€, which includes the costs for repowering the IC-engine and the costs to revamp the biological section of the facility (e.g., the digesters, the pumping sections, etc.). If the plant’s owner decided to invest, in 2035, the IC-engine would require again a repowering intervention at the cost of 275 k€. As the FiT will be cancelled out in 2027, starting from 2028, the plant’s owner would be paid the PUN (which, as previously said, is a proxy of the electricity market price) for the electricity fed into the grid. To make this decision (in 2028), the plants’ owner should consider the cost–benefit trade-offs of this additional investment. In detail, the plant’s owner should take into consideration from an economic perspective the additional investment costs paid for repowering the IC-engine and revamping the facility biological section, the plant’s operating costs (e.g., labor costs, feedstock costs, etc.) and the revenues gained by selling the electricity fed into the grid. In this scenario, due to the uncertainty over electricity prices, the discount rate is the adjusted rate of return. The discount rate is equal to r = 6% and has been calculated according to the Capital Asset Pricing Model [90]. In 2028, the investment NPV in 2028 would be highly negative:Consequently, according to data reported in Section 5, in 2028, the plant’s owner would be better off by not investing and, by contrast, shutting down the plant, as annual average costs would be indeed higher than average annual revenues.

- Scenario 3 (SC-3). This scenario’s conditions are similar to those of scenario SC-2, with an exception made for the additional installation of an ORC in 2028 to increase the power generation of the existing biogas plant. Following the guidelines reported in Ref. [84] and considering a commercially available unit, if the plant’s owner decided to install an ORC labeled for a design power of 100 kWel, the annual electricity production would increase by 500 MWh. The ORC self-consumption is usually equal to 8% of the generated electricity. Consequently, the additional electricity quota produced via the ORC and fed into the grid would be of 457.5 MWh per year. At the time of the ORC repowering, the expected electricity quota fed into the grid would be equal to 366 MWh. Based on the market analysis conducted among the main European ORC manufacturers, the ORC installation costs are equal to 400 k€, whereas annual maintenance costs are about 4% of installation costs (i.e., 16 k€). Maintenance costs pertain to organic fluid refilling, heat exchanger cleaning and checking the turbine. The ORC manufacturer recommends a repowering of the ORC every 5 years. The cost of this repowering is estimated in 45 k€. Regardless of the ORC installation, analogously to scenario SC-2, the investment NPV in 2028 would be negative:where r is equal to 6%.

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| bcm | Billion Cubic Meter |

| CIB | Consorzio Italiano Biogas |

| CO2 | Carbon Dioxide |

| EU | European Union |

| FiT | Feed-in Tariff |

| GHG | Greenhouse Gases |

| GME | Gestore dei Mercati Energetici |

| GSE | Gestore dei Servizi Energetici |

| IC | Internal Combustion |

| LNG | Liquid Natural Gas |

| NOx | Nitrogen Oxide |

| NPV | Net Present Value |

| NREAP | National Renewable Action Plan |

| ORC | Organic Rankine Cycle |

| PUN | Single National Price |

| RES | Renewable Energy Sources |

| SC | Scenario |

References

- The United Nations Framework Convention on Climate Change. The Kyoto Protocol. UNFCCC Website 1997. Available online: http://unfccc.int/kyoto_protocol/items/2830.php (accessed on 25 September 2022).

- The United Nations Framework Convention on Climate Change. The Paris Agreement. UNFCCC Website 2015. Available online: https://unfccc.int/documents/184656 (accessed on 25 September 2022).

- European Parliament and of the Council. Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the promotion of the use of energy from renewable sources and amending and subsequently repealing Directives 2001/77/EC and 2003/30/EC. Off. J. Eur. Union 2009, 5, 2009. Available online: https://eur-lex.europa.eu/legal-content/en/ALL/?uri=CELEX%3A32009L0028 (accessed on 25 September 2022).

- The European Commission. The EU 2030 Climate and Energy Framework. Off. J. Eur. Union 2014, 140, 16–62. Available online: https://ec.europa.eu/clima/eu-action/climate-strategies-targets/2030-climate-energy-framework_it (accessed on 25 September 2022).

- The European Commission. Roadmap 2050: Roadmap for moving to a competitive low-carbon economy in 2050. Off. J. Eur. Union 2011. Available online: https://www.roadmap2050.eu/ (accessed on 25 September 2022).

- The European Parliament. EU Responses to Climate Change. Official Website of the European Parliament 2022. Available online: https://www.europarl.europa.eu/news/en/headlines/society/20180703STO07129/eu-responses-to-climate-change (accessed on 25 September 2022).

- The European Commission. The European Green Deal. Off. J. Eur. Union 2020. Available online: https://www.europarl.europa.eu/news/en/headlines/society/20200618STO81513/green-deal-key-to-a-climate-neutral-and-sustainable-eu (accessed on 25 September 2022).

- Ministero dello Sviluppo Economico. Piano Nazionale Integrato per l’Energia e il Clima 2030. Gazz. Uff. Della Repubb. Ital. 2020. Available online: https://www.mise.gov.it/index.php/it/energia/energia-e-clima-2030 (accessed on 25 September 2022).

- GSE–Gestore dei Servizi Energetici S.p.A. Rapporto Statistico 2020 Energia e Fonti Rinnovabili in Italia al 2020. GSE Official Website 2020. Available online: https://www.gse.it/documenti_site/Documenti%20GSE/Rapporti%20statistici/Rapporto%20Statistico%20GSE%20-%20FER%202020.pdf (accessed on 25 September 2022).

- Benato, A.; Stoppato, A. Energy and cost analysis of an Air Cycle used as prime mover of a Thermal Electricity Storage. J. Energy Storage 2018, 17, 29–46. [Google Scholar] [CrossRef]

- Cavazzini, G.; Benato, A.; Pavesi, G.; Ardizzon, G. Techno-economic benefits deriving from optimal scheduling of a Virtual Power Plant: Pumped hydro combined with wind farms. J. Energy Storage 2021, 37, 102461. [Google Scholar] [CrossRef]

- Mbah, R.E.; Wasum, D.F. Russian-Ukraine 2022 War: A review of the economic impact of Russian-Ukraine crisis on the USA, UK, Canada, and Europe. Adv. Soc. Sci. Res. J. 2022, 9, 144–153. [Google Scholar] [CrossRef]

- The European Commission. RePowerEU: A plan to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition. Off. J. Eur. Union 2022. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:fc930f14-d7ae-11ec-a95f-01aa75ed71a1.0001.02/DOC_1&format=PDF (accessed on 25 September 2022).

- European Biogas Association. The REPowerEU Puts forward a Biomethane Action Plan to Scale-Up the Sector by 2030. Web Source 2022. Available online: https://www.europeanbiogas.eu/the-repowereu-puts-forward-a-biomethane-action-plan-to-scale-up-the-sector-by-2030/ (accessed on 25 September 2022).

- Ministero dello Sviluppo Economico. Decreto Interministeriale 2 Marzo 2018–Promozione Dell’uso del Biometano nel Settore dei Trasporti. Web Source 2018. Available online: https://www.mise.gov.it/index.php/it/normativa/decreti-interministeriali/decreto-interministeriale-2-marzo-2018-promozione-dell-uso-del-biometano-nel-settore-dei-trasporti (accessed on 25 September 2022).

- Ministero della Transizione Ecologica. Decreto 5 Agosto 2022. Attuazione del PNRR: M2C2 I.1.4-Sviluppo del biometano Secondo Criteri per la Promozione Dell’economia Circolare-Produzione di Biometano Secondo Quanto Previsto dal Decreto 2 Marzo 2018. (22A04725) (GU Serie Generale n.192 del 18-08-2022). Web Source 2022. Available online: https://www.mise.gov.it/index.php/it/normativa/decreti-interministeriali/decreto-interministeriale-2-marzo-2018-promozione-dell-uso-del-biometano-nel-settore-dei-trasporti (accessed on 25 September 2022).

- Schiro, F.; Stoppato, A.; Benato, A. Modelling and analyzing the impact of hydrogen enriched natural gas on domestic gas boilers in a decarbonization perspective. Carbon Resour. Convers. 2020, 3, 122–129. [Google Scholar] [CrossRef]

- Italian Government. National Renewable Energy Action Plan. Web Source 2010. Available online: https://ec.europa.eu/energy/en/topics/renewable-energy/national-action-plans (accessed on 25 September 2022).

- Benato, A.; Macor, A. Italian biogas plants: Trend, subsidies, cost, biogas composition and engine emissions. Energies 2019, 12, 979. [Google Scholar] [CrossRef] [Green Version]

- Ferreira, M.; Marques, I.P.; Malico, I. Biogas in Portugal: Status and public policies in a European context. Energy Policy 2012, 43, 267–274. [Google Scholar] [CrossRef] [Green Version]

- Igliński, B.; Piechota, G.; Iwański, P.; Skarzatek, M.; Pilarski, G. 15 Years of the Polish agricultural biogas plants: Their history, current status, biogas potential and perspectives. Clean Technol. Environ. Policy 2020, 22, 281–307. [Google Scholar] [CrossRef]

- Kim, Y.S.; Yoon, Y.M.; Kim, C.H.; Giersdorf, J. Status of biogas technologies and policies in South Korea. Renew. Sustain. Energy Rev. 2012, 16, 3430–3438. [Google Scholar] [CrossRef]

- Nevzorova, T. Biogas production in the Russian federation: Current status, potential, and barriers. Energies 2020, 13, 3620. [Google Scholar] [CrossRef]

- Brémond, U.; Bertrandias, A.; Steyer, J.P.; Bernet, N.; Carrere, H. A vision of European biogas sector development towards 2030: Trends and challenges. J. Clean. Prod. 2021, 287, 125065. [Google Scholar] [CrossRef]

- Kemausuor, F.; Adaramola, M.S.; Morken, J. A review of commercial biogas systems and lessons for Africa. Energies 2018, 11, 2984. [Google Scholar] [CrossRef] [Green Version]

- Lee, B.; Park, J.G.; Shin, W.B.; Kim, B.S.; Byun, B.s.; Jun, H.B. Maximizing biogas production by pretreatment and by optimizing the mixture ratio of co-digestion with organic wastes. Environ. Eng. Res. 2019, 24, 662–669. [Google Scholar] [CrossRef] [Green Version]

- Ghouali, A.; Sari, T.; Harmand, J. Maximizing biogas production from the anaerobic digestion. J. Process. Control. 2015, 36, 79–88. [Google Scholar] [CrossRef] [Green Version]

- Song, Y.J.; Oh, K.S.; Lee, B.; Pak, D.W.; Cha, J.H.; Park, J.G. Characteristics of biogas production from organic wastes mixed at optimal ratios in an anaerobic co-digestion reactor. Energies 2021, 14, 6812. [Google Scholar] [CrossRef]

- Asadi, M.; McPhedran, K. Biogas maximization using data-driven modelling with uncertainty analysis and genetic algorithm for municipal wastewater anaerobic digestion. J. Environ. Manag. 2021, 293, 112875. [Google Scholar] [CrossRef]

- Sarker, S.; Lamb, J.J.; Hjelme, D.R.; Lien, K.M. A review of the role of critical parameters in the design and operation of biogas production plants. Appl. Sci. 2019, 9, 1915. [Google Scholar] [CrossRef] [Green Version]

- Nathan, S.S.; Mallikarjuna, J.; Ramesh, A. An experimental study of the biogas–diesel HCCI mode of engine operation. Energy Convers. Manag. 2010, 51, 1347–1353. [Google Scholar] [CrossRef]

- Barik, D.; Murugan, S. Investigation on combustion performance and emission characteristics of a DI (direct injection) diesel engine fueled with biogas–diesel in dual fuel mode. Energy 2014, 72, 760–771. [Google Scholar] [CrossRef]

- Yilmaz, I.; Gumus, M. Investigation of the effect of biogas on combustion and emissions of TBC diesel engine. Fuel 2017, 188, 69–78. [Google Scholar] [CrossRef]

- Bui, V.G.; Bui, T.M.T.; Hoang, A.T.; Nižetić, S.; Nguyen Thi, T.X.; Vo, A.V. Hydrogen-enriched biogas premixed charge combustion and emissions in direct injection and indirect injection diesel dual fueled engines: A comparative study. J. Energy Resour. Technol. 2021, 143, 120907. [Google Scholar] [CrossRef]

- Benaissa, S.; Adouane, B.; Ali, S.M.; Rashwan, S.S.; Aouachria, Z. Investigation on combustion characteristics and emissions of biogas/hydrogen blends in gas turbine combustors. Therm. Sci. Eng. Prog. 2022, 27, 101178. [Google Scholar] [CrossRef]

- Sharma, H.; Mahla, S.K.; Dhir, A. Effect of utilization of hydrogen-rich reformed biogas on the performance and emission characteristics of common rail diesel engine. Int. J. Hydrogen Energy 2022, 47, 10409–10419. [Google Scholar] [CrossRef]

- Deheri, C.; Acharya, S.K.; Thatoi, D.N.; Mohanty, A.P. A review on performance of biogas and hydrogen on diesel engine in dual fuel mode. Fuel 2020, 260, 116337. [Google Scholar] [CrossRef]

- Macor, A.; Benato, A. Regulated emissions of biogas engines–On site experimental measurements and damage assessment on human health. Energies 2020, 13, 1044. [Google Scholar] [CrossRef] [Green Version]

- Macor, A.; Benato, A. A Human Health Toxicity Assessment of Biogas Engines Regulated and Unregulated Emissions. Appl. Sci. 2020, 10, 7048. [Google Scholar] [CrossRef]

- Benato, A.; Macor, A. Costs to reduce the human health toxicity of biogas engine emissions. Energies 2021, 14, 6360. [Google Scholar] [CrossRef]

- Bartocci, P.; Zampilli, M.; Liberti, F.; Pistolesi, V.; Massoli, S.; Bidini, G.; Fantozzi, F. LCA analysis of food waste co-digestion. Sci. Total. Environ. 2020, 709, 136187. [Google Scholar] [CrossRef] [PubMed]

- Rehl, T.; Müller, J. Life cycle assessment of biogas digestate processing technologies. Resour. Conserv. Recycl. 2011, 56, 92–104. [Google Scholar] [CrossRef]

- Hijazi, O.; Munro, S.; Zerhusen, B.; Effenberger, M. Review of life cycle assessment for biogas production in Europe. Renew. Sustain. Energy Rev. 2016, 54, 1291–1300. [Google Scholar] [CrossRef]

- Aziz, N.I.H.A.; Hanafiah, M.M.; Gheewala, S.H. A review on life cycle assessment of biogas production: Challenges and future perspectives in Malaysia. Biomass Bioenergy 2019, 122, 361–374. [Google Scholar] [CrossRef]

- Esteves, E.M.M.; Herrera, A.M.N.; Esteves, V.P.P.; do Rosário Vaz Morgado, C. Life cycle assessment of manure biogas production: A review. J. Clean. Prod. 2019, 219, 411–423. [Google Scholar] [CrossRef]

- Starr, K.; Gabarrell, X.; Villalba, G.; Talens, L.; Lombardi, L. Life cycle assessment of biogas upgrading technologies. Waste Manag. 2012, 32, 991–999. [Google Scholar] [CrossRef]

- O’Connor, S.; Ehimen, E.; Pillai, S.; Black, A.; Tormey, D.; Bartlett, J. Biogas production from small-scale anaerobic digestion plants on European farms. Renew. Sustain. Energy Rev. 2021, 139, 110580. [Google Scholar] [CrossRef]

- Trypolska, G.; Kyryziuk, S.; Krupin, V.; Wąs, A.; Podolets, R. Economic Feasibility of Agricultural Biogas Production by Farms in Ukraine. Energies 2021, 15, 87. [Google Scholar] [CrossRef]

- Barbera, E.; Bertucco, A.; Nigam, K.D.; Kumar, S. Techno-economic analysis of a micro-scale biogas plant integrated with microalgae cultivation for the treatment of organic municipal waste. Chem. Eng. J. 2022, 450, 138323. [Google Scholar] [CrossRef]

- Winquist, E.; Rikkonen, P.; Pyysiäinen, J.; Varho, V. Is biogas an energy or a sustainability product?-Business opportunities in the Finnish biogas branch. J. Clean. Prod. 2019, 233, 1344–1354. [Google Scholar] [CrossRef]

- Sun, H.; Wang, E.; Li, X.; Cui, X.; Guo, J.; Dong, R. Potential biomethane production from crop residues in China: Contributions to carbon neutrality. Renew. Sustain. Energy Rev. 2021, 148, 111360. [Google Scholar] [CrossRef]

- Zhu, T.; Curtis, J.; Clancy, M. Promoting agricultural biogas and biomethane production: Lessons from cross-country studies. Renew. Sustain. Energy Rev. 2019, 114, 109332. [Google Scholar] [CrossRef]

- Xue, S.; Zhang, S.; Wang, Y.; Wang, Y.; Song, J.; Lyu, X.; Wang, X.; Yang, G. What can we learn from the experience of European countries in biomethane industry: Taking China as an example? Renew. Sustain. Energy Rev. 2022, 157, 112049. [Google Scholar] [CrossRef]

- Dale, B.E.; Bozzetto, S.; Couturier, C.; Fabbri, C.; Hilbert, J.A.; Ong, R.; Richard, T.; Rossi, L.; Thelen, K.D.; Woods, J. The potential for expanding sustainable biogas production and some possible impacts in specific countries. Biofuels Bioprod. Biorefining 2020, 14, 1335–1347. [Google Scholar] [CrossRef]

- Argalis, P.P.; Vegere, K. Perspective Biomethane Potential and Its Utilization in the Transport Sector in the Current Situation of Latvia. Sustainability 2021, 13, 7827. [Google Scholar] [CrossRef]

- Schmid, C.; Horschig, T.; Pfeiffer, A.; Szarka, N.; Thrän, D. Biogas Upgrading: A Review of National Biomethane Strategies and Support Policies in Selected Countries. Energies 2019, 12, 3803. [Google Scholar] [CrossRef] [Green Version]

- Rodero, M.R.; Ángeles, R.; Marín, D.; Díaz, I.; Colzi, A.; Posadas, E.; Lebrero, R.; Muñoz, R. Biogas purification and upgrading technologies. Biogas 2018, 6, 239–276. [Google Scholar]

- Khan, M.U.; Lee, J.T.E.; Bashir, M.A.; Dissanayake, P.D.; Ok, Y.S.; Tong, Y.W.; Shariati, M.A.; Wu, S.; Ahring, B.K. Current status of biogas upgrading for direct biomethane use: A review. Renew. Sustain. Energy Rev. 2021, 149, 111343. [Google Scholar] [CrossRef]

- Angelidaki, I.; Xie, L.; Luo, G.; Zhang, Y.; Oechsner, H.; Lemmer, A.; Munoz, R.; Kougias, P.G. Biogas upgrading: Current and emerging technologies. In Biofuels: Alternative Feedstocks and Conversion Processes for the Production of Liquid and Gaseous Biofuels; Acaemic Press: Cambridge, MA, USA, 2019; pp. 817–843. [Google Scholar]

- Zhao, J.; Li, Y.; Dong, R. Recent progress towards in-situ biogas upgrading technologies. Sci. Total. Environ. 2021, 800, 149667. [Google Scholar] [CrossRef]

- Ahmed, S.F.; Mofijur, M.; Tarannum, K.; Chowdhury, A.T.; Rafa, N.; Nuzhat, S.; Kumar, P.S.; Vo, D.V.N.; Lichtfouse, E.; Mahlia, T. Biogas upgrading, economy and utilization: A review. Environ. Chem. Lett. 2021, 19, 4137–4164. [Google Scholar] [CrossRef]

- Lombardi, L.; Francini, G. Techno-economic and environmental assessment of the main biogas upgrading technologies. Renew. Energy 2020, 156, 440–458. [Google Scholar] [CrossRef]

- Kapoor, R.; Ghosh, P.; Kumar, M.; Vijay, V.K. Evaluation of biogas upgrading technologies and future perspectives: A review. Environ. Sci. Pollut. Res. 2019, 26, 11631–11661. [Google Scholar] [CrossRef]

- Golmakani, A.; Nabavi, S.A.; Wadi, B.; Manovic, V. Advances, challenges, and perspectives of biogas cleaning, upgrading, and utilisation. Fuel 2022, 317, 123085. [Google Scholar] [CrossRef]

- Budzianowski, W.M.; Budzianowska, D.A. Economic analysis of biomethane and bioelectricity generation from biogas using different support schemes and plant configurations. Energy 2015, 88, 658–666. [Google Scholar] [CrossRef]

- Pasini, G.; Baccioli, A.; Ferrari, L.; Antonelli, M.; Frigo, S.; Desideri, U. Biomethane grid injection or biomethane liquefaction: A technical-economic analysis. Biomass Bioenergy 2019, 127, 105264. [Google Scholar] [CrossRef]

- Cucchiella, F.; D’Adamo, I. Technical and economic analysis of biomethane: A focus on the role of subsidies. Energy Convers. Manag. 2016, 119, 338–351. [Google Scholar] [CrossRef]

- Cucchiella, F.; D’Adamo, I.; Gastaldi, M. An economic analysis of biogas-biomethane chain from animal residues in Italy. J. Clean. Prod. 2019, 230, 888–897. [Google Scholar] [CrossRef]

- D’Adamo, I.; Falcone, P.M.; Ferella, F. A socio-economic analysis of biomethane in the transport sector: The case of Italy. Waste Manag. 2019, 95, 102–115. [Google Scholar] [CrossRef]

- Greco, C.; Comparetti, A.; Febo, P.; Navickas, K.; Orlando, S.; Venslauskas, K. LCA applied to an anaerobic digestion plant for biomethane and digestate production. In Proceedings of the International Scientific Conference “Rural Development”, Yogyakarta, Indonesia, 20–21 August 2019; pp. 126–132. [Google Scholar]

- Ardolino, F.; Parrillo, F.; Arena, U. Biowaste-to-biomethane or biowaste-to-energy? An LCA study on anaerobic digestion of organic waste. J. Clean. Prod. 2018, 174, 462–476. [Google Scholar] [CrossRef]

- Ardolino, F.; Cardamone, G.; Parrillo, F.; Arena, U. Biogas-to-biomethane upgrading: A comparative review and assessment in a life cycle perspective. Renew. Sustain. Energy Rev. 2021, 139, 110588. [Google Scholar] [CrossRef]

- Nizami, A.S.; Ismail, I.M. Life-cycle assessment of biomethane from lignocellulosic biomass. Life Cycle Assess. Renew. Energy Sources 2013, 1, 79–94. [Google Scholar]

- Maga, D. Life cycle assessment of biomethane produced from microalgae grown in municipal waste water. Biomass Convers. Biorefinery 2017, 7, 1–10. [Google Scholar] [CrossRef]

- TERNA S.p.A. Impianti di Generazione. TERNA Official Website 2021. Available online: https://download.terna.it/terna/3-IMPIANTI%20DI%20GENERAZIONE_8d9cece9d7e2a7d.pdf (accessed on 25 September 2022).

- European Biogas Association. EBA Statistical Report 2020. EBA Official Website 2020. Available online: https://www.europeanbiogas.eu/eba-statistical-report-2020/ (accessed on 25 September 2022).

- Presidente del Consiglio dei Ministri. Decreto Legislativo 16 Marzo 1999, n. 79. Attuazione Della Direttiva 96/92/CE Recante Norme Comuni per il Mercato Interno Dell’energia Elettrica. Gazzetta Ufficiale delle Repubblica Italiana 1999. Available online: https://web.camera.it/parlam/leggi/deleghe/99079dl.htm (accessed on 25 September 2022).

- Ministero dello sviluppo economico. D.M. 18 Dicembre 2008. Incentivazione Della Produzione di Energia Elettrica da Fonti Rinnovabili, ai Sensi Dell’articolo 2, Comma 150, Della Legge 24 Dicembre 2007, n. 244. Gazzetta Ufficiale delle Repubblica Italiana 2008. Available online: http://www.energia.provincia.tn.it/binary/pat_agenzia_energia/normativa/Min.svil.econ._DM%2018.12.08.1233048510.pdf (accessed on 25 September 2022).

- Autoritá per l’Energia Elettrica e il Gas. Delibera ARG/elt 1/09. Attuazione Dell’articolo 2, Comma 153, Della Legge n. 244/07 e Dell’articolo 20 del Decreto Ministeriale 18 Dicembre 2008, in Materia di incentivazione Dell’energia Elettrica Prodotta da Fonti Rinnovabili Tramite la Tariffa Fissa Onnicomprensiva e di Scambio sul Posto. Official Website 2009. Available online: https://www.arera.it/it/docs/09/001-09arg.htm# (accessed on 25 September 2022).

- Ministero dello Sviluppo Economico. Decreto Ministeriale 6 Luglio 2012 ed Allegati–Incentivi per Energia da Fonti Rinnovabili Elettriche Non Fotovoltaiche. Official Website 2012. Available online: https://www.mise.gov.it/index.php/it/normativa/decreti-ministeriali/decreto-ministeriale-6-luglio-2012-ed-allegati-incentivi-per-energia-da-fonti-rinnovabili-elettriche-non-fotovoltaiche (accessed on 25 September 2022).

- GSE–Gestore dei Servizi Energetici S.p.A. Rapporti Statistici. GSE Official Website 2022. Available online: https://www.gse.it/dati-e-scenari/statistiche (accessed on 25 September 2022).

- CIB–Consorzio Italiano Biogas. CIB Official Website 2022. Available online: https://www.consorziobiogas.it (accessed on 25 September 2022).

- Bellini, Emiliano, j.y.n. Work Begins on 50 MW Solar Park in Malawi. Available online: https://www.pv-magazine.com/2022/02/04/work-begins-on-50-mw-solar-park-in-malawi/ (accessed on 25 September 2022).

- Benato, A.; Macor, A. Biogas engine waste heat recovery using organic Rankine cycle. Energies 2017, 10, 327. [Google Scholar] [CrossRef]

- D’Alpaos, C. Methodological approaches to the valuation of investments in biogas production plants: Incentives vs market prices in Italy. Valori Valutazioni 2017, 53–63. Available online: https://siev.org/wp-content/uploads/2020/02/19_05_DAlpaos_Eng.pdf (accessed on 25 September 2022).

- Barbera, E.; Menegon, S.; Banzato, D.; D’Alpaos, C.; Bertucco, A. From biogas to biomethane: A process simulation-based techno-economic comparison of different upgrading technologies in the Italian context. Renew. Energy 2019, 135, 663–673. [Google Scholar] [CrossRef]

- Sibilio, S.; Rosato, A.; Ciampi, G.; Scorpio, M.; Akisawa, A. Building-integrated trigeneration system: Energy, environmental and economic dynamic performance assessment for Italian residential applications. Renew. Sustain. Energy Rev. 2017, 68, 920–933. [Google Scholar] [CrossRef]

- Bertolini, M.; D’Alpaos, C.; Moretto, M. Do Smart Grids boost investments in domestic PV plants? Evidence from the Italian electricity market. Energy 2018, 149, 890–902. [Google Scholar] [CrossRef]

- Castellini, M.; Di Corato, L.; Moretto, M.; Vergalli, S. Energy exchange among heterogeneous prosumers under price uncertainty. Energy Econ. 2021, 104, 105647. [Google Scholar] [CrossRef]

- Andreolli, F.; D’Alpaos, C.; Moretto, M. Valuing investments in domestic PV-Battery Systems under uncertainty. Energy Econ. 2022, 106, 105721. [Google Scholar] [CrossRef]

- Gestore Mercati Energetici. Esiti dei Mercati e Statistiche. Web Source 2022. Available online: https://www.mercatoelettrico.org/It/Tools/Accessodati.aspx?ReturnUrl=%2fit%2fStatistiche%2fME%2fDatiSintesi.aspx (accessed on 25 September 2022).

- Menoncin, F. Misurare il rischio. In Misurare e Gestire il Rischio Finanziario; Springer: Berlin/Heidelberg, Germany, 2009; pp. 161–193. [Google Scholar]

- Biondi, T.; Moretto, M. Solar Grid Parity dynamics in Italy: A real option approach. Energy 2015, 80, 293–302. [Google Scholar] [CrossRef] [Green Version]

- Banzato, D.; Canesi, R.; D’Alpaos, C. Biogas and biomethane technologies: An AHP model to support the policy maker in incentive design in Italy. In Smart and Sustainable Planning for Cities and Regions; Springer: Berlin/Heidelberg, Germany, 2017; pp. 319–331. [Google Scholar]

- International Renewable Energy Agency. Renewable Power Generation Costs in 2021. International Renewable Energy Agency, Abu Dhabi. Web Source 2022. Available online: https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jul/IRENA_Renewable_Power_Generation_Costs_2021.pdf (accessed on 25 September 2022).

- Van de Ven, D.J.; Capellan-Peréz, I.; Arto, I.; Cazcarro, I.; de Castro, C.; Patel, P.; Gonzalez-Eguino, M. The potential land requirements and related land use change emissions of solar energy. Sci. Rep. 2021, 11, 2907. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Benato, A.; D’Alpaos, C.; Macor, A. Possible Ways of Extending the Biogas Plants Lifespan after the Feed-In Tariff Expiration. Energies 2022, 15, 8113. https://doi.org/10.3390/en15218113

Benato A, D’Alpaos C, Macor A. Possible Ways of Extending the Biogas Plants Lifespan after the Feed-In Tariff Expiration. Energies. 2022; 15(21):8113. https://doi.org/10.3390/en15218113

Chicago/Turabian StyleBenato, Alberto, Chiara D’Alpaos, and Alarico Macor. 2022. "Possible Ways of Extending the Biogas Plants Lifespan after the Feed-In Tariff Expiration" Energies 15, no. 21: 8113. https://doi.org/10.3390/en15218113