Energy Transformation and the UAE Green Economy: Trade Exchange and Relations with Three Seas Initiative Countries

Abstract

:1. Introduction

2. Materials and Methods

2.1. Literature Review

2.2. Research Methodology

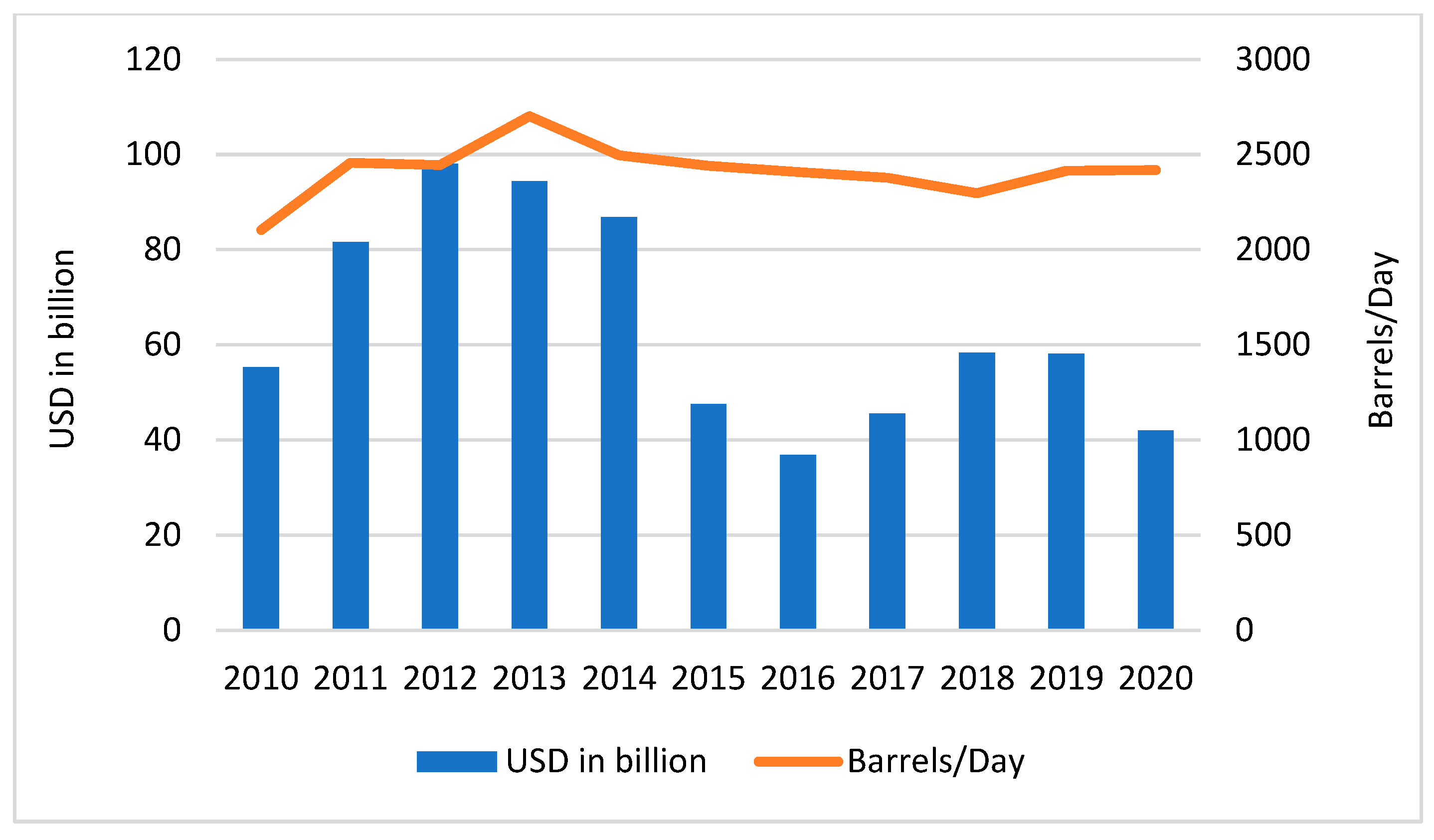

3. The United Arab Emirates Green Economy

4. Three Seas Initiative

5. Top Visits and Green Trade Exchange Case Studies

5.1. Trade and Regular Bilateral Visits between the 3SI Countries and the UAE

5.1.1. Austria

5.1.2. Bulgaria

5.1.3. Estonia

5.1.4. Latvia

5.1.5. Lithuania

5.1.6. Romania

5.2. Trade and Non-Regular Bilateral Visits between the 3SI and the UAE

5.2.1. Hungary

5.2.2. Poland

5.2.3. Slovakia

5.2.4. Slovenia

5.2.5. Croatia

5.2.6. The Czech Republic

5.3. The Comparison among Countries

6. Trend Analysis for Energy Transformation and Green Economy

6.1. Discussion: General Perspective

6.2. Three Seas Initiative Countries—The United Arab Emirates Perspective

6.2.1. The Baltic States

6.2.2. The Landlocked 3SI States

6.2.3. The Adriatic Sea States

6.2.4. The Black Sea States

7. Conclusions

7.1. Research Contributions

7.2. Practical and Theoretical Implications

7.3. Limitations and Future Directions

Funding

Data Availability Statement

Conflicts of Interest

References

- De Jong, M.; Hoppe, T.; Noori, N. City Branding, Sustainable Urban Development and the Rentier State. How Do Qatar, Abu Dhabi and Dubai Present Themselves in the Age of Post Oil and Global Warming? Energies 2019, 12, 1657. [Google Scholar] [CrossRef] [Green Version]

- Cranmer, S.J. Introduction to the Virtual Issue: Machine Learning in Political Science. Available online: https://www.cambridge.org/core/services/aop-file-manager/file/5c348274e401b41903dae11b/PAN-VSI-Intro-0119-Machine-learning.pdf (accessed on 7 September 2022).

- Rosenau, J.N. The Study of Political Adaptation; Pinter: London, UK; Nichols: New York, NY, USA, 1981. [Google Scholar]

- Torchim, W.M.; Donnelly, J.P.; Arora, K. Research Methods: The Essential Knowledge Base; Cengage Learning: Boston, MA, USA, 2016. [Google Scholar]

- Larson, R.; Farber, B. Elementary Statistics: Picturing the World; Pearson: New York, NY, USA, 2014. [Google Scholar]

- Ali, A.H.S. Societal Green Economy and its Impact on Sustainable Development. Int. J. Sustain. Dev. 2021, 16, 105–114. [Google Scholar] [CrossRef]

- Krzymowski, A. Sustainable Development Goals in Arab Region—United Arab Emirates’ Case Study. Probl. Ekorozw. 2020, 15, 211–220. [Google Scholar] [CrossRef]

- EmiratesGBC. Available online: https://emiratesgbc.org/uae-sustainability-initiatives/ (accessed on 15 April 2022).

- Krzymowski, A. The European Union and the United Arab Emirates as civilian and soft powers engaged in Sustainable Development Goals. J. Int. Stud. 2020, 13, 47–48. [Google Scholar] [CrossRef] [PubMed]

- Krzymowski, A. Role and Significance of the United Arab Emirates Foreign Aid for Its Soft Power Strategy and Sustainable Development Goals. Soc. Sci. 2022, 11, 48. [Google Scholar] [CrossRef]

- Górka, M. The Three Seas Initiative as a Political Challenge for the Countries of Central and Eastern Europe. Politics Cent. Eur. 2018, 14, 55–73. [Google Scholar] [CrossRef] [Green Version]

- Krzymowski, A. The Three Seas Initiative and the Graz Triangle Relations Towards the United Arab Emirates Relations. Croat. Political Sci. Rev. 2021, 58, 77–101. [Google Scholar] [CrossRef]

- Jakóbik, W. Nie dajcie się Nabrać Węgrom. BiznesAlert.pl. 2019. Available online: https://biznesalert.pl/wegry-import-lng-chorwacja-katar-gazprom-umowa-gazowa-pacs-energetyka-gaz-atom/ (accessed on 10 February 2022).

- Seroka, M. Chorwacja: Dobre Perspektywy Terminalu LNG na Wyspie Krk. Analizy. OSW. 2020. Available online: https://www.osw.waw.pl/pl/publikacje/analizy/2020-06-24/chorwacja-dobre-perspektywy-terminalu-lng-na-wyspie-krk. (accessed on 11 February 2022).

- European Commission. First Croatian LNG Terminal Officially Inaugurated in KRK Island. Available online: https://ec.europa.eu/inea/en/news-events/newsroom/first-croatian-lng-terminal-officially-inaugurated-krk-island (accessed on 14 February 2022).

- Garding, S.E.; Mix, D.E. The Three Seas Initiative. Congressional Research Service. 2021. Available online: https://aquadoc.typepad.com/files/crs_infocus_3si_26april2021.pdf (accessed on 14 May 2022).

- The World Bank. Available online: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD (accessed on 14 March 2022).

- Krzymowski, A. The Baltic Sea Countries of the Three Seas Initiative Creative Relations with the United Arab Emirates. Creat. Stud. 2021, 15, 40–57. [Google Scholar] [CrossRef]

- Esraa, H.; Tfaham, E.M. Abdullah bin Zayed, Latvian Counterpart, Discuss Boosting Bilateral Cooperation. Breitbart. 2014. Available online: https://www.breitbart.com/news/upi20140319-202510-4447/ (accessed on 17 July 2021).

- Bashir. Foreign Minister Receives Latvian Counterpart. WAM. 2015. Available online: http://wam.ae/en/details/1395281345682 (accessed on 27 July 2021).

- Banila, N. EBRD Mulls Lending $15 mln to UAE’s Chemie-Tech for Oils Recycling Plant in Romania. Available online: https://seenews.com/news/search_results/?author=209 (accessed on 14 March 2021).

- Krzymowski, A. The Significance of the Black Sea Countries of the Three Seas Initiative Relations with the United Arab Emirates. Online J. Model. New Eur. 2020, 34, 86–105. [Google Scholar] [CrossRef]

- Moran, H. Al Mansouri and His Hungarian Counterpart Discuss Cooperation. WAM. 2015. Available online: http://wam.ae/en/details/1395285584320 (accessed on 3 May 2021).

- Krzymowski, A. The Visegrad Group countries: The United Arab Emirates Perspective. Politics Cent. Eur. 2021, 17, 107–126. [Google Scholar] [CrossRef]

- Krzymowski, A. Republic of Poland & United Arab Emirates. 25 Years of Diplomatic Relations; Mohammed bin Rashid Al Maktoum Knowledge Foundation: Dubai, UAE, 2017. [Google Scholar]

- United Arab Emirates Ministry of Foreign Affairs and International Cooperation. Available online: https://www.mofaic.gov.ae/en (accessed on 5 July 2021).

- United Arab Emirates Ministry of Economy. Available online: https://www.moec.gov.ae/en/uae-trade-relation-dashboard (accessed on 14 August 2021).

- Naqbi, S.; Tsai, I.; Mezher, T. Market design for successful implementation of UAE 2050 energy strategy. Renew. Sustain. Energy Rev. 2019, 116, 109429. [Google Scholar] [CrossRef]

- CEIC Data. Available online: https://www.ceicdata.com/en/indicator/united-arab-emirates/crude-oil-exports (accessed on 7 July 2022).

- AlKhars, M.; Miah, F.; Qudrat-Ullah, H.; Kayal, A. A Systematic Review of the Relationship Between Energy Consumption and Economic Growth in GCC Countries. Sustainability 2020, 12, 3845. [Google Scholar] [CrossRef]

- Jaradat, M.S.; AL-Tamimi, K.A.M. Economic Impacts of Renewable Energy on the Economy of UAE. Int. J. Energy Econ. Policy 2022, 12, 156–162. [Google Scholar] [CrossRef]

- Observatory of Economic Complexity. Available online: https://oec.world/en/profile/country/are?yearSelector1=exportGrowthYear26 (accessed on 7 July 2022).

- Tehreem, F.; Mentel, G.; Doğan, B.; ·Hashim, Z.; Shahzad, U. Investigating the role of export product diversification for renewable, and non-renewable energy consumption in GCC (gulf cooperation council) countries: Does the Kuznets hypothesis exist? Environ. Dev. Sustain. 2022, 24, 8397–8417. [Google Scholar]

- Samour, A.; Baskaya, M.M.; Tursoy, T. The Impact of Financial Development and FDI on Renewable Energy in the UAE: A Path towards Sustainable Development. Sustainability 2022, 14, 1208. [Google Scholar] [CrossRef]

- Salimi, M.; Hosseinpour, M.; N. Borhani, T. Analysis of Solar Energy Development Strategies for a Successful Energy Transition in the UAE. Processes 2022, 10, 1338. [Google Scholar] [CrossRef]

- Alharbi, F.R.; Csala, D. Gulf Cooperation Council Countries’ Climate Change Mitigation Challenges and Exploration of Solar and Wind Energy Resource Potential. Appl. Sci. 2021, 11, 2648. [Google Scholar] [CrossRef]

- Ramachandran, T.; Mourad, A.-H.I.; Hamed, F. A Review on Solar Energy Utilization and Projects: Development in and around the UAE. Energies 2022, 15, 3754. [Google Scholar] [CrossRef]

- U.S. Department of Commerce. Resource Guide—United Arab Emirates—Oil and Gas 2022. Available online: https://www.trade.gov/energy-resource-guide-united-arab-emirates-oil-and-gas (accessed on 14 July 2022).

- Communication from the Commission to the European Parliament; the European Council; the Council; the European Economic and Social Committee and the Committee of the Regions. REPowerEU Plan. COM(2022) 230 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2022%3A230%3AFIN&qid=1653033742483 (accessed on 15 July 2022).

- European Commission. Available online: https://ec.europa.eu/commission/presscorner/detail/ov/speech_22_5493 (accessed on 17 July 2022).

- Communication from the Commission to the European Parliament; the European Council; the Council; the European Economic and Social Committee and the Committee of the Regions. The European Green Deal COM/2019/640 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2019:640:FIN (accessed on 5 July 2022).

- Communication from the Commission to the European Parliament; the European Council; the Council; the European Economic and Social Committee and the Committee of the Regions. A Hydrogen Strategy for a Climate-Neutral Europe. COM(2020) 301 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020DC0301 (accessed on 15 July 2022).

- EU Commission; Communication from the Commission to the European Parliament; the Council; the European Economic and Social Committee and the Committee of the Regions. ‘Fit for 55’: Delivering the EU’s 2030 Climate Target on the Way to Climate Neutrality, 14 July 2021, COM(2021) 550 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021DC0550 (accessed on 11 July 2022).

- Griffiths, S. Energy diplomacy in a time of energy transition. Energy Strategy Rev. 2019, 26, 100386. [Google Scholar] [CrossRef]

- Lu, J.; Ren, L.; Yao, S.; Qiao, J.; Strielkowski, W.; Streimikis, J. Comparative Review of Corporate Social Responsibility of Energy Utilities and Sustainable Energy Development Trends in the Baltic States. Energies 2019, 12, 3417. [Google Scholar] [CrossRef] [Green Version]

- Štreimikienė, D.; Lekavičius, V.; Stankūnienė, G.; Pažėraitė, A. Renewable Energy Acceptance by Households: Evidence from Lithuania. Sustainability 2022, 14, 8370. [Google Scholar] [CrossRef]

- Alkesh, S. Abu Dhabi’s Masdar and Europe’s Taaleri Jointly Inaugurate Wind Farms in Poland. The National News. 2021. Available online: https://www.thenationalnews.com/business/energy/2021/12/09/abu-dhabis-masdar-and-europes-taaleri-jointly-inaugurate-wind-farms-in-poland/ (accessed on 14 March 2022).

- Bednarczyk, J.L.; Brzozowska-Rup, K.; Luściński, S. Opportunities and Limitations of Hydrogen Energy in Poland against the Background of the European Union Energy Policy. Energies 2022, 15, 5503. [Google Scholar] [CrossRef]

- Cheng, W.; Lee, S. How Green Are the National Hydrogen Strategies? Sustainability 2022, 14, 1930. [Google Scholar] [CrossRef]

- Senova, A.; Skvarekova, E.; Wittenberger, G.; Rybarova, J. The Use of Geothermal Energy for Heating Buildings as an Option for Sustainable Urban Development in Slovakia. Processes 2022, 10, 289. [Google Scholar] [CrossRef]

- Gulf Business. UAE and Hungary Launch Economic Cooperation Programme. Available online: https://gulfbusiness.com/uae-and-hungary-launch-economic-cooperation-programme/ (accessed on 27 May 2022).

- Mikulić, D.; Keček, D. Investments in Croatian RES Plants and Energy Efficient Building Retrofits: Substitutes or Complements? Energies 2022, 15, 2. [Google Scholar] [CrossRef]

- Esraa, I.; AbdulKader, B. Croatia celebrates National Day at Expo 2020 Dubai. WAM. 2022. Available online: https://www.wam.ae/en/details/1395303027336 (accessed on 17 May 2022).

- Adams, H. UAE & Bulgaria Embrace Nuclear Power’s Renewable Energy. Sustainability. 2021. Available online: https://sustainabilitymag.com/diversity-and-inclusion-dandi/uae-and-bulgaria-embrace-nuclear-powers-renewable-energy (accessed on 27 February 2022).

- Marinescu, N. Changes in Renewable Energy Policy and Their Implications: The Case of Romanian Producers. Energies 2020, 13, 6493. [Google Scholar] [CrossRef]

- Alfaham, T. Romania-UAE Business Forum Calls for Establishing Joint Economic Partnerships. WAM. 2022. Available online: https://www.wam.ae/en/details/1395303025803 (accessed on 27 May 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Krzymowski, A. Energy Transformation and the UAE Green Economy: Trade Exchange and Relations with Three Seas Initiative Countries. Energies 2022, 15, 8410. https://doi.org/10.3390/en15228410

Krzymowski A. Energy Transformation and the UAE Green Economy: Trade Exchange and Relations with Three Seas Initiative Countries. Energies. 2022; 15(22):8410. https://doi.org/10.3390/en15228410

Chicago/Turabian StyleKrzymowski, Adam. 2022. "Energy Transformation and the UAE Green Economy: Trade Exchange and Relations with Three Seas Initiative Countries" Energies 15, no. 22: 8410. https://doi.org/10.3390/en15228410