Green and Blue Hydrogen Production: An Overview in Colombia

Abstract

:1. Introduction

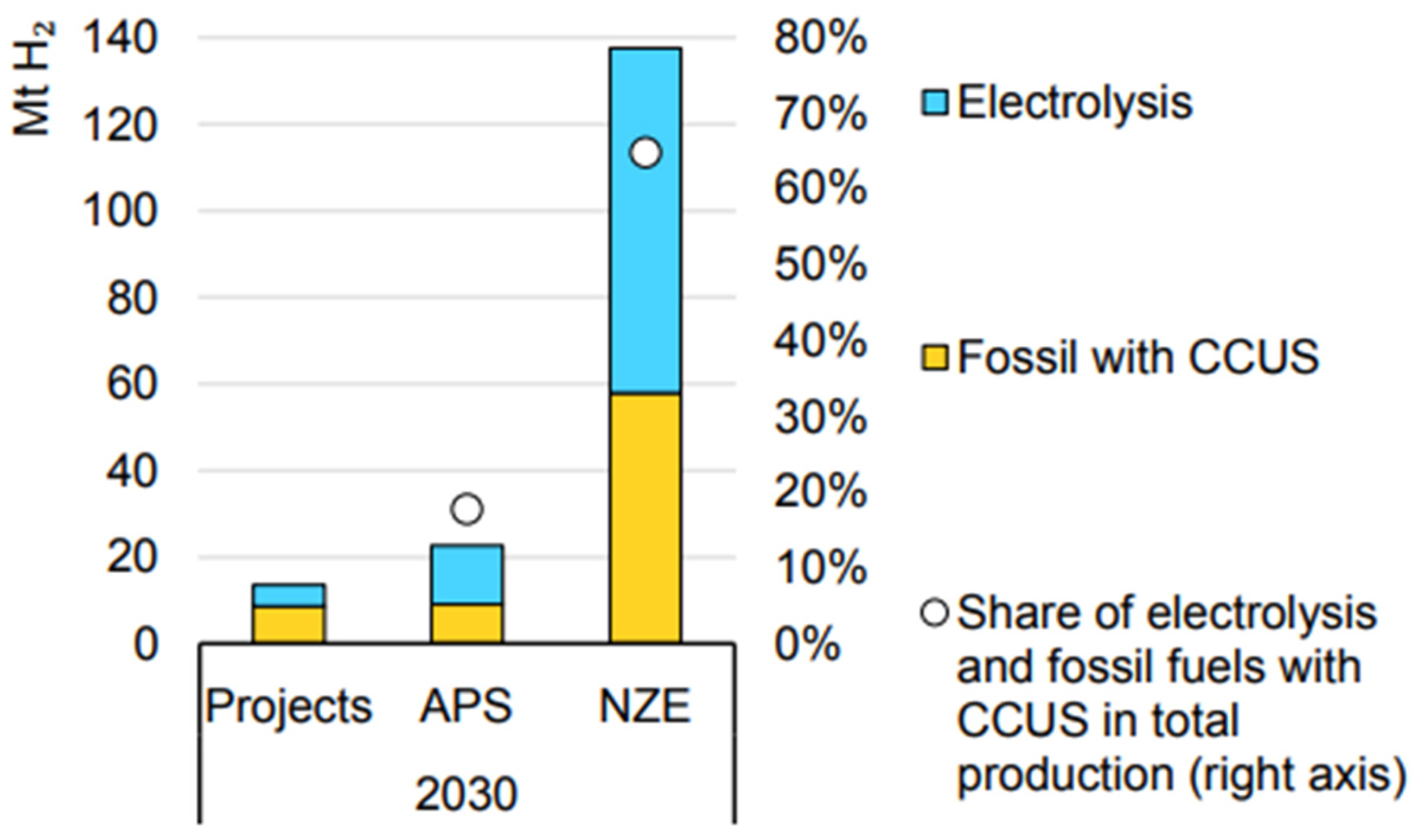

2. Hydrogen Production

2.1. The Hydrogen Color Code

- Brown H2: produced via the gasification of coal, generating CO2 emissions in the process;

- Grey H2: produced via natural gas reforming processes, generating CO2 emissions in the process;

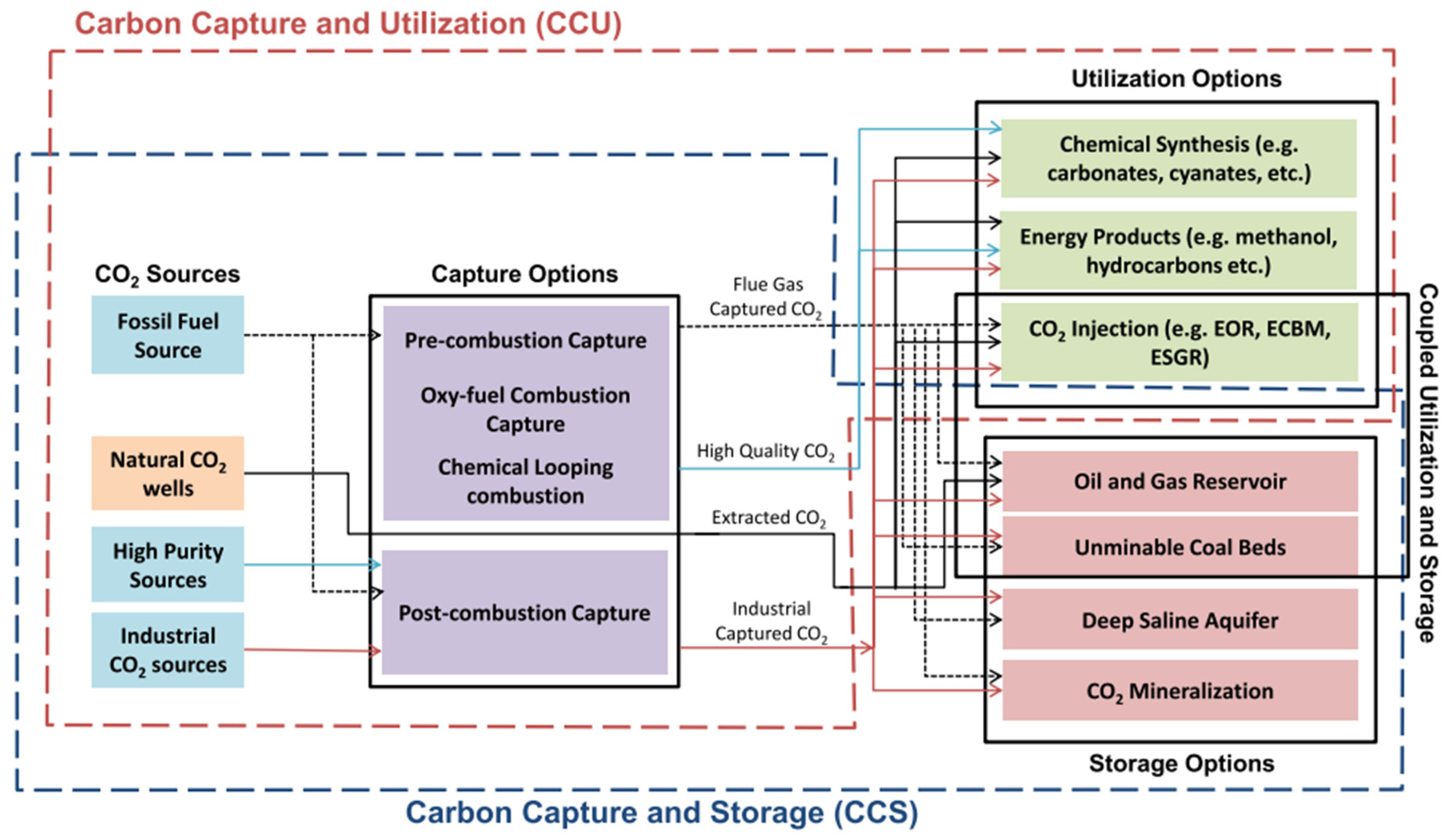

- Blue H2: produced via natural gas or biogas reforming processes with CO2 emissions but using carbon capture, utilization, and storage (CCUS) technologies for a neutral carbon system;

- Green H2: produced via water electrolysis powered by clean and renewable energy sources.

2.2. Hydrogen Production from Fossil Fuels and Biomass

2.2.1. Coal Gasification

2.2.2. Steam Reforming

Aqueous Phase Reforming

2.2.3. Hydrogen from Biomass

Biomass Fast Pyrolysis

Biomass Gasification

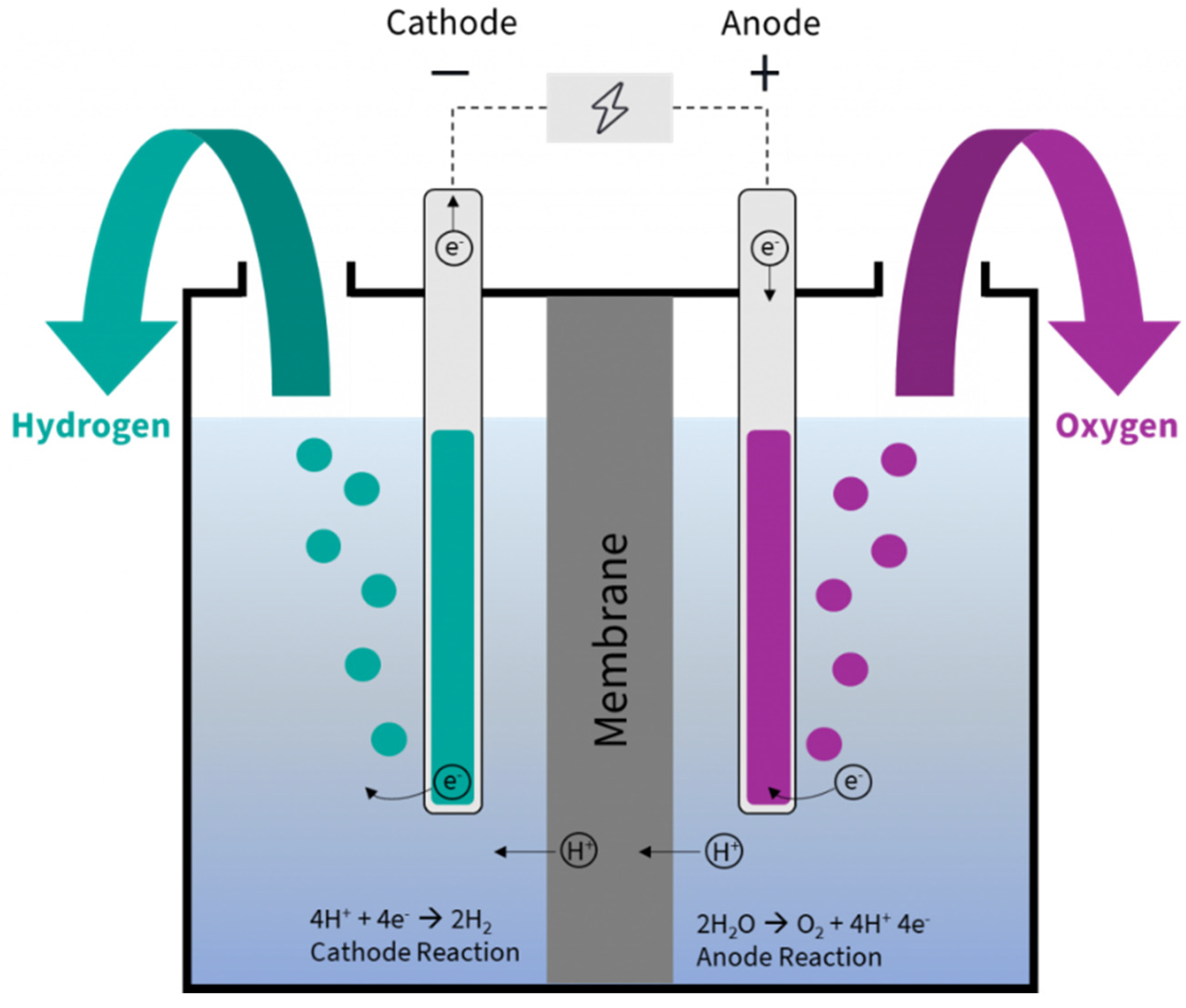

2.3. Green Hydrogen Production

2.3.1. Green Hydrogen Production Methods

2.3.2. Green Hydrogen Prices

2.4. Blue Hydrogen Production Prices

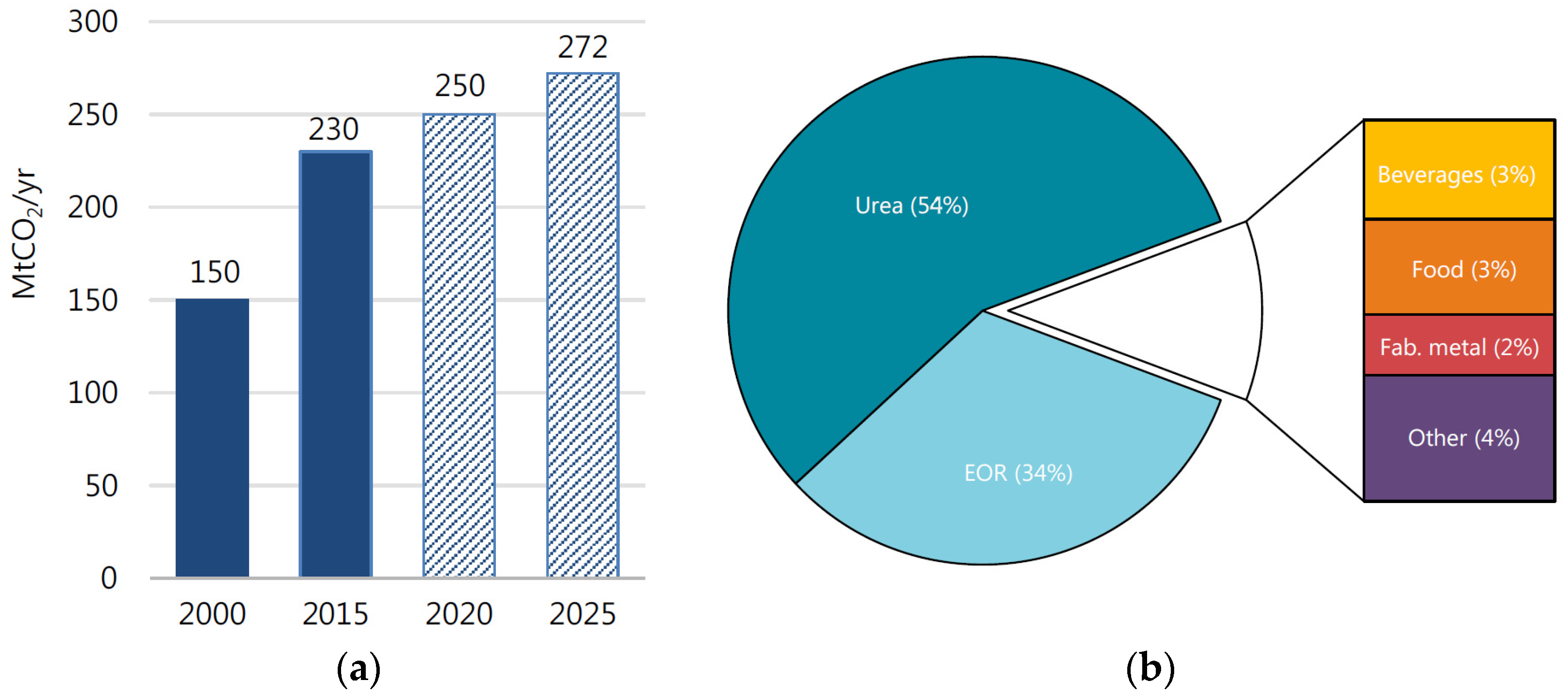

2.5. CO2 Emissions

Carbon Capture, Utilization, and Storage (CCUS)

3. Feasible Deployment Pathway of Blue Hydrogen Production in Colombia

4. Overview of Green Hydrogen Production in Colombia

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- da Silva Veras, T.; Mozer, T.S.; da Costa Rubim Messeder dos Santos, D.; da Silva César, A. Hydrogen: Trends, Production and Characterization of the Main Process Worldwide. Int. J. Hydrogen Energy 2017, 42, 2018–2033. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Global Hydrogen Review 2021. Available online: https://iea.blob.core.windows.net/assets/5bd46d7b-906a-4429-abda-e9c507a62341/GlobalHydrogenReview2021.pdf (accessed on 9 May 2022).

- Ministerio de Minas y Energía—Gobierno Colombiano. Hoja de Ruta del Hidrógeno en Colombia. Bogotá, Colombia; 2022. Available online: https://www.minenergia.gov.co/static/ruta-hidrogeno/src/document/Hoja%20Ruta%20Hidrogeno%20Colombia_2810.pdf (accessed on 8 May 2022).

- Energy Ministery of Chile. Plataforma de Electromovilidad—Conceptos de Hidrógeno Verde. 2018. Available online: https://energia.gob.cl/electromovilidad/hidrogeno-verde/definiciones-generales (accessed on 12 May 2022).

- Pareek, A.; Dom, R.; Gupta, J.; Chandran, J.; Adepu, V.; Borse, P.H. Insights into Renewable Hydrogen Energy: Recent Advances and Prospects. Mater. Sci. Energy Technol. 2020, 3, 319–327. [Google Scholar] [CrossRef]

- Dincer, I. Green Methods for Hydrogen Production. Int. J. Hydrogen Energy 2012, 37, 1954–1971. [Google Scholar] [CrossRef]

- Liu, Y.; Min, J.; Feng, X.; He, Y.; Liu, J.; Wang, Y.; He, J.; Do, H.; Sage, V.; Yang, G.; et al. A Review of Biohydrogen Productions from Lignocellulosic Precursor via Dark Fermentation: Perspective on Hydrolysate Composition and Electron-Equivalent Balance. Energies 2020, 13, 2451. [Google Scholar] [CrossRef]

- Kayfeci, M.; Keçebaş, A.; Bayat, M. Chapter 3—Hydrogen production. In Solar Hydrogen Production. Processes, Systems and Technologies; Academic Press: Cambridge, MA, USA, 2019; pp. 45–83. [Google Scholar] [CrossRef]

- U.S. Department of Energy; National Energy Technology. Laboratory. Gasification Systems. Available online: https://www.netl.doe.gov/carbon-management/gasification (accessed on 13 May 2022).

- Sharma, S.; Agarwal, S.; Jain, A. Significance of Hydrogen as Economic and Environmentally Friendly Fuel. Energies 2021, 14, 7389. [Google Scholar] [CrossRef]

- Valverde, M. Hydrogen from Coal. Coal Age; 2021. Available online: https://www.coalage.com/features/hydrogen-from-coal/ (accessed on 24 May 2022).

- Onozaki, M.; Watanabe, K.; Hashimoto, T.; Saegusa, H.; Katayama, Y. Hydrogen Production by the Partial Oxidation and Steam Reforming of Tar from Hot Coke Oven Gas. Fuel 2006, 85, 143–149. [Google Scholar] [CrossRef]

- U.S. Department of Energy; Energy Efficiency & Renewable Energy. Hydrogen Production: Natural Gas Reforming. Available online: https://www.energy.gov/eere/fuelcells/hydrogen-production-natural-gas-reforming (accessed on 18 May 2022).

- Zoppi, G.; Pipitone, G.; Pirone, R.; Bensaid, S. Aqueous Phase Reforming Process for the Valorization of Wastewater Streams: Application to Different Industrial Scenarios. Catal. Today 2022, 387, 224–236. [Google Scholar] [CrossRef]

- Pipitone, G.; Zoppi, G.; Pirone, R.; Bensaid, S. A Critical Review on Catalyst Design for Aqueous Phase Reforming. Int. J. Hydrogen Energy 2022, 47, 151–180. [Google Scholar] [CrossRef]

- Sanchez, N.; Rodríguez-Fontalvo, D.; Cifuentes, B.; Cantillo, N.M.; Uribe Laverde, M.Á.; Cobo, M. Biomass Potential for Producing Power via Green Hydrogen. Energies 2021, 14, 8366. [Google Scholar] [CrossRef]

- Ni, M.; Leung, D.Y.C.; Leung, M.K.H.; Sumathy, K. An Overview of Hydrogen Production from Biomass. Fuel Process. Technol. 2006, 87, 461–472. [Google Scholar] [CrossRef]

- Kalinci, Y.; Hepbasli, A.; Dincer, I. Biomass-Based Hydrogen Production: A Review and Analysis. Int. J. Hydrogen Energy 2009, 34, 8799–8817. [Google Scholar] [CrossRef]

- International Renewable Energy Agency. Global Hydrogen Trade to Meet the 1.5 °C Climate Goal: Part III—Green Hydrogen Cost and Potential. Abu Dhabi, United Arab Emirates. 2022. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/May/IRENA_Global_Hydrogen_Trade_Costs_2022.pdf (accessed on 18 May 2022).

- Sebbahi, S.; Nabil, N.; Alaoui-Belghiti, A.; Laasri, S.; Rachidi, S.; Hajjaji, A. Assessment of the Three Most Developed Water Electrolysis Technologies: Alkaline Water Electrolysis, Proton Exchange Membrane and Solid-Oxide Electrolysis. Mater. Today 2022, 66, 140–145. [Google Scholar] [CrossRef]

- Hussy, C. Water Electrolysis Explained—The Basis for Most Power-to-X Processes. 2022. Available online: https://ptx-hub.org/water-electrolysis-explained (accessed on 5 July 2022).

- Santos, A.L.; Cebola, M.-J.; Santos, D.M.F. Towards the Hydrogen Economy—A Review of the Parameters That Influence the Efficiency of Alkaline Water Electrolyzers. Energies 2021, 14, 3193. [Google Scholar] [CrossRef]

- Levene, J.I.; Mann, M.K.; Margolis, R.M.; Milbrandt, A. An Analysis of Hydrogen Production from Renewable Electricity Sources. Sol. Energy 2007, 81, 773–780. [Google Scholar] [CrossRef]

- Glaister, B.J.; Mudd, G.M. The Environmental Costs of Platinum–PGM Mining and Sustainability: Is the Glass Half-Full or Half-Empty? Miner. Eng. 2010, 23, 438–450. [Google Scholar] [CrossRef]

- Kraglund, M.R.; Carmo, M.; Schiller, G.; Ansar, S.A.; Aili, D.; Christensen, E.; Jensen, J.O. Ion-Solvating Membranes as a New Approach towards High Rate Alkaline Electrolyzers. Energy Environ. Sci. 2019, 12, 3313–3318. [Google Scholar] [CrossRef] [Green Version]

- Angeles-Olvera, Z.; Crespo-Yapur, A.; Rodríguez, O.; Cholula-Díaz, J.L.; Martínez, L.M.; Videa, M. Nickel-Based Electrocatalysts for Water Electrolysis. Energies 2022, 15, 1609. [Google Scholar] [CrossRef]

- Bespalko, S.; Mizeraczyk, J. Overview of the Hydrogen Production by Plasma-Driven Solution Electrolysis. Energies 2022, 15, 7508. [Google Scholar] [CrossRef]

- Jovan, D.J.; Dolanc, G. Can Green Hydrogen Production Be Economically Viable under Current Market Conditions. Energies 2020, 13, 6599. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Average Annual Capacity Factors by Technology. 2018. Available online: https://www.iea.org/data-and-statistics/charts/average-annual-capacity-factors-by-technology-2018 (accessed on 5 July 2022).

- International Renewable Energy Agency. Renewable Power Generation Costs in 2020 Abu Dhabi, United Arab Emirates. 2021. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Jun/IRENA_Power_Generation_Costs_2020.pdf (accessed on 15 September 2022).

- Hargrave, M. Investopedia.Weighted Average Cost of Capital (WACC) Explained with Formula and Example. 8 August 2022. Available online: https://www.investopedia.com/terms/w/wacc.asp (accessed on 30 June 2022).

- International Renewable Energy Agency. Hydrogen from Renewable Power: Technology Outlook for the Energy Transition. Abu Dhabi, United Arab Emirates. 2018. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Sep/IRENA_Hydrogen_from_renewable_power_2018.pdf (accessed on 30 June 2022).

- International Energy Agency (IEA). Putting CO2 to Use. Creating Value from Emissions. 2019. Available online: https://iea.blob.core.windows.net/assets/50652405-26db-4c41-82dc-c23657893059/Putting_CO2_to_Use.pdf (accessed on 19 May 2022).

- Tapia, J.F.D.; Lee, J.-Y.; Ooi, R.E.H.; Foo, D.C.Y.; Tan, R.R.A. Review of Optimization and Decision-Making Models for the Planning of CO2 Capture, Utilization and Storage (CCUS) Systems. Sustain. Prod. Consum. 2018, 13, pp. 1–15. [CrossRef]

- Global CCS Institute. Global status of CCS 2020. Available online: https://www.globalccsinstitute.com/wp-content/uploads/2021/03/Global-Status-of-CCS-Report-English.pdf (accessed on 15 May 2022).

- Hydrocarbon Engineering, Axens White Paper. Carbon Capture and Storage, a Necessary Tool to Fight Climate ChangeAxens: Houston, TX, USA. 2021. Available online: https://ppweb-media.s3.eu-west-1.amazonaws.com/whitepapers/files/Axens_WP_CCS_2022_EN.pdf (accessed on 15 May 2022).

- Promigas. Informe del Sector Gas Natural. 2021. Available online: http://52.247.87.160:52345/SiteAssets/ISGN%20COL%202021.pdf (accessed on 27 May 2022).

- Unidad de Planeación Minero Energética. El Carbón Colombiano Fuente de Energía Para el Mundo. Bogota, Colombia; 2007. Available online: http://www.upme.gov.co/docs/cadena_carbon.pdf (accessed on 23 June 2022).

- Unidad de Planeación Minero Energética. Zonas Carboníferas de Colombi. Bogota, Colombia; 2007. Available online: http://www.upme.gov.co/guia_ambiental/carbon/areas/zonas/indice.htm (accessed on 27 June 2022).

- International Energy Agency (IEA). Colombia. 2021. Available online: https://www.iea.org/countries/colombia (accessed on 28 June 2022).

- Lenton, C. Colombia’s Oil, Natural Gas Reserves Said Rapidly Dwindling. Natural Gas Intelligence. 2021. Available online: https://www.naturalgasintel.com/colombias-oil-natural-gas-reserves-said-dwindling-rapidly/ (accessed on 27 May 2022).

- Kosakowski, P. What Determines Oil Prices? Dotdash Meredith. 2021. Available online: https://www.investopedia.com/articles/economics/08/determining-oil-prices.asp#toc-the-bottom-line (accessed on 27 May 2022).

- Yáñez, É; Meerman, H.; Ramírez, A.; Castillo, É; Faaij, A. Fully Integrated CO2 Mitigation Strategy for an Existing Refinery: A Case Study in Colombia. Appl. Energy 2022, 313, 118771. [Google Scholar] [CrossRef]

- Nwidee, L.N.; Theophilus, S.; Barifcani, A.; Sarmadivaleh, M.; Iglauer, S. EOR Processes, Opportunities and Technological Advancements. In Chemical Enhanced Oil Recovery (cEOR)—A Practical Overview; Romero-Zeron, L., Ed.; IntechOpen: London, UK, 2016. [Google Scholar] [CrossRef] [Green Version]

- Suarez, A.L. El País se Alista para Contar con Cuatro Plantas Regasificadoras. Portafolio, 2020. Available online: https://www.portafolio.co/economia/gas-natural-colombia-se-alista-para-contar-con-cuatro-plantas-regasificadoras-545352(accessed on 25 June 2020).

- Cenit. Descripción de la Red. 2015. Available online: https://cenit-transporte.com/que-hacemos/ (accessed on 29 June 2022).

- Kenton, C.; Silton, B. Repurposing Natural Gas Lines: The CO2 Opportunity. ADL Ventures. 2020. Available online: https://adlventures.com/repurposing-natural-gas-lines-the-co2-opportunity/ (accessed on 28 June 2022).

- Castiblanco, O.; Cárdenas, D.J. Producción de Hidrógeno y Su Perspectiva En Colombia: Una Revisión. Gest. Ambient. 2020, 23, 299–311. [Google Scholar] [CrossRef]

- Moreno, J.; Cobo, M.; Barraza-Botet, C.; Sanchez, N. Role of Low Carbon Emission H2 in the Energy Transition of Colombia: Environmental Assessment of H2 Production Pathways for a Certification Scheme. Energy Convers. Manag. X 2022, 16, 100312. [Google Scholar] [CrossRef]

- Pinilla, Á. Á. Notas de Lectura—Curso Electivo Energía Eólica; Departamento de Ingeniería Mecánica: Bogota, Colombia, 2020; Available online: https://tinyurl.com/an7fyvxe (accessed on 30 June 2022).

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH. Implementación de Fuentes No Convencionales de Energías Renovables (FNCER) en el Sector Minero Colombiano. Bonn, Germany; 2021; Available online: https://ser-colombia.org/wp-content/uploads/2021/02/FNCER-en-el-sector-minero-Colombia-1.pdf (accessed on 30 June 2022).

- The Renewables Consulting Group & ERM. Hoja de Ruta Para el Despliegue de la Energía Eólica Costa Afuera en Colombia. 2021. Available online: https://www.minenergia.gov.co/static/ruta-eolica-offshore/src/document/Colombia%20Offshore%20Wind%20Roadmap%20VE.pdf (accessed on 23 June 2022).

- Unidad de Planeación Minero Energética. Plan Energético Nacional 2020–2050: La Transformación Energética Que Habilita el Desarrollo Sostenible. Bogota, Colombia; 2020. Available online: https://www1.upme.gov.co/DemandayEficiencia/Documents/PEN_2020_2050/Plan_Energetico_Nacional_2020_2050.pdf (accessed on 4 July 2022).

- Gracia, L.; Casero, P.; Bourasseau, C.; Chabert, A. Use of Hydrogen in Off-Grid Locations, a Techno-Economic Assessment. Energies 2018, 11, 3141. [Google Scholar] [CrossRef] [Green Version]

- Portafolio. Promigas y Ecopetrol Arrancan Con Los Pilotos De Hidrógeno. 2022. Available online: https://www.portafolio.co/negocios/empresas/promigas-y-ecopetrol-arrancan-con-los-pilotos-de-hidrogeno-563063 (accessed on 7 July 2022).

- Forbes. Promigas Activa Electrolizador Que Inyecta Hidrógeno Verde en Las Redes De Hidrógeno. 2022. Available online: https://forbes.co/2022/03/18/negocios/promigas-activa-electrolizador-que-inyecta-hidrogeno-verde-en-las-redes-de-hidrogeno-verde/ (accessed on 7 July 2022).

- Makaryan, I.A.; Sedov, I.V.; Salgansky, E.A.; Arutyunov, A.V.; Arutyunov, V.S. A Comprehensive Review on the Prospects of Using Hydrogen–Methane Blends: Challenges and Opportunities. Energies 2022, 15, 2265. [Google Scholar] [CrossRef]

- Mallouppas, G.; Ioannou, C.; Yfantis, E.A. A Review of the Latest Trends in the Use of Green Ammonia as an Energy Carrier in Maritime Industry. Energies 2022, 15, 1453. [Google Scholar] [CrossRef]

- Siemens Energy. Hydrogen Solutions. 2020. Available online: https://www.siemens-energy.com/global/en/offerings/renewable-energy/hydrogen-solutions.html/ (accessed on 7 July 2022).

- Minenergia. El Gobierno Financiará 10 Proyectos de Estudios Para el Desarrollo de Hidrógeno Verde y Azul en Colombia por Más de $6500 Millones. 2022. Available online: https://www.minenergia.gov.co/es/sala-de-prensa/noticias-index/el-gobierno-financiar%C3%A1-10-proyectos-de-estudios-para-el-desarrollo-de-hidr%C3%B3geno-verde-y-azul-en-colombia-por-m%C3%A1s-de-6500-millones/ (accessed on 9 November 2022).

- Minciencias. Convocatoria para el Apoyo de Proyectos en: Medición de Captura y Secuestro de Carbono y Procesos de Generación de Hidrógeno de Bajas Emisiones. 2022. Available online: https://minciencias.gov.co/convocatorias/innovacion-y-productividad/convocatoria-para-el-apoyo-proyectos-en-medicion-captura-y (accessed on 10 November 2022).

- National University of Colombia (UNAL). Avanza con Pasos Firmes en la Hoja de Ruta del Hidrógeno. 2022. Available online: http://agenciadenoticias.unal.edu.co/detalle/unal-avanza-con-pasos-firmes-en-la-hoja-de-ruta-del-hidrogeno (accessed on 10 November 2022).

| Electrolyzer Technology | Alkaline | PEM | |||

|---|---|---|---|---|---|

| Unit | 2017 | 2025 | 2017 | 2025 | |

| Efficiency | kWh electricity per kg H2 | 51 | 49 | 58 | 52 |

| Efficiency (LHV) | % | 65 | 68 | 57 | 64 |

| Lifetime stack | Operating hours | 80,000 | 90,000 | 40,000 | 50,000 |

| CAPEX-total system cost (incl. power supply and installation costs | $/kW | 750 | 480 | 1200 | 700 |

| OPEX | % of initial CAPEX/year | 2 | 2 | 2 | 2 |

| CAPEX-stack replacement | $/kW | 340 | 215 | 420 | 210 |

| Typical output pressure | bar | Atmospheric | 15 | 30 | 60 |

| System lifetime | Years | 20 | 20 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mantilla, S.; Santos, D.M.F. Green and Blue Hydrogen Production: An Overview in Colombia. Energies 2022, 15, 8862. https://doi.org/10.3390/en15238862

Mantilla S, Santos DMF. Green and Blue Hydrogen Production: An Overview in Colombia. Energies. 2022; 15(23):8862. https://doi.org/10.3390/en15238862

Chicago/Turabian StyleMantilla, Sebastián, and Diogo M. F. Santos. 2022. "Green and Blue Hydrogen Production: An Overview in Colombia" Energies 15, no. 23: 8862. https://doi.org/10.3390/en15238862

APA StyleMantilla, S., & Santos, D. M. F. (2022). Green and Blue Hydrogen Production: An Overview in Colombia. Energies, 15(23), 8862. https://doi.org/10.3390/en15238862