R&D Human Capital, Renewable Energy and CO2 Emissions: Evidence from 26 Countries

Abstract

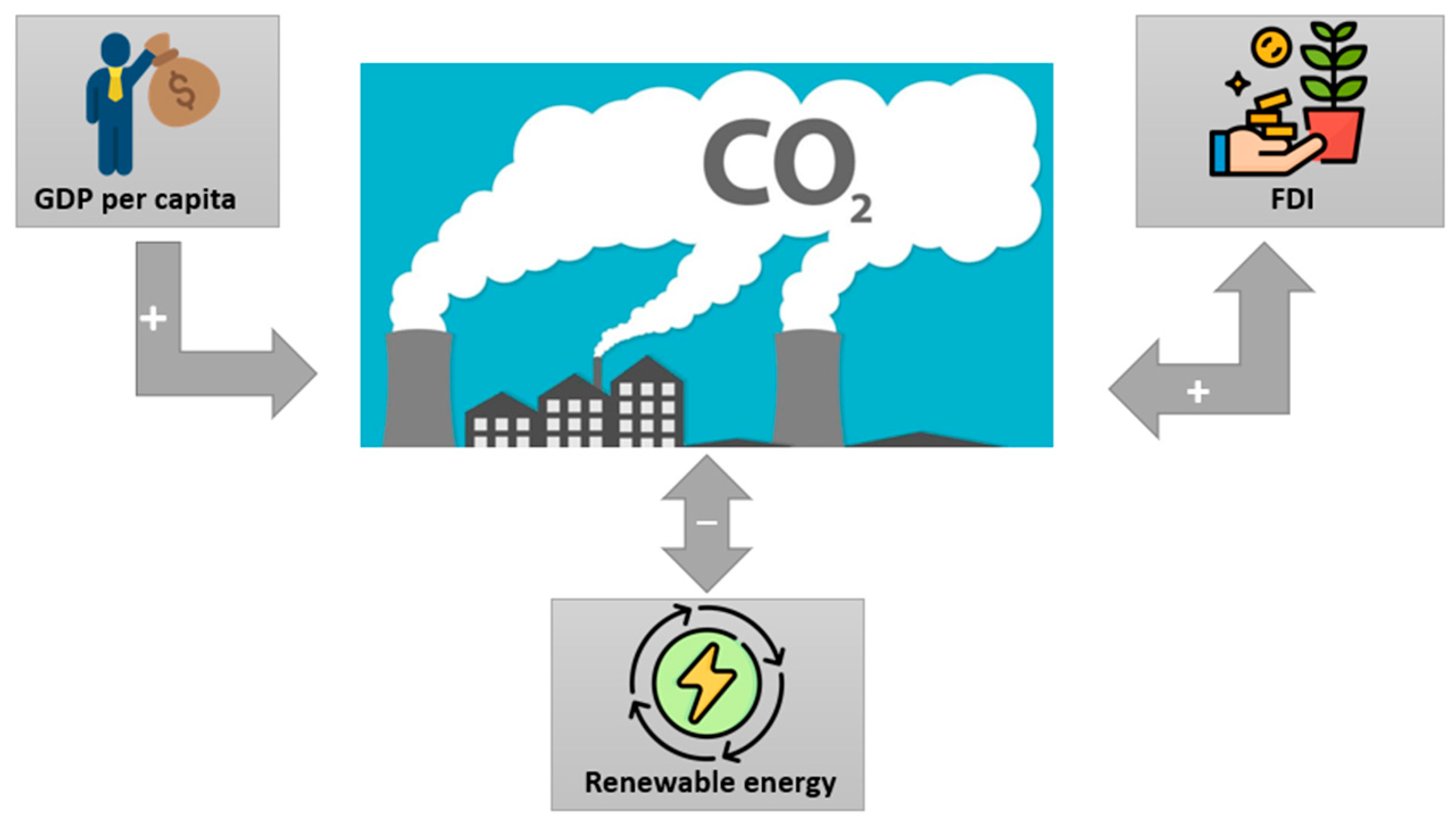

1. Introduction

2. Literature Review

3. Data and Methods

4. Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Calef, D.; Goble, R. The allure of technology: How France and California promoted electric and hybrid vehicles to reduce urban air pollution. Policy Sci. 2007, 40, 1–34. [Google Scholar] [CrossRef]

- Carrión-Flores, C.E.; Innes, R. Environmental innovation and environmental performance. J. Environ. Econ. Manag. 2010, 59, 27–42. [Google Scholar] [CrossRef]

- Irandoust, M. The renewable energy-growth nexus with carbon emissions and technological innovation: Evidence from the Nordic countries. Ecol. Indic. 2016, 69, 118–125. [Google Scholar] [CrossRef]

- Zeng, S.; Zhou, Y. Foreign Direct Investment’s Impact on China’s Economic Growth, Technological Innovation and Pollution. Int. J. Environ. Res. Public Health 2021, 18, 2839. [Google Scholar] [CrossRef]

- Erdoğan, S.; Yıldırım, S.; Yıldırım, D.; Gedikli, A. The effects of innovation on sectoral carbon emissions: Evidence from G20 countries. J. Environ. Manag. 2020, 267, 110637. [Google Scholar] [CrossRef]

- Irga, P.J.; Pettit, T.J.; Torpy, F.R. The phytoremediation of indoor air pollution: A review on the technology devel-opment from the potted plant through to functional green wall biofilters. Rev. Environ. Sci. Bio/Technol. 2018, 17, 395–415. [Google Scholar] [CrossRef]

- Özbay, R.D.; Athari, S.A.; Saliba, C.; Kirikkaleli, D. Towards Environmental Sustainability in China: Role of Glob-alization and Hydroelectricity Consumption. Sustainability 2022, 14, 4182. [Google Scholar] [CrossRef]

- Nentjes, A.; Wiersma, D. Innovation and pollution control. Int. J. Soc. Econ. 1988, 18, 18–29. [Google Scholar] [CrossRef]

- Salahodjaev, R. Is there a link between cognitive abilities and environmental awareness? Cross-national evidence. Environ. Res. 2018, 166, 86–90. [Google Scholar] [CrossRef]

- Obydenkova, A.; Salahodjaev, R. Intelligence, democracy, and international environmental commitment. Environ. Res. 2016, 147, 82–88. [Google Scholar] [CrossRef]

- Lin, X.; Zhao, Y.; Ahmad, M.; Ahmed, Z.; Rjoub, H.; Adebayo, T.S. Linking innovative human capital, economic growth, and CO2 emissions: An empirical study based on Chinese provincial panel data. Int. J. Environ. Res. Public Health 2021, 18, 8503. [Google Scholar] [CrossRef] [PubMed]

- Yan, L.; Wang, H.; Athari, S.A.; Atif, F. Driving green bond market through energy prices, gold prices and green energy stocks: Evidence from a non-linear approach. Econ. Res.-Ekon. Istraživanja 2022, 35, 6479–6499. [Google Scholar] [CrossRef]

- Garrone, P.; Grilli, L. Is there a relationship between public expenditures in energy R&D and carbon emissions per GDP? An empirical investigation. Energy Policy 2010, 38, 5600–5613. [Google Scholar] [CrossRef]

- Lee, K.-H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar] [CrossRef]

- Álvarez-Herránz, A.; Balsalobre, D.; Cantos, J.M.; Shahbaz, M. Energy Innovations-GHG Emissions Nexus: Fresh Empirical Evidence from OECD Countries. Energy Policy 2017, 101, 90–100. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Peng, Y.-L.; Ma, C.-Q.; Shen, B. Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 2017, 100, 18–28. [Google Scholar] [CrossRef]

- Ganda, F. The impact of innovation and technology investments on carbon emissions in selected organisation for economic Co-operation and development countries. J. Clean. Prod. 2019, 217, 469–483. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, S.; Umar, M.; Kirikkaleli, D.; Jiao, Z. Consumption-based carbon emissions and International trade in G7 countries: The role of Environmental innovation and Renewable energy. Sci. Total Environ. 2020, 730, 138945. [Google Scholar] [CrossRef]

- Nguyen, T.T.; Pham, T.A.T.; Tram, H.T.X. Role of information and communication technologies and innovation in driving carbon emissions and economic growth in selected G-20 countries. J. Environ. Manag. 2020, 261, 110162. [Google Scholar] [CrossRef]

- Wahab, S.; Zhang, X.; Safi, A.; Wahab, Z.; Amin, M. Does energy productivity and technological innovation limit trade-adjusted carbon emissions? Econ. Res.-Ekon. Istraživanja 2021, 34, 1896–1912. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Shi, W.; Jiang, L. Does China’s carbon emissions trading policy improve the technology innovation of relevant enterprises? Bus. Strategy Environ. 2020, 29, 872–885. [Google Scholar] [CrossRef]

- Saliba, C.B.; Hassanein, F.R.; Athari, S.A.; Dördüncü, H.; Agyekum, E.B.; Adadi, P. The Dynamic Impact of Re-newable Energy and Economic Growth on CO2 Emissions in China: Do Remittances and Technological Innovations Matter? Sustainability 2022, 14, 14629. [Google Scholar] [CrossRef]

- Obydenkova, A.; Nazarov, Z.; Salahodjaev, R. The process of deforestation in weak democracies and the role of Intelligence. Environ. Res. 2016, 148, 484–490. [Google Scholar] [CrossRef] [PubMed]

- Omanbayev, B.; Salahodjaev, R.; Lynn, R. Are greenhouse gas emissions and cognitive skills related? Cross-country evidence. Environ. Res. 2018, 160, 322–330. [Google Scholar] [CrossRef]

- Larkin, A.; Hystad, P. Towards Personal Exposures: How Technology Is Changing Air Pollution and Health Research. Curr. Environ. Health Rep. 2017, 4, 463–471. [Google Scholar] [CrossRef] [PubMed]

- Hassan, S.T.; Baloch, M.A.; Mahmood, N.; Zhang, J. Linking economic growth and ecological footprint through human capital and biocapacity. Sustain. Cities Soc. 2019, 47, 101516. [Google Scholar] [CrossRef]

- Yao, Y.; Ivanovski, K.; Inekwe, J.; Smyth, R. Human capital and CO2 emissions in the long run. Energy Econ. 2020, 91, 104907. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, S.; Dong, K.; Li, R.Y.M. How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 2020, 94, 105060. [Google Scholar] [CrossRef]

- Wang, F.; Wu, M. Does air pollution affect the accumulation of technological innovative human capital? Empirical evidence from China and India. J. Clean. Prod. 2020, 285, 124818. [Google Scholar] [CrossRef]

- Eshchanov, B.; Abdurazzakova, D.; Yuldashev, O.; Salahodjaev, R.; Ahrorov, F.; Komilov, A.; Eshchanov, R. Is there a link between cognitive abilities and renewable energy adoption: Evidence from Uzbekistan using micro data? Renew. Sustain. Energy Rev. 2021, 141, 110819. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Athari, S.A. Time-frequency co-movements between bank credit supply and economic growth in an emerging market: Does the bank ownership structure matter? N. Am. J. Econ. Finance 2020, 54, 101239. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.-F.; Chu, C.-S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econ. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Breitung, J. Nonparametric tests for unit roots and cointegration. J. Econ. 2002, 108, 343–363. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econ. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Pedroni, P. Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels; Emerald Group Publishing Limited: Bradford, UK, 2001. [Google Scholar] [CrossRef]

- Pedroni, P. Critical Values for Cointegration Tests in Heterogeneous Panels with Multiple Regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Ahmed, N.; Sheikh, A.A.; Hamid, Z.; Senkus, P.; Borda, R.C.; Wysokińska-Senkus, A.; Glabiszewski, W. Exploring the Causal Relationship among Green Taxes, Energy Intensity, and Energy Consumption in Nordic Countries: Dumitrescu and Hurlin Causality Approach. Energies 2022, 15, 5199. [Google Scholar] [CrossRef]

- Irani, F.; Athari, S.A.; Hadood, A.A.A. The impacts of country risk, global economic policy uncertainty, and macroeconomic factors on the Turkish tourism industry. Int. J. Hosp. Tour. Adm. 2022, 23, 1242–1265. [Google Scholar] [CrossRef]

- Kondoz, M.; Kirikkaleli, D.; Athari, S.A. Time-frequency dependencies of financial and economic risks in South American countries. Q. Rev. Econ. Finance 2020, 79, 170–181. [Google Scholar] [CrossRef]

- Karavias, Y.; Tzavalis, E. Testing for unit roots in short panels allowing for a structural break. Comput. Stat. Data Anal. 2014, 76, 391–407. [Google Scholar] [CrossRef]

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ. 2013, 36, 262–267. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial devel-opment on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Salahodjaev, R.; Isaeva, A. Post-Soviet states and CO2 emissions: The role of foreign direct investment. Post-Communist Econ. 2021, 34, 944–965. [Google Scholar] [CrossRef]

- Hao, Y.; Liu, Y.-M. Has the development of FDI and foreign trade contributed to China’s CO2 emissions? An empirical study with provincial panel data. Nat. Hazards 2014, 76, 1079–1091. [Google Scholar] [CrossRef]

- Blanco, L.; Gonzalez, F.; Ruiz, I. The Impact of FDI on CO2 Emissions in Latin America. Oxf. Dev. Stud. 2013, 41, 104–121. [Google Scholar] [CrossRef]

- Baloch, M.A.; Mahmood, N.; Zhang, J.W. Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci. Total Environ. 2019, 678, 632–638. [Google Scholar] [CrossRef]

- Kumar, S.; Managi, S. Energy price-induced and exogenous technological change: Assessing the economic and en-vironmental outcomes. Resour. Energy Econ. 2009, 31, 334–353. [Google Scholar] [CrossRef]

- Gu, G.; Wang, Z. Research on global carbon abatement driven by R&D investment in the context of INDCs. Energy 2018, 148, 662–675. [Google Scholar] [CrossRef]

| Variable | Indicator | Source | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| CO2 | CO2 emissions (metric tons per capita) | World Development Indicators (WDI) | 8.61 | 3.99 | 2.54 | 21.29 |

| RRD | Researchers in R&D (per million people) | World Development Indicators (WDI) | 2685.72 | 1447.22 | 213.58 | 7013.49 |

| FDI | Foreign direct investment, net inflows (% of GDP) | World Development Indicators (WDI) | 5.48 | 9.13 | −15.84 | 86.59 |

| GDP pc | GDP per capita (constant 2010 US$) | World Development Indicators (WDI) | 25,840.96 | 15,655.76 | 1332.41 | 65,432.75 |

| RE | Renewable energy consumption (% of total final energy consumption) | World Development Indicators (WDI) | 10.85 | 8.78 | 0.33 | 40.37 |

| POPG | Population growth (annual %) | World Development Indicators (WDI) | 0.39 | 0.87 | −2.26 | 5.32 |

| Form | Variable | Test | ||||

|---|---|---|---|---|---|---|

| LLC | Breitung | IPS | ADF Fisher | PP Fisher | ||

| Level | ln CO2 | 1.2358 | 2.5056 | 4.0181 | 45.9329 | 34.7407 |

| (0.8917) | (0.9939) | (1.0000) | (0.7101) | (0.9685) | ||

| First-difference | Δln CO2 | −8.1625 *** | −10.146 *** | −10.2910 *** | 229.0940 *** | 487.9605 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| Level | ln RRD | −3.0719 *** | 7.7004 | 3.0491 | 59.9960 | 49.9982 |

| (0.0011) | (1.0000) | (0.9989) | (0.2085) | (0.5530) | ||

| First-difference | Δln RRD | −8.6075 *** | −8.9015 *** | −9.8892 *** | 208.9463 *** | 351.0317 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| Level | ln GDP pc | −2.5543 | 8.9488 | −0.6820 | 44.0777 | 76.2989 |

| (0.0053) | (1.0000) | (0.2476) | (0.7746) | (0.0157) | ||

| First-difference | Δln GDP pc | −7.8853 *** | −8.0403 *** | −6.7039 *** | 175.9595 *** | 204.6046 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| Level | ln FDI | −6.1026 *** | −7.1488 *** | −5.9123 *** | 133.3009 *** | 158.4418 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0001) | (0.0000) | ||

| First-difference | Δln FDI | −13.237 *** | −14.465 *** | −11.8957 *** | 337.4060 *** | 617.9227 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| Level | ln RE | 0.2612 | 7.6633 | 5.4611 | 20.7966 | 31.0526 |

| (0.6030) | (1.0000) | (1.0000) | (1.0000) | (0.9907) | ||

| First-difference | Δln RE | −7.2622 *** | −9.5504 *** | −10.2925 *** | 226.8364 *** | 452.8732 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| Level | ln POPG | −8.1323 *** | 0.4863 | −1.5792 ** | 161.9481 *** | 106.7020 *** |

| (0.0000) | (0.6866) | (0.0571) | (0.0000) | (0.0000) | ||

| First-difference | Δln POPG | −7.7530 *** | −8.4494 *** | −6.7115 *** | 262.6809 *** | 343.1562 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| Variables | Intercept | Linear Trend |

|---|---|---|

| ln CO2 | −3.9318 *** | −0.8835 |

| Δln CO2 | −17.7569 *** | −9.6421 *** |

| ln RRD | −7.7910 *** | −0.2121 |

| Δln RRD | −18.4935 *** | −9.1178 *** |

| ln GDP pc | −10.2388 *** | 2.1072 |

| Δln GDP pc | −12.1393 *** | −5.0840 *** |

| ln FDI | −10.4964 *** | −6.0351 *** |

| Δln FDI | −5.0840 *** | −10.4964 *** |

| ln RE | −2.9500 *** | 0.2949 |

| Δln RE | −20.1432 *** | −12.5214 *** |

| ln POPG | −18.1378 *** | −7.8630 *** |

| Δln POPG | −25.8440 *** | −14.6723 *** |

| Test Statistic | Score |

|---|---|

| V-stat | −2.73 ** |

| Panel rho-stat | 1.221 |

| Panel PP-stat | −8.909 *** |

| Panel ADF-stat | −0.9854 |

| Group rho stat | 2.954 *** |

| Group PP stat | −10.67 *** |

| Group ADF stat | 0.8447 |

| Kao’s ADF | −12.9579 *** |

| Variance ratio | 2.6777 *** |

| FMOLS | |

|---|---|

| Δ ln RRD | −0.08 *** |

| (−5.64) | |

| Δ ln GDP pc | 0.54 *** |

| (35.75) | |

| Δ ln FDI | 0.05 *** |

| (4.19) | |

| Δ ln RE | −0.24 *** |

| (−32.59) | |

| Δ ln POPG | −0.02 |

| 0.09 |

| Null Hypothesis: CO2 Causalities | W-Stat | Zbar-Stat (p-Value) | Optimal Number of Lags (AIC) |

|---|---|---|---|

| RRD does not cause CO2 | 1.0557 | 0.2010 (0.8407) | 1 |

| CO2 does not cause RRD | 0.9161 | −0.3025 (0.7623) | 1 |

| GDP pc does not cause CO2 | 2.4879 | 5.3649 *** (0.0000) | 1 |

| CO2 does not cause GDP pc | 1.0299 | 0.1077 (0.9143) | 1 |

| FDI does not cause CO2 | 1.7056 | 2.5442 ** (0.0110) | 1 |

| CO2 does not cause FDI | 6.7268 | 4.9158 *** (0.0000) | 4 |

| RE does not cause CO2 | 7.8991 | 7.0291 *** (0.0000) | 4 |

| CO2 does not cause RE | 4.2206 | 5.6614 *** (0.0000) | 2 |

| POPG does not cause CO2 | 1.1809 | 0.6522 (0.5143) | 1 |

| CO2 does not cause POPG | 10.2530 | 11.2727 *** (0.0000) | 4 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mentel, G.; Tarczyński, W.; Azadi, H.; Abdurakmanov, K.; Zakirova, E.; Salahodjaev, R. R&D Human Capital, Renewable Energy and CO2 Emissions: Evidence from 26 Countries. Energies 2022, 15, 9205. https://doi.org/10.3390/en15239205

Mentel G, Tarczyński W, Azadi H, Abdurakmanov K, Zakirova E, Salahodjaev R. R&D Human Capital, Renewable Energy and CO2 Emissions: Evidence from 26 Countries. Energies. 2022; 15(23):9205. https://doi.org/10.3390/en15239205

Chicago/Turabian StyleMentel, Grzegorz, Waldemar Tarczyński, Hossein Azadi, Kalandar Abdurakmanov, Elina Zakirova, and Raufhon Salahodjaev. 2022. "R&D Human Capital, Renewable Energy and CO2 Emissions: Evidence from 26 Countries" Energies 15, no. 23: 9205. https://doi.org/10.3390/en15239205

APA StyleMentel, G., Tarczyński, W., Azadi, H., Abdurakmanov, K., Zakirova, E., & Salahodjaev, R. (2022). R&D Human Capital, Renewable Energy and CO2 Emissions: Evidence from 26 Countries. Energies, 15(23), 9205. https://doi.org/10.3390/en15239205