1. Introduction

Currently, much attention is paid to the transition towards a greener economy in various countries. For example, Hanuláková et al. discussed how consumers and companies can minimize their carbon footprints using a case study from Slovakia [

1]. Chehabeddine and Tvaronavičienė [

2] focused on the sustainable regional development in Iran, China, and the USA. Dudin et al. [

3] presented the “energy trilemma” (energy efficiency, energy security, and environmental sustainability) based on data from the International Energy Agency, while Marino and Pariso [

4] studied the case of SMEs from the 13 European Union Member States that aimed at ensuring sustainable and competitive production.

However, there is one country that is rarely associated with the transition to a green economy and renewable energy in the academic literature, both due to the structure of its energy market and its energy export; this country is the Russian Federation. This is a pity because (as Strielkowski et al. [

5] demonstrate) Russia has recently embarked on a path towards the modernization of its energy systems as well as the promotion of decarbonization and various energy-saving initiatives. In addition, as Lisin et al. [

6] demonstrated, the Russian power utilities’ development strategy, which was drawn up to 2030, features the principles of sustainable development. Furthermore, Tarkhanova et al. [

7] declared that Russia has “huge and almost unused” opportunities for building its green economy, even though its trends and factors can be very different from most developed countries. This view is supported by many other papers describing the potentials and pitfalls of the Russian energy sector’s transition towards renewable energy and a carbon-free future [

8,

9,

10].

Nevertheless, despite the necessity of the course taken during the transition towards a green economy and Sustainable Development Goals (SDG) [

11,

12], everyone would probably agree that the economic feasibility of such direction has to be carefully estimated, and the respective economic policy needs to be developed [

13,

14,

15].

This paper aims to provide a novel insight with respect to the previous studies focusing on the transition of the Russian energy sector by revealing renewable energy perspectives via the analysis of the wholesale electricity market in Russia. The aim of this paper is to present a comprehensive theoretical and practical assessment of the specifics of the functioning of the Russian wholesale electricity and capacity market. Moreover, the scientific value added, as well as the addition brought by this work in comparison with previous research on the Russian wholesale electricity market, is that it presents estimates of the maximum effect of the operation of a solar power plant (SPP) in various zones of the Russian energy market.

The Russian electricity and capacity market operates on the principle of a two-tier system that is divided into wholesale and retail markets and also includes many groups of participants [

16,

17]. However, the operation of the retail market is almost entirely determined by the efficiency of the wholesale market where producers directly sell electricity to power supply companies and large industrial enterprises [

18,

19]. As a result, the price of electricity in the retail market at a range of 50–55% depends on its cost in the wholesale market. Working in the wholesale market is a long-term investment which allows for a reduction in the cost of energy by eliminating a number of price surcharges and an increase in the freedom to choose an energy sales company [

20,

21,

22,

23]. In Russia, just like everywhere else, the wholesale market sells two goods: electricity and power. If electricity represents a traditional service, then power is a fairly specific commodity. Its purchase gives a participant in the wholesale market the right to demand from the seller of capacity that the generating equipment be kept in full readiness. This ensures the generation of electricity of a specified quality in the amount necessary to meet the customer’s need for it [

24,

25,

26]. As a result, the acquisition of capacity makes it possible to avoid a shortage in the regions in the medium and long run. According to the requirements of current Russian legislation (Resolution 743 adapted in 2013), all generating plants with an installed capacity of over 25 MW may operate only in the wholesale market. Plants with a capacity of up to 25 MW may operate at their own choice—in the wholesale or retail market [

27].

The main issues tackled in this paper are as follows: (1) a study of the specifics of the organization of the wholesale electricity market from the point of view of the instruments used for trading in electricity and capacity to ensure liberalization, maintenance of balance in the market, and stimulation of new investments; (2) a description of the basic principles of pricing in the wholesale electricity market depending on the instruments used as well as the territorial, climatic, and economic generating features of the regions; (3) an analysis of the structures and reasons for the formation of the prices of electricity and capacity in the price and non-price zones of the wholesale electricity market; and (4) a comparative assessment of the annual income of a solar power plant in various zones of the wholesale market, as well as in the retail energy market.

This paper is structured as follows:

Section 2 provides an overview of the specific trading instruments used in the wholesale electricity market, depending on the type of goods sold. It also describes the main territorial zones of the wholesale market, which differ in a set of natural, economic, and technical characteristics and are highlighted in order to differentiate the approaches to pricing within them.

Section 3 is devoted to the structural assessment of trade in the wholesale market and the analysis of prices that are formed by types of goods in price zones. Similar results for the non-price zones of the wholesale market are presented in

Section 4.

Section 5 compares the estimated annual income of the solar power plant that it could receive from operating in various areas of the wholesale market, as well as in the retail market. Finally,

Section 6 is devoted to the presentation of the obtained results, a discussion of the main conclusions, and a record of the key implications.

Methodology

For the sake of clarity and transparency, we briefly describe the research methodology employed hereinafter in this paper, which involves sequential implementation of the following main steps:

- -

Studying the peculiarities of pricing in the Russian energy market (based on data on the type of market, the type of goods sold, existing trading instruments on the market as well as possible cases of their use, and the belonging of territories to different zones (price/non-price) or isolated energy systems) and making a comparison of the Russian and international experiences;

- -

Structural and cause-and-effect analyses of sales volumes and prices for electricity and capacity formed in the Russian wholesale energy market between 2017 and 2019, in the first and second price zones (by types of such trading instruments), and then, based on the obtained data, calculation of the weighted average prices for the purchase of electricity and capacity using various trading instruments (for two price zones) (the analysis is based on annual statistics provided by the NP Market Council);

- -

A structural analysis of the volume of trade in electricity and capacity in the territories of non-price zones of the wholesale energy market of Russia in 2018 and 2019, as well as indicative and actual prices for electricity in these territories, taking into account their specifics for the same period (the initial data for such an assessment are from the annual report of the NP Market Council);

- -

A scenario assessment of the value of the annual income of the solar power plant project in various areas of the wholesale market and the retail market, and then, taking the obtained data into account, conduction of a preliminary comprehensive analysis of prices for electricity and capacity in various price and non-price zones of the Russian wholesale energy market, as well as the prices formed in the retail market.

2. Specifics of Pricing in the Wholesale Electricity and Capacity Market in Russia

The cost of electricity and capacity in the Russian energy market is influenced by many factors [

28,

29,

30,

31,

32]. These include the use of specific trading instruments as well as being in a specific market area defined by the state [

33,

34,

35].

Figure 1 shows the main market types and instruments used in electricity and capacity trading. The following Sections (

Section 2.1 and

Section 2.2) describe the specifics of such tools used directly in the wholesale market in greater detail.

2.1. Electricity Trading Tools in the Russian Wholesale Market

Since 2011, regulated contracts (RC) have been concluded only in relation to the volume of electricity intended for supply to the population and for certain territories. Electricity tariffs for such contracts are calculated by special government agencies. Moreover, the volume of supplies under the RC is limited by federal antimonopoly legislation (no more than 35% of the total supply of electricity for each producer) [

37,

38]. The electricity volumes that are not covered by regulated contracts are sold at unregulated prices using other market instruments.

The day-ahead market (DAM) allows for competitive selection of price bids from suppliers and buyers a day before the actual supply of electricity with predetermined prices and delivery volumes for each hour of the next day [

39,

40,

41,

42]. The DAM price is determined by balancing supply and demand and applies to all market participants. The volumes of planned production include the volumes of electricity for which bids with the lowest prices have been submitted and the volumes of planned consumption, which are those that buyers are ready to buy at the highest price or accept any prices prevailing in the market.

In addition, in the DAM, only the planned production and consumption volumes for the next day are determined; however, the actual consumption may differ significantly from the planned one. In this case, deviations in production and consumption are traded in real time in the balancing market (BM) [

43,

44]. Every three hours before the actual delivery, additional competitive selections of suppliers’ bids are carried out, taking into account the updated forecast for consumption in the power system. As a result, one of two possible situations arise: the price for the DAM can be higher or lower than the price for the BM.

When concluding free bilateral contracts (FBCs) [

45], market participants individually and independently determine counterparties, prices, and volumes of electricity supply. The main advantage of these contracts is the ability to thoroughly analyze the consumer, identify risks, and develop a program to manage these risks. However, at present, the relative unpopularity of FBCs is due to the lack of a sufficient number of large solvent consumers in the electricity market.

This structure of the Russian wholesale market, where electricity is traded, has many similarities with some individual European markets. For instance, the Italian spot market also consists of different segments [

46]: a day-ahead market (MGP), intraday markets (MIs), and an ancillary services market (MSD). Most of the sales and purchases of electricity here are carried out in the MGP segment. Similar to the Russian DAM, in this market, the prices and demand for the next day are determined using hourly parallel auctions.

The Italian energy market is balanced by the MI and MSD segments (similar to the Russian BM). In particular, the MIs allow operators to change the I/O schedules previously defined by the MGP, while the MSD market is designed for real-time balancing and energy storage. However, there are no instruments similar to the RC and FBC in the Italian spot market, which is most likely due to the specifics of the Russian energy sector. In addition, the Italian energy market, similar to the Russian one, is divided into zones: there are six main geographical zones and five limited production sites. Due to transmission restrictions and the behavior of providers, prices in these areas may also vary. The specifics of pricing in the zones of the Russian wholesale electricity and capacity market are presented further in

Section 2.3 of this paper.

2.2. Capacity Trading Instruments in the Russian Wholesale Market

Long-term competitive capacity take-off (CPT) is the main mechanism of purchases and sales in the wholesale market. The CPT’s task is to identify the generating facilities whose capacity meets demand in the most cost-effective way (at a lower price). The price for capacity sold as a result of the CPT is set for each price zone (for more details see

Section 2.3), subject to the following conditions [

47]:

- -

This is the same price for all generating facilities selected in the same price zone;

- -

This is the maximum price at which the entire demand for capacity selected according to the results of the CPT is satisfied.

If the specified demand for capacity exceeds the payable amount, it is possible to carry out a corrective competitive power take-off. Since 2016, the capacity has been achieved annually for each year for the three calendar years after the given CPT within the framework of the CPT [

48].

If the generating facility is not selected for competitive power take-off, then it can stop operation, trade only in electricity, or go into the category of generator operating in a forced mode (FM). Such capacities cannot operate in the market on general terms due to the high cost of the energy produced. At the same time, maintaining them in working order is necessary to ensure stability of the entire power system. They cannot be excluded from the power supply process due to the threat to the reliability of the power system in the region. However, the cost of such capacity is already set by the antimonopoly authority and does not exceed the price based on the results of the CPT for the previous period [

49].

Capacity supply agreements (CSA) are a special mechanism that stimulates investment in the power industry and ensures that investors fulfil their obligations to commission-generating capacities, including those based on renewable energy sources (RES) [

50,

51,

52,

53,

54]. On the one hand, the purpose of the CSA is to guarantee the commissioning of an energy facility with an installed capacity by a certain date. On the other hand, this mechanism provides guarantees for investors on the return of the invested amount and a certain rate of return within 15 years. The price for capacity supplied under CSA is determined based on the need to ensure the return on invested capital and the established rate of return. In essence, this mechanism shifts payment of the costs of building a new one, as well as modernizing the existing generation, to the final consumers, ensuring a return on investment to the owners of generating facilities. The facilities selected under the CSA are accounted for at the CPT as a priority in relation to the existing generation. The CSA mechanism is used in the Russian energy market to support the development of new nuclear power plants (NPP), hydroelectric power plants (HPP), and thermal power plants (TPP), as well as generating facilities operating on the basis of renewable energy sources [

55,

56,

57,

58,

59,

60].

Hence, the conclusion of free capacity purchase and sale agreements (FCPSA) [

61,

62] is carried out by market participants on an individual basis. Using this tool, they independently determine their counterparties, prices, and delivery volumes according to the same rules as the FBC mechanism for electricity trading.

Regulated contracts (RCs) for the sale of capacity operate on principles similar to electricity trade [

63,

64]. They are calculated only for the amount of power that is intended for the population.

2.3. Zones of the Russian Wholesale Electricity and Capacity Market

In addition to the type of product and the type of market and trading instruments, pricing on the wholesale electricity and capacity market depends on the affiliation of end consumers in a particular region. Hence, in Russia, there are several zones of the wholesale electricity and power market that can be identified, for which different mechanisms for the formation of prices for electricity and capacity have been developed (

Figure 2). Division into these zones is based on the following conditions: (1) economic—the volume of energy consumption taking into account the population density and growth rates of industrial production, (2) climatic, (3) the existing structure of energy generation, (4) the quality of the already established energy infrastructure, and (5) remoteness of individual regions. As a result, the prices for electricity and capacity in these territories can vary significantly (see

Figure 2 that follows).

In two price zones of the wholesale market, electricity is supplied to industrial enterprises, with the exception of certain territories, on a competitive basis at prices not regulated by the state. The first price zone includes the territories of the European part of Russia and the Urals, and the second is represented by Siberia.

In non-price zones, for technological reasons (due to low transmission capacity of networks), the organization of competitive market relations in the electric power industry is currently impossible. Therefore, the sale of electricity and capacity is carried out according to special rules and at state-regulated prices (tariffs).

In an isolated zone of the energy market that is not connected to a single national power grid, competition is basically impossible. Consequently, the power system here functions without a wholesale market, and prices for electricity and capacity are also regulated by the state. The share of these regions in the total energy consumption in the country does not exceed 2%.

3. Analysis of Prices for Electricity and Capacity in the Price Zones of the Wholesale Electricity Market in Russia

In modern practice, a plethora of research papers is devoted to the analysis of prices for electricity and capacity, not only in Russia [

66,

67,

68], but also in foreign wholesale markets [

69,

70,

71,

72]. Such works are usually devoted to studying the dependence of prices on demand [

73], the influence of various regional factors on pricing, the antimonopoly regulation of prices in the wholesale market [

23], the impact of the spreading “green” low-carbon energy on the price level [

74], and various pricing technologies [

75,

76].

Moreover, further down this section, we present the formed structure of trade and the actual dynamics of the value of goods on the market. In addition, we study the main reasons that influenced the formation of prices for electricity and capacity on the wholesale electricity market between 2017 and 2019.

3.1. Analysis of Electricity Prices in the Price Zones of the Wholesale Market

The volumetric structure of electricity trade in Russia split into two price zones is shown in

Figure 3 and

Figure 4. From 2017 to 2019, the general structure of electricity sales in each price zone did not fundamentally change, and fluctuations in individual market instruments remained within 2%. The bulk of electricity, both in the first and second price zones, was sold on the day-ahead market (over 70%). Otherwise, there were fundamental structural differences between price zones. Thus, in the first price zone, a little less than 20% falls on contracts at regulated prices, about 5%—on the balancing market, and less than 1%—on free bilateral contracts. In the second price zone, market shares are distributed more evenly: 10% falls on contracts at regulated prices, 5%—on the balancing market, and 15.3%—on free bilateral contracts. Moreover, both zones are characterized by a single trend—a gradual decrease in the share of DAM and BM and an increase in bilateral agreements of the types of RC and FBC.

The weighted average monthly electricity prices formed in the first and second price zones of the wholesale market for 2017–2019 are presented in

Figure 5 and

Figure 6.

The day-ahead market, which is dominant in the European part of Russia and the Urals (first price zone), as well as in Siberia (second price zone), is generally characterized by higher average electricity prices when compared to other market instruments. This means that the DAM tool effectively predicts the volume of electricity consumption in these territories.

Thus, the DAM index in the price zone of Europe and the Urals is gradually growing. In 2019, it was fixed at 1287.2 rubles/MWh, which is 3.2% higher than the previous year. In 2018, the index amounted to 1247.0 rubles/MWh and exceeded the value of 2017 by 3.6% (1203.7 rubles/MWh). The following reasons had the greatest impact on such price growth dynamics in the first zone of the DAM:

Growth in the average hourly demand and supply for electricity (1.4% and 1.6%, respectively) in 2018;

A slight decrease in the average hourly demand and supply for electricity (0.3% on average) in 2019;

An average decrease in the generation of hydroelectric power plants due to the decrease in hydropower reserves in 2019 (however, the decline in prices in the market in the autumn months of 2019 is due to the opposite effect—an increase in the generation of hydroelectric power plants due to seasonal high water);

A decrease in imports from Kazakhstan and an increase in exports to the energy systems of the Baltic States, Ukraine, the Republic of Belarus, and Finland;

A phased increase in gas tariffs (in 2019—by 3.4%; in 2018—by 3.5%);

The commissioning of a new power unit of the Rostov-on-Don NPP;

Growth in RES generation: an average of 174 MWh in 2019 compared to 107 MWh in 2018.

The second market zone in Siberia is also characterized by an increase in the average price of the DAM, but more abruptly. In 2019, the DAM index amounted to 896.5 rubles/MWh, which was only 0.2% higher than the value of the previous year. In 2018, the index was 894.5 rubles/MWh, and the value in 2017 increased by 3.4%. This dynamic is due to the following factors:

- –

Growth in average hourly demand and supply in 2018 by 2.3% and 2.9%, respectively;

- –

Growth in average hourly demand and supply by 0.6% in 2019;

- –

An increase in the generation of hydroelectric power plants in January–April 2019 restrained the growth of prices, and its decrease in May–June 2019 contributed to the maintenance of price levels at the beginning of the year;

- –

Availability of network restrictions on power flow between separate parts of the second price zone in 2019;

- –

Consistency of RES generation volumes: on average 11 MWh in 2019 and 10 MWh in 2018.

3.2. Analysis of Capacity Prices in the Price Zones of the Wholesale Market

The structure of capacity sales in the Russian wholesale market is shown in

Figure 7 and

Figure 8. In contrast to electricity trade in this sector, the structure of the first and second zones differs significantly.

In the zone of Europe and the Urals, the contribution of the main market instruments of capacity trading (CPT, FCPSA, RC, and CSA) is almost evenly distributed, with the exception, as a rule, of the infrastructure operation of power plants in forced modes. For the price zone of Siberia, a different situation is characteristic: in the structure of capacity trade, the dominant share is occupied by the CPT instrument (64% by the end of 2019), and the share of forced regimes has significantly decreased to 2.2%.

The contribution of the main and market instruments CPT and FCPSA to the total volume of capacity trading in the first price zone is only 50–52%, while in the second price zone, it lies within 72%. The current structure is explained by the presence of a forced component in the capacity trading market, namely, capacity supply contracts. In the first zone, their share reaches 20%, and, in the second, their share reaches 7%.

The availability of CSA for the modernization of thermal generation, support for the nuclear and hydraulic generation, or construction of generation based on renewable energy sources indicates that at the current stage the level of market prices for electricity and capacity in Russia does not provide payback for the construction of any type of generation without specific state support [

79,

80]. The calculated average cost of capacity by the types of market instruments and price zones is presented in

Table 1 and

Table 2.

The indicators for 2019 demonstrate an increase in the cost of capacity in the price zones of the wholesale market for almost all trading instruments. The only exception is the CSA mechanism, in terms of renewable energy. The level of state support for renewable energy generation through CSA is gradually decreasing. During the period covered by our study, the average cost of such capacity in the price zone of Europe and the Urals decreased by 17.7%, and it decreasedby 12.1% in Siberia.

Nevertheless, in 2019, the capacity price formed in the CSA RES in the first price zone exceeds the level of the market price for capacity determined by the operating costs of the existing generation (CPT) by almost 10 times, and in the second price zone by 11.5 times. The relative difference between the indicator data is gradually levelled out.

3.3. Weighted Average Unregulated Prices in the Price Zones of the Wholesale Market

The final weighted average unregulated market prices (WAUMP) for electricity and capacity of the wholesale market for 2017–2019 are shown in

Table 3. The presented data reflect the level of free prices for electricity and capacity for consumers of the Russian retail electricity market. During the study period, the cost of electricity and power in the first price zone always exceeds the same indicators in the second zone. Thence, in 2019, the average unregulated price for electricity including the capacity in the zone of Europe and the Urals was 1.4 times higher, and it was 1.3 times higher exclusively for capacity.

Meanwhile, the cost of electricity and capacity in the price zones of the wholesale market is constantly growing. In general, the rise in prices does not go beyond the established dynamics. However, the largest increase was recorded in the cost of capacity in the first price zone in 2019 and amounted to 20%. This price change is due to two main facts:

- -

An increase in the cost of purchasing capacity under the CSA of NPPs/HPPs by 48%, due to the start of the power supply from the power units of Rostov NPP and Leningrad NPP-2;

- -

An increase in the cost of purchasing capacity under CSA RES by more than 2.5 times, due to the commissioning of new facilities supplying capacity under this type of contract.

4. Analysis of Prices for Electricity and Capacity in the Non-Price Zones of the Russian Wholesale Electricity Market

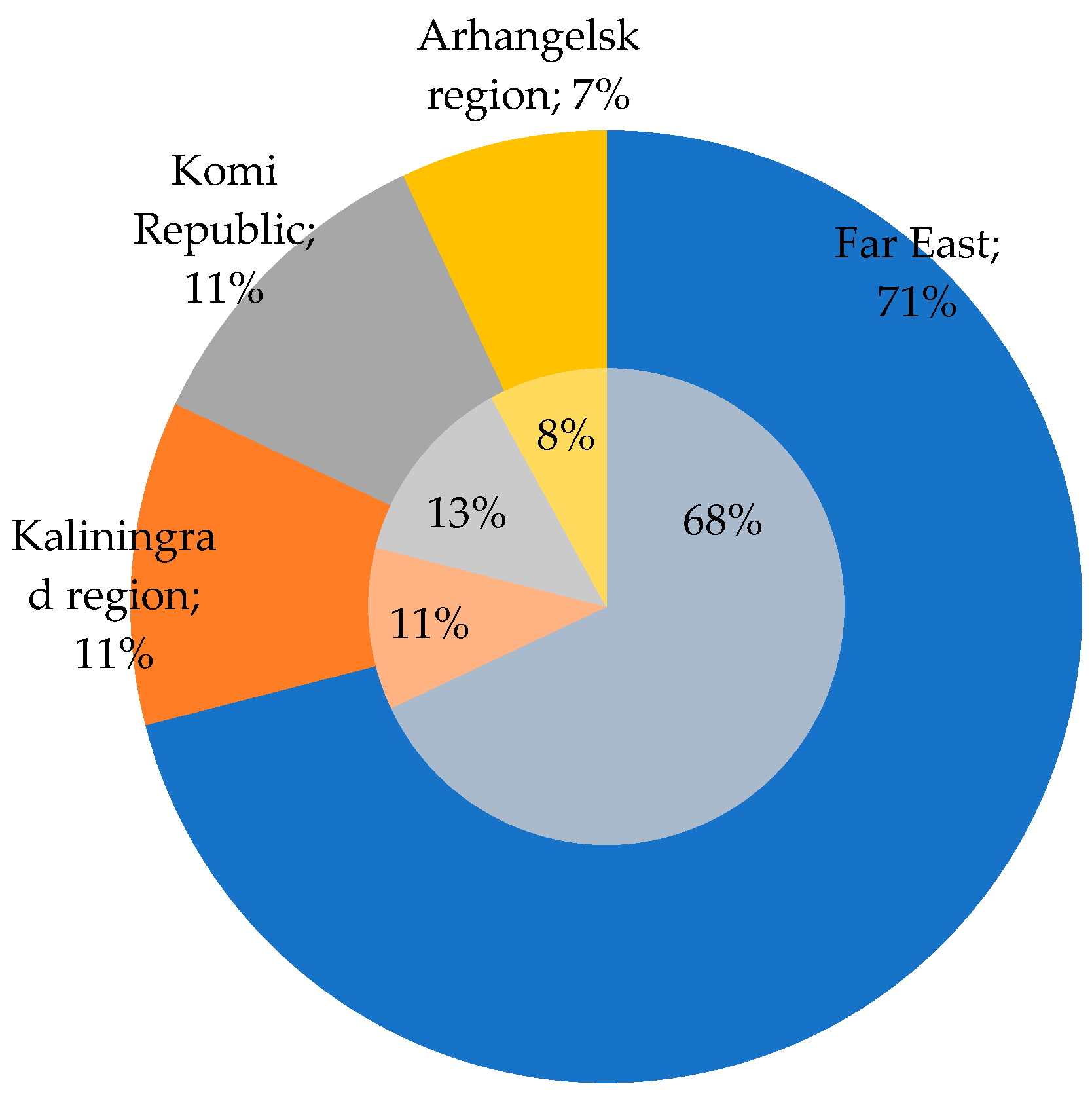

The non-price zones of the Russian wholesale market, with some exceptions, include the following regions: Kaliningrad and Arkhangelsk regions, the Komi Republic, and the territory of the Far East (

Figure 2). The structure of electricity purchases and the installed capacity of power plants in this zone are shown in

Figure 9 and

Figure 10. In total, for non-price zones in 2019, the volume of purchases on the wholesale market increased by 11% compared to 2018 and amounted to 52.8 billion kWh.

In the non-price zones of the wholesale market, the price for electricity and capacity is set by the state every six months. The dynamics of the average annual electricity price in this sector is presented in

Table 4.

The change in the actual price in comparison with the indicative price in this zone is mainly due to the change in cost of the planned hourly electricity consumption and the structure of its generation.

On average, the price for electricity in these territories exceeds 1 thousand rubles/MWh. However, there are some exceptions. The main factor determining the lower cost of electricity in the Far East is the implementation of the National Development Program for this area beginning in 2013 [

81,

82,

83]. To enhance investment activities in the region, the electricity tariff for industrial enterprises is set below the average level, and the draft program proposes to extend this benefit until 2028. In order to increase population density and stimulate the development of local territories, the electricity price for the population in the Far East is also the lowest level among all regulated zones. For the same reasons, the cost of capacity in the Far East is higher than in other regions of the non-price zones of the wholesale electricity market.

5. Income of a Solar Power Plant in Various Zones of the Wholesale Market and the Retail Market of Russia

The analysis of the prices for electricity and capacity in the wholesale electricity market indicates the existence of a significant difference in the cost of these goods for consumers, depending on regional affiliation. This section presents the results of a comparative analysis of the maximum annual income of the SPP, provided it operates in the price and non-price zones of the wholesale market, as well as in the retail market. The purpose of such an analysis is to assess in which zone of the Russian energy market, and under what conditions, there are more economic incentives for an SPP for the sale of electricity and capacity.

5.1. Case-Study: Basic Characteristics of the SPP Project

We consider the project of a solar power plant as an example. The main characteristics of this SPP are presented below and are as follows:

- –

The installed capacity is 10 MW;

- –

the installed capacity utilization factor is 17%;

- –

the estimated annual volume of electricity supply—14.89 thousand MWh.

The conditions stipulate that this station would operate on the market without specific support from the state in the form of a CSA. It is assumed that this station plans to sell electricity and capacity in the first and second price zones, as well as in the non-price zones, of the wholesale market. Additionally, the assessment of the SPP income was carried out at the prices of the retail energy market.

5.2. SPP Annual Income in the Price Zones of the Wholesale and Retail Markets

Taking into account the weighted average level of prices for electricity and capacity in the price zones of the wholesale market (

Table 3), an assessment of the SPP income was carried out when operating in these two zones. Calculations were made at average prices in 2018. The maximum possible annual income that can be received by a power plant operating on market conditions without government support is presented in

Table 5.

Our calculations show that the annual income that can be received by a similar solar power plant from the sale of electricity and capacity on the wholesale electricity and capacity market is up to 44.1 million rubles in the first price zone and up to 36.4 million rubles in the second price zone. For the sake of comparison, the sale of electricity and capacity in the retail market would provide a higher annual income by price zones—up to 95.9 and 82.9 million rubles, respectively. The significant difference in income on the wholesale and retail markets is due to the fact that consumers at the wholesale market are not subject to the additional financial burden from all types of CSA.

5.3. Annual Income of SPP in Non-Price Zones of the Wholesale Market

The maximum possible annual income of an SPP in the non-price zones of the wholesale electricity market, calculated at the prices of the second half of 2018, is presented in

Table 6.

Our calculations show that the sale of electricity and SPP capacity in non-price zones is economically more feasible than working in the price zones of the wholesale market. In this case, the annual effect increases by an average of 74%. The reasons for such a significant increase are associated with the higher level of prices for electricity (for the Kaliningrad, Arkhangelsk regions, and the Komi Republic) and capacity (for the Far East) regulated in remote regions of the non-price zone. Prices in the form of tariffs are set there by state directive, in comparison with the value formed in the market in price zones. However, the SPP income received in the non-price zone still remains lower than when a solar power plant operates in the retail market.

6. Discussion

Overall, one can see that the Russian energy market represents a complex and rather specific system. It consists of two levels—wholesale and retail markets, two types of goods—electricity and capacity, combines natural monopoly and market types of energy business, and also includes a set of trading instruments balancing the energy market, and many public and private participants. The transition to such rules of the game is associated with the gradual liberalization of the Russian energy market, which started back in 2001. According to widespread opinion, by the beginning of 2011, market liberalization was fully completed. Nowadays, the cost of electricity on the Russian energy market is formed based on the ratio of supply and demand. Only the price of electricity for the population continues to be regulated by the state. The main financial instrument of the market is the payment for capacity. It is this mechanism that guarantees investors a return on invested resources.

In addition, it can be shown that the cost of electricity and capacity in Russia is initially formed according to territorial principles, and subsequently by using a variety of market trading instruments which take into account the deficit/surplus of electricity and capacity for a set period. The analysis of prices on the wholesale market for different zones made it possible for us to calculate the maximum annual effect that a solar power plant can receive when operating in different zones of the energy market. Hence, on the wholesale market, it will receive the maximum annual income in the non-price zone in the Far East. With the lowest electricity prices, the cost of power is the highest. A comparative analysis of settlements for the wholesale electricity and power market with the retail market zones shows that the annual income from the sale of electricity and capacity there significantly exceeds the effect obtained even in the Far East. As a result, we formulated the premise that Russia has formed a powerful economic incentive for the transition of mainly small generation from the wholesale market to the retail one.

7. Conclusions

All in all, our comprehensive study of the wholesale electricity and capacity market in Russia has shown that its pricing depends on many factors. These include the type of goods sold, belonging to a certain zone of the wholesale electricity and capacity market which differs in climatic and economic characteristics, current and future structures of generating capacities, as well as the employed trading instruments.

Based on the results of the analysis of unregulated prices for the wholesale electricity market, we found that the cost of electricity in the first price zone (the European part of Russia and the Urals) for all types of trading instruments is significantly higher than in the second (Siberia) and is characterized by smoothed dynamics. This is due to the fact that new generating capacities of nuclear power have been introduced in the first market zone, renewable energy is developing at a higher rate, and the volume of exports to the energy systems of neighboring countries has also increased. At the same time, the structure of electricity trade in both zones is characterized by the overwhelming share of the day-ahead market. With regard to the sale of capacity in the price zones of the wholesale electricity market, the trade structure is fundamentally different. While in the first price zone the contribution of the main market instruments is distributed almost evenly, in the second price zone, there is an absolute dominance of competitive power take-off. The presence in the structure of each of the zones of contracts for the supply of capacity for certain types of generation indicates the low level of current payback of the construction of generation without specific support from the state. Due to regional features, the cost of power in the first zone also exceeds the indicators in the second zone. Nevertheless, each of them is characterized by a decrease in state support for renewable energy sources through CSA and an increase in support for thermal power plants. As a result, in the first zone, the weighted average unregulated price for electricity, taking into account the cost of capacity, is higher than in the second zone.

In the non-price zones of the Russian wholesale electricity market, the structure of electricity purchase and installed capacity by regions practically coincides and remains unchanged during 2018–2019. The predominant share of the Far East in this sector is due to both its large territory and active federal support for the region. Such government incentives are the main reasons for the low prices for electricity and the high prices for capacity in the Far East as compared to the more economically developed Kaliningrad region, Arkhangelsk region, and the Komi Republic.

In addition, we conducted an empirical assessment of the maximum annual income of a solar power plant when operating in various zones of the wholesale and retail markets. The object of our case study was an SPP with an installed capacity of 10 MW which plans to enter the market independently without state support. Our calculations revealed that on the wholesale market, the largest annual income for an SPP will be in the Far East, mainly due to the more expensive capacity. The effect of working in other zones of the wholesale market is almost two times lower. However, an SPP can achieve its maximum income only when working in the retail energy market due to additional payments by consumers of intermediaries’ premiums.

To sum this up, it becomes apparent that Russia is actually creating a powerful economic incentive for the transition of energy generation from the wholesale sector to the retail market. In the retail market, the cost of electricity and capacity for end users increases significantly due to surcharges from the power grid companies. However, when concluding direct contracts for the supply of electricity and capacity between the owners of generating capacities and the end users, excluding intermediaries in the form of power grid companies, an additional economic effect arises. This effect is enhanced when small generation facilities are located near or on the territory of consumers. As a result, generation owners and consumers can share the effect with the exclusion of payment for electricity and capacity transmission services.

Author Contributions

Conceptualization, G.C., M.T., L.G., W.S., J.S., and Y.P.; methodology, G.C. and J.S.; validation, G.C., M.T., LG., W.S., J.S., and Y.P.; formal analysis, G.C., M.T., W.S., J.S., and Y.P.; resources, G.C., W.S., and J.S.; writing—original draft preparation: G.C., M.T., L.G., W.S., J.S., and Y.P.; project administration, G.C. and W.S. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by a grant from the President of the Russian Federation (MK-4549.2021.2).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

| BM | Balancing market |

| CPT | Competitive power take-off |

| CSA | Capacity supply agreements |

| DAM | Day-ahead market |

| FBC | Free bilateral contracts |

| FCPSA | Free capacity purchase and sale agreements |

| FM | Generator operating in a forced mode |

| HPP | Hydroelectric power plant |

| MW | Megawatt |

| MWh | Megawatt-hour |

| NPP | Nuclear power plant |

| RC | Regulated contracts |

| RES | Renewable energy sources |

| SPP | Solar power plant |

| WAUMP | Weighted average unregulated market price |

| TPP | Thermal power plant |

References

- Hanuláková, E.; Daňo, F.; Kukura, M. Transition of business companies to circular economy in Slovakia. Entrep. Sustain. Issues 2021, 9, 204–220. [Google Scholar] [CrossRef]

- Chehabeddine, M.; Tvaronavičienė, M. Securing regional development. Insights Into Reg. Dev. 2020, 2, 430–442. [Google Scholar] [CrossRef]

- Dudin, M.N.; Frolova, E.E.; Protopopova, O.V.; Mamedov, A.A.; Odintsov, S.V. Study of innovative technologies in the energy industry: Nontraditional and renewable energy sources. Entrep. Sustain. Issues 2019, 6, 1704–1713. [Google Scholar] [CrossRef]

- Marino, A.; Pariso, P. The transition towards to the circular economy: European SMEs’ trajectories. Entrep. Sustain. Issues 2021, 8, 431–445. [Google Scholar] [CrossRef]

- Strielkowski, W.; Sherstobitova, A.; Rovny, P.; Evteeva, T. Increasing Energy Efficiency and Modernization of Energy Systems in Russia: A Review. Energies 2021, 14, 3164. [Google Scholar] [CrossRef]

- Lisin, E.; Rogalev, A.; Strielkowski, W.; Komarov, I. Sustainable modernization of the Russian power utilities industry. Sustain. Basel 2015, 7, 11378–11400. [Google Scholar] [CrossRef] [Green Version]

- Tarkhanova, E.A.; Chizhevskaya, E.L.; Fricler, A.V.; Baburina, N.A.; Firtseva, S.V. Green economy in Russia: The investments’ review, indicators of growth and development prospects. Entrep. Sustain. Issues 2020, 8, 649–661. [Google Scholar] [CrossRef]

- Lisin, E.; Marishkina, Y.; Strielkowski, W.; Streimikiene, D. Analysis of competitiveness: Energy sector and the electricity market in Russia. Econ. Res. Ekon. Istraživanja 2017, 30, 1820–1828. [Google Scholar] [CrossRef]

- Polyakov, M.; Khanin, I.; Shevchenko, G.; Bilozubenko, V. Constructing a model of national production system for building a circular economy. Entrep. Sustain. Issues 2021, 9, 287–299. [Google Scholar] [CrossRef]

- Tishkov, S.; Shcherbak, A.; Karginova-Gubinova, V.; Volkov, A.; Tleppayev, A.; Pakhomova, A. Assessment the role of renewable energy in socio-economic development of rural and Arctic regions. Entrep. Sustain. Issues 2020, 7, 3354–3368. [Google Scholar] [CrossRef]

- Radavičius, T.; Van der Heide, A.; Palitzsch, W.; Rommens, T.; Denafas, J.; Tvaronavičienė, M. Circular solar industry supply chain through product technological design changes. Insights Into Reg. Dev. 2021, 3, 10–30. [Google Scholar] [CrossRef]

- Khoshnava, S.M.; Rostami, R.; Zin, R.M.; Štreimikienė, D.; Yousefpour, A.; Strielkowski, W.; Mardani, A. Aligning the criteria of green economy (GE) and sustainable development goals (SDGs) to implement sustainable development. Sustain. Basel 2019, 11, 4615. [Google Scholar] [CrossRef] [Green Version]

- Giacomella, L. Techno-economic assessment (TEA) and life cycle costing analysis (LCCA): Discussing methodological steps and integrability. Insights Into Reg. Dev. 2021, 3, 176–197. [Google Scholar] [CrossRef]

- Brożyna, J.; Strielkowski, W.; Fomina, A.; Nikitina, N. Renewable energy and EU 2020 target for energy efficiency in the Czech Republic and Slovakia. Energies 2020, 13, 965. [Google Scholar] [CrossRef] [Green Version]

- Andryeyeva, N.; Nikishyna, O.; Burkinskyi, B.; Khumarova, N.; Laiko, O.; Tiutiunnyk, H. Methodology of analysis of the influence of the economic policy of the state on the environment. Insights Into Reg. Dev. 2021, 3, 198–212. [Google Scholar] [CrossRef]

- Ela, E.; Milligan, M.; Bloom, A.; Cochran, J.; Botterud, A.; Townsend, A.; Levin, T. Overview of Wholesale Electricity Markets. In Electricity Markets with Increasing Levels of Renewable Generation: Structure, Operation, Agent-based Simulation, and Emerging Designs, 1st ed.; Lopes, F., Coelho, H., Eds.; Springer International Publishing: Cham, WA, USA, 2018; pp. 3–21. [Google Scholar] [CrossRef]

- Gitelman, L.D.; Ratnikov, B.E. Economics and Business in the Electric Power Industry: An Interdisciplinary Textbook Ekonomika i Biznes v Elektroenergetike: Mezhdisciplinarnyj Uchebnik, 1st ed.; Ekonomika: Moscow, Russia, 2013; pp. 100–110. [Google Scholar]

- Trachuk, A.; Sandler, D.G. Methods of Evaluation of the Market Power Level on the Wholesale Electricity Market. In Challenges and Solutions in the Russian Energy Sector. Innovation and Discovery in Russian Science and Engineering, 1st ed.; Syngellakis, S., Brebbia, C., Eds.; Springer International Publishing: Cham, WA, USA, 2018; pp. 11–18. [Google Scholar] [CrossRef]

- Karpov, Y.S. Managing the Structure of the Russian Wholesale Electricity and Capacity Market, Aimed at Increasing Competition among Market Participants Upravlenie Strukturoj Rossijskogo Optovogo Rynka Elektroenergii i Moshchnosti, Orientirovannoe na Povyshenie Konkurencii Uchastnikov Rynka, 1st ed.; Moskovskij politekhnicheskij universitet: Moscow, Russia, 2016; pp. 50–60. [Google Scholar]

- Dzyuba, A.P.; Solovyeva, I.A. The study of instruments for managing the demand on energy consumption within the frames of wholesale and retail electricity markets in Russia. J. Econ. Entrep. Law 2016, 6, 147–162. [Google Scholar] [CrossRef] [Green Version]

- Dzyuba, A.P.; Solovyeva, I.A. Regional Aspects of Price-Dependent Management of Expenditures on Electric Power. Econ. Reg. 2020, 16, 171–186. [Google Scholar] [CrossRef]

- Zolotova, I.Y.; Dvorkin, V.V. Short-term forecasting of prices for the Russian wholesale electricity market based on neural networks. Stud. Russ. Econ. Dev. 2017, 28, 608–615. [Google Scholar] [CrossRef]

- Vasin, S.G.; Kirillova, O.Y.; Mihnenko, V.A. Antitrust regulation of prices in the wholesale and retail electricity markets [Antimonopol’noe regulirovanie cen na optovom i roznichnom rynkah elektroenergii]. Vestn. MIRBIS 2020, 2, 57–63. [Google Scholar] [CrossRef]

- Davidson, M.R.; Labutin, G.V. Market Applications in the Electricity Market of the Russian Federation. Int. J. Public Admin. 2019, 42, 1363–1369. [Google Scholar] [CrossRef]

- Lisin, E.; Amelina, A.; Strielkowski, W.; Lozenko, V.; Zlyvko, O. Mathematical and Economic Model of Generators’ Strategies on Wholesale Electricity Markets. Appl. Math. Sci. 2015, 9, 6997–7010. [Google Scholar] [CrossRef]

- Treshcheva, M.; Anikina, I.; Sergeev, V.; Skulkin, S.; Treshchev, D. Selection of Heat Pump Capacity Used at Thermal Power Plants under Electricity Market Operating Conditions. Energies 2021, 14, 226. [Google Scholar] [CrossRef]

- About Modification of Some Acts of the Government of the Russian Federation Concerning Competitive Power Selection for 2014. O Vnesenii Izmenenij v Nekotorye Akty Pravitel’stva Rossijskoj Federacii po Voprosam Provedeniya Konkurentnogo Otbora Moshchnosti na 2014 God. Available online: http://www.consultant.ru/document/cons_doc_LAW_151244/ (accessed on 10 December 2021).

- Annual Report on the Activities of the Association “NP market Council”. 2019. Godovoj Otchet o Deyatel’nosti Associacii “NP Sovet rynka”. Available online: https://www.np-sr.ru/sites/default/files/1_godovoy_otchet_0.pdf (accessed on 25 November 2021).

- Bowler, B.; Asprou, M.; Hartmann, B.; Mazidi, P.; Kyriakides, E. Enabling Flexibility through Wholesale Market Changes—A European Case Study. In Lecture Notes in Electrical Engineering, 1st ed.; Németh, B., Ekonomou, L., Eds.; Springer International Publishing: Cham, WA, USA, 2020; pp. 13–22. [Google Scholar] [CrossRef] [Green Version]

- Luo, G.; He, Y.; Zhao, C.; Zhang, X.; Lin, S.; Zhao, Y. Coordinated wholesale and retail market mechanism for providing demand-side flexibility. In Proceedings of the 2019 IEEE Sustainable Power and Energy Conference (iSPEC), Beijing, China, 21–23 November 2019; Volume 11, p. 8975245. [Google Scholar] [CrossRef]

- Lisin, E.; Strielkowski, W. Modelling new economic approaches for the wholesale energy markets in Russia and the EU. Transform. Bus. Econ. 2014, 13, 566–580. [Google Scholar]

- Nicholson, E. Procuring Flexibility in Wholesale Electricity Markets. Curr. Sustain. Renew. Energy Rep. 2019, 6, 100–106. [Google Scholar] [CrossRef]

- Appendix 1 to the Rules of the Wholesale Electricity and Capacity Market. Prilozhenie 1 k Pravilam Optovogo Rynka Elektricheskoj Energii i Moshchnosti. Available online: http://www.consultant.ru/document/cons_doc_LAW_112537/0031aaf5154fadf854e9d6d931259f7e6e89cc44/ (accessed on 15 December 2021).

- Konoplyanik, A.A. Russian gas at European energy market: Why adaptation is inevitable. Energy Strateg. Rev. 2012, 1, 42–56. [Google Scholar] [CrossRef]

- Akhmetshin, E.M.; Kopylov, S.I.; Lobova, S.V.; Panchenko, N.B.; Kostyleva, G. Specifics of the fuel and energy complex regulation: Seeking new opportunities for Russian and international aspects. Int. J. Energy Econ. Policy 2018, 8, 169–177. [Google Scholar]

- Overview of the Russian Electric Power Industry. Obzor Elektroenergeticheskoj Otrasli Rossii. Available online: https://www.ey.com/Publication/vwLUAssets/EY-power-market-russia-2018/$File/EY-power-market-russia-2018.pdf (accessed on 10 December 2021).

- Butuzov, V.A.; Amerkhanov, R.A.; Grigorash, O.V. Geothermal power supply systems around the world and in Russia: State of the art and future prospects. Therm. Eng. 2018, 65, 282–286. [Google Scholar] [CrossRef]

- Avdasheva, S.; Gimadi, V. Investor response to tariff options under regulation by contract: Evidence from Russian heating concessions. Util. Policy 2019, 57, 67–74. [Google Scholar] [CrossRef]

- Carvallo, J.P.; Murphy, S.P.; Sanstad, A.; Larsen, P.H. The use of wholesale market purchases by U.S. electric utilities. Energy Strateg. Rev. 2020, 30, 100508. [Google Scholar] [CrossRef]

- Chen, Y.; Sun, Y.; Li, B.; Yang, D.; Liu, D. The design of multi-energy market trading systems considers the wholesale and retail markets. IOP C. Ser. Earth. Environ. 2020, 513, 012022. [Google Scholar] [CrossRef]

- Miyamoto, T.; Kitamura, S.; Naito, K.; Mori, K.; Izui, Y. Distributed day-ahead scheduling of community energy management system group considering uncertain market prices using stochastic optimization. IEEJ Trans. Electr. Electron. Eng. 2020, 15, 401–408. [Google Scholar] [CrossRef]

- Negash, A.I.; Westgaard, S. Evaluating optimal cost-effectiveness of demand response in wholesale markets. In Proceedings of the 2018 IEEE Power & Energy Society General Meeting (PESGM), Portland, OR, USA, 5–10 August 2018; Volume 8, p. 8586377. [Google Scholar] [CrossRef] [Green Version]

- Farrokhseresht, M.; Paterakis, N.G.; Gibescu, M.; Slootweg, J.G. Participation of a combined wind and storage unit in the day-ahead and local balancing markets. In Proceedings of the 2018 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; Volume 6, p. 8469877. [Google Scholar] [CrossRef]

- Report on the Functioning of the Russian Unified Energy System 2019. Otchet o Funkcionirovanii Edinoj Energeticheskoj Sistemy Rossii 2019. Available online: http://match.ah.ms1.ru/index.php?id=tech_disc2020ups (accessed on 15 December 2021).

- Mahboubi-Moghaddam, E.; Nayeripour, M.; Aghaei, J.; Khodaei, A.; Waffenschmidt, E. Interactive Robust Model for Energy Service Providers Integrating Demand Response Programs in Wholesale Markets. IEEE Trans. Smart Grid 2018, 9, 2681–2690. [Google Scholar] [CrossRef]

- Shah, I.; Lisi, F. Forecasting of electricity price through a functional prediction of sale and purchase curves. J. Forecast. 2020, 39, 242–259. [Google Scholar] [CrossRef]

- Electricity and Capacity Market. Rynok Elektroenergii i Moshchnosti. Available online: https://www.np-sr.ru/ru/market/wholesale/index.htm (accessed on 23 December 2021).

- About the Approval of the Order of Determination of Zones of Free Flow of Electric Energy (Capacity). Ob Utverzhdenii Poryadka Opredeleniya zon Svobodnogo Peretoka Elektricheskoj Energii (Moshchnosti). Available online: https://base.garant.ru/195834/ (accessed on 15 December 2021).

- Simionescu, M.; Strielkowski, W.; Tvaronavičienė, M. Renewable energy in final energy consumption and income in the EU-28 countries. Energies 2020, 13, 2280. [Google Scholar] [CrossRef]

- Boute, A. Promoting renewable energy through capacity markets: An analysis of the Russian support scheme. Energy Policy 2012, 46, 68–77. [Google Scholar] [CrossRef]

- Chebotareva, G.; Strielkowski, W.; Streimikiene, D. Risk assessment in renewable energy projects: A case of Russia. J. Clean. Prod 2020, 269, 122110. [Google Scholar] [CrossRef]

- On Power Industry. Ob Elektroenergetike. Available online: http://www.consultant.ru/document/cons_doc_LAW_41502/ (accessed on 12 December 2021).

- Kozlova, M.; Collan, M. Modeling the effects of the new Russian capacity mechanism on renewable energy investments. Energy Policy 2016, 95, 350–360. [Google Scholar] [CrossRef]

- Kozlova, M.; Collan, M.; Luuka, P. Russian Mechanism to Support Renewable Energy Investments: Before and After Analysis. In Computational Methods and Models for Transport, 1st ed.; Diez, P., Neittaanmäki, P., Periaux, J., Tuovinen, T.T., Bräysy, O., Eds.; Springer International Publishing: Cham, WA, USA, 2018; pp. 243–252. [Google Scholar] [CrossRef]

- Jang, H. Market impacts of a transmission investment: Evidence from the ERCOT competitive renewable energy zones project. Energies 2020, 13, 3199. [Google Scholar] [CrossRef]

- Longoria, G.; Davy, A.; Shi, L. Subsidy-Free Renewable Energy Trading: A Meta Agent Approach. IEEE Trans. Sustain. Energy 2020, 11, 1707–1716. [Google Scholar] [CrossRef]

- Marshman, D.; Brear, M.; Jeppesen, M.; Ring, B. Performance of wholesale electricity markets with high wind penetration. Energy Econ. 2020, 89, 104803. [Google Scholar] [CrossRef]

- Peng, D.; Poudineh, R. Electricity market design under increasing renewable energy penetration: Misalignments observed in the European Union. Util. Policy 2019, 61, 100970. [Google Scholar] [CrossRef]

- Sawas, A.; Khani, H.; El-Taweel, N.; Farag, H.E.Z. Comparative Time-of-Use and wholesale electricity price-based scheduling in embedded power and natural gas distribution grids penetrated with large renewable generation. Electr. Power Syst. Res. 2019, 177, 105975. [Google Scholar] [CrossRef]

- Wellinghoff, J. Decarbonizing wholesale energy services. Electr. J. 2019, 32, 106627. [Google Scholar] [CrossRef]

- Patnam, B.S.K.; Pindoriya, N.M. Demand response in consumer-Centric electricity market: Mathematical models and optimization problems. Electr. Power Syst. Res. 2021, 193, 106923. [Google Scholar] [CrossRef]

- Karimi, H.; Jadid, S.; Saboori, H. Multi-objective bi-level optimisation to design real-time pricing for demand response programs in retail markets. IET Gener. Transm. Dis. 2019, 13, 1287–1296. [Google Scholar] [CrossRef]

- Nafkha, R.; Ząbkowski, T.; Gajowniczek, K. Deep Learning-Based Approaches to Optimize the Electricity Contract Capacity Problem for Commercial Customers. Energies 2021, 14, 2181. [Google Scholar] [CrossRef]

- Filipović, S.; Radovanović, M.; Lior, N. What does the sharing economy mean for electric market transitions? A review with sustainability perspectives. Energy Res. Soc. Sci. 2019, 58, 101258. [Google Scholar] [CrossRef]

- Geography of the Russian Electricity Market. Geografiya Rossijskogo Elektroenergeticheskogo Rynka. Available online: http://ais.np-sr.ru/iasen/information/IASE_0V_R0_OVERALL#0/0/OVERALL (accessed on 12 December 2021).

- Maksimov, A.G.; Shchurupova, D.V. Forecasting of the electricity price on the day-ahead electricity market in Russia. Cogent Phys. 2017, 4, 1316953. [Google Scholar] [CrossRef]

- Csereklyei, Z.; Qu, S.; Ancev, T. The effect of wind and solar power generation on wholesale electricity prices in Australia. Energy Policy 2019, 131, 358–369. [Google Scholar] [CrossRef]

- Woo, C.K.; Milstein, I.; Tishler, A.; Zarnikau, J. A wholesale electricity market design sans missing money and price manipulation. Energy Policy 2019, 134, 110988. [Google Scholar] [CrossRef]

- Borozan, S.; Mateska, A.K.; Krstevski, P. Progress of the electricity sectors in South East Europe: Challenges and opportunities in achieving compliance with EU energy policy. Energy Rep. 2021, 7, 8730–8741. [Google Scholar] [CrossRef]

- Wyrwoll, L.; Nobis, M.; Raths, S.; Moser, A. Evolution of fundamental price determination within electricity market simulations. Energies 2021, 14, 5454. [Google Scholar] [CrossRef]

- Härtel, P.; Korpås, M. Demystifying market clearing and price setting effects in low-carbon energy systems. Energy Econ. 2021, 93, 105051. [Google Scholar] [CrossRef]

- Loi, T.S.A.; Jindal, G. Electricity market deregulation in Singapore—Initial assessment of wholesale prices. Energy Policy 2019, 127, 1–10. [Google Scholar] [CrossRef]

- Afanasyev, D.O.; Fedorova, E.A.; Popov, V.U. Fine structure of the price-demand relationship in the electricity market: Multi-scale correlation analysis. Energy Econ. 2015, 51, 215–226. [Google Scholar] [CrossRef] [Green Version]

- Brown, P.R.; O’Sullivan, F.M. Shaping photovoltaic array output to align with changing wholesale electricity price profiles. Appl. Energy 2019, 256, 113734. [Google Scholar] [CrossRef]

- Radovanovic, A.; Nesti, T.; Chen, B. A Holistic Approach to Forecasting Wholesale Energy Market Prices. IEEE Trans. Power Syst. 2019, 34, 4317–4328. [Google Scholar] [CrossRef]

- Germeshausen, R.; Wölfing, N. How marginal is lignite? Two simple approaches to determine price-setting technologies in power markets. Energy Policy 2020, 142, 111482. [Google Scholar] [CrossRef]

- Annual Report on the Activities of the Association “NP Market Council”. 2017. Godovoj Otchet o Deyatel’nosti Associacii “NP Sovet rynka”. Available online: https://www.np-sr.ru/sites/default/files/1_go_0.pdf (accessed on 25 November 2021).

- Annual Report on the Activities of the Association “NP Market Council”. 2018. Godovoj Otchet o Deyatel’nosti Associacii “NP Sovet rynka”. Available online: https://www.np-sr.ru/sites/default/files/go_2018_god_.pdf (accessed on 12 December 2021).

- Chebotareva, G. Digital transformation of the energy sector: A case of Russia. E3S Web Conf. 2021, 250, 01001. [Google Scholar] [CrossRef]

- Lanshina, T.A.; John, A.; Potashnikov, V.Y.; Barinova, V.A. The slow expansion of renewable energy in Russia: Competitiveness and regulation issues. Energy Policy 2018, 120, 600–609. [Google Scholar] [CrossRef]

- National Program for the Development of the Far East. Nacional’naya Programma po Razvitiyu Dal’nego Vostoka. Available online: https://vostokgosplan.ru/wp-content/uploads/2019/04/Predlozheniya-NPRDV.pdf (accessed on 25 June 2021).

- Potanin, M.M. Instruments of state stimulation of economic development of the Far East. Instrumenty gosudarstvennogo stimulirovaniya ekonomicheskogo razvitiya Dal’nego Vostoka. Cust. Policy Russ. Far East Tamozhennaya Polit. Ross. Na Dal’nem Vost. 2011, 2, 37–54. [Google Scholar]

- Program for the Development of the Far East Until 2035. Programma Razvitiya Dal’nego Vostoka do 2035 Goda. Available online: https://www.vedomosti.ru/economics/articles/2019/09/03/810374-dalnemu-vostoku-2025 (accessed on 25 June 2021).

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).