Bidding Strategy for VPP and Economic Feasibility Study of the Optimal Sizing of Storage Systems to Face the Uncertainty of Solar Generation Modelled with IGDT

Abstract

:1. Introduction

- An optimal bidding strategy of VPP that seeks to maximise the benefits of VPP and perform the optimal sizing of ESS to deal with fluctuations in solar generation.

- An analysis of the robustness and opportunity of solar uncertainty using IGDT for the VPP operator to make risk-averse or conservative decisions to maximise its benefits.

- An economic study using return on investment (ROI) to determine the feasibility of investing in ESS to compensate for the uncertainty of solar generation in the short, medium and long terms.

2. Proposed Methodology

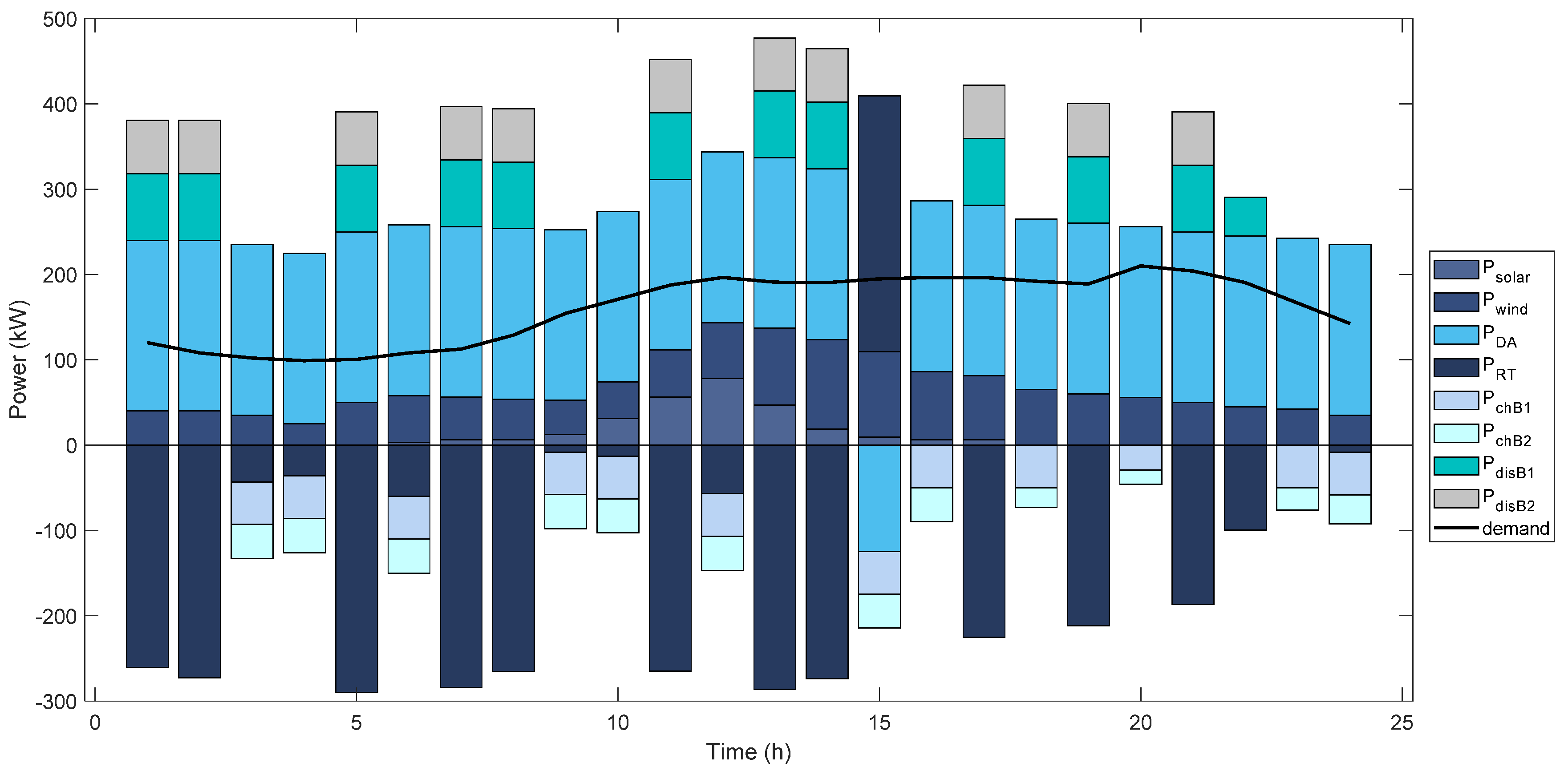

2.1. Deterministic Approach: Bidding Strategy of VPP to Trade in Real-Time Market

2.2. An Optimisation Approach to Model Solar Generation Uncertainty with IGDT

2.2.1. Robust Approach

2.2.2. Opportunistic Approach

2.3. An Optimal Approach to the Sizing Storage System to Deal with the Fluctuations

3. Case Study

4. Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| Indices | |

| t | Time in hours |

| I | Nodes |

| d | Time in days |

| b | Battery |

| Parameters | |

| B | Objective function for the deterministic approach |

| Expected profit based on the deterministic values | |

| Critical profit | |

| Profit deviation factor | |

| Susceptance | |

| , | Limits of power traded |

| Power agreed in DA market | |

| Solar power limit | |

| Load power | |

| M | Auxiliary parameter (big-value) |

| The efficiency of storage s | |

| The power-energy ratio of storage s | |

| The capacity of energy storage s | |

| Maximum capacity of energy storage limit | |

| Minimum capacity of energy storage limit | |

| Discharge power limit | |

| Charge power limit | |

| Wind power limit | |

| Limits of power that the VPP can trade in the DA and RT markets | |

| , | Active power flow limit in line ij |

| Variables | |

| Undesired solar uncertainty | |

| Power traded in the real-time market | |

| Power generated by the solar generator | |

| Power generated by the wind generator | |

| Discharge power by the batteries | |

| Charge power by the batteries | |

| Active power flow in line ij | |

| Generation angle | |

| Binary variable | |

| Energy stored in the battery b | |

| The capacity of energy storage s | |

References

- Yu, S.; Fang, F.; Liu, Y.; Liu, J. Uncertainties of virtual power plant: Problems and countermeasures. Appl. Energy 2019, 239, 454–470. [Google Scholar] [CrossRef]

- Tajeddini, M.A.; Rahimi-Kian, A.; Soroudi, A. Risk averse optimal operation of a virtual power plant using two stage stochastic programming. Energy 2014, 73, 958–967. [Google Scholar] [CrossRef] [Green Version]

- Fitiwi, D.Z.; de Cuadra, F.; Olmos, L.; Rivier, M. A new approach of clustering operational states for power network expansion planning problems dealing with RES (renewable energy source) generation operational variability and uncertainty. Energy 2015, 90, 1360–1376. [Google Scholar] [CrossRef]

- Verma, P.P.; Srinivasan, D.; Swarup, K.S.; Mehta, R. A Review of Uncertainty Handling Techniques in Smart Grid. Int. J. Uncertain. Fuzziness Knowlege-Based Syst. 2018, 26, 345–378. [Google Scholar] [CrossRef]

- Baringo, A.; Baringo, L. A Stochastic Adaptive Robust Optimization Approach for the Offering Strategy of a Virtual Power Plant. IEEE Trans. Power Syst. 2017, 32, 3492–3504. [Google Scholar] [CrossRef]

- Majidi, M.; Mohammadi-Ivatloo, B.; Soroudi, A. Application of information gap decision theory in practical energy problems: A comprehensive review. Appl. Energy 2019, 249, 157–165. [Google Scholar] [CrossRef] [Green Version]

- Ghahramani, M.; Nazari-Heris, M.; Zare, K.; Mohammadi-Ivatloo, B. Robust Optimal Planning and Operation of Electrical Energy Systems; Springer Nature Switzerland AG: Cham, Switzerland, 2019; ISBN 9783030042967. [Google Scholar]

- Rezaei, N.; Ahmadi, A.; Nezhad, A.E.; Khazali, A. Information-Gap Decision Theory: Principles and Fundamentals; Springer International Publishing: Cham, Switzerland, 2019; ISBN 9783030042967. [Google Scholar]

- Brekken, T.K.A.; Yokochi, A.; Von Jouanne, A.; Yen, Z.Z.; Hapke, H.M.; Halamay, D.A. Optimal energy storage sizing and control for wind power applications. IEEE Trans. Sustain. Energy 2011, 2, 69–77. [Google Scholar] [CrossRef]

- Mahesh, A.; Sandhu, K.S.; Rao, J.V. Optimal Sizing of Battery Energy Storage System for Smoothing Power Fluctuations of a PV/Wind Hybrid System. Int. J. Emerg. Electr. Power Syst. 2017, 18, 1–13. [Google Scholar] [CrossRef]

- Xia, S.; Chan, K.W.; Luo, X.; Bu, S.; Ding, Z.; Zhou, B. Optimal sizing of energy storage system and its cost-benefit analysis for power grid planning with intermittent wind generation. Renew. Energy 2018, 122, 472–486. [Google Scholar] [CrossRef]

- Yang, Y.; Li, H.; Aichhorn, A.; Zheng, J.; Greenleaf, M. Sizing strategy of distributed battery storage system with high penetration of photovoltaic for voltage regulation and peak load shaving. IEEE Trans. Smart Grid. 2014, 5, 982–991. [Google Scholar] [CrossRef]

- Ourahou, M.; Ayrir, W.; EL Hassouni, B.; Haddi, A. Review on smart grid control and reliability in presence of renewable energies: Challenges and prospects. Math. Comput. Simul. 2018, 167, 19–31. [Google Scholar] [CrossRef]

- Fernández-Blanco, R.; Dvorkin, Y.; Xu, B.; Wang, Y.; Kirschen, D.S. Optimal Energy Storage Siting and Sizing: A WECC Case Study. IEEE Trans. Sustain. Energy 2017, 8, 733–743. [Google Scholar] [CrossRef]

- Qin, M.; Chan, K.W.; Chung, C.Y.; Luo, X.; Wu, T. Optimal planning and operation of energy storage systems in radial networks for wind power integration with reserve support. IET Gener. Transm. Distrib. 2016, 10, 2019–2025. [Google Scholar] [CrossRef]

- Lei, J.; Gong, Q. Operating strategy and optimal allocation of large-scale VRB energy storage system in active distribution networks for solar/wind power applications. IET Gener. Transm. Distrib. 2017, 11, 2403–2411. [Google Scholar] [CrossRef]

- Zheng, L.; Hu, W.; Lu, Q.; Min, Y. Optimal energy storage system allocation and operation for improving wind power penetration. IET Gener. Transm. Distrib. 2015, 9, 2672–2678. [Google Scholar] [CrossRef] [Green Version]

- Borghini, E.; Giannetti, C.; Flynn, J.; Todeschini, G. Data-Driven Energy Storage Scheduling to Minimise Peak Demand on Distribution Systems with PV Generation. Energies 2021, 14, 3453. [Google Scholar] [CrossRef]

- Sedghi, M.; Ahmadian, A.; Aliakbar-Golkar, M. Optimal storage planning in active distribution network considering uncertainty of wind power distributed generation. IEEE Trans. Power Syst. 2016, 31, 304–316. [Google Scholar] [CrossRef]

- Arul, P.G.; Ramachandaramurthy, V.K. Mitigating techniques for the operational challenges of a standalone hybrid system integrating renewable energy sources. Sustain. Energy Technol. Assess. 2017, 22, 18–24. [Google Scholar] [CrossRef]

- Luo, X.; Wang, J.; Dooner, M.; Clarke, J. Overview of current development in electrical energy storage technologies and the application potential in power system operation. Appl. Energy 2015, 137, 511–536. [Google Scholar] [CrossRef] [Green Version]

- Yekini Suberu, M.; Wazir Mustafa, M.; Bashir, N. Energy storage systems for renewable energy power sector integration and mitigation of intermittency. Renew. Sustain. Energy Rev. 2014, 35, 499–514. [Google Scholar] [CrossRef]

- Kargarian, A.; Hug, G. Optimal sizing of energy storage systems: A combination of hourly and intra-hour time perspectives. IET Gener. Transm. Distrib. 2016, 10, 594–600. [Google Scholar] [CrossRef]

- Jayasekara, N.; Masoum, M.A.S.; Wolfs, P.J. Optimal operation of distributed energy storage systems to improve distribution network load and generation hosting capability. IEEE Trans. Sustain. Energy 2016, 7, 250–261. [Google Scholar] [CrossRef]

- Nick, M.; Cherkaoui, R.; Paolone, M. Optimal allocation of dispersed energy storage systems in active distribution networks for energy balance and grid support. IEEE Trans. Power Syst. 2014, 29, 2300–2310. [Google Scholar] [CrossRef]

- Nguyen, N.T.A.; Le, D.D.; Moshi, G.G.; Bovo, C.; Berizzi, A. Sensitivity Analysis on Locations of Energy Storage in Power Systems with Wind Integration. IEEE Trans. Ind. Appl. 2016, 52, 5185–5193. [Google Scholar] [CrossRef] [Green Version]

- Chen, S.X.; Gooi, H.B.; Wang, M.Q. Sizing of energy storage for microgrids. IEEE Trans. Smart Grid 2012, 3, 142–151. [Google Scholar] [CrossRef]

- Wong, L.A.; Ramachandaramurthy, V.K.; Taylor, P.; Ekanayake, J.B.; Walker, S.L.; Padmanaban, S. Review on the optimal placement, sizing and control of an energy storage system in the distribution network. J. Energy Storage 2019, 21, 489–504. [Google Scholar] [CrossRef]

- Das, C.K.; Bass, O.; Kothapalli, G.; Mahmoud, T.S.; Habibi, D. Overview of energy storage systems in distribution networks: Placement, sizing, operation, and power quality. Renew. Sustain. Energy Rev. 2018, 91, 1205–1230. [Google Scholar] [CrossRef]

- Sadeghian, O.; Oshnoei, A.; Khezri, R.; Muyeen, S.M. Risk-constrained stochastic optimal allocation of energy storage system in virtual power plants. J. Energy Storage 2020, 31, 101732. [Google Scholar] [CrossRef]

- Henao, M.M. Bidding Strategy for VPP Incorporating Price Market and Solar Generation Uncertainties using Information Gap Decision Theory. In Proceedings of the 9th IEEE International Conference on Smart Grid, Setubal, Portugal, 29 June–1 July 2021; IEEE: Setubal, Portugal; pp. 143–148. [Google Scholar]

- Montoya, O.D.; Grajales, A.; Grisales, L.F.; Castro, C.A. Ubicación y Operación Eficiente de Almacenadores de Energía en Micro-redes en Presencia de Generación Distribuida Optimal Location and Operation of Energy Storage Devices in Microgrids in Presence of Distributed Generation. Cintex 2017, 22, 97–117. [Google Scholar] [CrossRef]

- Mongird, K.; Viswanathan, V.; Balducci, P.; Alam, J.; Fotedar, V.; Koritarov, V.; Hadjerioua, B. Energy Storage Technology and Cost Characterization Report; Pacific Northwest National Laboratory: Oak Ridge, TN, USA, 2019. [Google Scholar]

| Battery | SoC ini | SoC fin | SoC min | SoC max | Φb (p.u) | Eb_c(i) (kW) | Eb_d(i) (kW) |

|---|---|---|---|---|---|---|---|

| B1 | 0.5 | 0.5 | 0.5 | 1 | 0.4 | 62.5 | 50 |

| B2 | 0.5 | 0.5 | 0.5 | 1 | 0.5 | 50 | 40 |

| Parameter | Value |

|---|---|

| Floss | 7.14% |

| ∆t | 1 |

| Susceptance | 0.419 S |

| Power limit | 1500 kW |

| Solar Uncertainty (UND) | Revenue Variation ($) | Revenue Variation (%) |

|---|---|---|

| 1.68 | 29,911 | 20% |

| 0.786 | 27,418 | 10% |

| 0 | 24,926 | 0% |

| −0.481 | 21,866 | −10% |

| −0.98 | 19,436 | −20% |

| −1 | 17,007 | −30% |

| −1 | 14,955 | −40% |

| Battery | Case 1 | Case 2 | Case 3 | |||

|---|---|---|---|---|---|---|

| Initial Battery Sizing (kWh) | Capital Cost Energy Capacity (USD) | Battery Sizing to Compensate for the Decrease in the Solar Generation to 48.7% (kWh) | Capital Cost Energy Capacity (USD) | Battery Sizing to Compensate for the Decrease in the Solar Generation to 98% (kWh) | Capital Cost Energy Capacity (USD) | |

| B1 | 250 | 59,000 | 572 | 134,992 | 750 | 177,000 |

| B2 | 200 | 47,200 | 230 | 54,280 | 600 | 141,600 |

| Battery | Additional Capacity Required | The Capital Cost Needed to Compensate for Solar Uncertainty of 48.7% | Additional Capacity Required | The Capital Cost Needed to Compensate for Solar Uncertainty of 98% | ||

|---|---|---|---|---|---|---|

| The Capital Cost of Batteries per kWh = $236/kWh | The Capital Cost of Batteries per kWh = $56/kWh | The Capital Cost of Batteries per kWh = $236/kWh | The Capital Cost of Batteries per kWh = $56/kWh | |||

| B1 | 322 | $75,992 | $18,032 | 500 | $118,000 | $28,000 |

| B2 | 30 | $7080 | $1680 | 600 | $94,400 | $22,400 |

| B1 + B2 | 352 | $83,072 | $19,712 | 1100 | $212,400 | $50,400 |

| Capital Cost of Batteries per kWh | ROI When the Additional Capacity Is 352 kWh (Years) | ROI When the Additional Capacity Is 1100 kWh (Years) |

|---|---|---|

| $236/kWh | 27 | 38.7 |

| $56/kWh | 6.44 | 9.18 |

| $30/kWh | 3.45 | 6 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maceas Henao, M.; Espinosa Oviedo, J.J. Bidding Strategy for VPP and Economic Feasibility Study of the Optimal Sizing of Storage Systems to Face the Uncertainty of Solar Generation Modelled with IGDT. Energies 2022, 15, 953. https://doi.org/10.3390/en15030953

Maceas Henao M, Espinosa Oviedo JJ. Bidding Strategy for VPP and Economic Feasibility Study of the Optimal Sizing of Storage Systems to Face the Uncertainty of Solar Generation Modelled with IGDT. Energies. 2022; 15(3):953. https://doi.org/10.3390/en15030953

Chicago/Turabian StyleMaceas Henao, Michelle, and Jairo José Espinosa Oviedo. 2022. "Bidding Strategy for VPP and Economic Feasibility Study of the Optimal Sizing of Storage Systems to Face the Uncertainty of Solar Generation Modelled with IGDT" Energies 15, no. 3: 953. https://doi.org/10.3390/en15030953