The Role of Pre-Commitments and Engle Curves in Thailand’s Aggregate Energy Demand System

Abstract

1. Introduction

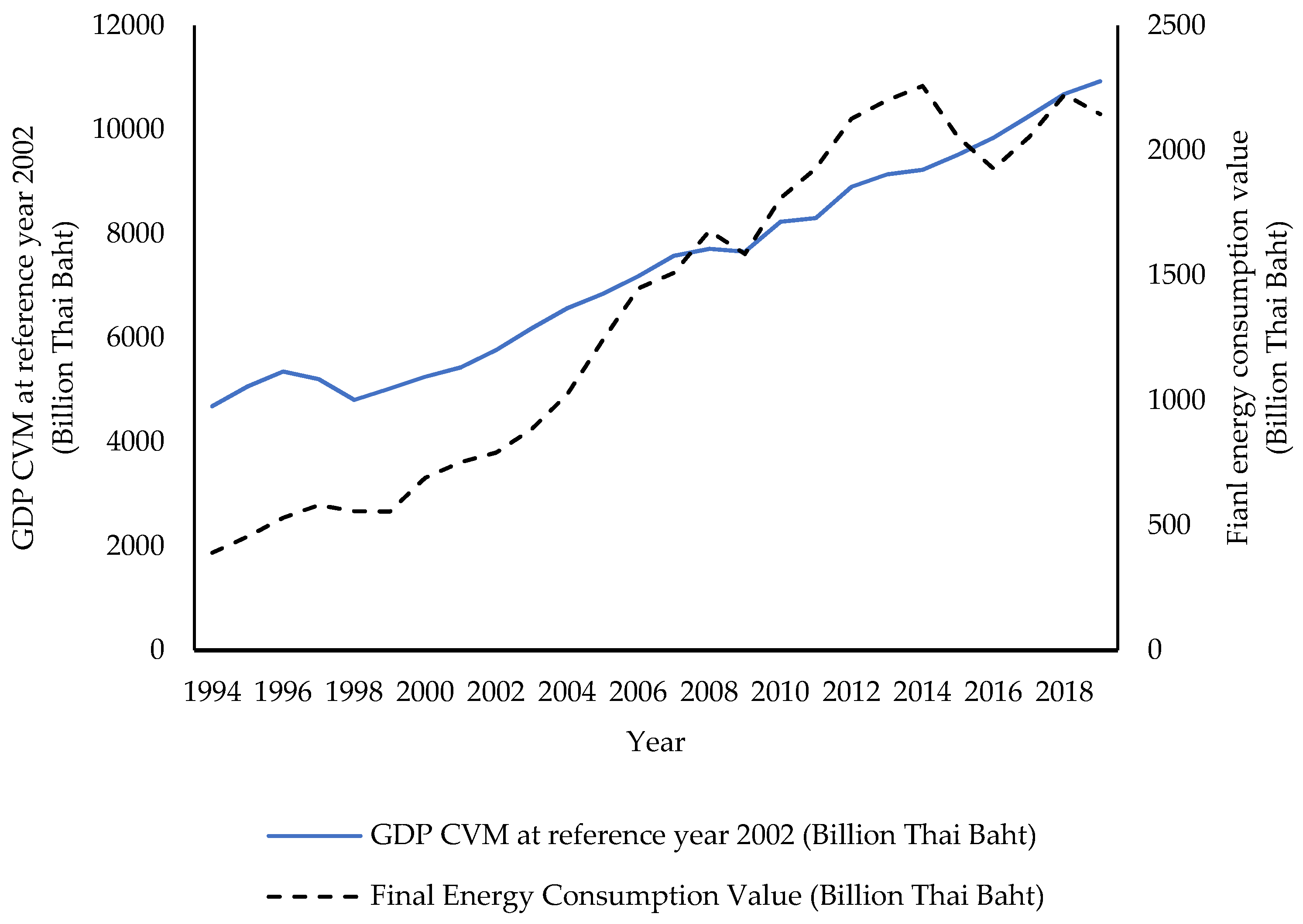

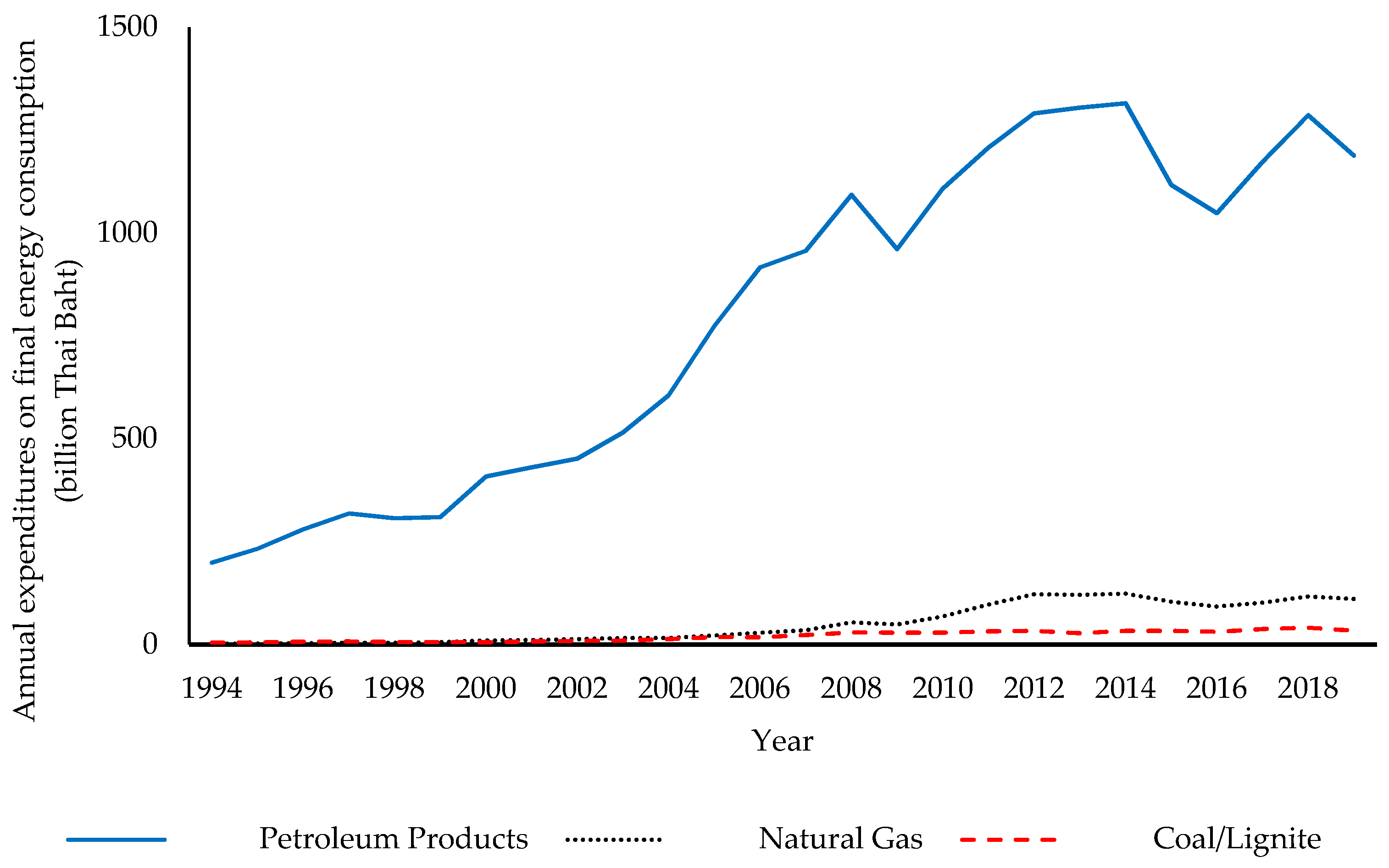

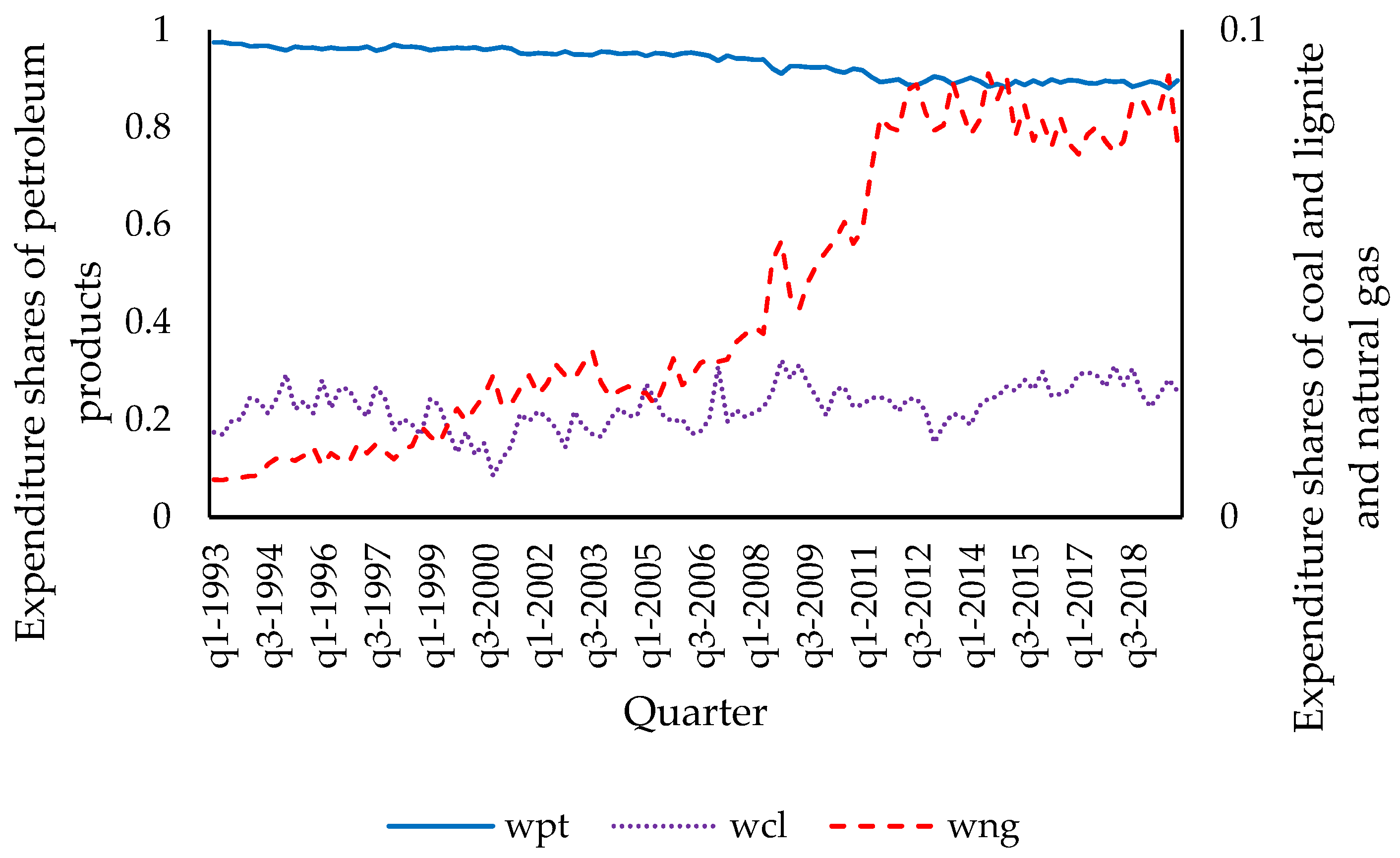

2. Thailand’s Energy System

3. Thailand Energy Demand Modeling

3.1. Bottom-Up Approaches

3.2. Economic/Econometric Approaches

3.3. Pre-Commitment Consumption and the Engel Curve

4. Methods and Data

5. Results and Discussion

5.1. Statistical Comparisons

5.2. Elasticities of Demand

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Energy Policy and Planning Office (EPPO). Energy statistics: Economic Data and Analysis Table 7.1-6: GDP, Energy, Import and Export of Goods. Available online: http://www.eppo.go.th/index.php/th/energy-information/static-energy/energy-economic (accessed on 12 May 2021).

- Buranakunaporn, S.; Oczkowski, E. A Dynamic econometric model of Thailand manufacturing energy demand. Appl. Econ. 2007, 39, 2261–2267. [Google Scholar] [CrossRef]

- Leesombatpiboon, P.; Joutz, F.L. Sectoral demand for petroleum in Thailand. Energy Econ. 2010, 32, S15–S25. [Google Scholar] [CrossRef]

- Chontanawat, J. Modelling Road Transportation of Energy Demand for Thailand. Funded by the Office of the Higher Education Commission and the Thailand Research Fund. 2011. Available online: https://elibrary.trf.or.th/project_content.asp?PJID=MRG5280244 (accessed on 6 July 2021). (In Thai).

- Samuelson, P.A. Some implications of “linearity”. Rev. Econ. Stud. 1947, 15, 88–90. [Google Scholar] [CrossRef]

- Bollino, C.A. Gaids: A Generalised Version of the almost ideal demand system. Econ. Lett. 1987, 23, 199–202. [Google Scholar] [CrossRef]

- Barnett, W.A.; Serletis, A. Consumer preferences and demand systems. J. Econom. 2008, 147, 210–224. [Google Scholar] [CrossRef]

- Rowland, C.S.; Mjelde, J.W.; Dharmasena, S. Policy implications of considering pre-commitments in US aggregate energy demand system. Energy Policy 2017, 102, 406–413. [Google Scholar] [CrossRef]

- Banks, J.; Blundell, R.; Lewbel, A. Quadratic Engel curves and consumer demand. Rev. Econ. Stat. 1997, 79, 527–539. [Google Scholar] [CrossRef]

- Energy Policy and Planning Office (EPPO). Energy Statistics: Petroleum Statistic Table 2.4-1: Demand and Supply of Crude Oil and Oil Products. Available online: http://www.eppo.go.th/index.php/th/energy-information/static-energy/static-petroleum (accessed on 12 May 2021).

- Bhattacharyya, S.C.; Timilsina, G.R. Modelling energy demand of developing countries: Are the specific features adequately captured? Energy Policy 2010, 38, 1979–1990. [Google Scholar] [CrossRef]

- Suganthi, L.; Samuel, A.A. Energy models for demand forecasting—A review. Renew. Sustain. Energy Rev. 2012, 16, 1223–1240. [Google Scholar] [CrossRef]

- Phdungsilp, A.; Wuttipornpun, T. Analyses of the decarbonizing Thailand’s energy system toward low-carbon futures. Renew. Sustain. Energy Rev. 2013, 24, 187–197. [Google Scholar] [CrossRef]

- Tanatvanit, S.; Limmeechokchai, B.; Chungpaibulpatana, S. Sustainable energy development strategies: Implications of energy demand management and renewable energy in Thailand. Renew. Sustain. Energy Rev. 2003, 7, 367–395. [Google Scholar] [CrossRef]

- Chaosuangaroen, P.; Limmeechokchai, B. Scenario-based assessment of energy savings in Thailand: A long-range energy alternative planning approach. Sci. Technol. Asia 2008, 13, 11–19. [Google Scholar]

- Phdungsilp, A. Integrated energy and carbon modeling with a decision support system: Policy scenarios for low-carbon city development in Bangkok. Energy Policy 2010, 38, 4808–4817. [Google Scholar] [CrossRef]

- Chollacoop, N.; Saisirirat, P.; Fukuda, T.; Fukuda, A. Scenario analyses of road transport energy demand: A case study of ethanol as a diesel substitute in Thailand. Energies 2011, 4, 108–125. [Google Scholar] [CrossRef]

- Chaichaloempreecha, A.; Chunark, P.; Limmeechokchai, B. Assessment of Thailand’s energy policy on CO2 emissions: Implication of national energy plans to achieve NDC Target. Int. Energy J. 2019, 19, 47–60. [Google Scholar]

- Misila, P.; Winyuchakrit, P.; Limmeechokchai, B. Thailand’s long-term GHG emission reduction in 2050: The achievement of renewable energy and energy efficiency beyond the NDC. Heliyon 2020, 6, e05720. [Google Scholar] [CrossRef] [PubMed]

- Thepkhun, P.; Limmeechokchai, B.; Fujimori, S.; Masui, T.; Shrestha, R.M. Thailand’s low-carbon scenario 2050: The AIM/CGE analyses of CO2 mitigation measures. Energy Policy 2013, 62, 561–572. [Google Scholar] [CrossRef]

- Selvakkumaran, S.; Limmeechokchai, B. Low carbon society scenario analysis of transport sector of an emerging economy—The AIM/Enduse modelling approach. Energy Policy 2015, 81, 199–214. [Google Scholar] [CrossRef]

- Chunark, P.; Limmeechokchai, B. Energy saving potential and CO2 mitigation assessment using the Asia-Pacific integrated model/haila in Thailand energy sectors. Energy Procedia 2015, 79, 871–878. [Google Scholar] [CrossRef][Green Version]

- Energy Policy and Planning Office (EPPO). Energy Statistics: Economic Data and Analysis Table 7.2-3: Energy Elasticity. Available online: http://www.eppo.go.th/index.php/th/energy-information/static-energy/energy-economic (accessed on 12 May 2021).

- Wibulpolprasert, W.; Teveyanan, B. The Social Cost of Thailand’s Transportation Fuel Pricing Policy; Discussion Paper No. 49; Puey Ungphakorn Institute for Economic Research: Bangkok, Thailand, 2016; Available online: https://www.pier.or.th/wp-content/uploads/2016/11/pier_dp_049.pdf (accessed on 21 June 2021).

- Patoomnakula, A.; Daloonpateb, A.; Mahathanasethc, I.; Premashthira, A. Analysis of Heterogeneous energy demand in transportation sector in hailand. Kasetsart J. Soc. Sci. 2021, 42, 69–74. [Google Scholar]

- Limanond, T.; Jomnonkwao, S.; Srikaew, A. Projection of future transport energy demand of Thailand. Energy Policy 2011, 39, 2754–2763. [Google Scholar] [CrossRef]

- Chaiwat, P.; Tangvitoontham, N. Petroleum’s Price transmission and imported demand for crude oil in Thailand. Int. J. Energy Econ. Policy 2014, 4, 476–483. Available online: http://www.econjournals.com/index.php/ijeep/article/download/844/491 (accessed on 23 August 2021).

- Hovhannisyan, V.; Gould, B.W. Quantifying the structure of food demand in China: An econometric approach. Agric. Econ. 2011, 42, 1–18. [Google Scholar] [CrossRef]

- Bigerna, S.; Bollino, C.A. A system of hourly demand in the Italian electricity market. Energy J. 2015, 36, 4. [Google Scholar] [CrossRef]

- Bigerna, S.; Bollino, C.A. Ramsey prices in the Italian electricity market. Energy Policy 2016, 88, 603–612. [Google Scholar] [CrossRef]

- Atalla, T.; Bigerna, S.; Bollino, C.A. Energy demand elasticities and weather worldwide. Econ. Politica 2018, 35, 207–237. [Google Scholar] [CrossRef]

- Uzawa, H. Production functions with constant elasticities of substitution. Rev. Econ. Stud. 1962, 29, 291–299. [Google Scholar] [CrossRef]

- Deaton, A.; Muellbauer, J. An almost ideal demand system. Am. Econ. Rev. 1980, 70, 312–326. [Google Scholar]

- Blackorby, C.; Russell, R.R. Will the real elasticity of substitution please stand up? (A comparison of the Allen/Uzawa and Morishima Elasticities). Am. Econ. Rev. 1989, 79, 882–888. Available online: http://www.jstor.org/stable/1827940 (accessed on 12 May 2021).

- Energy Policy and Planning Office (EPPO). Energy statistics: Summary Table 1.2-3: Final Modern Energy Consumption (KTOE). Available online: http://www.eppo.go.th/index.php/en/en-energystatistics/summary-statistic?orders[publishUp]=publishUp&issearch=1 (accessed on 12 May 2021).

- National Economic and Social Development Council. Gross Domestic Product Chain Volume Measures. Available online: https://www.nesdc.go.th/main.php?filename=QGDP_report (accessed on 12 May 2021).

- Bessler, D.A.; Wang, Z. D-separation, forecasting, and economic science: A conjecture. Theory Decis. 2012, 73, 295–314. [Google Scholar] [CrossRef]

| Study | Sector | Model | Elasticities | Data | |

|---|---|---|---|---|---|

| Own Price | Income | ||||

| [2] | Manufacturing | Dynamic translog | Fuel oil −0.521 LPG −0.146 Electricity −0.301 Diesel 0.889 Coal and lignite 0.732 | Annual 1979–1999 | |

| [3] | Final oil consumption for seven sectors | Dynamic panel and autoregressive distributed lag | Short run −0.40 to −0.26 Long run −1.70 to −0.76 | Panel 1981–2007 | |

| [4] | Road transport | Log-linear, cointegration and error correction | Short run/long run Diesel −0.23/−0.53 Gasoline −0.14/−0.57 | Short run/long run Diesel 0.57/1.32Gasoline 0.35/1.40 | Annual 1982–2008 |

| [23] | Final energy demand | Log-log | 0.923 | Annual 2008–2017 | |

| [24] | Transport | AIDS | Octane 95 −1.08 Octane 91 −1.21 Diesel −0.17 | Monthly 2011–2015 | |

| [25] | Transport | QAIDS | Uncompensated/compensatedgasoline −2.775/ −1.9296 LPG −0.8583/−0.5463 Diesel −1.018/−0.5474 | Panel Socio-economic survey (SES) in years 2009, 2013 and 2015 | |

| [26] | Transport | Log-linear | GDP 0.995 | Annual 1989–2008 | |

| [27] | Imported crude oil | Cointegration | Short run 0.042 Long run −0.066 | Short run 0.484 Long run 0.997 | Panel 2002–2011 |

| Model | ||||

|---|---|---|---|---|

| Parameter | GQAIDS | GAIDS | QAIDS | AIDS |

| Objective Value | 1.815 | 1.820 | 1.843 | 1.861 |

| Adjust of Wcl | 0.640 | 0.638 | 0.643 | 0.655 |

| Adjust of Wng | 0.989 | 0.986 | 0.988 | 0.983 |

| −0.002 (0.002) | n/a | 0.0002 (0.001) | n/a | |

| −0.014 *** (0.002) | n/a | −0.013 *** (0.001) | n/a | |

| 0.016 *** (0.001) | n/a | 0.013 *** (0.001) | n/a | |

| 571.06 *** (79.932) | 812.91 *** (180.1) | n/a | n/a | |

| 160.19 *** (59.351) | 112.56 (116.9) | n/a | n/a | |

| 5121.60 *** (13.109) | 6278.51 *** (391.9) | n/a | n/a | |

| −0.181 (0.231) | 0.165 (0.104) | 0.054 (0.165) | −0.086 *** (0.031) | |

| −1.644 *** (0.238) | 0.313 * (0.182) | −1.627 *** (0.168) | 0.157 * (0.090) | |

| 2.825*** (0.334) | 0.522** (0.244) | 2.573*** (0.235) | 0.929 *** (0.099) | |

| 0.045 (0.038) | −0.011 (0.011) | −0.002 (0.029) | 0.016 *** (0.003) | |

| 0.310 *** (0.036) | −0.027 (0.021) | 0.296 *** (0.025) | −0.014 (0.010) | |

| −0.355 *** (0.041) | 0.038 (0.027) | −0.294 *** (0.029) | −0.002 (0.011) | |

| 0.021 (0.017) | 0.030 *** (0.011) | 0.021*** (0.003) | 0.019 *** (0.002) | |

| −0.067 (0.050) | −0.010 (0.010) | 0.002 (0.042) | −0.003 (0.002) | |

| 0.046 (0.065) | −0.020 (0.015) | −0.023 (0.040) | −0.016*** (0.003) | |

| −0.352 *** (0.094) | 0.137 *** (0.019) | −0.386 *** (0.067) | 0.029 *** (0.004) | |

| 0.419 *** (0.092) | −0.126 *** (0.019) | 0.384 *** (0.061) | −0.026 *** (0.005) | |

| −0.465 *** (0.124) | 0.147 *** (0.026) | −0.361 *** (0.079) | 0.042 *** (0.006) | |

| AR(1) of Wcl | 0.376 *** (0.095) | 0.291 *** (0.096) | 0.338 *** (0.093) | 0.239 ** (0.092) |

| AR(2) of Wcl | 0.213 ** (0.104) | 0.200 * (0.103) | 0.198 ** (0.100) | 0.174 * (0.096) |

| AR(3) of Wcl | 0.040 (0.103) | 0.077 (0.101) | 0.063 (0.100) | 0.032 (0.095) |

| AR(4) of Wcl | 0.370 *** (0.096) | 0.411 *** (0.097) | 0.401 *** (0.094) | 0.344 *** (0.093) |

| AR(1) of Wng | 0.965 *** (0.107) | 0.926 *** (0.106) | 0.943 *** (0.105) | 0.807 *** (0.102) |

| AR(2) of Wng | −0.117 (0.148) | −0.063 (0.144) | −0.245 * (0.143) | 0.018 (0.133) |

| AR(3) of Wng | 0.298 * (0.176) | 0.248 * (0.145) | 0.394 *** (0.143) | 0.088 (0.134) |

| AR(4) of Wng | −0.135 (9.593) | −0.100 (0.107) | −0.080 (0.106) | 0.102 (0.103) |

| Wald Test of the null: | 5.82 × 109 *** | 1399.5 *** | n/a | n/a |

| Average Consumption (KTOE) | GQAIDS | GAIDS | |||

|---|---|---|---|---|---|

| Energy Source | Pre-Commitments (KTOE) | Percentage of the Average Consumption | Pre-Commitments (KTOE) | Percentage of the Average Consumption | |

| Coal and Lignite | 1493.48 | 571.06 | 38.24% | 812.91 | 54.43% |

| Natural Gas | 1069.81 | 160.19 | 14.97% | 112.56 | 10.52% |

| Petroleum Products | 8001.17 | 5121.60 | 64.01% | 6278.51 | 78.47% |

| Elasticities | GQAIDS | QAIDS | GAIDS | AIDS | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Price of | Price of | Price of | Price of | |||||||||

| Coal and Lignite | Natural Gas | Petroleum Products | Coal and Lignite | Natural Gas | Petroleum Products | Coal and Lignite | Natural Gas | Petroleum Products | Coal and Lignite | Natural Gas | Petroleum Products | |

| Expenditure Elasticities | ||||||||||||

| Expenditure Elasticities | 0.778 ** (0.343) | 0.335 ** (0.146) | 1.057 *** (0.012) | 1.117 *** (0.138) | 0.738 *** (0.118) | 1.018 *** (0.010) | 0.685 (0.484) | 0.489 ** (0.224) | 1.048 *** (0.022) | 1.609 *** (0.131) | 0.817 *** (0.133) | 0.998 *** (0.012) |

| Uncompensated own-and cross-price | ||||||||||||

| Coal and Lignite | −0.069 (0.152) | −0.042 (0.188) | −0.717 ** (0.289) | −0.203 ** (0.093) | −0.193 (0.127) | −0.725 *** (0.126) | −0.066 (0.182) | −0.172 (0.185) | −0.429 (0.539) | −0.284 *** (0.087) | −0.148 (0.092) | −1.220 *** (0.172) |

| Natural Gas | −0.003 (0.058) | −0.125 (0.085) | −0.330 * (0.166) | −0.055 (0.040) | −0.493 *** (0.055) | −0.326 ** (0.142) | −0.053 (0.064) | −0.101 (0.100) | −0.320 (0.262) | −0.029 (0.031) | −0.612 *** (0.055) | −0.163 (0.141) |

| Petroleum Products | −0.026 *** (0.007) | −0.081 *** (0.006) | −0.956 *** (0.014) | −0.017 *** (0.004) | −0.047 *** (0.006) | −0.955 *** (0.012) | −0.021 *** (0.007) | −0.068 *** (0.008) | −0.964 *** (0.026) | −0.017 *** (0.003) | −0.027 *** (0.005) | −0.954 *** (0.013) |

| Compensated own- and cross-price | ||||||||||||

| Coal and Lignite | −0.049 (0.151) | 0.018 (0.175) | 0.053 (0.250) | −0.174 * (0.093) | −0.107 (0.119) | 0.370 ** (0.152) | −0.048 (0.181) | −0.120 (0.190) | 0.247 (0.247) | −0.242 *** (0.087) | −0.024 (0.090) | 0.336 *** (0.121) |

| Natural Gas | 0.006 (0.059) | −0.099 (0.086) | 0.002 (0.077) | −0.036 (0.040) | −0.436 *** (0.057) | 0.397 *** (0.075) | −0.040 (0.064) | −0.063 (0.103) | 0.162 (0.108) | −0.008 (0.030) | −0.550 *** (0.054) | 0.627 *** (0.062) |

| Petroleum Products | 0.001 (0.007) | 0.0002 (0.006) | 0.092 *** (0.011) | 0.010 ** (0.004) | 0.031 *** (0.006) | 0.042 *** (0.009) | 0.006 (0.006) | 0.013 (0.008) | 0.070 *** (0.015) | 0.009 *** (0.003) | 0.050 *** (0.005) | 0.011 (0.011) |

| Allen own- and cross-price | ||||||||||||

| Coal and Lignite | −1.899 (5.842) | 0.233 (2.274) | 0.054 (0.253) | −6.761 * (3.620) | −1.392 (1.550) | 0.377 ** (0.155) | −1.866 (7.021) | −1.554 (2.466) | 0.250 (0.250) | −9.397 *** (3.388) | −0.310 (1.166) | 0.347 *** (0.125) |

| Natural Gas | −1.285 (1.121) | 0.002 (0.078) | −5.661 *** (0.740) | 0.405 *** (0.074) | −0.821 (1.342) | 0.164 (0.110) | −7.136 *** (0.699) | 0.649 *** (0.063) | ||||

| Petroleum Products | 0.093 *** (0.011) | 0.043 *** (0.009) | 0.071 *** (0.015) | 0.011 (0.011) | ||||||||

| Morishima | ||||||||||||

| Coal and Lignite | 0.083 (0.219) | 0.238 (0.302) | 0.300 ** (0.144) | 0.231* (0.130) | −0.072 (0.228) | 0.535 (0.556) | 0.465 *** (0.107) | −0.265 (0.179) | ||||

| Natural Gas | 0.066 (0.166) | 0.626 *** (0.179) | 0.148 (0.106) | 0.629 *** (0.154) | 0.013 (0.199) | 0.643 ** (0.285) | 0.255 *** (0.094) | 0.791 *** (0.153) | ||||

| Petroleum Products | 0.043 (0.156) | 0.043 (0.089) | 0.187 * (0.095) | 0.446 *** (0.059) | 0.045 (0.187) | 0.033 (0.107) | 0.267 *** (0.089) | 0.0585 *** (0.059) | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Duangnate, K.; Mjelde, J.W. The Role of Pre-Commitments and Engle Curves in Thailand’s Aggregate Energy Demand System. Energies 2022, 15, 1578. https://doi.org/10.3390/en15041578

Duangnate K, Mjelde JW. The Role of Pre-Commitments and Engle Curves in Thailand’s Aggregate Energy Demand System. Energies. 2022; 15(4):1578. https://doi.org/10.3390/en15041578

Chicago/Turabian StyleDuangnate, Kannika, and James W. Mjelde. 2022. "The Role of Pre-Commitments and Engle Curves in Thailand’s Aggregate Energy Demand System" Energies 15, no. 4: 1578. https://doi.org/10.3390/en15041578

APA StyleDuangnate, K., & Mjelde, J. W. (2022). The Role of Pre-Commitments and Engle Curves in Thailand’s Aggregate Energy Demand System. Energies, 15(4), 1578. https://doi.org/10.3390/en15041578