1. Introduction

Global warming—caused by anthropogenic greenhouse gas (GHG) emissions sourced from the combustion of hydrocarbons (coal, oil, and gas) [

1,

2]—along with increasing energy demands globally, are among the main triggers in the global search for alternative sources of energy that are less polluting and cleaner, like renewable energy technologies.

Hydrocarbon resources—with almost 30% of the world’s total proven oil reserves and around 20% of its total proven natural gas reserves [

3]—have been central in meeting the energy needs of the Gulf Cooperation Council (GCC) countries—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. However, the changing dynamics of the energy market both domestically and internationally has created pressure as well as a window of opportunity for the GCC states to re-assess their renewable energy development. The GCC states are faced with many internal challenges that trigger the need to develop alternative energy sources. These include growing domestic energy consumption, eating up oil and gas export potential, and triggering the energy security profile across the region. Further, annual rise of GHG emissions [

4] and increases in air pollutants due to industrial expansion and heavy reliance on hydrocarbon resources for operation are other factors that trigger the search for alternative clean energy sources. Furthermore, global climate mitigation measures targeting reduced consumption of hydrocarbons impose risk to the economic stability of oil-exporting GCC states. Renewable energy technologies represent an opportunity for GCC states to tackle such challenges and, at the same time, support their ambitions to diversify economies away from high dependence on hydrocarbons.

Renewable energy potential, particularly solar, seems to be remarkable and more so given the geographic location of the Arabian Peninsula within the sunbelt. While the GCC states are home to abundant renewable resources [

5,

6,

7], hydrocarbons continue to meet most of the Gulf Arab states’ primary energy needs, accounting for nearly 99% of primary energy consumption in the region [

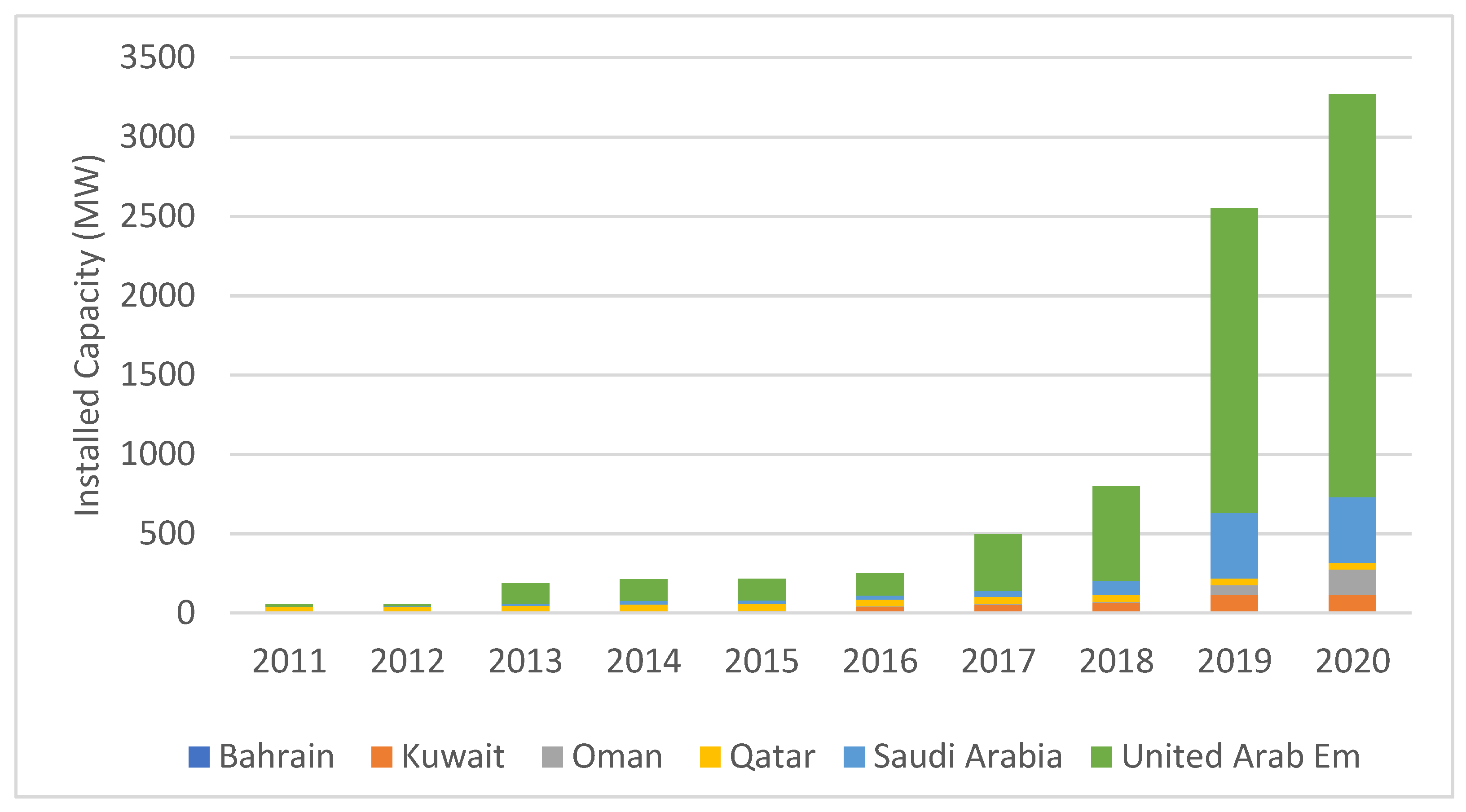

8], and the current role of renewables in meeting the region’s growing energy demand remains relatively negligible. Aware of the changing energy dynamics, the GCC investments in renewable energy have been on the rise, albeit slowly. That is, the total renewable energy installed capacity has increased from 17 megawatts in 2011 to 3271 megawatts in 2020 [

9]. Yet, the current share of renewable energy in the region’s total primary energy consumption still does not exceed 1%. Against this background, this paper aims to assess the reasons behind such underutilization of renewable energy resources in the GCC states.

Growing attention has been given to assess the barriers that have affected the growth of renewable energy development in the GCC (see, for example, [

10,

11,

12,

13,

14,

15,

16,

17,

18]). The latest investigation found that while institutions are conducive to promoting the development of renewables readily available in some GCC countries, they lack a clear mandate and dedicated planning capacity with limited incentives, regulations, and enforcement environment to attract investors [

7,

11]. Furthermore, market distortions, especially subsidized fuel and electricity, have led to low energy prices in the region and were identified as a major challenge that has discouraged the competitiveness of renewables compared to conventional energy sources [

14,

16]. A recent study identified the design and implementation of financial policies to support renewable energy adoption, which has been a challenge for their large-scale adoption [

19,

20]. These investigations provide a good explanation of why the share of renewable energy in the GCC has remained low. Yet, a systematic identification of barriers that explain the reasons behind the adoption of renewable energy in the GCC has been missing, or where available, is outdated. This paper contributes by providing an updated discussion of renewable energy adoption barriers in the GCC. The paper also provides a systematic identification of different technological, economic, institutional, cultural, and R&D barriers by discussing the general and specific barriers that have contributed to each barrier category.

This paper draws on secondary data sources, including scientific journal articles, governmental and companies’ websites and reports, and newspaper articles. The specific objectives of this paper are to: justify the importance of advancing renewable energy in the GCC (

Section 2); provide an overview of the current state of renewable energy development in each GCC state (

Section 3); identify the barriers that have slowed the deployment of renewable energy technologies across the GCC (

Section 4); and put forward policy recommendations to overcome barriers and promote successful implementation of renewable energy in the GCC (

Section 5).

3. The Current State of Renewable Energy in the Six GCC States

In their long-term economic development visions of the twenty-first century, the GCC countries set out ambitious targets and objectives for diversifying economies, making environmental sustainability an integral part of their economic development visions, including in areas of air quality, sanitation, drinking water, waste management, biodiversity, fisheries, climate change, and pollution. For instance, Saudi Arabia’s Vision 2030 holds sustainability at its heart and “drives collective commitment to creatively and responsibly meet current and future energy and climate challenges”; Bahrain Economic Vision 2030 states that “economic growth must never come at the expense of the environment and the long-term well-being of our people”; Kuwait Vision 2035 promises to “ensure environment regulations and efficient sustainability within the state”; Qatar National Vision 2030 states that “economic development and protection of the environment are two demands neither of which should be sacrificed for the sake of the other”; and Oman’s Tanfeedh program, promises to advance three environment-related national goals: environmental protection; crisis risk management; and science, technology, and innovation [

34]. Importantly, with the exception of Oman and Kuwait, the GCC countries have framed their Nationally Determined Contributions (NDCs) to be in line with their economic diversification efforts [

35].

Furthermore, the Gulf states have shown a progressive interest in developing emission reduction initiatives, which in many cases are backed by renewable energy targets. Saudi Arabia, for instance, sat a target for avoiding the use of up to 278 million tons of CO

2 eq annually by 2030 [

36], and Oman, in its second NDC, pledged to reduce its greenhouse gas (GHG) emissions by 7% relative to a business-as-usual scenario by 2030 [

37]. To fulfill these aspirations, renewable energy has been an integral part of emissions reduction initiatives. The Gulf Arab states have set renewable energy targets for 2025 and 2030, as well as aspirational long-term objectives for 2050 (

Table 1).

To achieve renewable energy targets, the Gulf states have developed a handful of renewable energy initiatives and projects. At the end of 2020, the region had 146 GW of installed power capacity, of which renewable energy accounted for 3271 MW. Of that, solar PV technologies remain the most dominant technology (71%), followed by solar CSP (23%), biomass and waste (4%), and wind (2%). The UAE can be considered a regional leader in renewable energy adoption, accounting for 68% of total regional renewable energy installed capacity, followed by Saudi Arabia (16%) and Kuwait (9%) (

Figure 1). Installed renewable electricity capacity in the GCC is dominated by a handful of utility-scale solar projects. The currently existing CSP capacity is located in Abu Dhabi’s Shams Solar Power Station, Kuwait’s Shagaya project, and Saudi Arabia’s Waad Al-Shamal. Almost all of the GCC’s commercial waste-to-energy generation capacity is in Qatar.

3.1. Bahrain: Ambitious but Stagnant Developer

Bahrain launched the kingdom’s Economic Vision 2030 in 2008, aimed to reduce dependence on oil and transition towards sustainability. The vision addresses Sustainable Development Goals 2030, with a target of 700 MW of renewable energy generation capacity by 2030 [

38]. It also includes a renewable energy target of generating 5% of its energy from renewables by 2025 and 10% by 2035. Up until 2020, all of Bahrain’s electricity generation was met by natural gas. The country plans to build a 100 MW solar plant to be operational in 2021.

The Askar Solar Power Plant is a project under construction in the Askar area in the Southern Governorate in the Kingdom of Bahrain, according to a power purchase agreement (build, own, and operate). This project is considered the first photovoltaic power plant of this size in the Kingdom of Bahrain, where the project will generate 100 megawatts through solar energy, achieving nearly 50% of the target specified in the National Renewable Energy Action Plan in the Kingdom, which aims to reach the contribution of photovoltaic energy in the power mix to 255 MW by 2025.

3.2. Kuwait: Ambitious but Reluctant Developer

Kuwait’s government has set a target to increase the share of renewables in the energy mix to 10% by 2020 and 15% by 2030. In Kuwait, the operational renewable energy projects presently consist of a handful of small demonstration projects. Launched in 2019, Shagaya Phase I is Kuwait’s flagship renewable energy project [

39]. Jointly developed by the Kuwait Institute for Scientific Research (KISR) and the Ministry of Electricity and Water, it consists of 10 MW of solar PV capacity, 10 MW of wind, and 50 MW of CSP. The second phase of the project, Shagaya Phase II, is expected to be one of the largest solar projects in Kuwait, with a 1.5 GW capacity. It is expected to generate 15% of the oil sector’s electricity needs to the project’s owner, the Kuwait National Petroleum Company.

The Shagaya Phase I project is managed by a consortium of the Spanish engineering company TSK and Kharafi National of Kuwait. While the Shagaya Phase I project is operational and feeds into the grid, there are still no regulations and policies in place for adopting renewable energy in the country.

Despite progress, there is still no dedicated entity to regulate and ensure that the country can achieve Kuwait’s renewable energy targets. The current energy-related institutional landscape mainly supports the hydrocarbon sector. Supported by the Ministry of Oil, the Supreme Petroleum Council (SPC) oversees Kuwait’s hydrocarbon sector policy. The Ministry for Electricity and Water, which also owns and operates Kuwait’s electric power system, acts as the regulator of the electricity market. The entity that has been responsible for supporting the development of renewable energy is the Kuwait Institute for Scientific Research (KISR), which is an independent national institute that conducts scientific research and provides consulting services within Kuwait, the region and internationally. KISR has contributed to developing several renewable energy projects, including Kuwait’s flagship solar PV, CSP and wind power project, Shagaya Phase I.

3.3. Oman: Progressive Developer

In Oman, the national oil company, the government, private, and academic sectors have been involved in developing few renewable energy projects. In 1995, the government established the first renewable energy project, a 10 kW wind-solar water desalination plant. Following the launch of its first study regarding the potential for Oman’s renewable energy investments in 2008, the government approved the first renewable energy project in 2017, a 303 kW solar project in Al Mazyunah developed by the Rural Areas Electricity Company. Private investors have also launched their own pilot projects, including a 6 MW CPV solar technology project built by a private investment company in 2010 and a 50 kW PV rooftop project developed by a state-owned electricity distribution company in 2012 [

40]. Petroleum Development Oman (PDO; Oman’s national oil company) has also been proactive in terms of studying the potential for renewable energy investment in Oman and in establishing its own pilot projects. In 2012, the PDO executed its first solar energy pilot project, a 7 MW pilot project at Amal to test the commercial viability of solar steam producing 50 tons of steam a day for enhanced oil recovery [

40].

Oman has adopted policies to support the adoption of renewable energy technologies both at a large scale and small scale. At the small scale level, for example, in 2013, the Authority for Public Services Regulation (formerly the Authority of Electricity Regulation) issued the first policy to incentivize the installation of renewable energy technologies in rural areas. Specifically, the new renewable energy policy aimed at integrating renewable energy into existing diesel-based energy systems that provide electricity to remote and rural areas. This policy drove the establishment of the first rural area pilot project Mazyonah 303 kW solar project. It also triggered the establishment of other rural area projects, such as the 500 kW wind-based pilot project based in the rural island of Masirah [

40].

Furthermore, in 2017, Oman issued a policy that enables individuals, such as homeowners and industrial and commercial premises, to produce electricity from renewable energy sources like solar and sell the surplus to electricity distribution companies at the cost of electricity. This policy is locally called the ‘Sahim’ scheme. In the initial phase of Sahim, the homeowners were expected to pay for the installation of these cells, but in the second phase of Sahim, customers are not expected to bear the costs of procuring, installing, operating, or maintaining the systems. The distribution companies act as agents for the local single buyer of electricity and buy rooftop PV-generated electricity from consumers via a net metering mechanism that allows for compensation for electricity generated by rooftop PV panels [

41].

On a large utility scale, in 2022, Oman inaugurated a 500 MW solar energy project in Ibri. The project is an Independent Power Plant awarded to the consortium led by the International Company for Water and Power Projects (ACWA Power) following an international competitive tender. Additionally, a 50 MW wind farm project in south Oman became operation in 2019.

In Oman, the Authority for Public Services Regulation (formerly the Authority of Electricity Regulation) oversees the regulation of renewable energy development in the country, along with regulating electricity and water services. It is financially and administratively independent. The Authority reports directly to the Council of Ministers.

3.4. Qatar: Ambitious but Stagnant Developer

Qatar is the only Gulf country that has a factory that produces polysilicon, which is a key component in a range of solar photovoltaic (PV) technologies. Located in Ras Laffan Industrial City, 80 km north of Doha, Qatar Solar Technologies (QSTec) is a joint venture (JV) between Qatar Solar (a subsidiary of Qatar Foundation), Germany’s SolarWorld AG, and Qatar Development Bank [

42]. Furthermore, Qatar is the only Gulf country to have an operational waste-to-energy facility, the 30 MW Mesaieed plant. While expected to be operational by the end of 2020, the first phase of the 800 MW Al Kharsaah solar PV project reached financial close only late in 2020 [

43]. Qatar’s government set a target to meet 20% of its power demand from renewables by 2030 [

42]. At present, however, Qatar is yet to have a dedicated entity that has clear mandates to support the development of renewable energy. Key institutions that have so far played a role in Qatar’s renewable energy development include the Ministry of Energy and Industry, Qatar Electricity and Water Company (Kahramaa, the country’s main utilities regulator), and the Qatar National Research Fund. The latter is a member of the Qatar Foundation and provides funds for research on a variety of subjects, including renewable energy.

3.5. Saudi Arabia: Progressive Developer

The Saudi National Renewable Energy Program plans to develop more than 35 projects across the Kingdom, which are being implemented by the Ministry of Energy.

The announced energy mix in the Kingdom of Saudi Arabia includes the goal of reaching 50% of renewable energy sources and 50% of gas by 2030. The Kingdom’s geographic location is among the best in the world for the production of solar and wind energy, and the Kingdom ranked sixth globally. It has the highest potential for solar energy production and ranked 13th in wind production on land [

44]. The renewable energy capacity in Saudi Arabia reached 700 MW in 2021, with wind power representing 400 MW (Domat Al-Jandal project) at USD 0.199 per kilowatt-hour, and photovoltaic energy representing 300 MW (Sakaka project), with the lowest supply ever for solar PV at a value of USD 0.234 per kilowatt-hour [

45].

It is worth mentioning here that the Kingdom of Saudi Arabia, during its presidency of the G-20, proposed activating the Circular Carbon Economy Initiative (CCE), which was endorsed by all G-20 countries as an integrated and practical approach to managing emissions. The circular carbon economy also takes into account different national circumstances by including a wide range of pathways and options available. However, the main importance is the reduction of greenhouse gas emissions, considering the efficiency of the system, national conditions, including the resources identified for it, and the particular political, economic, environmental, and social development contexts. The circular carbon economy is based on the “three strategies” to protect the environment (mitigating, removing, reusing, and recycling). Moreover, it contributes to the realization of a fourth strategy, namely, removal, i.e., the attempt to eliminate accumulated emissions in the atmosphere.

3.6. UAE: Leading Developer

The UAE launched its National Energy Strategy 2050 in 2017, which aims to produce 50% of its energy needs from clean sources (44% from renewable sources and 6% from nuclear sources) and reduce carbon emissions (“carbon footprint”) by 70% by 2050 [

46]. The UAE renewable energy capacity accounted for 68% of the total renewable energy capacity in the Gulf countries in 2018. The UAE has also played a leading regional role in the entry of the renewable energy sector to the Gulf countries, represented by hosting the headquarters of the International Renewable Energy Agency (IRENA).

Among the factors that helped the UAE expand the development of renewable energy early is its use of is utility-scale renewable energy auctions, which is the optimal policy framework to deploy renewable projects in a structured, cost-efficient, and generally transparent manner. Dubai’s approach to renewable energy auctions provides a framework for very low PPAs. Since 2015, Dubai has established leadership in utility-scale solar PV auctions in which the PPA was signed for Dubai’s first renewable energy IPP at the Mohammad bin Rashid Al Maktoum (MBR) Solar Park. Long-term, the PPA has a 25-year second phase solar park development, as well as a role in the local electricity authority. The Dubai Water and Electricity Authority (DEWA) is taking part ownership (51%) in the project consortium that won the bid, and being the electricity off-taker from a government-established site are complementary factors to the success of auctioned projects [

47].

The establishment of the MBR Solar Park is one very important factor for the successful promotion of renewable energy in Dubai because designated government locations create certainty for investors regarding the availability of solar resources as well as necessary grid connections. Another factor for Dubai’s success is attractive financing. The low PPA prices were achieved by extremely attractive financing terms offered by UAE banks with debt financing at 86% of the total project value with an interest rate near 4% and a 27-year tenor. Furthermore, minimal, if any, costs for land and grid connections and forward projections on improved technology performance were other factors in Dubai.

4. Why Is the Share of Renewables Still Low in the GCC?

Despite progress in deploying renewables across the GCC, there are many challenges in their development. Acknowledging the significance of these challenges differ from one country to another, these can be classified into institutional, market-related, technical, and cultural.

4.1. Institutional Barriers: Evolving but Limited Institutional Capacity to Support Renewable Energy

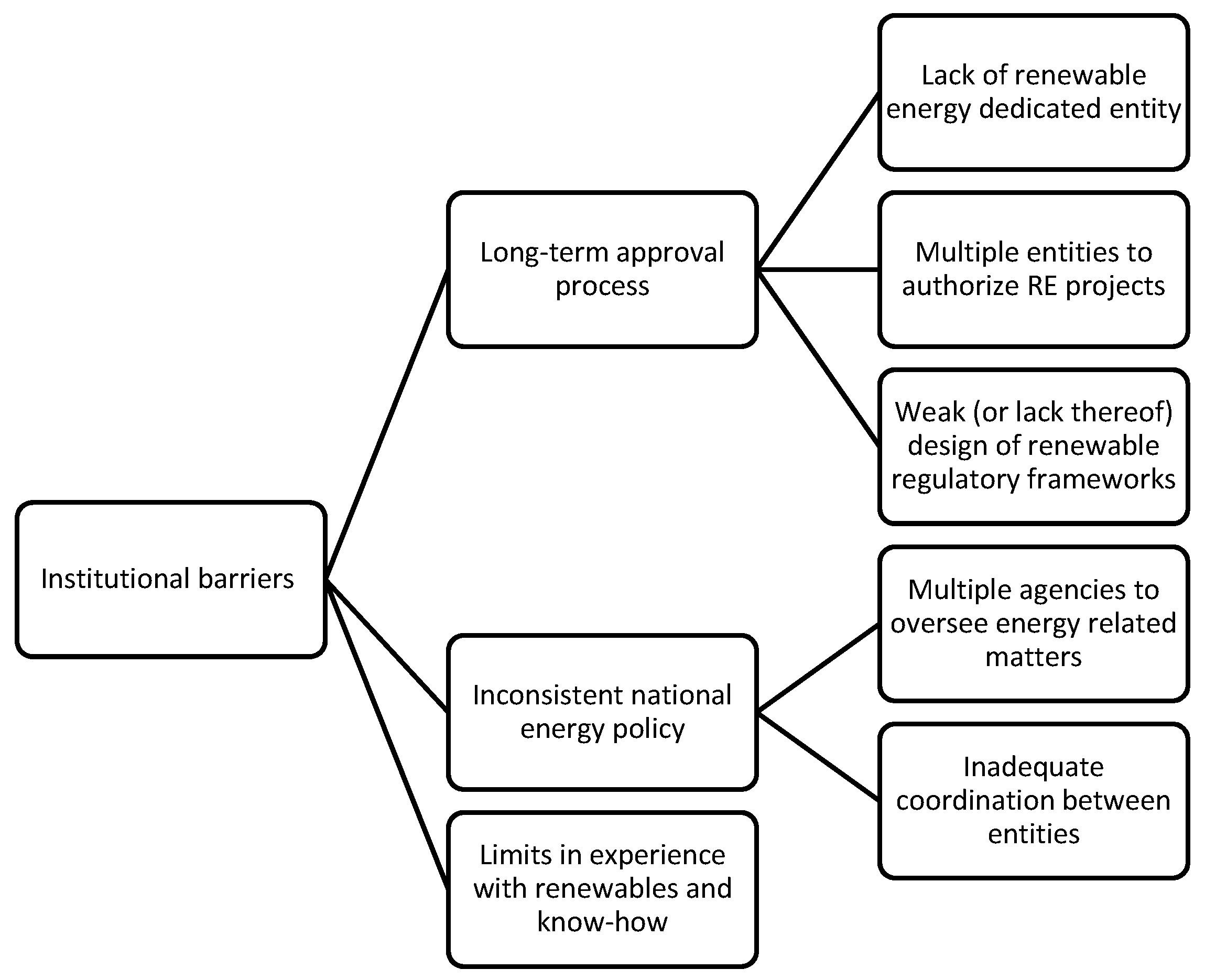

The institutional barriers that had impeded the deployment of renewable energy in the GCC are: (i) approval process to obtain long-term licensing; (ii) inconsistent national energy policy; and (iii) limited experience with renewables and know-how among officials (

Figure 2).

A main institutional barrier had been (i) approval process to obtain long-term licensing, permitting, and approval to authorize installation of renewable energy projects. Each of these processes requires consultation, review, and approval from multiple agencies and levels of government with little to no streamlining. One factor that has contributed to elongating the approval process to get licensing or permits is complicated governance processes. The complicated governance processes have been a result of the existence of multiple agencies to oversee the implementation of renewable energy projects. Importantly, inadequate coordination between these entities and, in some cases, the lack of a renewable energy-dedicated entity has had major issues to complicate governance processes and the subsequent long-term approval process. Moreover, limited cooperation between different government entities or government and business and academic entities has been a barrier delaying the deployment of renewable energy in some GCC states [

48]. Another factor that contributes to elongating the approval process is the limitations in the design and implementation of renewable regulatory frameworks [

11,

12,

15,

16]. While all GCC states have set targets to increase the share of renewable energy in their energy mix profile, regulatory frameworks that facilitate and incentivize the deployment of renewables are mostly lacking or need to be strengthened. Renewable energy does not receive enough legislative and regulatory support compared to conventional modes of power generation. In some cases, the power sector law, which dominantly supports the conventional modes of power generation, includes less (or lack thereof) regulatory and institutional backing or elements that support the deployment of renewable energy [

48].

A second institutional barrier is (ii) an inconsistent national energy policy due to the existence of multiple agencies, which has led to viewing energy-related matters—such as oil, gas, electricity, water desalination, greenhouse gas emission reduction, and renewable energy—separately [

16,

48]. This might be explained by the persistence of hierarchal, top-down governmental decision-making and, in some cases, the under-representation of renewable energy interest groups in the high-level decision-making arena, leaving little room for influencing or contributing to changes in state laws.

A third institutional barrier had been (iii) limits in experience with renewables and know-how among officials leading to delays in governmental initiation of new policies, strategies, and project approvals [

11,

15,

48,

49]. This also explains the delayed governmental reaction to international environmental agreements, approving new renewable energy targets, or making changes to existing laws.

4.2. Market Barriers: Favoritism towards Conventional Electricity Sources over Renewables

Two major market barriers impede the deployment of renewable energy in the GCC: (i) economic barriers, which disadvantage the competitiveness of renewable energy technologies, and (ii) high investment uncertainties (

Figure 3).

Regarding economic barriers, the governmental energy pricing in the form of subsidies on gas, diesel, and electricity tariffs along with the exclusion of the costs of environmental externalities, are major barriers to eliminate the competitiveness of renewable energy technologies, and hence their limited penetration into GCC’s electricity market [

11].

Furthermore, high up-front costs of renewable energy technologies and long payback periods have been barriers that disadvantage the competitiveness of renewable energy technologies with conventional energy sources [

11,

15,

19,

21]. This has been highly advantaged by the current sector’s law that specifies technology, economic, and technical conditions in favor of oil and gas-based technologies. The upfront costs remain to be seen, partially due to the exclusion of environmental externalities in evaluating the cost of fuels—namely oil and gas—and due to the lack of subsidy mechanisms that support the development of renewable energy technologies [

11].

In addition to the economic barriers, the second market barrier was (ii) high investment uncertainty, which was reinforced by the limitation of available renewable energy-related data and information and a highly controlled market [

16,

48]. Limitation of available data and information regarding renewable energy resource availability is a challenge for investors wishing to access the necessary information needed for investment decisions. The limitation of available data and information has also been a challenge for decision makers at the government level because decision-making processes need to be guided by adequate information. This limitation explains the reasons behind delays in the approval of renewable energy projects. On the other hand, the highly controlled power market, wherein most of the power sector’s value chain companies are owned by the government, challenged the entry of renewable energy private investors, especially small and medium enterprises who are not advantaged by the state patronage [

48]. Given the decentralized nature of renewables, small and medium enterprises, in many cases, cannot generate power on a large scale as in open-cycle gas turbines (OCGT) or closed-cycle gas turbines (CCGT). Therefore, small and medium enterprises can be locked in by the highly controlled power market, which, at the generation side, favors large scale power generation facilities and, at the distribution side, restricts the distribution of electricity to licensed state-owned distribution companies that can only purchase their electricity from the single buyer and seller of electricity.

4.3. Technical Barriers: Unfamiliarity with New Technical Challenges Associated with Renewables

Four main technical barriers have been impeding the deployment of renewable energy in the GCC: (i) the confidence in new technology; (ii) access to the national grid; (iii) the availability of areas required to install renewable energy technologies; and (iv) availability of skilled workforce (

Figure 4).

The main technical barrier has been the confidence in new technology. That is due to the low technological efficiency of renewable energy technologies compared to existing sources of power such as OCGT or CCGT, which have already achieved economy of scale [

48]. Specifically, RE technical efficiency is reduced by the specific environmental conditions of the GCC. According to current practices, the efficiency of renewable energy technologies (especially PV modules) in the GCC is faced with challenging existing environmental conditions, including dust, high temperature, and humidity. It is estimated that, for instance, Oman’s arid environmental conditions may reduce the efficiency of PV cells by approximately 10% compared with standard conditions [

15,

50]. Furthermore, unpredictability and intermittent supply of renewable energy sources is another technical challenge to the development of renewable energy technologies [

11]. Given that the peak production of energy from renewable energy resources coincides with peak energy demands, such as midday during summer times (due to the use of air conditioners), a need for energy storage may not be significant during the peak hours, yet is as an issue to meet energy needs during off-peak hours.

Furthermore, (ii) access to the national grid has been another technical barrier. All GCC countries allow for third-party access to the electricity grid through the dedicated power agency that authorizes grid connection licenses [

51]. However, most identified renewable energy resources in the GCC, especially wind and solar, are available in remote locations away from the main national grid or the main sites of power demand, such as coastal zones. That is, enabling grid access to remote locations might incur high connection costs, energy losses due to the long distances, and indeed would require grid code upgrades [

15,

16,

48].

In addition, (iii) the availability of area required to install renewable energy technologies presents a mix of challenges and opportunities for RE adoption in the GCC. The inconsistency between present infrastructure planning (such as rooftop design) and the specific needs of new technologies installation (like renewables) disadvantaged the installation of renewable energy technologies [

48]. However, with the exception of Kuwait and Bahrain [

12], the availability of areas to install large-scale renewable energy projects such as CSP is an advantage in the GCC because there are vast areas that do not need to be altered for any future installations (e.g., flat deserts) [

7,

11,

17].

Finally, (iv) the limited skilled workforce to maintain and operate renewable energy technologies is another technical challenge that needs to be addressed to support renewable energy deployment in the GCC.

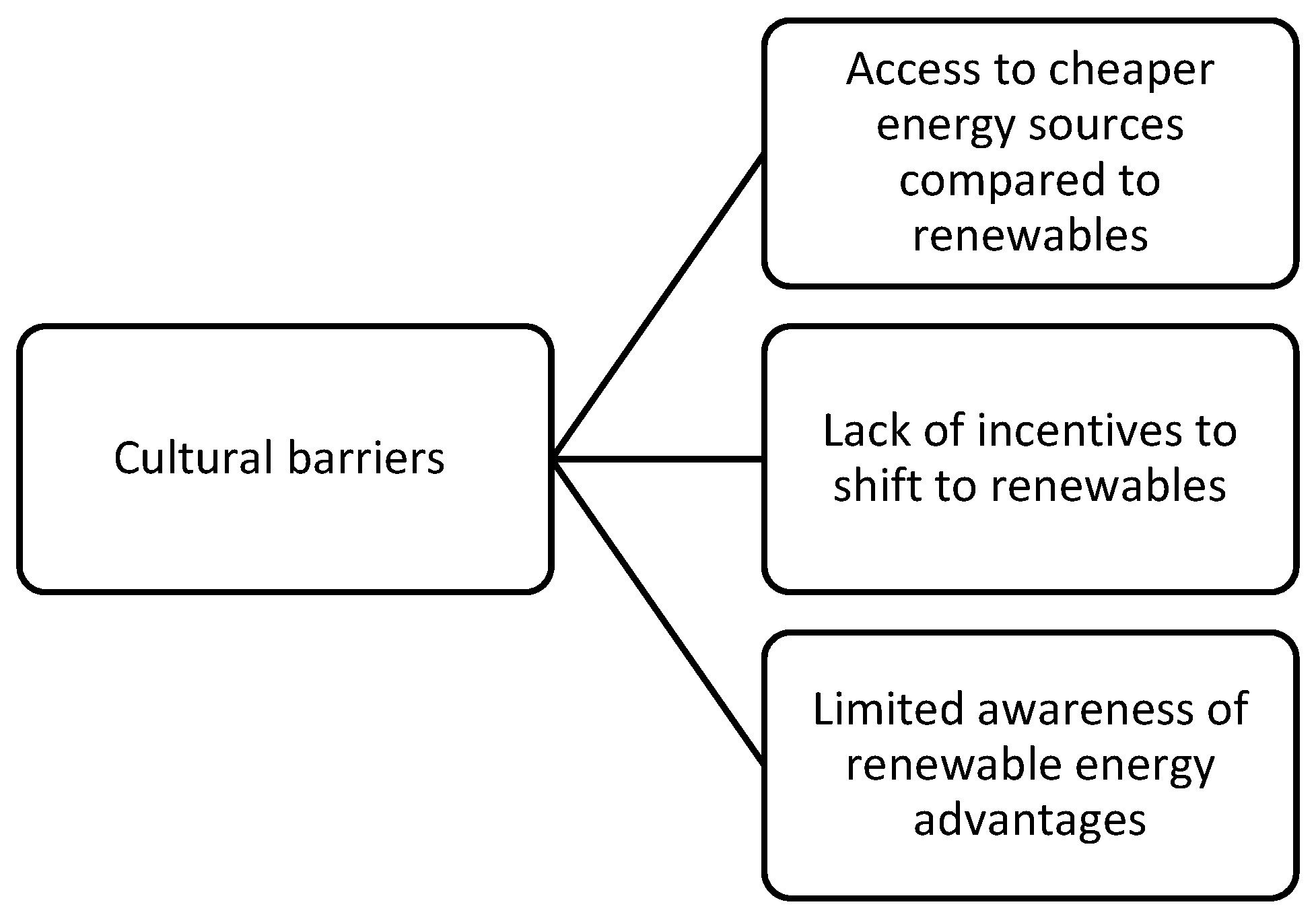

4.4. Cultural Barriers: Lack of Incentives and Desire for Renewable Energy

Public acceptance of renewable energy technologies, especially small-scale renewable energy systems, will remain a challenge, as nearly 100% of GCC nationals have access to electricity that is provided at low costs due to significant government support for this sector [

51]. Easy access to electricity at historically low costs has contributed to a number of negative cultural behaviors, such as excessive energy consumption, which impedes motivating residents to switch to renewable energy sources. Renewables are an expensive option compared to accessible cheap conventional energy supplies. This, in turn, eliminates the demand for renewable energy technologies, which in turn leads to a decrease in demand for renewable energy products [

51]. This easy access to cheap electricity may be another reason to distract customer awareness from the advantages of renewable energy technologies [

28,

52] (

Figure 5).

4.5. Innovation and Domestic Technological Production: Rising R&D Efforts but Further Support Needed

Despite the growth in the employment of renewable energy in the past few years, the Gulf countries, with the exception of Qatar and Saudi Arabia, are not competitive in the field of innovation and the production of renewable energy technology and rely heavily on importing the necessary technology and expertise from abroad.

There is an increasing growth in research and development support to enhance sustainable energy technologies and adapt them to the market and local climatic conditions. Examples include the Masdar Institute in the UAE and the Qatar Environment and Energy Research Institute. However, the Gulf countries still need a strong infrastructure to support and encourage innovation at the local level [

11]. In 2020, the average ratio of investment in research and development to GDP in the Gulf countries was 0.2% in Oman, 0.1% in Bahrain, 0.8% in Saudi Arabia, 0.5% in Qatar, and 0.8% in Qatar, 4% in Kuwait, and 0.7% in the United Arab Emirates, compared to 2% to 3% in industrialized countries. Gulf countries’ investments in research and development are well below the minimum percentage (1%) needed for an effective science and technology base as set by UNESCO [

53].

It should be noted here that many large companies, if not the majority of them, do not have in-house R&D departments, but the direction of new technologies is mainly through joint venture arrangements with foreign partners who lead the project in technology. Furthermore, most R&D institutions serve the interests of the company itself, which leaves little room for stimulating innovation in collaboration with smaller companies, R&D entities, or academia. There is also a strong preference for technology imports through international trade, and this applies to renewable energy technologies as well [

54].

5. Conclusions and Policy Insights

The aim of this study was to diagnose the current state of renewable energy development in the GCC and to identify the factors that have slowed down the adoption of renewable energy in the hydrocarbon-rich GCC states.

The GCC countries have shown progressive governmental support to renewable energy development and deployment over the last decade. Yet, the contribution of renewable energy in meeting the needs of energy provisions remains significantly small compared to the hydrocarbon resources, namely oil and gas, due to decades of abundance and experience with hydrocarbon resources. Whereas technical and economic feasibility issues have been identified as the main barriers to slowing the uptake of RE in the GCC, this paper uncovered that numerous additional factors have notably influenced such delays. These include institutional barriers, especially due to fragmented energy policy, the lack of or weakness of dedicated renewable energy entity, and a dedicated renewable energy regulatory framework. Unless receiving a proper governmental intervention, market barriers also exist to play a role in reducing the competitiveness of renewable energy technologies in the GCC because of high hydrocarbon subsidies, low electricity tariff structure, and highly controlled power market. Furthermore, while the support of renewable energy development in the GCC has received enormous attention and effort from local research entities, the implications of research outcomes do not span beyond the research arena, and the coordination gap between research, government, and the private sector remains wide. To overcome these challenges, we suggest:

5.1. Establish Dedicated Entity with Clear Mandates to Support Meeting Renewable Energy Targets

While all the Gulf Arab countries have announced ambitious goals with regard to renewable energy, some of these countries do not yet have a dedicated entity with clear powers and dedicated renewable energy regulatory frameworks to oversee the deployment of renewable energy sources and the achievement of the specified goals. Establishing a dedicated entity with clear terms of reference will reduce the institutional barriers mentioned in this paper, including facilitating the process of governance and obtaining the necessary permits and approvals for the development of renewable energy projects. It will also contribute to enhancing coordination of efforts for energy-related issues such as oil, gas, electricity, water desalination, reducing greenhouse gas emissions, and renewable energy among various energy entities.

5.2. Ensure Coordination between Different Energy Entities to Ensure Consistency and Avoid Policy Fragmentation

The collective action of all actors involved in renewable energy development—including public, private, financial, and academic—is essential to enabling a systematic transition towards renewable energy. The early recognition of the importance of each actor’s involvement in the decision-making process will minimize the risks associated with the uptake of renewable energy technologies and would enable the deployment of renewables on a large scale. Additionally, the involvement of different actors will help in avoiding the duplication of efforts and conflicts of interest, while ensuring effective coordination of efforts. It will also facilitate the sharing of knowledge, lessons, and experiences, as well as the flow of resources between actors.

5.3. Energy Subsidies

Review the pricing of hydrocarbons so that electricity prices reflect the cost of production. This will not only increase the competitiveness of renewable energy sources and promote efficient use of energy but will also reduce pressure on the budget of the Gulf states. However, attention should be paid to reviewing hydrocarbon prices and taking into account the potential effects of eliminating these subsidies on low-income consumers, especially in the residential sector. We find that the UAE, Bahrain, Saudi Arabia, and the Sultanate of Oman are the Gulf countries that have reformed their hydrocarbon subsidies among the GCC countries, bearing in mind the potential impact on low- and middle-income people.

5.4. Financial Incentives

Dedicated financial instruments are needed in order to incentivize investors to engage in renewable energy development, especially small private investors. Direct cash grants or soft loans can be a policy method of reducing the high upfront investment costs of renewables. Subsidies to support medium- to large-scale renewable energy asset investments can be an attractive mechanism for creating competitive environments for renewable energy projects and conventional energy supply technologies.

5.5. Support Distributional Renewables Alongside Large-Scale Projects

Rooftop PV module installations (solar panels) can be promising for the spread of small-scale renewable energy projects. Net metering—a billing mechanism that credits solar energy system owners for the electricity they generate—also has the potential to encourage consumers to measure their own electricity consumption and production from renewable sources. An additional point regarding enhancing the demand for renewables is the need to promote public awareness of the new RE technologies.

5.6. Support Investment in Research and Development and Work to Provide a Strong Infrastructure to Encourage Innovation at the National Level

The Gulf countries should focus on providing financial support for the development of renewable energy technology at the local level in order to reduce dependence on other countries to import renewable energy technology, especially that most of the imported renewable energy technologies do not work efficiently in the environment of the Gulf countries, due to several factors such as humidity, heat, and dust. Most importantly, the institutional structure needed to support innovation and stimulate cooperation between all stakeholders, including the academic, private, and government sectors, must be strengthened.

While secondary data and information are useful to inform the understanding of general and specific barriers that have impeded the deployment of renewable energy in the GCC, it is worth noting that this paper can benefit from an in-depth case study investigation to understand country-specific barriers and developments. Therefore, primary data collection through semi-structured interviews with stakeholders from academia, government, and the private sector would help to give an in-depth understanding of renewable energy development and barriers in each of the six GCC states.