Electricity Sector Reform Performance in Sub-Saharan Africa: A Parametric Distance Function Approach

Abstract

:1. Introduction

2. Literature Review

2.1. Legislation and Regulation

2.2. Restructuring–Unbundling, Corporatization, and Commercialization

2.3. Private Participation and Property Rights

2.4. The Role of Institutions, System Size and Initial Sector Structure in Reforms

2.5. Reform Performance in Sub-Saharan Africa

3. Methodology

A Stochastic Distance Function to Measure Reform Performance

4. Data

Control Variables and Inefficiency Determinants

5. Results and Discussion

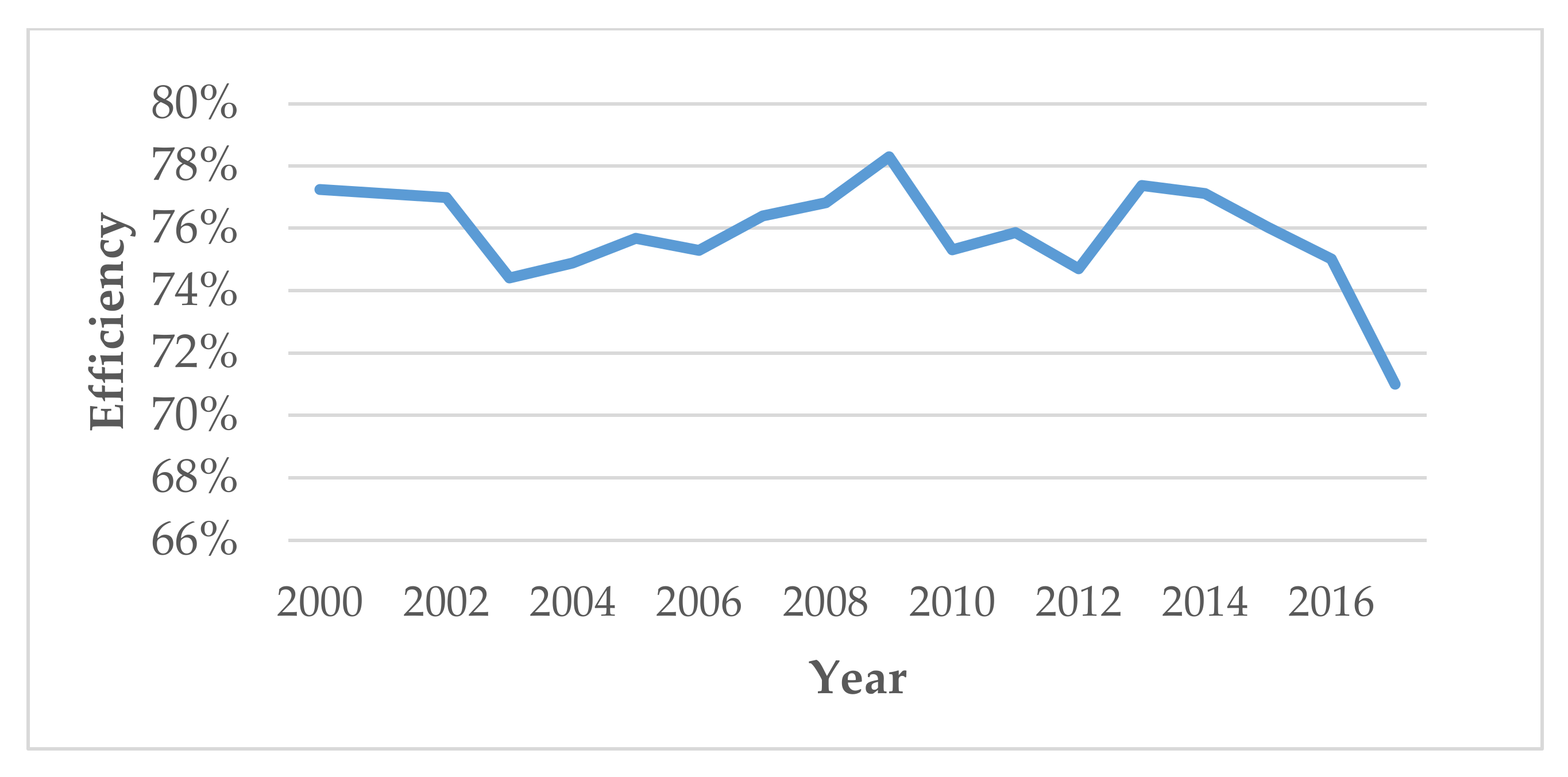

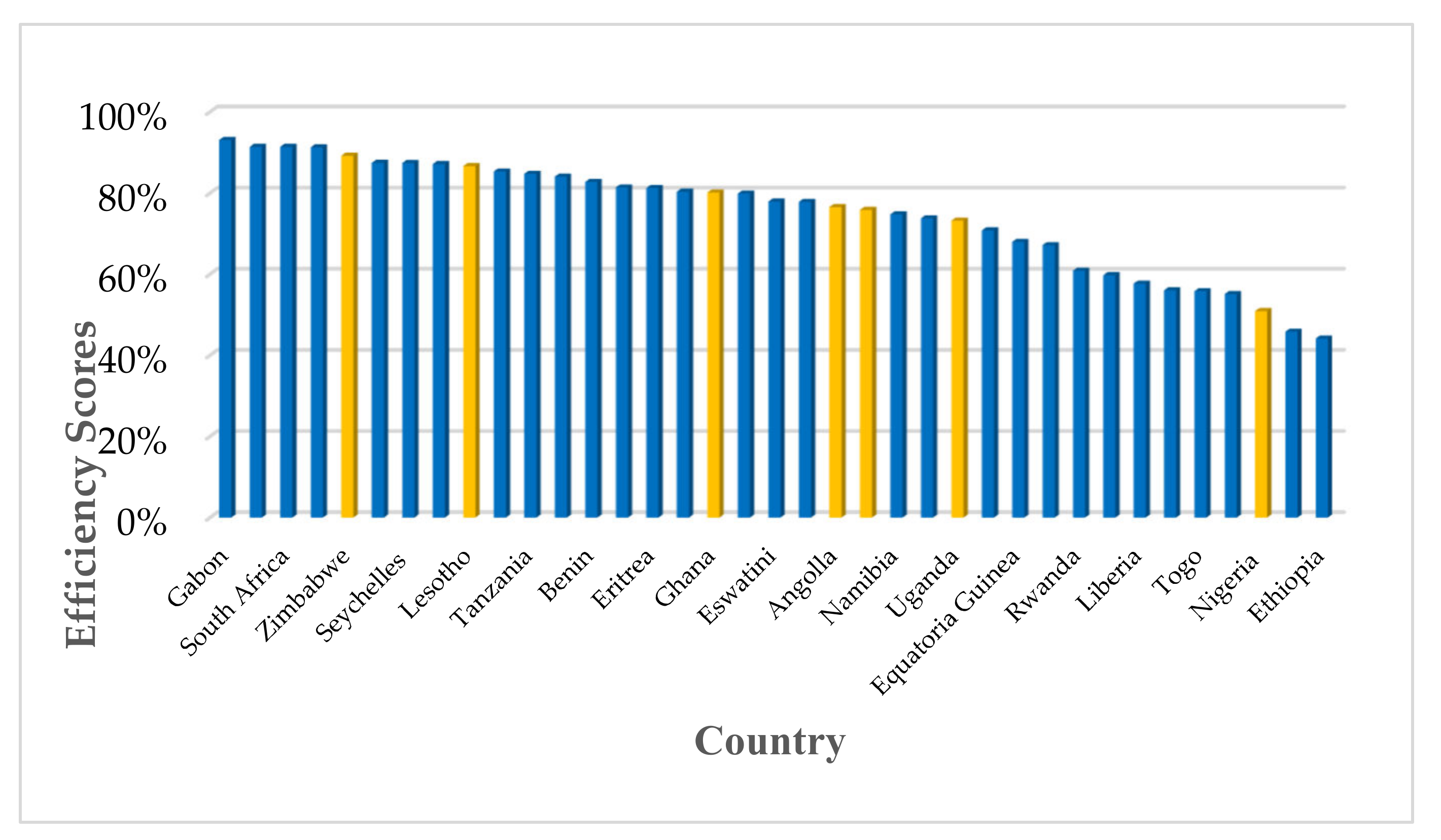

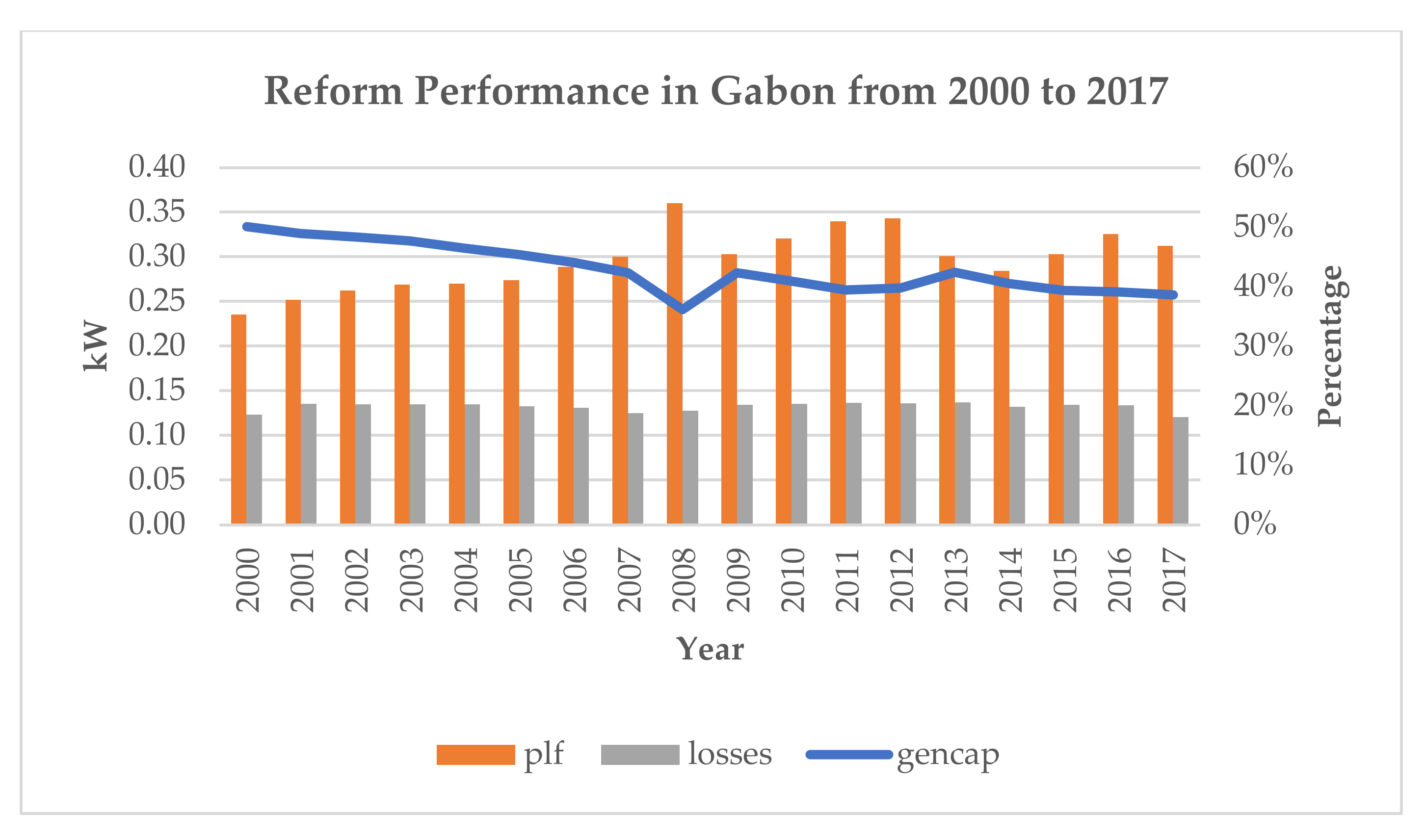

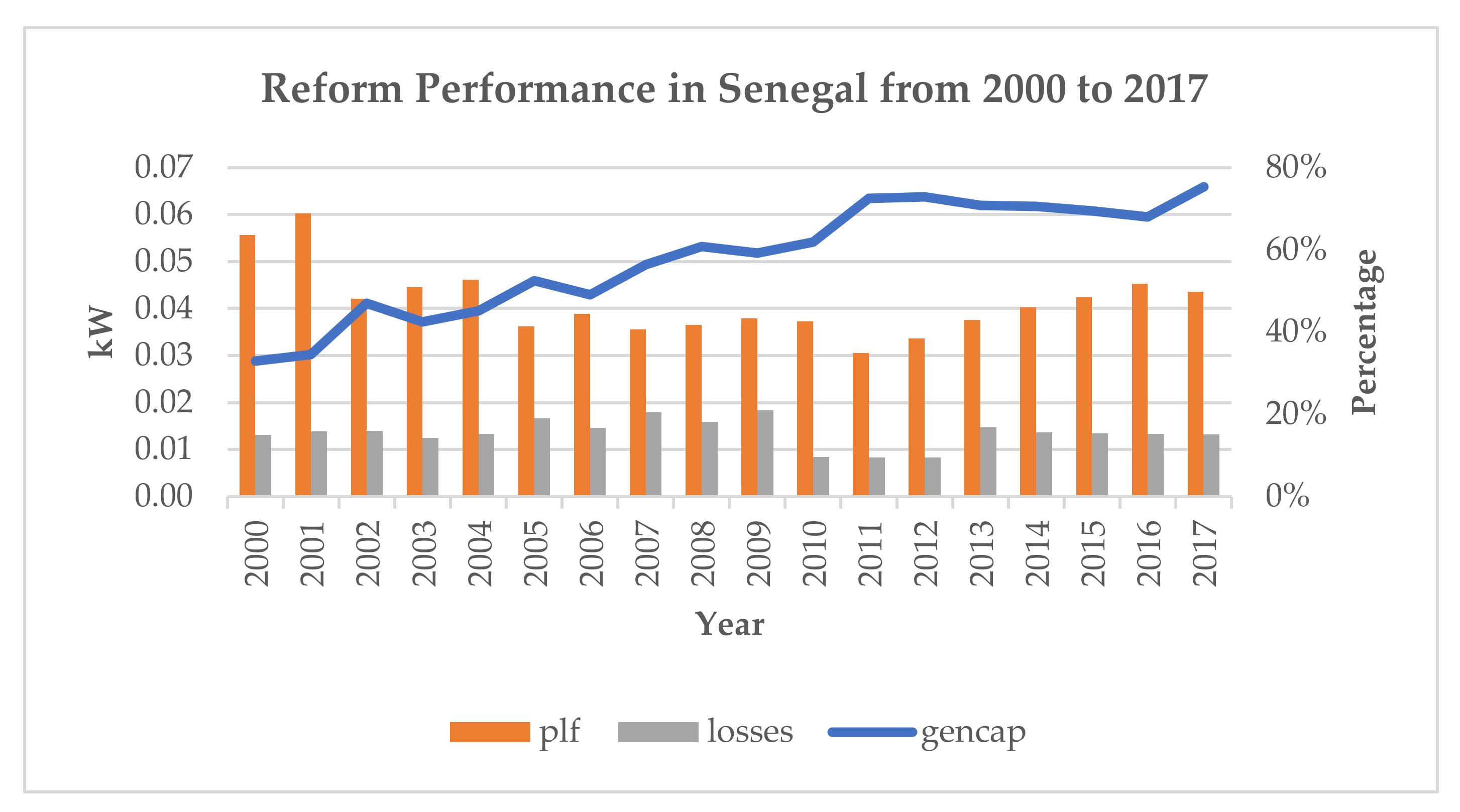

Reform Performance

6. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Country | Year Electricity Act Was Enacted | Year of Vertical Unbundling | Year in Which an Autonomous Sector Regulator Was Put in Place | Years in Which There Was Private Participation in the Management and Ownership in the Sector (Exclude IPPs). |

|---|---|---|---|---|

| Angola | 2002 | 2014 | No | 2008 |

| Benin | 2007 | No | No | No |

| Botswana | 2008 | No | No | No |

| Burkina Faso | 2007 | No | 2007 | No |

| Cabo Verde | 2006 | No | 2003 | 2000–2008 |

| Cameroon | 2011 | No | 2000 | 2000 until today |

| DR. Congo | 2010 | No | No | No |

| Cote d’Ivoire | 2000 | No | 2000 | 2000 until today |

| Equatorial Guinea | 2005 | No | No | No |

| Eritrea | 2004 | No | No | No |

| Eswatini | 2007 | No | 2007 | No |

| Ethiopia | 2000 | No | 2000 | No |

| Gabon | 2005 | No | No | 1996–2018 |

| The Gambia | 2005 | No | 2000 | No |

| Ghana | 2000 | 2000 | 2000 | No |

| Guinea | No | No | No | 2015–2017 |

| Kenya | 2000 | 2000 | 2007 | 2006 until today |

| Lesotho | 2002 | 2000 | No | No |

| Liberia | 2009 | No | No | 2010 until today |

| Malawi | 2002 | No | 2002 | No |

| Mali | 2000 | No | 2000 | 2000 until today |

| Mauritania | 2001 | No | 2001 | No |

| Mozambique | 2000 | No | No | No |

| Namibia | 2000 | No | 2000 | No |

| Nigeria | 2005 | 2006 | 2006 | 2006 until today |

| Rwanda | 2011 | No | 2001 | No |

| Sao Tome and Principe | No | No | 2005 | 2003 to 2006 |

| Senegal | 2000 | No | 2000 | No |

| Seychelles | 2012 | No | 2009 | No |

| Sierra Leone | 2011 | No | 2011 | No |

| South Africa | 2006 | No | 2000 | No |

| Tanzania | 2008 | No | 2000 | 2002 to 2006 |

| Togo | 2000 | No | 2000 | 2000–2006 |

| Uganda | 2000 | 2000 | 2000 | 2003 |

| Zambia | 2000 | No | 2000 | No |

| Zimbabwe | 2003 | 2003 | 2003 | No |

Appendix B

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Angola | 0.03 | 0.03 | 0.03 | 0.04 | 0.04 | 0.06 | 0.05 | 0.05 | 0.06 | 0.06 | 0.06 | 0.06 | 0.08 | 0.09 | 0.10 | 0.15 | ||

| Benin | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | 0.04 | 0.04 | 0.03 | |||||||

| Botswana | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.07 | 0.30 | 0.29 | 0.29 | 0.34 | ||||||||

| Burkina Faso | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.02 | 0.02 | 0.02 | 0.02 | |||||||

| Cabo Verde | 0.11 | 0.12 | 0.18 | 0.18 | 0.18 | 0.17 | 0.15 | 0.16 | 0.19 | 0.18 | 0.21 | 0.22 | 0.27 | 0.28 | 0.30 | 0.31 | 0.32 | 0.37 |

| Cameroon | 0.05 | 0.05 | 0.07 | 0.06 | 0.06 | 0.06 | 0.06 | 0.07 | 0.06 | 0.07 | 0.06 | 0.06 | 0.06 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 |

| DR Congo | 0.04 | 0.04 | 0.04 | 0.04 | 0.03 | 0.03 | 0.03 | 0.03 | ||||||||||

| Cote d’Ivoire | 0.08 | 0.08 | 0.08 | 0.08 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.08 | 0.08 | 0.09 |

| Eq. Guinea | 0.05 | 0.05 | 0.07 | 0.07 | 0.07 | 0.08 | 0.08 | 0.34 | 0.32 | 0.31 | 0.30 | 0.29 | 0.44 | |||||

| Eritrea | 0.06 | 0.06 | 0.06 | 0.06 | 0.05 | 0.05 | 0.04 | 0.04 | ||||||||||

| Ethiopia | 0.01 | 0.01 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.02 | 0.03 | 0.02 | 0.02 | 0.02 | 0.02 | 0.04 | 0.04 |

| Eswatini | 0.13 | 0.14 | 0.14 | 0.14 | 0.15 | 0.17 | 0.16 | 0.17 | 0.17 | 0.17 | 0.17 | |||||||

| Gabon | 0.33 | 0.33 | 0.32 | 0.32 | 0.31 | 0.30 | 0.29 | 0.28 | 0.24 | 0.28 | 0.27 | 0.26 | 0.26 | 0.28 | 0.27 | 0.26 | 0.26 | 0.26 |

| Gambia | 0.02 | 0.02 | 0.02 | 0.02 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.04 | 0.04 | 0.04 | 0.04 | 0.05 | 0.06 | 0.06 | 0.06 | 0.06 |

| Ghana | 0.06 | 0.07 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.09 | 0.10 | 0.10 | 0.11 | 0.11 | 0.11 | 0.11 | 0.14 | 0.14 | 0.16 |

| Guinea | 0.05 | 0.05 | 0.05 | |||||||||||||||

| Kenya | 0.03 | 0.03 | 0.03 | 0.03 | 0.04 | 0.04 | 0.04 | 0.03 | 0.03 | 0.03 | 0.03 | 0.04 | 0.04 | 0.04 | 0.04 | 0.05 | 0.05 | 0.05 |

| Lesotho | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 |

| Liberia | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | |||||||||

| Malawi | 0.04 | 0.04 | 0.05 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

| Mali | 0.01 | 0.02 | 0.02 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.04 | 0.04 | 0.04 | 0.04 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 |

| Mauritania | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.06 | 0.05 | 0.05 | 0.06 | 0.06 | 0.11 | 0.11 | 0.12 | |

| Mozambique | 0.13 | 0.13 | 0.13 | 0.12 | 0.12 | 0.12 | 0.11 | 0.12 | 0.11 | 0.11 | 0.11 | 0.10 | 0.10 | 0.10 | 0.10 | 0.09 | 0.09 | 0.10 |

| Namibia | 0.21 | 0.21 | 0.21 | 0.21 | 0.21 | 0.20 | 0.20 | 0.20 | 0.23 | 0.22 | 0.22 | 0.18 | 0.23 | 0.22 | 0.21 | 0.21 | 0.21 | 0.21 |

| Niger | 0.01 | 0.01 | ||||||||||||||||

| Nigeria | 0.05 | 0.05 | 0.05 | 0.06 | 0.06 | 0.05 | 0.05 | 0.05 | 0.06 | 0.06 | 0.06 | 0.07 | 0.07 | |||||

| Rwanda | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 | |

| Sao Tome and Principe | 0.09 | 0.09 | 0.09 | 0.08 | 0.08 | 0.08 | 0.12 | 0.12 | 0.12 | 0.11 | 0.13 | 0.13 | 0.14 | |||||

| Senegal | 0.03 | 0.03 | 0.04 | 0.04 | 0.04 | 0.05 | 0.04 | 0.05 | 0.05 | 0.05 | 0.05 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.07 |

| Seychelles | 0.73 | 0.71 | 0.91 | 0.90 | 0.95 | 0.95 | 0.93 | 0.93 | 1.62 | |||||||||

| Sierra Leone | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 | |||||||||||

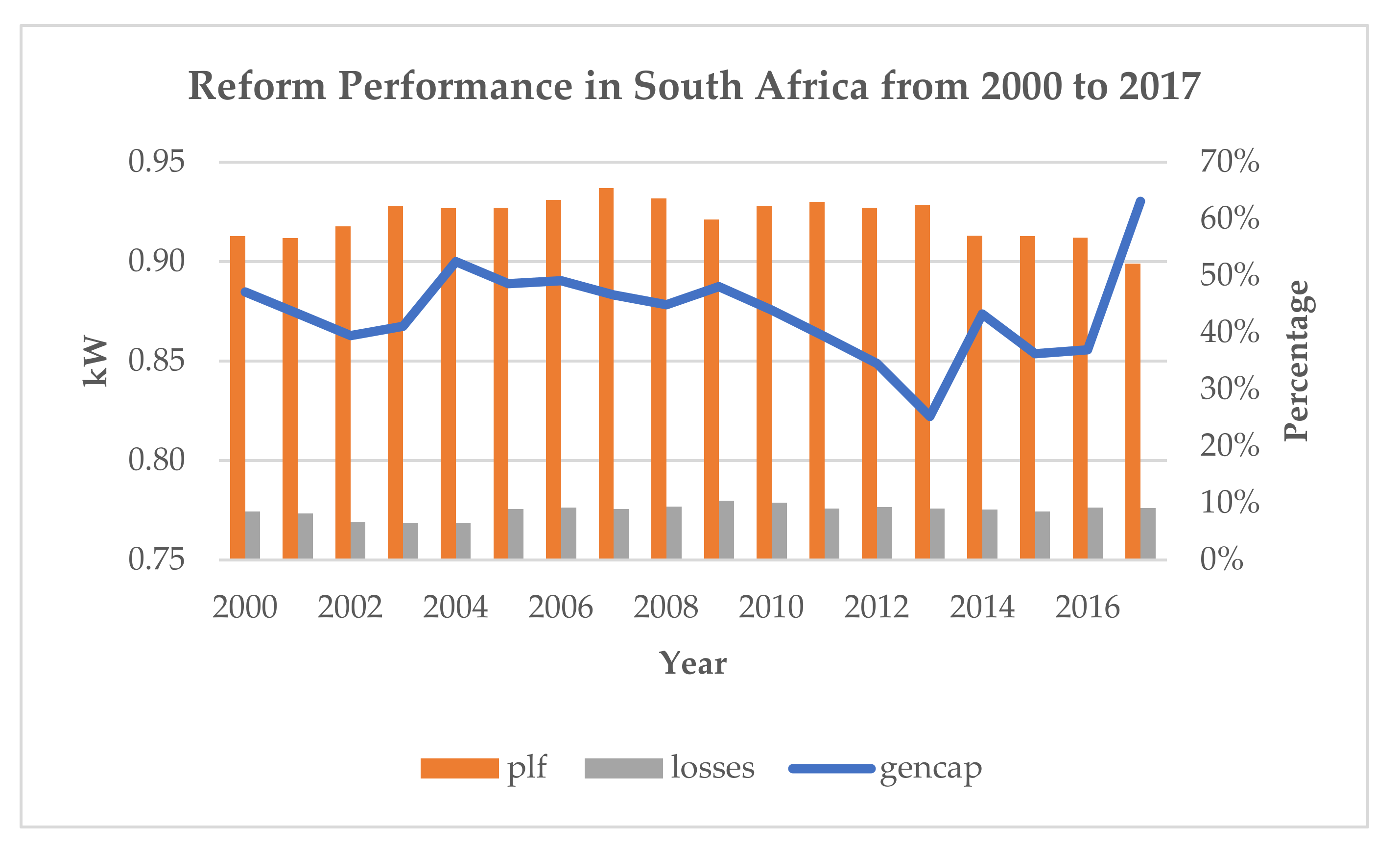

| South Africa | 0.88 | 0.87 | 0.86 | 0.87 | 0.90 | 0.89 | 0.89 | 0.88 | 0.88 | 0.89 | 0.88 | 0.86 | 0.85 | 0.82 | 0.87 | 0.85 | 0.86 | 0.93 |

| Tanzania | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.03 | 0.02 | 0.02 | 0.02 | 0.02 | 0.03 | 0.03 | 0.03 | |

| Togo | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

| Uganda | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 |

| Zambia | 0.16 | 0.16 | 0.16 | 0.16 | 0.15 | 0.15 | 0.14 | 0.14 | 0.13 | 0.13 | 0.14 | 0.14 | 0.14 | 0.14 | 0.16 | 0.15 | 0.17 | 0.17 |

| Zimbabwe | 0.17 | 0.17 | 0.17 | 0.16 | 0.17 | 0.17 | 0.17 | 0.17 | 0.16 | 0.16 | 0.16 | 0.15 | 0.14 | 0.14 | 0.14 |

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Angola | 38% | 43% | 39% | 34% | 43% | 30% | 39% | 44% | 42% | 41% | 45% | 60% | 51% | 43% | 40% | 27% | ||

| Benin | 15% | 13% | 10% | 13% | 11% | 9% | 5% | 11% | 10% | 8% | 10% | |||||||

| Botswana | 47% | 41% | 34% | 28% | 16% | 50% | 38% | 47% | 44% | 39% | ||||||||

| Burkina Faso | 27% | 27% | 31% | 25% | 21% | 22% | 31% | 33% | 33% | 32% | 36% | |||||||

| Cabo Verde | 35% | 35% | 25% | 27% | 30% | 32% | 39% | 39% | 35% | 39% | 38% | 37% | 31% | 32% | 29% | 29% | 29% | 27% |

| Cameroon | 50% | 46% | 35% | 39% | 43% | 45% | 53% | 44% | 48% | 45% | 48% | 52% | 40% | 41% | 46% | 48% | 47% | 46% |

| DR Congo | 34% | 34% | 33% | 35% | 37% | 37% | 36% | 37% | ||||||||||

| Cote d’Ivoire | 42% | 42% | 45% | 43% | 45% | 47% | 47% | 45% | 44% | 45% | 46% | 47% | 54% | 54% | 54% | 49% | 58% | 45% |

| Equatorial Guinea | 41% | 45% | 30% | 30% | 35% | 29% | 41% | 17% | 24% | 27% | 28% | 28% | 18% | |||||

| Eritrea | 18% | 19% | 17% | 19% | 22% | 23% | 24% | 26% | 28% | 29% | 30% | 27% | 27% | 22% | ||||

| Ethiopia | 22% | 21% | 11% | 12% | 11% | 13% | 14% | 16% | 18% | 20% | 26% | 30% | 36% | 42% | 46% | 50% | 34% | 37% |

| Eswatini | 38% | 31% | 38% | 41% | 46% | 39% | 37% | 34% | 30% | 22% | 25% | |||||||

| Gabon | 35% | 38% | 39% | 40% | 40% | 41% | 43% | 45% | 54% | 45% | 48% | 51% | 51% | 45% | 43% | 45% | 49% | 47% |

| Gambia | 33% | 56% | 53% | 53% | 51% | 51% | 50% | 48% | 51% | 43% | 37% | 39% | 38% | 31% | 27% | 28% | 29% | 27% |

| Ghana | 68% | 65% | 54% | 42% | 37% | 45% | 56% | 41% | 43% | 42% | 45% | 46% | 47% | 49% | 49% | 34% | 37% | 35% |

| Guinea | 23% | 30% | 31% | |||||||||||||||

| Kenya | 47% | 48% | 51% | 52% | 56% | 56% | 60% | 63% | 58% | 56% | 56% | 56% | 55% | 56% | 50% | 48% | 50% | 51% |

| Lesotho | 53% | 53% | 54% | 61% | 58% | 65% | 69% | 80% | 80% | 80% | 79% | 70% | 69% | 73% | 73% | 76% | 72% | 76% |

| Liberia | 26% | 22% | 21% | 21% | 21% | 21% | 21% | 20% | 19% | |||||||||

| Malawi | 29% | 28% | 27% | 29% | 31% | 32% | 33% | 34% | 39% | 42% | 44% | 45% | 44% | 44% | 41% | 41% | 41% | 36% |

| Mali | 78% | 42% | 43% | 37% | 37% | 35% | 37% | 34% | 36% | 24% | 25% | 24% | 22% | 20% | 21% | 23% | 25% | 23% |

| Mauritania | 41% | 42% | 38% | 39% | 37% | 41% | 42% | 47% | 45% | 42% | 43% | 47% | 39% | 39% | 25% | 24% | 19% | |

| Mozambique | 42% | 56% | 60% | 52% | 56% | 63% | 70% | 73% | 71% | 79% | 76% | 77% | 69% | 67% | 74% | 88% | 85% | 71% |

| Namibia | 42% | 36% | 43% | 46% | 40% | 46% | 43% | 49% | 51% | 43% | 36% | 47% | 35% | 40% | 35% | 35% | 33% | 38% |

| Niger | 23% | 19% | ||||||||||||||||

| Nigeria | 36% | 34% | 32% | 28% | 25% | 34% | 34% | 36% | 33% | 34% | 34% | 29% | 29% | |||||

| Rwanda | 26% | 29% | 35% | 36% | 23% | 31% | 30% | 36% | 35% | 35% | 41% | 42% | 43% | 36% | 34% | 38% | 36% | |

| Sao Tome and Principe | 33% | 34% | 36% | 38% | 42% | 46% | 30% | 34% | 34% | 37% | 34% | 36% | 34% | |||||

| Senegal | 64% | 69% | 48% | 51% | 53% | 41% | 44% | 41% | 42% | 43% | 43% | 35% | 38% | 43% | 46% | 48% | 52% | 50% |

| Seychelles | 61% | 66% | 56% | 58% | 57% | 57% | 59% | 63% | 37% | |||||||||

| Sierra Leone | 26% | 27% | 25% | 27% | 22% | 25% | 25% | |||||||||||

| South Africa | 57% | 57% | 59% | 62% | 62% | 62% | 63% | 65% | 64% | 60% | 62% | 63% | 62% | 62% | 57% | 57% | 57% | 52% |

| Tanzania | 74% | 80% | 51% | 37% | 45% | 41% | 50% | 50% | 54% | 54% | 53% | 58% | 61% | 64% | 54% | 65% | 64% | |

| Togo | 26% | 15% | 21% | 27% | 23% | 23% | 27% | 21% | 18% | 22% | 21% | 18% | 20% | 17% | 18% | 22% | 50% | 34% |

| Uganda | 67% | 68% | 74% | 66% | 71% | 48% | 36% | 43% | 44% | 50% | 52% | 49% | 46% | 47% | 46% | 44% | 45% | 47% |

| Zambia | 51% | 52% | 51% | 52% | 54% | 56% | 63% | 62% | 61% | 64% | 62% | 65% | 70% | 73% | 66% | 64% | 46% | 55% |

| Zimbabwe | 47% | 52% | 51% | 44% | 40% | 40% | 38% | 45% | 49% | 49% | 51% | 55% | 53% | 40% | 42% |

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Angola | 15% | 15% | 15% | 15% | 12% | 14% | 11% | 11% | 12% | 12% | 12% | 12% | 12% | 12% | 12% | 12% | ||

| Benin | 16% | 16% | 21% | 19% | 19% | 19% | 20% | 20% | 20% | 21% | 21% | |||||||

| Botswana | 10% | 12% | 10% | 12% | 11% | 9% | 7% | 13% | 14% | 15% | ||||||||

| Burkina Faso | 15% | 13% | 12% | 11% | 12% | 12% | 13% | 13% | 13% | 12% | 13% | |||||||

| Cabo Verde | 15% | 23% | 17% | 19% | 19% | 18% | 22% | 26% | 28% | 26% | 25% | 25% | 27% | 26% | 26% | 26% | 27% | 27% |

| Cameroon | 22% | 26% | 23% | 24% | 19% | 17% | 13% | 10% | 10% | 10% | 11% | 19% | 24% | 27% | 28% | 21% | 21% | 21% |

| DR Congo | 18% | 20% | 21% | 28% | 26% | 28% | 23% | 28% | 28% | 27% | 23% | 26% | 22% | 26% | 17% | 23% | 21% | 16% |

| Cote d’Ivoire | 18% | 20% | 21% | 28% | 26% | 28% | 23% | 28% | 28% | 27% | 23% | 26% | 22% | 26% | 17% | 23% | 21% | 16% |

| Equatorial Guinea | 10% | 10% | 10% | 10% | 11% | 10% | 10% | 10% | 10% | 11% | 11% | 11% | 11% | |||||

| Eritrea | 18% | 17% | 15% | 16% | 17% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | ||||

| Ethiopia | 10% | 12% | 11% | 11% | 11% | 11% | 11% | 11% | 13% | 15% | 20% | 21% | 19% | 15% | 19% | 19% | 19% | 19% |

| Eswatini | 12% | 12% | 13% | 12% | 11% | 12% | 12% | 12% | 12% | 12% | 12% | |||||||

| Gabon | 18% | 20% | 20% | 20% | 20% | 20% | 20% | 19% | 19% | 20% | 20% | 20% | 20% | 21% | 20% | 20% | 20% | 18% |

| Gambia | 22% | 22% | 22% | 20% | 19% | 22% | 22% | 22% | 21% | 21% | 22% | 20% | 21% | 21% | 19% | 19% | 19% | 22% |

| Ghana | 21% | 15% | 22% | 26% | 28% | 23% | 20% | 22% | 23% | 25% | 21% | 15% | 12% | 13% | 14% | 12% | 13% | 14% |

| Guinea | 12% | 10% | 10% | |||||||||||||||

| Kenya | 19% | 19% | 18% | 17% | 15% | 15% | 15% | 17% | 17% | 16% | 17% | 17% | 18% | 18% | 18% | 17% | 20% | 19% |

| Lesotho | 20% | 20% | 17% | 18% | 19% | 19% | 19% | 15% | 12% | 15% | 11% | 9% | 13% | 11% | 13% | 15% | 18% | 13% |

| Liberia | 8% | 8% | 13% | 13% | 13% | 13% | 14% | 17% | 17% | |||||||||

| Malawi | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 22% | 20% | 15% | 22% | 9% | 25% |

| Mali | 10% | 10% | 10% | 10% | 10% | 10% | 9% | 10% | 10% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 6% |

| Mauritania | 4% | 3% | 3% | 9% | 9% | 9% | 18% | 16% | 17% | 18% | 16% | 15% | 17% | 17% | 16% | 16% | 17% | |

| Mozambique | 20% | 21% | 22% | 16% | 16% | 15% | 18% | 19% | 19% | 20% | 19% | 18% | 17% | 18% | 17% | 30% | 17% | 15% |

| Namibia | 10% | 10% | 10% | 14% | 5% | 10% | 7% | 13% | 9% | 7% | 9% | 9% | 12% | 8% | 13% | 8% | 11% | 10% |

| Niger | 18% | 16% | ||||||||||||||||

| Nigeria | 21% | 21% | 15% | 15% | 15% | 15% | 15% | 15% | 15% | 15% | 15% | 15% | 15% | |||||

| Rwanda | 27% | 27% | 27% | 21% | 27% | 26% | 11% | 14% | 15% | 15% | 17% | 17% | 20% | 16% | 20% | 20% | 20% | |

| Sao Tome and Principe | 31% | 30% | 29% | 28% | 28% | 27% | 26% | 24% | 24% | 20% | 16% | 15% | 14% | |||||

| Senegal | 15% | 16% | 16% | 14% | 15% | 19% | 17% | 21% | 18% | 21% | 10% | 10% | 10% | 17% | 16% | 15% | 15% | 15% |

| Seychelles | 9% | 10% | 10% | 10% | 9% | 9% | 7% | 7% | 6% | |||||||||

| Sierra Leone | 51% | 44% | 58% | 44% | 31% | 30% | 30% | |||||||||||

| South Africa | 9% | 8% | 7% | 6% | 6% | 9% | 9% | 9% | 9% | 10% | 10% | 9% | 9% | 9% | 9% | 8% | 9% | 9% |

| Tanzania | 25% | 23% | 26% | 20% | 27% | 26% | 22% | 19% | 35% | 20% | 22% | 18% | 19% | 18% | 17% | 15% | 15% | |

| Togo | 6% | 15% | 14% | 14% | 13% | 15% | 14% | 17% | 17% | 16% | 17% | 16% | 15% | 16% | 15% | 14% | 14% | 9% |

| Uganda | 35% | 37% | 39% | 31% | 50% | 40% | 33% | 33% | 39% | 39% | 29% | 25% | 25% | 21% | 19% | 18% | 20% | 17% |

| Zambia | 4% | 4% | 4% | 4% | 4% | 6% | 7% | 13% | 22% | 20% | 19% | 24% | 8% | 10% | 17% | 12% | 15% | 10% |

| Zimbabwe | 12% | 13% | 13% | 11% | 12% | 11% | 16% | 18% | 17% | 19% | 17% | 17% | 18% | 17% | 18% |

Appendix C

| 2000 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Angola | 82% | 80% | 80% | 79% | 75% | 75% | 70% | 76% | 72% | 72% | 76% | 93% | 72% | 66% | 61% | 45% | |

| Benin | 66% | 67% | 84% | 70% | 70% | 65% | 92% | 84% | 91% | 95% | 94% | ||||||

| Botswana | 78% | 79% | 67% | 70% | 58% | 77% | 63% | 92% | 93% | 92% | |||||||

| B. Faso | 57% | 56% | 59% | 52% | 50% | 53% | 62% | 65% | 66% | 65% | 71% | ||||||

| Cabo Verde | 76% | 74% | 51% | 54% | 58% | 81% | 86% | 86% | 97% | 96% | 96% | 92% | 92% | 91% | 86% | 89% | 85% |

| Cameroon | 80% | 63% | 67% | 68% | 69% | 79% | 66% | 73% | 68% | 74% | 81% | 75% | 80% | 90% | 84% | 83% | 84% |

| DR Congo | 39% | 43% | 37% | 38% | 74% | 64% | 60% | 59% | |||||||||

| C. d’Ivoire | 80% | 91% | 94% | 95% | 97% | 93% | 96% | 95% | 92% | 90% | 93% | 96% | 97% | 93% | 92% | 95% | 0% |

| Eq. Guinea | 71% | 71% | 65% | 65% | 70% | 66% | 73% | 52% | 59% | 67% | 68% | 68% | 46% | ||||

| Eritrea | 90% | 86% | 77% | 83% | 84% | 69% | 73% | 73% | |||||||||

| Ethiopia | 42% | 28% | 30% | 28% | 31% | 32% | 34% | 38% | 43% | 53% | 56% | 59% | 59% | 64% | 70% | 44% | 45% |

| Eswatini | 80% | 72% | 83% | 84% | 93% | 84% | 81% | 78% | 69% | 57% | 62% | ||||||

| Gabon | 83% | 92% | 94% | 93% | 95% | 94% | 93% | 96% | 95% | 89% | 91% | 93% | 86% | 81% | 87% | 91% | 87% |

| Gambia | 72% | 93% | 95% | 95% | 94% | 95% | 94% | 94% | 91% | 87% | 87% | 87% | 81% | 74% | 75% | 79% | 78% |

| Ghana | 96% | 92% | 91% | 88% | 87% | 90% | 83% | 88% | 91% | 88% | 79% | 76% | 74% | 76% | 61% | 66% | 64% |

| Guinea | 58% | 62% | 63% | ||||||||||||||

| Kenya | 85% | 84% | 83% | 77% | 80% | 68% | 77% | 74% | 73% | 74% | 74% | 75% | 74% | 73% | 71% | 77% | 76% |

| Lesotho | 89% | 85% | 90% | 92% | 93% | 95% | 88% | 80% | 84% | 74% | 68% | 78% | 75% | 84% | 92% | 95% | 85% |

| Liberia | 54% | 43% | 56% | 56% | 57% | 57% | 60% | 65% | 64% | ||||||||

| Malawi | 61% | 54% | 57% | 59% | 62% | 63% | 63% | 69% | 72% | 73% | 74% | 87% | 85% | 74% | 82% | 69% | 84% |

| Mali | 80% | 58% | 54% | 54% | 54% | 54% | 54% | 55% | 37% | 39% | 39% | 41% | 36% | 38% | 40% | 44% | 43% |

| Mauritania | 77% | 70% | 75% | 71% | 76% | 92% | 95% | 95% | 95% | 95% | 96% | 92% | 90% | 72% | 71% | 64% | |

| Mozambique | 81% | 91% | 73% | 75% | 76% | 84% | 88% | 86% | 91% | 89% | 88% | 80% | 85% | 88% | 99% | 96% | 81% |

| Namibia | 84% | 81% | 88% | 68% | 82% | 74% | 88% | 86% | 72% | 66% | 83% | 67% | 70% | 71% | 63% | 64% | 71% |

| Niger | 55% | 55% | |||||||||||||||

| Nigeria | 63% | 60% | 52% | 49% | 49% | 55% | 53% | 55% | 53% | 55% | 53% | 51% | 48% | ||||

| Rwanda | 62% | 55% | 55% | 48% | 53% | 52% | 60% | 64% | 64% | 64% | 68% | 71% | 68% | 72% | 76% | 72% | |

| Sao Tome | 83% | 88% | 88% | 91% | 95% | 97% | 78% | 81% | 81% | 83% | 73% | 74% | 69% | ||||

| Senegal | 98% | 93% | 93% | 94% | 91% | 90% | 92% | 90% | 95% | 83% | 73% | 78% | 93% | 95% | 96% | 97% | 96% |

| Seychelles | 94% | 97% | 82% | 93% | 91% | 93% | 94% | 96% | 52% | ||||||||

| S. Leone | 94% | 88% | 97% | 86% | 76% | 77% | 77% | ||||||||||

| S. Africa | 80% | 83% | 86% | 92% | 92% | 96% | 96% | 95% | 93% | 95% | 95% | 94% | 94% | 89% | 89% | 89% | 82% |

| Tanzania | 95% | 82% | 63% | 75% | 70% | 90% | 82% | 96% | 87% | 88% | 87% | 91% | 94% | 88% | 94% | 95% | |

| Togo | 42% | 45% | 52% | 47% | 53% | 53% | 58% | 54% | 56% | 59% | 54% | 57% | 55% | 53% | 57% | 87% | 68% |

| Uganda | 92% | 95% | 78% | 93% | 87% | 75% | 76% | 85% | 84% | 75% | 71% | 68% | 66% | 62% | 59% | 62% | 60% |

| Zambia | 74% | 74% | 73% | 76% | 79% | 86% | 88% | 94% | 94% | 90% | 95% | 89% | 92% | 87% | 81% | 64% | 67% |

| Zimbabwe | 86% | 91% | 93% | 80% | 77% | 78% | 85% | 94% | 94% | 95% | 94% | 96% | 96% | 85% | 90% | ||

References

- Newbery, D.M. Network capacity auctions: Promise and problems. Util. Policy 2003, 11, 27–32. [Google Scholar] [CrossRef]

- Newbery, D.M. Regulatory Challenges to European Electricity Liberalization. Swed. Econ. Policy Rev. 2003, 9, 9–44. [Google Scholar]

- Jamasb, T.; Nepal, R.; Timislina, R.; Toman, M. Energy Sector Reform, Economic Efficiency and Poverty Reduction, 2014, University of Queensland School of Economics Discussion Papers Series 529. Available online: http://www.uq.edu.au/economics/abstract/529.pdf (accessed on 28 September 2021).

- Jamasb, T.; Nepal, R.; Timilsina, G.R. A Quarter Century Effort Yet to Come of Age: A Survey of Power Sector Reforms in Developing Countries. Energy J. 2017, 38, 195–234. [Google Scholar] [CrossRef] [Green Version]

- Bradshaw, Y.W.; Huang, J. Intensifying Global Dependency: Foreign debt, Structural Adjustment, and Third World Underdevelopment. Sociol. Q. 1991, 32, 321–342. [Google Scholar] [CrossRef]

- World Bank. The World Bank’s Role in the Electric Power Sector: Policies for Effective Institutional, Regulatory, and Financial Reform, 1993. World Bank Report, No. 11676. Available online: http://documents.worldbank.org/curated/en/477961468782140142/The-World-Banks-role-in-the-electric-power-sector-policies-for-effective-institutional-regulatory-and-financial-reform (accessed on 28 September 2021).

- World Bank. Private Sector Development in Electric Power, World Bank Report. 2003. Available online: http://documents.worldbank.org/curated/en/436591468125976661/016824232_200309276015837/additional/264270UG0PGD.pdf (accessed on 28 September 2021).

- Joskow, P.L.; Schmalensee, R. Markets for Power: An Analysis of Electric Utility Deregulation; MIT Press: Cambridge, MA, USA, 1983. [Google Scholar]

- Ennis, H.; Pinto, S. Privatization and Income Distribution in Argentina. 2002. Available online: https://www.researchgate.net/publication/265364411/download (accessed on 28 September 2021).

- Toba, N. Welfare impacts of electricity generation sector reform in the Philippines. Energy Policy 2007, 35, 6145–6162. [Google Scholar] [CrossRef] [Green Version]

- Jamasb, T.; Mota, R.; Newbery, D.; Pollitt, M. Electricity Sector Reform in Developing Countries: A Survey of Empirical Evidence on Determinants and Performance, 2005. World Bank Policy Research Paper, No. 3549. Available online: http://documents.worldbank.org/curated/en/393231468780575236/Electricity-sector-reform-in-developing-countries-a-survey-of-empirical-evidence-on-determinants-and-performance (accessed on 28 September 2021).

- Galal, A.; Jones, L.; Tandon, P.; Vogelsang, I. Welfare Consequences of Selling Public Enterprises: An Empirical Analysis. South. Econ. J. 1994, 62, 1098. [Google Scholar] [CrossRef]

- Domah, P.; Pollitt, M.G. The restructuring and privatisation of the electricity distribution and supply businesses in England and Wales: A social cost-benefit analysis. Fisc. Stud. 2001, 22, 107–146. [Google Scholar] [CrossRef] [Green Version]

- Pollitt, M.G. The role of policy in energy transitions: Lessons from the energy liberalisation era. Energy Policy 2012, 50, 128–137. [Google Scholar] [CrossRef]

- Sen, A.; Jamasb, T. Diversity in Unity: An Empirical Analysis of Electricity Deregulation in Indian States. Energy J. 2012, 33, 83–130. [Google Scholar] [CrossRef]

- Sen, A.; Nepal, R.; Jamasb, T. Have Model, Will Reform: Assessing Electricity Reforms in Non-OECD Asian Economies. Energy J. 2018, 39, 181–209. [Google Scholar] [CrossRef]

- Pollitt, M. Evaluating the evidence on electricity reform: Lessons for the South East Europe (SEE) market. Util. Policy 2009, 17, 13–23. [Google Scholar] [CrossRef] [Green Version]

- Bergara, M.E.; Henisz, W.J.; Spiller, P.T. Political Institutions and Electric Utility Investment: A Cross-Nation Analysis. Calif. Manag. Rev. 1998, 40, 18–35. [Google Scholar] [CrossRef] [Green Version]

- Kessides, I.N. The Impacts of Electricity Sector Reforms in Developing Countries. Electr. J. 2012, 25, 79–88. [Google Scholar] [CrossRef]

- Gratwick, K.N.; Eberhard, A. Demise of the standard model for power sector reform and the emergence of hybrid power markets. Energy Policy 2008, 36, 3948–3960. [Google Scholar] [CrossRef]

- Wamukonya, N. Power Sector Reforms in sub-Saharan Africa Some Lessons. Econ. Political Wkly. 2005, 40, 5302–5308. [Google Scholar]

- Joskow, P.L. Electricity Sectors in Transition. Energy J. 1998, 19, issn0195–issn6574. [Google Scholar] [CrossRef]

- Estache, A.; Foster, V.; Wodon, Q. Accounting for Poverty in Infrastructure Reform: Learning from Latin America’s Experience, 2002. World Bank Working Paper Report Number 23950. Available online: http://documents.worldbank.org/curated/en/413901468758394547/Accounting-for-poverty-in-infrastructure-reform-learning-from-Latin-Americas-experience (accessed on 28 September 2021).

- Carvalho, A.; Nepal, R.; Jamasb, T. Economic reforms and human development: Evidence from transition economies. Appl. Econ. 2015, 48, 1330–1347. [Google Scholar] [CrossRef] [Green Version]

- Bacon, R. Privatization and Reform in the Global Electricity Supply Industry. Annu. Rev. Energy Environ. 1995, 20, 119–143. [Google Scholar] [CrossRef]

- Bacon, R. A Scorecard for Energy Reform in Developing Countries. Viewpoint. World Bank, 1999. Available online: https://openknowledge.worldbank.org/handle/10986/11487 (accessed on 28 September 2021).

- Bacon, R.W.; Besant-Jones, J. Global Electric Power Reform, Privatization and Liberalisation of the Electric Power Industry in Developing Countries. Annu. Rev. Energy Environ. 2001, 26, 331–359. [Google Scholar] [CrossRef] [Green Version]

- Besant-Jones, J. Reforming Power Markets in Developing Countries: What Have We Learned? World Bank Report No. 38017. World Bank. 2006. Available online: http://documents.worldbank.org/curated/en/483161468313819882/pdf/380170REPLACEMENT0Energy19.pdf (accessed on 28 September 2021).

- Zhang, Y.F.; Parker, D.; Kirkpatrick, C. Electricity Sector Reform in Developing Countries: An Econometric Assessment of the Effects of Privatisation, Competition and Regulation. J. Regul. Econ. 2008, 33, 159–178. [Google Scholar] [CrossRef]

- Coase, R.H. The problem of social cost. J. Law Econ. 1960, 3, 1–44. [Google Scholar] [CrossRef]

- Guasch, J.L. Granting and Renegotiating Infrastructure Concessions: Doing it Right, 2004. World Bank Report. Available online: https://openknowledge.worldbank.org/handle/10986/15024 (accessed on 28 September 2021).

- Fischer, R.; Serra, P.; Joskow, P.L.; Hogan, W.W. Regulating the Electricity Sector in Latin America. Economía 2000, 1, 155–218. [Google Scholar] [CrossRef] [Green Version]

- Green, R.J.; Trotter, S.D. Electricity Regulation. In Regulatory Review 2002/2003; Vass, P., Ed.; Bath, Centre for the Study of Regulated Industries: Bath, UK, 2003; pp. 21–53, reprinted in The Development of Energy Regulation; Vass, P., Ed.; pp. 55–87. [Google Scholar]

- Ghosh, R.; Kathuria, V. The effect of regulatory governance on efficiency of thermal power generation in India: A stochastic frontier analysis. Energy Policy 2016, 89, 11–24. [Google Scholar] [CrossRef]

- Joskow, P.; Tirole, J. Merchant transmission investment. J. Ind. Econ. 2005, 53, 233–264. [Google Scholar] [CrossRef] [Green Version]

- Arrow, K.J. The Organization of Economic Activity: Issues Pertinent to the Choice of Market Versus Nonmarket Allocation’. In Public Expenditure and Policy Analysis; Haveman, R.H., Margolis, J., Eds.; Rand MacNally College Publishing Company: Chicago, IL, USA, 1970; pp. 67–78. [Google Scholar]

- Shubik, M. On different methods for allocating resources. Kyklos 1970, 23, 332–337. [Google Scholar] [CrossRef]

- Teplitz-Sembitzky, W. Regulation, Deregulation, or Reregulation-What Is Needed in The LDCs Power Sector? World Bank Working Paper Series 9213. 1990. Available online: http://documents.worldbank.org/curated/en/521881468739783393/Regulation-deregulation-or-reregulation-what-is-needed-in-the-LDCs-power-sector (accessed on 28 September 2021).

- Joskow, P.L. Regulation and Deregulation after 25 Years: Lessons for Research. Rev. Ind. Organ. 2005, 26, 169–193. [Google Scholar] [CrossRef]

- Posner, R.A. Theories of Economic Regulation. Bell J. Econ. Manag. Sci. 1974, 5, 335–358. [Google Scholar] [CrossRef] [Green Version]

- Den Hertog, J.D. General Theories of Regulation. 1999. Available online: https://www.mtk.ut.ee/sites/default/files/mtk/dokumendid/e35f555bc5922cc21262fabfac7de2fc.pdf (accessed on 28 September 2021).

- Cubbin, J.; Stern, J. The Impact of Regulatory Governance and Privatization on Electricity Industry Generation Capacity in Developing Economies. World Bank Econ. Rev. 2006, 20, 115–141. [Google Scholar] [CrossRef]

- Kim, J.; Mahoney, J.T. Property rights theory, transaction costs theory, and agency theory: An organizational economics approach to strategic management. Manag. Decis. Econ. 2005, 26, 223–242. [Google Scholar] [CrossRef] [Green Version]

- Jamasb, T. Between the state and market: Electricity sector reform in developing countries. Util. Policy 2006, 14, 14–30. [Google Scholar] [CrossRef]

- Jamasb, T.; Newbery, D.; Pollitt, M. Core Indicators for Determinants and Performance of the Electricity Sector in Developing Countries. World Bank Policy Research Working Paper 3599. 2005. Available online: http://documents.worldbank.org/curated/en/659371468152083306/Core-indicators-for-determinants-and-performance-of-the-electricity-sector-in-developing-countries (accessed on 28 September 2021).

- Joskow, P.L. Restructuring, Competition and Regulatory Reform in the U.S. Electricity Sector. J. Econ. Perspect. 1998, 11, 119–138. [Google Scholar] [CrossRef] [Green Version]

- Hunt, S. Making Competition Work in Electricity; John Wiley & Sons, Inc.: New York, NY, USA, 2002. [Google Scholar]

- Joskow, P.L. Markets for Power in the U.S: An Interim Assessment. Energy J. 2006, 27, 1–36. [Google Scholar] [CrossRef] [Green Version]

- Joskow, P.L. Introduction to Electricity Sector Liberalization: Lessons Learned from Cross- Country Studies. MIT School of Economics Study. 2006. Available online: https://economics.mit.edu/files/2093 (accessed on 28 September 2021).

- Newbery, D.M. Determining the regulatory asset base for utility price regulation. Util. Policy 1997, 6, 1–8. [Google Scholar] [CrossRef]

- Littlechild, S.C. Evolution of Global Electricity Markets: New Paradigms, New Challenges, New Approaches; Sioshansi, F.P., Pfaffenberger, W., Eds.; Elsevier Global Energy Policy and Economics Series: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Alchian, A.A. Some Economics of Property Rights. Il Politico 1965, 30, 816–829. [Google Scholar]

- Demsetz, H. Some Aspects of Property Rights. J. Law Econ. 1966, 9, 61–70. [Google Scholar] [CrossRef]

- Demsetz, H. Toward a Theory of Property Rights. Towards a Theory of Property Rights. Am. Econ. Rev. 1967, 57, 347–359. [Google Scholar]

- Demsetz, H. Ownership, Control and the Firm; Oxford University Press: New York, NY, USA, 1988. [Google Scholar]

- Hart, O.; Shleifer, A.; Vishny, R. The Proper Scope of Government: Theory and an Application to Prisons. Q. J. Econ. 1997, 112, 1127–1161. [Google Scholar] [CrossRef] [Green Version]

- Megginson, W.L.; Netter, J.M. From State to Market: A Survey of Empirical Studies on Privatization. J. Econ. Lit. 2001, 39, 321–389. [Google Scholar] [CrossRef] [Green Version]

- North, D.C. Institutions, Institutional Change, and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- North, D.C. A Transaction Cost Theory of Politics. J. Theor. Politics 1990, 2, 355–367. [Google Scholar] [CrossRef]

- Zhang, Y.F.; Parker, D.; Kirkpatrick, C. Competition, Regulation and Privatisation of Electricity Generation in Developing Countries: Does the Sequencing of the Reforms Matter? Q. Rev. Econ. Financ. 2005, 45, 358–379. [Google Scholar] [CrossRef] [Green Version]

- Estache, A.; Gomez-Lobo, A.; Leipziger, D. Utilities Privatization and the Poor: Lessons and Evidence from Latin America. World Dev. 2001, 29, 1179–1198. [Google Scholar] [CrossRef]

- Freije, S.; Rivas, L. Inequality and Welfare Changes: Evidence from Nicaragua. The Distributional Impact of Privatization in Developing Countries; Chapter, 3, Nellis, J., Birdsall, N., Eds.; Center for Global Development: Washington, DC, USA, 2003; pp. 85–121. [Google Scholar]

- McKenzie, D.J.; Mookherjee, D. The Distributive Impact of Privatization in Latin America: Evidence from Four Countries. Economia 2003, 3, 161–218. [Google Scholar] [CrossRef]

- Foss, K.; Foss, N. Assets, Attributes and Ownership. J. Econ. Bus. 2001, 8, 19–37. [Google Scholar] [CrossRef] [Green Version]

- Pejovich, S. Fundamentals of Economics: A Property Rights Approach; Fisher Institute: Dallas, NT, USA, 1979. [Google Scholar]

- Pejovich, S. Karl Marx, Property Rights School and the Process of Social Change. Kyklos 1982, 35, 383–397. [Google Scholar] [CrossRef]

- Laffont, J.J. Regulation and Development; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar]

- Levy, B.; Spiller, P.T. The Institutional Foundations of Regulatory Commitment: A Comparative Analysis of Telecommunications Regulation. J. Law Econ. Organ. 1994, 10, 201–246. [Google Scholar]

- Imam, M.I.; Jamasb, T.; Llorca, M. Sector reforms and institutional corruption: Evidence from electricity industry in Sub-Saharan Africa. Energy Policy 2019, 129, 532–545. [Google Scholar] [CrossRef] [Green Version]

- Imam, M.I.; Jamasb, T.; Llorca, M. Political Economy of Reform and Regulation in the Electricity Sector of Sub-Saharan Africa; Cambridge Working Papers in Economics CWPE 1949/Electricity Policy Research Group Working Paper EPRG, May 1917; Faculty of Economics, University of Cambridge: Cambridge, UK, 2019. [Google Scholar]

- Erdogdu, E. A cross-country analysis of electricity market reforms: Potential contribution of New Institutional Economics. Energy Econ. 2013, 39, 239–251. [Google Scholar] [CrossRef] [Green Version]

- Nepal, R.; Jamasb, T. Reforming the Power Sector in Transition: Do Institutions Matter? Energy Econ. 2012, 34, 1675–1682. [Google Scholar] [CrossRef]

- Loeb, M.; Magat, W.A. A Decentralized Method for Utility Regulation. J. Law Econ. 1979, 22, 399–404. [Google Scholar] [CrossRef]

- Laffont, J.-J.; Tirole, J. A Theory of Incentives in Procurement and Regulation; MIT Press: Cambridge, UK, 1993. [Google Scholar]

- Tommasi, M. Presidential Address: The Institutional Foundations of Public Policy. Economia 2006, 6, 1–36. [Google Scholar]

- Tommasi, M.; Velasco, A. Where Are We in the Political Economy of Reform? J. Policy Reform 1996, 1, 187–238. [Google Scholar] [CrossRef]

- Kaufmann, A.; Kraay, A.; Zoido-Lobaton, P. Governance Matters. World Bank Policy Research Paper Number WPS2196. 1999. Available online: http://documents.worldbank.org/curated/en/665731468739470954/Governance-matters (accessed on 28 September 2021).

- Kaufmann, A.; Kraay, K.; Mastruzzi, M. Governance Matters VIII. World BANK Policy Research Paper No. WPS4978. 2009. Available online: http://documents.worldbank.org/curated/en/598851468149673121/Governance-matters-VIII-aggregate-and-individual-governance-indicators-1996–2008 (accessed on 28 September 2021).

- Mahoney, C. The Power of Institutions. Eur. Union Politics 2004, 5, 441–466. [Google Scholar] [CrossRef]

- Olsson, O. Diamonds are a rebel’s best friend. World Econ. 2006, 29, 1133–1150. [Google Scholar] [CrossRef]

- Estache, A.; Wren-Lewis, L. Toward a Theory of Regulation for Developing Countries: Following Jean-Jacques Laffont’s Lead. J. Econ. Lit. 2009, 47, 729–770. [Google Scholar] [CrossRef]

- Besant-Jones, J.E.; Harris, C.G.; Stuggins, G.; Townsend, A.F. Operational Guidance for World Bank Staff: Public and Private Roles in the Supply of Electricity Services. World Bank Report, No. 37476. 2004. Available online: http://documents.worldbank.org/curated/en/183841468135585067/Operational-guidance-for-World-Bank-Group-staff-public-and-private-sector-roles-in-the-supply-of-electricity-services (accessed on 28 September 2021).

- Koch, F.; Reiter, A.; Bach, H. Effects of Climate Change on Hydropower Generation and Reservoir Management; Springer: Cham, Switzerland, 2016; pp. 593–599. [Google Scholar] [CrossRef]

- International Hydropower Association. 21 May 2020. Available online: https://www.hydropower.org/region-profiles/africa (accessed on 28 September 2021).

- Cole, M.; Elliott, R.; Stroble, E. Climate Change, Hydro-dependency and the African Dam Boom. World Dev. 2014, 60, 84–96. [Google Scholar] [CrossRef]

- Blimpo, M.; Cosgrove-Davies, M. Electricity Access in SSA: Uptake, Reliability and Complementary Factors for Economic Impact. Africa Development Forum Series Report No. 135194. 2019. Available online: http://documents.worldbank.org/curated/en/837061552325989473/pdf/135194-PUB-PUBLIC-9781464813610.pdf (accessed on 28 September 2021).

- Wolfram, C.D. Electricity Markets: Should the Rest of the World Adopt the United Kingdom’s Reforms? Regulation 1999, 22, 48–53. [Google Scholar]

- Pestieau, P.; Tulkens, H. Assessing and Explaining the Performance of Public Enterprises. Finanzarchiv 1993, 50, 293–323. [Google Scholar] [CrossRef]

- Plane, P. Privatisation, Technical Efficiency and Welfare Consequences: The Case of the Côte d’Ivoire Electricity Company (CIE). World Dev. 1999, 27, 343–360. [Google Scholar] [CrossRef]

- Estache, A.; Tovar, B.; Trujillo, L. How efficient are African electricity companies? Evidence from the Southern African countries. Energy Policy 2008, 36, 1969–1979. [Google Scholar] [CrossRef]

- Erdogdu, E. What Happened to Efficiency in Electricity Industries after Reforms? Energy Policy 2011, 39, 6551–6560. [Google Scholar] [CrossRef] [Green Version]

- Koopman, T. Analysis of production as an efficient combination of activities. In Activity Analysis of Production and Allowance. Monograph, No. 13; Koopmans, T.C., Ed.; John Wiley and Sons, Inc.: New York, NY, USA, 1951. [Google Scholar]

- Cooper, W.W.; Seiford, L.M.; Tone, K. Data Envelopment Analysis a Comprehensive Text with Models, Applications, References and DEA-Solver Software, 2nd ed.; Springer: Cham, Switzerland, 2007. [Google Scholar]

- Kuosmanen, T.; Kortelainen, M. Stochastic Non-smooth Envelopment of Data: Semi-parametric Frontier Estimation Subject to Shape Constraints. J. Product. Anal. 2012, 38, 11–28. [Google Scholar] [CrossRef] [Green Version]

- Aigner, D.; Lovell, C.A.K.; Schmidt, P. Formulation and estimation of stochastic frontier production function models. J. Econom. 1977, 6, 21–37. [Google Scholar] [CrossRef]

- Meeusen, W.; van den Broeck, J. Efficiency Estimation from Cobb-Douglas Production Functions with Composed Error. Int. Econ. Rev. 1977, 18, 435–444. [Google Scholar] [CrossRef]

- Shephard, R.W. Cost and Production Functions; Princeton University Press: Princeton, UK, 1953. [Google Scholar]

- Shephard, R.W. Theory of Cost and Production Functions; Princeton University Press: Princeton, UK, 1970. [Google Scholar]

- Lovell, C.A.K. Applying efficiency measurement techniques to the measurement of productivity change. J. Prod. Anal. 1996, 7, 329–340. [Google Scholar] [CrossRef]

- Kumbhakar, S.C.; Lovell, C.A.K. Stochastic Frontier Analysis; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Coelli, T.; Prasada Rao, D.S.; O’Donnell, C.J.; Battese, G.E. An Introduction to Efficiency and Productivity Analysis, 2nd ed.; Springer: New York, NY, USA, 2005. [Google Scholar]

- Kumbhakar, S.C.; Orea, L.; Rodríguez-Álvarez, A.; Tsionas, E.G. Do we estimate an input or an output distance function? An application of the mixture approach to European railways. J. Prod. Anal. 2007, 27, 87–100. [Google Scholar] [CrossRef]

- Estache, A.; Rossi, M.A. Do regulation and ownership drive the efficiency of electricity distribution? Evidence from Latin America. Econ. Lett. 2005, 86, 253–257. [Google Scholar] [CrossRef]

- Perelman, S.; Santin, D. Measuring educational efficiency at student level with parametric stochastic distance functions: An application to Spanish PISA results. Educ. Econ. 2008, 19, 29–49. [Google Scholar] [CrossRef]

- Melyn, W.; Moesen, W. Towards a Synthetic Indicator of Macroeconomic Performance: Unequal Weighting when Limited Information Is Available; Public Economics Research Paper 17; CES, KU Leuven: Leuven, Belgium, 1991. [Google Scholar]

- Cherchye, L.; Moesen, W.; Rogge, N.; van Puyenbroeck, T. An introduction to ‘benefit of the doubt’ composite indicators. Soc. Indic. Res. 2007, 82, 111–145. [Google Scholar] [CrossRef]

- Färe, R.; Primont, D. Multi-Output Production and Duality: Theory and Applications; Kluwer Academic Publishers: Boston, MA, USA, 1995. [Google Scholar] [CrossRef]

- Lovell, C.A.K.; Travers, P.; Richardson, S.; Wood, L. Resources and functioning: A new view of inequality in Australia. In Chapter in Models and Measurement of Welfare and Inequality; Eichhorn, W., Ed.; Springer: Berlin/Heidelberg, Germany, 1994; pp. 787–807. [Google Scholar]

- Battese, G.E.; Coelli, T.J. Prediction of firm-level technical efficiencies with a generalized frontier production function and panel data. J. Econom. 1988, 38, 387–399. [Google Scholar] [CrossRef]

- Stevenson, R.E. Likelihood functions for generalized stochastic frontier estimation. J. Econ. 1980, 13, 57–66. [Google Scholar] [CrossRef]

- Greene, W.H. Maximum Likelihood Estimation of Economic Frontier Functions. J. Econom. 1980, 13, 27–56. [Google Scholar] [CrossRef]

- Greene, W.H. On the estimation of a flexible frontier production model. J. Econ. 1980, 13, 101–115. [Google Scholar] [CrossRef]

- Greene, W.H. A Gamma-distributed stochastic frontier model. J. Econ. 1990, 46, 141–163. [Google Scholar] [CrossRef] [Green Version]

- Caudill, S.B.; Ford, J.M. Biases in Frontier Estimation Due to Heteroskedasticity. Econ. Lett. 1993, 41, 17–20. [Google Scholar] [CrossRef]

- Llorca, M.; Orea, L.; Pollitt, M.G. Efficiency and environmental factors in the US electricity transmission industry. Energy Econ. 2016, 55, 234–246. [Google Scholar] [CrossRef] [Green Version]

- Eberhard, A.; Gratwick, K.; Morella, E.; Antmann, P. Independent Power Projects in Sub-Saharan Africa: Investment Trends and Policy Lessons. Energy Policy 2017, 108, 390–424. [Google Scholar] [CrossRef]

- Foster, V.; Rana, A. Rethinking Power Sector Reforms in the Developing World. Sustainable Infrastructure Series. World Bank Report. 2020. Available online: https://openknowledge.worldbank.org/handle/10986/32335 (accessed on 28 September 2021).

- International Energy Agency. Boosting the Power Sector in Sub-Saharan Africa: China’s Involvement. IEA Report. 2016. Available online: https://www.oecd.org/publications/boosting-the-power-sector-in-sub-saharan-africa-9789264262706-en.htm (accessed on 28 September 2021).

- World Bank. Linking Up: Public-Private Partnerships in Power Transmission in Africa, World Bank Working Paper. 2017. Available online: http://hdl.handle.net/10986/27807 (accessed on 28 September 2021).

- Eberhard, A. Infrastructure Regulation in Developing Countries: An Exploration of Hybrid and Transitional Models. 2006. Available online: https://regulationbodyofknowledge.org/wp-content/uploads/2013/03/Eberhard_Infrastructure_regulation_in_developing_countries.pdf (accessed on 28 September 2021).

- International Energy Agency–IEA. The Impact of the Financial and Economic Crisis on Global Energy Investment. 2009. Available online: https://iea.blob.core.windows.net/assets/461ac14d-f098-48ce-9ea6-6d1d83160b97/TheImpactoftheFinancialandEconomicCrisisonGlobalEnergyInvestment.pdf (accessed on 28 September 2021).

- World Bank. Public-Private Partnership Stories. Gabon: Société d’Energie et d’Eau. World Bank Brief. 2010. Available online: https://www.ifc.org/wps/wcm/connect/5e5ae9d4-b56b-48ec-9117-682b5a4e21ae/PPPStories_Gabon_SocietedEnergice.pdf?MOD=AJPERES&CVID=lHI9VQW (accessed on 28 September 2021).

| Reform Steps (Inputs) | Description | Descriptive Statistics |

|---|---|---|

| Electricity law act | The presence of a law that initiated reforms (initiated sector liberalization). | Max = 1 Min = 0 Mean = 0.87 St. Dev. = 0.33 |

| Vertical unbundling unb | Legal unbundling-separate jurisdictions for generation, transmission and coupled distribution and retail. | Max = 1 Min = 0 Mean = 0.18 St. Dev. = 0.38 |

| Sector regulator reg | The presence of an autonomous sector regulator. | Max = 1 Min = 0 Mean = 0.74 St. Dev. = 0.44 |

| Control Variable | ||

| Private participation pi | Private participation in part or all segments of the ESI in the form of management service contracts, leases/affermage contracts, concessions, and divestments, among others. This includes brownfield PPP arrangements only. | Max = 1 Min = 0 Mean = 0.26 St. Dev. = 0.44 |

| Performance Indicator (Output) | Description | Descriptive Statistics |

|---|---|---|

| Installed generation capacity per capita gencap | Measures the level of investment per capita in the generation segment. It is calculated as (net installed generation capacity in kW/total population). It is measured in kilowatt. | Max = 1.61 Min = 0.01 Mean = 0.12 Std. Dev. = 0.19 |

| Plant load factor plf | Measures the efficiency of the generation assets. It is calculated as (total electricity production/(net installed generation capacity × number of hours in the year). It is measured in percentage. | Max = 0.88 Min = 0.05 Mean = 0.41 Std. Dev. = 0.15 |

| Transmission and distribution network energy losseslosses | Measures the efficiency of transmission and distribution assets. It is calculated as the sum of technical network losses divided by total electricity supply (where supply is the sum of domestic production and net imports). We note that several databases measure technical network energy losses as percentage of total production instead of total supply (i.e., production plus net imports). Where there are cross-border power exchanges, this results in overestimation of the actual technical losses. Our variable is measured in percentage and has been transformed in a ‘positive’ outcome/output to be in the model. Therefore, an increase in this variable, implies reductions of transmission and distribution losses. | Max = 0.58 Min = 0.032 Mean = 0.07 Std. Dev. = 0.16 |

| Control Variables and Inefficiency Determinants | Description | Descriptive Statistics |

|---|---|---|

| Regulatory quality rq | This is a dimension of the WGI which captures perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development. | Max = 4.30 Min = 1.26 Mean = 2.94 St. Dev = 0.55 |

| Governance effectiveness ge | This is a dimension of the WGI which captures perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of government commitment to such policies. | Max = 0.73 Min = −1.73 Mean = 0.66 Std. Dev. = 0.52 |

| Political stability and absence of violence ps | This is a dimension of the WGI which captures perceptions of the likelihood of political instability and/or politically motivated violence, including terrorism. | Max = 4.72 Min = 1.24 Mean = 3.13 Std. Dev. = 0.76 |

| Control of vorruption cc | This is a dimension of the WGI which captures perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests. An increase in this variable implies that a country is less corrupt, and a decrease implies that a country is more corrupt. | Max = 1.04 Min = −1.81 Mean = 0.54 Std. Dev. = 0.59 |

| Hydroelectric vapacity hydro | Installed hydroelectric capacity (MW). | Min = 0 Max = 3814 Mean = 522.31 Std. Dev. = 702.67 |

| Net installed generation capacity (MW) gc | This refers to the size of the generation capacity (MW). It serves as an indicator for the size of the electricity sector. | Max = 53,028 Min = 14.3 Mean = 2349 Std. Dev. = 7698 |

| Variable | Cobb-Douglas | Translog | Translog w. Inefficiency Determinants | |||

|---|---|---|---|---|---|---|

| Coefficient | Std. Error | Coefficient | Std. Error | Coefficient | Std. Error | |

| Frontier | ||||||

| Outputs | ||||||

| ln gencap | 0.88 | 1.03 | 0.85 | |||

| ln plf | 0.51 *** | 0.03 | 0.49 *** | 0.08 | 0.57 *** | 0.08 |

| ln losses | −0.39 *** | 0.02 | −0.52 *** | 0.07 | −0.42 *** | 0.07 |

| Inputs | ||||||

| act | 0.03 | 0.04 | −0.23 *** | 0.08 | −0.23 *** | 0.08 |

| unb | −0.13 *** | 0.03 | −0.43 ** | 0.21 | −0.47 *** | 0.18 |

| reg | −0.01 | 0.03 | −0.32 *** | 0.09 | −0.37 *** | 0.09 |

| Control Variables | ||||||

| pi | −0.13 *** | 0.03 | −0.10 *** | 0.03 | −0.21 *** | 0.04 |

| rq | −0.04 | 0.04 | 0.08 * | 0.04 | 0.06 | 0.04 |

| ge | −0.09 | 0.05 | −0.05 | 0.05 | −0.04 | 0.05 |

| ps | −0.06 *** | 0.02 | −0.12 *** | 0.02 | −0.09 *** | 0.02 |

| hydro | −0.01 *** | 0.01 | −0.01 *** | 0.01 | −0.01 *** | 0.01 |

| ln gc | 0.01 | 0.01 | −0.04 *** | 0.01 | −0.01 | 0.01 |

| Output Interactions | ||||||

| 0.5 (ln plf)2 | 0.25 *** | 0.06 | 0.21 *** | 0.05 | ||

| 0.5 (ln losses)2 | 0.26 *** | 0.04 | 0.24 *** | 0.04 | ||

| (ln plf) ⋅ (ln losses) | 0.29 *** | 0.04 | 0.27 *** | 0.04 | ||

| Input Interactions | ||||||

| act ⋅ unb | 0.36 * | 0.21 | 0.36 ** | 0.17 | ||

| act ⋅ reg | 0.26 *** | 0.09 | 0.25 *** | 0.08 | ||

| unb ⋅ reg | 0.06 | 0.09 | 0.08 | 0.10 | ||

| Inputs-Outputs Interactions | ||||||

| (ln plf) ⋅ act | −0.18 ** | 0.07 | −0.25 *** | 0.08 | ||

| (ln plf) ⋅ unb | −0.18 ** | 0.09 | −0.14 | 0.09 | ||

| (ln plf) ⋅ reg | 0.32 *** | 0.05 | 0.28 *** | 0.05 | ||

| (ln losses) ⋅ act | −0.09 * | 0.06 | −0.16 *** | 0.06 | ||

| (ln losses) ⋅ unb | −0.08 | 0.07 | −0.07 | 0.08 | ||

| (ln losses) ⋅ reg | 0.35 *** | 0.04 | 0.29 *** | 0.04 | ||

| intercept | −0.34 *** | 0.05 | 0.02 | 0.09 | 0.16 * | 0.09 |

| Noise Term | ||||||

| ln (σv2) | −5.07 *** | 0.36 | −5.04 *** | 0.35 | −5.56 *** | 0.32 |

| Inefficiency Term (variance) | ||||||

| intercept | −1.64 *** | 0.09 | −2.02 *** | 0.11 | −3.44 *** | 0.27 |

| ln gc | −0.45 *** | 0.10 | ||||

| pi | 0.86 *** | 0.22 | ||||

| hydro | 0.01 *** | 0.01 | ||||

| reg | 0.63 *** | 0.22 | ||||

| cc | −0.25 | 0.17 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Asantewaa, A.; Jamasb, T.; Llorca, M. Electricity Sector Reform Performance in Sub-Saharan Africa: A Parametric Distance Function Approach. Energies 2022, 15, 2047. https://doi.org/10.3390/en15062047

Asantewaa A, Jamasb T, Llorca M. Electricity Sector Reform Performance in Sub-Saharan Africa: A Parametric Distance Function Approach. Energies. 2022; 15(6):2047. https://doi.org/10.3390/en15062047

Chicago/Turabian StyleAsantewaa, Adwoa, Tooraj Jamasb, and Manuel Llorca. 2022. "Electricity Sector Reform Performance in Sub-Saharan Africa: A Parametric Distance Function Approach" Energies 15, no. 6: 2047. https://doi.org/10.3390/en15062047