Risk Contagion between Global Commodities from the Perspective of Volatility Spillover

Abstract

:1. Introduction

2. Literature Review

3. Research Method and Data Description

3.1. Construction of Risk Spillover Index

3.2. Data Description

4. Empirical Analysis

4.1. Static Analysis of Volatility Spillover

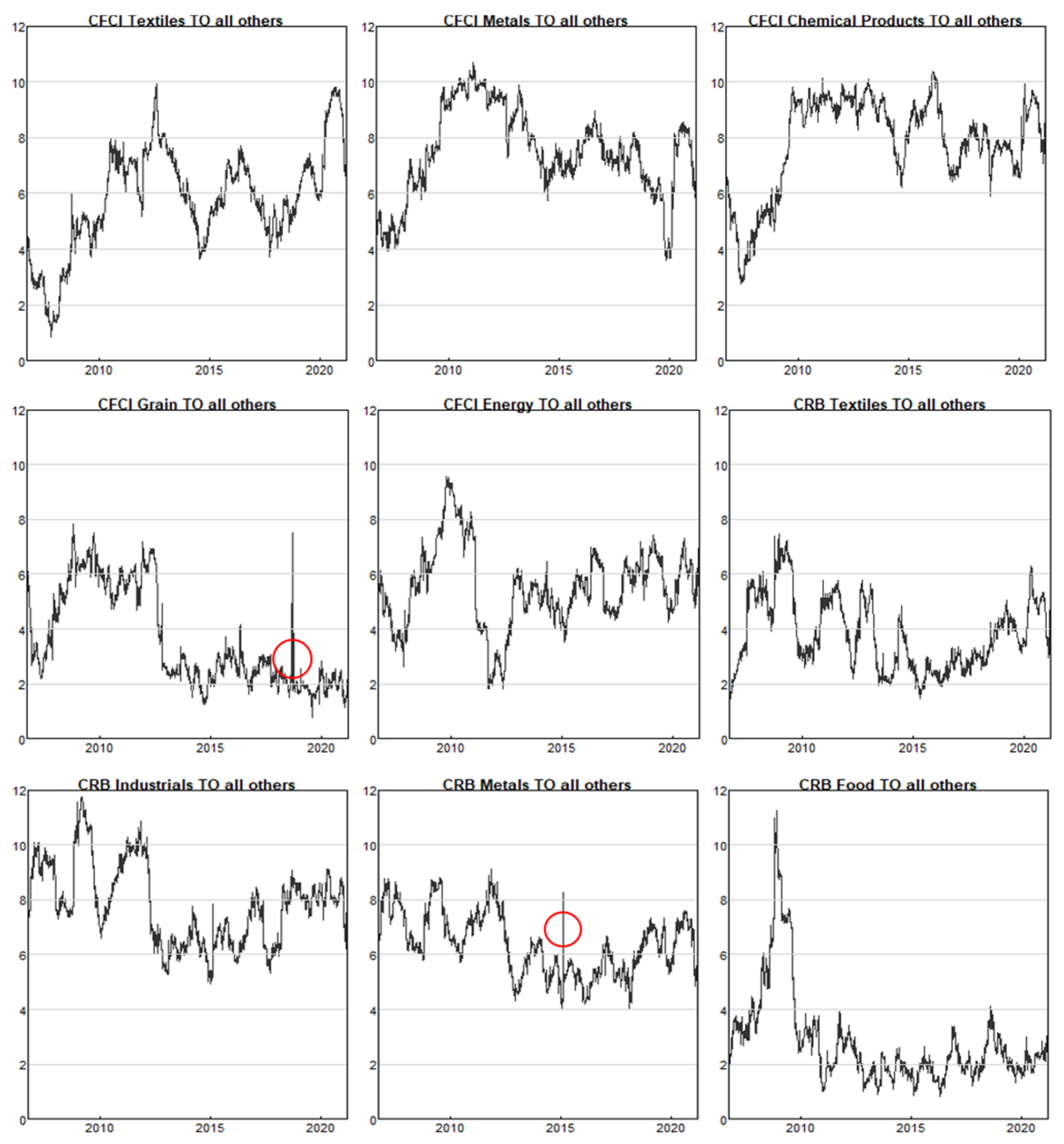

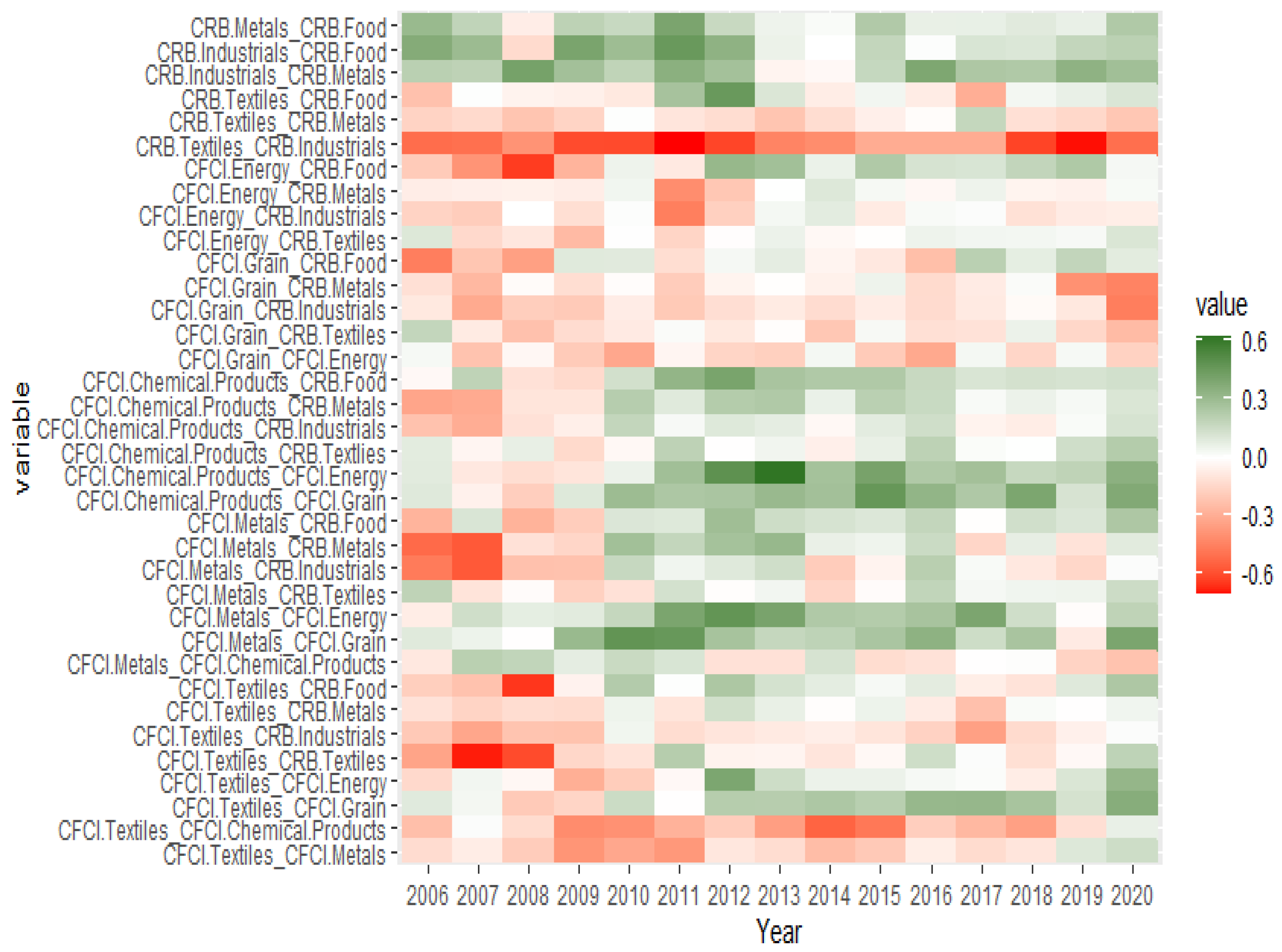

4.2. Dynamic Analysis of Volatility Spillover

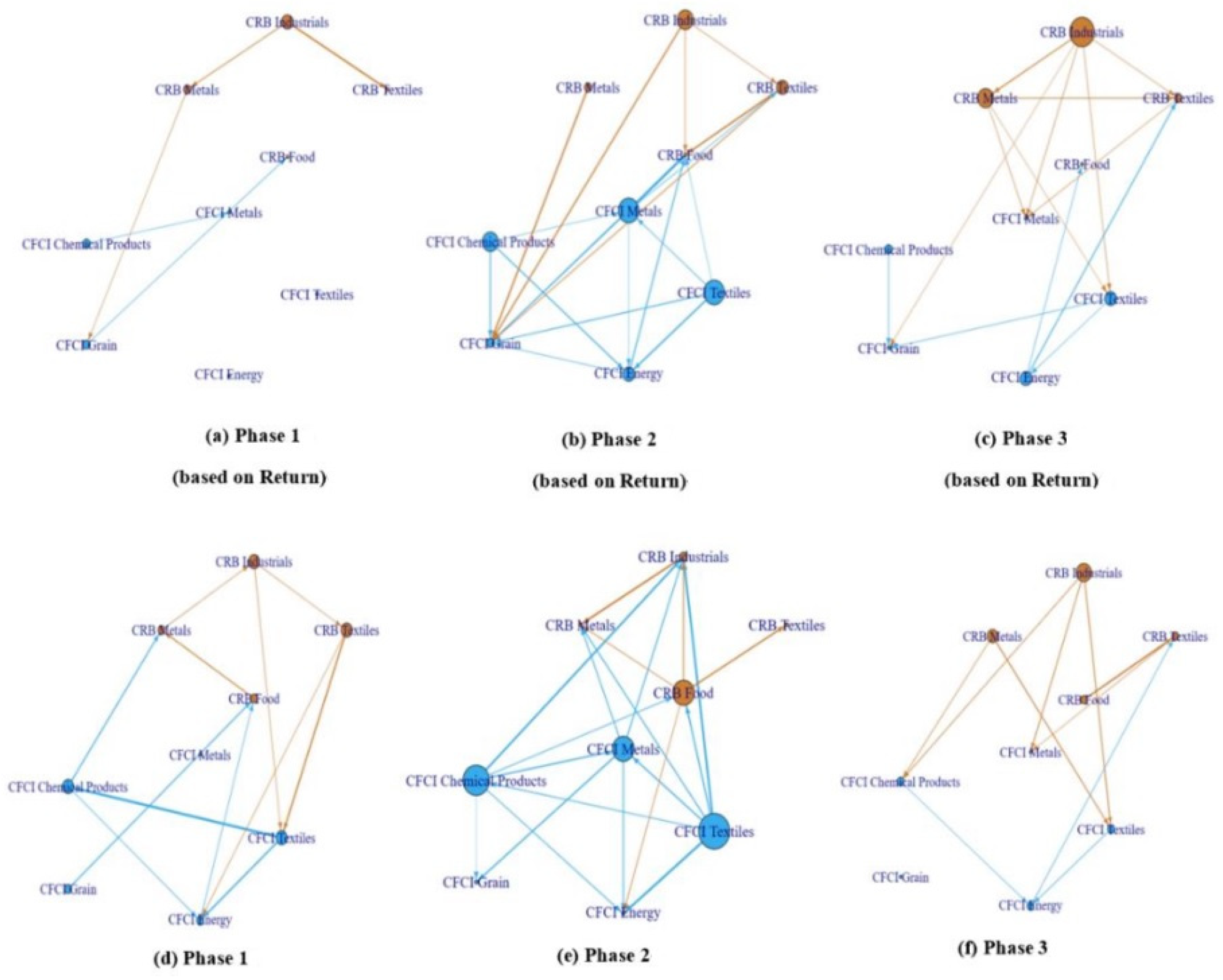

4.3. Dynamic Evolution of Risk Contagion during the COVID-19 Pandemic

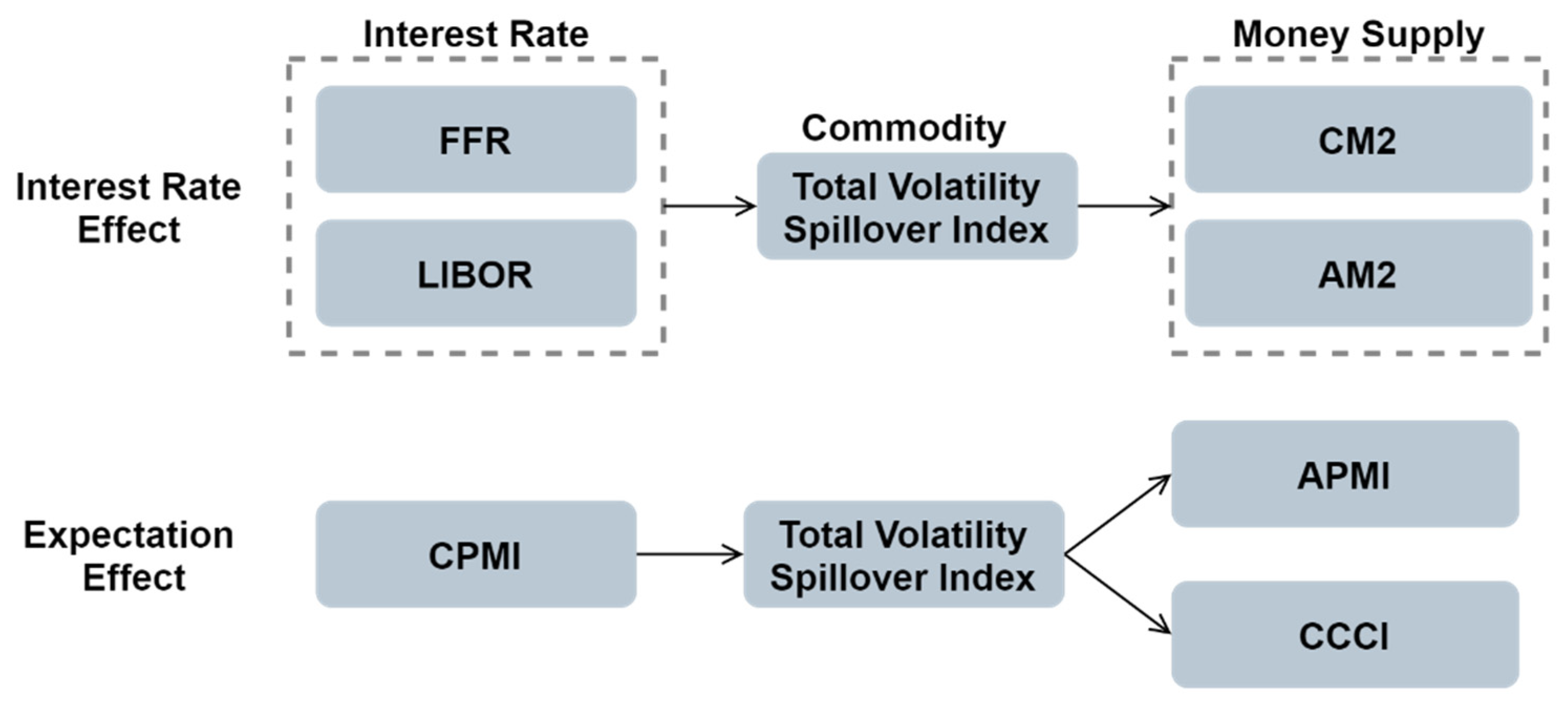

4.4. Analysis of the Risk Contagion Mechanism

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cavallo, E.; Galiani, S.; Noy, I.; Pantano, J. Catastrophic natural disasters and economic growth. Rev. Econ. Stat. 2013, 95, 1549–1561. [Google Scholar] [CrossRef] [Green Version]

- Worthington, A.; Valadkhani, A. Measuring the impact of natural disasters on capital markets: An empirical application using intervention analysis. Appl. Econ. 2004, 36, 2177–2186. [Google Scholar] [CrossRef] [Green Version]

- Zheng, Z.X.; Jiang, C.Y.; Xu, X.G.; Zhu, F.M. Monetary policy, commodity financialization and price fluctuation. Econ. Stud. 2020, 55, 76–91. [Google Scholar]

- Acerbi, C.; Tasche, D. On the coherence of expected shortfall. J. Bank. Financ. 2002, 26, S0378–S4266. [Google Scholar] [CrossRef] [Green Version]

- Hong, Y.M.; Cheng, S.W.; Liu, Y.H.; Wang, S.Y. Great risk spillover effect between China and the rest of the world. Econ. Q. 2004, 2, 703–726. [Google Scholar]

- Zhang, Q.; Wang, C.; Wang, K. Price risk measurement and analysis of livestock products market in China. Econ. Issues 2010, 3, 90–94. [Google Scholar] [CrossRef]

- Adrian, T.; Brunnermeier, M.K. CoVaR. Federal Reserve Bank of New York Staff Report; Princeton University: Princeton, NJ, USA, 2008; p. 348. [Google Scholar]

- Gao, G.H.; Pan, Y.L. Bank Systemic Risk Measurement—Analysis based on Dynamic CoVaR Method; Shanghai Jiao Tong University: Shanghai, China, 2011; Volume 45, pp. 1753–1759. [Google Scholar] [CrossRef]

- Mao, J.; Luo, M. Study on risk spillover effects between banking and securities industry—Analysis based on CoVaR model. New Financ. 2011, 5, 27–31. [Google Scholar]

- Li, S.W.; Wang, L.; Liu, X.X.; Zhang, J. Systemic risk research across banking and corporate departments. Theory Pract. Syst. Eng. 2020, 40, 2492–2504. [Google Scholar] [CrossRef]

- Baruník, J.; Křehlík, T. Measuring the frequency dynamics of financial connectedness and systemic risk. J. Financ. Econom. 2018, 16, 271–296. [Google Scholar] [CrossRef]

- Liu, Z.; Shi, X.; Zhai, P.; Wu, S.; Ding, Z.; Zhou, Y. Tail risk connectedness in the oil-stock nexus: Evidence from a novel quantile spillover approach. Resour. Policy 2021, 74, 102381. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ. J. 2009, 119, 159–171. [Google Scholar] [CrossRef] [Green Version]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef] [Green Version]

- Diebold, F.X.; Yilmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef] [Green Version]

- McMillan, D.G.; Speight, A.E.H. Return and volatility spillovers in three euro exchange rates. J. Econ. Bus. 2009, 62, 79–93. [Google Scholar] [CrossRef]

- Cronin, D. The interaction between money and asset markets: A spillover index approach. J. Macroecon. 2014, 39, 185–202. [Google Scholar] [CrossRef]

- Fu, Q.; Zhang, Y. Risk spillover effect study of China financial system—Empirical analysis based on the overflow index. Macroecon. Res. 2015, 7, 45–51+117. [Google Scholar] [CrossRef]

- Yang, Z.H.; Zhou, Y. Global systematic financial risk overflow and external impact. Chin. Soc. Sci. 2018, 12, 69–90+200–201. [Google Scholar]

- Singh, A.; Kaur, P. A short note on information transmissions across US-BRIC equity markets: Evidence from volatility spillover index. J. Quant. Econ. 2017, 15, 197–208. [Google Scholar] [CrossRef]

- Zheng, J.H.; Fu, Y.F.; Tao, J. Analysis of the impact of COVID-19 epidemic on Consumer Economy. Consum. Econ. 2020, 36, 3–9. [Google Scholar]

- Wu, Z.Y.; Zhu, H.M.; Zhu, J.S. Impact of COVID-19 epidemic on financial operation and policy suggestions. Econ. Vert. 2020, 3, 1–6+137. [Google Scholar] [CrossRef]

- Fang, Y.; Yu, B.; Wang, W. Research on risk measurement and control of Chinese financial market under the influence of COVID-19 epidemic. J. Cent. Univ. Financ. Econ. 2020, 8, 116–128. [Google Scholar] [CrossRef]

- Yang, Z.H.; Chen, Y.T.; Zhang, P.M. Macroeconomic impact, financial risk transmission and governance response under major public emergencies. Manag. World 2020, 36, 13–35+7. [Google Scholar] [CrossRef]

- Fang, Y.; Jia, Y.Y. Risk prevention and control in global foreign exchange market under the impact of COVID-19 epidemic. Contemp. Econ. Sci. 2021, 43, 1–15. [Google Scholar]

- Kamdem, J.S.; Essomba, R.S.; Berinyuy, J.N. Deep learning models for forecasting and analyzing the implications of Covid-19 spread on some commodities markets volatilities. Chaos Solit. Fractals 2020, 140, 110215. [Google Scholar] [CrossRef]

- Dmytrów, K.; Landmesser, J.; Bieszk-Stolorz, B. The connections between COVID-19 and the energy commodities prices: Evidence through the Dynamic Time Warping method. Energies 2021, 14, 4024. [Google Scholar] [CrossRef]

- Elleby, C.; Domínguez, I.P.; Adenauer, M.; Genovese, G. Impacts of the COVID-19 pandemic on the global agricultural markets. Environ. Resour. Econ. 2020, 76, 1067–1079. [Google Scholar] [CrossRef]

- Erten, B.; Ocampo, J.A. The future of commodity prices and the pandemic driven global recession: Evidence from 150 years of data. World Dev. 2021, 137, 105164. [Google Scholar] [CrossRef]

- Bakas, D.; Triantafyllou, A. Commodity price volatility and the economic uncertainty of pandemics. Econ. Lett. 2020, 193, 109283. [Google Scholar] [CrossRef]

- Li, X.; Li, B.; Wei, G.; Bai, L.; Wei, Y.; Liang, C. Return connectedness among commodity and financial assets during the COVID-19 pandemic: Evidence from China and the US. Resour. Policy 2021, 73, 102166. [Google Scholar] [CrossRef]

- Umar, Z.; Gubareva, M.; Teplova, T. The impact of Covid-19 on commodity markets volatility: Analyzing time-frequency relations between commodity prices and coronavirus panic levels. Resour. Policy 2021, 73, 102164. [Google Scholar] [CrossRef]

- Borgards, O.; Czudaj, R.L.; Van Hoang, T.H. Price overreactions in the commodity futures market: An intraday analysis of the Covid-19 pandemic impact. Resour. Policy 2021, 71, 101966. [Google Scholar] [CrossRef]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse response analysis in non-linear multivariate models. J. Econom. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Pesaran, H.H.; Shin, Y. Generalized impulse response analysis in linear multivariate models. Econ. Lett. 1998, 58, 17–29. [Google Scholar] [CrossRef]

- Zhang, X.; Liu, L.; Li, L. Finalization and China’s macroeconomic fluctuations. Financ. Res. 2017, 1, 35–51. [Google Scholar]

- Diks, C.; Panchenko, V. A new statistic and practical guidelines for nonparametric Granger causality testing. J. Econ. Dyn. Control. 2006, 30, 1647–1669. [Google Scholar] [CrossRef] [Green Version]

| China | International | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| CFCI Textiles | CFCI Metals | CFCI Chemical Products | CFCI Grain | CFCI Energy | CRB Textiles | CRB Industrials | CRB Metals | CRB Food | |

| Average | −0.008 | 0.015 | −0.001 | 0.020 | 0.019 | 0.007 | 0.015 | 0.029 | 0.014 |

| Median | 0.011 | 0.031 | 0.027 | 0.014 | 0.042 | 0.000 | 0.018 | 0.029 | 0.009 |

| Maximum | 14.544 | 7.018 | 9.667 | 22.457 | 8.175 | 9.934 | 4.966 | 12.788 | 3.782 |

| Minimum | −12.850 | −5.348 | −8.574 | −23.871 | −8.597 | −9.486 | −4.459 | −10.140 | −9.434 |

| Standard deviation | 1.106 | 1.282 | 1.476 | 1.068 | 1.476 | 0.528 | 0.524 | 1.058 | 0.736 |

| Skewness | 0.211 | −0.115 | −0.147 | 1.564 | −0.300 | 0.175 | −0.334 | −0.110 | −0.842 |

| Kurtosis | 25.080 | 5.679 | 5.407 | 179.598 | 6.118 | 68.314 | 15.311 | 20.908 | 13.644 |

| JB | 73,278 *** | 1086.6 *** | 883.2 *** | 4,687,304 *** | 1514.8 *** | 640,965 *** | 22,840 *** | 48,192 *** | 17,448 *** |

| ADF | −42.3 *** | −40.1 *** | −39.6 *** | −49.3 *** | −41.3 *** | −43.5 *** | −38.6 *** | −40.8 *** | −39.5 *** |

| Variety | CFCI Textiles | CFCI Metals | CFCI Chemical Products | CFCI Grain | CFCI Energy | CRB Textiles | CRB Industrials | CRB Metals | CRB Food | IN |

|---|---|---|---|---|---|---|---|---|---|---|

| CFCI Textiles | 53.2 | 8.6 | 19.44 | 2.61 | 5.1 | 4.68 | 3.33 | 1.85 | 1.19 | 46.8 |

| CFCI Metals | 7 | 43.56 | 16.92 | 2.65 | 12.48 | 1.43 | 6.79 | 7.54 | 1.63 | 56.44 |

| CFCI Chemical Products | 15.71 | 16.76 | 43.01 | 3.15 | 10.82 | 1.61 | 3.95 | 3.76 | 1.23 | 56.99 |

| CFCI Grain | 3.69 | 4.54 | 5.45 | 76.21 | 3.21 | 0.89 | 1.96 | 1.53 | 2.52 | 23.79 |

| CFCI Energy | 5.05 | 15.65 | 13.43 | 2.37 | 53.31 | 1.16 | 3.56 | 3.61 | 1.87 | 46.69 |

| CRB Textiles | 3.59 | 1.27 | 1.52 | 0.6 | 0.61 | 69.92 | 16.2 | 2.71 | 3.59 | 30.08 |

| CRB Industrials | 2.04 | 5.26 | 3.39 | 1.12 | 2.35 | 9.74 | 42 | 30.64 | 3.46 | 58 |

| CRB Metals | 1.3 | 6.44 | 3.71 | 0.94 | 2.66 | 1.83 | 34.16 | 46.57 | 2.39 | 53.43 |

| CRB Food | 1.04 | 1.42 | 1.49 | 2.27 | 0.87 | 4.05 | 5.65 | 3.85 | 79.37 | 20.63 |

| OUT | 39.43 | 59.93 | 65.34 | 15.71 | 38.09 | 25.37 | 75.6 | 55.5 | 17.88 | 392.85 |

| Column Total | 92.63 | 103.48 | 108.34 | 91.93 | 91.4 | 95.29 | 117.6 | 102.07 | 97.25 | 43.70% |

| Variety | CFCI Textiles | CFCI Metals | CFCI Chemical Products | CFCI Grain | CFCI Energy | CRB Textiles | CRB Industrials | CRB Metals | CRB Food | TNSIN |

|---|---|---|---|---|---|---|---|---|---|---|

| CFCI Textiles | 0 | 1.6 | 3.73 | −1.08 | 0.05 | 1.09 | 1.29 | 0.55 | 0.15 | 7.38 |

| CFCI Metals | −1.6 | 0 | 0.16 | −1.89 | −3.17 | 0.16 | 1.53 | 1.1 | 0.21 | −3.5 |

| CFCI Chemical Products | −3.73 | −0.16 | 0 | −2.3 | −2.61 | 0.09 | 0.56 | 0.05 | −0.26 | −8.36 |

| CFCI Grain | 1.08 | 1.89 | 2.3 | 0 | 0.84 | 0.29 | 0.84 | 0.59 | 0.25 | 8.08 |

| CFCI Energy | −0.05 | 3.17 | 2.61 | −0.84 | 0 | 0.55 | 1.21 | 0.95 | 1 | 8.6 |

| CRB Textiles | −1.09 | −0.16 | −0.09 | −0.29 | −0.55 | 0 | 6.46 | 0.88 | −0.46 | 4.7 |

| CRB Industrials | −1.29 | −1.53 | −0.56 | −0.84 | −1.21 | −6.46 | 0 | −3.52 | −2.19 | −17.6 |

| CRB Metals | −0.55 | −1.1 | −0.05 | −0.59 | −0.95 | −0.88 | 3.52 | 0 | −1.46 | −2.06 |

| CRB Food | −0.15 | −0.21 | 0.26 | −0.25 | −1 | 0.46 | 2.19 | 1.46 | 0 | 2.76 |

| TNSOUT | −7.38 | 3.5 | 8.36 | −8.08 | −8.6 | −4.7 | 17.6 | 2.06 | −2.76 | 0 |

| Panel A: Phase 1. | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variety | CFCI Textiles | CFCI Metals | CFCI Chemical Products | CFCI Grain | CFCI Energy | CRB Textiles | CRB Industrials | CRB Metals | CRB Food | TNSIN | |

| CFCI Textiles | VaR Return | 0.00 0.00 | −2.01 −1.57 | −17.7 0.77 | 2.07 0.32 | −12.93 −1.23 | 13.61 1.18 | 6.27 1.17 | 2.76 0.45 | −0.41 −0.45 | −8.34 0.64 |

| CFCI Metals | VaR Return | 2.01 1.57 | 0.00 0.00 | 9.67 2.38 | −0.21 1.30 | −1.99 0.35 | 1.93 0.34 | 1.00 0.92 | −0.31 0.21 | −1.50 0.97 | 10.6 8.04 |

| CFCI Chemical Products | VaR Return | 17.70 −0.77 | −9.67 −2.38 | 0.00 0.00 | −0.33 −0.59 | −6.58 −1.33 | 1.54 −1.47 | 0.14 −0.82 | 0.04 −1.69 | −3.50 0.43 | −0.66 −8.62 |

| CFCI Grain | VaR Return | −2.07 −0.32 | 0.21 −1.30 | 0.33 0.59 | 0.00 0.00 | −0.69 −1.31 | −1.30 1.19 | −1.02 0.24 | 3.88 2.79 | −9.24 −2.84 | −9.9 −0.96 |

| CFCI Energy | VaR Return | 12.93 1.23 | 1.99 −0.35 | 6.58 1.33 | 0.69 1.31 | 0.00 0.00 | 6.23 −0.13 | 3.76 1.16 | −4.78 0.20 | −6.13 1.83 | 21.27 6.58 |

| CRB Textiles | VaR Return | −13.61 −1.18 | −1.93 −0.34 | −1.54 1.47 | 1.30 −1.19 | −6.23 0.13 | 0.00 0.00 | 5.12 7.05 | −3.71 1.58 | −4.61 −0.54 | −25.21 6.98 |

| CRB Industrials | VaR Return | −6.27 −1.17 | −1.00 −0.92 | −0.14 0.82 | 1.02 −0.24 | −3.76 −1.16 | −5.12 −7.05 | 0.00 0.00 | 5.51 −3.96 | 0.84 −0.18 | −8.92 −13.86 |

| CRB Metals | VaR Return | −2.76 −0.45 | 0.31 −0.21 | −0.04 1.69 | −3.88 −2.79 | 4.78 −0.20 | 3.71 −1.58 | −5.51 3.96 | 0.00 0.00 | 9.39 0.53 | 6.00 0.95 |

| CRB Food | VaR Return | 0.41 0.45 | 1.5 −0.97 | 3.5 −0.43 | 9.24 2.84 | 6.13 −1.83 | 4.61 0.54 | −0.84 0.18 | −9.39 −0.53 | 0.00 0.00 | 15.16 0.25 |

| TNSOUT | VaR Return | 8.34 −0.64 | −10.6 −8.04 | 0.66 8.62 | 9.90 0.96 | −21.27 −6.58 | 25.21 −6.98 | 8.92 13.86 | −6.00 −0.95 | −15.16 −0.25 | 0.00 0.00 |

| Panel B: Phase 2 | |||||||||||

| Variety | CFCI Textiles | CFCI Metals | CFCI Chemical Products | CFCI Grain | CFCI Energy | CRB Textiles | CRB Industrials | CRB Metals | CRB Food | TNSIN | |

| CFCI Textiles | VaR Return | 0.00 0.00 | −9.90 −3.23 | −6.95 −1.25 | −4.21 −4.06 | −16.13 −6.37 | 0.90 −0.37 | −16.08 1.12 | −8.90 −0.40 | −10.18 −2.33 | −71.45 −17.99 |

| CFCI Metals | VaR Return | 9.90 3.23 | 0.00 0.00 | 3.66 2.28 | −10.94 −4.40 | −8.30 −1.99 | −4.74 −2.74 | −8.70 1.05 | −8.21 0.02 | 1.79 −9.77 | −25.54 −12.32 |

| CFCI Chemical Products | VaR Return | 6.95 1.25 | −3.66 −2.28 | 0.00 0.00 | −3.13 −4.43 | −7.56 −4.87 | 1.44 −0.90 | −14.77 −0.90 | −9.79 −1.17 | −6.47 −1.34 | −36.99 −14.64 |

| CFCI Grain | VaR Return | 4.21 4.06 | 10.94 4.40 | 3.13 4.43 | 0.00 0.00 | −0.20 2.93 | 0.70 3.58 | 4.89 5.62 | 4.27 6.43 | 1.08 −3.35 | 29.02 28.10 |

| CFCI Energy | VaR Return | 16.13 6.37 | 8.30 1.99 | 7.56 4.87 | 0.20 −2.93 | 0.00 0.00 | −0.98 0.64 | 2.29 0.58 | −0.71 −0.34 | 5.92 −4.72 | 38.71 6.46 |

| CRB Textiles | VaR Return | −0.9 0.37 | 4.74 2.74 | −1.44 0.90 | −0.70 −3.58 | 0.98 −0.64 | 0.00 0.00 | 2.13 2.59 | −0.91 1.13 | 11.62 −6.57 | 15.52 −3.06 |

| CRB Industrials | VaR Return | 16.08 −0.02 | 8.70 −1.05 | 14.77 0.90 | −4.89 −5.62 | −2.29 −0.58 | −2.13 −2.59 | 0.00 0.00 | −13.85 0.44 | 8.66 −2.92 | 25.05 −11.44 |

| CRB Metals | VaR Return | 8.90 0.40 | 8.21 −0.02 | 9.79 1.17 | −4.27 −6.43 | 0.71 0.34 | 0.91 −1.13 | 13.85 −0.44 | 0.00 0.00 | 5.70 −1.11 | 43.8 −7.22 |

| CRB Food | VaR Return | 10.18 2.33 | −1.79 9.77 | 6.47 1.34 | −1.08 3.35 | −5.92 4.72 | −11.62 6.57 | −8.66 2.92 | −5.70 1.11 | 0.00 0.00 | −18.12 32.11 |

| TNSOUT | VaR Return | 71.45 17.99 | 25.54 12.32 | 36.99 14.64 | −29.02 −28.10 | −38.71 −6.46 | −15.52 3.06 | −25.05 11.44 | −43.8 7.22 | 18.12 −32.11 | 0.00 0.00 |

| Panel C: Phase 3 | |||||||||||

| Variety | CFCI Textiles | CFCI Metals | CFCI Chemical Products | CFCI Grain | CFCI Energy | CRB Textiles | CRB Industrials | CRB Metals | CRB Food | TNSIN | |

| CFCI Textiles | VaR Return | 0.00 0.00 | 4.17 −1.26 | 2.86 0.57 | −0.89 −2.75 | −6.36 −2.46 | 1.03 −0.38 | 10.14 2.54 | 9.66 2.04 | −4.53 1.00 | 16.08 −0.70 |

| CFCI Metals | VaR Return | −4.17 1.26 | 0.00 0.00 | −4.77 0.69 | −4.67 −1.75 | −3.19 0.36 | 5.54 2.29 | 8.25 3.01 | 0.87 2.76 | −2.19 −1.07 | −4.33 7.55 |

| CFCI Chemical Products | VaR Return | −2.86 −0.57 | 4.77 −0.69 | 0.00 0.00 | −0.67 −2.99 | −5.64 −1.24 | 0.23 −0.98 | 7.69 0.63 | 6.95 0.78 | −4.05 0.15 | 6.42 −4.91 |

| CFCI Grain | VaR Return | 0.89 2.75 | 4.67 1.75 | 0.67 2.99 | 0.00 0.00 | 1.02 1.82 | 1.25 0.54 | −2.44 2.12 | −1.01 0.63 | 1.56 1.41 | 6.61 14.01 |

| CFCI Energy | VaR Return | 6.36 2.46 | 3.19 −0.36 | 5.64 1.24 | −1.02 −1.82 | 0.00 0.00 | −6.16 −4.82 | 0.84 −0.90 | 2.01 −0.73 | 1.84 −2.68 | 12.7 −7.61 |

| CRB Textiles | VaR Return | −1.03 0.38 | −5.54 −2.29 | −0.23 0.98 | −1.25 −0.52 | 6.16 4.82 | 0.00 0.00 | 1.16 2.44 | −4.55 3.40 | 14.41 −0.44 | 9.13 8.75 |

| CRB Industrials | VaR Return | −10.14 −2.54 | −8.25 −3.10 | −7.69 −0.63 | 2.44 −2.12 | −0.84 0.90 | −1.16 −2.44 | 0.00 0.00 | −4.00 −4.59 | −3.77 0.47 | −33.41 −13.96 |

| CRB Metals | VaR Return | −9.66 −2.04 | −0.87 −2.76 | −6.95 −0.78 | 1.01 −0.63 | −2.01 0.73 | 4.55 −3.40 | 4.00 4.59 | 0.00 0.00 | −2.84 −0.38 | −12.77 −4.67 |

| CRB Food | VaR Return | 4.53 −1.00 | 2.19 1.07 | 4.05 −0.15 | −1.56 −1.41 | −1.84 2.68 | −14.41 0.44 | 3.77 −0.47 | 2.84 0.38 | 0.00 0.00 | −0.43 1.54 |

| TNSOUT | VaR Return | −16.08 0.70 | 4.33 −7.55 | −6.42 4.91 | −6.61 −14.01 | −12.7 7.61 | −9.13 −8.75 | 33.41 13.96 | 12.77 4.67 | 0.43 −1.54 | 0.00 0.00 |

| Index –Return | Index –VaR | LIBOR | FFR | SHIBOR | AM2 | CM2 | CPMI | APMI | CCCI | ACCI | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Average | 51.07 | 49.49 | 1.07 | 1.02 | 2.33 | 0.07 | 0.14 | 50.47 | 52.98 | 109.68 | 82.45 |

| Median | 49.15 | 46.91 | 0.24 | 0.18 | 2.28 | 0.06 | 0.13 | 50.50 | 52.90 | 107.80 | 82.50 |

| Maximum | 67.65 | 77.46 | 6.88 | 5.41 | 13.83 | 0.27 | 0.30 | 52.30 | 64.70 | 127.00 | 101.40 |

| Minimum | 38.84 | 34.37 | 0.05 | 0.04 | 0.68 | 0.02 | 0.08 | 42.50 | 33.10 | 97.00 | 55.30 |

| Standard deviation | 7.21 | 9.47 | 1.50 | 1.46 | 0.91 | 0.05 | 0.05 | 1.21 | 5.22 | 8.15 | 12.33 |

| Skewness | 0.49 | 1.04 | 1.79 | 1.81 | 2.07 | 2.68 | 1.17 | −3.36 | −1.20 | 0.59 | −0.30 |

| Kurtosis | 2.09 | 3.50 | 5.24 | 5.36 | 16.90 | 10.04 | 4.34 | 22.10 | 5.60 | 2.19 | 2.05 |

| Variables | Based on Index–Return z-Statistic | Based on Index–Risk z-Statistic | ||

|---|---|---|---|---|

| LIBOR | 48.65 *** | 5.82 *** | 48.72 *** | 15.13 *** |

| FFR | 33.83 *** | 5.77 *** | 32.48 *** | 15.26 *** |

| SHIBOR | 30.7 *** | 5.68 *** | 30.62 *** | 15.37 *** |

| AM2 | 3.92 *** | 5.30 *** | 4.96 *** | 2.20 ** |

| CM2 | 2.01 ** | 5.06 *** | 1.38 | 2.11 ** |

| CPMI | 7.89 *** | 1.9 * | 7.59 *** | 1.72 * |

| APMI | 1.52 | 1.65 | 1.9 * | 1.56 |

| CCCI | 0.19 | 4.84 *** | −0.31 | 2.19 ** |

| ACCI | 0.17 | 4.69 *** | −0.11 | 2.09 ** |

| Interest Rate and Risk Spillover | Monetary Supply and Risk Spillover | Economic Expectations and Risk Spillover | Investor Confidence and Risk Spillover |

|---|---|---|---|

Index(Return)  FFR FFR | Index(Return)  CM2 CM2 | Index(Return)  APMI APMI | Index(Return)  ACCI ACCI |

Index(VaR)  FFR FFR | Index(VaR)  CM2 CM2 | Index(VaR)  APMI APMI | Index(VaR)  ACCI ACCI |

Index(Return)  LIBOR LIBOR | Index(Return)  AM2 AM2 | Index(Return)  CPMI CPMI | Index(Return)  CCCI CCCI |

Index(VaR)  LIBOR LIBOR | Index(VaR)  AM2 AM2 | Index(VaR)  CPMI CPMI | Index(VaR)  CCCI CCCI |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shen, H.; Pan, Q.; Zhao, L.; Ng, P. Risk Contagion between Global Commodities from the Perspective of Volatility Spillover. Energies 2022, 15, 2492. https://doi.org/10.3390/en15072492

Shen H, Pan Q, Zhao L, Ng P. Risk Contagion between Global Commodities from the Perspective of Volatility Spillover. Energies. 2022; 15(7):2492. https://doi.org/10.3390/en15072492

Chicago/Turabian StyleShen, Hong, Qi Pan, Lili Zhao, and Pin Ng. 2022. "Risk Contagion between Global Commodities from the Perspective of Volatility Spillover" Energies 15, no. 7: 2492. https://doi.org/10.3390/en15072492

APA StyleShen, H., Pan, Q., Zhao, L., & Ng, P. (2022). Risk Contagion between Global Commodities from the Perspective of Volatility Spillover. Energies, 15(7), 2492. https://doi.org/10.3390/en15072492