A Hybrid MCDM Model for Evaluating the Market-Oriented Business Regulatory Risk of Power Grid Enterprises Based on the Bayesian Best-Worst Method and MARCOS Approach

Abstract

:1. Introduction

1.1. Background and Motivation

1.2. Literature Review

- (1)

- There are few studies on the regulatory risk of power grid enterprises. Most of the studies only analyze regulatory risk as a part of grid risk, and do not specifically study the multi-dimensional regulatory risk of grid companies. The evaluation results are not comprehensive or complete.

- (2)

- There is a lack of research on the market-oriented business regulatory risk assessment for power grid enterprises. Existing studies mainly focus on regulatory business, or do not distinguish between market-oriented business and regulatory business. However, with the operation of the electricity market, the government has continuously emphasized the need to clarify the boundaries between the regulatory business and market-oriented business. The research on the regulatory risk of the market-oriented business for power grid enterprises is conducive to comprehensively grasping the regulatory risks faced by power grid enterprises.

1.3. Contributions and Article Organization

- (1)

- In view of the new regulatory relationship faced by power grid enterprises, this paper proposes a set of indicators that comprehensively reflect the market-oriented business regulatory risks of power grid enterprises, covering policy risk, business isolation risk, market risk, and safety risk. The comprehensive evaluation index system can fill the gap in the existing research and is of great significance for power grid enterprises to actively adapt to supervision and prevent supervision risks.

- (2)

- A market-oriented business regulatory risk assessment model of power grid enterprises based on BBWM-MARCOS is proposed in this paper. In the BBWM approach, Bayesian theory is introduced into the traditional BWM to form a certain decision-making environment, which can reduce the heterogeneity between indicators. Compared with the traditional TOPSIS method, MARCOS considers both the ideal solution and the anti-ideal solution, indicating that MARCOS has more significant stability and reliability, and better sample resolution.

2. Evaluation Index System of Market-Oriented Business Regulatory Risk for Power Grid Enterprises

- (1)

- Policy risk.

- (2)

- Business isolation risk.

- (3)

- Market risk.

- (4)

- Safety risk.

3. Basic Theory of the Evaluation Model for Market-Oriented Business Regulatory Risk

3.1. Bayesian Best-Worst Method for Weight Determination of Evaluation Indicators

3.2. MARCOS for Evaluation of Market-Oriented Business Regulatory Risk

3.3. The Framework of the Proposed Model

4. Case Study

4.1. Basic Information

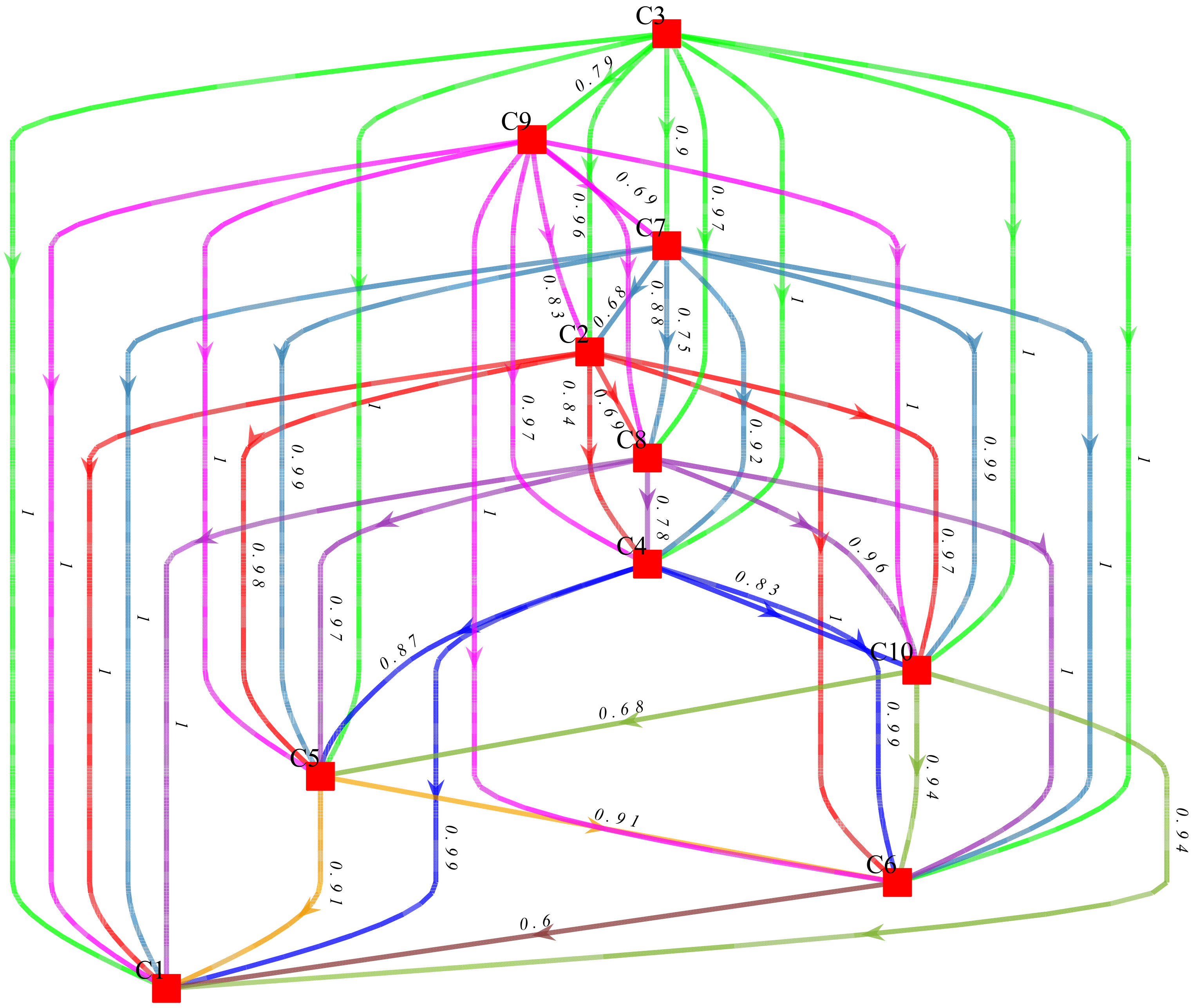

4.2. Determine the Weights of Risk Evaluation Indicators

4.3. Determine the Ranking of Alternatives

5. Comparison of the Results

5.1. Comparison of the Results of Model 1 and Model 2

5.2. Comparison of the Results by Model 1 and Model 3

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, X.; Liu, W.; Liang, G.; Zhao, J.; Qiu, J. Lessons learned from power industry reform and electricity spot market trial operation in Southern China. Energy Clim. Change 2021, 2, 100055. [Google Scholar] [CrossRef]

- Shi, J. Security Risk Assessment about Enterprise Networks on the Base of Simulated Attacks. Procedia Eng. 2011, 24, 272–277. [Google Scholar] [CrossRef] [Green Version]

- Jiang, B.; Li, J.; Shen, S. Supply Chain Risk Assessment and Control of Port Enterprises: Qingdao port as case study. Asian J. Shipp. Logist. 2018, 34, 198–208. [Google Scholar] [CrossRef]

- Wang, G.; Ma, J. A hybrid ensemble approach for enterprise credit risk assessment based on Support Vector Machine. Expert Syst. Appl. 2012, 39, 5325–5331. [Google Scholar] [CrossRef]

- Ávila, P.; Mota, A.; Bastos, J.; Patrício, L.; Pires, A.; Castro, H.; Cruz-Cunha, M.M.; Varela, L. Framework for a risk assessment model to apply in Virtual/Collaborative Enterprises. Procedia Comput. Sci. 2021, 181, 612–618. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, R.; Huang, P.; Wang, X.; Wang, S. Risk evaluation of large-scale seawater desalination projects based on an integrated fuzzy comprehensive evaluation and analytic hierarchy process method. Desalination 2019, 478, 114286. [Google Scholar] [CrossRef]

- Han, B.; Ming, Z.; Zhao, Y.; Wen, T.; Xie, M. Comprehensive risk assessment of transmission lines affected by multi-meteorological disasters based on fuzzy analytic hierarchy process. Int. J. Electr. Power Energy Syst. 2021, 133, 107190. [Google Scholar] [CrossRef]

- Zhou, J.; Bai, X.; Tian, J. Study on the impact of electric power and thermal power industry of Beijing–Tianjin–Hebei region on industrial sulfur dioxide emissions—From the perspective of green technology innovation. Energy Rep. 2022, 8, 837–849. [Google Scholar] [CrossRef]

- Proskuryakova, L.; Kyzyngasheva, E.; Starodubtseva, A. Russian electric power industry under pressure: Post-COVID scenarios and policy implications. Smart Energy 2021, 3, 100025. [Google Scholar] [CrossRef]

- Liu, M. Discussion on the Construction of Financial Risk Control System of Electric Power Research Institutes under the Background of Informational. IOP Conf. Ser. Earth Environ. Sci. 2019, 252, 032051. [Google Scholar] [CrossRef] [Green Version]

- Liu, Y.; Hou, H.; Zhou, K.; Liu, J. Research on Construction of Management and Control System of Electricity Bill Risks in Power Grid Enterprises under Energy Conservation and Emission Reduction Principle. Int. J. Bus. Manag. 2011, 6, 287. [Google Scholar] [CrossRef] [Green Version]

- Zhou, J.X. Operating Risk Evaluation of Thermal Power Enterprises Based on Literature Content Analysis. Procedia Environ. Sci. 2011, 11, 11–17. [Google Scholar]

- Zhe, L.; Ke, L.; Kaibi, W.; Xiaoliu, S. Research on Financial Risk Management for Electric Power Enterprises. Syst. Eng. Procedia 2012, 4, 54–60. [Google Scholar] [CrossRef] [Green Version]

- Ma, T.T.; Li, C.B.; Ren, L.N. The Application of Risk Analysis Based on the Gray Relational Analysis in Power Engineering Comprehensive Evaluation. Appl. Mech. Mater. 2013, 325–326, 619–623. [Google Scholar] [CrossRef]

- Zheng, X.L. Research on Project Risk Management of Power Engineering Based on Fuzzy Comprehensive Evaluation Method. Appl. Mech. Mater. 2013, 415, 287–293. [Google Scholar] [CrossRef]

- Wang, J. Construction of Risk Evaluation Index System for Power Grid Engineering Cost by Applying WBS-RBS and Membership Degree Methods. Math. Probl. Eng. 2020, 2020, 6217872. [Google Scholar] [CrossRef]

- Li, C.B.; Lu, G.S.; Si, W. The investment risk analysis of wind power project in China. Renew. Energy 2013, 50, 481–487. [Google Scholar] [CrossRef]

- Arango, L.G.; Arango, H.; Deccache, E.; Bonatto, B.D.; Pamplona, E.O. Economic Evaluation of Regulatory Tariff Risk Planning for an Electric Power Company. J. Control. Autom. Electr. Syst. 2019, 30, 292–300. [Google Scholar] [CrossRef]

- Fang, Y.; Zhao, Z.Q.; Gao, C.C.; Dai, Y.; Shi, S.H. Fuzzy Comprehensive Evaluation of Trading Regulatory Risk for a Unified and Interconnected Electricity Market in China. Adv. Mater. Res. 2014, 1070–1072, 1486–1490. [Google Scholar] [CrossRef]

- Sasaki, D.; Nakayama, M. Risk Management in an Electricity Transmission Project between Iceland and the UK. Int. J. Soc. Sci. Stud. 2016, 4, 17. [Google Scholar] [CrossRef] [Green Version]

- Li, W.; Li, B.; Fang, R.; You, P.; Zou, Y.; Xu, Z.; Guo, S. Risk Evaluation of Electric Power Grid Enterprise Related to Electricity Transmission and Distribution Tariff Regulation Employing a Hybrid MCDM Model. Mathematics 2021, 9, 989. [Google Scholar] [CrossRef]

- Ganhammar, K. The effect of regulatory uncertainty in green certificate markets: Evidence from the Swedish-Norwegian market. Energy Policy 2021, 158, 112583. [Google Scholar] [CrossRef]

- He, Q.; Fang, C. Regulatory sanctions and stock pricing efficiency: Evidence from the Chinese stock market. Pac.-Basin Financ. J. 2019, 58, 101241. [Google Scholar] [CrossRef]

- Liang, M.; Li, W.; Ji, J.; Zhou, Z.; Zhao, Y.; Zhao, H.; Guo, S. Evaluating the Comprehensive Performance of 5G Base Station: A Hybrid MCDM Model Based on Bayesian Best-Worst Method and DQ-GRA Technique. Math. Probl. Eng. 2022, 2022, 4038369. [Google Scholar] [CrossRef]

- Wang, S. Study on Province-Wide Evaluation Index System of Energy-Saving and Emission-Reduction in China. Adv. Mater. Res. 2015, 1092–1093, 1616–1619. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, F.; Wang, C.; Wang, Z. Assessing the resilience of the belt and road countries and its spatial heterogeneity: A comprehensive approach. PLoS ONE 2020, 15, e0238475. [Google Scholar] [CrossRef]

- Battiston, S.; Mandel, A.M.; Monasterolo, I.; Schuetze, F.; Visentin, S.B.G. A climate stress-test of the financial system. Nat. Clim. Change 2017, 7, 283–288. [Google Scholar] [CrossRef]

- Zhan, S. Legislative boundary and overall planning of monopoly business and competitive business from the perspective of electricity reform. China Power Enterp. Manag. 2020, 601, 33–35. [Google Scholar]

- Bedford, B.L.; Godwin, K.S. Fens of the United States: Distribution, characteristics, and scientific connection versus legal isolation. Wetlands 2003, 23, 608–629. [Google Scholar] [CrossRef]

- Park, S.; Park, C.Y.; Lee, C.; Han, S.H.; Yun, S.; Lee, D.E. Exploring inattentional blindness in failure of safety risk perception: Focusing on safety knowledge in construction industry. Saf. Sci. 2022, 145, 105518. [Google Scholar] [CrossRef]

- Renecle, M.; Curcuruto, M.; Lerín, F.J.G.; Marco, I.T. Enhancing safety in high-risk operations: A multilevel analysis of the role of mindful organising in translating safety climate into individual safety behaviours. Saf. Sci. 2021, 138, 105197. [Google Scholar] [CrossRef]

- Brunner, M.; Sauerwein, C.; Felderer, M.; Breu, R. Risk management practices in information security: Exploring the status quo in the DACH region. Comput. Secur. 2020, 92, 101776. [Google Scholar] [CrossRef] [Green Version]

- Wang, C.; Xu, M.; Olsson, G.; Liu, Y. Characterizing of water-energy-emission nexus of coal-fired power industry using entropy weighting method. Resour. Conserv. Recycl. 2020, 161, 104991. [Google Scholar] [CrossRef]

- Ghasemlounia, R.; Utlu, M. Flood prioritization of basins based on geomorphometric properties using principal component analysis, morphometric analysis and Redvan’s priority methods: A case study of Harit River basin. J. Hydrol. 2021, 603, 127061. [Google Scholar] [CrossRef]

- Mssa, B.; Maii, C. Estimation of earthquake vulnerability by using analytical hierarchy process. Nat. Hazards Res. 2021, 1, 153–160. [Google Scholar]

- Liu, X.; Deng, Q.; Gong, G.; Zhao, X.; Li, K. Evaluating the interactions of multi-dimensional value for sustainable product-service system with grey DEMATEL-ANP approach. J. Manuf. Syst. 2021, 60, 449–458. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method. Omega 2015, 53, 49–57. [Google Scholar] [CrossRef]

- Wu, Y.; Deng, Z.; Tao, Y.; Wang, L.; Liu, F.; Zhou, J. Site selection decision framework for photovoltaic hydrogen production project using BWM-CRITIC-MABAC: A case study in Zhangjiakou. J. Clean. Prod. 2021, 324, 129233. [Google Scholar] [CrossRef]

- Mohammadi, M.; Rezaei, J. Bayesian best-worst method: A probabilistic group decision making model. Omega 2019, 96, 102075. [Google Scholar] [CrossRef]

- Shan, C.; Dong, Z.; Lu, D.; Xu, C.; Wang, H.; Ling, Z.; Liu, Q. Study on river health assessment based on a fuzzy matter-element extension model. Ecol. Indic. 2021, 127, 107742. [Google Scholar] [CrossRef]

- Li, H.; Huang, J.; Hu, Y.; Wang, S.; Liu, J.; Yang, L. A new TMY generation method based on the entropy-based TOPSIS theory for different climatic zones in China. Energy 2021, 231, 120723. [Google Scholar] [CrossRef]

- Varghese, B.; Karande, P. AHP-MARCOS, a hybrid model for selecting gears and cutting fluids. Mater. Today Proc. 2021, 52, 1397–1405. [Google Scholar] [CrossRef]

- Iordache, M.; Pamucar, D.; Deveci, M.; Chisalita, D.; Wu, Q.; Iordache, I. Prioritizing the alternatives of the natural gas grid conversion to hydrogen using a hybrid interval rough based Dombi MARCOS model. Int. J. Hydrogen Energy 2022, 47, 10665–10688. [Google Scholar] [CrossRef]

- Celik, M.G. Hazard identification, risk assessment and control for dam construction safety using an integrated BWM and MARCOS approach under interval type-2 fuzzy sets environment. Autom. Constr. 2021, 127, 103699. [Google Scholar] [CrossRef]

- State Administration for Market Regulation. Anti-Monopoly Law of the People’s Republic of China. State Administration for Market Regulation. 2007. Available online: http://www.gov.cn/flfg/2007-08/30/content_732591.htm (accessed on 9 March 2022).

- General Office of the State Council. Regulations on Optimizing the Business Environment. General Office of the State Council. 2019. Available online: http://www.gov.cn/zhengce/content/2019-10/23/content_5443963.htm (accessed on 9 March 2022).

| Expert Number | The Best Indicator | The Worst Indicator |

|---|---|---|

| 1 | C3 | C6 |

| 2 | C3 | C6 |

| 3 | C7 | C6 |

| 4 | C9 | C1 |

| 5 | C3 | C1 |

| Indicator | Value of Weights | Indicator | Value of Weights |

|---|---|---|---|

| C1 | 0.0480 | C6 | 0.0481 |

| C2 | 0.1157 | C7 | 0.1296 |

| C3 | 0.1735 | C8 | 0.1097 |

| C4 | 0.0908 | C9 | 0.1452 |

| C5 | 0.0680 | C10 | 0.0715 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| A1 | 5 | 4 | 8 | 3 | 5 | 3 | 7 | 4 | 6 | 5 |

| A2 | 4 | 3 | 6 | 4 | 4 | 4 | 6 | 6 | 4 | 2 |

| A3 | 3 | 5 | 5 | 2 | 1 | 1 | 4 | 3 | 7 | 4 |

| A4 | 3 | 4 | 6 | 5 | 2 | 2 | 4 | 1 | 2 | 2 |

| A5 | 4 | 3 | 4 | 3 | 4 | 2 | 6 | 5 | 5 | 1 |

| A6 | 6 | 6 | 7 | 6 | 5 | 4 | 6 | 3 | 4 | 4 |

| A7 | 5 | 3 | 7 | 2 | 4 | 2 | 7 | 5 | 4 | 3 |

| A8 | 4 | 4 | 5 | 4 | 4 | 3 | 5 | 4 | 6 | 3 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| A1 | 0.0288 | 0.0868 | 0.0868 | 0.0605 | 0.0136 | 0.0160 | 0.0741 | 0.0274 | 0.0484 | 0.0143 |

| A2 | 0.0360 | 0.1157 | 0.1157 | 0.0454 | 0.0170 | 0.0120 | 0.0864 | 0.0183 | 0.0726 | 0.0358 |

| A3 | 0.0480 | 0.0694 | 0.1388 | 0.0908 | 0.0680 | 0.0481 | 0.1296 | 0.0366 | 0.0415 | 0.0179 |

| A4 | 0.0480 | 0.0868 | 0.1157 | 0.0363 | 0.0340 | 0.0241 | 0.1296 | 0.1097 | 0.1452 | 0.0358 |

| A5 | 0.0360 | 0.1157 | 0.1735 | 0.0605 | 0.0170 | 0.0241 | 0.0864 | 0.0219 | 0.0581 | 0.0715 |

| A6 | 0.0240 | 0.0579 | 0.0991 | 0.0303 | 0.0136 | 0.0120 | 0.0864 | 0.0366 | 0.0726 | 0.0179 |

| A7 | 0.0288 | 0.1157 | 0.0991 | 0.0908 | 0.0170 | 0.0241 | 0.0741 | 0.0219 | 0.0726 | 0.0238 |

| A8 | 0.0360 | 0.0868 | 0.1388 | 0.0454 | 0.0170 | 0.0160 | 0.1037 | 0.0274 | 0.0484 | 0.0238 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.0480 | 0.1157 | 0.1735 | 0.0908 | 0.0680 | 0.0481 | 0.1296 | 0.1097 | 0.1452 | 0.0715 | |

| 0.0240 | 0.0579 | 0.0868 | 0.0303 | 0.0136 | 0.0120 | 0.0741 | 0.0183 | 0.0415 | 0.0143 |

| A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | |

|---|---|---|---|---|---|---|---|---|

| 0.4566 | 0.5548 | 0.6886 | 0.7650 | 0.6646 | 0.4503 | 0.5679 | 0.5433 | |

| 1.2256 | 1.4890 | 1.8481 | 2.0532 | 1.7839 | 1.2085 | 1.5241 | 1.4582 |

| A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | |

|---|---|---|---|---|---|---|---|---|

| 0.6253 | 0.5157 | 0.4147 | 0.4089 | 0.4934 | 0.6947 | 0.5038 | 0.6036 |

| Models | Model Description |

|---|---|

| Model 1 | The proposed hybrid model based on BBWM and MARCOS |

| Model 2 | The hybrid model based on BWM and MARCOS |

| Model 3 | The hybrid model based on BBWM and TOPSIS |

| Experts | Value of Weights | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | |

| 1 | 0.0451 | 0.0789 | 0.3157 | 0.0631 | 0.0526 | 0.0395 | 0.0789 | 0.1578 | 0.1052 | 0.0631 |

| 2 | 0.0437 | 0.1020 | 0.3059 | 0.0612 | 0.0510 | 0.0437 | 0.1020 | 0.0765 | 0.1529 | 0.0612 |

| 3 | 0.0264 | 0.1983 | 0.1983 | 0.0616 | 0.0379 | 0.0236 | 0.2219 | 0.0852 | 0.1088 | 0.0379 |

| 4 | 0.0263 | 0.0949 | 0.1213 | 0.0686 | 0.0686 | 0.0295 | 0.0686 | 0.2210 | 0.2474 | 0.0537 |

| 5 | 0.0309 | 0.0882 | 0.2519 | 0.1501 | 0.0573 | 0.0519 | 0.0882 | 0.0882 | 0.1358 | 0.0573 |

| Average | 0.0345 | 0.1125 | 0.2386 | 0.0809 | 0.0535 | 0.0376 | 0.1119 | 0.1258 | 0.1500 | 0.0547 |

| A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | |

|---|---|---|---|---|---|---|---|---|

| 0.6983 | 0.5118 | 0.5043 | 0.4148 | 0.4186 | 0.6137 | 0.5060 | 0.6117 |

| A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | |

|---|---|---|---|---|---|---|---|---|

| Evaluation result | 0.4248 | 0.2349 | 0.1577 | 0.0472 | 0.0505 | 0.7151 | 0.1899 | 0.3982 |

| Method | Sample Separation Test Indicators | |||

|---|---|---|---|---|

| TOPSIS | 0.1361 | 0.6732 | 0.2126 | 0.0067 |

| MARCOS | 0.1085 | 0.7486 | 0.2696 | 0.0101 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Z.; Lin, S.; Ye, Y.; Xu, Z.; Zhao, Y.; Zhao, H.; Sun, J. A Hybrid MCDM Model for Evaluating the Market-Oriented Business Regulatory Risk of Power Grid Enterprises Based on the Bayesian Best-Worst Method and MARCOS Approach. Energies 2022, 15, 2978. https://doi.org/10.3390/en15092978

Zhang Z, Lin S, Ye Y, Xu Z, Zhao Y, Zhao H, Sun J. A Hybrid MCDM Model for Evaluating the Market-Oriented Business Regulatory Risk of Power Grid Enterprises Based on the Bayesian Best-Worst Method and MARCOS Approach. Energies. 2022; 15(9):2978. https://doi.org/10.3390/en15092978

Chicago/Turabian StyleZhang, Zhuola, Shiyuan Lin, Yingjin Ye, Zhao Xu, Yihang Zhao, Huiru Zhao, and Jingqi Sun. 2022. "A Hybrid MCDM Model for Evaluating the Market-Oriented Business Regulatory Risk of Power Grid Enterprises Based on the Bayesian Best-Worst Method and MARCOS Approach" Energies 15, no. 9: 2978. https://doi.org/10.3390/en15092978