Energy Prices Impact on Inflationary Spiral

Abstract

:1. Introduction

2. Literature Review

2.1. Change of Energy Mix and Transition to Green Production

2.2. Rising Energy Prices

2.3. Correlation between Energy Prices and Inflation

2.4. Inflationary Spiral?

3. Method

3.1. Argument

3.2. Model Specification

3.3. Data

3.3.1. Dependent Variable

3.3.2. Independent Variables

4. Results and Discussion

4.1. Overall Results

4.1.1. Electricity Prices

4.1.2. Renewable Electricity Sources

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Use | Source | Where |

|---|---|---|

| Share of gas in electricity generation | Eurostat: NRG_BAL_C | Introduction |

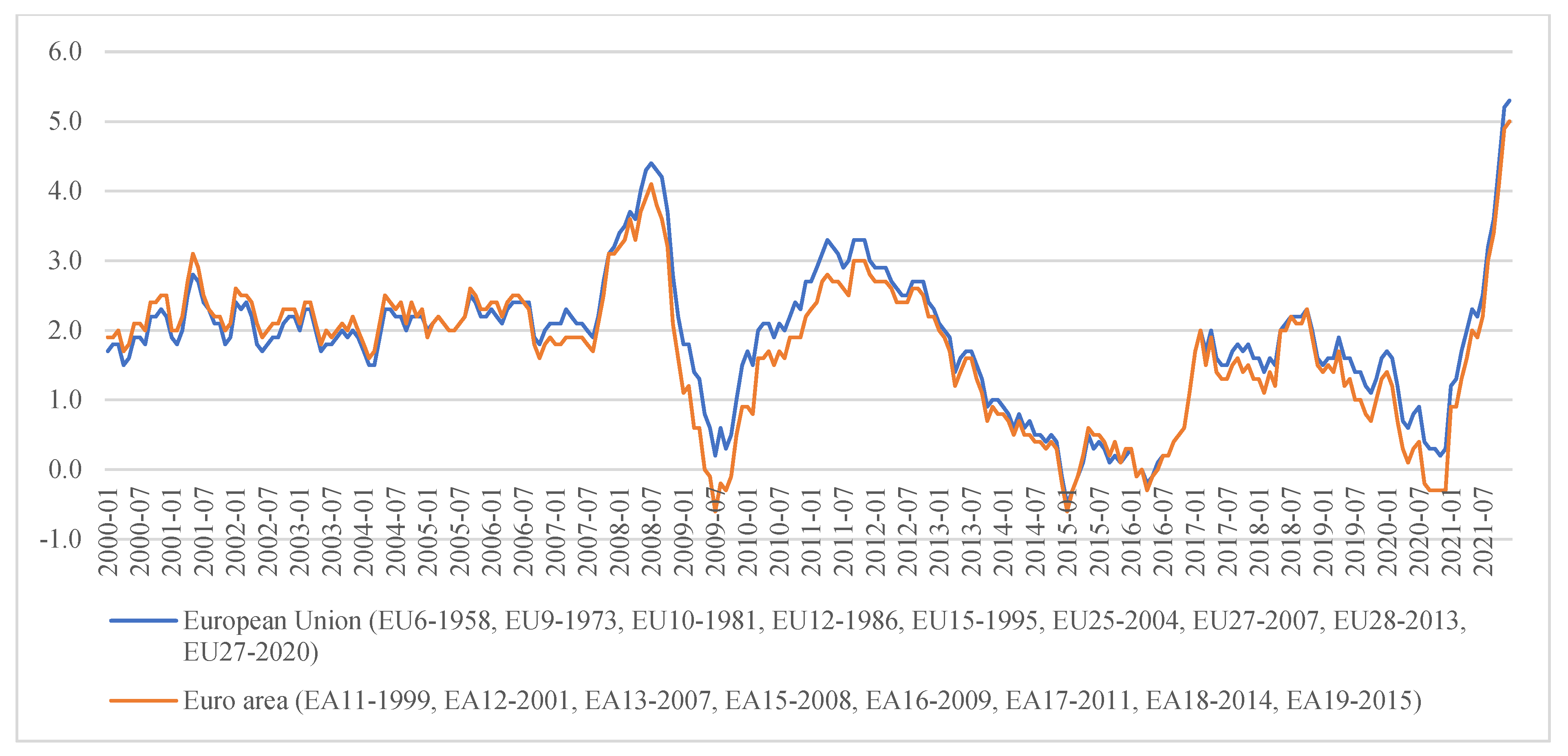

| Annual inflation rates | Eurostat: PRC_HICP_MANR | Figure 1 |

| Annual inflation rates time series | Eurostat: PRC_HICP_AIND | Figure 2 |

| Contribution to the EA inflation | Eurostat: PRC_HICP_CTRB | Table 1 and Table 3 |

| Electricity contribution in EA HICP | Eurostat: PRC_HICP_CTRB | Figure 3, Figure 4 and Figure 5 |

| Non-household electricity prices | Eurostat: NRG_PC_205 | Figure 6 and Figure 7 |

| Share of renewable sources on electricity consumption | Eurostat: NRG_IND_REN | Figure 8 |

| Regression electricity prices on inflation | Eurostat: PRC_HICP_MIDX Eurostat: NRG_PC_205 | Table 4 |

| Regression electricity prices on inflation with control for macroeconomic variables | Eurostat: PRC_HICP_MIDX Eurostat: NRG_PC_205 Eurostat: SDG_08_10 Eurostat: TIPSER11 Eurostat: NRG_IND_REN FRED ST. Louis FED: Liquid Liabilities (Broad Money) | Table 5 and Table 6 |

| National policies to shield consumers from rising energy prices | Bruegel. | Table 2 |

References

- Chiou-Wei, S.Z.; Chen, C.-F.; Zhu, Z. Economic growth and energy consumption revisited—Evidence from linear and nonlinear Granger causality. Energy Econ. 2008, 30, 3063–3076. [Google Scholar] [CrossRef]

- Kanagawa, M.; Nakata, T. Assessment of access to electricity and the socio-economic impacts in rural areas of developing countries. Energy Policy 2008, 36, 2016–2029. [Google Scholar] [CrossRef]

- Brodny, J.; Tutak, M. Analyzing Similarities between the European Union Countries in Terms of the Structure and Volume of Energy Production from Renewable Energy Sources. Energies 2020, 13, 913. [Google Scholar] [CrossRef] [Green Version]

- Karekezi, S.; Kimani, J. Have power sector reforms increased access to electricity among the poor in East Africa? Energy Sustain. Dev. 2004, 8, 10–25. [Google Scholar] [CrossRef]

- Nouni, M.; Mullick, S.; Kandpal, T. Providing electricity access to remote areas in India: Niche areas for decentralized electricity supply. Renew. Sustain. Energy Rev. 2008, 34, 430–434. [Google Scholar] [CrossRef]

- Oseni, M. Household’s access to electricity and energy consumption pattern in Nigeria. Renew. Sustain. Energy Rev. 2012, 16, 990–995. [Google Scholar] [CrossRef]

- Gao, J.; Zhu, S. A New Structural Analysis of Inflation and Economic Activity. Int. J. Econ. Sci. 2019, VIII, 35–51. [Google Scholar] [CrossRef]

- Pala, A. The Relation between Climate Change and Economic Growth: The Investigation The Regional Differences with RCM Model in EU-28 Countries. Int. J. Econ. Sci. 2020, IX, 135–155. [Google Scholar] [CrossRef]

- Kumar, N.; Reddy, A. Development, Energy and Enviroment: Alternative Paradigms. Department of Management Studies, Indian Institute of Science, Bangalore, 560 012. Available online: http://amulya-reddy.org.in/ (accessed on 4 February 2022).

- Rakin, P.D.; Margolis, R.M. Global Energy, Sustainability, and the Conventional Developlment Paradigm. Energy Sources Part A Recovery Util. Environ. Eff. 1998, 20, 363–383. [Google Scholar]

- Saygın, H.; Çetin, F. New Energy Paradigm and Renewable Energy: Turkey’s Vision. Insight Turk. 2010, 12, 107–128. [Google Scholar]

- Turton, H.; Barreto, L. Long-term security of energy, supply and climate change. Energy Policy 2006, 34, 2232–2250. [Google Scholar] [CrossRef]

- Schnabel, I. Member of the Executive Board of the ECB, A New Age of Energy Inflation: Climateflation, Fossilflation and Greenflation. Speech at a Panel on “Monetary Policy and Climate Change” at the ECB and Its Watchers XXII Conference, Frankfurt am Main, 17 March. Available online: https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220317_2~dbb3582f0a.en.html (accessed on 31 March 2022).

- Pisani-Ferry, J. The Case for Green Realism. Project Syndicate. Available online: https://www.project-syndicate.org/commentary/green-new-deal-costs-realism-by-jean-pisani-ferry-2019-02 (accessed on 31 March 2022).

- Gupta, E. Oil vulnerability index of oil-importing countries. Energy Policy 2008, 36, 1195–1211. [Google Scholar] [CrossRef]

- Dorian, J.P.; Franssen, H.T.; Simbeck, D.R. Global challenges in energy. Energy Policy 2006, 34, 1984–1991. [Google Scholar] [CrossRef]

- Qazi, A.; Hussain, F.; Rahimi, N.A.; Hardaker, G.; Alghazzawi, D.; Shaban, K.; Haruna, K. Towards Sustainable Energy: A Systematic Review of Renewable Energy Sources, Technologies, and Public Opinions. IEEE Access 2019, 7, 63837–63851. [Google Scholar] [CrossRef]

- Menges, R. Supporting renewable energy on liberalised markets: Green electricity between additionality and consumer sovereignty? Energy Policy 2003, 31, 583–596. [Google Scholar] [CrossRef]

- REN 21 (Renewable Energy Policy Network for the 21th Century). Renewables Global Status Report 2009 Update. Available online: http://www.ren21.net/pdf/RE_GSR_2009_Update.pdf/ (accessed on 4 February 2022).

- Zsiborács, H.; Hegedüsné Baranyai, N.; Vincze, A.; Zentkó, L.; Birkner, Z.; Máté, K.; Pintér, G. Intermittent Renewable Energy Sources: The Role of Energy Storage in the European Power System of 2040. Electronics 2019, 8, 729. [Google Scholar] [CrossRef] [Green Version]

- Kilinc-Ata, N. The evaluation of renewable energy policies across EU countries and US states: An econometric approach. Energy Sustain. Dev. 2016, 31, 83–90. [Google Scholar] [CrossRef]

- Haas, R.; Panzer, C.; Resch, G.; Ragwitz, M.; Reece, M.; Held, A. A historical review of promotion strategies for electricity from renewable energy sources in EU countries. Renew. Sustain. Energy Rev. 2011, 15, 1003–1034. [Google Scholar] [CrossRef]

- Čermáková, K.; Hromada, E. Change in the Affordability of Owner-Occupied Housing in the Context of Rising Energy Prices. Energies 2022, 15, 1281. [Google Scholar] [CrossRef]

- Zubíková, A.; Smolák, P. Macroeconomic impacts of the COVID-19 pandemic in the Czech Republic in the period of 2020–2021. Int. J. Econ. Sci. 2022, XI, 117–145. [Google Scholar] [CrossRef]

- Hromada, E.; Cermakova, K. Financial Unavailability Of Housing In The Czech Republic And Recommendations For Its Solution. Int. J. Econ. Sci. 2021, X, 47–57. [Google Scholar] [CrossRef]

- Eurostat. Complete Energy Balances. Available online: https://ec.europa.eu/eurostat/databrowser/view/NRG_BAL_C__custom_2080732/default/table?lang=en/ (accessed on 12 February 2022).

- Mork, K.A.; Hall, R.E. Energy Prices, Inflation, and Recession, 1974–1975. Energy J. 1980, 1, 31–63. [Google Scholar]

- Cavallo, M.; Oil Prices and Inflation. FRBSF Economic Letter. Available online: https://www.frbsf.org/economic-research/publications/economic-letter/2008/october/oil-prices-inflation/ (accessed on 4 February 2022).

- Jacques, R.; Moritz, L. Two scenarios for Europe: “Europe confronted with high energy prices” or “Europe after oil peaking”. Futures 2010, 42, 817–824. [Google Scholar]

- Cecrdlova, A. Comparison of the Approach of the Czech National Bank and the European Central Bank to the Effects of the Global Financial Crisis. Int. J. Econ. Sci. 2021, X, 18–46. [Google Scholar] [CrossRef]

- Kaderabkova, B.; Jasova, E.; Holman, R. Analysis of substitution changes in the Phillips curve in V4 countries over the course of economic cycles. Int. J. Econ. Sci. 2020, IX, 39–54. [Google Scholar] [CrossRef]

- Čermáková, K.; Jašová, E. Analysis of the Negative and Positive Impact of Institutional Factors on Unemployment in Visegrad Countries. Int. J. Econ. Sci. 2019, VIII, 20–34. [Google Scholar] [CrossRef] [Green Version]

- Kurekova, L.; Hejdukova, P. Multilevel research of migration with a focus on internal migration. Int. J. Econ. Sci. 2021, X, 86–102. [Google Scholar] [CrossRef]

- Čermáková, K.; Procházka, P.; Kureková, L.; Rotschedl, J. Do Institutions Influence Economic Growth? Prague Econ. Pap. 2020, 29, 672–687. [Google Scholar] [CrossRef]

- Rodroguez-Villalobos, M.; Julián-Arias, A.; Cruz-Montano, A. Effect of NAFTA on Mexico’s wage inequality. Int. J. Econ. Sci. 2019, VIII, 131–149. [Google Scholar] [CrossRef]

- Bernanke, B.S. Chairman of the Board of Governors of the US Federal Reserve System, Energy and The Economy. Remarks. Available online: https://www.bis.org/review/r060622a.pdf/ (accessed on 12 February 2022).

- BIS (Bank for International Settlements). Monetary Policy and the Measurement of Inflation: Prices, Wages and Expectations. BIS Papers, No. 49. Available online: https://www.bis.org/publ/bppdf/bispap49.pdf/ (accessed on 12 February 2022).

- Habermeier, K.F.; Ötker, I.; Vávra, D.; Vazquez, F.F.; Jácome, L.I.; Ishi, K.; Giustiniani, A.; Kisinbay, T. Inflation Pressures and Monetary Policy Options in Emerging and Developing Countries: A Cross Regional Perspective; IMF Working Paper No. 09/1; International Monetary Fund: Washington, DC, USA, 2009. [Google Scholar]

- Zoli, E. Commodity Price Volatility, Cyclical Fluctuations, and Convergence: What is Ahead for Inflation in Emerging Europe? IMF Working Papers; International Monetary Fund: Washington, DC, USA, 2009; pp. 1–19. [Google Scholar]

- Caceres, C.; Poplawski-Ribeiro, M.; Tartari, D. Inflation dynamics in the CEMAC region. J. Afr. Econ. 2012, 22, 239–275. [Google Scholar] [CrossRef]

- Lane, T. Deputy Governor of the Bank of Canada, Drilling Down–Understanding Oil Prices and Their Economic Impact. Remarks to the International Trade Association (MITA). Available online: https://www.bis.org/review/r150114a.htm/ (accessed on 12 February 2022).

- Abdallah, C.; Kpodar, K. How Large and Persistent is the Response of Inflation to Changes in Retail Energy Prices? IMF Working Paper; International Monetary Fund: Washington, DC, USA, 2020; p. 31. [Google Scholar]

- Rubene, L.; Koester, G. Recent Dynamics in Energy Inflation: The Role of Base Effects and Taxes. ECB Economic Bulletin, Issue 3/2021. Available online: https://www.ecb.europa.eu/pub/economic-bulletin/focus/2021/html/ecb.ebbox202103_04~0a0c8f0814.en.html (accessed on 12 February 2022).

- Schnabel, I. Member of the Executive Board of the ECB, Looking Through Higher Energy Prices? Monetary Policy and The Green Transition. Speech at a Panel on “Climate and the Financial System” at the American Finance Association 2022 Virtual Annual Meeting. Available online: https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220108~0425a24eb7.en.html/ (accessed on 12 February 2022).

- Martinsen, D.; Krey, V.; Markewitz, P. Implications of high energy prices for energy system and emissions—The response from an energy model for Germany. Energy Policy 2007, 35, 4504–4515. [Google Scholar] [CrossRef]

- Kost, C.; Shammugam, S.; Fluri, V.; Peper, D.; Memar, A.D.; Schlegel, T. Study: Levelized Cost of Electricity–Renewable Energy Technologies. Frauenhofer Institute for Solar Energy Systems, June 2021. Available online: https://www.ise.fraunhofer.de/en/publications/studies/cost-of-electricity.html (accessed on 31 March 2022).

- Appiah-Otto, I. Impact of Economic Policy Uncertainty on Renewable Energy Growth. Energy Res. Lett. 2021, 2, 5. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Sharma, S.S. Determinants of carbon dioxide emissions: Empirical evidence from 69 countries. Appl. Energy 2011, 88, 376–382. [Google Scholar] [CrossRef]

- Bose, B.K. Global Warming: Energy, Environmental Pollution, and the Impact of Power Electronics. IEEE Ind. Electron. Mag. 2010, 4, 6–17. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J. Environmental degradation, economic growth and energy consumption: Evidence of the environmental Kuznets curve in Malaysia. Energy Policy 2013, 60, 892–905. [Google Scholar] [CrossRef]

- Shafiei, S.; Salim, R.A. Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: A comparative analysis. Energy Policy 2014, 66, 547–556. [Google Scholar] [CrossRef] [Green Version]

- Ezzati, M.; Kammen, D.K. The Health Impacts of Exposure to Indoor Air Pollution from Solid Fuels in Developing Countries: Knowledge, Gaps, and Data Needs. Environ. Health Perspect. 2002, 110, 1057–1068. [Google Scholar] [CrossRef] [Green Version]

- COP25. Summary Report. Available online: https://www.ieta.org/resources/Documents/IETA-COP25-Report_2019.pdf/ (accessed on 4 February 2022).

- European Commission. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en/ (accessed on 4 February 2022).

- European Commission. Available online: https://ec.europa.eu/regional_policy/en/newsroom/news/2020/01/14-01-2020-financing-the-green-transition-the-european-green-deal-investment-plan-and-just-transition-mechanism/ (accessed on 4 February 2022).

- UNFCCC, Kyoto Protocol Reference Manual on Accounting of Emissions and Assigned Amount United Nations Framework Convention on Climate Change. Available online: http://unfccc.int/kyoto_protocol/items/3145.php/ (accessed on 4 February 2022).

- Borgersen, T.A. Social Housing Policy in a Segmented Housing Market: Indirect Effects on Markets and on Individuals. Int. J. Econ. Sci. 2019, VIII, 1–21. [Google Scholar] [CrossRef] [Green Version]

- Tomaszewski, K. Energy policy of the European Union in the context of economic security issues. Przegląd Politol. 2018, 1, 133–145. [Google Scholar] [CrossRef] [Green Version]

- REN21 (Renewable Energy Policy Network for the 21st Century), Renewables Global Status Report 2021. Available online: https://www.ren21.net/gsr-2021/ (accessed on 4 February 2022).

- Piebalgs, A. Energy Commissioner, European Response to energy challenges. Speech at the EU Energy and Environment Law and Policy Conference Brussels. European Commission. Available online: https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_07_70 (accessed on 4 February 2022).

- EIA (US Energy Information Administration). International Energy Outlook 2016. Available online: https://www.eia.gov/outlooks/ieo/pdf/0484.pdf (accessed on 4 February 2022).

- EIA (US Energy Information Administration). International Energy Outlook 2021. Available online: https://www.eia.gov/outlooks/ieo/electricity/sub-topic-01.php (accessed on 4 February 2022).

- Lahiani, A.; Sinha, A.; Shahbaz, M. Renewable Energy Consumption, Income, Co₂ Emissions, And Oil Prices In G7 Countries: The Importance Of Asymmetries. J. Energy Dev. 2017, 43, 157–191. [Google Scholar]

- Agora Energiewende, Renewables Overtake Gas and Coal in EU Electricity Generation. Available online: https://www.agora-energiewende.de/en/press/news-archive/renewables-overtake-gas-and-coal-and-coal-in-eu-electricity-generation-1/ (accessed on 12 February 2022).

- Gelabert, L.; Labandeira, X.; Linares, P. An ex-post analysis of the effect of renewables and cogeneration on Spanish electricity prices. Energy Econ. 2011, 33, S59–S65. [Google Scholar] [CrossRef]

- Percy, S.; Mountain, B. What Happens To Electricity Prices When The Wind And Sun Supply Half The Electricity Market? In Proceedings of the Local Energy, Global Markets, 42nd IAEE International Conference, Montreal, QC, Canada, 29 May–1 June 2019; International Association for Energy Economics: Cleveland, OH, USA, 2019. [Google Scholar]

- Choi, S.; Furceri, D.; Loungani, P.; Mishra, S.; Poplawski-Ribeiro, M. Oil Prices and Inflation Dynamics: Evidence from Advanced and Developing Economies. J. Int. Money Financ. 2017, 82, 71–96. [Google Scholar] [CrossRef]

- Apergis, N. Characteristics of inflation in Greece: Mean Spillover Effects among CPI Components. In Hellenic Observatory Papers on Greece and Southeast Europe; GreeSE Paper No. 43; London School of Economics: London, UK, 2011; p. 12. [Google Scholar]

- Hájková, D.; Král, P. CNB continues to tighten monetary policy. ČNB, Monetary Policy, 17 January 2022. [Google Scholar]

- Lagarde, C. President of the ECB, Monetary Policy in an Uncertain World. Speech at “The ECB and Its Watchers XXII” Conference, Frankfurt am Main, 17 March. Available online: https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220317~9d2f052c92.en.html (accessed on 31 March 2022).

- De Gregorio, J.; Landerretche, O.; Neilson, C. Another Pass-through Bites the Dust? Oil Prices and Inflation. Econ. J. 2007, 7, 155–208. [Google Scholar] [CrossRef] [Green Version]

- Blanchard, O.J.; Galí, J. The Macroeconomic Effects of Oil Price Shocks: Why are the 2000s so Different from the 1970s? In International Dimensions of Monetary Policy; National Bureau of Economic Research (NBER): Cambridge, MA, USA, 2007; pp. 373–421. [Google Scholar]

- Chen, S. Oil Price Pass-through into Inflation. Energy Econ. 2009, 31, 126–133. [Google Scholar] [CrossRef]

- Gelos, G.; Ustyugova, Y. Inflation Responses to Commodity Price Shocks–How and Why Do Countries Differ. J. Int. Money Financ. 2017, 72, 28–47. [Google Scholar] [CrossRef] [Green Version]

- Álvarez, L.J.; Hurtado, S.; Sánchez, I.; Thomas, C. The impact of oil price changes on Spanish and euro area consumer price inflation. Econ. Model. 2011, 28, 422–431. [Google Scholar] [CrossRef] [Green Version]

- Kilian, L. Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef] [Green Version]

- Peersman, G.; Van Robays, I. Cross-country differences in the effects of oil shocks. Energy Econ. 2012, 34, 1532–1547. [Google Scholar] [CrossRef] [Green Version]

- Baumeister, C.; Peersman, G. Time-Varying Effects of Oil Supply Shocks on the US Economy. Am. Econ. J. Macroecon. 2013, 5, 1–28. [Google Scholar] [CrossRef] [Green Version]

- Devore, S.; Olson, E. The Surprising Stability Between Gas Prices and Expected Inflation. Econ. Bull. Access Econ. 2020, 41, 710–719. [Google Scholar]

- Sussman, N.; Osnat, Z. Oil Prices, Inflation Expectations and Monetary Policy; Bank of Israel: Jerusalem, Israel, 2015. [Google Scholar]

- Hájková, D.; Šnobl, R. Proč je inflace v současnosti vysoká a jak dlouho tu s námi bude? ČNB, Měnová politika, 17 January 2022. [Google Scholar]

- Kilian, L.; Zhou, X. The Impact of Rising Oil Prices on US Inflation and Inflation Expectations in 2020–2023; Working Paper 2116; Federal Reserve Bank of Dallas: Dallas, TX, USA, 2021; p. 29. [Google Scholar]

- Lee, I. Oil could surge above $100 in the event of a cold winter-and spark inflation that drives the next macro crisis, BofA says. Markets Insider, 1 October 2021. [Google Scholar]

- Čermáková, K.; Bejček, M.; Vorlíček, J.; Mitwallyová, H. Neglected Theories of Business Cycle—Alternative Ways of Explaining Economic Fluctuations. Data 2021, 6, 109. [Google Scholar] [CrossRef]

- Hejduková, P.; Kureková, L.; Krechovská, M. The Measurement of Industry 4.0: An Empirical Cluster Analysis for EU Countries. Int. J. Econ. Sci. 2020, IX, 121–134. [Google Scholar] [CrossRef]

- Hromada, E.; Čermáková, K.; Krulický, T.; Machová, V.; Horák, J.; Mitwallyova, H. Labour Market and Housing Unavailability: Implications for Regions Affected by Coal Mining. Acta Montan. Slovaca 2021, 26, 404–414. [Google Scholar]

- Čermáková, K.; Filho, E.A.H. Effects of Expansionary Monetary Policy on Agricultural Commodities Market. Sustainability 2021, 13, 9317. [Google Scholar] [CrossRef]

- Kliber, P.; Rutkowska-Ziarko, A. Portfolio choice with a fundamental criterion–An algorithm and practical applicationon–A computation methods and empirical analysis. Int. J. Econ. Sci. 2021, X, 39–52. [Google Scholar] [CrossRef]

- Just, M.; Łuczak, A.; Kozera, A. Conditional Dependence Structure in the Precious Metals Futures Market. Int. J. Econ. Sci. 2019, VIII, 81–93. [Google Scholar] [CrossRef]

- Jašová, E.; Kadeřábková, B. Ambiguous effects of minimum wage tool of labour markets regulation–key study of V4 countries. Int. J. Econ. Sci. 2021, X, 58–85. [Google Scholar] [CrossRef]

- Al-Thaqeb, S.A.; Algharabali, B.G.; Alabdulghafour, K.T. The pandemic and economic policy uncertainty. Int. J. Financ. Econ. 2020, 1–11. [Google Scholar] [CrossRef]

- Lagarde, C. President of the ECB, Finding Resilience in Times of Uncertainty. Speech at an Event Organised by the Central Bank of Cyprus, Nicosia, March 30. Available online: https://www.bis.org/review/r220331a.htm (accessed on 31 March 2022).

- Istrefi, K.; Piloiu, A. Economic Policy Uncertainty and Inflation Expectations; Working papers 511; Banque de France: Paris, France, 2014; p. 43. [Google Scholar]

- Ghosh, T.; Sahu, S.; Chattopadhyay, S. Inflation expectations of households in India: Role of oil prices, economic policy uncertainty, and spillover of global financial uncertainty. Bull. Econ. Res. 2020, 73, 230–251. [Google Scholar] [CrossRef]

- Istiak, K.; Alam, R. Oil Prices, Policy Uncertainty and Asymmetries in Inflation Expectations. J. Econ. Stud. 2019, 46, 324–334. [Google Scholar] [CrossRef]

- Eser, F.; Karadi, P.; Lane, P.R.; Moretti, L.; Osbat, C. The Phillips curve at the ECB. Manch. Sch. 2020, 88, 50–85. [Google Scholar] [CrossRef]

- Topan, L.; Castro, C.; Jerez, M.; Barge-Gil, A. Oil price pass-through into inflation in Spain at national and regional level. SERIEs 2020, 11, 561–583. [Google Scholar] [CrossRef] [PubMed]

- Kassouri, Y.; Altıntaş, H. The quantile dependence of the stock returns of “clean” and “dirty” firms on oil demand and supply shocks. J. Commod. Mark. 2021, in press. [CrossRef]

- Gonçalves, E.; Henkel, L.; Kouvavas, O.; Porqueddu, M.; Trezzi, R. 2021 HICP Weights and Their Implications for the Measurement of Inflation. ECB Economic Bulletin, Issue 2/2021. Available online: https://www.ecb.europa.eu/pub/economic-bulletin/focus/2021/html/ecb.ebbox202102_06~6ead8c0475.en.html/ (accessed on 12 February 2022).

- Işık, C.; Sirakaya-Turk, E.; Ongan, S. Testing the efficacy of the economic policy uncertainty index on tourism demand in USMCA: Theory and evidence. Tour. Econ. 2019, 26, 1344–1357. [Google Scholar] [CrossRef]

- Ren, Y.; Guo, Q.; Zhu, H.; Ying, W. The effects of economic policy uncertainty on China ‘s economy: Evidence from time-varying parameter FAVAR. Appl. Econ. 2019, 52, 3167–3185. [Google Scholar] [CrossRef]

- ČNB. Vliv Dosud Rychle Rostoucích Světových cen Energetických Zdrojů. Zpráva o Inflaci–Příloha, IV/2008. Available online: https://www.cnb.cz/cs/menova-politika/zpravy-o-inflaci/tematicke-prilohy-a-boxy/Vliv-dosud-rychle-rostoucich-svetovych-cen-energetickych-zdroju/ (accessed on 21 January 2022).

| COICOP | 2020-12 | 2021-06 | 2021-07 | 2021-08 | 2021-09 | 2021-10 | 2021-11 | 2021-12 |

|---|---|---|---|---|---|---|---|---|

| Food including alcohol and tobacco | 0.25 | 0.15 | 0.35 | 0.43 | 0.44 | 0.43 | 0.49 | 0.71 |

| > Processed food including alcohol and tobacco | 0.16 | 0.15 | 0.26 | 0.29 | 0.31 | 0.35 | 0.39 | 0.47 |

| > Unprocessed food | 0.09 | 0.00 | 0.09 | 0.14 | 0.13 | 0.08 | 0.10 | 0.23 |

| Energy | −0.68 | 1.16 | 1.34 | 1.44 | 1.63 | 2.21 | 2.57 | 2.46 |

| > Electricity, gas and other fuels | −0.22 | 0.47 | 0.63 | 0.71 | 0.83 | 1.19 | 1.39 | 1.50 |

| >> Electricity | 0.01 | 0.23 | 0.22 | 0.26 | 0.31 | 0.43 | 0.51 | 0.65 |

| >> Gas | −0.06 | 0.11 | 0.25 | 0.28 | 0.31 | 0.44 | 0.52 | 0.54 |

| >> Liquid fuels | −0.15 | 0.13 | 0.15 | 0.15 | 0.20 | 0.29 | 0.31 | 0.24 |

| >> Solid fuels | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 |

| >> Heat energy | −0.01 | 0.00 | 0.01 | 0.01 | 0.02 | 0.03 | 0.04 | 0.05 |

| > Fuels and lubricants for per. transp. equipment | −0.46 | 0.69 | 0.70 | 0.74 | 0.80 | 1.02 | 1.18 | 0.96 |

| Non-energy industrial goods | −0.14 | 0.31 | 0.17 | 0.65 | 0.57 | 0.55 | 0.64 | 0.78 |

| Services (overall index excluding goods) | 0.30 | 0.28 | 0.31 | 0.43 | 0.72 | 0.86 | 1.16 | 1.02 |

| Country/Policy | Reduced Energy Tax/VAT | Retail Price Regulation | Wholesale Price Regulation | Transfers to Vulnerable Groups | Mandate to State-Owned Firms | Windfall Profits Tax/Regulation | Other |

|---|---|---|---|---|---|---|---|

| Austria | x | ||||||

| Belgium | x | x | x | x | |||

| Bulgaria | x | x | x | ||||

| Cyprus | x | x | |||||

| Czechia | x | x | |||||

| Denmark | x | ||||||

| Estonia | x | x | |||||

| France | x | x | x | x | x | ||

| Germany | x | x | x | x | |||

| Greece | x | x | |||||

| Hungary | x | ||||||

| Irland | x | x | x | ||||

| Italy | x | x | x | ||||

| Latvia | x | ||||||

| Lithuania | x | x | x | ||||

| Luxemburg | x | ||||||

| Netherlands | x | ||||||

| Norway | x | ||||||

| Poland | x | x | x | ||||

| Portugal | x | x | x | ||||

| Romania | x | x | x | x | |||

| Spain | x | x | x | x | x | ||

| Sweden | x |

| OLS Regression Results-Period before 2009 | ||||||

| Dep. Variable: | HICPexEl | R-squared: | 0.061 | |||

| Model: | OLS | Adj. R-squared: | 0.05 | |||

| Method: | Least Squares | F-statistic: | 2.462 | |||

| Date: | Friday, 25 February 2022 | Prob (F-statistic): | 0.12 | |||

| Time: | 0:27:05 | Log-Likelihood: | −63.89 | |||

| No. Observations: | 84 | AIC: | 131.8 | |||

| Df Residuals: | 82 | BIC: | 136.6 | |||

| Df Model: | 1 | |||||

| Covariance Type: | HC3 | |||||

| coef | std err | z | p > |z| | [0.025 | 0.975] | |

| const | 1.95 | 0.157 | 12.446 | 0 | 1.643 | 2.257 |

| Electricity Contribution | 4.322 | 2.755 | 1.569 | 0.117 | −1.077 | 9.721 |

| Omnibus: | 9.233 | Durbin-Watson: | 0.221 | |||

| Prob(Omnibus): | 0.01 | Jarque-Bera (JB): | 8.941 | |||

| Skew: | 0.743 | Prob(JB): | 0.0114 | |||

| Kurtosis: | 3.591 | Cond. No. | 32.9 | |||

| OLS Regression Results—Period after 2010 | ||||||

| Dep. Variable: | HICPexEl | R-squared: | 0.622 | |||

| Model: | OLS | Adj. R-squared: | 0.62 | |||

| Method: | Least Squares | F-statistic: | 53 | |||

| Date: | Friday, 25 Feburary 2022 | Prob (F-statistic): | 2E−11 | |||

| Time: | 0:27:44 | Log-Likelihood: | −132.9 | |||

| No. Observations: | 146 | AIC: | 269.9 | |||

| Df Residuals: | 144 | BIC: | 275.9 | |||

| Df Model: | 1 | |||||

| Covariance Type: | HC3 | |||||

| coef | std err | z | p > |z| | [0.025 | 0.975] | |

| const | 0.686 | 0.086 | 7.966 | 0 | 0.517 | 0.855 |

| Electricity Contribution | 6.7581 | 0.928 | 7.28 | 0 | 4.939 | 8.577 |

| Omnibus: | 7.931 | Durbin-Watson: | 0.239 | |||

| Prob(Omnibus): | 0.019 | Jarque-Bera (JB): | 4.132 | |||

| Skew: | −0.185 | Prob(JB): | 0.127 | |||

| Kurtosis: | 2.263 | Cond. No. | 8.82 | |||

| PanelOLS Estimation Summary-Biannual Deseasonalized Inflation | ||||

| Dep. Variable: | deseas_inflation | R-squared: | 0.0019 | |

| Estimator: | PanelOLS | R-squared (Between): | −0.7859 | |

| No. Observations: | 827 | R-squared (Within): | −0.0033 | |

| R-squared (Overall): | −0.0134 | |||

| Log-likelihood | −1185.2 | |||

| Cov. Estimator: | Robust | |||

| F-statistic: | 1.4764 | |||

| Entities: | 32 | p-value | 0.2247 | |

| Avg Obs: | 25.844 | Distribution: | F (1,768) | |

| Min Obs: | 10 | |||

| Max Obs: | 27 | F-statistic (robust): | 1.4185 | |

| p-value | 0.234 | |||

| Time periods: | 27 | Distribution: | F (1,768) | |

| Avg Obs: | 30.63 | |||

| Min Obs: | 30 | |||

| Max Obs: | 32 | |||

| Parameter Estimates | ||||

| Parameter | Std. Err. | T-stat | p-value | |

| const | 0.3264 | 0.3503 | 0.9319 | 0.3517 |

| el_price | −2.1926 | 1.8409 | −1.191 | 0.234 |

| PanelOLS Estimation Summary-Biannual Inflation | ||||

| Dep. Variable: | inflation | R-squared: | 0.0001 | |

| Estimator: | PanelOLS | R-squared (Between): | 0.0477 | |

| No. Observations: | 863 | R-squared (Within): | 0.0018 | |

| R-squared (Overall): | 0.0098 | |||

| Log-likelihood | −1554.6 | |||

| Cov. Estimator: | Robust | |||

| F-statistic: | 0.1061 | |||

| Entities: | 32 | p-value | 0.7447 | |

| Avg Obs: | 26.969 | Distribution: | F (1,802) | |

| Min Obs: | 10 | |||

| Max Obs: | 29 | F-statistic (robust): | 0.0892 | |

| p-value | 0.7653 | |||

| Time periods: | 29 | Distribution: | F (1,802) | |

| Avg Obs: | 29.759 | |||

| Min Obs: | 7 | |||

| Max Obs: | 32 | |||

| Parameter Estimates | ||||

| Parameter | Std. Err. | T-stat | p-value | |

| const | 1.1792 | 0.5158 | 2.2863 | 0.0225 |

| el_price | −0.8231 | 2.7565 | −0.2986 | 0.7653 |

| PanelOLS Estimation Summary | ||||

| Dep. Variable: | inflation | R-squared: | 0.3624 | |

| Estimator: | PanelOLS | R-squared (Between): | 0.7885 | |

| No. Observations: | 328 | R-squared (Within): | 0.3888 | |

| Date: | Friday, 29 April 2022 | R-squared (Overall): | 0.4691 | |

| Time: | 16:47:44 | Log-likelihood | −415.64 | |

| Cov. Estimator: | Robust | |||

| F-statistic: | 17.685 | |||

| Entities: | 27 | p-value | 0 | |

| Avg Obs: | 12.148 | Distribution: | F (9,280) | |

| Min Obs: | 6 | |||

| Max Obs: | 13 | F-statistic (robust): | 5.2417 | |

| p-value | 0 | |||

| Time periods: | 13 | Distribution: | F (9,280) | |

| Avg Obs: | 25.231 | |||

| Min Obs: | 22 | |||

| Max Obs: | 27 | |||

| Parameter Estimates | ||||

| Parameter | Std. Err. | T-stat | p-value | |

| const | 1.1817 | 0.8324 | 1.4197 | 0.1568 |

| el_price | 0.5853 | 3.0162 | 0.1941 | 0.8463 |

| share | −0.0838 | 0.0413 | −2.03 | 0.0433 |

| gdp | 0.032 | 0.0324 | 0.9901 | 0.323 |

| neer | −0.0969 | 0.0249 | −3.8901 | 0.0001 |

| el_lag | −0.26 | 3.1306 | −0.0831 | 0.9339 |

| ainf_lag | 0.4328 | 0.1048 | 4.1299 | 0 |

| ren_lag | 0.0723 | 0.0417 | 1.7345 | 0.0839 |

| gdp_lag | 0.0948 | 0.035 | 2.7054 | 0.0072 |

| neer_lag | −0.0745 | 0.0241 | −3.0875 | 0.0022 |

| RandomEffects Estimation Summary | ||||

| Dep. Variable: | inflation | R-squared: | 0.5603 | |

| Estimator: | RandomEffects | R-squared (Between): | 0.8856 | |

| No. Observations: | 328 | R-squared (Within): | 0.4771 | |

| Date: | Friday, 29 April 2022 | R-squared (Overall): | 0.5603 | |

| Time: | 16:50:02 | Log-likelihood | −495.41 | |

| Cov. Estimator: | Unadjusted | |||

| F-statistic: | 36.6 | |||

| Entities: | 27 | p-value | 0 | |

| Avg Obs: | 12.148 | Distribution: | F (11,316) | |

| Min Obs: | 6 | |||

| Max Obs: | 13 | F-statistic (robust): | 36.6 | |

| p-value | 0 | |||

| Time periods: | 13 | Distribution: | F (11,316) | |

| Avg Obs: | 25.231 | |||

| Min Obs: | 22 | |||

| Max Obs: | 27 | |||

| Parameter Estimates | ||||

| Parameter | Std. Err. | T-stat | p-value | |

| const | 0.8212 | 0.2904 | 2.8282 | 0.005 |

| el_price | −4.2559 | 3.5435 | −1.2011 | 0.2306 |

| share | −0.0856 | 0.0446 | −1.9197 | 0.0558 |

| gdp | 0.0176 | 0.0191 | 0.9226 | 0.3569 |

| neer | −0.1084 | 0.0233 | −4.6485 | 0 |

| bm | 0.0071 | 0.0069 | 1.0208 | 0.3081 |

| ainf_lag | 0.5024 | 0.0415 | 12.098 | 0 |

| el_lag | 4.1152 | 3.4968 | 1.1768 | 0.2401 |

| ren_lag | 0.0821 | 0.0451 | 1.8203 | 0.0697 |

| gdp_lag | 0.114 | 0.0186 | 6.1211 | 0 |

| neer_lag | −0.0788 | 0.0211 | −3.7288 | 0.0002 |

| bm_lag | 0.0376 | 0.0072 | 5.205 | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bednář, O.; Čečrdlová, A.; Kadeřábková, B.; Řežábek, P. Energy Prices Impact on Inflationary Spiral. Energies 2022, 15, 3443. https://doi.org/10.3390/en15093443

Bednář O, Čečrdlová A, Kadeřábková B, Řežábek P. Energy Prices Impact on Inflationary Spiral. Energies. 2022; 15(9):3443. https://doi.org/10.3390/en15093443

Chicago/Turabian StyleBednář, Ondřej, Andrea Čečrdlová, Božena Kadeřábková, and Pavel Řežábek. 2022. "Energy Prices Impact on Inflationary Spiral" Energies 15, no. 9: 3443. https://doi.org/10.3390/en15093443

APA StyleBednář, O., Čečrdlová, A., Kadeřábková, B., & Řežábek, P. (2022). Energy Prices Impact on Inflationary Spiral. Energies, 15(9), 3443. https://doi.org/10.3390/en15093443