Determinants of Return-on-Equity (ROE) of Biogas Plants Operating in Poland

Abstract

:1. Introduction

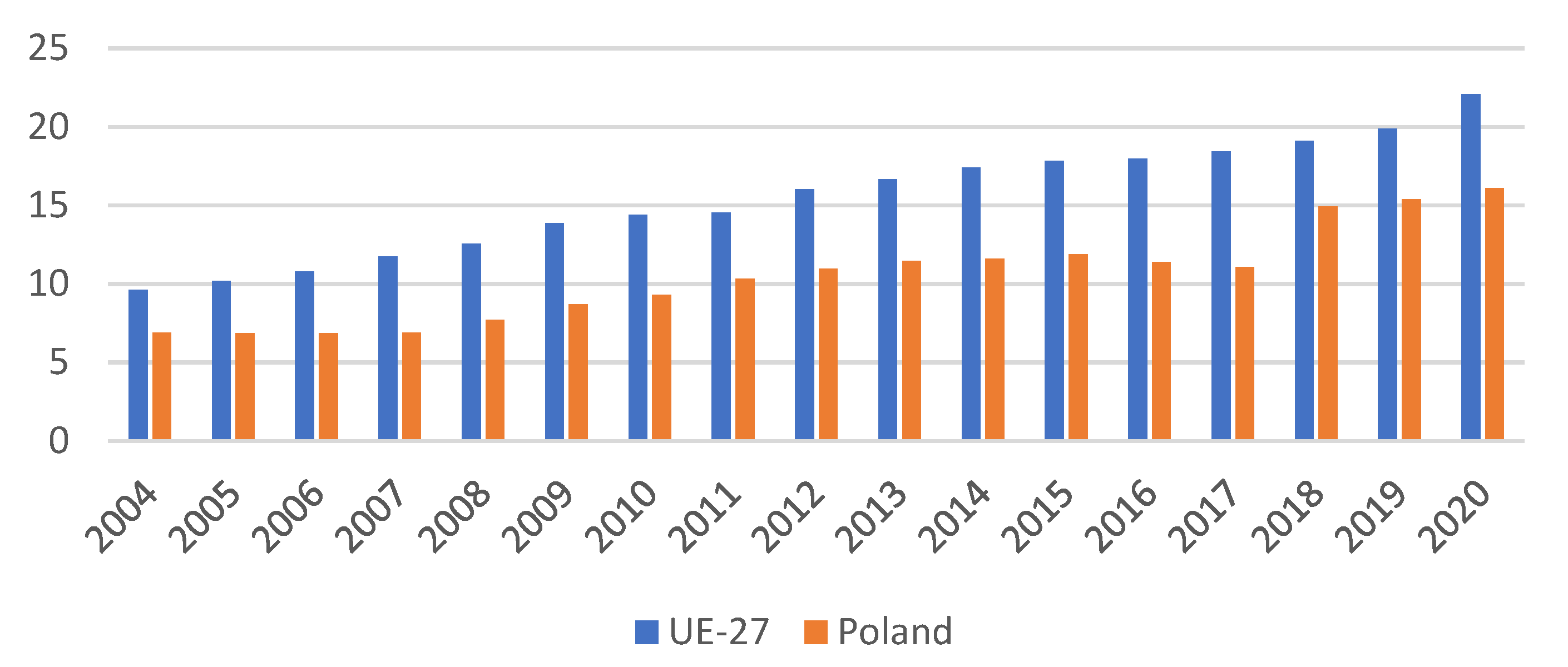

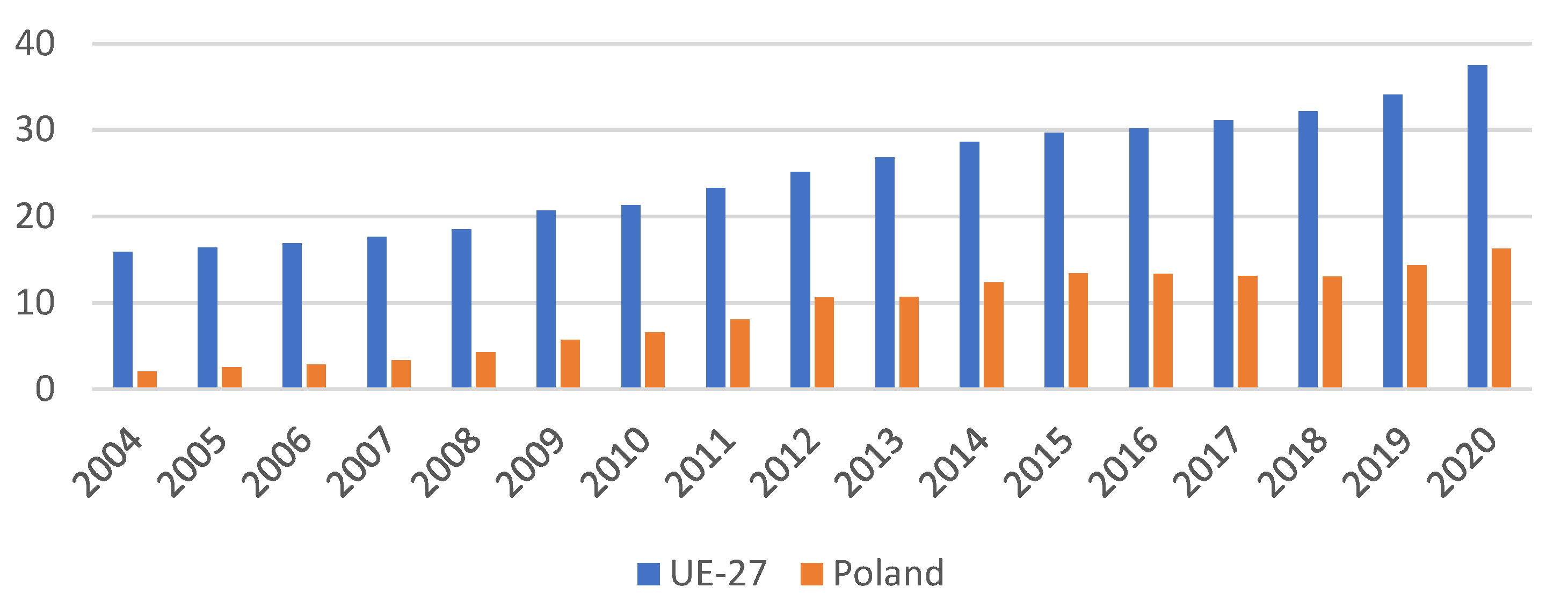

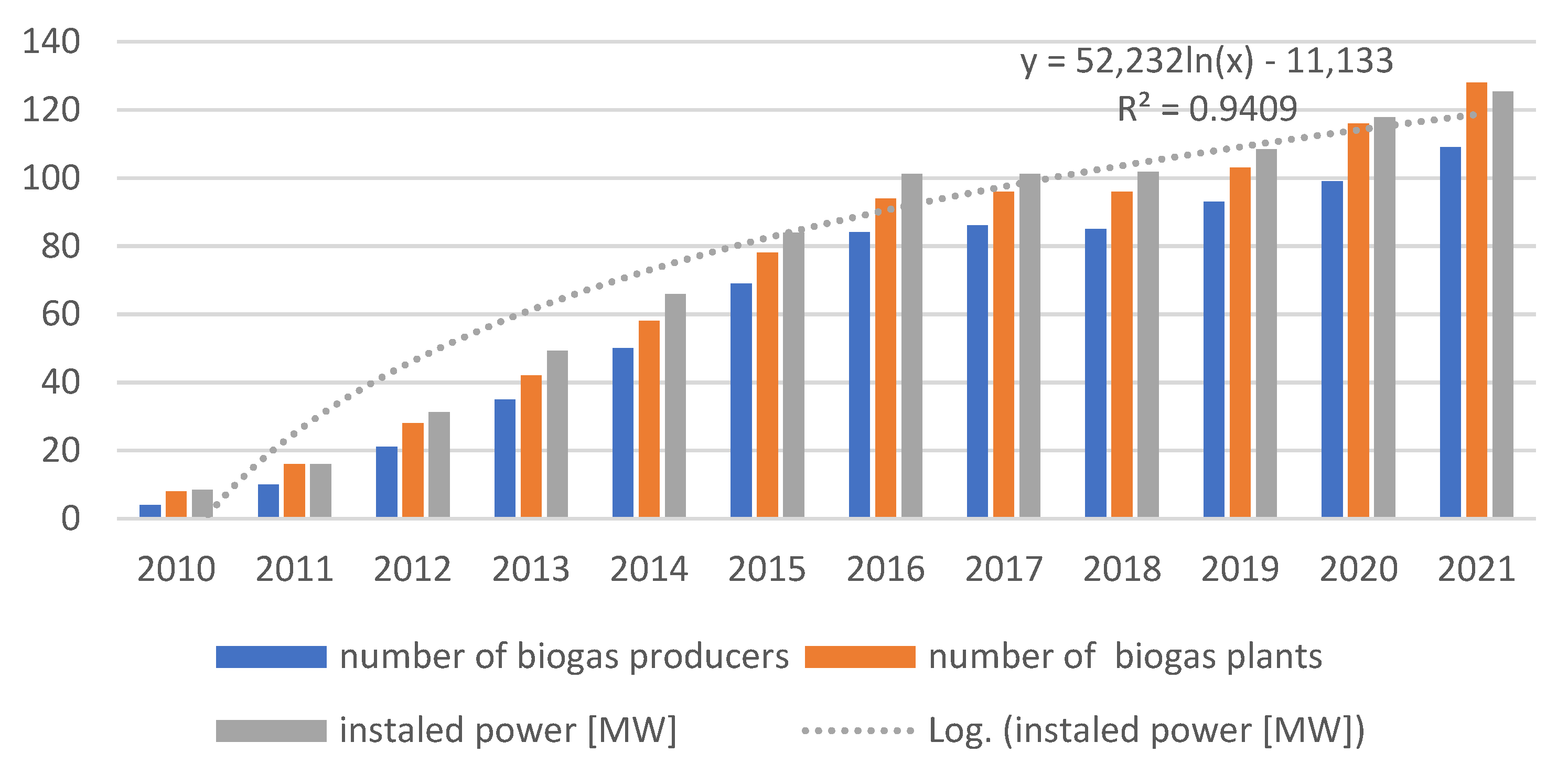

2. Conditions for the Development of Biogas in Poland

2.1. The Current State of Development of Biogas Plants in Poland

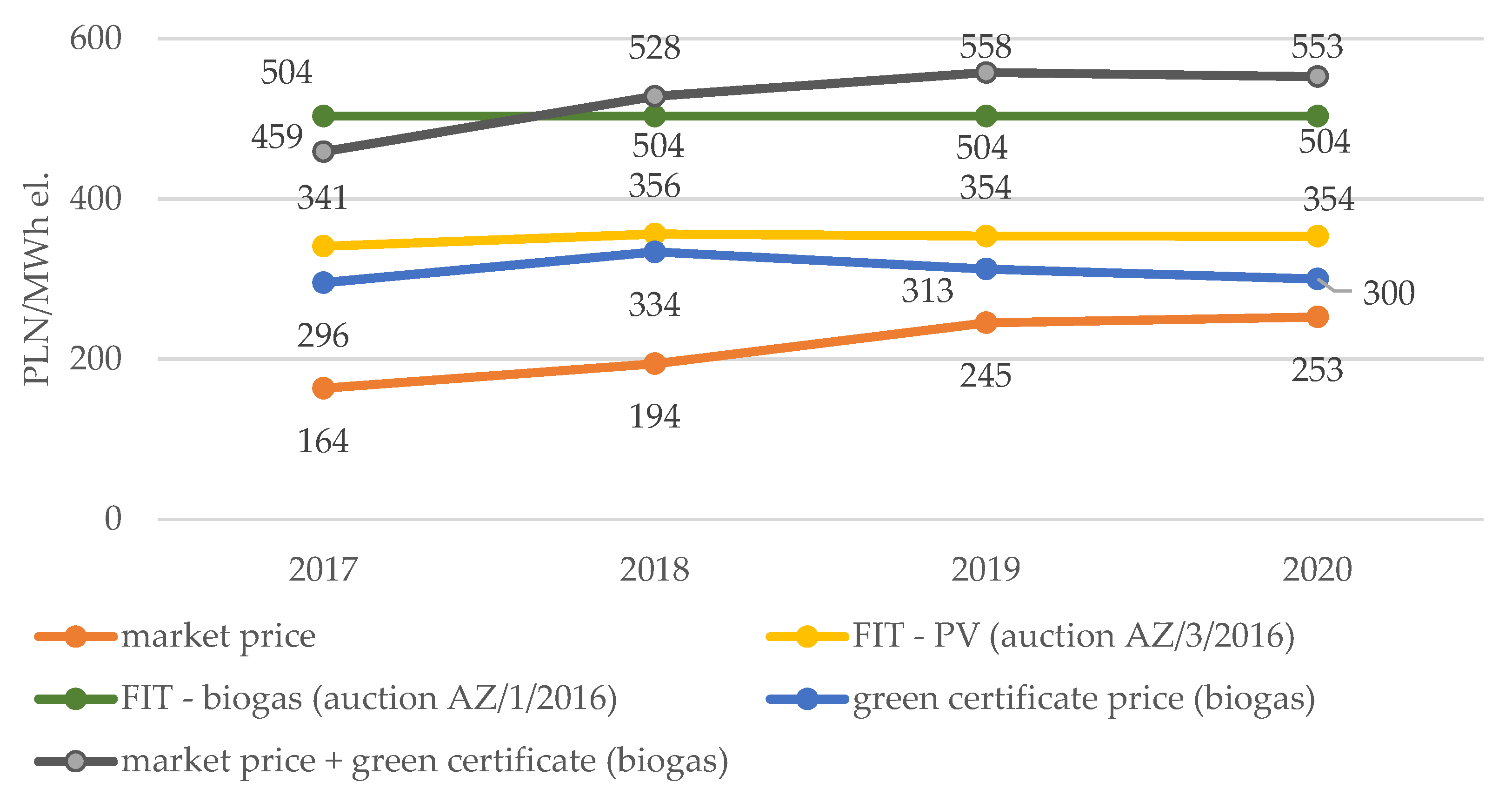

2.2. Sources of Energy Sales Prices from Biogas Plants in Poland

2.3. Factors Determining the Profitability of Biogas Plants

3. Theoretical Background of DuPont System

4. Materials and Methods

- calculation of dynamics indicators for both independent variables (factors) and a dependent variable (ROE),

- logarithmization of the dynamics indicators obtained in the first step,

- calculation of the dynamic indices reflecting the impact of changes in the values of factors (independent variables) on the value of the phenomenon under study (dependent variable) as a quotient of the logarithmized quantities (obtained in the second stage); the calculated indicators reflect the strength with which changes in the values of independent variables affect changes in the dependent variable.

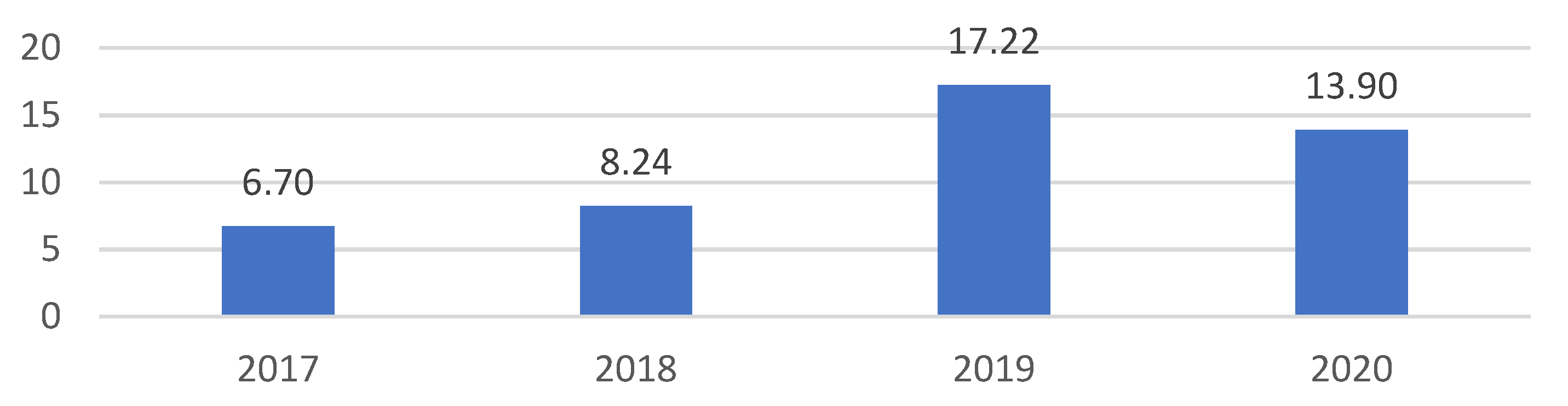

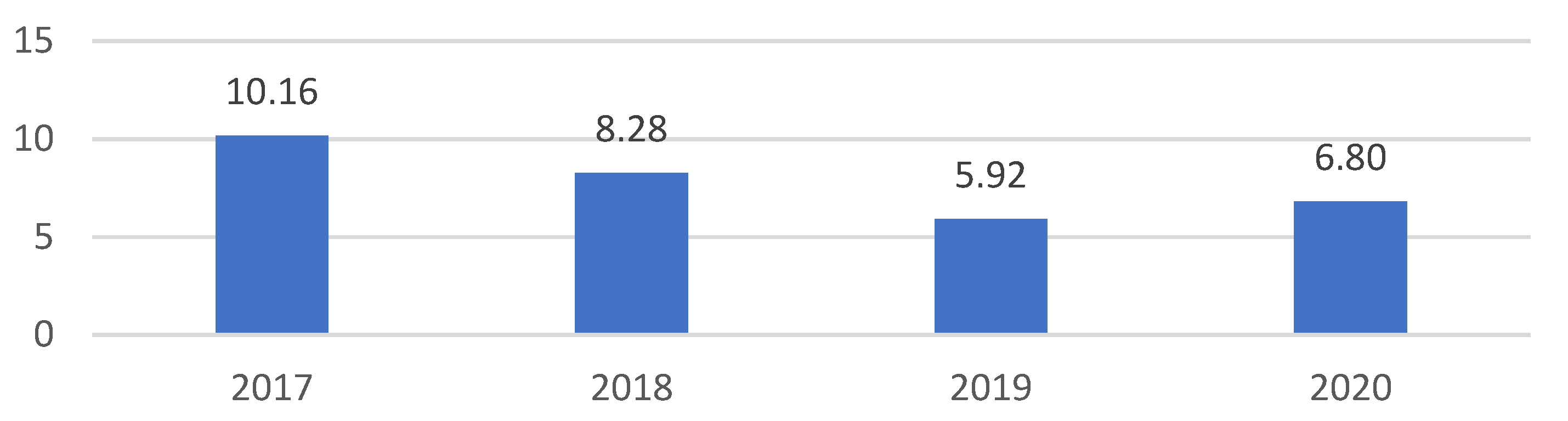

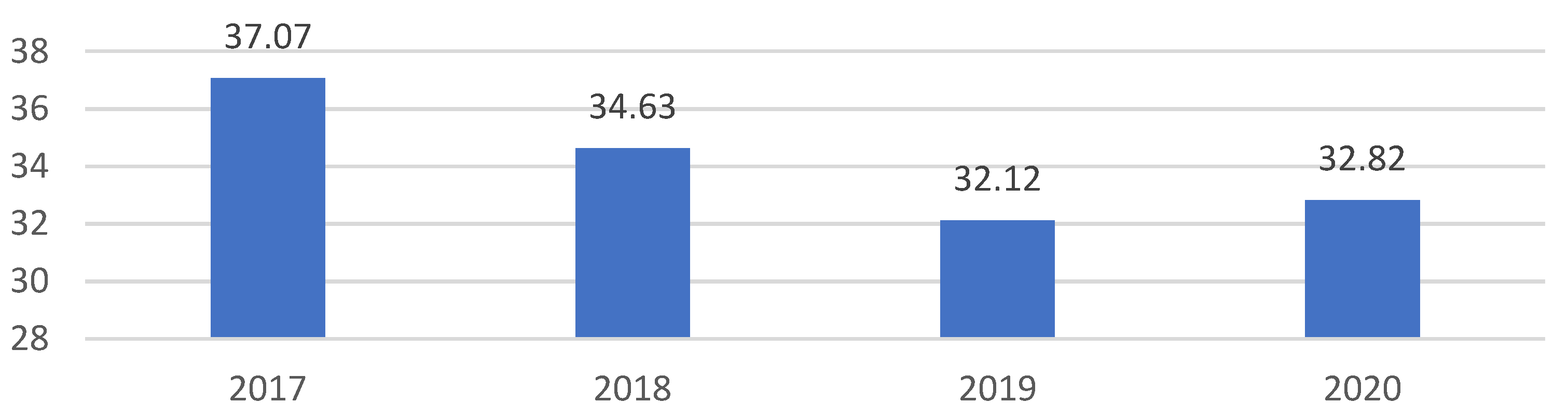

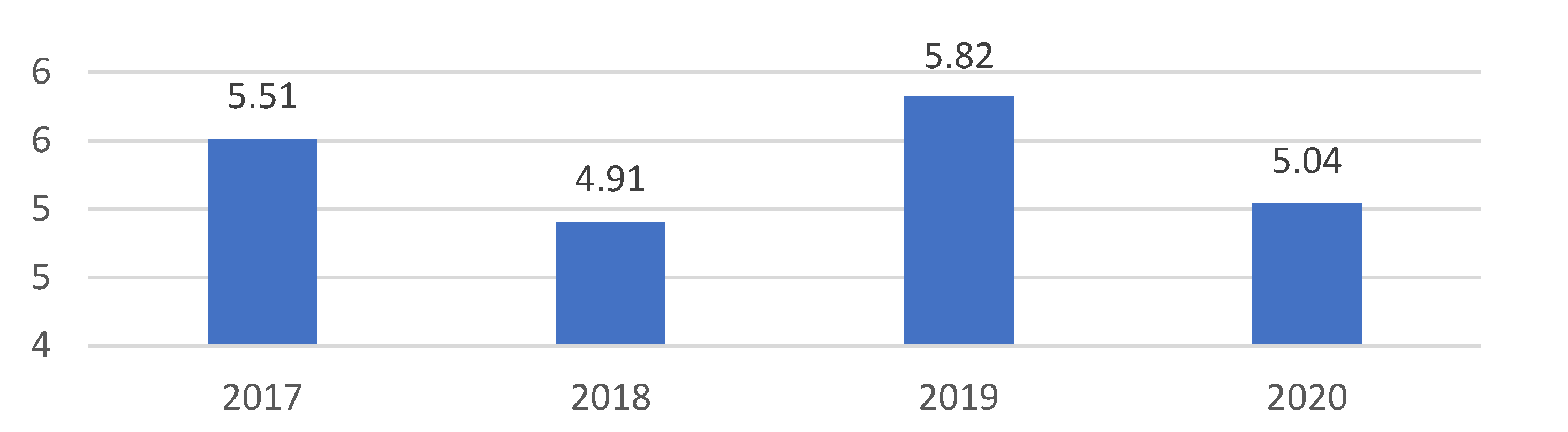

5. Results

6. Discussion

7. Conclusions

- In the analyzed period, biogas plants achieved an increase in ROE in 2019 and 2020 compared to that achieved in 2017–2018. Compared to the energy sector in Poland, the value of ROE indicators in the researched biogas plants should be considered satisfactory.

- Attention should be paid to the effectiveness of the production technologies used in biogas plants. The improvement or decrease in the value of the ROE indicator in the majority of biogas plants was associated with changes in the level of TAT and NPM, and these in turn depend, inter alia, on the improvement of management efficiency resulting from the implementation of new technologies and compliance with the technological regime.

- A high level of debt characterized the biogas plants covered by our research, and its reduction had a negative impact on ROE due to the decrease in financial leverage. However, the financial risk was limited. It seems that the development of energy production from biogas still requires instruments of state intervention: not only feed-in tariffs, but also access to low-interest investment loans.

- The level of profitability observed for the group of biogas plants in Poland (about 14%) was lower than what was established in similar research for biogas plants in Italy, where it was 20% [61], but higher than what was obtained in countries where the level of subsidisation is lower. In the USA, biogas plants achieved a level of profitability up to 12% [62].

8. Recommendations for Stakeholders

- From the point of view of diversification of energy sources, the price policy mechanisms applied to the biogas plant sector should be positively assessed. Supporting the production of biogas by applying FIT tariffs for producers of energy from biogas is expensive, but it provides a permanent basis for their operation and maintaining stable energy sources in the created renewable energy mix.

- The development policy of the biogas plant sector should consider the increase in both the public expenditure on research into optimal technological solutions and the scope of organizing the supply of raw materials for various types of biogas plants. The availability and costs of raw material for biogas plants must be the basic element of the cost-effectiveness calculation, which indicates the need to consider local and regional conditions for access to raw materials.

- The high level of debt recorded in the examined biogas plants generates a high level of financial risk, but it is also conducive to high ROE. Investors must consider the risk of the cost of capital to a greater extent, taking into account the stability of funding. For this reason, the development of energy production from biogas still requires instruments of state intervention: not only feed-in tariffs, but also access to low-interest investment loans.

9. Research Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| No. | Company | Overall Deviation of ROE | Partial Deviations | ||

|---|---|---|---|---|---|

| NPM | TAT | EQM | |||

| 1 | Bioelektrownia Sp. z o.o. | 7.146 | 3.169 | −0.148 | 4.125 |

| 2 | Gamawind Sp. z o.o. | 3.822 | 2.874 | 0.046 | 0.902 |

| 3 | Agro Bio Sp. z o.o. | 3.221 | 1.881 | 0.229 | 1.111 |

| 4 | Bioelektrownia Przykona Sp. z o.o. | 0.996 | −0.633 | −0.177 | 1.806 |

| 5 | Elektrociepłownia Bartos Sp. z o.o. | 0.695 | 0.867 | 0.001 | −0.173 |

| 6 | Allter Power Sp. z o.o. | 0.276 | 0.302 | 0.058 | −0.085 |

| 7 | DMG Sp. z o.o. | 0.238 | 0.279 | 0.001 | −0.043 |

| 8 | Nadmorskie Elektrownie Wiatrowe Darżyno Sp. z o.o. | 0.046 | 0.091 | 0.025 | −0.070 |

| 9 | Biogazownia Brzeżno Sp. z o.o. | 0.016 | 0.054 | −0.028 | −0.010 |

| 10 | Biogazownia Skarżyn Sp. z o.o. | 0.009 | 0.018 | −0.006 | −0.003 |

| 11 | Biogal Sp. z o.o. | −0.003 | −0.011 | 0.020 | −0.012 |

| 12 | Biogazownie Małopolskie Sp. z o.o. | −0.040 | −0.050 | 0.049 | −0.039 |

| 13 | Minex Kogeneracja Sp. z o.o. | −0.041 | −0.187 | 0.136 | 0.009 |

| 14 | Polskie Biogazownie “Energy-Zalesie” Sp. z o.o. | −0.051 | −0.042 | −0.008 | −0.001 |

| 15 | Elektrownia Biogazowa Cychry Sp. z o.o. | −0.066 | −0.047 | −0.013 | −0.006 |

| 16 | P.P.-H. “Kontrakt” Sp. z o.o. | −0.071 | 0.182 | 0.004 | −0.257 |

| 17 | “Ekogaz” Sp. z o.o. | −0.120 | −0.140 | 0.025 | −0.004 |

| 18 | Eko-Farmenergia Sp. z o.o. | −0.131 | −0.109 | −0.011 | −0.011 |

| 19 | Zielona Energia Michałowo Sp. z o.o. | −0.152 | −0.086 | 0.008 | −0.074 |

| 20 | Enerbio Sp. z o.o. | −0.161 | 0.363 | 0.076 | −0.600 |

| 21 | Biosas Malewski i Wspólnicy Sp. k. | −0.193 | 0.090 | −0.285 | 0.002 |

| 22 | Enerbio Eco Sp. z o.o. | −0.207 | −0.041 | −0.065 | −0.102 |

| 23 | Lorega Bio Sp. z o.o. | −0.246 | −4.007 | −0.729 | 4.489 |

| 24 | Eko-Energia Grzmiąca Sp. z o.o. | −0.260 | −0.165 | 0.094 | −0.190 |

| 25 | P.P.-H.-U. “Serafin” Sp. z o.o. | −0.437 | −0.406 | −0.037 | 0.006 |

| 26 | Ekowood Sp. z o.o. | −0.625 | −0.434 | −0.077 | −0.114 |

| 27 | Biogazownia Rypin Sp. z o.o. | −0.774 | 0.174 | −0.301 | −0.647 |

| 28 | Bioenergy Project Sp. z o.o. | −0.844 | −0.365 | 0.032 | −0.511 |

| No. | Company | Overall Deviation of ROE | Partial Deviations | ||

|---|---|---|---|---|---|

| NPM | TAT | EQM | |||

| 1 | Gamawind Sp. z o.o. | 11.723 | 14.838 | −0.783 | −2.332 |

| 2 | Elektrociepłownia Bartos Sp. z o.o. | 5.880 | 3.458 | −0.255 | 2.676 |

| 3 | Polskie Biogazownie “Energy-Zalesie” Sp. z o.o. | 2.613 | 2.686 | 0.012 | −0.086 |

| 4 | Biogazownia Rypin Sp. z o.o. | 2.267 | −0.100 | −0.299 | 2.666 |

| 5 | Enerbio Eco Sp. z o.o. | 1.248 | −0.810 | 0.699 | 1.360 |

| 6 | Enerbio Sp. z o.o. | 0.691 | 0.914 | 0.041 | −0.264 |

| 7 | Eko-Farmenergia Sp. z o.o. | 0.150 | 0.154 | 0.010 | −0.013 |

| 8 | Biogal Sp. z o.o. | 0.078 | 0.024 | 0.031 | 0.024 |

| 9 | Bioenergy Project Sp. z o.o. | 0.029 | 0.056 | −0.010 | −0.017 |

| 10 | Elektrownia Biogazowa Cychry Sp. z o.o. | −0.002 | −0.040 | 0.048 | −0.010 |

| 11 | Biogazownie Małopolskie Sp. z o.o. | −0.043 | −0.034 | 0.044 | −0.054 |

| 12 | Biosas Malewski i Wspólnicy Sp. k. | −0.055 | −0.049 | −0.003 | −0.003 |

| 13 | “Ekogaz” Sp. z o.o. | −0.062 | −0.065 | −0.001 | 0.005 |

| 14 | Nadmorskie Elektrownie Wiatrowe Darżyno Sp. z o.o. | −0.093 | −0.023 | 0.006 | −0.075 |

| 15 | Minex Kogeneracja Sp. z o.o. | −0.106 | −0.100 | −0.009 | 0.003 |

| 16 | DMG Sp. z o.o. | −0.134 | −0.136 | 0.026 | −0.024 |

| 17 | Biogazownia Brzeżno Sp. z o.o. | −0.154 | −0.367 | 0.213 | 0.000 |

| 18 | Biogazownia Skarżyn Sp. z o.o. | −0.307 | −0.281 | −0.002 | −0.025 |

| 19 | P.P.-H.-U. “Serafin” Sp. z o.o. | −0.382 | −0.117 | −0.009 | −0.256 |

| 20 | Zielona Energia Michałowo Sp. z o.o. | −0.534 | −0.277 | 0.067 | −0.324 |

| 21 | Ekowood Sp. z o.o. | −0.536 | 0.164 | 0.279 | −0.978 |

| 22 | Eko-Energia Grzmiąca Sp. z o.o. | −0.744 | 0.044 | 0.009 | −0.796 |

| 23 | Lorega Bio Sp. z o.o. | −1.001 | −1.578 | 0.011 | 0.566 |

| 24 | P.P.-H. “Kontrakt” Sp. z o.o. | −1.063 | −0.211 | −0.625 | −0.227 |

| 25 | Bioelektrownia Przykona Sp. z o.o. | −2.251 | −0.839 | −0.158 | −1.255 |

| 26 | Agro Bio Sp. z o.o. | −2.330 | 0.177 | −0.257 | −2.250 |

| 27 | Bioelektrownia Sp. z o.o. | −5.556 | 1.049 | −0.699 | −5.906 |

| 28 | Allter Power Sp. z o.o. | −7.333 | −7.442 | 0.002 | 0.108 |

References

- Kryszak, Ł.; Czyżewski, B. Determinanty Dochodów Rolniczych w Regionach Unii Europejskiej; CeDeWu Sp. z o.o.: Warsaw, Poland, 2020. [Google Scholar]

- Szymańska, E. Efektywność Gospodarstw Wyspecjalizowanych w Produkcji Żywca Wieprzowego w Polsce; SGGW: Warsaw, Poland, 2011. [Google Scholar]

- Weidman, S.M.; McFarland, D.J.; Meric, G.; Meric, I. Determinants of return-on-equity in USA, German and Japanese manufacturing firms. Manag. Financ. 2019, 45, 445–451. [Google Scholar] [CrossRef]

- Matsuo, Y. Re-Defining System LCOE: Costs and Values of Power Sources. Energies 2022, 15, 6845. [Google Scholar] [CrossRef]

- Kawecka-Wyrzykowska, E. Financing Energy Transition in Poland: Possible Contribution of EU Funds. Eur. Integr. Stud. 2022, 16, 65–77. [Google Scholar] [CrossRef]

- Księżopolski, K.; Drygas, M.; Pronińska, K.; Nurzyńska, I. The Economic Effects of New Patterns of Energy Efficiency and Heat Sources in Rural Single-Family Houses in Poland. Energies 2020, 13, 6358. [Google Scholar] [CrossRef]

- Available online: http://ec.europa.eu/eurostat/web/energy/data/shares (accessed on 11 May 2022).

- Weiland, P.; Rieger, C.; Ehrmann, T. Evaluation of the newest biogas plants in Germany with respect to renewable energy production, green house, gas reduction and nutrient management. In The Future of Biogas in Europe II; European Biogas Workshop: Esbjerg, Denmark, 2003. [Google Scholar]

- Pilarska, A.; Pilarski, K.; Myszura, M.; Boniecki, P. Perspektywy i problemy rozwoju biogazowni rolniczych w Polsce. Tech. Rol. Ogrod. Leśna 2013, 4, 1–4. [Google Scholar]

- Wicki, L.; Naglis-Liepa, K.; Filipiak, T.; Parzonko, A.; Wicka, A. Is the Production of Agricultural Biogas Environmentally Friendly? Does the Structure of Consumption of First- and Second-Generation Raw Materials in Latvia and Poland Matter? Energies 2022, 15, 5623. [Google Scholar] [CrossRef]

- Bąk, I.; Tarczyńska-Łuniewska, M.; Barwińska-Małajowicz, A.; Hydzik, P.; Kusz, D. Is Energy Use in the EU Countries Moving toward Sustainable Development? Energies 2022, 15, 6009. [Google Scholar] [CrossRef]

- Weiland, P. Production and energetic use of biogas from energy crops and wastes in Germany. Appl. Biochem. Biotechnol. 2003, 109, 263–274. [Google Scholar] [CrossRef]

- Weiland, P. Biomass Digestion in Agriculture: A Successful Pathway for the Energy Production and Waste Treatment in Germany. Eng. Life Sci. 2006, 6, 302–309. [Google Scholar] [CrossRef]

- Bridgwater, T. Biomass for energy. J. Sci. Food Agric. 2006, 86, 1755–1768. [Google Scholar] [CrossRef]

- Piwowar, A. Agricultural Biogas—An Important Element in the Circular and Low-Carbon Development in Poland. Energies 2020, 13, 1733. [Google Scholar] [CrossRef]

- Available online: https://www.kowr.gov.pl/uploads/pliki/analizy/sprawozdania/SPRAWOZDANIE_KOWR_2021.pdf (accessed on 8 June 2022).

- Powalka, M.; Klepacka, A.M.; Skudlarski, J.; Golisz, E. Aktualny stan sektora biogazu rolniczego w Polsce na tle krajów Unii Europejskiej. Zesz. Nauk. Szkoły Głównej Gospod. Wiej. W Warszawie. Probl. Rol. Światowego 2013, 13, 203–212. [Google Scholar]

- Ustawa z dnia 27 stycznia 2022 r. o zmianie ustawy o odnawialnych źródłach energii oraz ustawy o zmianie ustawy o odnawialnych źródłach energii oraz niektórych innych ustaw. Dz.U. 2022 poz. 467. Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20220000467 (accessed on 8 November 2022).

- Mazurek-Czarnecka, A.; Rosiek, K.; Salamaga, M.; Wasowicz, K.; Żaba-Nieroda, R. Study on Support Mechanisms for Renewable Energy Sources in Poland. Energies 2022, 15, 4196. [Google Scholar] [CrossRef]

- Godyń, I.; Dubel, A. Evolution of Hydropower Support Schemes in Poland and Their Assessment Using the LCOE Method. Energies 2021, 14, 8473. [Google Scholar] [CrossRef]

- Ordinance of the Minister of Climate of 24 April 2020 on the Reference Price of Electricity from Renewable Energy Sources in 2020 and the Periods Applicable to Producers Who Won Auctions in 2020. Dz.U.2020.798. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150000478/U/D20150478Lj.pdf (accessed on 8 November 2022).

- Supriyanto, E.; Sentanuhady, J.; Hasan, W.H.; Nugraha, A.D.; Muflikhun, M.A. Policy and Strategies of Tariff Incentives Related to Renewable Energy: Comparison between Indonesia and Other Developing and Developed Countries. Sustainability 2022, 14, 13442. [Google Scholar] [CrossRef]

- Available online: https://www.ure.gov.pl/pl/oze/aukcje-oze/ogloszenia-i-wyniki-auk (accessed on 9 October 2022).

- Pablo-Romero, M.D.P.; Sánchez-Braza, A.; Salvador-Ponce, J.; Sánchez-Labrador, N. An Overview of Feed-in Tariffs, Premiums and Tenders to Promote Electricity from Biogas in the EU-28. Renew. Sustain. Energy Rev. 2017, 73, 1366–1379. [Google Scholar] [CrossRef]

- Gustafsson, M.; Anderberg, S. Biogas Policies and Production Development in Europe: A Comparative Analysis of Eight Countries. Biofuels 2022, 13, 931–944. [Google Scholar] [CrossRef]

- Renewable Power Generation Costs in 2020; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021; ISBN 978-92-9260-348-9.

- Wicki, L.; Pietrzykowski, R.; Kusz, D. Factors Determining the Development of Prosumer Photovoltaic Installations in Poland. Energies 2022, 15, 5897. [Google Scholar] [CrossRef]

- Savickis, J.; Zemite, L.; Zeltins, N.; Bode, I.; Jansons, L. Natural Gas and Biomethane in the European Road Transport: The Latvian Perspective. Latv. J. Phys. Tech. Sci. 2020, 57, 57–72. [Google Scholar] [CrossRef]

- Burchart-Korol, D.; Gazda-Grzywacz, M.; Zarębska, K. Research and Prospects for the Development of Alternative Fuels in the Transport Sector in Poland: A Review. Energies 2020, 13, 2988. [Google Scholar] [CrossRef]

- Patrizio, P.; Chinese, D. The Impact of Regional Factors and New Bio-Methane Incentive Schemes on the Structure, Profitability and CO2 Balance of Biogas Plants in Italy. Renew Energy 2016, 99, 573–583. [Google Scholar] [CrossRef]

- Doronin, A.; Polishchuk, O.; Rybchak, V. Potential of Renewable Sources in Ukraine. J. Tour. Reg. Dev. 2021, 15, 25–31. [Google Scholar] [CrossRef]

- Kostecka-Jurczyk, D.; Marak, K.; Struś, M. Economic Conditions for the Development of Energy Cooperatives in Poland. Energies 2022, 15, 6831. [Google Scholar] [CrossRef]

- Streimikiene, D.; Baležentis, T.; Volkov, A.; Morkūnas, M.; Žičkienė, A.; Streimikis, J. Barriers and Drivers of Renewable Energy Penetration in Rural Areas. Energies 2021, 14, 6452. [Google Scholar] [CrossRef]

- Gostomczyk, W. Stan i perspektywy rozwoju rynku biogazu w UE i Polsce–ujęcie ekonomiczne. Zesz. Nauk. SGGW W Warszawie-Probl. Rol. Światowego 2017, 17, 48–64. [Google Scholar] [CrossRef] [Green Version]

- Stürmer, B.; Theuretzbacher, F.; Saracevic, E. Opportunities for the Integration of Existing Biogas Plants into the Austrian Electricity Market. Renew. Sustain. Energy Rev. 2021, 138, 110548. [Google Scholar] [CrossRef]

- Güsewell, J.; Eltrop, L.; Hufendiek, K. Seasonal Flexibilisation: A Solution for Biogas Plants to Improve Profitability. Adv. Appl. Energy 2021, 2, 100034. [Google Scholar] [CrossRef]

- Baena-Moreno, F.M.; Zhang, Z.; Zhang, X.P.; Reina, T.R. Profitability Analysis of a Novel Configuration to Synergize Biogas Upgrading and Power-to-Gas. Energy Convers. Manag. 2020, 224, 113369. [Google Scholar] [CrossRef]

- Karneyeva, Y.; Wüstenhagen, R. Solar Feed-in Tariffs in a Post-Grid Parity World: The Role of Risk, Investor Diversity and Business Models. Energy Policy 2017, 106, 445–456. [Google Scholar] [CrossRef]

- Winquist, E.; van Galen, M.; Zielonka, S.; Rikkonen, P.; Oudendag, D.; Zhou, L.; Greijdanus, A. Expert Views on the Future Development of Biogas Business Branch in Germany, the Netherlands, and Finland until 2030. Sustainability 2021, 13, 1148. [Google Scholar] [CrossRef]

- Jałowiec, T.; Wojtaszek, H. Analysis of the Res Potential in Accordance with the Energy Policy of the European Union. Energies 2021, 14, 6030. [Google Scholar] [CrossRef]

- Wicki, L. Food and Bioenergy-Evidence from Poland. In Proceedings of the 2017 International Conference “Economic Science for Rural Development”, LLU ESAF, Jelgava, Latvia, 27–28 April 2017; Auzina, A., Ed.; Latvian Agriculture University: Jelgava, Latvia, 2017; pp. 299–305. [Google Scholar]

- Bentivoglio, D.; Rasetti, M. Biofuel Sustainability: Review of Implications for Land Use and Food Price. Ital. Rev. Agric. Econ. 2015, 70, 7–31. [Google Scholar] [CrossRef]

- Fuess, L.T.; Zaiat, M.; Augusto Oller do Nascimento, C. Can Biogas-Producing Sugarcane Biorefineries Techno-Economically Outperform Conventional Ethanol Production? Deciphering the Way towards Maximum Profitability. Energy Convers. Manag. 2022, 254, 115206. [Google Scholar] [CrossRef]

- Ellacuriaga, M.; García-Cascallana, J.; Gómez, X. Biogas Production from Organic Wastes: Integrating Concepts of Circular Economy. Fuels 2021, 2, 144–167. [Google Scholar] [CrossRef]

- Bartkowiak, A.; Bartkowiak, P.; Kinelski, G. Efficiency of Shaping the Value Chain in the Area of the Use of Raw Materials in Agro-Biorefinery in Sustainable Development. Energies 2022, 15, 6260. [Google Scholar] [CrossRef]

- Bórawski, P.; Holden, L.; Bórawski, M.B.; Mickiewicz, B. Perspectives of Biodiesel Development in Poland against the Background of the European Union. Energies 2022, 15, 4332. [Google Scholar] [CrossRef]

- Czubaszek, R.; Wysocka-Czubaszek, A.; Tyborowski, R. Methane Production Potential from Apple Pomace, Cabbage Leaves, Pumpkin Residue and Walnut Husks. Appl. Sci. 2022, 12, 6128. [Google Scholar] [CrossRef]

- González, R.; Peña, D.C.; Gómez, X. Anaerobic Co-Digestion of Wastes: Reviewing Current Status and Approaches for Enhancing Biogas Production. Appl. Sci. 2022, 12, 8884. [Google Scholar] [CrossRef]

- Becerra-Pérez, L.A.; Rincón, L.; Posada-Duque, J.A. Logistics and Costs of Agricultural Residues for Cellulosic Ethanol Production. Energies 2022, 15, 4480. [Google Scholar] [CrossRef]

- Metson, G.S.; Feiz, R.; Lindegaard, I.; Ranggård, T.; Quttineh, N.H.; Gunnarsson, E. Not all sites are created equal–Exploring the impact of constraints to suitable biogas plant locations in Sweden. J. Clean. Prod. 2022, 349, 131390. [Google Scholar] [CrossRef]

- Muradin, M.; Foltynowicz, Z. Potential for Producing Biogas from Agricultural Waste in Rural Plants in Poland. Sustainability 2014, 6, 5065–5074. [Google Scholar] [CrossRef] [Green Version]

- Alves, O.; Garcia, B.; Rijo, B.; Lourinho, G.; Nobre, C. Market Opportunities in Portugal for the Water-and-Waste Sector Using Sludge Gasification. Energies 2022, 15, 6600. [Google Scholar] [CrossRef]

- Piwowar, A. Development of the Agricultural Biogas Market in Poland–Production Volume, Feedstocks, Activities and Behaviours of Farmers. Sci. J. Wars. Univ. Life Sci.–SGGW Probl. World Agric. 2019, 19, 88–97. [Google Scholar] [CrossRef] [Green Version]

- Klimek, K.; Kapłan, M.; Syrotyuk, S.; Bakach, N.; Kapustin, N.; Konieczny, R.; Dobrzyński, J.; Borek, K.; Anders, D.; Dybek, B.; et al. Investment Model of Agricultural Biogas Plants for Individual Farms in Poland. Energies 2021, 14, 7375. [Google Scholar] [CrossRef]

- Przesmycka, A.; Podstawka, M. Economic Profitability of Investment in Biogas Plant. Ann. PAAAE 2016, 18, 176–182. Available online: https://rnseria.com/resources/html/article/details?id=179361 (accessed on 7 November 2022).

- Baccioli, A.; Ferrari, L.; Guiller, R.; Yousfi, O.; Vizza, F.; Desideri, U. Feasibility Analysis of Bio-Methane Production in a Biogas Plant: A Case Study. Energies 2019, 12, 473. [Google Scholar] [CrossRef] [Green Version]

- Bai, D.; Jain, V.; Tripathi, M.; Ali, S.A.; Shabbir, M.S.; Mohamed, M.A.A.; Ramos-Meza, C.S. Performance of Biogas Plant Analysis and Policy Implications: Evidence from the Commercial Sources. Energy Policy 2022, 169, 113173. [Google Scholar] [CrossRef]

- Bedana, D.; Kamruzzaman, M.; Rana, M.J.; Mustafi, B.A.A.; Talukder, R.K. Financial and Functionality Analysis of a Biogas Plant in Bangladesh. Heliyon 2022, 8, e10727. [Google Scholar] [CrossRef]

- Zabolotnyy, S.; Melnyk, M. The Financial Efficiency of Biogas Stations in Poland. In Renewable Energy Sources: Engineering, Technology, Innovation; Mudryk, K., Werle, S., Eds.; Springer: Cham, Switzerland, 2018; pp. 83–93. [Google Scholar]

- Timpanaro, G.; Cosentino, S.; Danzì, C.; Foti, V.T.; Testa, G. Prickly Pear for Biogas Production: Technical-Economic Validation of a Biogas Power Installation in an Area with a High Prevalence of Cacti in Italy. Biofuels Bioprod. Biorefining 2021, 15, 615–636. [Google Scholar] [CrossRef]

- Iotti, M.; Bonazzi, G. Assessment of Biogas Plant Firms by Application of Annual Accounts and Financial Data Analysis Approach. Energies 2016, 9, 713. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q.; Thompson, E.; Valchuis, L.; Parsons, R. Energy Outputs and Financial Returns of On-Farm Biodigester Systems in the United States: A Case Study in Vermont. Int. J. Sustain. Green Energy 2017, 6, 10–18. [Google Scholar] [CrossRef] [Green Version]

- Hao, Y.; Choi, S.U. Operating Performance of Chinese Online Shopping Companies: An Analysis Using DuPont Components. Sustainability 2019, 11, 3602. [Google Scholar] [CrossRef] [Green Version]

- Kao, F.-C.; Ting, I.W.K.; Chou, H.-C.; Liu, Y.-S. Exploring the Influence of Corporate Social Responsibility on Efficiency: An Extended Dynamic Data Envelopment Analysis of the Global Airline Industry. Sustainability 2022, 14, 12712. [Google Scholar] [CrossRef]

- Brigham, E.F.; Houston, J.F. Fundamentals of Financial Management, 12th ed.; South-Western Cengage Learning: Mason, OH, USA, 2009. [Google Scholar]

- Jędrzejczak-Gas, J. Factors determining the profitability of equity in small and mediumsized enterprises in Poland. Management 2013, 17, 185–198. [Google Scholar] [CrossRef] [Green Version]

- Baležentis, T.; Galnaitytė, A.; Kriščiukaitienė, I.; Namiotko, V.; Novickytė, L.; Streimikiene, D.; Melnikiene, R. Decomposing Dynamics in the Farm Profitability: An Application of Index Decomposition Analysis to Lithuanian FADN Sample. Sustainability 2019, 11, 2861. [Google Scholar] [CrossRef] [Green Version]

- Pastusiak, R.; Soliwoda, M.; Jasiniak, M.; Stawska, J.; Pawłowska-Tyszko, J. Are Farms Located in Less-Favoured Areas Financially Sustainable? Empirical Evidence from Polish Farm Households. Sustainability 2021, 13, 1092. [Google Scholar] [CrossRef]

- Baran, M.; Kuźniarska, A.; Makieła, Z.J.; Sławik, A.; Stuss, M.M. Does ESG Reporting Relate to Corporate Financial Performance in the Context of the Energy Sector Transformation? Evidence from Poland. Energies 2022, 15, 477. [Google Scholar] [CrossRef]

- Borodin, A.; Mityushina, I.; Streltsova, E.; Kulikov, A.; Yakovenko, I.; Namitulina, A. Mathematical Modeling for Financial Analysis of an Enterprise: Motivating of Not Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 79. [Google Scholar] [CrossRef]

- Sajnóg, A.; Gawęda, A. Cross-sectoral detection of the Return on Equity determinants based on the 7-factor DuPont model. Stud. Law Econ. 2020, 114, 217–234. [Google Scholar] [CrossRef]

- Kijewska, A. Determinants of the return on equity ratio (ROE) on the example of companies from metallurgy and mining sector in Poland. Metalurgija 2016, 55, 285–288. Available online: https://hrcak.srce.hr/146696 (accessed on 3 November 2022).

- Priester, C.; Wang, J. Economic Value Added. In Financial Strategies for the Manager; Priester, C., Wang, J., Eds.; Tsinghua University Texts; Springer: Berlin/Heidelberg, Germany, 2010; pp. 118–135. [Google Scholar] [CrossRef]

- Hawawini, G.A.; Viallet, C. Finance for Executives; South-Western Publ.: Cincinnati, OH, USA, 1999. [Google Scholar]

- Burja, V.; Mărginean, R. The Study of Factors that may Influence the Performance by the DuPont Analysis in the Furniture Industry. Procedia Econ. Financ. 2014, 16, 213–223. [Google Scholar] [CrossRef] [Green Version]

- Bunea, O.-I.; Corbos, R.-A.; Popescu, R.-I. Influence of some financial indicators on return on equity ratio in the Romanian energy sector—A competitive approach using a DuPont-based analysis. Energy 2019, 189, 116251. [Google Scholar] [CrossRef]

- Altahtamouni, F.; Alfayhani, A.; Qazaq, A.; Alkhalifah, A.; Masfer, H.; Almutawa, R.; Alyousef, S. Sustainable Growth Rate and ROE Analysis: An Applied Study on Saudi Banks Using the PRAT Model. Economies 2022, 10, 70. [Google Scholar] [CrossRef]

- Aryantini, S.; Jumono, S. Profitability and value of firm: An evidence from manufacturing industry in Indonesia. Accounting 2021, 7, 735–746. [Google Scholar] [CrossRef]

- Garcia, J.; Lopes, J.; Nunes, A. Intangible assets–Influence on the ”return in equity on market value” (S&P100 Index). In Proceedings of the 12th Annual Conference of the EuroMed Academy of Business, EuroMed Press, Thessaloniki, Greece, 18–20 September 2019; pp. 278–291. [Google Scholar]

- Oriskóová, D.; Pakšiová, R. DuPont Analysis of Companies in The Slovak Republic Engineering Industry. In Proceedings of the IDIMT 2018: Strategic Modeling in Management, Economy and Society-26th Interdisciplinary Information Management Talks, Kutná Hora, Czech Republic, 5–7 September 2018; pp. 383–390. Available online: https://idimt.org/wp-content/uploads/proceedings/IDIMT_proceedings_2018.pdf (accessed on 3 December 2022).

- Filatov, E.A.; Bunkovsky, V.I. Analysis of the DuPont model of the construction industry in the Baikal region. In Proceedings of the International Scientific Conference Investments. Construction. Real Estate: New Technologies and Targeted Development Priorities-2020, 23–24 April 2020, Irkutsk, Russian Federation. IOP Conf. Ser. Mater. Sci. Eng. 2020, 880, 012092. [Google Scholar] [CrossRef]

- Botika, M. The use of DuPont analysis in abnormal returns evaluation: Empirical study of Romanian market. Procedia-Soc. Behav. Sci. 2012, 62, 1179–1183. [Google Scholar] [CrossRef] [Green Version]

- Padake, V.; Soni, R. Measurement of Efficiency of Top 12 Banks in India Using DuPont. Analysis. IUP J. Bank Manag. 2015, 14, 59–68. [Google Scholar]

- Shabani, H.; Morina, F.; Berisha, A. Financial Performance of the SMEs Sector in Kosovo: An Empirical Analysis Using the DuPont Model. Int. J. Sustain. Dev. Plan. 2021, 16, 819–831. [Google Scholar] [CrossRef]

- Açikgöz, T.; Kiliç, G. Investigation of Financial Performance and Market Value of Technology Firms With Dupont-Regression Analysis. J. Account. Financ. 2021, 90, 209–226. [Google Scholar] [CrossRef]

- Demmer, M. Improving Profitability Forecasts with Information on Earnings Quality. School of Business & Economics. Discuss. Pap. 2015. [Google Scholar] [CrossRef] [Green Version]

- Little, P.L.; Little, B.L.; Coffee, D. The Du Pont model: Evaluating alternative strategies in the retail industry. Acad. Strateg. Manag. J. 2009, 8, 71–80. [Google Scholar]

- Xu, X.; Liu, C.K. How to keep renewable energy enterprises to reach economic sustainable performance: From the views of intellectual capital and life cycle. Sustain. Soc. 2019, 9, 7. [Google Scholar] [CrossRef]

- Qing, C.; Lina, B.; Lijian, L. The Structuring Research of Du Pont Analysis System Based on EVA. In Proceedings of the 2010 3rd International Conference on Information Management, Innovation Management and Industrial Engineering, Kunming, China, 26–28 November 2010; Volume 3, pp. 222–226. [Google Scholar] [CrossRef]

- Kasik, J.; Snapka, P. A General Model Based on the DuPont System of Financial Analysis for Identification, Analysis and Solution of a Potential Crisis in a Business. Montenegrin J. Econ. 2020, 16, 55–66. [Google Scholar] [CrossRef]

- Beyer, D.; Hinke, J. European benchmarking of determinants of profitability for companies with accrual accounting in the agricultural sector. Agric. Econ. 2020, 66, 477–488. [Google Scholar] [CrossRef]

- Jałowiecki, P. Dupont analysis of polish agri-food industry selected sectors–logistic aspects. Res. Logist. Prod. 2018, 8, 217–227. [Google Scholar] [CrossRef]

- Jencova, S.; Litavcova, E.; Vasanicova, P. Implementation of Du Pont model in non-financial corporations. Montenegrin J. Econ. 2018, 14, 131–141. [Google Scholar] [CrossRef]

- Kusi, B.A.; Ansah-Adu, K.; Agyei, A. Evaluating banking profit performance in Ghana during and post profit decline: A five step du-Pont approach. EMAJ: Emerg. Mark. J. 2015, 5, 29–40. [Google Scholar] [CrossRef] [Green Version]

- Pointer, L.; Khoi, P.D. Predictors of Return on Assets and Return on Equity for Banking and Insurance Companies on Vietnam Stock Exchange. Entrep. Bus. Econ. Rev. 2019, 7, 185–198. [Google Scholar] [CrossRef]

- Boyd, S.; Boland, M.; Dhuyvetter, K.; Barton, D. Determinants of return on equity in US local farm supply and grain marketing cooperatives. J. Agric. Appl. Econ. 2007, 39, 201–210. [Google Scholar] [CrossRef] [Green Version]

- Nehring, R.; Gillespie, J.; Katchova, A.L.; Hallahan, C.; Harris, J.M.; Erickson, K. What’s Driving US Broiler Farm Profitability? Int. Food Agribus. Manag. Rev. 2015, 18, 59–78. [Google Scholar] [CrossRef]

- Albulescu, C.T. Banks’ Profitability and Financial Soundness Indicators: A Macro-level Investigation in Emerging Countries, Procedia Econ. Financ. 2015, 23, 203–209. [Google Scholar] [CrossRef] [Green Version]

- Růčková, P. Dependency of return on equity and use finance sources in building companies in V4 countries. Econ. Manag. 2015, 3, 73–83. Available online: https://dspace5.zcu.cz/handle/11025/17623 (accessed on 11 June 2022). [CrossRef]

- Athanasoglou, P.P.; Brissimis, S.N.; Delis, M.D. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. J. Int. Financ. Mark. Inst. Money 2008, 18, 121–136. [Google Scholar] [CrossRef] [Green Version]

- Filatov, E. Deterministic Factor Analysis of Three-Factor Dupont Model Using Filatov Methods. In Research Paradigms Transformation in Social Sciences; Ardashkin, I.B., Iosifovich, B.V., Martyushev, N.V., Eds.; Proceedings of the International Conference on Research Paradigms Transformation in Social Sciences (RPTSS 2018), 26–28 April 2018; European Proceedings of Social and Behavioural Sciences; Irkutsk National Research Technical University: Irkutsk, Russia; Volume 50, pp. 364–372. [CrossRef]

- Szczecińska, B. Wykorzystanie modelu analizy Du Ponta w ocenie efektywności wybranych przedsiębiorstw gospodarki żywnościowej. Zesz. Nauk. SGGW W Warszawie Ekon. I Organ. Gospod. Żywnościowej 2008, 64, 65–74. Available online: http://sj.wne.sggw.pl/article-EIOGZ_2008_n64_s65/ (accessed on 11 October 2022).

- Biśta, A. Metody analizy przyczynowej w diagnozie finansowej przedsiębiorstwa. In Narzędzia Analityczne w Naukach Ekonomicznych; Woźniak, K., Ed.; Mfiles.pl.: Cracow, Poland, 2015; Available online: https://wydawnictwo.mfiles.pl/content/narzedzia-analityczne-w-naukach-ekonomicznych (accessed on 11 October 2022).

- Dehning, B.; Stratopoulos, T. DuPont analysis of an IT-enabled competitive advantage. Int. J. Account. Inf. Syst. 2002, 3, 165–176. [Google Scholar] [CrossRef]

- Heikal, M.; Khaddafi, M.; Ummah, A. Influence analysis of return on assets (ROA), return on equity (ROE), net profit margin (NPM), debt to equity ratio (DER), and current ratio (CR), against corporate profit growth in automotive in Indonesia Stock Exchange. Int. J. Acad. Res. Bus. Soc. Sci. 2014, 4, 101–114. [Google Scholar] [CrossRef] [Green Version]

- Endri, E.; Sari, A.K.; Budiasih, Y.; Yuliantini, T.; Kasmir, K. Determinants of Profit Growth in Food and Beverage Companies in Indonesia. J. Asian Financ. Econ. Bus. 2020, 7, 739–748. [Google Scholar] [CrossRef]

- Zhu, Z.; Liao, H. Do subsidies improve the financial performance of renewable energy companies? Evidence from China. Nat. Hazards 2019, 95, 241–256. [Google Scholar] [CrossRef]

- Yu, J.; Yu, M. Financial subsidies, rent-seeking costs and operating performance of new energy companies. Soft Sci. 2019, 33, 59–63. [Google Scholar]

- Cui, Y.; Khan, S.U.; Li, Z.; Zhao, M. Environmental effect, price subsidy and financial performance: Evidence from Chinese new energy enterprises. Energy Policy 2021, 149, 112050. [Google Scholar] [CrossRef]

- Abor, J. The effect of capital structure on profitability: An empirical analysis of listed firms in Ghana. J. Risk Financ. 2005, 6, 438–445. [Google Scholar] [CrossRef]

| No. | Company | Installed Electric Capacity (MWe) | Overall Deviation of ROE | Partial Deviations | ||

|---|---|---|---|---|---|---|

| NPM | TAT | EQM | ||||

| Group I | ||||||

| 1 | Elektrociepłownia Bartos Sp. z o.o. | 0.8 | 15.625 | −1.590 | −0.357 | 17.572 |

| 2 | Bioelektrownia Przykona Sp. z o.o. | 1.897 | 2.949 | 3.101 | 0.017 | −0.169 |

| 3 | Bioenergy Project Sp. z o.o. | 1.996 | 1.213 | 0.919 | 0.014 | 0.280 |

| 4 | Gamawind Sp. z o.o. | 2 | 0.634 | 5.38 | 0.241 | −4.987 |

| 5 | Polskie Biogazownie “Energy-Zalesie” Sp. z o.o. | 2 | 0.344 | 0.325 | 0.046 | −0.027 |

| 6 | Biogazownia Brzeżno Sp. z o.o. | 0.8 | 0.331 | 0.302 | 0.043 | −0.015 |

| 7 | Biosas Malewski i Wspólnicy Sp. k. | 0.999 | 0.258 | 0.359 | −0.052 | −0.049 |

| 8 | Ekowood Sp. z o.o. | 1.2 | 0.225 | 0.235 | 0.039 | −0.049 |

| 9 | P.P.-H.-U. “Serafin” Sp. z o.o. | 0.99 | 0.134 | 0.150 | −0.020 | 0.004 |

| 10 | Elektrownia Biogazowa Cychry Sp. z o.o. | 2.134 | 0.013 | 0.009 | 0.006 | −0.003 |

| Group II | ||||||

| 11 | “Ekogaz” Sp. z o.o. | 0.999 | −0.003 | 0.036 | −0.028 | −0.011 |

| 12 | Nadmorskie Elektrownie Wiatrowe Darżyno Sp. z o.o. | 2.4 | −0.007 | 0.052 | 0.019 | −0.078 |

| 13 | Biogazownia Skarżyn Sp. z o.o. | 1.56 | −0.009 | −0.006 | −0.001 | −0.002 |

| 14 | Zielona Energia Michałowo Sp. z o.o. | 0.6 | −0.047 | −0.036 | 0.021 | −0.032 |

| 15 | Allter Power Sp. z o.o. | 1.6 | −0.065 | 0.080 | −0.081 | −0.064 |

| 16 | Biogal Sp. z o.o. | 3.6 | −0.067 | −0.048 | 0.004 | −0.023 |

| 17 | Biogazownia Rypin Sp. z o.o. | 1.875 | −0.116 | −0.005 | 0.048 | −0.159 |

| 18 | Biogazownie Małopolskie Sp. z o.o. | 0.998 | −0.121 | −0.117 | 0.010 | −0.013 |

| 19 | Enerbio Eco Sp. z o.o. | 0.999 | −0.137 | −0.104 | −0.020 | −0.013 |

| 20 | DMG Sp. z o.o. | 2.4 | −0.157 | −0.103 | 0.002 | −0.057 |

| 21 | P.P.-H. “Kontrakt” Sp. z o.o. | 0.999 | −0.158 | −0.040 | 0.006 | −0.123 |

| 22 | Bioelektrownia Sp. z o.o. | 1.2 | −0.167 | 0.415 | 0.020 | −0.602 |

| Group III | ||||||

| 23 | Eko-Energia Grzmiąca Sp. z o.o. | 1.6 | −0.270 | −0.247 | −0.002 | −0.020 |

| 24 | Eko-Farmenergia Sp. z o.o. | 0.999 | −0.329 | −0.294 | −0.029 | −0.007 |

| 25 | Agro Bio Sp. z o.o. | 0.4 | −0.332 | −0.314 | 0.010 | −0.028 |

| 26 | Enerbio Sp. z o.o. | 0.999 | −0.461 | −0.277 | −0.052 | −0.132 |

| 27 | Minex Kogeneracja Sp. z o.o. | 1.2 | −1.266 | −0.914 | −0.291 | −0.062 |

| 28 | Lorega Bio Sp. z o.o. | 0.999 | −1.335 | −1.457 | 0.010 | 0.112 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kusz, D.; Bąk, I.; Szczecińska, B.; Wicki, L.; Kusz, B. Determinants of Return-on-Equity (ROE) of Biogas Plants Operating in Poland. Energies 2023, 16, 31. https://doi.org/10.3390/en16010031

Kusz D, Bąk I, Szczecińska B, Wicki L, Kusz B. Determinants of Return-on-Equity (ROE) of Biogas Plants Operating in Poland. Energies. 2023; 16(1):31. https://doi.org/10.3390/en16010031

Chicago/Turabian StyleKusz, Dariusz, Iwona Bąk, Beata Szczecińska, Ludwik Wicki, and Bożena Kusz. 2023. "Determinants of Return-on-Equity (ROE) of Biogas Plants Operating in Poland" Energies 16, no. 1: 31. https://doi.org/10.3390/en16010031

APA StyleKusz, D., Bąk, I., Szczecińska, B., Wicki, L., & Kusz, B. (2023). Determinants of Return-on-Equity (ROE) of Biogas Plants Operating in Poland. Energies, 16(1), 31. https://doi.org/10.3390/en16010031