Abstract

The global industrial chain and energy supply chain are being reconfigured at an accelerated pace, and the uncertainty of China’s energy supply security is growing significantly. Empowering energy supply chains through the digital economy () has a positive effect on accelerating the transformation of China’s energy supply structure. This paper discusses the effect and mechanisms of the digital economy on energy supply chain efficiency (). Specifically, based on the panel data of 112 energy enterprises in China from 2011 to 2019, energy supply chain efficiency and digital economy at the enterprise level were evaluated through three-stage DEA and content analysis, respectively. A two-way fixed effects model and mediation effect mode were adopted to investigate the nexus of and . The results show that the digital economy improves energy supply chain efficiency, and the conclusion holds water even after a series of robustness tests and endogenous treatment. Meanwhile, its promotion effect is more significant among large enterprises, non-state enterprises and enterprises in high market-oriented regions. The main impact mechanisms are regional industrial agglomeration and technological innovation of enterprises. Based on the above conclusions, it is suggested to take advantage of the industrial aggregation effect and technological innovation effect of the digital economy to further improve the efficiency of the energy supply chain for the purpose of maintaining energy supply security.

1. Introduction

Due to the COVID-19 pandemic and the outbreak of the Russia–Ukraine war, the global energy supply chain is being reconfigured at an accelerated pace. Against the backdrop of increased uncertainty in the world economy, the ability of China’s energy industry to ensure the security and stability of its supply chain will have a decisive impact on whether China’s economy can achieve sustainable development. With the wide application of new-generation information technology, the supply chain has developed into a digital supply chain with deep integration of digital technology. The deep integration of digital technology with the real economy has enabled the transformation and upgrading of the traditional energy industry. By giving the supply chain new features of big data support, networked sharing, and intelligent collaboration, it can enhance the transparency of information in all aspects of the supply chain, strengthen the sensitivity of the supply chain to market demand and promote the efficient operation of the supply chain. Therefore, under the current situation, studying the relationship between the digital economy and energy supply chain efficiency is not only in line with the future trend of digital economy development, but also provides a reference for decision making to further promote the development of the digital economy, the transformation and upgrading of energy industry structure and the promotion of supply chain efficiency.

The digital economy, as an important driving force for the development of supply chain innovation in energy companies, is driving energy supply chain management to become increasingly digital, networked and intelligent. Supply chains have been described as networks of enterprises and their suppliers to produce, distribute and deliver a specific product or service. The energy supply chain is more complex compared to the traditional manufacturing supply chain. Its business is more focused on energy production and energy-efficient distribution, producing a limited number of products (e.g., electricity, heat) [1]. The core objective of the energy supply chain is not only to support products, improve efficiency, improve services and other static capabilities but also to link the enterprise ecology and digital development and other dynamic capabilities [2]. Therefore, energy supply chain efficiency includes not only the efficiency of the overall transmission of energy companies but also the accuracy of forecasting demand and supply, as well as the efficiency of the allocation and supply of materials [3]. The digital economy is important for the management of supply chains and their transmission in the energy sector. A digital economy is an economic activity supported by information and communication technologies and can also be defined more simply as an economy based on digital technologies [4]. Xu et al. believed that the digital economy is a set of economic and social activities carried out by people through the Internet and related technologies, including the functions provided by digital technologies based on the physical infrastructure, the devices used to access them and their applications [5]. Thus, with reference to the existing findings, this paper defines the digital economy as a series of economic activities based on digital technology that combines the real economy with big data. By developing the digital economy, enterprises can achieve the purpose of improving enterprise performance and optimizing supply chain management with intelligent management tools.

Existing studies mainly focused on the impact of the digital economy on supply chain efficiency. This is because, in the context of the rapid development of the digital economy, companies that want to adapt to the external environment must carry out the corresponding digital transformation, and the completion of digital transformation requires digital technology as a support [6]. The digital economy is a new economic model. For enterprises, the digital economy is mainly based on digital technology to promote the digitalization of industry and digital industry development. Scholars at home and abroad have explored the effect of digital technology on the supply chain from different perspectives, which can be broadly divided into three categories: First, digital technology promotes the flow of information between different subjects in the supply chain [7,8,9]. By improving the visualization of supply chain information, digital technology promotes the sharing of supply chain information and reduces the degree of information asymmetry in the supply chain. Thus, the flow of information enhances the efficiency of collaboration among the participating parties in the supply chain and makes supply chain decision-making more intuitive and transparent [10]. Second, digital technology enhances the traceability of supply chain management [11,12]. Existing studies have found that the application of blockchain technology gives real traceability of goods throughout the supply chain, which plays a role in preventing the occurrence of product fraud and other acts [13]. In addition, the value of blockchain technology in supply chain management becomes more significant when a company releases information that is not true [14]. Third, digital technology improves the trust between different actors in the supply chain [15,16,17]. The core feature of the digital economy is decentralization [18]; this feature enables the supply and demand sides to solve the agency problem in supply chain management effectively. For example, the information integration function of blockchain technology can effectively reduce the possibility of information distortion and fraud among members, which is an effective way to solve trust problems in the supply chain network [19]. However, from the perspective of technological evolution, the deepening of the digital economy also means that digital technologies are becoming increasingly complex, which inevitably leads to increased technical difficulties. The increase in technical difficulty may have a series of hedging effects on digital technology research and development, digital product production and digital technology application, resulting in a reduction in the value of digital technology application and digital economy spillover effects, and thus a negative impact on the improvement of supply chain efficiency [20]. The deepening of digital technology may have both positive and negative effects on the efficiency of the energy supply chain.

Other dimensions of studies on energy supply chain efficiency unfold from industrial agglomeration and technological innovation. First, industrial agglomeration can effectively improve supply chain efficiency [21,22]. It is found that the industrial agglomeration effect brought about by regional integration can bring about an improvement in supply chain management by achieving balanced employment of labor [23]. Ryszard and Marius (2019) find that EU enlargement and industrial agglomeration reduce the cost of trade between member states, promote the free movement of factors and contribute to economic growth across the EU [24]. Second, technological innovation can effectively improve supply chain efficiency, and this promotion effect is industry heterogeneous. Dmitry et al. (2018) concluded that technological innovation in the energy industry has the most significant contribution to supply chain efficiency improvement through comparison [25]. There is also evidence of a two-way causal relationship between supply chain efficiency and industry clusters and technological innovation [26]. In addition, academics have conducted in-depth research on the microeconomic effects of digital economy applications. Studies have proved that the digital economy plays an important role in firm productivity [27], enterprise performance [28], organizational structure [29], technological innovation [30] and stock liquidity [31].

However, the existing literature mainly focuses on the characteristics at the intra-firm level and does not move from intra-firm management collaboration to a larger scale of supply chain multi-agent collaboration. In summary, the existing literature mainly focuses on the mechanism of the digital economy on supply chain efficiency, but there are few studies focusing on the relationship between the digital economy and energy supply efficiency from the perspective of internal enterprise management. Moreover, there is no uniform conclusion on the effect of the deepening of the digital economy on energy supply chain efficiency. How the digital economy acts on the supply chain management of the energy industry is still unclear. Based on this, few studies have analyzed the digital economy and supply chain efficiency in the energy industry, and the role of industrial agglomeration and technological innovation has been neglected. This study evaluates the development level of the digital economy and energy supply chain efficiency with the panel data of 112 enterprises from 2011 to 2019.

The major contributions of this paper are as follows. (1) The three-stage DEA model is applied to explore the supply chain efficiency in the energy industry from the perspective of considering non-expected output. This model can more efficiently, scientifically and rationally filter out the effects of environmental and stochastic factors and then accurately measure the energy supply chain efficiency. (2) It constructs the comprehensive index evaluation system at the enterprise level and improves the measurement approach. This paper uses textual analysis to construct indicators that more comprehensively reflect the degree of the digital economy of energy enterprises and improve the measurement of the degree of the digital economy of enterprises at the micro level. (3) This paper provides a theoretical mechanism framework applicable to the digital economy and energy supply chain efficiency. This paper empirically discusses the impact path of the digital economy on energy supply chain efficiency by studying its mechanism of action from two perspectives of industrial agglomeration and technological innovation.

The rest of this paper is arranged as follows: Section 2 shows the literature review and the research hypotheses; Section 3 introduces the empirical model and data; Section 4 presents the empirical results and discussion; Section 5 provides further tests of the influence mechanism; Section 6 provides the conclusion and policy implications.

2. Research Hypotheses

In the energy industry, the manufacturing end cannot be separated from the upstream supply of materials and services. However, under the traditional energy supply chain management model, it is difficult for each participating entity in the supply chain to accurately understand the status and problems of related matters, and it also requires a lot of time and cost for supervision, which seriously restricts the improvement of supply chain efficiency. In addition, low logistics efficiency and high transportation costs have always been among the pain points faced by supply chain management in the energy industry. Therefore, with the development of the industrial internet, the core content of supply chain management for energy companies is more focused on the digital transformation of supply and services [32]. In the context of the digital economy, digitalization is the new paradigm of this era and data has become a core production factor for energy companies. On the supply side, energy enterprises can enhance the transparency of supply chain information through digital technology. Energy enterprises break the temporal and spatial limitations of raw material supply by relying on digital platforms, and strengthening the links between upstream and downstream companies in the supply chain [33], thereby reducing information search costs and transportation costs. Specifically, enterprises can integrate distribution channels based on big data information management systems, improve the utilization rate of distribution resources, and avoid wasting distribution resources through the “flattening” of channel operations. In other words, energy enterprises rely on the network service platform to achieve instant information sharing, thus reducing unnecessary links in the traditional distribution chain, making the advantageous resources more concentrated in some parts of the chain, improving the use rate of resources, thus achieving the improvement of supply chain efficiency. On the production side, energy companies use data to connect all parts of the supply chain and gradually optimize factor inputs in the production process [34]. The digital economy enables enterprises to break down the regional barriers in traditional factor markets. From a market perspective, the digital economy allows for improved distortions in factor markets, such as technology and labor resources, by increasing market competition and promoting specialized division of labor. From the company’s perspective, the digital economy increases the effectiveness of energy companies’ access to external resources while optimizing their internal supply chain management mechanisms [35]. On the sales side, the promotion of digital platforms has weakened the role of intermediaries in the distribution process of energy enterprises. The reduction in the number of distribution entities not only helps to accelerate product distribution but also helps to save distribution costs and optimize the allocation of distributed resources for the purpose of improving supply chain efficiency. At the same time, the development of the digital economy can, to a certain extent, promote innovation in the supply model, transaction methods and business management of energy enterprises to build a new supply chain ecology, thereby achieving energy saving and cost reduction and sustainable development. Therefore, the following hypothesis is proposed.

Hypothesis 1:

Digital economy has a positive impact on carbon energy supply chain efficiency.

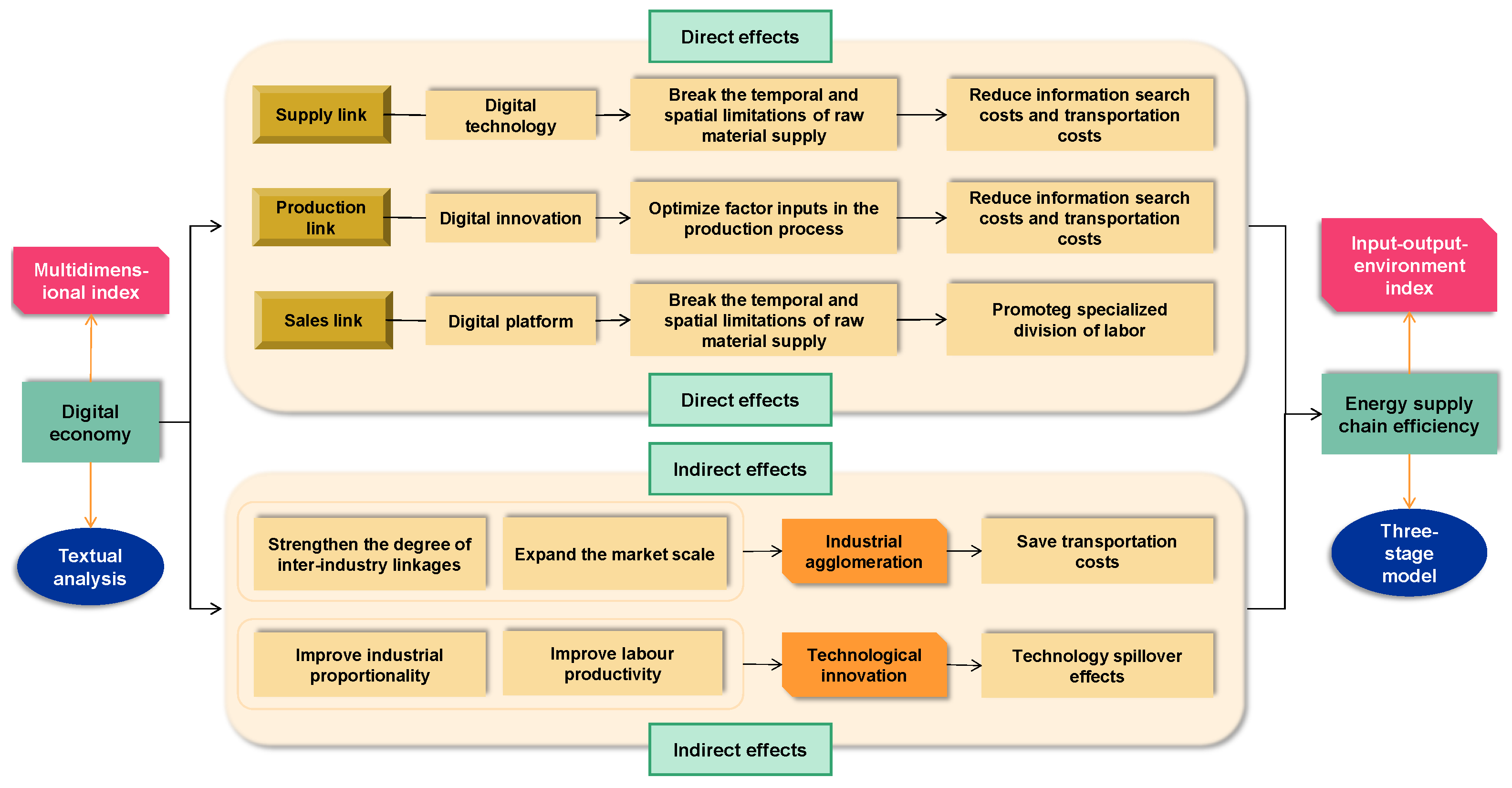

From the macro perspective, the improvement of energy supply chain efficiency is to ensure that the energy industry chain is uninterrupted; that is, the entire energy industry cycle is smooth. From the micro perspective, the improvement of energy supply chain efficiency is to improve the efficiency of energy enterprises in all aspects of energy transmission through continuous technological innovation and structural innovation. In addition to the direct impact of digital economy, digital economy can also affect energy supply chain efficiency indirectly. With reference to some scholars’ studies on the factors influencing energy supply chain efficiency [23,36,37], this paper focuses on the influence mechanism of the digital economy on energy supply chain efficiency from two perspectives, namely, industrial agglomeration and technological innovation. The impact mechanisms are as follows (see Figure 1).

Figure 1.

Mechanism of digital economy on energy supply chain efficiency.

2.1. Digital Economy Improves Energy Supply Chain Efficiency by Promoting Industrial Agglomeration

According to the theory of new economic geography, industrial agglomeration and diffusion are determined by a combination of regional market effects, price indices and market congestion effects [38]. The digital economy penetrates all aspects of energy industries in the form of digital technologies and digital services. Specifically, the digital economy enables enterprises to be innovative in production methods, internal processes and organization. At the same time, the digital economy strengthens the degree of inter-industry linkages and promotes industrial integration, thus forming new industries and new business models [39]. Meanwhile, the development of the digital economy can effectively reduce information asymmetry in the market and promote the rational allocation of resources. The digital economy promotes the free flow of factors while expanding the market scale in space, providing prerequisites for the development of industrial clusters [40]. The deepening of industrial agglomeration will have a cost-reducing effect and a resource-sharing effect, thus promoting energy supply chain efficiency. Industrial agglomeration can promote the free flow of factors and knowledge sharing by linking the complex social network system among production units, thus increasing the domestic added value of enterprises’ exports, improving the quality of product exports and increasing the quantity of product exports [41]. When an enterprise’s production quantity is certain, an increase in the number of exports can improve the enterprise’s inventory turnover and reduce the enterprise’s inventory. According to Marshallian externalities, saving transportation costs is an important reason why industrial agglomeration occurs. On the one hand, for enterprises, choosing the production mode of agglomeration can reduce transport costs and transaction costs, thereby reducing the explicit cost. On the other hand, under the conditions of industrial agglomeration and regional openness, the same industrial agglomeration and different industrial agglomeration, as well as the collaborative agglomeration of upstream and downstream industries, will have an interactive impact, which can reduce the implicit cost of enterprises. So, it can be concluded that industrial agglomeration can reduce the trade costs of enterprises. The reduction of trade costs can lead to the improvement of product quality and an increase in product exports. The above analysis shows that industrial agglomeration can contribute to both a reduction in inventories and a reduction in trade costs for energy companies. Therefore, the industry clustering effect of the digital economy can contribute to the improvement of energy supply chain efficiency. This led to the following hypothesis.

Hypothesis 2:

Industrial agglomeration is an important mechanism for the digital economy to affect energy supply chain efficiency.

2.2. Digital Economy Improves Energy Supply Chain Efficiency by Promoting Technological Innovation

The network connectivity effect of the digital economy brings new production factors such as information, technology, and data for industrial development, which promotes the digital development of enterprises while also enhancing their technical efficiency and innovation efficiency [42]. From a microscopic perspective, the rapidity, high permeability and sharing nature of the digital economy can effectively improve industrial proportionality and labor productivity. Moreover, the digital economy promotes the efficiency of information transfer between industrial chains, thus reducing the transaction costs such as information collection, inequality and lag. In addition, the digital economy can promote the optimization and improvement of production, transportation and sales and achieve the improvement of production efficiency, coordination efficiency and operation efficiency, thus boosting the level of technological innovation. The technological spillover effect and competitive advantage generated by an enterprise’s improved technological innovation will accelerate the speed of supply chain turnover of the enterprise. According to Schumpeter, innovation includes process innovation and product innovation. Process innovation refers to the improvement of the production process of a product during the production process. New technologies, machinery and equipment and new management models are introduced into the production process, reducing the cost of production, and generating economies of scale, leading to increased labor productivity, ultimately, improved product quality. Product innovation refers to the creation of new products. After the production of new products, because of its unique monopoly characteristics of production and export, the degree of specialization of the product itself will be improved, which is conducive to the improvement of product quality [43]. The improvement of product quality is more conducive to exports externally and can improve the visibility of the company internally, increase product sales, reduce the company’s inventory, and thus improve the energy supply chain efficiency [44]. When upstream energy companies adopt new technologies in their production, there is a technology spillover that will enable downstream enterprises to obtain higher profits [45]. The adoption of new technologies by downstream enterprises can reduce production costs, increase labor productivity, facilitate increased investment and give them an advantageous position in the competition, which in turn leads to increased profits for upstream enterprises. In other words, both upstream and downstream companies in an industry cluster can increase their profits and reduce their production costs through technological innovation, thus increasing energy supply chain efficiency. This leads to the following hypothesis.

Hypothesis 3:

Technological innovation is an important mechanism for the digital economy to affect energy supply chain efficiency.

3. Methods

3.1. Two-Way Fixed Effects Model

Based on the analysis of the factors influencing energy supply chain efficiency, referring to Chad and Clifford (2003) and Han and Zhigang (2013) [46,47], this paper uses two-way fixed effects model to estimate the impact of digital economy on energy supply chain efficiency. Based on the results of the Hausman test, we select the fixed effects model, considering individual and time effects. The following model is constructed to investigate the direct transmission mechanism.

where is the level of energy supply chain efficiency in enterprise at time ; is the development level of digital economy in enterprise at time ; is a vector that represents a series of control variables; is the individual fixed effect of enterprises that does not vary with time; controls the time-fixing effect; is the random perturbation term.

3.2. Variables Selection

3.2.1. Explained Variable

The explained variable herein is energy supply chain efficiency (). According to Sufian and Monideepa (2013), the supply chain plays many roles, including the effective integration of suppliers, manufacturers, warehouses and shops [48]. Regarding the methods of measuring supply chain efficiency. On the one hand, it has been pointed out that inventory management cost is an important component of supply chain costs and that inventory management in a firm is key to improving supply chain efficiency; therefore, inventory turnover period has also been used to measure the supply chain efficiency of an enterprise. On the other hand, indicator system is also widely used in the evaluation of supply chain efficiency. Chhabi et al. (2015) constructed a set of indicators system for evaluating the performance of manufacturing supply chains using the enhanced balanced scorecard method [49]. Wael (2021) empirically calculated supply chain efficiency based on evolutionary game theory, using hierarchical analysis and fuzzy decision-making methods [50]. As the field of supply chain efficiency research continues to develop, data envelopment analysis (DEA) has also been used more often in the measurement of supply chain efficiency. For energy companies, capital and labor are the main input factors. Chi et al. (2022) used a two-stage DEA model to establish input–output indicators to measure supply chain efficiency [51]. In order to filter out the influence of environmental and stochastic factors in a more efficient, scientific and reasonable way and then accurately demonstrate the efficiency level of each decision maker, with reference to Han et al. and Hahn et al. [2,52], this paper establishes input and output indicators from the production, processing and sales levels of energy enterprises, and the specific indicators are shown in Table 1.

Table 1.

Input and output indicators of the supply chain of energy enterprises.

Furthermore, referring to Mohammad et al. [53], this paper selects local GDP per capita and years of enterprise establishment as external environmental indicators, and the three-stage DEA model is used to evaluate energy supply chain efficiency. The traditional input-oriented DEA-BCC model is used in the first stage. The input–output slack variables analyzed in the first stage may be influenced by external environmental factors, random errors, and internal management factors. In the second stage, the above factors are measured, and their effects are removed through the SFA model. Assuming the existence of decision units, inputs indicators for each decision unit and environmental factors. The specific formula is as follows.

where represents the difference between actual input and target input of decision-making units ; is the degree of effect of environmental factors on ; is the random perturbation term; is managerial inefficiency; and are independent of each other, (0, ). The inputs of the decision units are adjusted to be in the same environment according to the regression results. The specific adjustment formula is as follows:

The third stage applies the adjusted output values from the second stage to replace the original values of outputs from the first stage, and the efficiency of the decision unit is measured using the BCC model.

3.2.2. Explanatory Variable

The core explanatory variable of this paper is digital economy (). No agreements have been reached on the connotation and measurement of digital economy. The existing literature uses two approaches to measure the level of digital economy of a company. On the one hand, the inputs related to the digital economy are used to reflect the extent to which firms are digital [54]. On the other hand, textual analysis is also utilized. Srinivasan and Chen (2019) valued unstructured data and used the word frequency of digital economy words in annual reports as a proxy for enterprises’ level of digital economization [55]. This study argues that the word frequency of digital economy reflects the importance that executives place on the development of the digital economy but does not necessarily reflect actual actions. Companies need to invest in human resources and assets to develop the digital economy, and annual reports disclose specific items of corporate intangible assets [56]. In this paper, after considering the availability of data, the proportion of intangible assets related to digital economy in the year-end intangible asset disclosed in the notes of financial statements to the total intangible assets are used as proxy variables. Specifically, when intangible assets detail information includes keywords related to digital economy such as “software”, “network”, “client”, “management system” and “intelligent platform” as well as related patents, mark the detailed item as “digital economy and technology intangible assets”. Then we sum up several digital economic and technological intangible assets of the same company in the same year and calculate their proportion in the intangible assets of this year, which is the proxy variable of the enterprise’s digital economy. In order to ensure the accuracy of the filtering, the filtered line items are also manually checked within 33,570 items.

3.2.3. Explained Variable

To control for the endogeneity problem arising from omitted variables, based on a review of the relevant literature, this paper selects a series of control variables, including operating cash flow () [32,50], nature of ownership () [1,45], profitability () [1], government subsidies () [1,53], ownership concentration () [53], return on assets () [16], growth capability () [57] and gross profit margin () [11]. The definitions and descriptions of the main variables are shown in Table 2. and gross profit margin () [11]. The definitions and descriptions of the main variables are shown in Table 2.

Table 2.

Definition of variables.

3.3. Data Source

In view of the data availability, this paper selects the panel data of 112 enterprises from 2011 to 2019 as the research samples. The reason why we set 2011 as the initial year is that the rapid development of digital economy in China and its integration with the real economy mainly occurred after 2011. The financial data of listed companies are obtained from the China Stock Market Accounting Research (CSMAR) database. Descriptive statistics for the variables are shown in Table 3.

Table 3.

Descriptive statistics of variables.

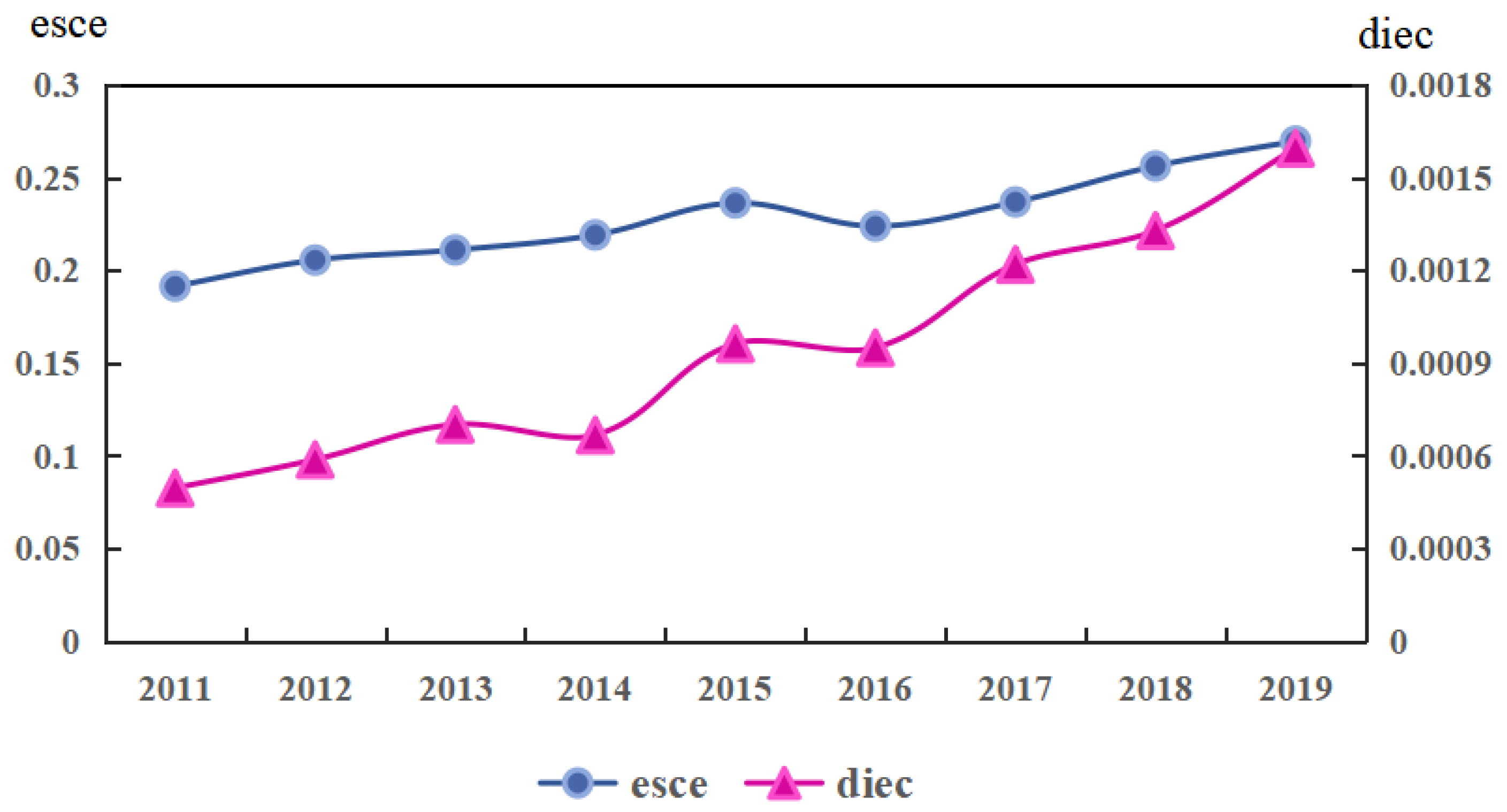

Figure 2 shows the average energy supply chain efficiency and the level of digital economy of 112 energy companies from 2011–2019. It can be found that both energy supply chain efficiency and the level of digital economy show a steady upward trend. In particular, the level of digital economy showed some volatility from 2014–2016. In 2014 and before, the development of China’s digital economy was still in its infancy. With the publication of “The Guidance of the State Council of China on Actively Promoting the ‘Internet+’ Action” in 2015, the ministries and commissions have closely introduced policies and opinions to encourage the development of digital economy, and since then, the digitization of China’s enterprises has entered a period of rapid development, and many small- and medium-sized enterprises have begun to develop digital economy. As a result, during the initial period of the policy’s issuance, the level of digital economy of each enterprise showed a fluctuating upward trend. Meanwhile, according to the above theoretical analysis, the development of digital economy has certain influence on energy supply chain efficiency. Therefore, energy supply chain efficiency also has shown certain fluctuations in this stage.

Figure 2.

Trends in energy supply chain efficiency and digital economy for 112 companies from 2011–2019.

4. Results

4.1. Baseline Estimation Results

Table 4 shows the estimation results of the digital economy’s impact on energy supply chain efficiency. Where column (1) shows the results controlling for fixed effects only, column (2) shows results with the addition of firm-level control variables and column (3) shows results with all sets of control variables added simultaneously. The results show that there is a significant positive relationship between the digital economy and energy supply chain efficiency, which passes the 1% significance level test, indicating that the digital economy can significantly promote energy supply chain efficiency. For energy companies, producers can use smart manufacturing technology to produce on demand at low cost and high efficiency to meet the diversified needs of the market while solving the long-standing problems of excessive investment in inventory and overcapacity in the energy industry. In the inventory management process, technological innovation based on advanced algorithms can enable enterprises to anticipate changes in demand and adjust inventory levels in a timely manner. Thus, the enterprise’s inventory management decisions will be transformed from the “sense-react” mode to the “forecast-execute” mode [37], which will enhance the dynamic balance between the supply and demand of energy enterprises. At the same time, as the Internet is widely used in various industries, the increase in the level of industrial agglomeration has led to the formation of an intricate supply chain network based on the Internet platform for suppliers, manufacturers, retailers, and customers. The vertical linear structure of “supplier-producer-sales end” of the traditional energy supply chain has been broken [21]. The change in supply chain structure not only improves the market responsiveness of the energy supply chain but also prevents the risk of “broken chains” in the energy supply chain. Hypothesis 1 is verified. In terms of control variables, enterprises with high operating cash flow, high-profit margins, high government subsidies, high ownership concentration, strong profitability and fast growth in operating income have relatively high energy supply chain efficiency. In the dynamic management of digital operation, the gathering of various types of advantageous resources, especially the introduction of technology systems, makes the operating cash flow, the business capacity and the operational capacity of enterprises more predictable and enhances the internal operational management of the whole enterprise as well as the supply chain management capacity [52]. The sign of changes in the control variables is generally in line with expectations. While the gross profit margin negatively affects the efficiency of the energy supply chain, as the excessive pursuit of gross profit margin may reduce the speed of asset turnover and hence energy supply chain efficiency.

Table 4.

Baseline regression results.

4.2. Heterogeneity Test

This paper examines the differences in the impact of the digital economy on energy supply chain efficiency in terms of the ownership of the firm, the size of the firm and the degree of marketability of the region in which it is located.

4.2.1. Type of Business Ownership

There are significant differences in supply chain management between state-owned (SOEs) and non-state-owned enterprises (non-SOEs). This section divides the sample into state-owned and non-state-owned enterprises based on differences in the equity and revenue shareholders of the enterprises. As can be seen from columns (1) and (2) of Table 5, the digital economy significantly improves supply chain efficiency at the 1% level for both state-owned and non-state-owned enterprises, but the improvement is more significant for non-state-owned enterprises. This indicates that the digital economy has a characteristic market-oriented [13]. Non-state-owned enterprises are highly market-oriented and oriented to generate economic profits, so they can adjust their production activities and organizational structure more quickly and are more fully informed about the market. The advantage of information screening and use by non-state enterprises enables them to respond quickly to changes in market conditions, consumer preferences and technological updates in order to better leverage the digital economy to improve supply chain efficiency. In addition, the digital economy is a knowledge-intensive industry. The advantage of innovation clusters generated by the concentration of high-tech enterprises plays a crucial role in the development of application scenarios and innovation in the digital economy industry. Non-state enterprises have a comparative advantage in digital economy innovation clusters [41].

Table 5.

Heterogeneity test of digital economy’s impact on energy supply chain efficiency.

4.2.2. Size of the Enterprise

Based on the micro characteristics of the enterprises themselves, this paper tests the heterogeneity according to the size of enterprises. Specifically, the sample was divided into large enterprises (LEs) and micro-, small- and medium-sized enterprises (MSMEs) according to the number of employees of enterprises in different industries, with reference to the Measures for Classifying Statistically Large, Small, Medium and Micro Enterprises (2017) issued by the National Bureau of Statistics [35]. The results from columns (3) and (4) of Table 5 show that the level of the digital economy of large enterprises significantly improves supply chain efficiency at the 1% level, but the improvement effect for MSMEs is not significant. This result suggests that the digital economy has a scale effect [58]. Large enterprises can make full use of their advantages in terms of capital, talent, technology and data to better exploit the amplifying multiplier effect of the digital economy on improving supply chain efficiency.

4.2.3. Degree of Marketization in the Region where the Enterprise Is Located

The vast size of China, coupled with the obvious differences in the distribution and inclination of resources and government policies in different regions, means that regions with different degrees of marketization have certain differences in the degree of government intervention, market environment and the rule of law environment. The degree of marketization of the region in which an enterprise is located is an important factor influencing the stability of the supply chain [59,60]. Is the extent to which the digital economy of energy enterprises contributes to supply chain efficiency also influenced by the degree of marketization in the region? This paper is used the total marketization index in the “China Marketization Index” compiled by Fan et al. (2011) to measure the degree of marketization in the province where the company is located. The larger the value indicates that, the higher the degree of marketization. As the index is only updated to 2016, this paper uses the historical average growth rate method to calculate the index value for each province for the remaining years. At the same time, the index is grouped according to the marketization index. The median value of the index is taken by the year as the criterion for judging the degree of marketization in each region. The enterprises with an index higher than the median value in that year are classified as deep market-oriented enterprises (DMOEs), while those below the median value in that year are classified as low market-oriented enterprises (LMOEs). The empirical results are presented in columns (5) and (6) of Table 5, where the digital economy significantly improves supply chain efficiency, but more so for energy enterprises in the deep market-oriented group. The reason for this may be that in deep market-oriented areas, catalyzed by the digital economy, knowledge and information flows faster, information is more symmetrical, and therefore competition is more intense, and upstream and downstream players in the supply chain enhance cooperation between firms more [61], which in turn improves supply chain efficiency.

4.3. Endogenous Treatment

The findings of the previous study may face endogeneity problems resulting from reverse causality. On the one hand, an increase in the level of the digital economy helps to promote energy supply chain efficiency; on the other hand, companies with a more efficient energy supply chain may also be more motivated to promote the deeper integration of the digital economy with the real economy. Based on this, this paper selects the level of the digital economy of each prefecture-level city () as the instrumental variable. The Kleibergen–Paap rk LM statistic is significant at the 1% level, rejecting the hypothesis of under-identification of instrumental variables, and the Cragg–Donald Wald F statistic is greater than Stock–Yogo weak instrumental variable identification test at the 10% level critical value, rejecting the weak instrumental variable hypothesis, thus indicating that the instrumental variables selected for this paper are reasonably reliable. The first stage regression results in column (1) of Table 6 show that the coefficient on is significantly positive at the 1% level, indicating that the selected instrumental variables satisfy the correlation requirement. Column (2) reports the results of the second stage regression, where the coefficient on is significantly positive at the 1% level, satisfying the baseline regression results and indicating that the findings of this paper still hold true after controlling for endogeneity issues. The paper further selects a one-period lag of the explanatory variable () as the instrumental variable to test for the endogeneity problem, and the results are shown in column (3) and column (4) of Table 6. The coefficient of is found to be significantly positive at the 5% level, indicating that the findings of this paper are robust and reliable.

Table 6.

Instrumental variable test results.

4.4. Robustness Test

4.4.1. Changing the Measurement of Energy Supply Chain Efficiency

This paper uses the following two indicators as alternative indicators of energy supply chain efficiency. First, inventory turnover is an important indicator reflecting the level of supply chain management. The shorter the inventory turnaround period, the faster the inventory can be converted into cash, indicating the higher the efficiency of the company’s supply chain. Therefore, in the robustness test, the natural logarithm of the inventory turnover period () is selected to measure the supply chain efficiency. The inventory turnaround period is calculated by the proportional relationship between operating costs and average inventory over a year. Second, since the business cycle can reflect the time taken by enterprises to complete the business process from purchasing inventory to selling inventory and recovering cash, this paper measures supply chain efficiency by the natural logarithm of the business cycle (). The business cycle is calculated from the proportional relationship between operating costs and the closing balance of accounts payable. The shorter the business cycle, the more efficient the supply chain of the enterprise. Columns (1) and (2) of Table 6 report the regression results. The results show that the coefficients are significantly negative at the level of 1%, indicating that the conclusions of this paper are robust.

4.4.2. Changing the Measurement of the Level of Digital Economy

This paper adopts the following two methods to re-measure the digital economy. First, five indicators are used to measure the level of the digital economy: mobile phone penetration rate, Internet broadband access ports, year-end resident population, Internet access port density and mobile Internet penetration rate. The data are standardized and then downscaled using the entropy value method to obtain the level of the digital economy (). Second, through text analysis of listed companies’ annual reports, the frequency of keywords related to the digital economy is used as its proxy variable to obtain the new indicator of the level of the digital economy (). The corresponding regression results are reported in columns (3) and (4) of Table 7. It can be found that the coefficient of is significantly positive at the 1% level, regardless of the method used to measure the level of the digital economy of enterprises, supporting that the findings of this paper are robust and reliable.

Table 7.

Robustness test.

5. Mediation Effect Analysis

Through the previous analysis, the digital economy can promote energy supply chain efficiency, and the specific mechanism of action needs to be further tested. This paper examines the mechanism by which the digital economy affects energy supply chain efficiency from the perspective of product markets. Technological innovation and industrial agglomeration are taken as mediating variables in mechanism analysis, and a mediating effect model is constructed to test its mechanism role. The specific model is as follows.

denotes the mediating variables of this paper, which are industrial agglomeration () and technological innovation (). Based on the availability of data and comparability among enterprises, the ratio of R&D expenditure to operating revenue is chosen to measure the level of enterprise technological innovation. In addition, this paper uses location entropy indexes to measure the industrial agglomeration of enterprises. The formula for calculating industrial agglomeration is as follows.

denotes industry; denotes enterprise; denotes city; denotes year. is the total number of people employed in the energy sector in city in year . is the employment number of industry in year . is the total number of people employed in the energy industry nationally. If and pass the significance test, and is smaller or less significant than , indicating a significant mediating effect.

Column (1) in Table 8 shows the results of the test of Equation (4), which indicates the impact of the digital economy on energy supply chain efficiency. From the results in column (1), the regression coefficient of the degree of the digital economy is 5.738 and passes the significance test, indicating that the improvement of the level of the digital economy can promote the improvement of energy supply chain efficiency. Hypothesis 1 is verified. Energy supply chain efficiency is different from the supply chain efficiency of traditional enterprises, and the efficiency improvement is more reflected in the process of production and transmission [62]. A digital economy, based on digital technology, can further accelerate the speed of information dissemination and communication between the upstream and downstream of the supply chain, effectively alleviating the “bullwhip effect” in the production chain, thus promoting the accuracy of supply and demand matching and the improvement of operational efficiency along the whole chain.

Table 8.

Intermediary effect regression results.

Columns (2) and (4) of Table 8 show the regression results of Equation (5), i.e., the relationship between the digital economy and the mediating variables. The results in column (2) show that the digital economy promotes industrial agglomeration, and the higher the level of the digital economy of enterprises, the more it contributes to the synergistic agglomeration of local industries. The results in column (4) show that the digital economy promotes technological innovation because the increased level of the digital economy promotes cooperation and exchange between regions, which is conducive to knowledge spillover and technology diffusion, thus promoting technological innovation. At the same time, the digital economy relies on digital technology, whose characteristics such as “reprogrammability” and “data homogeneity” reduce the cost of data-based technological innovation activities, thereby increasing the efficiency of technological innovation [20].

Columns (3) and (5) of Table 8 show the regression results of Equation (6). From the regression results, the digital economy affects energy supply chain efficiency through industrial agglomeration and technological innovation, which confirms Hypotheses 2 and 3. This indicates that the development of the digital economy not only contributes directly to the efficiency of the energy supply chain but also indirectly promotes the efficiency of the energy supply chain through industrial agglomeration and technological innovation. In the context of the digital economy, industrial clusters enable enterprises to pool multiple resources to promote synergies [63]. Energy enterprises can improve supply chain efficiency through synergies. At the same time, technological innovation facilitates energy enterprises above a certain scale to allocate supply chain resources more scientifically [64], thus rapidly improving supply chain efficiency. Hypotheses 2 and 3 are verified.

6. Conclusions and Policy Implications

In the context of the rapid development of the digital economy, promoting the deep integration of the supply chain with the digital economy is both an important driver for building a digital supply chain system and a key point for promoting the development of China’s digital economy. With the panel data of 112 enterprises from 2011 to 2019, this study evaluates the development level of the digital economy and energy supply chain efficiency. Then, this paper employs a two-way fixed effects model and an intermediary effect model to empirically investigate the effect of the digital economy on energy supply chain efficiency and its internal mechanism. The main conclusions include: (1) Digital economy plays a positive role in promoting energy supply chain efficiency. This conclusion is verified by robustness tests and endogenous treatment. (2) The impact of the digital economy on energy supply chain efficiency has heterogeneity. The effect of the digital economy on promoting energy supply chain efficiency is more significant among large enterprises, non-state enterprises and enterprises in high market-oriented regions.

Based on the conclusions, this paper puts forward the following recommendations for enterprises and governments, respectively, in further promoting the digital economy transformation of energy enterprises:

First, it is suggested that energy enterprises should seize the development opportunities brought by the digital economy to the energy industry. On the one hand, energy enterprises should gradually introduce digital technology into the production and operation process and promote the digital transformation of the supply chain. Specifically, efforts should be made to utilize the upstream and downstream conduction effect of digital technology to open channels for the circulation of data elements and promote the efficient and collaborative development of energy enterprises upstream and downstream in the supply chain. The digital supply chain not only requires the enterprises themselves to increase digital investment but also requires close cooperation between upstream and downstream energy enterprises. Therefore, it is suggested to accelerate the opening of data channels for upstream and downstream enterprises in the supply chain, lead the flow of talent, technology and capital with data flow, improve the accuracy of matching supply and demand along the whole chain and reduce external coordination and transaction costs, realize the integration of production, supply and sales and comprehensively improve the efficiency of the supply chain. On the other hand, core enterprises in the energy industry should be encouraged to build supply chain collaboration platforms to connect upstream suppliers and downstream users. Core enterprises can guide upstream and downstream enterprises to develop efficiently and collaboratively through accurate forecasting of end-user demand and improve the rapid response capability of the supply chain. Furthermore, it is suggested to use data elements throughout all aspects of the supply chain to promote the digital transformation of business processes within enterprises. It is also important that enterprises should encourage their employees to innovate, actively bring in advanced technology talents and ensure the proportion of investment in research and development to improve their technological innovation capacity.

Second, it suggested that the government accelerate the construction of digital supply chain-related policies and systems. Specifically, several industry-representative digital enterprises should be cultivated. Forming experience and practices that can be replicated to drive more enterprises in the industry to realize the deep integration of the supply chain and digital economy. What is more, according to the heterogeneity of enterprises and cities, the development of the supply chain in the energy industry should be adapted to local conditions and policies. It means that specific measures should be taken according to the specific situation of the city, and for cities with a high degree of marketization, the “trickle-down effect” should be emphasized while also helping the “siphon effect”. Moreover, different strategies should be adopted depending on the size of the enterprise and the type of ownership. It is suggested to accelerate the market-oriented reform of state-owned enterprises and provide certain policy support for enterprises that are more affected by the digital economy. In addition, cooperation between enterprises should be strengthened to give full play to the diffusion effect of the digital economy industry agglomeration and the spillover effect of technological innovation. Local governments can integrate different digital economy platforms to create an integrated digital economy smart service platform to strengthen the mutual collaboration among energy enterprises in the region. Additionally, the relevant authorities should encourage the exchange and sharing of advanced technologies among different enterprises. It is suggested to organize exchange seminars and advanced technological innovation competitions to promote the dissemination of knowledge and technology.

This study has certain limitations. (1) this study is limited to 112 energy enterprises because the data of some energy enterprises are not published, or the published data are incomplete. In the future, the research can be further extended to more enterprises as the area of data disclosure continues to expand. (2) this paper attempts to measure the level of digital economization of an enterprise at the level of intangible assets, but the measurement still cannot accurately quantify the level of development of an enterprise’s digital economy. In the future, a more reasonable measurement method will be constructed under the condition of technical feasibility and data availability. (3) this study is conducted in a Chinese scenario with data from 112 energy companies in China. Whether the findings can be generalized to other countries remains to be tested. In the future, a comparative study with different country scenarios could be conducted simultaneously, which may lead to more interesting conclusions. Finally, although the sample data before 2019 were selected in this study considering the impact of the COVID-19 pandemic on enterprise business conditions, as a relatively stable economic form during the COVID-19 pandemic, the promotion effect of the digital economy on energy supply chain efficiency during the pandemic is worth further analysis in the future.

Author Contributions

Conceptualization, S.F. and J.T.; methodology, S.F.; software, J.T.; validation, J.T., J.L. and J.P.; formal analysis, J.T.; investigation, J.L.; resources, J.T.; data curation, S.F.; writing—original draft preparation, J.T.; writing—review and editing, J.L., J.P. and C.W.; visualization, J.T. and C.W.; supervision, J.P.; project administration, S.F.; funding acquisition, S.F., J.L. and J.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the MOE (Ministry of Education in China) Project of Humanities and Social Sciences research project of Science (No. 18YJCZH029). The authors would also like to acknowledge financial support from the youth talent project of the Wuhan-Shuguang project (No. 2022010801020365), the Research Fund Project of Wuhan Institute of Technology (No. K202248), the Statistical Research Project of the National Bureau of Statistics in China (No. 2022LY057), Social Science Foundation of Hubei Province (No. HBSK2022YB336, HBSK2022YB339) and the Social Science Foundation of Wuhan Institute of Technology (No. R202105).

Data Availability Statement

Not applicable.

Acknowledgments

We are grateful for the coauthors and the comments and suggestions from the editor and anonymous reviewers who helped improve the paper. We would also like to express our gratitude to the Ministry of Education in China, the Knowledge Innovation Program of the Wuhan Shuguang Project, Social Science Foundation of Hubei Province, and the Research Fund Project of the Wuhan Institute of Technology for providing funding support.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Saurav, N. Supply chain efficiency framework to improve business performance in a competitive era. Manag. Res. Rev. 2020, 44, 477–508. [Google Scholar] [CrossRef]

- Han, H.; Gu, X. Evaluation of Innovation Efficiency of High-Tech Enterprise Knowledge Supply Chain Based on AHP-DEA. J. Math. 2022, 2022, 3210474. [Google Scholar] [CrossRef]

- Zhai, D.; Jennifer, S.; Yang, F.; Sheng, A. Measuring energy supply chains’ efficiency with emission trading: A two-stage frontier-shift data envelopment analysis. J. Clean. Prod. 2019, 210, 1462–1474. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, Y.; Li, H.; Zhong, K. Digital Economy Development, Industrial Structure Upgrading and Green Total Factor Productivity: Empirical Evidence from China’s Cities. Int. J. Environ. Res. Public Health 2022, 19, 2414. [Google Scholar] [CrossRef]

- Xu, G.; Lu, T.; Chen, X.; Liu, Y. The convergence level and influencing factors of China’s digital economy and real economy based on grey model and PLS- SEM. J. Intell. Fuzzy Syst. 2022, 42, 1575–1605. [Google Scholar] [CrossRef]

- Lee, C.; Wang, D.; Desouza, K.C.; Evans, R. Digital Transformation and the New Normal in China: How Can Enterprises Use Digital Technologies to Respond to COVID-19? Sustainability 2021, 13, 10195. [Google Scholar] [CrossRef]

- Mashalah, H.A.; Hassini, E.; Gunasekaran, A.; Bhatt, M.D. The impact of digital transformation on supply chains through e-commerce: Literature review and a conceptual framework. Transp. Res. Part E 2022, 165, 102837. [Google Scholar] [CrossRef]

- Nayal, K.; Kumar, S.; Raut, R.D.; Queiroz, M.M.; Priyadarshinee, P.; Narkhede, B.E. Supply chain firm performance in circular economy and digital era to achieve sustainable development goals. Bus. Strat. Environ. 2021, 31, 1058–1073. [Google Scholar] [CrossRef]

- Pasqualino, R.; Demartini, M.; Bagheri, F. Digital Transformation and Sustainable Oriented Innovation: A System Transition Model for Socio-Economic Scenario Analysis. Sustainability 2021, 13, 11564. [Google Scholar] [CrossRef]

- Dorsaf, Z.; Salomée, R.; Laurence, V. Does digitalising the supply chain contribute to its resilience? Int. J. Phys. Distrib. Logist. 2020, 51, 149–180. [Google Scholar] [CrossRef]

- Dwivedi, A.; Paul, S.K. A framework for digital supply chains in the era of circular economy: Implications on environmental sustainability. Bus. Strategy Environ. 2022, 31, 1249–1274. [Google Scholar] [CrossRef]

- Xu, Q.; Hu, Q.; Chin, T.; Chen, C.; Shi, Y.; Xu, J. How Supply Chain Integration Affects Innovation in a Digital Age: Moderating Effects of Sustainable Policy. Sustainability 2019, 11, 5460. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Del Vecchio, P.; Oropallo, E.; Secundo, G. Blockchain technology for bridging trust, traceability and transparency in circular supply chain. Inf. Manag. 2022, 59, 103508. [Google Scholar] [CrossRef]

- Wang, M.; Wang, B.; Abareshi, A. Blockchain Technology and Its Role in Enhancing Supply Chain Integration Capability and Reducing Carbon Emission: A Conceptual Framework. Sustainability 2020, 12, 10550. [Google Scholar] [CrossRef]

- Choi, D.; Chung, C.; Seyha, T.; Young, J. Factors Affecting Organizations’ Resistance to the Adoption of Blockchain Technology in Supply Networks. Sustainability 2020, 12, 8882. [Google Scholar] [CrossRef]

- Mikhaylova, A.; Sakulyeva, T.; Shcherbina, T.; Levoshich, N.; Truntsevsky, Y. Impact of Digitalization on the Efficiency of Supply Chain Management in the Digital Economy. Int. J. Enterp. Inf. Syst. 2021, 17, 34–46. [Google Scholar] [CrossRef]

- Brett, M.; John, V.G.; Yingchao, L. On the Inattention to Digital Confidentiality in Operations and Supply Chain Research. Prod. Oper. Manag. 2018, 27, 1492–1515. [Google Scholar] [CrossRef]

- Miao, Z. Digital economy value chain: Concept, model structure, and mechanism. Appl. Econ. 2021, 53, 4342–4357. [Google Scholar] [CrossRef]

- Matenga, A.E.; Mpofu, K. Blockchain-Based Cloud Manufacturing SCM System for Collaborative Enterprise Manufacturing: A Case Study of Transport Manufacturing. Appl. Sci. 2022, 12, 8664. [Google Scholar] [CrossRef]

- Gianluca, E.; Alessandro, M.; Giuseppina, P. Digital entrepreneurship ecosystem: How digital technologies and collective intelligence are reshaping the entrepreneurial process. Technol. Forecast. Soc. Chang. 2020, 150, 119791. [Google Scholar] [CrossRef]

- Joshua, D.; Edward, F. Regional industrial structure and agglomeration economies: An analysis of productivity in three manufacturing industries. Reg. Sci. Urban Econ. 2012, 42, 1–14. [Google Scholar] [CrossRef]

- Daisuke, N. An integrated production-stage analysis on market areas and supply areas. Ann. Reg. Sci. 2010, 45, 453–471. [Google Scholar] [CrossRef]

- Wang, X.; Lin, Y.; Shi, Y. Linking industrial agglomeration and manufacturers inventory performance: The moderating role of firm size and enterprise status in the supply chain. J. Manuf. Technol. Manag. 2020, 32, 448–484. [Google Scholar] [CrossRef]

- Ryszard, R.; Mariusz, P. EU membership and economic growth: Empirical evidence for the CEE countries. Eur. J. Comp. Econ. 2019, 16, 3–40. [Google Scholar] [CrossRef]

- Dmitry, I.; Ajay, D.; Tsan-Ming, C. New flexibility drivers for manufacturing, supply chain and service operations. Int. J. Prod. Res. 2018, 56, 3359–3368. [Google Scholar] [CrossRef]

- Rachael, D.G.; Eric, F.L.; Rosamond, L.N. The new economic geography of land use change: Supply chain configurations and land use in the Brazilian Amazon. Land Use Policy 2013, 34, 262–275. [Google Scholar] [CrossRef]

- Zhou, Z.; Liu, W.; Cheng, P.; Li, Z. The Impact of the Digital Economy on Enterprise Sustainable Development and Its Spatial-Temporal Evolution: An Empirical Analysis Based on Urban Panel Data in China. Sustainability 2022, 14, 11948. [Google Scholar] [CrossRef]

- Tian, J.; Liu, Y. Research on Total Factor Productivity Measurement and Influencing Factors of Digital Economy Enterprises. Procedia Comput. Sci. 2021, 187, 390–395. [Google Scholar] [CrossRef]

- Su, W. Blockchain Empowers Chain Enterprises in the Digital Economy to Strengthen Risk Management Research. J. Electr. Comput. Eng. 2022, 2022, 2580176. [Google Scholar] [CrossRef]

- Sekerin, V.D.; Zaitsev, I.A.; Gorokhova, A.E.; Zaitseva, T.S. Method for evaluating innovativeness of an enterprise in the conditions of the digital economy. J. Phys. Conf. Ser. 2021, 1864, 012051. [Google Scholar] [CrossRef]

- Chen, N.; Sun, D.; Chen, J. Digital transformation, labour share, and industrial heterogeneity. J. Innov. Knowl. 2022, 7, 100173. [Google Scholar] [CrossRef]

- Tsipoulanidis, A.; Nanos, I. Contemporary Potentials and Challenges of Digital Logistics and Supply Chain Management. Int. J. Innov. Technol. Manag. 2022, 19, 2241003. [Google Scholar] [CrossRef]

- Yi, M.; Liu, Y.; Sheng, M.S.; Wen, L. Effects of digital economy on carbon emission reduction: New evidence from China. Energy Policy 2022, 171, 113271. [Google Scholar] [CrossRef]

- Nguyen, T.; Duong, Q.H.; Van Nguyen, T.; Zhu, Y.; Zhou, L. Knowledge mapping of digital twin and physical internet in Supply Chain Management: A systematic literature review. Int. J. Prod. Econ. 2021, 244, 108381. [Google Scholar] [CrossRef]

- Mesnik, D.N. Use of Information Technology by Transport Enterprises: Cryptocurrency Mining Mechanism Based on Blockchain Technology. Sci. Tech. 2020, 19, 168–176. [Google Scholar] [CrossRef]

- Liu, H.; Fan, L.; Shao, Z. Threshold effects of energy consumption, technological innovation, and supply chain management on enterprise performance in China’s manufacturing industry. J. Environ. Manag. 2021, 300, 113687. [Google Scholar] [CrossRef]

- Zhang, H. Efficiency of the supply chain collaborative technological innovation in China: An empirical study based on DEA analysis. J. Ind. Eng. Manag. 2015, 8, 1623–1638. [Google Scholar] [CrossRef]

- Yao, Y.; Pan, H.; Cui, X.; Wang, Z. Do compact cities have higher efficiencies of agglomeration economies? A dynamic panel model with compactness indicators. Land Use Policy 2022, 115, 106005. [Google Scholar] [CrossRef]

- Vishal, V.; Priyanka, J. Role of digital economy and technology adoption for financial inclusion in India. Indian Growth Dev. Rev. 2021, 14, 302–324. [Google Scholar] [CrossRef]

- Yoo, R.K.; Allan, M.W.; Sangwon, P.; Jason, L.C. Spatial spillovers of agglomeration economies and productivity in the tourism industry: The case of the UK. Tour. Manag. 2021, 82, 104201. [Google Scholar] [CrossRef]

- Rosa, P.F.; Ana, R.S. The role of firm location and agglomeration economies on export propensity: The case of Portuguese SMEs. EuroMed J. Bus. 2020, 16, 195–217. [Google Scholar] [CrossRef]

- Ning, J.; Yin, Q.; Yan, A. How does the digital economy promote green technology innovation by manufacturing enterprises? Evidence from China. Front. Environ. Sci. 2022, 10, 967588. [Google Scholar] [CrossRef]

- Xin, C.; Zhou, Y.; Zhu, X.; Li, L.; Chen, X. Optimal Decisions for Carbon Emission Reduction through Technological Innovation in a Hybrid-Channel Supply Chain with Consumers’ Channel Preferences. Discret. Dyn. Nat. Soc. 2019, 2019, 1–24. [Google Scholar] [CrossRef]

- Beigizadeh, R.; Delgoshaei, A.; Ariffin, M.K.A.; Hanjani, S.E.; Ali, A. A comprehensive model for determining technological innovation level in supply chains using green investment, eco-friendly design and customer collaborations factors. Rairo-Oper. Res. 2022, 56, 2775–2880. [Google Scholar] [CrossRef]

- Tarei, P.K.; Chand, P.; Gangadhari, R.K.; Kumar, A. Analysing the inhibitors of complexity for achieving sustainability and improving sustainable performance of petroleum supply chain. J. Clean. Prod. 2021, 310, 127360. [Google Scholar] [CrossRef]

- Chad, S.; Clifford, W. Firm inventory behavior and the returns from highway infrastructure investments. J. Urban Econ. 2003, 55, 398–415. [Google Scholar] [CrossRef]

- Han, L.; Zhigang, L. Road investments and inventory reduction: Firm level evidence from China. J. Urban Econ. 2013, 76, 43–52. [Google Scholar] [CrossRef]

- Sufian, Q.; Monideepa, T. Lean and agile supply chain strategies and supply chain responsiveness: The role of strategic supplier partnership and postponement. Supply Chain Manag. 2013, 18, 571–582. [Google Scholar] [CrossRef]

- Chhabi, R.M.; Saurav, D.; Siba, S.M. Evaluation of leanness, agility and leagility for supply chain of automotive industries. Int. J. Agile Syst. Manag. 2015, 8, 85–115. [Google Scholar] [CrossRef]

- Wael, H.E.G. Analysis of supply chain operations reference (SCOR) and balanced scorecard (BSC) in measuring supply chains efficiency using DEMATEL and DEA techniques. J. Glob. Oper. Strateg. 2021, 14, 680–700. [Google Scholar] [CrossRef]

- Chi, E.; Jiang, B.; Peng, L.; Zhong, Y. Uncertain Network DEA Models with Imprecise Data for Sustainable Efficiency Evaluation of Decentralized Marine Supply Chain. Energies 2022, 15, 5313. [Google Scholar] [CrossRef]

- Hahn, G.; Brandenburg, M.; Becker, J. Valuing supply chain performance within and across manufacturing industries: A DEA-based approach. Int. J. Prod. Econ. 2021, 240, 108203. [Google Scholar] [CrossRef]

- Mohammad, A.; Hosein, D.; Kaveh, K.; Ashkan, H. Measuring Performance of a Three-Stage Network Structure Using Data Envelopment Analysis and Nash Bargaining Game: A Supply Chain Application. Int. J. Inf. Tech. Decis. 2018, 17, 1429–1467. [Google Scholar]

- Babina, T.; Fedyk, A.; He, A.X.; Hodson, J. Artificial Intelligence, Firm Growth, and Industry Concentration. SSRN 2022. [Google Scholar] [CrossRef]

- Wilbur, C.; Suraj, S. Going Digital: Implications for Firm Value and Performance. SSRN 2022. [Google Scholar] [CrossRef]

- Jiang, K.; Du, X.; Chen, Z. Firms’ digitalization and stock price crash risk. Int. Rev. Financ. Anal. 2022, 82, 102196. [Google Scholar] [CrossRef]

- Wei, J.; Liu, Y.; Wang, L.; Sun, X. Research on evaluation of manufacturing cloud service oriented to environmental benefits of supply chain. Environ. Sci. Pollut. Res. 2021, 28, 59473–59485. [Google Scholar] [CrossRef]

- Saadat, N.L.K.; Kasimu, S.; Shakilah, N. Digital technologies in micro and small enterprise: Evidence from Uganda’s informal sector during the COVID-19 pandemic. World J. Sci. Technol. 2021, 18, 93–108. [Google Scholar] [CrossRef]

- Lu, H.; Peng, J.; Lu, X. Do Factor Market Distortions and Carbon Dioxide Emissions Distort Energy Industry Chain Technical Efficiency? A Heterogeneous Stochastic Frontier Analysis. Energies 2022, 15, 6154. [Google Scholar] [CrossRef]

- Tang, P.; Jiang, Q.; Mi, L. One-vote veto: The threshold effect of environmental pollution in China’s economic promotion tournament. Ecol. Econ. 2021, 185, 107069. [Google Scholar] [CrossRef]

- Zhang, L.; Fu, S.; Tian, J.; Peng, J. A Review of Energy Industry Chain and Energy Supply Chain. Energies 2022, 15, 9246. [Google Scholar] [CrossRef]

- Scholastica, N.E.; Gioia, F. A review on energy supply chain resilience through optimization. Renew. Sustain. Energy Rev. 2020, 134, 110088. [Google Scholar] [CrossRef]

- Zhu, X.; Liu, Y.; He, M.; Luo, D.; Wu, Y. Entrepreneurship and industrial clusters: Evidence from China industrial census. Small Bus. Econ. 2018, 52, 595–616. [Google Scholar] [CrossRef]

- Yang, B.; Liu, B.; Peng, J.; Liu, X. The impact of the embedded global value chain position on energy-biased technology progress: Evidence from chinas manufacturing. Technol. Soc. 2022, 71, 102065. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).