An Analysis of the Effects of Renewable Energy Intermittency on the 2030 Korean Electricity Market

Abstract

:1. Introduction

2. Background

2.1. Policy of Korea

2.2. Intermittency and Curtailment of VRE

2.2.1. Intermittency of VRE

2.2.2. Response to Intermittency

3. 2030 Electricity Market Analysis Model

3.1. Annual Market Analysis Model

3.1.1. Overview of Annual Market Analysis Model

3.1.2. Linear Programing (LP) Relaxation Model

3.1.3. Scenario for Addressing the Intermittency of VRE

- Scenario A: Securing of constant operating reserve by time (applying current the Korean electricity market’s operation rules).

- Scenario B: Changes in operating reserve secured by time for responding to intermittency of VRE (securing of additional operating reserve in proportion to VRE power generation).

- Scenario C: Changes in operating reserve secured by time for responding to intermittency of VRE + separation of upward and downward reserve + participation in securing of VRE downward reserve.

3.2. Analysis of Scenario Results

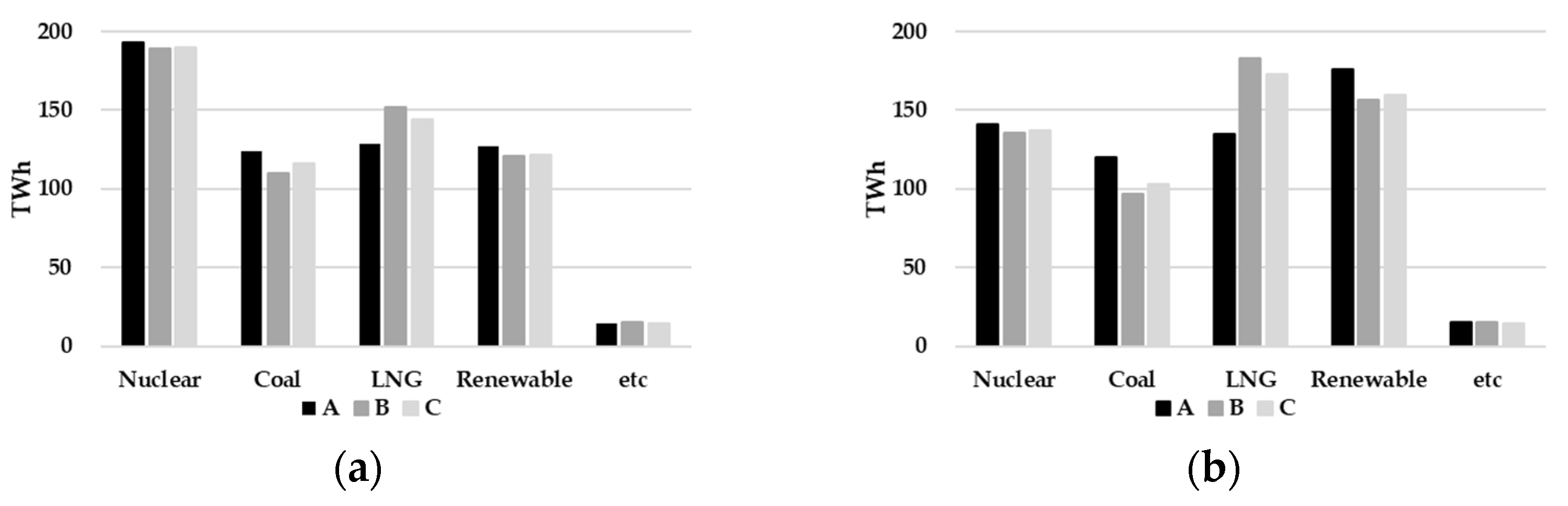

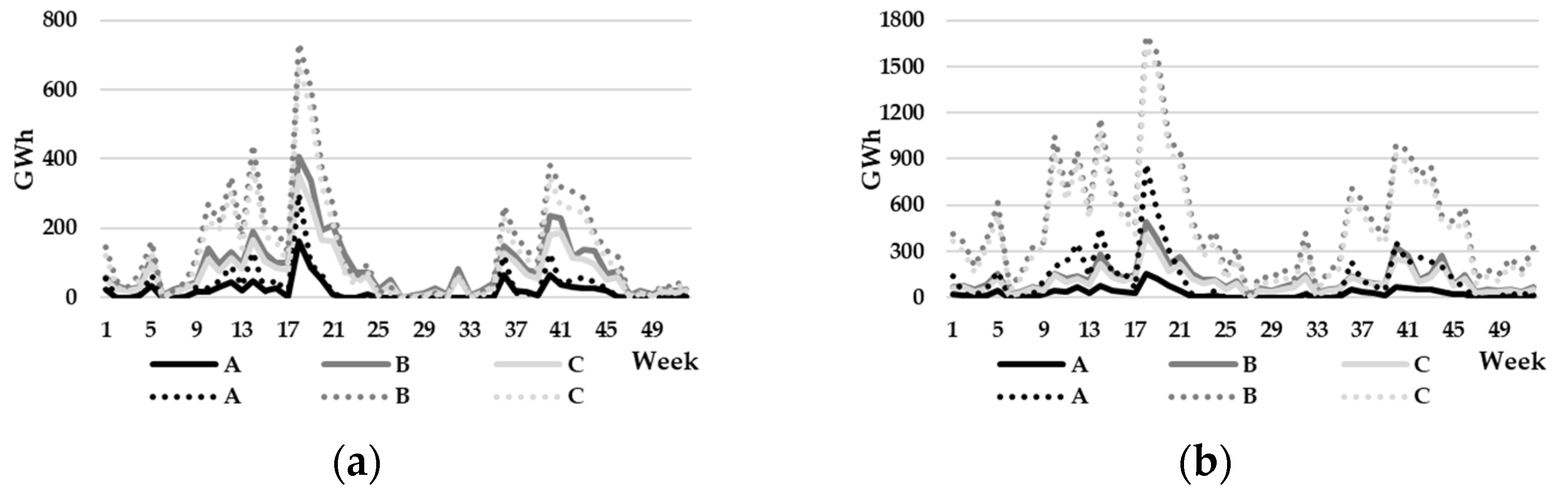

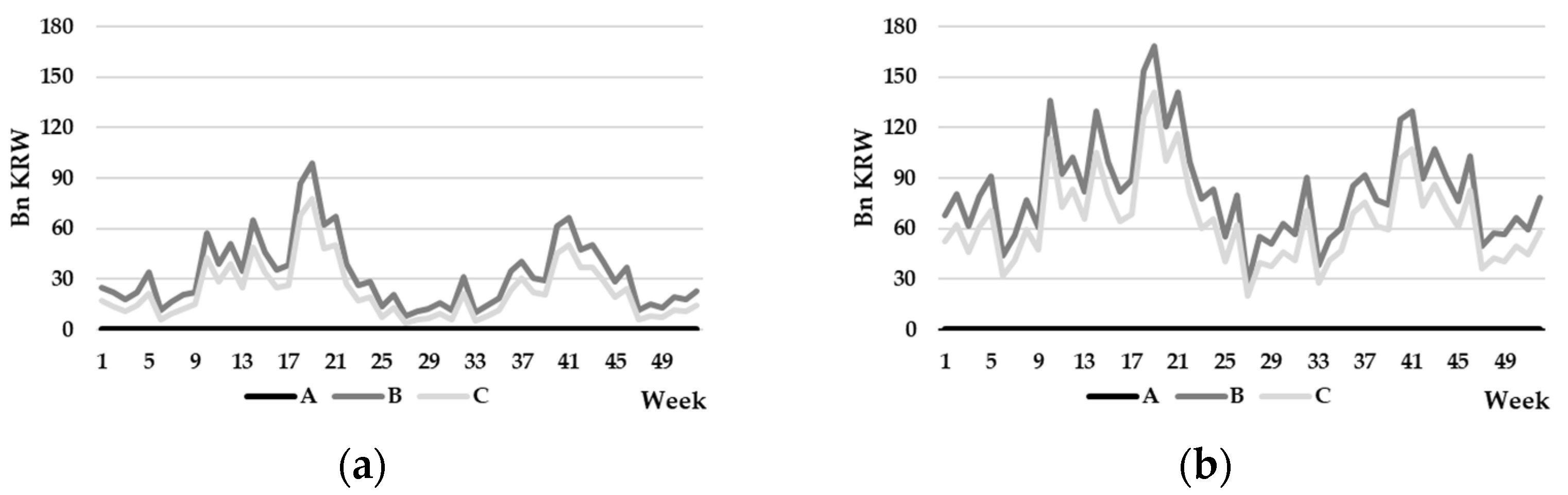

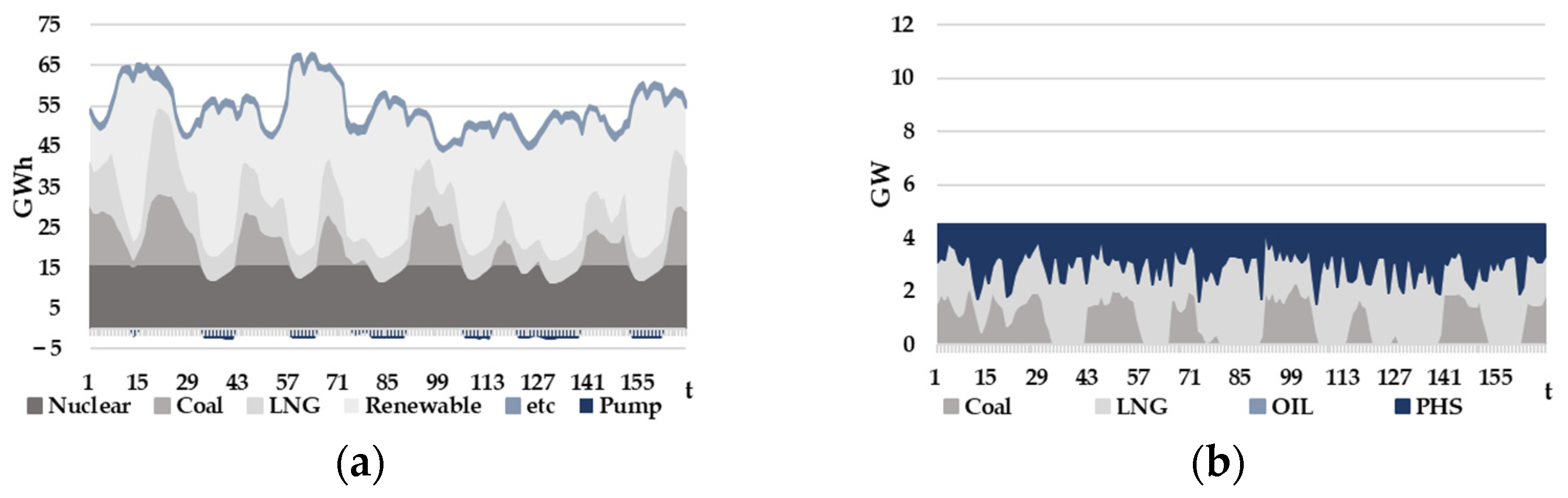

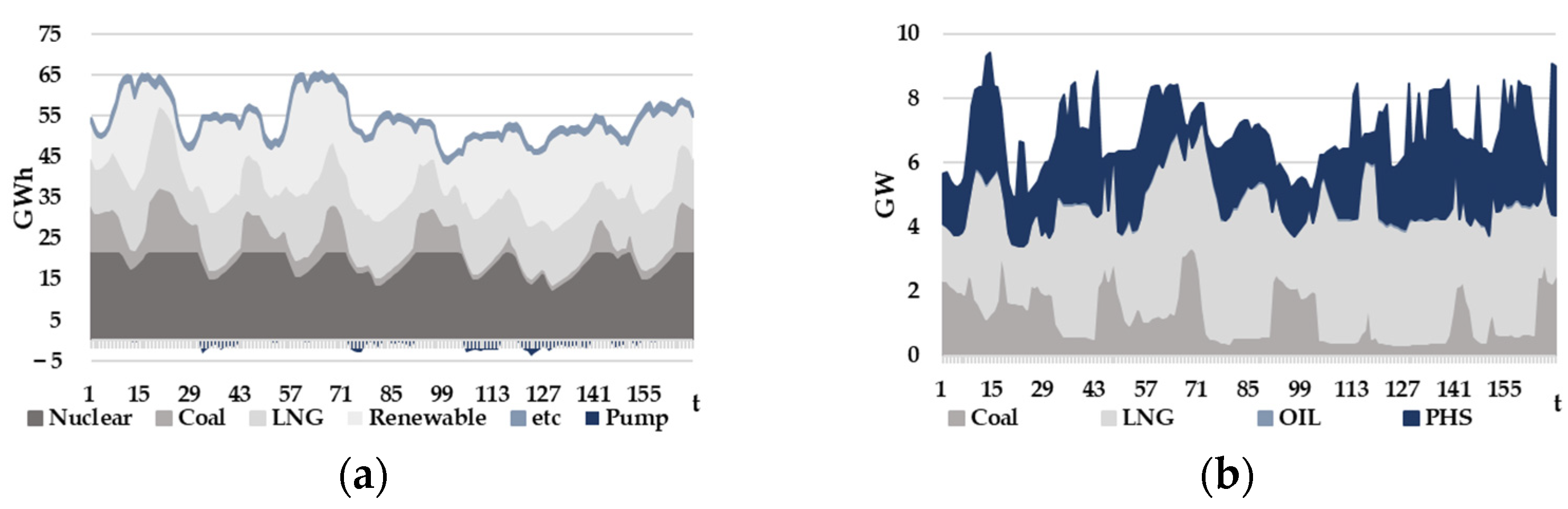

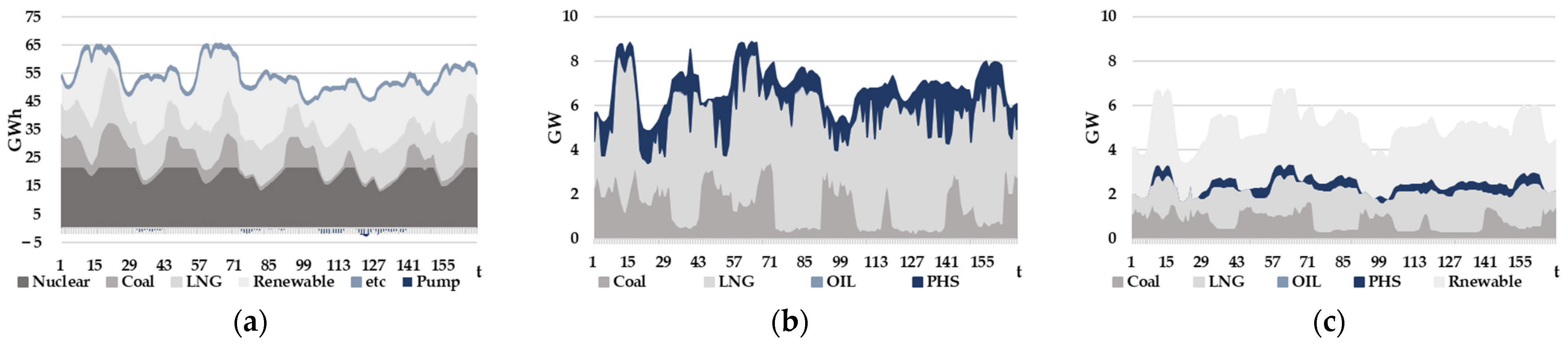

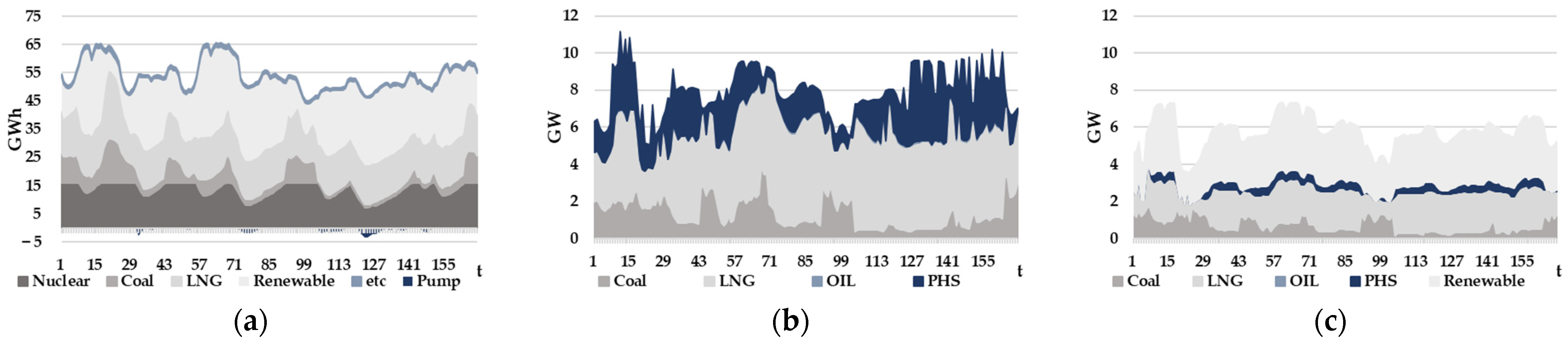

3.2.1. Annual Electricity-Market Operation

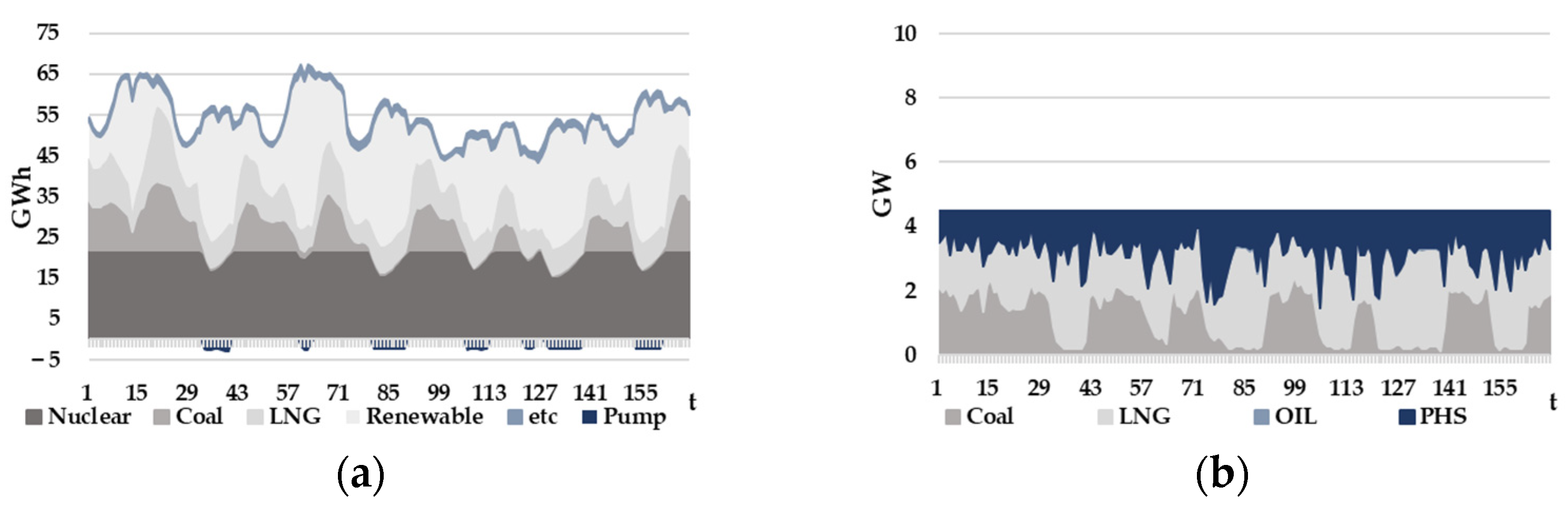

3.2.2. Analysis of Maximum Curtailment Time for VRE

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- United Nations Framework Convention on Climate Change. Paris Agreement. 2015. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement (accessed on 5 January 2023).

- Baharvandi, A.; Aghaei, J.; Niknam, T.; Shafie-Khah, M.; Godina, R.; Nojavan, S. Bundled Generation and Transmission Planning Under Demand and Wind Generation Uncertainty Based on a Combination of Robust and Stochastic Optimization. IEEE Trans. Sustain. Energy 2018, 9, 1477–1486. [Google Scholar] [CrossRef]

- Bird, L.; Milligan, M.; Lew, D. Integrating Variable Renewable Energy: Challenges and Solutions; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2013.

- Saez-Gallego, J.; Morales, J.M.; Maden, H.; Jonsson, T. Determining reserve requirements in DK1 area of Nord Pool using a probabilistic approach. Energy 2014, 74, 682–693. [Google Scholar] [CrossRef]

- Wang, B.; Hobbs, B.F. Real-Time Markets for Flexiramp: A Stochastic Unit Commitment-Based Analysis. IEEE Trans. Power Syst. 2015, 31, 846–860. [Google Scholar] [CrossRef]

- Hirth, L.; Ziegenhagen, I. Balancing power and variable renewables: Three links. Renew. Sustain. Energy Rev. 2015, 50, 1035–1051. [Google Scholar] [CrossRef]

- Korean Ministry of Trade, Industry and Energy. Submission under the Paris Agreement the Republic of Korea’s Enhanced Update of Its First Nationally Determined Contribution. 2021. Available online: https://www.2050cnc.go.kr/base/board/read?boardManagementNo=4&boardNo=100&searchCategory=&page=1&searchType=&searchWord=&menuLevel=2&menuNo=12 (accessed on 12 January 2023).

- Korean Ministry of Trade, Industry and Energy. 10th Basic Plan for Long-term Electricity Supply and Demand. 2023. Available online: https://www.motie.go.kr/motie/ms/nt/announce3/bbs/bbsView.do?bbs_seq_n=68162&bbs_cd_n=6¤tPage=1&search_key_n=&cate_n=&dept_v=&search_val_v=&biz_anc_yn_c= (accessed on 23 January 2023).

- Kim, E.H.; Park, Y.G.; Roh, J.H. Competitiveness of open-cycle gas turbine and its potential in the future Korean electricity market with high renewable energy mix. Energy Policy 2019, 129, 1056–1069. [Google Scholar] [CrossRef]

- Ko, Y.J.; Choi, G.Y.; Lee, S.Y.; Kim, S.S. Economic analysis of pumped hydro storage under Korean governmental expansion plan for renewable energy. In Proceedings of the 6th International Conference on Energy and Environment Research (ICEER), University of Aveiro, Aveiro, Portugal, 22–25 July 2019. [Google Scholar]

- Korea Power Exchange. The Electricity Market Operation Rules. 2023. Available online: https://new.kpx.or.kr/board.es?mid=a10205010000&bid=0030 (accessed on 9 January 2023).

- Ela, E.; Diakov, V.; Ibanez, E.; Heaney, M. Impacts of Variability and Uncertainty in Solar Photovoltaic Generation at Multiple Timescales; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2013.

- KEPCO Economy & Management Research Institute. Power Economics Review. 2019. Available online: https://home.kepco.co.kr/kepco/KR/ntcob/list.do?boardCd=BRD_000271&menuCd=FN3120 (accessed on 3 March 2023).

- Lee, J.Y.; Lee, J.H.; Wi, Y.M. Impact of Revised Time of Use Tariff on Variable Renewable Energy Curtailment on Jeju Island. Electronics 2021, 10, 135. [Google Scholar] [CrossRef]

- Nguyen, T.A.; Byrne, R.H.; Chalamala, B.R.; Gyuk, I. Maximizing the Revenue of Energy Storage Systems in Market Areas Considering Nonlinear Storage Efficiencies. In Proceedings of the 2018 International Symposium on Power Electronics, Electrical Drives, Automation and Motion (SPEEDAM), Amalfi, Italy, 20–22 June 2018. [Google Scholar]

- Choi, G.Y. A Study on Linearization of Unit Commitment for Annual Power Market Simulation. Master’s Thesis, Tech University of Korea, Siheung, Republic of Korea, 2021. Available online: https://library.tukorea.ac.kr/search/i-discovery/1671699?type=biblios-list-view (accessed on 20 February 2023).

- Lee, J.H.; Lee, S.Y.; Lee, K.S. Multistage Stochastic Optimization for Microgrid Operation Under Islanding Uncertainty. IEEE Trans. Smart Grid 2021, 12, 56–66. [Google Scholar] [CrossRef]

- Korea Hydro & Nuclear Power. The Analysis of the Value and Benefits of Pumped Hydro Storage Units According to Changes in the Energy Policy of the New Government; Korea Hydro & Nuclear Power: Gyeongju, Republic of Korea, 2020. [Google Scholar]

| Capacity (MW) | Rules | |

|---|---|---|

| Frequency Control | 700 | response within 5 min maintain output for more than 30 min |

| Primary | 1000 | response within 10 s maintain output for more than 5 min |

| Secondary | 1400 | response within 10 min maintain output for more than 30 min |

| Tertiary | 1400 | response within 30 min |

| Nuclear | Coal | LNG | Oil | PHS | Sum | |

|---|---|---|---|---|---|---|

| Capacity (GW) | 29.0 | 30.8 | 57.0 | 0.71 | 4.7 | 122.2 |

| Ratio (%) | 23.7 | 25.2 | 23.7 | 0.6 | 3.8 | 100 |

| Scenario | A | B | C |

|---|---|---|---|

| 1 | Scenario 1-A | Scenario 1-B | Scenario 1-C |

| 2 | Scenario 2-A | Scenario 2-B | Scenario 2-C |

| Scenario | Nuclear | Coal | LNG | Renewable | |

|---|---|---|---|---|---|

| 1 | B | −1.89 | −11.03 | +18.29 | −4.82 |

| C | −1.41 | −6.33 | +11.95 | −3.82 | |

| 2 | B | −3.57 | −19.51 | +35.68 | −11.26 |

| C | −2.80 | −14.16 | +27.89 | −9.61 | |

| Scenario | Carbon Emission Trading Price (1000 KRW/tCO2eq) | Coal (1000 KRW/MWh) | LNG (1000 KRW/MWh) | Annual Generation Cost (Trillion KRW) | |

|---|---|---|---|---|---|

| 1 | A | 70 | 112.72 | 121.25 | 30.05 |

| B | 72 | 114.36 | 121.99 | 31.75 | |

| C | 71 | 113.45 | 121.62 | 31.23 | |

| 2 | A | 70 | 112.72 | 121.25 | 30.11 |

| B | 77 | 118.46 | 123.86 | 34.44 | |

| C | 75 | 116.82 | 123.12 | 33.52 | |

| Scenario | 1 | 2 | ||||

|---|---|---|---|---|---|---|

| A | B | C | A | B | C | |

| Primary | 8.76 | 14.46 | 14.66 | 8.76 | 16.80 | 17.16 |

| Secondary | 18.40 | 28.00 | 28.35 | 18.40 | 31.95 | 32.55 |

| Tertiary | 12.26 | 15.20 | 15.31 | 12.26 | 16.41 | 16.59 |

| Scenario | 1 | 2 | ||||

|---|---|---|---|---|---|---|

| A | B | C | A | B | C | |

| MAX | 127.0 | 127.93 | 127.91 | 130.1 | 141.5 | 137.6 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 |

| AVG(ALL) | 107.2 | 91.44 | 95.1 | 103.0 | 82.6 | 86.0 |

| AVG(CUT) | 111.0 | 106.33 | 108.1 | 111.4 | 109.7 | 111.1 |

| Scenario | AVG(ALL) (1000 KRW/MWh) | AVG(CUT) (1000 KRW/MWh) | Weekly Generation Cost (Bn KRW) | |

|---|---|---|---|---|

| 1 | A | 74.6 | 101.9 | 287.0 |

| B | 46.5 | 78.9 | 373.7 | |

| C | 53.1 | 85.8 | 354.5 | |

| 2 | A | 68.9 | 106.1 | 272.6 |

| B | 35.9 | 82.6 | 426.4 | |

| C | 41.6 | 90.8 | 399.4 | |

| Scenario | Generation (MWh) | Securing Reserve (MW) | Average Generation Rate (%) | Generators above Min Output (EA) | Generators below Min Output (EA) | |

|---|---|---|---|---|---|---|

| 1 | A | 680 | 205 | 46.48 | 2 | 1 |

| B | 2139 | 612 | 59.68 | 7 | 1 | |

| C | 1804 | Upward 506 Downward 506 | 33.45 | 4 | 7 | |

| 2 | A | 0 | 0 | 0 | 0 | 0 |

| B | 2187 | 625 | 70.00 | 8 | 0 | |

| C | 2664 | Upward 842 Downward 441 | 58.14 | 8 | 2 | |

| Scenario | Generation (MWh) | Securing Reserve (MW) | Average Generation Rate (%) | Generators above Min Output (EA) | Generators below Min Output (EA) | |

|---|---|---|---|---|---|---|

| 1 | A | 7204 | 3338 | 42.20 | 28 | 15 |

| B | 14,772 | 4094 | 51.97 | 48 | 14 | |

| C | 12,996 | Upward 4292 Downward 1853 | 42.71 | 24 | 43 | |

| 2 | A | 6446 | 3331 | 48.41 | 21 | 9 |

| B | 16,609 | 4548 | 52.65 | 53 | 17 | |

| C | 14,343 | Upward 4656 Downward 2184 | 44.68 | 28 | 44 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Do, I.; Lee, S.; Seo, G.-S.; Kim, S. An Analysis of the Effects of Renewable Energy Intermittency on the 2030 Korean Electricity Market. Energies 2023, 16, 4189. https://doi.org/10.3390/en16104189

Do I, Lee S, Seo G-S, Kim S. An Analysis of the Effects of Renewable Energy Intermittency on the 2030 Korean Electricity Market. Energies. 2023; 16(10):4189. https://doi.org/10.3390/en16104189

Chicago/Turabian StyleDo, Insu, Siyoung Lee, Gab-Su Seo, and Sungsoo Kim. 2023. "An Analysis of the Effects of Renewable Energy Intermittency on the 2030 Korean Electricity Market" Energies 16, no. 10: 4189. https://doi.org/10.3390/en16104189