Governance and Performance in Romanian Energy Companies

Abstract

:1. Introduction

2. Literature Review

2.1. Importance of Corporate Governance

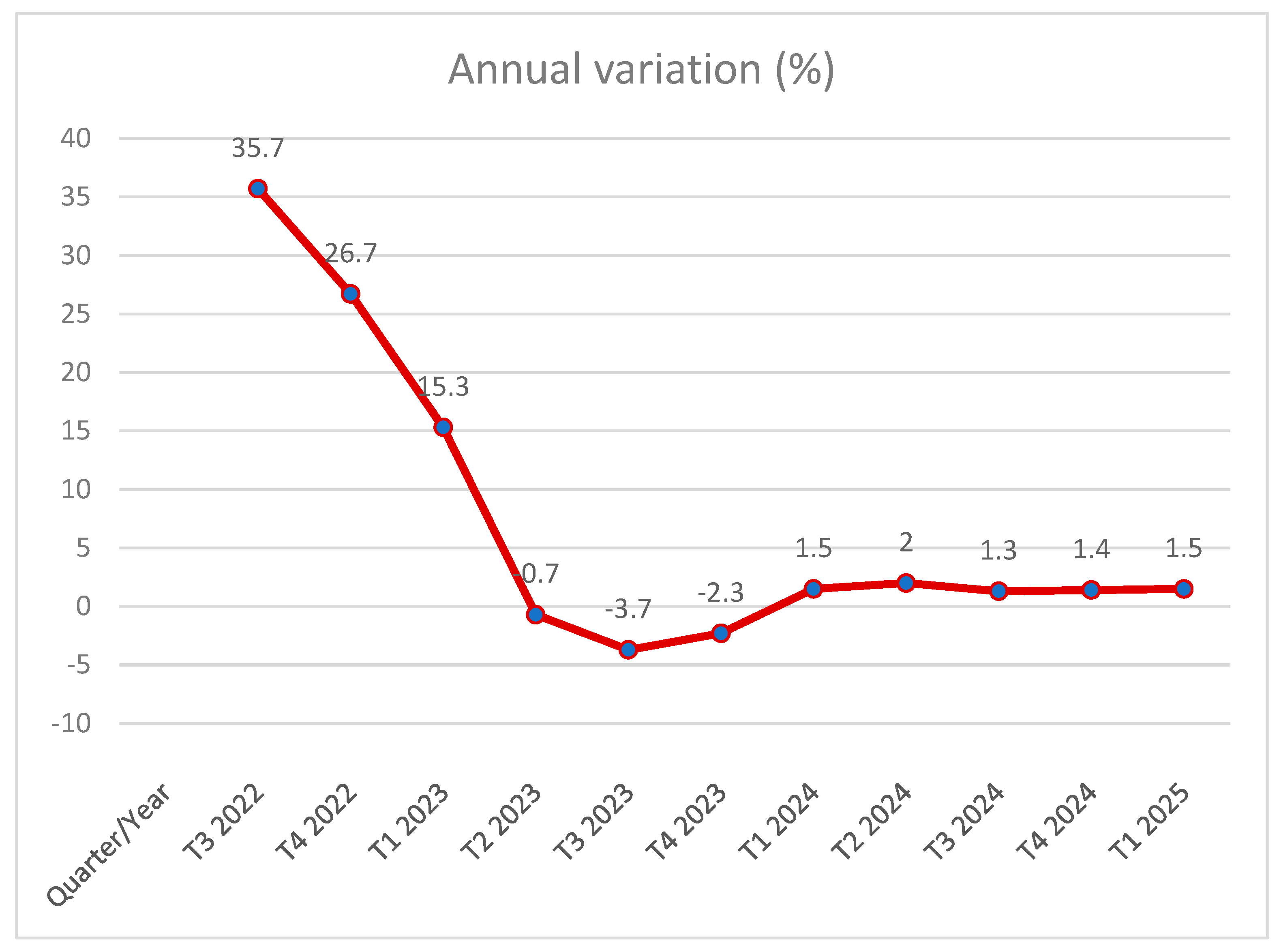

2.2. The Energy Sector

- -

- number of board members (a positive influence) [47];

- -

- the presence of women on the board (a negative influence) [47];

- -

- the higher number of directorships of directors (high tenure affects the fulfilment of duties and independence and weakens corporate governance) [48];

- -

- gender diversity of executives [49]: innovation is negatively affected by the proportion of female executives. Economic innovation is promoted by women in high tax burden areas. Women’s caution in eco-innovation decisions stems from high investment risk. The results of a study performed for listed companies in China’s energy industry demonstrate the importance of CEO–CFO pairing indicators on corporate decision-making and crash risk. It was found that the assignment of a CEO (chief executive officer) and CFO (chief finance officer) of the same gender had a beneficial impact on the long-term share price stability of energy companies [49].

3. Materials and Methods

3.1. Research Materials and Methods according to the Literature

3.2. Sample Selection and Data Collection

3.3. Presentation of the Validation Model

- y is the dependent variable (explained, endogenous, resultant), in the case study represented by the performance (Ca) of the companies analyzed;

- x is the vector of independent variables (explanatory, exogenous), of dimension 1 × p, in the case study represented by the governance index (Ig) obtained using the scoring method;

- α is the vector of coefficients, of dimension p × 1, the parameters of the model;

- ε is a variable, interpreted as an error (disturbance, measurement error).

4. Results

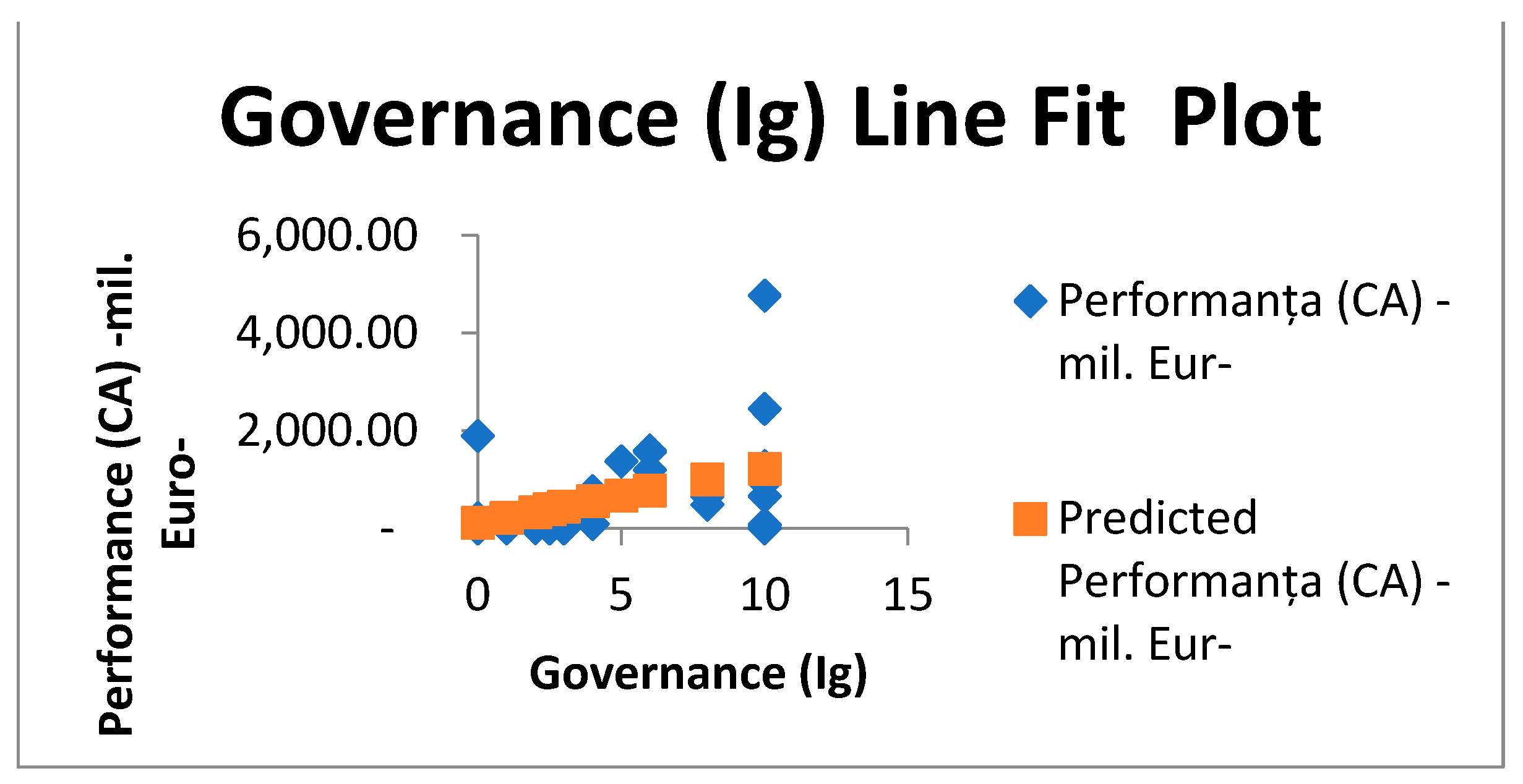

(167.22) (29.28)

- β_0, β_1 are the model parameters (Intercept and Slope parameters);

- i = energy company;

- CAi = performance quantified by the turnover of energy company i;

- Igi = Governance index of energy company i;

- N = population volume.

5. Discussion

- -

- greater transparency in the appointment of board members leads to the selection of the best professionally trained people so that their decisions will also lead to increased financial performance and shareholder value of companies;

- -

- implementation of corporate governance principles regarding the separation of the control function from the executive function leads to a streamlining of the work of the members of the Management Board, the Supervisory Board, the Executive Board, and the Executive Management;

- -

- the functioning of the Nomination Committee and the Remuneration Committee contributes to increasing transparency regarding the appointment and remuneration of the members of the governing bodies, the basic principle being that the payment of directors’ fees should be in line with the financial performance of the companies;

- -

- the establishment of specialized committees, such as the audit committee, helps to streamline corporate decision-making by facilitating communication between those responsible for corporate governance and the external auditor;

- -

- implementing a risk management system makes companies more efficient when control is strengthened by appointing internal auditors;

- -

- the appointment of statutory auditors, together with increased transparency on financial reporting, increases the confidence of current and potential investors in the financial results reported by companies, helping to attract new capital;

- -

- greater transparency of company decisions leads to greater respect for shareholders’ rights, such as the right to be informed, the right to vote, the right to be elected, the right to receive dividends.

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- OECD Principles of Corporate Governance. 1999. Available online: www.oecd.org (accessed on 15 March 2023).

- International Standards on Auditing and Code of Ethics. International Federation of Accountants. 2009. Available online: www.ifac.org (accessed on 15 March 2023).

- Bigioi, A.D. Teoria Generala a Guvernantei Corporative; Editura ASE: Bucharest, Romania, 2015. [Google Scholar]

- Bigioi, A.D. Transparenta Raportarii Financiare, Normele si Profesia Contabila—In Sprijinul Guvernantei Corporative. Ph.D. Thesis, The Bucharest University of Economic Studies, Bucharest, Romania, 2012. [Google Scholar]

- Feleaga, L.; Feleaga, N. Contabilitate Financiara: O Abordare Europeana si Internationala; Editura Economica: Bucharest, Romania, 200; Volume 1, pp. 149–168.

- BNR Forcasts. Available online: https://www.bnr.ro/Proiectii-BNR-4351-Mobile.aspx (accessed on 27 April 2023).

- Electricity & Gas Hit Record Prices in 2022. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/w/DDN-20230426-2 (accessed on 27 April 2023).

- Kubiczek, J.; Derej, W. Financial performance of businesses in the COVID-19 pandemic conditions—Comparative study. Polish J. Manag. Stud. 2021, 24, 183–201. [Google Scholar] [CrossRef]

- Jebran, K.; Chen, S.H. Can we learn lessons from the past? COVID-19 crisis and corporate governance responses. Int. J. Financ. Econ. 2023, 28, 421–429. [Google Scholar] [CrossRef]

- Khatib, S.F.A.; Nour, A. The impact of Corporate Governance on firm performance during the COVID-19 pandemic: Evidence from Malaysia. J. Asian Financ. Econ. Bus. 2021, 8, 943–952. [Google Scholar]

- Hindasah, L.; Akmalia, A. Can Corporate Governance protect firm performance during the COVID-19 pandemic? Qual. Access Success 2023, 24, 174–182. [Google Scholar]

- Dang, V.C.; Nguyen, Q.K. Internal corporate governance and stock price cash risk: Evidence from Vietnam. J. Sustain. Financ. Investig. 2021, 1–18. [Google Scholar] [CrossRef]

- Almustafa, H.; Nguyen, Q.K. The impact of COVID-19 on firm risk and performance in MENA countries: Does national governance quality matter? PLoS ONE 2023, 18, e0281148. [Google Scholar] [CrossRef]

- Wieczorek-Kosmala, M.; Henschel, T. The role of ERM and corporate governance in managing COVID-19 impacts: SMEs perspective. J. Risk Financ. Manag. 2022, 15, 587. [Google Scholar] [CrossRef]

- Rhode, D.; Packel, A.K. Diversity on corporate boards: How much difference does difference make? Del. J. Corp. Law 2014, 39, 377–426. [Google Scholar] [CrossRef] [Green Version]

- Sarhan, A.A.; Ntim, C.G.; Al-Najjar, B. Board diversity, corporate governance, corporate performance, and executive pay. Int. J. Financ. Econ. 2019, 24, 761–786. [Google Scholar] [CrossRef]

- Al-rahahleh, A.S. Corporate governance quality, board gender diversity and corporate dividend policy: Evidence from Jordan. Australas. Account. Bus. Financ. J. 2017, 11, 86–104. [Google Scholar] [CrossRef] [Green Version]

- Dionne, G.; Triki, T. Risk management and corporate governance: The importance of independence and financial knowledge for the Board and the Audit Committee. Risk Manag. Insur. Rev. 2019, 22, 247–277. [Google Scholar] [CrossRef]

- Melon-Izco, A.; Ruiz-Cabestre, F.J.; Ruiz-olalla, C. Determinants of good governance practices: The role of board independence. Span. J. Financ. Account.-Rev. Esp. Financ. Contab. 2020, 49, 370–393. [Google Scholar] [CrossRef]

- Karim, S.; Manab, N.A. Assessing the Governance Mechanism, Corporate Social Responsibility and Performance: The moderating effect of Board Independence. Glob. Bus. Rev. 2020, 0972150920917773. [Google Scholar] [CrossRef]

- Dos Santos, J.M.P. Financial knowledge for corporate boards: What should board members know? Indep. J. Manag. Prod. 2021, 12, 265–281. [Google Scholar] [CrossRef]

- Filipovic, M. Research on the relationship between governance structures and external audit in Corporate Governance. Ekon. Pregl. 2021, 72, 522–549. [Google Scholar]

- Serra, S.; Lemos, K. The influence of corporate governance and audit in risk discosure. Rev. Evid. Contab. Financ. 2020, 8, 106–124. [Google Scholar] [CrossRef]

- Cho, C.C.; Wu, C.H. Role of auditor in agency conflict and corporate governance. Empirical analyses of Taiwanese firms. Chin. Manag. Stud. 2014, 8, 333–353. [Google Scholar] [CrossRef]

- Chen, G.; Firth, M.; Gao, N.D.; Rui, O.M. Do ownership Structure and Governance Mechanism Have an Effect on Corporate Fraud in China’s Listed Firms? 2005. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=728945 (accessed on 10 April 2023).

- Lappalainen, J.; Niskanen, M. Financial Performance of SMEs-Evidence on the Impact of Ownership Structure and Board Composition. 2009. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1500853 (accessed on 10 April 2023).

- Castaner, X.; Goranova, M.; Hermes, N. Ownership and corporate governance across institutional contexts. Corp. Gov. Int. Rev. 2022, 30, 638–655. [Google Scholar] [CrossRef]

- Batra, S.; Saini, M.; Yadav, M. Mapping the intellectual structure of corporate governance and ownership structure: A bibliometric analysis. Int. J. Law Manag. 2023, 65, 333–353. [Google Scholar] [CrossRef]

- Lu, L.W. The moderating effect of corporate governance on the relationship between corporate sustainability performance and corporate financial performance. Int. J. Discl. Gov. 2021, 18, 193–206. [Google Scholar] [CrossRef]

- Nguyen, N.P.A.; Dao, T.T.B. Liquidity, corporate governance performance: A meta-analysis. Cogent Bus. Manag. 2022, 9, 2137960. [Google Scholar] [CrossRef]

- Neralla, N.G. Can corporate governance structure effect on corporate performance: An empirical investigation from Indian companies. Int. J. Discl. Gov. 2022, 19, 282–300. [Google Scholar] [CrossRef]

- Hapsari, D.W.; Yadiati, W.; Suharman, H.; Rosdini, D. The mediating impact of value chain in the link between corporate governance and SOEs performance. Australas. Account. Bus. Financ. J. 2023, 17, 75–85. [Google Scholar] [CrossRef]

- Hermanto, Y.B.; Lusy, L.; Widyastuti, M. How financial performance and state-owned enterprise (SOE) values are affected by Good Corporate Governance and intellectual capital perspective. Economies 2021, 9, 134. [Google Scholar] [CrossRef]

- Abang’a, A.O.; Tauringana, V.; Wang’ombe, D.; Achiro, L.O. Corporate governance and financial performance of state-owned enterprises in Kenya. Corp. Gov. Int. J. Bus. Soc. 2022, 22, 798–820. [Google Scholar] [CrossRef]

- Csedo, Z.; Magyari, J.; Zavarko, M. Dynamic Corporate Governance, Innovation, and Sustainability: Post-COVID Period. Sustainability 2022, 14, 3189. [Google Scholar] [CrossRef]

- Alrazi, B.; Husin, N.M. Institutional Governance Framework for Determining Carbon-related Accounting Practices: An Exploratory Study of Electricity Generating Companies in Malaysia. In Proceedings of the IOP Conference Series: Earth and Environmental Science, Kuala Lumpur, Malaysia, 23–25 February 2016. [Google Scholar]

- Milojevic, M.; Urbanski, M.; Terzic, I.; Prasolov, V. Impact of Non-Financial Factors on the Effectiveness of Audits in Energy Companies. Energies 2020, 13, 6212. [Google Scholar] [CrossRef]

- Fakoya, M.B.; Nakeng, M.V. Board characteristics and sustainable energy performance of selected companies in South Africa. Sustain. Prod. Consum. 2019, 18, 190–199. [Google Scholar] [CrossRef]

- Zhang, D.Y.; Zhang, Z.W.; Ji, Q.; Lucey, B.; Liu, J. Board characteristics, external governance and the use of renewable energy: International evidence. J. Int. Financ. Mark. Inst. Money 2021, 7, 101317. [Google Scholar] [CrossRef]

- Alhawaj, A.; Buallay, A.; Abdallah, W. Sustainability reporting and energy sectorial performance: Developed and emerging economies. Int. J. Energy Sect. Manag. 2022, 17, 739–760. [Google Scholar] [CrossRef]

- Liu, P.D.; Zhu, B.Y.; Yang, M.Y.; Chu, X. ESG and financial performance: A qualitative comparative analysis in China’s new energy companies. J. Clean. Prod. 2022, 379, 134721. [Google Scholar] [CrossRef]

- Hurduzeu, G.; Noja, G.G.; Cristea, M.; Dracea, R.M.; Filip, R.I. Revisiting the impact of ESG practices on firm financial performance in the energy sector: New empirical evidence. Econ. Comput. Econ. Cybern. Stud. Res. 2022, 56, 37–53. [Google Scholar]

- Zheng, S.N.; He, C.H.; Hsu, S.C.; Sarkis, J.; Chen, J.H. Corporate environmental performance prediction in China: An empirical study of energy service companies. J. Clean. Prod. 2020, 266, 121395. [Google Scholar] [CrossRef]

- Robaina, M.; Madaleno, M. The relationship between emissions reduction and financial performance: Are Portuguese companies in a sustainable development path? Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1876. [Google Scholar] [CrossRef]

- Szczepankiewicz, E.I.; Blazynska, J.; Zaleska, B.; Ullah, F.; Loopesko, W.E. Compliance with Corporate Governance Principles by Energy Companies Compared with All Companies Listed on the Warsaw Stock Exchange. Energies 2022, 15, 6481. [Google Scholar] [CrossRef]

- Wahyuningrum, I.F.S.; Budihardjo, M.A. Relationship between Company Financial Performance, Characteristic and Environmental Disclosure of ASX Listed Companies. In Proceedings of the 3rd International Conference on Energy, Environmental and Information System (ICENIS 2018), Semarang, Indonesia, 14–15 August 2018; Volume 73, p. 10024. [Google Scholar]

- Georgakopoulos, G.; Toudas, K.; Poutos, E.I.; Kounadeas, T.; Tsavalias, S. Capital Structure, Corporate Governance, Equity Ownership and Their Impact on Firms’ -Profitability and Effectiveness in the Energy Sector. Energies 2022, 15, 3625. [Google Scholar] [CrossRef]

- Aljaaidi, K.S. Economic value of energy and petrochemical companies and multiple directorships: Evidence from Saudi Arabia. AD-Minist. 2022, 41, 149–166. [Google Scholar] [CrossRef]

- Gong, X.; Lin, A.L.; Chen, X.Q. CEO-CFO gender congruence and stock price crash risk in energy companies. Econ. Anal. Policy 2022, 75, 591–609. [Google Scholar] [CrossRef]

- Ma, Z.; Shu, G.; Wang, Q.; Wang, L.F. Sustainable Governance and Green Innovation: A Perspective from Gender Diversity in China’s Listed Companies. Sustainability 2022, 14, 6403. [Google Scholar] [CrossRef]

- Bashindzhagyan, A.; Kharchilava, K.; Belyayeva, I. Influence of Corporate Governance on Financial Performance Of Russian State-Owned Companies. In Proceedings of the Global Challenges and Prospects of the Modern Economic Development, Samara, Russia, 6–8 December 2018. [Google Scholar]

- Grabinska, B.; Kedzior, M.; Kedzior, D.; Grabinski, K. The Impact of Corporate Governance on the Capital Structure of Companies from the Energy Industry. The Case of Poland. Energies 2021, 14, 7412. [Google Scholar] [CrossRef]

- Shaikh, I. Environmental, social and governance (ESG) practice and firm performance: An international evidence. J. Bus. Econ. Manag. 2022, 23, 218–237. [Google Scholar] [CrossRef]

- Constantinescu, D.; Mititean, P. Association of ESG factors’ disclosure with the value of European companies from energy industry. In Proceedings of the 8th International Scientific Conference IFRS: Global rules and local use-beyond the numbers, Prague, Czech Republic, 8–9 October 2020. [Google Scholar]

- Malanski, L.K. Vertical integration and corporate governance over electricity sector companies’profitability. Rev. Gest. E Secr. GESEC 2022, 13, 1711–1729. [Google Scholar] [CrossRef]

- Paun, D. Sustainability and Financial Performance of Companies in the Energy Sector in Romania. Sustainability 2017, 9, 1722. [Google Scholar] [CrossRef] [Green Version]

- Matei, F.B.; Boboc, C.; Ghita, S. The relationship between corporate social responsibility and financial performance in Romanian companies. Econ. Comput. Econ. Cybern. Stud. Res. 2021, 55, 297–314. [Google Scholar]

- Bigioi, A.D.; Bigioi, C.E. Study on corporate governance at Romanian banking institutions. Manag. Strateg. J. 2018, 41, 90–97. [Google Scholar]

- Bigioi, A.D.; Bigioi, C.E. Harmonization of national rules with the new international recommendations on corporate governance. Case study from insurance company in Romania. Manag. Strateg. J. 2017, 34, 105–113. [Google Scholar]

- Arora, A.; Bodhanwala, S. Relationship between corporate governance index and firm performance: Indian evidence. Glob. Bus. Rev. 2017, 19, 675–689. [Google Scholar] [CrossRef]

- Korent, D.; Dundek, I.; Calopa, M.K. Corporate governance practices and firm performance measured by Croatian Corporate Governance Index (CCGI®). Econ. Res. Ekon. Istraz. 2014, 27, 221–231. [Google Scholar] [CrossRef]

- Ling, L.; Jong, L.; Law, W.; Chieng, F. Family director board governance index: An analysis of family directors and firm performance in Malaysia. J. Gen. Manag. 2023. [Google Scholar] [CrossRef]

- Shaukat, A.; Trojanowski, G. Board governance and corporate performance. J. Bus. Financ. Account. 2018, 45, 184–208. [Google Scholar] [CrossRef] [Green Version]

- Al-ahdal, W.M.; Alsamhi, M.H.; Tabash, M.I.; Farhan, N.H. The impact of corporate governcane on financial performance of Indian and GCC listed firms: An empirical investigation. Res. Int. Bus. Financ. 2020, 51, 101083. [Google Scholar] [CrossRef]

- Dos Santos Sant’Ana, N.L.; Pires Sant’Ana, P.C. Corporate governance index and its relationship to market value. Rev. Gest. Tecnol. 2021, 21, 49–75. [Google Scholar]

- Dos Santos, T.A.; de Souza, A.A.; Pessanha, G.R.G. Corporate governance index for companies in the Brasilian stock market. Rev. Gest. Financ. Contab. 2019, 9, 72–92. [Google Scholar]

- Mansour, M.; Hashim, H.A.; Salleh, Z.; Al-ahdal, W.M.; Almaqtari, F.A.; Qamhan, M.A. Governance practices and corporate performance: Assessing the competence of principal-based guidelines. Cogent Bus. Manag. 2022, 9, 2105570. [Google Scholar] [CrossRef]

- Information about Legal Persons. Romanian Ministry of Finance. Available online: www.mfinante.gov.ro (accessed on 10 April 2023).

| Period of Analysis | Number of Companies/Country | Performance Measured as | Index Structure | Conclusion | Study |

|---|---|---|---|---|---|

| 2009–2014 | 407/India | return on net worth return on assets | board structure, ownership structure; market for corporate control; product market competition | Positive relation with performance | [60] |

| 2007–2009 | Croatia | Tobin’s Q | transparency of the business; relations with shareholders; the board of directors; the supervisory board; internal audit and control; | Strong relation with performance | [61] |

| 2016–2020 | 221/Malaysia | ROE EBIT | ratio of family directors on board equals to or exceed those of independent directors; the appointment of family women directors; family director as the board chairman family CEO duality | Negative relation with performance | [62] |

| 1999–2008 | 2212/UK | ROA ROE ROIC Tobin’s Q | percentage of NEDs on the board; majority of NEDs independent; presence of remuneration committee; presence of audit committee; presence of nomination committee; at least half of audit committee members are independent; independent NED chairing audit committee | Positive relation with performance | [63] |

| 2009–2016 | 53/India and 53/Gulf Corporate Council countries | ROE Tobin’s Q |

board accountability index; audit committee index; transparency disclosure index | Board accountability and audit committee have an insignificant impact on firms’ performances | [64] |

| 2010–2017 | 26/Brazil | Market value | composition of the board of directors ownership and control structure compensation to managers; protection of minority shareholders transparency; and quality of the independent audit | Positive relation with performance | [65] |

| 2010–2016 | 116/Brazil | (i) ownership and control structure; (ii) information disclosure and transparency; (iii) composition of the board of directors; (iv) management incentives; (v) shareholder rights | Composition of the board of director was the one with the greatest weight in the composition of the governance index. | [66] | |

| 2009–2016 | 84/Jordan | Market share | disclosure and transparency; board effectiveness and composition; shareholders’ rights | Firms with better overall corporate governance have better performance | [67] |

| Test Number | Description of the Question | Score |

|---|---|---|

| T1 | Does the company publish a governance code? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T2 | Does the company publish policies to combat conflicts of interest? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T3 | Does the Management Board consist of at least five members? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T4 | Are there independent board members? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T5 | Does the company disclose information about any relationship with a shareholder who directly or indirectly owns shares representing more than 5% of all voting rights? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T6 | Does the company publish information on the existence of a secretary on the Board responsible for supporting the work of the Board? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T7 | Is there information on the evaluation of members of the Management Board? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T8 | Does the company publish information about the number of board meetings? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T9 | Does the corporate governance statement include information on the exact number of independent members? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T10 | Does the company publish information on the existence of Nomination Committees? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T11 | Does the company publish information on the existence of Audit Committees? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T12 | Is the chairman of the Audit Committee an independent non-executive member? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T13 | Does the Audit Committee review the internal control system annually? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T14 | Does the company publish internal audit information? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T15 | Does the Audit Committee assess conflicts of interest in relation to transactions of the company and its subsidiaries with related parties? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T16 | Does the Audit Committee assess the effectiveness of the internal control system and the risk management system? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T17 | Does the Audit Committee monitor the application of internal audit standards? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T18 | Does the company publish information on audit committee reports to management? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T19 | Does the company publish policies on equal treatment of shareholders? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T20 | Does the company publish policies on transactions with shareholders holding more than 5% of the share capital? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T21 | Does the company publish information on the outsourcing of internal audit? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T22 | Does the Internal Audit Department report functionally to the Board through the Audit Committee? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T23 | Does the company publish information on the remuneration policy for members of the governing bodies? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T24 | Does the company publish an investor relations section on its website? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T25 | Does the company publish its updated Articles of Association on its website? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T26 | Are the professional CVs of the members of the governing bodies published on the website? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T27 | Are current financial reports and regular reports (quarterly, half yearly, and annual) published on the website? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T28 | Does the company publish information on general meetings of shareholders on its website? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T29 | Does the company publish information on dividend payments? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T30 | Does the company publish on the website the contact details of a person to provide information on request? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T31 | Does the company publish information on the statutory auditor’s reports? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T32 | Does the company publish information on its dividend distribution policy? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T33 | Does the company publish information on revenue and expenditure forecasts? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T34 | Does the company’s management respect the right of shareholders to attend general meetings? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T35 | Do the external auditors attend the general meeting of shareholders? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T36 | Does the Board of Directors provide shareholders with a brief assessment of the internal control and significant risk management systems? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T37 | Can journalists attend general meetings of shareholders? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T38 | Do the quarterly and half yearly financial reports include information in both Romanian and English? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T39 | Does the company hold press conferences to present its financial results? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| T40 | Does the company publish information on social responsibility? | If the answer is “YES”, score = 0.25, otherwise the score is 0 |

| Company | Governance (Ig) | Performance (CA) -Mil. Euro- |

|---|---|---|

| C1 | 0 | 1.83 |

| C2 | 0 | 4.82 |

| C4 | 0 | 13.12 |

| C5 | 0 | 126.67 |

| C7 | 0 | 4.48 |

| C8 | 0 | 42.34 |

| C9 | 0 | 2.37 |

| C10 | 0 | 0.26 |

| C12 | 0 | 13.65 |

| C15 | 0 | 60.29 |

| C18 | 0 | 215.19 |

| C20 | 0 | 7.99 |

| C21 | 0 | 1894.11 |

| C22 | 0 | 12.54 |

| C24 | 0 | 3.83 |

| C25 | 0 | 39.13 |

| C31 | 0 | 8.88 |

| C33 | 0 | 2.20 |

| C27 | 1 | 1.16 |

| C32 | 2 | 6.18 |

| C14 | 2.5 | 2.58 |

| C28 | 3 | 4.85 |

| C41 | 3 | 216.29 |

| C26 | 4 | 721.15 |

| C29 | 4 | 95.95 |

| C42 | 4 | 766.36 |

| C36 | 5 | 1378.70 |

| C11 | 6 | 1201.22 |

| C19 | 6 | 1571.10 |

| C43 | 6 | 1599.26 |

| C6 | 8 | 489.51 |

| C16 | 8 | 654.97 |

| C17 | 8 | 677.02 |

| C3 | 10.00 | 666.53 |

| C13 | 10 | 68.86 |

| C23 | 10 | 934.52 |

| C30 | 10 | 82.98 |

| C34 | 10 | 662.50 |

| C35 | 10 | 1280.37 |

| C37 | 10 | 11.96 |

| C38 | 10 | 1157.05 |

| C39 | 10 | 4766.70 |

| C40 | 10 | 2455.41 |

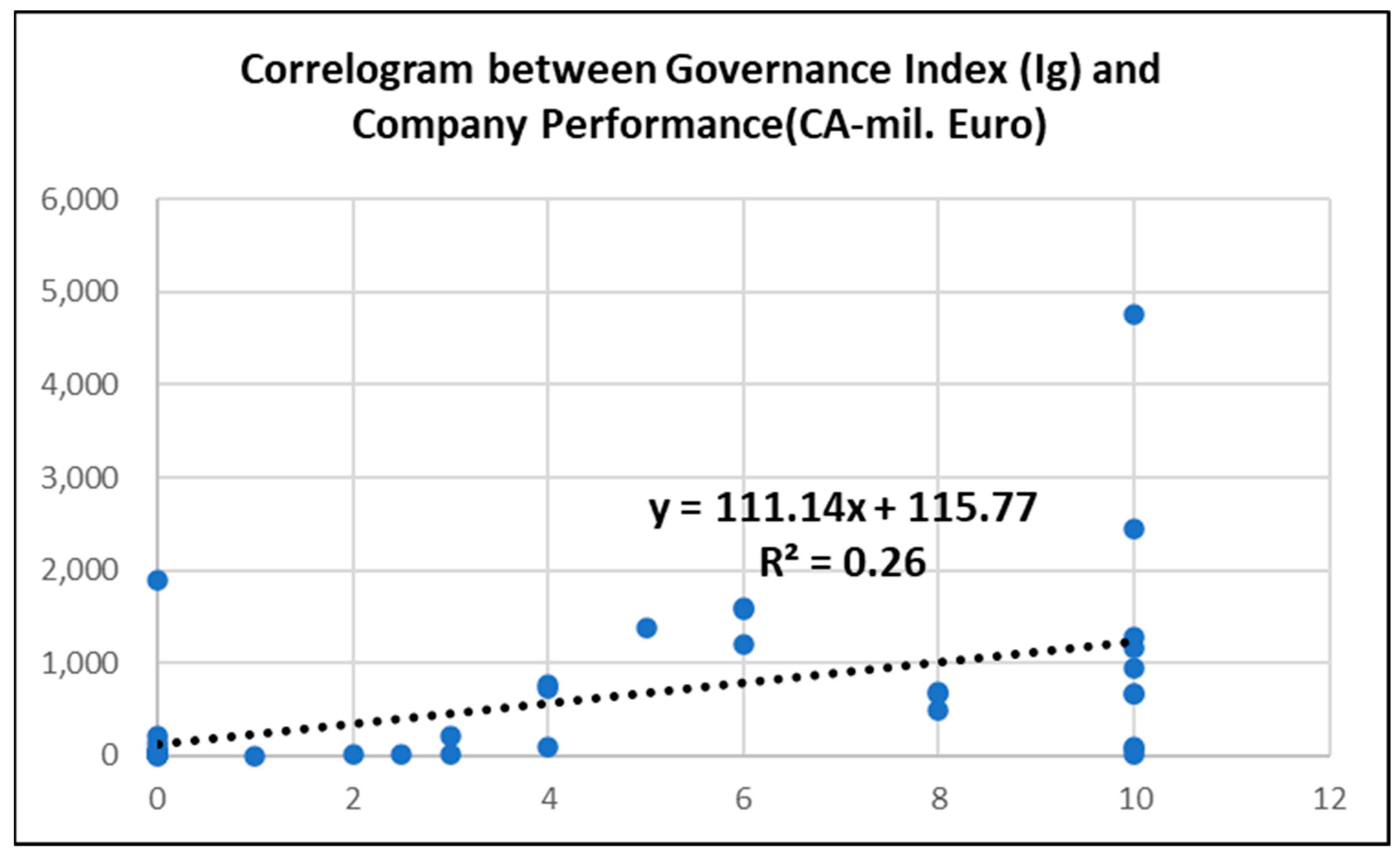

| Regression Statistics | |

|---|---|

| Multiple R | 0.510 |

| R Square | 0.260 |

| Adjusted R Square | 0.242 |

| Standard Error | 789.119 |

| Observations | 43 |

| df | SS | MS | F | Significance F | |

|---|---|---|---|---|---|

| Regression | 1 | 8,969,718.298 | 8,969,718.298 | 14.40436752 | 0.000478229 |

| Residual | 41 | 25,531,037.7 | 622,708.2366 | ||

| Total | 42 | 34,500,756 |

| Coefficients | Standard Error | t Stat | p-Value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | |

|---|---|---|---|---|---|---|---|---|

| Intercept | 115.7653 | 167.2220 | 0.6923 | 0.49266 | −221.9464 | 453.4769 | −221.9464 | 453.4769 |

| Governance (Ig) | 111.1378 | 29.2830 | 3.7953 | 0.00048 | 51.9997 | 170.2760 | 51.9997 | 170.2760 |

| Observation | Predicted Performance (CA) -Mil. Euro- | Residuals | Standard Residuals |

|---|---|---|---|

| 1 | 115.765261 | −113.93289 | −0.146130053 |

| 2 | 115.765261 | −110.9436 | −0.142295993 |

| 3 | 115.765261 | −102.64588 | −0.131653356 |

| 4 | 115.765261 | 10.909086 | 0.013991967 |

| 5 | 115.765261 | −111.28643 | −0.142735702 |

| 6 | 115.765261 | −73.42977 | −0.094180844 |

| 7 | 115.765261 | −113.39561 | −0.145440933 |

| 8 | 115.765261 | −115.50222 | −0.148142864 |

| 9 | 115.765261 | −102.11388 | −0.130971013 |

| 10 | 115.765261 | −55.470699 | −0.071146584 |

| 11 | 115.765261 | 99.429208 | 0.12752766 |

| 12 | 115.765261 | −107.77722 | −0.138234805 |

| 13 | 115.765261 | 1778.3479 | 2.280904729 |

| 14 | 115.765261 | −103.22537 | −0.132396611 |

| 15 | 115.765261 | −111.93315 | −0.143565187 |

| 16 | 115.765261 | −76.634376 | −0.098291064 |

| 17 | 115.765261 | −106.88319 | −0.137088122 |

| 18 | 115.765261 | −113.56748 | −0.145661371 |

| 19 | 226.9031069 | −225.74008 | −0.289533674 |

| 20 | 338.0409528 | −331.85871 | −0.425641177 |

| 21 | 393.6098758 | −391.03336 | −0.50153844 |

| 22 | 449.1787987 | −444.32406 | −0.569888961 |

| 23 | 449.1787987 | −232.88435 | −0.298696905 |

| 24 | 560.3166447 | 160.83067 | 0.20628103 |

| 25 | 560.3166447 | −464.36883 | −0.595598329 |

| 26 | 560.3166447 | 206.047 | 0.264275377 |

| 27 | 671.4544906 | 707.24797 | 0.907114523 |

| 28 | 782.5923365 | 418.62893 | 0.536932441 |

| 29 | 782.5923365 | 788.50678 | 1.011336882 |

| 30 | 782.5923365 | 816.66742 | 1.047455651 |

| 31 | 1004.868028 | −515.35509 | −0.660993178 |

| 32 | 1004.868028 | −349.90275 | −0.44878442 |

| 33 | 1004.868028 | −327.84737 | −0.420496244 |

| 34 | 1227.14372 | −560.61553 | −0.71904411 |

| 35 | 1227.14372 | −1158.2797 | −1.485606768 |

| 36 | 1227.14372 | −292.62162 | −0.375315778 |

| 37 | 1227.14372 | −1144.1595 | −1.467496224 |

| 38 | 1227.14372 | −564.64827 | −0.724216499 |

| 39 | 1227.14372 | 53.224597 | 0.068265739 |

| 40 | 1227.14372 | −1215.1867 | −1.558595541 |

| 41 | 1227.14372 | −70.090776 | −0.089898259 |

| 42 | 1227.14372 | 3539.552 | 4.539820825 |

| 43 | 1227.14372 | 1228.2669 | 1.575372183 |

| Percentile | Performance (CA) -Mil. Euro- |

|---|---|

| 1.1627907 | 0.263043 |

| 3.4883721 | 1.16303 |

| 5.8139535 | 1.832367 |

| 8.1395349 | 2.197783 |

| 10.465116 | 2.369651 |

| 12.790698 | 2.576513 |

| 15.116279 | 3.83211 |

| 17.44186 | 4.478833 |

| 19.767442 | 4.82166 |

| 22.093023 | 4.854736 |

| 24.418605 | 6.182241 |

| 26.744186 | 7.988037 |

| 29.069767 | 8.882069 |

| 31.395349 | 11.95699 |

| 33.72093 | 12.53989 |

| 36.046512 | 13.11938 |

| 38.372093 | 13.65138 |

| 40.697674 | 39.13089 |

| 43.023256 | 42.33549 |

| 45.348837 | 60.29456 |

| 47.674419 | 68.86399 |

| 50 | 82.98419 |

| 52.325581 | 95.94782 |

| 54.651163 | 126.6743 |

| 56.976744 | 215.1945 |

| 59.302326 | 216.2944 |

| 61.627907 | 489.5129 |

| 63.953488 | 654.9653 |

| 66.27907 | 662.4954 |

| 68.604651 | 666.5282 |

| 70.930233 | 677.0207 |

| 73.255814 | 721.1473 |

| 75.581395 | 766.3636 |

| 77.906977 | 934.5221 |

| 80.232558 | 1157.053 |

| 82.55814 | 1201.221 |

| 84.883721 | 1280.368 |

| 87.209302 | 1378.702 |

| 89.534884 | 1571.099 |

| 91.860465 | 1599.26 |

| 94.186047 | 1894.113 |

| 96.511628 | 2455.411 |

| 98.837209 | 4766.696 |

| Performance_CA | Governance_Ig | ||

|---|---|---|---|

| Pearson Correlation | Performance_CA | 1.000 | 0.510 |

| Governance_Ig | 0.510 | 1.000 | |

| Sig. (1-tailed) | Performance_CA | 0.000 | |

| Governance_Ig | 0.000 | ||

| N | Performance_CA | 43 | 43 |

| Governance_Ig | 43 | 43 | |

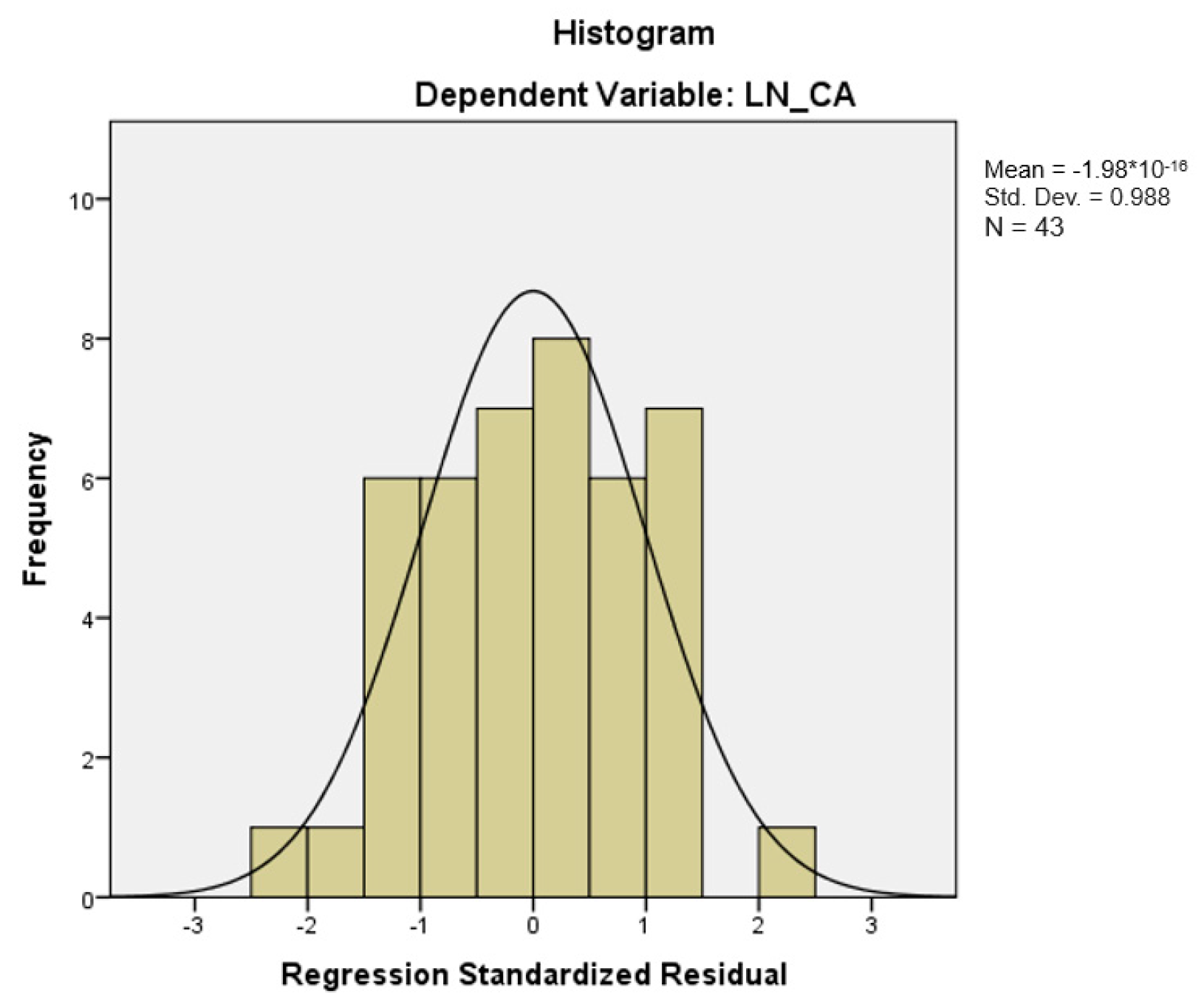

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 127.248 | 1 | 127.248 | 31.682 | 0.0000015 b |

| Residual | 164.673 | 41 | 4.016 | |||

| Total | 291.921 | 42 | ||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 2.618 | 0.425 | 6.165 | 0.0000003 | |

| Ig | 0.419 | 0.074 | 0.660 | 5.629 | 0.0000015 | |

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

|---|---|---|---|---|---|

| 1 | 0.660 a | 0.436 | 0.422 | 2.00410 | 1.417 |

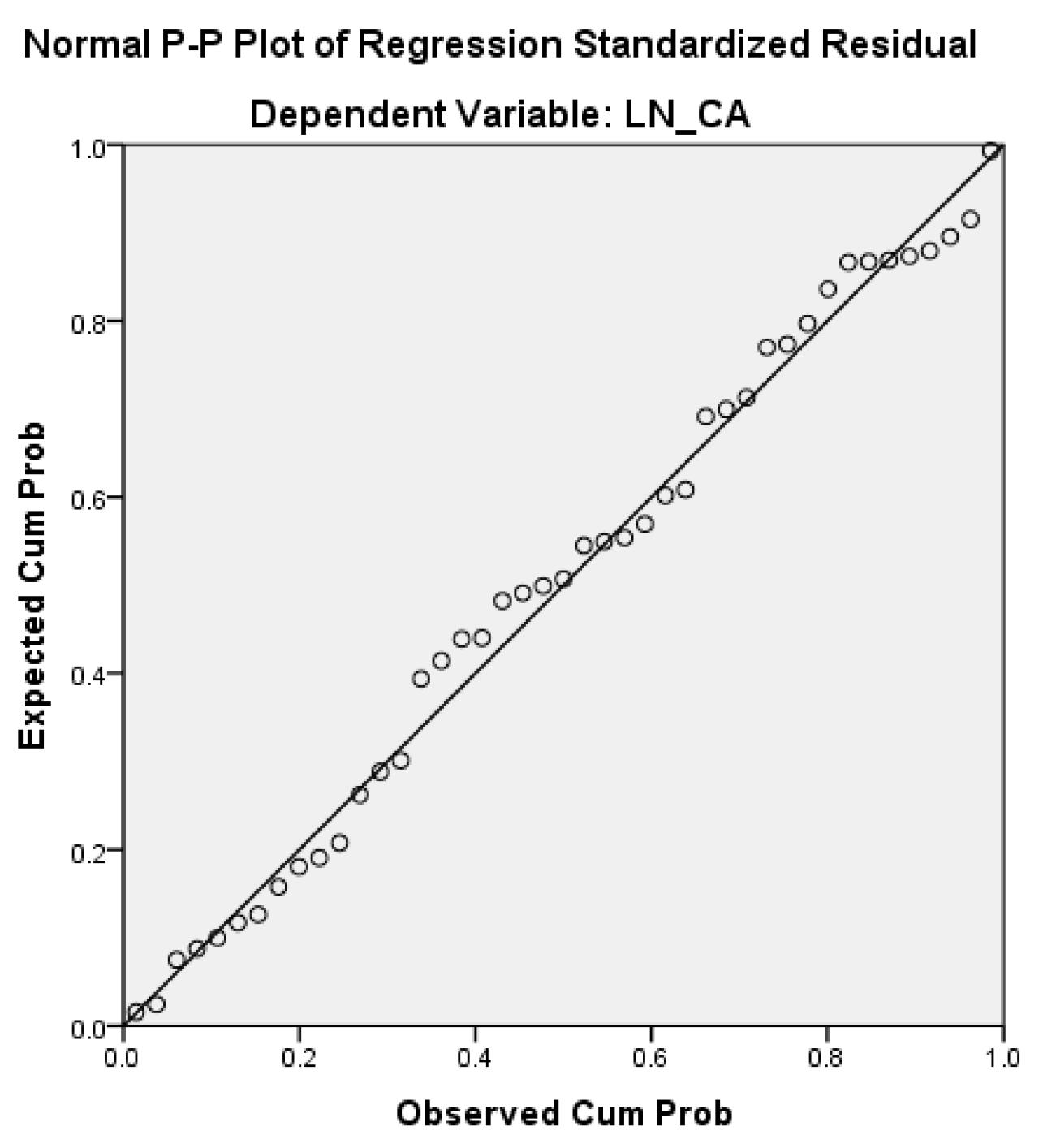

| Kolmogorov–Smirnov a | Shapiro–Wilk | |||||

|---|---|---|---|---|---|---|

| Statistic | df | Sig. | Statistic | df | Sig. | |

| Standardized Residual | 0.067 | 43 | 0.200 * | 0.984 | 43 | 0.792 |

| Auxiliary R Square | 0.009184 | Coefficients | |

| Lagrange Multiplier | 0.394910 | Intercept | 4.226 |

| Chi_Square_crit | 5.991465 | Ig | −0.014 |

| p Value | 0.820817 | Ig2 | −0.010 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bigioi, A.D.; Bigioi, C.E. Governance and Performance in Romanian Energy Companies. Energies 2023, 16, 5041. https://doi.org/10.3390/en16135041

Bigioi AD, Bigioi CE. Governance and Performance in Romanian Energy Companies. Energies. 2023; 16(13):5041. https://doi.org/10.3390/en16135041

Chicago/Turabian StyleBigioi, Adrian Doru, and Cristina Elena Bigioi. 2023. "Governance and Performance in Romanian Energy Companies" Energies 16, no. 13: 5041. https://doi.org/10.3390/en16135041

APA StyleBigioi, A. D., & Bigioi, C. E. (2023). Governance and Performance in Romanian Energy Companies. Energies, 16(13), 5041. https://doi.org/10.3390/en16135041