A Comprehensive Review of the Distinctive Tendencies of the Diffusion of E-Mobility in Central Europe

Abstract

1. Introduction

- Q1. What diffusion differences can be found in the case of electric vehicles in the studied countries compared to the EU average?

- Q2. Is the market of the region united or diverse regarding the possibilities and speed of spread?

- Q3. How many electric vehicles may spread in the region and what their expected share could be? What specifics do the countries in the region show in relation to the spread of electric cars?

- Are indirect CO2 emissions over the entire life cycle of EVs lower than ICVs? In particular, how much GHG is generated by the electricity generation required for EVs to operate, and how much other GHG is generated during the EV’s life cycle?

- Is the amount of other air pollutant emissions over the EV’s life cycle smaller compared to ICV?

- Is the noise emission by EVs smaller than that of ICVs?

2. International Case Studies on the Reasons for the Spread of BEVs

3. Data Collection, Calculation Method

4. Results

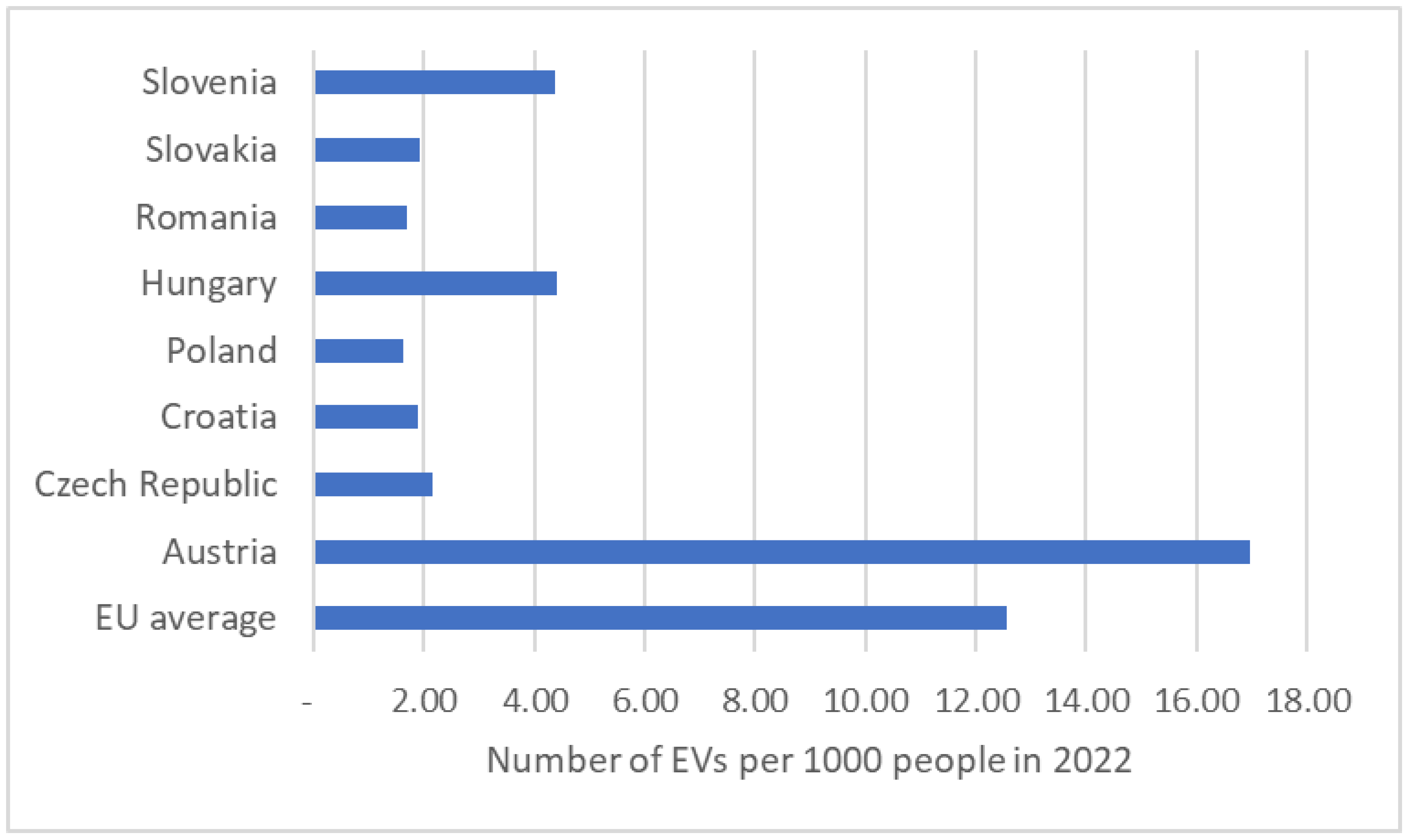

4.1. Current Situation of Electromobility

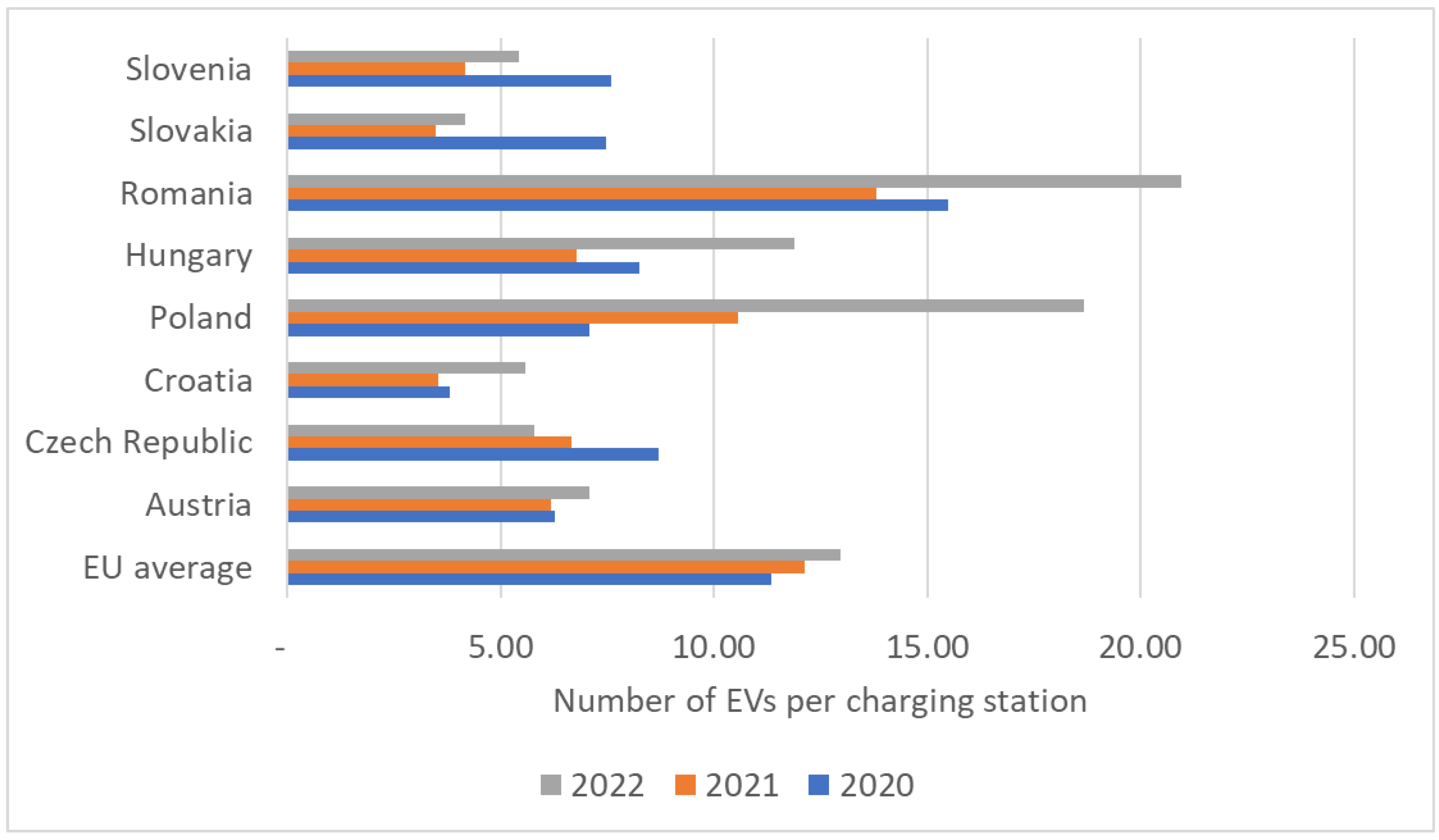

4.2. Analysis of Electromobility Infrastructure

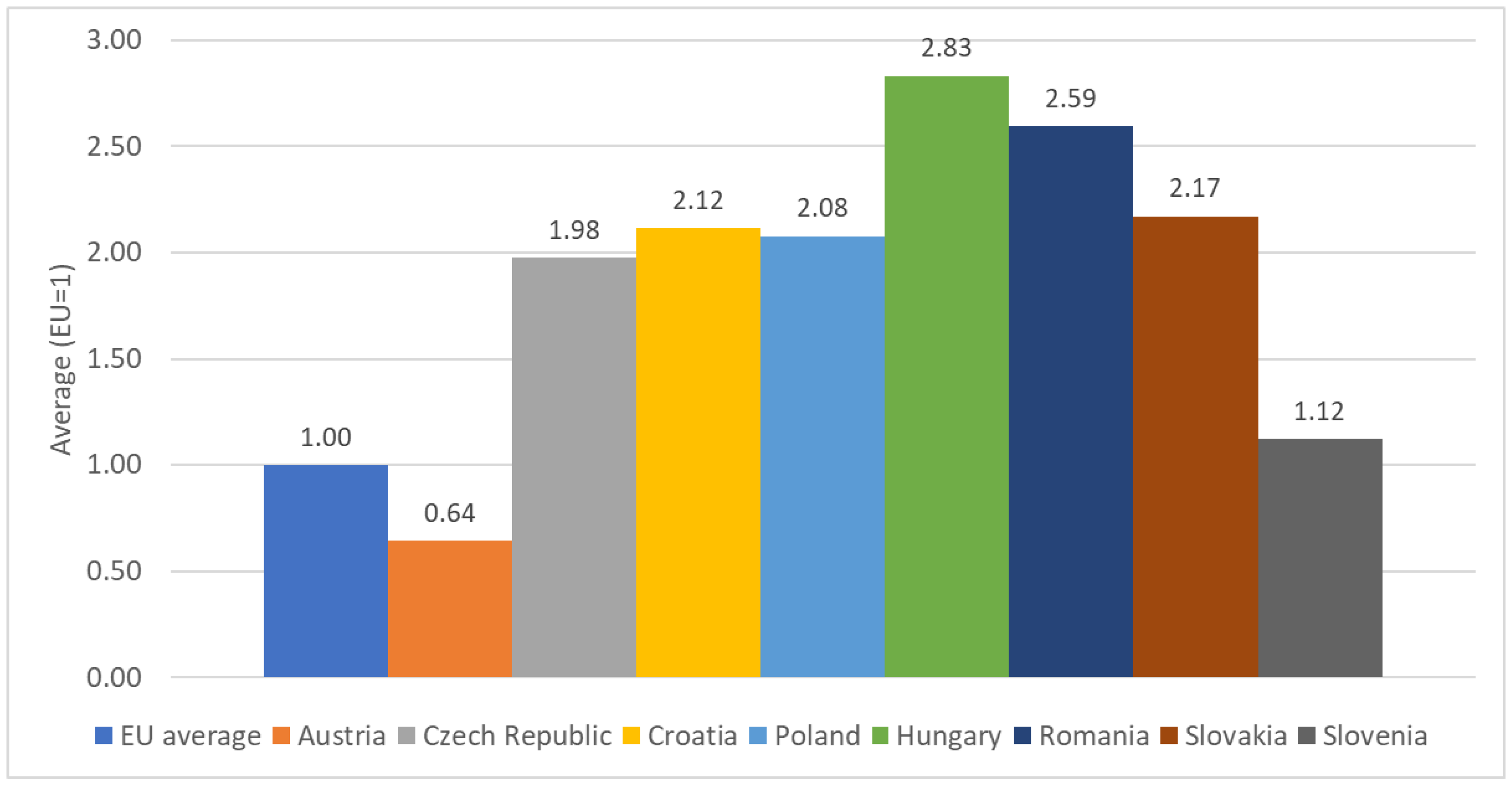

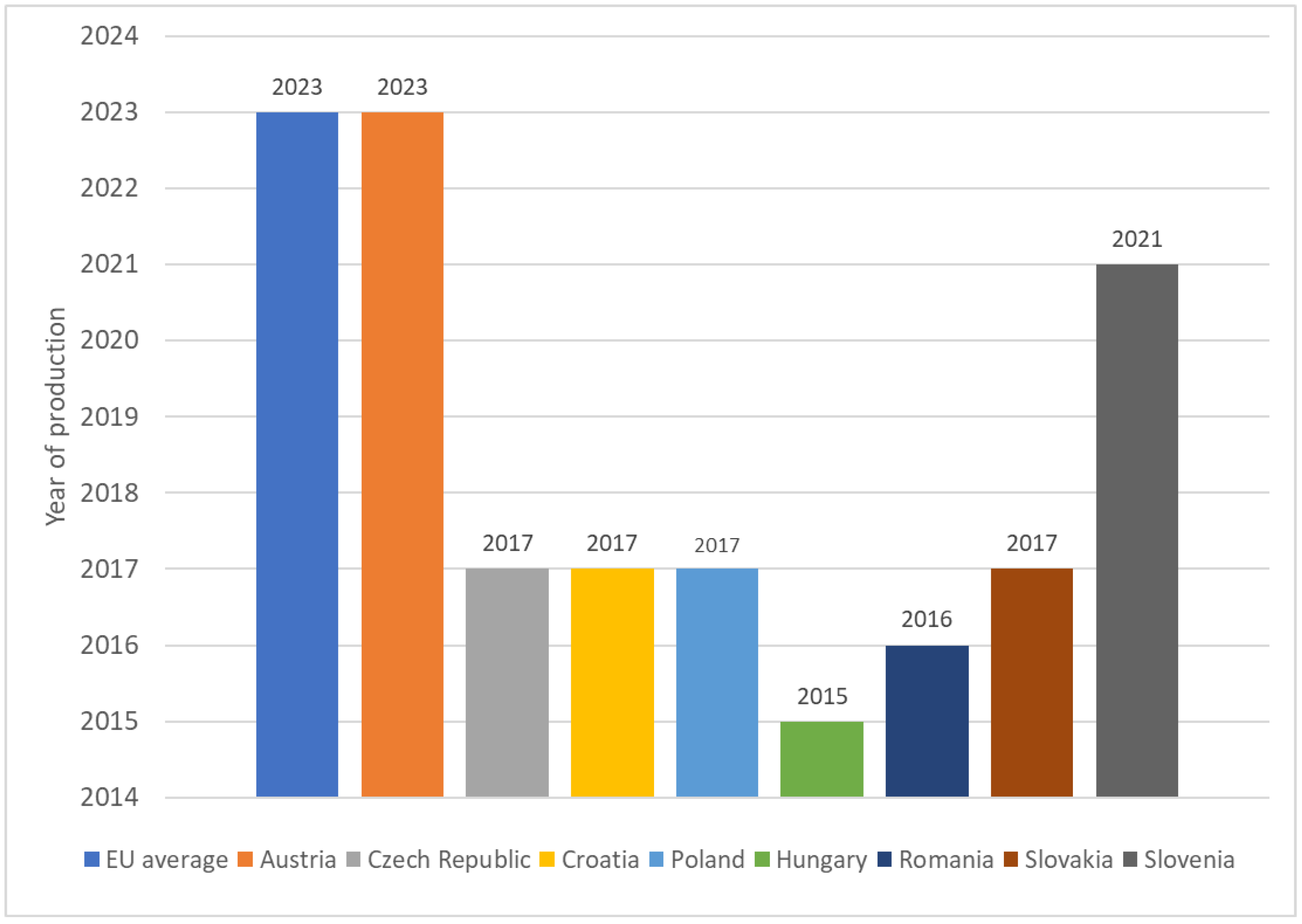

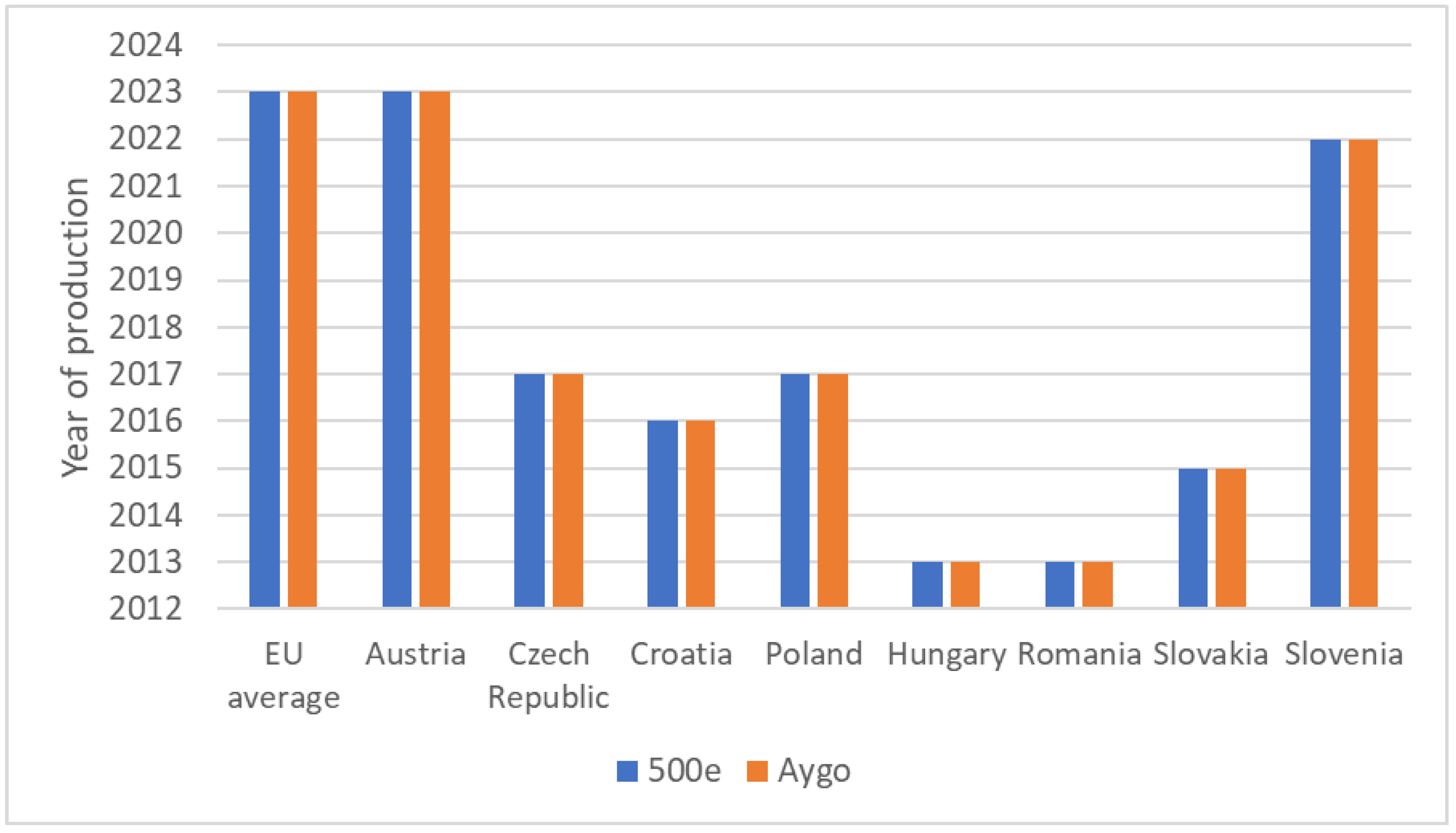

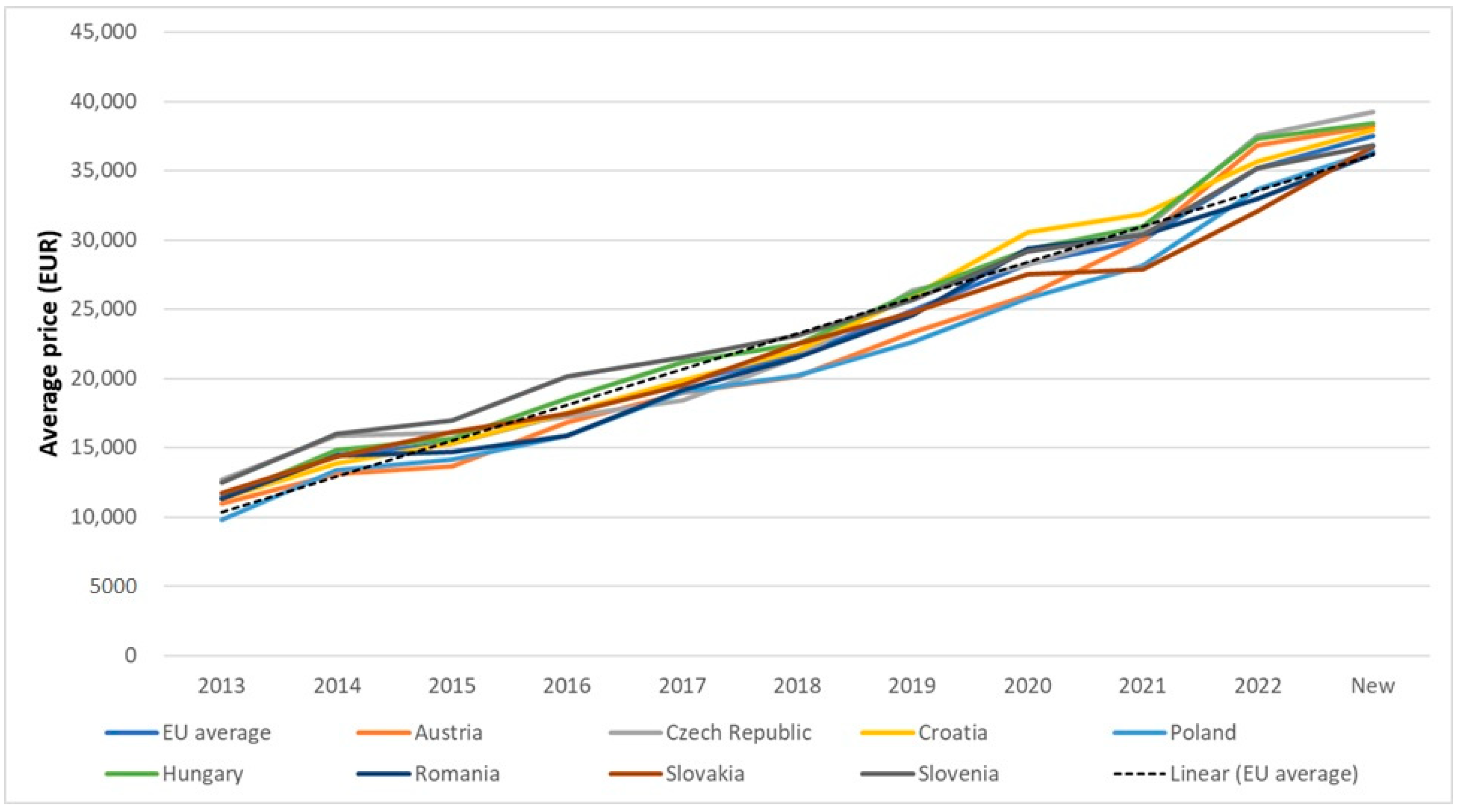

4.3. The Significance of Purchasing Power in the Spread of EVs

- 2019 VW Golf 1.5 TSI

- 2015 BMW Series 5

- New Toyota Yaris 1.0

- 2016 Mitsubishi Outlander PHEV

- 2016 BMW i3

- 2016 VW Golf GTE PHEV

- 2018 Nissan Leaf

- 2017 e-Golf

- 2019 Renault Zoe

- 2019 Fiat 500e

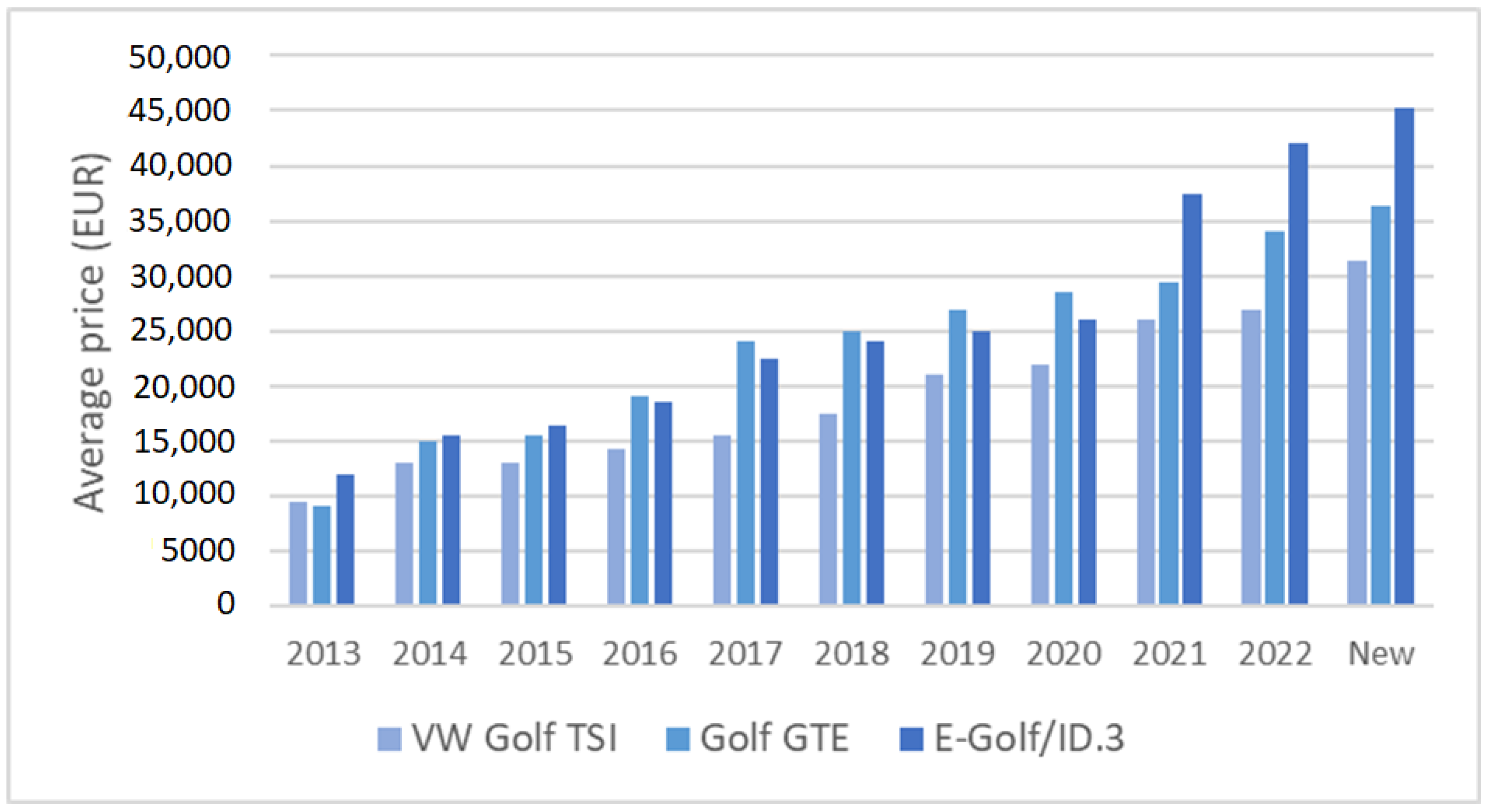

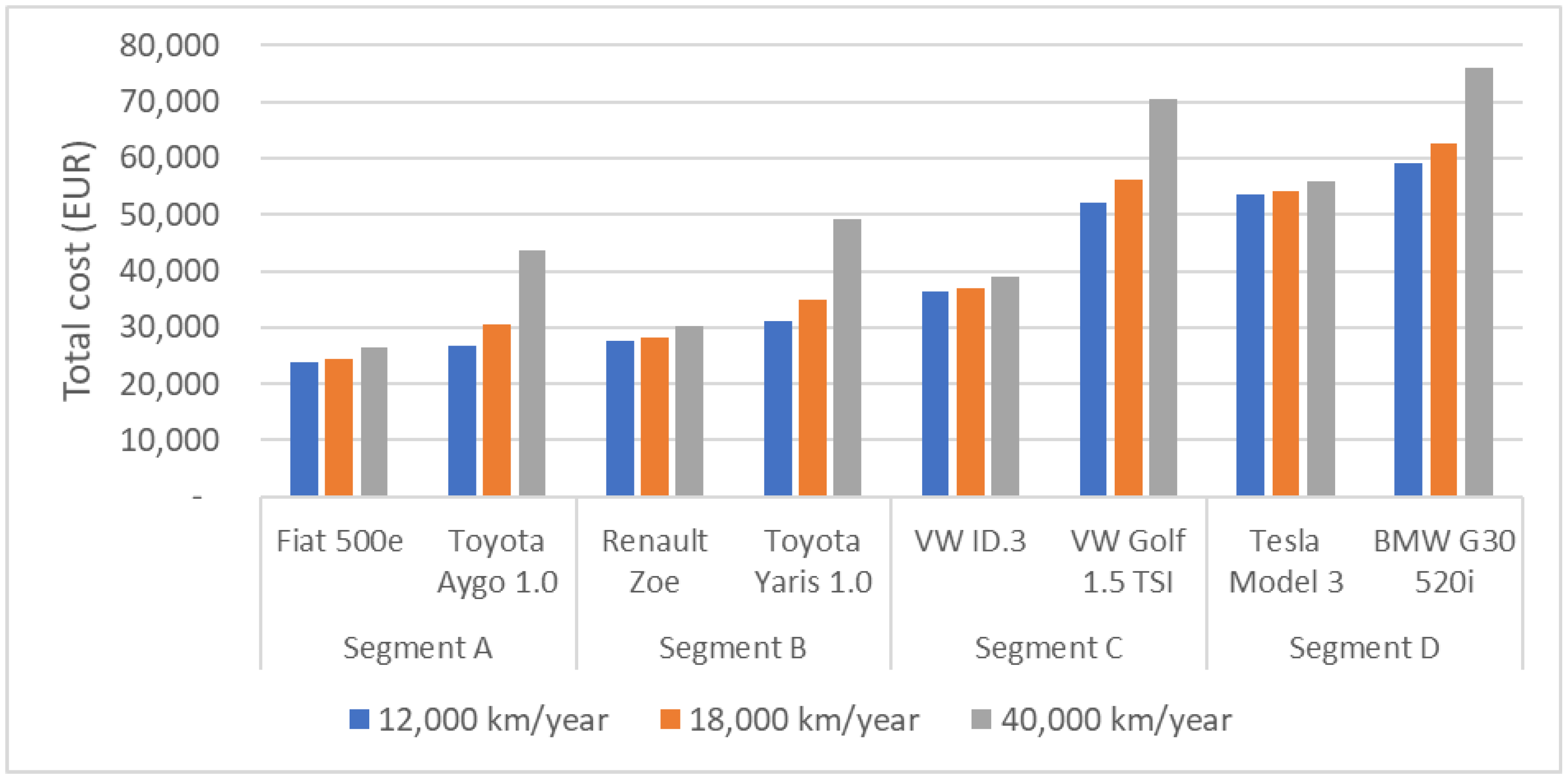

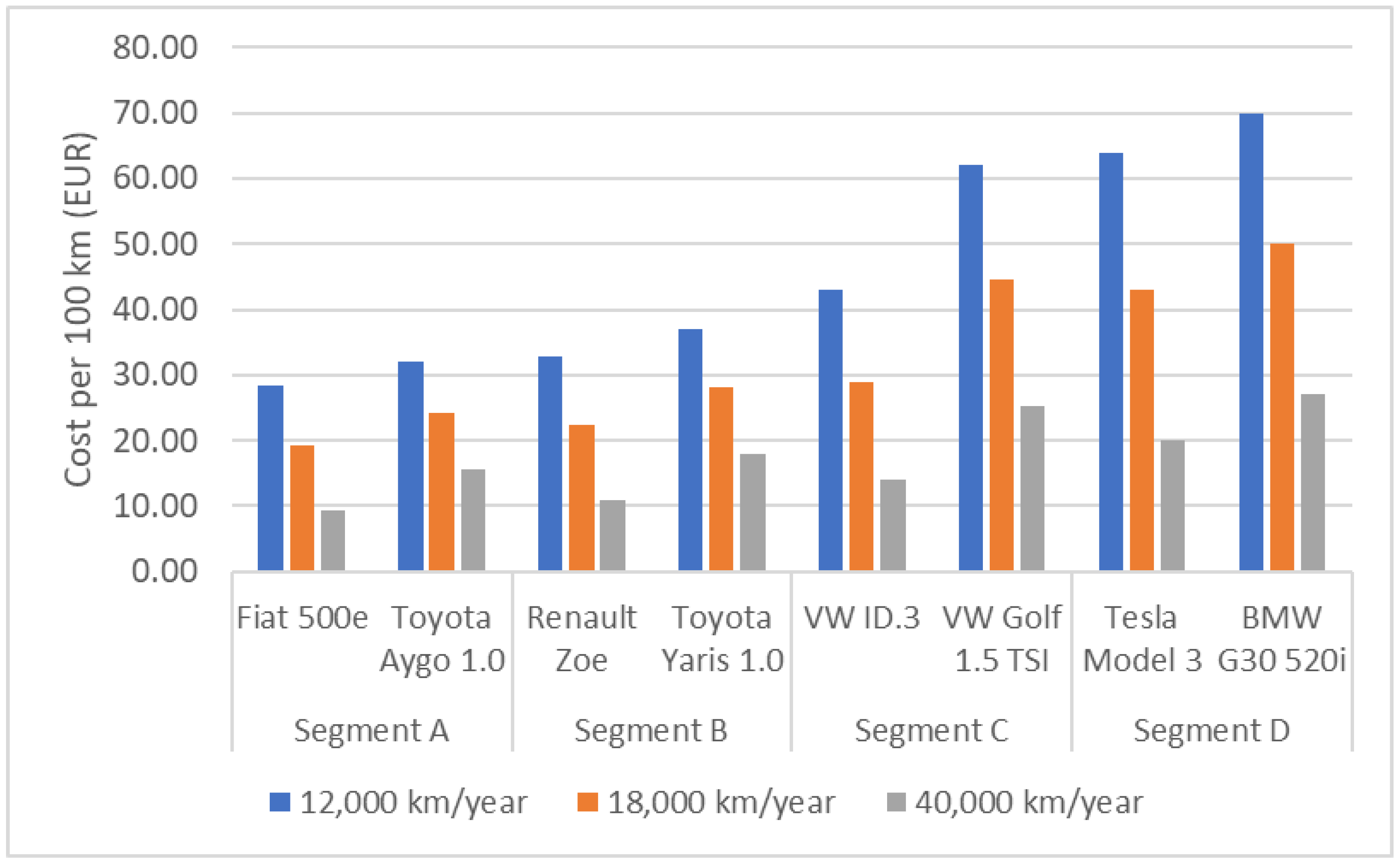

4.4. Operational Costs: Comparison between ICEV and BEV

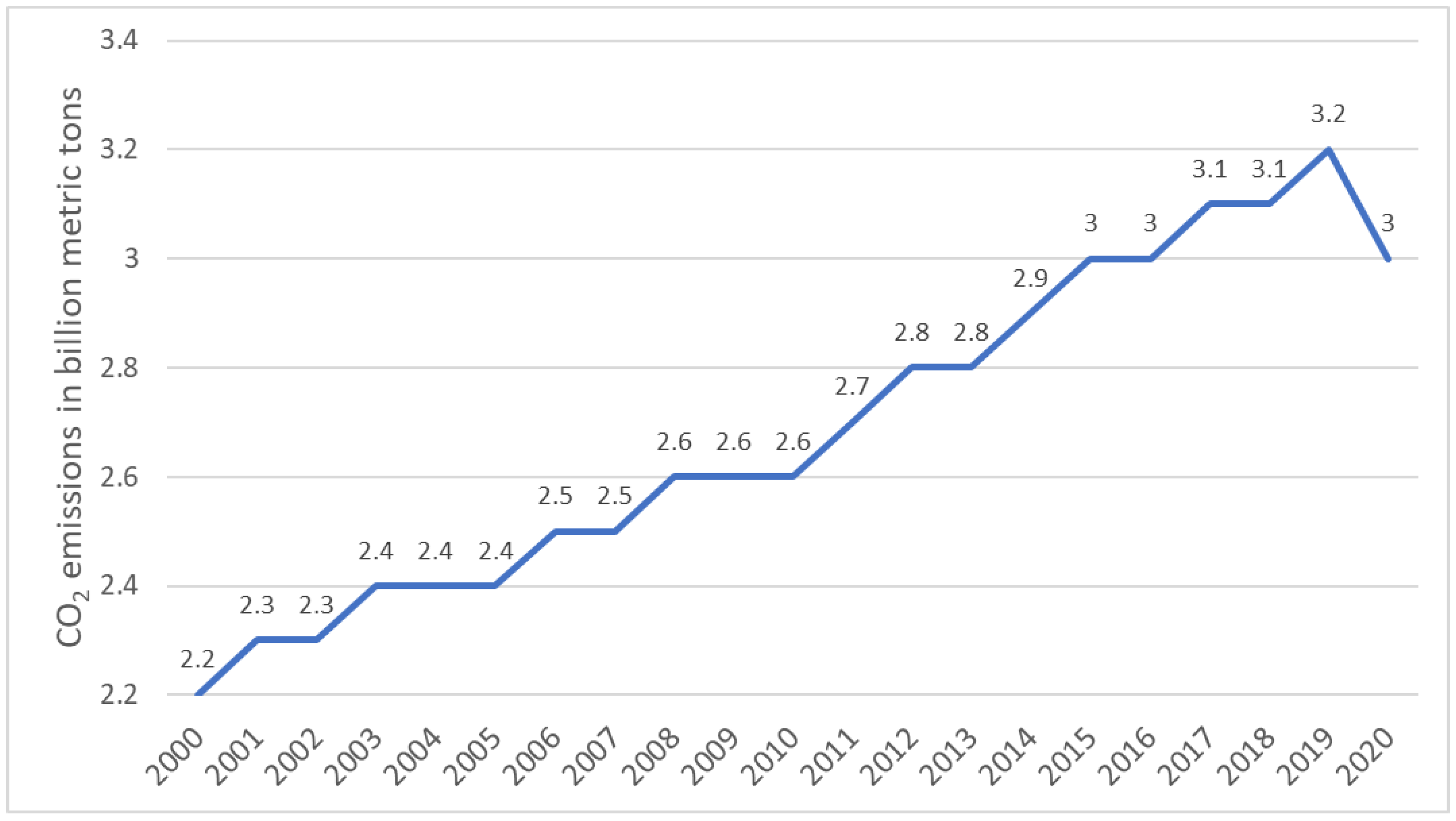

4.5. Environmental Aspects of the Spread of Electric Passenger Cars

4.6. Comparison of the Indirect and Direct CO2 Emission of EVs and ICVs

4.6.1. Greenhouse Gas Emission of Electricity Production Required for Operating EVs

4.6.2. Other GHG Emissions Generated in the Life Cycle of EV

4.6.3. Comparison of Other Air Pollution and Noise Emission of EV and ICV

5. Conclusions and Future Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| ICEV | Internal Combustion Engine Vehicle |

| ICE | Internal Combustion Engine |

| EV | Electric Vehicle |

| BEV | Battery Electric Vehicle |

| PEV | Plug-in Electric Vehicle |

| HEV | Hybrid Electric Vehicle |

| PHEV | Plug-in Hybrid Electric Vehicle |

| EU | European Union |

| GHG | Greenhouse gas |

| EAFO | European Alternative Fuels Observatory |

| LPG | Liquefied Petroleum Gas |

| EoL | End of Life |

| CEE | Central and Eastern Europe |

| TCO | Total Cost of Ownership |

| V2G | Vehicle-To-Grid |

| EEA | European Environmental Agency |

| ACEA | European Automobile Manufacturers’ Association |

| NCM | Lithium Nickel-Manganese-Cobalt |

| BAU | Business As Usual |

References

- Dollinger, M.; Fischerauer, G. Physics-Based Prediction for the Consumption and Emissions of Passenger Vehicles and Light Trucks up to 2050. Energies 2023, 16, 3591. [Google Scholar] [CrossRef]

- Kampker, A.; Heimes, H.H.; Offermanns, C.; Frieges, M.H.; Graaf, M.; Soldan Cattani, N.; Späth, B. Cost-Benefit Analysis of Downstream Applications for Retired Electric Vehicle Batteries. World Electr. Veh. J. 2023, 14, 110. [Google Scholar] [CrossRef]

- Maurer, F.; Rieke, C.; Schemm, R.; Stollenwerk, D. Analysis of an Urban Grid with High Photovoltaic and e-Mobility Penetration. Energies 2023, 16, 3380. [Google Scholar] [CrossRef]

- Ogunkunbi, G.A.; Meszaros, F. Investigating the Role of Urban Vehicle Access Regulations as a Policy Tool for Promoting Electric Mobility in Budapest. Urban Sci. 2023, 7, 39. [Google Scholar] [CrossRef]

- EAFO European Alternative Fuels Observatory. Available online: https://alternative-fuels-observatory.ec.europa.eu/transport-mode/road (accessed on 19 February 2023).

- Razmjoo, A.; Ghazanfari, A.; Jahangiri, M.; Franklin, E.; Denai, M.; Marzband, M.; Astiaso Garcia, D.; Maheri, A. A Comprehensive Study on the Expansion of Electric Vehicles in Europe. Appl. Sci. 2022, 12, 11656. [Google Scholar] [CrossRef]

- Hildermeier, J.; Burger, J.; Jahn, A.; Rosenow, J. A Review of Tariffs and Services for Smart Charging of Electric Vehicles in Europe. Energies 2023, 16, 88. [Google Scholar] [CrossRef]

- Feckova Skrabulakova, E.; Ivanova, M.; Rosova, A.; Gresova, E.; Sofranko, M.; Ferencz, V. On Electromobility Development and the Calculation of the Infrastructural Country Electromobility Coefficient. Processes 2021, 9, 222. [Google Scholar] [CrossRef]

- Brdulak, A.; Chaberek, G.; Jagodziński, J. BASS Model Analyssis in “Crossing the Chasm” in E-Cars Innovation Diffusion Scenarios. Energies 2021, 14, 3216. [Google Scholar] [CrossRef]

- Giechaskiel, B.; Lähde, T.; Clairotte, M.; Suarez-Bertoa, R.; Valverde, V.; Melas, A.D.; Selleri, T.; Bonnel, P. Emissions of Euro 6 Mono- and Bi-Fuel Gas Vehicles. Catalysts 2022, 12, 651. [Google Scholar] [CrossRef]

- Mądziel, M. Liquified Petroleum Gas-Fuelled Vehicle CO2 Emission Modelling Based on Portable Emission Measurement System, On-Board Diagnostics Data, and Gradient-Boosting Machine Learning. Energies 2023, 16, 2754. [Google Scholar] [CrossRef]

- Zimakowska-Laskowska, M.; Laskowski, P.; Wojs, M.K.; Orliński, P. Prediction of Pollutant Emissions in Various Cases in Road Transport. Appl. Sci. 2022, 12, 11975. [Google Scholar] [CrossRef]

- Fabiś, P.; Flekiewicz, M. The Influence of LPG and DME Mixtures on Passenger Car Performance. Energies 2022, 15, 7144. [Google Scholar] [CrossRef]

- Golab, A.; Zwickl-Bernhard, S.; Auer, H. Minimum-Cost Fast-Charging Infrastructure Planning for Electric Vehicles along the Austrian High-Level Road Network. Energies 2022, 15, 2147. [Google Scholar] [CrossRef]

- Loschan, C.; Schwabeneder, D.; Lettner, G.; Auer, H. Flexibility potential of aggregated electric vehicle fleets to reduce transmission congestions and redispatch needs: A case study in Austria. Int. J. Electr. Power Energy Syst. 2023, 146, 108802. [Google Scholar] [CrossRef]

- Kulmer, V.; Seebauer, S.; Hinterreither, H.; Kortschak, D.; Theurl, M.; Haas, W. Transforming the s-shape: Identifying and explaining turning points in market diffusion curves of low-carbon technologies in Austria. Res. Policy 2021, 51, 104371. [Google Scholar] [CrossRef]

- European Environment Agency. New Registrations of Electric Vehicles in Europe. Available online: https://www.eea.europa.eu/data-and-maps/indicators/proportion-of-vehicle-fleet-meeting-5/assessment (accessed on 27 December 2021).

- Lauvergne, R.; Perez, Y.; Françon, M.; Tejeda De La Cruz, A. Integration of electric vehicles into transmission grids: A case study on generation adequacy in Europe in 2040. Appl. Energy 2022, 326, 120030. [Google Scholar] [CrossRef]

- Mangipinto, A.; Lombardi, F.; Sanvito, D.F.; Pavičević, M.; Quoilin, S.; Colombo, E. Impact of mass-scale deployment of electric vehicles and benefits of smart charging across all European countries. Appl. Energy 2022, 312, 118676. [Google Scholar] [CrossRef]

- Koengkan, M.; Fuinhas, J.A.; Belucio, M.; Alavijeh, N.K.; Salehnia, N.; Machado, D.; Silva, V.; Dehdar, F. The Impact of Battery-Electric Vehicles on Energy Consumption: A Macroeconomic Evidence from 29 European Countries. World Electr. Veh. J. 2022, 13, 36. [Google Scholar] [CrossRef]

- EAFO European Alternative Fuels Observatory. 2022. Available online: https://alternative-fuels-observatory.ec.europa.eu/consumer-portal/fuel-price-comparison (accessed on 19 February 2023).

- Neves, S.A.; Marques, A.C.; Fuinhas, J.A. Technological progress and other factors behind the adoption of electric vehicles: Empirical evidence for EU countries. Res. Transp. Econ. 2019, 74, 28–39. [Google Scholar] [CrossRef]

- Tucki, K.; Orynycz, O. Bioenergy and Biofuels. Sustainability 2021, 13, 9972. [Google Scholar] [CrossRef]

- Tucki, K.; Orynycz, O.; Mitoraj-Wojtanek, M. Perspectives for Mitigation of CO2 Emission due to Development of Electromobility in Several Countries. Energies 2020, 13, 4127. [Google Scholar] [CrossRef]

- Tucki, K.; Orynycz, O.; Dudziak, A. The Impact of the Available Infrastructure on the Electric Vehicle Market in Poland and in EU Countries. Int. J. Environ. Res. Public Health 2022, 19, 16783. [Google Scholar] [CrossRef]

- Ioan, B.; Mozi, R.M.; Lucian, G.; Gheorghe, F.; Horia, T.; Ioan, B.; Mircea-Iosif, R. An Empirical Investigation on Determinants of Sustainable Economic Growth. Lessons from Central and Eastern European Countries. J. Risk Financ. Manag. 2020, 13, 146. [Google Scholar] [CrossRef]

- Popescu, G. FDI and Economic Growth in Central and Eastern Europe. Sustainability 2014, 6, 8149–8163. [Google Scholar] [CrossRef]

- Faragó, P.; Gálos, K.; Fekete, D. Elements of Divergence in Urbanization between Central and Eastern Europe (CEE) and the Core of the Continent. Sustainability 2022, 14, 12377. [Google Scholar] [CrossRef]

- Lafuente, J.Á.; Marco, A.; Monfort, M.; Ordóñez, J. Social Exclusion and Convergence in the EU: An Assessment of the Europe 2020 Strategy. Sustainability 2020, 12, 1843. [Google Scholar] [CrossRef]

- Pellényi, G.M. The Role of Central & Eastern Europe in Global Value Chains: Evidence from Occupation—Level Employment Data. Eur. Comm. Econ. Br. 2020, 62, 1–20. [Google Scholar]

- Astrov, V.; Holzner, M.; Leitner, S.; Mara, I.; Podkaminer, L.; Rezai, A. Wage Developments in the Central and Eastern European EU Member States; The Vienna Institute for International Economic Studies: Wien, Austria, 2019; pp. 1–68. [Google Scholar]

- Raszkowski, A.; Bartniczak, B. Sustainable Development in the Central and Eastern European Countries (CEECs): Challenges and Opportunities. Sustainability 2019, 11, 1180. [Google Scholar] [CrossRef]

- ACEA. Passenger Car Registrations: −13.7% Five Months into 2022; −11.2% in May. Available online: https://www.acea.auto/pc-registrations/passenger-car-registrations-13-7-five-months-into-2022-11-2-in-may/ (accessed on 13 February 2023).

- Li, W.; Long, R.; Chen, H.; Geng, J. A review of factors influencing consumer intentions to adopt battery electric vehicles. Renew. Sustain. Energy Rev. 2017, 78, 318–328. [Google Scholar] [CrossRef]

- Dutta, B.; Hwang, H.-G. Consumers Purchase Intentions of Green Electric Vehicles: The Influence of Consumers Technological and Environmental Considerations. Sustainability 2021, 13, 12025. [Google Scholar] [CrossRef]

- Breetz, H.L.; Salon, D. Do electric vehicles need subsidies? Ownership costs for conventional, hybrid, and electric vehicles in 14 U.S. cities. Energy Policy 2018, 120, 238–249. [Google Scholar] [CrossRef]

- Fluchs, S. The diffusion of electric mobility in the European Union and beyond. Transp. Res. Part D Transp. Environ. 2020, 86, 102462. [Google Scholar] [CrossRef]

- Bubeck, S.; Tomaschek, J.; Fahl, U. Perspectives of electric mobility: Total cost of ownership of electric vehicles in Germany. Transp. Policy 2016, 50, 63–77. [Google Scholar] [CrossRef]

- Danielis, R.; Giansoldati, M.; Rotaris, L. A probabilistic total cost of ownership model to evaluate the current and future prospects of electric cars uptake in Italy. Energy Policy 2018, 119, 268–281. [Google Scholar] [CrossRef]

- Palmer, K.; Tate, E.J.; Wadud, Z.; Nellthorp, J. Total cost of ownership and market share for hybrid and electric vehicles in the UK, US and Japan. Appl. Energy 2018, 209, 108–119. [Google Scholar] [CrossRef]

- Adepetu, A.; Keshav, S. The relative importance of price and driving range on electric vehicle adoption: Los Angeles case study. Transportation 2017, 44, 353–373. [Google Scholar] [CrossRef]

- Hardman, S.; Chandan, A.; Tal, G.; Turrentine, T. The effectiveness of financial purchase incentives for battery electric vehicles—A review of the evidence. Renew. Sustain. Energy Rev. 2017, 80, 1100–1111. [Google Scholar] [CrossRef]

- Christidis, P.; Focas, C. Factors Affecting the Uptake of Hybrid and Electric Vehicles in the European Union. Energies 2019, 12, 3414. [Google Scholar] [CrossRef]

- Cecere, G.; Corrocherc, N.; Guerzoni, M. Price or performance? A probabilistic choice analysis of the intention to buy electric vehicles in European countries. Energy Policy 2018, 118, 19–32. [Google Scholar] [CrossRef]

- Ali, I.; Naushad, M. A Study to Investigate What Tempts Consumers to Adopt Electric Vehicles. World Electr. Veh. J. 2022, 13, 26. [Google Scholar] [CrossRef]

- Habich-Sobiegalla, S.; Kostka, G.; Anzinger, N. Electric vehicle purchase intentions of Chinese, Russian and Brazilian citizens: An international comparative study. J. Clean. Prod. 2018, 205, 188–200. [Google Scholar] [CrossRef]

- Tu, J.-C.; Yang, C. Key Factors Influencing Consumers’ Purchase of Electric Vehicles. Sustainability 2019, 11, 3863. [Google Scholar] [CrossRef]

- Franzò, S.; Nasca, A.; Chiesa, V. Factors affecting cost competitiveness of electric vehicles against alternative powertrains: A total cost of ownership-based assessment in the Italian market. J. Clean. Prod. 2022, 363, 132559. [Google Scholar] [CrossRef]

- Park, E.; Lim, J.; Cho, Y. Understanding the Emergence and Social Acceptance of Electric Vehicles as Next-Generation Models for the Automobile Industry. Sustainability 2018, 10, 662. [Google Scholar] [CrossRef]

- Hardman, S.; Tal, G. Exploring the Decision to Adopt a High-End Battery Electric Vehicle: Role of Financial and Nonfinancial Motivations. Transp. Res. Rec. 2016, 2572, 20–27. [Google Scholar] [CrossRef]

- Graham, J.D.; Brungard, E. Consumer Adoption of Plug-In Electric Vehicles in Selected Countries. Future Transp. 2021, 1, 303–325. [Google Scholar] [CrossRef]

- Silvia, C.; Krause, R.M. Assessing the impact of policy interventions on the adoption of plug-in electric vehicles: An agent-based model. Energy Policy 2016, 96, 105–118. [Google Scholar] [CrossRef]

- Wu, G.; Inderbitzin, A.; Bening, C.R. Total cost of ownership of electric vehicles compared to conventional vehicles: A probabilistic analysis and projection across market segments. Energy Policy 2015, 80, 196–214. [Google Scholar] [CrossRef]

- Ouyang, D.; Zhou, S.; Ou, X. The total cost of electric vehicle ownership: A consumer-oriented study of China’s post-subsidy era. Energy Policy 2021, 149, 112023. [Google Scholar] [CrossRef]

- Liu, Z.; Song, J.; Kubal, J.; Susarla, N.; Knehr, K.W.; Islam, E.S.; Nelson, P.K.; Ahmed, S. Comparing total cost of ownership of battery electric vehicles and internal combustion engine vehicles. Energy Policy 2021, 158, 112564. [Google Scholar] [CrossRef]

- Dumortier, J.; Siddiki, S.; Carley, S.; Cisney, J.; Krause, R.M.; Lane, B.W.; Rupp, J.A.; Graham, J.D. Effects of providing total cost of ownership information on consumers’ intent to purchase a hybrid or plug-in electric vehicle. Transp. Res. Part A Policy Pract. 2015, 72, 71–86. [Google Scholar] [CrossRef]

- AutoScout24. Available online: https://www.autoscout24.at/ (accessed on 3 February 2023).

- Das WeltAuto Austria. Available online: https://www.dasweltauto.at/ (accessed on 3 February 2023).

- Gebrauchtwagen Austria. Available online: https://www.gebrauchtwagen.at/ (accessed on 3 February 2023).

- Njuskalo Croatia. Available online: https://www.njuskalo.hr/ (accessed on 3 February 2023).

- Oglasnik Croatia. Available online: https://www.oglasnik.hr/auto-moto-i-nautika (accessed on 3 February 2023).

- Autoto. Available online: https://www.autoto.hr/ (accessed on 3 February 2023).

- Auti.hr. Available online: https://www.auti.hr/ (accessed on 3 February 2023).

- Das WeltAuto Croatia. Available online: https://www.rabljenavozila.com.hr/ (accessed on 3 February 2023).

- OTOMOTO. Available online: https://www.otomoto.pl/ (accessed on 3 February 2023).

- DobrevAvto. Available online: https://www.doberavto.si/ (accessed on 3 February 2023).

- Avto.net. Available online: https://www.avto.net/ (accessed on 3 February 2023).

- Kocsi.hu. Available online: https://www.kocsi.hu/ (accessed on 3 February 2023).

- Használtautó.hu. Available online: https://www.hasznaltauto.hu/ (accessed on 3 February 2023).

- JóAutók.hu. Available online: https://www.joautok.hu/ (accessed on 3 February 2023).

- OOYYO Hungary. Available online: https://www.ooyyo.com/hungary/c=CDA31D7114D6854F111B8F6F9D671453/ (accessed on 3 February 2023).

- Bestauto. Available online: https://www.bestauto.ro/ (accessed on 4 February 2023).

- AUTOVIT. Available online: https://www.autovit.ro/ (accessed on 4 February 2023).

- OLX. Available online: https://www.olx.ro/ (accessed on 4 February 2023).

- OOYYO Romania. Available online: https://www.ooyyo.com/romania/c=CDA31D7114D6854F111B746F9D671453/ (accessed on 4 February 2023).

- AAA AUTO Czech Republic. Available online: https://www.aaaauto.cz/ (accessed on 4 February 2023).

- Sauto.cz. Available online: https://www.sauto.cz/ (accessed on 4 February 2023).

- AutoBazar EU. Available online: https://www.autobazar.eu/ (accessed on 4 February 2023).

- AAA AUTO Slovakia. Available online: https://www.aaaauto.sk/ (accessed on 4 February 2023).

- AUTOVIA.SK. Available online: https://www.autovia.sk/ (accessed on 4 February 2023).

- Fileru, I.F. Toyota Prius—A Successful Pioneering in Hybrid Vehicle World. Appl. Mech. Mater. 2015, 809–810, 1139–1144. [Google Scholar] [CrossRef]

- Fiat Austria Official. Available online: https://www.fiat.at/ (accessed on 6 February 2023).

- Fiat Croatia Official. Available online: https://www.fiat.hr/ (accessed on 6 February 2023).

- Fiat Poland Official. Available online: https://www.fiat.pl/ (accessed on 6 February 2023).

- Fiat Slovenia Official. Available online: https://www.fiat.si/ (accessed on 6 February 2023).

- Fiat Hungary Official. Available online: https://www.fiat.hu/ (accessed on 6 February 2023).

- Fiat Romania Official. Available online: https://www.fiat.com.ro/ (accessed on 6 February 2023).

- Fiat Slovakia Official. Available online: https://www.fiat.sk/ (accessed on 6 February 2023).

- Fiat Czech Republic Official. Available online: https://www.fiat.cz/ (accessed on 6 February 2023).

- Renault Austria Official. Available online: https://www.renault.at/ (accessed on 6 February 2023).

- Renault Croatia Official. Available online: https://www.renault.hr/ (accessed on 6 February 2023).

- Renault Poland Official. Available online: https://www.renault.pl/ (accessed on 6 February 2023).

- Renault Slovenia Official. Available online: https://www.renault.si/ (accessed on 6 February 2023).

- Renault Hungary Official. Available online: https://www.renault.hu/ (accessed on 6 February 2023).

- Renault Romania Official. Available online: https://www.renault.ro/ (accessed on 6 February 2023).

- Renault Slovakia Official. Available online: https://www.renault.sk/ (accessed on 6 February 2023).

- Renault Czech Republic Official. Available online: https://www.renault.cz/ (accessed on 6 February 2023).

- Volkswagen Austria Official. Available online: https://www.volkswagen.at/ (accessed on 6 February 2023).

- Volkswagen Croatia Official. Available online: https://www.volkswagen.hr/ (accessed on 6 February 2023).

- Volkswagen Poland Official. Available online: https://www.volkswagen.pl/ (accessed on 6 February 2023).

- Volkswagen Slovenia Official. Available online: https://www.volkswagen.si/ (accessed on 6 February 2023).

- Volkswagen Hungary Official. Available online: https://www.volkswagen.hu/ (accessed on 6 February 2023).

- Volkswagen Romania Official. Available online: https://www.volkswagen.ro/ (accessed on 6 February 2023).

- Volkswagen Slovakia Official. Available online: https://www.volkswagen.sk/ (accessed on 6 February 2023).

- Volkswagen Czech Republic Official. Available online: https://www.volkswagen.cz/ (accessed on 6 February 2023).

- Tesla Official. Available online: https://www.tesla.com/ (accessed on 6 February 2023).

- Nissan Austria Official. Available online: https://www.nissan.at/ (accessed on 7 February 2023).

- Nissan Croatia Official. Available online: https://www.nissan.hr/ (accessed on 7 February 2023).

- Nissan Poland Official. Available online: https://www.nissan.pl/ (accessed on 7 February 2023).

- Nissan Slovenia Official. Available online: https://www.nissan.si/ (accessed on 7 February 2023).

- Nissan Hungary Official. Available online: https://www.nissan.hu/ (accessed on 7 February 2023).

- Nissan Romania Official. Available online: https://www.nissan.ro/ (accessed on 7 February 2023).

- Nissan Slovakia Official. Available online: https://www.nissan.sk/ (accessed on 7 February 2023).

- Nissan Czech Republic Official. Available online: https://www.nissan.cz/ (accessed on 7 February 2023).

- Mitsubishi Austria Official. Available online: https://www.mitsubishi-motors.at/ (accessed on 7 February 2023).

- Mitsubishi Croatia Official. Available online: https://www.mitsubishi-motors.hr/ (accessed on 7 February 2023).

- Mitsubishi Poland Official. Available online: https://www.mitsubishi.pl/ (accessed on 7 February 2023).

- Mitsubishi Slovenia Official. Available online: https://www.mitsubishi-motors.si/ (accessed on 7 February 2023).

- Mitsubishi Hungary Official. Available online: https://www.mitsubishi.hu/ (accessed on 7 February 2023).

- Mitsubishi Romania Official. Available online: https://www.mitsubishi-motors.ro/ (accessed on 7 February 2023).

- Mitsubishi Slovakia Official. Available online: https://www.mitsubishi-motors.sk/ (accessed on 7 February 2023).

- Mitsubishi Czech Republic Official. Available online: https://www.mitsubishi-motors.cz/ (accessed on 7 February 2023).

- BMW Austria Official. Available online: https://www.bmw.at/ (accessed on 7 February 2023).

- BMW Croatia Official. Available online: https://www.bmw.hr/ (accessed on 7 February 2023).

- BMW Poland Official. Available online: https://www.bmw.pl/ (accessed on 7 February 2023).

- BMW Slovenia Official. Available online: https://www.bmw.si/ (accessed on 7 February 2023).

- BMW Hungary Official. Available online: https://www.bmw.hu/ (accessed on 7 February 2023).

- BMW Romania Official. Available online: https://www.bmw.ro/ (accessed on 7 February 2023).

- BMW Slovakia Official. Available online: https://www.bmw.sk/ (accessed on 7 February 2023).

- BMW Czech Republic Official. Available online: https://www.bmw.cz/ (accessed on 7 February 2023).

- Volvo Austria Official. Available online: https://www.volvocars.com/at/ (accessed on 7 February 2023).

- Volvo Croatia Official. Available online: https://www.volvocars.com/hr/ (accessed on 7 February 2023).

- Volvo Poland Official. Available online: https://www.volvocars.com/pl/ (accessed on 7 February 2023).

- Volvo Slovenia Official. Available online: https://www.volvocars.com/si/ (accessed on 7 February 2023).

- Volvo Hungary Official. Available online: https://www.volvocars.com/hu/ (accessed on 7 February 2023).

- Volvo Romania Official. Available online: https://www.volvocars.com/ro/ (accessed on 7 February 2023).

- Volvo Slovakia Official. Available online: https://www.volvocars.com/sk/ (accessed on 7 February 2023).

- Volvo Czech Republic Official. Available online: https://www.volvocars.com/cz/ (accessed on 7 February 2023).

- Toyota Austria Official. Available online: https://www.toyota.at/ (accessed on 8 February 2023).

- Toyota Croatia Official. Available online: https://www.toyota.hr/ (accessed on 8 February 2023).

- Toyota Poland Official. Available online: https://www.toyota.pl/ (accessed on 8 February 2023).

- Toyota Slovenia Official. Available online: https://www.toyota.si/ (accessed on 8 February 2023).

- Toyota Hungary Official. Available online: https://www.toyota.hu/ (accessed on 8 February 2023).

- Toyota Romania Official. Available online: https://www.toyota.ro/ (accessed on 8 February 2023).

- Toyota Slovakia Official. Available online: https://www.toyota.sk/ (accessed on 8 February 2023).

- Toyota Czech Republic Official. Available online: https://www.toyota.cz/ (accessed on 8 February 2023).

- EAFO European Alternative Fuels Observatory: Compare Cost and CO2 Emissions of Passenger Cars. Available online: https://alternative-fuels-observatory.ec.europa.eu/consumer-portal/calculator (accessed on 19 February 2023).

- Zhou, Y.; Wang, M.; Hao, H.; Johnson, L.R.; Wang, H. Plug-in electric vehicle market penetration and incentives: A global review. Mitig. Adapt. Strateg. Glob. Chang. 2015, 20, 777–795. [Google Scholar] [CrossRef]

- Cansino, J.M.; Sánchez-Braza, A.; Sanz-Díaz, T. Policy Instruments to Promote Electro-Mobility in the EU28: A Comprehensive Review. Sustainability 2018, 10, 2507. [Google Scholar] [CrossRef]

- Tsakalidis, A.; Thiel, C. Electric Vehicles in Europe from 2010 to 2017: Is Full-Scale Commercialisation Beginning? An Overview of the Evolution of Electric Vehicles in Europe; Technical Report No. EUR 29401 EN; Publications Office of the European Union: Luxembourg, 2018; ISBN 978-92-79-96719-1. [Google Scholar]

- Fiorello, D.; Martino, A.; Zani, L.; Christidis, P.; Navajas-Cawood, E. Mobility Data across the EU 28 Member States: Results from an Extensive CAWI Survey. Transp. Res. Procedia 2016, 14, 1104–1113. [Google Scholar] [CrossRef]

- IEA. Global EV Outlook 2021, IEA, Paris. 2021. Available online: https://www.iea.org/reports/global-ev-outlook-2021 (accessed on 15 April 2023).

- IEA. Global EV Outlook 2022, IEA, Paris. 2022. Available online: https://www.iea.org/reports/global-ev-outlook-2022 (accessed on 24 April 2023).

- Dik, A.; Omer, S.; Boukhanouf, R. Electric Vehicles: V2G for Rapid, Safe, and Green EV Penetration. Energies 2022, 15, 803. [Google Scholar] [CrossRef]

- EUROSTAT Population on 1 January 2022. Available online: https://ec.europa.eu/eurostat/databrowser/view/TPS00001/default/table?lang=en (accessed on 11 February 2023).

- Brzezińska, D. LPG cars in a car park environment—How to make it safe. Int. J. Environ. Res. Public Health 2019, 16, 1062. [Google Scholar] [CrossRef]

- Jena, P.R.; Managi, S.; Majhi, B. Forecasting the CO2 emissions at the global level: A multilayer artificial neural network modelling. Energies 2021, 14, 6336. [Google Scholar] [CrossRef]

- Bryła, P.; Chatterjee, S.; Ciabiada-Bryła, B. Consumer Adoption of Electric Vehicles: A Systematic Literature Review. Energies 2023, 16, 205. [Google Scholar] [CrossRef]

- Ogunkunbi, G.A.; Al-Zibaree, H.K.Y.; Meszaros, F. Modeling and Evaluation of Market Incentives for Battery Electric Vehicles. Sustainability 2022, 14, 4234. [Google Scholar] [CrossRef]

- Ogunkunbi, G.A.; Al-Zibaree, H.K.Y.; Meszaros, F. Evidence-Based Market Overview of Incentives and Disincentives in Electric Mobility as a Key to the Sustainable Future. Future Transp. 2021, 1, 290–302. [Google Scholar] [CrossRef]

- Bohdanowicz, Z.; Kowalski, J.; Biele, C. Intentions to Charge Electric Vehicles Using Vehicle-to-Grid Technology among People with Different Motivations to Save Energy. Sustainability 2022, 14, 12681. [Google Scholar] [CrossRef]

- Sobiech-Grabka, K.; Stankowska, A.; Jerzak, K. Determinants of Electric Cars Purchase Intention in Poland: Personal Attitudes v. Economic Arguments. Energies 2022, 15, 3078. [Google Scholar] [CrossRef]

- Brătucu, G.; Trifan, A.; Dovleac, L.; Chițu, I.B.; Todor, R.D.; Brătucu, R. Acquisition of Electric Vehicles—A Step towards Green Consumption. Empirical Research among Romanian Students. Sustainability 2019, 11, 6639. [Google Scholar] [CrossRef]

- Hecht, C.; Spreuer, K.G.; Figgener, J.; Sauer, D.U. Market Review and Technical Properties of Electric Vehicles in Germany. Vehicles 2022, 4, 903–916. [Google Scholar] [CrossRef]

- Kajanova, M.; Bracinik, P. The Vehicle-to-Grid Concept with Respect to the Preferences of Electric Vehicle Drivers and Charging Station Operators. Appl. Sci. 2022, 12, 5476. [Google Scholar] [CrossRef]

- Falkoni, A.; Pfeifer, A.; Krajačić, G. Vehicle-to-Grid in Standard and Fast Electric Vehicle Charging: Comparison of Renewable Energy Source Utilization and Charging Costs. Energies 2020, 13, 1510. [Google Scholar] [CrossRef]

- Viola, F. Electric Vehicles and Psychology. Sustainability 2021, 13, 719. [Google Scholar] [CrossRef]

- Wang, N.; Pan, H.; Zheng, W. Assessment of the incentives on electric vehicle promotion in China. Transp. Res. Part A Policy Pract. 2017, 101, 177–189. [Google Scholar] [CrossRef]

- European Environment Agency (EEA). Available online: https://www.eea.europa.eu/publications/electric-vehicles-in-europe (accessed on 15 July 2020).

- Xu, M.; Yang, H.; Wang, S. Mitigate the range anxiety: Siting battery charging stations for electric vehicle drivers. Transp. Res. Part C Emerg. Technol. 2020, 114, 164–188. [Google Scholar] [CrossRef]

- Kim, E.; Heo, E. Key Drivers behind the Adoption of Electric Vehicle in Korea: An Analysis of the Revealed Preferences. Sustainability 2019, 11, 6854. [Google Scholar] [CrossRef]

- García-Martínez, E.; Muñoz-Cruzado-Alba, J.; Sanz-Osorio, J.F.; Perié, J.M. Design and Experimental Validation of Power Electric Vehicle Emulator for Testing Electric Vehicle Supply Equipment (EVSE) with Vehicle-to-Grid (V2G) Capability. Appl. Sci. 2021, 11, 11496. [Google Scholar] [CrossRef]

- Cabrera-Tobar, A.; Blasuttigh, N.; Massi Pavan, A.; Lughi, V.; Petrone, G.; Spagnuolo, G. Energy Scheduling and Performance Evaluation of an e-Vehicle Charging Station. Electronics 2022, 11, 3948. [Google Scholar] [CrossRef]

- Zhao, Z.; Xu, M.; Lee, C.K. Capacity Planning for an Electric Vehicle Charging Station Considering Fuzzy Quality of Service and Multiple Charging Options. IEEE Trans. Veh. Technol. 2021, 70, 12529–12541. [Google Scholar] [CrossRef]

- Pop, H.; Grama, A.; Fodor, A.; Rusu, C. Infrastructure Development for Electric Vehicle Charging Stations in Cluj-Napoca Municipality—A Case Study. Energies 2023, 16, 3552. [Google Scholar] [CrossRef]

- Liao, F.; Molin, E.J.; van Wee, B. Consumer preferences for electric vehicles: A literature review. Transp. Rev. 2017, 37, 252–275. [Google Scholar] [CrossRef]

- Luo, T.; Song, Y.; Li, G. An agent-based simulation study for escaping the “chicken-egg” dilemma between electric vehicle penetration and charging infrastructure deployment. Resour. Conserv. Recycl. 2023, 194, 106966. [Google Scholar] [CrossRef]

- Ghosh, N.; Mothilal Bhagavathy, S.; Thakur, J. Accelerating electric vehicle adoption: Techno-economic assessment to modify existing fuel stations with fast charging infrastructure. Clean Technol. Environ. Policy 2022, 24, 3033–3046. [Google Scholar] [CrossRef]

- Skrúcaný, T.; Kendra, M.; Stopka, O.; Milojević, S.; Figlus, T.; Csiszár, C. Impact of the Electric Mobility Implementation on the Greenhouse Gases Production in Central European Countries. Sustainability 2019, 11, 4948. [Google Scholar] [CrossRef]

- Zamfir, A.-I.; Croitoru, E.O.; Burlacioiu, C.; Dobrin, C. Renewable Energies: Economic and Energy Impact in the Context of Increasing the Share of Electric Cars in EU. Energies 2022, 15, 8882. [Google Scholar] [CrossRef]

- Lieutenant, K.; Borissova, A.V.; Mustafa, M.; McCarthy, N.; Iordache, I. Comparison of “Zero Emission” Vehicles with Petrol and Hybrid Cars in Terms of Total CO2 Release—A Case Study for Romania, Poland, Norway and Germany. Energies 2022, 15, 7988. [Google Scholar] [CrossRef]

- Živčák, J.; Kádárová, J.; Puškár, M.; Kočišová, M.; Lachvajderová, L. Expected Impacts of the Massive Increase in Electric Vehicles in Slovakia. Appl. Sci. 2020, 10, 8945. [Google Scholar] [CrossRef]

- Mutavdžija, M.; Kovačić, M.; Buntak, K. Assessment of Selected Factors Influencing the Purchase of Electric Vehicles—A Case Study of the Republic of Croatia. Energies 2022, 15, 5987. [Google Scholar] [CrossRef]

- Kumar, P.; Nikolovski, S.; Ali, I.; Thomas, M.S.; Ahuja, H. Impact of Electric Vehicles on Energy Efficiency with Energy Boosters in Coordination for Sustainable Energy in Smart Cities. Processes 2022, 10, 1593. [Google Scholar] [CrossRef]

- Dudziak, A.; Caban, J.; Stopka, O.; Stoma, M.; Sejkorová, M.; Stopková, M. Vehicle Market Analysis of Drivers’ Preferences in Terms of the Propulsion Systems: The Czech Case Study. Energies 2023, 16, 2418. [Google Scholar] [CrossRef]

- Zavorka, R.; Paar, M. A Focus on Electromobility within Smart City Solutions—Charging Stations, Renewable Energy, and Air Quality Monitoring. Sensors 2022, 22, 7841. [Google Scholar] [CrossRef] [PubMed]

- Dvořáček, L.; Horák, M.; Knápek, J. Simulation of Electric Vehicle Charging Points Based on Efficient Use of Chargers and Using Recuperated Braking Energy from Trains. Energies 2022, 15, 571. [Google Scholar] [CrossRef]

- Siebenhofer, M.; Ajanovic, A.; Haas, R. How Policies Affect the Dissemination of Electric Passenger Cars Worldwide. Energies 2021, 14, 2093. [Google Scholar] [CrossRef]

- Ajanovic, A.; Siebenhofer, M.; Haas, R. Electric Mobility in Cities: The Case of Vienna. Energies 2021, 14, 217. [Google Scholar] [CrossRef]

- Borowska-Stefańska, M.; Kowalski, M.; Kurzyk, P.; Mikušová, M.; Wiśniewski, S. Privileging Electric Vehicles as an Element of Promoting Sustainable Urban Mobility—Effects on the Local Transport System in a Large Metropolis in Poland. Energies 2021, 14, 3838. [Google Scholar] [CrossRef]

- Kakkar, R.; Gupta, R.; Agrawal, S.; Tanwar, S.; Sharma, R.; Alkhayyat, A.; Neagu, B.-C.; Raboaca, M.S. A Review on Standardizing Electric Vehicles Community Charging Service Operator Infrastructure. Appl. Sci. 2022, 12, 12096. [Google Scholar] [CrossRef]

- Barjoveanu, G.; Dinita, F.; Teodosiu, C. Aging Passenger Car Fleet Structure, Dynamics, and Environmental Performance Evaluation at the Regional Level by Life Cycle Assessment. Sustainability 2022, 14, 8443. [Google Scholar] [CrossRef]

- Vrabie, C. Electric Vehicles Optimism versus the Energy Market Reality. Sustainability 2022, 14, 5388. [Google Scholar] [CrossRef]

- EAFO European Alternative Fuels Observatory. 2022. Available online: https://alternative-fuels-observatory.ec.europa.eu/transport-mode/road/european-union-eu27/infrastructure (accessed on 19 February 2023).

- Hardman, S.; Fleming, K.L.; Kare, E.; Ramadan, M. A Perspective on Equity in the Transition to Electric Vehicles. MIT Sci. Policy Rev. 2021, 2, 46–54. [Google Scholar] [CrossRef]

- Vassileva, I.; Campillo, J. Adoption barriers for electric vehicles: Experiences from early adopters in Sweden. Energy 2017, 120, 632–641. [Google Scholar] [CrossRef]

- Westin, K.; Jansson, J.; Nordlund, A. The importance of socio-demographic characteristics, geographic setting, and attitudes for adoption of electric vehicles in Sweden. Travel Behav. Soc. 2018, 13, 118–127. [Google Scholar] [CrossRef]

- EUROSTAT 2022b Average Full Time Adjusted Salary Per Employee. Available online: https://ec.europa.eu/eurostat/databrowser/view/NAMA_10_FTE/default/table?lang=en (accessed on 7 February 2023).

- Creutzig, F.; Niamir, L.; Bai, X.; Callaghan, M.; Cullen, J.; Díaz-José, J.; Figueroa, M.; Grubler, A.; Lamb, W.F.; Leip, A.; et al. Demand-Side Solutions to Climate Change Mitigation Consistent with High Levels of Well-Being. Nat. Clim. Chang. 2022, 12, 36–46. [Google Scholar] [CrossRef]

- Garcia, S.; Cordeiro, A.; Nääs, I.D.A.; Neto, P.L.D.O.C. The sustainability awareness of Brazilian consumers of cotton clothing. J. Clean. Prod. 2019, 215, 1490–1502. [Google Scholar] [CrossRef]

- Omahne, V.; Knez, M.; Obrecht, M. Social Aspects of Electric Vehicles Research—Trends and Relations to Sustainable Development Goals. World Electr. Veh. J. 2021, 12, 15. [Google Scholar] [CrossRef]

- Bjerkan, K.Y.; Nørbech, T.E.; Nordtømme, M.E. Incentives for Promoting Battery Electric Vehicle (BEV) Adoption in Norway. Transp. Res. Part D Transp. Environ. 2016, 43, 169–180. [Google Scholar] [CrossRef]

- Improving the Sustainability of Passenger and Freight Transport. Available online: https://www.iea.org/topics/transport (accessed on 3 May 2023).

- Temporelli, A.; Carvalho, M.L.; Girardi, P. Life Cycle Assessment of Electric Vehicle Batteries: An Overview of Recent Literature. Energies 2020, 13, 2864. [Google Scholar] [CrossRef]

- CO2 Intensity of Electricity Generation—European Environment Agency. Available online: https://www.eea.europa.eu/data-and-maps/data/co2-intensity-of-electricity-generation (accessed on 3 May 2023).

- Global CO2 emissions from Passenger Cars 2020|Statista. Available online: https://www.statista.com/statistics/1107970/carbon-dioxide-emissions-passenger-transport/ (accessed on 6 May 2023).

- Carbon-Dioxide Emissions of Passenger Transport. Available online: https://www.eea.europa.eu/en/topics/in-depth/transport-and-mobility (accessed on 3 May 2023).

- A European Strategy for Low-Emission Mobility—European Environment Agency. Available online: https://www.eea.europa.eu/policy-documents/a-european-strategy-for-low (accessed on 3 May 2023).

- Greenhouse Gas Emissions from Transport in Europe—European Environment Agency. Available online: https://www.eea.europa.eu/ims/greenhouse-gas-emissions-from-transport (accessed on 3 May 2023).

- Commission Regulation (EU) No 459/2012 of 29 May 2012 Amending Regulation (EC) No 715/2007 of the European Parliament and of the Council and Commission Regulation (EC) No 692/2008 as Regards Emissions from Light Passenger and Commercial Vehicles (Euro 6) Text with EEA Relevance. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32012R0459 (accessed on 3 May 2023).

- European Green Deal Package. European Green Deal: The “Fit for 55 Package”|Thought Leadership|Insights|Linklaters. Available online: https://www.linklaters.com/en/insights/thought-leadership/energy/european-green-deal (accessed on 3 May 2023).

- Ghosh, A. Possibilities and Challenges for the Inclusion of the Electric Vehicle (EV) to Reduce the Carbon Footprint in the Transport Sector: A Review. Energies 2020, 13, 2602. [Google Scholar] [CrossRef]

- Sobol, L.; Dyjakon, A. The Influence of Power Sources for Charging the Batteries of Electric Cars on CO2 Emissions during Daily Driving: A Case Study from Poland. Energies 2020, 13, 4267. [Google Scholar] [CrossRef]

- Huo, H.; Cai, H.; Zhang, Q.; Liu, F.; He, K. Life-cycle assessment of greenhouse gas and air emissions of electric vehicles: A comparison between China and the U.S. Atmos. Environ. 2015, 108, 107–116. [Google Scholar] [CrossRef]

- Requia, W.J.; Mohamed, M.; Higgins, C.D.; Arain, A.; Ferguson, M. How clean are electric vehicles? Evidence-based review of the effects of electric mobility on air pollutants, greenhouse gas emissions and human health. Atmos. Environ. 2018, 185, 64–77. [Google Scholar] [CrossRef]

- Huo, H.; Zhang, Q.; Wang, M.Q.; Streets, D.G.; He, K. Environmental Implication of Electric Vehicles in China. Environ. Sci. Technol. 2010, 44, 4856–4861. [Google Scholar] [CrossRef]

- Neugebauer, M.; Żebrowski, A.; Esmer, O. Cumulative Emissions of CO2 for Electric and Combustion Cars: A Case Study on Specific Models. Energies 2022, 15, 2703. [Google Scholar] [CrossRef]

- Wu, Q.; Sun, S. Energy and Environmental Impact of the Promotion of Battery Electric Vehicles in the Context of Banning Gasoline Vehicle Sales. Energies 2022, 15, 8388. [Google Scholar] [CrossRef]

- Gil-Garcia, I.C.; García-Casales, M.S.; Dagher, H.; Molina-Garcia, A. Electric Vehicle and Renewable Energy Sources: Motor Fusion in the Energy Transition from a Multi Indicator Perspective. Sustainability 2021, 13, 3430. [Google Scholar] [CrossRef]

- Gryparis, E.; Papadopoulos, P.; Leligou, H.C.; Psomopoulos, C.S. Electricity demand and carbon emission in power generation under high penetration of electric vehicles. A European Union perspective. Energy Rep. 2020, 6, 475–486. [Google Scholar] [CrossRef]

- Vanderheiden, S. Assessing the case against the SUV. Environ. Polit. 2006, 15, 23–40. [Google Scholar] [CrossRef]

- Jochem, P.; Babrowski, S.; Fichtner, W. Assessing CO2 emissions of electric vehicles in Germany in 2030. Transp. Res. Part A Policy Pract. 2015, 78, 68–83. [Google Scholar] [CrossRef]

- Choi, H.; Shin, J.; Woo, J. Effect of electricity generation mix on battery electric vehicle adoption and its environmental impacts. Energy Policy 2018, 121, 13–24. [Google Scholar] [CrossRef]

- Koengkan, M.; Fuinhas, J.A.; Teixeira, M.; Kazemzadeh, E.; Auza, A.; Dehdar, F.; Osmani, F. The Capacity of Battery Electric and Plug-int Hybrid Vehicles to Mitigate CO2 Emissions: Macroeconomic Evidence from the European Union Countries. World Electr. Veh. J. 2022, 13, 58. [Google Scholar] [CrossRef]

- Kawamoto, R.; Mochizuki, H.; Moriguchi, Y.; Nkano, T.; Motohashi, M.; Sakai, Y.; Inaba, A. Estimation of CO2 Emissions of Internal Combustion Engine Vehicle and Battery Electric Vehicle Using LCA. Sustainability 2019, 11, 2690. [Google Scholar] [CrossRef]

- Costa, C.M.; Barbosa, J.C.; Goncales, R.; Castro, H.; Del Campo, F.J. Recycling and environmental issues of lithium-ion batteries: Advances, challenges and opportunities. Energy Storage Mater. 2021, 37, 433–465. [Google Scholar] [CrossRef]

- Pan, S.; Roy, A.; Choi, Y.; Eslami, E.; Thomas, S.; Jiang, X.; Gao, O. Potential impacts of electric vehicles on air quality and health endpoints in the Greater Houston Area in 2040. Atmos. Environ. 2019, 207, 38–51. [Google Scholar] [CrossRef]

- Nichols, B.G.; Kockelman, K.M.; Reiter, M. Air quality impacts of electric vehicle adoption in Texas. Transp. Res. Part D Transp. Environ. 2015, 34, 208–218. [Google Scholar] [CrossRef]

- Timmers, V.; Achten, P. Non-exhaust PM emissions from electric vehicles. Atmos. Environ. 2016, 134, 10–17. [Google Scholar] [CrossRef]

- Przydatek, G.; Ryniewicz, A.; Irmia, O.; Tomozei, C.; Mosnegutu, E.; Bodziony, M. Analysis of Noise Levels in Typical Passenger Cars. Sustainability 2023, 15, 7910. [Google Scholar] [CrossRef]

- Lan, Z.; Yuan, M.; Shao, S.; Li, F. Noise Emission Models of Electric Vechicles Considering Sppeed, Acceleration and Motion State. Int. J. Environ. Res. Public Health 2023, 20, 3531. [Google Scholar] [CrossRef]

- Campello-Vicente, H.; Peral-Orts, R.; Campillo-Davo, N.; Velasco-Sanchez, E. The effect of electric vehicles on urban noise maps. Appl. Acoust. 2017, 116, 59–64. [Google Scholar] [CrossRef]

- Møller Iversen, L.; Marbjerg, G.; Bendtsen, H. Noise from electric vehicles—‘state-of-the-art’ literature survey. In Proceedings of the Internoise 2013, Innsbruck, Austria, 15–18 September 2013. [Google Scholar]

- Altinsoy, M.E. The Evaluation of Conventional, Electric and Hybrid Electric Passenger Car Pass-By Noise Annoyance Using Psychoacoustical Properties. Appl. Sci. 2022, 12, 5146. [Google Scholar] [CrossRef]

| Territorial Entity | EV Fleet | Ratio of EVs in Total Passenger Car Fleet (%) | Number of EVs PER 1000 Citizens | Number of Charging Points Per 10,000 Citizens (2022) | |

|---|---|---|---|---|---|

| Number of EVs (pcs.) in 2020 | Change 2022 (%) (2020 = 100%) | ||||

| EU average | 77,510 | 180.8 | 2.10 | 12.56 | 10.7 |

| Austria | 59,744 | 155.3 | 2.75 | 16.99 | 25.5 |

| Czech Republic | 9835 | 130.3 | 0.34 | 2.15 | 3.8 |

| Croatia | 1906 | 285.3 | 0.39 | 1.89 | 3.3 |

| Poland | 12,475 | 393.5 | 0.22 | 1.64 | 1.0 |

| Hungary | 10,753 | 295.5 | 0.97 | 4.39 | 3.7 |

| Slovakia | 3506 | 199.7 | 0.39 | 1.93 | 5.0 |

| Slovenia | 4457 | 106.9 | 0.69 | 4.38 | 9.0 |

| Romania | 7410 | 329.1 | 0.39 | 1.67 | 0.9 |

| Car Type | Difference in Price (EV-ICE), Euro | Operational Costs of EVs (EV-ICE), Euro | Amortisation (EV-ICE), % | ||||

|---|---|---|---|---|---|---|---|

| 12,000 km | 18,000 km | 40,000 km | 12,000 km | 18,000 km | 40,000 km | ||

| Fiat vs. Aygo | 12,626 | 3087 | 6145 | 17,354 | 10.6 | 21.1 | 59.7 |

| Zoe vs. Yaris | 13,346 | 3547 | 6871 | 19,056 | 10.6 | 20.4 | 56.7 |

| ID3 vs. Golf | −5381 | 15,781 | 19,117 | 31,343 | 39.8 | 48.3 | 79.1 |

| Tesla vs. BMW | 2759 | 5329 | 8476 | 20,010 | 9.8 | 15.7 | 36.9 |

| Car Type | CO2 Emissions (kg) for the Total (7 Years) Mileage | CO2 Emission (g/km) | |||

|---|---|---|---|---|---|

| 12,000 km/year | 18,000 km/year | 40,000 km/year | |||

| Segment A | Toyota Aygo 1.0 | 9408 | 14,112 | 31,360 | 112 |

| Segment B | Toyota Yaris 1.0 | 10,416 | 15,624 | 34,720 | 124 |

| Segment C | Volkswagen Golf 1.5 TSI | 10,416 | 15,624 | 34,720 | 124 |

| Segment D | BMW G30 520i | 12,600 | 18,900 | 42,000 | 150 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Horváth, G.; Bai, A.; Szegedi, S.; Lázár, I.; Máthé, C.; Huzsvai, L.; Zakar, M.; Gabnai, Z.; Tóth, T. A Comprehensive Review of the Distinctive Tendencies of the Diffusion of E-Mobility in Central Europe. Energies 2023, 16, 5421. https://doi.org/10.3390/en16145421

Horváth G, Bai A, Szegedi S, Lázár I, Máthé C, Huzsvai L, Zakar M, Gabnai Z, Tóth T. A Comprehensive Review of the Distinctive Tendencies of the Diffusion of E-Mobility in Central Europe. Energies. 2023; 16(14):5421. https://doi.org/10.3390/en16145421

Chicago/Turabian StyleHorváth, Gábor, Attila Bai, Sándor Szegedi, István Lázár, Csongor Máthé, László Huzsvai, Máté Zakar, Zoltán Gabnai, and Tamás Tóth. 2023. "A Comprehensive Review of the Distinctive Tendencies of the Diffusion of E-Mobility in Central Europe" Energies 16, no. 14: 5421. https://doi.org/10.3390/en16145421

APA StyleHorváth, G., Bai, A., Szegedi, S., Lázár, I., Máthé, C., Huzsvai, L., Zakar, M., Gabnai, Z., & Tóth, T. (2023). A Comprehensive Review of the Distinctive Tendencies of the Diffusion of E-Mobility in Central Europe. Energies, 16(14), 5421. https://doi.org/10.3390/en16145421