An Alternative Regulation of Compensation Mechanisms for Electric Energy Transgressions of Service Quality Limits in Dispersed and Seasonal Areas

Abstract

:1. Introduction

1.1. Literature Review

1.2. Novel Contribution

- The vicious cycle promoted by financial compensation for irrigating consumers.

- The parameters for modifying quality indicator thresholds.

- The proposed regulatory mechanism, defined as an interruptible tariff, to guide and limit the scope of financial compensation caused by interruptions in the power supply.

- The composition of an investment fund, obtained as a result of the appropriation of part of the financial compensation.

2. Theoretical Regulatory Framework and Motivation

2.1. Regulatory Theoretical Framework

- DIC: individual interruption duration.

- FIC: individual interruption frequency.

- DMIC: maximum duration of continuous interruption.

- n: number of interruptions for the individual consumer.

- t(i): duration time of interruption (i) for the individual consumer, in hours.

- t(i)max: time of the maximum duration of continuous interruption (i), in hours.

- DEC: equivalent duration of interruption per consumer.

- FEC: equivalent frequency of interruption per consumer.

- i: index of billed consumer units in the set.

- Cc: total number of billed consumer units in the set for the calculation period (monthly, quarterly, or annually), served at low voltage or medium voltage.

- DICV: verified interruption duration.

- DICp: continuity limit for the interruption duration indicator.

- DMICV: verified maximum duration of continuous interruption.

- FICV: verified interruption frequency.

- FICp: continuity limit for the interruption frequency indicator.

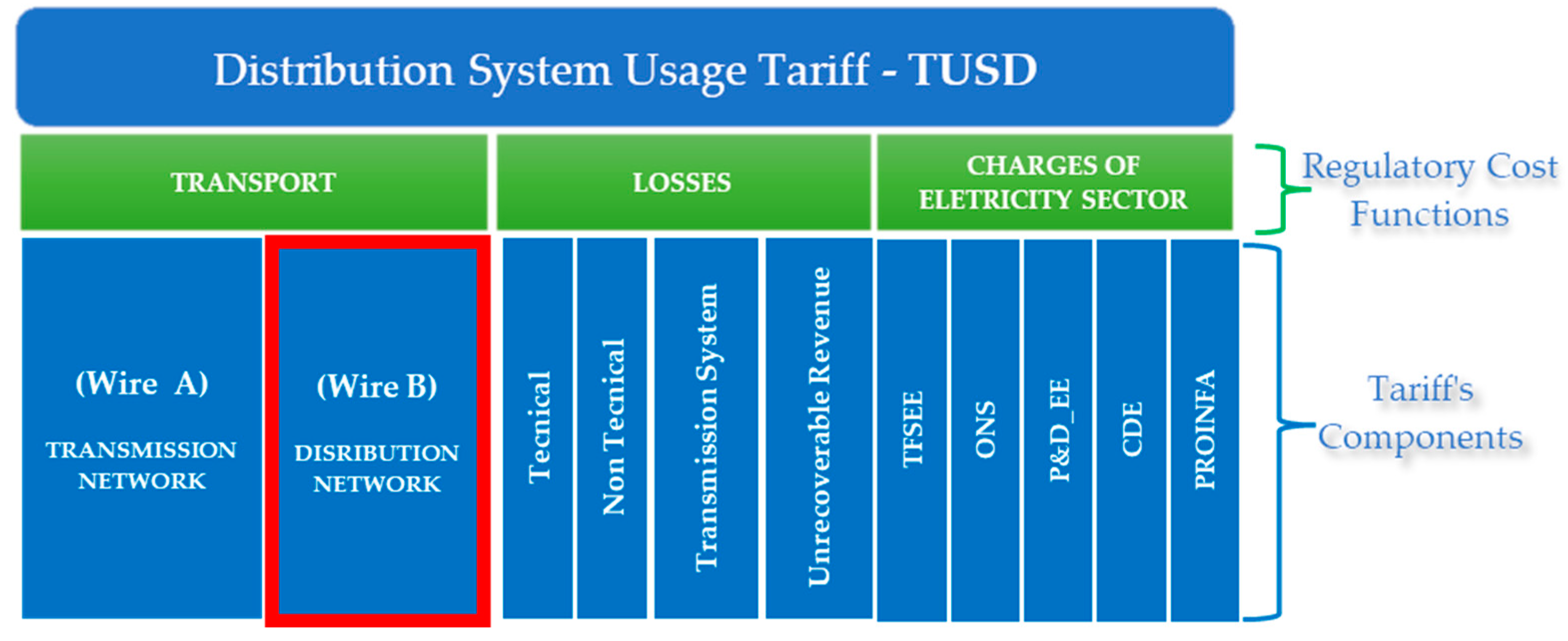

- EUSDB: base monetary value in the compensation calculation, which corresponds to the Distribution System’s Charge Use related to the Wire Regulatory Component portion.

- 730: average number of hours in a month.

- : weighting Factor—34 for low voltage consumer units; 40 for medium voltage consumer units, and 108 for high voltage consumer units.

2.2. Motivation

- Upon occurrence of interruptions, consumers perceive a deficient service provision.

- These interruptions signal for an increase in regulatory requirements by the regulatory agency (ANEEL), imposing more stringent limits. Consequently, these requirements resulting in an increase in the amount of financial compensation to be paid to the users by the power utility.

- Thus, they lead the power utility to an economic situation of unbalance between revenue (EUSDB) and expense (Financial Compensation).

- This imbalance leads the power utility to a loss of economic power to make investments.

- Not making investments in service quality implies a reduction in the quality level and closes the cycle.

3. Proposal for Compensation Mechanism Methodology: Interruptible Tariff

- EUSDB: Distribution System Use Charge for Wire B tariff.

- IA: actual indicator value.

- IP: indicator standard value.

- Comp: value of financial compensation for violation of the standard indicator.

- : weighting factor equal to 40 for medium voltage consumers.

- 730: total monthly average hours.

- Pmax (%): maximum percentage discount limit [0–100%].

- DICV: duration of interruption verified.

- DICp: continuity limit for interruption duration indicator.

- DMICV: maximum duration of continuous interruption verified.

- FICV: interruption frequency verified.

- FICp: continuity limit for interruption frequency indicator.

- EUSDB: base monetary value in the compensation calculation, corresponding to the Distribution System Use Charge related to the TUSD Wire B component.

- 730: average number of hours in a month.

- : weighting factor of 40 for consumers in medium voltage.

- The monetary value of the Distribution System Use Charge—EUSDB—related to the application of the Distribution System Use Tariff—TUSD Wire B. This monetary base is the result of the consumer’s billing, calculated from the peak demand volume [kW] and multiplied by the TUSD Wire B tariff (R$/kW), as presented in Table 2.

- Violations of continuity indicators during the period: DIC, FIC, or DMIC.

- The standard indicators: DIC, FIC, and DMIC regulatory limits.

- VI: violation of indicators.

- Comp_Ini: initial financial compensation.

- VB: base violation.

- IA: measured indicator.

- IP: standard indicator (target), regulatory limit.

- 730: average number of hours per month.

- Initially, calculate the initial financial compensation () according to expressions (10)–(12).

- Perform the optimization process based on the objective function in expression 9 and the respective constraints (9a)–(9d).

- With the values of x1 and x2 obtained from the optimization process, calculate the discount on the EUSDB by applying the interruptible tariff according to the following expression (17):

- Check for residual compensation in cases where > , using the following expression (18):

- Finally, calculate the gain, which represents the difference between the initial compensation with the discount values in the EUSDB and the residual compensation, according to expression (19)

- Form an investment fund for quality improvement applications formed by the gain and the residual compensation.

4. Case Study

4.1. Energy Consumption Characteristics

4.2. Process of Rice Cultivation

4.3. Characteristics of Energy Supply Networks

4.4. Quality of Service

5. Application of the Proposed Methodology in the Case Study

- Indicator violation less than the base violation: ;

- Indicator violation greater than or equal to the base violation: .

5.1. Indicator Violation Less Than the Base Violation (VI < VB)

- (i): First, calculate the value of the financial compensation according to expressions (10), (11), or (12).

- (ii): Then, solve the optimization problem to calculate the decision variables and .

- (iii): Then, calculate the EUSDB discount.

- (iv): Finally, calculate the gain.

5.2. Indicators Violation Greater or Equal to the Base Violation (VI ≥ VB)

- i: irrigating consumers who had violated indicators.

- UC: number of consumers who had violated indicators in the period.

- j: years of the previous Tariff Review cycle.

- n: period from 2018 to 2021.

- EUSDB: Distribution System Use Charge related to TUSD Wire B.

- Ip: standard indicator (regulatory limit).

- : increase coefficient (DIC, FIC, and DMIC), which is 40. for the MT consumer unit.

- 730: hours per month.

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ANEEL | Agência Nacional de Energia Elétrica |

| Cc | Total number of billed consumer units in the set for the calculation period |

| CDE | Conta de Desenvolvimento Energético |

| CPFL | Companhia Paulista de Força e Luz |

| DEC | Duração Equivalente de Interrupção por consumidor |

| DIC | Duração de Interrupção Individual |

| DICp | Continuity limit for the interruption duration indicator; |

| DICV | Verified interruption duration |

| DMIC | Duração Máxima de Interrupção Contínua |

| ERSE | Entidade Reguladora dos Serviços Energéticos |

| EUSD | Encargo de Uso do Sistema de Distribuição |

| EUSDB | Encargo de Uso do Sistema de Distribuição—Fio B |

| FEC | Frequencia Equivalente de Interrupção por consumidor |

| FIC | Frequencia de Interrupção Individual |

| FICp | Continuity limit for the interruption frequency indicator |

| FICV | Verified interruption frequency |

| IBDR | Incentive-based demand response |

| i | Index of billed consumer units in the set |

| Measured indicator, in hours | |

| Standard indicator, in hours | |

| Weighting factor | |

| kWh | kilowatt-hour |

| kW | kilowatt |

| MUSD | Montante de Uso do Sistema de Distribuição |

| LV | Low voltage |

| MV | Medium voltage |

| n | Number of interruptions for the individual consumer |

| ONS | Operador Nacional dos Sistema Elétrico Brasileiro |

| OQL | Optimal quality level |

| PBDR | Price-based Demand Response |

| Pmax (%) | Maximum percentage discount limit |

| P&D_EE | Pesquisa e Desenvolvimento e Eficiência Energética |

| PROINFA | Programa de Incentivo às Fontes Alternativas de Energia Elétrica |

| PRODIST | Procedimentos de Distribuição de Energia Elétrica no Sistema Elétrico Nacional |

| PRORET | Procedimentos de Regulação Tarifária Elétrica no Sistema Elétrico Nacional |

| R$ | Real, Brasilian monetary unit |

| RGE Sul | Rio Grande Energia Sul |

| TE | Tarifa de Energia |

| THS Verde | Green Seasonal Time-of-Use Tariff |

| t(i) | Duration time of interruption (i) for the individual consumer, in hours |

| t(i)max | Time of the maximum duration of continuous interruption (i), in hours |

| SAIDI | System Average Interruption Duration Index |

| SAIFI | System Average Interruption Frequency Index |

| SIN | Sistema Interligado Nacional |

| TFSEE | Taxa de Fiscalização de Serviços de Energia Elétrica |

| TUSD | Tarifa de Uso do Sistema de Distribuição |

| VB | Violation base |

| VI | Violation of indicators |

| Discount to be applied on EUSDB, in percent | |

| Violation of financial compensation that equals the discount on EUSDB, in hours |

References

- ANEEL: PRODIST Módulo 8-Qualidade do Fornecimento de Energia Elétrica. Available online: https://www2.aneel.gov.br/cedoc/aren2021956_2_7.pdf (accessed on 24 September 2022).

- Białkowski, M.; Szetela, B. Discount as an Example of a Guarantee Instrument in the Field of the Consumer’s Right to Energy of an Adequate Quality. Energies 2023, 16, 1559. [Google Scholar] [CrossRef]

- Ellman, D.; Xiao, Y. Incentives to Manipulate Demand Response Baselines with Uncertain Event Schedules. IEEE Trans. Smart Grid 2021, 12, 1358–1369. [Google Scholar] [CrossRef]

- Schmitt, K.; Bhatta, R.; Chamana, M.; Murshed, M.; Osman, I.; Bayne, S.; Canha, L. A Review on Active Customers Participation in Smart Grids. J. Mod. Power Syst. Clean Energy 2023, 11, 3–16. [Google Scholar] [CrossRef]

- Inês, C.; Guilherme, P.L.; Esther, M.G.; Swantje, G.; Stephen, H.; Lars, H. Regulatory Challenges and Opportunities for Collective Renewable Energy Prosumers in the EU. Energy Policy 2020, 138, 111212. [Google Scholar] [CrossRef]

- Scheller, F.; Krone, J.; Kühne, S.; Bruckner, T. Provoking Residential Demand Response Through Variable Electricity Tariffs–A Model-Based Assessment for Municipal Energy Utilities. Technol. Econ. Smart Grids Sustain. Energy 2018, 3, 7. [Google Scholar] [CrossRef] [Green Version]

- Venizelou, V.; Philippou, N.; Hadjipanayi, M.; Makrides, G.; Efthymiou, V.; Georghiou, G.E. Development of a Novel Time-of-Use Tariff Algorithm for Residential Prosumer Price-Based Demand Side Management. Energy 2018, 142, 633–646. [Google Scholar] [CrossRef]

- Fraija, A.; Agbossou, K.; Henao, N.; Kelouwani, S.; Fournier, M.; Hosseini, S.S. A Discount-Based Time-of-Use Electricity Pricing Strategy for Demand Response with Minimum Information Using Reinforcement Learning. IEEE Access 2022, 10, 54018–54028. [Google Scholar] [CrossRef]

- Xue, W.; Zhao, X.; Li, Y.; Mu, Y.; Tan, H.; Jia, Y.; Wang, X.; Zhao, H.; Zhao, Y. Research on the Optimal Design of Seasonal Time-of-Use Tariff Based on the Price Elasticity of Electricity Demand. Energies 2023, 16, 1625. [Google Scholar] [CrossRef]

- Pandey, V.C.; Gupta, N.; Niazi, K.R.; Swarnkar, A.; Thokar, R.A. An Adaptive Demand Response Framework Using Price Elasticity Model in Distribution Networks. Electr. Power Syst. Res. 2022, 202, 107597. [Google Scholar] [CrossRef]

- Aalami, H.A.; Moghaddam, M.P.; Yousefi, G.R. Modeling and Prioritizing Demand Response Programs in Power Markets. Electr. Power Syst. Res. 2010, 80, 426–435. [Google Scholar] [CrossRef]

- Moghaddam, M.P.; Abdollahi, A.; Rashidinejad, M. Flexible Demand Response Programs Modeling in Competitive Electricity Markets. Appl. Energy 2011, 88, 3257–3269. [Google Scholar] [CrossRef]

- Gellings, C.W.; Chamberlin, J.H. Demand-Side Management: Concepts and Methods; PennWell Publishing Company: Tulsa, OK, USA, 1993. [Google Scholar]

- Sharifi, R.; Fathi, S.H.; Vahidinasab, V. A review on Demand-side tools in electricity market, Renew. Sustain. Energy Rev. 2017, 72, 565–572. [Google Scholar] [CrossRef]

- Nikzad, M.; Mozafari, B. Reliability Assessment of Incentive- and Priced-Based Demand Response Programs in Restructured Power Systems. Int. J. Electr. Power Energy Syst. 2014, 56, 83–96. [Google Scholar] [CrossRef]

- ERSE: Relatório Da Qualidade De Serviço Do Setor Elétrico. Available online: https://www.erse.pt/media/lgepvosb/relatorio_rqs-se-2016.pdf (accessed on 25 November 2022).

- ERSE: Atualização da Tarifa de Energia do Setor Elétrico. Available online: https://www.erse.pt/media/re4l30ps/atualiza%C3%A7%C3%A3o-tenergia-se-2022-t4.pdf (accessed on 25 November 2022).

- SCE: Agricultural and Pumping Interruptible Program (AP-I). Available online: https://www.sce.com/sites/default/files/2019-07/AP-I%20Fact%20Sheet%200519%20r4_WCAG%20final_2.pdf (accessed on 26 January 2023).

- SCE: Rate Schedule Tou-Pa-3 for Agricultural & Paumping Service Customers. Available online: https://www.sce.com/sites/default/files/inline-files/TOU-PA-3%20Rate%20Fact%20Sheet_WCAG.pdf (accessed on 26 January 2023).

- IEEE Std. 1366-2012; IEEE Guide for Electric Power Distribution Reliability Indices. (Revision of IEEE Std. 1366-2003). IEEE Press: New York, NY, USA, 2012; pp. 1–43. [CrossRef]

- ANEEL: PRORET Módulo 7–Estrutura Tarifária das Concessionárias de Distribuição (Submódulo 7.2: Tarifas de Referência). Available online: https://www2.aneel.gov.br/cedoc/aren20231060_2_2.pdf (accessed on 15 November 2022).

- ANEEL: PRODIST Módulo 1–Glossário de Termos Técnicos do PRODIST. Available online: https://www2.aneel.gov.br/cedoc/aren2021956_2.pdf (accessed on 15 November 2022).

- ANEEL: PRORET Módulo 7–Estrutura Tarifária das Concessionárias de Distribuição (Submódulo 7.1: Procedimentos Gerais). Available online: https://www2.aneel.gov.br/cedoc/aren20231060_2_1.pdf (accessed on 15 November 2022).

- ANEEL: Resolução Normativa Nº 1000/2021–Regras de Prestação do Serviço Público de Distribuição de Energia Elétrica. Available online: https://www2.aneel.gov.br/cedoc/ren20211000.pdf (accessed on 15 November 2022).

- Paiva, E.M.C.D.; Heatwole, C.D.; Paiva, J.B.D.; Paiva, R.C.D.; Beling, F.A. Trends in Streamflow in the Ibicuí River Basin, Brazil: Influence of Rice Crop Irrigation. Trans. ASABE 2013, 56, 1371–1375. [Google Scholar]

- Pinto, V.M.; de Borja Reis, A.F.; de Melo, M.L.A.; Reichardt, K.; Santos, D.; de Jong van Lier, Q. Sustainable Irrigation Management in Tropical Lowland Rice in Brazil. Agric. Water Manag. 2023, 284, 108345. [Google Scholar] [CrossRef]

- Uberti, V.A. Lógica Fuzzy para Avaliação de Eficiência Energética em Sistemas de Irrigação de Lavouras de Arroz. Master’s Thesis, Universidade Federal de Santa Maria, Santa Maria, Brazil, 24 March 2017. [Google Scholar]

- SOSBAI: Arroz Irrigado–Recomendações Técnicas da Pesquisa para o Sul do Brasil. Available online: https://www.sosbai.com.br/uploads/documentos/recomendacoes-tecnicas-da-pesquisa-para-o-sul-do-brasil_906.pdf (accessed on 16 December 2021).

- CEPED UFSC: Atlas Brasileiro de Desastres Naturais 1991 a 2012. Available online: https://sosgisbr.files.wordpress.com/2018/02/brasil.pdf (accessed on 16 December 2021).

| Indicators Brazilian Indices | Indicators IEEE Std 1366 (2003) | Equation |

|---|---|---|

| DEC | SAIDI | |

| FEC | SAIFI |

| Energy Demand and Consumption | Quantity Registered | Non-Tax Tariff | Discounts | Discounted Revenue | ||

|---|---|---|---|---|---|---|

| TUSD (R$/kW) | TUSD (R$/MWh) | TE (R$/MWh) | ||||

| 1. Contracted Demand (kW) | 190.00 | - | - | - | - | - |

| 2. Billed Demand (kW) | 194.00 | 22.87 | - | - | 6.00% | R$4084.59 |

| 3. Demand Exceeded (kW) | 4.40 | 45.47 | - | - | 6.00% | R$189.18 |

| 4. Energy consumption for peak TUSD (kWh) | 6236.00 | - | 907.62 | - | 6.00% | R$5302.32 |

| 5. Energy consumption for off-peak TUSD (kWh) | 39,588.00 | - | 85.77 | - | 6.00% | R$3191.73 |

| 6. Energy consumption for reserved hourly interval TUSD (kWh) | 28,788.00 | - | 85.77 | - | 70.00% | R$740.74 |

| 7. Energy consumption for peak TE (kWh) | 6236.00 | - | - | 435.59 | 6.00% | R$2533.36 |

| 8. Energy consumption for off-peak TE (kWh) | 39,588.00 | - | - | 259.96 | 6.00% | R$9673.82 |

| 9. Energy consumption for reserved hourly interval TE (kWh) | 28,788.00 | - | - | 259.96 | 70.00% | R$2245.12 |

| Total—Irrigation Consumer’s Energy Bill | R$27,998.86 | |||||

| Consumer | Violated Indicator | EUSDB [R$] | Accurate Indicator (IA) [h] | DIC Limit (DICP) [h] | FIC Limit (FICP) | DMIC Limit (DMICP) [h] |

|---|---|---|---|---|---|---|

| UC545 | DMIC | 1695.67 | 11.99 | 13.0 | 5.0 | 10.0 |

| UC2 | DIC | 829.49 | 28.22 | 19.0 | 5.0 | 14.0 |

| UC3 | DIC | 1020.34 | 33.30 | 19.0 | 5.0 | 14.0 |

| UC546 | DIC | 425.06 | 31.08 | 28.0 | 7.0 | 20.0 |

| UC1066 | DMIC | 1758.78 | 28.18 | 28.0 | 7.0 | 20.0 |

| UC1068 | DMIC | 1202.45 | 28.18 | 28.0 | 7.0 | 20.0 |

| UC10 | DIC | 3429.11 | 33.83 | 28.0 | 7.0 | 20.0 |

| UC1310 | DMIC | 1968.56 | 28.86 | 28.0 | 7.0 | 20.0 |

| UC1311 | DMIC | 305.95 | 28.86 | 28.0 | 7.0 | 20.0 |

| UC1337 | DMIC | 2681.28 | 28.86 | 28.0 | 7.0 | 20.0 |

| UC1070 | DMIC | 1792.86 | 28.18 | 28.0 | 7.0 | 20.0 |

| UC749 | DMIC | 4055.85 | 32.11 | 28.0 | 7.0 | 20.0 |

| UC757 | DMIC | 658.74 | 24.35 | 28.0 | 7.0 | 20.0 |

| UC761 | DMIC | 1348.19 | 24.35 | 28.0 | 7.0 | 20.0 |

| UC762 | DMIC | 223.11 | 24.35 | 28.0 | 7.0 | 20.0 |

| UC763 | DMIC | 4935.05 | 24.35 | 28.0 | 7.0 | 20.0 |

| UC18 | DMIC | 332.57 | 26.68 | 28.0 | 7.0 | 20.0 |

| UC19 | DMIC | 760.62 | 26.68 | 28.0 | 7.0 | 20.0 |

| UC20 | DMIC | 324.38 | 26.68 | 28.0 | 7.0 | 20.0 |

| UC21 | DMIC | 377.13 | 20.72 | 28.0 | 7.0 | 20.0 |

| UC34 | DMIC | 1728.21 | 20.72 | 28.0 | 7.0 | 20.0 |

| UC37 | DIC | 5578.98 | 37.13 | 19.0 | 5.0 | 14.0 |

| UC566 | DMIC | 16.48 | 23.20 | 28.0 | 7.0 | 20.0 |

| UC41 | DIC | 15,291.45 | 28.63 | 19.0 | 5.0 | 14.0 |

| UC48 | DIC | 1362.95 | 40.78 | 28.0 | 7.0 | 20.0 |

| UC49 | DIC | 1375.60 | 40.78 | 28.0 | 7.0 | 20.0 |

| UC50 | DIC | 1831.46 | 40.78 | 28.0 | 7.0 | 20.0 |

| UC66 | DIC | 497.60 | 43.31 | 28.0 | 7.0 | 20.0 |

| UC781 | DMIC | 3021.96 | 26.15 | 28.0 | 7.0 | 20.0 |

| UC785 | DMIC | 1547.26 | 32.11 | 28.0 | 7.0 | 20.0 |

| Consumer | Initial Compensation (Comp_Ini) [R$] | x1 [%] | x2 [h] | Violation of the Standard Indicator (VI) [h] | Residual Compensation (Comp_Res) [R$] | Quality Investment Fund (Gain) [R$] | Discount on EUSDB [R$] |

|---|---|---|---|---|---|---|---|

| UC545 | 184.90 | 9.8% | 1.99 | 1.99 | 0.00 | 18.18 | 166.72 |

| UC2 | 419.06 | 33.6% | 9.22 | 9.22 | 0.00 | 140.65 | 278.41 |

| UC3 | 799.50 | 43.9% | 14.30 | 14.30 | 0.00 | 351.24 | 448.26 |

| UC546 | 71.74 | 14.4% | 3.08 | 3.08 | 0.00 | 10.36 | 61.38 |

| UC1066 | 788.32 | 30.9% | 8.18 | 8.18 | 0.00 | 243.98 | 544.34 |

| UC1068 | 538.96 | 30.9% | 8.18 | 8.18 | 0.00 | 166.81 | 372.15 |

| UC10 | 1095.44 | 24.2% | 5.83 | 5.83 | 0.00 | 265.22 | 830.22 |

| UC1310 | 955.70 | 32.7% | 8.86 | 8.86 | 0.00 | 312.34 | 643.36 |

| UC1311 | 148.53 | 32.7% | 8.86 | 8.86 | 0.00 | 48.54 | 99.99 |

| UC1337 | 1301.70 | 32.7% | 8.86 | 8.86 | 0.00 | 425.42 | 876.29 |

| UC1070 | 803.59 | 30.9% | 8.18 | 8.18 | 0.00 | 248.71 | 554.88 |

| UC749 | 2691.31 | 39.9% | 12.11 | 12.11 | 0.00 | 1073.51 | 1617.80 |

| UC757 | 157.02 | 19.2% | 4.35 | 4.35 | 0.00 | 30.22 | 126.79 |

| UC761 | 321.35 | 19.2% | 4.35 | 4.35 | 0.00 | 61.85 | 259.50 |

| UC762 | 53.18 | 19.2% | 4.35 | 4.35 | 0.00 | 10.24 | 42.94 |

| UC763 | 1176.30 | 19.2% | 4.35 | 4.35 | 0.00 | 226.41 | 949.89 |

| UC18 | 121.73 | 26.8% | 6.68 | 6.68 | 0.00 | 32.62 | 89.11 |

| UC19 | 278.41 | 26.8% | 6.68 | 6.68 | 0.00 | 74.60 | 203.81 |

| UC20 | 118.73 | 26.8% | 6.68 | 6.68 | 0.00 | 31.81 | 86.92 |

| UC21 | 14.88 | 3.8% | 0.72 | 0.72 | 0.00 | 0.56 | 14.31 |

| UC34 | 68.18 | 3.8% | 0.72 | 0.72 | 0.00 | 2.59 | 65.59 |

| UC37 | 5542.29 | 49.8% | 18.13 | 18.13 | 0.00 | 2762.01 | 2780.29 |

| UC566 | 2.89 | 14.9% | 3.20 | 3.20 | 0.00 | 0.43 | 2.46 |

| UC41 | 8068.86 | 34.5% | 9.63 | 9.63 | 0.00 | 2787.06 | 5281.80 |

| UC48 | 954.44 | 41.2% | 12.78 | 12.78 | 0.00 | 393.09 | 561.34 |

| UC49 | 963.29 | 41.2% | 12.78 | 12.78 | 0.00 | 396.74 | 566.55 |

| UC50 | 1282.52 | 41.2% | 12.78 | 12.78 | 0.00 | 528.22 | 754.30 |

| UC66 | 417.44 | 45.6% | 15.31 | 15.31 | 0.00 | 190.44 | 227.00 |

| UC781 | 1018.36 | 25.2% | 6.15 | 6.15 | 0.00 | 256.68 | 761.68 |

| UC785 | 1026.70 | 39.9% | 12.11 | 12.11 | 0.00 | 409.53 | 617.17 |

| Consumer | Violated Indicator | EUSDB [R$] | Accurate Indicator (IA) [h] | DIC Limit (DICP) [h] | FIC Limit (FICP) | DMIC Limit (DMICP) [h] |

|---|---|---|---|---|---|---|

| UC1 | DMIC | 204.09 | 37.94 | 13.0 | 5.0 | 10.0 |

| UC1064 | DIC | 1428.60 | 54.84 | 19.0 | 5.0 | 14.0 |

| UC740 | DIC | 1413.16 | 103.87 | 19.0 | 5.0 | 14.0 |

| UC13 | DIC | 4294.10 | 59.08 | 28.0 | 7.0 | 20.0 |

| UC25 | DIC | 576.90 | 62.67 | 19.0 | 5.0 | 14.0 |

| UC557 | DIC | 1665.14 | 60.55 | 28.0 | 7.0 | 20.0 |

| UC562 | DIC | 2093.60 | 60.55 | 28.0 | 7.0 | 20.0 |

| UC766 | DIC | 1318.40 | 60.55 | 28.0 | 7.0 | 20.0 |

| UC1071 | DIC | 893.21 | 83.83 | 28.0 | 7.0 | 20.0 |

| UC42 | DIC | 3623.80 | 97.90 | 28.0 | 7.0 | 20.0 |

| UC567 | DIC | 5544.81 | 194.98 | 28.0 | 7.0 | 20.0 |

| UC775 | DIC | 704.57 | 70.71 | 24.0 | 5.0 | 18.0 |

| UC569 | DIC | 5836.57 | 60.55 | 28.0 | 7.0 | 20.0 |

| UC54 | DIC | 234.23 | 65.72 | 24.0 | 5.0 | 18.0 |

| UC60 | DMIC | 2437.36 | 55.64 | 28.0 | 7.0 | 20.0 |

| Consumer | EUSDB [R$] | Initial Compensation (Comp_Ini) [R$] | x1 [%] | x2 [h] | Violation of the Standard Indicator (VI) [h] | Residual Compensation (Comp_Res) [R$] | Quality Investment Fund (Gain) [R$] | Discount on EUSDB (Discount_EUSDB) [R$] |

|---|---|---|---|---|---|---|---|---|

| UC1 | 204.09 | 312.46 | 50.0% | 18.25 | 27.94 | 54.18 | 156.23 | 102.05 |

| UC1064 | 1428.60 | 2805.54 | 50.0% | 18.25 | 35.84 | 688.47 | 1402.77 | 714.30 |

| UC740 | 1413.16 | 6571.77 | 50.0% | 18.25 | 84.87 | 2579.30 | 3285.88 | 706.58 |

| UC13 | 4294.10 | 7312.91 | 50.0% | 18.25 | 31.08 | 1509.41 | 3656.46 | 2147.05 |

| UC25 | 576.90 | 1380.45 | 50.0% | 18.25 | 43.67 | 401.78 | 690.23 | 288.45 |

| UC557 | 1665.14 | 2969.88 | 50.0% | 18.25 | 32.55 | 652.37 | 1484.94 | 832.57 |

| UC562 | 2093.60 | 3734.07 | 50.0% | 18.25 | 32.55 | 820.23 | 1867.04 | 1046.80 |

| UC766 | 1318.40 | 2351.45 | 50.0% | 18.25 | 32.55 | 516.52 | 1175.73 | 659.20 |

| UC1071 | 893.21 | 2732.49 | 50.0% | 18.25 | 55.83 | 919.64 | 1366.24 | 446.61 |

| UC42 | 3623.80 | 13,879.63 | 50.0% | 18.25 | 69.90 | 5127.92 | 6939.82 | 1811.90 |

| UC567 | 5544.81 | 50,732.69 | 50.0% | 18.25 | 166.98 | 22,593.94 | 25,366.35 | 2772.40 |

| UC775 | 704.57 | 1803.32 | 50.0% | 18.25 | 46.71 | 549.37 | 901.66 | 352.29 |

| UC569 | 5836.57 | 10,409.88 | 50.0% | 18.25 | 32.55 | 2286.66 | 5204.94 | 2918.29 |

| UC54 | 234.23 | 535.45 | 50.0% | 18.25 | 41.72 | 150.61 | 267.73 | 117.11 |

| UC60 | 2437.36 | 4759.87 | 50.0% | 18.25 | 35.64 | 1161.25 | 2379.94 | 1218.68 |

| Year | Financial Compensation (R$) | EUSDB (R$) | Target/ EUSDB (%) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Violated Indicators | Target—Standard Indicators | |||||||||

| DIC | FIC | DMIC | Total | DIC | FIC | DMIC | Total | |||

| 2018 | 1,134,433 | 36,071 | 361,435 | 1,531,940 | 1,682,270 | 117,475 | 838,936 | 2,638,681 | 1,983,375 | 33.0% |

| 2019 | 2,170,651 | 54,802 | 936,945 | 3,162,398 | 2,455,176 | 206,607 | 1,215,927 | 3,877,710 | 3,083,107 | 25.8% |

| 2020 | 1,377,835 | 65,679 | 733,093 | 2,176,606 | 2,288,012 | 196,117 | 1,453,517 | 3,937,645 | 3,372,932 | 16.7% |

| 2021 | 1,672,808 | 86,620 | 396,343 | 2,155,771 | 2,760,616 | 350,255 | 1,069,958 | 4,180,830 | 3,357,090 | 24.5% |

| Total | 6,355,728 | 243,172 | 2,427,816 | 9,026,715 | 9,186,074 | 870,455 | 4,578,338 | 14,634,866 | 11,796,505 | 24.06% |

| Consumer | x1 [%] | x2 [h] | Violation of the Standard Indicator (VI) [h] | Residual Compensation (Comp_Res) [R$] | Quality Investment Fund (Gain) [R$] | Discount on EUSDB (Discount_EUSDB) [R$] |

|---|---|---|---|---|---|---|

| UC545 | 9.8% | 1.99 | 1.99 | 0.00 | 18.18 | 166.72 |

| UC2 | 24.0% | 5.76 | 9.22 | 119.41 | 100.58 | 199.08 |

| UC3 | 24.0% | 5.76 | 14.30 | 362.74 | 191.88 | 244.88 |

| UC546 | 14.4% | 3.08 | 3.08 | 0.00 | 10.36 | 61.38 |

| UC1066 | 24.0% | 5.76 | 8.18 | 177.02 | 189.20 | 422.11 |

| UC1068 | 24.0% | 5.76 | 8.18 | 121.02 | 129.35 | 288.59 |

| UC10 | 24.0% | 5.76 | 5.83 | 9.55 | 262.90 | 822.99 |

| UC1310 | 24.0% | 5.76 | 8.86 | 253.87 | 229.37 | 472.46 |

| UC1311 | 24.0% | 5.76 | 8.86 | 39.46 | 35.65 | 73.43 |

| UC1337 | 24.0% | 5.76 | 8.86 | 345.79 | 312.41 | 643.51 |

| UC1070 | 24.0% | 5.76 | 8.18 | 180.44 | 192.86 | 430.29 |

| UC749 | 24.0% | 5.76 | 12.11 | 1071.99 | 645.91 | 973.40 |

| UC757 | 19.2% | 4.35 | 4.35 | 0.00 | 30.22 | 126.79 |

| UC761 | 19.2% | 4.35 | 4.35 | 0.00 | 61.85 | 259.50 |

| UC762 | 19.2% | 4.35 | 4.35 | 0.00 | 10.24 | 42.94 |

| UC1 | 24.0% | 5.76 | 27.94 | 188.49 | 74.99 | 48.98 |

| UC1064 | 24.0% | 5.76 | 35.84 | 1789.35 | 673.33 | 342.86 |

| UC740 | 24.0% | 5.76 | 84.87 | 4655.39 | 1577.22 | 339.16 |

| UC13 | 24.0% | 5.76 | 31.08 | 4527.23 | 1755.10 | 1030.58 |

| UC25 | 24.0% | 5.76 | 43.67 | 910.69 | 331.31 | 138.46 |

| UC557 | 24.0% | 5.76 | 32.55 | 1857.47 | 712.77 | 399.63 |

| UC562 | 24.0% | 5.76 | 32.55 | 2335.43 | 896.18 | 502.47 |

| UC766 | 24.0% | 5.76 | 32.55 | 1470.69 | 564.35 | 316.42 |

| UC1071 | 24.0% | 5.76 | 55.83 | 1862.32 | 655.80 | 214.37 |

| UC42 | 24.0% | 5.76 | 69.90 | 9678.81 | 3331.11 | 869.71 |

| UC567 | 24.0% | 5.76 | 166.98 | 37,226.09 | 12,175.85 | 1330.75 |

| UC775 | 24.0% | 5.76 | 46.71 | 1201.43 | 432.80 | 169.10 |

| UC569 | 24.0% | 5.76 | 32.55 | 6510.73 | 2498.37 | 1400.78 |

| UC54 | 24.0% | 5.76 | 41.72 | 350.73 | 128.51 | 56.21 |

| UC60 | 24.0% | 5.76 | 35.64 | 3032.53 | 1142.37 | 584.97 |

| Discount Limit | EUSDB (R$) | Financial Compensation (R$) | Residual Financial Compensation (R$) | Quality Investment Fund (R$) | Discount on EUSDB (R$) |

|---|---|---|---|---|---|

| 50.0% | 135,634.54 | 266,950.39 | 81,153.83 | 129,282.58 | 56,513.97 |

| 24.0% | 135,634.54 | 266,950.39 | 171,509.52 | 63,936.83 | 31,504.04 |

| Year | EUSDB (R$) | Financial Compensation (R$) | Residual Compensation (R$) | Quality Investment Fund (R$) | Discount on EUSDB (R$) |

|---|---|---|---|---|---|

| 2018 | 1,983,375.21 | 1,531,939.96 | 251,759.37 | 677,878.88 | 602,301.72 |

| 2019 | 3,083,107.19 | 3,162,397.88 | 698,209.14 | 1,454,722.00 | 1,009,466.74 |

| 2020 | 3,372,932.34 | 2,176,606.08 | 246,475.95 | 927,773.88 | 1,002,356.24 |

| 2021 | 3,357,090.47 | 2,155,771.07 | 322,926.66 | 929,225.99 | 903,618.42 |

| Total | 11,796,505.20 | 9,026,714.99 | 1,519,371.12 | 3,989,600.75 | 3,517,743.12 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

de Bitencourt, J.A.; Bernardon, D.P.; Eichkoff, H.S.; Garcia, V.J.; Silva, D.W.; Chiara, L.M.; Gomes, R.L.B.; Butto, S.A.; Barbosa, S.M.K.; Pose, A.C.A. An Alternative Regulation of Compensation Mechanisms for Electric Energy Transgressions of Service Quality Limits in Dispersed and Seasonal Areas. Energies 2023, 16, 5588. https://doi.org/10.3390/en16155588

de Bitencourt JA, Bernardon DP, Eichkoff HS, Garcia VJ, Silva DW, Chiara LM, Gomes RLB, Butto SA, Barbosa SMK, Pose ACA. An Alternative Regulation of Compensation Mechanisms for Electric Energy Transgressions of Service Quality Limits in Dispersed and Seasonal Areas. Energies. 2023; 16(15):5588. https://doi.org/10.3390/en16155588

Chicago/Turabian Stylede Bitencourt, Julio A., Daniel P. Bernardon, Henrique S. Eichkoff, Vinicius J. Garcia, Daiana W. Silva, Lucas M. Chiara, Renan L. B. Gomes, Sebastian A. Butto, Solange M. K. Barbosa, and Alejandre C. A. Pose. 2023. "An Alternative Regulation of Compensation Mechanisms for Electric Energy Transgressions of Service Quality Limits in Dispersed and Seasonal Areas" Energies 16, no. 15: 5588. https://doi.org/10.3390/en16155588