Balancing Profit and Environmental Sustainability with Carbon Emissions Management and Industry 4.0 Technologies

Abstract

:1. Introduction

2. Research Background

2.1. Introduction to Industry 4.0

2.2. The Impact of Industry 4.0 on the Textile Industry

2.3. Relationship between ERP, TOC, ABC, and Industry 4.0

3. Research Design and Methods

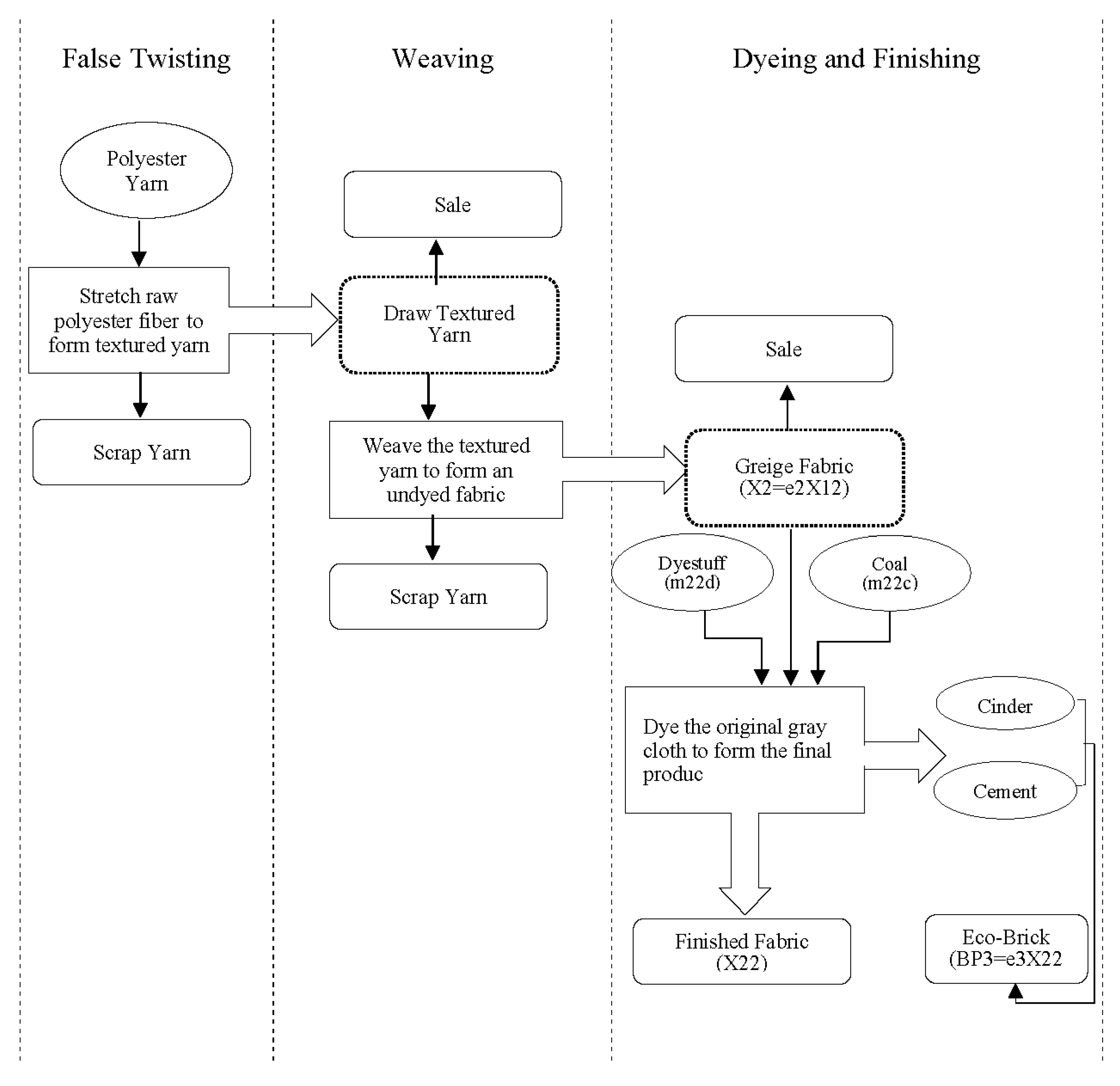

3.1. The Production Process of a Typical Textile Company

3.2. Process Assumptions

3.3. Single-Period Objective Function

| The selling price per unit of the product; | |

| Textured Yarn Sales Quantity; | |

| The amount of textured yarn that will enter the weaving process; | |

| Sales volume of raw gray cloth; | |

| Sales volume of finished cloth; | |

| By-product sales; | |

| Input–output relationship coefficient in false twisting process; | |

| Input–output relationship coefficient in weaving process; | |

| The input–output relationship coefficient of manufacturing environmentally friendly bricks; | |

| ; | |

| Cost of heat and water saved per unit of recycling; | |

| The quantity of raw material polyester fiber; | |

| Quantity of dye raw materials; | |

| The amount of cinder produced; | |

| Amount of cement; | |

| Direct labor costs for regular hours; | |

| This is a dummy variable of 0 and 1; | |

| Wage rate for direct labor in case of overtime; | |

| Overtime; | |

| Working Hours Limits for Regular Working Hours; | |

| Heat and water recovery in green energy; | |

| Fixed cost. |

3.3.1. Unit Direct Labor Cost Function

| Direct labor time required to move M; | |

| Direct labor time required to move ; | |

| Direct labor time required to move ; | |

| Direct labor time per batch activity from start to finish; | |

| The number of shipments per batch activity from start to finish; | |

| Setup time per batch of direct labor; | |

| Set the quantity of products in the batch activity; | |

| Direct labor hours in normal working hours; | |

| Overtime hours; | |

| Limits on normal direct labor hours; | |

| Direct labor hour limits for overtime; | |

| This is a dummy variable of 0 and 1. |

3.3.2. Batch Cost Transfer Function

3.3.3. Heat Energy and Water Energy Recovery Function

3.3.4. Input–Output Relationship Function

3.3.5. Other Sales and Production Functions

- —Machine hours consumed by the false twisting process;

- —Machine hours consumed in the weaving process;

- —Machine hours consumed by the dyeing-and-finishing process;

- —Machine hour limits for the false twist process;

- —Machine hour limits for the weaving process;

- —Machine hour limits for dyeing-and-finishing processes.

3.4. Single-Period Carbon Tax Cost Model

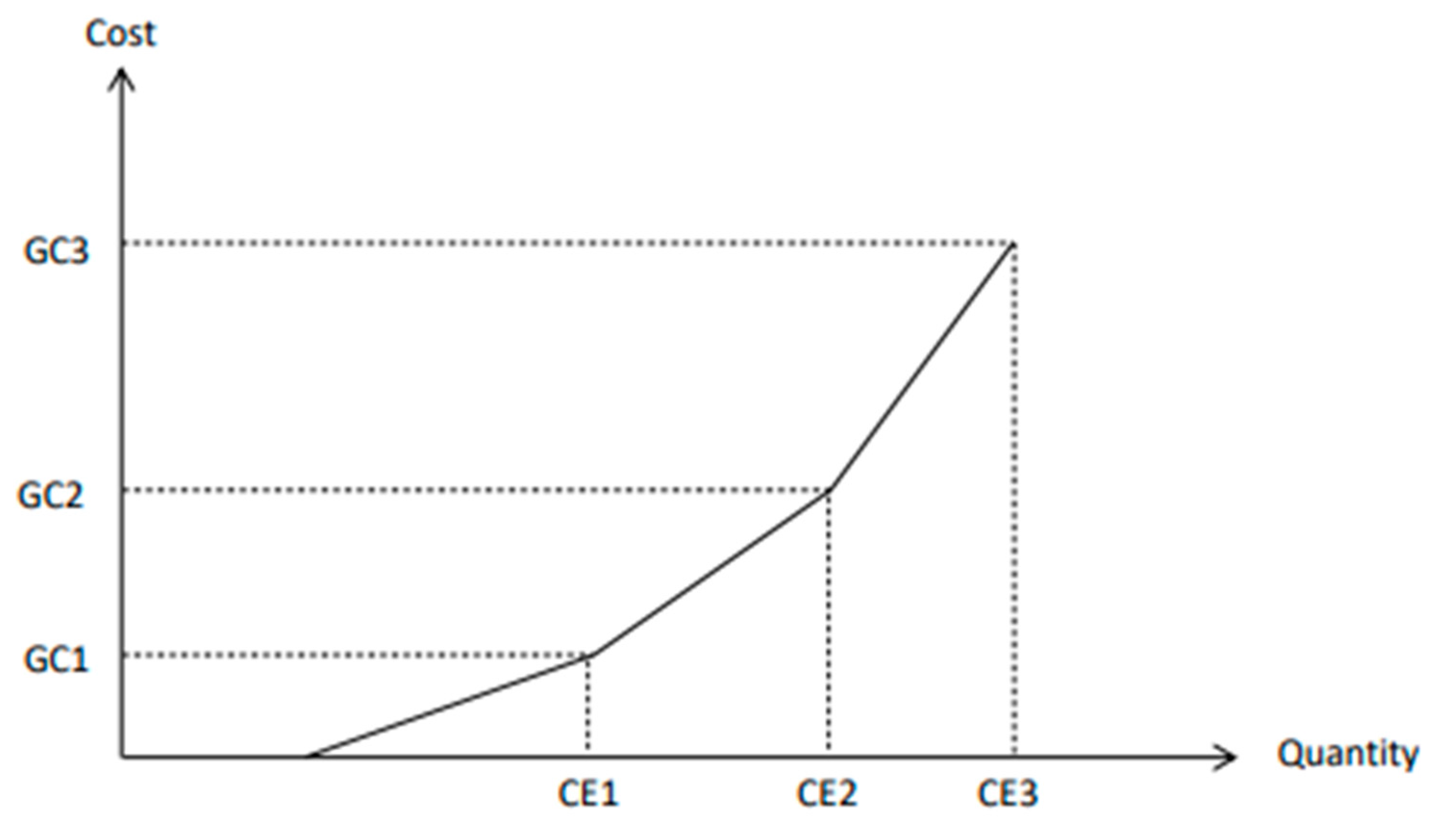

3.4.1. Cost Function of Continuous Progressive Tax Rate Carbon Tax with Tax Exemption

| Total carbon emissions in the dyeing-and-finishing process; | |

| First-stage total carbon tax cost; | |

| Second-stage total carbon tax cost; | |

| The total carbon tax cost of the third stage; | |

| Carbon emissions from duty-free credits; | |

| The total carbon emissions of the first stage; | |

| The total carbon emissions of the second stage; | |

| The total carbon emission of the third stage; | |

| 0, 1 dummy variable; | |

| A special set of non-negative variable types—at most, two adjacent variables can be non-zero; | |

| Total National Carbon Emissions Cap. |

3.4.2. Continuous Progressive Tax Rate Carbon Tax Cost Function with Tax Exemption Quota (Including Carbon Rights Trading)

| Total carbon emissions in the dyeing-and-finishing process; | |

| First-stage total carbon tax cost; | |

| Second-stage total carbon tax cost; | |

| The total carbon tax cost of the third stage; | |

| Carbon emissions from duty-free credits; | |

| The total carbon emissions of the first stage; | |

| The total carbon emissions of the second stage; | |

| The total carbon emission of the third stage; | |

| 0, 1 dummy variable; | |

| A special set of non-negative variable types, at most two adjacent variables can be non-zero; | |

| Total National Carbon Emissions Cap. |

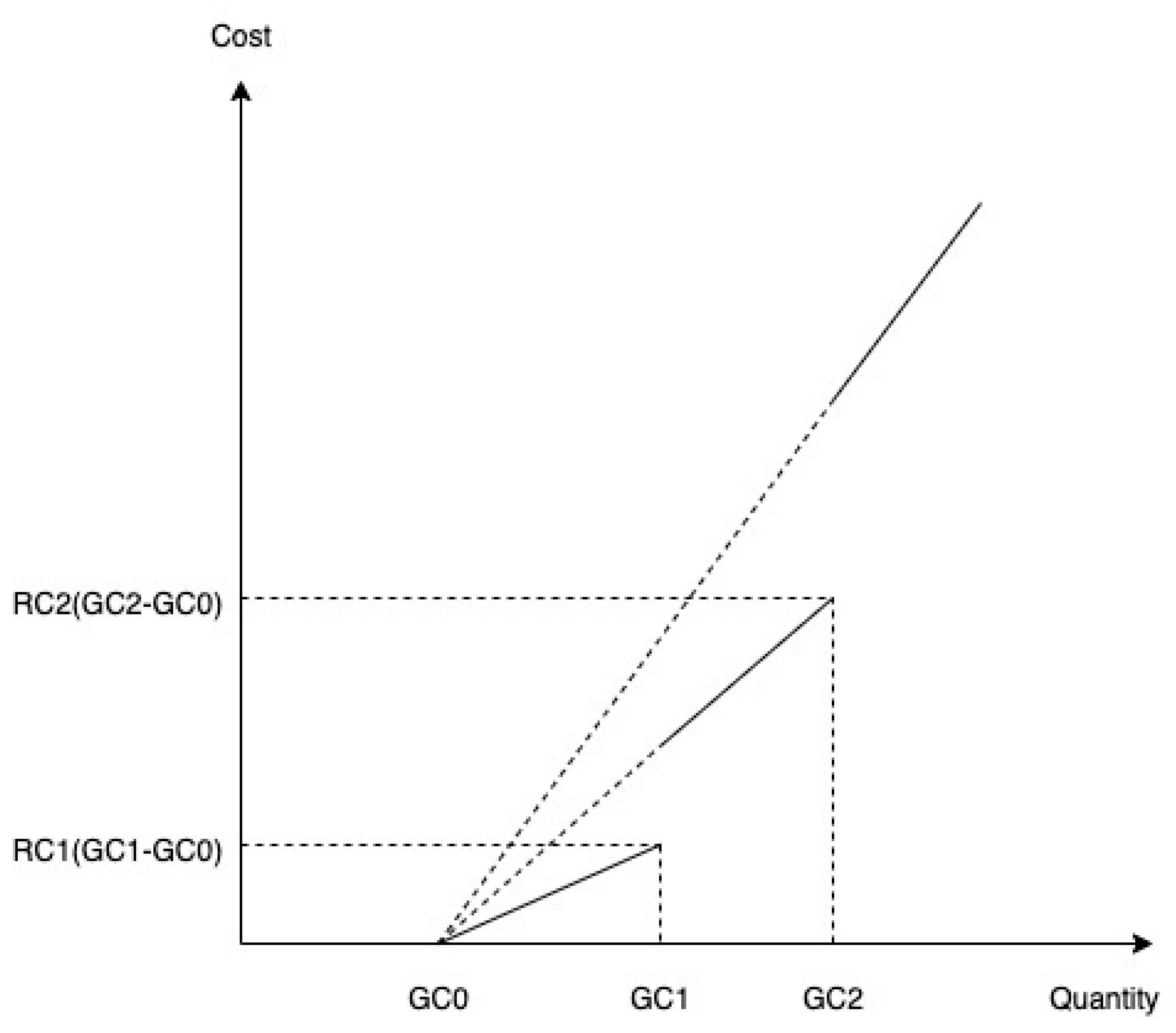

3.4.3. Tax Cost Function of Carbon with Discontinuous Progressive Tax Rate with Tax Exemption Quota

| Total carbon emissions in the dyeing-and-finishing process; | |

| Carbon emissions from duty-free credits; | |

| First-stage total carbon tax cost; | |

| Second-stage total carbon tax cost; | |

| The total carbon tax cost of the third stage; | |

| Not reaching the total carbon emissions for which a fee is charged; | |

| The total carbon emissions of the first stage; | |

| The total carbon emissions of the second stage; | |

| The total carbon emission of the third stage; | |

| 0, 1 dummy variable; | |

| National carbon cap. |

3.4.4. Carbon Tax Cost Function with Discontinuous Progressive Tax Rate with Tax Exemption Quota (Including Carbon Rights Trading)

| Total carbon emissions in the dyeing-and-finishing process; | |

| Carbon emissions from duty-free credits; | |

| First-stage total carbon tax cost; | |

| Second-stage total carbon tax cost; | |

| The total carbon tax cost of the third stage; | |

| Not reaching the total carbon emissions for which a fee is charged | |

| The total carbon emissions of the first stage; | |

| The total carbon emissions of the second stage; | |

| The total carbon emission of the third stage; | |

| National carbon cap; | |

| The maximum amount of carbon emissions that can be purchased; | |

| Single Carbon Right Cost Rate; | |

| The company’s total carbon emissions when ; | |

| The company’s total carbon emissions when ; | |

| 0, 1 dummy variable; | |

| 0, 1 dummy variable. |

4. Single-Period Model Analysis

4.1. Data Interpretation and Optimal Decision Analysis

4.2. The Best Solution of One-Period Model 1

4.3. The Best Solution of the Second Single-Period Model

4.4. The Best Solution of the Third Single-Period Model

4.5. The Best Solution of the Fourth Single-Period Model

4.6. Single-Period Model Comparison

5. Multi-Period Models

5.1. Model Functions

5.2. Carbon Tax Cost Function of Continuous Incremental Tax Rate with Tax Exemption Quota

5.2.1. Objective Equation

5.2.2. Unit Direct Labor Cost Constraint

5.2.3. Batch Cost Handling Constraints

5.2.4. Restricted Heat and Water Energy Recovery

5.2.5. Restricted Formula of Input–Output Relationship

5.2.6. Other Sales and Production Restrictions

5.2.7. Carbon Tax Cost Constraints

5.2.8. Raw Material Restriction Formula

- —The sum of the raw materials required for the three phases;

- —The maximum volume of raw materials used in the three phases.

5.3. Carbon Tax Cost Function of Continuous Incremental Tax Rate with Tax Exemption Quota (Including Carbon Trading)

5.3.1. Objective Equation

5.3.2. Carbon Tax Cost Constraints

5.4. Carbon Tax Cost Function with Discontinuous Incremental Tax Rate with Tax Exemption Quota

5.4.1. Objective Equation

5.4.2. Carbon Tax Cost Constraints

5.5. Carbon Tax Cost Function with Discontinuous Incremental Tax Rate with Tax-Free Quota (Including Carbon Rights Trading)

5.5.1. Objective Equation

5.5.2. Carbon Tax Cost Constraints

6. Multi-Period Model Analysis

6.1. Experimental Data of the Multi-Period Model

6.1.1. The Best Solution of Multi-Period Model 1

6.1.2. The Best Solution of the Second Multi-Period Model

6.1.3. The Best Solution of the Third Multi-Period Model

6.1.4. The Best Solution of the Fourth Multi-Period Model

6.1.5. Comparison of Multi-Period Models

6.2. Sensitivity Analysis

7. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Choudhury, A.R. Environmental impacts of the textile industry and its assessment through life cycle assessment. In Roadmap to Sustainable Textiles and Clothing; Springer: Berlin/Heidelberg, Germany, 2014; pp. 1–39. [Google Scholar] [CrossRef]

- Brettel, M.; Friederichsen, N.; Keller, M.; Rosenberg, M. How virtualization, decentralization and network building change the manufacturing landscape: An Industry 4.0 Perspective. Int. J. Mech. Ind. Sci. Eng. 2014, 8, 37–44. [Google Scholar]

- Rüßmann, M.; Lorenz, M.; Gerbert, P.; Waldner, M.; Justus, J.; Engel, P.; Harnisch, M. Industry 4.0: The future of productivity and growth in manufacturing industries. Boston Consult. Group 2015, 9, 54–89. [Google Scholar]

- Tsai, W.-H. Green production planning and control for the textile industry by using mathematical programming and industry 4.0 techniques. Energies 2018, 11, 2072. [Google Scholar] [CrossRef]

- Schoeberl, P.; Brik, M.; Braun, R.; Fuchs, W. Treatment and recycling of textile wastewater—Case study and development of a recycling concept. Desalination 2005, 171, 173–183. [Google Scholar] [CrossRef]

- Lee, J.; Bagheri, B.; Kao, H.-A. A cyber-physical systems architecture for industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Awad, M.I.; Hassan, N.M. Joint decisions of machining process parameters setting and lot-size determination with environmental and quality cost consideration. J. Manuf. Syst. 2018, 46, 79–92. [Google Scholar] [CrossRef]

- Rojko, A. Industry 4.0 concept: Background and overview. Int. J. Interact. Mob. Technol. 2017, 11, 77–90. [Google Scholar] [CrossRef]

- Park, S.; Huh, J.-H. Effect of cooperation on manufacturing it project development and test bed for successful industry 4.0 project: Safety management for security. Processes 2018, 6, 88. [Google Scholar] [CrossRef]

- Schwab, K. The Fourth Industrial Revolution, Currency; Crown: New York, NY, USA, 2017. [Google Scholar]

- Lee, J.; Kao, H.-A.; Yang, S. Service innovation and smart analytics for industry 4.0 and big data environment. Procedia Cirp 2014, 16, 3–8. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Zhang, D.; Li, D.; Zhang, C. Towards smart factory for industry 4.0: A self-organized multi-agent system with big data based feedback and coordination. Comput. Netw. 2016, 101, 158–168. [Google Scholar] [CrossRef]

- Leamer, E.E. Wage inequality from international competition and technological change: Theory and country experience. Am. Econ. Rev. 1996, 86, 309–314. [Google Scholar]

- Boyes, H.; Hallaq, B.; Cunningham, J.; Watson, T. The industrial internet of things (IIoT): An analysis framework. Comput. Ind. 2018, 101, 1–12. [Google Scholar] [CrossRef]

- Mahmood, H.; Furqan, M.; Hassan, M.S.; Rej, S. The environmental Kuznets Curve (EKC) hypothesis in China: A review. Sustainability 2023, 15, 6110. [Google Scholar] [CrossRef]

- Ragowsky, A.; Somers, T.M. Enterprise resource planning. J. Manag. Inf. Syst. 2002, 19, 11–15. [Google Scholar]

- Sumner, M. Enterprise Resource Planning; Pearson Education: London, UK, 2007. [Google Scholar]

- Leon, A. ERP Demystified; Tata McGraw-Hill Education: New York, NY, USA, 2008. [Google Scholar]

- Lasi, H.; Fettke, P.; Kemper, H.-G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Lopez, A.; Ricco, G.; Ciannarella, R.; Rozzi, A.; Di Pinto, A.; Passino, R. Textile wastewater reuse: Ozonation of membrane concentrated secondary effluent. Water Sci. Technol. 1999, 40, 99–105. [Google Scholar] [CrossRef]

- Chequer, F.D.; de Oliveira, G.A.R.; Ferraz, E.A.; Cardoso, J.C.; Zanoni, M.B.; de Oliveira, D.P. Textile dyes: Dyeing process and environmental impact. Eco-Friendly Text. Dye. Finish. 2013, 6, 151–176. [Google Scholar] [CrossRef]

- Dodman, D. Blaming cities for climate change? An analysis of urban greenhouse gas emissions inventories. Environ. Urban. 2009, 21, 185–201. [Google Scholar] [CrossRef]

- Ramanathan, V.; Feng, Y. Air pollution, greenhouse gases and climate change: Global and regional perspectives. Atmos. Environ. 2009, 43, 37–50. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Chen, H.-C.; Liu, J.-Y.; Chen, S.-P.; Shen, Y.-S. Using activity-based costing to evaluate capital investments for green manufacturing systems. Int. J. Prod. Res. 2011, 49, 7275–7292. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Hung, S.-J. A fuzzy goal programming approach for green supply chain optimisation under activity-based costing and performance evaluation with a value-chain structure. Int. J. Prod. Res. 2009, 47, 4991–5017. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Chen, H.-C.; Leu, J.-D.; Chang, Y.-C.; Lin, T.W. A product-mix decision model using green manufacturing technologies under activity-based costing. J. Clean. Prod. 2013, 57, 178–187. [Google Scholar] [CrossRef]

| Activities Resource | Process 1 | Process 2 | Process 3 | |||||

|---|---|---|---|---|---|---|---|---|

| Textured Yarn | Waste Yarn | Gray Cloth | Scrap Cloth | Finished Cloth | Eco-friendly Bricks | |||

| Selling Price Per Unit | TWD 97,000 | TWD 570 | TWD 135,000 | TWD 2100 | TWD 202,500 | TWD 2300 | ||

| Production Factor | 0.96 | 0.95 | 0.14 | |||||

| 0.04 | 0.05 | |||||||

| Direct Material Cost | 65,000 | 7000 | ||||||

| 1800 | 1500 | |||||||

| Machine Hour Limit | ||||||||

| Machine 1 | Machine Hours | 3 | ||||||

| Machine 2 | 4 | |||||||

| Machine 3 | 5 | |||||||

| 3 | 2 | 1 | ||||||

| Carbon Tax Limit | 7 | |||||||

| Direct Labor Constraints | ||||||||

| Cost | 47,840,000 | = 101,660,000 | ||||||

| Labor Hours | 598,000 | |||||||

| Wage Rate | ||||||||

| Carbon Tax Limit | ||||||||

| Emissions | 50,000 | 170,000 | 180,000 | |||||

| Tax Rate | 800/ton | 1100/ton | 1500/ton |

| Batch Job | Starting Point of Handling | Handling End Point | Textured Yarn | Gray Cloth | Finished Cloth | |

|---|---|---|---|---|---|---|

| 0 | 1 | 5,2 | ||||

| 1 | 2 | 1,1 | ||||

| 1 | 0 | 0.5,1 | ||||

| 2 | 3 | 1,1 | ||||

| 2 | 0 | 2,1 | ||||

| 3 | 0 | 3,2 | ||||

| 3,2 |

| Input–output relationship: | Machine hour objective function: |

| Batch-handling objective function: | |

| Target carbon tax function: | Direct artificial objective function: |

| Input–output relationship: | Input–output relationship: |

| Batch-handling objective function: | |

| Target carbon tax function: | Direct artificial objective function: |

| ] | |

| Input–output relationship: | Machine hour objective function: |

| Batch-handling objective function: | |

| Target carbon tax function: | Direct artificial objective function: |

| Input–output relationship: | Machine hour objective function: |

| Batch-handling objective function: | |

| Target carbon tax function: | Direct artificial objective function: |

| Model | Profit | Carbon Emission | Carbon Tax cost | Main Product Quantity (X11) | Main Product Quantity (X21) | Main Product Quantity (X22) | Heat Recovery Benefits | Water Recycling Benefits |

|---|---|---|---|---|---|---|---|---|

| Model 1 | 3,073,768,000 | 150,000 | 139,000,000 | 13,400 | 2321.429 | 21,428.57 | 1,221,428 | 2,185,715 |

| Model 2 | 3,463,244,000 | 159,250 | 154,714,000 | 13,400 | 1000 | 22,750 | 1,296,750 | 2,320,500 |

| Model 3 | 3,100,768,000 | 150,000 | 112,000,000 | 13400 | 2321.429 | 21,428.57 | 1,221,428 | 2,185,715 |

| Model 4 | 3,171,162,000 | 159,250 | 124,950,000 | 13,400 | 1000 | 22,750 | 1,296,750 | 2,320,500 |

| Model | Profit | Carbon Emission | Total Cost of Carbon Tax | Main Product Quantity (X11) | Main Product Quantity (X21) | Main Product Quantity (X22) | ||

|---|---|---|---|---|---|---|---|---|

| The First Phase | The Second Phase | The Third Phase | Sum of Three Periods | Sum of Three Periods | Sum of Three Periods | |||

| Model 1 | 9000,984,000 | 150,000 | 135,000 | 121,500 | 369,150,000 | 36252.63 | 16,928.57 | 58,071.42 |

| Model 2 | 9595,298,000 | 156,662 | 161,940 | 169,198 | 507,360,000 | 36279.63 | 5314.285 | 69,685.72 |

| Model 3 | 8816,679,000 | 170,000 | 66,500 | 170,000 | 301,200,000 | 44,297.74 | 9285.714 | 58,071.42 |

| Model 4 | 9687,638,000 | 170,000 | 170,000 | 147,800 | 415,020,000 | 36,252.63 | 5314.285 | 69,675.71 |

| Model | The Total Income of the Third Phase of Heat Recovery | The Total Income of the Third Phase of Water Reclamation | ||||||

| Model 1 | 3,310,071 | 5,923,286 | ||||||

| Model 2 | 4,212,085 | 7,107,943 | ||||||

| Model 3 | 3,310,072 | 5,923,286 | ||||||

| Model 4 | 3,972,086 | 7,107,943 | ||||||

| Carbon Tax Rate of Change | Carbon Tax Rate | Profit | Profit Rate of Change |

|---|---|---|---|

| Carbon Tax Single-Period Sensitivity Analysis | |||

| 800/1100/1500 | |||

| 840/1155/1575 | |||

| 880/1210/1650 | |||

| 920/1265/1725 | |||

| 960/1320/1800 | |||

| 1000/1375/1875 | |||

| Carbon Tax Multi-Period Sensitivity Analysis | |||

| 800/1100/1500 | |||

| 840/1155/1575 | |||

| 880/1210/1650 | |||

| 920/1265/1725 | |||

| 960/1320/1800 | |||

| 1000/1375/1875 | |||

| Rate of Change in Tax-free Allowance | Tax-Free Amount | Profit | Profit Rate of Change |

| Single-Period Sensitivity Analysis of Tax Exemption Quota | |||

| 10000 | |||

| 9500 | |||

| 9000 | |||

| 8500 | |||

| 8000 | |||

| 7500 | |||

| Sensitivity Analysis of Multi-Period Tax Exemption Quota | |||

| 10000 | |||

| 9500 | |||

| 9000 | |||

| 8500 | |||

| 8000 | |||

| 7500 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, W.-H. Balancing Profit and Environmental Sustainability with Carbon Emissions Management and Industry 4.0 Technologies. Energies 2023, 16, 6175. https://doi.org/10.3390/en16176175

Tsai W-H. Balancing Profit and Environmental Sustainability with Carbon Emissions Management and Industry 4.0 Technologies. Energies. 2023; 16(17):6175. https://doi.org/10.3390/en16176175

Chicago/Turabian StyleTsai, Wen-Hsien. 2023. "Balancing Profit and Environmental Sustainability with Carbon Emissions Management and Industry 4.0 Technologies" Energies 16, no. 17: 6175. https://doi.org/10.3390/en16176175

APA StyleTsai, W.-H. (2023). Balancing Profit and Environmental Sustainability with Carbon Emissions Management and Industry 4.0 Technologies. Energies, 16(17), 6175. https://doi.org/10.3390/en16176175