Overview of the Russian Coal Market in the Context of Geopolitical and Economic Turbulence: The European Embargo and New Markets

Abstract

:1. Introduction

2. Materials and Methods

3. Research Results

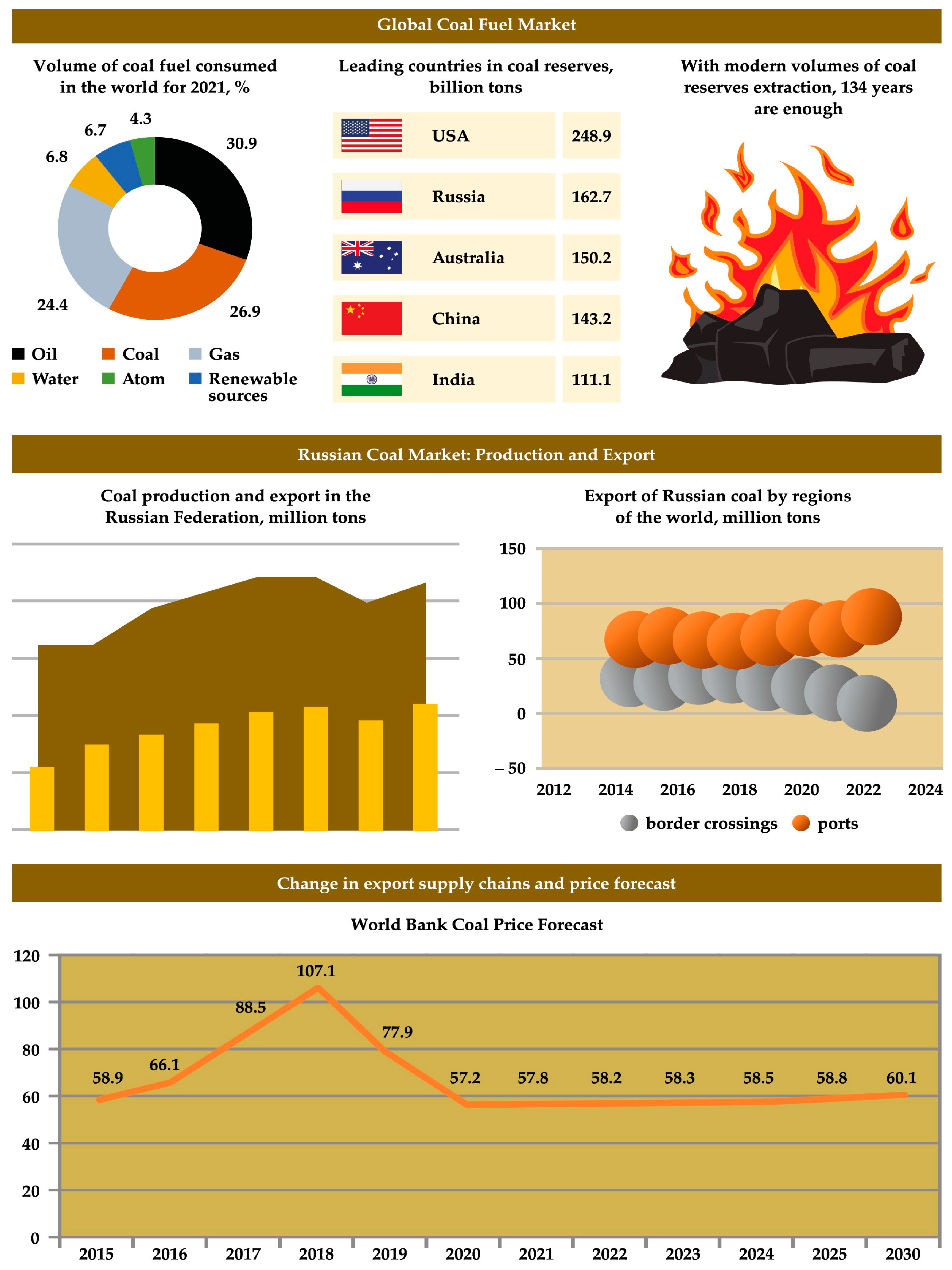

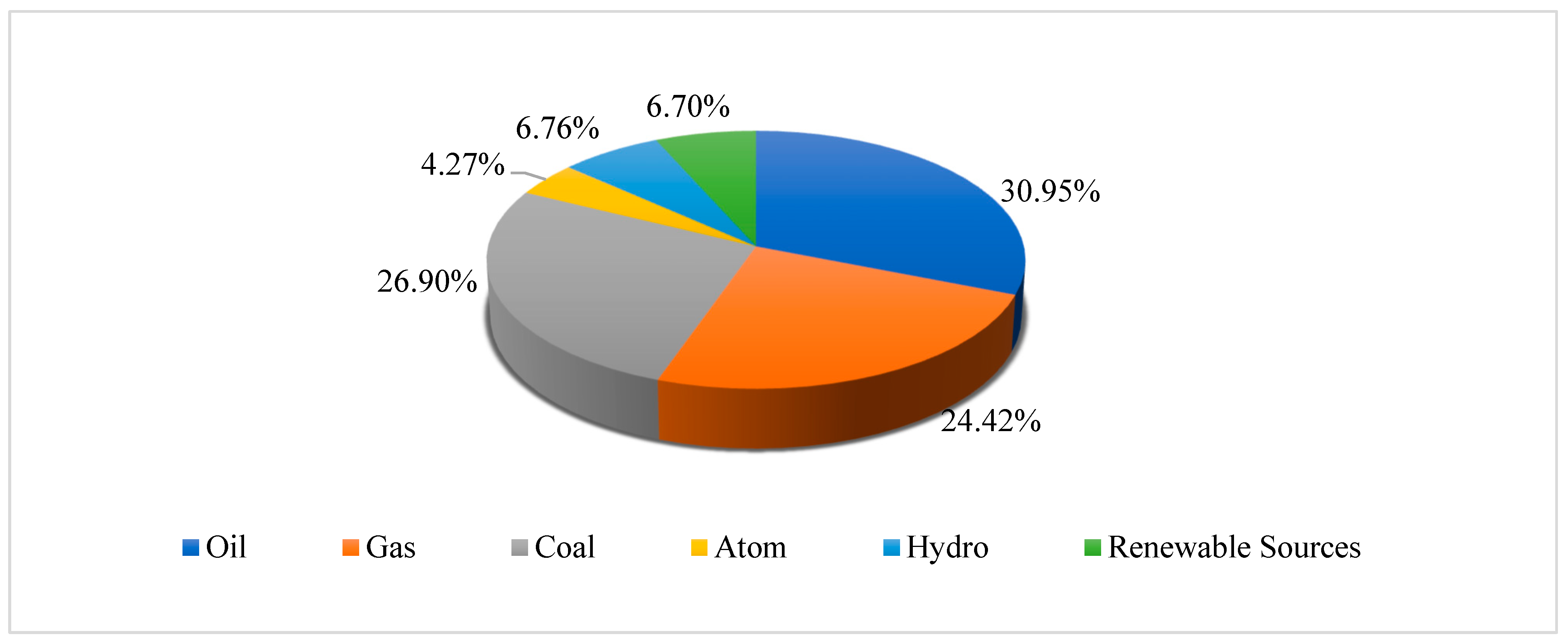

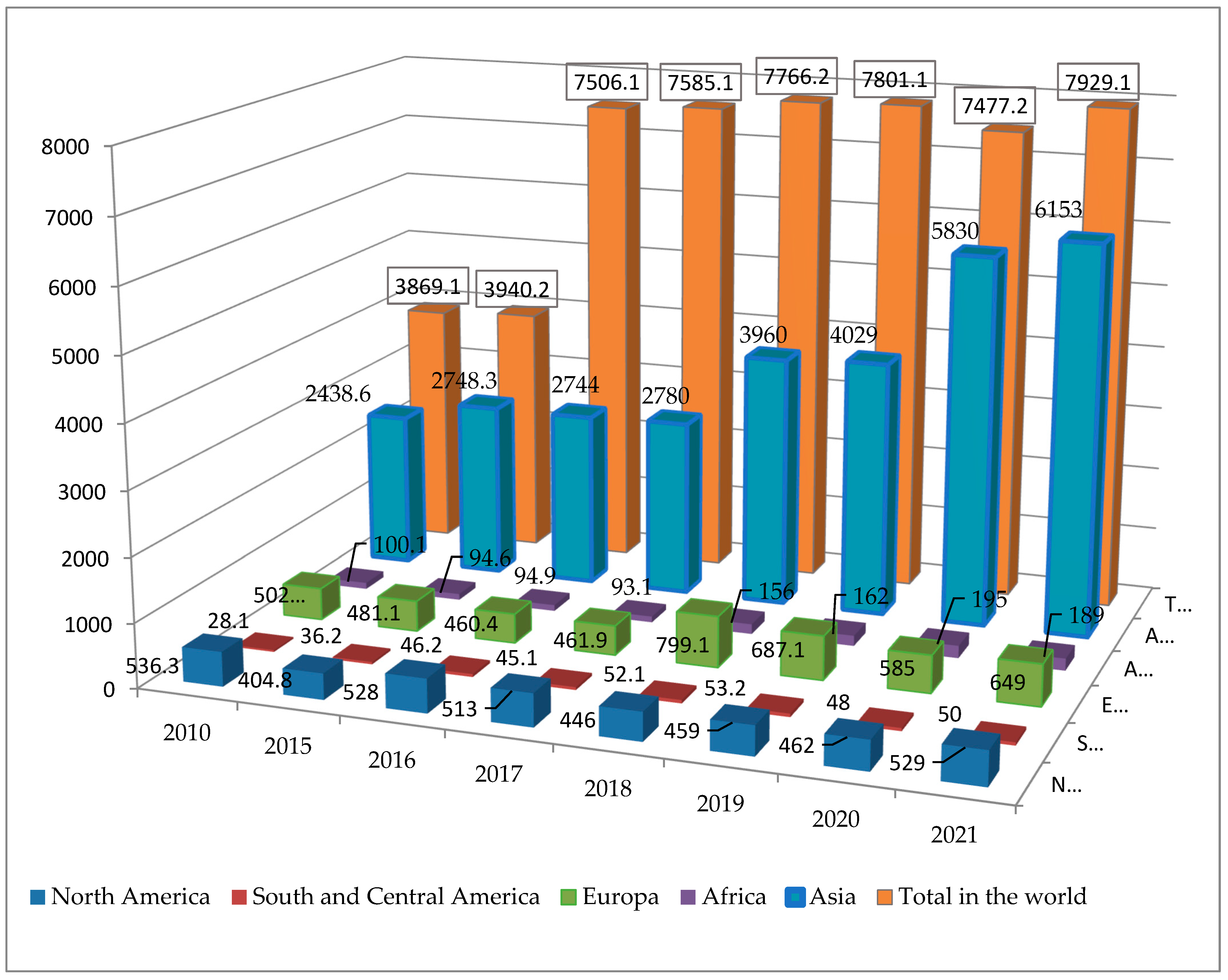

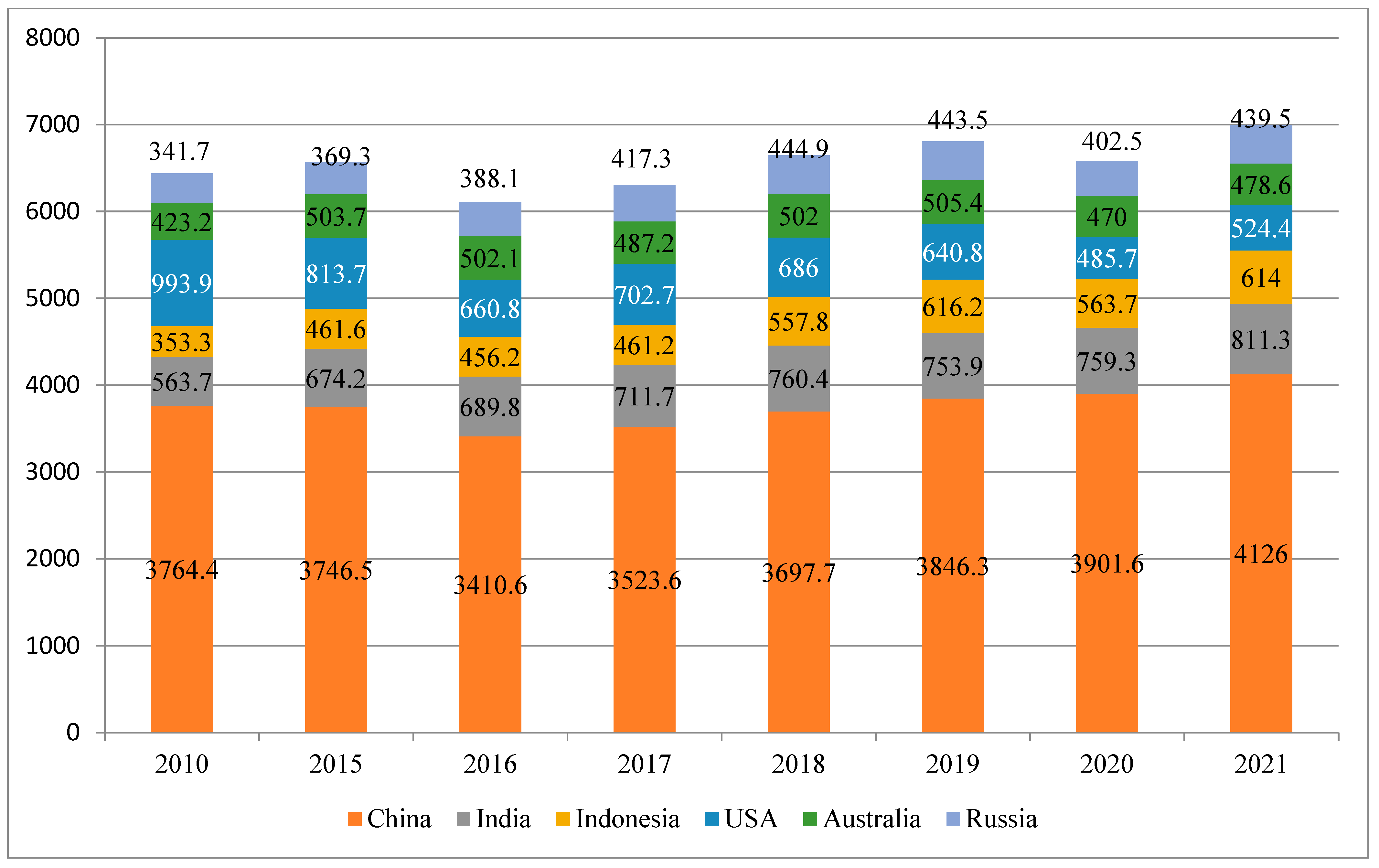

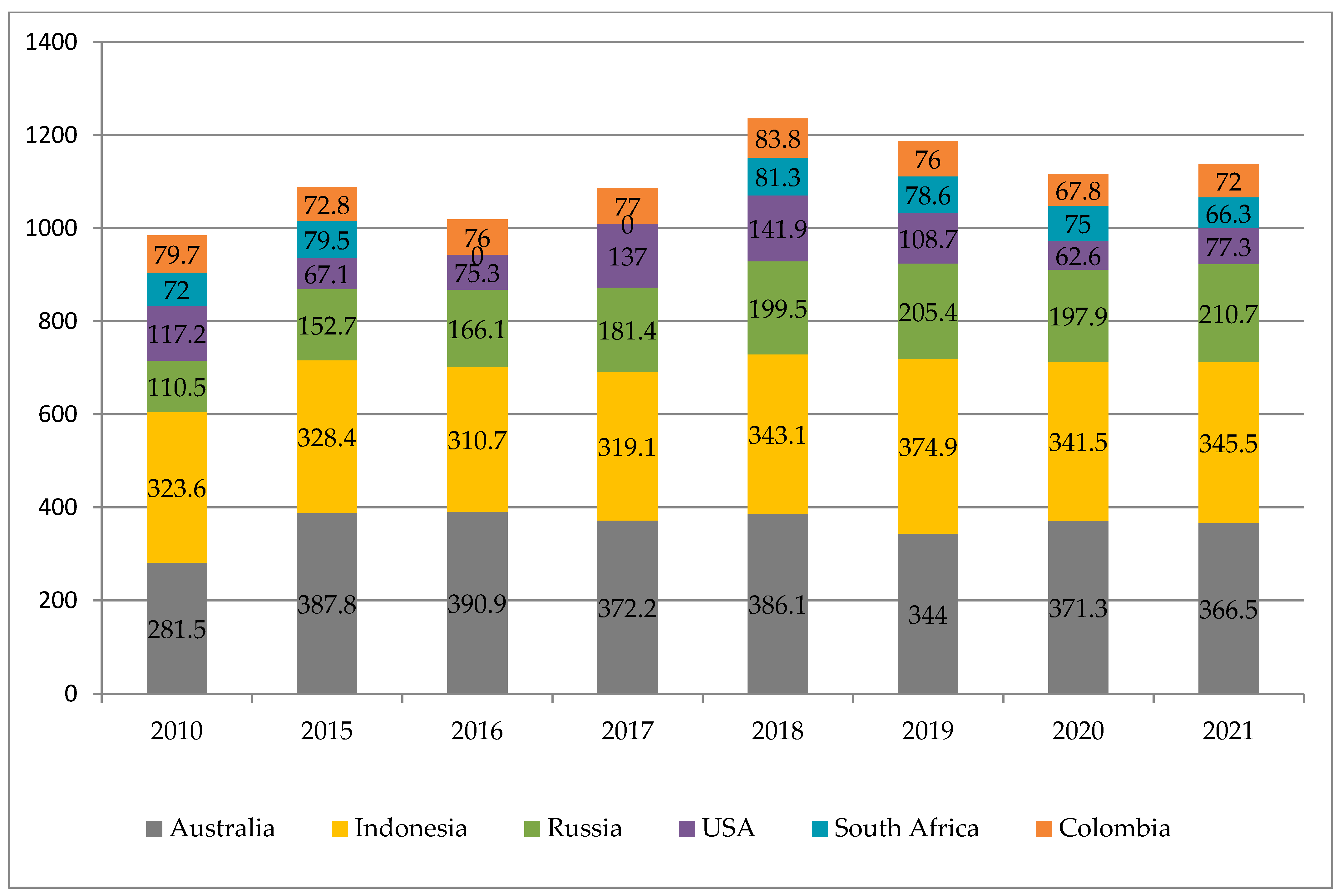

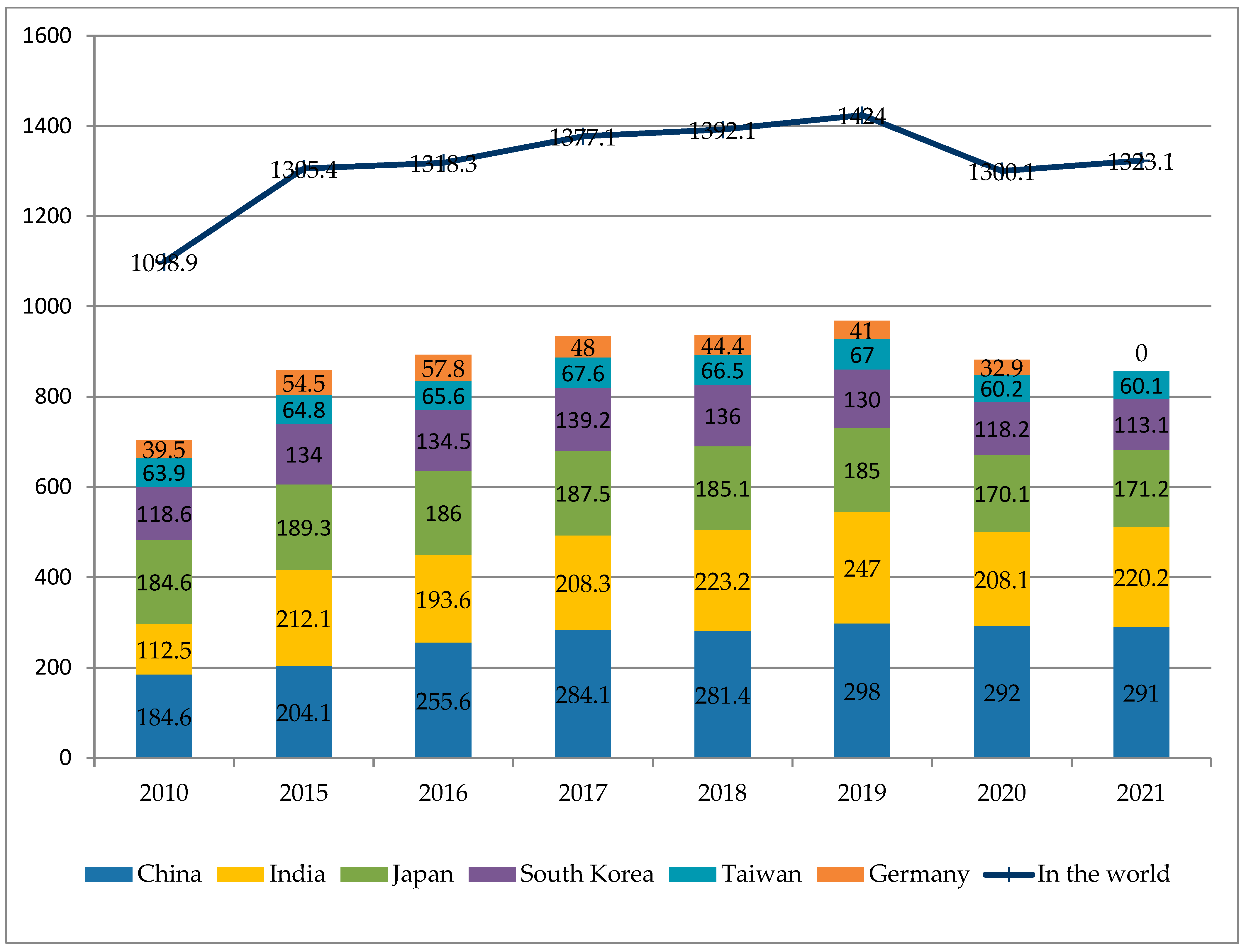

3.1. Analysis of the Global Coal Fuel Market

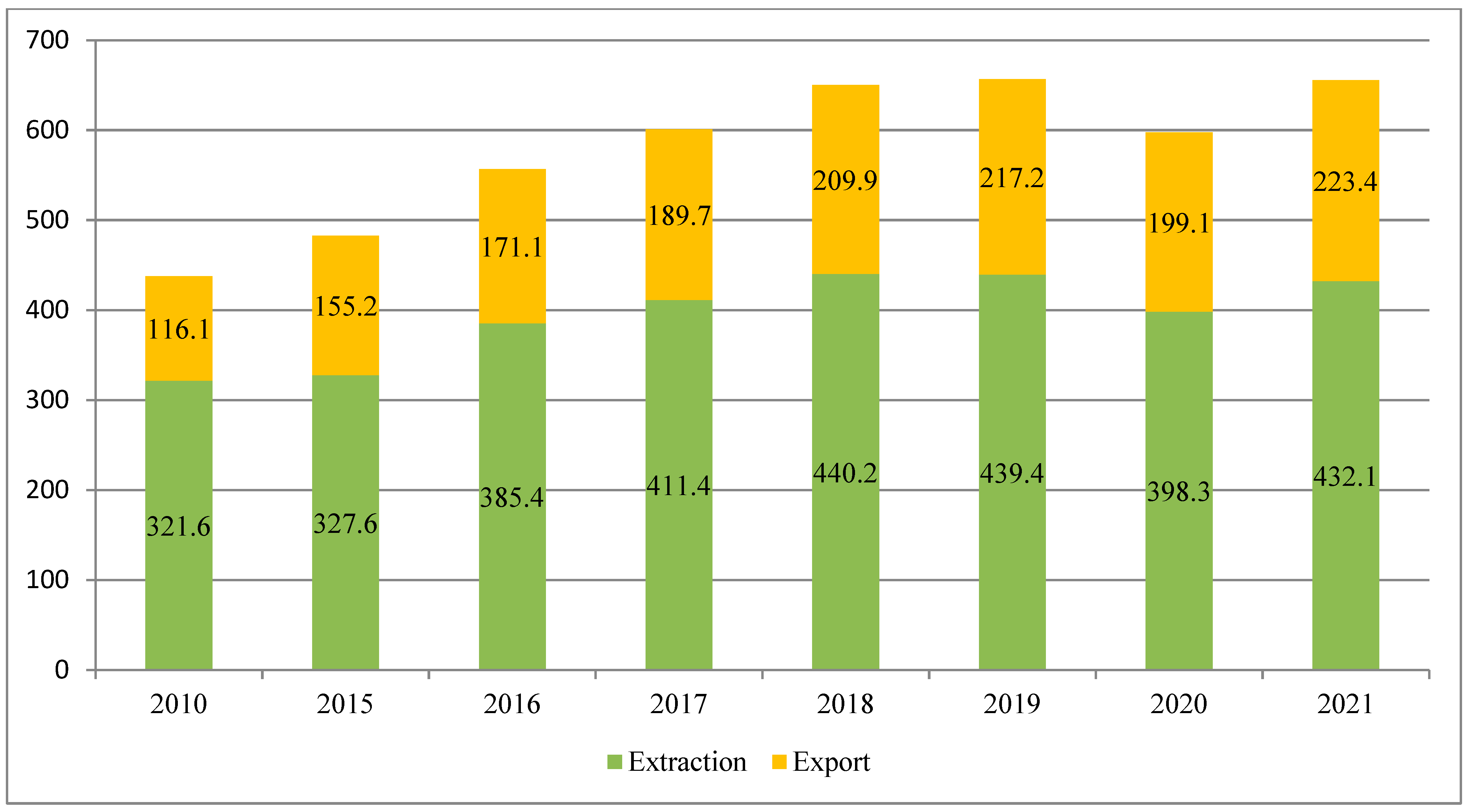

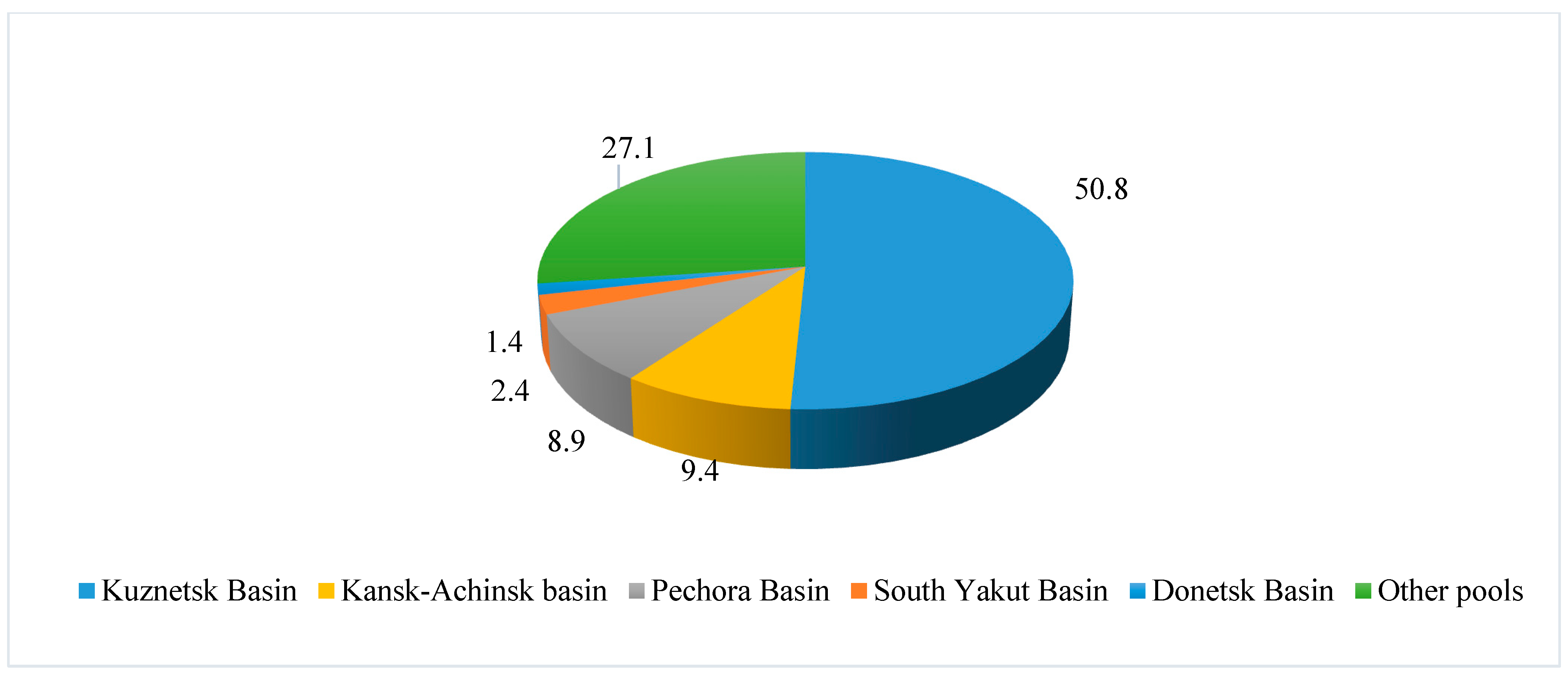

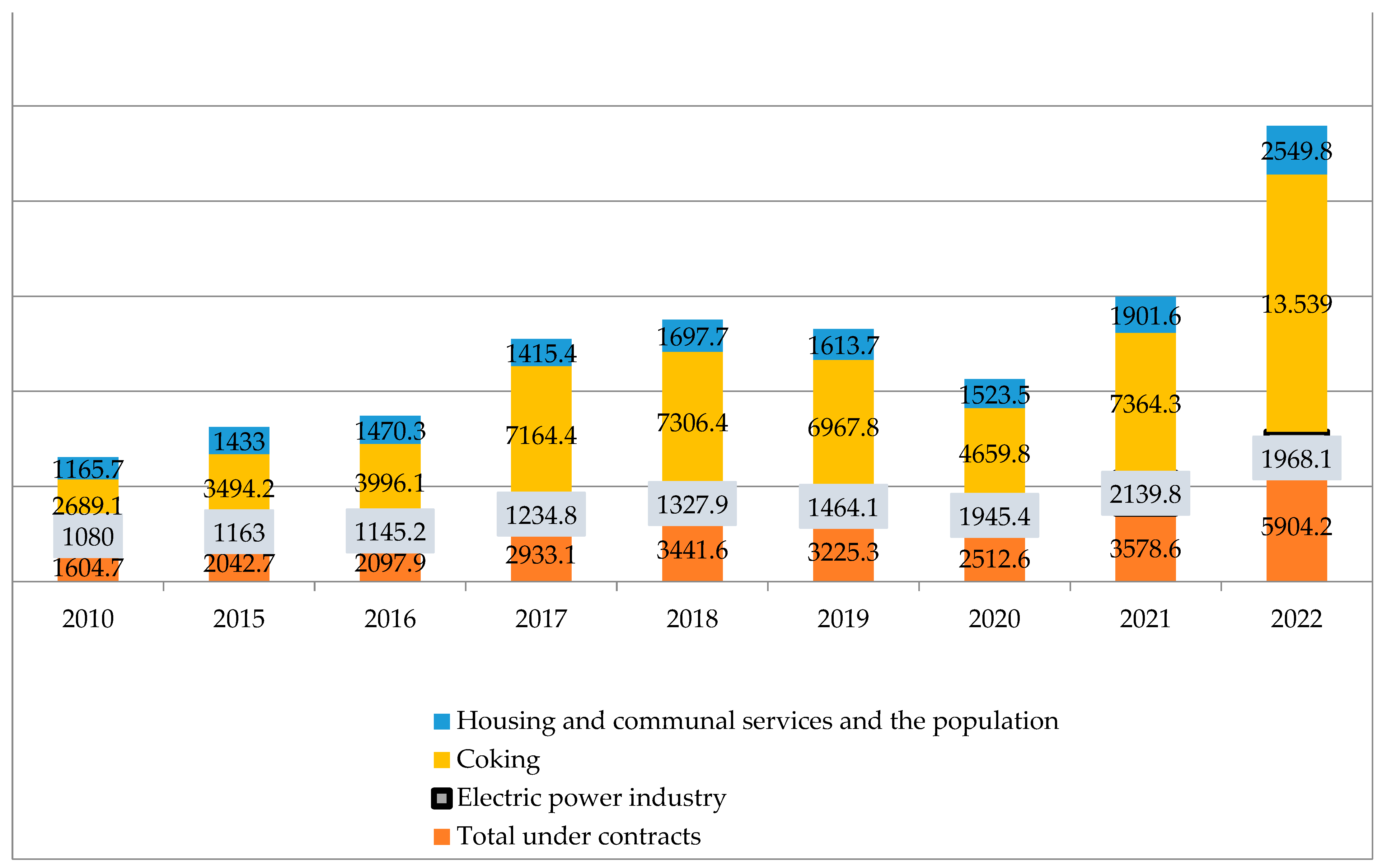

3.2. Research of the Russian Coal Market: Reserves, Production and Export

- PJSC “Kuzbassrazrezugol Coal Company” is Russia’s largest open-pit energy and coking coal mining company, developing 17 coal deposits in the Kemerovo Region. In 2021, it produced 45.3 million tons of coal, about 75% of which it exports and 25% is used in the domestic market. Before the embargo was imposed, it supplied raw materials to 35 countries, in 2022—to 20 states.

- PJSC “Siberian Coal Energy Company” (“SUEK-Kuzbass”) is one of the five largest integrated energy companies in the world of coal suppliers. The group includes coal mining, processing enterprises, generating, logistics and service assets in Siberia, the Urals, the Far East of Russia, and ports in the east, west and south of Russia. SUEK-Kuzbass employs 70,000 people in 12 Russian regions. The Group of Companies manages 17 mines and eight mines in Kuzbass, Buryatia, Khakassia and Khabarovsk Krai, more than 60% of which is extracted by the open method. The company is the leader in terms of coal production in Russia (102.5 million tons in 2021) and supplies. coal to consumers from more than 40 countries through a corporate distribution network that includes several ports: Vanino in the Far East, Murmansk on the Barents Sea, Taman on the Black Sea and Ust-Luga on the Baltic. After the introduction of an embargo on coal imports from the Russian Federation, reorientation to the eastern direction and insufficient transport capacity, the company increased exports of products through western ports, which increased the length and duration of transportation and freight costs by 9 times. The company’s revenue for 2021 amounted to US$ 9.7 billion (+46%) by 2020 [46].

- EvrazHolding LLC (PJSC Raspadskaya Coal Company) is a major exporter of coking coal and has two sections, eight mines in the Republic of Tyva and the Kemerovo region. In 2021, the company produced 22.8 million tons of coal, and sold 17 million tons: 14.5 million tons of coal concentrate and 2.4 million tons of ordinary coal, of which 7.1 million tons of concentrate were sold on the domestic market, 7.4 million tons were exported.

- PJSC Sibantracite Group is the world’s largest producer of high—quality anthracite, leading open-pit mining. The company includes coal companies of the Novosibirsk region: five coal mines, two processing plants, and a fleet of machinery and equipment. The company ranks first in the world in the production of metallurgical coals and exports of high-quality anthracite.

- The PJSC Holding Company “SDS-coal” has a balance sheet reserve of 2 billion tons, two sections, two mines, and three processing plants in corporate management. Before the sanctions were imposed, it exported 89% of its products to European and Asian countries.

- PJSC “Borodinsky Section” is a branch of the Siberian Coal Energy Company, located in the Krasnoyarsk Territory and the largest open-pit coal mining enterprise in Russia. The annual production is more than 20 million tons of coal per year on 2 thousand hectares of a mining field using high-performance rotary complexes, quarry locomotives and other modern equipment.

- PJSC Stroyservice is a group of companies uniting enterprises in the Kemerovo Region, Perm Krai for the extraction, enrichment and marketing of products. In the corporate management of PJSC Stroyservice: five coal mining companies, four processing plants, a coke plant, a railway and auto repair enterprise, with about 12 thousand employees.

- The PJSC “Russian coal”, founded in 2002, operates in three regions of the country (Krasnoyarsk Territory, the Republic of Khakassia and the Amur Region), has a balance reserve of 1.458 billion tons, manages six coal mines (“North-East”, “Kirbinsky”, “Abansky”, “Yerkovetsky”, “Sayano-Partizansky”, “Pereyaslovsky”) and supplies products to 60 subjects of the country.

- There are three large coal mining companies operating in PJSC Yakutia (Yakutugol, Kolmar, Elgaugol), producing a total of 31 million tons of coal. “PJSC “UK “Elga Coal” is the largest coking coal deposit in Russia, whose reserves are estimated at 2.2 billion tons. Since 2022, a significant part of the products has been exported to the eastern market.

- The international company PJSC “En+ Group” is a vertically integrated producer of aluminum and electricity, an asset manager in the field of energy, non-ferrous metallurgy and mining, logistics and strategically related industries [47].

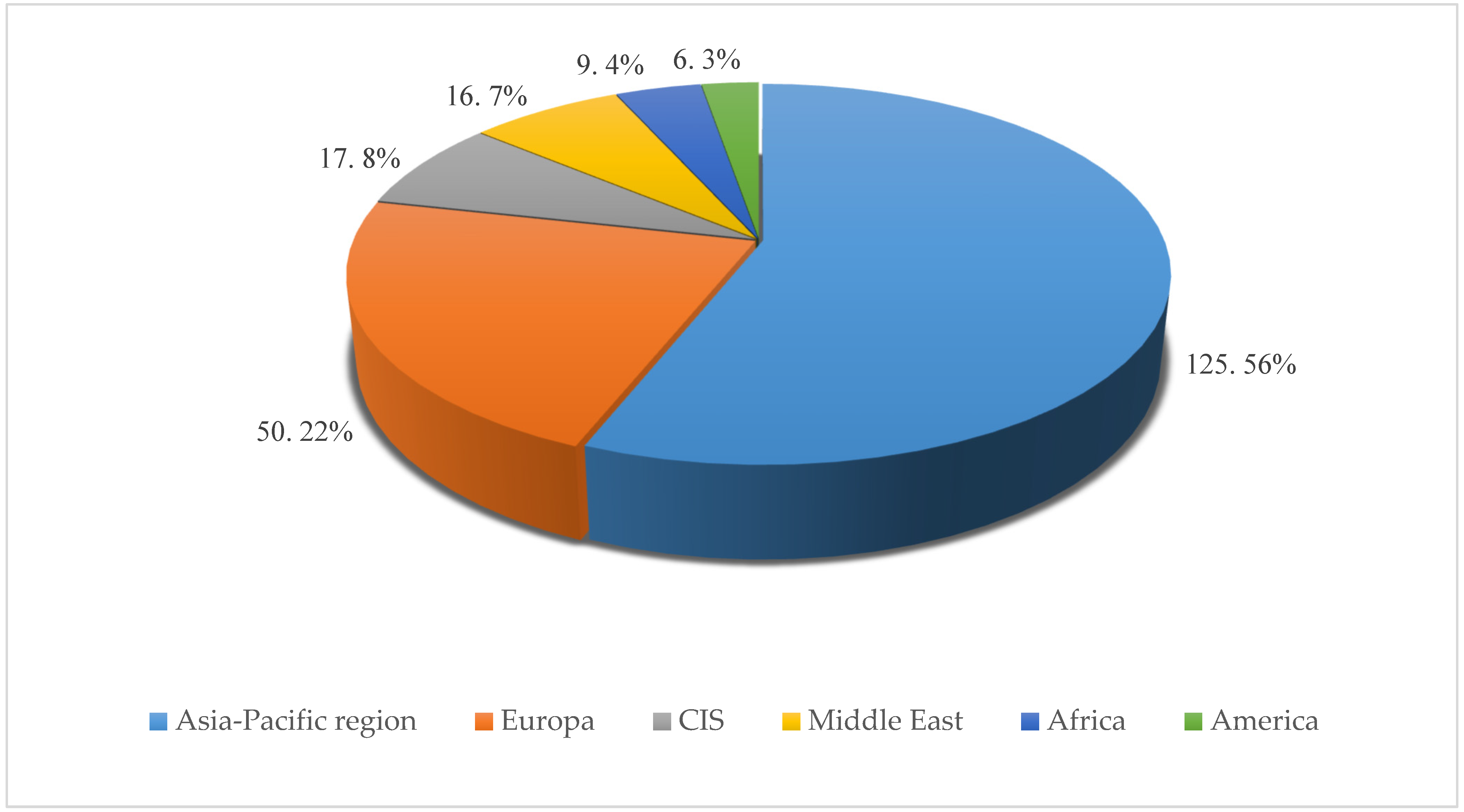

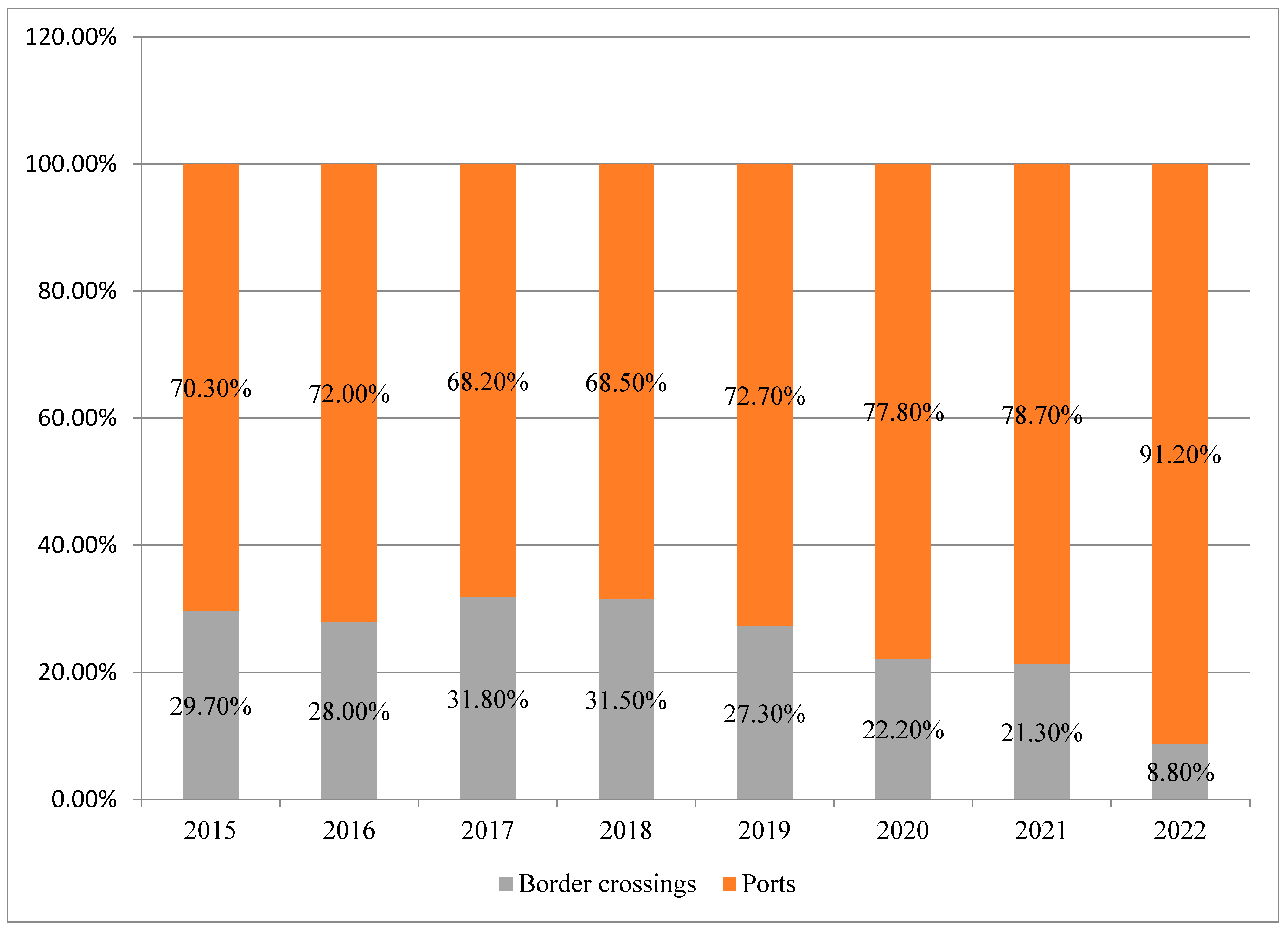

3.3. The Impact of the Sanctions Regime and the Transformation Processes of Logistics Chains on the Supply of Solid Fuel to the Foreign Market

4. Discussion

- -

- the emergence of a complex of new problems, high uncertainty and lack of experience in developing and organizing appropriate measures to manage the transition to new directions of energy exports, uncertainty in forecasting the dynamics of energy prices and reliability of energy supply;

- -

- fundamental change of structures in the energy sector and the emergence of completely unpredictable restrictions for their transformation;

- -

- the need to take into account many regional factors that vary significantly depending on local conditions.

- -

- reduction of energy consumption, the corresponding reduction of production, transformation in the structure of production and reduction in consumer comfort;

- -

- the need to analyze analytical opinions on the forecast of coal consumption trends and price statics in the global and European coal markets;

- -

- the significance of assessing future trends and key uncertainties in the development of global energy markets, taking into account the events that have occurred.

- According to the forecast of the Ministry of Economic Development of Russia, in the medium term, coal production in the country is likely to grow by 2.2–3.4% per year with a volume of 510 million tons by 2024. An equally optimistic forecast is contained in the Program for the Development of the Coal Industry until 2035, according to which coal production was supposed to increase to 459–593 million tons by 2025, to 485–668 million tons by 2035 [55]. However, in accordance with the revised version of the Program, production is projected to decrease by 0.3% by 2022 and stabilize in 2023, and in general, coal production will decrease by 11.8% over the period 2019–2023, from 439.2 million to 387.4 million tons. The Ministry of Economic Development explains the decline in indicators primarily by low coal prices in Europe and a reduction in purchases by key European consumers. In addition, according to the document, in the near future the industry will face additional restrictions on foreign markets due to the transition of foreign countries to renewable energy, increased environmental requirements and the introduction of a carbon tax, which will lead to a significant reduction in the capacity of the world market.

- The report of the International Energy Agency (IEA) of 2022 predicts a decrease in coal production in Russia by 0.3% annually to 392 million tons by 2025 and the achievement of a plateau in global demand for coal in the amount of 7.4 billion tons. According to experts, in the medium term, the dynamics of global production will be determined by three factors: the exclusion of coal-fired thermal power plants from operation, the intensive development of renewable energy, and the growth of competition with natural gas. According to the forecasts of the International Energy Agency, the dynamics of coal consumption in the regions of the world will be differentiated. So, in China, the demand for coal will gradually reach a plateau, India and Southeast Asian countries will increase coal production within five years, and consumption in Europe and North America will decrease after a temporary rise in 2021.

- The forecast of British Petroleum “Energy Outlook 2022”, prepared before the start of the special military operation, did not include an analysis of the possible consequences of events and predicted a decrease in the share of fossil fuels in total final energy consumption from about 65% in 2019 to 30–50% by 2050. Coal accounts for the largest decrease as the world makes the transition to low-carbon fuels. According to the forecast, a similar trend of transition to a lower-carbon fuel balance is also evident in primary energy, as the use of fossil fuels, including coal, in the global energy system is declining [61,62,63].

- According to experts of the British analytical center “Ember” and the German institute “Agora Energiewende”, the European market is becoming unpromising for Russian coal exporters. The report notes that coal consumption has been declining in almost all EU countries and most countries intend to stop using coal in the electric power industry by 2030 [64,65,66].

- The forecast of a decrease in the use of coal on a global scale is also confirmed in the assessment report of the Intergovernmental Panel on Climate Change at the United Nations, which notes that global coal consumption will decrease from 162 EJ (exajoules) in 2019, up to 2 EJ in 2060. This trend of changing demand for coal will certainly lead to a reduction in its production and a decrease in cost [74,75].

- The International Monetary Fund in its scenario considered the change in the price of Australian and Asian coal, predicting its increase not higher than $80 per ton. Considering the projected trajectories of coal prices, the fund’s analysts note a high probability of an increase in Australian coal prices to $78.4 per ton by 2025 compared to the price of $76.6 for 2023 [76].

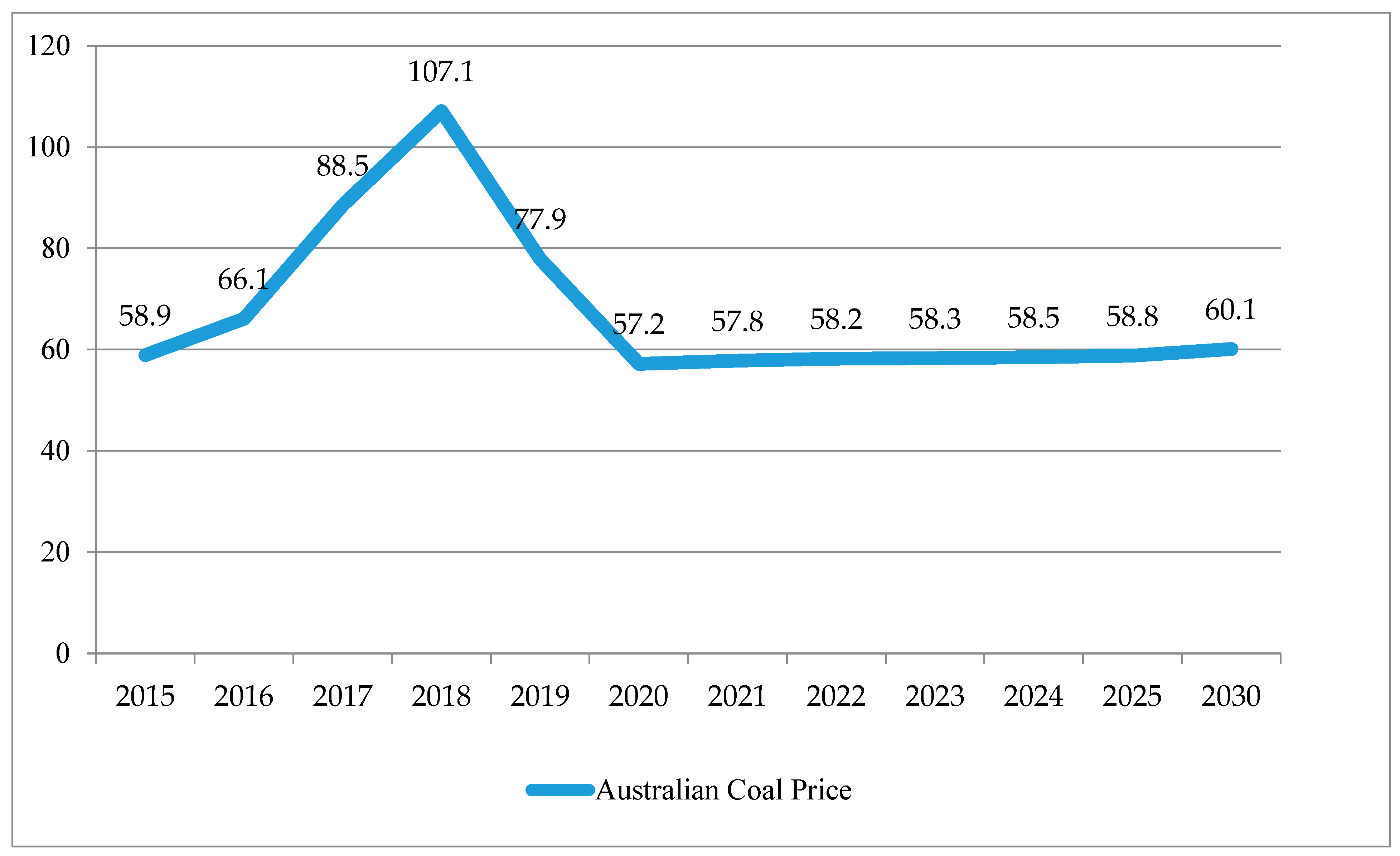

- A more pragmatic opinion regarding the estimated price of Australian coal was held by the analysts of the World Bank (Figure 13) when determining its price in 2023 at $58.3. USD and 58.8 USD per ton in 2025 (forecast date 21 April 2021).Figure 13. The projected price of coal of the World Bank. Source: World Bank data [77].Figure 13. The projected price of coal of the World Bank. Source: World Bank data [77].

- According to the Russian “Program for the development of the coal industry until 2035”, the forecast prices for domestic coal are presented in Table 4.

5. Conclusions

- The development of the global and Russian coal industry in the medium term is determined by the global growth in demand for coal and the trend of reorientation of export supplies to the Asia-Pacific region. The growth of energy consumption by industrialized countries does not allow abandoning coal as an energy source in the short term, which is confirmed by the current changes taking place in Europe, long-term statistics and there is a need to develop a diversified energy model [99,100,101,102,103].

- In the coming years, production and domestic consumption are expected to increase, as the domestic coal market for Russian producers is becoming more important due to the growing risks in international trade and the possibility of its wider use for electricity generation, heat and coke production.

- Coal prices are subject to multidirectional trends and may differ in the European and Asian markets in the next one and a half to two years. The direction of changes in coal prices in the short term will be determined by the influence of political factors on the supply of coal in Russia and the ability of coal companies to increase production to meet demand. The long-term dynamics of coal prices will be determined by global economic growth, in particular, the Chinese economy and the global transition to renewable energy, which indicates a high degree of uncertainty in forecasts. In Asian markets, there may be some decrease compared to 2021, for Europe, the import price is likely to continue to rise.

- Insufficient capacity of the eastern landfill of the “Russian Railways”, port facilities, and the need for the formation of transport infrastructure for new coal fuel production regions have actualized the problems of a possible increase in export capacities due to the construction of marine transshipment bases in the southern direction, allowing for a continuous flow of supplies and ensuring their uniformity [104].

- In our opinion, in the longer term, the risks caused by the processes of energy transition and the intentions of a significant number of countries to achieve a carbon-neutral state are becoming relevant again. These threats are significant due to the growing trend of promoting “carbon neutrality” and the likelihood of abandoning further large-scale development of traditional energy industries. At the same time, there are risks of denying the concept of energy transition and continuing to invest in unpromising projects. An additional argument for the need to diversify the Russian economy is the current global crisis [105,106].

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Borodin, A.; Vygodchikova, I.; Panaedova, G.; Mityushina, I. Rating of Stability of Russian Companies in Oil and Gas and Electric Power Industries Based on Interval Volatility. Energies 2023, 16, 5387. [Google Scholar] [CrossRef]

- Borodin, A.; Panaedova, G.; Ilyina, I.; Harputlu, M.; Kiseleva, N. Overview of the Russian Oil and Petroleum Products Market in Crisis Conditions: Economic Aspects, Technology and Problems. Energies 2023, 16, 1614. [Google Scholar] [CrossRef]

- Borisov, A.; Borodin, A.; Gubarev, R.; Dzyuba, E.; Sagatgareev, E. Managing the Investment Attractiveness of the Federal Subjects of Russia in the Context of the UN Sustainable Development Goals. MGIMO Rev. Int. Relat. 2022, 15, 202–230. [Google Scholar] [CrossRef]

- Bosikov, I.; Martyushev, N.; Klyuev, R.; Savchenko, I.; Kukartsev, V.; Kukartsev, V.; Tynchenko, Y. Modeling and Complex Analysis of the Topology Parameters of Ventilation Networks When Ensuring Fire Safety While Developing Coal and Gas Deposits. Fire 2023, 6, 95. [Google Scholar] [CrossRef]

- Malozyomov, B.V.; Golik, V.I.; Brigida, V.; Kukartsev, V.V.; Tynchenko, Y.A.; Boyko, A.A.; Tynchenko, S.V. Substantiation of Drilling Parameters for Undermined Drainage Boreholes for Increasing Methane Production from Unconventional Coal-Gas Collectors. Energies 2023, 16, 4276. [Google Scholar] [CrossRef]

- Zehir, C.; Özyeşil, M.; Borodin, A.; Aktürk, E.B.; Faedfar, S.; Çikrikçi, M. Corporate Governance’s Impact on Sustainable Finance: An Analysis of Borsa Istanbul Energy Sector Companies. Energies 2023, 16, 5250. [Google Scholar] [CrossRef]

- Kulikov, A.; Alabed Alkader, N.; Panaedova, G.; Ogorodnikov, A.; Rebeka, E. Modelling Optimal Capital Structure in Gas and Oil Sector by Applying Simulation Theory and Programming Language of Python (Qatar Gas Transport Company). Energies 2023, 16, 4067. [Google Scholar] [CrossRef]

- Hakam, D.F. Mitigating Market Power and Promoting Competition in Electricity Markets through a Preventive Approach: The Role of Forward Contracts. Energies 2023, 16, 3543. [Google Scholar] [CrossRef]

- IEA. Electricity Market Report. 2022. 62 p. Available online: https://iea.blob.core.windows.net/assets/660c2410-218c-4145-9348-c782e185dcdf/ElectricityMarketReport-July2022.pdf (accessed on 12 February 2023).

- IEA. World Energy Outlook 2022. International Energy Agency (IEA) 524 p. Available online: https://iea.blob.core.windows.net/assets/b21195ad-2dcf-4ea0-a3e1-cece143cd735/WorldEnergyOutlook2022.pdf (accessed on 11 March 2023).

- The World Bank. Available online: https://www.worldbank.org/en/home (accessed on 9 July 2023).

- The United Nations Statistics Division. Available online: https://unstats.un.org/sdgs/report/2022/The-Sustainable-Development-Goals-Report-2022_Russian.pdf (accessed on 9 July 2023).

- BP. Statistical Review of World Energy 2020|69th Edition. 68 p. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf (accessed on 22 January 2023).

- World Energy Transitions. Outlook 2022. About IRENA. Available online: https://www.irena.org/Digital-Report/World-Energy-Transitions-Outlook-2022 (accessed on 12 February 2023).

- Atashi, H.; Veiskarami, S. Green fuel from coal via ficher—Tropsch process scenario of optimal condition of process and modelling. Int. J. Coal Sci. Technol. 2018, 5, 230–243. [Google Scholar] [CrossRef]

- Li, H.; Chen, L.; Wang, D.; Zhang, H. Analysis of the price correlation between the international natural gas and coal. Energy Procedia 2017, 142, 3141–3146. [Google Scholar] [CrossRef]

- Li, J.; Xie, C.; Long, H. The roles of inter-fuel substitution and inter-market contagion in driving energy prices: Evidences from China’s coal market. Energy Econ. 2019, 84, 104525. [Google Scholar] [CrossRef]

- PJSC “Morcenter-TEK”. Available online: https://morcenter.ru/o-kompanii (accessed on 9 May 2023).

- Global Renewable Energy Power Purchase Agreements by Sector, 2010–2021. Available online: https://www.iea.org/data-and-statistics/charts/global-renewable-energy-power-purchase-agreements-by-sector-2010-2021 (accessed on 15 September 2022).

- Tankaev, R.; Frolov, A. World Energy. Available online: https://itek.ru/reviews/mirovaya-energetika/ (accessed on 4 June 2023).

- IEA. Coal 2021. Analysis and Forecast to 2024, 99 p. Available online: https://iea.blob.core.windows.net/assets/f1d724d4-a753-4336-9f6e-64679fa23bbf/Coal2021.pdf (accessed on 21 April 2023).

- BP Statistical Review of World Energy 2022|71st Edition. 60 p. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf (accessed on 22 January 2023).

- IEA. Coal 2015. Medium-Term Market Report 2015. Market Analysis and Forecasts to 2020. 166 p. Available online: https://iea.blob.core.windows.net/assets/f35daa59-ad05-4f9c-9c4d-ead374867ddb/MTCMR2015.pdf (accessed on 22 April 2023).

- IEA. Coal 2016. Medium-Term Market Report 2016. Market Analysis and Forecasts to 2021. Available online: https://iea.blob.core.windows.net/assets/87b9df7a-de2c-4ee3-9411e18e420bef47/MTCMR2016.pdf (accessed on 12 February 2023).

- IEA. Coal 2018 Analysis and Forecasts to 2023, 135 p. Available online: https://www.iea.org/reports/coal-2018 (accessed on 11 March 2023).

- IEA. Coal 2019. Analysis and Forecast to 2024. Available online: https://iea.blob.core.windows.net/assets/96956778-90de-465e-85bb-21c860aba509/MRScoal2019.pdf (accessed on 12 February 2023).

- IEA. Coal 2020. Analysis and Forecast to 2025, 85 p. Available online: https://www.iea.org/reports/coal-2020 (accessed on 18 February 2023).

- Coal 2022. Analysis and Forecast to 2025, 137 p. Available online: https://iea.blob.core.windows.net/assets/91982b4e-26dc-41d5-88b1-4c47ea436882/Coal2022.pdf (accessed on 19 March 2023).

- Petrenko, I.E. The Results of the Work of the coal Industry of Russia for 2022. Coal 2023, 3, 21–33. [Google Scholar] [CrossRef]

- Varichev, A.; Kretov, S.; Ismagilov, R. Integrated approach to intelligent production management systems. Mining 2016, 3, 4–7. [Google Scholar]

- Energy Institute Statistical Review of World Energy 2023. Available online: http://www.emccement.com/pdf/Statistical_Review_of_World_Energy_2023.pdf (accessed on 21 July 2023).

- Guide to Energy Statistics 2022. Available online: https://www.eeseaec.org/zapasy-energonositelej-energeticeskij-potencial (accessed on 11 May 2023).

- Kondratiev, V.B.; Popov, V.V.; Kedrova, G.V. Global coal market: State and prospects. Min. Ind. 2019, 2, 144. Available online: https://mining-media.ru/ru/article/ekonomic/14678-globalnyj-rynok-uglya-sostoyanie-i-perspektivy (accessed on 22 March 2023).

- Annual Book of ASTM Standards. Available online: https://www.astm.org/products-services/bos.html (accessed on 12 March 2023).

- PJSC “Kuzbassrazrezugol”. Available online: https://www.kru.ru/ru/ (accessed on 21 February 2023).

- PJSC Siberian Coal Energy Company (PJSC SUEK). Available online: https://www.suek.ru/ (accessed on 11 January 2023).

- PJSC EvrazHolding. Available online: https://www.evraz.com/ru/ (accessed on 10 March 2023).

- PJSC “Sibantracite”. Available online: https://https://elsi-group.ru/actives/ (accessed on 14 February 2023).

- PJSC “SDS-ugol”. Available online: https://sds-ugol.ru/ (accessed on 12 January 2023).

- PJSC “Russian Coal”. Available online: https://www.ruscoal.ru/ (accessed on 13 February 2023).

- PJSC “Elgaugol”. Available online: https://elsi-group.ru/ (accessed on 22 February 2023).

- PJSC “Yakutugol”. Available online: http://www.yakutugol.ru/ (accessed on 11 May 2023).

- PJSC “Coal Mining Company “Kolmar” (UK “Kolmar”). Available online: https://www.kolmar.ru/company/ (accessed on 17 February 2023).

- PJSC “En+ Group”. Available online: https://enplusgroup.com/ru/ (accessed on 10 February 2023).

- Kuzbass Fuel Company. Available online: https://ktk.company/company (accessed on 10 March 2023).

- Annual Report of the Exciner Company “Siberian Coal Energy Company” (PJSC “SUEK”) for 2021, 2. Available online: https://www.suek.ru/upload/files/pdf/ru/SUEK_AR21_RU.pdf (accessed on 14 March 2023).

- Annual Report of PJSC “En+ Group” “Progress of En+ Group towards Carbon Neutrality”. 2022. Available online: https://enplusgroup.com/upload/iblock/05c/46cr5fyd7b2nqp7c7u2w1cqfc5chpgpe/En_-Progress-to-net-zero.pdf (accessed on 12 February 2023).

- Coal. 2022, Volume 3, pp. 9–23. Available online: http://www.ugolinfo.ru/artpdf/RU2203009.pdf (accessed on 12 April 2023).

- Ministry of Energy of the Russian Federation. Available online: https://minenergo.gov.ru/system/download/433/183749 (accessed on 19 January 2023).

- Website of the Federal Customs Service of Russia: Data on Exports and Imports of Russia for January–December 2021. Available online: https://customs.gov.ru/press/federal/document/325 (accessed on 10 June 2023).

- Energy Development Center. Analytical Report 9. Coal Market: Leaving for Asia. Available online: https://entran.ru/wp-content/uploads/2022/12/report_2022.pdf (accessed on 29 January 2023).

- Pechenkin, A.N. Reorientation of Russian coal industry exports under the conditions of the European Union embargo. Reg. Sect. Econ. 2023, 1, 171–177. [Google Scholar] [CrossRef]

- Coal Passes to the South. The Profitability of Its Exports Changes Direction. Merchant. 28 February 2023. Available online: https://www.kommersant.ru/doc/5843095 (accessed on 14 May 2023).

- Coal Industry of Russia: Logistic and Sanctions Crossroads. Oil and Gas Vertical. 16 May 2023. Available online: https://ngv.ru/articles/ugolnaya-otrasl-rossii-logistichesko-sanktsionnoe-perepute/ (accessed on 10 April 2023).

- Information and Analytical Bulletin “Mortsentr-TEK”. Moscow 2021, 3, 16. Available online: https://morcenter.ru/sites/default/files/inline/files/Morcenter-TFC%20digest%202021-3.pdf (accessed on 19 April 2023).

- Marine News of Russia. Available online: http://www.morvesti.ru/themes/1694/90265/ (accessed on 9 June 2023).

- Bulk Cargo Terminals. Available online: https://morproekt.ru/services/projectflow/project-types/terminaly-navalochnykh-gruzov (accessed on 10 April 2023).

- Coal Transshipment Terminals. Trends, Projects, Prospects. Available online: https://morproekt.ru/articles/blog/1104-soal-transshipment-terminals-trends-projects-prospects (accessed on 18 February 2023).

- Foreign Trade of Russia. Available online: https://russian-trade.com/reports-and-reviews/2020-02/torgovlya-mezhdu-rossiey-i-indiey-v-2019-g/ (accessed on 17 May 2023).

- Energy Outlook 2022. 57 p. Available online: https:www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2022.pdf (accessed on 18 January 2023).

- International Renewable Energy Agency. Available online: https://www.renewable-ei.org/pdfdownload/activities/REvision2021_DGielen_210310.pdf (accessed on 18 February 2023).

- RBC. Available online: https://plus.rbc.ru/news/608a3c997a8aa91fa951ff0f (accessed on 11 May 2023).

- Industrial Production in Russia. 2021: Stat. Sat. Rosstat. M. 2022. 141 p. Available online: https://gks.ru/bgd/regl/b21_48/Main.htm (accessed on 15 March 2023).

- Energy Statistics Pocketbook 2022. United Nations. New York. 2022. 79 p. Available online: https://unstats.un.org/unsd/energystats/pubs/documents/2022pb-web.pdf (accessed on 12 February 2023).

- Rusetskaya, M.I.; Mancerova, T.F.; Korsak, E.P. Analysis of the Energy Complex Member of the EAEU Countries and the Formation of Groups-Technologies of its Digitalization. ENERGETIKA. Proc. CIS High. Educ. Inst. Power Eng. Assoc. 2023, 66, 169–185. (In Russian) [Google Scholar] [CrossRef]

- Kirsanov, A.K. China Mining: An Overview of the Modern State. Min. Sci. Technol. 2023, 8, 115–127. [Google Scholar] [CrossRef]

- International Energy Agency «EnerFuture World Energy Scenarios to 2050». 223 p. Available online: https://iea.blob.core.windows.net/assets/161e2f2e-11d2-456e-b371-5f85f176d8c0/Energyto2050-ScenariosforaSustainableFuture.pdf (accessed on 15 February 2023).

- Synthesis Report of the Ipcc Sixth Assessment Report (AR6). 85 p. Available online: https://www.ipcc.ch/report/ar6/syr/downloads/report/IPCC_AR6_SYR_LongerReport.pdf (accessed on 12 April 2023).

- Schmidt, A.V. Essence and indicators of economic stability of industrial enterprises. Bus. Edu. Right. 2011, 3, 55–66. [Google Scholar]

- Nurunnabi, M.; Esquer, J.; Munguia, N.; Zepeda, D.; Perez, R.; Velazquez, L. Reaching the sustainable development goals 2030: Energy efficiency as an approach to corporate social responsibility (CSR). GeoJournal 2020, 85, 363–374. [Google Scholar] [CrossRef]

- Energy Outlook 2022. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdf/energy-economics/energy-outlook/bp-energy-outlook-2022.pdf (accessed on 18 April 2023).

- Global Energy Outlook. Available online: https://energystats.enerdata.net/total-energy/world-import-export-statistics.html (accessed on 12 May 2023).

- Short-Term Energy Outlook. STEO April 2023. 51 p. Available online: https://www.eia.gov/outlooks/steo/pdf/steofull.pdf (accessed on 15 May 2023).

- Global Energy & ClimateTrends. 2022. 56 p. Available online: https://www.enerdata.net/publications/reports-presentations/world-energy-trends.html (accessed on 22 June 2023).

- Global Energy Transformation: A Roadmap to 2050. 52 p. Available online: https://www.irena.org/publications/2019/Apr/Global-energy-transformation-A-roadmap-to-2050-2019Edition (accessed on 21 April 2023).

- Statistical Overview of Global Energy Data. Available online: https://www.energyinst.org/statistical-review/resources-and-data-downloads (accessed on 17 July 2023).

- IMF Data. Available online: https://ru.knoema.com/xfakeuc/coal-price-forecasts-long-term-2021-to-2030-data-and-charts (accessed on 12 April 2023).

- News. Available online: https://iz.ru/1314411/2022-04-02/analitik-sprognoziroval-dinamiku-tcen-na-rossiiskii-ugol-na-piat-let (accessed on 14 April 2023).

- Real Time. Available online: https://realnoevremya.ru/articles/213422-chto-proishodit-s-ugolnoy-otraslyu-v-rossii (accessed on 15 July 2023).

- World Bank Data. Available online: https://data.worldbank.org/ (accessed on 17 February 2023).

- The Program for the Development of the Coal Industry until 2035. Available online: http://static.government.ru/media/files/OoKX6PriWgDz (accessed on 14 July 2023).

- Business Research and Insights. Available online: https://business.nab.com.au/wp-content/uploads/2021/03/Minerals-Energy-Outlook-March-2021.pdf (accessed on 18 June 2023).

- Klyuev, R.; Morgoev, I.; Morgoeva, A.; Gavrina, O.; Martyushev, N.; Efremenkov, E.; Mengxu, Q. Methods of Forecasting Electric Energy Consumption: A Literature Review. Energies 2022, 15, 8919. [Google Scholar] [CrossRef]

- Bloomberg News Agency. Available online: https://Bloomberg.com (accessed on 10 July 2023).

- Central Dispatch Control of the Fuel and Energy Complex. Available online: https://www.cdu.ru (accessed on 20 August 2023).

- Ministry of Economic Development of the Russian Federation. Available online: https://www.economy.gov.ru/ (accessed on 10 August 2023).

- Rabe, M.; Streimikiene, D.; Bilan, Y. The Concept of Risk and Possibilities of Application of Mathematical Methods in Supporting Decision Making for Sustainable Energy Development. Sustainability 2019, 11, 1018. [Google Scholar] [CrossRef]

- Analytical Center under the Government of the Russian Federation. Available online: https://ac.gov.ru/ (accessed on 11 July 2023).

- Independent Pricing Agency “Argus Media”. Available online: https://www.argusmedia.com/ru (accessed on 20 August 2023).

- Online News Site of the World Mining and Metallurgical Industry. Operating mode. Available online: https://www.mining.com/ (accessed on 12 April 2023).

- Analytical Research Center “FITCH Solutions”. Available online: https://www.fitchsolutions.com/ (accessed on 13 July 2023).

- KPMG Audit Company. Available online: https://home.kpmg/ (accessed on 20 August 2023).

- Rating Agency “Fitch Ratings”. Available online: https://www.fitchratings.com/ (accessed on 20 August 2023).

- International Consulting Company “McKinsey”. Available online: https://www.mckinsey.com (accessed on 20 August 2023).

- Dobrego, K.V. On the Problem of Arrangement of Hybrid Energy Storage Systems. ENERGETIKA. Proc. CIS High. Educ. Inst. Power Eng. Assoc. 2023, 66, 215–232. [Google Scholar] [CrossRef]

- Analytical Agency for Market Research “Research and Sales Markets”. Available online: https://www.researchandmarkets.com (accessed on 11 January 2023).

- Center for Socio-Economic Research. Available online: https://www.csr.ru/ru/ (accessed on 12 July 2023).

- Financial Market Access Platform. Available online: https://ru.investing.com/ (accessed on 11 July 2023).

- Information and Analytical Agency “Port-News”. Available online: https://portnews.ru/ (accessed on 20 August 2023).

- Transnational Non-Gas Company “Energy Forecast”. Available online: https://www.bp.com/ (accessed on 20 August 2023).

- Roblek, V.; Thorpe, O.; Bach, M.P. The Fourth Industrial Revolution and the Sustainability Practices: A Comparative Automated Content Analysis Approach of Theory and Practice. Sustainability 2020, 12, 8497. [Google Scholar] [CrossRef]

- Yanovsky, A.B. Coal: The Battle for the Future. Coal 2020, 8, 9–14. [Google Scholar] [CrossRef]

- Climate Change by 2022. Climate Change Mitigation, IPCC, Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Available online: https://report.ipcc.ch/ar6wg3/pdf/IPCC_AR6_WGIII_FinalDraft_FullReport.pdf (accessed on 24 August 2023).

- Trading Platform for Traders “TradingView”. Available online: http://ru.tradingview.com (accessed on 24 August 2023).

- Rating Agency “Expert RA”. Available online: https://www.raexpert.ru/ (accessed on 24 August 2023).

- IPCC. Summary for Policy Makers. Q: Climate Change by 2023: A Summary Report. In Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC: Geneva, Switzerland, 2023; pp. 1–42. [Google Scholar] [CrossRef]

| № | Country | Total Reserves | Hard | Lignite | Total Share | Security Ratio, R/|P * |

|---|---|---|---|---|---|---|

| 1 |  USA USA | 248.9 | 219,534 | 30,003 | 23.33% | 357 |

| 2 |  Russia Russia | 162.7 | 71,719 | 90,447 | 15.16% | 391 |

| 3 |  Australia Australia | 150.2 | 72,571 | 76,508 | 13.94% | 301 |

| 4 |  China China | 143.2 | 133,467 | 8128 | 13.24% | 39 |

| 5 |  India India | 111.1 | 100,858 | 5073 | 9.90% | 136 |

| 6 |  Indonesia Indonesia | 34.9 | 28,163 | 11,728 | 3.73% | 49 |

| 7 |  Germany Germany | 35.9 | 0 | 35,900 | 3.36% | 206 |

| 8 |  Ukraine Ukraine | 34.4 | 32,039 | 2336 | 3.21% | 500 |

| 9 |  Poland Poland | 28.4 | 21,067 | 5865 | 2.52% | 114 |

| 10 |  Kazakhstan Kazakhstan | 25.6 | 25,605 | 0 | 2.39% | 239 |

| Types of Coal | Heat of Combustion (kcal/kg) | Hydrocarbon Content | Mining Regions | Scope of Application |

|---|---|---|---|---|

| Anthracite | 8100–8350 | 94% | Donetsk, Gorlovka, Tunguska, Taimyr basins, Ural, Magadan region | Energy, metallurgy, chemical industry |

| Coking coal | 8600–8750 | 88–90% | Donetsk, Pechora, Kizelovsky, Kuznetsky, Karaganda, Yuzhno-Yakut, Tunguska basins | Metallurgy |

| Hard coal | 5500–7500 | 75–95% | Elbinsky, Lensky, Minusinsky, Kuznetsky, Pechora, Tunguska, Taimyr, Yuzhno-Yakut, Bureinsky basins | Fuel energy, metallurgy, chemical industry |

| Lignite | 4000–5500 | 50–77% | Lena, Kansk-Achinsk, Tunguska, Kuznetsk, Taimyr, Moscow region pools | Use in small thermal power plants, heating of private houses, chemical industry |

| The Company | Mining | Export | |

|---|---|---|---|

| 1 | PJSC “UK “Kuzbassrazrezugol” | 38.776.7 | 30.941.8 |

| 2 | PJSC SUEK-Kuzbass | 32.040.3 | 40.010.4 |

| 3 | PJSC EvrazHolding | 23.255.4 | 7550.3 |

| 4 | Sibantracite Group | 22.019.3 | 16.942.6 |

| 5 | PJSC HC “SDS-Ugol” | 19.299.2 | 13.806.4 |

| 6 | PJSC “Borodinsky Section” | 19.065.3 | 12.756.0 |

| 7 | PJSC Stroyservice | 16.662.7 | 79.14.0 |

| 8 | PJSC “Russian Coal” | 14.735.7 | 4212.9 |

| 9 | PJSC “UK “Elga Ugol” | 14.695.4 | 14.011.4 |

| 10 | PJSC “En+ Group” | 14.492.4 | 12.458.0 |

| Total | 432.100.0 | 223.300.0 |

| Type of Coal | Direction | Conservative Forecast | Optimistic Forecast | Conservative Forecast | Optimistic Forecast | Conservative Forecast | Optimistic Forecast |

|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | |||||

| Energy coal | Eastern | 58 | 75 | 75 | 79 | 88 | 90 |

| Western | 53 | 69 | 53 | 72 | 55 | 81 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Panaedova, G.; Borodin, A.; Zehir, C.; Laptev, S.; Kulikov, A. Overview of the Russian Coal Market in the Context of Geopolitical and Economic Turbulence: The European Embargo and New Markets. Energies 2023, 16, 6797. https://doi.org/10.3390/en16196797

Panaedova G, Borodin A, Zehir C, Laptev S, Kulikov A. Overview of the Russian Coal Market in the Context of Geopolitical and Economic Turbulence: The European Embargo and New Markets. Energies. 2023; 16(19):6797. https://doi.org/10.3390/en16196797

Chicago/Turabian StylePanaedova, Galina, Alex Borodin, Cemal Zehir, Sergey Laptev, and Andrey Kulikov. 2023. "Overview of the Russian Coal Market in the Context of Geopolitical and Economic Turbulence: The European Embargo and New Markets" Energies 16, no. 19: 6797. https://doi.org/10.3390/en16196797

APA StylePanaedova, G., Borodin, A., Zehir, C., Laptev, S., & Kulikov, A. (2023). Overview of the Russian Coal Market in the Context of Geopolitical and Economic Turbulence: The European Embargo and New Markets. Energies, 16(19), 6797. https://doi.org/10.3390/en16196797