Market-Based TSO–DSO Coordination: A Comprehensive Theoretical Market Framework and Lessons from Real-World Implementations

Abstract

:1. Introduction

- Development of the TMF to formalize new, innovative market concepts and their impact on existing markets;

- Application of this framework to the market design concepts proposed by the OneNet demonstrators;

- Identification of real-world challenges of designing, implementing and integrating novel markets for system services into the existing market architecture.

2. The Theoretical Market Framework

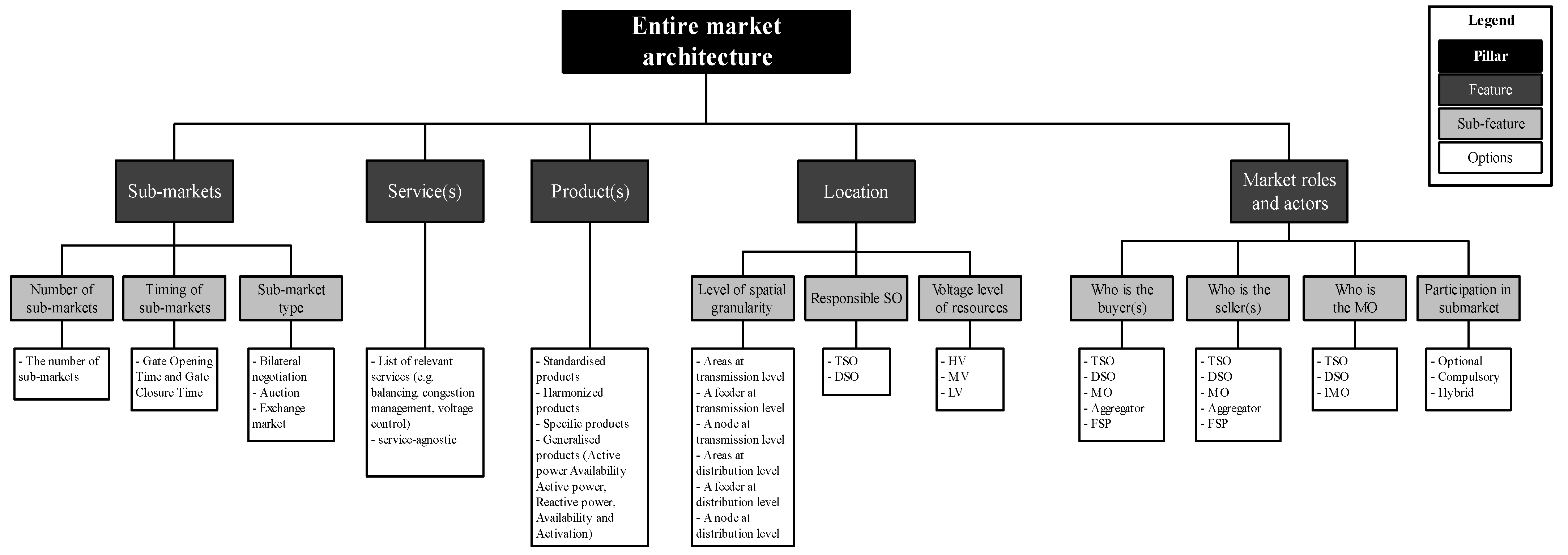

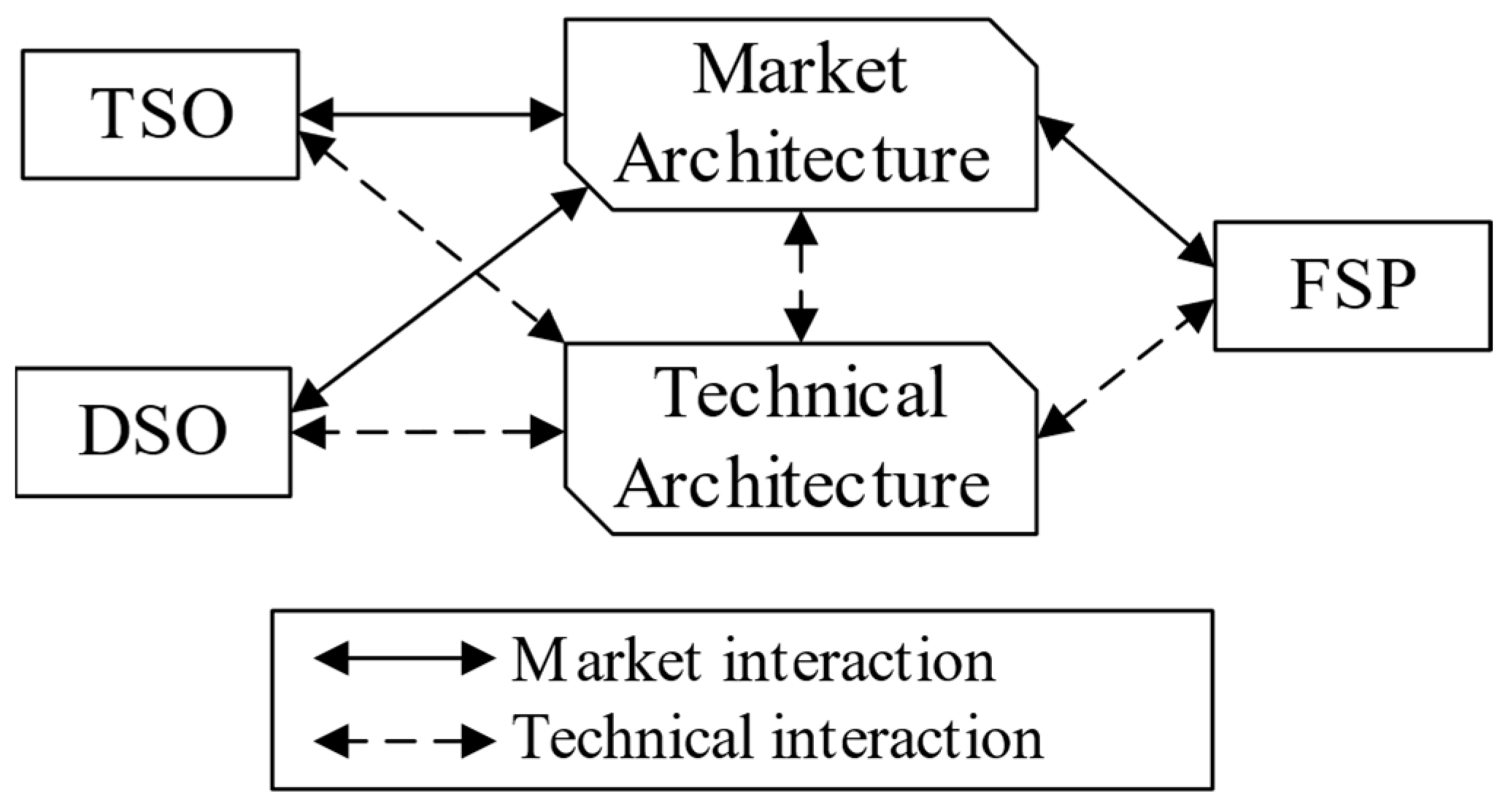

2.1. Entire Market Architecture

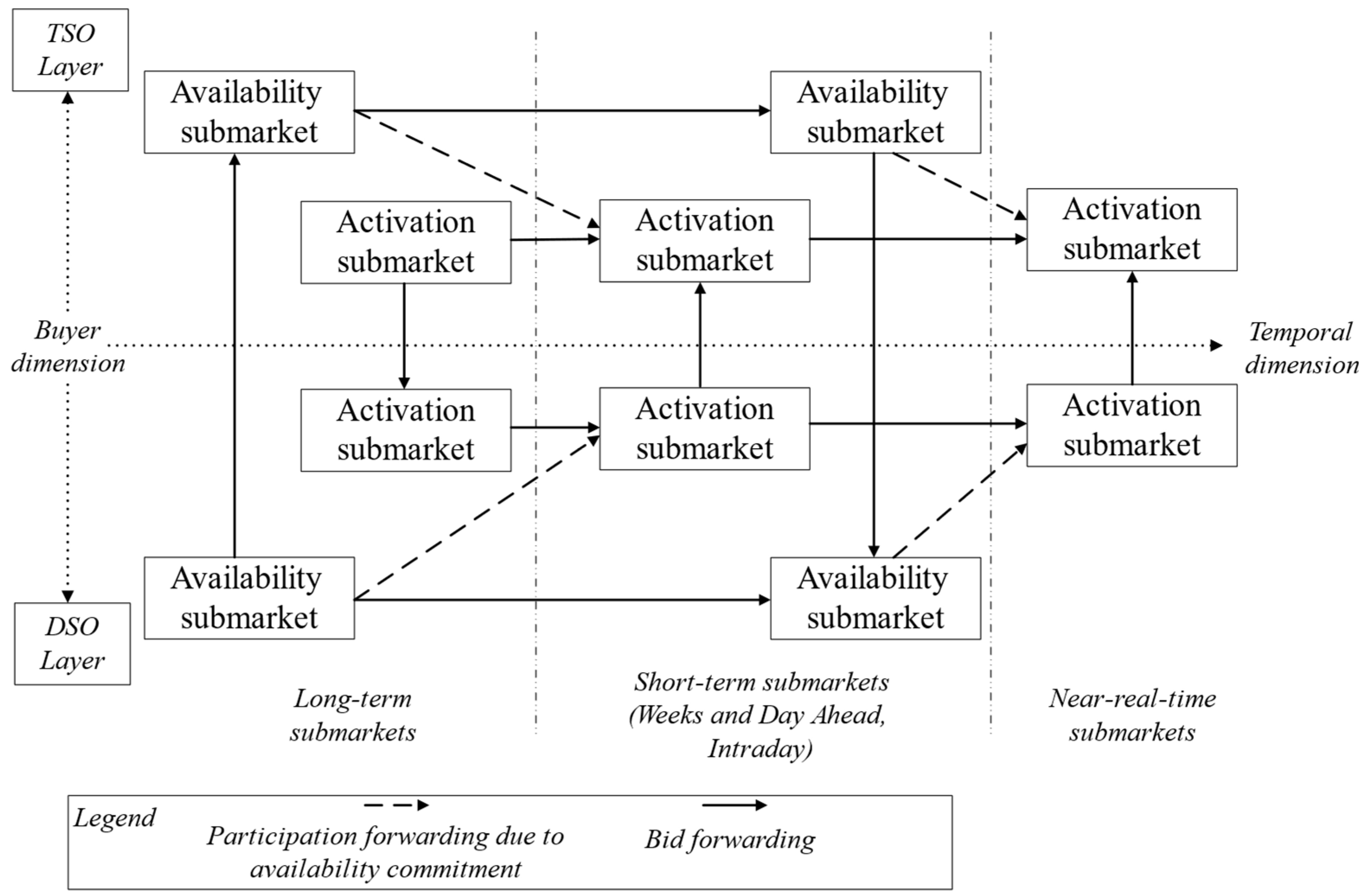

2.2. Sub-Market Coordination

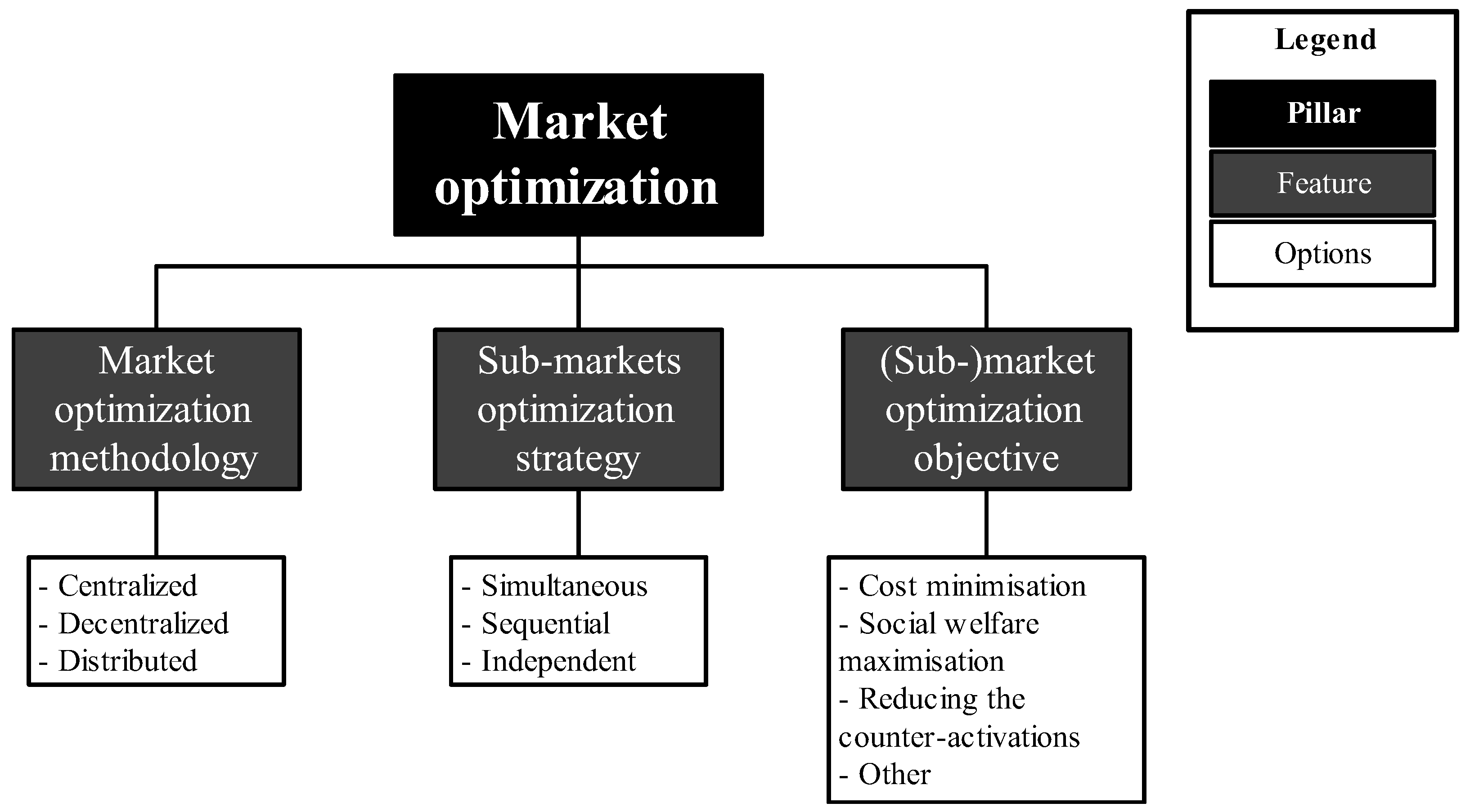

2.3. Market Optimization

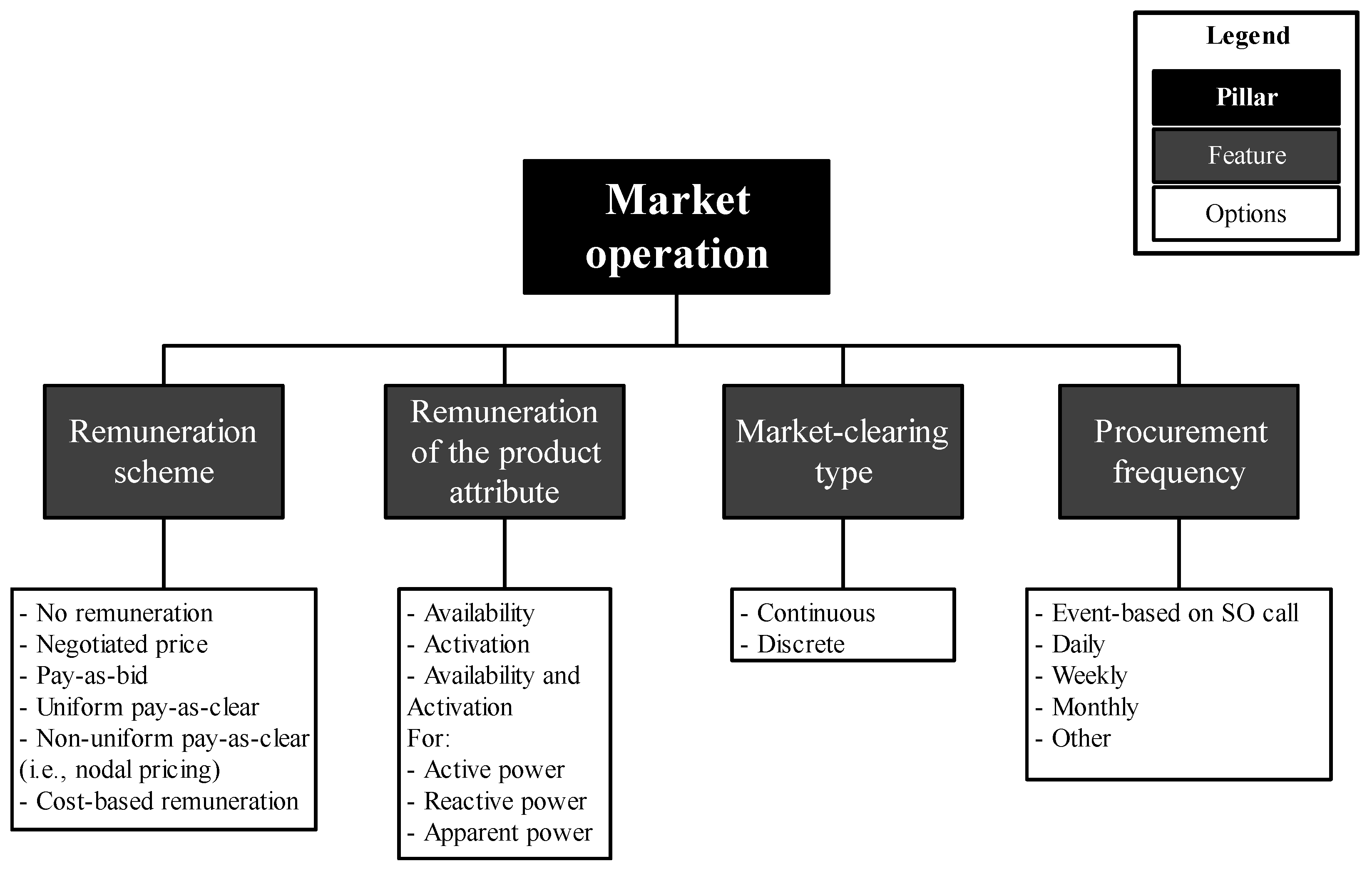

2.4. Market Operation

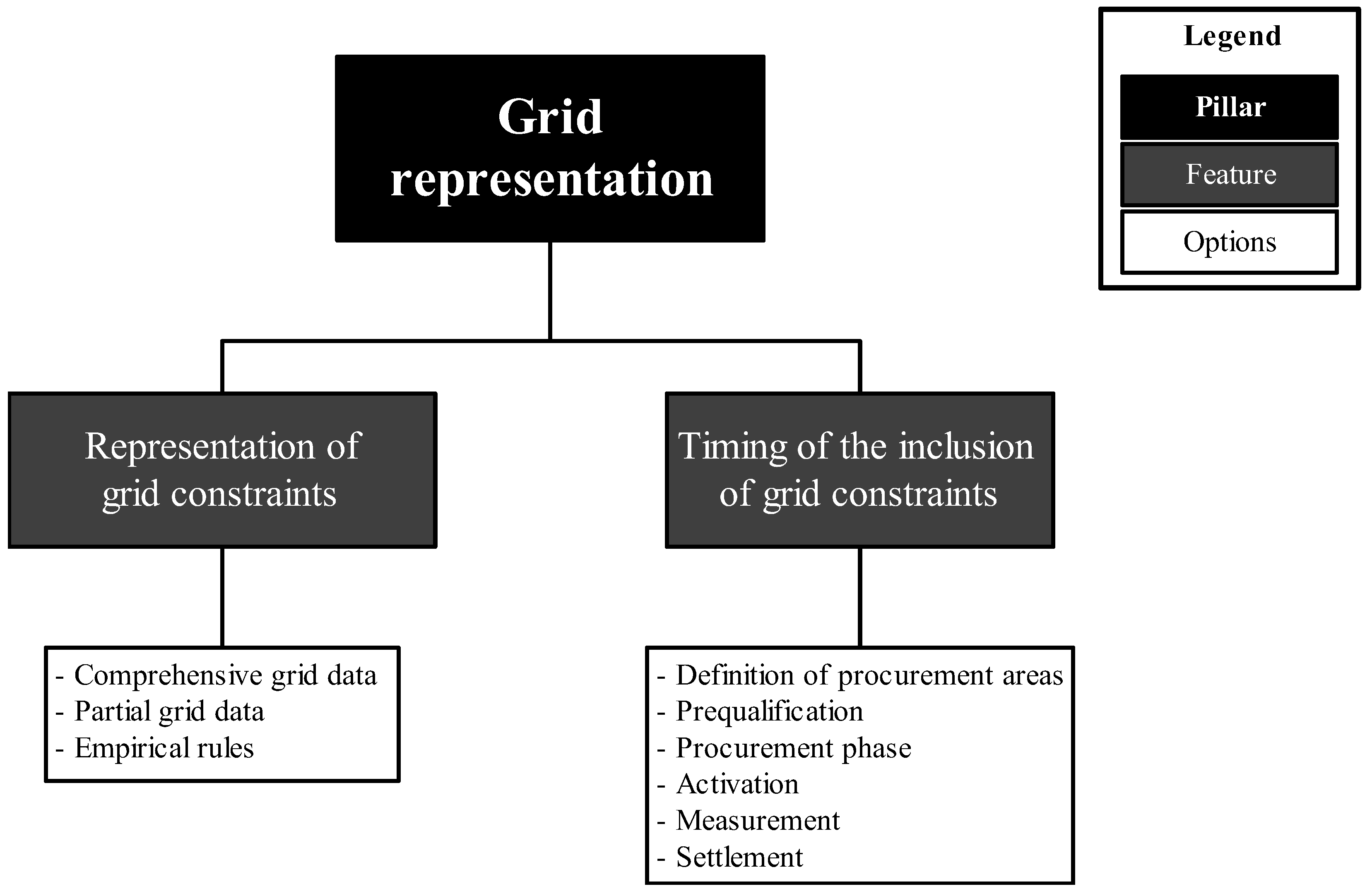

2.5. Grid Representation

3. Application of the Theoretical Market Framework to the OneNet Demonstrators

- Identification of buyer–seller interactions;

- Definition of sub-markets of the market architecture;

- Description of each sub-market using the TMF features;

- Description of the interactions between sub-markets using the TMF features;

- High-level description of the market architecture.

3.1. Procedure Adopted to Analyze the OneNet Demonstrators Using the TMF

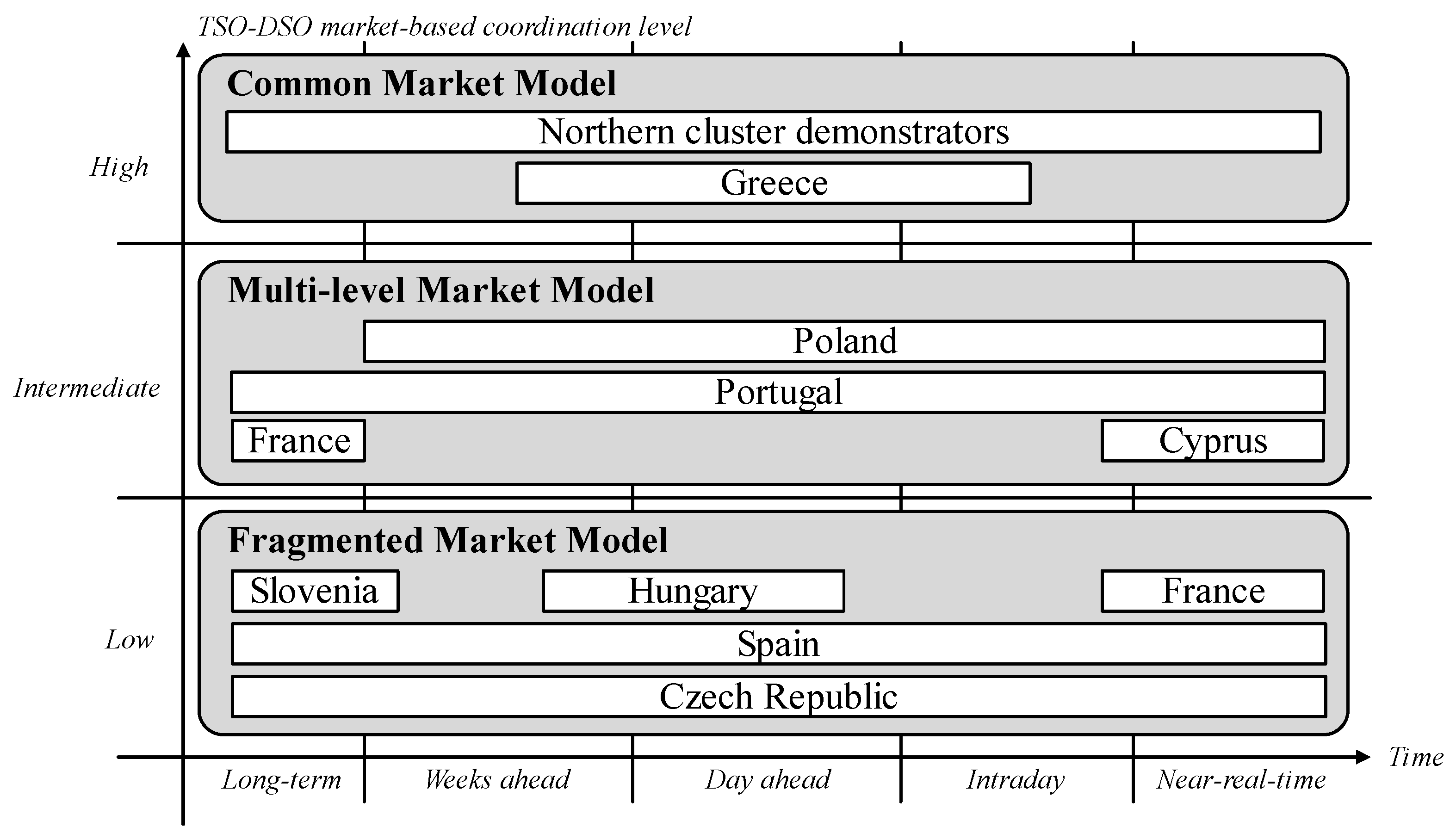

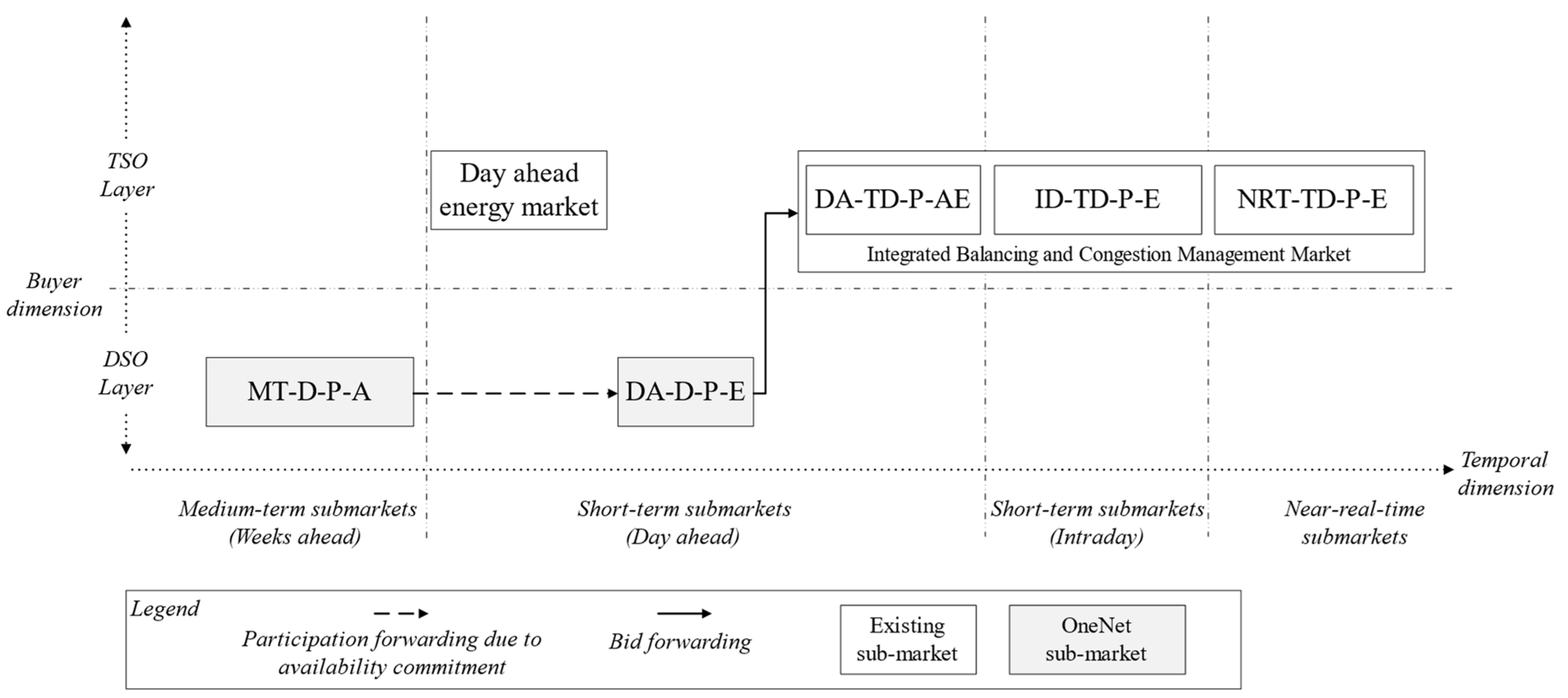

3.2. TMF Analysis of the Northern and Polish Demonstrators’ Market Architectures

4. Real-World Challenges of Implementing TSO–DSO Market-Based Coordination

4.1. Challenges Related to the Design of Market Architecture Structural Aspects

4.2. Challenges Related to Sub-Market Coordination Aspects

4.3. Challenges Related to Market Optimization Design Aspects

4.4. Challenges Related to Market Operation Design Aspects

4.5. Challenges Related to Grid Representation in the Market Architecture

4.6. Analysis of Challenges and Recommendations across the Analyzed Demonstrators

4.7. Policy Recommendations and Insights Emerged from the Applicationof the TMF

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| aFRR | automatic frequency restoration reserves |

| CS | coordination schemes |

| D | distribution network |

| DA | day-ahead |

| DSO | distribution system operator |

| FCR | frequency containment reserves |

| FSP | flexible service provider |

| GCT | gate closure time |

| H2020 | Horizon 2020 |

| HV | high voltage |

| ID | intraday |

| IMO | independent market operator |

| LT | long-term |

| LV | low voltage |

| mFRR | manual frequency restoration reserves |

| MO | market operator |

| MV | medium voltage |

| NRT | near-real-time |

| P | active power |

| Q | reactive power |

| RES | renewable energy source |

| SO | system operator |

| ST | short-term |

| T | transmission network |

| TMF | theoretical market framework |

| TSO | transmission system operator |

| V/I | voltage or current |

Appendix A

References

- European Commission. COM (2018) 773 Final, A Clean Planet for All: A European Strategic Long-Term Vision for A Prosperous, Modern, Competitive and Climate Neutral Economy. 28 November 2018. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52018DC0773 (accessed on 10 December 2020).

- CIGRE Working Group C6.19. CIGRE Technical Brochure, Planning and Optimization Methods for Active Distribution Systems; CIGRE, Paris. 2016. Available online: https://e-cigre.org/publication/ELT_276_7-planning-and-optimization-methods-for-active-distribution-systems (accessed on 13 April 2023).

- Hillberg, E.; Antony, Z.; Barbara, H.; Steven, W.; Jean, P.; Jean-Yves, B.; Sebastian, L.; Gianluigi, M.; Kjetil, U.; Irina, O.; et al. Flexibility needs in the future power system. In International Smart Grid Action Network—ISGAN Annex 6; ISGAN: Vienna, Austria, 2019. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Power System Flexibility for the Energy Transition, Part 1: Overview for Policy Makers. 2018. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Nov/IRENA_Power_system_flexibility_1_2018.pdf (accessed on 5 February 2021).

- International Energy Agency (IEA). Status of Power System Transformation 2019—Power System Flexibility. IEA Webstore. 2019. Available online: https://webstore.iea.org/status-of-power-system-transformation-2019 (accessed on 5 February 2021).

- Gerres, T.; Ávila, J.P.C.; Martínez, F.M.; Abbad, M.R.; Arín, R.C.; Miralles, Á.S. Rethinking the electricity market design: Remuneration mechanisms to reach high RES shares. Results from a Spanish case study. Energy Policy 2019, 129, 1320–1330. [Google Scholar] [CrossRef]

- Vicente-Pastor, A.; Nieto-Martin, J.; Bunn, D.W.; Laur, A. Evaluation of Flexibility Markets for Retailer–DSO–TSO Coordination. IEEE Trans. Power Syst. 2019, 34, 2003–2012. [Google Scholar] [CrossRef]

- Bertsch, J.; Growitsch, C.; Lorenczik, S.; Nagl, S. Flexibility in Europe’s power sector—An additional requirement or an automatic complement? Energy Econ. 2016, 53, 118–131. [Google Scholar] [CrossRef]

- Lind, L.; Cossent, R.; Chaves-Ávila, J.P.; Román, T.G.S. Transmission and distribution coordination in power systems with high shares of distributed energy resources providing balancing and congestion management services. WIREs Energy Environ. 2019, 8, e357. [Google Scholar] [CrossRef]

- European Union, Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU (Text with EEA relevance.), OJ L. 2019. Available online: http://data.europa.eu/eli/dir/2019/944/oj/eng (accessed on 26 December 2020).

- Bublitz, A.; Keles, D.; Zimmermann, F.; Fraunholz, C.; Fichtner, W. A survey on electricity market design: Insights from theory and real-world implementations of capacity remuneration mechanisms. Energy Econ. 2019, 80, 1059–1078. [Google Scholar] [CrossRef]

- Cramton, P. Electricity market design. Oxf. Rev. Econ. Policy 2017, 33, 589–612. [Google Scholar] [CrossRef]

- Poudineh, R.; Peng, D. Electricity Market Design for A Decarbonised Future: An Integrated Approach; Oxford Institute for Energy Studies: Oxford, UK, 2017. [Google Scholar] [CrossRef]

- Anatolitis, V.; Azanbayev, A.; Fleck, A.-K. How to design efficient renewable energy auctions? Empirical insights from Europe. Energy Policy 2022, 166, 112982. [Google Scholar] [CrossRef]

- Bell, K.; Gill, S. Delivering a highly distributed electricity system: Technical, regulatory and policy challenges. Energy Policy 2018, 113, 765–777. [Google Scholar] [CrossRef]

- Bellenbaum, J.; Höckner, J.; Weber, C. Designing flexibility procurement markets for congestion management—investigating two-stage procurement auctions. Energy Econ. 2022, 106, 105775. [Google Scholar] [CrossRef]

- Hu, J.; Harmsen, R.; Crijns-Graus, W.; Worrell, E.; van den Broek, M. Identifying barriers to large-scale integration of variable renewable electricity into the electricity market: A literature review of market design. Renew. Sustain. Energy Rev. 2018, 81, 2181–2195. [Google Scholar] [CrossRef]

- Mastropietro, P.; Rodilla, P.; Rangel, L.E.; Batlle, C. Reforming the colombian electricity market for an efficient integration of renewables: A proposal. Energy Policy 2020, 139, 111346. [Google Scholar] [CrossRef]

- Muñoz, F.D.; Suazo-Martínez, C.; Pereira, E.; Moreno, R. Electricity market design for low-carbon and flexible systems: Room for improvement in Chile. Energy Policy 2021, 148, 111997. [Google Scholar] [CrossRef]

- Petitet, M.; Perrot, M.; Mathieu, S.; Ernst, D.; Phulpin, Y. Impact of gate closure time on the efficiency of power systems balancing. Energy Policy 2019, 129, 562–573. [Google Scholar] [CrossRef]

- Tolmasquim, M.T.; de Barros Correia, T.; Porto, N.A.; Kruger, W. Electricity market design and renewable energy auctions: The case of Brazil. Energy Policy 2021, 158, 112558. [Google Scholar] [CrossRef]

- van der Veen, R. Designing Multinational Electricity Balancing Markets. 2012. Available online: https://repository.tudelft.nl/islandora/object/uuid%3Ae1c5777e-be4c-4df3-a764-f622c828c709 (accessed on 2 June 2022).

- Woo, C.K.; Milstein, I.; Tishler, A.; Zarnikau, J. A wholesale electricity market design sans missing money and price manipulation. Energy Policy 2019, 134, 110988. [Google Scholar] [CrossRef]

- Abbasy, A.; van der Veen, R.; Hakvoort, R. Timing of Markets- the Key Variable in Design of Ancillary Service Markets for Power Reserves. In Proceedings of the 3rd World Congress on Social Simulation: Scientific Advances in Understanding Societal Processes and Dynamics, Kassel, Germany, 6–9 September 2010; pp. 1–14. [Google Scholar]

- Gerard, H.; Puente, E.I.R.; Six, D. Coordination between transmission and distribution system operators in the electricity sector: A conceptual framework. Util. Policy 2018, 50, 40–48. [Google Scholar] [CrossRef]

- Delnooz, A.; Vanschoenwinkel, J.; Rivero, E.; Madina, C. Coordinet Deliverable 1.3—Definition of Scenarios and Products for the Demonstration Campaigns. Coordinet Project (EU H2020). 2019. Available online: https://private.coordinet-project.eu/files/documentos/5d72415ced279Coordinet_Deliverable_1.3.pdf (accessed on 14 June 2023).

- Gürses-Tran, G.; Monti, A.; Vanschoenwinkel, J.; Kessels, K.; Chaves-Ávila, J.P.; Lind, L. Business use case development for TSO–DSO interoperable platforms in large-scale demonstrations. In Proceedings of the CIRED 2020 Berlin Workshop (CIRED 2020), Berlin, Germany, 22–23 September 2020; Volume Se2020, pp. 672–674. [Google Scholar] [CrossRef]

- Ruwaida, Y.; Chaves-Avila, J.P.; Etherden, N.; Gomez-Arriola, I.; Gürses-Tran, G.; Kessels, K.; Madina, C.; Sanjab, A.; Santos-Mugica, M.; Trakas, D.N.; et al. TSO-DSO-Customer coordination for purchasing flexibility system services: Challenges and lessons learned from a demonstration in Sweden. IEEE Trans. Power Syst. 2022, 38, 1883–1895. [Google Scholar] [CrossRef]

- E. CEDEC, ENTSO-E, E. GEODE TSO-DSO Report-An Integrated Approach to Active System Management. 2019. Available online: https://docstore.entsoe.eu/Documents/Publications/Position%20papers%20and%20reports/TSO-DSO_ASM_2019_190416.pdf (accessed on 7 December 2020).

- INTERRFACE. H2020 Project INTERRFACE Deliverable 3.1—Definition of New/Changing Requirements for Services. INTERRFACE H2020 Project; Interrface: Luxemburg, 2020. [Google Scholar]

- Hadush, S.Y.; Meeus, L. DSO-TSO cooperation issues and solutions for distribution grid congestion management. Energy Policy 2018, 120, 610–621. [Google Scholar] [CrossRef]

- OneNet Project. OneNet H2020 Project OneNet H2020 Project Website. Available online: https://onenet-project.eu/ (accessed on 29 June 2021).

- Kessels, K.; Torbaghan, S.S.; Virag, A.; Le Cadre, H. D3.2 Magnitude Project—Evaluation of Future Market Designs for Multi Energy System. March 2019. Available online: https://www.magnitude-project.eu/wp-content/uploads/2019/07/MAGNITUDE_DEL3.2_R1.0-submitted.pdf (accessed on 31 May 2021).

- Drivakou, K.; Bachoumis, T.; Tzoumpas, A.; Troncia, M.; Dominguez, F. OneNet Deliverable 2.1—Review on Markets and Platforms in Related Activities. OneNet H2020 Project. March 2021. Available online: https://onenet-project.eu/wp-content/uploads/2021/08/D2.1-Review-on-markets-and-platforms-in-related-activities-1.pdf (accessed on 18 November 2021).

- Italian Regulatory Authority for Energy, Networks and Environment (ARERA) DCO 322/2019/R/eel, Testo Integrato del Dispacciamento Elettrico (TIDE)—Orientamenti Complessivi. 23 July 2019. Available online: https://www.arera.it/allegati/docs/19/322-19.pdf (accessed on 18 November 2021).

- Bindu, S.; Troncia, M.; Ávila, J.P.C.; Sanjab, A. Bid Forwarding as a Way to Connect Sequential Markets: Opportunities and Barriers. In Proceedings of the 2023 19th International Conference on the European Energy Market (EEM), Lappeenranta, Finland, 6–8 June 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Magois, S.; Serra, M.; Loevenbruck, P.; Budke, J.; Kacprzak, P.; Willeghems, G.; Puente, E.R.; Delaney, N. Conceptual Market Organisations for the Provision of Innovative System Services: Role Models, Associated Market Designs and Regulatory Frameworks—EU-SysFlex Deliverable 3.2. EU-SysFlex H2020 Project. 2020. Available online: https://eu-sysflex.com/wp-content/uploads/2020/06/EU-SysFlex_Task-3.2-Deliverable-Final.pdf (accessed on 30 November 2020).

- EUniversal H2020 Project EUniversal Deliverable: D5.1—Identification of Relevant Market Mechanisms for the Procurement of Flexibility Needs and Grid Services. EUniversal H2020 Project. 2021. Available online: https://euniversal.eu/wp-content/uploads/2021/02/EUniversal_D5.1.pdf (accessed on 4 March 2021).

- EPEX SPOT–GME–Nord Pool–OMIE–OPCOM–OTE–TGE EUPHEMIA Public Description—PCR Market Coupling Algorithm. Price Coupling of Regions (PCR) Project. 2016. Available online: https://www.nemo-committee.eu/assets/files/Euphemia-Public-Description.pdf (accessed on 10 November 2021).

- European Commission, Joint Research Centre. Nodal Pricing in the European Internal Electricity Market; Publications Office: Luxemburg, 2020; Available online: https://data.europa.eu/doi/10.2760/41018 (accessed on 27 September 2021).

- Drivakou, K.; Bachoumis, T.; Tzoumpas, A.; Augusto, C.; Giovanett, S.; Dominguez, F.; Troncia, M.; Lind, L.; Oliveira, F.; Gandhi, S.; et al. Business Use Cases for the OneNet D2.3. Deliverable D2.3 OneNet H2020 Project. 2021. Available online: https://onenet-project.eu/wp-content/uploads/2022/10/D2.3-Business-Use-Cases-for-the-OneNet.pdf (accessed on 5 June 2022).

- Ávila, J.P.C.; Troncia, M.; Silva, C.D.; Willeghems, G. OneNet Deliverable 3.1—Overview of Market Designs for the Procurement of System Services by DSOs and TSOs. OneNet H2020 Project. 2021. Available online: https://onenet-project.eu/wp-content/uploads/2021/08/D31-Overview-of-market-designs-for-the-procurement-of-system-services-by-DSOs-and-TSOs-1.pdf (accessed on 29 November 2022).

- Avila, J.P.C. European Short-Term Electricity Market Designs under High Penetration of Wind Power; TU Delft, Delft University of Technology: Delft, The Netherlands, 2014; Available online: http://repository.tudelft.nl/view/ir/uuid:cbc2c7bd-d65e-4f4c-9f88-2ab55c11def8/ (accessed on 4 January 2016).

- Kyle, A.S. Continuous Auctions and Insider Trading. Econometrica 1985, 53, 1315–1335. [Google Scholar] [CrossRef]

- Ávila, J.P.C. European Short-term Electricity Market Designs under High Penetration of Wind Power; Universidad Pontificia de Comillas & Université Paris-Sud: Enschede, The Netherlands, 2014; Available online: https://repositorio.comillas.edu/xmlui/handle/11531/2683 (accessed on 5 June 2022).

- Bompard, E.; Ma, Y.; Napoli, R.; Abrate, G. The Demand Elasticity Impacts on the Strategic Bidding Behavior of the Electricity Producers. IEEE Trans. Power Syst. 2007, 22, 188–197. [Google Scholar] [CrossRef]

| Element | First | Second | Third | Fourth |

|---|---|---|---|---|

| Meaning | Timing (considering gate closure time) | Grid connection of service providers | Electric variable of the product traded | Generalized product traded |

| Options | LT (Long-term) | T (Transmission) | P (Active power) | A (Availability) |

| MT (Medium-term) | D (Distribution) | Q (Reactive power) | E (Activation) | |

| DA (Day-ahead) | TD (Transmission and distribution) | PQ (Active and reactive power) | AE (Availability and activation) | |

| ID (intraday) | ||||

| NRT (Near-real-time) |

| Attribute | Polish DA-D-P-E | Polish DA-TD-P-AE | Northern LT-TD-P-AE | Northern ID-TD-P-E | Northern NRT-TD-P-E |

|---|---|---|---|---|---|

| Feature: Sub-market dimension | |||||

| Timing of the sub-markets | Day-ahead | Day-ahead | More than month ahead, event-based | From weeks ahead to intraday | Near-real-time |

| Sub-market type | Auction market | Auction market | Auction market | Auction market | Auction market |

| Feature: Service(s) | |||||

| Service | Congestion management, voltage control | Congestion management, frequency control | Service agnostic | Congestion management, frequency control | Congestion management, frequency control |

| Feature: Product(s) | |||||

| Product procured | Active power activation | Active power activation | Active power availability and activation | Active power activation | Active power activation |

| Feature: Location | |||||

| Level of spatial granularity | Distribution grid | National, transmission grid distribution grid interface nodes | National, transmission grid distribution grid | National, transmission grid distribution grid | National, transmission grid distribution grid |

| Responsible system operator | DSO | TSO | TSO, DSO | TSO, DSO | TSO, DSO |

| Voltage level for resources | MV, LV | HV, MV, LV (frequency control only) | HV, MV, LV | HV, MV, LV | HV, MV, LV |

| Feature: Market roles and actors | |||||

| Who is the buyer(s) | DSO | TSO | TSO, DSO | TSO, DSO | TSO, DSO |

| Who is the seller(s) | FSP | FSP | FSP | FSP | FSP |

| Who is the MO | DSO | TSO | DSO, TSO, IMO | DSO, TSO, IMO | DSO, TSO, IMO |

| Participation in sub-market | Hybrid | Hybrid | Optional | Hybrid | Optional |

| Polish Demonstrator | Northern Demonstrator | Northern Demonstrator | ||

|---|---|---|---|---|

| Sub-markets | A | DA-D-P-E | Intraday energy | ID-TD-P-E |

| B | DA-TD-P-E | ID-TD-P-E | NRT-TD-P-E | |

| Market optimization pillar | ||||

| Feature: Market optimization methodology | Decentralized | Centralized | Centralized | |

| Feature: Sub-markets optimization strategy | Sequential | Simultaneous | Sequential | |

| Sub-markets coordination pillar | ||||

| Feature: Allocation principle of flexibility | Forwarding of bids | Yes (only for frequency control) | Yes (only for congestion management) | Yes |

| Commitment to bid selection | Conditional (forwarded bids are aggregated) | Conditional (bids with locational information) | Formal | |

| System operators order | Priority for DSO | No Priority | No Priority | |

| Polish Demonstrator | Northern Demonstrator | |

|---|---|---|

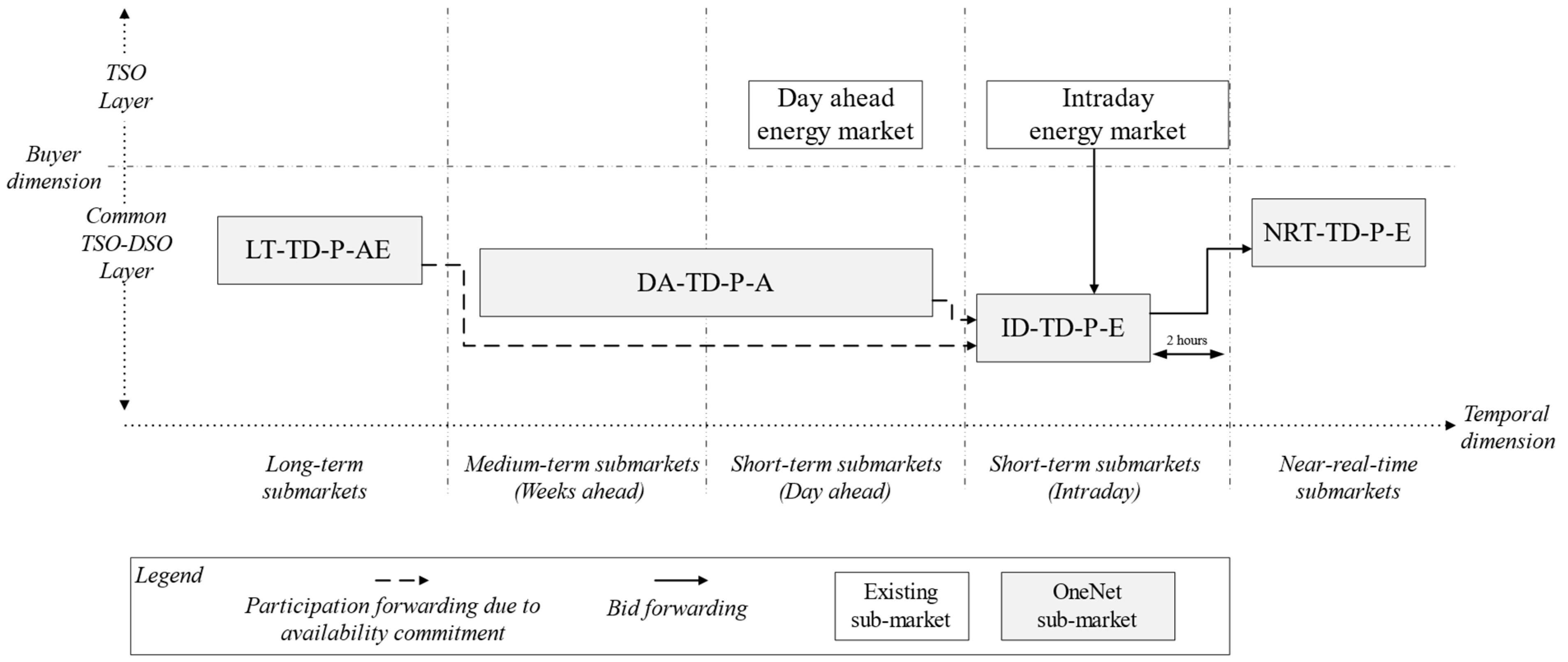

| Entire market architecture | Multi-layered TSO–DSO market architecture for congestion management and voltage control with active power activation products. | Common TSO–DSO market architecture characterized by service-agnostic products for congestion management and frequency control with active power activation and availability products. |

| Sub-market coordination | Forwarding of bids from local to national market with priority to DSO for flexibility allocation. Bid forwarding considers aggregation with grid constraint check. | Bids from intraday energy markets can be forwarded to other markets if bids include locational information and pass grid constraints check. No priority to TSO or DSO for flexibility allocation. |

| Market optimization | Decentralized optimization with sequential strategy. The local market (DA-D-P-E) has priority, bids may be forwarded to the national level (DA-TD-P-AE). | Centralized market optimization and simultaneous markets optimization. Bid sharing between intraday energy market and other sub-markets, given certain conditions. |

| Market operation | Day-ahead operational procedures with specific auction mechanisms for congestion management and voltage control. | From long-term to near-real-time, with auction mechanisms for multiple services. |

| Grid representation | Grid constraints check at the DSO level with detailed representation of grid. Forwarded bids undergo aggregation considering DSO grid constraints. | Bids including locational information are checked for grid constraints compliance. Moreover, bid forwarding and selection checks the uniqueness of bids among sub-markets to prevent double clearing |

| Market Design Challenge | Demonstrator’s Challenge | Demonstrator’s Solution |

|---|---|---|

| Market Integration | The Polish demonstrator aims at enhancing TSO–DSO cooperation at the national level. The complexity arises in achieving an efficient multi-layered TSO–DSO structure. | In Polish demonstrator prioritization is given to local markets, with flexibility allocations from local markets to national ones. Decentralized optimization to ensure local constraints are accounted for before scaling to a national perspective. |

| The northern demonstrator seeks to integrate local and national markets in one cross-border architecture involving multiple TSOs and DSOs. The complexity here is in managing interactions across borders. | The northern demonstrator adopted a common TSO–DSO market architecture, integrating both TSO and DSO as buyers in a single coordination platform that realizes a centralized market optimization. | |

| Liquidity and DERs participation | For the Polish demonstrator: ensuring market liquidity while focusing primarily on local markets and TSO–DSO interactions at the national level. | Polish demonstrator solution: unlock DERs’ potential by creating multiple business opportunities with value staking from the local to the national level. |

| For the northern demonstrator: ensuring market liquidity with cross-border markets integration. | For the northern demonstrator: a common TSO–DSO market, ensuring all stakeholders, regardless of region, operate on a single platform unlocking cross-border and cross-service market participation. | |

| Ensuring proper allocation of flexibility | For both Polish and northern demonstrators: ensure adequate coordination between sub-markets that realizes a proper flow and prioritization of bids and optimizes flexibility allocation. | Polish demonstrator: sequential optimization and forwarding of bids from local to national markets, with prioritization for DSOs. |

| Northern demonstrator: centralized optimization with shared bids between sub-markets without TSO or DSO priority. | ||

| Maintaining grid security with DERs | For both Polish and northern demonstrators: with increasing distributed energy resources participating in the market, maintaining the security of the electricity supply becomes more complex. | Polish demonstrator: bid filtering and aggregation at DSO level with grid constraints check before bid forwarding to the TSO market. |

| Northern demonstrator: flexibility register with prequalification to ensure grid constraints are respected and the uniqueness of bid selection among the sub-markets avoiding double clearing. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Troncia, M.; Chaves Ávila, J.P.; Damas Silva, C.; Gerard, H.; Willeghems, G. Market-Based TSO–DSO Coordination: A Comprehensive Theoretical Market Framework and Lessons from Real-World Implementations. Energies 2023, 16, 6939. https://doi.org/10.3390/en16196939

Troncia M, Chaves Ávila JP, Damas Silva C, Gerard H, Willeghems G. Market-Based TSO–DSO Coordination: A Comprehensive Theoretical Market Framework and Lessons from Real-World Implementations. Energies. 2023; 16(19):6939. https://doi.org/10.3390/en16196939

Chicago/Turabian StyleTroncia, Matteo, José Pablo Chaves Ávila, Carlos Damas Silva, Helena Gerard, and Gwen Willeghems. 2023. "Market-Based TSO–DSO Coordination: A Comprehensive Theoretical Market Framework and Lessons from Real-World Implementations" Energies 16, no. 19: 6939. https://doi.org/10.3390/en16196939

APA StyleTroncia, M., Chaves Ávila, J. P., Damas Silva, C., Gerard, H., & Willeghems, G. (2023). Market-Based TSO–DSO Coordination: A Comprehensive Theoretical Market Framework and Lessons from Real-World Implementations. Energies, 16(19), 6939. https://doi.org/10.3390/en16196939