Potential Business Models of Carbon Capture and Storage (CCS) for the Oil Refining Industry in Thailand

Abstract

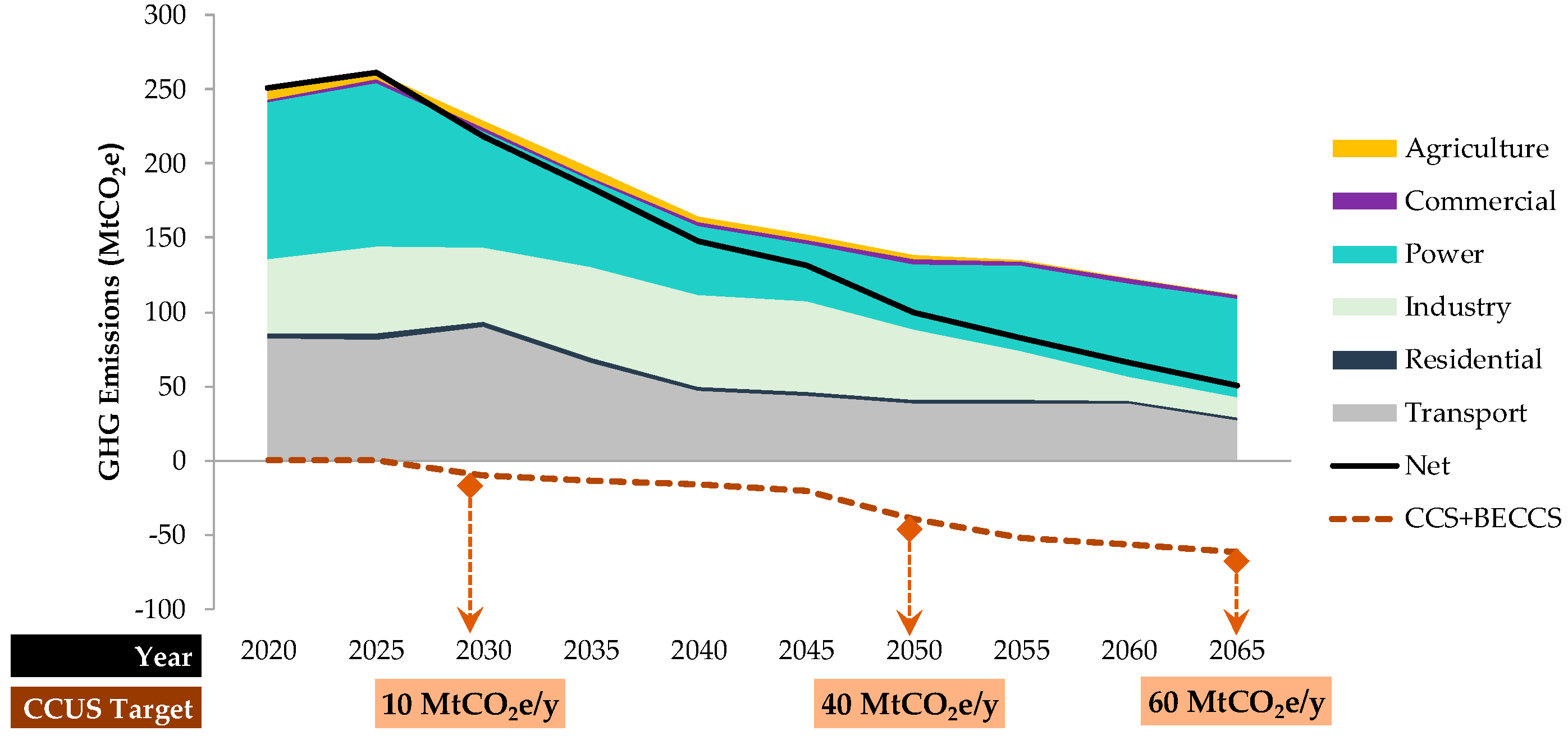

:1. Introduction

2. Oil Refining Industry CCS Potential

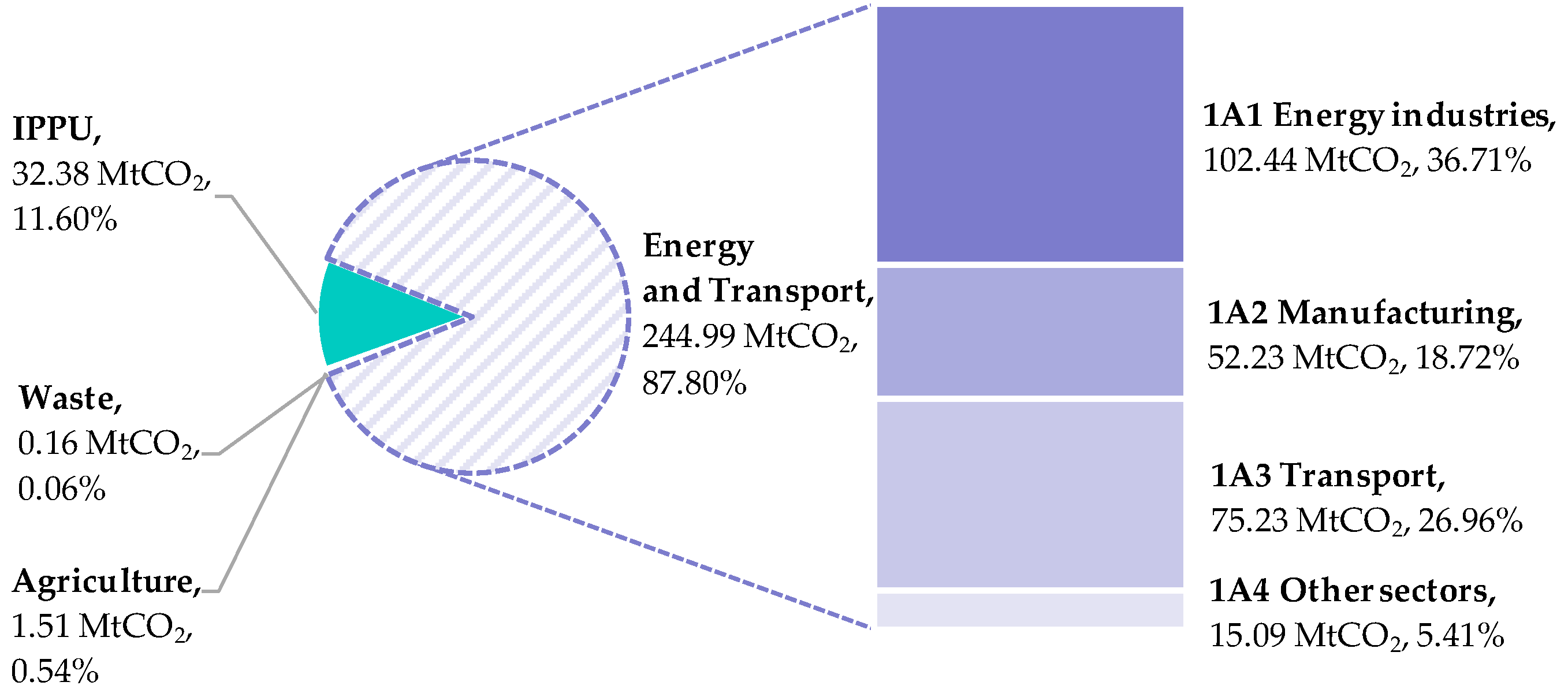

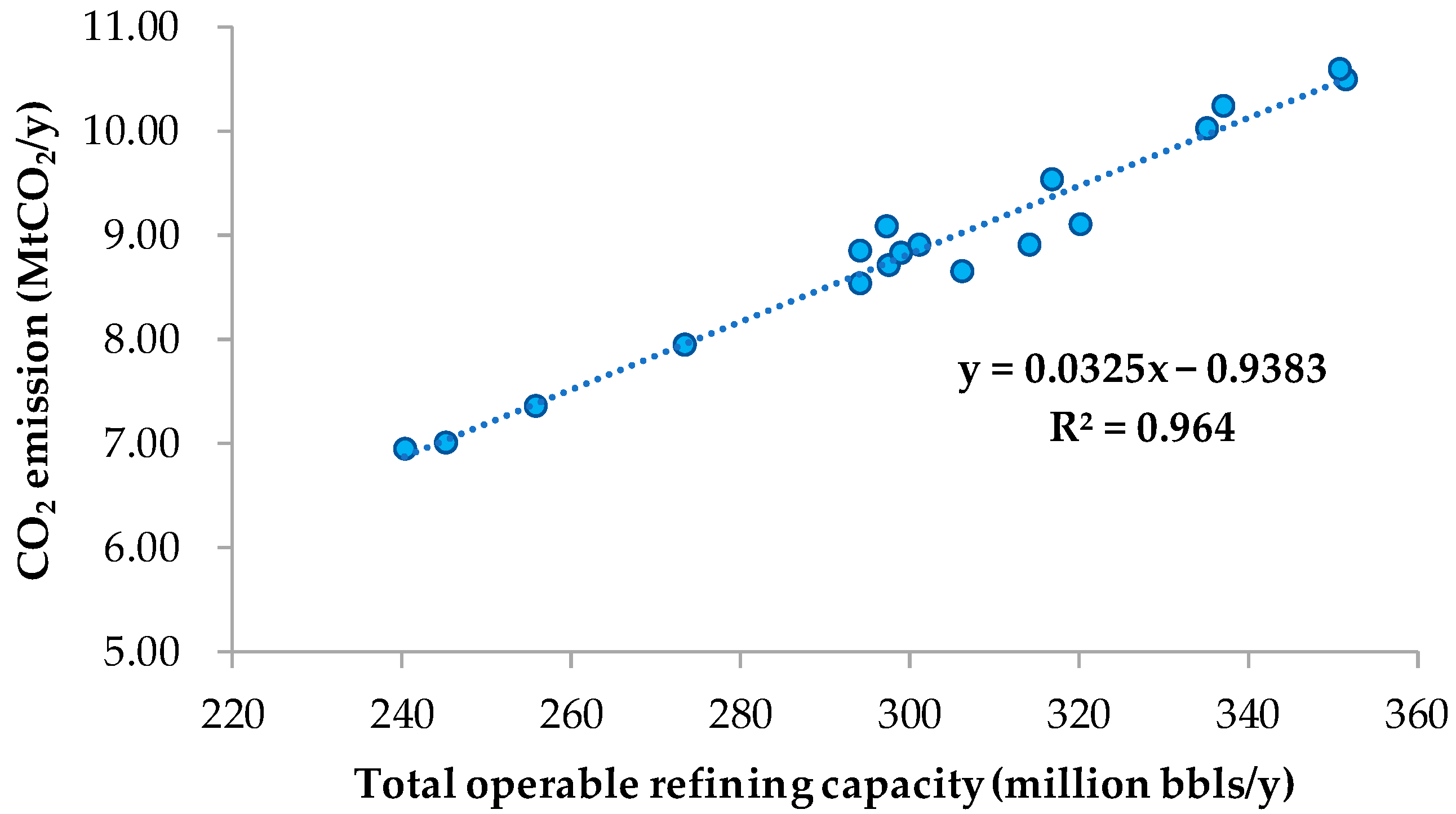

2.1. Evaluation of the Capture Potential of the Oil Refining Sector

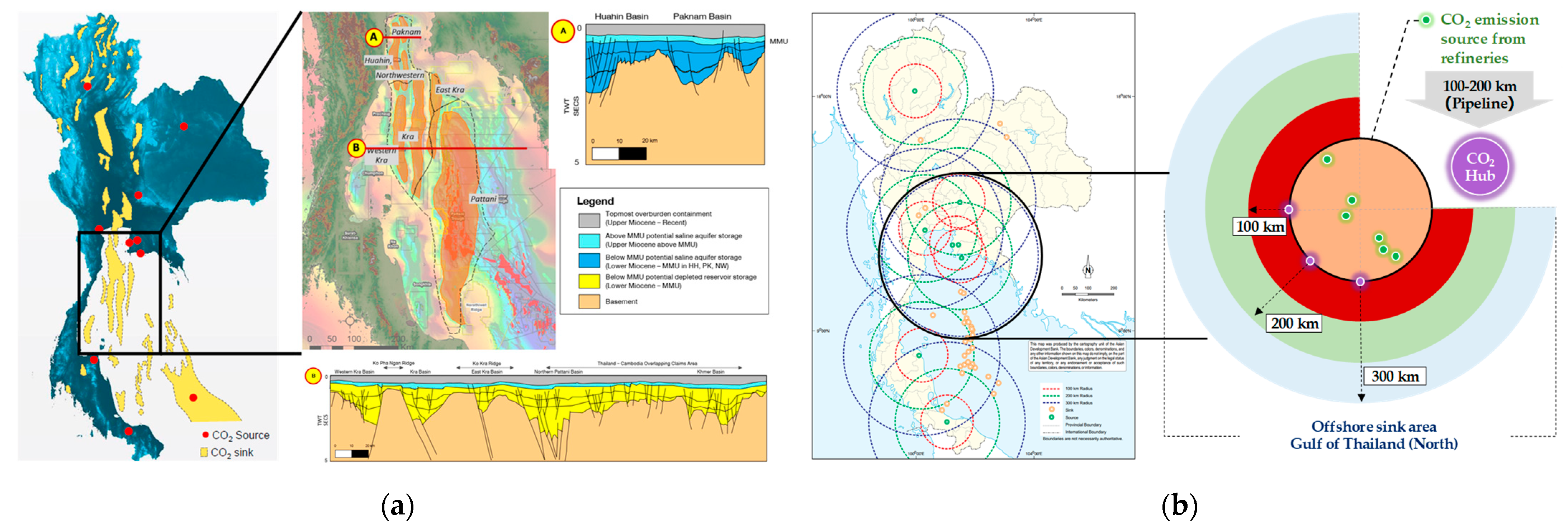

2.2. Evaluation Source to Sink Matching for the Refining Sector

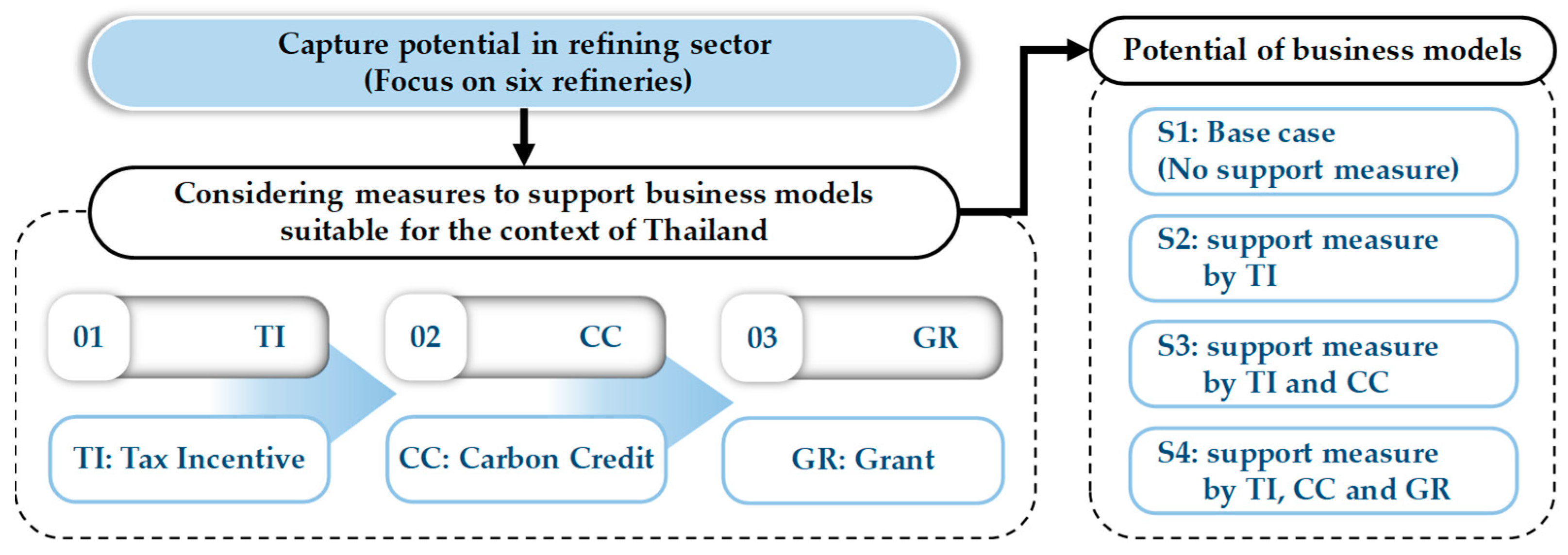

3. Potential of a CCS Business Model

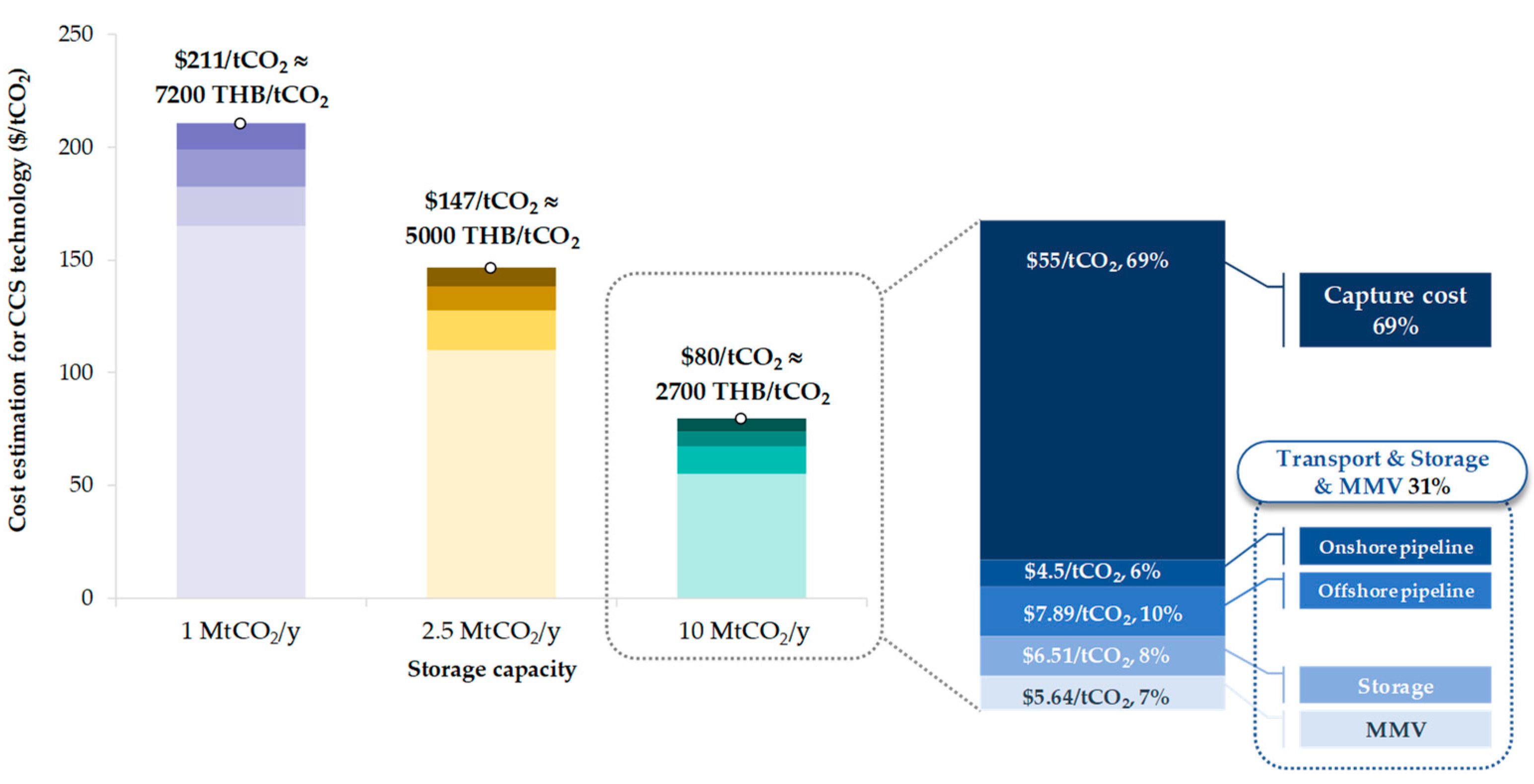

3.1. Cost Estimation for CCS Technology Investment at Various Scales

3.2. Business Model Options for Supporting CCS in the Refining Sector in Thailand

3.2.1. Potential of Private Investment Model: Capturing Technology

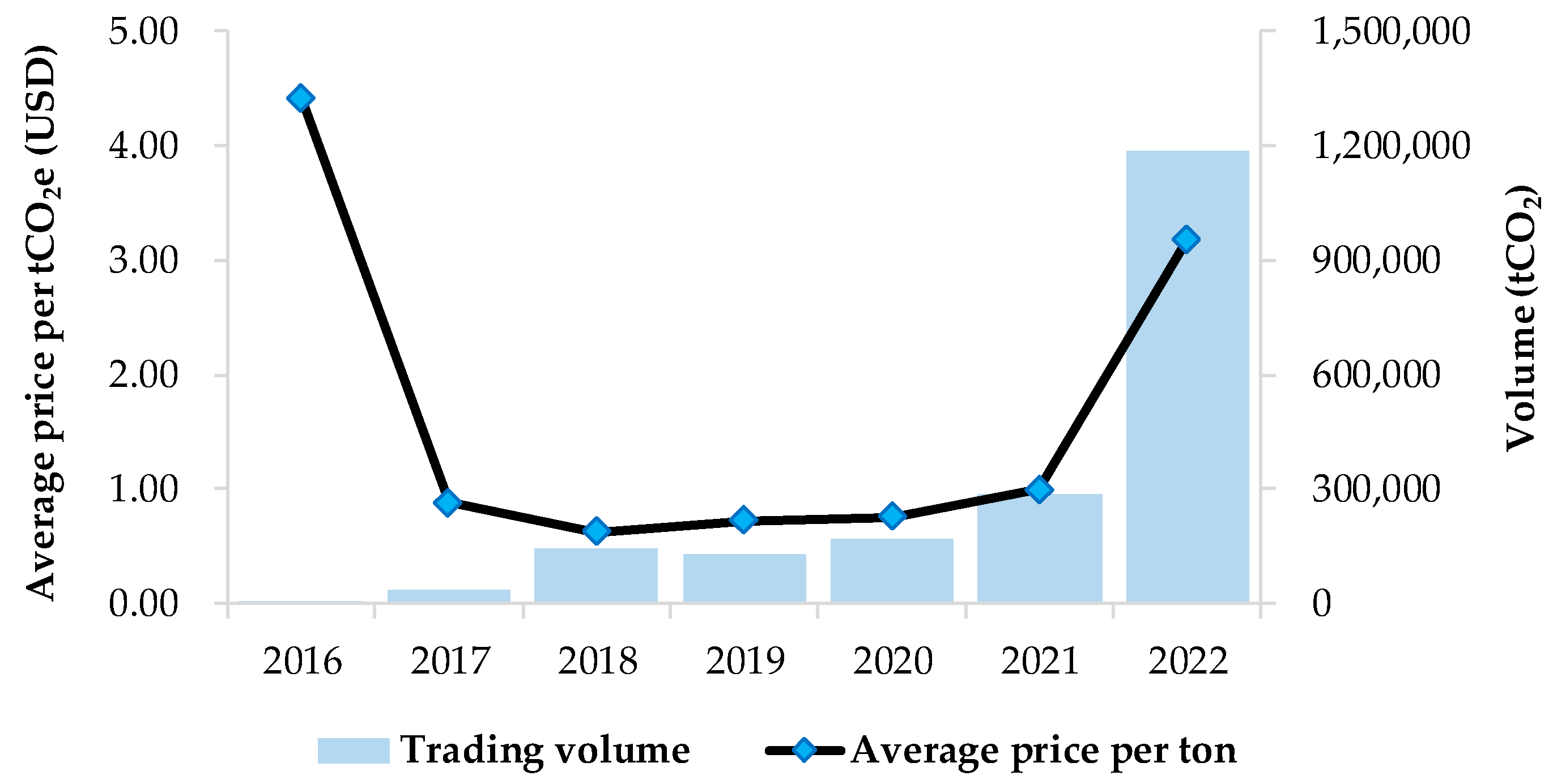

3.2.2. Carbon Credit Scenario (CC: S3)

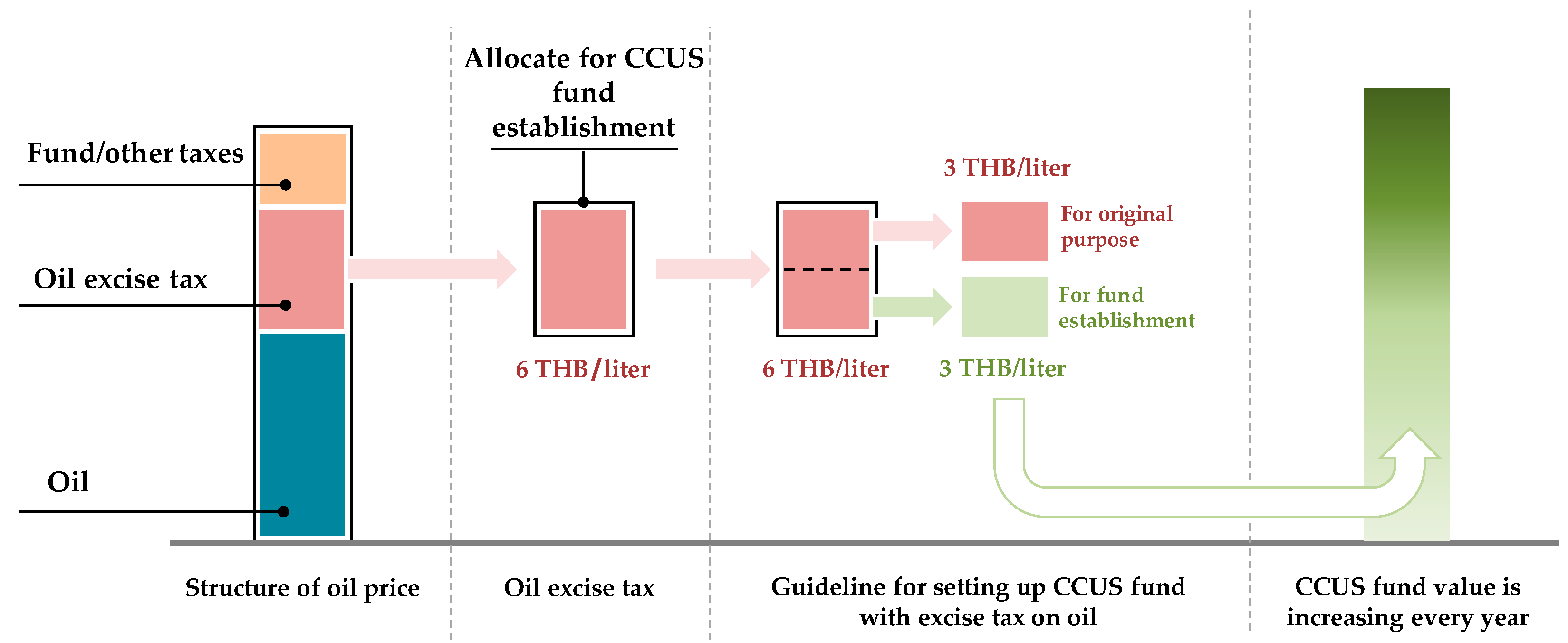

3.2.3. Grant Support (GR: S4)

3.3. Potential of a Public Investment Model: Transportation, Storage and MMV

- In scenarios where the government undertakes management and investment across the entirety of the transport, storage, and MMV sectors, while stipulating a 3% average ROI to be achieved within a 10-year timeframe, a charge amounting to 242 THB/tCO2 becomes imperative.

- The government sector assumes responsibility for oversight and investment spanning all facets of transportation, storage, and MMV, with an objective of attaining an average ROI of 3% over a 15-year duration, a collection of 211 THB/tCO2 becomes a requisite.

- The ambit of transportation and storage fees encapsulates the expenses associated with the complete spectrum of operational and subsequent entities that follow the capture phase.

4. Results and Discussion

- S4.1: In the event that the government does not implement any assistance measures, it is imperative for the government to allocate a portion of the oil excise tax revenue, approximately 20%, as part of the revenue-sharing mechanism.

- S4.2: If the government has implemented only one assistance measure, namely a Tax Incentive (S2), the public sector should allocate a minimum of 10% of the oil excise tax revenue for the share deduction under the GR scenario.

- S4.3: In the scenario where the government has implemented only two additional assistance measures, namely a Tax Incentive (S2) and Carbon Credit at $5/tCO2 (S3.1), the government will decrease the share deduction from the oil excise tax revenue to approximately 9% under the GR scenario.

- S4.4: In the scenario where the government has implemented only two additional measures, specifically, the Tax Incentive (S2) and Carbon Credit at $10/tCO2 (S3.2), the government sector will decrease the share deduction from oil excise tax revenue to approximately 7% under the GR scenario.

- S4.5: In the event that the government has implemented only two additional assistance measures, specifically the Tax Incentive (S2) and Carbon Credit at $20/tCO2 (S3.3), the government will decrease the share deduction from the oil excise tax revenue to approximately 4% under the GR scenario.

5. Conclusions

- The estimated potential capture volume is approximately 9.79 MtCO2/y, as determined through the evaluation of the capture potential across all six refineries.

- The study identified a viable CO2 source within the refining sector and a compatible CO2 sink located in the northern Gulf of Thailand.

- The government is required to establish a new legal entity tasked with managing and developing investment infrastructure. This entity will generate government revenue by collecting service fees associated with pipeline usage, CO2 storage, and long-term monitoring of CO2 emissions through MMV processes.

- In the case where the government takes on the responsibility of managing and investing in transportation, storage and MMV processes, and aims for an average ROI of 3% over a 15-year period, the tariff rate would be set at 211 THB/tCO2.

- Providing crucial support through the allocation of initial funding in the form of grants, would thereby make the adoption of CCS technology within the refinery industry a viable prospect. In instances where specific incentive policies have not been established, the government should consider earmarking a minimum of 20% of the revenue generated from oil excise taxes to facilitate the initial implementation of CCS.

- In the future, the development of effective CCS policies should encompass measures such as tax incentives and the sale of carbon credits at prices higher than the current rates. This strategic approach would lead to a reduction of 4–10% in the government’s expenditure for funds derived from oil excise taxes, particularly when carbon credits are valued at more than $20/tCO2.

- Nevertheless, it is imperative for the government sector to actively address this challenge by establishing a dedicated fund, funded through oil excise taxes. This fund serves the critical purpose of creating incentives for entrepreneurs to invest in CCS initiatives, thereby generating revenue essential for fully supporting the development and implementation of the CCS system.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wongsapai, W.; Ritkrerkkrai, C.; Pongthanaisawan, J. Integrated model for energy and CO2 emissions analysis from Thailand’s long-term low carbon energy efficiency and renewable energy plan. Energy Procedia 2016, 100, 492–495. [Google Scholar] [CrossRef]

- Fischedick, M.; Roy, J. Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Intergov. Panel Clim. Change 2014, 1454, 147. [Google Scholar]

- Lennan, M.; Morgera, E. The Glasgow Climate Conference (COP26). Int. J. Mar. Coast. Law 2022, 37, 137–151. [Google Scholar] [CrossRef]

- Climate Action Tracker (CAT). Thailand—Main Climate Target (2030 Conditional NDC Target). 2022. Available online: https://climateactiontracker.org/countries/thailand/targets/ (accessed on 15 August 2023).

- Natural Resources and Environmental Policy and Planning, ONEP. Thailand’s Long-Term Low Emission Development Strategy (Revised). 2022. Available online: https://unfccc.int/sites/default/files/resource/ThailandLT-LEDS%28RevisedVersion%29_08Nov2022.pdf (accessed on 15 August 2023).

- The UNFCCC Secretariat (UN Climate Change). Thailand. Biennial Update Report (BUR4). 2022. Available online: https://unfccc.int/documents/624750 (accessed on 15 August 2023).

- Quang, D.V.; Milani, D.; Zahra, M.A. A review of potential routes to zero and negative emission technologies via the integration of renewable energies with CO2 capture processes. Int. J. Greenh. Gas Control. 2023, 124, 103862. [Google Scholar] [CrossRef]

- Gerbelová, H.; Versteeg, P.; Ioakimidis, C.S.; Ferrão, P. The effect of retrofitting Portuguese fossil fuel power plants with CCS. Appl. Energy 2013, 101, 280–287. [Google Scholar] [CrossRef]

- Tramme, E. Carbon Removal with CCS Technologies; Global CCS Institute: Melbourne, Australia, 2021. [Google Scholar]

- Global CCS Institute. Fact Sheet: Capturing CO2. Available online: https://www.globalccsinstitute.com/wp-content/uploads/2018/12/Global-CCS-Institute-Fact-Sheet_Capturing-CO2.pdf (accessed on 15 August 2023).

- The London School of Economics and Political Science (LSE). What is Carbon Capture, Usage and Storage (CCUS) and What Role Can It Play in Tackling Climate Change? 2023. Available online: https://www.lse.ac.uk/granthaminstitute/explainers/what-is-carbon-capture-and-storage-and-what-role-can-it-play-in-tackling-climate-change/ (accessed on 15 August 2023).

- Ahlstrom, J.M.; Walter, V.; Goransson, L.; Papadokonstantakis, S. The role of biomass gasification in the future flexible power system—BECCS or CCU? Renew. Energy 2022, 190, 596–605. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Energy Technology Perspectives 2020: Special Report on Carbon Capture Utilisation and Storage CCUS in Clean Energy Transitions; IEA: Paris, France, 2020. [Google Scholar]

- Thepsaskul, W.; Wongsapai, W.; Jaitieng, T.; Daroon, S.; Raksakulkarn, V.; Muangjai, P.; Ritkrerkkrai, C. Gap Analysis and Key Enabling Factors for Carbon Capture Utilization and Storage development in Thailand Oil and Gas Industry to Achieve Carbon Neutrality Target. Chem. Eng. Trans. 2023, 106. in proof. [Google Scholar]

- Tianyang, L.; Guan, D.; Shan, Y.; Zheng, B.; Liang, X.; Meng, J.; Qiang, Z.; Tao, S. Adaptive CO2 emissions mitigation strategies of global oil refineries in all age groups. One Earth 2021, 4, 1114–1126. [Google Scholar]

- Abella, J.P.; Bergerson, J.A. Model to investigate energy and greenhouse gas emissions implications of refining petroleum: Impacts of crude quality and refinery configuration. Environ. Sci. Technol. 2012, 46, 13037–13047. [Google Scholar] [CrossRef]

- Jing, L.; El-Houjeiri, H.M.; Monfort, J.C.; Brandt, A.R.; Masnadi, M.S.; Gordon, D.; Bergerson, J.A. Carbon intensity of global crude oil refining and mitigation potential. Nat. Clim. Change 2020, 10, 526–532. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). World Energy Outlook; IEA: Paris, France, 2018. [Google Scholar]

- Leeson, D.; Mac Dowell, N.; Shah, N.; Petit, C.; Fennell, P.S. A Techno-economic analysis and systematic review of carbon capture and storage (CCS) applied to the iron and steel, cement, oil refining and pulp and paper industries, as well as other high purity sources. Int. J. Greenh. Gas Control. 2017, 61, 71–84. [Google Scholar] [CrossRef]

- Shijun, M.; Lei, T.; Meng, J.; Liang, X.; Guan, D. Global oil refining’s contribution to greenhouse gas emissions from 2000 to 2021. Innovation 2023, 4, 100361. [Google Scholar]

- Energy Policy and Planning Office (EPPO). Historical Statistics of Crude Oil, Natural Gas, and Oil Refining 1986–2022. Available online: https://www.eppo.go.th/index.php/th/energy-information/static-energy/static-petroleum (accessed on 15 August 2023).

- Martin-Roberts, E.; Scott, V.; Flude, S.; Johnson, G.; Haszeldine, R.S.; Gilfillan, S. Carbon capture and storage at the end of a lost decade. One Earth 2021, 4, 1569–1584. [Google Scholar] [CrossRef]

- Hong, W.Y. A techno-economic review on carbon capture, utilisation and storage systems for achieving a net-zero CO2 emissions future. Carbon Capture Sci. Technol. 2022, 3, 100044. [Google Scholar] [CrossRef]

- Wang, X.; Song, C. Carbon capture from flue gas and the atmosphere: A perspective. Front. Energy Res. 2020, 8, 560849. [Google Scholar] [CrossRef]

- Leung, D.Y.C.; Caramanna, G.; Maroto-Valer, M.M. A overview of current status of carbon dioxide capture and storage technologies. Renew. Sustain. Energy Rev. 2014, 39, 426–443. [Google Scholar] [CrossRef]

- Lee, Y.; Kim, J.; Kim, H.; Park, T.; Jin, H.; Kim, H.; Park, S.; Lee, K.S. Operation of a Pilot-Scale CO2 Capture Process with a New Energy-Efficient Polyamine Solvent. Appl. Sci. 2020, 10, 7669. [Google Scholar] [CrossRef]

- Madugula, A.C.S.; Sachde, D.; Hovorka, S.D.; Meckel, T.A. Estimation of CO₂ emissions from petroleum refineries based on the total operable capacity for carbon capture applications. Chem. Eng. J. Adv. 2021, 8, 100162. [Google Scholar] [CrossRef]

- Oil and Gas Climate Initiative (OGCI). CO2 Storage Resource Catalogue Cycle 3 Report. 2022. Available online: https://www.ogci.com/wp-content/uploads/2023/04/CSRC_Cycle_3_Main_Report_Final.pdf (accessed on 30 August 2023).

- Global CCS Institute (GCCSI). Global Status of CCS. 2022. Available online: https://www.globalccsinstitute.com/resources/global-status-report/download/ (accessed on 30 August 2023).

- Asian Development Bank (ADB). Prospects for Carbon Capture and Storage in Southeast Asia. 2013. Available online: https://www.adb.org/sites/default/files/publication/31122/carbon-capture-storage-southeast-asia.pdf (accessed on 30 August 2023).

- Choomkong, A.; Sirikunpitak, S.; Darnsawasdi, R.; Yordkayhun, S. A study of CO2 emissions sources and sinks in Thailand. Energy Procedia 2017, 138, 452–457. [Google Scholar] [CrossRef]

- PTT Exploration and Production Public Company Limited. Available online: https://www.thailand-energy-academy.org/assets/upload/coursedocument/file/E205%20EP%20The%20National%20Energy%20Security%20and%20the%20Ways%20Forward.pdf (accessed on 30 August 2023).

- Kheirinik, M.; Ahmed, S.; Rahmanian, N. Comparative techno-economic analysis of carbon capture processes: Pre-combustion, post-combustion, and oxy-fuel combustion operations. Sustainability 2021, 13, 13567. [Google Scholar] [CrossRef]

- Energy Transitions Commission (ETC). Carbon Capture, Utilisation & Storage in the Energy Transition: Vital but Limited. Available online: https://www.energy-transitions.org/wp-content/uploads/2022/08/ETC-CCUS-Report-V1.9.pdf (accessed on 30 August 2023).

- Budinis, S.; Krevor, S.; Dowell, N.M.; Brandon, N.; Hawkes, A. An assessment of CCS costs, barriers, and potential. Energy Strategy Rev. 2018, 22, 61–81. [Google Scholar] [CrossRef]

- Zero Emissions Platform (ZEP). The Costs of CO2 Capture, Transport and Storage: Post-Demonstration CCS in EU. 2011. Available online: https://zeroemissionsplatform.eu/document/the-costs-of-co2-capture-transport-and-storage/ (accessed on 30 August 2023).

- Smith, E.; Morris, J.; Kheshgi, H.; Teletzke, G.; Herzog, H. The cost of CO2 transport and storage in global integrated assessment modeling. Int. J. Greenh. Gas Control. 2021, 109, 103367. [Google Scholar] [CrossRef]

- Thailand Greenhouse Gas Management Organization (TGO). Carbon Credit Price, Volume and Turnover of Carbon Credits from the T-VER Project. 2023. Available online: http://carbonmarket.tgo.or.th/#vmenu_1 (accessed on 30 August 2023).

| Oil Refinery Plant | Crude Oil Refining Volume in 2022 | GHG Emission * | CO2 Capture Efficiency by Amine | Capture Potential with Capture Technology by Amine Technic | |

|---|---|---|---|---|---|

| Barrel/Day | Barrel/Year | tCO2/Year | % | MtCO2/Year | |

| Refinery1 (R1) | 287,414 | 94,846,620 | 2,815,048 | 98 | 2.76 |

| Refinery2 (R2) | 175,298 | 57,848,340 | 1,716,939 | 98 | 1.68 |

| Refinery3 (R3) | 152,723 | 50,398,590 | 1,495,830 | 98 | 1.47 |

| Refinery4 (R4) | 152,372 | 50,282,760 | 1,492,392 | 98 | 1.46 |

| Refinery5 (R5) | 132,772 | 43,814,760 | 1,300,422 | 98 | 1.27 |

| Refinery6 (R6) | 119,848 | 39,549,840 | 1,173,839 | 98 | 1.15 |

| Total (R1 to R6) | 1,020,427 | 336,740,910 | 9,994,470 | 9.79 | |

| CO2 Capture of Refining Sector | Low | High | Mean | |

|---|---|---|---|---|

| CO2 Capture Range of refining | ($/tCO2) | 55 | 165 | 110 |

| Post (amine-based) combustion | 63 | 87 | 75 | |

| Pre-combustion | 47 | 113 | 80 | |

| Oxyfuel-combustion | 48 | 99 | 73.5 | |

| Transportation Distance (km) | 100 | 180 | 200 | 300 | 500 |

|---|---|---|---|---|---|

| For 1 to2.5 MtCO2/y ($/tCO2) | |||||

| Onshore pipeline | 3.27 | 5.89 | 6.54 * | 9.81 | Not applicable |

| Offshore pipeline | 5.63 | 10.14 | 10.89 * | 14.67 | 22.24 |

| Ship | 4.97 | 8.94 | 9.03 | 9.47 | 10.36 |

| Liquefaction (for ship transport) | 5.78 | 5.78 | 5.78 | 5.78 | 5.78 |

| Ship (include liquefaction) | 10.74 | 14.72 | 14.80 | 15.25 | 16.13 |

| For 10 MtCO2/y ($/tCO2) | |||||

| Onshore pipeline | 2.26 | 4.07 | 4.50 | 6.69 | Not applicable |

| Offshore pipeline | 4.10 | 7.38 | 7.89 | 10.43 | 15.51 |

| Ship (include liquefaction) | 9.02 | 13.59 | 13.68 | 14.09 | 14.92 |

| Storage and MMV (Mt/y) | 1 | 2 | 2.5 | 3.2 | 6 | 10 | 15 | |

|---|---|---|---|---|---|---|---|---|

| Storage | ($/tCO2) | 16.47 | 12.62 | 10.70 | 8.00 | 6.73 | 6.51 | 6.24 |

| MMV | 11.67 | 9.61 | 8.58 | 7.14 | 5.95 | 5.64 | 5.25 | |

| Details | Refineries | Total | Unit | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| R1 | R2 1 | R3 1 | R4 | R5 | R6 | |||||

| No. | A. Base case: no CCS implementation | |||||||||

| (1) | Profit (including income tax) | Ref. 2 | 42,024 | 16,884 | 52,778 | 9594 | 11,829 | 28,004 | 161,114 | million THB |

| (2) | Income tax | Ref. 2 | 8918 | 2351 | 7228 | 2377 | 2,320 | 12,852 | 36,046 | |

| (3) | Proportion of income tax payment | (2)/(1) | 21.22 | 13.93 | 13.70 | 24.77 | 19.61 | 45.89 | % | |

| B. CCS implementation through tax incentive scenario | ||||||||||

| (4) | GHG reduction potential | Est. 3 | 2.76 | 1.68 | 1.47 | 1.46 | 1.27 | 1.15 | 9.79 | MtCO2/y |

| (5) | Share of GHG reduction potential | % of (4) | 28.19 | 17.16 | 15.02 | 14.91 | 12.97 | 11.75 | 100 | % |

| (6) | Initial investment | (5) × 18,307 | 5161 | 3142 | 2749 | 2730 | 2375 | 2151 | 18,307 | million THB |

| (7) | Total of tax deduction ratio (2 times) | (6) × 2 | 10,322 | 6283 | 5498 | 5460 | 4750 | 4301 | 36,615 | |

| (8) | Before tax deduction | (1)–(7) | 31,702 | 10,601 | 47,281 | 4134 | 7079 | 23,703 | 124,500 | |

| (9) | Tax payment (in case of CCS implementation) | (8) × (3) | 6727 | 1476 | 6475 | 1024 | 1388 | 10,878 | 27,969 | |

| (10) | Tax margin | (2)–(9) | 2190 | 875 | 753 | 1353 | 932 | 1974 | 8076 | |

| (11) | Net virtual cost | (6)–(10) | 2971 | 2267 | 1996 | 1378 | 1443 | 177 | 10,231 | |

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Capex | 8168 | ||||||||||

| O and M 10% | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | |

| MMV cost 5% | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | |

| WACC through 10 years | 82 | 82 | 82 | 82 | 82 | 82 | 82 | 82 | 82 | 82 | |

| ROI 3% | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | |

| Cumulative expense | 8168 | 9720 | 11,272 | 12,824 | 14,376 | 15,928 | 17,480 | 19,031 | 20,583 | 22,135 | 23,687 |

| T and S fee: 10 Years | 242 THB/tCO2 | ||||||||||

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Capex | 8168 | |||||||||||||||

| O and M 10% | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | 817 | |

| MMV cost 5% | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | 408 | |

| WACC through 15 years | 54 | 54 | 54 | 54 | 54 | 54 | 54 | 54 | 54 | 54 | 54 | 54 | 54 | 54 | 54 | |

| ROI 3% | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | 245 | |

| Cumulative expense | 8168 | 9693 | 11,217 | 12,742 | 14,267 | 15,791 | 17,316 | 18,841 | 20,366 | 21,890 | 23,415 | 24,940 | 26,464 | 27,989 | 29,514 | 31,038 |

| T and S fee: 15 Years | 211 THB/tCO2 | |||||||||||||||

| Share of Excise Tax on Oil (% Deduction) | 4% | 7% | 9% | 12% | 20% | Unit | |

|---|---|---|---|---|---|---|---|

| Subsidy per liter | Gasoline | 0.23 | 0.41 | 0.53 | 0.70 | 1.17 | THB/liter |

| Diesel | 0.05 | 0.09 | 0.12 | 0.16 | 0.27 | ||

| Subsidy per liter (gasoline + diesel) | 0.29 | 0.50 | 0.65 | 0.86 | 1.44 | ||

| Subsidy per year | Gasoline | 2648 | 4633 | 5957 | 7943 | 13,239 | Million THB/year |

| Diesel | 1467 | 2568 | 3301 | 4402 | 7337 | ||

| Subsidy per year (gasoline + diesel) | 4115 | 7201 | 9259 | 12,345 | 20,575 | ||

| CO2 Capture | Initial Investment | TI (Tax Incentive) | CC (Carbon Credit) | Remaining Investment | GR: Deduction from Oil Excise Tax Revenue |

|---|---|---|---|---|---|

| Capture Cost $55/tCO2 | (Million THB) | (%) | |||

| S1: Base case (no measure) | 18,307 | Not applicable | 18,307 | S4.1: 20 | |

| S2: Tax Incentive | 18,307 | 8076 | Not applicable | 10,231 | S4.2: 10 |

| S3.1 Carbon Credit $5/tCO2 | 18,307 | 8076 | 1664 | 8567 | S4.3: 9 |

| S3.2 Carbon Credit $10/tCO2 | 18,307 | 8076 | 3329 | 6902 | S4.4: 7 |

| S3.3 Carbon Credit $20/tCO2 | 18,307 | 8076 | 6657 | 3574 | S4.5: 4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thepsaskul, W.; Wongsapai, W.; Sirisrisakulchai, J.; Jaitiang, T.; Daroon, S.; Raksakulkan, V.; Muangjai, P.; Ritkrerkkrai, C.; Suttakul, P.; Wattakawigran, G. Potential Business Models of Carbon Capture and Storage (CCS) for the Oil Refining Industry in Thailand. Energies 2023, 16, 6955. https://doi.org/10.3390/en16196955

Thepsaskul W, Wongsapai W, Sirisrisakulchai J, Jaitiang T, Daroon S, Raksakulkan V, Muangjai P, Ritkrerkkrai C, Suttakul P, Wattakawigran G. Potential Business Models of Carbon Capture and Storage (CCS) for the Oil Refining Industry in Thailand. Energies. 2023; 16(19):6955. https://doi.org/10.3390/en16196955

Chicago/Turabian StyleThepsaskul, Waranya, Wongkot Wongsapai, Jirakom Sirisrisakulchai, Tassawan Jaitiang, Sopit Daroon, Varoon Raksakulkan, Phitsinee Muangjai, Chaichan Ritkrerkkrai, Pana Suttakul, and Gengwit Wattakawigran. 2023. "Potential Business Models of Carbon Capture and Storage (CCS) for the Oil Refining Industry in Thailand" Energies 16, no. 19: 6955. https://doi.org/10.3390/en16196955

APA StyleThepsaskul, W., Wongsapai, W., Sirisrisakulchai, J., Jaitiang, T., Daroon, S., Raksakulkan, V., Muangjai, P., Ritkrerkkrai, C., Suttakul, P., & Wattakawigran, G. (2023). Potential Business Models of Carbon Capture and Storage (CCS) for the Oil Refining Industry in Thailand. Energies, 16(19), 6955. https://doi.org/10.3390/en16196955