Identifying Economic and Clean Strategies to Provide Electricity in Remote Rural Areas: Main-Grid Extension vs. Distributed Electricity Generation

Abstract

:1. Introduction

2. Materials and Methods

2.1. Methods Overview

2.2. Case Study

2.2.1. Assumptions and Data

2.2.2. Main-Grid-Extension (MGE) Costs

2.2.3. Off-Grid Distributed Generation (DG)

Off-Grid Conventional Power Generator Operational Parameters

Off-Grid PV System Assumptions

Off-Grid Wind Energy Assumptions

Off-Grid Energy Storage

Costs and Other System Assumptions

2.3. Grid Interconnection Evaluation

2.4. Optimal Off-Grid Distributed Generation Mix

| Sets and indexes | |

| Set of fossil-fuel-fired power generation units. Indexed by u ∈ {1, 2,.., U} | |

| Set of variable renewable energy types (i.e., intermittent) power generators. Indexed by i ∈ {1 = PV, 2 = wind} | |

| Set of isolated power networks/areas. Indexed by n ∈{1, 2, 3} | |

| Set of hours in the planning horizon. Indexed by t ∈{1, 2,.., 8760 × 20} | |

| Set of years in the planning horizon. Indexed by y ∈{1, 2,.., 20} | |

| Constants | |

| T | Number of intervals in the time horizon; equals 20 |

| H | Number of hours in one year; equals 8760 |

| M | Large positive constant number (e.g., 106) |

| Decision Variables | |

| Buildu,y,n | Equals 1 if power generation unit u is built in year y at area n and equals 0 otherwise |

| Equals 1 if unit u is committed to operating in time t at area n | |

| Gu,t,n | Power generation [MW] from unit u in time t at area n |

| Gi,t,n | Power generation [MW] from units type i in time t at area n |

| SRu,t,n | Spinning reserve [MW] provided by unit u in interval t at area n |

| Spinning reserve [MW] provided by battery energy storage in interval t at area n | |

| NSRu,t,n | Non-spinning reserve [MW] provided by unit u in interval t at area n |

| Surplus of generation over demand [MW] in interval t at area n | |

| Shortage of generation below demand [MW] in interval t at area n | |

| Shortage of spinning reserve below requirement [MW] in interval t at area n | |

| Shortage of non-spinning reserve below requirement [MW] in interval t at area n | |

| Size in MW of renewable energy (i = 1 for solar PV and i = 2 for wind turbine) in year y at area n | |

| Size of energy storage (MW) in year y at area n | |

| ESt,n | Quantity of energy storage (MWh) in time t at area n |

| Quantity of energy discharged from energy storage (MWh) in time t at area n | |

| Energy storage discharge status. Equals 1 if the battery is discharging energy during time t at area n and equals 0 if it is not discharging | |

| Quantity of energy charged to energy storage (MWh) in time t at area n | |

| Energy storage charge status. Equals 1 if the battery is charging energy during time t at area n and equals 0 if it is not charging | |

| Quantity of spinning reserves [MW] required in interval t at area n | |

| Parameters | |

| Cost of starting up unit u [$] in interval t at area n | |

| Dt | System power demand in interval t [MW] |

| Dt,n | System power demand [MW] in interval t at area n |

| Quantity of non-spinning reserves [MW] required in interval t at area n | |

| Penalty cost of the system’s over/under generation [$/MWh] | |

| Penalty cost of system’s spinning reserve shortage [$/MWh] | |

| Penalty cost of system’s non-spinning reserve shortage [$/MWh] | |

| Marginal cost [$/MWh] of operating unit u in interval t at area n | |

| Cost of spinning reserves [$/MWh] provided by unit u in interval t at area n | |

| Capital costs or CapEx ($) incurred to build generation unit u in time t at isolated area n. | |

| FCF | Fixed Charge Factor, a.k.a Fixed Charge Rate. Multiplying CapEx by FCF yields the annualized capital costs |

| fixed operation and maintenance cost [$/MW] of operating unit u in interval t at area n | |

| Start-up cost [$] of unit u in interval t at area n | |

| Capital costs or CapEx ($/MW) incurred to install energy storage in time t at isolated area n. | |

| Fixed operation and maintenance cost [$/MW] of operating energy storage in interval t at area n | |

| Social cost of carbon dioxide emissions ($/tonne) in time t | |

| Social cost of nitrous oxide emissions ($/tonne) in time t | |

| Social cost of methane emissions ($/tonne) in time t | |

| Maximum generation [MW] of unit u at area n | |

| Minimum generation [MW] of unit u at area n | |

| Forecasted generation [MW] of intermittent source i in interval t at area n | |

| Maximum ramp-up rate of generator u [MW/Hour] at area n | |

| Maximum ramp-down rate of generator u [MW/Hour] at area n | |

| Minimum uptime of unit u [number of intervals] at area n | |

| Minimum downtime of unit u [number of intervals] at area n | |

| Initial minimum uptime of unit u [number of intervals] at area n | |

| Initial minimum downtime of unit u [number of intervals] at area n | |

| CFu.n | Annual capacity factor of unit u at area n |

| Annual efficiency degradation rate (%) | |

| Energy storage charging efficiency (%) | |

| Energy storage discharging efficiency (%) | |

| Maximum energy storage charging/discharging rate (%) | |

| Minimum energy storage capacity (%) | |

| CO2u | Carbon dioxide emissions rate (tonne/MWh) from unit u |

| N2Ou | Nitrous oxide emissions rate (tonne/MWh) from unit u |

| CH4u | Methane emissions rate (tonne/MWh) from unit u |

- The total annual electricity generation from fossil-fuel-fired units and variable renewable energy, plus the energy discharged from the battery, must equal demand plus energy charging the battery. Any shortage or surplus is quantified and penalized in the objective function:

- The spinning reserves provided by generators or batteries must be above the minimum requirement. If not, the shortage in spinning reserves is calculated and penalized in the objective function:

- The spinning reserve requirements are equal to or exceed the maximum between 3% of electricity demand plus 5% of the renewable energy systems’ electricity and the capacity of the largest synchronized (i.e., scheduled to produce) generator:

- The non-spinning reserves provided by generators must equal or exceed a minimum requirement (which is equal to 12% of the area’s electricity demand) [19]:

- The power generation from conventional generators must be between their minimum and maximum limits:

- The total electricity supplied from each fossil-fuel-fired unit each year is limited by the product of its generation capacity and capacity factor:

- Start-up costs are incurred when a power-generating unit passes from being offline to being online:

- The power generators must operate within the limits of their capability to ramp up and ramp down their production:

- The power generation from variable renewable energy sources is bounded by their installed capacity:

- The power generation from solar PV and wind farms cannot be more than their installed power generation capacity adjusted by annual degradation:

- The fossil-fuel-fired power generators operate within their minimum up-time and minimum downtime limits:

- The energy stored in the battery is equal to the energy stored in the prior period plus the energy charged from the grid minus the energy discharged to the grid:

- The charge and discharge rates of the battery do not exceed its maximum physical limit. The energy discharged is also constrained by the provision of spinning reserves:

- The level of energy stored in the batteries must be between the maximum and minimum design limits at all times:

- The binary variable indicating if a battery is charging should equal 1 when energy goes into the battery. The binary variable indicating that the battery is in discharging mode should equal 1 when the battery is discharging energy into the grid or providing spinning reserves, or both:

- At all times, the battery should be in either charging or discharging mode:

- All decision variables are non-negative:

2.5. Scenarios to Explore Results’ Sensitivity to Assumptions

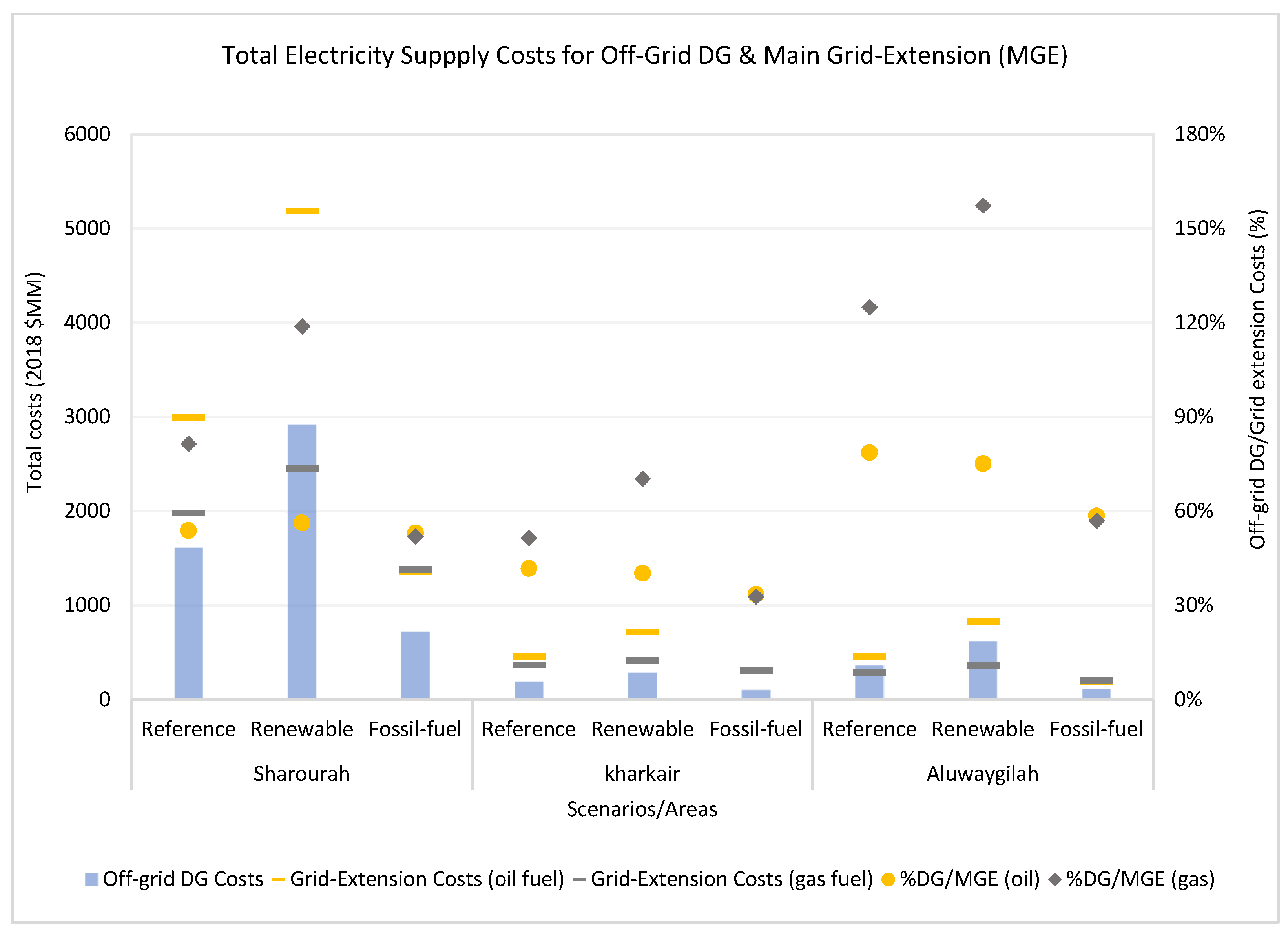

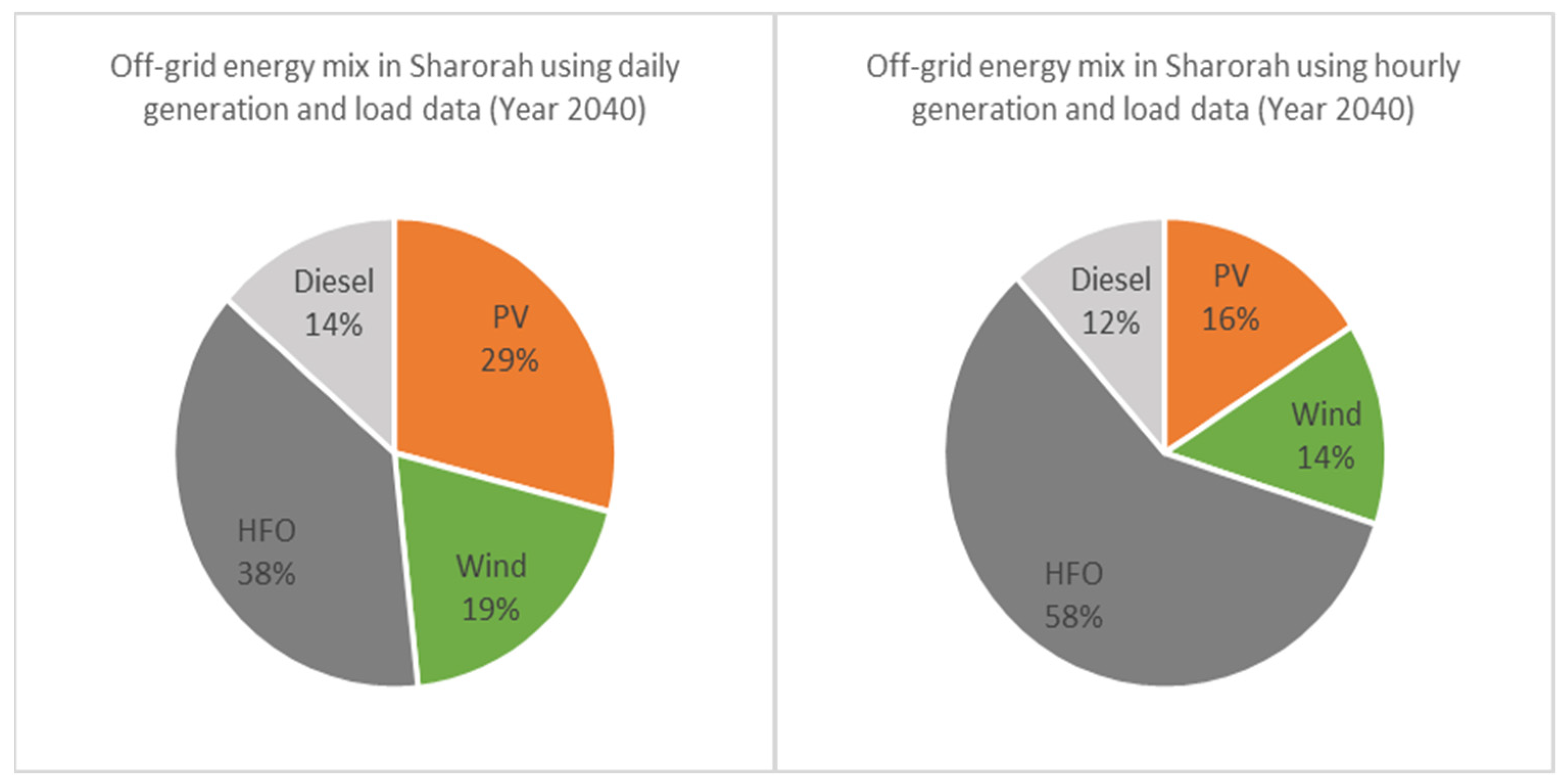

3. Results and Discussion

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- United Nations. Report: Universal Access to Sustainable Energy Will Remain Elusive Without Addressing Inequalities. 2021. Available online: https://www.un.org/sustainabledevelopment/blog/2021/06/report-universal-access-to-sustainable-energy-will-remain-elusive-without-addressing-inequalities/ (accessed on 16 November 2022).

- Thushara, D.S.M.; Hornberger, G.M.; Baroud, H. Decision analysis to support the choice of a future power generation pathway for Sri Lanka. Appl. Energy 2019, 240, 680–697. [Google Scholar] [CrossRef]

- Trottera, P.A.; Cooper, N.J.; Wilson, P.R. A multi-criteria, long-term energy planning optimisation model with integrated on-grid and off-grid electrification—The case of Uganda. Appl. Energy 2019, 243, 288–312. [Google Scholar] [CrossRef]

- Moretti, L.; Astolfi, M.; Vergara, C.; Macchi, E.; Pérez-Arriaga, J.I.; Manzolini, G. A design and dispatch optimization algorithm based on mixed integer linear programming for rural electrification. Appl. Energy 2019, 233–234, 1104–1121. [Google Scholar] [CrossRef]

- Nock, D.; Levin, T.; Baker, E. Changing the policy paradigm: A benefit maximization approach to electricity planning in developing countries. Appl. Energy 2020, 264, 114583. [Google Scholar] [CrossRef]

- Molyneaux, L.; Wagner, L.; Foster, J. Rural electrification in India: Galilee Basin coal versus decentralized renewable energy micro grids. Renew. Energy 2016, 89, 422–436. [Google Scholar] [CrossRef] [Green Version]

- Thiam, D.-R. Renewable decentralized in developing countries: Appraisal from microgrids project in Senegal. Renew. Energy 2010, 35, 1615–1623. [Google Scholar] [CrossRef]

- Luta, D.N.; Raji, A.K. Decision-making between a grid extension and a rural renewable off-grid system with hydrogen generation. Int. J. Hydrogen Energy 2018, 43, 9535–9548. [Google Scholar] [CrossRef]

- Golbarg Rohani, M.N. Techno-economical analysis of stand-alone hybrid renewable power system for Ras Musherib in United Arab Emirates. Energy 2014, 64, 828–841. [Google Scholar] [CrossRef]

- Zeyringer, M.; Pachauri, S.; Schmid, E.; Schmidt, J.; Worrell, E.; Morawetz, U.B. Analyzing grid extension and stand-alone photovoltaic systems for the cost-effective electrification of Kenya. Energy Sustain. Dev. 2015, 25, 75–86. [Google Scholar] [CrossRef]

- Szabó, S.; Bódis, K.; Huld, T.; Moner-Girona, M. Sustainable energy planning: Leapfrogging the energy poverty gap in Africa. Renew. Sustain. Energy Rev. 2013, 28, 500–509. [Google Scholar] [CrossRef]

- Deichmann, U.; Meisner, C.; Murray, S.; Wheeler, D. The economics of renewable energy expansion in rural Sub-Saharan Africa. Energy Policy 2011, 39, 215–227. [Google Scholar] [CrossRef] [Green Version]

- SEC At Glance. SEC Official Webpage. Available online: https://www.se.com.sa/en-us/invshareholder/Pages/BackgroundOnBusinessSegment.aspx (accessed on 2 November 2022).

- Saudi Electricity Company. 2019 Annual Report. 2020. Available online: https://www.se.com.sa/en-us/Pages/AnnualReports.aspx (accessed on 5 November 2022).

- Water & Electricity Regulatory Authority (WERA). Annual Statistical Booklet for Electricity and Seawater Desalination Industries. 2019. Available online: https://wera.gov.sa/Statistics/ (accessed on 20 November 2022).

- Government of Saudi Arabia. Saudi Arabia’s Vision 2030. 2016. Available online: http://vision2030.gov.sa/en/media-center (accessed on 20 October 2022).

- ACWA Power. Rabigh 2 IPP: Project News. Available online: https://www.acwapower.com/en/projects/rabigh-2-ipp/ (accessed on 25 October 2022).

- The National Renewable Energy Program. 2018. Available online: https://www.powersaudiarabia.com.sa/web/index.htm (accessed on 5 November 2022).

- Government of Saudi Arabia. National Transformation Program. 2016. Available online: http://vision2030.gov.sa/sites/default/files/NTP_En.pdf (accessed on 25 October 2022).

- Pletka, R.; Khangura, J.; Rawlins, A.; Waldren, E.; Wilson, D. Capital Costs for Transmission and Substations; 2019 Update, Report prepared by Black & Veatch Corporation for Western Electric Coordinating Council (WECC); Black & Veatch Corporation: Overland Park, KS, USA, 2019; p. 56. [Google Scholar]

- US Energy Information Administration. Cost and Performance Characteristics of New Generating Technologies. In Annual Energy Outlook 2019; US Energy Information Administration (EIA): Washington, DC, USA, 2019; p. 3. [Google Scholar]

- Wärtsilä. Energy Exemplar, Power System Optimization by Increased Flexibility; Wärtsilä Corporation: Helsinki, Finland, 2014. [Google Scholar]

- Rajagopalan, M.; Gandotra, S. Fuel-flexible, efficient generation using internal combustion engines (ICEs) to meet growing demand in Myanmar. In Powergen ASIA 2015; Wärtsilä India Pvt. Ltd.: Mumbai, India, 2015. [Google Scholar]

- Energy and Environmental Economics, Inc. Capital Cost Review of Generation Technologies; Energy and Environmental Economics, Inc.: San Francisco, CA, USA, 2014; Available online: https://www.wecc.biz/Reliability/2014_TEPPC_Generation_CapCost_Report_E3.pdf (accessed on 10 November 2022).

- EPA. Emission Factors for Greenhouse Gas Inventories. 2015. Available online: https://www.epa.gov/sites/production/files/2015-11/documents/emission-factors_nov_2015.pdf (accessed on 2 November 2022).

- Feldman, D.; Vignesh, R.; Fu, R.; Ramdas, A.; Desai, J.; Margolis, R. U.S. Solar Photovoltaic System Cost Benchmark: Q1 2020; NREL/TP-6A20-77324; National Renewable Energy Laboratory: Golden, CO, USA, 2021. Available online: https://www.nrel.gov/docs/fy21osti/77324.pdf (accessed on 2 November 2022).

- Jordan, D.C.; Kurtz, S.R. Photovoltaic Degradation Rates-an Analytical Review. Prog. Photovolt. 2013, 21, 12–29. [Google Scholar] [CrossRef] [Green Version]

- Holbert, K.E. Solar Calculations. 2007. Available online: http://holbert.faculty.asu.edu/eee463/SolarCalcs.pdf (accessed on 2 November 2022).

- Alqahtani, B.J.; Holt, K.M.; Patiño-Echeverri, D.; Pratson, L. Residential Solar PV Systems in the Carolinas: Opportunities and Outcomes. Environ. Sci. Technol. 2016, 50, 2082–2091. [Google Scholar] [CrossRef] [PubMed]

- NASA. Surface Meteorology and Solar Energy. 2018. Available online: https://eosweb.larc.nasa.gov/cgi-bin/sse/[email protected] (accessed on 2 November 2022).

- Johnson, G.L. Wind Energy Systems; Kansas State University: Manhattan, KS, USA, 2006; p. 449. [Google Scholar]

- Renewable Resource Atlas. 2020. Available online: https://rratlas.kacare.gov.sa/RRMMDataPortal/en/MapTool (accessed on 11 October 2022).

- General Electric. 2.75–120 Wind Turbine. 2017. Available online: https://www.gerenewableenergy.com/wind-energy/turbines/275-120 (accessed on 2 November 2022).

- GE Energy: GE 2.75–120 Data. 2017. Available online: https://en.wind-turbine-models.com/turbines/983-ge-general-electric-ge-2.75-120#datasheet (accessed on 2 November 2022).

- Lazard. Lazard’s Levelized Cost of Storage Analysis—Version 5.0; Lazard: Hamilton, Bermuda, 2019; p. 47. [Google Scholar]

- Smith, K.; Saxon, A.; Keyser, M.; Lundstrom, B.; Cao, Z.; Roc, A. Life Prediction Model for Grid-Connected Li-ion Battery Energy Storage System; National Renewable Energy Laboratory: Golden, CO, USA, 2017.

- Lazard. Lazard’s Levelized Cost of Energy Analysis—Version 11.0; Lazard: Hamilton, Bermuda, 2017; p. 22.

- U.S. Energy Information Administration (EIA). Capital Cost and Performance Characteristic Estimates for Utility Scale Electric Power Generating Technologies; US Energy Information Administration (EIA): Washington, DC, USA, 2020; p. 212. [Google Scholar]

- Moss, S.; Godden, P. Aurecon: Cost and Technical Parameters Review 2020. Consultation Report for Australian Energy Market Operator (AEMO). Revision 3. December 2020. Available online: https://www.aemo.com.au/ (accessed on 2 November 2022).

- U.S. DOE. Combined Heat and Power Technology Fact Sheet Series Overview of CHP Technologies. November 2017; pp. 1–4. Available online: https://www.energy.gov/eere/amo/combined-heat-and-power-basics (accessed on 2 November 2022).

- Organization of the Petroleum Exporting Countries. 2016 OPEC World Oil Outlook; Organization of the Petroleum Exporting Countries: Vienna, Austria, October 2016. [Google Scholar]

- EIA. Annual Energy Outlook 2020: Natural Gas Supply, Disposition, and Prices; US Energy Information Administration (EIA): Washington, DC, USA, 2020.

- Natural Gas and the Vision 2030. Jadwa Investment. 2016. Available online: http://www.jadwa.com/en/search/index?q=natural+gas&__buffer=true (accessed on 2 November 2022).

- Annual Energy Outlook 2020: Petroleum and Other Liquids Prices. 2020. Available online: https://www.eia.gov/outlooks/aeo/data/browser/#/?id=12-AEO2020&cases=ref2020&sourcekey=0 (accessed on 2 November 2022).

- Technical Support Document: Social Cost of Carbon, Methane, and Nitrous Oxide; Interim Estimates under Executive Order 13990; Interagency Working Group on Social Cost of Greenhouse Gases, United States Government: Washington, DC, USA, 2021.

- Akar, S.; Beiter, P.; Cole, W.; Feldman, D.; Kurup, P.; Lantz, E.; Margolis, R.; Oladosu, D.; Stehly, T.; Rhodes, G.; et al. 2020 Annual Technology Baseline (ATB) Cost and Performance Data for Electricity Generation Technologies; National Renewable Energy Laboratory: Golden, CO, USA, 2022. Available online: https://data.nrel.gov/submissions/145 (accessed on 5 November 2022).

- Schmidt, O.; Hawkes, A.; Gambhir, A.; Staffell, I. The future cost of electrical energy storage based on experience rates. Nat. Energy 2017, 2, 1–8. [Google Scholar] [CrossRef] [Green Version]

- U.S. Bureau of Labor Statistics. Inflation & Prices: Consumer Price Index; U.S. Bureau of Labor Statistics: Washington, DC, USA, 2021. Available online: https://www.bls.gov/data/#prices (accessed on 2 November 2022).

- Ela, E.; Milligan, M.; Kirby, B. Technical Report, NREL/TP-5500-51978; National Renewable Energy Laboratory: Golden, CO, USA, 2011. Available online: http://www.nrel.gov/docs/fy11osti/51978.pdf (accessed on 2 November 2022).

- Bhattacharyya, S.C. Review of alternative methodologies for analysing off-grid electricity supply. Renew. Sustain. Energy Rev. 2012, 16, 677–694. [Google Scholar] [CrossRef]

- Mandelli, S.; Barbieri, J.; Mereu, R.; Colombo, E. Off-grid systems for rural electrification in developing countries: Definitions, classification and a comprehensive literature review. Renew. Sustain. Energy Rev. 2016, 58, 1621–1646. [Google Scholar] [CrossRef]

- Mahapatra, S.; Dasappa, S. Rural electrification: Optimizing the choice between decentralized renewable energy sources and grid extension. Energy Sustain. Dev. 2012, 16, 146–154. [Google Scholar] [CrossRef]

- Oparaku, O.U. Rural area power supply in Nigeria: A cost comparison of the photovoltaic, diesel/gasoline generator and grid utility options. Renew. Energy 2003, 28, 2089–2098. [Google Scholar] [CrossRef]

- Mousavi, S.A.; Zarchi, R.A.; Astaraei, F.R.; Ghasempour, R.; Khaninezhad, F.M. Decision-making between renewable energy configurations and grid extension to simultaneously supply electrical power and fresh water in remote villages for five different climate zones. J. Clean. Prod. 2021, 279, 123617. [Google Scholar] [CrossRef]

- Nfah, E.M.; Ngundam, J.M. Feasibility of mico-hydro and photovoltaic hybrid power systems for remote villages in Cameroon. Renew. Energy 2009, 34, 1445–1550. [Google Scholar] [CrossRef]

- Dalton, G.J.; Lockington, D.A.; Baldock, T.E. Feasibility Analysis Of Stand-Alone Renewable Energy Supply Options For A Large Hotel. Renew. Energy 2008, 33, 1475–1490. [Google Scholar] [CrossRef]

- Bhuiyan, M.M.; Asgar, M.A.; Mazumder, R.K.; Hussain, M. Economic evaluation of a stand-alone residential photovoltaic power system in Bangladesh. Renew Energy 2000, 21, 403–410. [Google Scholar] [CrossRef]

- Bouffard, F.; Kirschen, D.S. Centralised and distributed electricity systems. Energy Policy 2008, 36, 4504–4508. [Google Scholar] [CrossRef]

| Isolated Load | Region | Existing System (as of 2020) | Distance from the Grid (Km) | Electricity Demand Annual Growth Rate (2021–2040) | ||

|---|---|---|---|---|---|---|

| Capacity (MW) | Peak Load (MW) | Gen. (MWh) | ||||

| Kharkhir | Southern | 17 | 14 | 49,996 | 503 | 1.3% |

| Uwayqilah | N Eastern | 28.8 | 25.1 | 124,344 | 145 | 1.6% |

| Sharorah | Southern | 226 | 127 | 624,335 | 340 | 2.0% |

| Location | Sharorah | Kharkhir | Uwayqilah | |

|---|---|---|---|---|

| Parameter | ||||

| T/L length (km) | 340 | 503 | 145 | |

| T/L voltage rating (kV) | 380 | 132 | 132 | |

| T/L cap cost ($k/km) * | 450 | 190 | 190 | |

| Annual T/L O&M cost (% of Capex) * | 5 | 5 | 5 | |

| Substation/Transformer cost ($k) * | 3990 | 2760 | 2760 | |

| Shunt reactor ($k/MVar) * | 21 | 21 | 21 | |

| T/L power losses (%) ** | 8 | 8 | 8 | |

| Capital costs of centrally dispatched CCPPs to meet new load ($k/MW) *** | 788 | 788 | 788 | |

| Annual non-fuel O&M costs of grid-connected CCPPs ($k/MW) *** | 10.3 | 10.3 | 10.3 | |

| Energy efficiency of CCPPs (%) *** | 52 | 52 | 52 | |

| Location | Sharorah | Kharkhir | Uwayqilah | |

|---|---|---|---|---|

| Parameter | ||||

| GHI [kWh/m2/year] | 2371 | 2339 | 2097 | |

| Temperature [T°] | 25.8 | 28.2 | 22.62 | |

| Relative Humidity [%] | 25.11 | 25.7 | 29.31 | |

| Ground Wind speed (m/s) | 3.2 | 3.5 | 3.8 | |

| Annual Avg. air density (kg/m3) | 1.0768 | 1.1123 | 1.1351 | |

| Annual Avg. wind speed at 92 m height (m/s) | 6.053 | 6.284 | 6.372 | |

| Annual Avg. pressure (kPa) | 92.573 | 96.298 | 96.302 | |

| Annual Avg. temperature (K) | 299.78 | 301.93 | 296.02 | |

| Average Cp | 0.3568 | 0.3586 | 0.3572 | |

| Scenario | Reference | Renewables Favorable | Fossil-Fuels Favorable | |

|---|---|---|---|---|

| Parameter | ||||

| Oil prices [$/Bbl] | ref case 2016 OPEC | High price case 2016 OPEC | Low price case 2016 OPEC | |

| Cost of Carbon Emissions [$/tonne] | SCC assuming a 3% discount rate [45] | SCC assuming a 2.5% discount rate [45] | SCC assuming a 5% discount rate [45] | |

| Solar PV capital costs [$/kW] | NREL ATB middle scenario | NREL ATB low scenario | NREL ATB high scenario | |

| Wind turbine capital cost ($/kW) | NREL ATB mid scenario | NREL ATB low scenario | NREL ATB high scenario | |

| Li-ion battery capital cost ($/kW) | Average scenario in [47] | Low scenario in [47] | High scenario in [47] | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alqahtani, B.J.; Patino-Echeverri, D. Identifying Economic and Clean Strategies to Provide Electricity in Remote Rural Areas: Main-Grid Extension vs. Distributed Electricity Generation. Energies 2023, 16, 958. https://doi.org/10.3390/en16020958

Alqahtani BJ, Patino-Echeverri D. Identifying Economic and Clean Strategies to Provide Electricity in Remote Rural Areas: Main-Grid Extension vs. Distributed Electricity Generation. Energies. 2023; 16(2):958. https://doi.org/10.3390/en16020958

Chicago/Turabian StyleAlqahtani, Bandar Jubran, and Dalia Patino-Echeverri. 2023. "Identifying Economic and Clean Strategies to Provide Electricity in Remote Rural Areas: Main-Grid Extension vs. Distributed Electricity Generation" Energies 16, no. 2: 958. https://doi.org/10.3390/en16020958