Capacity Mechanisms in Europe and the US: A Comparative Analysis and a Real-Life Application for Greece

Abstract

:1. Introduction

2. Literature Review

- (a)

- A comparative analysis of various capacity mechanisms that are either in force or under approval in key countries/regions in Europe and the US is provided. Although many works have been presented in the literature so far focusing on the principles and the challenges associated with the operation of capacity mechanisms, mostly in the USA or in particular European countries as described above, to the best of our knowledge there is no reported work that provides a detailed and in-depth analysis on the necessities that led to the establishment of capacity mechanisms, along with various fundamental technical and operational features associated with the design and operation of different capacity mechanisms, mainly in Europe and complementarily in the US.

- (b)

- A real-life example regarding the application of a long-term capacity remuneration mechanism that is going to be established in Greece in the near future is analytically presented. A detailed simulation of the envisaged capacity mechanism auction has been performed for the forthcoming decade (2022–2031). This is aimed at estimating the outcome of the auctions as well as the total annual cost that will have to be undertaken by the electricity supply companies and, ultimately, the end-consumers under differentiated scenarios regarding the future Greek power system operating conditions. To the best of our knowledge, there is no reported work in the literature so far that addresses the detailed setup and practical replication of a capacity mechanism that is formulated according to the Reliability Options scheme, not only for the Greek power system but also for any other power system. In addition, we could not find any similar study that provides detailed quantitative results regarding the auction clearing prices, as well as the annual total cost that has to be undertaken by the end-consumers for the financing of such a capacity mechanism under differentiated power system and market operating conditions.

3. Analysis of Capacity Mechanisms in Europe and the US

- Necessity of the capacity mechanism

- Capacity mechanism product

- Capacity mechanism design

- Eligibility for participation

- Auction frequency

- Contract duration

- Bid limits and awarded price

- Capacity requirement and demand curve

- Secondary market

- Penalties

- −

- Europe: Italy, France, Germany, Belgium, Poland, Great Britain, Ireland, Cyprus

- −

- United States: Pennsylvania, New Jersey, and Maryland (PJM) Interconnection, New England

3.1. Necessity of the Capacity Mechanism

3.2. Capacity Mechanism Product

3.3. Capacity Mechanism Design

3.4. Eligibility for Participation

3.5. Auction Frequency

3.6. Contract Duration

3.7. Bid Limits and Auction Clearing Price Mechanism

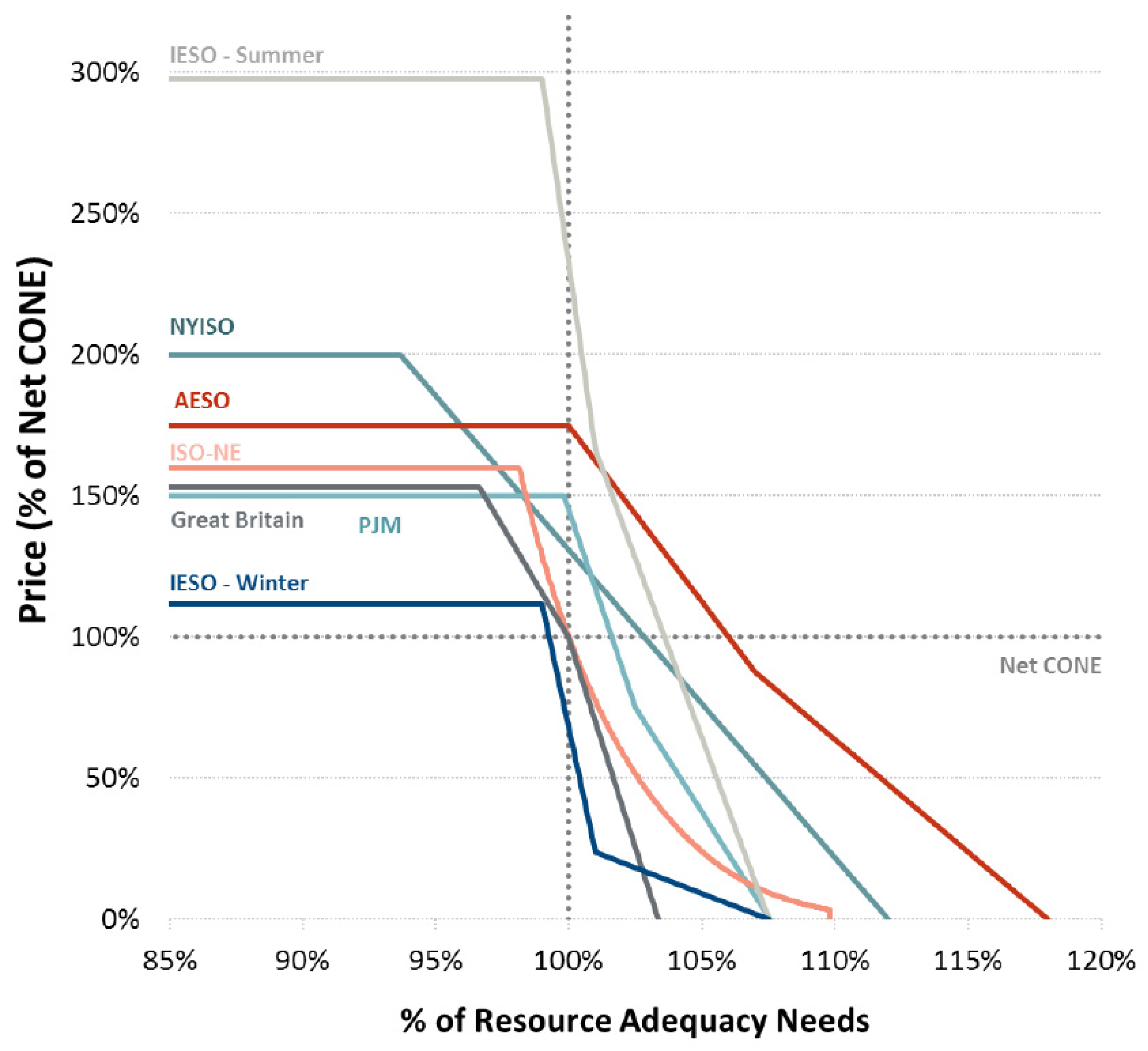

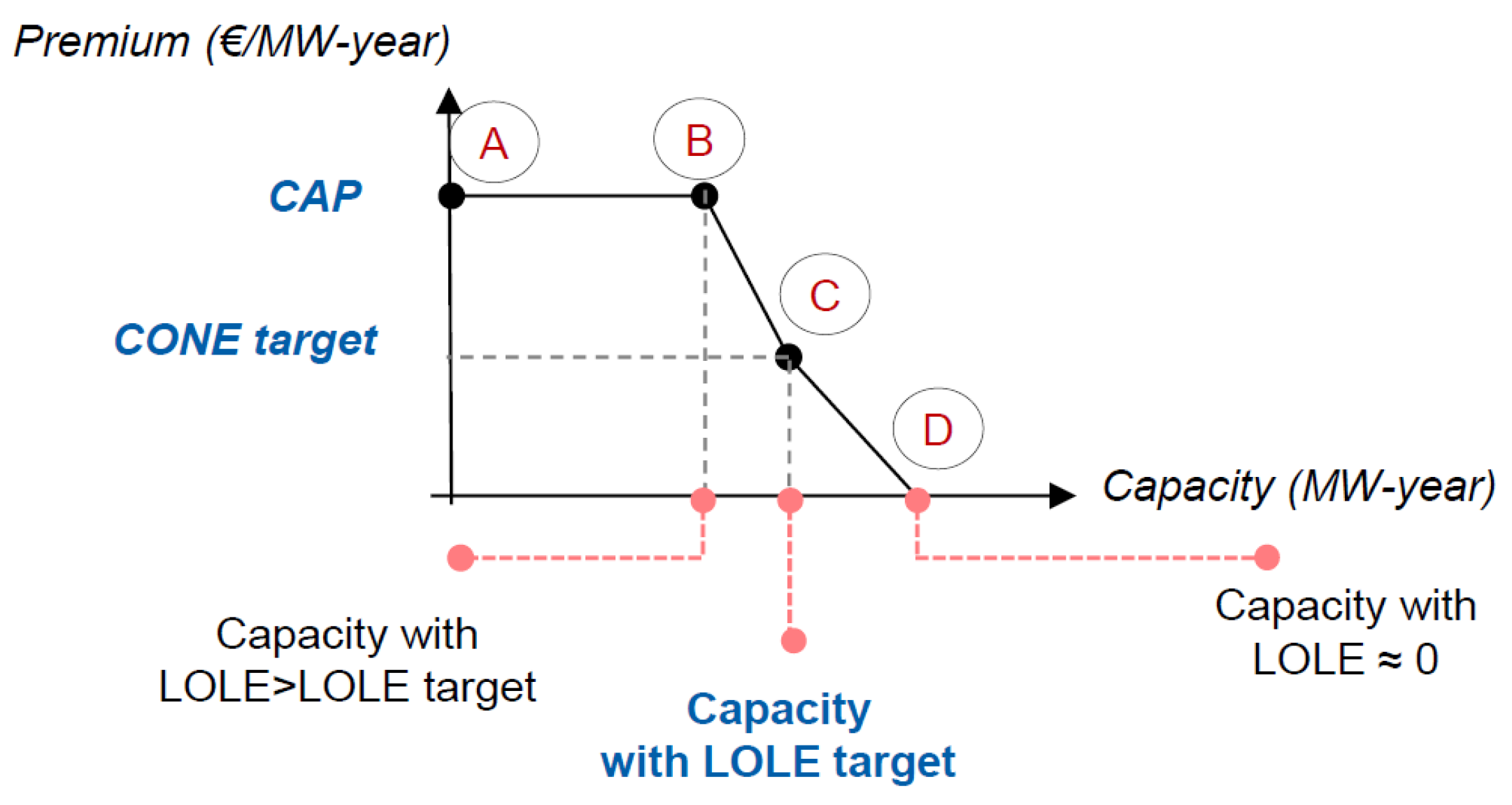

3.8. Capacity Requirement and Demand Curve

3.9. Secondary Market

3.10. Penalties

3.11. Comparative Presentation of Capacity Mechanisms

4. Long-Term Capacity Remuneration Mechanism in the Greek Electricity Market

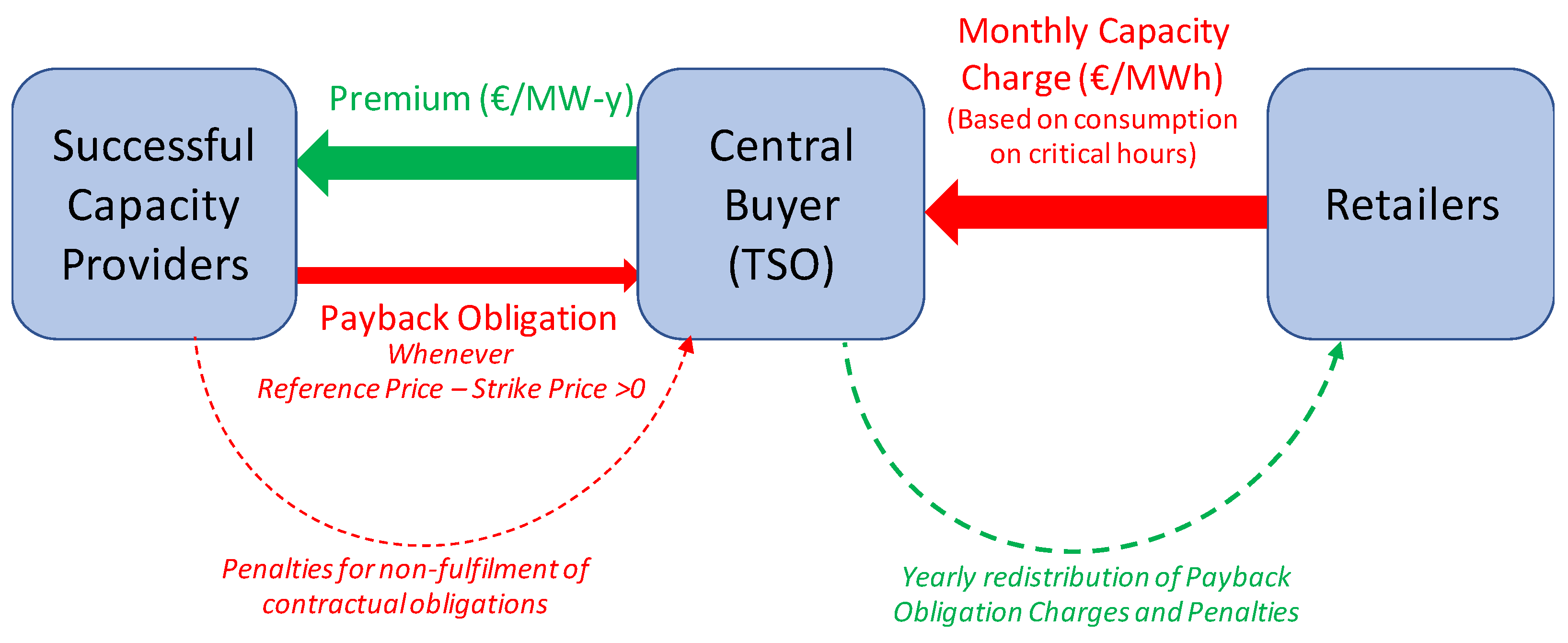

4.1. Overview of the Greek Capacity Remuneration Mechanism

- (i)

- comply with certain availability obligations during the delivery period

- (ii)

- pay any difference between the market Reference Price and the Strike Price whenever the Reference Price exceeds the Strike Price (‘Payback Obligation’) and

- (iii)

- incur penalties for non-availability.

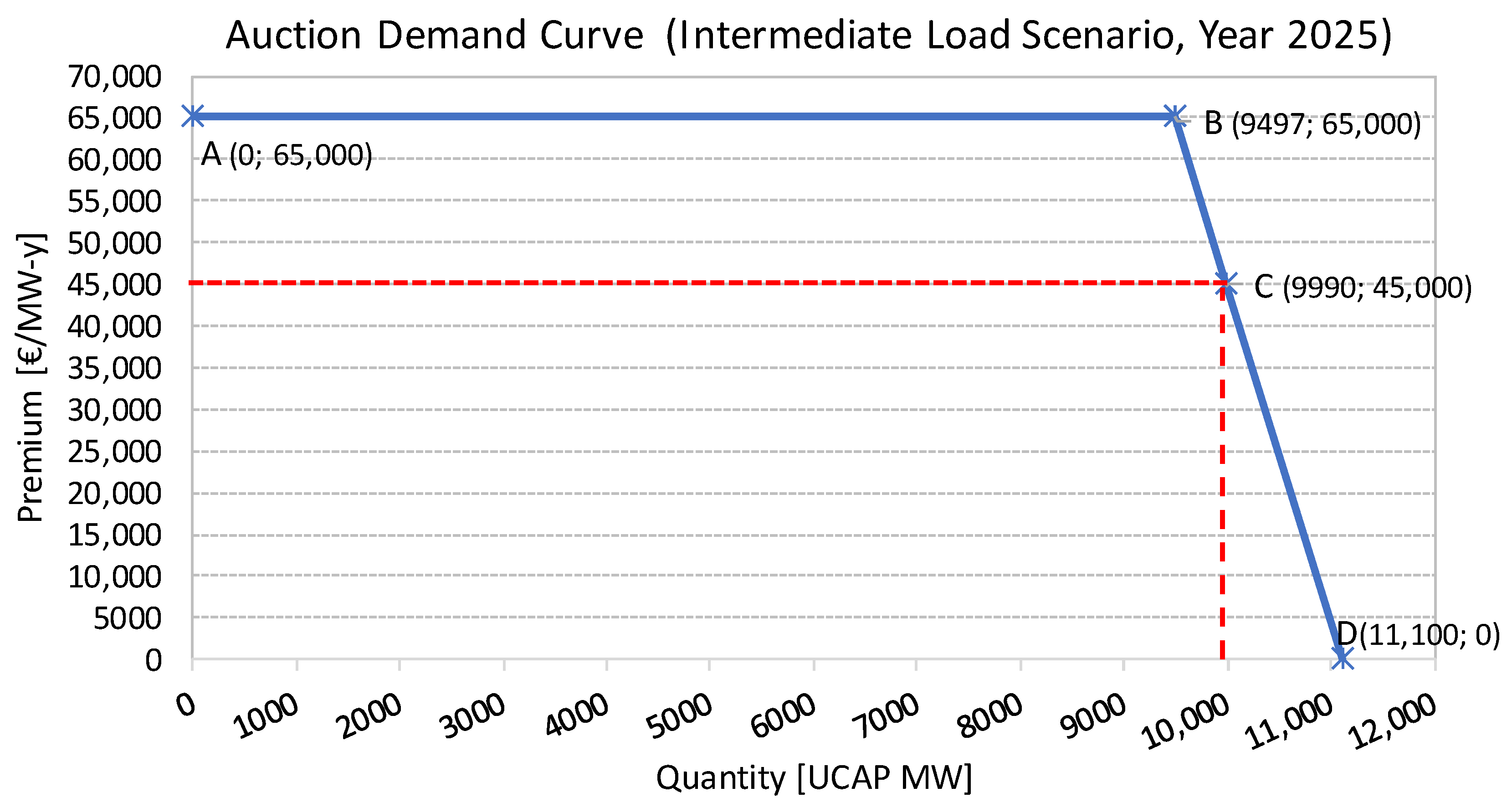

4.2. Simulation of the Capacity Remuneration Mechanism

4.2.1. Methodology and Tools

4.2.2. Assumptions and Input Data

- Thermal units: For each thermal unit, the de-rating factor was considered equal to the unit’s Demand Equivalent Forced Outage Rate (EFORd), as included in the most recent Long-Term Capacity Adequacy Study 2020–2030 conducted by ADMIE [46].

- Hydro units: The current large hydro units total Net Capacity (NCAP) is equal to 3171 MW and is expected to increase to 3331 MW in 2022 and 3360 MW in 2025. Considering the limited availability of hydro units to fully serve system capacity needs, given the strong dependence of hydro generation on the available water reserves, especially when consecutive hours of water discharging are required and following the provisions of the Italian mechanism where expected de-rating factors for hydro units range from 40% to 60%, for hydro capacity an average derating factor equal to 50% is assumed for the entire study period.

- Storage Units:

- −

- Pumped Storage Plants: Three new pumped storage plants have been considered to enter commercial operation in 2025, with an aggregated eligible NCAP equal to 773 MW.

- −

- Battery Energy Storage Systems (BESS): Two (2) BESS penetration scenarios have been considered, where the average annual projected installed capacity that is eligible to participate in the capacity auctions is shown in the Appendix A.

- RES units: RES plants installed capacity are separated in two groups, as follows:

- −

- The first group includes all RES plants that historically receive state aid (on the basis of feed-in-tariff or feed-in-premium schemes). It is assumed that this group comprises all existing RES plants, as well as all RES plants that will have been installed and enter commercial operation in the Greek interconnected power system until the end of 2024. These RES units are considered as subsidized RES capacity and, therefore, are ineligible to receive any remuneration from the capacity auction. However, the de-rated RES installed capacity of this group is implicitly considered to be offered at 0 €/MW-y in the auction.

- −

- The second group includes all future RES plants that will be installed in the Greek power system from January 2025 onwards. It is supposed that these units will not receive any state aid and therefore will participate directly to the wholesale electricity market (merchant RES plants). These RES plants are considered eligible to participate explicitly in the capacity auctions on the basis of their de-rated capacity.

- Interconnections: The participation of interconnections is differentiated on the basis of whether the interconnection connects Greece with an EU country or a non-EU (third) country, as follows:

- −

- Interconnections with non-EU countries (implicit participation): The foreign capacity located outside Greece and EU (i.e., Albania, North Macedonia and Turkey) is ineligible to receive any remuneration from the capacity auction. However, an equivalent de-rated interconnection capacity will be used to decrease the level for generation needed to achieve the reliability standard, hence affecting the demand curve of the auction. A thorough analysis of historical electricity flows data in these interconnections resulted in an equivalent de-rated interconnection capacity equal to ~300 MW, which is considered to be offered at 0 €/MW-y in the auction and receive no remuneration.

- −

- Interconnections with EU countries (explicit participation): Regarding the interconnections with EU member states (i.e., Italy and Bulgaria), cross-border participation is formulated on the basis of the “interconnector led” model, whereby interconnectors can explicitly participate in the capacity auctions (instead of foreign capacity providers), with the amount of their de-rated capacity (taking into consideration the technical availability and historical usage of the interconnection and commercial flows at times of stress) and are entitled to receive capacity payments for their awarded capacity (the respective revenues are considered to be split 50/50 between the TSOs). A thorough analysis of historical electricity flows data in these interconnections resulted in an equivalent de-rated interconnection capacity equal to ~200 MW, which is eligible to participate explicitly in the capacity auction.

- Demand Response: The aggregated demand response Unforced Capacity (UCAP) that will participate explicitly in the CRM from 2022 onwards was considered equal to 750 ΜW, so that it is close to the latest auctioned capacity of the interruptibility scheme that is currently in force (800 MW). This way, it is assumed that the interruptibility scheme will no longer be extended from 2022 onwards and, therefore, all eligible demand portfolios will have the right to participate in the envisaged CRM.

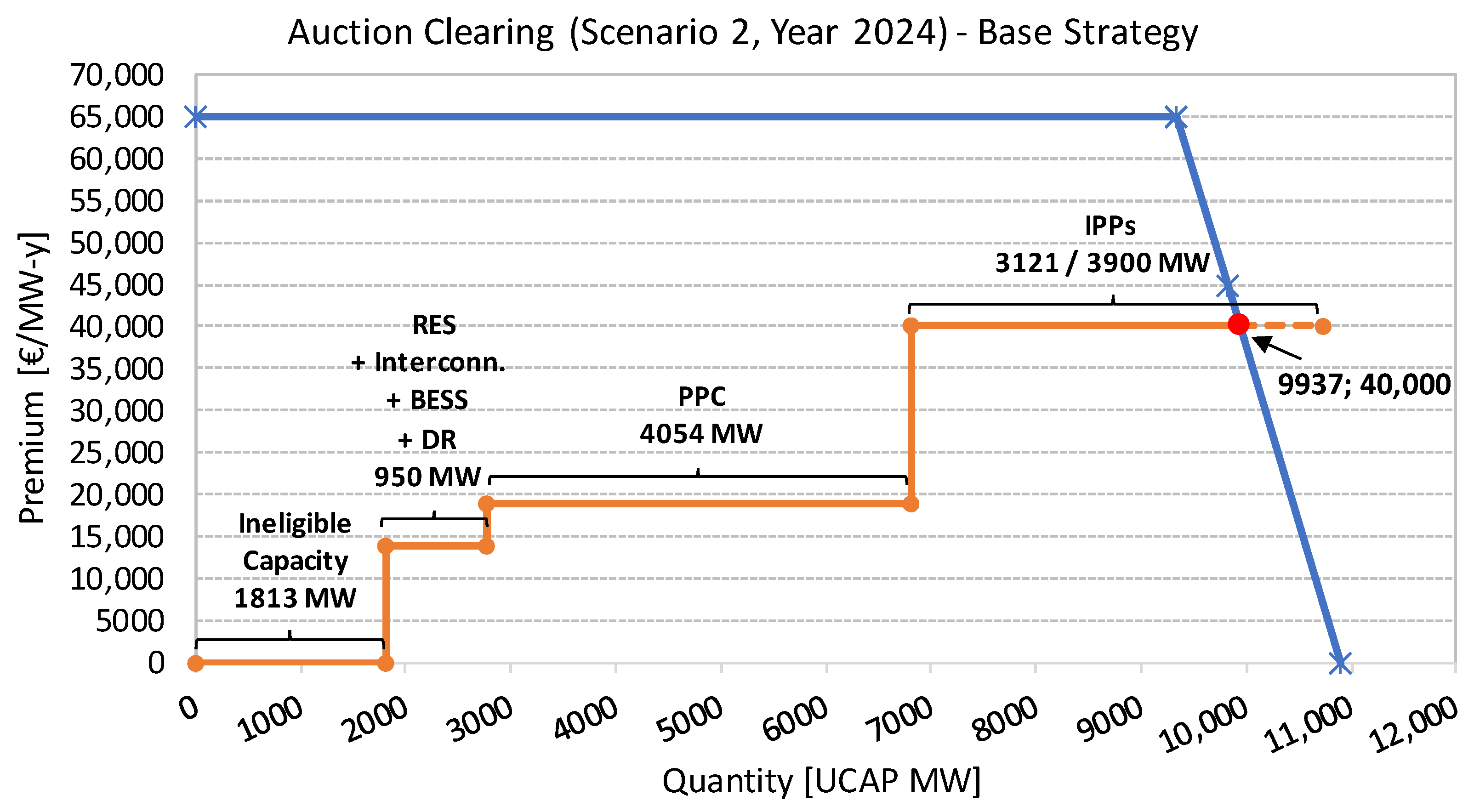

- Ineligible capacity resources, which include subsidized RES capacity and capacity on the interconnection lines between Greece and non-EU countries, are considered to offer their entire (de-rated) capacity at 0 €/ΜW-y, while they do not receive any remuneration. In other words, these capacities affect only the auction demand curve (the latter is shifted to the left) and, therefore, they limit the eligible winning capacity, thus having an indirect, yet notable, impact on the auction outcome.

- Eligible RES units and demand response portfolios are expected to act as price-takers and offer their entire de-rated eligible capacity at very low levels (close to 0 €/ΜW-y).

- Given that the auction follows the “pay-as-clear” principle, and considering that the ex-monopolist Public Power Corporation (PPC) is expected to be a net buyer in the capacity market (similar to the wholesale electricity market), a rational bidding strategy is to offer its entire eligible capacity at low premiums (significantly lower than the pure price cap for existing capacity), aiming at the minimization of the total cost of the auction mechanism.

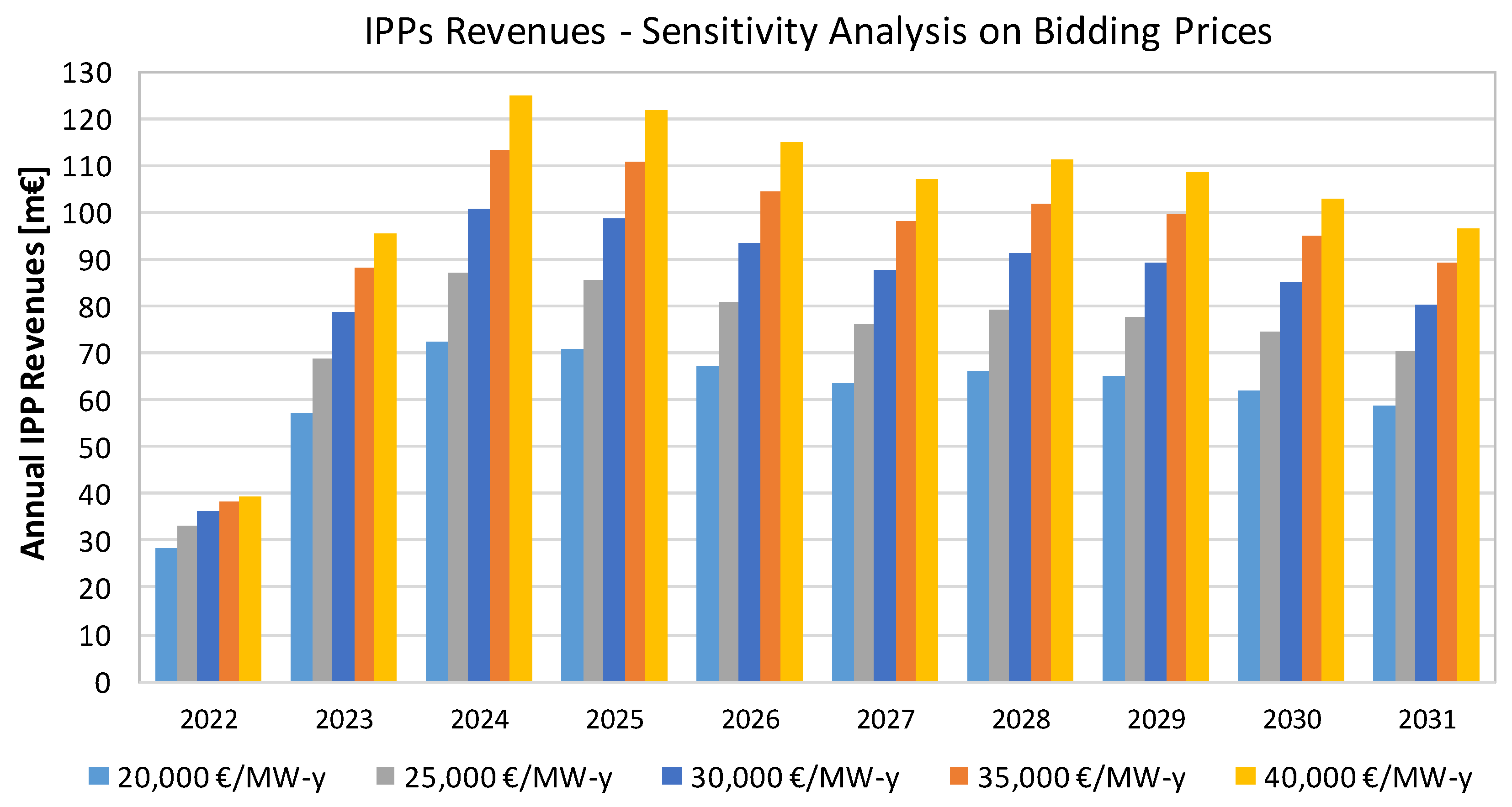

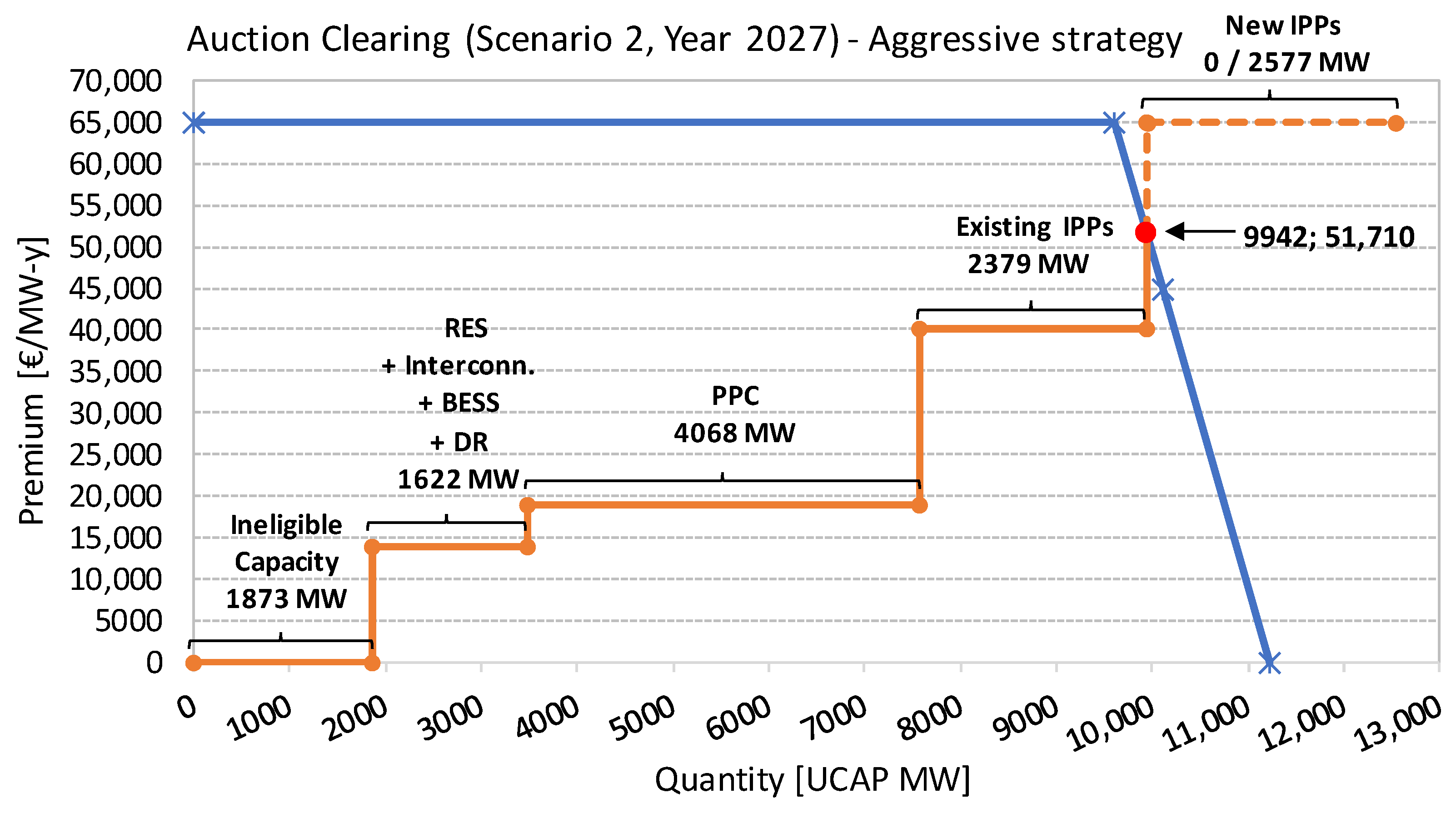

- Independent Power Producers (IPPs) that represent existing and new capacity (both gas-fired and pumped storage units) are expected to follow a more aggressive bidding strategy, since they are expected to be net sellers in the capacity market and, therefore, they will try to maximize their net profits (revenues minus charges) from the auction. Regarding existing IPP capacity, these units have been considered to bid their entire (de-rated) capacity at 40,000 €/MW-y. Regarding new IPP units, two different cases have been considered, as described below.

- Scenario 1: Low system peak load & High RES and BESS penetration

- Scenario 2: Intermediate system peak load & High RES and BESS penetration

- Scenario 3: High system peak load & Low RES and BESS penetration

- −

- Base Strategy: All IPP units (existing and new gas-fired combined cycle thermal units and pumped storage hydro units) offer their entire (de-rated) capacity at 40,000 €/MW-y (bid cap for existing units).

- −

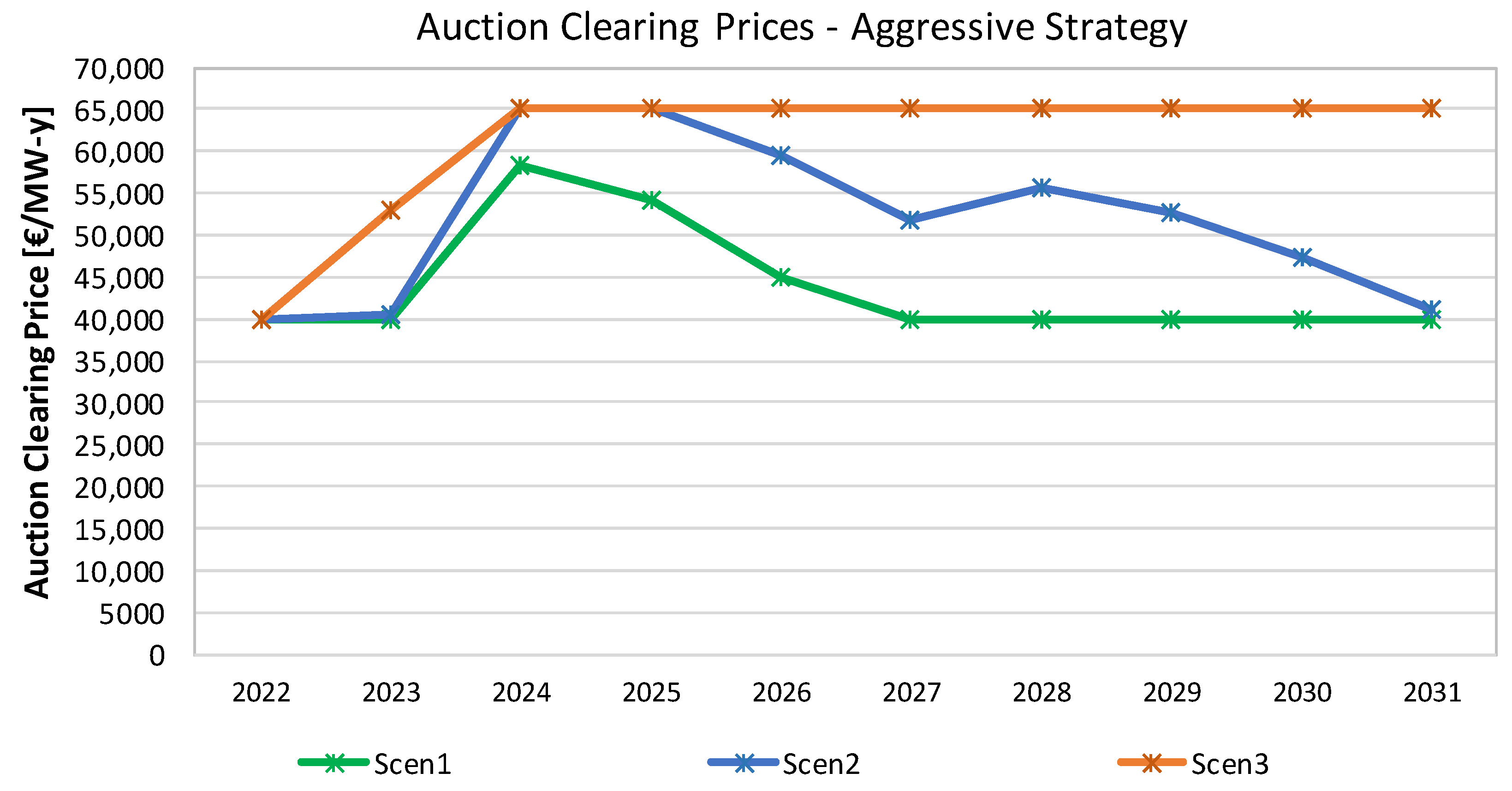

- Aggressive Strategy: Existing IPP units offer their entire (de-rated) capacity at 40,000 €/MW-y, while new IPP units offer their entire (de-rated) capacity at 65,000 €/MW-y. In this case, the provisions of the draft CRM proposal, according to which the bid cap for existing units will function as a pure price cap for these units for the first five (5) years of the implementation (period 2022–2026), while afterwards (period 2027–2031) existing capacity will be able to receive a premium higher than their bid cap only if new capacity is contracted, is also taken into account in the respective calculations.

4.2.3. Simulation Results

5. Conclusions and Prospects for Further Work

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Year | Total Electricity Consumption [TWh] | System Peak Load [MW] | ||||

|---|---|---|---|---|---|---|

| Low | Intermediate | High | Low | Intermediate | High | |

| 2022 | 52.38 | 53.58 | 54.77 | 9750 | 9979 | 10,207 |

| 2023 | 54.45 | 56.03 | 57.60 | 10,420 | 10,731 | 11,041 |

| 2024 | 55.86 | 57.67 | 59.47 | 10,565 | 10,907 | 11,248 |

| 2025 | 57.00 | 58.93 | 60.85 | 10,740 | 11,100 | 11,460 |

| 2026 | 57.15 | 59.31 | 61.46 | 10,770 | 11,173 | 11,575 |

| 2027 | 57.28 | 59.63 | 61.98 | 10,790 | 11,233 | 11,675 |

| 2028 | 58.94 | 61.73 | 64.51 | 11,100 | 11,630 | 12,160 |

| 2029 | 60.08 | 62.81 | 65.54 | 11,320 | 11,835 | 12,350 |

| 2030 | 60.73 | 63.45 | 66.16 | 11,450 | 11,960 | 12,470 |

| 2031 | 61.06 | 63.92 | 66.78 | 11,515 | 12,053 | 12,590 |

| Year | Eligible Resources Capacity [MW] | |||

|---|---|---|---|---|

| Hydro | Pumped-Storage | BESS | ||

| Low | High | |||

| 2022 | 1666 | 0 | 0 | 0 |

| 2023 | 1666 | 0 | 0 | 0 |

| 2024 | 1666 | 0 | 0 | 0 |

| 2025 | 1680 | 387 | 75 | 100 |

| 2026 | 1680 | 387 | 100 | 200 |

| 2027 | 1680 | 387 | 150 | 300 |

| 2028 | 1680 | 387 | 200 | 400 |

| 2029 | 1680 | 387 | 250 | 500 |

| 2030 | 1680 | 387 | 300 | 600 |

| 2031 | 1680 | 387 | 363 | 725 |

| Year | Low Scenario | High Scenario | ||

|---|---|---|---|---|

| Ineligible Capacity [MW] | Eligible Capacity [MW] | Ineligible Capacity [MW] | Eligible Capacity [MW] | |

| 2022 | 1204 | 0 | 1212 | 0 |

| 2023 | 1354 | 0 | 1377 | 0 |

| 2024 | 1465 | 0 | 1513 | 0 |

| 2025 | 1510 | 58 | 1573 | 80 |

| 2026 | 1510 | 156 | 1573 | 225 |

| 2027 | 1510 | 259 | 1573 | 372 |

| 2028 | 1510 | 368 | 1573 | 523 |

| 2029 | 1510 | 481 | 1573 | 678 |

| 2030 | 1510 | 595 | 1573 | 834 |

| 2031 | 1510 | 692 | 1573 | 959 |

References

- Stoft, S. Power Systems Economics: Designing Markets for Electricity; John Wiley and Sons: New York, NY, USA, 2002. [Google Scholar]

- Crampton, P.; Stoft, S. “The Convergence of Market Designs for Adequate Generating Capacity with Special Attention to the CAISO’s Resource Adequacy Problem”, MIT-CEEPR (Series) 06-007WP. 2006. Available online: https://drum.lib.umd.edu/bitstream/handle/1903/7056/cramton-stoft-market-design-for-resource-adequacy.pdf?sequence=1&isAllowed=y (accessed on 10 November 2022).

- Joskow, P.L. Capacity payments in imperfect electricity markets: Need and design. Util. Policy 2008, 16, 159–170. [Google Scholar] [CrossRef]

- Spees, K.; Newell, S.A.; Pfeifenberger, J.P. Capacity Markets—Lessons Learned from the First Decade. Econ. Energy Environ. Policy 2013, 2, 1–26. [Google Scholar] [CrossRef]

- Bushnell, J.; Flagg, M.; Mansur, E. Capacity Markets at a Crossroads; Energy Institute at Hass Working Paper; University of California: Berkeley, CA, USA, 2017. [Google Scholar]

- Bhagwat, P.C.; de Vries, L.J.; Hobbs, B.F. Expert survey on capacity markets in the US: Lessons for the EU. Util. Policy 2016, 38, 11–17. [Google Scholar] [CrossRef] [Green Version]

- Duggan, J.E. Capacity Market Mechanism Analyses: A Literature Review. Curr. Sustain. Energy Rep. 2020, 7, 186–192. [Google Scholar] [CrossRef]

- Byers, C.; Levin, T.; Botterud, A. Capacity market design and renewable energy: Performance incentives, qualifying capacity, and demand curves. Electr. J. 2018, 31, 65–74. [Google Scholar] [CrossRef]

- Kozlova, M.; Overland, I. Combining capacity mechanisms and renewable energy support: A review of the international experience. Renew. Sustain. Energy Rev. 2022, 155, 111878. [Google Scholar] [CrossRef]

- Mastropietro, P.; Fontini, F.; Rodilla, P.; Batlle, C. The Italian capacity remuneration mechanism: Critical review and open questions. Energy Policy 2018, 123, 659–669. [Google Scholar] [CrossRef]

- Komorowska, A.; Benalcazar, P.; Kaszyński, P.; Kamiński, J. Economic consequences of a capacity market implementation: The case of Poland. Energy Policy 2020, 144, 111683. [Google Scholar] [CrossRef]

- Crampton, P.; Ockenfels, A.; Stoft, S. Capacity market fundamentals. Econ. Energy Environ. Policy 2013, 2, 27–46. [Google Scholar]

- Bhagwat, P.C.; Iychettira, K.K.; Richstein, J.C.; Chappin, E.J.; De Vries, L.J. The effectiveness of capacity markets in the presence of a high portfolio share of renewable energy sources. Util. Policy 2017, 48, 76–91. [Google Scholar] [CrossRef]

- Wolak, F. Long-Term Resource Adequacy in Wholesale Electricity Markets with Significant Intermittent Renewables; Working paper 29033; National Bureau of Economic Research: Cambridge, MA, USA, 2021. [Google Scholar]

- Lynch, M.; Nolan, S.; Devine, M.T.; O’Malley, M. The impacts of demand response participation in capacity markets. Appl. Energy 2019, 250, 444–451. [Google Scholar]

- Fraunholz, C.; Keles, D.; Fichtner, W. On the role of electricity storage in capacity remuneration mechanisms. Energy Policy 2021, 149, 112014. [Google Scholar] [CrossRef]

- Brito-Pereira, P.; Mastropietro, P.; Rodilla, P.; Barroso, L.A.; Batlle, C. Adjusting the aim of capacity mechanisms: Future-proof reliability metrics and firm supply calculations. Energy Policy 2022, 164, 112891. [Google Scholar] [CrossRef]

- Söder, L.; Tómasson, E.; Estanqueiro, A.; Flynn, D.; Hodge, B.-M.; Kiviluoma, J.; Korpås, M.; Neau, E.; Couto, A.; Pudjianto, D.; et al. Review of wind generation within adequacy calculations and capacity markets for different power systems. Renew. Sustain. Energy Rev. 2020, 119, 109540. [Google Scholar] [CrossRef]

- Holmberg, P.; Tangerås, T.P. Strategic Reserves versus Market-wide Capacity Mechanisms; EPRG Working Paper 2109; Research Institute of Industrial Economics: Stockholm, Sweden, 2021. [Google Scholar]

- Roques, F. Hybrid Electric Market Models: Key Principles and Possible Approaches; Presentation to CEEM Conference. June 2021. Available online: https://www.iaee.org/proceedings/article/16944 (accessed on 10 November 2022).

- Schittekatte, T.; Meeus, L. Capacity Remuneration Mechanisms in the EU: Today, T, and a Look Further Ahead; RSC Working Paper 2021/71; Florence School of Regulation: Florence, Italy, 2021. [Google Scholar]

- Terna. Analisi dei dati elettrici 2016. 2016. Available online: https://download.terna.it/terna/0000/0994/85.PDF (accessed on 10 November 2022).

- European Network of Transmission System Operators for Electricity (ENTSO-E). Mid-term Adequacy Forecast 2017 edition. 2017. Available online: https://www.entsoe.eu/Documents/SDC%20documents/MAF/20170918_MAF_2017_FOR_CONSULTATION.pdf (accessed on 10 November 2022).

- European Commission. Italian Implementation Plan. 2020. Available online: https://www.mise.gov.it/images/stories/documenti/Piano_di_implementazione_Reg_UE_943_2019-Mercato_elettrico.pdf (accessed on 10 November 2022).

- Ministero dello sviluppo economico and Ministero dell’ Ambiente e della Tutela del Territorio e del Mare, Italy. Strategia Energetica Nazionale 2017. 2017. Available online: https://www.mite.gov.it/comunicati/strategia-energetica-nazionale-2017 (accessed on 10 November 2022).

- European Commission. State Aid SA.42011 (2017/N)—Italian Capacity Mechanism. 2018. Available online: https://ec.europa.eu/competition/state_aid/cases/270875/270875_1979508_218_2.pdf (accessed on 10 November 2022).

- European Commission. State Aid: Commission Approves Revised French Market-wide Capacity Mechanism. 2016. Available online: https://ec.europa.eu/commission/presscorner/api/files/document/print/en/ip_16_3620/IP_16_3620_EN.pdf (accessed on 10 November 2022).

- R2b Energy Consulting. Effects of the German Capacity Reserve on Neighbouring Member States; Technical Report; Federal Ministry for Economic Affairs and Climate Action: Berlin, Germany, 2021. [Google Scholar]

- European Commission. State Aid SA.45852 (2017/C)—German Capacity Reserve. 2018. Available online: https://ec.europa.eu/competition/state_aid/cases/269083/269083_1983030_171_13.pdf (accessed on 10 November 2022).

- European Commission. State Aid SA. 54915 (2019/N)—Belgium Capacity Remuneration Mechanism. 2020. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020AS54915&from=GA (accessed on 10 November 2022).

- European Commission. SA.48648 (2017/NN)—Belgium—Strategic Reserve. 2018. Available online: https://ec.europa.eu/competition/state_aid/cases/272020/272020_1964726_118_2.pdf (accessed on 10 November 2022).

- European Commission. State aid No. SA.46100 (2017/N)—Planned Polish Capacity Mechanism. 2018. Available online: https://ec.europa.eu/competition/state_aid/cases/272253/272253_1977790_162_2.pdf (accessed on 10 November 2022).

- Department of Energy & Climate Change, UK. Capacity Market: Design and Implementation Update, Annex C. 2012. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/65637/7104-emr-annex-c-capacity-market-design-and-implementat.pdf (accessed on 10 November 2022).

- University of Cambridge. UK Electricity Market Reform and the Energy Transition: Emerging Lessons. 2018. Available online: https://www.eprg.group.cam.ac.uk/wp-content/uploads/2018/06/1817-Text.pdf (accessed on 10 November 2022).

- European Commission. State aid No. SA.44464 (2017/N)—Irish Capacity Mechanism. 2017. Available online: https://ec.europa.eu/competition/state_aid/cases/267880/267880_1948214_166_2.pdf (accessed on 10 November 2022).

- Batlle, C.; Pérez-Arriaga, I.J. Design criteria for implementing a capacity mechanism in deregulated electricity markets. Util. Policy 2008, 16, 184–193. [Google Scholar] [CrossRef] [Green Version]

- Cramton, P.; Ockenfels, A. Economics and Design of Capacity Markets for the Power Sector. In Interdisziplinäre Aspekte der Energiewirtschaft. Energie in Naturwissenschaft, Technik, Wirtschaft und Gesellschaft; von Weizsäcker, C., Lindenberger, D., Höffler, F., Eds.; Springer Vieweg: Wiesbaden, Germany, 2016. [Google Scholar]

- Benedettini, S. PJM and ISO-NE forward Capacity Markets: A Critical Assessment. 2013. Available online: https://simonabenedettini.files.wordpress.com/2015/01/report.pdf (accessed on 10 November 2022).

- PJM Interconnection. PJM Manual [18]: PJM Capacity Market. 2021. Available online: https://www.pjm.com/-/media/documents/manuals/m18.ashx (accessed on 10 November 2022).

- Billinton, R.; Allan, R. Reliability Evaluation of Power Systems, 2nd ed.; Plenum: New York, NY, USA, 1996. [Google Scholar]

- Simoglou, C.K.; Bakirtzis, E.A.; Biskas, P.N.; Bakirtzis, A.G. Probabilistic evaluation of the long-term power system resource adequacy: The Greek case. Energy Policy 2018, 117, 295–306. [Google Scholar] [CrossRef]

- The Brattle Group. Singapore Forward Capacity Market—High-Level Design Straw Proposal. 2019. Available online: https://www.ema.gov.sg/cmsmedia/Annex%20A%20-%20High-Level%20Design%20Straw%20Proposal%20v1.pdf (accessed on 10 November 2022).

- Department of Energy & Climate Change, UK. Implementing Electricity Market Reform (EMR). 2014. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/324176/Implementing_Electricity_Market_Reform.pdf (accessed on 10 November 2022).

- McNamara, F. Capacity Market, Department of Energy & Climate Change, UK. 2014. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/335760/capacity_market_policy_presentation.pdf (accessed on 10 November 2022).

- Proposal of the Ministry of Energy and Environment for the Submission of the Final Notification to DG Competition for the Establishment of a Long-Term Capacity Remuneration Mechanism in the Greek Electricity Market. April 2019. Available online: https://www.clientearth.org/media/mc3asmzl/clientearth-response-to-the-consultation-of-the-long-term-capacity-remuneration-mechanism-in-the-greek-electricity-market-ce-en.pdf (accessed on 10 November 2022).

- Long-Term Capacity Adequacy Study 2020–2030, December 2019, ADMIE. Available online: https://www.admie.gr/sites/default/files/users/dssas/meleti-eparkeias-ishyos-2020-2030.pdf (accessed on 10 November 2022).

- Simoglou, C.K.; Biskas, P.N.; Bakirtzis, E.A.; Matenli, A.N.; Petridis, A.I.; Bakirtzis, A.G. Evaluation of the Capacity Credit of RES: The Greek Case. In Proceedings of the 2013 IEEE Grenoble Conference, Grenoble, France, 16–20 June 2013. [Google Scholar]

- Garver, L.L. Effective Load Carrying Capability of Generating Units. IEEE Trans. Power Appar. Syst. 1966, 85, 910–919. [Google Scholar] [CrossRef]

- Greek Independent Transmission Operator. Ten-Year Network Development Plan 2021–2030. 2021. Available online: https://www.admie.gr/en/grid/development/ten-year-development-plan (accessed on 10 November 2022).

- National Energy and Climate Plan (NECP) 2020–2030, Greek Ministry of Environment and Energy. December 2019. Available online: https://www.e-nomothesia.gr/kat-periballon/apophase-kubernetikou-sumbouliou-4-2019.html (accessed on 10 November 2022). (In Greek).

| Subject | Italy | France | Germany | Belgium | Poland |

|---|---|---|---|---|---|

| Necessity | Retirement of conventional thermal capacity | Winter peak load increase | RES development | Nuclear phase-out in 2022–2025 | Mothballing and phasing-out of old inefficient power units by 2020 |

| System load increase | RES growth | Retirement of nuclear power plants in 2022 | Thermal capacity phase-out in neighboring countries | Market failures (“missing money”, high price volatility) | |

| Decarbonization | Inadequate investments, “missing money” | Market failures (“missing money”, high price volatility) | Lack of investments | ||

| Inadequate investments, “missing money” | Strategic reserve mechanism not successful | ||||

| Product | Capacity Availability (ROs) | Capacity Guarantees | Reserve Capacity Availability | Capacity Availability (ROs) | Capacity Availability |

| Location | |||||

| Type | Descending clock central auctions | Over-The-Counter & Auctions | Auctions | Single-round central auctions | Descending clock central auctions |

| Eligibility | Existing and new generating units (conventional & RES) | Certified generating units | Generating units | Existing and new generating units | Existing and new generating units |

| Demand Response | Certified DR operators | Storage | Demand Response | Demand Response | |

| Storage | Demand response operators | Storage | Storage | ||

| Foreign capacity | Foreign capacity | Foreign capacity | |||

| Auction Frequency | Main auction: Y-4 | Auctions in March, April, June, Sept., Oct. and Dec. of Y-1 | Every 2 years for two-year delivery period | Main auction: Y-4 | Main auction: Y-5 |

| Adjustment Auctions: Y-3, Y-2, Y-1 | Additional auction: Y-1 | Four additional auctions, one for each quarter of delivery year: Y-1 | |||

| Auction clearing | Pay-as-clear | Pay-as-bid | Pay-as-clear | Pay-as-bid (first two delivery periods), Pay-as-clear (next delivery periods) | Pay-as-clear |

| Bid limits / Price cap | New capacity: 75,000–95,000 €/ΜW-y | Change every year | 100,000 €/MW-y | 80,000–105,000 €/ΜW-y | Auction price cap (new units): 1.5 × CONE (97,500–105,000€/MW-y) |

| Existing capacity: 25,000–45,000 €/ΜW-y | 20,000 €/MW-y (2017), 40,000 €/MW-y (2018), 60,000 €/MW-y (2019) | Intermediate price cap for first Y-4 auction for 1-year contract: 20,800–31,200 €/ΜW-y | Existing capacity (price-takers): 45,000 €/MW-y | ||

| Minimum bid quantity: 1 MW | Minimum bid quantity: 2 MW | ||||

| Contracts Duration | Existing capacity: 3 years | Existing capacity: 1 year | 2 years | 1, 3, 8 or 15 years depending on CAPEX range | Existing capacity: 1 year (5 years for increased CAPEX) |

| New capacity: 15 years | New capacity: 7 year | New capacity: 5 or 15 years, depending on CAPEX range. | |||

| 5 and 15-year agreements: Possible extension by 2 years for low-carbon capacity and district heating | |||||

| Capacity Requirement | According to target LOLE (3 h/y) | Capacity Guarantees requirement for 100–150 peak hours per delivery year | 2 GW | According to target LOLE (3 h/y), reservation of 2–3 GW for Y-1 auctions | According to target LOLE (3 h/y) |

| Demand Curve | Downward sloping curve | No demand curve | No demand curve | Downward sloping curve for Y-4 auctions, vertical curve for Y-1 auctions | Downward sloping curve |

| Secondary market | Yes | Yes | Not allowed | Yes | Yes (OTC or organized market) |

| Penalties | Yes (for temporary and definitive non-fulfilment) | Imbalance settlement between forecasts and actual results | Yes (up to 20% of total remuneration) | Yes (monthly limit equal to 20% of respective revenues) | Yes (hourly, monthly and annual limits) & bonus for over-performance |

| Subject | Great Britain | Ireland | Cyprus | USA-PJM | USA–New England |

| Necessity | Coal power plants retirement | “Missing money” problem | High dependence on fossil fuels | System load increase | RES generation increase |

| System load increase | Decarbonization | System load increase | Low and volatile market prices | Low and volatile market prices | |

| Decarbonization | Limited interconnections | Lack of interconnections | Lack of investments | “Missing money” problem | |

| Lack of investments, “missing money” problem | Limited potential for demand response | System limitations to accommodate high RES shares | Lack of investments | ||

| Product | Capacity Availability | Capacity Availability (ROs) | Reserve Capacity Availability | Capacity Availability | Capacity Availability |

| Location | Locational value of capacity | Locational value of capacity | |||

| Type | Descending clock central auctions | Central auctions | Central auctions | Central auctions | Descending clock central auctions |

| Eligibility | Existing and new generating units | Existing and new generating units (conventional & RES) | Existing and new generating units | Load serving entities (mandatory) | Existing and new generating units |

| Demand Response | Demand Response | Demand Response | Existing generating units (mandatory) & planned units (voluntary) | Existing and new Demand Response | |

| Storage | Storage | Storage | Existing and new demand response resources (voluntary) | Existing and new imports | |

| Foreign capacity | Foreign capacity | Qualifying transmission upgrades (voluntary) | |||

| Energy efficiency resources (voluntary) | |||||

| Auction Frequency | Main auction: Y-4 | Main auction: Y-4 | Main auction: Y-1 | Base Residual Auction: Y-3 | Main Auction: Y-3 |

| Additional auction: Y-1 | Adjustment Auctions: Y-2, Y-1 | Incremental Auctions: M-23, M-13, M-3 | Reconfiguration Auctions: Y-1, M-1 | ||

| Auction clearing | Pay-as-clear | Pay-as-clear | Pay-as-clear | Pay-as-clear Adjustment for location | Pay-as-clear Adjustment for location |

| Bid limits/ Price cap | Price cap: 75,000 £/MW-y, Existing capacity: 25,000 £/MW-y | New capacity: 138,450 €/ΜW-y | Price cap: 33,000 €/MW-y | Price cap: Max [CONE; 1.5 (CONE-Energy & Ancillary Services Revenue)] | Price cap (starting price): 2 × CONE |

| Minimum bid price: £0/kW | Existing capacity: 46,150 €/ΜW-y | Bid quantity: Full capacity | Bid cap for existing units | Price floor (end price): 0.6 × CONE | |

| Minimum bid quantity: 2 MW | Minimum bid quantity: 0.1 MW | Minimum bid quantity: 0.1 MW | |||

| Contracts Duration | Existing capacity: 1 year, (up to 3 years for plant refurbishment) | Existing capacity: 1 year | 1 year | 1 year | 1 year |

| New capacity: up to 15 years | New capacity: 10 years | ||||

| Capacity Requirement | According to target LOLE | According to target LOLE (8 h/y) | Based on resource adequacy studies | Target capacity: FPR x Peak load Forecast | According to target LOLE (0.1 day/y) |

| Demand Curve | Downward sloping curve | Downward sloping curve | No demand curve | Downward sloping curve | Vertical demand curve |

| Secondary market | Yes | Yes | No | Yes (Bilateral Market) | Yes (Reconfiguration auctions) |

| Penalties | Yes (1/24th of the relevant auction’s clearing price, in £/MWh) | N/A | N/A | Yes [=Shortage capacity x Auction price + Max (20$/MW-day, 0.2*Auction price)] | Yes (maximum daily, monthly and annual penalties) |

| RES Technology | De-Rating Factor [%] |

|---|---|

| Wind | 85.0% |

| PV | 90.0% |

| Small Hydro | 65.0% |

| Biomass-Biogas | 50.0% |

| Cogeneration | 80.0% |

| Solar Thermal | 90.0% |

| Scenario 1 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Year | Auction Winning Capacity [MW] (A) | Ineligible Capacity [MW] (B) | Awarded Eligible Capacity [MW] (C) = (A) − (B) & (C) = (D) + (E) + (F) | RES + Interconn. + BESS + DR Awarded Capacity [MW] (D) | PPC Total UCAP [MW] | PPC Awarded Capacity [MW] (E) | IPPs Total UCAP [MW] | IPPs Awarded Capacity [MW] (F) |

| 2022 | 8883 | 1512 | 7371 | 950 | 5644 | 5644 | 2781 | 777 |

| 2023 | 9494 | 1677 | 7817 | 950 | 4759 | 4759 | 3137 | 2107 |

| 2024 | 9626 | 1813 | 7813 | 950 | 4054 | 4054 | 3900 | 2809 |

| 2025 | 9785 | 1873 | 7912 | 1130 | 4068 | 4068 | 4913 | 2714 |

| 2026 | 9813 | 1873 | 7940 | 1375 | 4068 | 4068 | 4934 | 2497 |

| 2027 | 9831 | 1873 | 7958 | 1622 | 4068 | 4068 | 4956 | 2268 |

| 2028 | 10,113 | 1873 | 8240 | 1873 | 4068 | 4068 | 4971 | 2299 |

| 2029 | 10,314 | 1873 | 8441 | 2128 | 4068 | 4068 | 4977 | 2245 |

| 2030 | 10,432 | 1873 | 8559 | 2384 | 4068 | 4068 | 4977 | 2107 |

| 2031 | 10,491 | 1873 | 8618 | 2634 | 4068 | 4068 | 4977 | 1917 |

| Scenario 2 | ||||||||

| 2022 | 9092 | 1512 | 7580 | 950 | 5644 | 5644 | 2781 | 986 |

| 2023 | 9777 | 1677 | 8100 | 950 | 4759 | 4759 | 3137 | 2391 |

| 2024 | 9937 | 1813 | 8124 | 950 | 4054 | 4054 | 3900 | 3121 |

| 2025 | 10,113 | 1873 | 8240 | 1130 | 4068 | 4068 | 4913 | 3042 |

| 2026 | 10,180 | 1873 | 8307 | 1375 | 4068 | 4068 | 4934 | 2864 |

| 2027 | 10,235 | 1873 | 8362 | 1622 | 4068 | 4068 | 4956 | 2672 |

| 2028 | 10,596 | 1873 | 8723 | 1873 | 4068 | 4068 | 4971 | 2782 |

| 2029 | 10,783 | 1873 | 8910 | 2128 | 4068 | 4068 | 4977 | 2714 |

| 2030 | 10,897 | 1873 | 9024 | 2384 | 4068 | 4068 | 4977 | 2572 |

| 2031 | 10,982 | 1873 | 9109 | 2634 | 4068 | 4068 | 4977 | 2407 |

| Scenario 3 | ||||||||

| 2022 | 9300 | 1504 | 7796 | 950 | 5644 | 5644 | 2781 | 1201 |

| 2023 | 10,060 | 1654 | 8406 | 950 | 4759 | 4759 | 3137 | 2696 |

| 2024 | 10,248 | 1765 | 8483 | 950 | 4054 | 4054 | 3900 | 3479 |

| 2025 | 10,441 | 1810 | 8631 | 1083 | 4068 | 4068 | 4913 | 3480 |

| 2026 | 10,546 | 1810 | 8736 | 1206 | 4068 | 4068 | 4934 | 3462 |

| 2027 | 10,637 | 1810 | 8827 | 1359 | 4068 | 4068 | 4956 | 3400 |

| 2028 | 11,079 | 1810 | 9269 | 1518 | 4068 | 4068 | 4971 | 3683 |

| 2029 | 11,252 | 1810 | 9442 | 1681 | 4068 | 4068 | 4977 | 3693 |

| 2030 | 11,362 | 1810 | 9552 | 1845 | 4068 | 4068 | 4977 | 3639 |

| 2031 | 11,471 | 1810 | 9661 | 2005 | 4068 | 4068 | 4977 | 3588 |

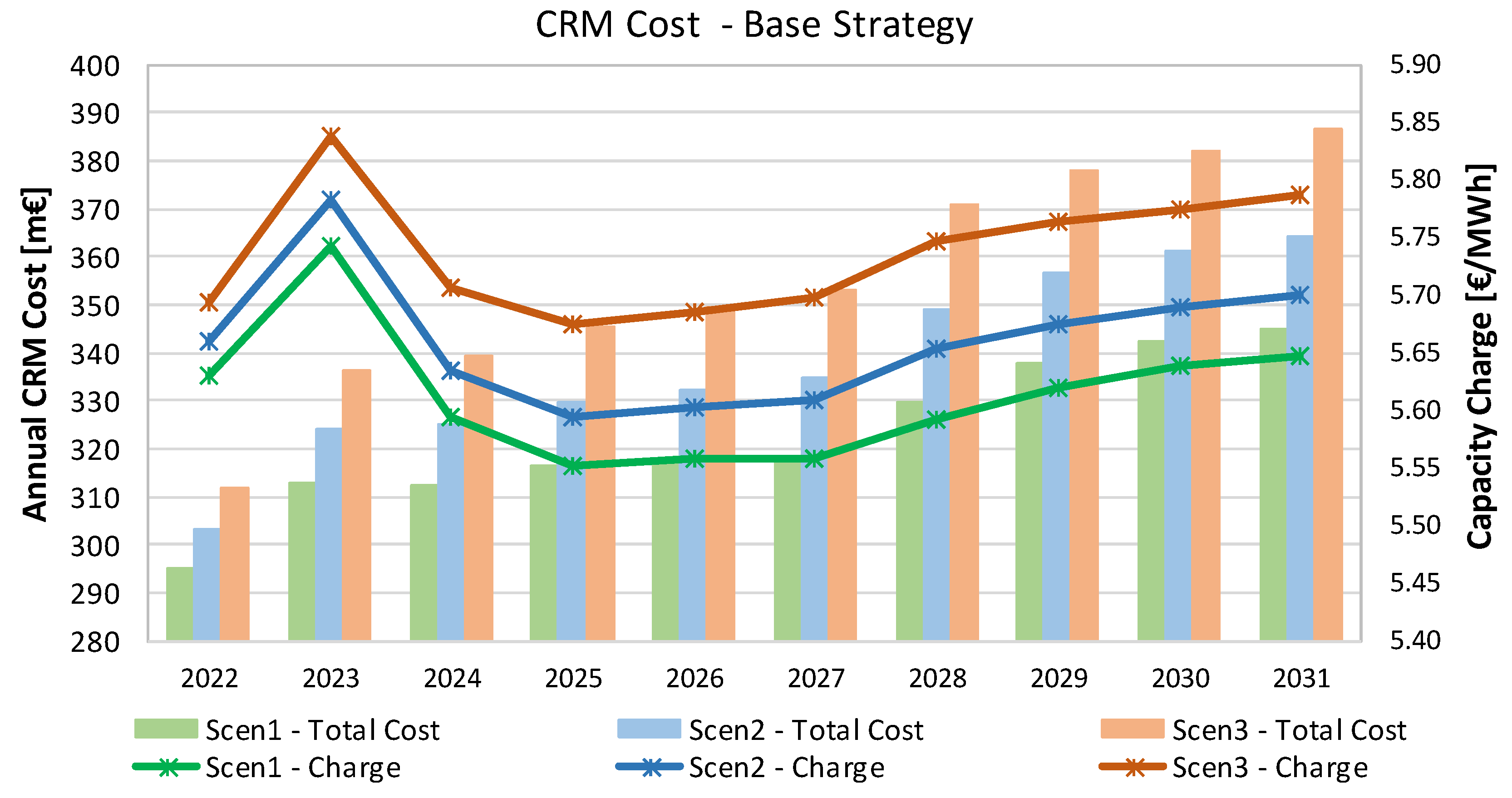

| Year | Scenario 1 | Scenario 2 | Scenario 3 | |||

|---|---|---|---|---|---|---|

| Total Cost [m€] | Capacity Charge [€/ΜWh] | Total Cost [m€] | Capacity Charge [€/ΜWh] | Total Cost [m€] | Capacity Charge [€/ΜWh] | |

| 2022 | 294.9 | 5.63 | 303.2 | 5.66 | 311.8 | 5.69 |

| 2023 | 312.7 | 5.74 | 324.0 | 5.78 | 336.2 | 5.84 |

| 2024 | 312.5 | 5.59 | 325.0 | 5.64 | 339.3 | 5.71 |

| 2025 | 316.5 | 5.55 | 329.6 | 5.59 | 345.3 | 5.67 |

| 2026 | 317.6 | 5.56 | 332.3 | 5.60 | 349.4 | 5.69 |

| 2027 | 318.3 | 5.56 | 334.5 | 5.61 | 353.1 | 5.70 |

| 2028 | 329.6 | 5.59 | 348.9 | 5.65 | 370.8 | 5.75 |

| 2029 | 337.6 | 5.62 | 356.4 | 5.67 | 377.7 | 5.76 |

| 2030 | 342.4 | 5.64 | 361.0 | 5.69 | 382.1 | 5.77 |

| 2031 | 344.7 | 5.65 | 364.3 | 5.70 | 386.4 | 5.79 |

| Year | Scenario 1 | Scenario 2 | Scenario 3 | |||

|---|---|---|---|---|---|---|

| Total Cost [m€] | Capacity Charge [€/ΜWh] | Total Cost [m€] | Capacity Charge [€/ΜWh] | Total Cost [m€] | Capacity Charge [€/ΜWh] | |

| 2022 | 294.9 | 5.63 | 303.2 | 5.66 | 311.8 | 5.69 |

| 2023 | 312.7 | 5.74 | 323.9 | 5.78 | 334.3 | 5.80 |

| 2024 | 310.5 | 5.56 | 324.9 | 5.63 | 347.0 | 5.83 |

| 2025 | 317.5 | 5.57 | 331.7 | 5.63 | 355.8 | 5.85 |

| 2026 | 319.1 | 5.58 | 337.7 | 5.69 | 362.2 | 5.89 |

| 2027 | 318.3 | 5.56 | 417.3 | 7.00 | 531.6 | 8.58 |

| 2028 | 329.6 | 5.59 | 462.6 | 7.49 | 558.6 | 8.66 |

| 2029 | 337.6 | 5.62 | 452.2 | 7.20 | 569.1 | 8.68 |

| 2030 | 342.4 | 5.64 | 417.3 | 6.58 | 575.8 | 8.70 |

| 2031 | 344.7 | 5.65 | 372.5 | 5.83 | 582.5 | 8.72 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Simoglou, C.K.; Biskas, P.N. Capacity Mechanisms in Europe and the US: A Comparative Analysis and a Real-Life Application for Greece. Energies 2023, 16, 982. https://doi.org/10.3390/en16020982

Simoglou CK, Biskas PN. Capacity Mechanisms in Europe and the US: A Comparative Analysis and a Real-Life Application for Greece. Energies. 2023; 16(2):982. https://doi.org/10.3390/en16020982

Chicago/Turabian StyleSimoglou, Christos K., and Pandelis N. Biskas. 2023. "Capacity Mechanisms in Europe and the US: A Comparative Analysis and a Real-Life Application for Greece" Energies 16, no. 2: 982. https://doi.org/10.3390/en16020982

APA StyleSimoglou, C. K., & Biskas, P. N. (2023). Capacity Mechanisms in Europe and the US: A Comparative Analysis and a Real-Life Application for Greece. Energies, 16(2), 982. https://doi.org/10.3390/en16020982