1. Introduction

The expansion of renewable energies has transitioned from merely a global trend to a reality, spurred by behavioral changes in consumers, decision makers, entrepreneurs, and governments. This shift is driven by the pursuit of efficient and sustainable electricity consumption, which has been motivated by global commitments to reduce carbon footprints. These commitments were initiated in the nineties through various international environmental agreements, forums, and protocols.

The most outstanding representatives of this generation of clean alternative sources are solar-photovoltaic (PV) and wind (EOL) sources. However, the intermittent energy dispatch from these sources, influenced by the variability of primary environmental conditions like solar irradiation, temperature, and wind strength, necessitates their co-location or hybridization with battery energy storage systems (BESS)—a solution validated by both research and market trends. This approach ensures a reliable energy supply with characteristics closer to those of generator-based synchronous generation sources, such as hydro (UHE) and thermoelectric (UTE) sources [

1,

2,

3].

It is worth noting that BESS, along with demand-side management (DSM), intelligent charging strategies for electric vehicles (V2G), and CH&P plants, are classified as renewable energy resources, as they do not strictly speaking constitute sources as such since the bidirectional flow of energy between load and source is present.

Despite this crucial cooperation between the battery energy storage system (BESS) and intermittent sources, there is a significant challenge in most countries when it comes to accepting solutions that involve the integration of BESS into their regulatory frameworks. This challenge often arises due to a lack of understanding about BESS. However, it behaves similarly to a load when it is in the process of being recharged. The BESS must be understood as a new asset with its specificities of equipment controlled by power electronics and dynamics of charge and discharge and, therefore, its regulation.

Additionally, in the European context, where a decisive commitment to the energy transition is evident, experience with battery energy storage regulations plays a crucial role for other technologies. The European Union Strategy for Hydrogen, along with “Fit for 55” and the Renewable Energy Directive, are creating fertile ground for the development and implementation of green hydrogen technologies. Europe, with its prior experience in battery energy storage regulations, can bolster the process of establishing robust regulations for hydrogen storage. This collaboration between different regulatory frameworks can facilitate a cohesive environment where energy storage technologies, whether batteries or green hydrogen, can thrive together, thereby maximizing the efficiency and effectiveness of clean energy storage in Europe [

4,

5,

6].

This paper presents the outcomes of an R&D research initiative promoted by AES, which aimed to comprehensively analyze and extract best practices through an international survey. The study focused on assessing the status in three key areas: (a) regulatory policies; (b) incentives and subsidies; and (c) engagement in deregulated energy markets (also referred to as energy choice market). The primary focus was on BESS applications in countries that have taken the lead in adopting this technology.

This study aims to develop a comprehensive set of best practices for countries that have already integrated intermittent renewable sources into their energy generation mix to a certain extent. These countries are looking to initiate hybridization projects within their generation mix through the implementation of BESS solutions. To achieve this objective, the study is based on relevant previous scientific articles and related international legislation concerning renewable energy and distributed energy resources (DERs).

The authors underscore that consolidating the best practices into a single article was the result of preliminary research conducted in preparation for this study. They note that they did not identify a similar proposal within the broader international scientific community. As a result, they consider this work to be a valuable reference on the subject for related research in the field of energy storage system (ESS).

Following this introduction, the paper is organized into five sections before concluding. In

Section 2, the authors elucidate the methodology employed for conducting the research, adhering to established scientific research protocols.

Section 3,

Section 4 and

Section 5 encompass the research findings and insights gleaned from the scientific inquiry conducted within countries that are trailblazers in the integration of BESS within their electrical systems. These countries encompass the USA, Australia, Canada, Chile, Colombia, and numerous Member States of the European Union. Lastly,

Section 6 serves as the platform for presenting and discussing the outcome of the study—an annotated compilation of practices designed to bolster future research endeavors and sustainable projects related to BESS.

2. Materials and Methods

The literature review followed a deductive approach using a typological procedure that relied on an indirect documentation technique. This involved conducting bibliographical research within existing scientific publications. Given the legal aspect of the subject matter, the authors explored the regulatory framework, incentives, and the deregulated energy market in various regions, including the USA, Australia, Canada, Chile, Colombia, and several Member States of the European Union. The research aimed to achieve four main objectives:

- (a)

Create an international map of applications for hybrid PV-HBESS arrays in microgrids.

- (b)

Survey the international regulatory landscape in regions such as Europe, the USA, Latin America, Australia, and Canada regarding this solution.

- (c)

Assess the national status of DER applications.

- (d)

Propose regulatory interventions to support the studied solution.

3. International Regulatory Status on BESS

3.1. Europe

Europe has been working on consolidating regulatory guidelines and policies for ESS to address the importance and potential of this solution for the future of its electrical system. Packages like the STORE Project, Clean Energy for All Europeans, the European Green Deal, and the 2020 European Climate Law have been implemented, impacting regulatory structures in European countries [

7,

8,

9,

10,

11]. However, barriers remain, such as inadequate support for ESS projects and the lack of a clear regulatory framework definition.

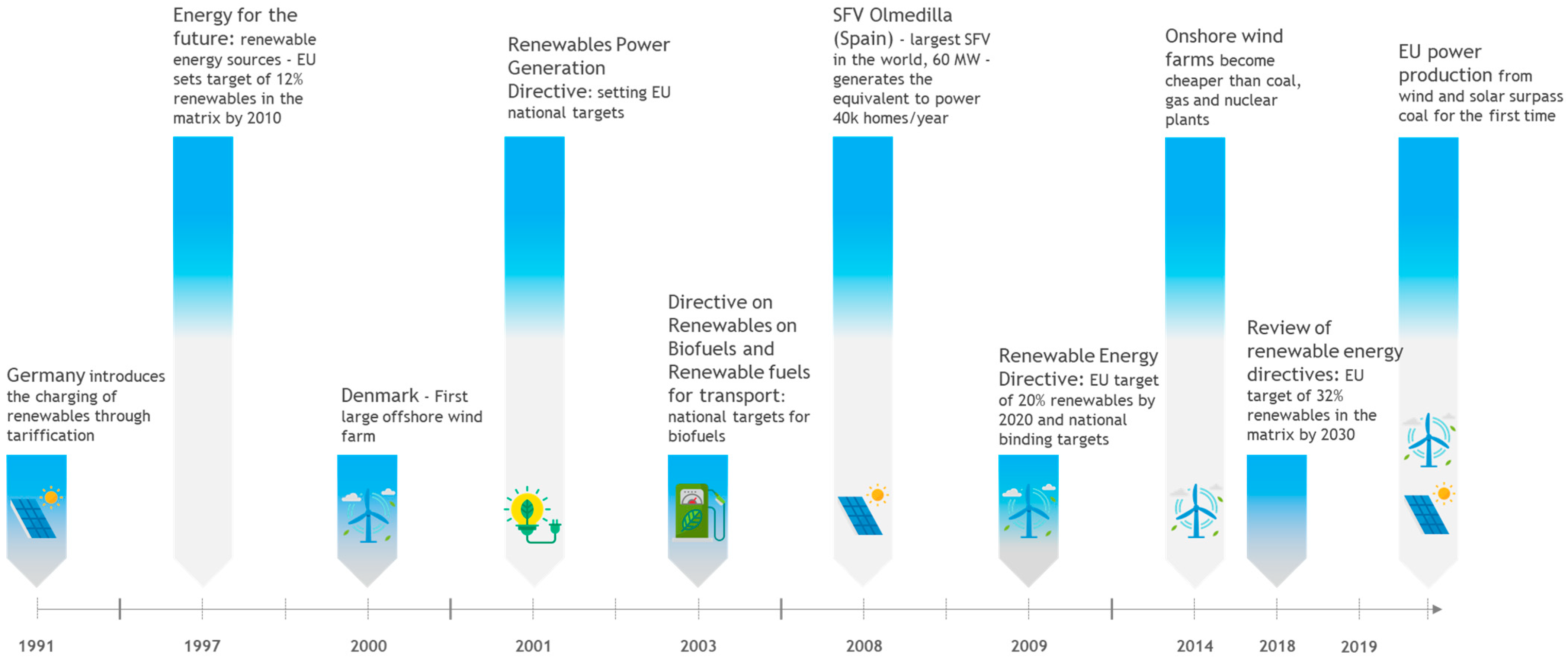

Figure 1 illustrates the chronology of incentives through packages and projects related to renewable energy in the European Union.

Additionally, the lack of normative conceptualization about the dual operation of ESSs makes the solution often treated as traditional power generation or load systems, making it challenging to implement energy storage solutions. To overcome these obstacles, the European Union (EU) must collaborate with Member States to create a clear regulatory framework, develop appropriate infrastructure, provide financial and tax incentives, and raise awareness of the added benefits of ESSs.

3.1.1. European Regulatory Framework for Clean Energy

The EU electricity sector has been a focus of various initiatives to increase renewable energy sources’ share in energy generation, all of these by means of normative instruments such as the Directives and Communications of the European Parliament, which set targets for renewable energy sources in energy generation and provide mechanisms to achieve them. Other initiatives include Energy 2020, Energy Roadmap 2050, the Clean Energy Package for all Europeans, the Renewable Energy Directive (EU)2018/2001 [

12], the Common Rules for the internal electricity market (EU)2019/944 [

13], the European Green Deal, and the European Climate Law (2020) [

14].

The EU is committed to transitioning to renewable energy sources and energy efficiency, and these regulatory initiatives are crucial to achieving this goal. The “Technical Report—Study on Energy Storage—Contribution to the Security of Electricity Supply in Europe” (EU, 2020) identified barriers to the integration of small and large-scale energy storage solutions (BTM: behind-the-meter and FTM: front-the-meter) in the European electricity sector, such as the lack of conceptualization, legal provisions for hybridization, public support, and coherence between Member States about policies. The report also presents characteristics, facts, and practices related to public support, regulation, the energy market, ancillary services, grid connection aspects, taxes, fees, operator involvement, barriers, and best practices derived from a survey of Member States on the status of procurement of small and large-scale BTM and FTM energy storage solutions [

15,

16].

Spain

Spain has planned to develop short-term auctions for co-located energy storage systems with solar-photovoltaic energy. The government considers 6 GW of storage, with 3.5 GW for pumping and 2.5 GW for batteries. However, Spain’s regulatory framework lacks regulation for ESSs, limiting storage agents’ participation in ancillary services markets and exposing them to double charging of network access tariffs.

Double charging is a highly counterproductive obstacle for the storage business, as it financially penalizes the storage agent by charging the ESS twice, understanding that when it is charged, it behaves like a consumer, and when it is unloaded, it behaves like a generator.

At the end of May 2023, the Ministry for Ecological Transition, through the resolution called Orden TED/567/2023, instituted the regulatory sandbox environment for the promotion of research and innovation in the Spanish electricity sector to evolve towards a regulatory framework that welcomes new technologies for the generation and consumption of electricity, which includes the BESS.

The following subtopics present the regulatory advances made by some European member states, except the UK, strongly influenced by the recent Clean Energy for All Europeans, the European Green Deal, and the 2020 European Climate Law packages.

It should be noted that the initiatives introduced by these packages establish binding targets and commitments for EU member states about clean energy, climate neutrality, and sustainability. Member states are therefore obliged, without prejudice to flexibility mechanisms (“opt-out clauses”, which allow certain member states to choose not to participate in certain EU policies or decisions in specific areas), to take measures and implement policies in line with the agreed objectives to fulfill their obligations within the EU [

17].

UK

The UK already has a regulatory framework for power generation, which has been amended to add the definitions of “energy storage” and “energy storage facility” to provide regulatory clarity on the treatment of energy storage within the current framework.

For new license applications, licensees operating or owning electrical energy storage facilities must provide information (oversight) to their suppliers to support the correct calculation of fees.

In 2019, the government launched, in the scope of an R&D action, the “Storage at Scale” contest to fund innovative large-scale electrical energy storage solutions. This competition sought innovative, replicable large-scale energy storage solutions that could provide a market-competitive alternative to conventional commercial large-scale energy storage technologies, such as pumped hydro or batteries (such as lithium-ion, lead acid, or sodium-sulfur). Two successful projects won together almost GBP 20 million. The competition ended after operational testing in December 2021.

Electricity storage is included in the National Energy and Climate Plan (2019), with the pressing challenge of discussing proposals for issues such as double charging. However, existing regulatory loopholes may expose storage agents to double charging of final consumption fees; in addition, current policies do not address the ownership and operation of storage by network operators.

Some distribution network operators are at the forefront of creating flexible markets where electrical energy storage can solve their NWA (non-wire alternatives) actions.

Greece

In 2019, in Greece, a public consultation was promoted to create a new regulatory framework for the installation, operation, and pricing of these DERs in electricity transmission and distribution (T&D) networks. The high penetration of intermittent renewable energy sources has convinced the regulatory authorities that using ESS is essential to guarantee generation in an economically viable way. Consequently, in 2020, they authorized a complete regulatory framework for the operation of ESSs in the energy market, along with simplified administrative procedures.

For one thing, market participation is voluntary by default but mandatory in state aid cases. The market, for example, has three products for balancing capacity: frequency containment reserve (FCR), automatic replacement reserve, and manual replacement reserve. Storage’s share of the Greek energy market could yield around EUR 100,000 per megawatt-hour per year if it participated in the frequency containment reserve (FCR).

Regarding co-location with intermittent renewable sources, with a solar irradiance 50% greater than that of Germany, Greece has excellent possibilities for several energy storage projects co-located with PV, including on a utility scale, commercial and industrial distribution, and microgrids.

The Greek ministerial decision for the auction scheme was under consultation by means of a public consultation [

18] launched on 23 September 2023, considering three auctions scheduled to award 1000 MW by 2025. The first auction took place in June 2023, with a minimum duration of 2 h [

19]. The second auction will take place in Q3 2023, with a minimum period of 2 h. The third auction will be held in Q4 2023, with a minimum duration of 4 h. All projects must be operational by the end of 2025.

The geographical distribution of the auctions is limited to 300 MW in the same regional unit. The bidding date is expected within 6–8 weeks of the announcement date. The offers are in single-stage bidding in EUR/MW/year, with a one-off CAPEX support set at 200,000 EUR/MW. Two guarantees of at least 200,000 EUR/MW are required for capex support. The competition level has been increased to 100%, with a maximum project size of 100 MW and a maximum share per company/group of companies at 25% of the auction volume.

Against this excellent status, however, investor certainty and the economic situation, particularly post-pandemic, are still challenging aspects of market development.

Finland

Finland’s government investment program, Energy Aid, offers co-financing for low-carbon energy projects, including battery storage facilities, but storage costs cannot exceed 50% of total costs. By doing this, Finland tried to double public funding for clean energy innovation by 2020, which required active participation in Set-Plan’s key action No. 7 on battery recycling.

Another fact is that the energy storage regulation in Finland is not specific, with small-scale BTM batteries for residential and commercial applications only needing approval in city planning. In contrast, large-scale FTM storages involve more steps for approval, but permission for large-scale projects also includes public audiences as part of the licensing procedure.

In 2018, BESS began providing FCR (frequency containment reserve, the primary frequency control scheme correspondent in the European energy market), while loads could provide FRR (frequency restoration reserve, the secondary frequency scheme). Fingrid just conducted a pilot to allow independent aggregators to participate in the FRR balancing market, with a minimum duration until the end of 2019. Storage in ancillary services is only permitted for applications not related to frequency support. The current ESS regulatory framework in Finland has not adequately conceptualized storage, resulting in double charging of network dues [

20].

Denmark and Norway

Denmark and Norway have energy policies targeting short-term heat storage applications, allowing combined heat and power (CH&P) producers to balance CH&P supply and demand. However, the ESS policy is not comprehensive. Energinet, the national electricity and gas TSO (transmission system operator) serving the electricity grid in these countries (Denmark and Norway), has included the ESS in its expansion planning through 2035, expecting ESSs to play a role in short-term flexibility coupled with gas storage. The Danish government recognizes the importance of ESSs to meet future needs and has established funding for ESS development and demonstration projects. In this way, the Danish Energy Research (NER) has identified seven key areas to improve joint Nordic research efforts, including the ESS.

The rise of intermittent renewable energy sources has increased the demand for electrical energy storage solutions, and BESS is expected to play a significant role. The current regulatory status allows ESS devices, including BESS, to participate in energy markets, and TSO Energinet has published specific grid codes for battery connection and access. However, agents with ESS applications are considered ordinary consumers with no exemption from taxes and fees.

The Danish government aims to enable diverse ESS applications to decarbonize the energy supply through ambitious plans, such as the deployment of more than one million green cars by 2030 and a new gas strategy. Both countries argue that energy storage, primarily through batteries, is crucial to the green transition and ensuring sufficient energy supplies.

Ireland

In Ireland, a micro-electricity pilot scheme was launched in July 2018 to support photovoltaic generation (PV) and home-BESS systems for end consumers. Large-scale FTM ESS (mainly reversible hydropower plants) are restricted to supporting the heating and transport sectors. Also, policies related to small-scale BTM ESSs should be developed to facilitate self-production. A regional approach for strategically located BESS installations for congestion relief is also proposed.

ESSs possess the entitlement to engage in energy markets, depending on the technology used. Energy storage facilities can participate in what is known as the Irish Capacity Remuneration Mechanism (CRM), which addresses timing factors related to when the storage system is operational. In Ireland, there is no practice of compensation systems, whether measuring (“net metering”) or billing (“net billing”).

Overall, energy storage regulation in Ireland is still evolving, and trends are moving towards using ESS technologies with legal certainty for end consumers and supporting the transition to a decarbonized energy supply. However, as in other Member States, Irish regulatory policy also does not distinguish between generation technologies and ESS, leading to the same problems discussed regarding double charging.

Germany

Germany increasingly integrates ESSs into renewable energy plants to absorb excess electricity during high supply periods and avoid power generation shutdowns.

Market incentive programs are being invested in supporting these systems; for instance, the new Federal Battery Law modernizes Directive 2006/66/EG on batteries and accumulators and the Federal Emissions Control Act and Building Code, which also include storage system facilities.

Energy accumulations by reversible hydroelectric and batteries can participate individually or by aggregation, with direct participation limited to 1 MW. CH&P plants increasingly use thermal storage to capitalize on electricity price volatility, and grid users combine PV systems with local storage to increase self-consumption from 30% to 80%, driven by low feed-in tariffs.

In terms of participation in the frequency market, reversible hydroelectric systems can provide primary frequency control and secondary frequency control, while BESS can only provide the primary one.

Germany’s energy storage regulation has been strengthened recently to encourage integrating renewable energy into the energy system and drive the energy transition.

Table 1 below summarizes, in terms of the status of the regulatory framework, market participation, challenges and initiatives, strengths and weaknesses, the regulatory environment of the European countries addressed in the present work.

3.2. USA

The North American electricity sector has regulatory deconcentration since it has different entities (operators and agencies) with varied competencies, defining norms for exploration, production, transport, etc. Federal agencies, for example, have played a prominent role in the US regulatory scenario.

For a better understanding of the North American regulatory status, it is necessary to understand the energy storage policy within a historical context, as

Figure 2 shows a timeline starting in 1978.

Policy development has consistently fueled reform in the risk-averse and slow-moving utility sectors. The beginning of the search for Federal regulation regarding ESS in the US dates to 2009, with the US DoE investing USD 35 billion in smart grids, renewable sources, and energy efficiency.

Effectively, the FERC (Federal Energy Regulatory Commission) Directives 755 and 784, between 2011 and 2013, directly addressed the ESS in their texts in the context of market regulation. As of 2018, however, FERC Directives 841 and 845 have come to break down technical and market barriers to create the first conditions for the legal reception of ESS by States [

22].

Important points about the Facts of FERC Directives 841/2018 [

22]:

RTOs (regional transmission operators)/ISOs (independent system operators) must: (a) remove barriers to ESS participation in wholesale markets; (b) establish rules that open capacity, energy, and ancillary services markets for ESS; and (c) review tariffs and establish a participation model for ESSs that recognizes their particular physical and operational characteristics.

Preliminary approval of the plans of the RTOs PJM (Pennsylvania–New Jersey–Maryland Interconnection) and SPP (Southwest Power Pool) for hosting the ESS in their districts.

Defines the minimum ESS size requirements.

Does not address many important issues: DERs, interconnection, ESS as transmission (virtual power lines), and multi-technology capabilities (hybrids);

Provides for the full implementation of independent system operators (ISOs) by 2022.

The primary purpose of FERC Order 845 was to revise generator interconnection contracts and procedures to remove uncertainties and provide greater transparency in the interconnection processes for generators above 20 MW. Embedded in the directive are concepts and clarifications that enable the definitions of FERC Order 841, which removes barriers to the participation of energy storage systems (ESS) in US electrical networks. Here are some significant points about the Facts of FERC Directives 845/2018 [

23]:

The definition of “Generating Plant” was also changed to include ESS, even considering that storages are assets that also consume energy from the network.

Allows generator agents to add ESS to an existing installation.

Ensures that if a generation owner has “surplus interconnection”, he can request an accelerated interconnection process to use the surplus, adding ESS, for example, or even transferring this surplus to a branch.

FERC refused to define standards for modeling ESS assets in the interconnection process, leaving it up to RTOs/ISOs to do so.

Amid the SARS-CoV-2 pandemic, FERC Directive 2222 (2020) and its complement, 2222-A (2021), allowed DERs to participate alongside conventional resources in regional wholesale markets organized in clusters of DERs via agent aggregators, in addition to complementing FERC Order 841. Facts about FERC Directives 2222 and 2222-A [

24,

25]:

ISOs must allow: (a) DER aggregations to participate directly in ISO markets and establish DER aggregators as a type of market participant and (b) DER aggregators to register aggregations under one or more participation models that accommodate the physical and operational characteristics of the aggregations.

Establish a minimum size requirement for DER aggregations.

Define market share agreements for DER aggregators.

Coordinate negotiations between the aggregator agent, distributor, and retail regulatory authorities.

Demand side management (DSM) actions are defined as a category of DER;

Heterogeneous aggregations (FV-DSM, WIND-ESS, DSM-ESS, PV-ESS, among other combinations) are now allowed.

North American regulatory agencies have federal regulations, as mentioned above, but also state ones, which are intended to compose retail market rules, distribution rules, and utility fees.

Throughout development and federal regulatory changes, ESS integration in state regulation was reflected. Work [

21] points out the regulatory status for hosting ESS within the scope of the American States (50) and Territories (6), showing the current practices of these fifty-six federative entities. Of these states, ten have started their regulatory processes to include ESS in their electrical matrices: Arizona, California, Hawaii, Illinois, Maryland, Massachusetts, Nevada, New Mexico, New York, and Oregon.

Among the analyzed states, the cases of California, Massachusetts, Nevada, and New York stand out, whose main points of the ESS regulatory framework are presented below, together with a summary table of the most relevant regulatory set:

Definition of ESS and redefinition of the technical-regulatory terminology put in place to contemplate the ESS.

Forecast of hybrid PV-BESS arrays, referred to as “Paired” PV-ESS;

Authorization for prosumers with an ESS portfolio to migrate to aggregator communities;

Deals with the “Dual-Use” of generation combined with ESS managed by the distributors;

Provision for reimbursement of connection costs for prosumer users of the compensation system who decide to hybridize their portfolio with ESS (a new law has ended the incentive for future contracts);

Authorization for distributors to deploy and operate their own ESS resources to enable NWA;

Regulation of the use of ESS resources and DSM actions to reduce demand peaks in distribution systems;

Encouraging electricity and natural gas distribution companies to employ ESS as part of their internal energy efficiency policies;

Authorization of ESS BTM applications for consumers to adhere to energy efficiency programs;

Definition of targets for distributors, referring to the use of ESS to reduce demand peaks and increase capacity;

Network export restrictions for consumers participating in credit compensation systems (net metering) as users of FV solutions paired with ESS (FV-BESS, for example).

Table 2 lists the essential regulatory documents that define the current US framework.

3.3. Australia

Storage regulation in Australia has reached an advanced stage, driven by the “Rule Determination on Integrating Energy Storage Systems into the NEM—National Electricity Amendment Rule 2021” document from the Australian Energy Market Commission (AEMC) [

26]. This important document is the roadmap to facilitate the entry and continued operation of storage and hybrid facilities in the Australian national electricity market, thereby creating an ecosystem conducive to efficient market share. Notably, the rules compiled in this legislation bring about a transformation in the structure of non-energy costs while at the same time establishing technical and market compliance requirements. While the document in question does not purport to cover the full range of storage regulatory issues in Australia, it does represent a significant step forward in the legal certainty and effectiveness of the energy storage business.

Regarding BESS, the document proposes essential changes in the industry, inaugurating an era of greater participation for small and large-scale batteries. These innovative reforms seek to level the playing field, ensuring parity among all participants in the face of recovering non-energy costs. The result expected by AEMC is one in which generator or storage customers can experience investment returns.

The issue of double billing of storage participants was addressed by maintaining the existing structure but making it possible for transmission-connected storage to be connected under an agreement with a negotiated price or to choose a prescribed service with a corresponding transmission system usage fee. AEMC has not required storage to automatically pay network tariffs, including the prescribed TUOS (transmission use of the system) charge, allowing for providing services, including ancillary services, power services, power support agreements, export tariffs, frequency response mode, and system security of critical services, with reasonable cost effectiveness.

With the current storage regulatory landscape, Australia is positioned at the forefront of the storage revolution, propelling the country toward an effective energy transformation.

3.4. Canada

Regarding Canada’s status, Ontario and Alberta are the two most advanced provinces in the regulatory acceptance of ESS. The [

27,

28] documents record comments and consultations on regulation, legislation, and authorization documents from Alberta Electric System Operator (AESO) and Ontario Energy Board (OEB) that are representative in presenting the status of the matter.

Thus, as far as Alberta is concerned, stakeholders generally have an interest in: (a) Clarifying whether the abandonment of the capacity market and the review of the exclusive energy market affect the activities or schedule of the energy storage roadmap, as well as how tariff assets are being considered to participate in the exclusive energy market project; (b) Consider a method to ensure that changes made to the authorization documents have sufficient flexibility to allow for the incorporation and operation of the evolving nature of energy storage and other technologies in the Alberta Interconnected Energy System (AIES) and also clarify how the Alberta Utilities Commission (AUC) and the Department of Energy (DOE) will be involved in the delivery of the energy storage roadmap, ensuring alignment of proposed solutions, particularly in the short term; (c) Work with other stakeholders to identify policies, legislation, or regulatory changes to support energy storage integration, including better understanding whether energy storage as an option for delay/mitigation of transmission investments (NWA) is within the scope of the long-term energy storage roadmap, including issues of ownership, market share, etc.

For Ontario, with more emphasis on the storage and technical-operational markets, the following regulatory commentary is available: (a) The Ontario Independent Power System Operator (IESO) will review and modify its Market Rules, where possible, to clarify the division of storage resources in markets managed by this operator; (b) The Ontario Energy Board (OEB) should review its grid codes to consider participation in energy storage and its regulatory framework, including processes and requirements for connections, so that the storage can provide BTM services and at the distribution and transmission (FTM) levels, for the provision of various services to different network domains; (c) The Government of Ontario should consider the role of energy storage as part of new legislation and regulations, as well as amendments to existing legislation and regulations, including Ontario Regulations 124/02 and 442/01 relating to the charging of gross income and tariff protection plan surcharge for rural and remote areas; (d) The OEB will consider the application of charges and the setting of tariffs as initiatives foreseen in its Business Plans, in order to identify the necessary regulatory interventions to facilitate the integration of DERs, including storage; and (e) The IESO should lead discussions with the storage community to better understand the breadth of wholesale market services that energy storage can provide and how to integrate these into markets currently managed by the IESO.

3.5. Latin America

As in some emerging countries worldwide, regulation of energy storage in most Latin American countries is under development. Energy storage regulations are starting to emerge across the region. Chile and Colombia, however, stand out as pioneers in discussing the use of energy storage in their power systems.

3.5.1. Chile

The legal regulation of ESSs in Chile is very advanced. In 2016, the General Electricity Services Law was published, which specifically addresses this issue, facilitating the participation of these technologies in the country’s energy markets and reducing the need for inadequate interpretation of regulations. The law also stipulates free access to transmission facilities if the technical and economic conditions are not discriminatory for all users [

20].

According to the National Electricity Coordinator (CEN), free access consists of the right of an interested party to connect to any transmission facility connected to the electricity grid. This principle is like that used in the Brazilian model. The National Electric Energy Commission (CNE—Comisión Nacional de Energía) determines the remuneration of transmission installations, which is calculated every six months and divided based on the projected energy billed in each system.

Although the plants do not reimburse the transmission networks, the facilities are built for the exclusive use of the users themselves. A significant challenge for the transmission sector is enabling the rapid commissioning of plants with intermittent power generation, such as wind and solar power, compared to commissioning the transmission system. To this end, Chilean regulations provide for developing energy-generating centers whose network structure must be planned and designed to meet future needs and promote market competitiveness.

ESSs can help alleviate congestion in renewable energy transmission and contribute to variable renewable energy (VRE) source designs by improving control of power injections into the grid. The company AES Andes announced that it would more than double its storage capacity in Chile in the next two years, adding 112 MW of battery storage and another 188 MW in various projects [

29,

30,

31].

3.5.2. Colombia

Resolution 098 of 2019 by the Energy and Gas Regulation Commission (CREG) of Colombia began to regulate and use the ESS in the national electricity system, including mapping needs, project implementation, proposal selection process, remuneration, the quality of electricity, and guarantees. This regulation aims to mitigate the problems caused by the lack/inadequacy of electricity transmission networks in the national electricity grid [

32].

In July 2022, CREG published Resolution 101.023 of 2022, which specified the quality-of-service (QoS) requirements for electrical energy storage systems (EESS) approved in CREG Resolution 098 of 2019. This new regulation includes articles on the scope of application, EESS’s quality of service to meet the needs of the National Transmission System (SNT—Sistema Nacional de Transmisión) and the Regional Transmission System (STR—Sistema de Transmisión Regional), compensation for non-compliance with targets, unplanned events, limits on amounts to be compensated, maintenance programs, and other measures. The resolution entered into force on the date of its publication [

33].

4. International Incentive and Subsidies Status on BESS Deployment

In the subsections of this section, the leading financial incentive programs (FIs) surveyed in the international scenario were mapped and presented in descending order of the volume of incentives raised by the survey.

4.1. USA

The United States had the highest number of BESS and BESS FTM implementation incentives. The following stand out as significant sources of incentives at the federal level:

The Investment Tax Credit (ITC): The ITC offers a 30% tax credit for residential and commercial solar energy systems, whether combined with energy processing [

34].

The Energy Storage Tax Incentive and Deployment Act (ESTIDA): ESTIDA proposes a tax credit for ESSs to deploy 35 GW of energy storage by 2025. ESTIDA is defined in HR 1684 [

35].

The US regulatory framework, however, is quite complex. This is due to the significant autonomy that States have in formulating their regulatory frameworks for thematic energy. At the state level, the Public Service Concessionaire Commissions (PUCs), the State Legislature, and the State Executive have the autonomy to define regulatory policy and incentive plans, as shown in

Figure 3. The result is dozens of incentive plans at the State and Federal levels.

Forty-six state incentives were identified throughout the survey, distributed across the US federal units, and classified as shown in

Figure 4,

Figure 5 and

Figure 6.

The following are some brief descriptions of nine US statewide financial incentives,

Table 3, accessed in the survey in the context of BESS facilities, hosted in the database [

28]:

Property Tax Exclusion for Solar Energy Systems and Solar Plus Storage System (PTESE4S) is a California property and/or territorial tax incentive. It includes qualified solar energy systems: thermal storage, space heating, heliothermic, and photovoltaic, collocated with BESS Li-Ion. Solar pool heating systems and solar hot tub heating systems are not eligible.

Sales and Use Tax Exemption for Electric Power Generation and Storage Equipment (SUTEEPG) is a California purchase tax incentive. Subsidies only apply to co-located storage with small renewables or other innovative technologies aligned with reducing or mitigating the carbon footprint. It is outside the scope of SUTEEPG to generate energy from nuclear power plants, large hydroelectric plants, or fossil fuels, except when used in cogeneration. The normative instrument AB 1817 of 2018 created the SUTEEPG incentive program.

Energy Storage Tax Credit (ESTC) is a Maryland personal tax credit. The State of Maryland offers the ESTC to taxpayers who install ESSs on their residential or commercial properties. Taxpayers must apply to the MEA (Maryland Energy Administration) for a tax credit certificate, which qualifies them for the incentive. The MEA will award up to USD 750,000 (USD 300,000 for residential taxpayers and USD 450,000 for commercial taxpayers) in energy storage tax credits each year on a first-come, first-served basis while funding is available. Eligible applicants will be placed on a waitlist if any of the reserved funding allocations are oversubscribed.

Energy Storage Sales and Use Tax Reimbursement (ESSUTR) is a Maine purchase tax incentive. In May 2022, through the normative instrument LD 2030, the State of Maine enacted the ESSUTR to encourage the acquisition of BESS. Eligible systems are those with a capacity equal to or greater than 50 MW and located in a single location in the state. Purchases made on or after 1 January 2023, and before 31 December 2025, are eligible, and refund requests can be filed within three years of payment.

Tax Credit for Residential Energy Storage Systems (TCRESS) is a Colorado personal tax credit. Homeowners looking to purchase BESS in Colorado are entitled to TCRESS. The tax credit is charged directly at the point of sale, where the buyer receives a 10% discount, while the seller will apply for the government credit.

Solar + Storage Rebate Program (S+SRP) is an Oregon discount program. Incentives are available for residential co-located BESS with PV systems, and rebates are paid to the contractor who installs the equipment, as approved by the program, not directly to the customer. The normative instrument H.B. 2618 of 2019 established the S+SRP program in Oregon, allocating USD 2 million for the State Department of Energy to administer.

Sales Tax Exemption for Energy Storage Systems (STEESS) is a Colorado purchase tax incentive. The STEESS is also available to homeowners who wish to purchase BESS in Colorado, but unlike the TCRESS credit incentive, it is completely tax-free for the purchaser.

Renewable Energy and Energy Storage Property Tax Exemption (REESPTE) is a South Carolina property and/or territorial tax incentive. The state of South Carolina offers, through the REESPTE program, exemption from property and/or territorial tax for owners of residences, businesses, and industries that acquire renewable energy systems with a nominal capacity of up to 20 kW-AC co-located with BESS.

Retail Energy Storage Incentive Program (RESIP) is a New York discount program. In December 2018, the New York Public Service Commission (PSC) adopted an energy storage target of 1500 MW by 2025 and a target of 3000 MW by 2030. In this context, the NYSERDA (New York State Energy Research and Development Authority) RESIP provides financial incentives for new BESS projects smaller than 5 MW (CA) that are (a) BTM applications at the end customer or (b) directly interconnected to the distribution system.

4.2. Australia

In Australia, the Clean Energy Regulator (CER) is the government agency responsible for administering regulatory policies and financial incentives to reduce carbon emissions and increase clean energy use. CER is vigilant in following up on actions to pay in the renewable energy target (RET), an Australian government program designed to reduce greenhouse gas emissions associated with the electricity sector and encourage the generation of electricity from renewable sources.

The RET allows large-scale mills and small-scale system owners to receive tradable certificates issued through an online trading platform the CER manages.

The certificates are then purchased from the retail market and sent to the CER to comply with the retailers’ legal obligations regarding the RET. This mechanism creates a market that provides financial incentives for both large-scale renewable energy plants and owners of small-scale renewable energy systems, representing an inherent subsidy to the Australian energy market and, therefore, independent of any specific incentive program.

Explicitly referring to BESS, in Australia, they are not eligible to participate individually in financial incentive programs as well as large and small-scale renewables. However, if these systems are approved to be co-located with BESS, they may be eligible.

Thus, unlike the USA, the Australian incentive programs presented below do not contemplate stand-alone applications of BESS but only co-located applications with intermittent renewable sources. The following brief descriptions are presented of three financial incentives/programs in the context of BESS facilities accessed in the Australia survey:

Smart Distributed Batteries Project (SDBP) is a New South Wales (NSW) discount program. The SDBP incentives program, funded by the NSW Government, was created to facilitate the development of a 6 MW virtual power plant (VPP) to reinforce the NSW electricity grid and reduce electricity costs. In this context, SolarHub offered a discount to approximately 650 residential and small business customers to encourage the installation of BESS. Customers should join the VPP to receive a discount based on the characteristics of the inverter-battery system. For example, a 10 kWh battery exporting up to 5 kW would be eligible for a USD 4950 rebate.

Distributed Energy Buyback Scheme (DEBS) is a Western Australia buyback-type discount program. The DEBS pricing structure was strategically defined to encourage families to use or store their solar energy generation in the middle of the day. This aims to take advantage of maximum irradiation levels. Additionally, it encourages the installation of panels that will generate electricity at the end of the day, producing more renewable energy when electricity demand is typically higher.

Home and Business Battery Scheme (HBBS) is a Northern Territory subsidy program for purchases. As a homeowner, business, or non-profit organization in Australia’s Northern Territory (NT), you can apply for a subsidy through HBBS to purchase and install battery inverters. Homeowners who own businesses can use it for their homes and businesses. The concession is available to eligible beneficiaries, regardless of the distribution concessionaire to which it is linked.

4.3. Canada

Regarding Canada, up to the current stage of the research, the following financial incentive policies were identified at the federal level [

37]:

Canada Greener Homes Initiative (Canada Greener Homes Grant and Canada Greener Homes Loan);

Green Infrastructure Programs (Energy Efficient Buildings RD&D (Research, Development, and Demonstration), Emerging Renewable Power, Clean Energy for Rural and Remote Communities, and Indigenous Off-Diesel Initiative).

However, by only referring to the Canada Greener Homes initiative, it was possible to raise details about the financial incentives granted. The programs at the core of the Green Infrastructure initiatives, although relevant and available in official repositories of the Canadian Government, are only global investments.

Then, we are showing the most relevant federal incentive programs to the current status of research in Canada:

Canada Greener Homes Grant (CGHG) is a federal subsidy program for purchases and services. The CGHG Program helps homeowners save, creates jobs across Canada for energy consultants, and contributes to the fight against climate change. Owners select their province or territory to learn more about eligibility requirements and the appropriate grant application process for their needs.

The Canada Greener Homes Loan (CGHL) is a federal personal loan. The CGHL Program differs from the CGHG only concerning the amounts involved; in terms of applying to the CGHL, only homeowners eligible for the CGHG can use the CGHL, as the CGHL is an additional financial incentive in the form of a personal loan.

5. BESS Participation Experiences in International Deregulated Energy Markets

Energy storage technologies are being increasingly deployed around the world. Recently, costs have been the most significant obstacle to deploying these assets. Still, in the case of BESS, this is changing, given the price drop of the apparatus involved in the storage system, especially batteries and inverters. Energy agencies, T&D operators, governments, economic blocks, and investors are increasingly considering the development of the potential of BESS. However, this is still within the scope of the current regulatory framework existing with conventional applications that, integrated with wind and solar, allow greater adoption of renewable energy, thereby reducing greenhouse gas emissions.

It is also notable that, besides reducing carbon emissions, energy storage has other advantages that can be leveraged even in a superficial regulatory environment. Specifically concerning BESS, the low-cost, scalable, distributed, efficient, and low maintenance. Considering the wide variety of existing ESS technologies, each with unique attributes, further expands the applications.

This traditional model of electricity regulation in most countries, however, is still very much based on synchronous generation (hydroelectric and thermoelectric), focused on serving only consumption without directly contemplating the exclusive attributes brought by the practice of energy storage.

For example, the flexibility brought to the electrical system to be able to alternate between generation and load, as when a consumer (prosumer) discharges a battery into the network during peak hours and charges the battery during off-peak hours.

For the sustainable penetration of ESSs, however, energy market participants and policymakers need to consider these flexible resource usage possibilities for this emerging energy paradigm. In this case, distributed and intermittent energy sources are increasingly prominent, which further justifies the adoption of the ESS to ensure the dispatchability of this alternative energy.

BESS are multiple-use assets that can act to reduce demand peaks, enable arbitration, increase the reliability and resilience of the network, allow compensation for the intermittency of wind and solar energy, and enable the postponement/mitigation of investments in the network. It is worth noting that these services or applications are not mutually exclusive. So, if the regulatory framework permits, the ESS can provide these services simultaneously. There are no technological barriers for a customer to install energy storage to meet on-site electricity needs during the monthly peak while using the same energy storage at all other times to gain revenue in the ancillary energy and services markets and in providing operating reserves.

This work too reviews the leading alternatives for a BESS to operate in the free electricity markets, collected from the researched international experiences. Energy storage can be used for pool price arbitrage, where electricity is stored when prices are low and sold on the grid when prices rise.

5.1. Services Provided by BESS in the Deregulated Energy Market

In the deregulated energy market, however, not only energy purchase and sale negotiations are carried out but also the so-called network services, such as the main ones listed below:

Ancillary Services: They guarantee the stability and quality of the electrical system, mainly concerning frequency and voltage regulation;

Energy Storage Services: Negotiating large-scale storage services like batteries to optimize energy use and supply;

Capacity Contracts: Guarantee the availability of energy or power for a specific period;

Demand Side Management Services: Programs to reduce consumption during periods of high demand;

Negotiation of Carbon Credits: Compensation or mitigation of greenhouse gas emissions;

Renewable Energy Certificates (RECs): Allow the purchase of energy generated by renewable sources with certificates that prove its renewable origin.

At this point, BESS’s versatility stands out when compared with conventional sources based on synchronous generators (hydroelectric, thermoelectric) and even intermittent renewable sources (wind, solar-photovoltaic). This is because the BESS can have a programmable load or source behavior when it is unloaded or loaded, allowing for stacking several network services simultaneously throughout the day and, therefore, can be thought of, even when designing it, as a source of multiple revenues, which is the concept of revenue stacking.

Revenue stacking favors the economic viability of BESS, as it allows the storage agent to compose a list of services negotiated at different prices and volatilities to create a “portfolio effect” [

38]. This further enhances the possibilities of trading this energy storage asset on the deregulated energy market with reduced risks and, consequently, more significant returns.

Worldwide experience shows that BESS can provide its bench of services for three groups of stakeholders: (a) system operators (ISO and RTO), (b) T&D utilities (utility services), and (c) final consumers (customers), which reflects this reality in the USA.

In practice, the services that BESS can trade on the deregulated energy market depend on the interconnection point of its installation in the electrical system. When connected, for example, to the grid at the transmission level, typically through large-scale applications, the BESS can negotiate support for intermittent energy sources (wind and solar), participate in tenders in the energy market through operations of purchase and sale, operate in the ancillary services market (with emphasis on services), and operate in the capacity reserve markets. When connected in distribution, BESS can provide all transmission-level services and still be traded in the NWA market to postpone/mitigate investment and support the integration of renewable energy connected to the transmission subsystem, all of which, when provided for in the country’s regulatory framework [

39].

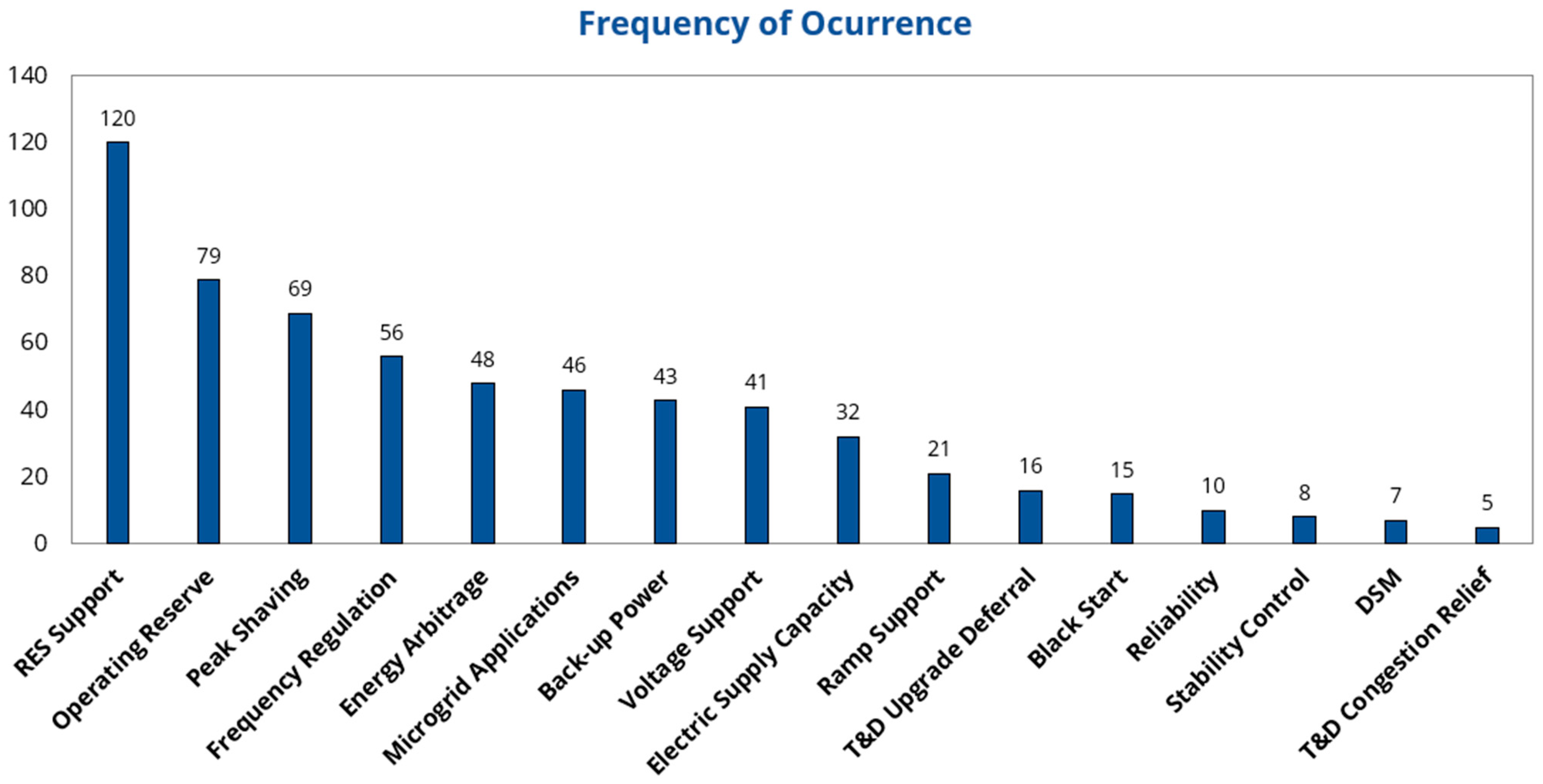

In search of a global vision of the participation preferences of BESS in deregulated markets worldwide by T&D concessionaires and IPPs (independent power producers), this research accessed the database “DOE Global Energy Storage Database” maintained by the North American Government Laboratory SANDIA. The survey was carried out in a universe of 376 BESS-type enterprises in commercial operation in 2021. These data are shown in the graphic of the frequency of occurrences of the services practiced, indicated in

Figure 6.

It can be seen from the analysis of

Figure 6 that among the five most practiced services in the energy choice markets are: RES support, operating reserve (spinning, non-spinning, and supplementary), peak shaving, frequency regulation, and energy arbitrage.

The work [

40], one of the most relevant in mapping confirmed cases of BESS performance in deregulated markets for the commercialization of energy services and network services, reinforces the research carried out in the DOE Global Energy Storage Database of Lab SANDIA. As presented in

Figure 7, among the five most popular services in energy choice markets are four of those found in the statistics carried out on SANDIA’s worldwide database, namely, in this order of frequency of occurrence: peak shaving, frequency response, RES support, and energy arbitrage.

6. BESS Regulatory, Incentive, and Market Good Practices

Having addressed the most relevant regulatory issues of essential players in the implementation of ESS around the world, namely Finland, Greece, Denmark, Norway, Spain, UK, Germany, USA, Australia, Canada, Colombia, and Chile, it is possible to list essential points to be observed when structuring a regulatory framework for storage to guide countries that wish to accept these solutions as part of their decarbonization policies and to support intermittent renewables:

To establish a regulatory definition of the “storage” asset as an asset with dual behavior in which it sometimes behaves as a load, but it is not regulatorily a load, and sometimes it acts as a source, but it is also not regulatorily speaking. Australia and the US state of California offer essential lessons in this regard.

Promoting collaboration among stakeholders. Successful regulatory frameworks require government collaboration in the executive and legislative spheres, regulatory agencies, and public service concessionaires. In Europe, the cooperation of the EU (European Union) and member states to develop a clear regulatory framework for ESSs has helped to build a comprehensive and practical regulatory framework.

Availability of financial and tax incentives. Financial and tax incentives can play a significant role in promoting the adoption of energy storage solutions. European examples: Spain, which has planned short-term auctions for energy storage systems co-located with photovoltaic solar energy, and Germany, which offers market incentive programs to support ESSs. North America, through the USA and Canada, also stands out.

Enabling the use of storage to support ancillary services. Barriers related to the integration of ESS in electricity markets include problems with the performance of ancillary services due to the lack of regulatory provisions for them. Regulators should encourage and support ESS participation in ancillary services markets to increase network stability and reliability and create a market environment for enabling the storage business.

Regarding financial incentives to boost the implementation of storage systems, with particular attention to BESS, which applies BTM and FTM applicability, it is noteworthy that the pioneering countries in the definition of incentive policies prioritized the following three types of incentives:

Tax Credits. It is granted by governments to allow individuals or companies to reduce their tax burden based on the investment made in BESS facilities. For example, the US Investment Tax Credit (ITC) offers a 30% tax credit for residential and commercial solar energy systems, including energy storage.

Purchase/Sale Tax Incentives. Which offers tax exemptions or reductions on sales or purchases of BESS equipment. For example, Oregon’s Solar + Storage Rebate Program (S+SRP) offers incentives for residential BESS co-located with PV systems through rebates.

Grant Program. In this type, governments offer direct financial subsidies to encourage the installation of the BESS. For example, the Intelligent Distributed Battery Project (SDBP) in New South Wales, Australia, offers BESS installation discounts to residential and small business customers.

Finally, referring to the participation of BESS in the energy choice market environment, the so-called deregulated market, for the purchase and sale of electricity, the research identified that the reference countries in the implementation of storage prioritized remuneration in the energy choice market through the following services, as already addressed in

Section 5.1: (a) peak shaving, (b) frequency response, (c) RES support, and (d) energy arbitrage.

7. Conclusions

The findings of the study underscore the significance of energy storage systems (ESS), particularly battery energy storage systems (BESS), as integral elements within power systems. These systems exhibit unique technical characteristics that are influenced by advanced power electronics and intricate control systems. It is noteworthy to mention that battery energy storage systems (BESS) demonstrate a dualistic behavior in terms of charge generation, which is observable during both the battery charging and discharging processes. The distinctive characteristic of battery energy storage systems (BESS) presents a difficulty in conventional categorizations, as it does not readily fit into the classification of either a load or a generator. Instead, it functions as a novel and versatile third resource.

Furthermore, this study emphasizes the valuable insights offered by pioneering nations that have successfully implemented storage systems. These lessons provide valuable insights and best practices that are essential for the effective management of risks associated with ESS business plans in emerging economies within the clean technology sector. The key aspects to be considered encompass the significance of establishing a clearly defined energy storage system (ESS) definition, fostering collaborative engagement with pertinent stakeholders, and formulating diverse incentive strategies, including tax credits, purchase/sale tax incentives, and grant programs. These measures, together with a well-planned incentive policy, are crucial to promoting interest and facilitating the smooth incorporation of ESS/BESS solutions into regulatory frameworks.

The research findings offer valuable insights into the preferences of prominent nations for services provided by storage. These nations have demonstrated the significance of deregulated markets in promoting the expansion of storage services. The potential advantages of this approach have been acknowledged, encompassing the capacity to participate in peak shaving, frequency regulation, support for renewable energy sources (RES), and energy arbitrage applications.

The aforementioned findings underscore the notable potential of energy storage systems (ESS) to induce significant transformations within the dynamic energy industry.

8. Challenges and Future Perspectives

The authors point out that there are still regulatory challenges related to the topic covered in this article but not yet addressed here, namely the sustainability and responsible management of the disposal of battery materials, especially lithium films, second use/second-life policies, recycling, and disposal. Finding a balance between expanding the use of BESS and environmental management is essential for a sustainable energy future.

Regarding the prospects, it is understood that BESS will play an important role in expanding the application of green hydrogen in electricity generation in combination with fuel cells. These technologies are not competing but complementary since the firmness of generation from fuel cells is still dependent on their association with the deterministic behavior of batteries.