Research on Oil and Gas Energy Cooperation between China and Central-North Asian Countries under the “One Belt and One Road” Strategy

Abstract

:1. Introduction

2. Data and Methods

3. Results

3.1. Present Situation of Oil and Gas Energy in Central-North Asian Countries

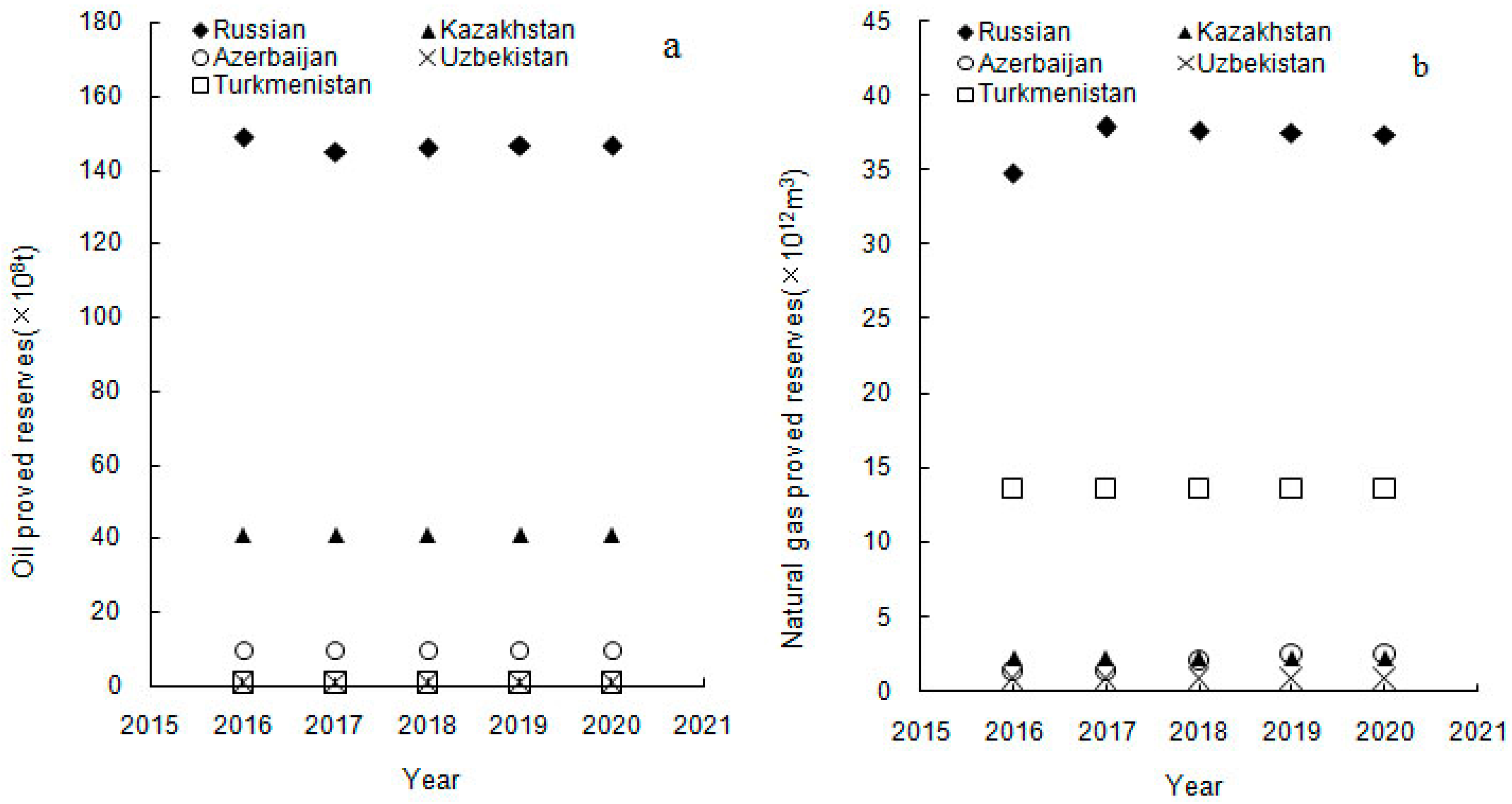

3.1.1. Oil and Gas Distribution and Production Capacity

3.1.2. Oil and Gas Consumption and Export Capacity

3.2. China’s Oil and Gas Demand and Security

4. Discussion

4.1. Oil and Gas Supply and Demand Balance

4.2. Interdependence

4.3. Oil and Gas Energy Complementation

5. Conclusions and Suggestions

- (1)

- Making full use of the platform of the “One Belt and One Road” strategy, China should strengthen and deepen its oil and gas energy cooperation with Central-North Asian countries to meet China’s demand for oil and gas energy.

- (2)

- When engaging in oil and gas energy cooperation with Central-North Asian countries, China needs to adopt a differentiated cooperation strategy.

- (3)

- China should expand the scope of oil and gas cooperation with Central-North Asian countries, and strengthen and improve the cooperation of the whole oil industry chain with Central-North Asian countries.

- (4)

- The oil and gas energy cooperation between China and Central-North Asian countries should adhere to the principles of equality, mutual benefit and win–win cooperation, so as to promote the in-depth and steady development of cooperation.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ang, B.W.; Choong, W.L.; Ng, T.S. Energy security: Definitions, dimensions and indexes. Renew. Sustain. Energy Rev. 2015, 42, 1077–1093. [Google Scholar] [CrossRef]

- Bahgat, G. Europe’s energy security: Challenges and opportunities. Int. Aff. 2006, 82, 961–975. [Google Scholar] [CrossRef]

- Le, T.H.; Nguyen, C.P. Is energy security a driver for economic growth? Evidence from a global sample. Energy Policy 2019, 129, 436–451. [Google Scholar] [CrossRef]

- Hou, M.F. Current situation, challenges and countermeasures of china’s energy transformation and energy security under the goal of carbon neutrality. J. Southwest Pet. Univ. (Sci. Technol. Ed.) 2023, 45, 1–10. (In Chinese) [Google Scholar]

- Yalta, A.T.; Cakar, H. Energy consumption and economic growth in China: A reconciliation. Energy Policy 2012, 41, 666–675. [Google Scholar] [CrossRef]

- Liu, X. Analysis for economic growth and energy. Appl. Stat. Manag. 2006, 25, 443–447. (In Chinese) [Google Scholar]

- Yang, H.X.; Zheng, X. Research on relationship of energy consumption and economic development and prospects. Commer. Era 2012, 1, 109–111. (In Chinese) [Google Scholar]

- Zhang, K. Natural gas supply-demand situation and prospect in China. Nat. Gas Ind. B 2014, 1, 103–112. [Google Scholar]

- Yang, X.M. Reflections on China’s petroleum development strategy. Mark. Mod. 2013, 25, 193. (In Chinese) [Google Scholar]

- Ji, C.W.; Zheng, D.X. Facing the challenge for China to become a net oil importer: Suggestions for re-formulating China’s oil development strategy. Intertrade 1994, 7, 23–24. (In Chinese) [Google Scholar]

- Yang, B.; Swe, T.; Chen, Y.X.; Zeng, C.Y.; Shu, H.H.; Li, X.; Yu, T.; Zhang, X.S.; Sun, L.M. Energy cooperation between Myanmar and China under One Belt One Road: Current state, challenges and perspectives. Energy 2021, 215, 119130. [Google Scholar] [CrossRef]

- Zhang, L. Energy cooperation under the framework of “The Silk Road Economic Belt”. Econ. Probl. 2015, 5, 6–11. (In Chinese) [Google Scholar]

- Cheng, L.K. Three questions on China’s “Belt and Road Initiative”. China Econ. Rev. 2016, 40, 309–313. [Google Scholar] [CrossRef]

- Hafeez, M.Y.; Chunhui, Y.; Strohmaier, D.; Ahmed, M.; Jie, L. Does finance affect environmental degradation: Evidence from One Belt and One Road Initiative region? Environ. Sci. Pollut. Res. 2018, 25, 9579–9592. [Google Scholar] [CrossRef]

- Rauf, A.; Liu, X.; Amin, W.; Ozturk, I.; Rehman, O.U.; Hafeez, M. Testing EKC hypothesis with energy and sustainable development challenges: A fresh evidence from Belt and Road Initiative economies. Environ. Sci. Pollut. Res. 2018, 25, 32066–32080. [Google Scholar] [CrossRef] [PubMed]

- Fung Business Intelligence Centre. The Belt and Road Initiative: 65 Countries and Beyond. 2016. Available online: https://www.fbicgroup.com/?q=reports&page=4 (accessed on 6 July 2023).

- Lin, B.; Bae, N.; Bega, F. China’s Belt & Road Initiative nuclear export: Implications forenergy cooperation. Energy Policy 2020, 142, 111519. [Google Scholar]

- Lin, B.; Bega, F. China’s Belt & Road Initiative coal power cooperation: Transitioning toward low-carbon development. Energy Policy 2021, 156, 112438. [Google Scholar]

- Huang, Y.P. Understanding China’s Belt & Road Initiative: Motivation, framework and assessment. China Econ. Rev. 2016, 40, 314–321. [Google Scholar]

- Zhao, Y.J.; Shuai, J.; Shi, Y.; Lu, Y.; Zhang, Z.M. Exploring the co-opetition mechanism of renewable energy trade between China and the “Belt and Road” countries: A dynamic game approach. Renew. Energy 2022, 191, 998–1008. [Google Scholar] [CrossRef]

- Kaifang, S.; Bailang, Y.; Chang, H.; Jianping, W.; Xiufeng, S. Exploring spatiotemporal patterns of electric power consumption in countries along the Belt and Road. Energy 2018, 150, 847–859. [Google Scholar]

- Hafeez, M.; Yuan, C.; Khelfaoui, I.; Sultan, M.O.A.; Waqas, A.M.; Jie, L. Evaluating the energy consumption inequalities in the One Belt and One Road region: Implications for the environment. Energies 2019, 12, 1358. [Google Scholar] [CrossRef]

- Wu, Y.; Wang, J.; Ji, S.; Song, Z. Renewable energy investment risk assessment for nations along China’s Belt & Road initiative: An ANP-cloud model method. Energy 2020, 190, 116381. [Google Scholar]

- Muhammad, S.; Long, X.; Salman, M.; Dauda, L. Effect of urbanization and international trade on CO2 emissions across 65 belt and road initiative countries. Energy 2020, 196, 117102. [Google Scholar] [CrossRef]

- Hussain, J.; Khan, A.; Zhou, K. The impact of natural resource depletion on energy use and CO2 emission in Belt & Road initiative countries: A cross-country analysis. Energy 2020, 199, 117409. [Google Scholar]

- Duan, F.; Ji, Q.; Liu, B.Y.; Fan, Y. Energy investment risk assessment for nations along China’s Belt & Road Initiative. J. Clean. Prod. 2018, 170, 535–547. [Google Scholar]

- Zhao, Y.B.; Liu, X.F.; Wang, S.J.; Ge, Y.J. Energy relations between China and the countries along the Belt and Road: An analysis of the distribution of energy resources and interdependence relationships. Renew. Sustain. Energy Rev. 2019, 107, 133–144. [Google Scholar] [CrossRef]

- Hao, W.; Shah, S.M.A.; Nawaz, A.; Asad, A.; Iqbal, S.; Zahoor, H.; Maqsoon, A. The impact of energy cooperation and the role of the one belt and road initiative in revolutionizing the geopolitics of energy among regional economic powers: An analysis of infrastructure development and project management. Complexity 2020, 2020, 8820021. [Google Scholar] [CrossRef]

- Shuai, J.; Leng, Z.H.; Cheng, J.H.; Shi, Z.Y. China’s renewable energy trade potential in the “Belt-and-Road” countries: A gravity model analysis. Renew. Energy 2020, 161, 1025–1035. [Google Scholar]

- Gao, C.; Tao, S.; Su, B.; Mensah, I.A.; Sun, M. Exploring renewable energy trade coopetition relationships: Evidence from belt and road countries, 1996–2018. Renew. Energy 2023, 202, 196–209. [Google Scholar] [CrossRef]

- Aguilera, R.F.; Inchauspe, J.; Rippler, D. The Asia Pacific natural gas market: Large enough for all? Energy Policy 2014, 65, 1–6. [Google Scholar] [CrossRef]

- Yuan, P. Research on deepening energy cooperation of Central Asian countries under the framework of “The Silk Road Economic Belt”. Res. Dev. 2014, 1, 51–54. (In Chinese) [Google Scholar]

- Zhao, Y.; Shen, L.J.; Hao, L.S. Position and evolution of the “Silk Road Economic Belt” in the world oil supply pattern. J. Nat. Resour. 2016, 31, 732–742. (In Chinese) [Google Scholar]

- Zou, C.N.; Xiong, B.; Xue, H.Q.; Zheng, D.W.; Ge, Z.X.; Wang, Y.; Jiang, L.Y.; Pan, S.Q.; Wu, S.T. The role of new energy in carbon neutral. Pet. Explor. Dev. 2021, 48, 411–420. [Google Scholar] [CrossRef]

- Zou, C.N.; Ma, F.; Pan, S.Q.; Lin, M.J.; Zhang, G.S.; Ying, B.X.; Wang, Y.; Liang, Y.B.; Yang, Z. Earth energy evolution, human development and carbon neutral strategy. Pet. Explor. Dev. 2022, 49, 411–428. [Google Scholar] [CrossRef]

- Jia, A.L.; Cheng, G.; Chen, W.Y.; Li, Y.L. Forecast of natural gas supply and demand in China under the background of “Dual Carbon Targets”. Pet. Explor. Dev. 2023, 50, 492–504. [Google Scholar] [CrossRef]

- Shi, L. Energy Channel between Central Asia and China and China’s Energy Security. Around Southeast Asia 2011, 10, 86–89. (In Chinese) [Google Scholar]

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|

| Import volume (×106 tons) | ||||||

| Russian Federation | 0.20 | 0.60 | 0.00 | N | N | N |

| Kazakhstan | 0.02 | 0.04 | 0.03 | 0.04 | 0.01 | N |

| Azerbaijan | N | 0.06 | N | N | N | N |

| Uzbekistan | 0.21 | 0.26 | 0.46 | 0.65 | 0.61 | N |

| Turkmenistan | N | N | N | N | N | N |

| Export volume (×106 tons) | ||||||

| Russian Federation | 272.20 | 252.17 | 259.83 | 269.20 | 239.20 | 230.00 |

| Kazakhstan | 49.77 | 56.68 | 58.44 | 59.65 | 57.94 | 67.61 |

| Azerbaijan | 32.48 | 30.50 | 30.10 | 27.70 | 24.80 | 27.12 |

| Uzbekistan | N | N | N | N | N | N |

| Turkmenistan | 2.48 | 1.70 | 1.05 | 0.80 | 0.68 | N |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|

| Import volume (×108 cubic meters) | ||||||

| Russian Federation | 89.9 | 88.4 | 94.4 | 91.7 | 90.4 | N |

| Kazakhstan | 70.4 | 64.4 | 102.1 | 170.3 | 134.5 | N |

| Azerbaijan | 3.1 | 21.7 | 18.5 | N | N | N |

| Uzbekistan | 18.2 | 16.1 | N | N | N | N |

| Turkmenistan | N | N | N | N | N | N |

| Export volume (×108 cubic meters) | ||||||

| Russian Federation | 2143.8 | 2296.1 | 2219.3 | 2614.2 | 2402.3 | 2471.0 |

| Kazakhstan | 152.0 | 182.6 | 282.0 | 276.3 | 214.0 | 151.0 |

| Azerbaijan | 82.7 | 91.0 | 101.9 | 121.6 | 142.3 | 189.4 |

| Uzbekistan | 102.6 | 116.5 | 133.1 | 109.4 | 27.3 | 23.8 |

| Turkmenistan | 534.0 | 591.4 | 630.7 | 644.4 | 595.6 | 352.0 |

| Year | China | Russian | Kazakhstan | Azerbaijan | Uzbekistan | Turkmenistan | World | |

|---|---|---|---|---|---|---|---|---|

| Oil | ||||||||

| Per capita supply a (×106 tons) | 2021 | 0.14 | 3.67 | 4.60 | 3.47 | 0.08 | 1.99 | 0.55 |

| Mean annual exportable volume b (×106 tons) | 2016–2021 | −452.4 | 402.8 | 72.3 | 33.4 | −1.0 | 5.7 | 38.6 |

| Mean annual export capacity c (%) | 2016–2021 | −232.9 | 72.9 | 83.4 | 88.1 | −33.8 | 46.3 | 0.9 |

| Natural gas | ||||||||

| Per capita supply a (cubic meters) | 2021 | 148 | 4798 | 1709 | 3143 | 1474 | 13148 | 523 |

| Mean annual exportable volume b (×109 cubic meters) | 2016–2021 | −121.8 | 208.9 | 15.3 | 11.2 | 8.9 | 36.6 | 20.4 |

| Mean annual export capacity c (%) | 2016–2021 | −69.84 | 32.02 | 48.46 | 47.68 | 16.24 | 55.5 | 0.53 |

| Year | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Oil | |||||

| Russian Federation | 15.48 | 13.09 | 15.42 | 15.53 | |

| Kazakhstan | 0.50 | 0.46 | 0.67 | 0.88 | |

| Azerbaijan | 0.12 | 0.21 | 0.46 | 0.05 | |

| Uzbekistan | 0.00 | 0.00 | 0.00 | 0.00 | |

| Turkmenistan | 0.00 | 0.00 | 0.02 | 0.00 | |

| Central-North Asia | 16.09 | 13.76 | 16.57 | 16.46 | |

| Natural gas | |||||

| Russian Federation | 0.62 | 0.78 | 2.56 | 7.74 | 10.16 |

| Kazakhstan | 1.13 | 4.61 | 5.19 | 5.16 | 3.81 |

| Azerbaijan | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Uzbekistan | 3.71 | 5.24 | 3.73 | 1.74 | 3.18 |

| Turkmenistan | 35.10 | 27.51 | 24.49 | 20.08 | 20.33 |

| Central-North Asia | 40.56 | 38.14 | 35.97 | 34.72 | 35.65 |

| Year | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Oil | |||||

| Russian Federation | 27.51 | 24.59 | 34.94 | 34.63 | |

| Kazakhstan | 3.92 | 3.87 | 6.28 | 6.64 | |

| Azerbaijan | 1.83 | 3.79 | 10.12 | 1.03 | |

| Uzbekistan | 0.00 | 0.00 | 0.00 | 0.00 | |

| Turkmenistan | 0.00 | 0.00 | 16.18 | 0.00 | |

| Central-North Asia | 21.27 | 19.47 | 27.84 | 26.00 | |

| Natural gas | |||||

| Russian Federation | 0.26 | 0.45 | 1.34 | 4.62 | 6.69 |

| Kazakhstan | 6.02 | 20.92 | 25.69 | 34.58 | 41.07 |

| Azerbaijan | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Uzbekistan | 30.89 | 50.35 | 46.60 | 91.55 | 92.44 |

| Turkmenistan | 57.66 | 55.81 | 51.99 | 48.36 | 93.96 |

| Central-North Asia | 12.02 | 14.49 | 13.06 | 14.73 | 18.20 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Duan, M.; Duan, Y. Research on Oil and Gas Energy Cooperation between China and Central-North Asian Countries under the “One Belt and One Road” Strategy. Energies 2023, 16, 7326. https://doi.org/10.3390/en16217326

Duan M, Duan Y. Research on Oil and Gas Energy Cooperation between China and Central-North Asian Countries under the “One Belt and One Road” Strategy. Energies. 2023; 16(21):7326. https://doi.org/10.3390/en16217326

Chicago/Turabian StyleDuan, Mingchen, and Yi Duan. 2023. "Research on Oil and Gas Energy Cooperation between China and Central-North Asian Countries under the “One Belt and One Road” Strategy" Energies 16, no. 21: 7326. https://doi.org/10.3390/en16217326