Analysis of the Suitability of the EOLO Wind-Predictor Model for the Spanish Electricity Markets

Abstract

1. Introduction

2. Materials and Methods

- European electricity markets, which for this study, were located in Spain.

- The wind-predictor model, EOLO.

- The datasets for the study.

2.1. European Electricity Markets

- The state, with its resources, only intervenes in energy transport planning.

- All activities of the electricity industry were divided into regulated activities (transport and distribution) and non-regulated activities (generation, commercialization), so that energy is available for all users.

- Any independent company can access the network for both generation and demand purposes.

- Regulated activities in network businesses are considered regulated natural monopolies, with tariffs paid by all network users.

- The regulatory commission’s responsibilities include promoting and achieving competition and supervising the transparency and independence of the system’s operation.

- The creation of calendar that establishes when and who participates in different electricity markets, as well as the amount of energy each participant can produce

- All energy producers can participate under equal conditions and with diverse bidding strategies for different electricity markets.

2.1.1. The Spanish Case

- Generation activity is made up of natural or legal persons who have the capacity to generate electricity. That electricity can be for their own consumption or for third parties. Furthermore, other activities include the set-up, operation, and maintenance of their production centers.

- Iberian Energy Market Operator (OMIE) is the distribution agent in charge of carrying out the activities of economic and technical management of the electrical system; that is, OMIE generates the supply and demand curves for the electricity market.

- Red Eléctrica de España (REE) is the transportation company that is responsible for transporting electric energy, as well as building, maintaining, and maneuvering the transportation facilities used for this activity. Furthermore, it is responsible for the operation of the electrical system, which involves balancing electricity production and consumption to guarantee the proper functioning of the electrical system so that consumers receive the electricity they need safely and securely, without the system becoming overloaded or collapsing.

2.2. Wind-Predictor Model: EOLO

- Meteorological predictions published by the Spanish State Meteorological Agency (AEMET) through the API AEMET Opendata (https://opendata.aemet.es accessed on 15 October 2022). It is important to note that the EOLO wind predictor model must replace this source of information with a corresponding one when it is used for another country. Some options to replace the meteorological information are available in Table 3.

- Data concerning the state of the electric system and the evolution of the different markets were obtained from REE’sSystem Operator Information System (e-sios) (https://www.esios.ree.es accessed on 15 October 2022) through its API. When the EOLO wind-predictor model is outsourced to another country, this information source must be replaced with a corresponding one. Some options to replace this information are available in Table 1.

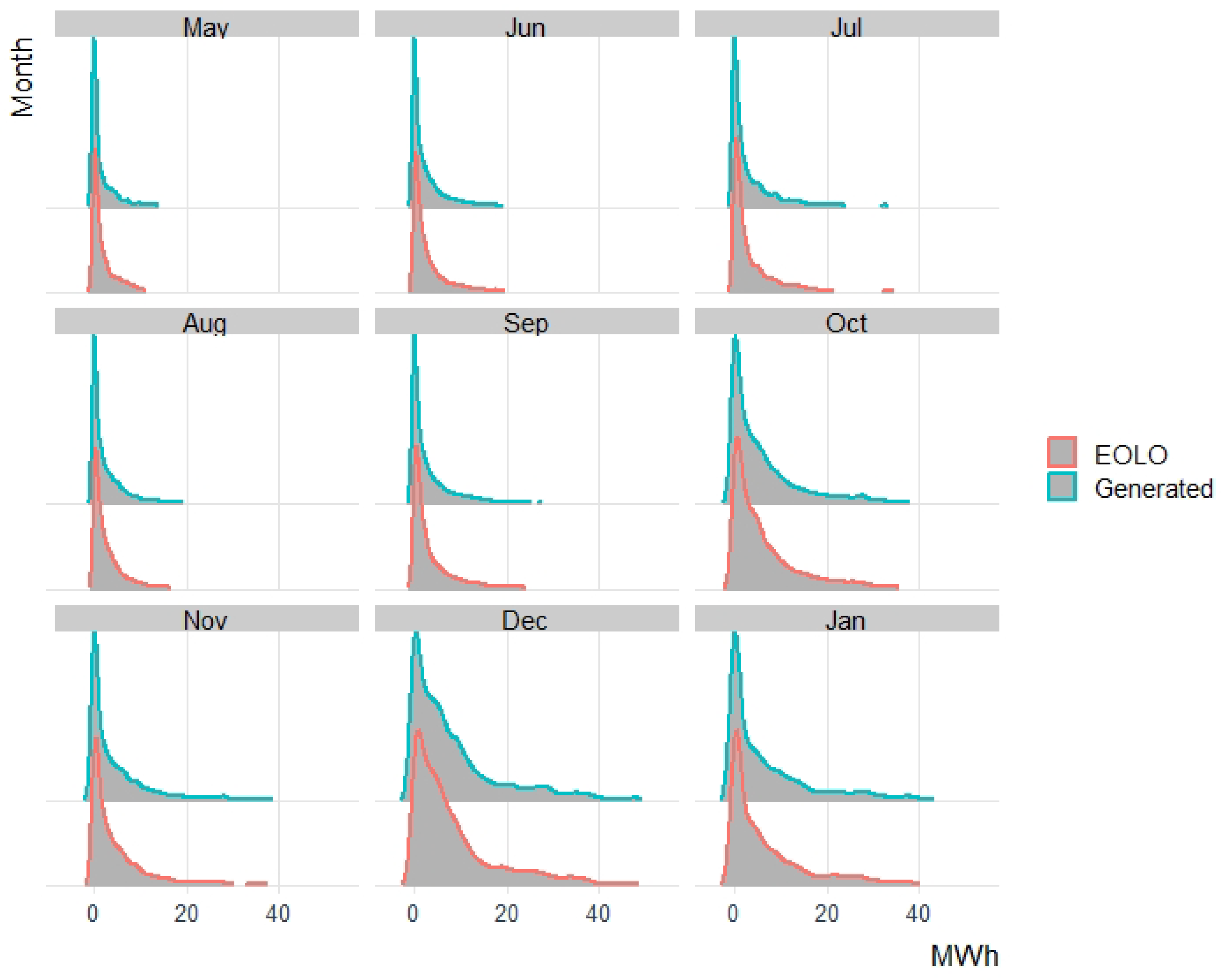

2.3. Dataset

2.4. Methodology

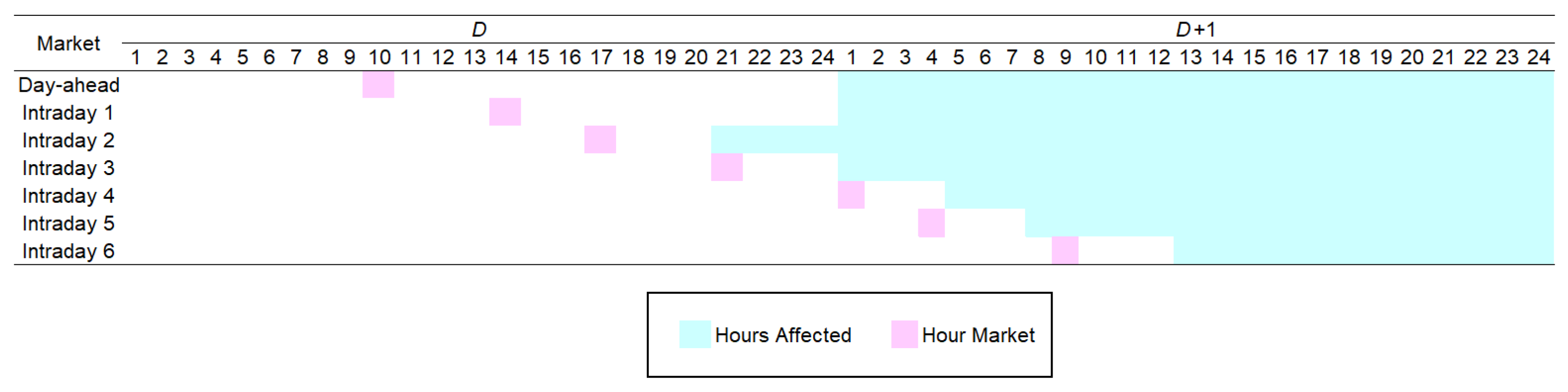

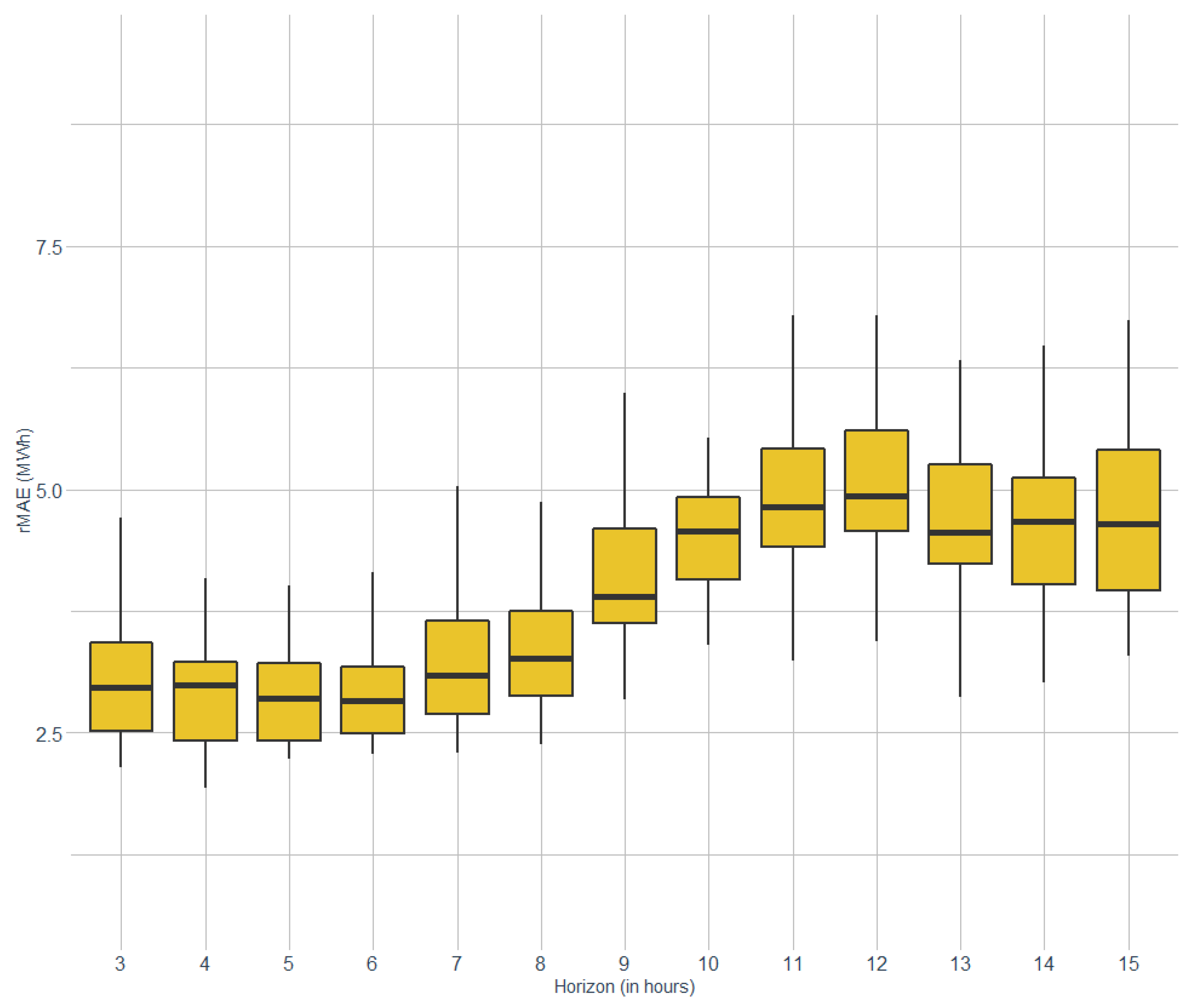

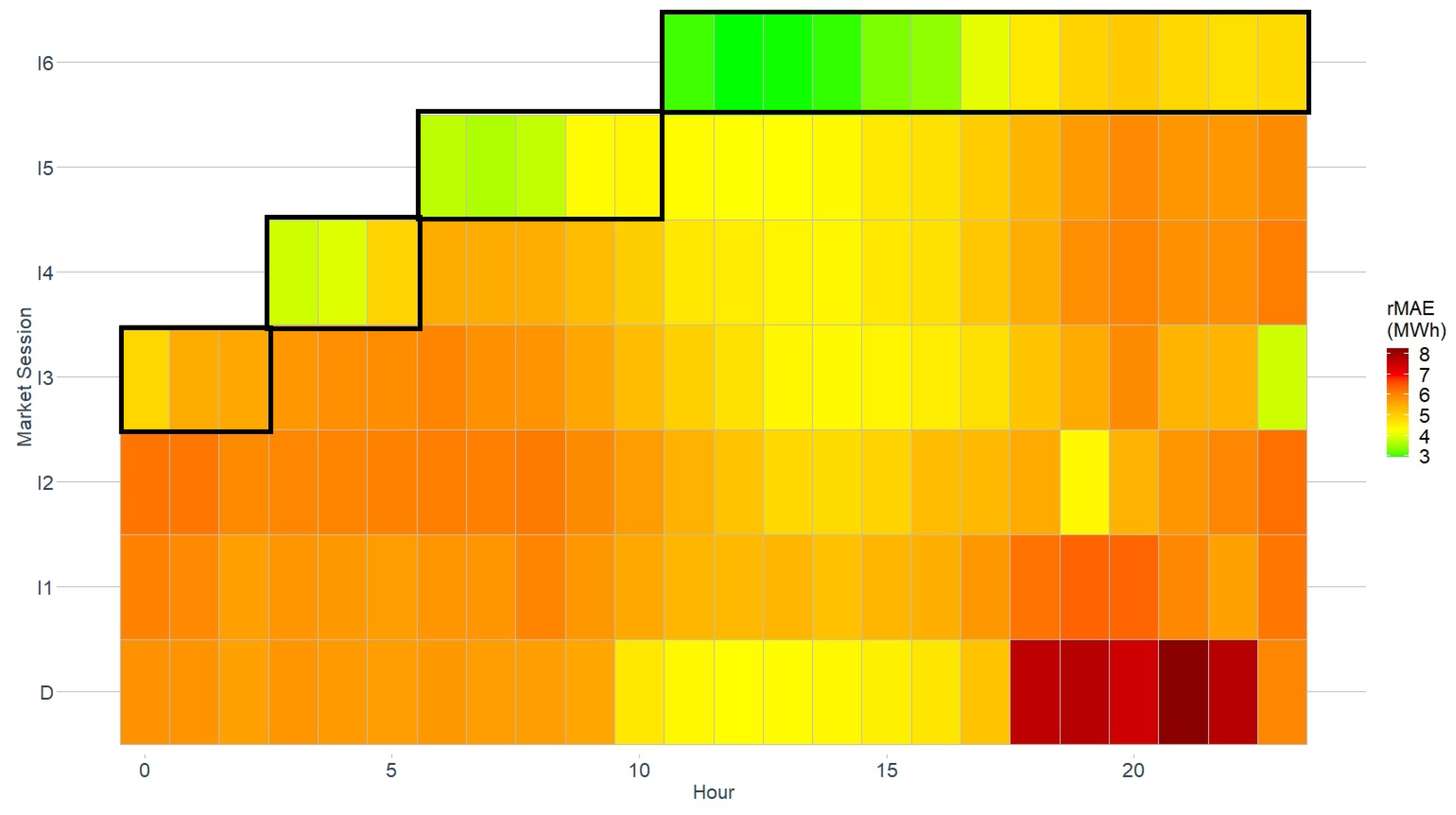

- The application of the EOLO predictor: the wind farms used in this period. These aspects are described in Section 2.3. The only criteria for the selection of these wind farms and the study period were the availability of evaluation data from a collaborative wind farm company. Detailed information about these wind farms, including their nominal power, is shown in Table 4.In [29], the EOLO predictor computed the output for all time horizons considered in different markets, including results from the second hour (the closest horizon considered in the different electricity markets, either the continuous market) up to 38th hour (the furthest horizon for the daily or day-ahead market). In this study, we have allowed the EOLO to choose the target market, either the day-ahead, 1st-6th hour intraday, or continuous market; in order to reduce its computational demands as we only computed the specific outputs for the different markets. The options are summarized in Table 2. This resulted in the EOLO providing a reduced output for the different markets (e.g., for the day-ahead market, EOLO generated the output for the horizons from the 14th to the 38th hours; or for the sixth intraday market, EOLO only generated the output for the horizons from the 3rd to the 15th hours).

- In [29], several basic predictors based on historical data are used to generate new data to feed the automatic learning models. In practical applications, the following models have been used for that purpose: (i) persistence models, which are based on the assumption that the energy produced in the future will be the same as it is now; (ii) moving average models, which are based on the assumption that the energy produced in the future is rational according to past events, which is also known as the mean value of the past productions; and (iii) meteorological models, which estimate the energy to be produced as a function of the meteorological forecast. Based on [29], these authors concluded that the proposed models were not enough to predict a long-term horizon.Therefore, we used the same models but included more variants of the moving average models to estimate the behavior of a wind farm based on the previous days. Based on all the data presented to the automatic learning models, EOLO chose variables that had the strongest association to the target in the training data. Thus, the computational cost derived from the increased input data was minimal. Furthermore, the training of the automatic learning models was only conducted when the relative correlation order between the different variables had changed.

- After the incorporation of the these improvements, the simulations were performed for the selected wind farms. In total, 210 simulations were executed, with 7 simulations for each of the 30 wind farms, one for each of the different markets (the day-ahead market and the 6 intraday markets).These simulations were performed in the Calendula cluster, a property of Castilla y León Supercomputing Center (SCAYLE (http://www.scayle.es accessed on 15 October 2022 )), where we used the Cascade Lake cluster, which was made up of 37 servers with the following technical specifications: 2 Intel Xeon Gold 6240 processors, with 18 cores each and working at a frequency of 2.6 GHz; 192 GB of RAM; and an Infiniband HDR 100 Gbps connection. In addition, this cluster had 7 NVidia Tesla V100 GPU units.For each simulation, we used 4 servers and 1 processor. With these resources, it required approximately 60 h to perform 210 simulations.

- Once all the simulations were completed, we evaluated the performance of the EOLO forecasts for the different markets. For this purpose, we used the normalized mean absolute error () as a measure of the quality of the forecasts:where refers to the measure of the production, corresponds to the predicted value, refers to the nominal power of the wind farm, and n is the total sample number of the validation set. provided an idea of the magnitude of the error concerning the magnitude of the prediction to be performed (i.e., a certain absolute error may be excellent if the magnitude of the data evaluated is greater than the error, but it can also be poor if the magnitude of the data evaluated is in the same order of magnitude). This type of error was used to compare all the wind farms without the influence of their power.

- Finally, we grouped both the forecasts obtained by EOLO and the error indices, utilizing different criteria, and we designed several graphical representations to assist in interpreting the results. Results are provided with details in Section 3.

3. Results

3.1. The Day-Ahead Market

3.2. Intraday Markets

3.3. Comparison of All Markets

4. Discussion

Limitations of the Study and Avenues of Future Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AEMET | Spanish State Meteorological Agency |

| Cecoel | Electrical Control Center |

| Cecre | Special Regime Control Center |

| CM | Continuous Market |

| Carbon Dioxide | |

| D | On day |

| The next day | |

| DAM | Day-ahead Market |

| EU | European Union |

| IM | Intraday Market |

| Normalized Mean Absolute Error | |

| NWP | Numerical Weather Predictions |

| OMIE | Iberian Energy Market Operator |

| REE | Red Eléctrica de España |

| SCAYLE | Castilla y León Supercomputing Center |

References

- Green, R. Shifting supply as well as demand: The new economics of electricity with high renewables. In Handbook on Electricity Markets; Edward Elgar Publishing: Cheltenham Glos, UK, 2021; pp. 408–427. [Google Scholar]

- Commission, E. Communication From the Commission; Technical Report; The European Green Deal: Brussels, Belgium, 2019. [Google Scholar]

- Pelau, C.; Acatrinei, C. The paradox of energy consumption decrease in the transition period towards a digital society. Energies 2019, 12, 1428. [Google Scholar] [CrossRef]

- Qué hace la UE para Fomentar el Desarrollo de la Energía Renovable? Available online: https://www.europarl.europa.eu/news/es/headlines/society (accessed on 9 January 2023).

- AEE: Wind Energy in Spain. Available online: https://aeeolica.org/en/about-wind-energy/wind-energy-in-spain/ (accessed on 15 October 2022).

- Rubin, O.; Babcock, B. The impact of expansion of wind power capacity and pricing methods on the efficiency of deregulated electricity markets. Energy 2013, 59, 676–688. [Google Scholar] [CrossRef]

- Ibargüengoytia-González, P.; Reyes-Ballesteros, A.; Borunda-Pacheco, M.; García-López, U. Wind power forecasting using Artificial Intelligence tools. Ing. Investig. Tecnol. 2018, 19, 1–11. [Google Scholar]

- Brunetto, C.; Tina, G. Wind generation imbalances penalties in day-ahead energy markets: The Italian case. Electr. Power Syst. Res. 2011, 81, 1446–1455. [Google Scholar] [CrossRef]

- Pinson, P. Estimation of the Uncertainty in Wind Power Forecasting. Ph.D. Thesis, École Nationale Supérieure des Mines de Paris, Paris, France, 2006. [Google Scholar]

- Frías-Paredes, L. Modelado Matemático de la Incertidumbre Asociada a la Generación de Energías Renovables. Ph.D. Thesis, Public University of Navarra, Navarra, Spain, 2017. [Google Scholar]

- Ley 54/1997, de 27 de Noviembre, d.S.E. Boletín Oficial del Estado, núm. 285. de 28 de Noviembre de 1997. pp. 35097–35126. Available online: https://www.boe.es/buscar/pdf/1997/BOE-A-1997-25340-consolidado.pdf (accessed on 15 October 2022). (In Spanish).

- Pollitt, M. The European Single Market in Electricity: An Economic Assessment. Rev. Ind. Organ. 2019, 55, 63–87. [Google Scholar] [CrossRef]

- Chaparro-Peláez, J.; Acquila-Natale, E.; Hernández-García, Á.; Iglesias-Pradas, S. The digital transformation of the retail electricity market in Spain. Energies 2020, 13, 2085. [Google Scholar] [CrossRef]

- Schittekatte, T.; Reif, V.; Meeus, L. Welcoming new entrants into European electricity markets. Energies 2021, 14, 4051. [Google Scholar] [CrossRef]

- Martinez-Rico, J.; Zulueta, E.; Fernandez-Gamiz, U.; Ruiz de Argandoña, I.; Armendia, M. Forecast error sensitivity analysis for bidding in electricity markets with a hybrid renewable plant using a battery energy storage system. Sustainability 2020, 12, 3577. [Google Scholar] [CrossRef]

- Banshwar, A.; Sharma, N.K.; Sood, Y.R.; Shrivastava, R. Real time procurement of energy and operating reserve from Renewable Energy Sources in deregulated environment considering imbalance penalties. Renew. Energy 2017, 113, 855–866. [Google Scholar] [CrossRef]

- Jiménez del Caso, S. Investigación de las Variables Independientes y Previsión del Precio del Mercado Diario Eléctrico. Ph.D. Thesis, Universidad de Salamanca, Salamanca, Spain, 2017. [Google Scholar]

- Gomez, T.; Herrero, I.; Rodilla, P.; Escobar, R.; Lanza, S.; de la Fuente, I.; Llorens, M.L.; Junco, P. European Union Electricity Markets: Current Practice and Future View. IEEE Power Energy Mag. 2019, 17, 20–31. [Google Scholar] [CrossRef]

- Cramton, P. Market Design in Energy and Communications. Available online: https://www.cramton.umd.edu/papers2015-2019/cramton-market-design-in-energy-and-communications.pdf (accessed on 15 October 2022).

- García-Lobo, M. Métodos de Predicción de la Generación Agregada de Energía Eólica. Ph.D. Thesis, Universidad Carlos III de Madrid, Madrid, Spain, 2010. [Google Scholar]

- Farmer, H. European Electricity Market Design. Ph.D. Thesis, University of Graz, Graz, Austria, 2022. [Google Scholar]

- Fichas Temáticas Sobre la Unión Europea. Available online: https://www.europarl.europa.eu/factsheets/es/sheet/45/el-mercado-interior-de-la-energia (accessed on 9 January 2023).

- EUENERGY. Available online: https://euenergy.live (accessed on 9 January 2023).

- Ruiz-Navarro Pinar, J.L. La Transición energética: Sus aspectos jurídicos. Rev. Las Cortes Gen. 2013, 90, 125–205. [Google Scholar] [CrossRef]

- OMIE: The Electricity Market Is Structured into a Day-Ahead Market, an Intraday Auction Market and an Intraday Continuous Market. Available online: https://www.omie.es/en/mercado-de-electricidad (accessed on 15 October 2022).

- Antonanzas, J.; Pozo-Vázquez, D.; Fernandez-Jimenez, L.; Martinez-de Pison, F. The value of day-ahead forecasting for photovoltaics in the Spanish electricity market. Sol. Energy 2017, 158, 140–146. [Google Scholar] [CrossRef]

- Iberdrola, Sostenibilidad. Available online: https://www.iberdrola.com/sostenibilidad/almacenamiento-de-energia-eficiente (accessed on 15 October 2022).

- Rivier-Abbad, J. Electricity market participation of wind farms: The success story of the Spanish pragmatism. Energy Policy 2010, 38, 3174–3179. [Google Scholar] [CrossRef]

- Prieto-Herráez, D.; Martínez-Lastras, S.; Frías-Paredes, L.; Asensio-Sevilla, M.; González-Aguilera, D. EOLO, a wind predictor based on public information. Manuscript submitted for publication.

- Prieto-Herráez, D.; Frías-Paredes, L.; Cascón, J.; Lagüela-López, S.; Gastón-Romeo, M.; Asensio-Sevilla, M.; Martín-Nieto, I.; Fernandes-Correia, P.M.; Laiz-Alonso, P.; Carrasco-Díaz, O.F.; et al. Local wind speed forecasting based on WRF-HDWind coupling. Atmos. Res. 2021, 248, 105219. [Google Scholar] [CrossRef]

- Ferragut, L.; Asensio, M.I.; Simon, J. High definition local adjustment model of 3D wind fields performing only 2D computations. Int. J. Numer. Methods Biomed. Eng. 2011, 27, 510–523. [Google Scholar] [CrossRef]

| Electricity Market | Countries | Reference |

|---|---|---|

| EXAA | Austria | https://www.exaa.at (accessed on 9 January 2023) |

| EPEX | Belgium, France, Germany, Netherlands, and Switzerland | https://www.epexspot.com (accessed on 9 January 2023) |

| IBEX | Bulgaria | https://ibex.bg (accessed on 9 January 2023) |

| CROPEX | Croatia | https://www.cropex.hr (accessed on 9 January 2023) |

| OTE | Czech Republic | https://www.ote-cr.cz (accessed on 9 January 2023) |

| GME | Italy | https://www.mercatoelettrico.org (accessed on 9 January 2023) |

| HENEX | Greece | https://www.enexgroup.gr (accessed on 9 January 2023) |

| HUPX | Hungary | https://hupx.hu (accessed on 9 January 2023) |

| Nord Pool Spot | Scandinavian and Baltic countries | https://www.nordpoolgroup.com (accessed on 9 January 2023) |

| POLPX | Poland | https://www.tge.pl (accessed on 9 January 2023) |

| OPCOM | Romania | https://www.opcom.ro (accessed on 9 January 2023) |

| SEEPEX | Serbia | https://www.seepex-spot.com (accessed on 9 January 2023) |

| OMIE | Spain and Portugal | https://www.omie.es (accessed on 9 January 2023) |

| OKTE | Slovakia | https://www.okte.sk (accessed on 9 January 2023) |

| SOUTHPOOL | Slovenia | https://www.bsp-southpool.com (accessed on 9 January 2023) |

| Session Number | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Session Opening | 14:00 D | 17:00 D | 21:00 D | 1:00 | 4:00 | 9:00 |

| Hourly periods | 1–24 | 21–24 D y 1–24 | 1–24 | 5–24 | 8–24 | 13–24 |

| Schedule horizon | 10–34 | 3–31 | 3–27 | 3–23 | 3–20 | 3–15 |

| Number of hours | 24 h | 28 h | 24 h | 20 h | 17 h | 12 h |

| Country | Meteorology Agency | Reference |

|---|---|---|

| Austria | Central Institute for Meteorology and Geodynamics | https://www.zamg.ac.at (accessed on 9 January 2023) |

| Belgium | Institut Royal Météorologique | https://www.meteo.be (accessed on 9 January 2023) |

| France | Meteo France | https://meteofrance.com (accessed on 9 January 2023) |

| Germany | Deutscher Wetterdienst | https://www.dwd.de (accessed on 9 January 2023) |

| Netherlands | Royal Netherlands Meteorological Institute | https://www.knmi.nl (accessed on 9 January 2023) |

| Switzerland | MeteoSwiss | https://www.meteoswiss.admin.ch (accessed on 9 January 2023) |

| Bulgaria | National Institute of Meteorology and Hydrology | http://www.meteo.bg (accessed on 9 January 2023) |

| Croatia | Meteorological and Hydrological Service | http://meteo.hr (accessed on 9 January 2023) |

| Czech Republic | Czech Hydrometeorological Institute | https://www.chmi.cz (accessed on 9 January 2023) |

| Italy | Servizio Meteorologico | http://www.meteoam.it (accessed on 9 January 2023) |

| Greece | Hellenic National Meteorological Service | http://www.emy.gr (accessed on 9 January 2023) |

| Hungary | Meteorological Service of the Republic of Hungary | https://www.met.hu (accessed on 9 January 2023) |

| Scandinavian | Danish Meteorological Institute; Swedish Meteorological and Hydrological Institute; Norwegian Meteorological Institute | https://www.dmi.dk https://www.smhi.se https://www.met.no (accessed on 9 January 2023) |

| Baltic countries | Estonian Weather Service; Latvian Environment, Geology and Meteorology Agency; Lithuanian Hydrometeorological Service; Finnish Meteorological Institute | https://www.ilmateenistus.ee https://videscentrs.lvgmc.lv http://www.meteo.lt https://www.ilmatieteenlaitos.fi (accessed on 9 January 2023) |

| Poland | Institute of Meteorology and Water Management | https://www.imgw.pl (accessed on 9 January 2023) |

| Romania | National Meteorological Administration | https://www.meteoromania.ro (accessed on 9 January 2023) |

| Serbia | Republic Hydrometeorological Service of Serbia | https://www.hidmet.gov.rs (accessed on 9 January 2023) |

| Spain | Agencia Estatal de Meteorología | https://www.aemet.es (accessed on 9 January 2023) |

| Portugal | Institute Português do Mar e da Atmosfera | https://www.ipma.pt (accessed on 9 January 2023) |

| Slovakia | Solvak Hydrometeorological Institute | https://www.shmu.sk (accessed on 9 January 2023) |

| Slovenia | Meteorological Office | http://www.arso.gov.si (accessed on 9 January 2023) |

| Wind Farm | Power (KW) | From | To |

|---|---|---|---|

| Farm_1 | 5500 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_2 | 28,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_3 | 29,900 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_4 | 17,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_5 | 14,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_6 | 11,900 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_7 | 21,710 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_8 | 5000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_9 | 5000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_10 | 12,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_11 | 50,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_12 | 49,900 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_13 | 36,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_14 | 50,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_15 | 30,800 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_16 | 16,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_17 | 36,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_18 | 30,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_19 | 16,900 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_20 | 18,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_21 | 30,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_22 | 21,250 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_23 | 24,000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_24 | 39,600 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_25 | 13,600 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_26 | 6600 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_27 | 9610 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_28 | 7000 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_29 | 10,800 | 31 May 2020 UTC | 28 Jan 202 UTC |

| Farm_30 | 49,500 | 31 May 2020 UTC | 28 Jan 202 UTC |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Martínez-Lastras, S.; Frías-Paredes, L.; Prieto-Herráez, D.; Gastón-Romeo, M.; González-Aguilera, D. Analysis of the Suitability of the EOLO Wind-Predictor Model for the Spanish Electricity Markets. Energies 2023, 16, 1101. https://doi.org/10.3390/en16031101

Martínez-Lastras S, Frías-Paredes L, Prieto-Herráez D, Gastón-Romeo M, González-Aguilera D. Analysis of the Suitability of the EOLO Wind-Predictor Model for the Spanish Electricity Markets. Energies. 2023; 16(3):1101. https://doi.org/10.3390/en16031101

Chicago/Turabian StyleMartínez-Lastras, Saray, Laura Frías-Paredes, Diego Prieto-Herráez, Martín Gastón-Romeo, and Diego González-Aguilera. 2023. "Analysis of the Suitability of the EOLO Wind-Predictor Model for the Spanish Electricity Markets" Energies 16, no. 3: 1101. https://doi.org/10.3390/en16031101

APA StyleMartínez-Lastras, S., Frías-Paredes, L., Prieto-Herráez, D., Gastón-Romeo, M., & González-Aguilera, D. (2023). Analysis of the Suitability of the EOLO Wind-Predictor Model for the Spanish Electricity Markets. Energies, 16(3), 1101. https://doi.org/10.3390/en16031101