Corporate Social Responsibility: A Business Strategy That Promotes Energy Environmental Transition and Combats Volatility in the Post-Pandemic World

Abstract

:1. Introduction

2. Corporate Social Responsibility: A Tool for Empowering Sustainability and Enhancing Energy-Efficient Investments

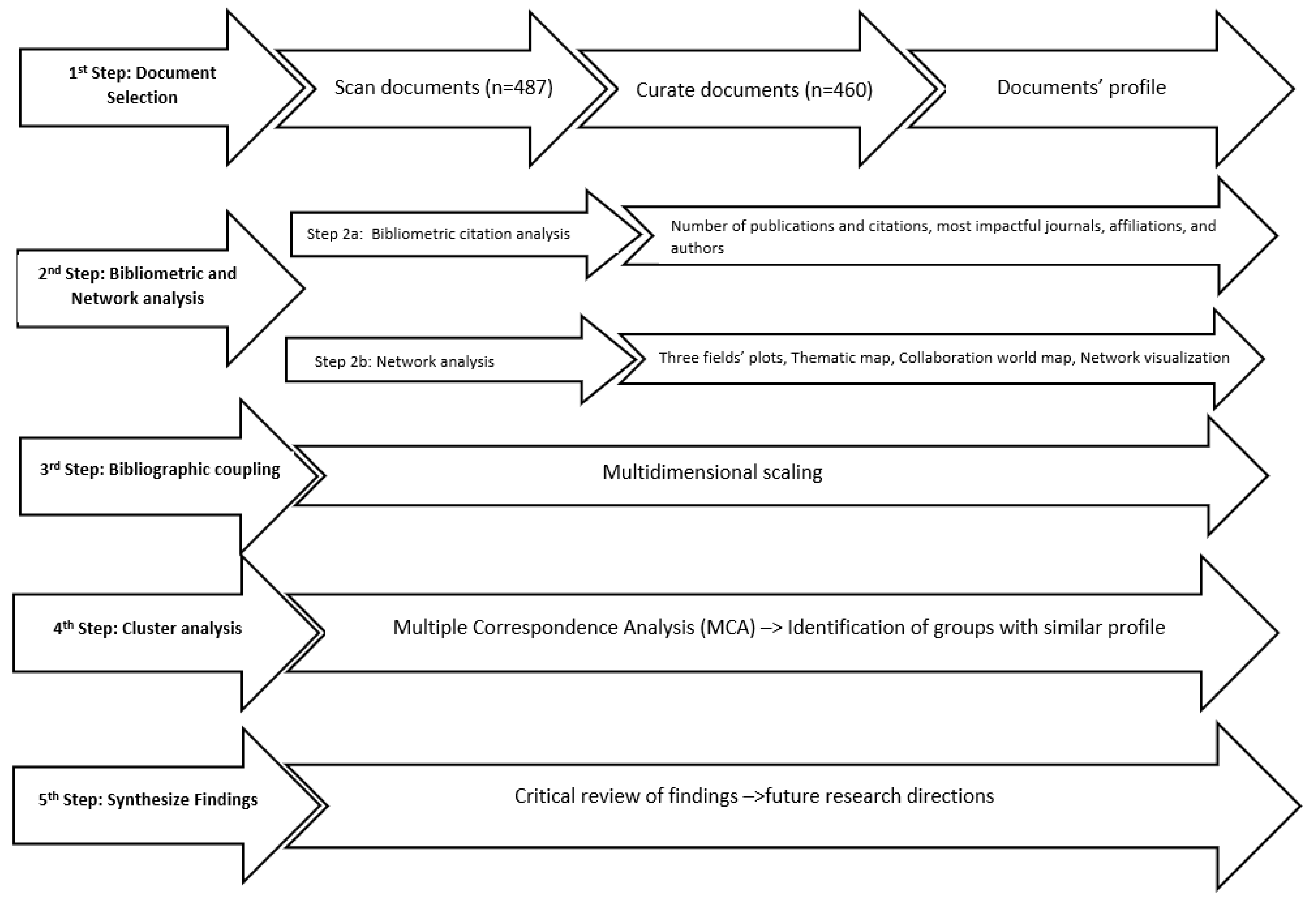

3. Materials and Methods

3.1. Bibliometric Analysis Method

3.2. Data Extraction

4. Results

4.1. Annual Publication and Timespan Trend

4.2. Most Influential Journals, Institutions, and Authors

4.3. Network, Bibliographic Coupling, and Cluster Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chen, F.; Huang, Z.-X.; Wang, F.; Xie, Z. Can corporate social responsibility disclosure alleviate asset price volatility? Evidence from China. Econ. Model. 2022, 116, 105985. [Google Scholar] [CrossRef]

- Kong, D.; Shu, Y.; Wang, Y. Corruption and corporate social responsibility: Evidence from a quasi-natural experiment in China⋆. J. Asian Econ. 2021, 75, 101317. [Google Scholar] [CrossRef]

- Boubaker, S.; Cellier, A.; Manita, R.; Saeed, A. Does corporate social responsibility reduce financial distress risk? Econ. Model. 2020, 91, 835–851. [Google Scholar] [CrossRef]

- Barbarossa, C.; Chen, Y.; Romani, S.; Korschun, D. Not all CSR initiatives are perceived equal: The influence of CSR domains and focal moralities on consumer responses to the company and the cause. J. Clean. Prod. 2022, 380, 134949. [Google Scholar] [CrossRef]

- Cui, D.; Ding, M.; He, Z.; Shen, M. Restricted shares and CSR: Evidence from foreign strategic investors in China. Pac.-Basin Financ. J. 2022, 76, 101865. [Google Scholar] [CrossRef]

- Shayan, N.F.; Mohabbati-Kalejahi, N.; Alavi, S.; Zahed, M.A. Sustainable Development Goals (SDGs) as a Framework for Corporate Social Responsibility (CSR). Sustainability 2022, 14, 1222. [Google Scholar] [CrossRef]

- Kang, Y.A.; Baker, M.A. Which CSR message most appeals to you? The role of message framing, psychological ownership, perceived responsibility and customer altruistic values. Int. J. Hosp. Manag. 2022, 106, 103287. [Google Scholar] [CrossRef]

- Sun, Y.; Xu, C.; Li, H.; Cao, Y. What drives the innovation in corporate social responsibility (CSR) disclosures? An integrated reporting perspective from China. J. Innov. Knowl. 2022, 7, 100267. [Google Scholar] [CrossRef]

- Darendeli, A.; Fiechter, P.; Hitz, J.-M.; Lehmann, N. The role of corporate social responsibility (CSR) information in supply-chain contracting: Evidence from the expansion of CSR rating coverage. J. Account. Econ. 2022, 74, 101525. [Google Scholar] [CrossRef]

- Chen, G.; Firth, M.; Gao, D.N.; Rui, O.M. Ownership structure, corporate governance, and fraud: Evidence from China. J. Corp. Financ. 2006, 12, 424–448. [Google Scholar] [CrossRef]

- Leclercq-Machado, L.; Alvarez-Risco, A.; Esquerre-Botton, S.; Almanza-Cruz, C.; Anderson-Seminario, M.D.L.M.; Del-Aguila-Arcentales, S.; Yáñez, J.A. Effect of Corporate Social Responsibility on Consumer Satisfaction and Consumer Loyalty of Private Banking Companies in Peru. Sustainability 2022, 14, 9078. [Google Scholar] [CrossRef]

- Coppola, A.; Cozzi, M.; Romano, S.; Viccaro, M. CSR profiles and innovation in Italian agri-food firms. J. Clean. Prod. 2022, 371, 133625. [Google Scholar] [CrossRef]

- Kong, X.; Jin, Y.; Liu, L.; Xu, J. Firms’ exposures on COVID-19 and stock price crash risk: Evidence from China. Finance Res. Lett. 2023, 52, 103562. [Google Scholar] [CrossRef]

- Sadiq, M.; Lin, C.-Y.; Wang, K.-T.; Trung, L.M.; Duong, K.D.; Ngo, T.Q. Commodity dynamism in the COVID-19 crisis: Are gold, oil, and stock commodity prices, symmetrical? Resour. Policy 2022, 79, 103033. [Google Scholar] [CrossRef]

- Bezzola, S.; Günther, I.; Brugger, F.; Lefoll, E. CSR and local conflicts in African mining communities. World Dev. 2022, 158, 105968. [Google Scholar] [CrossRef]

- Guo, C.; Yang, B.; Fan, Y. Does mandatory CSR disclosure improve stock price informativeness? Evidence from China. Res. Int. Bus. Finance 2022, 62, 101733. [Google Scholar] [CrossRef]

- Ahsan, S.; Ahmmed, T.; Alam, F. The COVID-19, power generation and economy–Case study of a developing country. Electr. J. 2022, 35, 107145. [Google Scholar] [CrossRef]

- Islam, S.M.; Habib, A. How impact investing firms are responding to sustain and grow social economy enterprises in light of the COVID-19 pandemic. J. Bus. Ventur. Insights 2022, 18, e00347. [Google Scholar] [CrossRef]

- Guo, F.; Huang, Y.; Wang, J.; Wang, X. The informal economy at times of COVID-19 pandemic. China Econ. Rev. 2021, 71, 101722. [Google Scholar] [CrossRef]

- He, F.; Qin, S.; Liu, Y.; Wu, J. CSR and idiosyncratic risk: Evidence from ESG information disclosure. Financ. Res. Lett. 2022, 49, 102936. [Google Scholar] [CrossRef]

- Achi, A.; Adeola, O.; Achi, F.C. CSR and green process innovation as antecedents of micro, small, and medium enterprise performance: Moderating role of perceived environmental volatility. J. Bus. Res. 2021, 139, 771–781. [Google Scholar] [CrossRef]

- Clark, E.; Lakshmi, G. Assymetric information and the pricing of sovereign eurobonds: India 1990–1992. Glob. Financ. J. 2007, 18, 124–142. [Google Scholar] [CrossRef]

- Pham, L.; Do, H.X. Green bonds and implied volatilities: Dynamic causality, spillovers, and implications for portfolio management. Energy Econ. 2022, 112, 106106. [Google Scholar] [CrossRef]

- Tamala, J.K.; Maramag, E.I.; Simeon, K.A.; Ignacio, J.J. A bibliometric analysis of sustainable oil and gas production research using VOSviewer. Clean. Eng. Technol. 2022, 7, 100437. [Google Scholar] [CrossRef]

- Xie, L.; Chen, Z.; Wang, H.; Zheng, C.; Jiang, J. Bibliometric and Visualized Analysis of Scientific Publications on Atlantoaxial Spine Surgery Based on Web of Science and VOSviewer. World Neurosurg. 2020, 137, 435–442.e4. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Faruk, M.; Rahman, M.; Hasan, S. How digital marketing evolved over time: A bibliometric analysis on scopus database. Heliyon 2021, 7, e08603. [Google Scholar] [CrossRef]

- Habib, A.; Hasan, M.M.; Jiang, H. Stock price crash risk: Review of the empirical literature. Account. Financ. 2018, 58, 211–251. [Google Scholar] [CrossRef] [Green Version]

- Adekoya, O.B.; Oliyide, J.A.; Asl, M.G.; Jalalifar, S. Financing the green projects: Market efficiency and volatility persistence of green versus conventional bonds, and the comparative effects of health and financial crises. Int. Rev. Financ. Anal. 2021, 78, 101954. [Google Scholar] [CrossRef]

- Li, Z.; Kuo, T.-H.; Siao-Yun, W.; Vinh, L.T. Role of green finance, volatility and risk in promoting the investments in Renewable Energy Resources in the post-COVID-19. Resour. Policy 2022, 76, 102563. [Google Scholar] [CrossRef]

- Li, X.; Wang, S.S.; Wang, X. Trust and stock price crash risk: Evidence from China. J. Bank. Financ. 2017, 76, 74–91. [Google Scholar] [CrossRef]

- Li, C.; Lin, S.; Sun, Y.; Afshan, S.; Yaqoob, T. The asymmetric effect of oil price, news-based uncertainty, and COVID-19 pandemic on equity market. Resour. Policy 2022, 77, 102740. [Google Scholar] [CrossRef] [PubMed]

- Azimli, A. Degree and structure of return dependence among commodities, energy stocks and international equity markets during the post-COVID-19 period. Resour. Policy 2022, 77, 102679. [Google Scholar] [CrossRef] [PubMed]

- Duan, J.; Lin, J. Information disclosure of COVID-19 specific medicine and stock price crash risk in China. Finance Res. Lett. 2022, 48, 102890. [Google Scholar] [CrossRef]

- Huang, S.; Liu, H. Impact of COVID-19 on stock price crash risk: Evidence from Chinese energy firms. Energy Econ. 2021, 101, 105431. [Google Scholar] [CrossRef]

- Liu, M. The driving forces of green bond market volatility and the response of the market to the COVID-19 pandemic. Econ. Anal. Policy 2022, 75, 288–309. [Google Scholar] [CrossRef]

- Kim, Y.; Li, H.; Li, S. Corporate social responsibility and stock price crash risk. J. Bank. Financ. 2014, 43, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Han, Y.; Li, J. Should investors include green bonds in their portfolios? Evidence for the USA and Europe. Int. Rev. Financ. Anal. 2022, 80, 101998. [Google Scholar] [CrossRef]

- Zhang, J.; Chen, Z.; Altuntaş, M. Tracing volatility in natural resources, green finance and investment in energy resources: Fresh evidence from China. Resour. Policy 2022, 79, 102946. [Google Scholar] [CrossRef]

- Lee, M.T.; Raschke, R.L. Stakeholder legitimacy in firm greening and financial performance: What about greenwashing temptations?☆. J. Bus. Res. 2023, 155, 113393. [Google Scholar] [CrossRef]

- Shin, J.; Moon, J.J.; Kang, J. Where does ESG pay? The role of national culture in moderating the relationship between ESG performance and financial performance. Int. Bus. Rev. 2022; in press. [Google Scholar] [CrossRef]

- DasGupta, R. Financial performance shortfall, ESG controversies, and ESG performance: Evidence from firms around the world. Finance Res. Lett. 2021, 46, 102487. [Google Scholar] [CrossRef]

- Sabbaghi, O. The impact of news on the volatility of ESG firms. Glob. Financ. J. 2020, 51, 100570. [Google Scholar] [CrossRef]

- Roy, P.P.; Rao, S.; Zhu, M. Mandatory CSR expenditure and stock market liquidity. J. Corp. Financ. 2022, 72, 102158. [Google Scholar] [CrossRef]

- Aouadi, A.; Marsat, S. Do ESG Controversies Matter for Firm Value? Evidence from International Data. J. Bus. Ethic 2016, 151, 1027–1047. [Google Scholar] [CrossRef]

- Latif, B.; Gunarathne, N.; Gaskin, J.; Ong, T.S.; Ali, M. Environmental corporate social responsibility and pro-environmental behavior: The effect of green shared vision and personal ties. Resour. Conserv. Recycl. 2022, 186, 106572. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Úbeda, F.; Aracil, E. Effects of environmental corporate social responsibility on innovativeness of spanish industrial SMEs✰,✰✰,★,★★. Technol. Forecast. Soc. Chang. 2020, 162, 120355. [Google Scholar] [CrossRef]

| Step | Keyword Search | Articles |

|---|---|---|

| 1 | “corporate social responsibility” AND “volatility” | 3852 |

| 2 | “corporate responsibility” AND “volatility” | 595 |

| 3 | “corporate accountability” AND “volatility” | 185 |

| 4 | ((“corporate social responsibility “ OR “ corporate responsibility “ OR “ corporate accountability”) AND “volatility” AND “stock market”) | 1912 |

| 5 | ((“corporate social responsibility “ OR “ corporate responsibility “ OR “ corporate accountability”) AND “volatility” AND (“stock market” OR “stock price”) | 974 |

| 6 | ((“corporate social responsibility “ OR “ corporate responsibility “ OR “ corporate accountability”) AND “volatility” AND “stock market” AND “stock price” AND “crisis”) | 561 |

| 7 | ((“corporate social responsibility “ OR “ corporate responsibility “ OR “ corporate accountability”) AND “volatility” AND (“stock market” OR “stock price”) AND (“crisis” OR “COVID”) | 608 |

| 8 | ((“corporate social responsibility “ OR “ corporate responsibility “ OR “ corporate accountability”) AND (“volatility” OR “risk” OR “crash risk”) AND (“stock market” OR “stock price”) AND (“crisis” OR “COVID”) | 391 |

| 9 | ((“corporate social responsibility “ OR “ corporate responsibility “ OR “ corporate accountability” OR “sustainability”) AND (“volatility” OR “risk” OR “crash risk”) AND (“stock market” OR “stock price”) AND (“crisis” OR “COVID”) | 487 |

| 10 | ((“corporate social responsibility “ OR “ corporate responsibility “ OR “ corporate accountability” OR “sustainability”) AND (“volatility” OR “risk” OR “crash risk”) AND (“stock market” OR “stock price”) AND (“crisis” OR “COVID”)AND (LIMIT-TO (DOCTYPE, “ar”)) | 460 |

| Sources | Articles | H-Index | Subject Area | ABS List | Scimago List |

|---|---|---|---|---|---|

| Sustainability (Switzerland) | 31 | 109 | Management, Monitoring, Policy, and Law | Q1 | |

| Journal of Corporate Finance | 16 | 109 | Business, Management, and Accounting | 4 **** | Q1 |

| International Review of Financial Analysis | 14 | 69 | Finance | 3 *** | Q1 |

| Journal Of Business Ethics | 14 | 208 | Business, Management, and Accounting | 3 *** | Q1 |

| Finance Research Letters | 13 | 62 | Finance | 2 ** | Q1 |

| Research In International Business And Finance | 12 | 51 | Finance | 2 ** | Q1 |

| Energy Economics | 11 | 168 | Economics, Econometrics, and Finance | 3 *** | Q1 |

| Pacific Basin Finance Journal | 10 | 62 | Finance | 2 ** | Q1 |

| Accounting and Finance | 9 | 52 | Finance | 2 ** | Q1 |

| Journal of Banking and Finance | 9 | 172 | Finance | 3 *** | Q1 |

| Affiliations | Articles |

|---|---|

| Central South University, CH | 27 |

| Central University of Finance and Economics, CH | 19 |

| Tianjin University, CH | 18 |

| Macquarie University, AU | 17 |

| Polytechnic Of State Finance Stan, ID | 14 |

| Xi’an Jiaotong University, CH | 14 |

| Zhongnan University of Economics and Law, CH | 13 |

| Capital University of Economics and Business, CH | 12 |

| Jilin University, CH | 12 |

| University Of International Business and Economics, CH | 12 |

| Authors | Articles | Articles Fractionalized | Affiliation |

|---|---|---|---|

| Wang J | 8 | 2.50 | Texas A&M University |

| Hasan Mm | 7 | 3.50 | Sebelas Maret University |

| Li X | 7 | 2.28 | National University of Singapore |

| Wang X | 7 | 2.58 | National University of Singapore |

| Zhang Y | 7 | 2.17 | Birmingham University |

| Chen Y | 6 | 1.92 | National University of Tainan |

| Liu X | 6 | 1.67 | Brunel University |

| Chen S | 5 | 1.92 | Shou University |

| Habib A | 5 | 1.87 | Purdue University |

| Liu J | 5 | 1.75 | Harvard University |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karagiannopoulou, S.; Sariannidis, N.; Ragazou, K.; Passas, I.; Garefalakis, A. Corporate Social Responsibility: A Business Strategy That Promotes Energy Environmental Transition and Combats Volatility in the Post-Pandemic World. Energies 2023, 16, 1102. https://doi.org/10.3390/en16031102

Karagiannopoulou S, Sariannidis N, Ragazou K, Passas I, Garefalakis A. Corporate Social Responsibility: A Business Strategy That Promotes Energy Environmental Transition and Combats Volatility in the Post-Pandemic World. Energies. 2023; 16(3):1102. https://doi.org/10.3390/en16031102

Chicago/Turabian StyleKaragiannopoulou, Sofia, Nikolaos Sariannidis, Konstantina Ragazou, Ioannis Passas, and Alexandros Garefalakis. 2023. "Corporate Social Responsibility: A Business Strategy That Promotes Energy Environmental Transition and Combats Volatility in the Post-Pandemic World" Energies 16, no. 3: 1102. https://doi.org/10.3390/en16031102

APA StyleKaragiannopoulou, S., Sariannidis, N., Ragazou, K., Passas, I., & Garefalakis, A. (2023). Corporate Social Responsibility: A Business Strategy That Promotes Energy Environmental Transition and Combats Volatility in the Post-Pandemic World. Energies, 16(3), 1102. https://doi.org/10.3390/en16031102