1. Introduction

The European Union (EU) has set the target to achieve climate neutrality by 2050 [

1] to comply with the Paris Climate Agreement’s goal of keeping global warming well below 2 °C or even 1.5 °C [

2] compared to pre-industrial levels. As an intermediate step for 2030, the EU proposed the “Fit-for-55” package [

3] in July 2021 that aims at reducing greenhouse gas (GHG) emissions by at least 55% while increasing the share of renewable energy sources in the overall energy mix to at least 40%. In response to the disruption of global energy markets in 2022 and the associated challenges, the REPowerEU program [

4] proposes to increase the goal for renewable energy to 45% and, among other things, focuses on ambitious energy saving targets and a ramp-up of green hydrogen production. Electricity from renewable energy sources (RES-E) is expected to play a key role in the energy transition. This is also reflected in Austria’s Renewable-Expansion-Act (“Erneuerbaren Ausbau Gesetz”, EAG) [

5] that was passed in July 2021 stipulating a goal of 100% RES-E by 2030 on a national balance (i.e., national renewable electricity generation should at least equal national electricity demand; a complete phase-out of fossil fuel based electricity generation is not required). In order to achieve this target, the EAG defines that +27 TWh of RES-E (+11 TWh photovoltaic (PV), +10 TWh wind, +5 TWh hydro and +1 TWh biomass) have to be added between 2020 and 2030. This fundamental structural change of Austria’s electricity system demands a substantial increase in infrastructure investments.

Techno-economic implications associated with the transformation of the Austrian energy system have been assessed in previous studies. For example, in the context of

MonMech the effects of the current policy mix and an extended set of policy instruments on Austrian GHG emissions were analyzed in [

6,

7,

8,

9]. Another example is

el.Adapt [

10], which focused on the required adaptations of the Austrian electricity sector due to climate change until 2050. However, in these studies, the electricity sector was either modeled in a very simplified way, or the distributional impacts of a transition to 100% RES-E in Austria were not addressed. Moreover, these studies were based on less ambitious targets for 2030.

On European level, Bussar et al. [

11] analyzed the large-scale integration of renewable energy. They modeled a European power system with 21 interconnected regions using a single-node representation. Power exchange between the regions is allowed via variable net transfer capacities (NTC). They conclude that restrictions in transmission infrastructure require more long-term energy storage and that the cost of electricity generation can be reduced with a good mix of technologies. Zappa et al. [

12] model seven different scenarios analyzing if a 100% renewable European power system is feasible until 2050. The model includes the EU28 countries, Switzerland and Norway with a ’center-of-gravity’ (single-node) approach per country. According to their research, a 100% renewable system could be operated without decreasing system adequacy, but generation and transmission capacities would have to be increased by 90% and 240%, respectively. Child et al. [

13] simulate two transition pathways to reach 100% renewable energy in Europe by 2050 with Europe being divided into 20 defined regions. In the first scenario these regions are modeled independently, and in the second scenario the regions are connected via transmission capacities. Their outcomes show that better grid interconnections lower overall power system cost, but also that prosumers with PV and battery installations can reduce the need for interconnections. Zhong et al. [

14] come to the conclusion that for Sweden a 100% renewable electricity generation composed of hydro and wind power is reachable within 20 years. For the simulation hourly load profiles and generation data has been used, but grid restrictions have not been taken into account. Krajačić et al. [

15] show that Portugal could theoretically achieve 100% electricity from renewable energy sources within 10 years. They perform an open (Portugal with imports and exports) and a closed system calculation (no imports and exports allowed for Portugal), concluding that in the closed system calculation more installed capacity is needed. Furthermore, for Portugal, Fernandes et al. [

16] use an electricity system model to analyze RES-E scenarios. They show that for a 100% renewable system more storage and interconnection capacities are needed. Krakowski et al. [

17] use the energy model TIMES combined with a thermodynamic framework to assess the reliability of the French power system with a high penetration of renewable energies. Their results indicate that dispatchable power plants, imports and demand response will play a major role in systems with high shares of renewables. The storage, grid exchange and flexible electricity generation for a 100% renewable energy system for the Baltic Sea region (covering Norway, Denmark, Sweden, Finland, Estonia, Latvia and Lithuania) are analyzed by Child et al. [

18] with the LUT Energy System Transition Model based on a linear optimization approach. They conclude that a 100% renewable power system can be an efficient and economical solution for the studied region.

While these studies also address the transition to a renewable electricity system, they either do not use a detailed representation of the European electricity sector (using a single-node approach instead) or only model the technical challenges of a transformation towards 100% renewable electricity.

The original contribution of this paper is closing this gap by presenting an innovative approach of combining a bottom-up electricity system model and a top-down macroeconomic model. The technical model of the continental European electricity system

ATLANTIS [

19] is linked with the macroeconomic model for Austria

DYNK [

20] to analyze the effects of increasing the share of RES-E on wholesale electricity prices and electricity demand. Moreover, a sensitivity analysis with respect to CO

prices is performed. With this approach of linking an electricity model with a macroeconomic model, all relevant feedback mechanisms can be considered and the analysis is expanded into the areas of energy and socio-economics. Furthermore, with

ATLANTIS the continental European electricity grid restrictions are considered, instead of using a simplified representation.

The structure of the paper is as follows: In

Section 2, the macroeconomic model

DYNK and the model of the European electricity system

ATLANTIS are introduced and their linking is explained.

Section 3 gives an overview on the scenarios for the Austrian and Continental European electricity system.

Section 4 shows the results of the iterative process presenting the results of the interlinked models and sensitivity analyses with respect to the CO

price. Finally,

Section 5 discusses the results and concludes the paper.

2. Model Descriptions and Interlinking

This section introduces the macroeconomic model DYNK and the electricity-economic model ATLANTIS and explains the linking between these two models.

2.1. DYNK

The DYNK model is a single-country macroeconomic model. It resembles an Input-Output Model in its core and expands this approach by specific production and consumption functions, a commodity price system, wage bargaining on the labor market, and a commodity and production taxation system. These expansions resemble elements of Dynamic Stochastic General Equilibrium (DSGE) models, since the DYNK model also depicts an adjustment path towards a long-term equilibrium. As a single-country model, DYNK describes the economic inter-linkages between 76 industries and the consumption of ten household income groups, differentiating between 59 consumption categories in Austria.

Four different sources of technical change are modeled in

DYNK at a disaggregated level: total factor productivity (TFP), factor-bias, material efficiency in production and energy efficiency in private consumption. These sources of technological change—in combination with changes in relative prices—drive economic growth and resource use and therefore ultimately determine decoupling. The

DYNK model can be characterized as “New Keynesian” since a full employment equilibrium only exists in the long run. However, this equilibrium cannot be attained in the short term because of existing institutional rigidities, which relate to both the consumer and the producer side. Consumers face liquidity constraints, producers face wage bargaining, and the capital market is imperfect. Consequently, the reactions to policy shocks on macroeconomic level can differ substantially depending on the deviation of the initial situation in the labor market from the long-run equilibrium.

DYNK links physical energy and material flow data to real sectoral activities, intermediate inputs in production and consumption activities. This covers the final energy demand in detail of up to 22 energy types that are based on the physical energy flow accounts by Statistik Austria [

21]. Due to the detailed modeling of consumption and production structures the

DYNK model is well suited for analyzing the drivers of energy and material use in the Austrian economy.

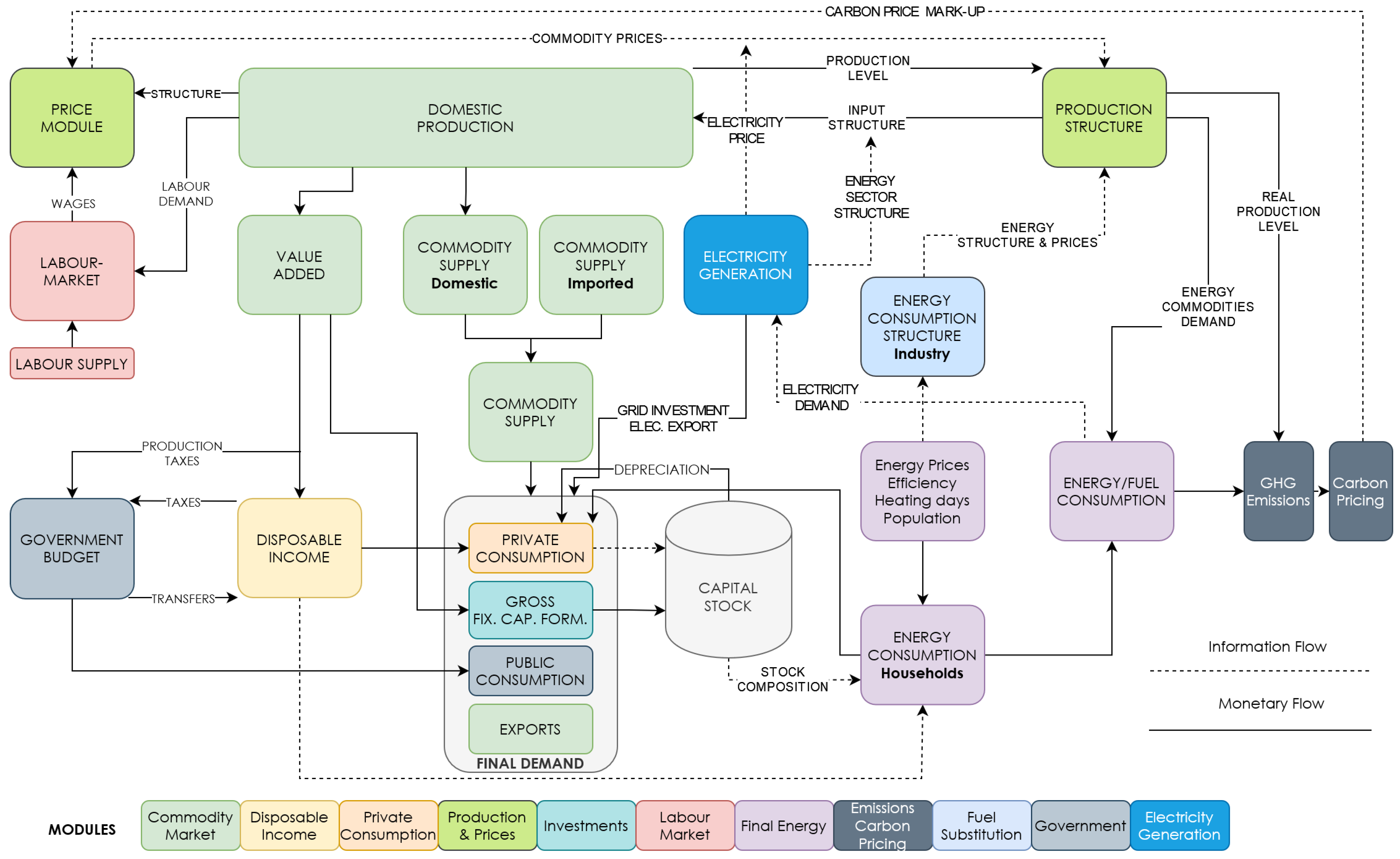

The current model comprises eleven interrelated modules (see

Figure 1). The solution process is an iteration over all modules until convergence is achieved. In the following, each module is presented shortly in order to provide an overview of the main features of the model, drivers for the simulations and interactions between different model components. In the description, emphasis is put on the newly developed module “Electricity Generation” (Module 11), for the other modules and data sets used in

DYNK a more detailed description can be found in Kirchner et al. [

20].

2.1.1. Module 1: Commodity Market

This module represents the Input-Output core of the model. The commodities demanded by public and private consumers, investment and exports are supplied by a set of sectors. The production necessary to satisfy the demand is calculated using a Leontief equation. Thereby it is guaranteed that the demand of commodities equals supply. The results of this module are employment, value added and production value per sector. The data set used are Input-Output-Tables [

22] of the Austrian Economy for the year 2017.

2.1.2. Module 2: Disposable Income

Disposable income for private households is derived from value added generated in the sectoral production activities. Pre-defined transfers and unearned income are added, and taxes and social contributions are subtracted using tax rates of the respective year. This yields ’disposable income’ for private households, which is the basis for consumption in the next modules. Data sources are the national Non-Financial-Sector-Accounts [

23] of private households for the year 2017.

2.1.3. Module 3: Private Consumption

The consumption decisions of private households (part of final demand) are simulated in this module using several behavioral equations that apply coefficients estimated by time series analysis using Austria-specific data. These equations comprise consumption of energy products (space heating, electricity for appliances and vehicle utilization), durable commodities (housing and vehicles) and a bundle of residual non-durable and non-energy commodities. The commodity composition of this residual bundle is defined by the application of an AIDS (Almost Ideal Demand System). In all equations estimated coefficients and prices define the commodity structure in the respective simulation. The resulting consumption vector is part of final demand and therefore input in Module 1. The applied data comprises a wide range of consumption-related data taken from data bases of EUROSTAT and Statistik Austria (for details see Kirchner et al. [

20]).

2.1.4. Module 4: Production and Prices

In this module, a Translog production function specification is applied. The function determines, based on input commodity prices and technology, factor and investment demand as well as output prices. Own- and cross-price elasticities are applied to determine the composition of 5 input-bundles (factors), i.e., Capital (K), Labor (L), Energy (E), Imported commodities (M) and Domestically produced commodities (D), or KLEMD in total. This means that the five factor shares react to relative price constellations whereas the sub-commodity-structure of the factors is constant (Leontief technologies). The principle of the Translog estimations and equations can be found in Sommer and Kratena [

8] or in the documentation of FIDELIO2 [

24]. The module applies production functions with a Translog specification for each sector. To estimate the coefficients of the Translog equations, system estimations and the Seemingly Unrelated Regression (SUR) estimation method are applied for each specific sector. The coefficients are seen as exogenous in this model. The primary source for the estimations were derived from the WIOD (World Input-Output Database, Release 2013 and 2016) data set that contains World Input Output Tables (WIOT) in current and previous year’s prices, Environmental Accounts (EA), and Socioeconomic Accounts (SEA).

2.1.5. Module 5: Investments

In DYNK, each sector has a specific commodity structure of its investment based on the Input-Output Tables of Statistics Austria. The change in each investment level is linked to the moving average of the economic surplus (factor K) of the sector of the previous 5 years (gross surplus is a part of value added). By this approach, two economic effects are covered. First, the investment needs to satisfy changes in demand (rising production leads to rising value added) and, second, price triggered shifts to the factor capital (and related investments) via the production function (Module 4).

2.1.6. Module 6: Labor Market

The labor market determines the price index for the factor labor, which is one of the five factors in production function (Module 4) and thereby influences the sectoral production prices throughout the economy. The labor market simulates wage negotiations by applying wage curves. These wage curves, in terms of the gross hourly wage rates of the employees, are industry-specific and react to changes in labor productivity and price levels based on econometrically estimated relations. The labor price (index) in the Translog Equations (Module 4) is linked to the developments of these wage rates plus employers’ social security payments.

2.1.7. Module 7: Energy

This module derives the final energy demand of the economy from the economic development. Here the real (i.e., nominal values deflated by the respective gross commodity price) inputs of energy commodities in production and consumption are linked to the physical energy consumption of each sector and households via energy intensity coefficients (Terajoule (TJ) per EUR). The coefficients are deduced from the monetary values in the Input-Output Table and the physical units provided by the Physical Energy Flow Accounts by Statistik Austria [

21].

2.1.8. Module 8: Emissions and Carbon Pricing

The energy-related carbon emissions are linked to the energy consumption derived in Module 7 via carbon intensity coefficients, i.e., these emissions are linked to the respective fuel use based on sectoral emissions provided by Statistik Austria [

25]. Process emissions that occur due to processes other than combustion are linked to real production values of the respective sectors, again via emission coefficients. An exogenous carbon price is used to infer additional costs for the emissions, i.e., the combustion of fuels or process emissions. The derived costs are used as a mark-up on the commodity taxes system of the Input-Output Tables. Thereby the (gross) prices for specific carbon-containing commodities increase leading to substitution and saving reactions throughout the system.

DYNK as a single-region model does not consider the effects of rising carbon prices in other European countries. The reduction in real exports might hence be overestimated as prices in other European countries would rise as well.

2.1.9. Module 9: Fuel Substitution

The sub-structure of commodities of each of the five factors in Module 4 (KLEMD) are constant, i.e., “Leontief technologies”. The sole exception is the factor energy (E), comprising six commodities (CPA05_07 Mining of fossil fuels, CPA16 wood products, CPA19 mineral oil products, CPA35.1 Electricity, CPA35.2 Natural Gas, CPA35.3 District heat). They represent the input of energy in form of coal, oil, gas, electricity, district heat, and renewables in the production process. Five of the six shares of these energy factors are defined by another Translog specification as in Module 4. The share of district heating is unchanged because our Translog specification can only handle 5 factors and the share of district heating in the affected ETS industries is negligible. Hence these factors are also endogenous depending on relative (gross) prices and trends. The main sources for the estimation of the Translog coefficients were EUROSTAT energy balances and WIOD (revision 2016) environmental accounts as well as fossil energy carrier prices from the IEA database. The method here again is a system estimation using the SUR estimation method in order to obtain the parameters of equations of the shares and the unit costs for each specific sector.

2.1.10. Module 10: Government

In module 10, the revenues and expenditures of the regional government are simulated. If expenditures exceed revenues the difference (net lending) is added to the public debt. Only a few elements of revenue and expenditure can be derived from the Supply-Use-Tables structure (taxes in Module 1) and the household’s income composition (taxes in Module 2). Hence, the public household is simulated in a relatively simple fashion. Nevertheless, a mechanism is applied that allows choosing whether public debt is endogenous or exogenous.

2.1.11. Module 11: Electricity Generation

This new module represents the interface to the

ATLANTIS model and allows to simulate changes of the annual physical electricity generation (and their costs) in

DYNK. A necessity for simulating changes in electricity generation in

DYNK was to extract the NACE sector “Electricity generation” from the sector “Electricity, Gas and Heat generation and supply (NACE D35) in all Input-Output Tables of

DYNK. This disaggregation has been based on a custom analysis of relevant primary statistics by Statistics Austria. The input structure of the electricity generation sector was then further differentiated into eleven technology-specific cost structures according to the technologies in

ATLANTIS plus a residual that represents grid and distribution services. The production value of the eleven technologies is based on the production costs provided by

ATLANTIS; their commodity structure is based on the structures of respective electricity generation technologies for Austria in the multi-regional Input-Output Table EXIOBASE (

www.exiobase.eu, accessed on 20 February 2023).

The inputs from ATLANTIS are investments in electricity generation technologies, the generation costs of the respective electricity generation mix as well as wholesale price.

The investments in electricity generation technologies are translated into a commodity structure based on literature reviews focusing on the three most relevant technologies for the electricity transition in Austria: wind [

26,

27,

28], hydro [

26,

29] and PV [

26,

30,

31,

32]. The resulting investment vector is then transferred to the electricity sector’s investment in Module 5. The wholesale price of electricity is translated to end-user prices by adding grid costs, fees and taxes. The resulting price determines the output price index of the electricity sector in Module 4. The generation mix defines the commodity input structure of the electricity sector by using weighted input structures for each technology. The weight is determined by the results of

ATLANTIS. Furthermore, variations in cost components (costs of operation, fuel, emission permits, labor compensation and depreciation) are considered as well. The adapted input structure is transferred to a change in intermediate inputs of the sector in the Input-Output Tables in Module 1.

2.2. ATLANTIS

In this section, we provide a brief overview of the

ATLANTIS model [

19] developed at the Institute of Electricity Economics and Energy Innovation (IEE), Graz University of Technology.

ATLANTIS is a techno-economic model of the continental European power system that incorporates both the technical and economic aspects of the power system for long-term scenario simulations. The technical aspects of the model include, inter alia, the continental European electricity system based on 4022 nodes (power stations) with regionalism demand distribution, the transmission grid (including 6864 lines and 1471 transformers), and 79,146 generators (including thermal power plants, renewables, and storage units). The power flow is modeled as direct current (DC) optimal power flow (DC-OPF), which is a good approximation of reality in the transmission grid. Due to the scale of the continental European power system, the temporal framework is based on discretized time duration curves. Since the model is intended for long-term system planning and given the uncertainty of input data over such lengthy time frames, this is reasonable. The economic aspects of the model include, among others, information about electricity companies, fuel prices, and inflation rates to calculate electricity trading between companies, market prices as well as balance sheets and profit and loss accounts for the included companies.

The

ATLANTIS model is structured into six different modules, as can be seen on the left side of

Figure 2. In the first step, the database and scenarios are implemented. The database includes

ATLANTIS-specific information, e.g., the power plants, the transmission network, load profiles, etc. as well as other exogenous parameters that are aligned with the

DYNK model such as fuel prices, CO

prices, inflation rates, etc.

In the following step, system adequacy is evaluated. This entails assessing whether the winter and summer peak load can be covered with the existing generation capacities given the restrictions of the existing transmission grid (based on a DC-OPF). As a result, a lack of generation and/or transmission capacity is identified.

For this study, each month was divided into two peak and two off-peak periods in order to strike a reasonable balance between accuracy and computational time. ATLANTIS runs two different models per period, where the results of the first model (Zonal Pricing Model) set the initial values for the second one (Redispatch Zonal Pricing Model) for faster model run times. The models are explained in detail in the following sections.

2.2.1. Single Node per Country—Zonal Pricing Model

In the Zonal Pricing (ZP) model, the merit order is calculated per country/zone with the Net Transfer Capacities (NTCs) that cause restrictions in electricity imports and exports between the countries, allowing a coupling between the markets. Within a zone, the cost-optimal dispatch of power plants is calculated by defining a linear optimization problem with the objective of maximising social welfare as defined in Equation (1a). With this, the respective zonal price (market clearing price for each zone) is determined. Trading between ”cheaper“ and "more expensive” zones can thus arise while complying with the commercial restrictions of the NTCs. The ZP-Model provides the zonal price per country/market, the trade flows between the countries/markets as well as the ideal dispatch per power plant (no grid restrictions). The following constraints have to be considered: cleared part of supply has to be smaller than maximum supply in a market (1b); cleared part of demand has to be smaller than maximum demand in a market (1c); limit of trading between two markets based on the defined NTCs (1d); and balance constraint of the markets (1e).

subject to:

with:

| countries, market areas (index) |

| n | block bid of demand (index) |

| a | block bid of supply (index) |

| cleared part of demand block n

in market i

[MW] |

| cleared part of supply block a in market i [MW] |

| demand price [EUR/MWh] |

| marginal costs of supply block a in zone i [EUR/MWh] |

| import in market i from market j [MW] |

| export from market i to market j [MW] |

| net transfer capacity between market i and j [MW] |

As this model considers every zone/country as a single node where all the power plants are connected to and all the demand occurs, the dispatch of the power plants does not consider restrictions related to the grid because of congested lines.

2.2.2. Grid Restrictions with DC-OPF—Redispatch Zonal Pricing Model

The Redispatch Zonal Pricing (RDZP) model takes the results of the power plant dispatch from the ZP model as starting values for the solver but incorporates the grid restrictions by implementing a DC-OPF. The DC-OPF is defined as a mixed-integer linear optimization problem with the objective of minimizing overall system costs (2a). The first sum defines the cost of power plant dispatching, the second sum describes the cost of using phase shifting transformers and the third sum defines the penalty costs for cross-market redispatch, that ensures that inner-market redispatch should be used first. (If inner-market redispatch is not enough, the binary variable

switches to 1 to allow cross-market redispatch). Constraint (2b) defines the equilibrium of generation, demand and the power flows to and from a node; (2c) represents the unit commitment (if the power plant is dispatched or not) for thermal power plants; load flow limits of lines are set with (2d) for AC-lines and (2e) for DC-lines; (2f) ensures the power balance between generation demand and export/import per market; (2g) sets the limits for the control angle of phase shifting transformers and (2h) limits the angle of power lines (since the DC load flow is a simplification of the AC load flow, which requires a very small phase angle along a line).

subject to:

with:

| G | generators (Index) |

| D | demand (Index) |

| C | countries, market areas (Index) |

| nodes (Index) |

| marginal costs of generator G [EUR/MWh] |

| binary variable to allow cross-border redispatch [−] |

| (optimized) feed-in power of generator G at node n [p.u.] |

| power demand at node n [p.u.] |

| power base for per unit calculation [MW] |

| penalty weights (p.u.) |

| binary variable for unit commitment [−] |

| (optimized) angle of phase shifter l, PST [rad] |

| maximum angle of phase shifter [rad] |

| active power flow on line l between node n and m [p.u.] |

| minimum power of generator G [p.u.] |

| maximum power of generator G [p.u.] |

| maximum transmission capacity of AC line l [p.u.] |

| maximum transmission capacity of DC line l [p.u.] |

| import/export saldo (result from DC-OPF) [p.u.] |

| (optimized) commitment of DC link l [rad] |

| maximum controlling range of a DC link [rad] |

In many countries the heat produced by combined heat and power (CHP) plants is needed in winter months for district heating purposes, making them must-run power plants that have to produce even if they would not be dispatched based on the merit order system. For this model run, power plants with heating output have a must-run flag set in the winter months (November to February) and are therefore forced to produce. According to Austria’s energy balance from Statistics Austria, in 2021 heating demand for district heating was 26 TWh. CHP plants contributed 14.7 TWh, showing the importance of the heat production of CHP plants [

33]. Some industrial power plants are also needed throughout the year and, for that reason, have a must-run flag set for the whole year.

In case of line congestions, an intra-zonal redispatch is carried out and, if this is not sufficient, a redispatch across zones is done. In addition to the results of the ZP-Model, the RDZP-Model also provides the line utilization and the “positive” and “negative” redispatch for each power plant.

2.3. Model Linkage

The basis for linking ATLANTIS and DYNK is handling the ATLANTIS model’s output as a disaggregate technological representation of the different electricity sub-sectors. The ATLANTIS solution’s data on electricity generation and distribution of the RDZP model is linked to the corresponding variables in the DYNK model. For example, in ATLANTIS the simulation yields results for fixed (capital) and operational (energy, labor, materials) costs as well as produced electricity per power plant type which is fed into DYNK. The resulting electricity price of the ATLANTIS model is linked to the output price index in DYNK. In the other direction, the resulting electricity demand of DYNK is fed into the ATLANTIS model. This is done until convergence is reached. Due to technical and practical reasons, the data exchanged between ATLANTIS and DYNK comprises full scenario results (up to 2030). Both models were calibrated to the year 2017 and the simulations cover the period from 2017 to 2030.

The different modules of the

ATLANTIS model as well as the links between

ATLANTIS and

DYNK are depicted in

Figure 2.

As the models are operated by two different organizations, cloud servers are utilized to exchange the results. An ad hoc data structure based on Excel files was developed for exchanging data between the two models. For this, the data input mechanisms of the two models have been adapted. Likewise, the output of the ATLANTIS model was updated to specifically write the results needed for DYNK (installed capacity, produced electricity, electricity price, and fixed and operational costs, each per power plant type and year) into a single file.