Integrated Policies to Reduce Australia’s Electricity Sector Greenhouse Gas Emissions to Net Zero by 2050

Abstract

:1. Introduction

- strengthen signals for investment in the right mix of capacity to keep the system reliable, affordable, and secure;

- deliver essential system services to maintain grid stability;

- improve transmission and access arrangements to ensure timely transmission investment, incentivise better use of the network to lower costs for consumers, and reduce investment uncertainty;

- better enable participation of flexible demand side resources and the integration of distributed energy resources (DER) [31].

2. Methodology

- ○

- Balance of electricity demand and supply;

- ○

- Sufficient supply of reserve and response services;

- ○

- Sufficient inertia available;

- ○

- Sufficient reliable capacity to meet peak demand.

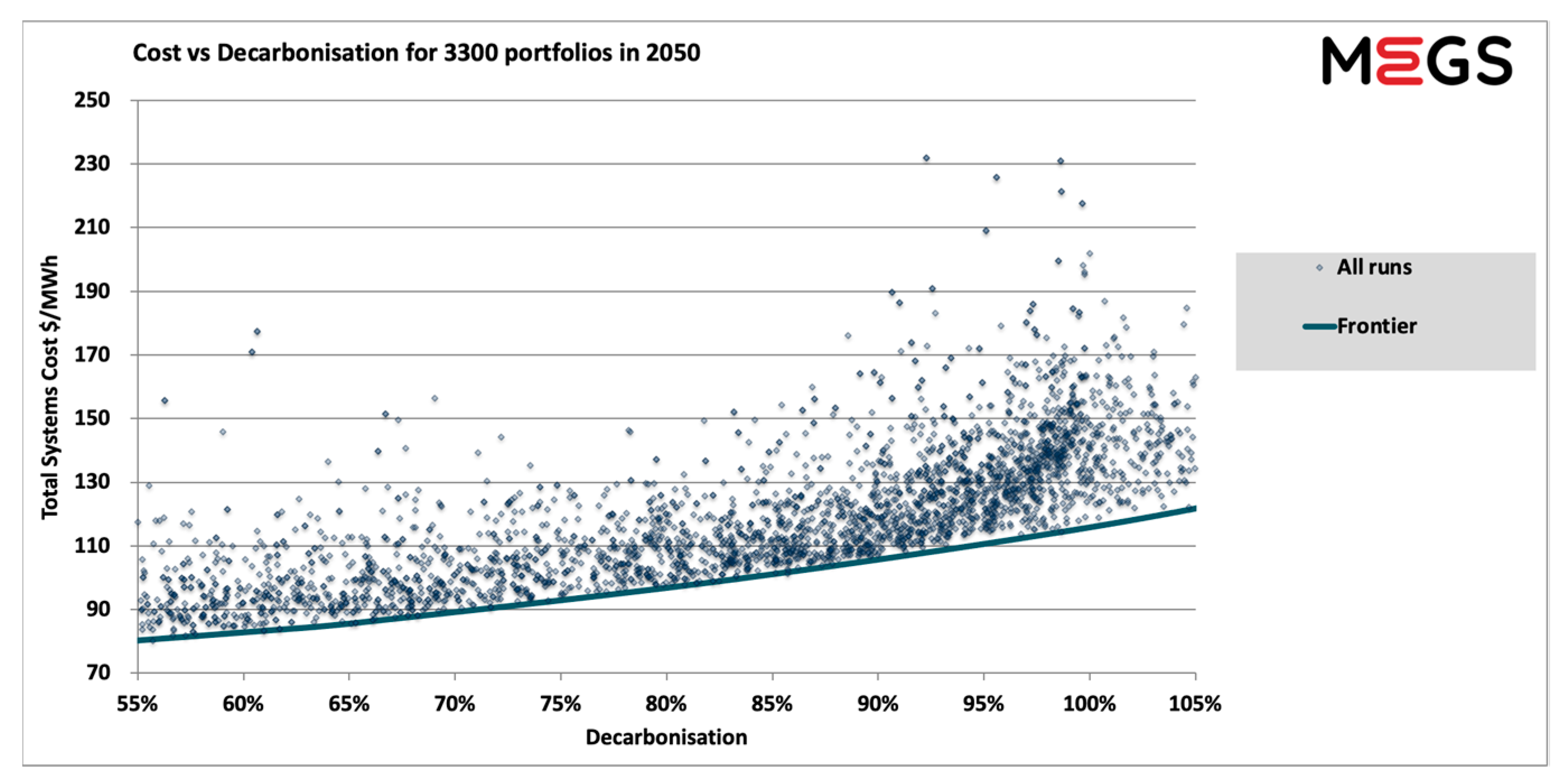

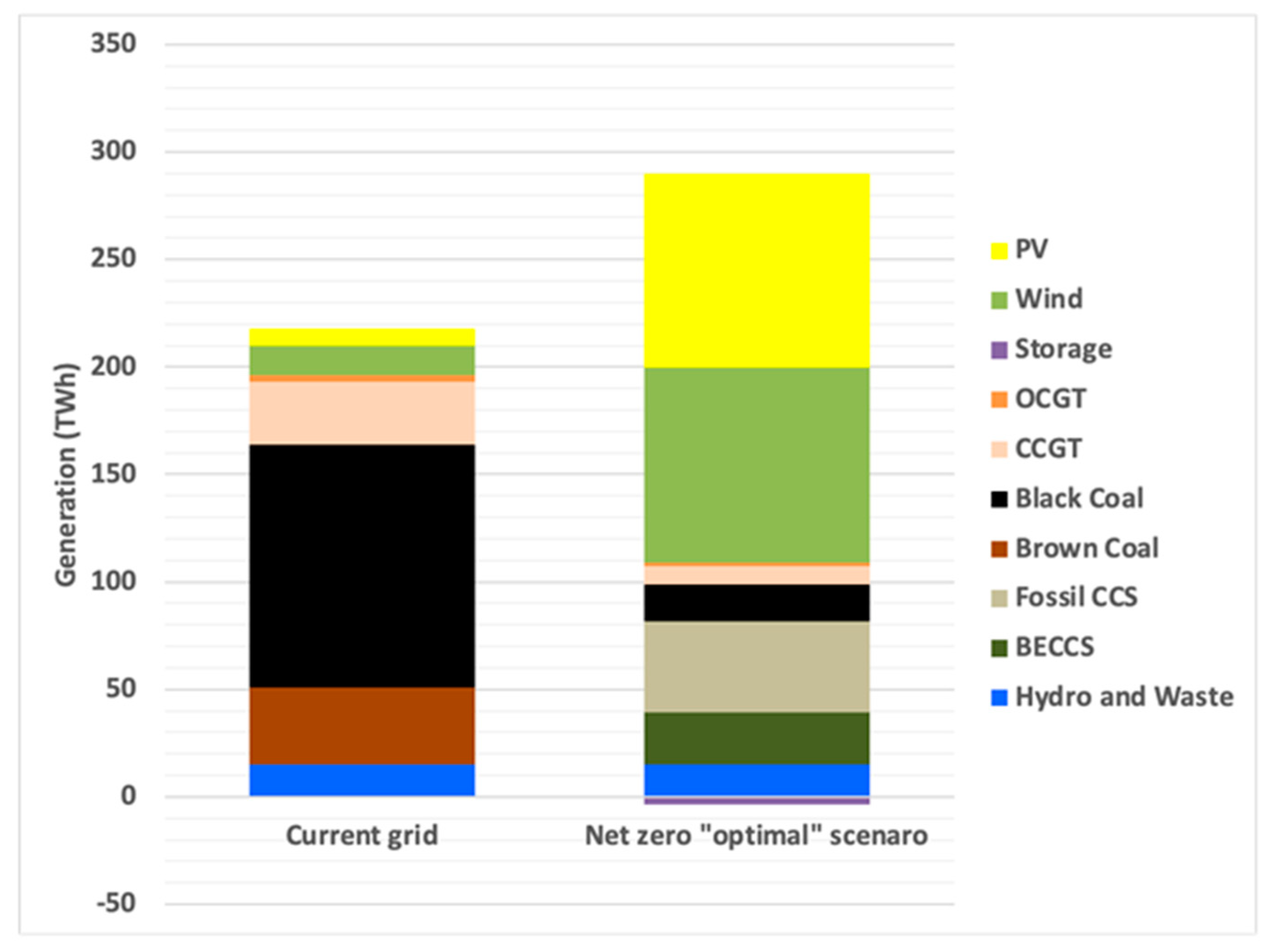

3. The “No Constraints” Scenario

4. The Pathway Forward Using the “No Constraints” Scenario

4.1. Variable Renewable Energy: Wind and Solar PV

- Projects: infrastructure solutions to a defined issue which has a business case.

- Initiatives: potential infrastructure solutions to a defined issue that is at the early stage of study and the business case is not yet completed [51].

- Extend the Renewable Energy Target to meet the 2050 generation target of approximately 91 TWh annually of wind and approximately 91 TWh annually of solar PV.

- Invest in transmission infrastructure to enable build out rates of VRE.

- Develop Renewable Energy Zones, proposed by State Governments as well as the ESB, to optimise economies of scale.

- Incentivise smart meters, behind the meter solar PV and batteries, and community storage to enable the aggregation of assets to participate as virtual power plants (VPPs) under the wholesale demand response mechanism.

- Develop a pathway to initiate an e-waste and recycling industry that will match forecast volumes of waste.

4.2. Energy Storage

- Introduce a firm capacity market to give large-scale storage facilities certainty in revenue.

- Introduce a CfD scheme for large-scale storage projects to secure revenue certainty.

4.3. Unabted Gas

- Setting a Reserve Capacity Requirement two years ahead, published in the WEM Electricity Statement of Opportunities [63];

- Allocating Certified Reserve Capacity and Capacity Credits based on a facility’s ability to dispatch [63];

- Administering a Reserve Capacity auction if the allocation of Capacity Credits through the trade declaration process is insufficient [64];

- Testing capacity providers twice per year (once in summer and once in winter) for facilities, and once per year for demand side participants (DSP) [65];

- Assigning an Individual Reserve Capacity Requirement to each Market Customer, based on contributions to the system peak, to allocate the cost of Capacity Credits fairly among Market Customers [63].

- A “pipeline” of gas supply to be developed in a futures market to ensure supply. This can be incorporated into the firm capacity market outlook, securing gas supply contracts the year prior, and the National Gas Infrastructure Plan [68];

- Introduce a firm capacity market to incentivise peaking facilities.

- A “pipeline” of gas supply to be developed in a futures market to ensure supply;

- Introduce a firm capacity market to incentivise peaking facilities;

- Strengthening of the ancillary services market to allow this mechanism to incentivise investment in facilities that provide grid service.

4.4. Unabated Black Coal

- Plant modernisation to extend the life of existing plants and allow them to reliably operate in a flexible manner. A modernisation fund, such as the European Union’s Emissions Trading Scheme (ETS) Modernisation Fund [73] and/or the CEFC Grid Reliability Fund [74], would enable the transformation of coal units into peaking units. This could also be achieved through innovation grants for plant modernisation to meet flexibility requirements.

- A firm capacity market to allow for plants to operate in both the energy and capacity market, which can provide a financial incentive to remain on the system.

4.5. Carbon Capture, Utilisation and Storage, and Bioenergy and Carbon Capture and Storage

- Ensure bioenergy feedstock reserves and expand security of supply;

- Update the Geoscience Australia CO2 storage atlas to include storage based on sustainable flow rate and duration;

- Introduce a tax credit mechanism akin to the 45Q;

- Introduce emissions standards for new thermal plant;

- Establish a firm capacity market;

- Introduce CfDs for new build CCUS plants;

- Include CCUS plants in low-emissions merit order dispatch;

- Classify CO2 hub infrastructure as a Priority Development Area.

4.6. Unabated Brown Coal

4.7. Hydro Power

4.8. Nuclear Power—Additional Considerations

- High energy density: nuclear power plants can produce a large amount of electricity from a small amount of fuel, making them relatively efficient [92].

- Low emissions: nuclear power does not produce CO2 emissions and is considered a low-emissions power generation technology [93].

- Reliability: nuclear power plants are designed to run continuously, which makes them a reliable source of electricity [92].

- Waste disposal: Australia already has an operational radioactive waste disposal system, managed by the Australian Radioactive Waste Agency. A single waste disposal facility is currently the subject of a development study [94].

- Technological advancements: nuclear power technologies are continuously improving internationally in both power generation and monitoring [95]. Reactors currently under construction have simpler designs as a means to reduce capital cost, as well as increasing fuel efficiency and safety [95]. Additionally, advancements in modelling power systems including nuclear reactors has advanced, with a new methodology for the estimation of the long-term impacts of spent nuclear fuel that can be included in whole of system modelling [96].

- High capital costs: the costs associated with constructing nuclear power plants are high, and pose a potential barrier to the adoption of nuclear power [97].

- Public perception: in a poll by the Institute of Public Affairs, 53% of respondents agree that nuclear power should be considered to reduce emissions, while 24% were unsure, and 23% disagree [98]. In 2011, the Lowy Institute polled the same query with only 35% of respondents in favour of nuclear power, 3% unsure, and 62% opposed [99]. While there is an increase in a positive public response, there is still considerable opposition to nuclear power in Australia that will need to be addressed if this technology is to be considered.

5. Discussion

- Further analysis is required to understand the implications of the “no constraints” scenario via a socio-political assessment, which forms the basis of future works;

- Issues of social licence, geopolitics, and volatile markets will likely constrain the outcome of the “no constraints” scenario. Further analysis is required to assess the viability of this scenario from a socio-political perspective, incorporating the ongoing sustainability of coal-fired power generation in Australia;

- Further modelling and analysis would be required to understand the implications of change to the electricity system at a regional level.

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- NSW Department of Planning Industry and Environment. Fact Sheet: Achieving Net-Zero Emissions by 2050; Office of Environment and Heritage: Sydney South, NSW, Australia, 2016. Available online: https://www.environment.nsw.gov.au/-/media/OEH/Corporate-Site/Documents/Climate-change/achieving-net-zero-emissions-by-2050-fact-sheet-160604.pdf (accessed on 14 May 2022).

- Australian Energy Market Operator (AEMO). Draft 2020 Integrated System Plan; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2019. [Google Scholar]

- Victorian Department of Environment Land Water and Planning. Net-Zero Emissions, Climate-Ready Economy and Community. 2022. Available online: https://www.delwp.vic.gov.au/corporate-plan/zero-emission-climate-ready-economy-and-community (accessed on 14 May 2022).

- Tasmanian Government. Tasmania: Net Zero by 2030. Emissions Pathway Review Summary Report. 2021. Available online: https://www.dpac.tas.gov.au/__data/assets/pdf_file/0011/587342/Tasmanian_Emissions_Pathway_Review_-_Summary_Report.pdf (accessed on 14 May 2022).

- Queensland Government. Transition to a Zero Carbon Economy. 2022. Available online: https://www.qld.gov.au/environment/climate/climate-change/transition (accessed on 14 May 2022).

- NSW Adapt NSW. Nsw Government Action on Climate Change. 2022. Available online: https://www.climatechange.environment.nsw.gov.au/nsw-government-action-climate-change (accessed on 14 May 2022).

- Minister for Industry Energy and Emissions Reduction. Australia’s plan to Reach Our Net Zero Target by 2050. 2021. Available online: https://www.minister.industry.gov.au/ministers/taylor/media-releases/australias-plan-reach-our-net-zero-target-2050 (accessed on 14 May 2022).

- Boston, A.; Bongers, G.; Byrom, S. The Effect of Renewable Energy Targets on the National Energy Market; The University of Queensland: Brisbane, QLD, Australia, 2018. [Google Scholar]

- Boston, A.; Bongers, G.; Byrom, S.; Bongers, N. The Lowest Total System Cost Nem—The Impact of Constraints; The University of Queensland: Brisbane, QLD, Australia, 2020. [Google Scholar]

- Boston, A. Managing Flexibility Whilst Decarbonising the GB Electricity System; Energy Research Partnership (ERP): Birmingham, UK, 2015. [Google Scholar]

- Byrom, S.; Boston, A.; Bongers, G.; Dargusch, P.; Garnet, A.; Bongers, N. Total systems cost: A better metric for valuing electricity in supply network planning and decision-making. J. Environ. Inform. Lett. 2021, 11, 75–85. [Google Scholar] [CrossRef]

- Boston, A.; Bongers, G.; Byrom, S. Snowy 2.0 and Beyond—The Value of Large-Scale Energy Storage; The University of Queensland: Brisbane, QLD, Australia, 2020. [Google Scholar]

- Boston, A.; Bongers, G.; Byrom, S.; Bongers, N. What Happens When We Add Big Infrastructure to the Nem? The University of Queensland: Brisbane, QLD, Australia, 2020. [Google Scholar]

- Boston, A.; Bongers, G.; Byrom, S.; Bongers, N. Decarbonised Electricity: The Lowest Cost Path to Net Zero Emissions; Gamma Energy Technology P/L: Brisbane, QLD, Australia, 2021; p. 94. [Google Scholar]

- Jenkins, J.D.; Thernstrom, S. Deep Decarbonisation of the Electric Power Sector: Insights from Recent Literature. 2017. Available online: https://www.innovationreform.org/wp-content/uploads/2018/02/EIRP-Deep-Decarb-Lit-Review-Jenkins-Thernstrom-March-2017.pdf (accessed on 5 November 2022).

- Mazengarb, M. Csiro Gencost: Wind and Solar Still Reign Supreme as Cheapest Energy Sources. 2021. Available online: https://reneweconomy.com.au/csiro-gencost-wind-and-solar-still-reign-supreme-as-cheapest-energy-sources/ (accessed on 27 January 2023).

- Toscano, N.; Foley, M. Fossil Fuels Fall to Record Low in Power Grid as Renewables Hit New High. The Sydney Morning Herald 2023. Available online: https://www.smh.com.au/business/the-economy/fossil-fuels-fall-to-record-low-in-power-grid-as-renewables-hit-new-high-20230124-p5cf3o.html (accessed on 23 January 2023).

- Australian Energy Market Operator (AEMO). About the National Electricity Market (Nem); Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2020; Available online: https://aemo.com.au/energy-systems/electricity/national-electricity-market-nem/about-the-national-electricity-market-nem (accessed on 21 January 2021).

- Australian Energy Market Operator (AEMO). Nem Generation Information July 2020; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2020. [Google Scholar]

- Wei, J.; Sanborn, S.; Slaughter, A. Digital Innovation. Deloitte Insights, 9 April 2019. Available online: https://www2.deloitte.com/insights/us/en/industry/power-and-utilities/digital-transformation-utility-of-the-future.html (accessed on 2 February 2021).

- International Renewable Energy Agency (IRENA). Electricity Storage and Renewables: Costs and Markets to 2030; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates, 2017. [Google Scholar]

- Hill, B.; Barr, R.; Parker, R. Cost, Reliability, and Emissions. Nuclear Power Solves the Australian Electricity Supply Trilemma; Nuclear for Climate Australia: Berrima, NSW, Australia, 2018. [Google Scholar]

- Ringkjøb, H.-K.; Haugan, P.M.; Solbrekke, I.M. A review of modelling tools for energy and electricity systems with large shares of variable renewables. Renew. Sustain. Energy Rev. 2018, 96, 440–459. [Google Scholar] [CrossRef]

- Finkel, A.; Moses, K.; Munro, C.; Effeney, T.; O’Kane, M. Independent Review into the Future Security of the National Electricity Market; Department of Climate Change, Energy, the Environment and Water: Canberra, ACT, Australia, 2017.

- Australian Energy Market Operator (AEMO). 2020 Integrated System Plan; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2020. [Google Scholar]

- COAG Energy Council. Energy Security Board Terms of Reference. 2018. Available online: http://www.coagenergycouncil.gov.au/sites/prod.energycouncil/files/publications/documents/Energy%20Security%20Board%20ToR.pdf (accessed on 5 November 2020).

- COAG Energy Council. Energy Security Board. 2020. Available online: http://www.coagenergycouncil.gov.au/market-bodies/energy-security-board (accessed on 5 November 2020).

- Australian Energy Regulator (AER). Retailer Reliability Obligation; Australian Energy Regulator (AER): Canberra, ACT, Australia, 2020. Available online: https://www.aer.gov.au/retail-markets/retailer-reliability-obligation (accessed on 24 March 2022).

- Schott, K.; Swift, D.; Savage, C.; York, M.; Zibelman, A. Energy Security Board: Post-2025 Market Design Directions Paper; Energy Security Board: Sydney, NSW, Australia, 2021.

- Macdonald-Smith, A. Generators Back Power Reforms to Keep Lights on. Australian Financial Review, 29 July 2021. Available online: https://www.afr.com/policy/energy-and-climate/generators-back-power-reforms-to-keep-lights-on-20210729-p58dzk (accessed on 29 August 2021).

- Department of Industry Science Energy and Resources. Post-2025 Market Design. 2021. Available online: https://www.energy.gov.au/government-priorities/energy-ministers/priorities/national-electricity-market-reforms/post-2025-market-design (accessed on 21 May 2022).

- Elsheikh, A.H.; Sharshir, S.W.; Abd Elaziz, M.; Kabeel, A.E.; Guilan, W.; Haiou, Z. Modeling of solar energy systems using artificial neural network: A comprehensive review. Sol. Energy 2019, 180, 622–639. [Google Scholar] [CrossRef]

- Byrom, S.; Bongers, G.D.; Dargusch, P.; Garnett, A.; Boston, A. A case study of Australia’s emissions reduction policies—An electricity planner’s perspective. J. Environ. Manag. 2020, 276, 111323. [Google Scholar] [CrossRef] [PubMed]

- Boston, A.; Bongers, G. Megs: Modelling energy and grid services to explore decarbonisation of power systems at lowest total system cost. Energy Strategy Rev. 2021, 38, 100709. [Google Scholar] [CrossRef]

- Dictionary, C. Definition of ‘Policy’. 2020. Available online: https://www.collinsdictionary.com/dictionary/english/policy (accessed on 10 December 2020).

- Kenton, W. Market. Investopedia. 2020. Available online: https://www.investopedia.com/terms/m/market.asp (accessed on 10 December 2020).

- Graham, P.; Foster, J. Gencost 2020–21: LCOE Methods and Results; CSIRO: Canberra, ACT, Australia, 2021.

- Australian Energy Market Operator (AEMO). 2021 Inputs Assumptions and Scenarios Report; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2021. [Google Scholar]

- Brazzale, R. Nem Review 2018: More Renewables, Greater Efficiency, Less Emissions. Renew Economy, 14 February 2019. Available online: https://reneweconomy.com.au/nem-review-2018-more-renewables-greater-efficiency-less-emissions-16524/ (accessed on 29 October 2020).

- Australian Energy Market Operator (AEMO). Victorian Annual Planning Report; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2021. [Google Scholar]

- Australian Energy Market Operator (AEMO). 2022 Integrated System Plan; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2022. [Google Scholar]

- Australian Government. The Australian Government Guide to Regulation; Australian Government: Canberra, ACT, Australia, 2014. Available online: https://www.pmc.gov.au/sites/default/files/publications/Australian_Government_Guide_to_Regulation.pdf (accessed on 10 December 2020).

- AGL. Coopers Gap Wind Farm. 2020. Available online: https://www.agl.com.au/about-agl/how-we-source-energy/coopers-gap-wind-farm (accessed on 24 March 2022).

- Clean Energy Council. Wind. 2018. Available online: https://www.cleanenergycouncil.org.au/resources/technologies/wind (accessed on 24 March 2022).

- Clean Energy Council (CEC). Clean Energy Australia Report 2020; Clean Energy Council (CEC): Melbourne, VIC, Australia, 2020. [Google Scholar]

- Aurecon. 2019 Costs and Technical Parameter Review, Consultation Report; Australian Energy Market Operator (AEMO): Brisbane, QLD, Australia, 2019. [Google Scholar]

- Susskind, L.; Chun, J.; Gant, A.; Hodgkins, C.; Cohen, J.; Lohmar, S. Sources of opposition to renewable energy projects in the united states. Energy Policy 2022, 165, 112922. [Google Scholar] [CrossRef]

- Mazengarb, M. Social Licence Emerges as Critical Issue for Renewable Energy Zones, NSW Says. 2021. Available online: https://reneweconomy.com.au/social-licence-emerges-as-critical-issue-for-renewable-energy-zones-nsw-says/ (accessed on 21 May 2022).

- Clean Energy Regulator. Large-Scale Renewable Energy Target. 2018. Available online: http://www.cleanenergyregulator.gov.au/RET/About-the-Renewable-Energy-Target/How-the-scheme-works/Large-scale-Renewable-Energy-Target (accessed on 24 March 2022).

- Clean Energy Regulator. The Renewable Power Percentage. 2020. Available online: http://www.cleanenergyregulator.gov.au/RET/Scheme-participants-and-industry/the-renewable-power-percentage (accessed on 24 March 2022).

- Infrastructure Australia. Infrastructure Priority List. 2020. Available online: https://www.infrastructureaustralia.gov.au/infrastructure-priority-list (accessed on 3 November 2020).

- Australian Energy Market Operator (AEMO). Virtual Power Plant (VPP) Demonstrations; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2020; Available online: https://aemo.com.au/en/initiatives/major-programs/nem-distributed-energy-resources-der-program/pilots-and-trials/virtual-power-plant-vpp-demonstrations (accessed on 3 November 2020).

- Gill, M. Power of Choice 2.0: Analysis of Smart Meter Benefits. 2021. Available online: https://www.aemc.gov.au/sites/default/files/2021-12/power_of_choice_2.0_-_analysis_of_smart_meter_benefits_-_dr_martin_gill.pdf (accessed on 21 May 2022).

- Australian Energy Market Operator (AEMO). Wholesale Demand Response Mechanism; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2021; Available online: https://aemo.com.au/energy-systems/electricity/national-electricity-market-nem/market-operations/wdrm (accessed on 17 July 2022).

- Enel, X. Wholesale Demand Response Mechanism. 2022. Available online: https://www.enelx.com/au/en/demand-response/wholesale-drm (accessed on 17 July 2022).

- Hornsdale Power Reserve. South Australia’s Big Battery. 2020. Available online: https://hornsdalepowerreserve.com.au/ (accessed on 4 November 2020).

- Snowy Hydro. Snowy 2.0—About. 2020. Available online: https://www.snowyhydro.com.au/snowy-20/about/ (accessed on 24 March 2022).

- Hydro Tasmania. The Case for Deep Storage—Why the NEM Needs Battery of the Nation; Hydro Tasmania: Hobart, TAS, Australia, 2020. [Google Scholar]

- Wild, P. Determining commercially viable two-way and one-way ‘contract-for-difference’ strike prices and revenue receipts. Energy Policy 2017, 110, 191–201. [Google Scholar] [CrossRef]

- Simshauser, P. On the stability of energy-only markets with government-initiated contracts-for-differences. Energies 2019, 12, 2566. [Google Scholar] [CrossRef] [Green Version]

- The State of Victoria Department of Environment Land Water and Planning. Victorian Renewable Energy Auction Scheme: Consultation Paper; The State of Victoria Department of Environment Land Water and Planning: Melbourne, VIC, Australia, 2015.

- Department for Business Energy & Industrial Strategy. Electricity Market Reform: Contracts for Difference. 2017. Available online: https://www.gov.uk/government/collections/electricity-market-reform-contracts-for-difference (accessed on 24 March 2022).

- Australian Energy Market Operator (AEMO). Reserve Capacity Mechanism; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2020; Available online: https://aemo.com.au/energy-systems/electricity/wholesale-electricity-market-wem/wa-reserve-capacity-mechanism (accessed on 24 March 2022).

- Australian Energy Market Operator (AEMO). Reserve Capacity Auction; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2020; Available online: https://aemo.com.au/energy-systems/electricity/wholesale-electricity-market-wem/wa-reserve-capacity-mechanism/reserve-capacity-auction (accessed on 24 March 2022).

- Australian Energy Market Operator (AEMO). Facility Tests; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2020; Available online: https://aemo.com.au/energy-systems/electricity/wholesale-electricity-market-wem/wa-reserve-capacity-mechanism/facility-tests (accessed on 15 July 2020).

- Murphy, K.; Morton, A. Labor to Support $600m Kurri Kurri Power Plant but Only if it Runs on Green Hydrogen by 2030. The Guardian, 31 January 2022. Available online: https://www.theguardian.com/australia-news/2022/jan/31/labor-to-support-600m-kurri-kurri-power-plant-but-only-if-it-runs-on-green-hydrogen-by-2030 (accessed on 14 May 2022).

- Australian Competition and Consumer Commission. East Coast Gas Prices Appear Too High and Future Supply is Uncertain; Australian Competition and Consumer Commission: Canberra, ACT, Australia, 2020. Available online: https://www.accc.gov.au/media-release/east-coast-gas-prices-appear-too-high-and-future-supply-is-uncertain (accessed on 5 November 2022).

- Clarke, M. Federal Government Threatens to Build Gas Plant if Electricity Sector Doesn’t Replace Retiring Coal-Fired Power Stations. ABC News, 14 September 2020. [Google Scholar]

- Troy, N.; Flynn, D.; O’Malley, M. Multi-mode operation of combined-cycle gas turbines with increasing wind penetration. IEEE Trans. Power Syst. 2010, 27, 484–492. [Google Scholar] [CrossRef] [Green Version]

- Australian Energy Market Operator (AEMO). Ancillary Services; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2020; Available online: https://aemo.com.au/en/energy-systems/electricity/national-electricity-market-nem/system-operations/ancillary-services (accessed on 3 March 2022).

- Australian Energy Regulator (AER). Wholesale Electricity Market Performance Report 2018—LCOE Modelling Approach, Limitations and Results; Australian Energy Regulator (AER): Canberra, ACT, Australia, 2018.

- Australian Energy Market Operator (AEMO). Draft 2022 Integrated System Plan; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2021. [Google Scholar]

- Nielson, L. The European Emissions Trading System-Lessons for Australia; Parliament of Australia Department of Parliamentary Services: Canberra, ACT, Australia, 2008.

- Department of Industry Science Energy and Resources. Grid Reliability Fund. Energy.gov. 2020. Available online: https://www.energy.gov.au/government-priorities/energy-programs/grid-reliability-fund (accessed on 3 November 2020).

- Australian Energy Market Operator (AEMO). Quarterly Energy Dynamics Q4 2021; Australian Energy Market Operator (AEMO): Melbourne, VIC, Australia, 2022; Available online: https://aemo.com.au/-/media/files/major-publications/qed/2021/q4-report.pdf?la=en&hash=CD6B71C8573830867349B6A9570E9D22 (accessed on 14 May 2022).

- Garnett, A.; Greig, C.; Bongers, G.; Stott, C.; Byrom, S. Energy security and prosperity in australia: A roadmap for ccs. Options for nem power generation replacement with regard to ccs potential. 2023; unpublished manuscript. [Google Scholar]

- Australian Renewable Energy Agency. Australia’s Bioenergy Roadmap; Australian Renewable Energy Agency: Canberra, ACT, Australia, 2021. Available online: https://arena.gov.au/assets/2021/11/australia-bioenergy-roadmap-report.pdf (accessed on 21 May 2022).

- Bongers, G.; Byrom, S.; Garnett, A. Hub Development: Industrial Scale Deployment via Retrofitting Sequencing and Pipeline Development; The University of Queensland: Brisbane, QLD, Australia, 2019. [Google Scholar]

- Graham, P.; Hayward, J.; Foster, J.; Havas, L. Gencost 2020–21; CSIRO: Canberra, ACT, Australia, 2021.

- Christensen, J.; Crabtree, B. Primer: 45q Tax Credit for Carbon Capture Projects; Great Plains Institute: Minneapolis, MN, USA, 2019. [Google Scholar]

- Carbon Capture Coalition. 45q Tax Credits. 2018. Available online: https://carboncapturecoalition.org/45q-legislation/ (accessed on 24 March 2022).

- Bongers, G.; Byrom, S.; Constable, T. Retrofitting CCS to Coal: Enhancing Australia’s Energy Security; CO2CRC Limited: Melbourne, VIC, Australia, 2017. [Google Scholar]

- Bui, M.; Adjiman, C.S.; Bardow, A.; Anthony, E.J.; Boston, A.; Brown, S.; Fennell, P.S.; Fuss, S.; Galindo, A.; Hackett, L.A.; et al. Carbon capture and storage (CCS): The way forward. Energy Environ. Sci. 2018, 11, 1062–1076. [Google Scholar] [CrossRef] [Green Version]

- Domenichini, R.; Mancuso, L.; Ferrari, N.; Davison, J. Operating flexibility of power plants with carbon capture and storage (CCS). Energy Procedia 2013, 37, 2727–2737. [Google Scholar] [CrossRef] [Green Version]

- Climate Change Authority. Australia’s Climate Policy Options; Climate Change Authority: Canberra, ACT, Australia, 2015.

- Government of Canada. Technical Backgrounder: Federal Regulations for Electricity Sector. 2018. Available online: https://www.canada.ca/en/environment-climate-change/services/managing-pollution/energy-production/technical-backgrounder-regulations-2018.html (accessed on 18 February 2021).

- Queensland Department of State Development. State Infrastructure Fund. 2019. Available online: http://www.statedevelopment.qld.gov.au/infrastructure/infrastructure-planning-and-policy/state-infrastructure-fund.html (accessed on 3 September 2020).

- Global CCS Institute (GCCSI). Global Status of CCS: Special Report: Understanding Industrial CCS Hubs and Clusters; Global CCS Institute (GCCSI): Melbourne, VIC, Australia, 2016. [Google Scholar]

- Australian Government. Australian Radiation Protection and Nuclear Safety Act 1998; compilation no. 12.; Australian Government: Canberra, ACT, Australia, 2016.

- Cronshaw, I. Australian Electricity Options: Nuclear. Parliament of Australia, 20 July 2020. Available online: https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/rp2021/AustralianElectricityOptionsNuclear (accessed on 22 November 2022).

- Sovacool, B.; Stirling, A. The Sustainability of Nuclear Power and the Critical Importance of Independent Research. Nature Portfolio, 5 October 2020. Available online: https://socialsciences.nature.com/posts/the-sustainability-of-nuclear-power-and-the-critical-importance-of-independent-research (accessed on 22 November 2022).

- Department of Energy (DOE). Nuclear Power is the Most Reliable Energy Source and It’s not Even Close. 2021. Available online: https://www.energy.gov/ne/articles/nuclear-power-most-reliable-energy-source-and-its-not-even-close (accessed on 9 February 2023).

- International Energy Agency (IEA). Nuclear Power in a Clean Energy System. 2019. Available online: https://www.iea.org/reports/nuclear-power-in-a-clean-energy-system (accessed on 9 February 2023).

- Department for Business Energy & Industrial Strategy. Australian Radioactive Waste Agency. 2023. Available online: https://www.industry.gov.au/australian-radioactive-waste-agency (accessed on 9 February 2023).

- World Nuclear Association (WNA). Advanced Nuclear Power Reactors. 2021. Available online: https://world-nuclear.org/information-library/nuclear-fuel-cycle/nuclear-power-reactors/advanced-nuclear-power-reactors.aspx (accessed on 9 February 2023).

- Oettingen, M. Assessment of the radiotoxicity of spent nuclear fuel from a fleet of pwr reactors. Energies 2021, 14, 3094. [Google Scholar] [CrossRef]

- CSIRO. Gencost: Annual Electricity Cost Estimates for Australia; CSIRO: Canberra, ACT, Australia, 2022. Available online: https://www.csiro.au/en/research/technology-space/energy/energy-data-modelling/gencost-2021-22 (accessed on 24 October 2022).

- Wild, D. Australians Back Nuclear Power. 2022. Available online: https://ipa.org.au/publications-ipa/media-releases/australians-back-nuclear-power#:~:text=70%25%20of%20Coalition%20voters%20support,plants%20(30%25%20oppose) (accessed on 9 February 2023).

- Lowy Institute. Lowy Institute Poll 2022, Nuclear Power in Australia. 2022. Available online: https://poll.lowyinstitute.org/charts/nuclear-power-in-australia/ (accessed on 9 February 2023).

- University of Queensland. Net Zero Australia Study Launches. 2021. Available online: https://chemeng.uq.edu.au/article/2021/06/net-zero-australia-study-launches (accessed on 10 February 2023).

- University of Melbourne; University of Queensland; Princeton University; Nous Group. Interim Results; Nous Group: Hobart, TAS, Australia, 2022. [Google Scholar]

| Weather | The weather can be chosen from ten historic years. This affects wind, solar, and hydro generation, and electricity demand in a consistent manner. |

| Fuel prices | Fuel types can be allocated a level of volatility. All fuels in that group will experience the same random price change chosen annually from a lognormal distribution. |

| Capital expenditure | New build plants can be allocated a level of volatility. The capex of all plants in that group will experience the same random change chosen annually from a lognormal distribution. |

| New build projects | New plants can be subject to a 50:50 chance of being built. |

| Low emissions projects | Lower emissions generation options, such as renewables, gas, and CCS, can be subject to a higher or lower build rate. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Byrom, S.; Bongers, G.; Dargusch, P.; Garnett, A. Integrated Policies to Reduce Australia’s Electricity Sector Greenhouse Gas Emissions to Net Zero by 2050. Energies 2023, 16, 2259. https://doi.org/10.3390/en16052259

Byrom S, Bongers G, Dargusch P, Garnett A. Integrated Policies to Reduce Australia’s Electricity Sector Greenhouse Gas Emissions to Net Zero by 2050. Energies. 2023; 16(5):2259. https://doi.org/10.3390/en16052259

Chicago/Turabian StyleByrom, Steph, Geoff Bongers, Paul Dargusch, and Andrew Garnett. 2023. "Integrated Policies to Reduce Australia’s Electricity Sector Greenhouse Gas Emissions to Net Zero by 2050" Energies 16, no. 5: 2259. https://doi.org/10.3390/en16052259