Abstract

The EU policymakers have adopted legislation to support communities taking responsibility for the energy transition. However, their development and integration are still in their early stages: many studies are performed without considering the overlapped social, economic, political, electrical, and information technology tasks simultaneously. This paper is the first to look at energy communities in their entirety, from the roles of the actors to the organisation, regulation, technical solution, and the market, to the use and business cases. The waterfall methodology was used throughout the work. The results show that energy communities can be viable by becoming reliable players so DSOs can better integrate the acquired flexibility and other services into their processes without compromising power supply. Their technical integration requires a coordinated operation and control of the entire power grid, including transmission and distribution, and the end-users, as proposed by the LINK holistic solution. The suggested fractal-based market structure, with the national, regional and local markets harmonised with the grid, facilitates the direct participation of small customers and distributed resources to the energy market. The results of this work may help policymakers, regulators, and industry representatives define new energy policies and processes related to research and development programs for implementing fully integrated renewable energy communities.

1. Introduction

The rise of collective consumption, meaning the Peer-to-Peer (P2P) based activity of obtaining, giving, or sharing access to goods and services, coordinated through online community services [1] and the need to promote the Distributed Energy Resources (DERs) has provided the hub for Energy Communities (EnCs). The local supply they promote may achieve broad beneficial economic, social, environmental, and governance outcomes [2].

Since 2018, EU policymakers have adopted legislation to support local communities in taking responsibility for the energy transition [3,4]. Two kinds of EnC are distinguished: Renewable Energy Communities (REnCs) and Citizen Energy Communities. This paper focuses on REnCs. Their development and operation overlap and intertwine the social, economic, political, electrical, and information technology tasks.

1.1. Literature Review on Organisation Forms

As per definition, the REnCs (see Appendix A) may have a vast spectrum of organisation forms. Cooperatives [5,6] are the most common form of the organisational structure adopted by EnC initiatives. They constitute democratic structures that follow a set of internationally agreed principles and make decisions on a one-member-one-vote basis; an elected board governs day-to-day operations. “Limited” or “joint and several” Partnerships [5,6] or Corporations [7,8] that, in contrast with the first form, is a legally approved single entity that acts as a legal person before the law. Associations [9] are individuals or legal persons who agree to form a typical structure and pursue a common goal or purpose. They can be registered or non-registered. Associations can vary from small informal, local hobby groups to large multinational interest groups.

This type of diverse organisation and self-governance raise questions about their reliability to be integrated into the existing power systems structures [10]. This paper specifies the relevant actors and the organisation forms of a REnC under a holistic approach considering the socio-cultural conditions and technical, economic, and financial topics.

1.2. Literature Review in Technical Challenges

The EnCs are widely associated with promoting and using DERs. The electricity produced by the latter could provide flexibility, and in addition to the customers, even Transmission and Distribution System Operators (TSOs and DSOs) can benefit from their further deployment [11]. The DSOs may procure local flexibility using the information about transactions between other stakeholders to ensure the grid constraints are respected [12]. The demand from DSOs to buy flexibility products is expected to grow [13].

From a technical perspective, all research on the realisation of EnCs or P2P transactions builds on microgrids [14,15,16,17]. This direct correlation leads to a one-to-one translation of the technical challenges of microgrid implementation to the ones of EnCs.

While smart grids tend to focus on the entire electric system, including generation and storage, regardless of size, transmission and distribution grid, and customer devices [18,19], microgrids are limited to small-scale energy consumers, electricity producers and storage [20]. The diverse types of microgrids or structures, such as Low-Voltage (LV) customer Microgrids, LV Microgrids [21,22] and Medium-Voltage (MV) Microgrids [23], or Microgrids restricted to the customer level, CELLs or Multi-Microgrids at LV levels, and Multi-CELLs in MV levels [24] are highly intertwined and extremely complicated [20]. Multiagent systems dealing with autonomous decision modelling are widely proposed to additionally place DERs without reengineering the whole system. Based on local information, the multiagent methods for controlling voltage in radial feeders [25] do not consider the superordinated grid and the uncontrolled reactive power provoked there.

1.3. Literature Review on Economic Challenges

The big suppliers dominate today’s electricity market. The current market structure dates to when electricity was mainly generated in large power plants and fed into the transmission grid. The potential of local energy markets is considered very high in the literature: nearly all publications identify them as crucial to promoting the integration of large-scale renewable DERs and creating viable EnCs [26,27,28,29,30]. The local energy market can provide ancillary services and relieve the balancing market needed to meet electricity demand. It opens doors for the interactive grid and customer participation [31].

Despite all the developments and progress, many drawbacks [32] have been identified. They mainly concern coordination within the power grids (between transmission and distribution), the power grid with the customer, and the new local market structure. For example, significant voltage and loss challenges may occur due to extensive local PV generation if local generation and consumption are unfavourably distributed on the grid. Local markets could exacerbate these challenges. In other studies, the market structure is changed by adopting time-based pricing mechanisms and reliability-based incentive offerings. The entrance of DERs into the market realises using load service aggregators [33].

There are complex interdependencies between economic, political, and social market objectives to support extensions to the market design and bidding strategies [34], especially as electricity is a key strategic resource of our times. The DERs, an increasing captive power generation type involving a surge in power producers and self-optimising systems, require an entirely different market architecture [35].

First, the holistic consideration of the power system, Customer Plants (CP), premises where the electrical equipment (which consumes or generates electricity) of a person or organisation are located, and the market allows for harmonising the EnCs with the entire power grid. In the publications analysed above, liberalised markets were either considered in the form of bilateral contracts, auctions, energy pools etc. (without allowing participants to trade), or in the form of a local market without considering or harmonising with the actual market structure. This paper depicts a fractal market structure that includes three fractal levels: the international or national market, which corresponds to today’s market, and regional and local markets. Producers, consumers and storage or prosumers are eligible participants in the market regardless of their size. This authorisation changes the way electricity is traded between market participants. Additionally, the Link structure of the entire power system and CPs not only improves the supply reliability and grid flexibility but also technically supports the EnCs, P2P trading, and Demand Response (DR). Furthermore, this paper sets out a roadmap for the development and deployment of fully integrated REnCs.

The structure of this paper is summarised as follows. Section 2 overviews the methodology and methods used, and the pilot sites considered. Selected results regarding challenges to establishing an EnC are summarized in Section 3, while Section 4 argues about business organisations, including actors, their roles and structure. Section 5 presents the rise of the fully integrated REnCs treating the technical, market, and communication architecture topics. It also introduces some relevant use and business cases. The main achievements of this work are discussed in Section 6.

2. Methodology

Figure 1 shows an overview of the study methodology for designing the roadmap for a viable renewable EnC. The waterfall method is used for EnC development because it is linear, sequential, and easy to understand. The study started with stakeholder mapping and analysis survey to identify an overall understanding of local stakeholder motives, expectations, challenges, and visions for future implementations of EnCs. Further information on the interview scenario is given in Appendix B.

Figure 1.

The methodology used for designing the roadmap for a viable renewable EnC.

The holistic approach and analysis were necessary to coordinate the technical interaction of EnC activities with the power grid to ensure and extend their flexibility. The market structure was also investigated and further developed, considering the holistic approach.

The holistic analysis was based on the LINK architecture, considering two pilot regions in Sweden’s and Austria’s green- and brownfield areas, respectively.

2.1. LINK-Holistic Approach

The LINK holistic approach was used for the comprehensive analysis in this study, as its architecture encompasses the entire power system, the CPs, and the electricity market [21,36]. It also accommodates the EnCs regardless of the ownership of the power systems’ assets [37].

2.2. Pilot Sites

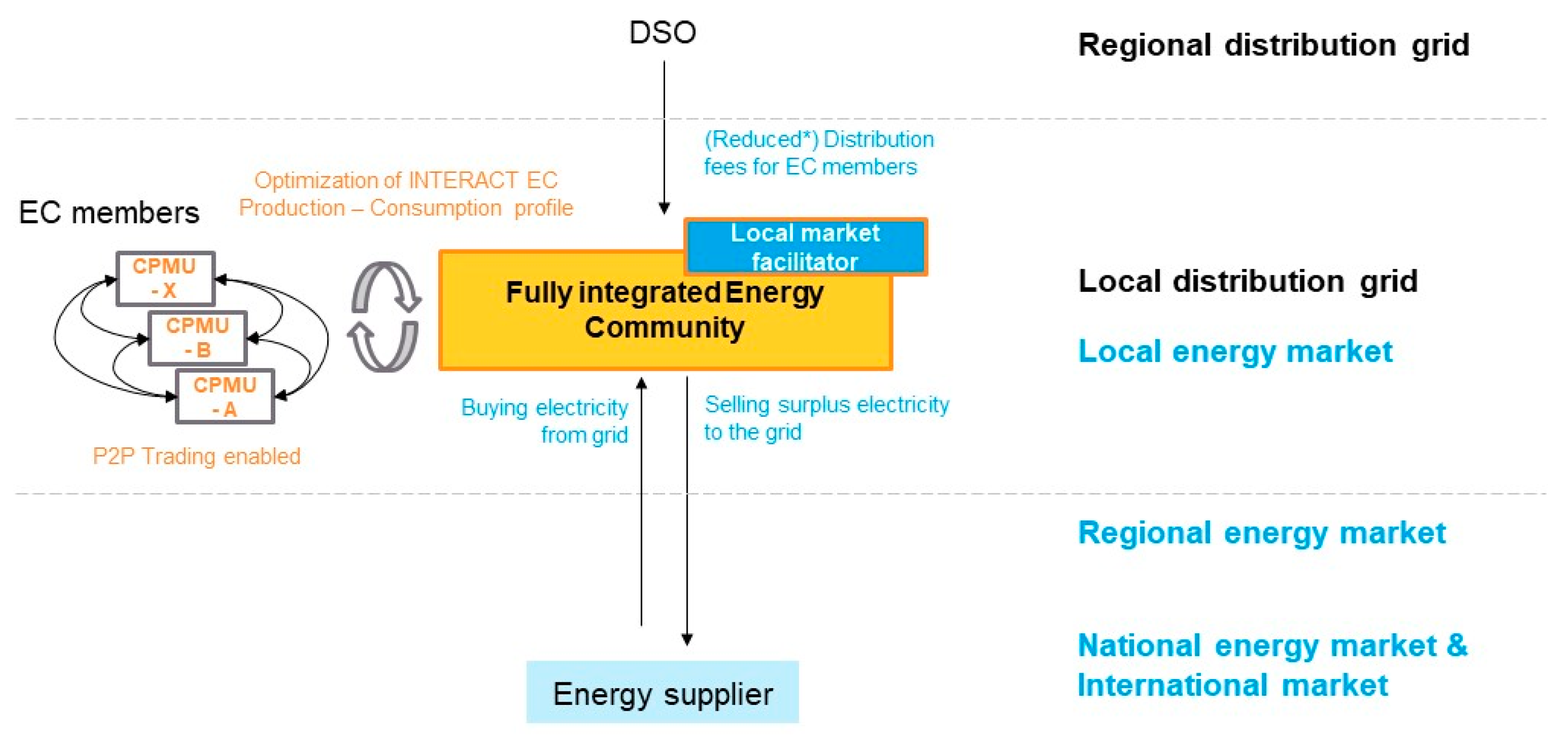

This work focuses on two pilot sites: Großschönau in Austria and Fyllinge in Sweden. While Großschönau is a fully built-up area, in Fyllinge, a new district is in planning.

2.2.1. Brownfield Area: Großschönau, Austria

Großschönau is a small rural municipality in Lower Austria with 450 inhabitants and a surface area of about two km2, Figure 2a. More than one kWp of photovoltaic is installed per capita in the municipality; currently, 21 out of 109 permanently used buildings have PV installed, whereas the smallest installed PV has a size of 1.08 kWp, and the largest 72 kWp. An energy data measuring network is in place for all public buildings, and private houses are also connected. Several public charging stations for electric cars are privately and commercially used. Heat pumps are available and accessible to increase the flexibility of a potential EnC.

Figure 2.

Pilot sites in aerial view: (a) Großschönau, Austria; (b) Orange square shows the green field area in Fyllinge, Sweden.

The 0.4 kV LV grid in Großschönau has five LV subsystems connected through Distribution Transformers (DTRs) in two different 10 kV feeders. This paper details the results of only one of the five subsystems, subsystem “K” (see Section 5.1.1).

2.2.2. Greenfield Area: Fyllinge, Sweden

Fyllinge, a greenfield area, is southeast of the Swedish city of Halmstad. To date, little has been built in the area; it is mainly unused land. This area has recently been identified as suitable for residential buildings in the overview plan, meaning there is still a process to decide its details. Assumptions, such as the number of households and installed production capacity, have been made for this work based on recent development projects in similar cases that might not necessarily reflect the final decisions. The pilot is planned as a solar city, meaning that all suitable rooftops will be covered with PVs. Therefore, own production will cover a large part of the area’s average electricity consumption over a year. The area will be equipped with heating systems, such as district heating and heat pumps. Due to the significant uncertainties in the greenfield area, a comparison between the potential of an energy community in a brownfield area is of little use. However, the conclusions from studying the potential of the brownfield area will provide valuable principles for planning for the greenfield case, i.e., how to allow for extensive integration of distributed production without unnecessary investment in the local grid or how to use energy communities to allow for closer cooperation between real estate developers and grid owners.

3. Challenges to Establishing Energy Communities

A pathway to establishing EnCs is examined from a multi- and interdisciplinary perspective, as current regulations and the state of the art do not enable their harmonised operation with the power system and direct connection to the energy market. The stakeholder analysis with interviews representing various stakeholder groups in the pilot sites revealed multiple challenges regarding the perceived costs, risks, competencies, and trust in EnCs.

The definition of EnCs and the corresponding legislation is still very general, mainly related to the basic independent operation and does not provide clear structures for building EnCs that harmonise with the power grid and deliver a reliable actor. As a result, it is nearly impossible to estimate the cost of contracting and deploying infrastructure, billing services, and possibly the investment cost of other technologies for integrated operation. In addition, when asked about currently possible basic EnC operations, Austrian stakeholders’ representatives expect higher costs for those setting up an EnC for the first time, as unclear conditions are likely to be associated with unforeseen expenses. Non-monetary costs include effort and personal involvement in setting up and managing the EnC (membership acquisition, billing, contracting partners, etc.); see Appendix C.

There is a high level of uncertainty about the potential costs and benefits of an EnC, due to a lack of applied cases and the changing market situation. In addition, various risks are perceived, such as lack of information, on procedural details in calculations and settlements for members, of settings and participant’s roles, and clear responsibilities, as well as organisational burdens and structural barriers from other stakeholders on which an EnC depends, such as DSOs, utilities, or third-party providers. The risk is that customers do not follow their expected roles and lack clear benefits, motivation, knowledge, and time.

Trust in actors engaged in organising and planning the EnC, as well as inviting citizens to become members, is a key aspect in the acceptability of the solutions, especially in areas where local actors have a high impact on decision outcomes and, therefore, hold responsibility. When people know little about technology, acceptance may mostly depend on trust in actors responsible for the technology as a heuristic or alternative ground on which to base one’s opinion [38].

The assessment in Austria shows that the municipality and its organisations are trusted and preferred in leading the EnC. In contrast, existing and new energy providers are not chosen to fill this role. Moreover, citizens, opinion leader organisations and private businesses are not preferred. Respondents generally show high awareness of the unclear status and potential unexpected outcomes, yet, also have high trust in the organisations currently involved to find a good structure and beneficial pathways to move forward.

In Sweden, in the case of the greenfield approach Fyllinge in the early stage, only three stakeholders were involved. The DSO was owned by the municipality and was interested in increasing the exploitation rate with the need to increase the grid capacity. In a later stage, future inhabitants will be involved, and a legal organizational form is needed.

4. Business Organisation

Based on the existing generic definition of REnCs [3,4], the INTERACT project expands this definition with specific rights and obligations to ensure integrated operation.

An integrated EnC, as defined by the INTERACT project, means a legal entity:

(a) Which is based on open and voluntary participation.

(b) That is autonomous and effectively controlled by shareholders or members that are located in the proximity of the renewable energy sources, owned and developed by that legal entity or its members.

(c) Where the shareholders or members are natural persons, SMEs, or local authorities, including municipalities.

(d) With the primary purpose of providing environmental, economic, and social community benefits for its shareholders or members or for the local areas where it operates rather than financial profits.

(e) Which establishes and operates local markets in harmony with the grids and other markets to enable the active energy trading of the shareholders or members.

4.1. Actors and Roles

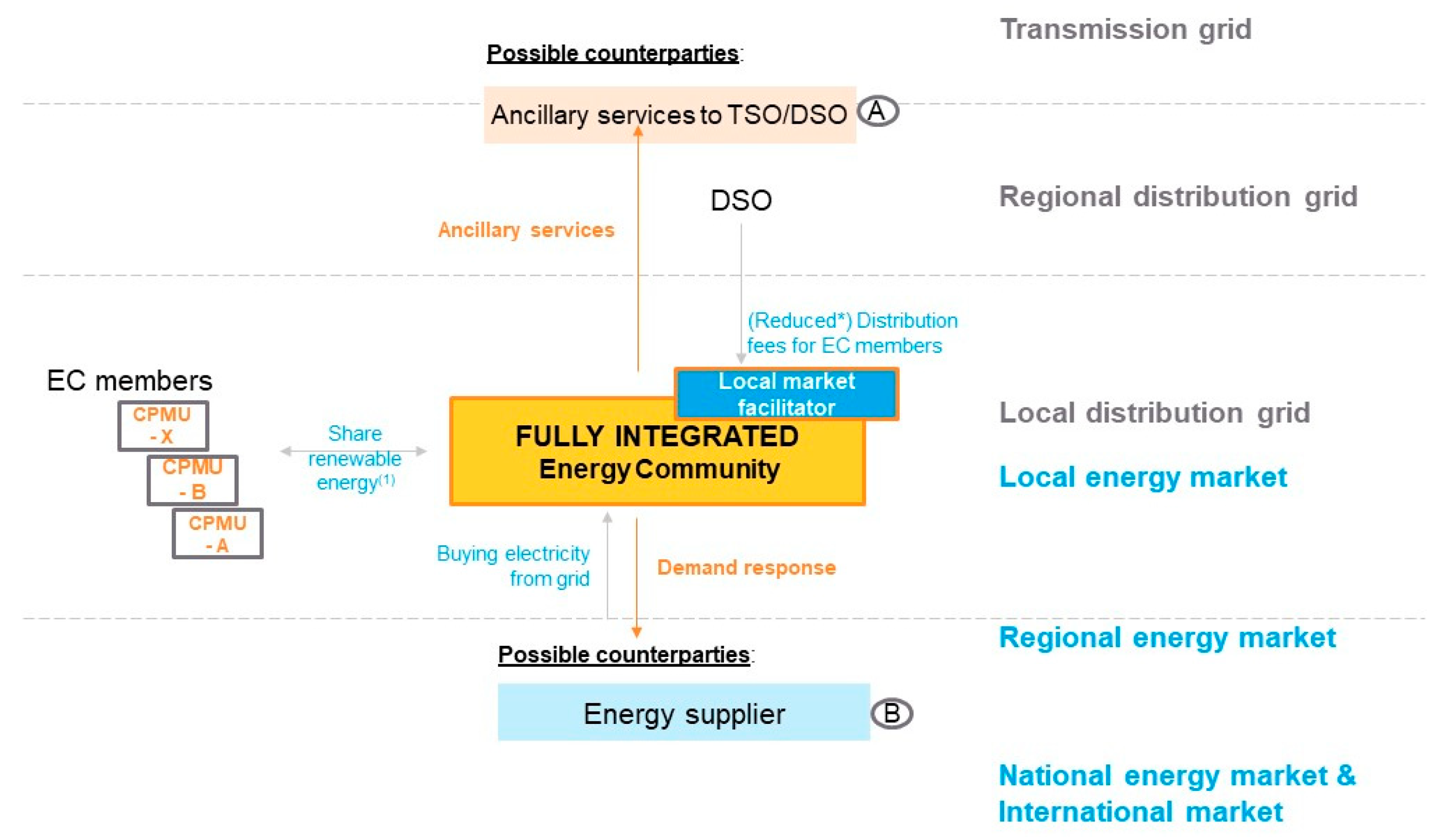

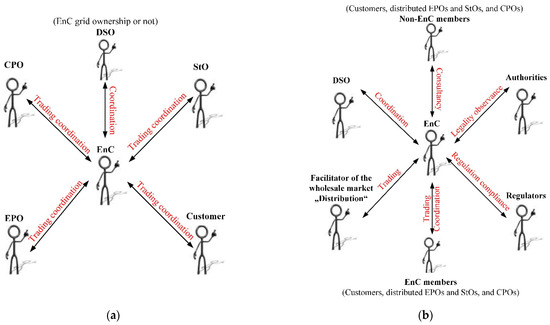

Figure 3 overviews the actors relevant to an integrated EnC and their interactions and roles. The EnC can interact with many actors in the energy sector, such as customers, distributed Electricity Producer Operator (EPO) or Storage Operator (StO), Charging Point Operator (CPO), authorities, regulators, and market facilitators. Concerning its roles, it is essential to distinguish between external and internal tasks.

Figure 3.

Overview of the EnC actors and their roles: (a) Internal; (b) External.

Internally, the EnC interacts with its members, such as the customers (consumers or prosumers), distributed EPOs and StOs, and the DSO(s) to whose grid its members’ facilities are connected, Figure 3a. It coordinates the energy and flexibility trading in the local market (see Section 5.2.2 Market’s Fractal Structure), the long-term planning of facilities, the day-ahead and short-term operation planning, and all legally and organizationally required issues. Additionally, the EnC fulfils community services, e.g., it cares about the members’ concerns, brings them together, promotes knowledge share, etc. Externally, it interacts with many actors in the energy sector, Figure 3b. They are DSOs (in the role of the technical or wholesale market “Distribution” operator), authorities, and regulators.

4.2. Structure and Organisation

Depending on the size and strategic target of the EnC, they might either be attached to an existing entity or organised by setting up a new entity. Existing entities having a high degree of trust that can add an EnC to their portfolio are local municipalities and municipality-owned companies. When setting up a new entity, various possibilities are given by law, differing in the owners’ influence on the business, owners’ liability, degree of formality, and planned duration of the organisation. In large groups, we identified partnerships, corporations, cooperatives, community trusts and foundations, and associations as the possible legal structure of an EnC. Depending on the chosen organisation of the EnC, ownership of assets is possible. Community-owned assets can be differentiated into non-electrical and electrical assets. The non-electrical assets mainly cover Communication Technology (CT) infrastructure, land, buildings, and intellectual property. While electrical assets mainly cover electricity grids, production facilities, EV loading facilities, and storage facilities.

The main value-creation activities for the EnCs are categorised into economic, environmental, and social values. The economic benefits include the electricity cost reduction (see Section 5.2.4 Market’s Mechanism), revenue generation, creation of jobs and stimulation of the local economy. The EnCs reduce CO2 emissions and improve infrastructure utilisation (see Section 5.1.2 LINK Technical Solution), thus having a respectable environmental impact. They create additionally many social benefits, such as energy autonomy, access and democracy, security of supply, self-determination, and education in the energy field.

All values described above can be categorised into financial and non-financial. While non-financial values may be hard to estimate, the financial ones must be shared fairly among the community members to maintain the equity and stability of the EnC [39]. In an unstable EnC, unsatisfied members may prefer opting out of the EnC and may even create a smaller one on their own. An EnC is stable when financial values are shared by transparent and understandable procedures so that:

- Each member receives more than they would receive after opting out of the EnC.

- Each subgroup of members receives more than it would receive after creating an EnC on its own.

Financial values can be shared based on simple (e.g., each member receives equal or pro-rata values) or more sophisticated allocation rules (marginal contribution and Shapely value), whereas sophisticated allocation rules tend to ensure the stability of the EC and the simple ones tend to fail to do so [39].

5. Rise of the Fully Integrated Renewable Energy Communities

Although the power grid is a unique vast electromagnetic machine, its operation is highly fragmented. The increasing DER share makes its reliable operation even more complicated than it already was and poses significant challenges for grid operators. The fully integrated renewable EnCs contribute to overcoming these challenges.

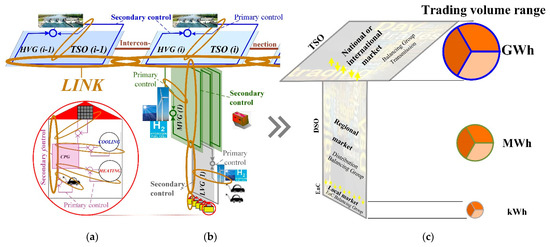

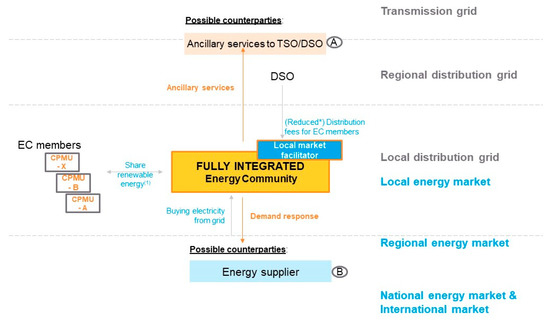

5.1. Technical Holistic Solution

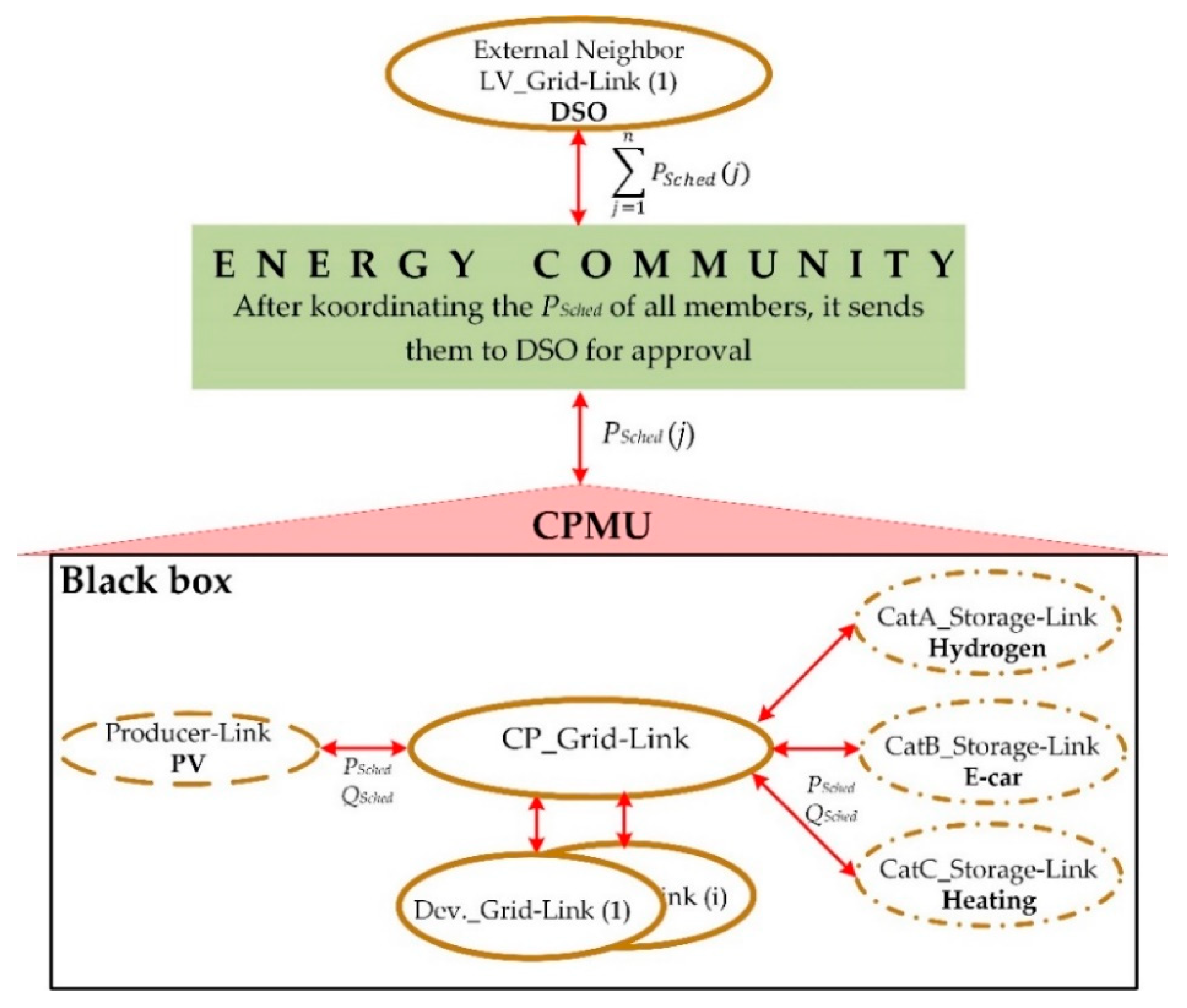

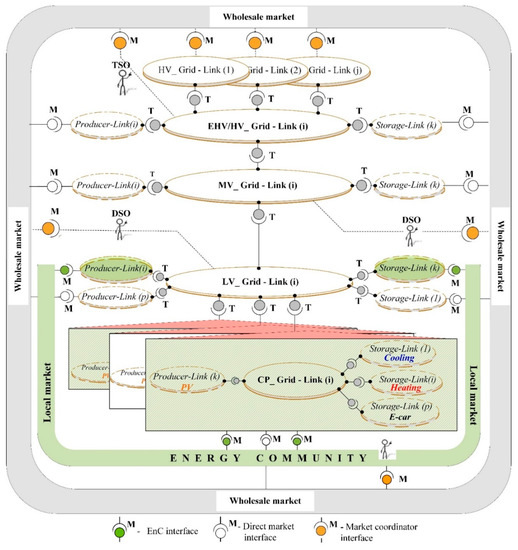

The LINK Architecture enables the deployment of EnCs without ownership of electrical facilities [37], Figure 4. Grid-Links are set up in all voltage and CP levels. A technical interface “T” joins them with the corresponding Storage and Producer-Links. The electricity market comprises the entire architecture so that all actors can participate in the market on a non-discriminatory basis via the “M” market interfaces. Market facilitators, i.e., TSOs, DSOs, etc., are connected to it via the orange interfaces.

Figure 4.

EnC without ownership of electrical facilities embedded in the LINK-Architecture.

The EnC participants act as black boxes, disclosing only the exchanges with the grid, thus guaranteeing the privacy of each customer. A local electricity market can be established with the participation of all EnC members. They can trade electricity with each other, whereas the total EnC energy surplus or deficit can be handled in the neighbouring markets. In this case, the EnC acts as a retailer. Any market actor, i.e., consumers, prosumers, and DER operators’ service providers that are not EnC members trade their electricity in the whole market directly or through an aggregator.

5.1.1. Status Quo

The status quo analysis focuses on the brownfield area (Austrian pilot site). In the greenfield area (Swedish pilot site), everything is in the process of being created with considerable data uncertainties, so concrete simulations and investigations were impossible.

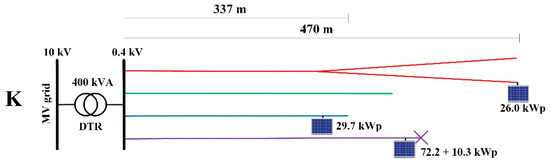

Subsystem K of the Austrian pilot site was selected to illustrate the status quo and the benefits of integrated EnCs. It connects to the MVG through a 400 kVA, 10/0.4 kV DTR, Figure 5. The total feeders’ length is 1820 m: The largest feeder is 470 m long, while the shortest is 337 m. The feeders are shown in different colours according to a code; the longest in red, then in green, purple and the shortest one in light blue.

Figure 5.

Overview of the topology and main PV facilities of the subregion K in Großschönau.

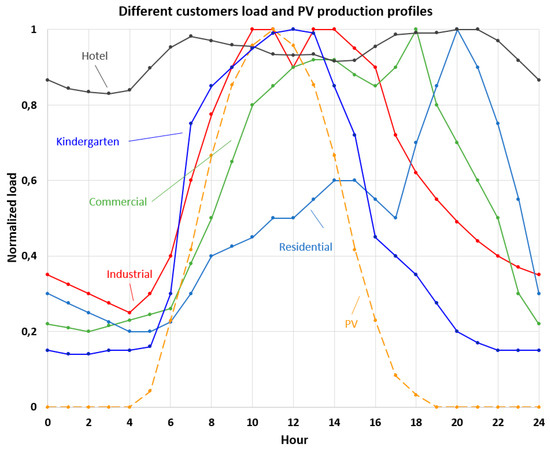

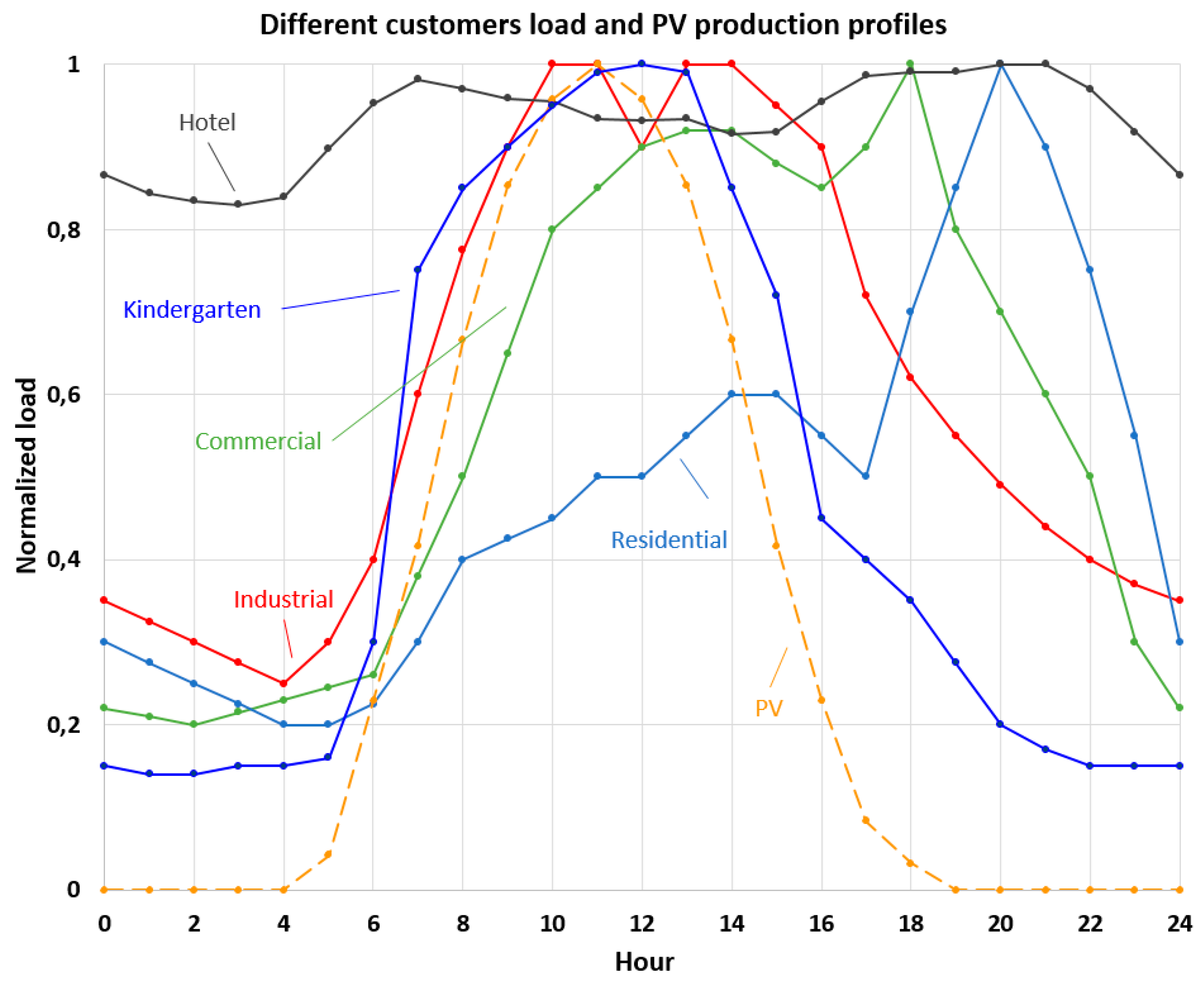

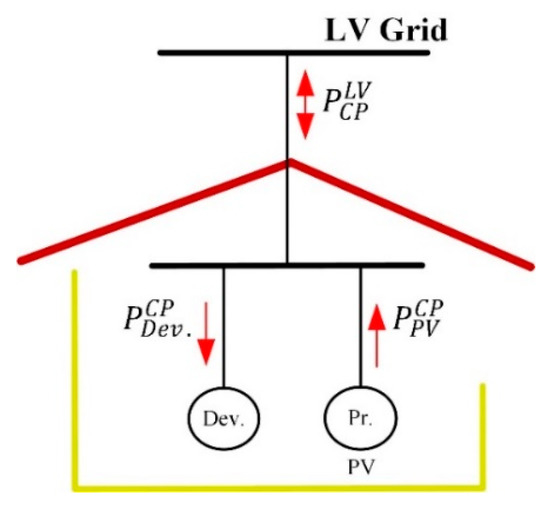

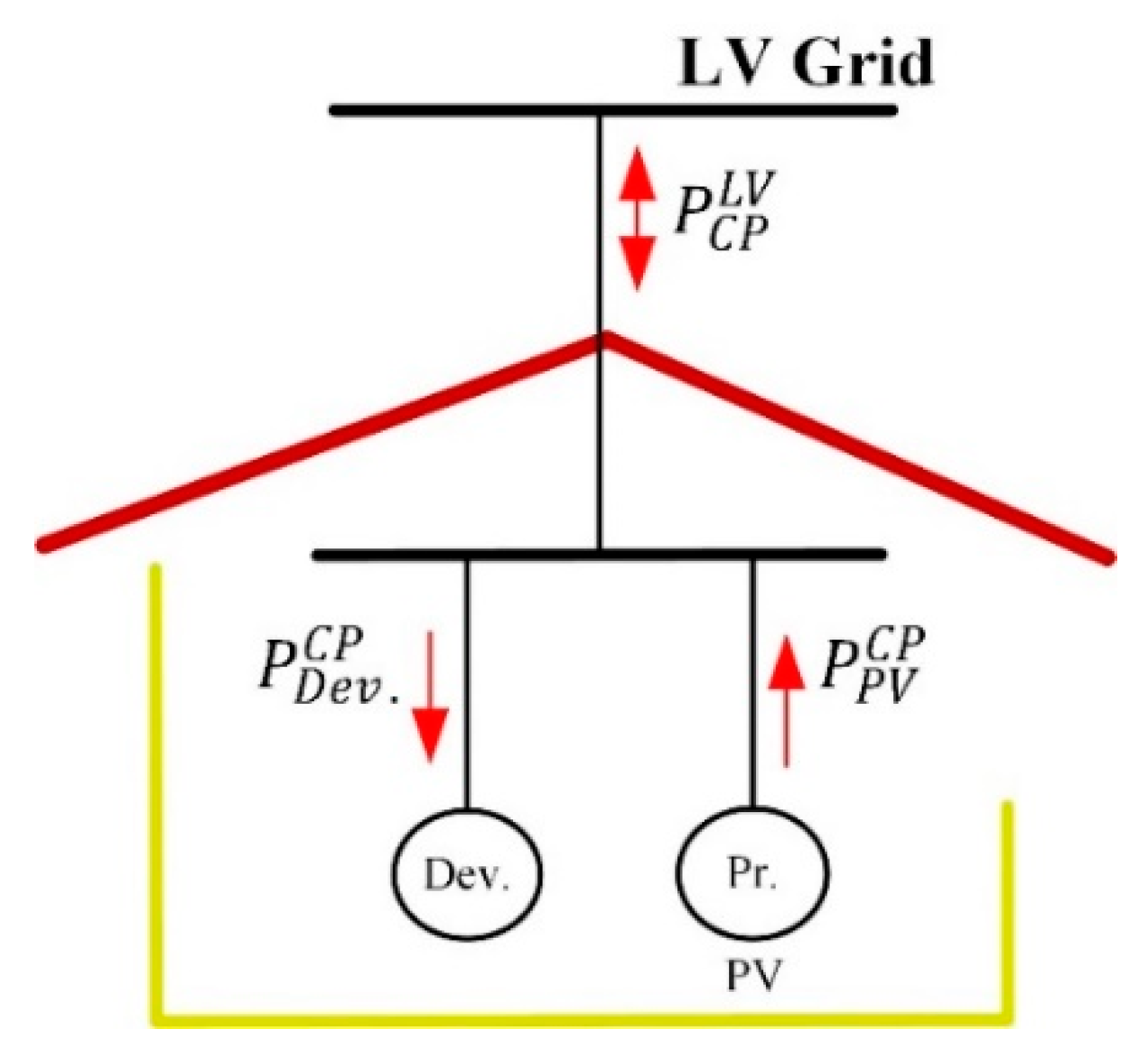

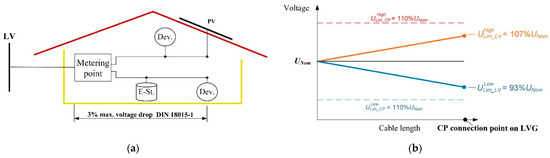

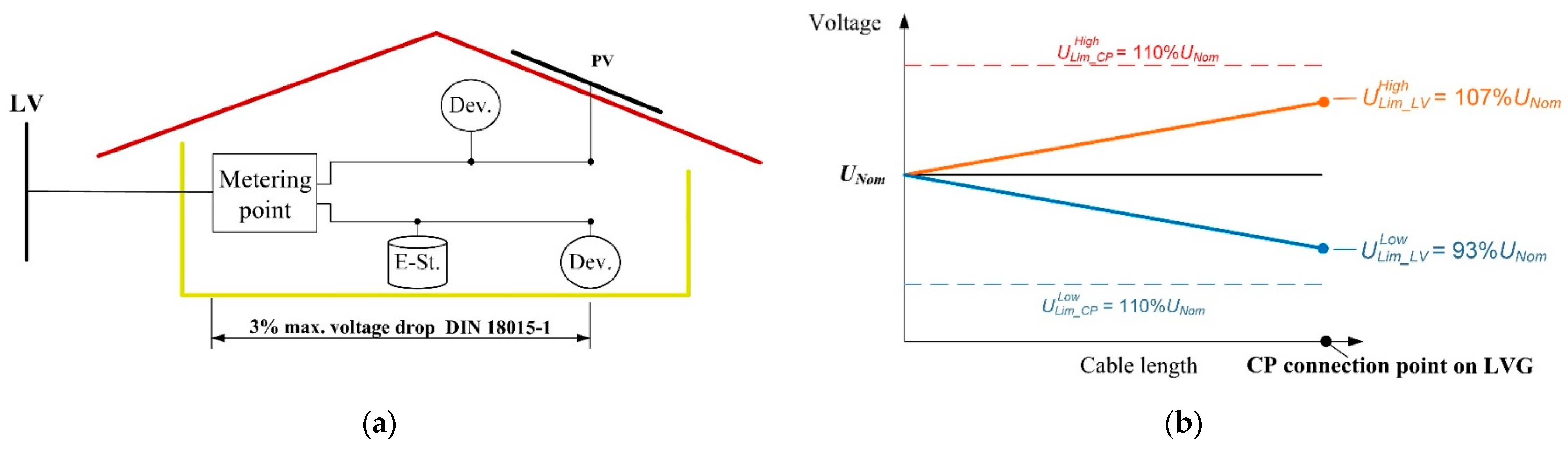

In this subsystem are installed ten PV facilities with about 169 kWp. Four relatively large PV facilities (26.0, 29.7, 72.2 and 10.3 kWp) are connected almost at the end of three feeders. It supplies one e-charging station with an installed capacity of 17 kW. Feeders are modelled through the π equivalent circuit diagram with 150 mm2 for the main cables and 50 mm2 for the laterals; see Appendix D, Table A2. The load is classified into broad types extracted from billing data or load inventory surveys. Six load classes are typically considered: residential, commercial, industrial, agriculture, hotel, and kindergarten (load profiles and the respected cos(φ) are shown in Figure A1 and Table A3). The maximal normalized load for all load profiles is one. The ZIP model considers the load dependency from the voltage; see Table A4. The CPs are modelled through the active power consumed by different electrical devices, , and the active power injected by the PV facility, . From the LV perspective, only the power exchanged with the CP in total, , is relevant, Figure A2.

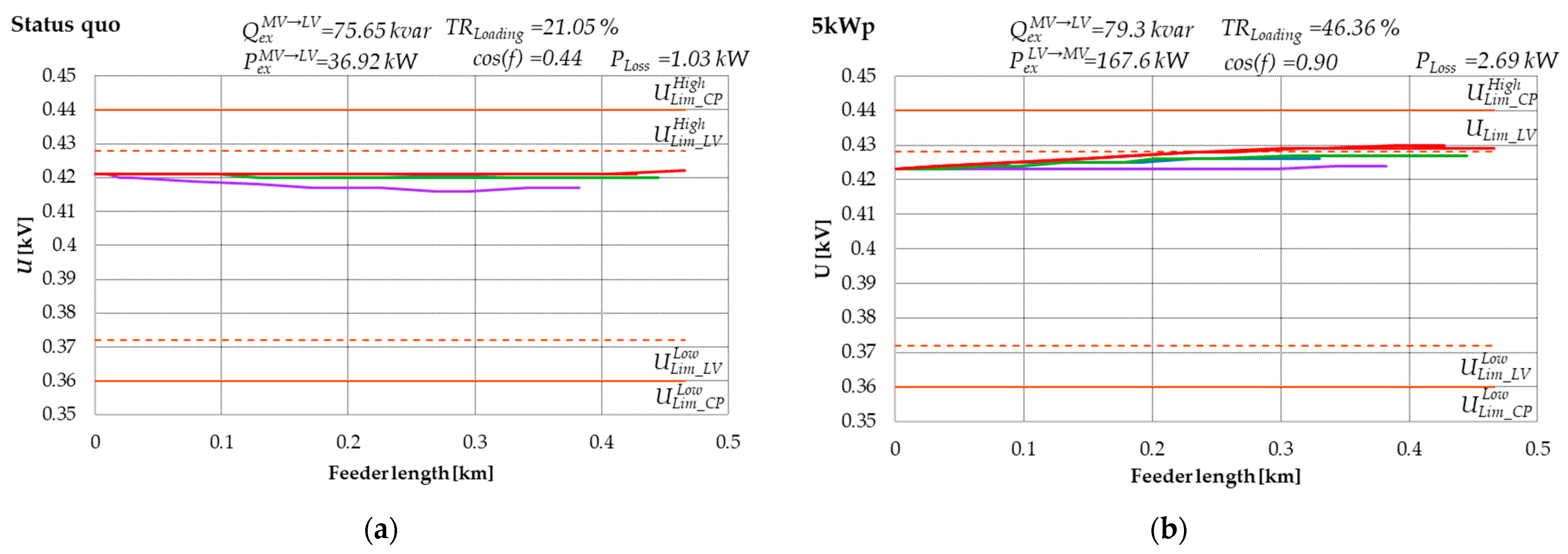

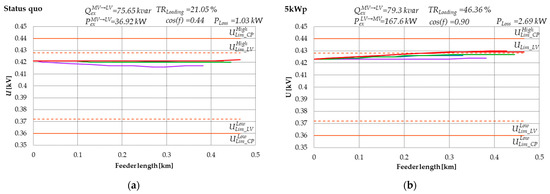

Figure 6a shows the voltage profiles of all feeders according to the colour code on a typical summer day at 11:00 h. All voltage profiles are practically bundled and have an almost straight course. Voltage limits are set as calculated in Appendix D, Figure A3. The K consumes about 37 kW from the MVG, active power exchange in DTR level Pex, with a low power factor of 0.44 (the reactive power exchange Qex is more than double of the Pex). This low power factor indicates an ineffective infrastructure utilisation in this period. The subsystem load is still larger than the total PV production. This behaviour dedicates to PV facilities, which provide electricity with a unit power factor. The DTR is underloaded, with a transformer loading TRLoading of about 21%; no voltage limits are violated. Figure 6b shows the voltage profiles assuming all buildings without an installed PV receive a 5 kWp PV facility on their rooftops. The entire PV production is larger than the feeder load, thus provoking a feedback flow to the MV grid of 167.6 kW. All voltage profiles have a rising course, causing the violation of the upper voltage limit. With 46.36% loading, the DTR continues to be underloaded.

Figure 6.

Voltage profiles during maximum PV production (11:00 a.m.) for two scenarios: (a) Status quo; (b) Additional 5 kWp in each rooftop.

In summary, additional PV installations turn the active power flow direction, provoking the rising voltage profile courses. The upper voltage limit is violated, requiring countermeasures to eliminate it.

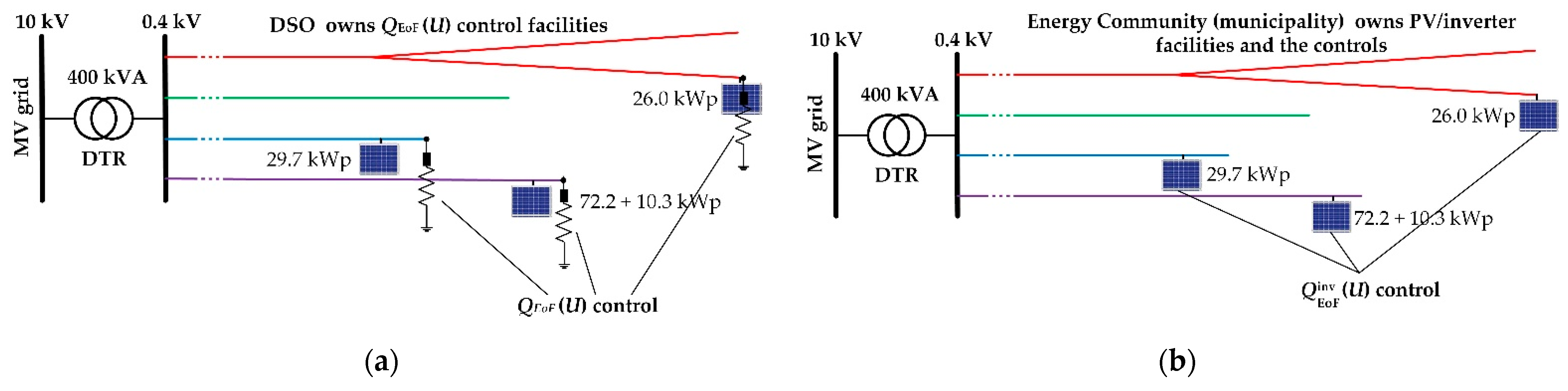

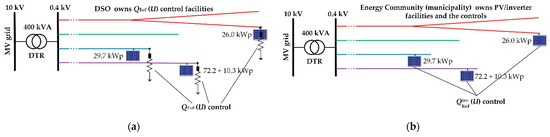

One effective countermeasure is installing concentrated reactive power control devices at the end of the violated feeders [40]. These devices may be established by the DSO, Figure 7a, or by the EnC, Figure 7b. In the case of subsystem K, three large PV facilities are connected at the end of three different feeders. By oversizing their inverters, the municipality or the future EnC can provide reactive power (consume inductive power) when needed to the grid to eliminate voltage violations. The EnC may provide the ancillary service “Reactive power” to the DSO to help them keep the voltage within limits.

Figure 7.

Overview of the countermeasures to eliminate the violation of the upper voltage limit provoked by power feedback: (a) Taken by DSO; (b) Taken by EnC.

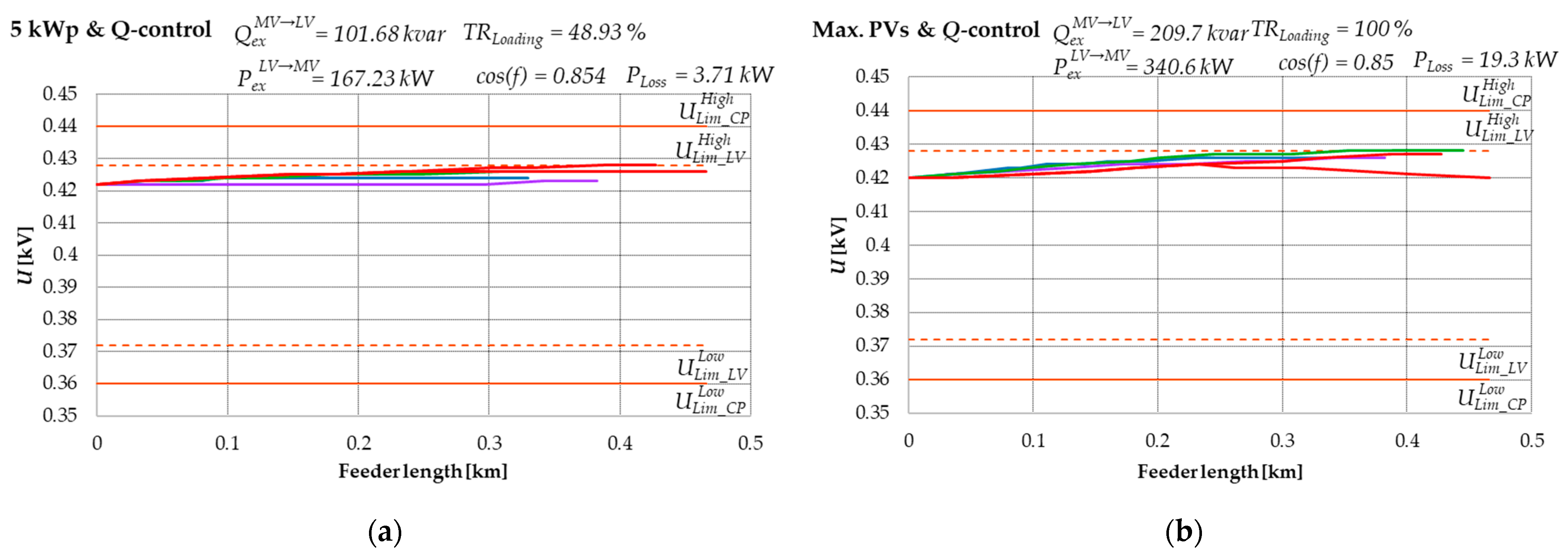

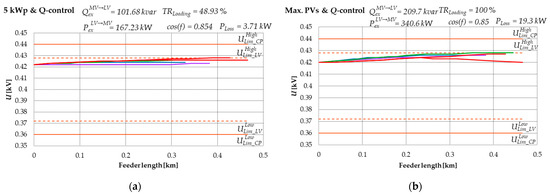

Indeed, simulations show that oversizing the inverters and thus consuming an additional reactive power of 22.38 kvar eliminates all voltage violations. Figure 8a shows the voltage profiles during maximum PV production (11:00 a.m.) combined with Q-autarky at the CP level and Q-control at the feeder level when five kWp PVs are installed on every rooftop. The PV production covers the entire load, and the power surplus of 167.23 kW is fed into the MV grid. The power factor increases to 0.854. The DTR is loaded up to 48.93%. There are still unused areas on the rooftops that may accommodate additional PVs. Figure 8b shows the case of the maximal PV installations without overloading the existing infrastructure. The power surplus increased by more than 100%, reaching 340.6 kW. In addition, the reactive power consumption from the MVGs increased by about 100%, reaching 209.7 kvar. The subsystem is effectively used at a power factor of 0.85.

Figure 8.

Voltage profiles during maximum PV production (11:00 a.m.) combined with Q-autarky in CP level and Q-control at the feeder level for two scenarios: (a) 5 kWp PVs installed in every rooftop; (b) Maximum PV installation without overloading the DTR.

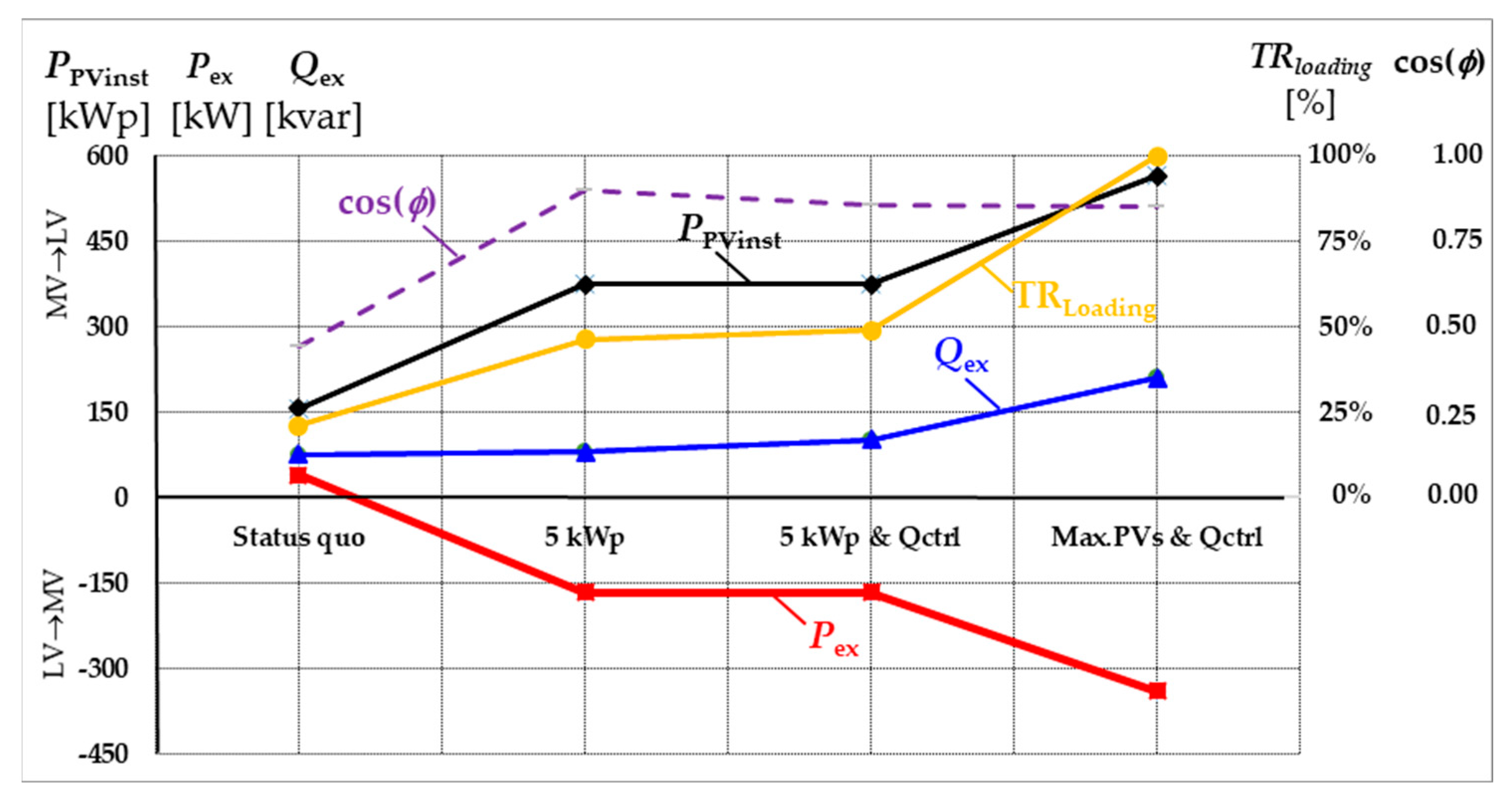

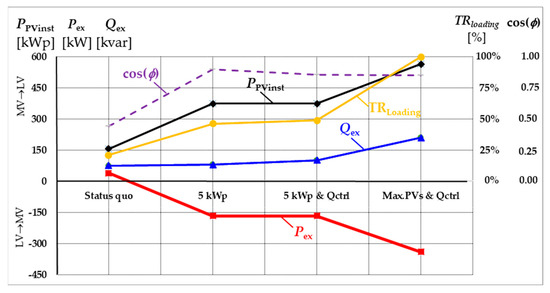

Figure 9 depicts the behaviour of the LV subsystem “K” at different installation levels of rooftop PV facilities. Despite the high demand for PV facilities, the installation rate is very low. In the PV production periods, the infrastructure is ineffectively used by a power factor lower than 0.5 (the infrastructure begins to be effectively used by a power factor larger than 0.7). Concentrated reactive power control is a very effective countermeasure since the provoked reactive power flow is controllable and predictable.

Figure 9.

The LV subsystem “K” behaviour at different installation levels of rooftop PV facilities.

5.1.2. LINK Technical Solution

The LINK’s technical solution is designed for brown- and greenfield cases. The difference lies in the implementation steps. In the brownfield case, an upgrade of the existing relevant architecture and partly new implementations are required. In contrast, the solution is already integrated into the planning phase in the greenfield case.

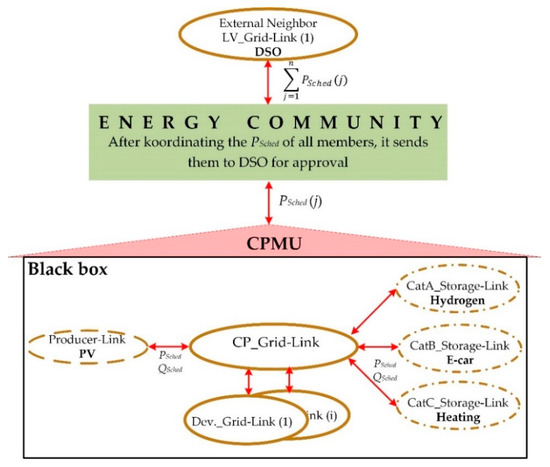

This solution is applied to practically realise viable EnCs. The standardised chain control structures allow for a flexible and coordinated operation of the entire power system, including CPs, organised in the EnC structures. The Customer Plant Management Unit (CPMU) is to be deployed at the CP level, including the Secondary Control Unit set up in the CP-grid area to interact with the higher-level secondary control units as envisioned in the LINK solution, Figure 10. The CPMU acts as a black box that does not provide information about the CP devices. It is responsible for realising the interaction between the LVG and CPs. Communication with the grid occurs only through secure channels, thus protecting the power delivery system from cyberattacks. The LV_Grid-Link sends negotiated set points Pset_point, Qset_point to the CPMU. It supervises the exchange with the grid in real-time and generates and delivers the daily and hourly generation of P schedules. The latter is fundamental for the Production-Load balance process, one of the basic operation processes in power systems. The CPMU controls the reactive power within the CP, realising their Q-autarkic behaviour. It is the hub for realising the End-Use Sector Coupling by optimising electricity production and consumption combined with hydrogen or biomethane production [41] and heating and cooling resources [42].

Figure 10.

Functional/technological architecture; production load balance process.

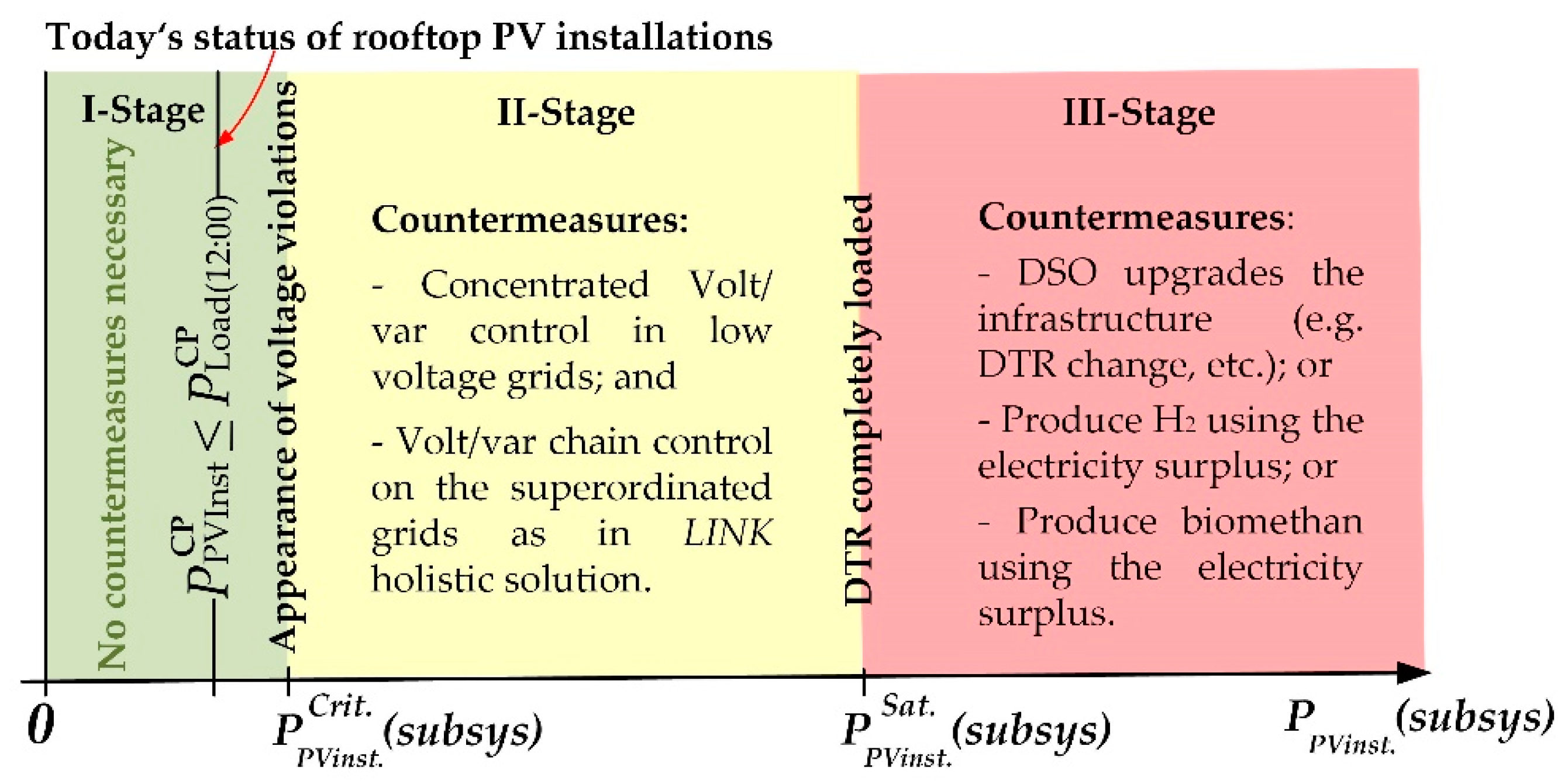

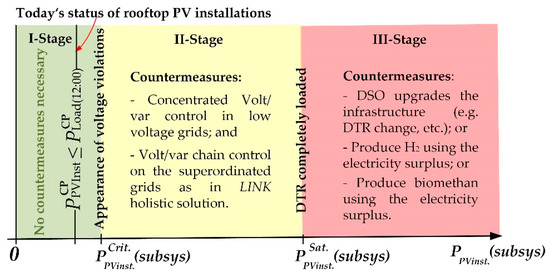

The EnC’s aim is to promote local electricity production by integrating DERs. As discussed above, this integration requires various countermeasures at different integration stages to ensure a reliable and sustainable grid operation. Figure 11 shows the critical parameters for the uptake capacity of rooftop PV facilities in an LV subsystem and the countermeasures for their maximum expansion. Three installation stages were figured out.

Figure 11.

Critical parameters for the uptake capacity of rooftop PV facilities in a LV subsystem and the countermeasures for their maximum expansion.

In the first stage, the green area, the PV installations in the LV subsystem up to the critical value does not require any countermeasures,

Currently, in the legislation of many countries and the corresponding grids codes, PV installation is permitted so long as their power production is smaller or covers the CP load at each point in time:

In this case, the voltage profiles of all feeders are almost bundled and have an almost straight course. No voltage limit violation occurs. The existing infrastructures are underutilised.

In the second stage, the yellow area, where:

voltage violations appear, countermeasures are needed to guarantee reliable and sustainable operation. The PV hosting capacity of the existing subsystem infrastructure is saturated, . The countermeasures should be taken coordinated between the EnC and the grid operators. Installing CPMUs in the premises of all EnC members who are consumers or prosumers allows for flexible and coordinated actions with the corresponding DSOs concerning active and reactive power. The CPMU feature, which makes the customer Q-autarkic, halves the data amount to be exchanged between the EnC and the DSO. It additionally simplifies the algorithms to estimate the state of the grid. As discussed above, EnCs may provide ancillary services in reactive power through suitable oversizing inverters of relevant PV facilities. To guarantee a secure grid operation, the grid operators should set up the Volt/var chain control on the superordinated grids as in LINK holistic solution [43].

In the third stage, the red area, where:

in addition to the countermeasures to eliminate voltage violations, additional countermeasures are required to ensure the secure utilisation of the infrastructure. The countermeasures can be diverse and realised by different stakeholders. The DSO may reinforce the infrastructure (e.g., change the DTR, etc.), or the EnC may store or use the surplus of electricity to produce hydrogen or biomethane, thus helping the economy’s decarbonisation [41,42].

5.2. Fractal Market Solution

Redesigning the market in line with the structure of the power grid and adjusting its mechanisms is necessary to realise the democratisation of the power industry, enable the DR, and meet today’s requirements.

The market structure proposed in this paper aims to provide consumers with reliable, environmentally friendly electricity at the lowest possible cost and promote EnCs and sector coupling. It applies in brown- and green area cases and pursues two main objectives in the design.

The first objective is operation efficiency, making the best use of existing resources. Splitting markets at the national/international, regional, and local levels significantly reduces the current complexity due to the variety and economics of the resources, their uncertainties, and power system constraints. Furthermore, an efficient welfare-maximising outcome is achieved by optimising each market area and the area’s coordination.

The second objective is stimulating capital investment by providing appropriate incentives for its efficient use. Efficient capital investments are usually prompted by suitable price mechanisms, e.g., spot prices. However, electricity is not an ordinary commodity but a unique property. Reliability characterises it. It requires a power reserve to meet demand when supply and demand uncertainties would otherwise create electricity shortages. Intelligent pricing mechanisms should be developed to take this feature into account. A capacity market could also coordinate investments.

The proposed market structure is quite simple, as it is derived from the fractal geometry of Smart Grids. It promotes the direct and equal participation of all actors in the market regardless of the size of their units, making it fair.

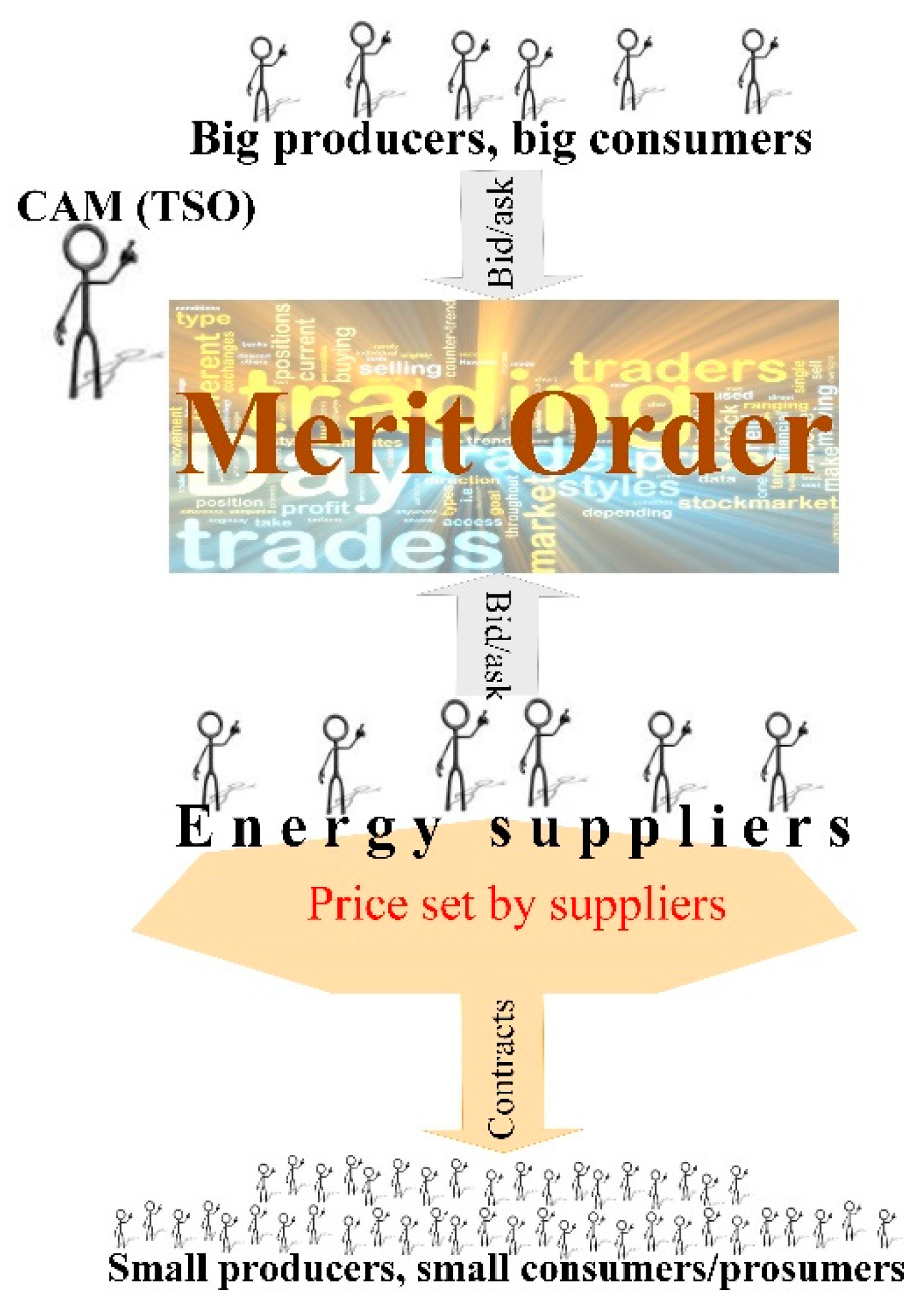

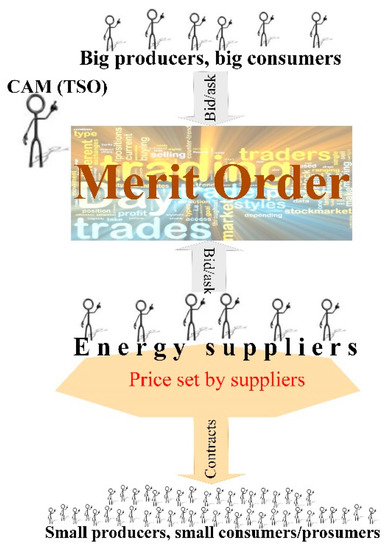

5.2.1. Status Quo of the Economical Processing in the Power Industry

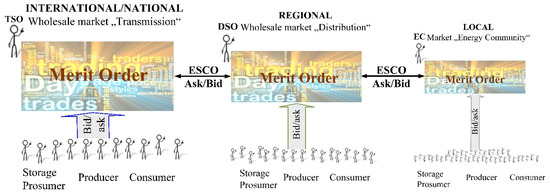

The current economic processing in the power industry is a mixture of market activities and contracts, Figure 12. The players in the electricity market are limited to large electricity producers, consumers, and energy suppliers, which are few. The market is facilitated by the Control Area Manager (CAM), whose role is usually taken over by TSOs.

Figure 12.

Overview of the economical processing used currently in the power industry.

After trading the electricity in the market, the Energy Supplier Companies determine on their own the selling and buying of electricity prices to smaller customers and producers. The latter can buy and sell electricity using various contracting forms. That means that millions of small customers, such as residential ones, etc., and small distributed producers and storage are not considered market players and consequently cannot participate directly in the trading process: they can only choose between different energy suppliers.

The mixed form of economical processing in the power industry is the source of non-transparent pricing for the end customers and the breeding ground for speculations. New regulatory and policy changes to promote DERs have led to changes in the electricity market, including the introduction of time-based pricing mechanisms and reliability-based incentives. Nevertheless, no essential structural changes have been performed yet to allow millions of consumers, prosumers and DERs to participate in the market directly.

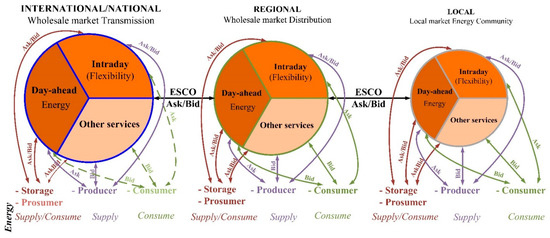

5.2.2. Market’s Fractal Structure

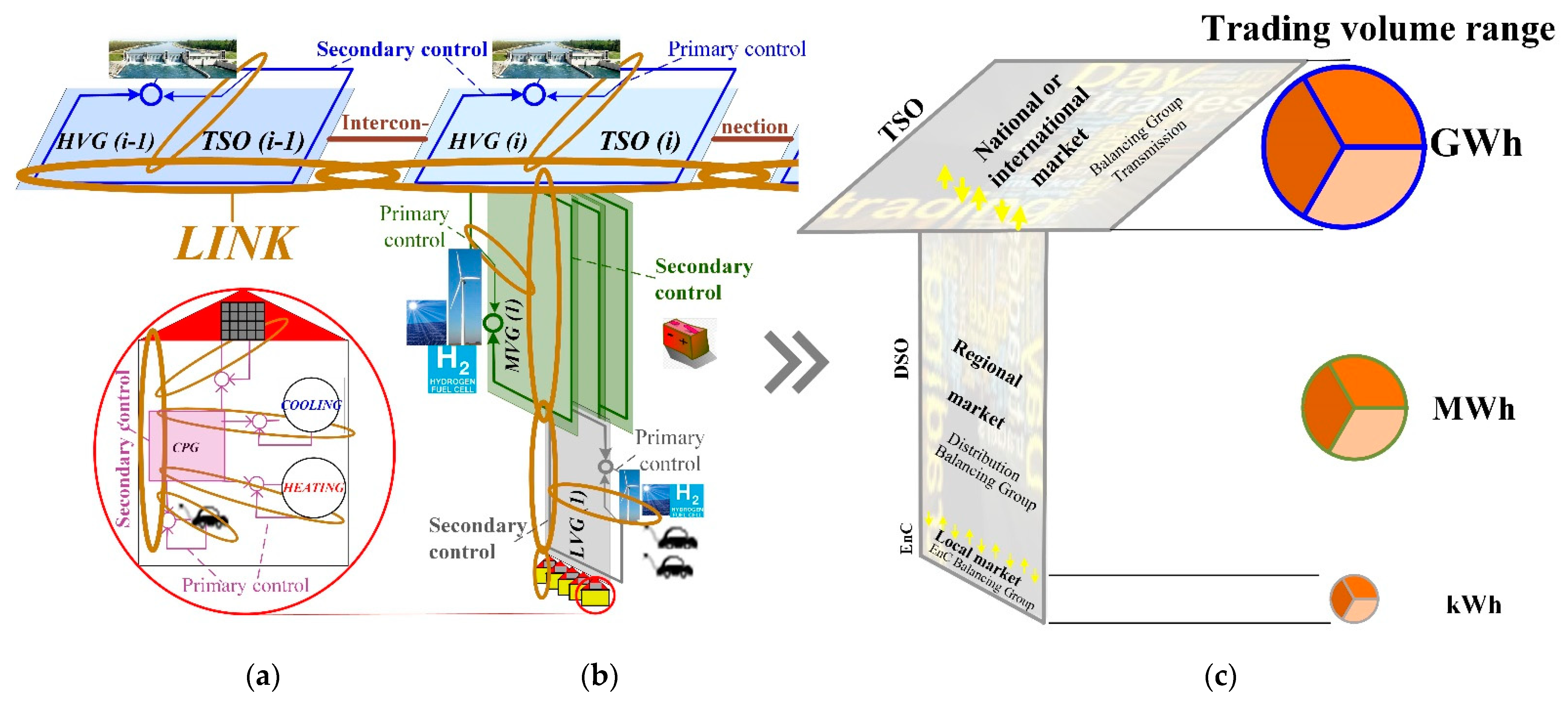

The LINK-Solution postulates a fractal structure for the power industry that automates different operation processes and enables the information exchange needed for the market operation, Figure 13. The basis of the LINK fractal structure is the holistic technical model of Smart Grids “Energy supply chain net,” Figure 13a. It has a T-setup, where the very high and High Voltage Grids (HVG) are established on the horizontal axis, while the Medium and Low Voltage Grids (MVG and LVG) and CPs are located on the vertical axis. The new market, Figure 13b, is designed to have the same T-setup as the Smart Grids, allowing their harmonisation. It increases the space granularity of the electricity market by introducing new market categories to the existing ones in the transmission area, renamed national/international market. The new markets are the regional markets in the distribution area and the local markets in the EnC-area of customer plants.

Figure 13.

The fractal assembly of Smart Grids in LINK-Solution: (a) Energy supply chain net holistic model; (b) LINK-market arrangement; (c) Fractal range of trading volumes.

The regional market is a whole market with DERs and customers, or an EnC, whose members are connected in the distribution grid, as players. The DSOs take over the role of market facilitators for the regional markets.

The retailed local market aims to trade energy and services near electricity generation, considering environmental, socio-economic, and technical criteria (e.g., CO2 reduction, welfare maximisation, power system reliability, etc.). The participating actors are customers (prosumers and consumers) and DERs. The EnC takes over the role of the local market facilitator.

Figure 13c shows the range of trading volumes for the different market categories. The trading volume defines the market size. It refers to the total energy traded during a specific period. The market patterns and the trading volume sizes repeat in ever-smaller scopes.

The division of the total energy trading volume (ETr) over a period by the length of the period (h) gives the Average Trading Volume (ATV). The result is the average trading volume per unit of time, typically per day:

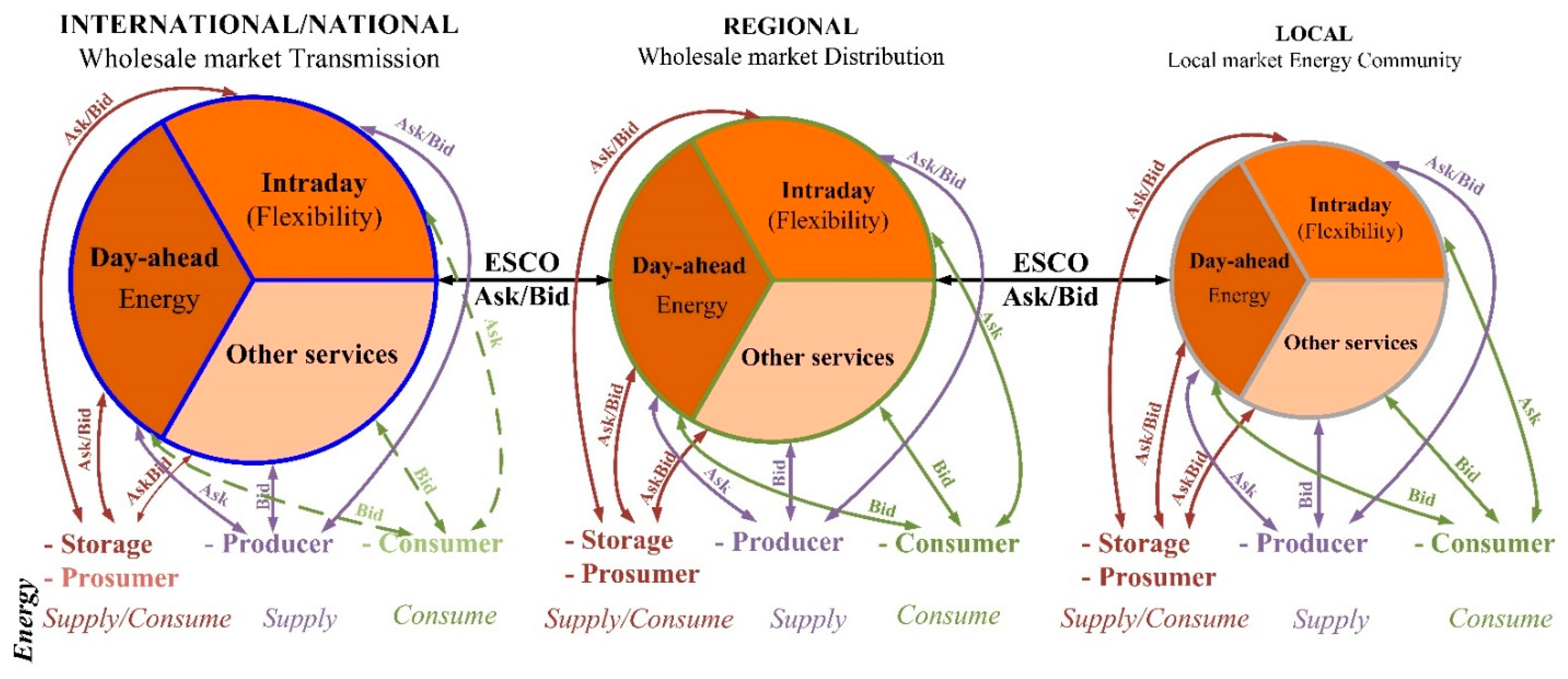

The ATV for the national market ranges (GWhs), regional one (MWhs), and local market (kWhs). All market categories, i.e., international/national, regional and local, have identical segment arrangements, as shown in Figure 14. The TSOs, DSOs, and EnCs conduct the respective markets in all segments, such as energy (day ahead), flexibility (intraday) and other services [44]. The same types of market players are involved in all three-market categories. In LINK-Architecture, production and storage facilities are present in all fractal layers of Smart Grids. Their operators join all three-market categories. Producers offer energy in the day-ahead and intraday market and other services. Storage supply or consume energy, and their operators offer and demand in all market segments. Markets have two additional atypical participants: the prosumers and consumers. Like storage operators, prosumers ask and bid in all market segments because they can supply or consume energy. Consumers consume energy, bid in the day-ahead and intraday market, and ask for other services. Energy Service Companies (ESCO) may bid and ask between markets.

Figure 14.

Overview of the electricity market structure derived from the fractal LINK-structure.

Each market category is defined as a price area, i.e., the largest geographic area where market players can trade without capacity allocation. This is the Link-Grid area, where the LINK chain control supervises and mitigates the boundary congestion. The regulator defines these areas in collaboration with TSOs, DSOs, and EnCs.

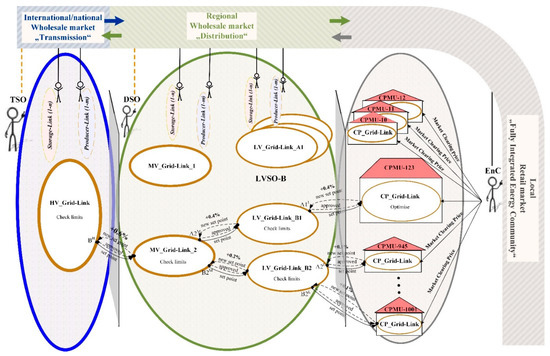

5.2.3. Harmonised Market Structure

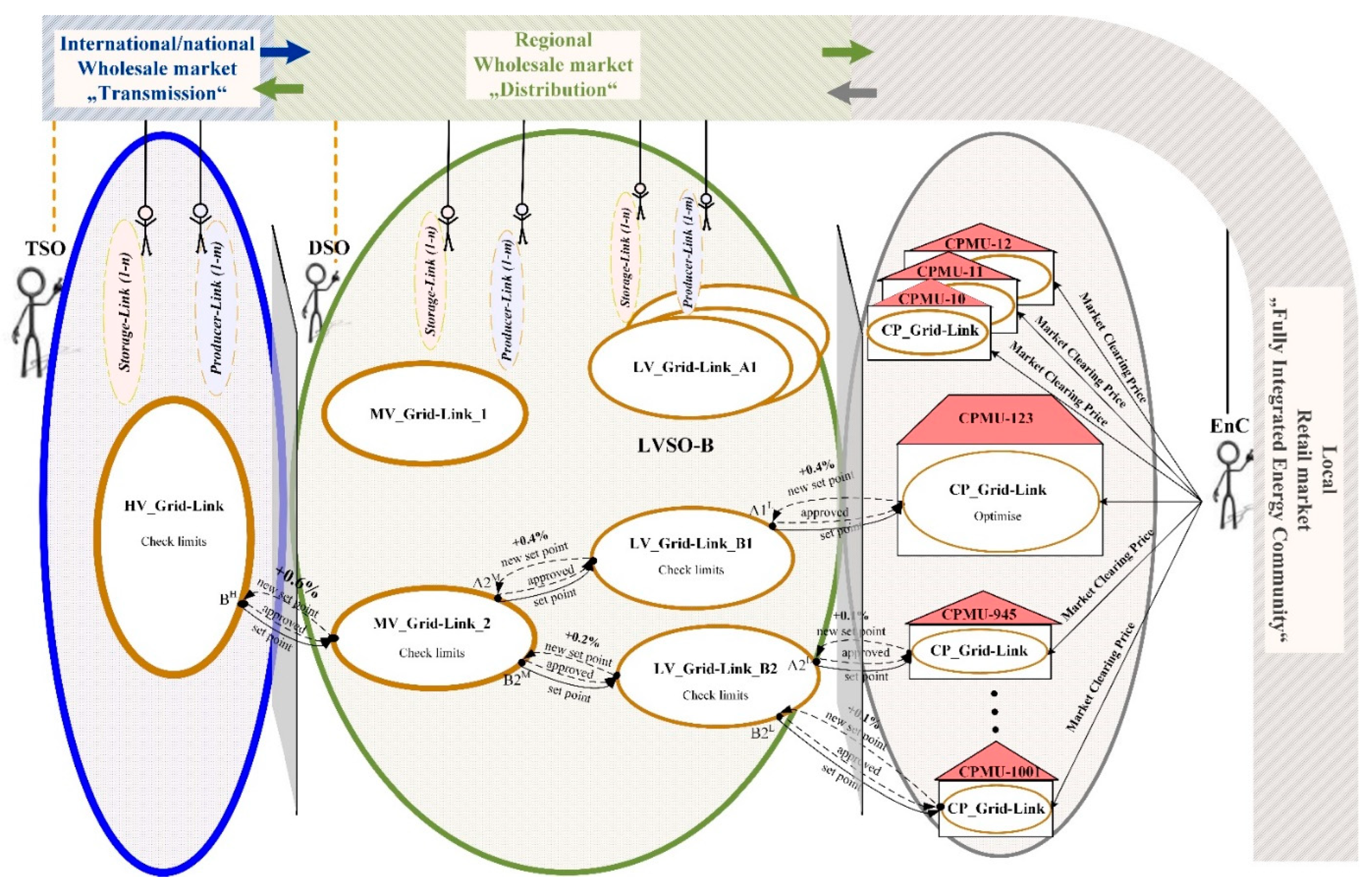

Figure 15 illustrates the market structure harmonisation with the Grid-Link setups of the power grid and CPs. It is presented by considering the price-driven DR. Realizing regional and local markets requires the establishment of Balancing Group Areas (BGAs).

Figure 15.

Harmonised market structure with the power grid and CPs according to the LINK holistic approach.

A BGA is a geographical and pricing area comprising one or more Grid-Links. Usually, the TSO operating area is encompassed in one Grid-Link, while the DSO operating area may contain several. All Grid-Links included in one BGA should be operated by the same DSO.

Grid-Links may have external and internal boundaries. External boundaries exist between different grid owners or operators, i.e., between the TSO and DSO, DSO_1 and DSO_2. They are subject to data security and privacy due to the data exchange between companies. The internal interfaces between various Grid-Links having the same owner or operator, e.g., the same DSO, are considered intern: they are not subject to data security and privacy. The external boundaries of Grid-Links correspond with the geographic BGA boundaries.

All electricity producers, storages, and CPs electrically connected to the Grid-Links belonging to the same fully integrated EnC create their own BGA.

5.2.4. Market’s Mechanism

The components to be defined to construct a market mechanism are the format of the bids, the clearing rule, the pricing rule, and the information the market participants have access to [45].

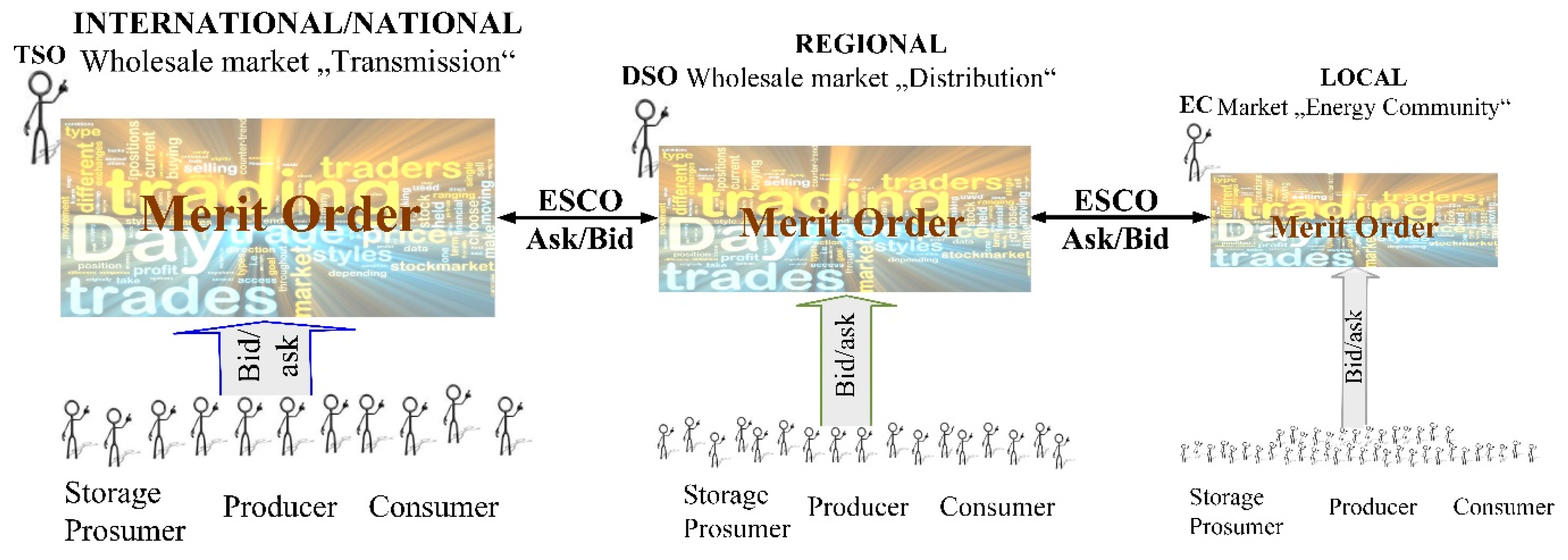

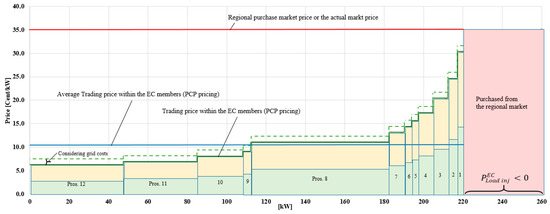

The pricing mechanism refers to the process where forces of demand and supply determine the prices of commodities and the changes therein. It is the buyers and sellers who determine the price of an item. The Merit Order mechanism has long been established in the electricity market. Figure 16 shows an overview of the pricing mechanisms used in different fractal structures of the market. Based on the main fractal principle of repeating the same shape and features in various structure sizes, the Merit Order mechanism is used in the international, regional, and local markets.

Figure 16.

Overview of the pricing mechanisms used in different fractal structures of the market.

The Merit Order mechanism enables demand and supply market forces to free play. In trouble, political and economic conditions may create severe social problems: other pricing mechanisms are needed to make goods affordable for the broad population.

The new market structure allows all consumers and producers, regardless of size, to democratically decide on the price mechanism that can be applied in each period. For the first time, small customers and producers can actively participate in the local market design described below.

The local EnC market is designed to allow neighbours to supply each other with electricity and democratically set the pricing rules. This approach makes them more independent of international and regional electricity market developments.

The EnC, as a facilitator of the local retail market, has a portfolio of pricing mechanisms. The EnC entity democratically decides which pricing mechanisms from its portfolio to use for a given period. It involves its members, the executive board and eventually the supervising board. The EnC should formally inform the controlling body, e.g., the energy authority, of any change in the pricing mechanism and the application period. It has the following portfolio of pricing mechanisms, which may be applied in different circumstances: Merit Order based on arbitrary price offers, Merit Order based on Levelized Cost of Energy (LCOE) price offers, and Power Purchase Agreements.

Local Retail Market: Merit Order Based on Arbitrary Price Offers

The EnC uses the Merit Order based on unregulated price offers of the producers, prosumers, and consumers. Standard market behaviour leads to bits based on marginal prices to maximise the chances of receiving the order, which is then valued not on the bidding price but based on the Merit Order system. Participants can switch to another pricing mechanism depending on the actual conditions.

Local Retail Market: Staggered Price Mechanism Using Merit Order Built on LCOE

This pricing mechanism uses the LCOE instead of the unregulated price offers. We use a fictitious renewable EnC for calculations to show the pricing mechanism on real values. The values are partially based on the Austrian demo site, where missing data was added randomly (i.e., installation year of PV, etc.). It is therefore assumed that the fictitious renewable EnC has 142 members, of which 12 are prosumers with installed PV facilities, and the rest are consumers. After calculating the PV production price, the actual and the proposed pricing mechanisms are discussed.

- Total Energy Supplied

The LCOE of an energy-generating facility is the cost of building and operating the asset per unit of total electricity generated over an assumed lifetime [46]. The average production kWh cost purchased through a PV depends on the size of the facility, type of equipment and local incentives. It may be calculated based on (8) as follows:

where is average electricity production price of the PV facility of prosumer i; NPV is Net Present Value of PV facility that is the difference between the present value of cash inflows and the present value of cash outflows over a period of time; is Total Energy Supplied by the PV over the assumed lifetime.

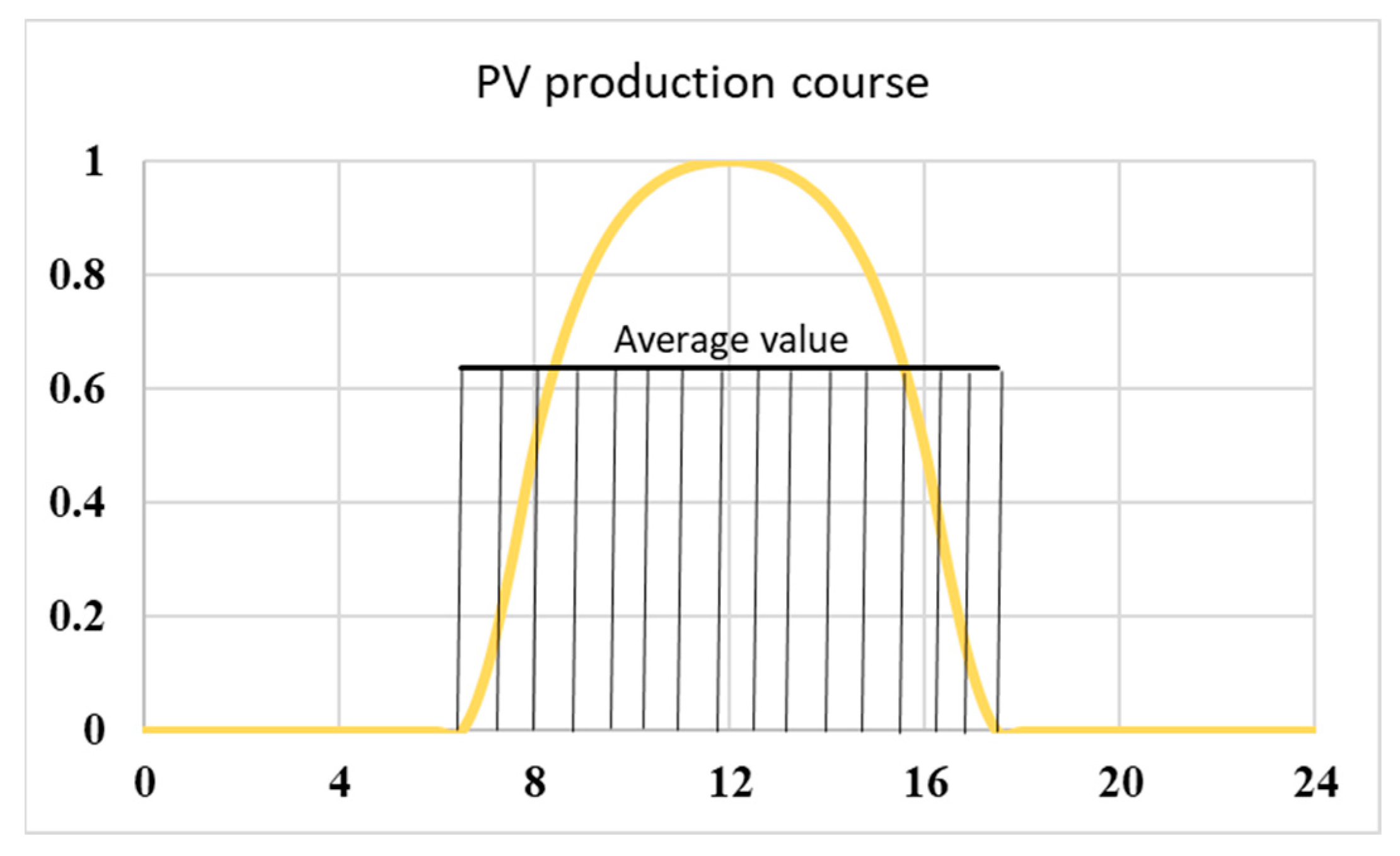

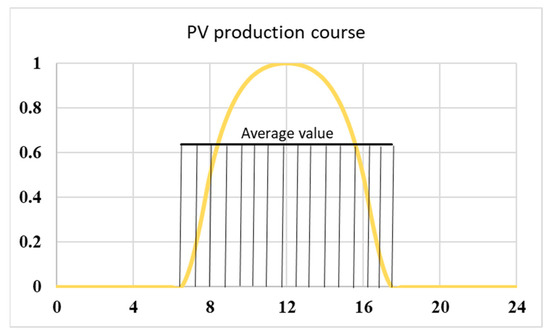

The strongly depends on the PV installed capacity, . Like all technical systems, they are delivered with a warranty period TWarr. During this warranty period, which can be 22 to 25 years, the production performance of the system may change. This effect is considered by , the average electric power efficiency of the PV panel over the lifetime. As is well known, the PV production curve is not constant over the day but resembles a half-sine curve, as shown in Figure 17. The daily energy produced may be calculated using the average value of the half-sine of 0.637 and the daily sun-shining hours (lined area in the figure).

Figure 17.

PV production course over the day.

Because there are cloudy and hazy days throughout the year, the sun does not shine on all 365 days; consequently, the PV systems do not produce. Therefore, the average hours of sunshine per day over a year, , are used to calculate the (9).

where is Installed PV capacity [kWp]; TWarr is Warranty period of PV panel [Years]; is Average electric power efficiency of the PV panel over the lifetime [%]; is the average hours of sunshine per day over a year.

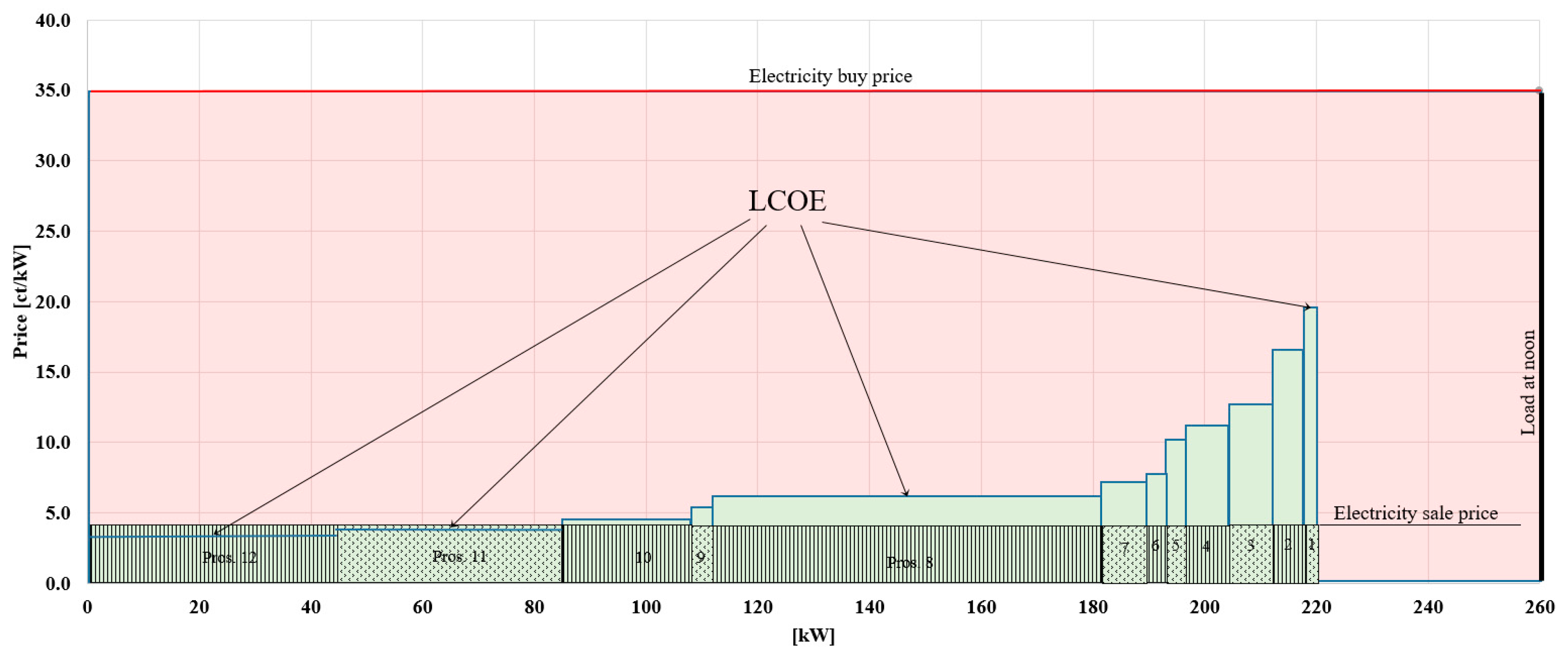

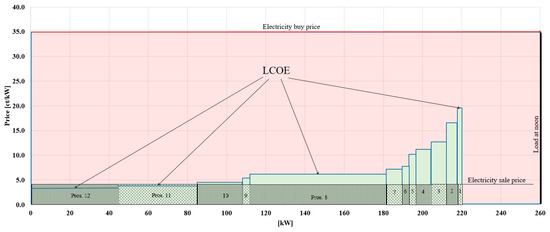

- Current scheme for purchasing and selling electricity

Figure 18 shows the current scheme for buying and selling electricity. The considered CPs consist of a mix of prosumers and consumers. Twelve prosumers are considered with various installed sizes, from 4.23 to 72.03 kWp, of PV facilities in different years, from 2010 to 2021, see Appendix E, Table A5. The PV’s production costs are obtained by applying Equation (9) with 90% efficiency over the 22 years of PV facility lifespan. The average hours of sunshine per day over one year are estimated at 5.5 h.

Figure 18.

The current scheme for purchasing and selling electricity to CPs consists of prosumers and consumers.

While the Break-Even-Price, is the financial gain that each prosumer should earn in one-hour power delivery to cover the installation costs is presented by the green areas and calculated by:

where is the power surplus of prosumer i. While the BEP for all prosumers is EUR 10.56 and is calculated using:

Figure 18 shows results at noon when all PVs supply with maximal capacity; the load for every CP, be it prosumer or consumer, is assumed to be 2 kW.

Typically, a prosumer may cover or not its native load, so that it may inject or consume electricity as in:

When the prosumer covers his own electricity needs and may sell the surplus; but when , the prosumer does not cover his own electricity needs and must buy electricity.

In the calculated case, all prosumers cover their own electricity needs and have a surplus available for sale, calculated as follows:

All prosumers together have a power surplus of 220 kW to sell. Depending on the legislation of each country, prosumers may be allowed [47] or not [48] to inject into the LV grid. If they are allowed, the sale price strongly depends on the connection point on the grid: until recently, the selling price, , was marginal, and it may even be negative. That means the prosumer has to pay to inject into the grid.

The actual sale price is derived from dedicated internet platforms. We assume a price of 4 ct/kWh, and the revenue of each prosumer, is calculated by:

The green-lined area in Figure 18 presents the monetary amount each prosumer earns in one-hour power delivery calculated by (14).

The total revenue of all prosumers, is EUR 8.78, resulting from the following equation

The electricity of 260 kW to cover the needs of all EnC members acting as consumers, is purchased at the selling price of 35 cents/kWh set in the platform. The red area in Figure 18 represents the expense of all consumers, reaching EUR 91.00, Table 1, calculated by:

Table 1.

Financial situation of the EnC when using the current scheme for purchasing and selling electricity.

This example shows that the current pricing scheme does not promote more PV installations because the EUR 8.80 revenue does not cover the EUR 10.56 needed to break even. Covering self-consumption remains the primary investment motive.

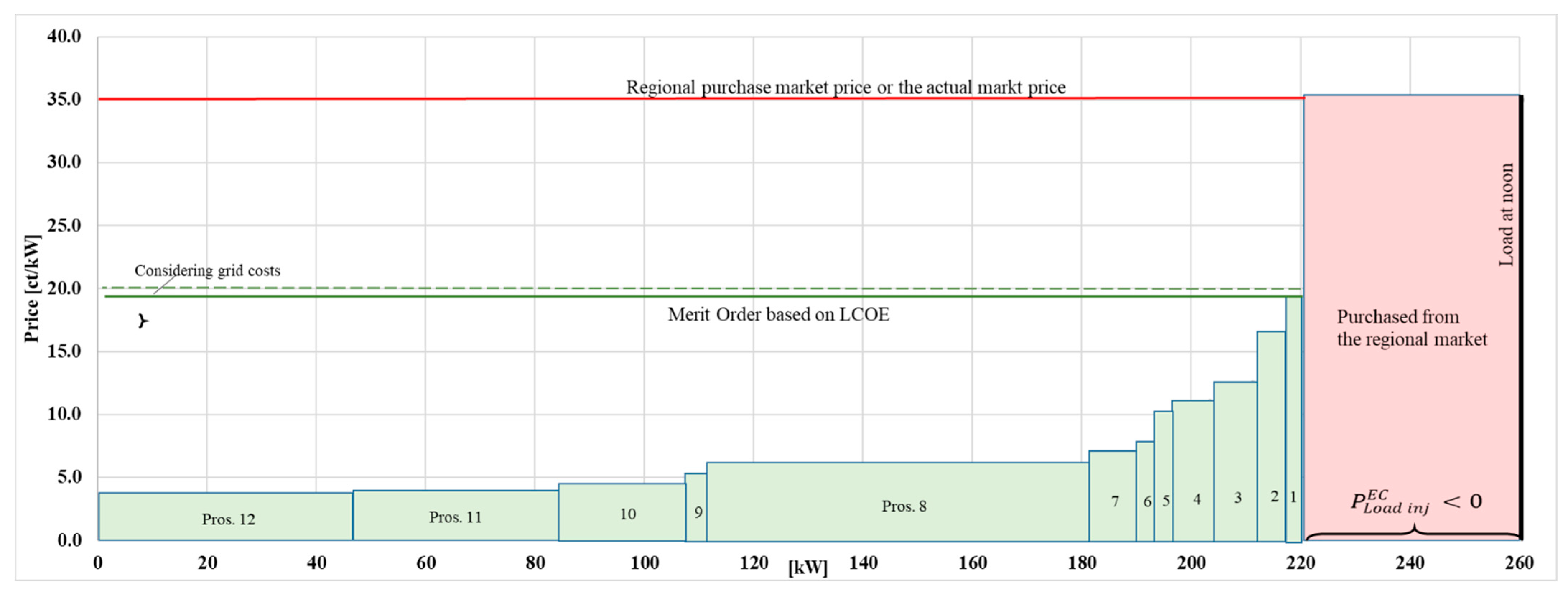

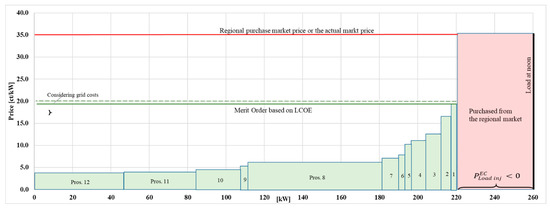

- Merit-Order based on LCOE

Electricity bills are subject to ever-increasing tariffs, which depend on the prices of primary resources and the global relationship between the supply and demand for energy. The electricity price levels observed during the Russian war in Ukraine have shown that, in certain situations, tariffs no longer correspond to the electricity production price but are incredibly high, causing significant economic and social problems. This pricing mechanism’s goal is to promote investments in distributed generation in the EnC area and achieve a fair electricity price.

Figure 19 shows the Merit Order mechanism based on LCOE: prosumers and consumers buy and sell in the local market. To cover the energy needs of its members, the EnC or ESCO buys on the regional market. In the case of a power surplus within the EnC area, the EnC or ESCO bids it on the regional market it participates in. As only renewable energy sources are eligible in a REnC, the price of primary resources does not play any role in pricing on the local market. This fact prevents speculation and decreases the impact of the global relationship between supply and demand. The pricing mechanism has two components; the one used for trading within the EnC members, and the regional market or market price used for trading the energy not balanced within the EnC area.

Figure 19.

Staggered price mechanism using the Merit Order built on LCOE: EnC buys electricity on the regional market.

The PV surplus is cumulatively set in the X-axis: only prosumers and distributed energy resource operators participate in the merit order process. The total load of the consumers in the EnC is 260 kW, of which prosumers can supply 220 kW to the EnC members, based on Equation (18). The local Merit-Order principle determines the electricity sale price between the EC members. The is determined by the prosumer “1”, who had the most expensive investment costs.

All prosumers will earn EUR 31.51, reflecting a larger value than the price needed to break even, see Table 2.

Table 2.

Financial situation of the EC when using Merit Order based on LCOE price offers.

The remainder of the 40 kW is calculated by:

where n is the number of EnC members acting like prosumers; m is the number of EnC members acting like consumers and must be purchased outside the EnC. In our case, prosumers cover their own electricity needs, . This power amount is bought in the regional market with using the following equation:

The EnC’s purchasing of electricity on the regional market, in this case, is EUR 14.00. Consumers must settle with two suppliers, the EnC and the EnC members, the latter being prosumers, producers, or store owners. Their total consumer spending is EUR 45.51, about 50% less than their spending with the current pricing mechanism. All prosumers cover their investments and make a profit that encourages consumers to invest, e.g., in further PV systems.

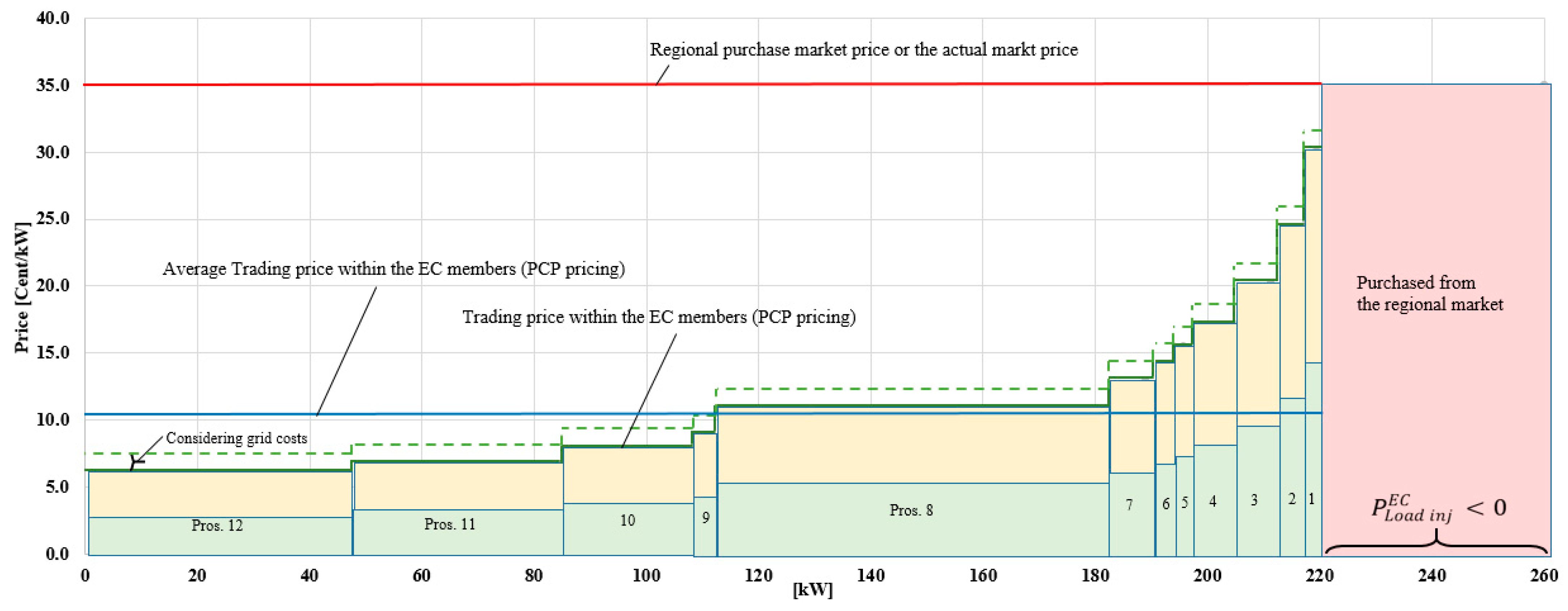

Local Retail Market: Power Purchase Agreement

The pricing model Power Purchase Agreement (PPA) reflects a basic agreement between the producer and the consumer to use the production facility over its lifetime together at predefined conditions, securing the producer’s investment and the supply at defined prices for the consumer. The agreed price should be based on a cost-plus approach, considering the production facility’s Capital Expenditures (CAPEX) and Operating Expenditures (OPEX) of the production facility. Because the partnership is agreed upon for a pre-determined investment period, the risk is low, and prices to the consumer are likely to be lower than otherwise because they stay stable and predictable.

Continuing with the fictitious EnC discussed above, each prosumer agrees on a Producer-Consumer Partnership latest when joining the EnC. We assume that each prosumer agreed on a PPA when the investment decision was taken to reduce the risk of a not profitable investment. The EnC, on the other hand, will assess whether enough consumers are within the community to use another source of electricity, and if this is given, agrees to a PPA to fix electricity prices over a longer time.

Table A6 shows the installation costs of the PV facilities owned by EnC members. To motivate the producer to invest in the facility, not only do the investment costs have to be returned, but an entrepreneurial margin also needs to be achieved. In the calculation below, counterparties agree on a 5% investment profit per year for the producer without considering any interest or compound interest.

With the PPA pricing model, customers and producers have long-term security over the pricing. In terms of falling investment costs, prices for consumers will decrease with newly added producers. Producers already invested at higher costs still have the guarantee of not getting into the negative values, which might have prevented them from investing in the first place. A PPA pricing model, therefore, might be appropriate in emerging industries where investment costs fall, and investment sizes rise over time.

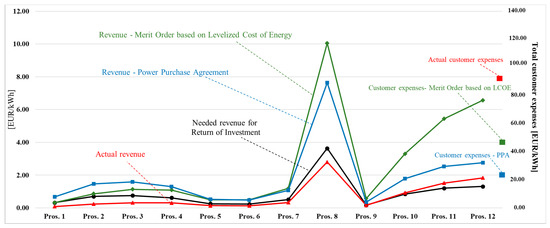

Figure 20 shows the PPA pricing model for the 12 prosumers: each prosumer has a fixed price over the investment lifetime. The average consumer price depends on the costs and sizes of all prosumers included in the EnC.

Figure 20.

Merit Order mechanism based on PPA: EnC buys electricity on the regional market.

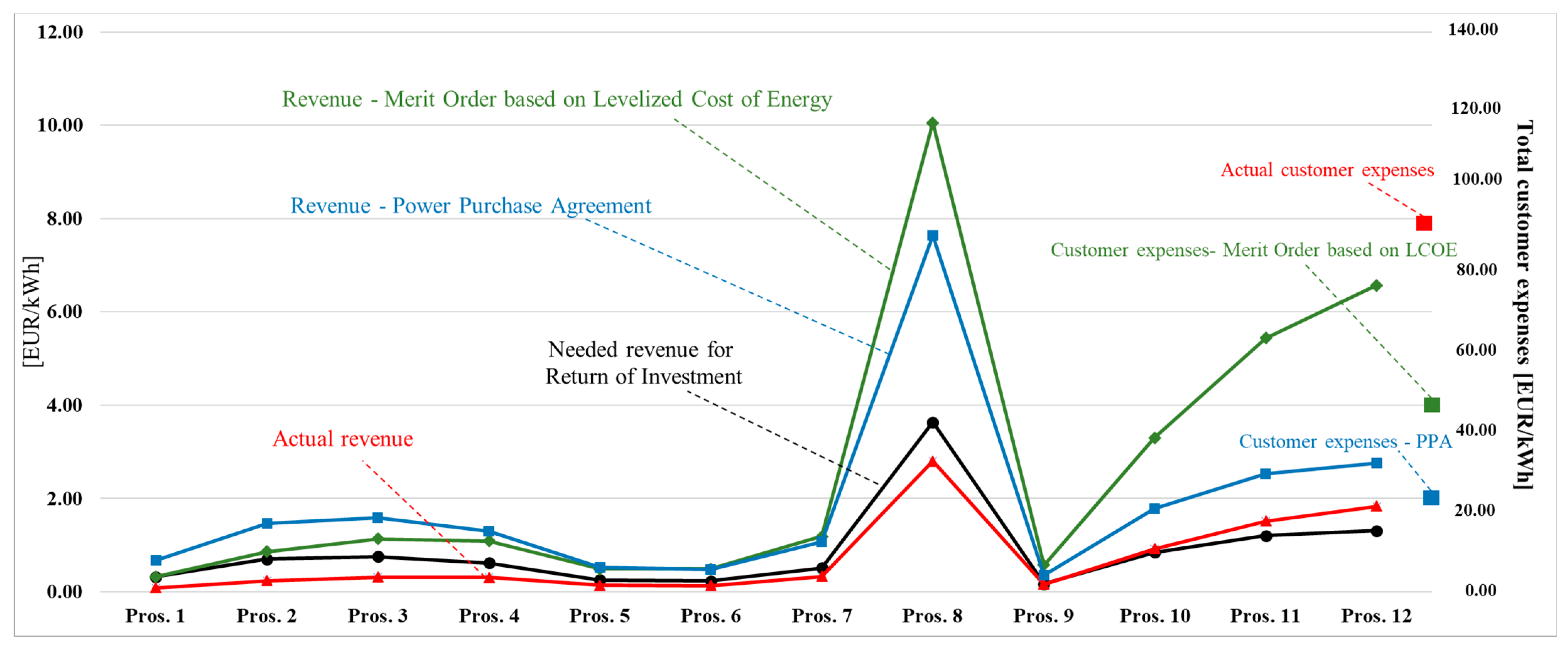

The individual revenues of each prosumer and the total customer expenses for the current pricing scheme, the staggered pricing model with Merit Order based on LCOE and PPA pricing model, are shown in Figure 21. As the prosumers are sorted by investment costs per kWh, it is visible that for the early development stages of the industry, the PPA pricing model offers higher prices to the prosumers. In contrast, when the investment costs are lowered, the prosumers’ prices are reduced over time. Nevertheless, in all cases, the prices are above the needed revenue to break even, which is the basic target of a PPA.

Figure 21.

Overview of prosumers’ revenues and customers’ expenses for different pricing schemes.

Of course, the examples here show only one situation of one virtual EnC. The situation can get more complex, for example, when local supply is exceeding local demand. Furthermore, in all shown cases, the regional price is higher than the local price, which is favourable for consumers but may not be for producers, who might earn more money when participating directly in the regional market.

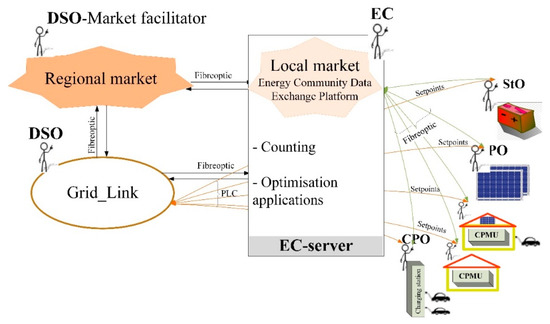

5.3. Communication Technology Architecture

The designed EnC is a reliable and established player supported by legislation. Only in this way can they be accepted by the DSOs and the members. The proposed CT architecture and components meet the high demands of the utilities concerning infrastructure reliability, security from cyberattacks and protection from access by third parties, cost-effectiveness and so on.

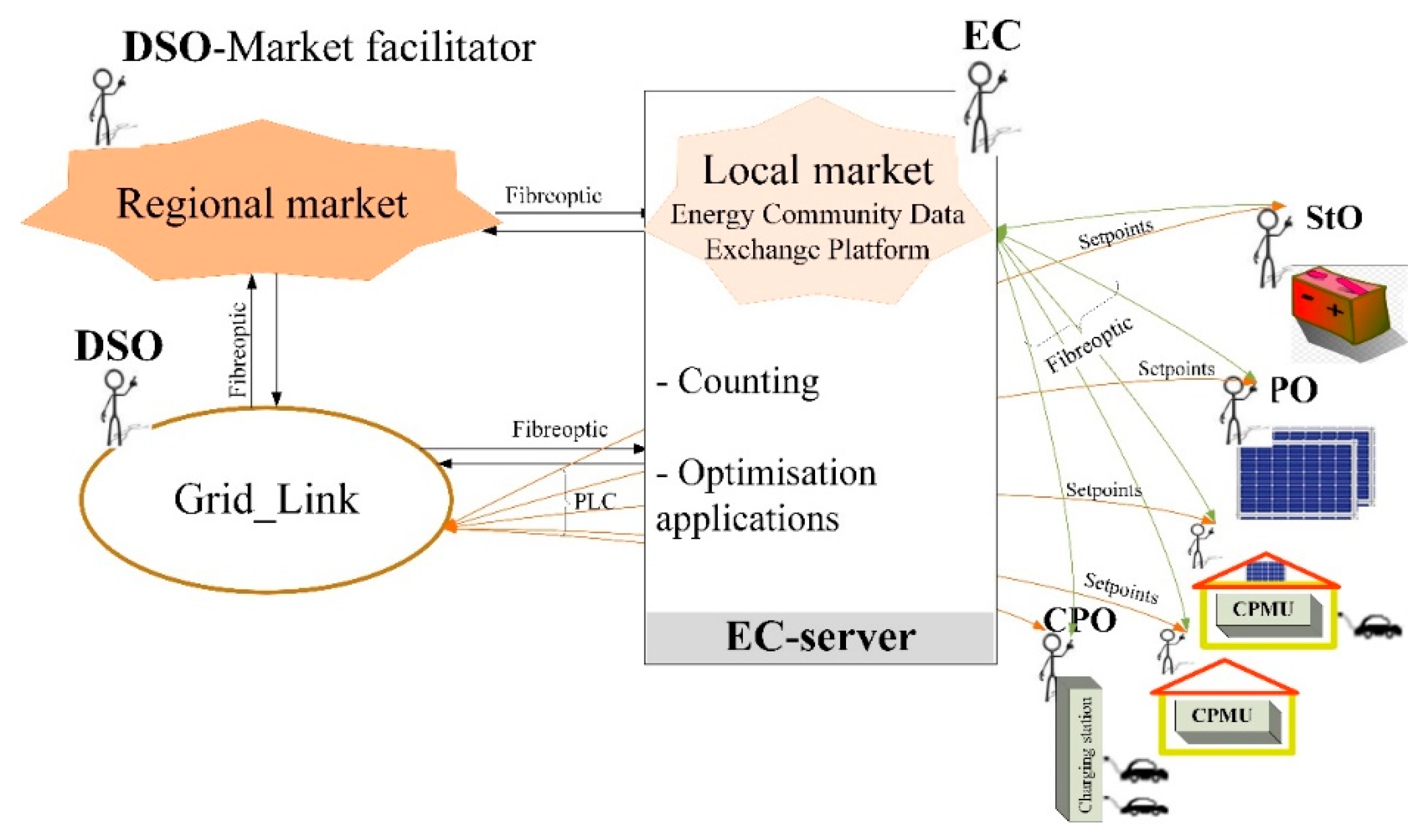

Figure 22 shows an overview of the CT architecture for the fully integrated EnC. The DSO is the facilitator of the regional market, while the EnC of the local market. The local market will be set up locally on the EnC server for data privacy and cybersecurity. In the latter, optimisation processes will be performed on the EnC level. Each EnC member will have two interfaces: one with information relevant to the market (green) and the other with technical data (orange). The market-relevant communication between all actors realises by utilising fibre optics. The communication between the DSO and EnC members related to technical issues, such as sending setpoints, achieves by using Power Line Communication technologies. Thus, the reliability and security of the communication are guaranteed.

Figure 22.

Overview of the CT architecture for the fully integrated EnC.

The solution applies in brown- and green-area cases.

5.4. Use Cases

Use cases developed for the fully integrated EnC (regardless of brown- or green-area cases) systematically describe the intended structure to minimise misconstructions and support the understanding of functionalities. They represent the interactions between the actors, the latter and the market, straightforwardly and logically. Many use cases [49] for normal and abnormal grid operations were developed during the INTERACT project. However, this paper presents only the DR and the P2P trading use cases.

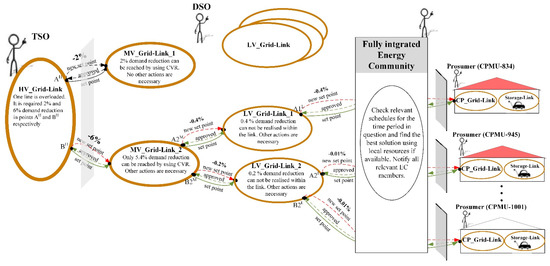

5.4.1. Demand Response

The DR, be it price- or emergency driven, is one of the most comprehensive operation processes of Smart Grids, including the entire power system, CPs, and electricity markets. This process extends the flexibility of power systems on all DERs. It is dedicated to short-term load reduction or increase in response to a signal from the power grid operator when system reliability is jeopardised or a price signal from the electricity market.

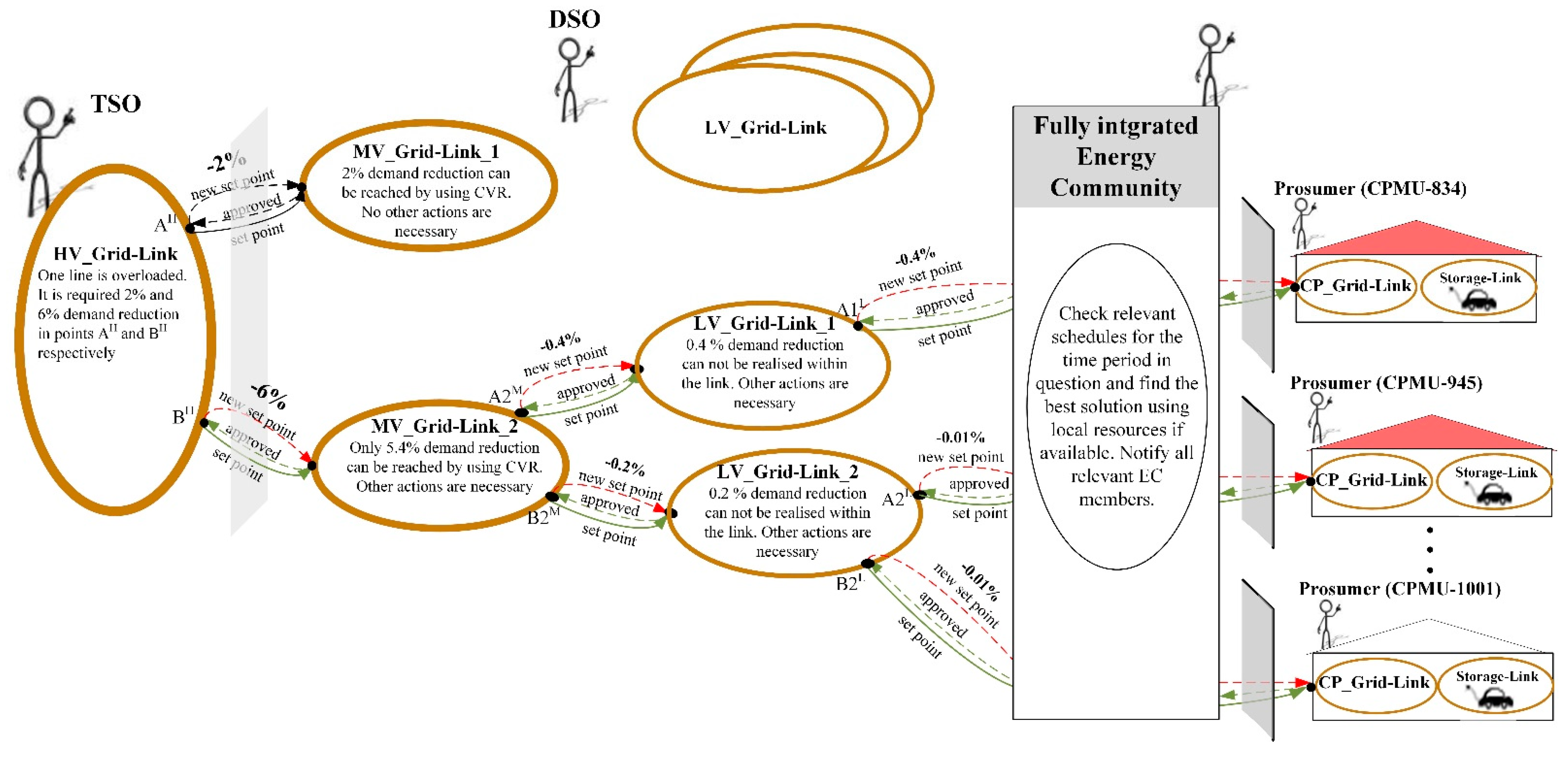

Figure 23 shows the implication of prosumers in the congestion alleviation process. It describes the emergency-driven DR, particularly involving the residential, commercial, and small business sectors. The TSO, affected DSOs, EnC, and EnC members are the actors involved in this use case. The TSO initiates the process described in this use case. An overload is expected in a high-voltage transmission line of up to 8% in the following hours. Using the relevant applications, the TSO defines the Boundary Links Nodes (BLiNs) AH and BH on his grid, where the load decrease should be 2% and 6%, respectively, to eliminate the overload. Both Grid-Links connected on the BLiNs are MV_Grid-Links. They are operated from the same operator DSO. Afterwards, TSO initiates a demand decrease request and proposes two new setpoints accompanied by the setting and duration. After receiving the request for the new setpoints, the DSO starts its DR process and investigates all possibilities to decrease the load using its internal resources, e.g., the Conservation Voltage Reduction (CVR). The 2% power reduction in the BLiN AH realises by performing the CVR on MV_Grid-Link [50]. No other actions are needed. The new setpoint is notified to the TSO.

Figure 23.

Implication of prosumers in congestion alleviation process: Emergency driven DR.

The reduction desired on the BLiN BH is more extensive than at AH, about 6%. Only one part of it, e.g., 5.4%, can be reached by performing CVR in MV_Grid-Link_2. Other actions are necessary for the rest, about 0.6% demand reduction. The DSO investigates his Link-Grid and the day-1 schedules and identifies the BLiNs A2M and B2M as the most suitable ones, where the power flow should be reduced by 0.4% and 0.2%, respectively. The LV_Grid-Link_1 and LV_Grid-Link_2 are connected, respectively, to the BLiNs A2M and B2M. Both LV_Links are operated from the same DSO. Afterwards, the DSO initiates a demand decrease request and proposes two new setpoints accompanied by the setting and duration. After receiving the request for new setpoints, the DSO involves the EnC. Based on the contracts, the latter investigates all possibilities for participation in emergency load control and sends a request for consumption reduction to the concerned participants. The CPMUs of the affected prosumers check the relevant schedules for the period in question, find the best solution using available local resources, and approve the new set points. The information goes back to the TSO, who acknowledges the new setpoints. This process may require a few iterations if the DSO detects contingencies.

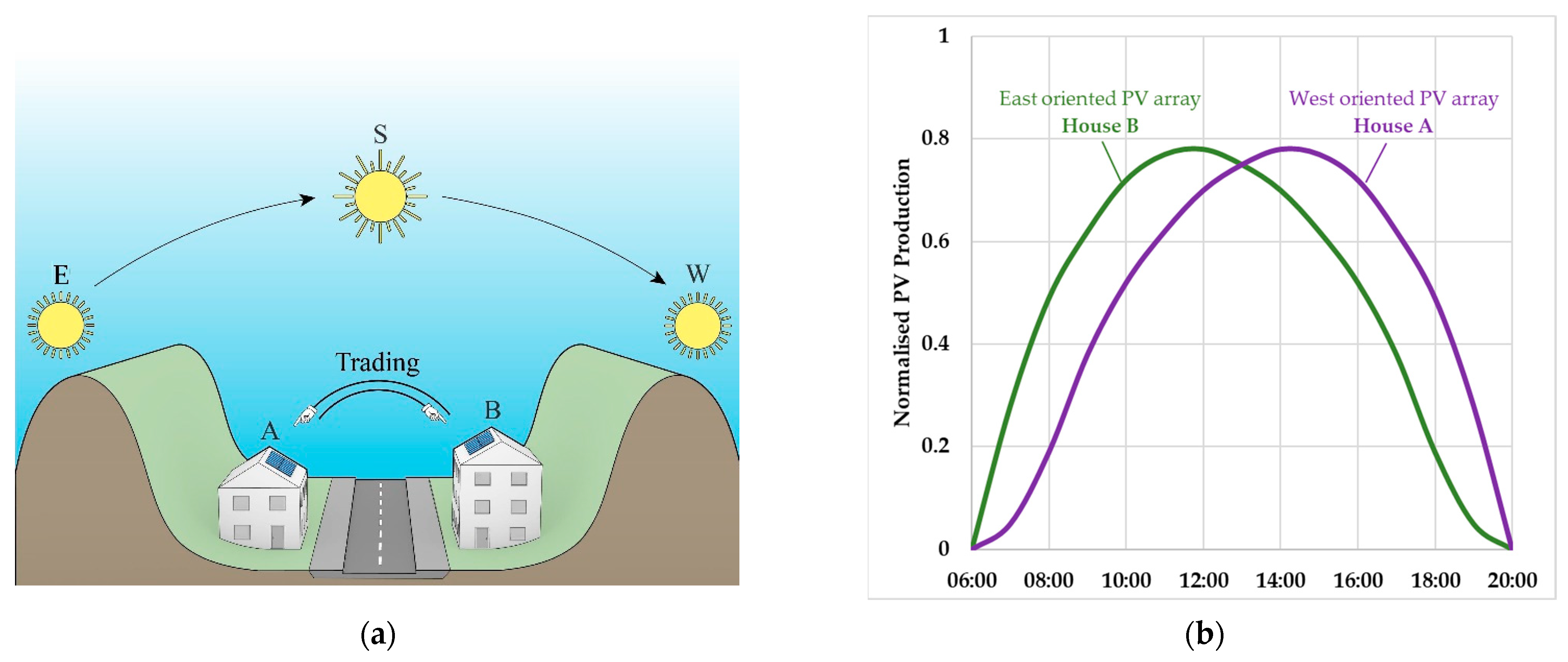

5.4.2. Peer-to-Peer Trading

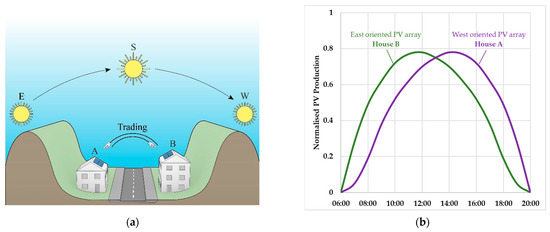

Peer-to-peer (P2P) electricity trading refers to the selling and buying power between two or more grid-connected parties. The P2P electricity trading allows consumers to select who they buy electricity from and to whom they sell it. Figure 24 shows a typical case in a rural valley where P2P trading can play a significant role. Due to geographical conditions and current architecture, PV facilities can only be built east- or west-oriented (E or W), Figure 24a,b shows the PV production profiles for both identical facilities, normalised on south-oriented (S) arrays [51]. In the morning, the east-oriented PV arrays, house B, produce more electricity than west-oriented PV arrays, and house A, before midday and vice-versa.

Figure 24.

Schematic presentation of P2P trading in a rural area: (a) PV facilities can only be built east- or west-oriented; (b) Profiles of normalised PV productions.

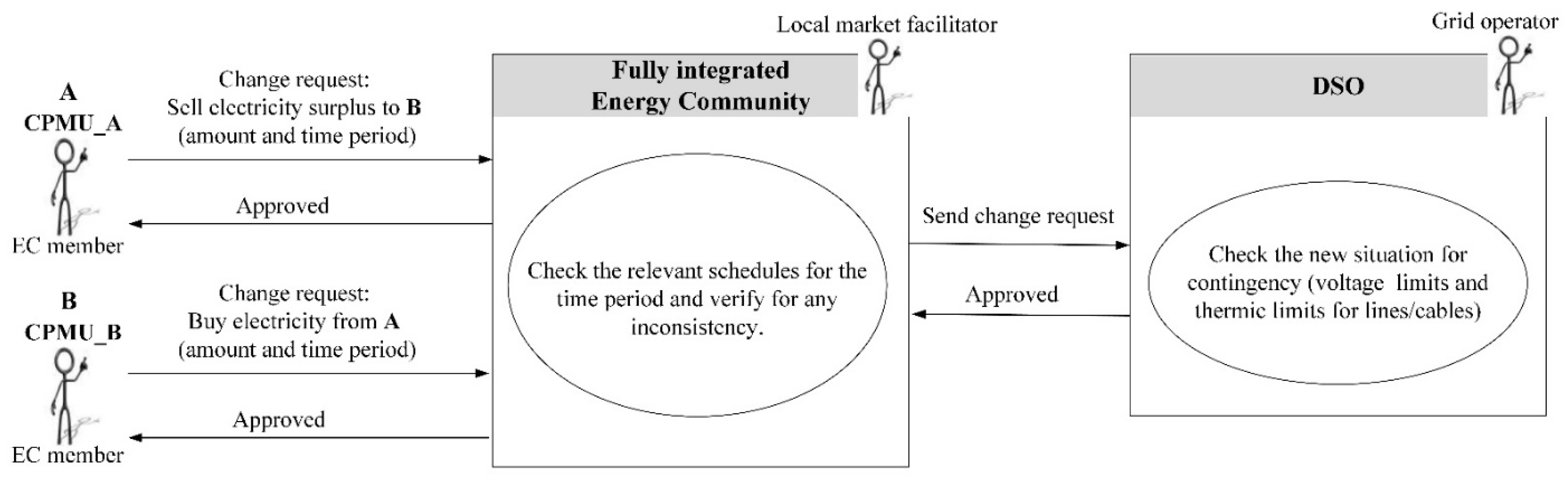

This use case describes the checking of the technical feasibility of this kind of transaction.

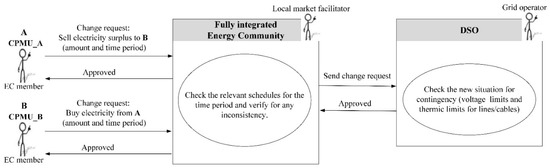

Figure 25 shows the notification and approval processes in the P2P trading use case. The EnC, in the role of the local market facilitators, its members, and DSO in the grid operator role, are the actors involved in this use case. All EnC members acting as prosumers or consumers are equipped with a CPMU. Any of the affected EnC members, be it a prosumer (CPMU), producer, storage, or CPO, send a change request to the EnC having the role of the local market facilitator. The latter checks all schedules for the relevant period and tries to reach a balance within the EnC. He notifies all members who may be interested in the transaction. Afterwards, he sends a change request, including all affected members, to the DSO for verification and approval. After checking the new grid situation for contingency, i.e., voltage violations and thermal limits of lines and cables, he approves the change request. The local market facilitator gives the information further to the EnC members. This process may require a few iterations if the DSO detects contingencies.

Figure 25.

Notification and approval processes in the P2P trading use case.

5.5. Business Cases

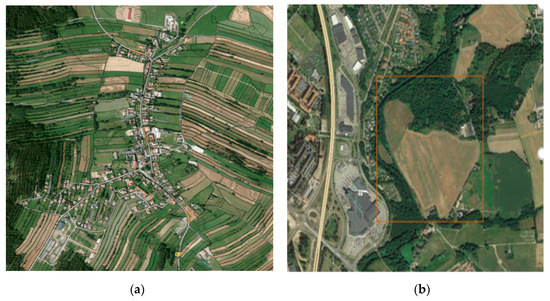

Creating the fully integrated EnC means reorganising existing relationships and, most likely, gradually developing towards a more sophisticated operation mode. We describe, regardless of brown- or green-area cases, two business cases, providing flexibility through DR and P2P.

5.5.1. Providing Flexibility: Demand Response

Providing flexibility to the energy market is one of the key potential future EnC’s activities. Using the communication technology architecture described in Section 5.3, the trigger points from the grid starting different DR processes are processed by the EnC and forwarded to the EC members. On the market side, the service can be offered directly on the ancillary services market depending on the flexibility potential of the EnC.

Figure 26 shows the involved actors and the principle of this operation from a technical and market view. There are two types of possible counterparties for providing flexibility, which differ in the kind of service offered via bilateral agreements or flexibility markets:

Figure 26.

Business case: Providing flexibility to the market.

- Bilateral agreement between TSO or DSO and EnC; and

- Flexibility market.

These services can be provided on the side of EnC by shifting energy consumption to a different time–by various appliances (so-called controllable loads: smart chargers, energy storage appliances, or other appliances with controllable load). The local market facilitator, the EnC, notifies the respective CPMUs to execute the demand change.

Providing these services is not mutually exclusive–in fact, all these services fulfil the same defined goal: modifying the load to guarantee the grid’s reliability. These services can be driven either by congestion alleviation in the case of ancillary services, i.e., emergency-driven DR, or price-driven DR.

Table 3 shows the cost- and revenue structure of the fully integrated EnC, including the flexibilities. The cost structure has investment and operation pillars. The community assets, such as production and storage facilities, and the CT structure, including the advanced EnC platform and CPMU unit for each member, are included in the investment pillar of the cost structure. The operation pillar includes the increased purchase of electricity from EnC members, the reduced purchase of electricity at the market (Energy Supplier), the maintenance of CT structure and CPMUs and administration costs such as billing, membership fee, bookkeeping, etc. The revenue stream is related to the operation. It constitutes the increased sales of electricity to EnC members, reduced sales of electricity surplus through the Energy Supplier, reduced grid tariffs, direct funding of EnC operations (if available), membership fees and additional service fees (if available) and revenue from flexibilities sold to the energy market. The service needs to be set up internally by defining and accessing the available flexibilities within the EnC and, afterwards, externally by linking the EnC to one or more of the counterparties named above.

Table 3.

Cost structure and revenue streams for integrated EnC operation mode.

5.5.2. Peer-to-Peer Trading

Three transaction structures [52] are identified for P2P trading:

- Full P2P market, where the peers negotiate directly with each other.

- Community-based market, where the EnC manages trading activities in the community.

- Hybrid P2P, which is a combination of 1 and 2.

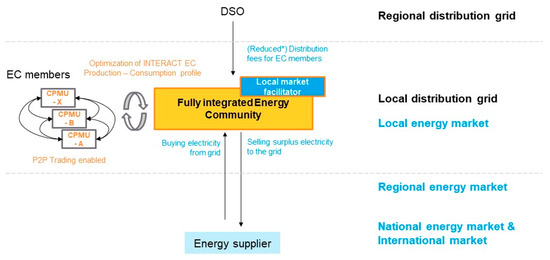

The P2P trading is opening additional price flexibilities within the EnC, allowing all members to trade with each other based on their agreed pricing strategies. The EnC itself acts either purely as a facilitator of these trades and subsequently operates only with the remaining energy potential or might offer special separate pricing algorithms for such bargains. Figure 27 shows the additional trading possibilities when P2P trading is enabled as an individual service.

Figure 27.

Business case: Peer-to-peer trading.

The role of the local market facilitator is crucial both for technical reasons (i.e., communication with DSO to check on grid contingencies) and business reasons (i.e., price settlement, process execution and administration). He helps set the price or directly organises the local market where a bid-order mechanism or other automated algorithms are creating the price. Opening the possibility for EnC members to start trading with each other with their set prices by using the set-up of the EnC might cause disharmony between the members, significantly when it reduces the benefits of the other members.

The CAPEX cost structure for this business case will be like the cost structure in Table 3, as there will be a need for investment and operating costs for the CPMU units and the cost for EnC platform, including the local market facilitator function. The OPEX depends in the same way as the revenue streams on the chosen mechanism of price settlement for P2P trading in comparison to usual EnC trading. Ideally, the margin of the EnC stays the same, and only the price agreement between selling and purchasing EnC members differs.

6. Discussion

The EnCs represent an intriguing new way of organising energy vectors that puts the End-Users at the centre and promotes DERs for more sustainable developments. Despite considerable regulatory support, their story challenges the existing structures and raises many questions about (self-)governance, technical compatibility with the grid, energy exchange participation, etc. Interviewed stakeholders show a wide variety of motivators to participate. Furthermore, they vary from meta-level (secure our future) to very specific motivators (business expansion). To achieve the desired maturity, EnCs need to be viable by becoming reliable players so that DSOs can better integrate the flexibility and other services they acquire into their processes without compromising the quality of the power supply. Their technical integration requires a coordinated operation and control of the entire power grid, including transmission and distribution, and the End-Users proposed by the LINK holistic solution. The chain of secondary controls on the whole grid combined with the CPMUs at the customer level guarantees the required coordinated operation technically. Further research is needed to detail, develop, and implement this technical solution.

The new fractal-based market structure, with the national-, regional and local markets harmonised with the grid, facilitates small customers and DERs’ direct participation in the energy market. Further research and insights into currently existing EnCs are needed to develop more pricing mechanisms, which are optimised following local structures and local motives for creating individual local EnCs.

The results of this work apply to the brown- and green areas. Nevertheless, there is a difference in the technical part’s implementation steps. In the brownfield case, an upgrade of the existing relevant architecture and partly new implementations are required. In contrast, the solution is already integrated into the planning phase in the greenfield case.

The outcomes of this work may help policymakers, regulators, and industry representatives define new energy policies and processes related to research and development programs for implementing fully integrated renewable EnCs, as well as detailing the steps for integrating them on a large scale. The observations made in this work show that, at least in Austria, municipalities and their organizations enjoy trust and preference for EnC leading. If studies in other countries support these observations, a new policy is needed, as local authorities are usually not prepared to take the lead role in EnC.

The development of EnCs and their implementation will be a long process that can be staggered in the implementation of (1) The basic operations, including, i.e., sharing renewable energy produced within the EnCs; (2) Advanced operations, including, i.e., exploitation of the flexibility potential of the production-load balance, EV charging, P2P trading; (3) Integrated operation, including, i.e., the integration into the power system, facilitating the local energy market, providing flexibility to the market and the grid; (4) Fully integrated operation, including, i.e., fully integration into the energy systems, enabling and supporting the DR process in distribution and transmission levels.

Author Contributions

Conceptualisation, A.I. and H.B.; methodology, A.I., H.B. and M.A.; validation, H.B., M.O. and A.I.; formal analysis, M.A. and A.W.; investigation, A.W., H.B. and M.O.; resources, H.B.; writing—original draft preparation, A.I.; writing—review and editing, H.B., M.A., M.O. and A.W.; visualisation, A.I., H.B. and M.A.; supervision, A.I.; project administration, H.B.; funding acquisition, H.B. All authors have read and agreed to the published version of the manuscript.

Funding

This paper is written within the INTERACT project, which receives funding from the Joint Programming Initiative Urban Europe (Funding number 37474305) in the PED Pilot Call. The Austrian Ministry of Climate Action, Environment, Energy, Mobility, Innovation, and Technology, the Technology Agency of the Czech Republic and Viable Cities, a research program funded by the Swedish Energy Agency, Formas and Vinnova, support the project.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

| ATV | Average Trading Volume |

| BGA | Balancing Group Areas |

| BEP | Break Even Price |

| BliN | Boundary Links Node |

| CAM | Control Area Manager |

| CAPEX | Capital Expenditures |

| CP | Customer Plants |

| CPMU | Customer Plant Management Unit |

| CPO | Charging Point Operator |

| CT | Communication Technology |

| CVR | Conservation Voltage Reduction |

| DER | Distributed Energy Resources |

| DR | Demand Response |

| DSO | Distribution System Operators |

| DTR | Distribution Transformer |

| EHV | Extra High Voltage |

| EnC | Energy Communities |

| EPO | Electricity Producer Operator |

| ESCO | Energy Service Companies |

| HVG | High Voltage Grid |

| LCOE | Levelized Cost of Energy |

| LV | Low-Voltage |

| LVG | Low Voltage Grid |

| MV | Medium-Voltage |

| MVG | Medium Voltage Grid |

| NPV | Net Present Value |

| OPEX | Operating Expenditures |

| P2P | Peer-to-Peer |

| PPA | Power Purchase Agreement |

| REnC | Renewable Energy Communities |

| StO | Storage Operator |

| TSO | Transmission System Operators |

Appendix A. REnC Definition

The REnC is a legal entity that, following the applicable national law, is based on open and voluntary participation. It is autonomous and effectively controlled by shareholders or members located in the proximity of the renewable energy resources owned and developed by that legal entity. Its shareholders or members are natural persons, SMEs or local authorities, including municipalities.

The primary purpose of a REnC is to provide environmental, economic, or social community benefits for its shareholders or members or for the local areas where it operates rather than financial profits. It can engage in activities based on renewable energy sources, including generation, energy efficiency, supply, aggregation, mobility, energy sharing, self-consumption, and district heating and cooling.

Appendix B. Interview Guideline for Stakeholder Analysis

The stakeholder analysis was conducted via 18 semi-structured interviews with representatives of eight identified stakeholder groups. For the greenfield approach in Sweden, each of the three stakeholders was interviewed: infrastructure/DSO, municipality, and real estate developer. For the brownfield approach in Austria, 15 interviews were held in total with at least one interviewed representative of each of the seven identified stakeholder groups: municipality (1), municipal organisations (2), opinion leader organisations (2), private businesses (3), infrastructure/DSO (1), local associations (4), and citizens (2). Perspectives on EnCs were assessed, the potential roles of the stakeholders within EnCs identified and an assessment of other stakeholder groups made.

The interview guideline consisted of a pre-formatted interview guide with a mixture of open-ended, single/multiple choice and rating questions, which were to be filled out and discussed in the presence of an interviewer. The interview guideline was structured in two parts, where one part was explicitly addressed to representatives already involved in the planning or organization of the EnC. At the same time, the other part was also addressed towards people not part of the planning stage. Questions addressed to representatives involved in the planning were asking about the stage of planning and current plans regarding members, goals, business cases, ownership structures, organizational planning, roles in the EnC, pre-arrangements, as well as expected benefits and current challenges. This section was only applied to the brownfield approach in Austria. Questions addressed towards all stakeholder group representatives covered knowledge background on EnC, benefits and burdens in participation, the assessment of expertise, roles, conflicts of interest, and interest in an influence on the success of an EnC. These questions were part of both the brownfield and the greenfield approach.

Table A1.

Interview Guidance: themes, topics, and types of questions.

Table A1.

Interview Guidance: themes, topics, and types of questions.

| Theme | Topics | Type of Questions | |

|---|---|---|---|

| 1 | Interviewee characteristics | Personal and professional background (educational background, years of experience in organization, field of expertise, position in organization, role in represented stakeholder group). | Open-ended |

| 2 | Interviewee energy literacy | Knowledge level, educational or professional experience with energy related topics generally, and technologies specifically, knowledge of EnC. | Open-ended |

| 3 | Interviewee EnC involvement | Involvement in EnC Planning or Vision. | Single choice (Yes; No, Maybe) |

| 4 | EnC Planning, if 3 Yes | Status of EnC. Which stage of planning, what is the Vision for the EnC, who are participating organisations/groups; Planned number of members; Minimal number of participating members needed; Organisational structure; Goals for EnC; Ownership structures; Organizational form; Planned business cases; current agreements; Recent organizational and administrative questions. | A mixture of multiple-choice and open-ended questions |

| 5 | Motives | Interests and motivation to participate in EnC. | Open-ended |