Global Hydrogen and Synfuel Exchanges in an Emission-Free Energy System

Abstract

1. Introduction

2. Literature Review

3. Methodology

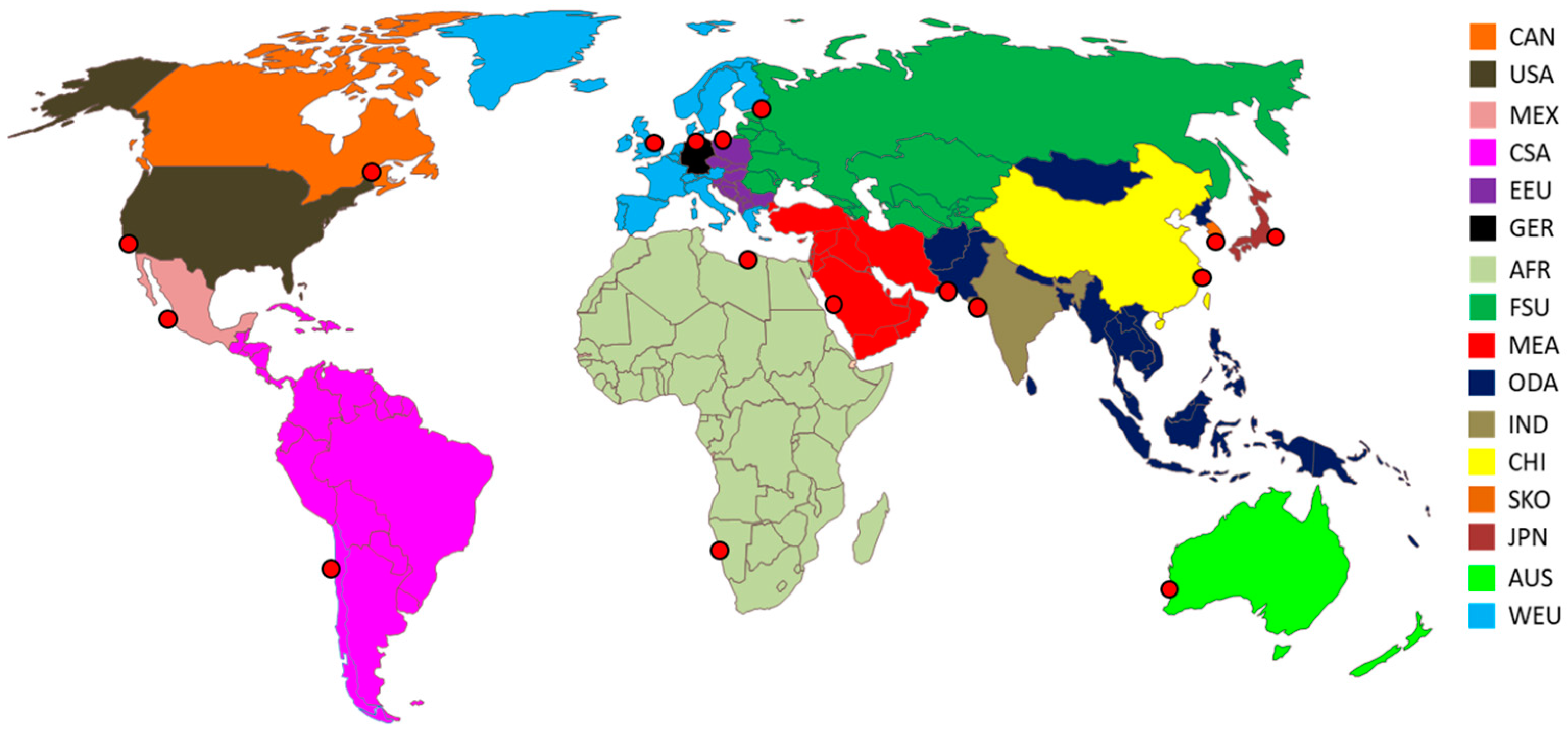

3.1. Global Energy System Model TIAM

3.2. Modeling of the Supply Curves in TIAM

3.3. Supply Curve Hydrogen

3.4. Supply Curve Synthetic Fuels

3.5. Sector Modeling

4. Results

4.1. Scenario Definitions

4.2. CO2 Reduction Measures

4.3. Final Energy Demand

4.4. Global Hydrogen and Synfuel Production

5. Conclusions and Outlook

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| km | CAN | USA | MEX | CSA | EEU | GER | AFR | FSU | MEA | ODA | IND | CHI | SKO | JPN | AUS | WEU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CAN | 13,187 | 4820 | 17,600 | 7327 | 6493 | 9587 | 8313 | 13,836 | 15,420 | 16,407 | 22,781 | 21,292 | 18,851 | 23,658 | 5820 | |

| USA | 13,187 | 7200 | 16,051 | 16,337 | 16,727 | 16,776 | 19,076 | 22,646 | 21,843 | 20,577 | 10,648 | 9834 | 9182 | 18,534 | 17,852 | |

| MEX | 4820 | 7200 | 13,296 | 14,546 | 11,147 | 14,904 | 12,464 | 15,554 | 24,272 | 18,997 | 13,105 | 12,323 | 11,521 | 22,000 | 12,284 | |

| CSA | 17,600 | 16,051 | 13,296 | 13,865 | 12,562 | 13,546 | 14,691 | 21,161 | 24,261 | 19,466 | 23,022 | 23,853 | 24,264 | 21,366 | 14,433 | |

| EEU | 7327 | 16,337 | 14,546 | 13,865 | 819 | 6986 | 1191 | 9167 | 16,044 | 12,836 | 21,483 | 22,348 | 22,232 | 20,772 | 1393 | |

| GER | 6493 | 16,727 | 11,147 | 12,562 | 819 | 6722 | 1637 | 8130 | 12,834 | 12,329 | 20,235 | 21,591 | 21,484 | 21,156 | 917 | |

| AFR | 9587 | 16,776 | 14,904 | 13,546 | 6986 | 6722 | 11,349 | 4257 | 8847 | 11,755 | 25,177 | 26,677 | 16,500 | 16,686 | 6412 | |

| FSU | 8313 | 19,076 | 12,464 | 14,691 | 1191 | 1637 | 11,349 | 9852 | 17,188 | 13,854 | 21,903 | 22,888 | 23,430 | 22,641 | 2461 | |

| MEA | 13,836 | 22,646 | 15,554 | 21,161 | 9167 | 8130 | 4257 | 9852 | 4758 | 4254 | 12,530 | 13,119 | 13,497 | 12,895 | 7745 | |

| ODA | 15,420 | 21,843 | 24,272 | 24,261 | 16,044 | 12,834 | 8847 | 17,188 | 4758 | 513 | 10,249 | 10,802 | 12,436 | 9598 | 11,804 | |

| IND | 16,407 | 20,577 | 18,997 | 19,466 | 12,836 | 12,329 | 11,755 | 13,854 | 4254 | 513 | 9539 | 10,308 | 11,100 | 9342 | 11,917 | |

| CHI | 22,781 | 10,648 | 13,105 | 23,022 | 21,483 | 20,235 | 25,177 | 21,903 | 12,530 | 10,249 | 9539 | 838 | 1850 | 8048 | 19,939 | |

| SKO | 21,292 | 9834 | 12,323 | 23,853 | 22,348 | 21,591 | 26,677 | 22,888 | 13,119 | 10,802 | 10,308 | 838 | 1662 | 8792 | 25,557 | |

| JPN | 18,851 | 9182 | 11,521 | 24,264 | 22,232 | 21,484 | 16,500 | 23,430 | 13,497 | 12,436 | 11,100 | 1850 | 1662 | 9542 | 23,037 | |

| AUS | 23,658 | 18,534 | 22,000 | 21,366 | 20,772 | 21,156 | 16,686 | 22,641 | 12,895 | 9598 | 9342 | 8048 | 8792 | 9542 | 20,010 | |

| WEU | 5820 | 17,852 | 12,284 | 14,433 | 1393 | 917 | 6412 | 2461 | 7745 | 11,804 | 11,917 | 19,939 | 25,557 | 23,037 | 20,010 |

Appendix B

| Region | Port Name | Lat | Lon |

|---|---|---|---|

| AFR | Port of Walvis Bay | −2,294,438,616 | 1,448,237,595 |

| SKO | Port of Busan | 3,510,370,188 | 1,290,414,886 |

| CSA | Port of Buenos Aires | −3,456,909,495 | −5,838,273,273 |

| AUS | Fremantle Ports | −320,529,628 | 1,157,408,536 |

| CAN | Port of Quebec | 4,682,265,707 | −7,120,249,041 |

| CHI | Port of Shanghai | 3,063,068,515 | 1220,847,303 |

| GER | Port of Hamburg | 535,410,807 | 9,986,766,343 |

| WEU | Port of Birmingham | 5,363,207,459 | −185,406,508 |

| IND | Mundra Port | 2,274,104,731 | 697,157,146 |

| JPN | Port of Keihin | 3,542,669,641 | 1,396,843,441 |

| AFR | Port of Benghazi | 3,211,470,309 | 200,423,606 |

| MEX | Puerto De Manzanillo | 197,070,599 | −71,744,7426 |

| ODA | Port of Karachi | 2,483,708,206 | 6,698,086,793 |

| EEU | Port of Gdynia | 545,360,318 | 1,853,554,754 |

| FSU | Port of Saint Petersburg | 5,988,860,049 | 3,018,117,919 |

| MEA | Port of Jeddah | 2,149,503,622 | 391,551,345 |

| USA | Port of Los Angeles | 3,372,839,414 | −1,182,402,335 |

Appendix C

| TIAM Region | Region Name | Further Description |

|---|---|---|

| AFR | Africa | Full African continent |

| AUS | Australia | Australia, New Zealand |

| CAN | Canada | - |

| CHI | China | - |

| CSA | Central and South America | Full South America and North America except Canada, USA and Mexico |

| EEU | Eastern European Union | Albania, Bosnia–Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Macedonia, Poland, Romania, Slovakia, Slovenia, Yugoslavia |

| FSU | Former Soviet Union | Russia and old Soviet states |

| GER | Germany | - |

| IND | India | - |

| JPN | Japan | - |

| MEX | Mexico | - |

| MEA | Middle East Asia | Near East except Africa |

| ODA | Other Developing Asia | Asia except China, India, Japan and South Korea |

| SKO | South Korea | - |

| USA | United States of America | - |

| WEU | Western European Union | Portugal, Spain, France, Great Britain, Sweden, Norway, Finland, Italy, Greece, Switzerland, Austria |

Appendix D

| Hydrogen Production | Hydrogen Export | Synfuel Production | Synfuel Export | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BAU | 1_5D | SoS1 | SoS2 | BAU | 1_5D | SoS1 | SoS2 | BAU | 1_5D | SoS1 | SoS2 | BAU | 1_5D | SoS1 | SoS2 | |

| AFR | 125 | 1154 | 1276 | 2593 | 0 | 13 | 18 | 866 | 0 | 1959 | 1941 | 984 | 0 | 1835 | 1629 | 672 |

| AUS | 15 | 13 | 39 | 59 | 0 | 0 | 0 | 32 | 0 | 1873 | 939 | 984 | 0 | 1873 | 852 | 922 |

| CAN | 11 | 2 | 4 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 8 | 5 | 0 | 0 | 0 | 0 |

| CHI | 826 | 734 | 734 | 1050 | 0 | 0 | 0 | 0 | 0 | 0 | 487 | 318 | 0 | 0 | 0 | 92 |

| CSA | 247 | 972 | 871 | 894 | 0 | 0 | 0 | 0 | 0 | 184 | 21 | 217 | 0 | 41 | 0 | 152 |

| EEU | 4 | 8 | 10 | 6 | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 4 | 0 | 0 | 0 | 0 |

| FSU | 180 | 1577 | 1416 | 1477 | 0 | 0 | 0 | 0 | 0 | 0 | 121 | 75 | 0 | 0 | 0 | 0 |

| GER | 18 | 0 | 8 | 5 | 0 | 0 | 0 | 0 | 0 | 0 | 30 | 20 | 0 | 0 | 0 | 0 |

| IND | 59 | 3153 | 2962 | 3035 | 0 | 0 | 0 | 0 | 0 | 0 | 139 | 86 | 0 | 0 | 0 | 0 |

| JPN | 53 | 31 | 49 | 25 | 0 | 0 | 0 | 0 | 0 | 0 | 46 | 36 | 0 | 0 | 0 | 0 |

| MEA | 589 | 2480 | 3736 | 2431 | 0 | 1236 | 2202 | 898 | 0 | 2187 | 957 | 976 | 0 | 1764 | 220 | 650 |

| MEX | 27 | 10 | 7 | 5 | 0 | 0 | 0 | 0 | 0 | 838 | 585 | 91 | 0 | 811 | 501 | 7 |

| ODA | 875 | 1485 | 1227 | 1205 | 0 | 0 | 0 | 0 | 0 | 0 | 334 | 228 | 0 | 0 | 0 | 0 |

| SKO | 102 | 14 | 41 | 25 | 0 | 0 | 0 | 0 | 0 | 0 | 23 | 25 | 0 | 0 | 0 | 0 |

| USA | 189 | 850 | 850 | 817 | 0 | 0 | 0 | 0 | 0 | 0 | 318 | 807 | 0 | 0 | 0 | 0 |

| WEU | 323 | 36 | 146 | 93 | 0 | 0 | 0 | 0 | 0 | 0 | 180 | 112 | 0 | 0 | 0 | 0 |

References

- United Nations. Framework Convention on Climate Change (COP21) Paris Agreement. 2016. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 22 January 2023).

- IPCC. Mitigation Pathways Compatible with 1.5 °C in the Context in the Context of Sustainable Development; IPCC: Geneva, Switzerland, 2018. [Google Scholar]

- GlobalCarbonAtlas. 2023. Available online: http://www.globalcarbonatlas.org/en/CO2-emissions (accessed on 28 February 2023).

- BP. Statistical Review of World Energy 2022. 2022. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 28 February 2023).

- European Commission. Communication from the Comission to the European Parliament. The European Green Deal. 2019. Available online: https://commission.europa.eu/publications/communication-european-green-deal_en (accessed on 2 March 2023).

- Bundesregierung Deutschland. Klimaschutzgesetz. 2021. Available online: https://www.bundesregierung.de/breg-de/themen/klimaschutz/klimaschutzgesetz-2021-1913672 (accessed on 7 February 2023).

- Senate of the United States. Inflation Reduction Act. 2022. Available online: https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_of_2022.pdf (accessed on 25 January 2023).

- Agora Verkehrswende; Agora Energiewende. Die Zukünftigen Kosten Strombasierter Synthetischer Brennstoffe. 2018. Available online: https://www.agora-energiewende.de/fileadmin/Projekte/2017/SynKost_2050/Agora_SynCost-Studie_WEB.pdf (accessed on 2 March 2023).

- Nikolaidis, P.; Poullikkas, A. A comparative overview of hydrogen production processes. Renew. Sustain. Energy Rev. 2017, 67, 597–611. [Google Scholar] [CrossRef]

- Schmidt, P.; Batteiger, V.; Roth, A.; Weindorf, W.; Raksha, T. Power-to-Liquids as Renewable Fuel Option for Aviation: A Review. Chem. Ing. Tech. 2018, 90, 127–140. [Google Scholar] [CrossRef]

- Fasihi, M.; Bogdanov, D.; Breyer, C. Techno-Economic Assessment of Power-to-Liquids (PtL) Fuels Production and Global Trading Based on Hybrid PV-Wind Power Plants. Energy Procedia 2016, 99, 243–268. [Google Scholar] [CrossRef]

- Chapman, A.J.; Fraser, T.; Itaoka, K. Hydrogen import pathway comparison framework incorporating cost and social preference: Case studies from Australia to Japan. Int. J. Energy Res. 2017, 41, 2374–2391. [Google Scholar] [CrossRef]

- Rosen, M.A.; Koohi-Fayegh, S. The prospects for hydrogen as an energy carrier: An overview of hydrogen energy and hydrogen energy systems. Energy Ecol. Environ. 2016, 1, 10–29. [Google Scholar] [CrossRef]

- Fasihi, M.; Bogdanov, D.; Breyer, C. Long-Term Hydrocarbon Trade Options for the Maghreb Region and Europe—Renewable Energy Based Synthetic Fuels for a Net Zero Emissions World. Sustainability 2017, 9, 306. [Google Scholar] [CrossRef]

- Ueckerdt, F.; Bauer, C.; Dirnaichner, A.; Everall, J.; Sacchi, R.; Luderer, G. Potential and risks of hydrogen-based e-fuels in climate change mitigation. Nat. Clim. Chang. 2021, 11, 384–393. [Google Scholar] [CrossRef]

- Blanco, H.; Nijs, W.; Ruf, J.; Faaij, A. Potential for hydrogen and Power-to-Liquid in a low-carbon EU energy system using cost optimization. Appl. Energy 2018, 232, 617–639. [Google Scholar] [CrossRef]

- European Union. Assessment of Hydrogen Delivery Options. 2011. Available online: https://joint-research-centre.ec.europa.eu/system/files/2021-06/jrc124206_assessment_of_hydrogen_delivery_options.pdf (accessed on 2 March 2023).

- IRENA. Global Hydrogen Trade to Meet the 1.5 °C Climate Goal. Part II: Technology Review of Hydrogen Carriers. 2022. Available online: https://www.irena.org/publications/2022/Apr/Global-hydrogen-trade-Part-II (accessed on 2 March 2023).

- Brändle, G.; Schönfisch, M.; Schulte, S. Estimating Long-Term Global Supply Costs for Low-Carbon Hydrogen. 2020. Available online: https://www.ewi.uni-koeln.de/cms/wp-content/uploads/2021/03/EWI_WP_20-04_Estimating_long-term_global_supply_costs_for_low-carbon_Schoenfisch_Braendle_Schulte-1.pdf (accessed on 2 March 2023).

- Niermann, M.; Timmerberg, S.; Drünert, S.; Kaltschmitt, M. Liquid Organic Hydrogen Carriers and alternatives for international transport of renewable hydrogen. Renew. Sustain. Energy Rev. 2021, 135, 110171. [Google Scholar] [CrossRef]

- DLR. Wasserstoff als ein Fundament der Energiewende. Teil 1: Technologien und Perspektiven für Eine Nachhaltige und ökonomische Wasserstoffversorgung. 2020. Available online: https://elib.dlr.de/137796/1/DLR_Wasserstoffstudie_Teil_1_final.pdf (accessed on 2 March 2023).

- Gallardo, F.I.; Monforti Ferrario, A.; Lamagna, M.; Bocci, E.; Garcia, D.A.; Baeza-Jeria, T.E. A Techno-Economic Analysis of solar hydrogen production by electrolysis in the north of Chile and the case of exportation from Atacama Desert to Japan. Int. J. Hydrogen Energy 2021, 46, 13709–13728. [Google Scholar] [CrossRef]

- Wijayanta, A.T.; Oda, T.; Purnomo, C.W.; Kashiwagi, T.; Aziz, M. Liquid hydrogen, methylcyclohexane, and ammonia as potential hydrogen storage: Comparison review. Int. J. Hydrogen Energy 2019, 44, 15026–15044. [Google Scholar] [CrossRef]

- Ishimoto, Y.; Voldsund, M.; Nekså, P.; Roussanaly, S.; Berstad, D.; Gardarsdottir, S.O. Large-scale production and transport of hydrogen from Norway to Europe and Japan: Value chain analysis and comparison of liquid hydrogen and ammonia as energy carriers. Int. J. Hydrogen Energy 2020, 45, 32865–32883. [Google Scholar] [CrossRef]

- Stiller, C.; Svensson, A.M.; Møller-Holst, S.; Bünger, U.; Espegren, K.A.; Holm, Ø.B.; Tomasgard, A. Options for CO2-lean hydrogen export from Norway to Germany. Energy 2008, 33, 1623–1633. [Google Scholar] [CrossRef]

- Kamiya, S.; Nishimura, M.; Harada, E. Study on Introduction of CO2 Free Energy to Japan with Liquid Hydrogen. Phys. Procedia 2015, 67, 11–19. [Google Scholar] [CrossRef]

- Fraunhofer IWES. Mittel- Und Langfristige Potenziale Von Ptl-Und H2-Importen Aus Internationalen Ee-Vorzugsregionen. 2017. Available online: https://www.erneuerbar-mobil.de/sites/default/files/2019-10/Teilbericht_Potenziale_PtL_H2_Importe_FraunhoferIWES.pdf (accessed on 28 February 2023).

- Teichmann, D.; Arlt, W.; Wasserscheid, P. Liquid Organic Hydrogen Carriers as an efficient vector for the transport and storage of renewable energy. Int. J. Hydrogen Energy 2012, 37, 18118–18132. [Google Scholar] [CrossRef]

- Heuser, M.P.; Grube, T.; Heinrichs, H.; Robinius, M.; Stolten, D. Worldwide Hydrogen Provision Scheme Based on Re-newable Energy. 2020. Available online: https://www.preprints.org/manuscript/202002.0100/v1 (accessed on 2 March 2023).

- adelphi Consult GmbH. Grüner Wasserstoff: Internationale Kooperationspotenziale für Deutschland. Kurzanalyse zu ausgewählten Aspekten potenzieller Nicht-EU-Partnerländer. 2020. Available online: https://www.adelphi.de/de/system/files/mediathek/bilder/Gr%C3%BCner%20Wasserstoff_Internationale%20Kooperationspotenziale%20f%C3%BCr%20Deutschland_finale%20Version.pdf (accessed on 2 March 2023).

- Yue, M.; Lambert, H.; Pahon, E.; Roche, R.; Jemei, S.; Hissel, D. Hydrogen energy systems: A critical review of technologies, applications, trends and challenges. Renew. Sustain. Energy Rev. 2021, 146, 111180. [Google Scholar] [CrossRef]

- Staffell, I.; Scamman, D.; Velazquez Abad, A.; Balcombe, P.; Dodds, P.E.; Ekins, P.; Shah, N.; Ward, K.R. The role of hydrogen and fuel cells in the global energy system. Energy Environ. Sci. 2019, 12, 463–491. [Google Scholar] [CrossRef]

- Brandon, N.P.; Kurban, Z. Clean energy and the hydrogen economy. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2017, 375, 20160400. [Google Scholar] [CrossRef] [PubMed]

- Quarton, C.J.; Tlili, O.; Welder, L.; Mansilla, C.; Blanco, H.; Heinrichs, H.; Leaver, J.; Samsatli, N.J.; Lucchese, P.; Robinius, M.; et al. The curious case of the conflicting roles of hydrogen in global energy scenarios. Sustain. Energy Fuels 2020, 4, 80–95. [Google Scholar] [CrossRef]

- Dodds, P.E.; Staffell, I.; Hawkes, A.D.; Li, F.; Grünewald, P.; McDowall, W.; Ekins, P. Hydrogen and fuel cell technologies for heating: A review. Int. J. Hydrogen Energy 2015, 40, 2065–2083. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Green Hydrogen for Industry: A Guide to Policy Making. 2022. Available online: https://www.irena.org/publications/2022/Mar/Green-Hydrogen-for-Industry (accessed on 2 March 2023).

- Deutsche Energie-Agentur GmbH. Dena-Leitstudie Aufbruch Klimaneutralitaet. 2021. Available online: https://www.dena.de/fileadmin/dena/Publikationen/PDFs/2021/Abschlussbericht_dena-Leitstudie_Aufbruch_Klimaneutralitaet.pdf (accessed on 2 March 2023).

- BCG. Klimapfade 2.0. Ein Wirtschaftsprogramm für Klima und Zukunft. 2021. Available online: https://web-assets.bcg.com/f2/de/1fd134914bfaa34c51e07718709b/klimapfade2-gesamtstudie-vorabversion-de.pdf (accessed on 2 March 2023).

- Luderer, G.; Kost, C.; Sörgel, D. Deutschland auf dem Weg zur Klimaneutralität 2045—Szenarien und Pfade im Modellvergleich. 2021. Available online: https://ariadneprojekt.de/media/2021/11/Ariadne_Szenarienreport_Oktober2021_Kapitel1_Gesamtperspektive.pdf (accessed on 2 March 2023).

- Sensfuss, F.; Sensfuß, F.; Lux, B.; Bernath, C.; Kiefer, C.; Pfluger, B.; Kleinschmitt, C.; Franke, K.; Deac, G.; Brugger, H.; et al. Langfristszenarien für die Transformation des Energiesystems in Deutschland 3. Kurzbericht: 3 Hauptszenarien. 2021. Available online: https://www.isi.fraunhofer.de/content/dam/isi/dokumente/cce/2021/LFS_Kurzbericht.pdf (accessed on 2 March 2023).

- Öko-Institut e.V.; Wuppertal Institut; Prognos. Klimaneutrales Deutschland 2045. 2021. Available online: https://static.agora-energiewende.de/fileadmin/Projekte/2021/2021_04_KNDE45/A-EW_209_KNDE2045_Zusammenfassung_DE_WEB.pdf (accessed on 2 March 2023).

- ETSAP TIMES Documentation—Part II. Available online: https://github.com/etsap-TIMES/TIMES_Documentation/blob/master/Documentation_for_the_TIMES_Model-Part-II.pdf (accessed on 7 February 2023).

- Remme, U. Overview of TIMES: Parameters, Primal Variables & Equations. 2007. Available online: https://iea-etsap.org/workshop/brazil_11_2007/times-remme.pdf (accessed on 2 March 2023).

- Franzmann, D.; Heinrichs, H.; Lippkau, F.; Addanki, T.; Winkler, C.; Buchenberg, P.; Hamacher, T.; Blesl, M.; Linßen, J.; Stolten, D. Future Projections of Global Green Liquid Hydrogen Cost-Potentials for Export Needs. arXiv 2023. [Google Scholar] [CrossRef]

- Welder, L.; Ryberg, D.; Kotzur, L.; Grube, T.; Robinius, M.; Stolten, D. Spatio-temporal optimization of a future energy system for power-to-hydrogen applications in Germany. Energy 2018, 158, 1130–1149. [Google Scholar] [CrossRef]

- Pietzcker, R.C.; Osorio, S.; Rodrigues, R. Tightening EU ETS targets in line with the European Green Deal: Impacts on the decarbonization of the EU power sector. Appl. Energy 2021, 293, 116914. [Google Scholar] [CrossRef]

- IEA. Projected Costs of Generating Electricity. 2020. Available online: https://www.iea.org/reports/projected-costs-of-generating-electricity-2020 (accessed on 3 March 2023).

- Kost, C.; Schlegl, T.; Fraunhofer ISE. Stromgestehungskosten erneuerbare Energien. 2018. Available online: https://www.ise.fraunhofer.de/content/dam/ise/de/documents/publications/studies/DE2018_ISE_Studie_Stromgestehungskosten_Erneuerbare_Energien.pdf (accessed on 28 February 2023).

- TUM-ENS Urbs. Available online: https://github.com/tum-ens/urbs (accessed on 7 February 2023).

- Buchenberg, P.; Addanki, T.; Franzmann, D.; Winkler, C.; Lippkau, F.; Hamacher, T.; Kuhn, P.; Heinrichs, H.; Blesl, M. Global Potentials and Costs of Synfuels via Fischer–Tropsch Process. Energies 2023, 16, 1976. [Google Scholar] [CrossRef]

- Pyo, M.-J.; Moon, S.-W.; Kim, T.-S. A Comparative Feasibility Study of the Use of Hydrogen Produced from Surplus Wind Power for a Gas Turbine Combined Cycle Power Plant. Energies 2021, 14, 8342. [Google Scholar] [CrossRef]

- IEA. Technology Roadmap Hydrogen and Fuel Cells. 2015. Available online: https://www.iea.org/reports/technology-roadmap-hydrogen-and-fuel-cells (accessed on 2 March 2023).

- International Energy Agency—IEA. The Future of Hydrogen; IEA: Paris, France, 2019. [Google Scholar]

- CSIRO. Opportunities for Hydrogen in Commercial Aviation. 2020. Available online: https://www.csiro.au/-/media/Do-Business/Files/Futures/Boeing-Opportunities-for-hydrogen-in-commercial-aviation.pdf (accessed on 2 March 2023).

- McKinsey & Company. Hydrogen-Powered Aviation. A Fact-Based Study of Hydrogen Technology, Economics, and Climate Impact by 2050. 2020. Available online: https://op.europa.eu/en/publication-detail/-/publication/55fe3eb1-cc8a-11ea-adf7-01aa75ed71a1/language-en (accessed on 28 February 2023).

- IEA. G20 Hydrogen Report: Assumptions. 2020. Available online: https://iea.blob.core.windows.net/assets/a02a0c80-77b2-462e-a9d5-1099e0e572ce/IEA-The-Future-of-Hydrogen-Assumptions-Annex.pdf (accessed on 2 March 2023).

- Noland, J.K. Hydrogen Electric Airplanes: A disruptive technological path to clean up the aviation sector. IEEE Electrif. Mag. 2021, 9, 92–102. [Google Scholar] [CrossRef]

- Routescanner. Available online: https://www.routescanner.com/ (accessed on 7 January 2023).

- ETSAP-TIAM: Some Details on Model and Database. Available online: https://iea-etsap.org/TIAM_f/TIAM%20description_slides.pdf (accessed on 20 January 2023).

| AFR | AUS | CAN | CHI | CSA | GER | EEU | FSU | IND | JPN | SKO | MEA | MEX | ODA | USA | WEU | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Potential [TWh] | 188 | 433 | 76.9 | 155 | 154 | 0.5 | 1.1 | 104 | 21.8 | 0.7 | 0.1 | 196 | 53.6 | 24.5 | 128 | 3.8 |

| Minimal Costs [EUR/MWh] | 58.5 | 71.6 | 117 | 99.4 | 62.4 | 94 | 93 | 76.2 | 70.8 | 89 | 85 | 53.9 | 103 | 63.8 | 79.4 | 84.7 |

| AFR | AUS | CAN | CHI | CSA | GER | EEU | FSU | IND | JPN | SKO | MEA | MEX | ODA | USA | WEU | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Potential [TWh] | 139,463 | 321,855 | 54,953 | 113,924 | 113,060 | 436 | 873 | 83,303 | 16,120 | 482 | 112 | 145,219 | 39,621 | 18,158 | 95,650 | 2839 |

| Minimal Costs [EUR/MWh] | 80.3 | 81.6 | 117.9 | 82.4 | 80.8 | 97.8 | 94.1 | 100.9 | 88.8 | 108.9 | 94.6 | 81.1 | 85.0 | 79.9 | 90.3 | 85.0 |

| No. | Scenario Name | Description |

|---|---|---|

| 1 | BAU | No climate policy. |

| 2 | 1_5D | 1.5 °C conform scenario based on given CO2 budget for 2015–2100 (cf. [2]). |

| 3 | SoS1 | Security of Supply scenario, based on 1_5D scenario. Further implementation: at least 50% of hydrogen and synfuels must be out of domestic production. No restriction for trading. |

| 4 | SoS2 | Security of Supply scenario, based on 1_5D scenario. Further implementation: at least 33% of hydrogen and synfuels must be out of domestic production. At least two trading partners. Each trading partner can satisfy a maximum share of 33% of the local demand. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lippkau, F.; Franzmann, D.; Addanki, T.; Buchenberg, P.; Heinrichs, H.; Kuhn, P.; Hamacher, T.; Blesl, M. Global Hydrogen and Synfuel Exchanges in an Emission-Free Energy System. Energies 2023, 16, 3277. https://doi.org/10.3390/en16073277

Lippkau F, Franzmann D, Addanki T, Buchenberg P, Heinrichs H, Kuhn P, Hamacher T, Blesl M. Global Hydrogen and Synfuel Exchanges in an Emission-Free Energy System. Energies. 2023; 16(7):3277. https://doi.org/10.3390/en16073277

Chicago/Turabian StyleLippkau, Felix, David Franzmann, Thushara Addanki, Patrick Buchenberg, Heidi Heinrichs, Philipp Kuhn, Thomas Hamacher, and Markus Blesl. 2023. "Global Hydrogen and Synfuel Exchanges in an Emission-Free Energy System" Energies 16, no. 7: 3277. https://doi.org/10.3390/en16073277

APA StyleLippkau, F., Franzmann, D., Addanki, T., Buchenberg, P., Heinrichs, H., Kuhn, P., Hamacher, T., & Blesl, M. (2023). Global Hydrogen and Synfuel Exchanges in an Emission-Free Energy System. Energies, 16(7), 3277. https://doi.org/10.3390/en16073277