Abstract

The European electricity market model continues to evolve in the face of new challenges. This systematic literature review aims to assess the status of research and discussion on the current model and its market mechanisms. In addition, it aims to ascertain the kinds of modelling tools that have been used to model market mechanisms or formulate proposals for changes to current practice. The results show that the challenges of individual market mechanisms have been identified quite extensively in the research sample. However, the number of papers identified for inclusion in the systematic literature review was quite small, from which it can be concluded that there are surprisingly few publications focusing on this particular topic. Nevertheless, the trend indicates a probable increase in research in the subject area in the future. The general standpoint among researchers seems to be that the goals set by the EU are, as it were, a law of nature that cannot be deviated from. Consequently, new radical change proposals or comprehensive reforms were not encountered in the study. In addition, it was found that optimization was the most commonly used modelling method in the papers included in the literature review.

1. Introduction

European electricity markets have existed for nearly three decades, and throughout this time, market designs have undergone significant development to meet new challenges and adapt to social, political, and technological change. Despite this long period of development, market designs have not yet stabilized into a fixed form, as the latest challenges have yet to be fully resolved. Recent changes in the energy sector, such as the increased share of renewable energy, decentralized production, and the growing need for demand response, challenge the functionality of the current model. Smart grids are enabling the integration of distributed resources and multi-directional power flows incorporated with real time measurement data. In order to achieve long-term and short-term electricity market objectives, there is a need to focus on the basic principles of the market, good governance, and advance planning [1]. A functional electricity market can be defined using a variety of criteria, depending, for example, on who defines the concept, and what kind of market structure is desired. To retain confidence in the functionality of the market, prices must correspond to the demand and the costs of energy production. In an electricity market with free competition, the main purpose is to make the market work more efficiently. Clearly, there must be enough transmission capacity to enable an effective market, and the market must be transparent. Each market participant should be taken into account when designing the electricity market rules, as these rules should create financial incentives for market participants that improve the real-time reliability and long-term adequacy of the energy system [2].

Dissatisfaction with the current market model has reared its head every now and then, and discontent seems to have increased during the current energy crisis. Whereas some actors claim that the current market model requires only small changes to certain structures, more radical voices argue that the entire market model requires renewal. For example, in Ref. [3], the entire current wholesale electricity pricing model is challenged, but at the same time it is noted that pricing structures must be based on efficiency, user preferences, and incentive effects. Furthermore, the paper states that while it has been decreed that electricity is sold in quantities of energy (EUR/MWh price), there are alternative ways to execute pricing. For many industrial users, for example, maximum demand (in power, e.g., MW) is an essential element in tariffs. Winkler and Altmann [4] divide changes to the electricity market design to drive transition to a completely renewable electricity system into three groups: changes to the current market design, add-ons to the current market design, and more radical market changes.

Public discussion about electricity market design is mostly sparked by no other concern than the price of electricity. In particular, large fluctuations in electricity prices and extremely high price peaks have created mistrust towards the market. Recently, there has also been a lot of discussion about the fact that in times of high market prices for electricity, producers of renewable energy may temporarily make large profits. When the market situation causes some electricity consumers great financial distress, the topic understandably creates some resentment. On the other hand, when the price of electricity is low for a longer time, especially conventional electricity producers are in a tight spot, as it becomes difficult to cover the operating costs of the facilities. One way or the other, the European market system should attempt to remove uncertainty in the electricity market caused by fossil fuels, especially natural gas [5]. Uncertainty not only refers to high electricity prices, but from the point of view of energy security, a sustainable system should achieve geopolitical independence.

Silva-Rodriguez et al. [6] studied short-term changes to the electricity market model proposed in the literature and assessed their suitability for improving market performance. The results of their analysis showed that there is a lack of a comprehensive solution to improve market design, as the literature offers solutions only for specific issues affecting the market model. They conclude that to comprehensively solve the challenges facing the current model, different elements of the proposed solutions should be combined into a mutually functional whole in a sustainable market design for the future.

Various models and tools to analyse electricity markets have been developed and presented in the literature. For instance, Pfenninger et al. [7] conducted a broad review of models related to national and international energy policy. The models examined were categorized into four classes: energy system optimization models (for normative scenarios), energy system simulation models (for forecasts and predictions), power system and electricity market models (for operational decisions and business planning), and qualitative and mixed-methods scenarios (for narrative scenarios). Ventosa et al. [8] divided electricity market modelling trends into three different groups: equilibrium models, optimization models, and simulation models. In their analysis, the authors state that equilibrium models illustrate overall market behaviour considering competition among all participants, while optimization models concentrate mainly on the profit maximization problem of one participant in the market. If the modelling problem is too complex for equilibrium models to solve, simulation models can be used instead. Another wide-ranging review of electricity market simulation modelling tools can be found in Hampton and Foley [9], where methods for optimal operation of future retail electricity markets are assessed. Methods examined in the study include analytical methods, proprietary and open-source modelling tools, and development frameworks.

Siala et al. [10] compared five different power market model frameworks, both qualitatively and quantitatively, of which four are optimization models (DIMENSION, EUREGEN, E2M2, and Urbs), and one is a simulation model (Hector). In addition to model type, three other key features (planning horizon, temporal resolution, and spatial resolution) were assessed. Based on the results, the authors gave recommendations for better use of models. Müsgens [11] classified developed electricity market models into three different classes: partial equilibrium models focusing on technical constraints, agent-based models, and oligopoly models focusing on strategic behaviour.

To promote the design of a future-proof electricity market, this paper provides a summary of how the existing market design has been studied, how the current design has been questioned, what kind of changes have been proposed to improve it, and the ways in which these proposals have been modelled. The purpose of the article is to provide an in-depth look at the current situation, and to investigate proposed alternatives to the current market model. The research does not focus on any specific market participant, i.e., the consumer’s point of view is not examined separately, but the literature review aims to give a general view for the subject. It is clear that the present market model is deficient and has not developed sufficiently to account for the ongoing energy transition. Using a systematic literature review approach, this paper aims to appraise studies that have tackled the subject area and examine the proposed solutions. The methodology of the study follows the principles of PRISMA [12], and a total of 11 different keyword combinations were searched from Scopus for the review. The results of the systematic literature review are organized according to the different electricity market mechanisms. The themes in which the results are divided are as follows: bidding zone configuration, market coupling, nodal pricing, intraday markets, balancing markets, capacity remuneration mechanisms, add-ons, market clearing, modelling electricity markets and bidding optimization, risk hedging, and power-based modelling instead of energy-based. Utilizing the division of models presented in Ref. [8], this study also considers the methods used to model the market mechanisms. Furthermore, the temporal distribution of the studied papers is investigated.

In contrast to much other work, this paper aims to provide a comprehensive overview of market design and market mechanism-specific modelling. In Ref. [6], for example, examination of market mechanisms is limited to short-term markets, and Winkler and Altmann [4] disregard market design developments at the European level. Furthermore, the analyses in Refs. [7,10] are based purely on modelling methods of electricity markets, and the focus in Ref. [9] is solely on modelling methods for retail electricity market design. In this article, we review the modelling methods used for each market mechanism. Thus, to the best of our knowledge, this article is the first to combine a comprehensive market design review, the systematic literature review method, and a comparison of market mechanism-specific modelling methods. The main contributions of this study can be further summarized as follows:

- The study contributes to the ongoing discourse on electricity markets by providing a comprehensive overview of the existing literature concerning the electricity market design, including how it has been studied, questioned, and how the change proposals have been modelled;

- The paper provides an in-depth analysis of the subject area through a systematic literature review by investigating the change proposals to the current market model;

- By not focusing on any specific market participant, the review offers a general view of the subject;

- As a methodology, a systematic literature review approach based on PRISMA principles is used, covering 11 different keyword combinations that were searched from the Scopus database in October and November 2022;

- -

- The results of the literature review are organized according to the different electricity market mechanisms.

- -

- The modelling methods used in the studies are reviewed for each market mechanism, following the division of models presented in Ref. [8].

- To provide a better understanding of the evolution of research in this area, the temporal distribution of the studied papers is investigated;

- A comprehensive and integrated analysis of market design and market mechanism-specific modelling, which has not been achieved in previous works (e.g., Refs. [4,6,7,9,10]), is provided;

- The study offers relevant insights to academics, policymakers, and industry practitioners interested in the electricity market design and its operation.

The structure of the rest of the article is as follows: Section 2 briefly discusses the basic principles of European electricity markets. Section 3 describes the methodology used in the study. The results of the study are presented in Section 4 and discussed in Section 5. Finally, Section 6 concludes the paper.

2. Main Parameters of the Current European Electricity Market Model

In order that the same price for electricity can occur everywhere in a single market area, transmission capacity should be practically unlimited, and no losses should occur. Since this is not possible, a number of different options for pricing electricity have been developed. For example, while European electricity markets utilize uniform pricing within bidding zones, U.S. electricity markets have adopted the nodal pricing system. On European markets, electricity can be traded in two ways: at power exchanges such as Nord Pool and EPEX SPOT offering standardized products, or through bilateral over-the-counter (OTC) trades. Markets organized by power exchanges are anonymous, optional, and open to all participants who meet the entrance requirements [13]. Sealed-bid mechanisms, where the intersection of demand and supply curves determines the clearing price, are the most utilized approaches in electricity market auctions. At a market trading in the short-term electricity market, the market price is determined via a marginal pricing scheme in both zonal and nodal pricing [14]. In OTC trading, the purchase and sale of electricity takes place directly between the buyer and the seller in a bilateral trade without intermediaries, i.e., outside the power exchanges.

Since 1999, an internal market for electricity has been progressively implemented throughout the European Union [15]. Utilizing directives, laws, and regulations, the EU has been aiming to organize integrated competitive electricity markets while ensuring supply security and sustainability. The current European Electricity Target Model is based on zonal pricing where bidding zones are formed geographically (state borders or smaller or larger areas) [16]. Electricity is traded in different periods of time in different markets, where the trading models vary. Electricity is not only traded in the form of energy, but also in the form of transmission capacity and energy flexibility. Such markets are required because electricity has a different value at different places and times. Because consumption and production must be met at every moment, flexibility also has its own trading value [17].

In forward markets, standardized products are traded from a couple of years to one month before delivery. The trade is organized by a financial exchange, or market participants can conclude bilateral OTC agreements [18]. In the day-ahead market, which is the reference market, electricity is traded by auction for each hour of the next day. The intraday market is used to adjust unforeseen changes in production and consumption, and trading is done on the same day as delivery. In intraday markets, most European countries utilize a scheme of continuous trading, although Italy, Spain, and Portugal use mainly staggered auctions [19]. Balancing markets are used to secure the balance between supply and demand. In Ref. [1], it is claimed that the best market design to meet future challenges will continue to be effective spot markets with support for forward contracting and competitive retail markets that promote demand response. It is further stated that a firm and consistent climate policy tied to the carbon price would support this goal by significantly mitigating the uncertainty of investment.

It is assumed that within each zone in the network, none or only a little congestion occurs [20]. When congestion occurs, the transmission capacity can be allocated between the different bidding zones. Therefore, in the case of congestion, different prices may occur in different bidding zones. In the day-ahead European electricity market, congestion within bidding zones is managed with re-dispatching generation units after market closure. In re-dispatching after-market clearing, Transmission System Operators (TSOs) regulate the operation of power plants against remuneration. For cross-zonal trade, there are two methodologies to define the available transmission capacity: the Available Transfer Capacity (ATC) approach and the Flow-Based (FB) approach. In ATC, available commercial capacity on each zonal border is defined bilaterally, whereas in FB, all TSOs within a geographical area (Capacity Calculation Region, CCR) coordinate to consider the grid externalities in the transmission capacities provided to the market. The FB approach is seen as more preferable because the socio-economic welfare is increased by optimizing the power exchanges between different bidding zones [21]. Additionally, security of supply is improved and price convergence increased in the whole region.

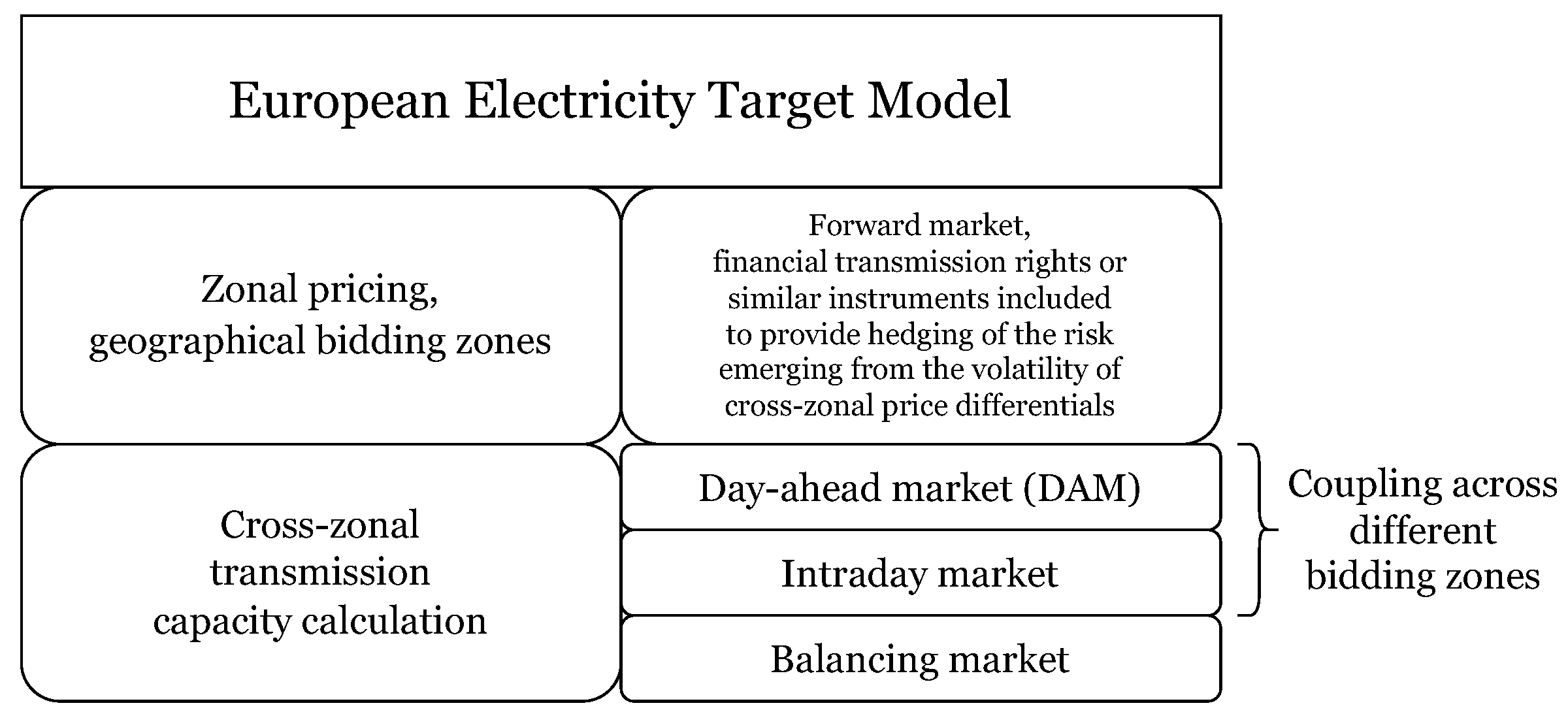

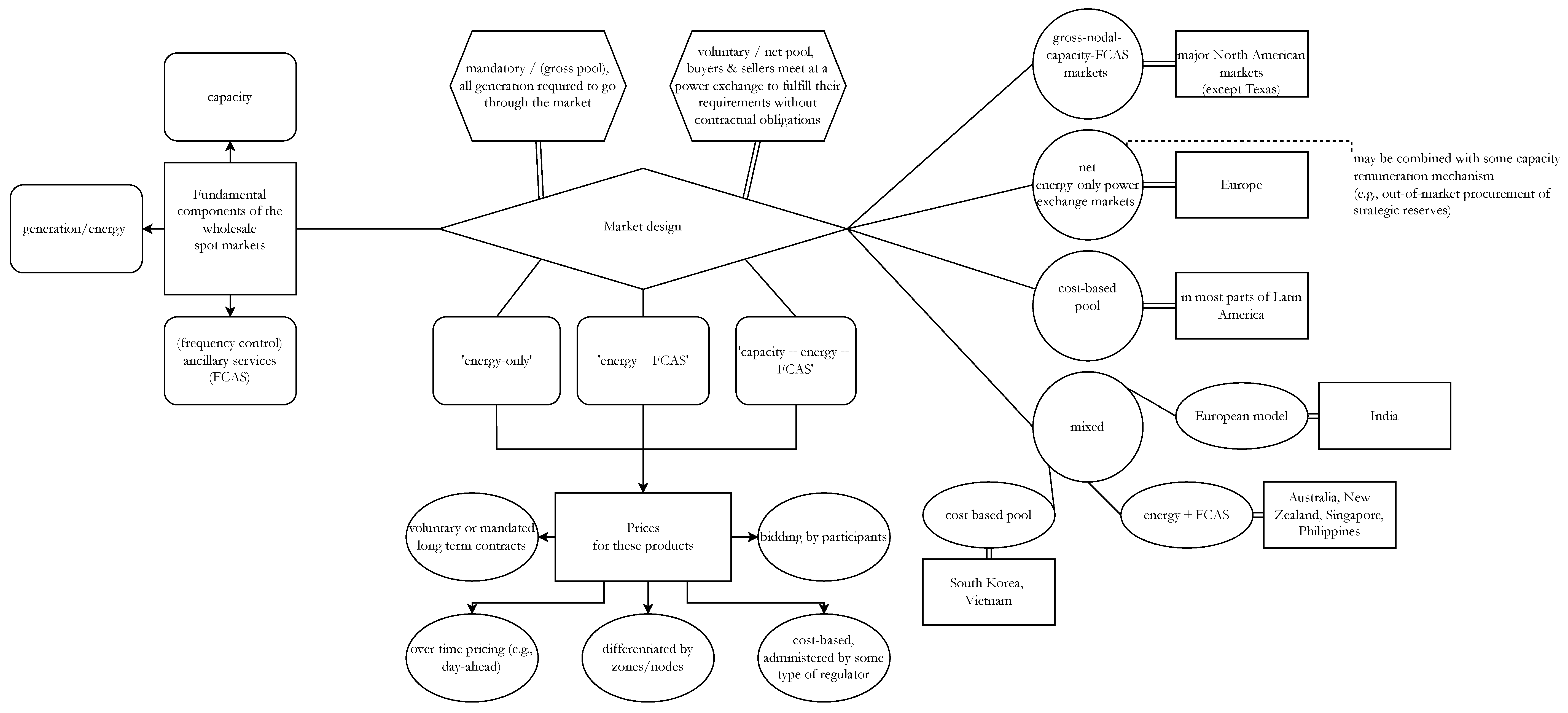

The key components of the current European electricity market model are presented in Figure 1. Considering the issue of electricity markets from a wider perspective, a more comprehensive diagram illustrating the fundamentals of different electricity market designs, adapted from Ref. [22], is presented in Figure A1, which can be found in the Appendix A.

Figure 1.

Key components of the current European Electricity Target Model (own illustration, adapted from Ref. [16]).

3. Methodology

The study utilizes the step-by-step process of a systematic literature review, based on which the articles to be analysed are selected and from which the data is extracted for this study. The review process follows the PRISMA principles explained in Ref. [12]. This section describes the protocol for selection of articles for more detailed analysis.

Systematic Literature Review

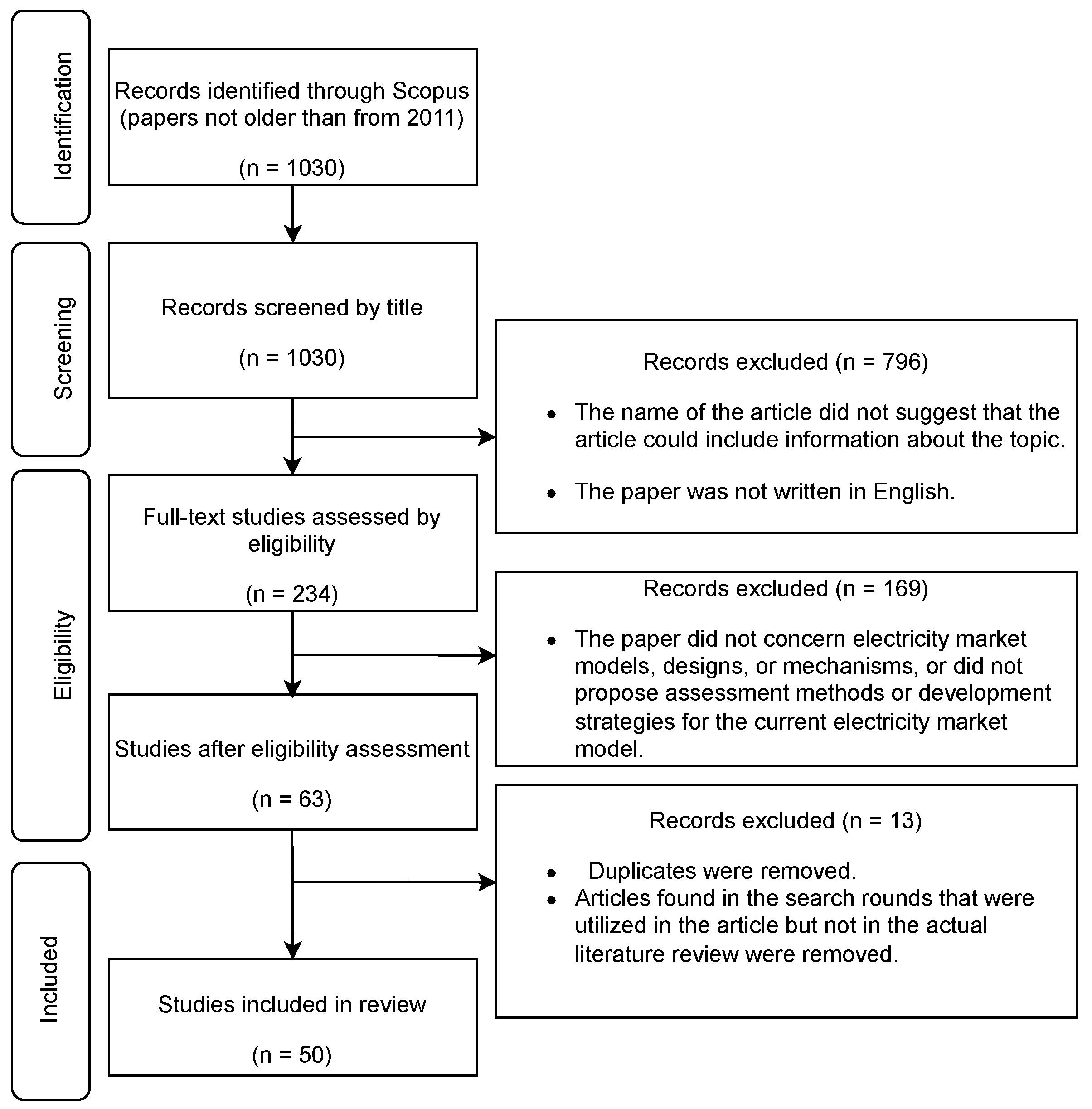

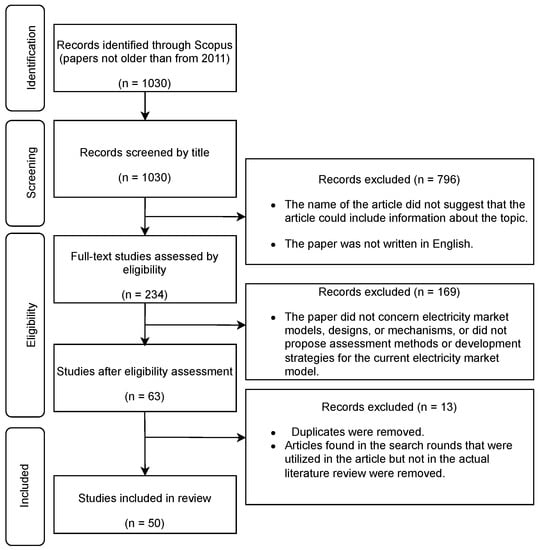

The systematic examination of literature discussing electricity market models and designs starts with a search in the Scopus database using keyword combinations. Eleven different keyword combinations were used in total (see Table 1). The fields of paper title, abstract, and keywords were searched for the first 10 keyword combinations, but only the title field was searched for the last one. The keyword combination search took place on 7 October and 11 November 2022. Already at this stage, articles older than from 2011 were filtered out to obtain relatively recent studies. A total of 1030 results were found from the Scopus database, of which 234 papers were saved for later investigation. These saved articles were extracted according to the title. If the name of the article suggested that the article could include information about the topic, it was saved for later use. The saved articles then underwent a full paper review in which the entire article was skimmed through to check whether it contained information relevant to the research. It should be noted that some of the sources found can appear on several keyword combination lists at the same time. The keyword combinations used and the search results obtained are listed in Table 1. The final number of papers included in the literature review differs from the final number of saved articles, as a couple of search results contained duplicates. In addition, the final number does not include articles found in the search rounds that were utilized in the article but not in the actual literature review. The search process following the principles of PRISMA is presented in Figure 2.

Table 1.

Keyword combinations used for the systematic literature review.

Figure 2.

PRISMA flowchart for the systematic literature review.

Some of the articles may examine issues other than considering only the European electricity market model. However, the results mainly concern the European electricity market. The approaches of other models have not been removed from the results, because this issue or refinement was not taken as one of the criteria when reviewing the papers.

In the following sections, the results of the systematic literature review are divided into different market mechanisms, which are analysed and discussed individually.

4. Results

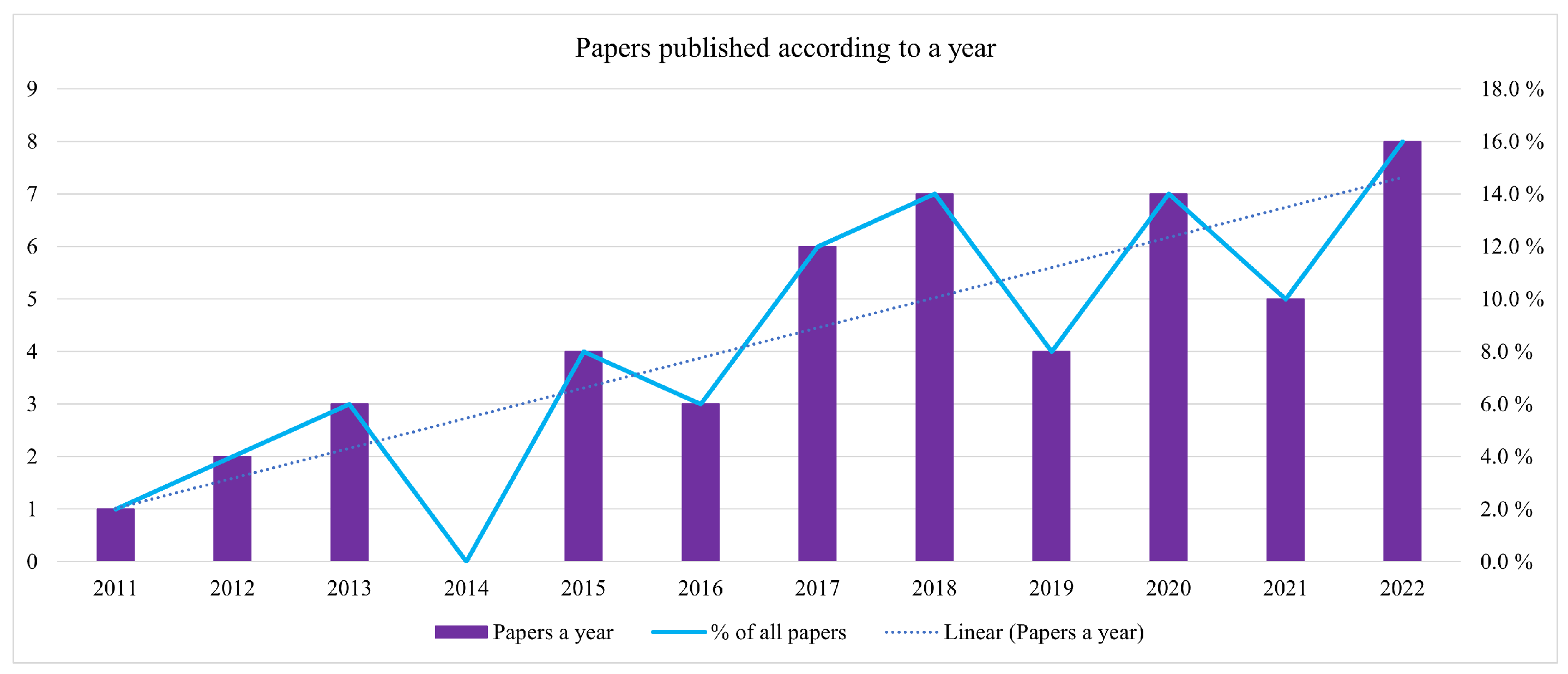

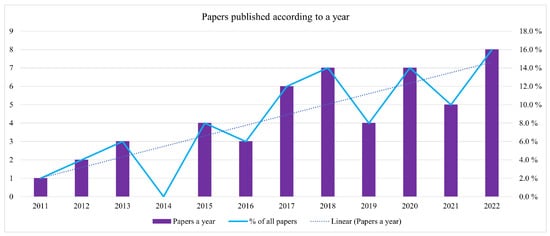

This systematic literature review aims to reveal the state of discussion about the current European electricity market model and its various mechanisms, as well as what kind of changes have been proposed for the current design. The results are organized according to the different electricity market mechanisms. Additionally, as a side plot, the methods utilized for modelling were also examined. First, however, the temporal distribution of the studied papers was investigated. The papers selected for closer examination were analysed according to the annual development in the number of publications in this subject area. Figure 3 presents the number of publications per year in numbers and as a percentage. It can be seen that the number of publications has been increasing over the years.

Figure 3.

Number of papers published by year.

4.1. Bidding Zone Configuration

The growing share of renewables in most electricity markets is leading to an increase in grid congestion and costs for congestion management [23]. In response, regulators and operators are attempting to address the issue of structural and physical congestion in electricity markets through changes to bidding zone configuration in the network. In European electricity markets, Capacity Allocation and Congestion Management for Electricity (CACM) determines the evaluation criteria for future configurations of bidding zones. The most important criteria parameters for bidding zones are network security, market efficiency, stability, and robustness [24].

Bertsch et al. [25] argue that in a context of restricted grid expansion, the current zonal market model has shortcomings, especially in the projection of price signals. Furthermore, important scarcities in the network are not appropriately taken into account in investment decisions. The study claims that the more restricted the grid expansion, the more administrative intervention is needed. However, the use of load curtailment to avoid energy imbalances is politically unwanted and, furthermore, expensive. One option proposed is that contract generation capacity should be administered outside the market. They further suggest that redefinition of zones or the introduction of locational price elements would be a suitable approach for addressing energy imbalances while keeping administrative interventions at a minimum.

Felling and Weber [26] see the reconfiguration of the price zones in Central Western Europe as a possible mid-term solution for tackling increasing congestion in the transmission grid. Their paper attempts to identify possible new price zone configurations by applying a hierarchical cluster algorithm that clusters locational marginal prices and weights nodes depending on the demand- and-supply situation. The results of their study indicated that the borders of the price zones do not align with national borders for the different scenarios studied and that price variations within price zones can be mitigated by reconfiguration.

Ambrosius et al. [23] presented that if a switch to a more efficient bidding zone configuration is devised, and this change is anticipated by market participants, welfare can increase even before the actual implementation of the reconfiguration. Furthermore, even minor probabilities for the expectation of a reconfiguration of bidding zones can result in more expeditious investment in generation and transmission. Lundin [27] examined changes in price zone configurations and justified an increase in the number of price zones by stating that when investments in generation are made in areas where the marginal value of production is high, it reduces the need to increase the transmission capacity. This claim was made based on the investigation of the impact on investments of a Swedish price zone configuration reform in 2011, in which Sweden was divided into four different price zones instead of the previous single zone comprising the whole country. Using a difference-in-differences (DiD) estimator, it was found that after the reform, 18% of all large players’ construction projects were allocated to the high price zone, which further indicates that the reform had an effect on the locational preferences of investors. Moreover, as the European Commission [28] has mandated that by the end of 2025, 70% of each country’s cross-border transmission capacity should be available for trade, Lundin foresees that more market splitting reforms will be implemented throughout Europe in the coming years.

Five indicators (evolution of the commercial exchanges on different borders, price convergence and divergence, evolution of social welfare, and loop flows) to assess the effect of different configurations of bidding zones in zonal electricity market are presented in Ref. [29]. The aim of the indicators is to help in the evaluation of whether the proposed measures are beneficial for the electricity market and their possible effect on loop flows in the system.

Sirin and Yilmaz [30], who studied the Turkish balancing market, argue that the Turkish electricity market should be modified to better reflect the temporal and geographical characteristics of variable renewable energies (VREs), thus allowing the imbalance and integration costs of VREs to be reduced. Currently, the hourly settlement used in Turkey unsuccessfully reflects the intermittency and sub-hourly variability of VREs. Furthermore, as the Turkish electricity market is designed as a single zone, the local generation characteristics of variable renewable sources are not effectively incorporated. To reduce the costs of imbalance and VREs integration, the authors suggest an electricity market with multiple bidding zones and shorter settlement periods.

4.2. Market Coupling

In European Market Coupling, electricity is allowed to flow freely across national borders where and when it is needed. Electricity is distributed more efficiently across the borders as the electricity flows are guided by price signals. Implicit trading instead of separate trading of cross-border capacity and electricity mitigates the unnecessary risk that is inherent in separate trading. Ringler et al. [20] analysed the development of Central Western Europe Market Coupling to increase the knowledge of the integrated impact on welfare and generation adequacy in interrelated electricity markets. One of the main arguments of the paper is that market coupling in Europe increases generation adequacy and welfare, and it should therefore be continued and strengthened. However, increasing interconnection capacities in a market coupling may increase generation adequacy but does not necessarily increase welfare. The same pattern can occur with capacity mechanisms, i.e., with a strategic reserve. The authors state that a stable and transparent regulatory framework with cross-border congestion management in the form of implicit auctions as a key component should be provided by European energy policy. Furthermore, coordination of electricity market designs is required among member states.

Within the Core region in Europe, congestion between different bidding zones is managed with a Flow-Based Market Coupling (FBMC) Mechanism implemented in 2015. The Core region consists of 13 countries (Austria, Belgium, Croatia, the Czech Republic, France, Germany, Hungary, Luxembourg, the Netherlands, Poland, Romania, Slovakia, and Slovenia) and 16 TSOs with 10 Nominated Electricity Market Operators (NEMOs). The Flow-Based Market Coupling mechanism is designed to be implemented in the coming years also for the long-term and intraday electricity markets [21]. Corona et al. [31] scrutinized the evolution of market integration in Central Western Europe in the post-implementation period of FBMC from the point of view of price convergence. The study reveals that especially Germany and France play a remarkable role in the market integration process as, for example, the high penetration of RES in Germany is a significant driver of congestion in the region.

Poplavskaya et al. [32] tackle the challenge of congestion caused by increasing amounts of renewable energy, which further limit cross-border trade and increase the frequency and magnitude of congestion events. To optimize cross-border trade, they propose a methodology for congestion management in zonal day-ahead markets that integrates a preventive re-dispatch into flow-based market coupling. This scheme is compared to two other cases: a nodal market model, and the zonal market model with flow-based market coupling. The study showed that compared to other options, the proposed approach is able to potentially lower the risk of strategic bidding. Additionally, it can increase cross-border trade and price convergence. Furthermore, it mitigates overall system costs, and therefore, according to the authors, could be a politically and practically more suitable approach in Europe than nodal pricing.

4.3. Nodal Pricing

In nodal markets, electricity prices reflect constraints in the transmission network and losses in the electricity supply between nodes. Bjørndal et al. [33] examined the impact of implementing a nodal pricing model in a joint day-ahead market for one country while a zonal pricing system is applied for the rest of the market. This hybrid scheme was proposed earlier in Ref. [34]. The scheme was implemented in a joint power market for Poland, Germany, the Czech Republic, and Slovakia, and nodal pricing was applied for Poland. The hybrid pricing system was compared to the full nodal pricing scheme and the full zonal pricing scheme, and it was found that countries that are affected by wind energy from the neighbouring country would gain advantage from applying nodal pricing to address grid congestion. Furthermore, the use of nodal pricing would reduce the need for re-dispatching and load curtailment and enhance the collection of congestion rent. Compared to zonal pricing, the average unit price decreased with the hybrid pricing. Surprisingly, countries with large amounts of wind power would benefit from keeping the zonal pricing method.

According to Ahmadi and Akbari Foroud [35], using nodal pricing in reactive power markets can spread signals effectively to invest in reactive power resources in requisite locations. However, they claim that the traditional nodal pricing of reactive power has several disadvantages, for example, it does not provide correct economic signals. Another disadvantage of this traditional model is that it does not consider opportunity and availability compensations for generators. Therefore, they propose an improved nodal pricing method to calculate the price of reactive power. These separate payments for the availability of generation units are considered in their model.

4.4. Intraday Markets

Kuppelwieser and Wozabal [19] analysed continuous (case: Germany) and auction-based (case: Italy) intraday power markets from the point of view of liquidity costs. To utilize the benefits of both market designs and to mitigate the liquidity costs, they suggest a hybrid system containing both continuous and auction-based market designs, similar to the system implemented in Spain already in 2018. In this hybrid option, auction intraday markets hours away from delivery could enable increased liquidity by pooling orders. Respectively, continuous markets starting near delivery could help to reduce forecast errors for variable RES output shortly before the physical delivery.

4.5. Balancing Markets

The benefits produced by regional coordination of balancing capacity markets were studied in Ref. [36]. The results of their case study of Central Western Europe showed that the more cost-effective acquirement of balancing capacity resources and electricity generation scheduling are enabled with the exchange of balancing capacity. Furthermore, the coordination of cross-border balancing capacity, particularly when joined with alternative firm and flexible capacity sources (e.g., rarely used high-capacity demand response) can mitigate the need for back-up capacity. It is further stated that in the short-term, the increased coordination of the acquirement and sizing of balancing capacity enables more cost-efficient operation of the power system without extra investments, and in the long-term, it may reduce the need for generation capacity which could otherwise demand financial assistance to spur adequate investment.

Ehrhart and Ocker [37] analysed changes to the design of balancing power markets in Germany. The changes considered are the mixed-price rule, ‘free energy bids’, uniform prices, and prequalification criteria for balancing power. Put simply, the mixed-price rule refers to the sum of the capacity and the energy value together, uniform price is used to incentivize truthful bidding and increase efficiency, and ‘free energy bids’ refer to market flexibilization to facilitate the integration of volatile RES. The results of their study indicated that the mixed-price rule does not affect the market equilibrium and may motivate suppliers’ bidding behaviour to change unfavourably. The work also claims that free energy bids do not advance competition. Furthermore, they state that uniform pricing does not direct to truthful bidding, although reducing balancing power prequalification criteria seems to be a promising approach to reduce costs.

4.6. Capacity Remuneration Mechanisms

Keles et al. [38] considered whether an ‘energy-only’ market offers sufficient incentives for investing in new power plants in Germany, or whether it should be extended with capacity remuneration mechanisms (more specifically, a strategic reserve and a central capacity market) to ensure product-secured capacity. Their analyses point out that in the short- and mid-term, the existing ‘energy-only’ market leads to a market equilibrium, but the cost advantage reduces, and generation adequacy cannot be ensured completely in the long run. Furthermore, even though a strategic reserve can also incentivize investments and ensure the security of supply in a market with high RES, a capacity market performs better in the longer run. However, the authors note that the key challenges of a capacity market are found in the need to avoid overcapacities and their related costs.

Capacity remuneration mechanisms are studied also in Ref. [39]. Hach et al. developed a dynamic capacity investment model to investigate the affordability and reliability of capacity market design options in a case study of Great Britain. They use three different scenarios to compare the capacity markets: no capacity market, a capacity market for new capacity only, and a capacity market for both existing and new capacity. Their results indicate that capacity markets improve the generation adequacy and reliability but do not necessarily increase the costs of generation. Moreover, they state that capacity markets can even lower the wholesale electricity price and diminish price volatility.

Billimoria and Poudineh [40] claim in their research that capacity acquisition by a non-commercial central entity has some challenges and inefficiencies. To mention a few, the economic aspects of reliability-related outages are allocated to consumers with no choice of how to manage or transfer risk and the inefficiency and unfairness resulting from recovering the costs of procured capacity through volumetric retail tariffs. In response, they provide an insurer-of-last-resort model to tackle the challenges of centralized capacity mechanisms. The model provides a financial risk and reward structure for the central authority who has discretionary power regarding capacity and reserves.

Rios-Festner et al. [41] studied capacity remuneration mechanisms and their impact on capacity adequacy and market efficiency in the long-run. The assessed mechanisms are a price-based (capacity payment) and a quantity-based (capacity market) capacity remuneration mechanism, which are both inserted in an ‘energy-only’ market and compared to the case of an ‘energy-only’ market without these incentives. Their results indicate that especially integrating capacity markets to an ‘energy-only’ market enables firm behaviour of the system in the long term and limits the occurrence of construction cycles. Here, the construction cycles are referred to as the long-term evolution of the power system in terms of subsequent periods of under- and over-investment in generation [41]. Moreover, a capacity market can be seen as preferable to capacity payments in promoting capacity adequacy and increasing the security of the supply. The authors remind that the higher energy prices caused by mechanism designs that are trying to achieve more firm system evolution in the long term increase the value of construction of new generation projects, which further prompts generators to invest in irreversible investments under uncertainty.

Bucksteeg et al. [42] recommend that to maintain the supply security in Europe, common European-wide rules for a coordinated introduction of capacity mechanisms with coordinated determination of capacity requirements should be developed. In their study, they compare uncoordinated capacity markets with coordinated capacity markets in Europe. The authors state that unilateral introduction of capacity markets should be avoided as asymmetric capacity markets (unilateral national capacity markets in certain countries, no capacity markets in others) distort generation investments and cause unfavourable cost effects. From a short-term point of view, it is claimed that countries without capacity markets are free-riding at the expense of countries with capacity markets. In the longer term, the problem of missing money increases in an ‘energy-only’ market, and producers leave the domestic market, which in turn causes the security of supply to decrease in countries that do not use capacity markets as production investments move to countries that use reliability mechanisms. The simulation results reveal that compared to independent national capacity markets, a coordinated European-wide capacity market (capacity requirements are commonly determined) results in lower capacity requirements and system costs. In addition to the lower capacity requirements, the lower system costs are explained by relocating generation investments to lower-price regions and utilizing more existing (base load) generation. However, the results show, too, that for some countries, coordinated capacity markets with a joint provision of firm capacity cause increased dependency on import capabilities. Thus, supply security and self-sufficiency will decrease if simultaneous scarcity occurs.

The study of Khan et al. [43] examined the need for capacity markets to secure adequacy of the system taking into account the possibilities created by demand response and electrical energy storages. Within their research frame, it is shown that although the capacity market ensures security of supply, demand response and electrical energy storages can perform the same function at reduced cost. The need for a capacity market decreases as demand response and electricity storages are utilized in the market, and the costs for consumers thus decrease.

The different capacity remuneration mechanisms in the U.S. are discussed in Ref. [44]. Different Independent System Operators (ISOs)/Regional Transmission Organizations (RTOs) in the U.S. have their own approaches for achieving system reliability. The authors especially highlight ISO New England’s proposal of a two-settlement capacity auction. In the first auction round, a minimum bid price rule would be in use, which would exclude the majority of renewable energies from participating, but retirement offers below the clearing price would have the delivery obligation. In the second auction, a fixed amount of capacity would be represented by the cleared retirement offers from the first auction, and the clearing price would be the transfer price between the two auctions.

4.7. Add-Ons

Add-ons can be added to the current market design if it does not produce cost recovery and adequate incentives for investments [4]. Helgesen and Tomasgard [45] investigated the economic effects of tradable green certificates with their policy and power market model. Their model considers the characteristics of the network, as they significantly affect the placement of production plants and the redistributive effects of the social welfare of the support system (in this case, green certificates). The study found that the support system examined can facilitate new producers to enter the market, but this can come at the expense of existing companies, which leads to welfare being transferred from old companies to consumers and new companies.

Tómasson et al. [46] examined the implications for investment levels of administrative price caps. Additionally, they proposed an incentive mechanism for generation capacity in electricity markets where price caps exist. Their research showed that despite the level of the price cap in the market, and with their incentive mechanism, the optimal generation mix stays the same as without a price cap, and an investment level maximizing the social welfare is produced. The incentive mechanism is based on an uplift payment for generators, which raises the received price to the level it would have been without a price cap.

4.8. Market Clearing

In order to enhance the cost-effectiveness of electricity markets, a market clearing model needs to be designed to provide transparent information to delineate the correlation between the market and the power systems operations, but also for pricing system security [47]. Market clearing should be transparent and fair and produce a viable dispatch [48]. The supply–demand equilibrium in price formation is often modelled with an economic dispatch (a merit order approach, matching supply and demand at lowest cost) or unit commitment approach [49]. The unit commitment (UC) problem seeks to minimize the total cost of power generation in a certain period of the day; it defines the valid generator schedules, which are related to certain demand forecast and spinning reserve constraints [50].

In Europe, the single price coupling algorithm called Euphemia has been developed to calculate the allocation of power and electricity prices across Europe in the day-ahead market. The algorithm considers the market and network constraints when matching the demand and supply for each period in a day. The calculation is executed at the bidding zone level. As a Social Welfare Maximization Problem (SWMP), it seeks to maximize the social welfare while calculating the Marginal Clearing Price (MCP), and it is formulated as a Mixed Integer Quadratic Program (MIQP) [51].

The papers concerning the market clearing in this study address the topic mainly from a market design point of view and try to consider the diversity of the market as much as possible in their proposals for market clearing. However, some of the studies may propose solutions for market clearing also to tackle the challenges of computational complexities. Lam et al. [52] state that the conventional payment scheme of the European day-ahead market is challenging because of the non-convexity and the short computation time requirement. To tackle these problems, they propose a new clearing model in place of Euphemia. Other proposals for market clearing options can be found in Refs. [53,54,55,56,57]. In Ref. [53], the market clearing model is established with limited competition, and the power is divided into two parts: one part is competitive, i.e., it participates in the market competition, and the other part, which does not participate in the market competition, can be used, for example, for planning or dispatching. In Ref. [54] it is argued that Euphemia has limitations regarding the capture of critical technical aspects of power systems, as with the unit commitment (UC) problem. Therefore, the authors of the paper extend the current scheme of the hourly-offers module of Euphemia to solve the problem of optimal market clearing in a joint energy and reserve market. The security-constrained market clearing (SCMC) model from Rezaee Jordehi et al. [56] is applied in a power system with storage systems and wind power plants to handle the possible contingencies for generators and transmission lines. The Benders decomposition algorithm improved with price-based cuts is used to solve the day-ahead electricity market clearing problem in the European electricity market in Ref. [57]. A bidding framework using opposition-based gravitational search algorithm (OGSA) and considering renewable energy sources and market constraints is proposed for a pool-based day-ahead energy marketplace in Ref. [58].

Koltsaklis and Dagoumas [55] propose a market clearing model for the wholesale electricity market that utilizes mixed integer linear programming (MILP). They argue that for the economic operation of a risk-averse power utility, the endeavour is a balanced portfolio in both wholesale and retail markets. Moreover, they state that large profit margins in one market may indicate lower margins in another, or alternatively weaken the utility’s competitive edge. In their model, they therefore focus especially on the integration of the retail and wholesale market. As an important note, they emphasize that in an era of energy transition, production facilities must be highly accommodating as electricity market mechanisms change and the increase in renewable energy and smart grids causes structural changes at the system level [55].

Kim and Hur [47] investigated a Security Constrained Optimal Power Flow based market clearing model with the aim of improving market efficiency. The voltage security margin and overcoming off-line transmission capacity limits related to system security were also considered in the study. Generally, the Optimal Power Flow (OPF) model addresses the challenge of defining the best operating levels for electricity generators while meeting the demands generated throughout a transmission network. The objective of the model is usually to minimize the operating cost. Local marginal prices and nodal congestion prices (NCPs) are assessed in Ref. [47], and it was found that compared to prices from traditional market-clearing models, NCPs are non-volatile with the Security Constrained Optimal Power Flow based market clearing model.

The study of Wu et al. [59] compared a clearing model based on security-constrained unit commitment, a distributed robust optimization (DRO) model based on Wasserstein metric, and an optimization model based on a box uncertainty set. In security-constrained unit commitment (SCUC), additional constraints are applied to ensure that transmission lines are not overloaded [60]. The Wasserstein metric illustrates the spatial scales of different probability distributions.

Two approaches (non-linear and linear pricing rules) to calculate market-clearing prices are compared in Ref. [61]. In non-linear (discriminatory) pricing rules, in addition to a uniform price (taken from the unit commitment model), additional side-payments are dispensed on a basis of differentiated production per generation unit. These additional payments cover the fixed operation costs of generators that cannot be recovered through uniform prices. In linear (non-discriminatory) pricing rules, the effect of non-convexities is included in the produced uniform price. The study’s simulations showed that the linear pricing rule appears to promote a more effective generation mix. Furthermore, the linear pricing rule does not necessarily produce higher energy prices than a non-linear pricing rule. Instead, by attracting lower variable cost producers to the market, prices can decrease. According to the authors, in the long run, a properly designed linear pricing rule can be more effective. However, the authors remind that changing the pricing rule does not significantly affect investment decisions.

Two sequential market clearing models are compared in a study by Björndal et al. [62]. In sequential market clearing, the markets are cleared sequentially in two stages. If the day-ahead and real-time markets are considered, the day-ahead market is cleared in the first stage with uncertainty associated to load and/or generation levels in the real-time market. The real-time market is cleared in the second stage after all uncertainty is resolved. The authors compare a stochastic market clearing model that is an integrated model considering both the day-ahead and real-time market and the uncertainty with a myopic market clearing model where the first market does not consider the uncertainty or the bids to the second market but is cleared based only on given bids. The study showed that both market clearing models suffer from a contradiction between the optimality of the system related to the scheduled wind power production and the optimality of the wind power producer. Consequently, there is a reduction in social surplus, which is more severe in the conventional myopic model. Therefore, the stochastic dispatch model will result in a higher expected surplus, but the expected social welfare is dependent on the “quality of the information that the system operator will base the market clearing on” [62].

Joint and sequential clearing of energy and reserve markets were evaluated in a case study of the Central Western European power system by Van den Bergh and Delarue [63]. While most European markets are based on sequential market clearing, joint clearing is widely applied on North American markets [64]. Joint markets are based on a Unit Commitment style optimization, and day-ahead energy and reserves clear simultaneously. Energy and reserves, on the other hand, are cleared sequentially in sequential markets without taking into account the interdependencies [63]. Sequential markets are based on a quantity-price optimization where energy and reserves are dispatched at portfolio level. The results of the case study indicated higher costs for sequential energy-reserve market clearing. However, the authors do not see, at least in the near future, that joint energy reserve clearing could become the target market design in the context of the European electricity market. The higher costs of sequential reserve scheduling are due to the limitations and technical inflexibilities of conventional power plants. Therefore, according to the authors, more renewables and flexible load should enter the reserve market to provide more flexible reserve provision. When the growing share of renewables increases the need for reserves, the costs rise further. To address this problem, the authors propose improved dimensioning of reserves (i.e., more dynamic or short-term reserve sizing).

4.9. Modelling Electricity Markets and Bidding Optimization

An open-source model, called flexABLE, for modelling electricity markets is evaluated in Ref. [65]. An economic dispatch and unit-commitment approach are used as benchmarks in the assessment. Although the accuracy of the modelled mean prices does not improve remarkably with the modelling method compared to the other two approaches, both high and low price spikes are better controlled with the considered approach. Furthermore, the accuracy of the modelled market prices improves when introducing a control reserve market and a district heating market.

A model for analysing the effects of large-scale RES penetration in terms of the system marginal price of the day-ahead market on the Hellenic Power System is presented in Ref. [66]. The aim of the model is to investigate the systems’ behaviour for high shares of renewable energy entering the market and different configurations of thermal capacity. The results highlight the interaction of renewable energy, thermal, and hydro power plants.

A model for North–West European Electricity Market for the year 2020 is developed and used to analyse the impacts of national renewable energy targets in Ref. [67]. The results indicate that cross-border power flows have a greater impact on market dynamics in the presence of spatially distributed variable RES, and there is a growing need for integrated modelling of interconnected regions. It was furthermore found that if EU member states create renewable energy plans individually and in isolation, more congestion and policy challenges will arise.

The effects of the increasing amount of wind power on the short-term electricity market in the UK are investigated in Ref. [68] using agent-based modelling. Mahler et al. [49] present a model for simulating electricity prices on day-ahead markets that combines power system constraints (a stock constraint for hydro power), market clearing, and statistical methods. A model based on mixed-integer linear programming for optimal operational and financial planning at an annual level in competitive and uncertain power markets is presented and tested on a case study of the interconnected Greek power system in Ref. [69].

Perfect competition, Cournot competition, and a Bilevel approach (a hierarchical optimization problem with other optimization problems as constraints) for modelling electricity markets are compared according to their ability to derive electricity prices and simulate strategic behaviour in Ref. [70]. The results show that the prices are very much overestimated by the Cournot model when compared to the perfect competition model and real market data. Furthermore, the perfect competition model is seen as the best option for modelling electricity markets in most research applications, as its results remain close to reality, and its complexity can be managed.

A model to calculate market equilibrium and to simulate local market power under non-perfect competition in a transboundary electricity system is proposed and implemented in a case study of the Central Western European (CWE) and Iberian electricity markets in Ref. [71]. The market equilibrium model is Conjectural-Variation-based, in which companies make a conjecture about the reaction of their competitors when they change their price or quantities.

The bidding optimization of a wind power producer in the day-ahead electricity wholesale markets is investigated in Ref. [72] with agent-based modelling. The results of the study highlight the importance of improved accuracy in forecasting wind power production. From the point of view of wind power producers, improved forecast accuracy can increase their net profits, and by using learning algorithms to learn from past day-ahead strategic offers, profits can be improved even more. Another model considering optimal bidding decisions for wind power generators to improve net earnings is presented in Ref. [73]. This stochastic bi-level model employs stochastic market clearing and joint energy and reserve optimization, and the uncertainty of wind power production is taken into account. A profit maximization model for a power producer in a pool-based electricity market where a cost recovery mechanism is in use is developed in Ref. [74]. The cost recovery mechanism ensures that the producer will receive payment, which at its smallest is the same as the operating cost of the facility.

4.10. Risk Hedging

Hedging instruments are developed to tackle risks on the market. In a study by de Maere d’Aertrycke et al. [75], a particular concern is the long-term electricity price risk that affects new production capacities. The authors analyse the long-term demand risk in ‘energy-only’ markets, focusing especially on how risk and hedging instruments have an effect on adequacy, which they determine as a quantity of unserved load. The study deals with a number of risk mitigation instruments: contracts for differences (CfDs) and reliability options (ROs), and forward capacity markets (FCMs). In CfDs, generators are paid a fixed price for electricity for contracted capacity to support investments and to mitigate uncertainty in revenue. The contract ensures additional revenues when the reference price (wholesale market price) is below the strike price (measure for investment costs for renewable generation technology). For more details, see Ref. [76]. Respectively, Reliability Options are power capacity call options that power producers sell to the System Operator (SO) in exchange for a premium [77]. With ROs, producers are committed to supply electricity to the market and refund the spare revenues to the SO that would be earned if electricity prices rise above the strike price. For a more detailed consideration, see Andreis et al. [77]. According to de Maere d’Aertrycke et al., CfDs and ROs complement an ‘energy-only’ market quite well, but the authors note that they also bring their own risks, such as liquidity risk. FCMs, the third instrument considered, affect the market according to how capacity demand is calibrated; in the worst case, they can lead to a decrease in welfare and investment.

A centralized cash-settled options market is examined in a study by Alshehri et al. [78]. The approach can be applied in parallel with an existing electricity market to reduce the risks induced by renewables entering the market. In brief, electricity options enable the holder of the option the right, but not the obligation, to buy (call option) or sell (put option) a certain amount of electricity at a fixed price in the future [79]. A premium is paid by the holder for the right to exercise the option. Options are traded at exchanges or privately in bilateral deals. With cash-settled option contracts, settlement is paid out in cash, and physical delivery is not required. The possessor of a cash-settled call option is entitled to a financial remuneration that is equal to the positive difference between the real-time price and the pre-negotiated strike price for an advance premium [78]. The concluding remarks of the study are that bilateral cash-settled call options make it possible to reduce the volatility of payments, but also lessen the risks of negative payments of renewable suppliers.

4.11. Power-Based Modelling Instead of Energy-Based

In energy-based modelling of electricity markets, the real daily demand curve is approximated with a staircase curve, meaning that demand is assumed to be constant for one hour and then shifts up or down for the next period. An approximation where the demand curve is constant and equal to the predicted energy consumption during each hour is used, and it is assumed that during the same period, the change in the output power is the same as the change in the generated or consumed energy. Consequently, energy-based modelling has been claimed to induce mismatches between the day-ahead schedules and real-time operation. Power-based modelling, on the other hand, applies a trajectorial load curve, and this model has been proposed as a more promising approach as the technical limitations of the units can be considered more realistically, and the day-ahead schedules can be ensured to be consistent with the ramping capability of the generating units [80]. It is argued in Ref. [81] that day-ahead schedules based on power trajectories are comprehensively better than energy-based schedules.

Rahmati and Akbari Froud [80] investigated the change in the electricity market design from energy-based modelling to power-based modelling. Their study confirmed the results of previous similar studies that an energy-based model may lead to real-time inconsistencies when the scheduling of the generators is infeasible. In addition, the transition from energy- to power-based modelling results in lower accepted daily demand. However, it was found in their study that when using power-based modelling, a higher level of fluctuation in the net load profile causes more unstable price profiles. The authors claim that this may undermine the performance of electricity market and increase the risk of market participants.

Philipsen et al. [81] criticize the inefficiency of the day-ahead electricity market and argue that energy-based markets trade the wrong product. In their study, they compare energy-based scheduling with hourly resolution with a case with increased resolution and with power-based scheduling. The outcome of the study indicated that to improve the efficiency of day-ahead schedules and to achieve lower costs, instead of increasing the resolution of the schedule, the scheduling of electricity should be done in terms of power rather than energy. Power-based scheduling, it is claimed, mitigates imbalances caused by the current market model, which in turn prevents frequency disturbances. In addition, when the share of renewable electricity sources in the system increases, the power-based market’s relative performance increases as well. Their study also suggests that this transformation can lead to reduced costs by several percentage points, which would mean millions of euros per year in real-world systems.

4.12. Used Modelling Methods

Table 2 summarizes the papers included in the study. The papers are categorized according to the market mechanisms discussed. The modelling method used (optimization, equilibrium, agent-based simulation) is given for each paper and a possible specification of the kind of model. If no indication of the modelling method is given in the paper, it is assumed that none of the three methods mentioned above have been used (N/A in the table). In such cases, it may be that no modelling has been used in the paper, or the method may be, for example, a statistical approach or similar. The main input parameters for the models were power plant technical data, demand, renewable and fossil fuelled generation, costs, and electricity market prices. However, as the main target was not to investigate the modelling methods in greater detail, the input and output parameters for each paper have not been identified in the table. As can be seen from the table, optimization is clearly the most used method. However, there are also several subspecies of optimization, an example of which is mixed-integer linear programming, which were used in several papers. Some papers used agent-based simulation (5 pcs) and equilibrium (6 pcs) modelling methods, and a couple of studies used a hybrid method, i.e., one or more modelling methods were used simultaneously. However, since optimization clearly dominates as a modelling method, no clear differences can be found between the modelling methods of different market mechanisms.

Table 2.

Modelling methods used in the papers.

5. Discussion

The literature review shows that many different aspects of the current electricity market model are under extensive discussion in the literature, and individual challenges facing market mechanisms are well recognized. Changes to the market mechanisms are seen as desirable, and efforts are being made to develop market mechanisms that better meet the current needs of the electricity market and the energy system. A particularly large number of papers discuss market clearing solutions, which suggests that there are flaws in the understanding of market clearing and a desire to develop current approaches. In addition, general electricity market modelling and bidding optimization were discussed in several papers. Capacity remuneration mechanisms and bidding zone configuration were also discussed in several papers, from which it can be concluded that researchers see a lot of challenges and areas for development. However, the results show that the papers have not presented comprehensive solutions to the challenges of the current market model, and solutions have only been presented to individual challenges within the model. Thus, the results of this work are in line with the study in Ref. [6]. As a whole, there were rather few papers selected through the systematic literature review process (n = 50), which indicates that despite its importance, there are surprisingly few publications examining this particular topic. It should, however, be noted that the sample size might possibly have increased with additional keyword combination searches. Furthermore, it is possible that some relevant articles were not captured if the keywords used in the search appeared only in the article body and not in the title, abstract, or keywords.

Due to the energy crisis, a growing number of studies related to market design have been published lately (e.g., Refs. [82,83,84,85]). However, the literature research for this paper has been done during October and November 2022, and hence, it has not been possible to include the latest research papers in the database. Nevertheless, the authors suggest that longitudinal analyses regarding the electricity market design research would be provided after the energy crisis.

It is noteworthy that the papers included in the systematic literature review and the solutions or development proposals presented in them mainly aim for a stronger integration of the European wide electricity market. For example, Corona et al. [31] note that the energy policies of individual countries are reflected in their neighbouring countries, and therefore coordination between different participants in the integrated electricity market is very important, and they thus encourage decision-making at the European level. In addition, many papers remind us that the European Commission’s long-term objective is to create an Internal Electricity Market on the wholesale level (e.g., Ref. [20]). Improved liquidity, greater social welfare, and better efficiency are seen as the justification for development of the common electricity market [54].

However, Deane et al. [67] mention the shortcomings of the Internal Electricity Market, such as a lack of straightforward and standardized regulations, incompatible market design, highly concentrated markets, vertical integration, inadequate infrastructure for interconnections between countries, and inadequate incentives to improve infrastructure. Nevertheless, discussions about, for example, returning to national or more regulated markets are not found in the studies. The absence of ideas for more radical or comprehensive changes to the market design can be considered surprising in view of the dramatic change in the energy system from the energy transition and widespread digitalization.

Studies concerning the European electricity market model have, on the whole, been carried out in such a way that they are in line with the rules set by the European Commission. The studies aim to achieve the targets of European energy policy, and the framework of the research is set to adapt to regulations directly from the EU. There is a general desire among researchers to implement the requirements set by the EU. The question arises whether the achievement of the EU’s goals is always a valid starting point, and whether the framework set by the EU should always be taken as the premise for research. As seen in the results (Figure 3), the research of electricity market design has increased over the years, and it can be assumed that it will increase even more in the future. With the growing pace of energy research and the energy crisis, more extensive proposals for market changes and more radical solutions might be presented in the future.

6. Conclusions

It has taken several decades for the European electricity market model to develop into its current form. The model has faced several challenges, of which the most recent is the current energy transition with its large penetration of renewable energy. To the best of the authors’ knowledge, this article is the first to combine a comprehensive market design review, a systematic literature review method, and a comparison of market mechanism-specific modelling methods. Based on the systematic literature review, the study examined academic discussion on the current European electricity market model. The aim was to find out what kinds of research exists on the subject, and what kinds of proposals for change to the current model or separate market mechanisms have been presented. In addition, the methods used to model particular topics were also noted.

Individual challenges facing specific market mechanisms were rather well identified in the papers included in the systematic literature review, and efforts have been made to propose market mechanisms to better meet the current needs of the electricity market and energy system. Especially topics such as market clearing, general electricity market modelling and bidding optimization, capacity remuneration mechanisms and bidding zone configuration have received special attention and sparked discussion. Optimization was the most utilized modelling method in the modelling of electricity markets and market mechanisms. However, it is worth noting that there are many different modelling methods within optimization. As optimization as a modelling method dominates, it is not possible to determine clear differences between the modelling methods for different market mechanisms.

The two main findings of the study were that the studies followed the framework set by the EU, and they mainly focused on achieving the goals set by the European Union without questioning them. Therefore, comprehensive reforms or more radical outputs were surprisingly absent. Secondly, the results obtained through the systematic literature review show that there are surprisingly few publications on this particular topic. However, it is possible that a larger number of different keyword combinations in the search process could have increased the number of papers in the literature review. The results further show that the amount of research on this topic is increasing, and it can be assumed that the current energy crisis will accelerate research on the topic even more.

In the future, with increasing electrification of society and industry, the electricity sector will become increasingly integrated with other sectors, and it therefore requires more research from a market perspective. In addition, the energy transition entails huge investments. For this reason, the effects of the electricity market model on investments should be studied in greater detail. In particular, research should examine whether the current market model generates sufficient incentives for investments in energy storage systems. Furthermore, the study of the European electricity market model would benefit from examining regional differences in market models (for example USA, Australia, and China).

Author Contributions

Conceptualization, J.J. and S.H.; methodology, J.J.; writing—original draft preparation, J.J.; writing—review and editing, S.H. and S.A.; visualization, J.J.; supervision, S.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

Special thanks to Peter Jones for proofreading and valuable feedback.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| OTC | Over-The-Counter |

| EU | European Union |

| TSO | Transmission System Operator |

| ATC | Available Transfer Capacity |

| FB | Flow-Based |

| CCR | Capacity Calculation Region |

| ISO | Independent System Operator |

| RES | Renewable Energy Sources |

| VRES | Variable Renewable Energy Sources |

| NEMO | National Electricity Market Operator |

| EUPHEMIA | Pan-European Hybrid Electricity Market Integration Algorithm |

| MCP | Market Clearing Price |

| SWMP | Social Welfare Maximization Problem |

| MIQP | Mixed Integer Quadratic Program |

| CACM | Capacity Allocation and Congestion Management |

| DiD | Difference-in-Differences |

| FBMC | Flow-Based Market Coupling |

| RTO | Regional Transmission Organization |

| UC | Unit Commitment |

| MILP | Mixed Integer Linear Programming |

| OGSA | Opposition-based Gravitational Search Algorithm |

| OPF | Optimal Power Flow |

| NCP | Nodal Congestion Price |

| SCMC | Security-Constrained Market Clearing |

| DRO | Distributed Robust Optimization |

| SCUC | Security-Constrained Unit Commitment |

| CWE | Central Western Europe |

| CfD | Contracts for Differences |

| RO | Reliability Option |

| FCM | Forward Capacity Market |

Appendix A

Figure A1.

Fundamentals of electricity market designs (own illustration, adapted from Chattopadhyay and Klein [22]).

Figure A1.

Fundamentals of electricity market designs (own illustration, adapted from Chattopadhyay and Klein [22]).

References

- Cramton, P. Electricity market design. Oxf. Rev. Econ. Policy 2017, 33, 589–612. [Google Scholar] [CrossRef]

- Wolak, F.A. Wholesale electricity market design. In Handbook on Electricity Markets; Edward Elgar Publishing: Cheltenham, UK, 2021; Chapter 4. [Google Scholar] [CrossRef]

- Keay, M. Electricity Markets Are Broken—Can They Be Fixed? Oxford Institute for Energy Studies. 2016. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2016/02/Electricity-markets-are-broken-can-they-be-fixed-EL-17.pdf (accessed on 4 February 2023).

- Winkler, J.; Altmann, M. Market Designs for a Completely Renewable Power Sector. Z. für Energiewirtschaft 2012, 36, 77–92. [Google Scholar] [CrossRef]

- European Commission. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions. Tackling Rising Energy Prices: A toolbox for Action and Support. COM(2021) 660 Final; Technical Report; European Commission: Brussels, Belgium, 2021.

- Silva-Rodriguez, L.; Sanjab, A.; Fumagalli, E.; Virag, A.; Gibescu, M. Short term wholesale electricity market designs: A review of identified challenges and promising solutions. Renew. Sustain. Energy Rev. 2022, 160, 112228. [Google Scholar] [CrossRef]

- Pfenninger, S.; Hawkes, A.; Keirstead, J. Energy systems modeling for twenty-first century energy challenges. Renew. Sustain. Energy Rev. 2014, 33, 74–86. [Google Scholar] [CrossRef]

- Ventosa, M.; Baíllo, Á.; Ramos, A.; Rivier, M. Electricity market modeling trends. Energy Policy 2005, 33, 897–913. [Google Scholar] [CrossRef]

- Hampton, H.; Foley, A. A review of current analytical methods, modelling tools and development frameworks applicable for future retail electricity market design. Energy 2022, 260, 124861. [Google Scholar] [CrossRef]

- Siala, K.; Mier, M.; Schmidt, L.; Torralba-Díaz, L.; Sheykhha, S.; Savvidis, G. Which model features matter? An experimental approach to evaluate power market modeling choices. Energy 2022, 245, 123301. [Google Scholar] [CrossRef]

- Müsgens, F. Equilibrium prices and investment in electricity systems with CO2-emission trading and high shares of renewable energies. Energy Econ. 2020, 86, 104107. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, 71. [Google Scholar] [CrossRef]

- EPEX SPOT. Basics of the Power Market; EPEX SPOT: Paris, France, 2022. [Google Scholar]

- Salovaara, K.; Makkonen, M.; Gore, O.; Honkapuro, S. Electricity Markets Framework in Neo-Carbon Energy 2050 Scenarios; Neo-Carbon Energy WP1 Working Paper 3/2016; Lappeenranta University of Technology (LUT): Lappeenranta, Finland, 2016. [Google Scholar]

- European Parliament and Council. Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU (Recast); European Parliament and Council: Brussels, Belgium, 2019. [Google Scholar]

- Pototschnig, A.; Glachant, J.M.; Meeus, L.; Ortigosa, P. Recent Energy Price Dynamics and Market Enhancements for the Future Energy Transition; European University Institute (EUI): San Domenico di Fiesole, Italy, 2022. [Google Scholar]

- Reif, V.; Schittekatte, T. Electricity Markets in the EU; Florence School of Regulation: Florence, Italy, 2020. [Google Scholar]

- Meeus, L. The Evolution of Electricity Markets in Europe; Edward Elgar Publishing Ltd.: Cheltenham, UK, 2020. [Google Scholar]

- Kuppelwieser, T.; Wozabal, D. Liquidity costs on intraday power markets: Continuous trading versus auctions. Energy Policy 2021, 154, 112299. [Google Scholar] [CrossRef]

- Ringler, P.; Keles, D.; Fichtner, W. How to benefit from a common European electricity market design. Energy Policy 2017, 101, 629–643. [Google Scholar] [CrossRef]

- ENTSO-E. Launch of Flow-Based Market Coupling in the Core Region Enhances Energy Transition. Flow-Based Market Coupling Mechanism Optimises Day-Ahead European Electricity Market for 13 Countries; ENTSO-E: Brussels, Belgium, 2022. [Google Scholar]

- Chattopadhyay, D.; Klein, M. Wholesale electricity spot market design: Find a way or make it. Electr. J. 2021, 34, 107030. [Google Scholar] [CrossRef]

- Ambrosius, M.; Egerer, J.; Grimm, V.; van der Weijde, A. Uncertain bidding zone configurations: The role of expectations for transmission and generation capacity expansion. Eur. J. Oper. Res. 2020, 285, 343–359. [Google Scholar] [CrossRef]

- ENTSO-E. First Edition of the Bidding Zone Review; Final Report; ENTSO-E: Brussels, Belgium, 2018. [Google Scholar]

- Bertsch, J.; Brown, T.; Hagspiel, S.; Just, L. The relevance of grid expansion under zonal markets. Energy J. 2017, 38, 129152. [Google Scholar] [CrossRef]

- Felling, T.; Weber, C. Consistent and robust delimitation of price zones under uncertainty with an application to Central Western Europe. Energy Econ. 2018, 75, 583–601. [Google Scholar] [CrossRef]

- Lundin, E. Geographic price granularity and investments in wind power: Evidence from a Swedish electricity market splitting reform. Energy Econ. 2022, 113, 106208. [Google Scholar] [CrossRef]

- European Council. Regulation (EU) 2019/943 of the European Parliament and of the Council of 5 June 2019 on the Internal Market for Electricity (Recast); European Council: Brussels, Belgium, 2019.

- Sarfati, M.; Hesamzadeh, M.R.; Canon, A. Five indicators for assessing bidding area configurations in zonally-priced power markets. In Proceedings of the IEEE Power & Energy Society General Meeting, Denver, CO, USA, 26–30 July 2015; pp. 1–5. [Google Scholar] [CrossRef]

- Sirin, S.M.; Yilmaz, B.N. The impact of variable renewable energy technologies on electricity markets: An analysis of the Turkish balancing market. Energy Policy 2021, 151, 112093. [Google Scholar] [CrossRef]