A Systematic Review of European Electricity Market Design Options

Abstract

:1. Introduction

- The study contributes to the ongoing discourse on electricity markets by providing a comprehensive overview of the existing literature concerning the electricity market design, including how it has been studied, questioned, and how the change proposals have been modelled;

- The paper provides an in-depth analysis of the subject area through a systematic literature review by investigating the change proposals to the current market model;

- By not focusing on any specific market participant, the review offers a general view of the subject;

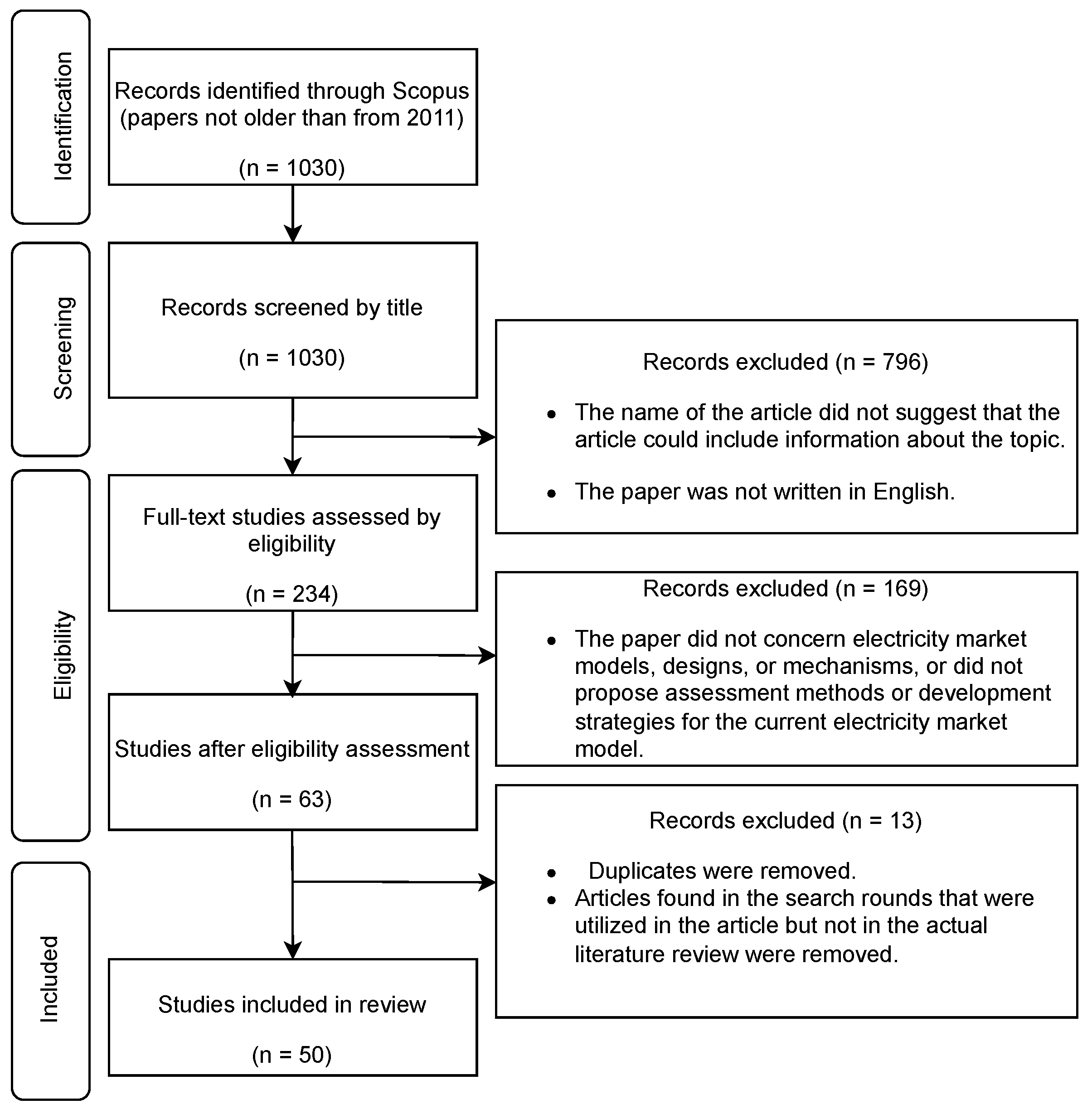

- As a methodology, a systematic literature review approach based on PRISMA principles is used, covering 11 different keyword combinations that were searched from the Scopus database in October and November 2022;

- -

- The results of the literature review are organized according to the different electricity market mechanisms.

- -

- The modelling methods used in the studies are reviewed for each market mechanism, following the division of models presented in Ref. [8].

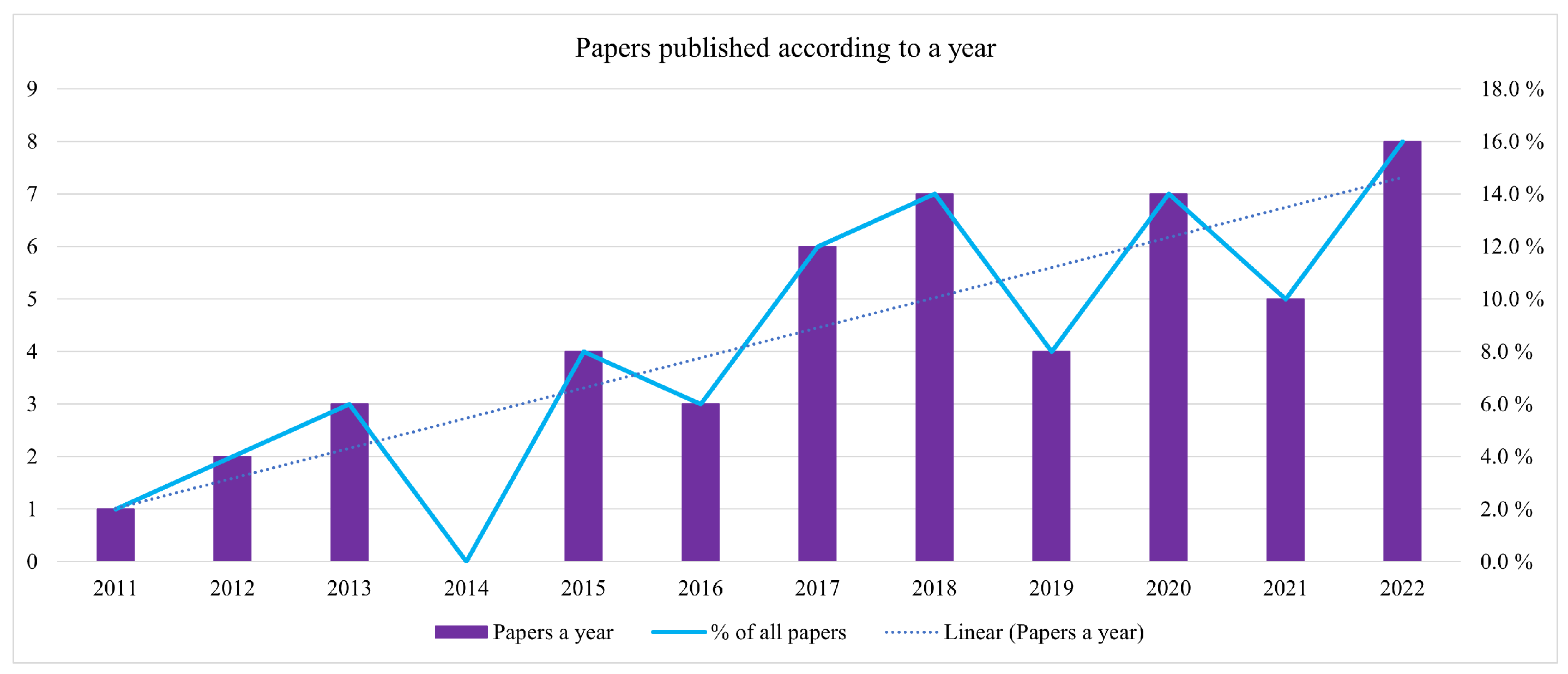

- To provide a better understanding of the evolution of research in this area, the temporal distribution of the studied papers is investigated;

- The study offers relevant insights to academics, policymakers, and industry practitioners interested in the electricity market design and its operation.

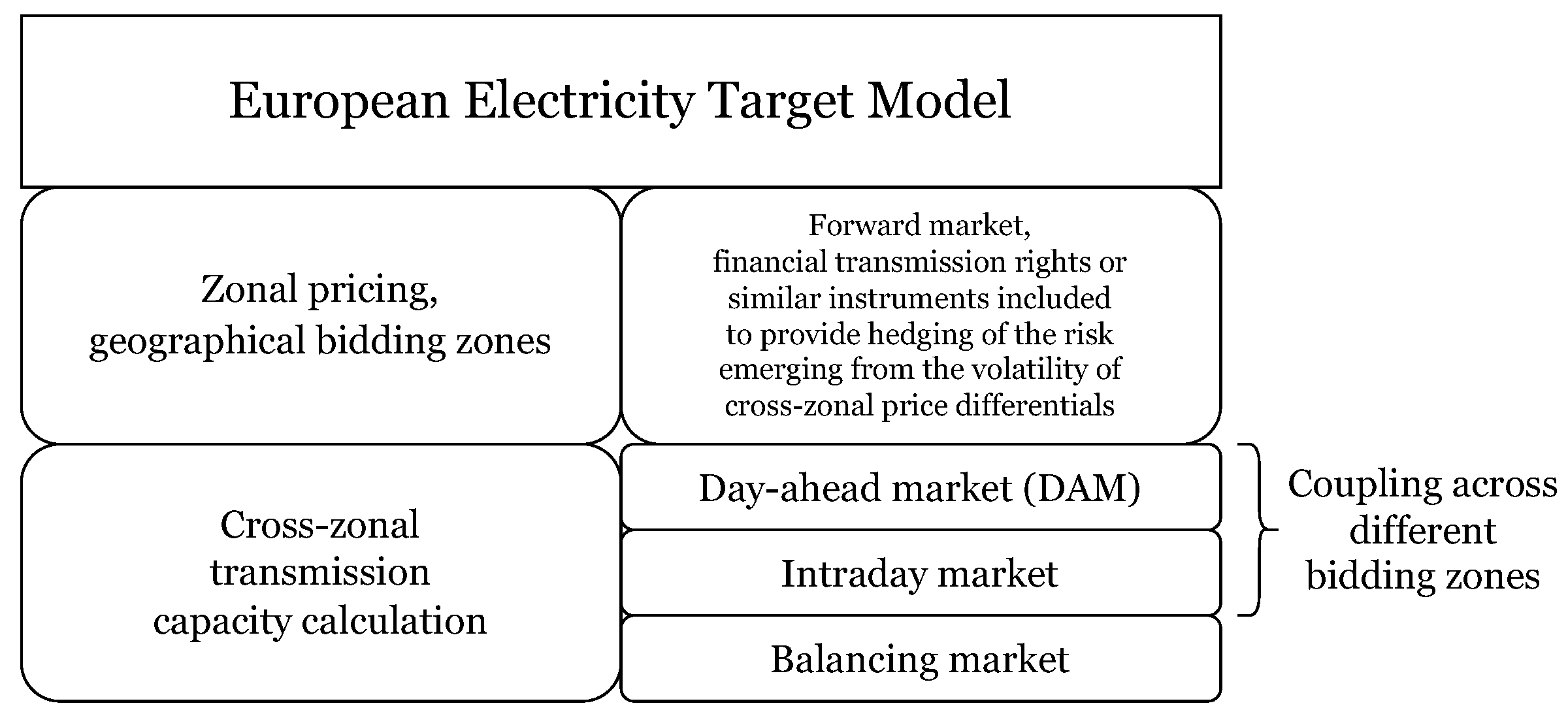

2. Main Parameters of the Current European Electricity Market Model

3. Methodology

Systematic Literature Review

4. Results

4.1. Bidding Zone Configuration

4.2. Market Coupling

4.3. Nodal Pricing

4.4. Intraday Markets

4.5. Balancing Markets

4.6. Capacity Remuneration Mechanisms

4.7. Add-Ons

4.8. Market Clearing

4.9. Modelling Electricity Markets and Bidding Optimization

4.10. Risk Hedging

4.11. Power-Based Modelling Instead of Energy-Based

4.12. Used Modelling Methods

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| OTC | Over-The-Counter |

| EU | European Union |

| TSO | Transmission System Operator |

| ATC | Available Transfer Capacity |

| FB | Flow-Based |

| CCR | Capacity Calculation Region |

| ISO | Independent System Operator |

| RES | Renewable Energy Sources |

| VRES | Variable Renewable Energy Sources |

| NEMO | National Electricity Market Operator |

| EUPHEMIA | Pan-European Hybrid Electricity Market Integration Algorithm |

| MCP | Market Clearing Price |

| SWMP | Social Welfare Maximization Problem |

| MIQP | Mixed Integer Quadratic Program |

| CACM | Capacity Allocation and Congestion Management |

| DiD | Difference-in-Differences |

| FBMC | Flow-Based Market Coupling |

| RTO | Regional Transmission Organization |

| UC | Unit Commitment |

| MILP | Mixed Integer Linear Programming |

| OGSA | Opposition-based Gravitational Search Algorithm |

| OPF | Optimal Power Flow |

| NCP | Nodal Congestion Price |

| SCMC | Security-Constrained Market Clearing |

| DRO | Distributed Robust Optimization |

| SCUC | Security-Constrained Unit Commitment |

| CWE | Central Western Europe |

| CfD | Contracts for Differences |

| RO | Reliability Option |

| FCM | Forward Capacity Market |

Appendix A

References

- Cramton, P. Electricity market design. Oxf. Rev. Econ. Policy 2017, 33, 589–612. [Google Scholar] [CrossRef]

- Wolak, F.A. Wholesale electricity market design. In Handbook on Electricity Markets; Edward Elgar Publishing: Cheltenham, UK, 2021; Chapter 4. [Google Scholar] [CrossRef]

- Keay, M. Electricity Markets Are Broken—Can They Be Fixed? Oxford Institute for Energy Studies. 2016. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2016/02/Electricity-markets-are-broken-can-they-be-fixed-EL-17.pdf (accessed on 4 February 2023).

- Winkler, J.; Altmann, M. Market Designs for a Completely Renewable Power Sector. Z. für Energiewirtschaft 2012, 36, 77–92. [Google Scholar] [CrossRef]

- European Commission. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions. Tackling Rising Energy Prices: A toolbox for Action and Support. COM(2021) 660 Final; Technical Report; European Commission: Brussels, Belgium, 2021.

- Silva-Rodriguez, L.; Sanjab, A.; Fumagalli, E.; Virag, A.; Gibescu, M. Short term wholesale electricity market designs: A review of identified challenges and promising solutions. Renew. Sustain. Energy Rev. 2022, 160, 112228. [Google Scholar] [CrossRef]

- Pfenninger, S.; Hawkes, A.; Keirstead, J. Energy systems modeling for twenty-first century energy challenges. Renew. Sustain. Energy Rev. 2014, 33, 74–86. [Google Scholar] [CrossRef]

- Ventosa, M.; Baíllo, Á.; Ramos, A.; Rivier, M. Electricity market modeling trends. Energy Policy 2005, 33, 897–913. [Google Scholar] [CrossRef]

- Hampton, H.; Foley, A. A review of current analytical methods, modelling tools and development frameworks applicable for future retail electricity market design. Energy 2022, 260, 124861. [Google Scholar] [CrossRef]

- Siala, K.; Mier, M.; Schmidt, L.; Torralba-Díaz, L.; Sheykhha, S.; Savvidis, G. Which model features matter? An experimental approach to evaluate power market modeling choices. Energy 2022, 245, 123301. [Google Scholar] [CrossRef]

- Müsgens, F. Equilibrium prices and investment in electricity systems with CO2-emission trading and high shares of renewable energies. Energy Econ. 2020, 86, 104107. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, 71. [Google Scholar] [CrossRef]

- EPEX SPOT. Basics of the Power Market; EPEX SPOT: Paris, France, 2022. [Google Scholar]

- Salovaara, K.; Makkonen, M.; Gore, O.; Honkapuro, S. Electricity Markets Framework in Neo-Carbon Energy 2050 Scenarios; Neo-Carbon Energy WP1 Working Paper 3/2016; Lappeenranta University of Technology (LUT): Lappeenranta, Finland, 2016. [Google Scholar]

- European Parliament and Council. Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU (Recast); European Parliament and Council: Brussels, Belgium, 2019. [Google Scholar]

- Pototschnig, A.; Glachant, J.M.; Meeus, L.; Ortigosa, P. Recent Energy Price Dynamics and Market Enhancements for the Future Energy Transition; European University Institute (EUI): San Domenico di Fiesole, Italy, 2022. [Google Scholar]

- Reif, V.; Schittekatte, T. Electricity Markets in the EU; Florence School of Regulation: Florence, Italy, 2020. [Google Scholar]

- Meeus, L. The Evolution of Electricity Markets in Europe; Edward Elgar Publishing Ltd.: Cheltenham, UK, 2020. [Google Scholar]

- Kuppelwieser, T.; Wozabal, D. Liquidity costs on intraday power markets: Continuous trading versus auctions. Energy Policy 2021, 154, 112299. [Google Scholar] [CrossRef]

- Ringler, P.; Keles, D.; Fichtner, W. How to benefit from a common European electricity market design. Energy Policy 2017, 101, 629–643. [Google Scholar] [CrossRef]

- ENTSO-E. Launch of Flow-Based Market Coupling in the Core Region Enhances Energy Transition. Flow-Based Market Coupling Mechanism Optimises Day-Ahead European Electricity Market for 13 Countries; ENTSO-E: Brussels, Belgium, 2022. [Google Scholar]

- Chattopadhyay, D.; Klein, M. Wholesale electricity spot market design: Find a way or make it. Electr. J. 2021, 34, 107030. [Google Scholar] [CrossRef]

- Ambrosius, M.; Egerer, J.; Grimm, V.; van der Weijde, A. Uncertain bidding zone configurations: The role of expectations for transmission and generation capacity expansion. Eur. J. Oper. Res. 2020, 285, 343–359. [Google Scholar] [CrossRef]

- ENTSO-E. First Edition of the Bidding Zone Review; Final Report; ENTSO-E: Brussels, Belgium, 2018. [Google Scholar]

- Bertsch, J.; Brown, T.; Hagspiel, S.; Just, L. The relevance of grid expansion under zonal markets. Energy J. 2017, 38, 129152. [Google Scholar] [CrossRef]

- Felling, T.; Weber, C. Consistent and robust delimitation of price zones under uncertainty with an application to Central Western Europe. Energy Econ. 2018, 75, 583–601. [Google Scholar] [CrossRef]

- Lundin, E. Geographic price granularity and investments in wind power: Evidence from a Swedish electricity market splitting reform. Energy Econ. 2022, 113, 106208. [Google Scholar] [CrossRef]

- European Council. Regulation (EU) 2019/943 of the European Parliament and of the Council of 5 June 2019 on the Internal Market for Electricity (Recast); European Council: Brussels, Belgium, 2019.

- Sarfati, M.; Hesamzadeh, M.R.; Canon, A. Five indicators for assessing bidding area configurations in zonally-priced power markets. In Proceedings of the IEEE Power & Energy Society General Meeting, Denver, CO, USA, 26–30 July 2015; pp. 1–5. [Google Scholar] [CrossRef]

- Sirin, S.M.; Yilmaz, B.N. The impact of variable renewable energy technologies on electricity markets: An analysis of the Turkish balancing market. Energy Policy 2021, 151, 112093. [Google Scholar] [CrossRef]

- Corona, L.; Mochon, A.; Saez, Y. Electricity market integration and impact of renewable energy sources in the Central Western Europe region: Evolution since the implementation of the Flow-Based Market Coupling mechanism. Energy Rep. 2022, 8, 1768–1788. [Google Scholar] [CrossRef]

- Poplavskaya, K.; Totschnig, G.; Leimgruber, F.; Doorman, G.; Etienne, G.; de Vries, L. Integration of day-ahead market and redispatch to increase cross-border exchanges in the European electricity market. Appl. Energy 2020, 278, 115669. [Google Scholar] [CrossRef]

- Bjørndal, E.; Bjørndal, M.; Cai, H.; Panos, E. Hybrid pricing in a coupled European power market with more wind power. Eur. J. Oper. Res. 2018, 264, 919–931. [Google Scholar] [CrossRef]

- Bjørndal, E.; Bjørndal, M.; Cai, H. Nodal pricing in a coupled electricity market. In Proceedings of the 11th International Conference on the European Energy Market (EEM14), Krakow, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar] [CrossRef]

- Ahmadi, H.; Akbari Foroud, A. A stochastic framework for reactive power procurement market, based on nodal price model. Int. J. Electr. Power Energy Syst. 2013, 49, 104–113. [Google Scholar] [CrossRef]

- Ihlemann, M.; van Stiphout, A.; Poncelet, K.; Delarue, E. Benefits of regional coordination of balancing capacity markets in future European electricity markets. Appl. Energy 2022, 314, 118874. [Google Scholar] [CrossRef]

- Ehrhart, K.M.; Ocker, F. Design and regulation of balancing power auctions: An integrated market model approach. J. Regul. Econ. 2021, 60, 55–73. [Google Scholar] [CrossRef]

- Keles, D.; Bublitz, A.; Zimmermann, F.; Genoese, M.; Fichtner, W. Analysis of design options for the electricity market: The German case. Appl. Energy 2016, 183, 884–901. [Google Scholar] [CrossRef]

- Hach, D.; Chyong, C.K.; Spinler, S. Capacity market design options: A dynamic capacity investment model and a GB case study. Eur. J. Oper. Res. 2016, 249, 691–705. [Google Scholar] [CrossRef]

- Billimoria, F.; Poudineh, R. Market design for resource adequacy: A reliability insurance overlay on energy-only electricity markets. Util. Policy 2019, 60, 100935. [Google Scholar] [CrossRef]

- Rios-Festner, D.; Blanco, G.; Olsina, F. Long-term assessment of power capacity incentives by modeling generation investment dynamics under irreversibility and uncertainty. Energy Policy 2020, 137, 111185. [Google Scholar] [CrossRef]

- Bucksteeg, M.; Spiecker, S.; Weber, C. Impact of Coordinated Capacity Mechanisms on the European Power Market. Energy J. 2019, 40, 221–264. [Google Scholar] [CrossRef]

- Khan, A.S.M.; Verzijlbergh, R.A.; Sakinci, O.C.; de Vries, L.J. How do demand response and electrical energy storage affect (the need for) a capacity market? Appl. Energy 2018, 214, 39–62. [Google Scholar] [CrossRef]

- Byers, C.; Levin, T.; Botterud, A. Capacity market design and renewable energy: Performance incentives, qualifying capacity, and demand curves. Electr. J. 2018, 31, 65–74. [Google Scholar] [CrossRef]

- Helgesen, P.I.; Tomasgard, A. An equilibrium market power model for power markets and tradable green certificates, including Kirchhoff’s Laws and Nash-Cournot competition. Energy Econ. 2018, 70, 270–288. [Google Scholar] [CrossRef]

- Tómasson, E.; Hesamzadeh, M.R.; Söder, L.; Biggar, D.R. An incentive mechanism for generation capacity investment in a price-capped wholesale power market. Electr. Power Syst. Res. 2020, 189, 106708. [Google Scholar] [CrossRef]

- Kim, M.; Hur, D. An optimal pricing scheme in electricity markets by parallelizing security constrained optimal power flow based market-clearing model. Int. J. Electr. Power Energy Syst. 2013, 48, 161–171. [Google Scholar] [CrossRef]

- Conejo, A.J.; Carrión, M.; Morales, J.M. Market Clearing Considering Equipment Failures. In Decision Making under Uncertainty in Electricity Markets; Springer: Boston, MA, USA, 2010; pp. 357–403. [Google Scholar] [CrossRef]

- Mahler, V.; Girard, R.; Kariniotakis, G. Data-driven structural modeling of electricity price dynamics. Energy Econ. 2022, 107, 105811. [Google Scholar] [CrossRef]

- Pinto, M.S.; Miranda, V.; Saavedra, O.R. Risk and unit commitment decisions in scenarios of wind power uncertainty. Renew. Energy 2016, 97, 550–558. [Google Scholar] [CrossRef]

- NEMO Committee. EUPHEMIA Public Description. Single Price Coupling Algorithm. 2020. Available online: https://www.nemo-committee.eu/ (accessed on 4 February 2023).

- Hong Lam, L.; Ilea, V.; Bovo, C. New Clearing Model to Mitigate the Non-Convexity in European Day-ahead Electricity Market. Energies 2020, 13, 4716. [Google Scholar] [CrossRef]

- Deng, J.; Wang, H.B.; Wang, C.M.; Zhang, G.W. A novel power market clearing model based on the equilibrium principle in microeconomics. J. Clean. Prod. 2017, 142, 1021–1027. [Google Scholar] [CrossRef]

- Koltsaklis, N.E.; Dagoumas, A.S. Incorporating unit commitment aspects to the European electricity markets algorithm: An optimization model for the joint clearing of energy and reserve markets. Appl. Energy 2018, 231, 235–258. [Google Scholar] [CrossRef]

- Koltsaklis, N.E.; Dagoumas, A.S. An optimization model for integrated portfolio management in wholesale and retail power markets. J. Clean. Prod. 2020, 248, 119198. [Google Scholar] [CrossRef]

- Rezaee Jordehi, A.; Tabar, V.S.; Ahmadi Jirdehi, M. A two-stage stochastic model for security-constrained market clearing with wind power plants, storage systems and elastic demands. J. Energy Storage 2022, 51, 104550. [Google Scholar] [CrossRef]

- Ceyhan, G.; Köksalan, M.; Lokman, B. Extensions for Benders cuts and new valid inequalities for solving the European day-ahead electricity market clearing problem efficiently. Eur. J. Oper. Res. 2022, 300, 713–726. [Google Scholar] [CrossRef]

- Singh, S.; Fozdar, M.; Malik, H.; Fernández Moreno, M.d.V.; García Márquez, F.P. Influence of Wind Power on Modeling of Bidding Strategy in a Promising Power Market with a Modified Gravitational Search Algorithm. Appl. Sci. 2021, 11, 4438. [Google Scholar] [CrossRef]

- Wu, Y.; Su, X.; Liu, S.; Jiang, Y.; Shao, Q. Electricity Market Clearing Model Considering Uncertainty of Wind Power. In Proceedings of the 5th Conference on Energy Internet and Energy System Integration (EI2), Taiyuan, China, 22–24 October 2021; pp. 2748–2752. [Google Scholar] [CrossRef]

- Wood, A.; Wollenberg, B.; Sheblé, G. Power Generation, Operation, and Control; Wiley: Hoboken, NJ, USA, 2013. [Google Scholar]

- Herrero, I.; Rodilla, P.; Batlle, C. Electricity market-clearing prices and investment incentives: The role of pricing rules. Energy Econ. 2015, 47, 42–51. [Google Scholar] [CrossRef]

- Bjørndal, E.; Bjørndal, M.; Midthun, K.; Tomasgard, A. Stochastic electricity dispatch: A challenge for market design. Energy 2018, 150, 992–1005. [Google Scholar] [CrossRef]

- Van den Bergh, K.; Delarue, E. Energy and reserve markets: Interdependency in electricity systems with a high share of renewables. Electr. Power Syst. Res. 2020, 189, 106537. [Google Scholar] [CrossRef]

- Divényi, D.; Polgári, B.; Sleisz, Á.; Sőrés, P.; Raisz, D. Algorithm design for European electricity market clearing with joint allocation of energy and control reserves. Int. J. Electr. Power Energy Syst. 2019, 111, 269–285. [Google Scholar] [CrossRef]

- Qussous, R.; Harder, N.; Schäfer, M.; Weidlich, A. Increasing the realism of electricity market modeling through market interrelations. In Proceedings of the Open Source Modelling and Simulation of Energy Systems (OSMSES), Aachen, Germany, 4–5 April 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Nakos, C. Impact assessment of large scale RES penetration for the Hellenic power system; A market simulation model analysis. In Proceedings of the IREP Symposium Bulk Power System Dynamics and Control—IX Optimization, Security and Control of the Emerging Power Grid, Rethymno, Greece, 25–30 August 2013; pp. 1–10. [Google Scholar] [CrossRef]

- Deane, J.; Driscoll, A.; Gallachóir, B. Quantifying the impacts of national renewable electricity ambitions using a North–West European electricity market model. Renew. Energy 2015, 80, 604–609. [Google Scholar] [CrossRef]

- Pakka, V.H.; Ardestani, B.M.; Rylatt, R.M. Agent-based modelling of the UK short term electricity market: Effects of intermittent wind power. In Proceedings of the 9th International Conference on the European Energy Market, Florence, Italy, 10–12 May 2012; pp. 1–8. [Google Scholar] [CrossRef]

- Koltsaklis, N.E.; Nazos, K. A stochastic MILP energy planning model incorporating power market dynamics. Appl. Energy 2017, 205, 1364–1383. [Google Scholar] [CrossRef]

- Koschker, S.; Möst, D. Perfect competition vs. strategic behaviour models to derive electricity prices and the influence of renewables on market power. OR Spectrum 2016, 38, 661–686. [Google Scholar] [CrossRef]

- Orgaz, A.; Bello, A.; Reneses, J. A New Model to Simulate Local Market Power in a Multi-Area Electricity Market: Application to the European Case. Energies 2019, 12, 2068. [Google Scholar] [CrossRef]

- Li, G.; Shi, J. Agent-based modeling for trading wind power with uncertainty in the day-ahead wholesale electricity markets of single-sided auctions. Appl. Energy 2012, 99, 13–22. [Google Scholar] [CrossRef]

- Lei, M.; Zhang, J.; Dong, X.; Ye, J.J. Modeling the bids of wind power producers in the day-ahead market with stochastic market clearing. Sustain. Energy Technol. Assess. 2016, 16, 151–161. [Google Scholar] [CrossRef]

- Baslis, C.; Biskas, P.; Bakirtzis, A. A profit maximization model for a power producer in a pool-based energy market with cost recovery mechanism. In Proceedings of the 8th International Conference on the European Energy Market (EEM), Zagreb, Croatia, 25–27 May 2011; pp. 294–299. [Google Scholar] [CrossRef]

- De Maere d’Aertrycke, G.; Ehrenmann, A.; Smeers, Y. Investment with incomplete markets for risk: The need for long-term contracts. Energy Policy 2017, 105, 571–583. [Google Scholar] [CrossRef]

- Department for Business, Energy & Industrial Strategy. Evaluation of the Contracts for Difference Scheme. [Phase 1: Allocation Rounds 1 & 2]; Final Report; Department for Business, Energy & Industrial Strategy: London, UK, 2019.

- Andreis, L.; Flora, M.; Fontini, F.; Vargiolu, T. Pricing reliability options under different electricity price regimes. Energy Econ. 2020, 87, 104705. [Google Scholar] [CrossRef]

- Alshehri, K.; Bose, S.; Başar, T. Cash-settled options for wholesale electricity markets. IFAC-PapersOnLine 2017, 50, 13605–13611. [Google Scholar] [CrossRef]

- Agency for the Cooperation of Energy Regulators (ACER). European Electricity Forward Markets and Hedging Products—State of Play and Elements for Monitoring; Final Report; ACER: London, UK, 2015.

- Rahmati, I.; Akbari Foroud, A. An equilibrium-based model to investigate market performance of power-based electricity market. IET Gener. Transm. Distrib. 2022, 16, 2425–2440. [Google Scholar] [CrossRef]

- Philipsen, R.; Morales-España, G.; de Weerdt, M.; de Vries, L. Trading power instead of energy in day-ahead electricity markets. Appl. Energy 2019, 233-234, 802–815. [Google Scholar] [CrossRef]

- Ovaere, M.; Kenis, M.; Van den Bergh, K.; Bruninx, K.; Delarue, E. The effect of flow-based market coupling on cross-border exchange volumes and price convergence in Central Western European electricity markets. Energy Econ. 2023, 118, 106519. [Google Scholar] [CrossRef]

- Pedro, A.; Krutnik, M.; Yadack, V.M.; Pereira, L.; Morais, H. Opportunities and challenges for small-scale flexibility in European electricity markets. Util. Policy 2023, 80, 101477. [Google Scholar] [CrossRef]

- Kröger, D.; Peper, J.; Rehtanz, C. Electricity market modeling considering a high penetration of flexible heating systems and electric vehicles. Appl. Energy 2023, 331, 120406. [Google Scholar] [CrossRef]

- Lindberg, M.B. The power of power markets: Zonal market designs in advancing energy transitions. Environ. Innov. Soc. Transit. 2022, 45, 132–153. [Google Scholar] [CrossRef]

| Keyword Combinations | Number of Documents Found | Number of Papers Saved for Further Consideration | Number of Papers Included in the Final Review |

|---|---|---|---|

| TITLE-ABS-KEY (“european electricity market model”) | 12 | 3 | 2 |

| TITLE-ABS-KEY (“european electricity market design”) | 8 | 5 | 2 |

| TITLE-ABS-KEY (“electricity market design” AND differences) | 12 | 11 | 5 |

| TITLE-ABS-KEY (“(energy or electricity) and market and (design or model)” AND comparison) | 28 | 3 | 1 |

| TITLE-ABS-KEY ((energy OR electricity) AND market AND (design OR model) AND (comparison OR differences) AND regulations AND incentives) | 36 | 5 | 1 |

| TITLE-ABS-KEY (“european electricity market”) | 342 | 64 | 14 |

| TITLE-ABS-KEY (“(energy for electricity) and market and (design for model)” AND differences) | 69 | 13 | 4 |

| TITLE-ABS-KEY (“electricity market” AND problematic) | 39 | 7 | 4 |

| TITLE-ABS-KEY (existing AND “market design options”) | 8 | 6 | 4 |

| TITLE-ABS-KEY (“energy-only” AND “market model*”) | 19 | 13 | 7 |

| (TITLE (power AND market) AND TITLE (model*)) | 457 | 104 | 19 |

| TOTAL | 1030 | 234 | 63 |

| Market Mechanism | Source | Year | Model | Possible Model Specification |

|---|---|---|---|---|

| Bidding zone configuration | [27] | 2022 | N/A | difference-in-differences (DiD) estimator |

| [30] | 2021 | N/A | ||

| [23] | 2020 | optimization | mixed-integer nonlinear trilevel optimization model | |

| [26] | 2018 | optimization | ||

| [25] | 2017 | optimization | linear optimization | |

| [29] | 2015 | equilibrium | mixed complementarity problem | |

| Market coupling | [31] | 2022 | N/A | statistical probit model |

| [32] | 2020 | optimization | multi-stage linear optimization problem | |

| [20] | 2017 | agent-based simulation | ||

| Nodal pricing | [33] | 2018 | hybrid | quadratic problem and linear problem |

| [35] | 2013 | optimization | ||

| Intraday markets | [19] | 2021 | N/A | |

| Balancing markets | [36] | 2022 | optimization | mixed-integer linear programming |

| [37] | 2021 | N/A | ||

| Capacity remuneration mechanisms | [41] | 2020 | optimization | |

| [42] | 2019 | optimization | linear optimization | |

| [40] | 2019 | N/A | ||

| [43] | 2018 | hybrid | agent-based modelling and linear optimization | |

| [44] | 2018 | N/A | ||

| [38] | 2016 | agent-based simulation | ||

| [39] | 2016 | N/A | ||

| Add-ons | [46] | 2020 | equilibrium | mixed complementarity problem |

| [45] | 2018 | equilibrium | mixed complementarity, partial equilibrium model | |

| Market clearing | [57] | 2022 | optimization | mixed-integer programming |

| [56] | 2022 | optimization | mixed-integer linear programming | |

| [58] | 2021 | optimization | ||

| [59] | 2021 | optimization | mixed-integer linear programming | |

| [55] | 2020 | optimization | mixed-integer linear programming | |

| [63] | 2020 | optimization | mixed-integer linear programming | |

| [52] | 2020 | optimization | ||

| [62] | 2018 | optimization | mathematical programming with equilibrium constraints (MPEC) | |

| [54] | 2018 | optimization | mixed-integer linear programming | |

| [53] | 2017 | equilibrium | ‘man-made’ equilibrium model | |

| [61] | 2015 | optimization | ||

| [47] | 2013 | optimization | nonlinear constrained optimization problem | |

| Modelling electricity markets and bidding optimization | [65] | 2022 | agent-based simulation | open-source model flexABLE |

| [49] | 2022 | optimization | ||

| [71] | 2019 | optimization | equivalent quadratic optimization | |

| [69] | 2017 | optimization | mixed-integer linear programming | |

| [73] | 2016 | optimization | mathematical programming with equilibrium constraints (MPEC) | |

| [70] | 2015 | optimization | ||

| [67] | 2015 | optimization | mixed-integer linear programming | |

| [66] | 2013 | optimization | mixed-integer programming | |

| [68] | 2012 | agent-based simulation | ||

| [72] | 2012 | agent-based simulation | ||

| [74] | 2011 | optimization | mixed-integer linear programming | |

| Risk hedging | [75] | 2017 | equilibrium | stochastic equilibrium model |

| [78] | 2017 | optimization | ||

| Power-based modelling instead of energy-based | [80] | 2022 | equilibrium | mixed complementarity problem |

| [81] | 2019 | optimization | mixed-integer programming |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Honkapuro, S.; Jaanto, J.; Annala, S. A Systematic Review of European Electricity Market Design Options. Energies 2023, 16, 3704. https://doi.org/10.3390/en16093704

Honkapuro S, Jaanto J, Annala S. A Systematic Review of European Electricity Market Design Options. Energies. 2023; 16(9):3704. https://doi.org/10.3390/en16093704

Chicago/Turabian StyleHonkapuro, Samuli, Jasmin Jaanto, and Salla Annala. 2023. "A Systematic Review of European Electricity Market Design Options" Energies 16, no. 9: 3704. https://doi.org/10.3390/en16093704