Subsidy Policies and Economic Analysis of Photovoltaic Energy Storage Integration in China

Abstract

1. Introduction

1.1. Background

1.2. Literature Review

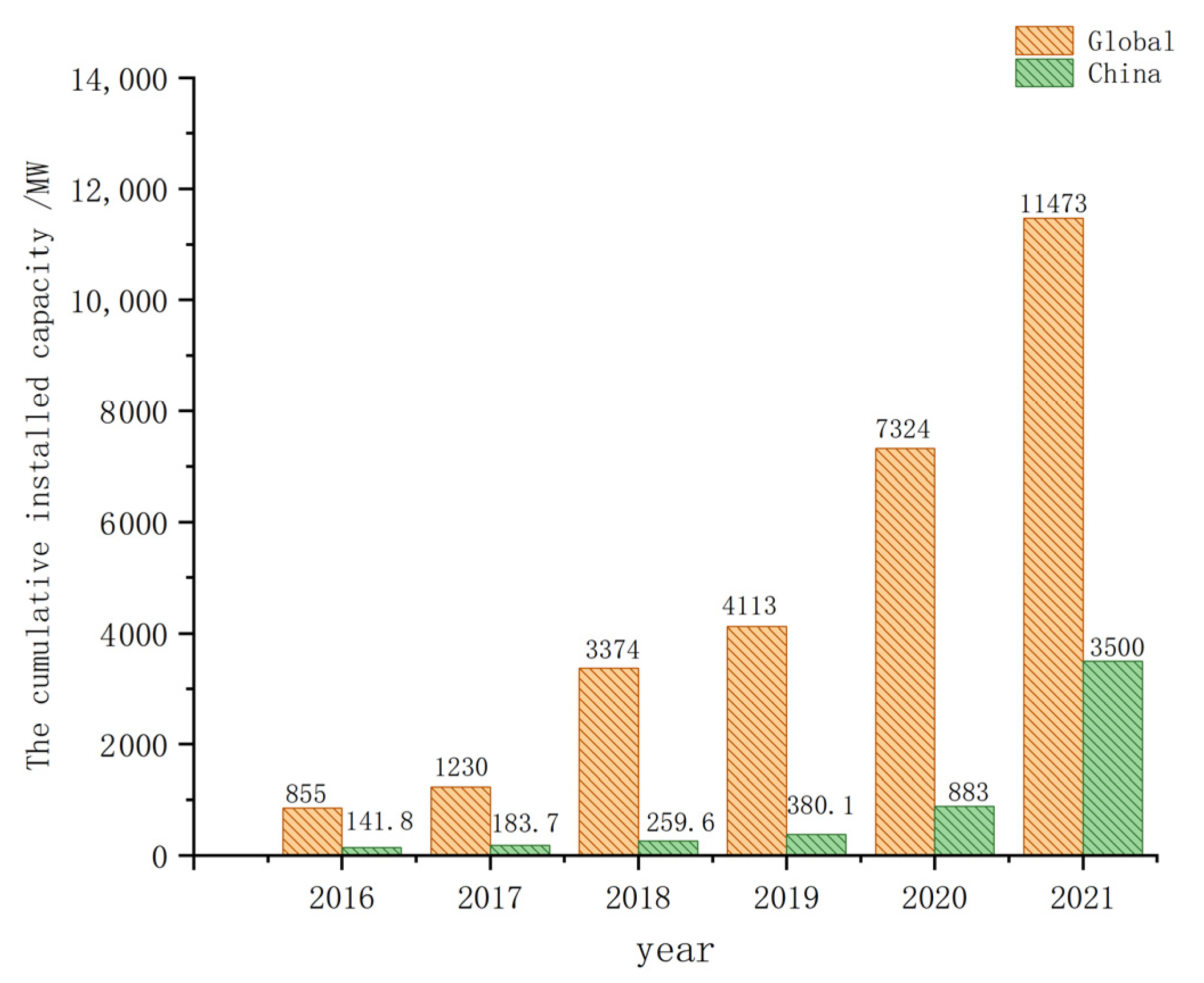

2. The Development Status of China’s Photovoltaic Energy Storage Market

2.1. General Situation

2.2. Relevant Policy

2.2.1. Policies Related to the Configuration of Energy Storage for Photovoltaic Projects

2.2.2. Policies Related to Energy Storage Subsidies

2.3. The Main Problems of China’s PV-ES Integration Subsidy Policy

- (1)

- Insufficient subsidy intensity hampers investment incentives: The current bottleneck restraining industry development remains the cost factor. While the photovoltaic industry has gradually reduced generation costs through years of technological iteration and capacity construction, the mandatory storage requirements for new energy sources are likely to increase the costs of photovoltaic projects, thereby diminishing profitability. Excessive costs could deter investment in PV-ES integration projects, hindering industry development and the establishment of a mechanism for new power installation development based on storage and peak-shifting capabilities. Hence, subsidy policies are indispensable. However, the current subsidies for energy storage mostly range from 0.1 to 0.3 RMB/kWh, with subsidy periods mostly limited to three years. These subsidies are insufficient to cover the investment costs of energy storage facilities, failing to mitigate investment risks for investors or provide stable expected returns, thus struggling to stimulate investment and construction willingness in the capital market. Therefore, the industry also anticipates further subsidy policies or the implementation of market-oriented trading mechanisms to encourage more investors to participate in system construction.

- (2)

- Broad subsidy standards lack targeted measures: Due to the complexity of energy storage technology and markets, the technologies employed and the proportion of energy storage configurations significantly impact the lifecycle costs of PV-ES integration projects. While energy storage subsidy policies typically specify storage ratios ranging from 10% to 20%, some local policies demand high proportions of storage. In situations where energy storage subsidies already struggle to cover the investment costs of energy storage facilities, requiring high proportions of storage means project operators not only fail to generate electricity revenue but also incur losses, resulting in negative internal rates of return. If market conditions are not considered, mandating high proportions of storage for power stations could dampen enthusiasm for capital investment in photovoltaic projects. Therefore, on the basis of reasonably allocating energy storage proportions, it is essential to research and formulate more effective subsidy standards for high-proportion energy storage support, actively explore more suitable subsidy schemes covering the additional costs incurred by energy storage in PV-ES integration projects. With changes in project capacity, policy levels, and energy storage configurations, significant fluctuations in project internal rates of return are expected. Thus, to achieve the desired level of returns, it is necessary to formulate corresponding subsidy standards tailored to different project circumstances.

3. Economic Analysis Model of PV-ES Integration

3.1. PV-ES Integration Project Cost and Benefits

3.2. The PV-ES Integration Project LCOE Model

3.3. LCOE-NPV System Dynamics Model

4. Case Study

4.1. Initial Data and Parameter Settings

4.2. Analysis of Simulation Results in Different Ways

4.2.1. Energy Storage Configuration Ratio Scenario

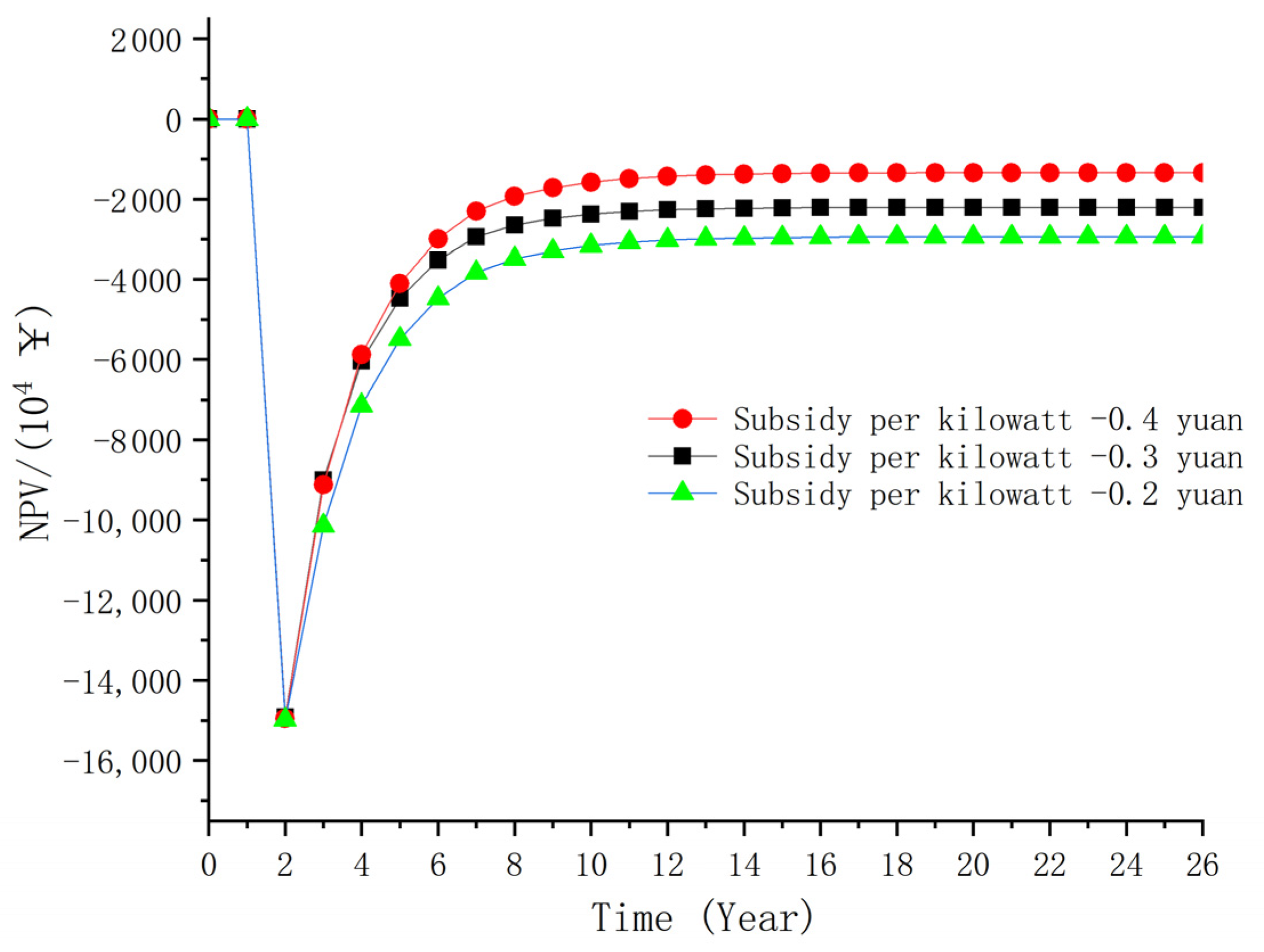

4.2.2. Energy Storage Subsidy Scenario

- (1)

- Scenario of subsidizing 10% energy storage configuration

- (2)

- Scenario of subsidizing 15% energy storage configuration

5. Conclusions

6. Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ministry of Ecology and Environment of China. China’s Climate Change Policy and Action 2023 Annual Report [R/OL]]. (2023-10-27)[2024-02-19]. Available online: https://www.mee.gov.cn/ywgz/ydqhbh/wsqtkz/202310/W020231027674250657087.pdf (accessed on 19 February 2024).

- Wang, F.; Quan, L.; Cong, L.; Lu, M. Economic benefits of distributed photovoltaic power generation under different operating modes in situation of subsidy reduction: A case of Beijing-Tianjin-Hebei. J. Arid. Land Resour. Environ. 2024, 38, 87–94. [Google Scholar]

- Wang, J.; Lin, Y.; Wu, C.; Yang, B. Current situation and development of solar photovoltaic industry under the background of carbon neutrality. Energy Storage Sci. Technol. 2022, 11, 731–732. [Google Scholar]

- Zhang, Y.; Huang, B. Cost analysis and policy suggestions of China’s new energy development. Electr. Power 2018, 51, 10–15. [Google Scholar]

- Varma, R.K.; Salama, M. Large-scale photovoltaic solar power integration in transmission and distribution networks. In Proceedings of the 2011 IEEE Power and Energy Society General Meeting, Detroit, MI, USA, 24–28 July 2011; pp. 1–4. [Google Scholar] [CrossRef]

- Choudhury, S. Review of energy storage system technologies integration to microgrid: Types, control strategies, issues, and future prospects. J. Energy Storage 2022, 48, 103966. [Google Scholar] [CrossRef]

- Peng, T.; Zhang, Y.; Zhao, J. Distributed Energy Storage Cluster Control Method for DC Microgrid Considering Flexibility. Math. Probl. Eng. 2022, 2022, 6761595. [Google Scholar]

- Rekioua, D.; Kakouche, K.; Babqi, A.; Mokrani, Z.; Oubelaid, A.; Rekioua, T.; Azil, A.; Ali, E.; Alaboudy, A.H.K.; Abdelwahab, S.A.M. Optimized Power Management Approach for Photovoltaic Systems with Hybrid Battery-Supercapacitor Storage. Sustainability 2023, 15, 14066. [Google Scholar] [CrossRef]

- Bayod-Rújula, Á.A.; Tejero-Gómez, J.A. Analysis of the Hybridization of PV Plants with a BESS for Annual Constant Power Operation. Energies 2022, 15, 9063. [Google Scholar] [CrossRef]

- Weng, S.; Ma, T.; Kanzumba, K.; Zhao, F.; Zhang, Y.; Li, B.; Xue, P. Battery capacity design and optimal operation control of photovoltaic-battery system considering electrochemical aging. J. Energy Storage 2024, 79, 110103. [Google Scholar] [CrossRef]

- Coppitters, D.; De Paepe, W.; Contino, F. Robust design optimization and stochastic performance analysis of a grid-connected photovoltaic system with battery storage and hydrogen storage. Energy 2020, 213, 118798. [Google Scholar] [CrossRef]

- Chen, G.; Yuan, Y.; Fu, Z. Application of storage battery to restrain the photovoltaic power fluctuation. Proc. CSU-EPSA 2014, 26, 27–31. [Google Scholar]

- Hodge, B.M.; Martinez-Anido, C.B.; Wang, Q.; Chartan, E.; Florita, A.; Kiviluoma, J. The combined value of wind and solar power forecasting improvements and electricity storage. Appl. Energy 2018, 214, 1–15. [Google Scholar] [CrossRef]

- Lakhain, R.; Doluweera, G.; Bergerson, J. Internalizing land use impacts for life cycle cost analysis of energy systems:A case of California photovoltaic implementtation. Appl. Energy 2014, 116, 253–259. [Google Scholar] [CrossRef]

- Hin, J.N.C.; Zmeureanu, R. Optimization of a residential solar combisystem for minimum life cycle cost, energy use and exergy destroyed. Sol. Energy 2014, 100, 102–113. [Google Scholar]

- Perez, M.; Perez, R.; Rábago, K.R.; Putnam, M. Overbuilding & curtailment: The cost-effective enablers of firm PV generation. Sol. Energy 2019, 180, 412–422. [Google Scholar]

- Wen, J.; Liu, N.; Pei, J.; Xu, R.; Liu, D. Life cycle cost analysis for energy storage technology. Therm. Power Gener. 2021, 50, 24–29. [Google Scholar]

- Zhao, X.; Wang, Z. Technology, cost, economic performance of distributed photovoltaic industry in China. Renew. Sustain. Energy Rev. 2019, 110, 53–64. [Google Scholar]

- Dunhu, C.; Chuan, T.; Zeyang, Z.; Qi, M.; Kuang, Y.; Liming, H. Economic benefit analysis on photovoltaic power generation with LCOE model: The case of poverty alleviation project in rural area of Yichang city. Res. Environ. Sci. 2020, 33, 2412–2420. [Google Scholar]

- Pan, B.B.; Chen, Z.H.; Jia, N.F.; Li, Y.H.; Hao, Y. Research on cost accounting of photovoltaic power generation-Analysis based on LCOE method. Price Theory Pract. 2019, 05, 138–140+144. [Google Scholar]

- Wang, J.Y.; Zhou, B.R.; Wu, W.; Zheng, M.; Lu, S.; Yao, W.; Zhao, W. Levelized cost of energy of centralized photovoltaic power in western China and distributed photovoltaic power in eastern China. South. Power Syst. Technol. 2020, 14, 80–89. [Google Scholar]

- Jacob, R.; Riahi, S.; Liu, M.; Belusko, M.; Bruno, F. Technoeconomic Impacts of Storage System Design on the Viability of Concentrated Solar Power Plants. J. Energy Storage 2021, 34, 101987. [Google Scholar] [CrossRef]

- Schmidt, O.; Melchior, S.; Hawkes, A.; Staffell, I. Projecting the Future Levelized Cost of Electricity Storage Technologies. Joule 2019, 3, 81–100. [Google Scholar] [CrossRef]

- Lv, S.; Cai, S.; Wang, S. Economic evaluation and development suggestion of distributed PV- Energy storage system in China. Electr. Power 2015, 48, 139–144. [Google Scholar]

- Sun, B.; Liao, Q.Q.; Liu, Y.; Liu, Y.; Zhou, G.; Ge, H. Economic analysis of hybrid system containing distributed photovoltaic power and battery stored energy. Electr. Power Constr. 2016, 37, 102–107. [Google Scholar]

- Wang, X.; Chu, C.; Cao, Z.; Chu, C.; Ju, M. Empirical analysis of cost-CO2-energy benefits of distributed photovoltaic—Battery storage system—taking (PV-BSS) in a case study in rural Jiaozhou Shandong. China Environ. Sci. 2022, 42, 402–414. [Google Scholar]

- Liu, J.; Cao, L.; Ma, J.; Zhang, J. Economic analysis of user’s grid-connected PV system based on energy storage system. Acta Energiae Solaris Sin. 2012, 33, 1887–1892. [Google Scholar]

- Gatto, A.; Sadik-Zada, E.R.; Lohoff, T.; Aldieri, L.; Vinci, C.P.; Peitz, K.A. An exemplary subsidization path for the green hydrogen economy uptake: Rollout policies in the United States and the European Union. J. Clean. Prod. 2024, 440, 140757. [Google Scholar] [CrossRef]

- La Monaca, S.; Ryan, L. Solar PV where the sun doesn’t shine: Estimating the economic impacts of support schemes for residential PV with detailed net demand profiling. Energy Policy 2017, 108, 731–741. [Google Scholar] [CrossRef]

- Zhang, J.; Cho, H.; Luck, R.; Mago, P.J. Integrated photovoltaic and battery energy storage (PV-BES) systems: An analysis of existing financial incentive policies in the US. Appl. Energy 2018, 212, 895–908. [Google Scholar] [CrossRef]

- Xiao, H.; Yue, C. The Comparison and Research on Supporting Policy of Renewable Energy Development of China and Britain[J/OL]. Express Water Resour. Hydropower Inf. 2024, 1–7. Available online: http://kns.cnki.net/kcms/detail/42.1142.tv.20240307.1537.002.html (accessed on 23 April 2024).

- Zhang, Y. Research on Economic Analysis and Investment Development Path of Despersed Wind Power Projects. Master’s Thesis, North China Electric Power University, Beijing, China, 2020. [Google Scholar] [CrossRef]

- Liu, Y.; Hao, M.; Li, G.; Yuan, S. Study on economic effect evaluation of wind power storage project: Levelized cost model and application analysis based on system dynamics. Price Theory Pract. 2021, 11, 96–101. [Google Scholar]

- Wang, Q. Advanced System Dynamics; Tsinghua University Press: Beijing, China, 1995. [Google Scholar]

- Tan, J.; Wang, B.; Li, Y. Application of system dynamics on comprehensive benefit valuation of demand response. Autom. Electr. Power Syst. 2014, 38, 128–134. [Google Scholar]

- Dong, H.A.N.; Zheng, Y.A.N.; Yiqun, S.; Qiang, S.; Yibin, Z. Dynamic assessment method for smart grid based on system dynamics. Autom. Electr. Power Syst. 2012, 36, 16–21. [Google Scholar]

- Zhao, X.; Feng, T.; Yang, Y. Impacting mechanism of renewable portfolio standard on China‘s power source structure and its effect. Power Syst. Technol. 2014, 38, 974–979. [Google Scholar]

- Zhao, S.; Wang, B.; Li, Y.; Sun, M.; Zeng, W. System dynamics based analysis on incentive mechanism of distributed renewable energy. Autom. Electr. Power Syst. 2017, 41, 97–104. [Google Scholar]

- Zhang, L.; Ge, L.; Chen, C.; Tang, M. Simulation on the development of residential distributed photovoltaic power genenation under the declining trend of Feed-in-Tariff. J. Syst. Simul. 2021, 33, 1397–1405. [Google Scholar] [CrossRef]

- Xie, Y.; Bai, J.; Huang, Y.; Wang, S.; Wang, Y.; Hu, J. Analysis of annual power generation of bifacial PV array under occlusion of different spindle structures. Acta Energiae Solaris Sin. 2023, 44, 134–140. [Google Scholar]

- Li, Y.; Wang, K. Research on the characteristics and economic analysis of new energy power generation. Appl. Energy Technol. 2022, 6, 51–53. [Google Scholar]

- Zhang, Y. Study on the influencing factors of photovoltaic power generation efficiency. Chin. Sci. Technol. J. Database (Dig. Ed.) Eng. Technol. 2023, 6, 11–13. [Google Scholar]

- Wang, Q.; Wang, S.; Liu, J.; Guo, W.; Kang, W.; Liu, D.; Hu, Y. Research on the phased Marketization scale and path of new energy in provincial power grids. Glob. Energy Internet 2023, 6, 406–416. [Google Scholar] [CrossRef]

| Project Name | Project Location | Installed Capacity of Photovoltaic Power Generation/MW | Energy Storage Capacity/MWh |

|---|---|---|---|

| Kezuohou Banner 100 MW Photovoltaic Energy Storage Project | Kezuohou Banner, Tongliao City, Inner Mongolia | 100 | 30 MW/60 MWh |

| 360 MW + 60 MW/120 MWh Photovoltaic Energy Storage Fusion Power StationProject | Laizhou City, Shandong Province | 360 | 60 MW/120 MWh |

| Shengtong Industrial Park Photovoltaic Storage Integration Project | Changsha, Hunan Province | 9.8 | 16.5 MW/40 MWh |

| Three Gorges 10 MW Centralized Photovoltaic Storage Project | Badu County, Qamdo City, Tibet Autonomous Region | 10 | 2.5 MW/10 MWh |

| Hangzhou Bay Geely Automobile (polar Krypton factory) Distributed Photovoltaic Storage Project | Ningbo City, Zhejiang Province | 29 | 6 MW/12 MWh |

| Low Carbon Campus Vanadium Flow Battery PV Storage And Charging Integrated Project | Shuozhou city, Shanxi Province | 1.705 | 25 kW/100 kWh |

| Region | Subsidy Amount | Main Content |

|---|---|---|

| Yueqing City, Zhejiang Province | 0.89 yuan/kWh | The subsidy of 0.89 yuan/kWh on the basis of the existing electricity price 0.89 yuan/kWh |

| Nanjing City, Jiangsu Province | 0.2 yuan/kWh | The subsidy of 0.2 yuan/kWh for the operation of photovoltaic energy storage charging and discharging facilities above 500 kWh |

| Foshan City, Guangdong Province | 10~30 (104¥) | The one-time subsidy for the purchase of energy storage equipment in many places in Shunde ranges from 100 thousand yuan to 300 thousand yuan |

| Shenyang City, Liaoning Province | 10% of the investment | Photovoltaic energy storage charging demonstration stations are rewarded by 10% of the investment, with a maximum of 500 thousand yuan per station |

| Qinghai Province | 0.1 yuan/kWh | The subsidy for new energy distribution and storage projects is 0.1 yuan/kWh |

| Xi’an City, Shanxi Province | No more than half a million | From 1 January 2021 to 31 December 2023, energy storage systems of not less than 1 MWh will be subsidized by investment enterprises based on 20% of the actual investment in energy storage equipment, with a maximum of 500 thousand yuan |

| Yiwu City, Zhejiang Province | 0.25 yuan/kWh | The actual discharge in the peak segment is based on the subsidy of 0.25 yuan/kWh of the energy storage operator, subsidy for two years |

| Suzhou City, Jiangsu Province | 0.3 yuan/kWh | Energy storage projects in Suzhou Park, the subsidy is 0.3 yuan/kWh, subsidy for three years |

| Wujiang District, Suzhou City | 0.9 yuan/kWh | Suzhou Wujiang District distributed photovoltaic large-scale development implementation plan proposed: operating energy storage project subsidies 0.9 yuan/kWh, subsidy for two years |

| Zhaoqing City, Guangdong Province | 150 yuan/kWh | The one-time subsidy of 150 yuan/kWh, up to 1.5 million yuan |

| Ningxia | 0.8 yuan/kWh | For energy storage projects completed in 2022 and 2023, the charge and discharge times are not less than 300 times, and the subsidy is 0.8 yuan/kWh |

| Sichuan Province | 230 yuan/kW | The annual utilization hours are not less than 600 h, and the subsidy is 230 yuan/kW, up to 1 million yuan, subsidy for three years |

| Chaoyang District, Beijing | Not more than 20% of the total investment | Subsidies for energy storage projects should not exceed 20% of the total investment |

| Wuhu City, Anhui Province | 0.3 yuan/kWh | The subsidy of 0.3 yuan/kWh, the maximum subsidy of 1 million yuan, the project put into operation before 31 December 2023, the subsidy period of a single project is 5 years |

| Nanning City, Guangxi Province | 0.1 yuan/Wh | The subsidy for power and energy storage batteries is 0.1 yuan/Wh, and the maximum subsidy amount is 11.55 billion yuan |

| Futian District, Shenzhen | 0.5 yuan/kWh | A subsidy of 0.5 yuan/kWh is given to projects with more than 1 million yuan |

| Hefei City, Anhui Province | 0.3 yuan/kWh | 0.3 yuan/kWh, for two consecutive years |

| Tongliang District, Chongqing | 0.5 yuan/kWh | 0.5 yuan/kWh, for three consecutive years |

| Wuxi City, Jiangsu Province | 0.1 yuan/W | 0.1 yuan/W, The maximum limit for a single project is 500 thousand yuan |

| Inner Mongolia | 0.35 yuan/kWh | The discharge allowance for energy storage is 0.35 yuan/kWh, no more than ten years |

| Variables | Unit | Symbol Interpretation |

|---|---|---|

| 104¥ | Total cost of PV-ES integrated project | |

| 104¥ | System initial construction cost | |

| 104¥ | System operation and maintenance costs | |

| 104¥ | Energy storage replacement cost | |

| 104¥ | Tax payable | |

| 104¥ | Insurance expense | |

| 104¥ | Labor cost | |

| 104¥ | Interest expense | |

| 104¥ | Cost recovery | |

| 104¥ | Other costs | |

| 104¥ | Total revenue of PV-ES integrated project | |

| kWh | Photovoltaic power generation on-grid electricity | |

| kWh | The discarded light power stored in energy storage | |

| yuan/kWh | The on-grid tariff implemented by the photovoltaic power station | |

| 104¥ | Energy storage auxiliary services revenue | |

| - | Energy storage subsidy | |

| kWh | Power generation of PV-ES integrated project | |

| year | Life of PV-ES integrated project | |

| - | Discount rate | |

| MW | Installed capacity of power generation system | |

| hour | Annual utilization hours | |

| - | Plant rate | |

| - | Photovoltaic installed system efficiency | |

| - | Component decay rate |

| Name of a Variable | Type of Variable | Unit |

|---|---|---|

| LCOE | Auxiliary variable | yuan/kWh |

| Total present value of cost | State variable | 104 ¥ |

| Cash outflows after tax | Auxiliary variable | 104 ¥/year |

| Pre-tax cash outflow | Auxiliary variable | 104 ¥/year |

| Total taxable amount | Auxiliary variable | 104 ¥/year |

| Total present value of electricity generation | State variable | kWh |

| NPV | State variable | 104 ¥ |

| Cash inflow | Auxiliary variable | 104 ¥/year |

| Scenario | Configure or Not Energy Storage | Energy Storage Allocation Ratio | Have or Not Subsidy | Subsidy Method | Subsidy Intensity |

|---|---|---|---|---|---|

| 1 | No | / | / | / | / |

| 2 | Yes | 5% | No | / | / |

| 10% | |||||

| 15% | |||||

| 3 | Yes | 10% | Yes | Initial investment allowance | 10% |

| 20% | |||||

| 30% | |||||

| 4 | Yes | 10% | Yes | Discharge allowance | 0.2 yuan/kWh |

| 0.3 yuan/kWh | |||||

| 0.4 yuan/kWh | |||||

| 5 | Yes | 15% | Yes | Initial investment allowance | 10% |

| 20% | |||||

| 30% | |||||

| 6 | Yes | 15% | Yes | Discharge allowance | 0.2 yuan/kWh |

| 0.3 yuan/kWh | |||||

| 0.4 yuan/kWh |

| Energy Storage Allocation Ratio | IRR |

|---|---|

| No energy storage | 8.14% |

| 5% | 7.12% |

| 10% | 6.36% |

| 15% | 5.67% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, W.; Li, R.; Zhu, S. Subsidy Policies and Economic Analysis of Photovoltaic Energy Storage Integration in China. Energies 2024, 17, 2372. https://doi.org/10.3390/en17102372

Zhao W, Li R, Zhu S. Subsidy Policies and Economic Analysis of Photovoltaic Energy Storage Integration in China. Energies. 2024; 17(10):2372. https://doi.org/10.3390/en17102372

Chicago/Turabian StyleZhao, Wenhui, Rong Li, and Shuan Zhu. 2024. "Subsidy Policies and Economic Analysis of Photovoltaic Energy Storage Integration in China" Energies 17, no. 10: 2372. https://doi.org/10.3390/en17102372

APA StyleZhao, W., Li, R., & Zhu, S. (2024). Subsidy Policies and Economic Analysis of Photovoltaic Energy Storage Integration in China. Energies, 17(10), 2372. https://doi.org/10.3390/en17102372