National Environmental Taxes and Industrial Waste in Countries across Europe

Abstract

:1. Introduction and Motivation

2. Methodological Framework

2.1. Fixed Effects Model

2.2. Empirical Model Specification

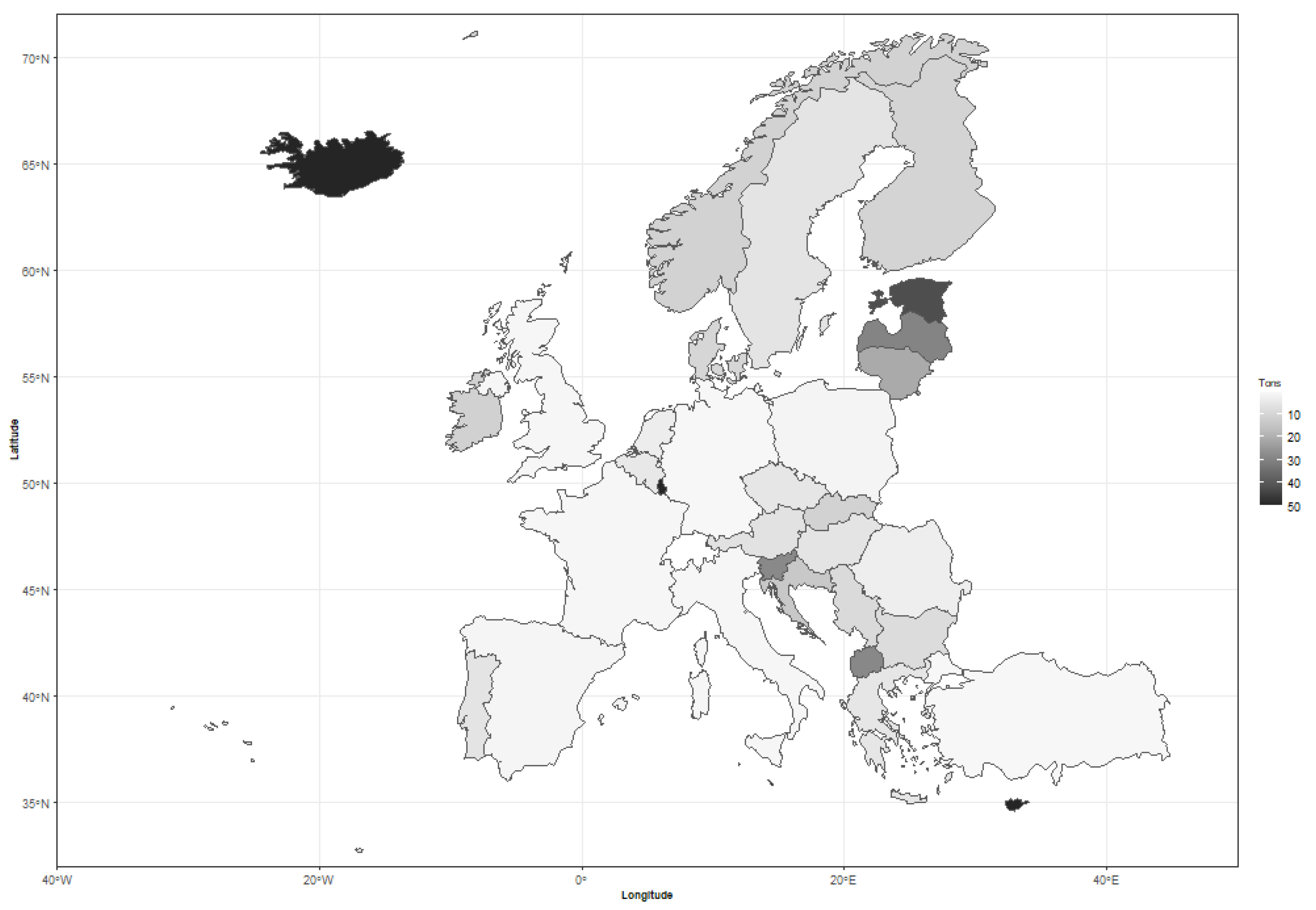

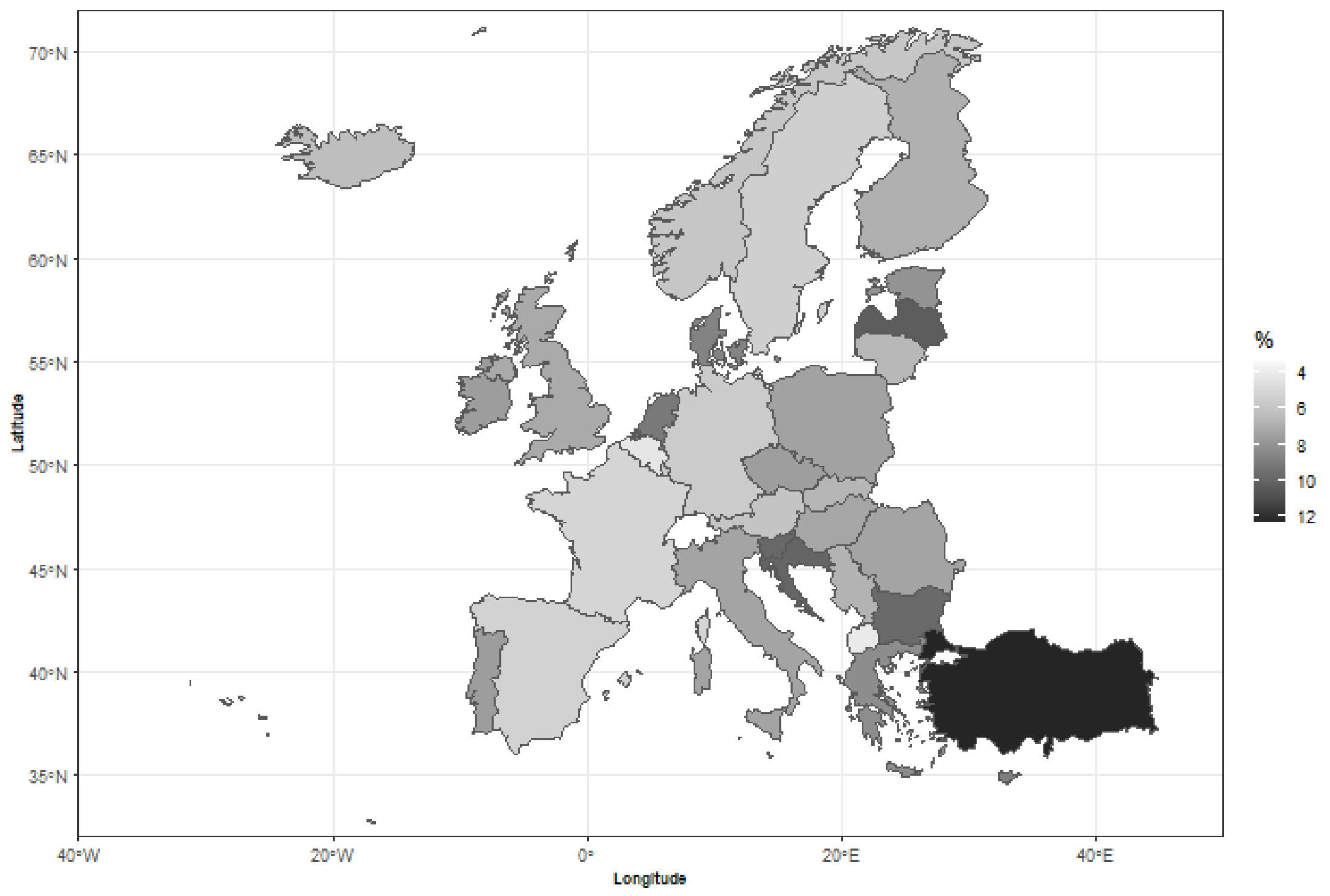

3. Data and Variables

4. Results and Discussion

5. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| EU | European Union |

| ESA | European System of Accounts |

| FE | Fixed effect model |

| OECD | Organisation for Economic Co-operation and Development |

| RE | Random effect model |

| UNFCC | United Nations Framework Convention on Climate Change |

References

- UNFCCC. United Nations Climate Change: Annual Report. 2020. Available online: https://unfccc.int/sites/default/files/resource/UNFCCC_Annual_Report_2020.pdf (accessed on 8 March 2024).

- European Commission. Environmental Implementation Review. European Union. Available online: https://ec.europa.eu/environment/eir/pdf/report_es_es.pdf (accessed on 4 February 2024).

- European Environment Agency. Prevention of Hazardous Waste in Europe—The Status in 2015 (Report No. 35). Publications Office of the European Union. Available online: https://www.eea.europa.eu/publications/waste-prevention-in-europe/file (accessed on 5 February 2024).

- Herczeg, M.; Skovgaard, M.; Zoboli, R.; Mazzanti, M. Diverting Waste from Landfill: Effectiveness of Waste Management Policies in the European Union; European Environment Agency: Copenhagen, Denmark, 2009.

- OECD. Environmental Performance Reviews: Greece 2020; OECD Publishing: Paris, France, 2020. [Google Scholar]

- European Commission. Environmental Taxes—A Statistical Guide. Publications Office of the European Union. Available online: https://ec.europa.eu/eurostat/documents/3859598/5936129/KS-GQ-13-005-EN.PDF (accessed on 8 March 2024).

- Sterner, T.; Köhlin, G. Environmental taxes in Europe. In Environmental Taxation in Practice; Routledge: London, UK, 2017; pp. 3–28. [Google Scholar]

- Bosquet, B. Environmental tax reform: Does it work? A survey of the empirical evidence. Ecol. Econ. 2000, 34, 19–32. [Google Scholar] [CrossRef]

- OECD. Taxation, Innovation and the Environment; OECD Publishing: Paris, France, 2011. [Google Scholar]

- European Environment Agency. Environmental Taxation and EU Environmental Policies (EEA Report No. 17). Publications Office of the European Union. Available online: https://www.eea.europa.eu/publications/environmental-taxation-and-eu-environmental-policies (accessed on 5 February 2024).

- Andreoni, V. Environmental taxes: Drivers behind the revenue collected. J. Clean. Prod. 2019, 221, 17–26. [Google Scholar] [CrossRef]

- Filipiak, B.Z.; Wyszkowska, D. Determinants of Reducing Greenhouse Gas Emissions in European Union Countries. Energies 2022, 15, 9561. [Google Scholar] [CrossRef]

- Pereira, A.M.; Pereira, R.M. Energy Taxation Reform with an Environmental Focus in Portugal. Energies 2023, 16, 1232. [Google Scholar] [CrossRef]

- Qi, J.; Song, Y.; Zhang, Y. Environmental Protection Tax and Energy Efficiency: Evidence from Chinese City-Level Data. Energies 2023, 16, 8104. [Google Scholar] [CrossRef]

- Rafique, M.Z.; Fareed, Z.; Ferraz, D.; Ikram, M.; Huang, S. Exploring the heterogenous impacts of environmental taxes on environmental footprints: An empirical assessment from developed economies. Energy 2022, 238, 121753. [Google Scholar] [CrossRef]

- Xu, Y.; Wen, S.; Tao, C.Q. Impact of environmental tax on pollution control: A sustainable development perspective. Econ. Anal. Policy 2023, 79, 89–106. [Google Scholar] [CrossRef]

- Hoogmartens, R.; Eyckmans, J.; Van Passel, S. Landfill taxes and Enhanced Waste Management: Combining valuable practices with respect to future waste streams. Waste Manag. 2016, 55, 345–354. [Google Scholar] [CrossRef] [PubMed]

- Katare, B.; Serebrennikov, D.; Wang, H.H.; Wetzstein, M. Social-optimal household food waste: Taxes and government incentives. Am. J. Agric. Econ. 2017, 99, 499–509. [Google Scholar] [CrossRef]

- Mazzanti, M.; Montini, A.; Nicolli, F. Waste dynamics in economic and policy transitions: Decoupling, convergence and spatial effects. J. Environ. Plann. Manag. 2012, 55, 563–581. [Google Scholar] [CrossRef]

- Nicolli, F.; Mazzanti, M. Landfill diversion in a decentralized setting: A dynamic assessment of landfill taxes. Resour. Conserv. Recycl. 2013, 81, 17–23. [Google Scholar] [CrossRef]

- Sasao, T. Does industrial waste taxation contribute to reduction of landfilled waste? Dynamic panel analysis considering industrial waste category in Japan. Waste Manag. 2014, 34, 2239–2250. [Google Scholar] [CrossRef] [PubMed]

- Yi, Y.; Liu, S.; Fu, C.; Li, Y. A joint optimal emissions tax and solid waste tax for extended producer responsibility. J. Clean. Prod. 2021, 314, 128007. [Google Scholar] [CrossRef]

- Hossain, M.E.; Rej, S.; Hossain, M.R.; Bandyopadhyay, A.; Tama, R.A.Z.; Ullah, A. Energy mix with technological innovation to abate carbon emission: Fresh evidence from Mexico applying wavelet tools and spectral causality. Environ. Sci. Pollut. Res. 2023, 30, 5825–5846. [Google Scholar] [CrossRef] [PubMed]

- Lau, C.K.; Gozgor, G.; Mahalik, M.K.; Patel, G.; Li, J. Introducing a new measure of energy transition: Green quality of energy mix and its impact on CO2 emissions. Energy Econ. 2023, 122, 106702. [Google Scholar] [CrossRef]

- Mongo, M.; Belaïd, F.; Ramdani, B. The effects of environmental innovations on CO2 emissions: Empirical evidence from Europe. Environ. Sci. Policy 2021, 118, 1–9. [Google Scholar] [CrossRef]

- Stergiou, E.; Kounetas, K. European Industries’ Energy Efficiency under Different Technological Regimes: The Role of CO2 Emissions, Climate, Path Dependence and Energy Mix. Energy J. 2021, 42, 93–128. [Google Scholar] [CrossRef]

- Töbelmann, D.; Wendler, T. The impact of environmental innovation on carbon dioxide emissions. J. Clean. Prod. 2020, 244, 118787. [Google Scholar] [CrossRef]

- Yirong, Q. Does environmental policy stringency reduce CO2 emissions? Evidence from high-polluted economies. J. Clean. Prod. 2022, 341, 130648. [Google Scholar] [CrossRef]

- Hou, S.; Yu, K.; Fei, R. How does environmental regulation affect carbon productivity? The role of green technology progress and pollution transfer. J. Environ. Manag. 2008, 345, 118587. [Google Scholar] [CrossRef]

- Jiang, Y.; Guo, Y.; Bashir, M.F.; Shahbaz, M. Do renewable energy, environmental regulations and green innovation matter for China’s zero carbon transition: Evidence from green total factor productivity. J. Environ. Manag. 2024, 352, 120030. [Google Scholar] [CrossRef] [PubMed]

- Stergiou, E.; Rigas, N.; Kounetas, K.E. Environmental productivity growth across European industries. Energy Econ. 2023, 123, 106707. [Google Scholar] [CrossRef]

- Tang, M.; Cao, A.; Guo, L.; Li, H. Improving agricultural green total factor productivity in China: Do environmental governance and green low-carbon policies matter? Environ. Sci. Pollut. Res. 2023, 30, 52906–52922. [Google Scholar] [CrossRef] [PubMed]

- Yang, S.; Liu, F. Impact of industrial intelligence on green total factor productivity: The indispensability of the environmental system. Ecol. Econ. 2024, 216, 108021. [Google Scholar] [CrossRef]

- Sedova, B. On causes of illegal waste dumping in Slovakia. J. Environ. Plann. Manag. 2016, 59, 1277–1303. [Google Scholar] [CrossRef]

- Vallés-Giménez, J.; Zárate-Marco, A. Industrial waste, green taxes and environmental policies in a regional perspective. Reg. Stud. 2022, 56, 1510–1523. [Google Scholar] [CrossRef]

- Tan, Z.; Wu, Y.; Gu, Y.; Liu, T.; Wang, W.; Liu, X. An overview on implementation of environmental tax and related economic instruments in typical countries. J. Clean. Prod. 2022, 330, 129688. [Google Scholar] [CrossRef]

- Bailey, I.; Rupp, S. Geography and climate policy: A comparative assessment of new environmental policy instruments in the UK and Germany. Geoforum 2005, 36, 387–401. [Google Scholar] [CrossRef]

- Tchórzewska, K.B.; Garcia-Quevedo, J.; Martinez-Ros, E. The heterogeneous effects of environmental taxation on green technologies. Res. Policy 2022, 51, 104541. [Google Scholar] [CrossRef]

- Greene, W. Estimating Econometric Models with Fixed Effects; New York University: New York, NY, USA, 2001. [Google Scholar]

- David, M.; Nimubona, A.D.; Sinclair-Desgagné, B. Emission taxes and the market for abatement goods and services. Resour. Energy Econ. 2011, 33, 179–191. [Google Scholar] [CrossRef]

- Baltagi, B.H. Econometric Analysis of Panel Data; Springer: Berlin/Heidelberg, Germany, 1995; Volume 4, pp. 135–145. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2001. [Google Scholar]

- Hausman, J.A. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Imai, K.; Kim, I.S. On the use of two-way fixed effects regression models for causal inference with panel data. Political Anal. 2021, 29, 405–415. [Google Scholar] [CrossRef]

- Nemerow, N.L. Industrial Waste Treatment: Contemporary Practice and Vision for the Future; Elsevier: Amsterdam, The Netherlands, 2010. [Google Scholar]

- Bartelings, H.; Van Beukering, P.; Kuik, O.; Linderhof, V.; Oosterhuis, F. Effectiveness of Landfill Taxation; U.S. Department of Energy: Washington, DC, USA, 2005.

- Semenova, G. Waste disposal, introduction of waste reform and environmental tax in Russia. E3S Web Conf. 2019, 138, 02012. [Google Scholar] [CrossRef]

- Turner, R.K.; Salmons, R.; Powell, J.; Craighill, A. Green taxes, waste management and political economy. J. Environ. Manag. 1998, 53, 121–136. [Google Scholar] [CrossRef]

- Sofia, D.; Gioiella, F.; Lotrecchiano, N.; Giuliano, A. Mitigation strategies for reducing air pollution. Environ. Sci. Pollut. Res. 2020, 27, 19226–19235. [Google Scholar] [CrossRef] [PubMed]

- Dechezleprêtre, A.; Sato, M. The impacts of environmental regulations on competitiveness. Rev. Environ. Econ. Policy 2017, 11, 181–360. [Google Scholar] [CrossRef]

- Lægreid, O.M.; Povitkina, M. Do political institutions moderate the GDP-CO2 relationship? Ecol. Econ. 2018, 145, 441–450. [Google Scholar] [CrossRef]

| Variable | Description | Type |

|---|---|---|

| Country | The country for which the data observations are recorded | Categorical |

| Year | The year in which the data observations were recorded | Numeric |

| Waste | Total waste (hazardous and non-hazardous) generated by the industrial sector | Continuous |

| EnvTaxR | Revenue generated from environmentally related taxes | Continuous |

| EnInt | Energy intensity level of primary energy consumption relative to gross domestic product | Continuous |

| EnProd | Productivity of energy consumption in terms of economic output | Continuous |

| RD | Gross domestic expenditure on research and development for all sectors as a proportion of GDP | Continuous |

| Pop | Proportion of the population aged 65 years and older | Continuous |

| GDP | Gross domestic product, a measure of the country’s economic performance | Continuous |

| Statistic | Mean | St. Dev. | Min | Max |

|---|---|---|---|---|

| Waste | 183,518 | 493,387 | 312.180 | 2,338,530 |

| HazWaste | 7664 | 19.840 | 2.649 | 107,850 |

| NonHazWaste | 175,864 | 473.923 | 303.826 | 2,512,550 |

| EnvTaxR | 7.159 | 2.258 | 1.000 | 17.000 |

| EnInt | 3.990 | 1.825 | 1.000 | 16.000 |

| EnProd | 6.537 | 3.166 | 1.426 | 24.453 |

| RD | 1.683 | 0.901 | 0.340 | 3.730 |

| Pop | 18.158 | 2.386 | 7.200 | 23.080 |

| GDP | 46,983,827 | 656.099 | 568,315 | 313,137,776.2 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| EnvTaxR | −1.091 *** | −1.087 *** | − 0.948 *** | −0.852 *** |

| (0.187) | (0.186) | (0.185) | (0.179) | |

| EnInt | −0.311 | −0.420 * | −0.524 ** | |

| (0.221) | (0.219) | (0.210) | ||

| EnProd | 0.693 *** | 0.550 ** | −0.530 * | |

| (0.248) | (0.246) | (0.274) | ||

| RD | 0.575 *** | 0.470 *** | ||

| (0.125) | (0.121) | |||

| Pop | 0.054 *** | |||

| (0.022) | ||||

| GDP | 0.778 *** | |||

| (0.101) | ||||

| Country FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Constant | 19.94 *** | 18.95 *** | 18.63 *** | −0.683 |

| (0.417) | (0.832) | (0.822) | (2.551) | |

| Observations | 646 | 646 | 646 | 646 |

| 0.1104 | 0.1344 | 0.1626 | 0.2404 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| EnvTaxR | −1.093 *** | −1.093 *** | −0.946 *** | −0.853 *** |

| (0.186) | (0.185) | (0.184) | (0.178) | |

| EnInt | −0.375 * | −0.489 ** | −0.593 *** | |

| (0.220) | (0.218) | (0.208) | ||

| EnProd | 0.719 *** | 0.568 ** | −0.515 * | |

| (0.247) | (0.245) | (0.272) | ||

| RD | 0.603 *** | 0.496 *** | ||

| (0.125) | (0.120) | |||

| Pop | 0.057 *** | |||

| (0.021) | ||||

| GDP | 0.781 *** | |||

| (0.099) | ||||

| Country FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Constant | 19.93 *** | 18.98 *** | 18.65 *** | −0.783 |

| (0.417) | (0.829) | (0.817) | (2.553) | |

| Observations | 646 | 646 | 646 | 646 |

| 0.1138 | 0.1422 | 0.1732 | 0.2520 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stergiou, E.; Rigas, N.; Ferrara, G.; Mantzari, E.; Kounetas, K. National Environmental Taxes and Industrial Waste in Countries across Europe. Energies 2024, 17, 2411. https://doi.org/10.3390/en17102411

Stergiou E, Rigas N, Ferrara G, Mantzari E, Kounetas K. National Environmental Taxes and Industrial Waste in Countries across Europe. Energies. 2024; 17(10):2411. https://doi.org/10.3390/en17102411

Chicago/Turabian StyleStergiou, Eirini, Nikos Rigas, Giancarlo Ferrara, Eleni Mantzari, and Konstantinos Kounetas. 2024. "National Environmental Taxes and Industrial Waste in Countries across Europe" Energies 17, no. 10: 2411. https://doi.org/10.3390/en17102411

APA StyleStergiou, E., Rigas, N., Ferrara, G., Mantzari, E., & Kounetas, K. (2024). National Environmental Taxes and Industrial Waste in Countries across Europe. Energies, 17(10), 2411. https://doi.org/10.3390/en17102411