Abstract

Flexibility provision for ancillary services and electricity markets has been widely seen as crucial for the future of highly interconnected energy systems with high shares of renewables. Yet, little research has so far addressed (1) how its procurement could be best operationalized and (2) how limited flexible resources can be used more efficiently given the growing system needs. This paper focuses on flexibility services for transmission operators, specifically balancing and redispatch, as well as the intraday market within the context of the European electricity market. To analyze possible services and/or market combinations, we compare three modes of flexibility procurement: (a) sequential, (b) parallel and (c) combined. We evaluate the different modes of procurement options based on eight criteria. We further investigate how the procurement of flexibility, including small-scale technical units, could be organized via a flexibility platform given the most promising implementation setup, and detail the process for “flexibility service provider <> flexibility platform <> market interaction”, taking the multi-use-case logic into account.

1. Introduction

The provision of flexibility for ancillary services and participation in electricity markets holds considerable significance for forthcoming highly interconnected energy systems characterized by substantial renewable energy integration. Yet, little research has so far addressed (1) how its procurement could be best operationalized and (2) how the use of limited flexible resources can be used more efficiently given the growing system needs.

Flexibility service providers (FSPs) and transmission system operators (TSOs) play significant roles in ensuring the efficient operation of modern electricity grids. One key aspect of their collaboration lies in the utilization of flexible resources for multiple services and markets, spanning a multitude of use cases. The introduction of an integrated flexibility bidding process represents a paradigm shift towards optimizing resource allocation and enhancing market liquidity. It is aimed at efficiently providing flexibility services for the transmission system operator across multiple markets, including the balancing market, as well as the redispatch (RD) and intraday (ID) markets. The fundamental idea within this approach is to increase liquidity if flexibility resources are accessible from a single platform for multiple markets and purposes. More specifically, the goals are to maximize the number of eligible providers for flexibility services at the transmission level and increase the eligible volume of flexibility through existing and new FSPs. The aim of boosting liquidity in flexibility markets needs to be weighed against the challenges of addressing specific system requirements and customizing products. Additionally, a standardized flexibility product is inefficient in capturing the unique value of individual flexibility attributes, such as those specific to certain technologies. However, as we demonstrate below, the standardization of flexibility products represents a scale. The tradeoffs between liquidity, system efficiency, ease of participation and implementation effort define the varying degrees of solutions along this spectrum.

There is a wide field of academic research examining the use of flexibility in the energy system. Ref. [1] conducted a comprehensive literature review focusing on market mechanisms and flexibility products. Their analysis delved into various aspects of flexibility, such as product definition, metrics, market design and market agent coordination. Ref. [2] contributed to this field by examining four European pioneering projects that implement flexibility markets, utilizing a questionnaire-based approach. Ref. [3] investigated different topics in the context of local flexibility markets, including coordination challenges and inc-dec gaming. (Inc-dec gaming is a strategy that takes advantage of the disparity between the zonal electricity market price and the local value—and thus, the remuneration—of a redispatch action. If the local value is anticipated to be higher than the zonal price, a market participant is incentivized to lower their offer in the day-ahead market to increase it for redispatch, thereby securing a higher profit, and vice versa [4].) Ref. [5] analyzed different market models by comparing their description, market structure, market timing and implementation. The MERLIN project analyzed different market designs for flexibility services, focusing on identifying how network operators are using flexibility services when dealing with grid management issues. Among other things, they find that distinctive rules on market design in terms of types of service are required [6]. Another study that focuses on the procurement of Flexibility Services within the Distribution System by reviewing international projects is Ref. [7].

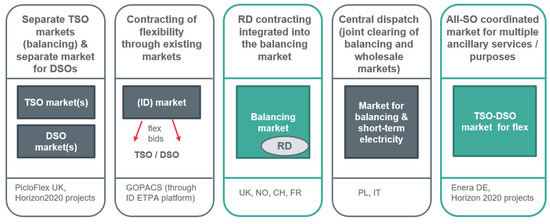

However, only a limited number of studies, primarily from applied research projects involving prototype implementation, offer economically focused market design with comprehensive descriptions of products and trading mechanisms. The mentioned research projects explored various methodologies for leveraging the same resource across multiple products or services. To provide a comprehensive overview of various projects and approaches, Figure 1 shows prevalent options used in different countries or demonstrated through diverse platforms that include TSO services and markets as well as distribution grid approaches. Separate markets for transmission system operators (TSOs) and distribution system operators (DSOs) have already been implemented in the UK (supporting four DSOs and one TSO), Ireland, Italy, Portugal, Lithuania and New York using the platform PicloFlex [8]. Other implementation proposals for separate TSO and DSO markets have been made in a few European Horizon 2020 projects, such as Integrid [9] and InterFlex [10,11]. An option for contracting flexibility using the existing markets is used by TenneT Netherlands. The Dutch TSO covers some of its redispatch (RD) demand through the national intraday (ID) market platform ETPA. The TSO as well as several DSOs use ID bids for intraday redispatch paying the bid–ask spread for the service (project GOPACS [12]). Several European countries, such as France, Switzerland, Norway and the UK, contract RD through their balancing markets. In countries with central dispatch, e.g., Italy and Poland, balancing and short-term markets are cleared jointly. Finally, flexibility can be procured jointly in a coordinated fashion by TSOs and DSOs for several services. Such concepts have been explored in the SINTEG region platform Enera [13] as well as in Horizon 2020 projects, such as CoordiNet [14] and INTERRFACE [15].

Figure 1.

Existing options for contracting flexibility. At the bottom of each option, examples of where the practice is used are provided. The options that were deemed the focus of this study are marked in teal.

To summarize, beyond these few research projects, there are no full-fledged “universal-flex” markets in Europe, whereas multi-use bids are already used in some countries for several balancing products (Finland) or for balancing and redispatch (Switzerland and France). Combined auctions are also used for the dynamic distribution of balancing capacity requirements between two products (cf. Switzerland).

Ref. [16] states that standardized products allow for more transparent competition between FSPs due to the creation of a merit order list (MOL) of bids, enabling buyers to select the most cost-efficient bid. We build upon their work by analyzing the potential for standardizing heterogeneous flexibility products and markets, as well as exploring possible approaches to achieving this standardization.

Following the approach of [17], we consider three main fields in our analysis: technical aspects, economic aspects and the legal environment. In Section 3.1, we provide an overview of the existing practices of different countries and present the lessons learned and best practices. Based on a conceptual discussion over possible organizational models for flexibility markets, including market design as well as product design aspects, including market timings and remuneration schemes (Section 3.2, Section 3.3 and Section 3.4), we investigate how the procurement of flexibility, including small-scale technical units, could be organized via a flexibility platform given the most promising implementation setup (Section 3.5). Furthermore, we detail the process for the “FSP <> flexibility platform <> market interaction”. Finally, we discuss the needed platform functionalities in the context of existing coupled wholesale electricity markets, international balancing platforms, and established national processes using the example of Austria (Section 4).

2. Materials and Methods

This qualitative analysis of the possibilities for the use of flexibility for multiple services was systemically conducted through six sequential steps:

- Examination of regulatory framework and the existing practices of different countries: This initial step involved examining the regulatory framework governing flexibility markets and studying existing practices across different countries. It provided a foundational understanding of the legal and regulatory landscape surrounding flexibility utilization.

- Organizational model analysis: Building upon the regulatory analysis, this step focused on exploring various organizational models for flexibility markets. Factors such as responsibilities for bid allocation and pricing mechanisms were considered in this phase to understand how different organizational structures impact the implementation of multi-use flexibility.

- Analysis of specific market combinations: In this stage, specific combinations of flexibility markets were analyzed to identify potential synergies and challenges associated with integrating flexibility across multiple services.

- Integration of technical requirements: For each identified organizational model and market combination, in this step, we explored how technical aspects, such as prequalification requirements or locational information, could be integrated to facilitate seamless utilization flexibility across multiple services.

- Integration of product requirements: Similarly, this stage focused on integrating product requirements, such as pricing rules, to enable the multi-use of flexibility within each identified model.

We start with an overview of details and main lessons learned from relevant practices in different countries for contracting different flexibility products and the current regulatory framework.

To further analyze possible services and/or market combinations, we compare three organizational models of procurement: (a) sequential, (b) parallel and (c) combined. We evaluate the different use-case and mode-of-procurement options, extending the work from [5], based on eight criteria: timings, TSO and FSP perspective, potential for product harmonization, potential for technical harmonization, effect on liquidity, effect on gaming and complexity of integration. In addition, we consider other crucial design questions, such as implications for portfolio bidding and pricing rules and whether the different services from the same flexible resource may be offered at different bid prices. Thereby we analyze the combinations between two but also more markets, including balancing, RD and ID market bids. For the analysis of specific market combinations, we take the approach of analyzing the different attributes of flexibility. Therefore, we introduce different dimensions of flexibility:

- Technical dimension—This refers to the technical attributes of flexibility, i.e., the type of flexibility, mode of activation, prequalification, preparation and ramping period, full activation time, and locational information.

- Trading dimension—This includes attributes such as timing, product rules and auction/procurement rules.

Based on this analysis, we introduce a fourth possibility of market organization: the hybrid approach. This approach is further analyzed in Section 3.4 and Section 3.5, where we detail the process for “FSP <> flexibility platform <> market interaction”.

3. Results

3.1. Regulatory Framework

The options for the multi-use of flexibility differ not only from an organizational point of view but also from the applicable regulation. Therefore, it is key to consider European Union (EU) regulations in light of recent developments concerning international product standardization, particularly with the implementation of the European balancing platforms MARI and PICASSO, along with their accompanying harmonization processes. In this section, a short overview of relevant practices in different countries for contracting different flexibility products, as well as a summary of the most important EU regulations and their implications on this research, are given. Note that the goal of this section is not to provide a detailed description of the current practices in other countries but to identify additional aspects to be considered in the analysis or best practices concerning procedures and main operational principles.

3.1.1. Existing Practices in Different Countries

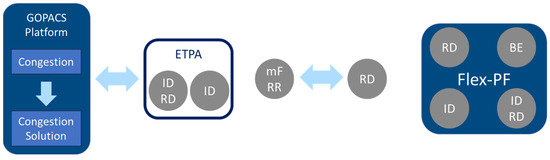

TenneT Netherlands uses an option for contracting flexibility using the existing markets. TenneT covers some of its needs for redispatch (RD) through the national intraday (ID) market platform, ETPA. The transmission system operator (TSO) as well as several distribution system operators (DSOs) use the ID bids for intraday redispatch (ID RD) for paying the bid–ask spread for the service (project GOPACS [12]). Furthermore, several European countries, such as France, Switzerland, Norway and the United Kingdom, contract RD through their balancing markets. In Spain, RD is procured in a market-based way where the TSO uses RD to prevent network congestion as well as voltage control issues. Furthermore, RD can be utilized to provide capacity reserves if the TSO determines that there are insufficient balancing energy resources in the system [18]. Regarding balancing products, in Finland, a product that combines Fast Frequency Reserves (FFRs) and Frequency Containment Reserves (FCRs) is in use.

The survey of the existing practices of different countries showed that beyond a handful of research projects, there are no full-fledged “universal-flex” markets in Europe, meaning that the flexibility is entirely handled in one single market, whereas the flexible resource can be deployed for multiple use cases. Multi-use-case bids are already used in a number of countries for several balancing products or for balancing and redispatch. Yet, none of the existing practices of different countries strive for the comprehensive inclusion of all flexibility use cases or use a dedicated flexibility platform like the one proposed in this paper for this purpose. For a comparison of the existing and proposed options, see Figure 2.

Figure 2.

On the left side, the GOPACS solution is depicted. Here, accordingly, flagged ID bids can be used for ID RD. The use of balancing bids (in this case, mFRR used in Switzerland) for RD is illustrated in the middle. The comprehensive inclusion of all flexibility use cases as proposed in this paper is shown on the right.

3.1.2. Use of Balancing Energy Bids for Congestion Management

Based on the ACER Decision 16-2020, there are two main activation purposes for balancing energy bids: (1) balancing and (2) system constraints, the latter of which includes congestion management [19].

Additionally, the ACER Decision on the activation purposes of balancing energy bids permits the use of mFRR bids—but not of aFRR bids—for addressing system constraints [19].

According to Art. 29, the Electricity Balancing Guideline (EBGL), TSOs are required to forward all submitted balancing energy (BE) bids to the platforms unless they apply for an exception under Art. 29 (10). This exception can be invoked if the gate closure time (GCT) of the local ID market takes place after the GCT of the cross-border platforms [20].

Furthermore, according to EBGL Art. 29 (10), “The minimum volume of bids submitted by the TSO shall be equal to or higher than the sum of the reserve capacity requirements for its LFC block according to Articles 157 and 160 of Regulation (EU) 2017/1485 and the obligations arising from the exchange of balancing capacity or sharing of reserves” [20,21]. This means for both aFRR and mFRR that only the volume beyond “the sum of the reserve capacity requirements for its LFC [load-frequency control] block” can be used for redispatch.

3.1.3. Implications of Framework Guideline on Demand Response

In June 2022, based on Art 59 of the Electricity Regulation, ACER published a draft Framework Guideline on Demand Response (FG DR) for consultation and presented the finalized version to the European Commission in December 2022. This guideline includes new rules regarding demand response, aggregation principles, prequalification processes, baseline definition, demand curtailment and storage. ENTSO-E is currently reviewing the FG DR proposed by ACER, and some parts are still subject to change.

The FG DR aims to provide product and pricing rules for congestion management (CM) and voltage control (VC), similar to the EBGL for balancing. Regarding market design for congestion management, the rules will cover variables such as “structure, number and clearing of market sessions, gate closure times (where relevant), products procured”, which system operators must observe when designing national markets for congestion management [22].

Additionally, the new rules aim at simplifying and harmonizing the prequalification process for balancing, congestion management and voltage control. They differentiate between ex ante prequalification, primarily for standard balancing products, and ex post validation for non-standard products, as well as for CM and VC.

Another significant point is that local flexibility markets will be regulated for the first time: DSOs will not be excluded from operating “local system operator (SO) markets” (CM and VC). These markets can also be operated by third parties; the forwarding of local bids by a third-party operator to wholesale markets may be allowed at the national level and would require the consent of the FSP.

The FG DR also emphasizes the importance of interoperability, aiming to facilitate the participation of FSPs in various markets. This includes the provision of a single flexibility register/SO system provision tool, which is relevant for the preparation phase. Additionally, all SOs are expected to maintain a table of equivalences (ToE). The FG DR suggests new rules to establish a ToE for products that require prequalification. In this regard, TSOs and DSOs should collaborate to create a common list of comparable attributes for all products. However, it is important to note that the intention of the FG DR is not to enforce identical rules across different national products. Instead, it aims to streamline various processes and critically evaluate whether certain requirements are still necessary.

3.2. Organizational Models and Possible Applications

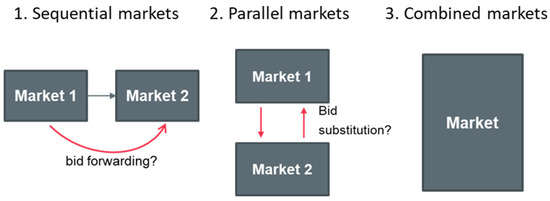

There are a number of options for using the same resource for different products or services. Possible market organization options, considering the multi-use-case logic and irrespective of the specific products, include the following:

- Sequential markets;

- Parallel procurement;

- Combined markets for two (or more) products.

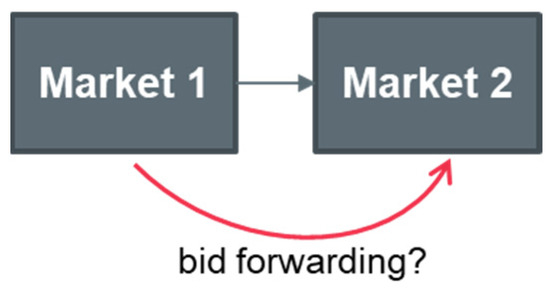

3.2.1. Sequential Markets

This model implies that the GCTs of the two markets are not the same and neither are the respective merit orders. In order to optimize the use of available flexibility, the model may include a bid-forwarding mechanism (see Figure 3): this enables the TSO to forward bids not awarded in the first market to the next market, provided the FSP is prequalified for both products.

Figure 3.

Schematic overview of sequential markets.

The main benefit of bid forwarding for the FSP is that this would allow them to participate in several markets with the same flexible resource(s). On the TSO side, if bid forwarding is allowed, it would help grid operators use the available flexibility more cost-efficiently; less flexibility would need to be procured in the subsequent market(s). In order to minimize the amount of unused flexibility, it could be complemented by the timely release of flexibility not awarded in one market that can be submitted to a subsequent market(s) at the FSP’s discretion.

In cases of bid release, the sequence of marketplaces matters, as it is not only the market design itself but also the availability of other commercialization options that affect bidders’ strategies. The sequence of the markets alters bidders’ decisions. The more market options follow after a given market’s GCT (on the condition that unawarded bids are released in time), the more opportunity costs an FSP will have to factor in. Opportunity costs are, in turn, affected by such factors as the expected price levels in each market and the probability of being awarded/activated.

If explicit bid forwarding is used, unallocated flexibility bids can be forwarded to other markets of an FSP’s choice by the TSO. This would simplify decision-making for the FSPs and lower their transaction costs. Ideally, an FSP would participate in the market that is (expected) to offer the highest expected revenue, considering the expected prices and activation probabilities for the different products.

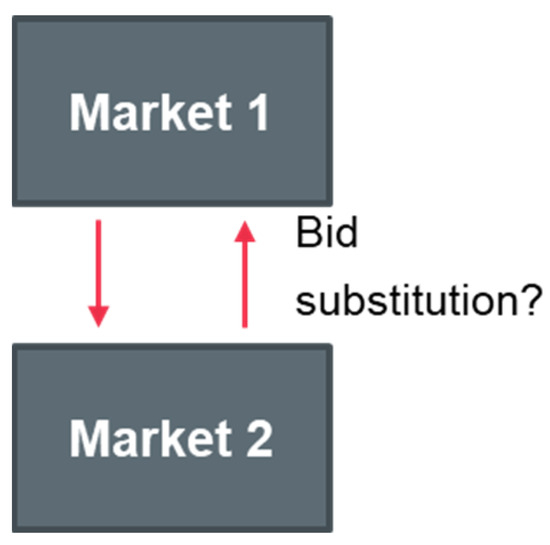

3.2.2. Parallel Procurement

A parallel procurement model would imply that the GCT of the two markets is the same (see Figure 4). Thus, FSPs need to make a simultaneous decision about the amount and price of flexibility bids in each market, unless some kind of explicit bid-linking mechanism is introduced, if the same (or partially the same) flexible resources are used.

Figure 4.

Schematic overview of parallel markets.

If two parallel markets are completely independent of each other, i.e., the flexibility resources behind the bids are not the same and neither are the merit orders, such an arrangement would likely result in a reduction in efficiency. The effect would likely be reduced liquidity in the markets involved, especially if the same assets participate (and are prequalified). Another drawback of two parallel but independent markets is the cannibalization of flexibility through ‘tying’ resources to different markets.

The more resources can provide several services, the bigger role the possibility of linking bids plays. Available flexibility resources could be used more efficiently by using bid substitution, that is, the same bid may be used for either service, implying a type of exclusive (exclusively linked, XOR) bid.

3.2.3. Combined Markets

A combined market for several services implies that there is only one GCT and the flexibility potential is entirely handled in one single market, whereas the flexible resource can be deployed for multiple use cases. (see Figure 5). In cases of such a universal flexibility product, the TSO has total decision-making authority as to what purpose the flexible resource is used for. This implies that the bid points to the same flexible resource and, ergo, can only have one price. This approach arguably simplifies the procedure for the TSO that conducts single co-optimization (or, if needed, several). It also simplifies decision-making for the FSPs that need to make only one trading decision, which could be favored, especially by smaller or less experienced FSPs. In the universal-flex product model, the products would have to be fully harmonized. On the downside, this could lead to either a large volume of excluded flexibility potential if the requirements converge to the “highest common denominator”, or a decrease in product quality if the requirements are lowered.

Figure 5.

Schematic overview of a combined market.

In the following, we outline possible combinations of redispatch procurement with other markets as compared to the status quo. In terms of wholesale electricity markets, we focus on the option of combining redispatch and the IDM.

Isolated markets and products

The current landscape comprises disparate markets operating in distinct, and sometimes overlapping, temporal frameworks.

From the TSO’s perspective, separate markets for congestion management and balancing offer the benefit of delineating the costs associated with each service. This facilitates a more accurate indication for future investments in transmission systems. However, some authors have concerns that, for example, using balancing bids for redispatch may introduce complications, potentially disrupting the calculation of imbalance prices [4].

Moreover, the use of individualized products allows for flexibility in adjusting product or technical requirements independently, without necessitating coordination or considering potential repercussions for other products. In particular, when striving to harmonize flexibility products, it is essential to recognize that identifying a standardized product as a “one-fits-all” or “one-fits-everything” solution, encompassing aspects like aggregation, bid size, lead time, etc., can be extremely difficult [16]. Moreover, individualized products offer the benefit of facilitating localized product design (for instance, also on the DSO level). This could lower entry barriers for small local market parties or aggregators.

An alternative would be the above-mentioned introduction of linking concepts between bids for different products, as will be discussed in more detail in the subsequent sections.

Balancing Capacity and Redispatch

From the TSO’s perspective, integrating the balancing capacity market with the RD market offers the advantage of ensuring short-term liquidity and securing a predetermined level of flexibility that can be accessed in advance. Additionally, insights from projects such as I4RD highlight a significant issue, particularly for smaller demand-response assets. If cost-based remuneration for redispatch is insufficient for flexibility service providers (FSPs) to cover their fixed costs, it creates a lack of investment incentives [23]. One potential solution to this issue would be to include capacity remuneration for redispatch. However, a notable drawback is that this would not only incur additional costs for the TSO in the form of reservation payments for redispatch, but also reduce liquidity in short-term electricity markets [24].

If the combination of the balancing capacity market and RD market was the sole avenue for providing flexibility for RD, the provision of short-term flexibility would become impossible. To address this challenge, voluntary bids would need to be allowed in the RD market as well, albeit this would increase the complexity of the overall system [24].

One potential strategy for minimizing costs associated with an RD capacity market could involve contracting providers for specific “service windows” during periods of typically high demand for the relevant flexibility service (e.g., winter evenings), thereby reducing reservation costs.

However, in general, a combined approach may not be advisable due to the largely independent nature of the amount that needs to be reserved for each product. Consequently, the co-optimization potential between the two is likely to be negligible. Nevertheless, there are two potential synergies between the balancing capacity market and the provision of redispatch:

- Bids that are not awarded in the balancing capacity market can be forwarded to the RD mechanism/market, provided they were submitted with locational information [24].

- “Constrained awarding of balancing capacity” involves selecting BC bids while considering the expected congestion and its location, thereby favoring the reservation of bids in areas expected to experience congestion [25].

Balancing Energy and Redispatch

Main benefit of allowing the FSP to submit the same flexibility bid for redispatch and the balancing energy market would be that entry into more than one market would be simplified, which would lower the barriers for participation, and therefore, an increase in liquidity in both markets could be achieved more easily. Moreover, it would be possible for the FSP to offer short-term flexibility, which is particularly important for smaller operators and resources with a shorter planning/forecast horizon. Such a combination would also likely require either a certain degree of product harmonization or the introduction of linking concepts between bids, thus further simplifying decision-making for the FSP.

On the flipside, in the case of product harmonization, an approach combining flexibility in the short term has lower plannability that comes hand in hand with a market that is as close to real time as the balancing energy market.

For the TSO, combining redispatch and the balancing energy market would ideally lead to more liquidity in a market close to real time. Uncertainties concerning market-influenced factors are significantly reduced after clearing of the day-ahead auction, which implies that a realistic estimate of expected congestion is available for such a combination.

An important benefit to consider is the lower gaming potential of redispatch providers that comes with the combination of balancing energy markets and redispatch. The FSP does not know or cannot reliably estimate in advance which services they will be activated for. This makes it de facto impossible for them to pursue an inc-dec gaming strategy, a common concern related to redispatch markets. Especially for smaller assets, which at the moment are not obliged to send their schedules in advance, the discussion of schedules, baselines and verification of the flexibility provision would be simplified, as the FSP would not know the activation purpose in advance.

The main challenge that arises from the TSO’s perspective is that if most FSPs bid closer to real time, it will become impossible to secure sufficient bids for remedial action optimization, and the risk of not obtaining a high enough volume of flexibility for congestion management is likely to be high. Therefore, other options that combine redispatch and balancing through bid linking rather than a full-fledged combined market are considered as alternatives in Section 3.5.

Intraday and Redispatch

When it comes to IDM, a relevant point is the distinction between the two existing exchange-based market forms: auction-based (discrete auctions) and continuous IDMs. In continuous trading, a ‘limit order book’-based platform is used. Here, market participants have the ability to submit their bids, which are continuously matched throughout the period between the IDM opening and minutes before the delivery time. A trade occurs when the bid price is equal to or higher than the asking price. This implies a specific price for each trade, whereas in a discrete auction, there are unique market clearing prices and set GCTs.

The two options that will be considered in the analysis below are as follows:

- Flexibility bids → IDM: releasing non-awarded flexibility bids from the flexibility platform to the IDM. In principle, the flexibility platform can also be used by (smaller) market participants as a conduit to the IDM, even if they are not providing any ancillary services.

- IDM → redispatch: running redispatch procurement and the continuous IDM in parallel with the help of rolling optimization in order to cover the remaining need for ID redispatch.

Note that for Option 2, it is unrealistic to assume that the TSO would be able to cover most of their redispatch demand in the intraday timeframe due to the proximity to real time. Nevertheless, it might be possible to use bids from the IDM for ID RD to cover the remaining need for redispatch when there are only a few options to account for in the optimization process. This would, however, require the FSPs to provide bids suitable for IDM and RD through the flexibility platform and include locational information with their bids (for instance, in the GOPACS concept in the Netherlands, the TSO actively trades in the continuous ETPA market, and the ID bids fulfill the standards for redispatch provision under the condition that additional geographical information is provided).

3.3. Integration of Technical Requirements and Product Requirements

The general assumption is that prequalification requirements, especially for balancing products, will not be less strict in the future. In this case, three scenarios are possible:

- The FSP’s resource can fulfill the requirements/is prequalified for several products;

- The FSP’s resource can fulfill the technical requirements/is prequalified for only one product;

- The FSP’s resources can be aggregated in different pools depending on the product, and the respective pools fulfill the requirements/are prequalified for those products.

Option 1 implies the possibility of providing every service that the FSP’s assets are prequalified for. It would be a welcome process simplification on the FSP’s side if an asset that is already prequalified for a “more valuable” (i.e., more technically challenging) product would not require a separate prequalification for other products that are technically easier to deliver. It might be challenging, however, to define “value”, as for different flexibility services, the most valuable product requirements may differ (fastest reaction, duration, etc.). Moreover, how challenging it is to provide a service is also technology-dependent. One approach to evaluating the compatibility of a given resource or pool of resources with a given product is with the help of a table of equivalences, as has been proposed in the Draft Framework Guideline on Demand Response [22].

In general, it seems crucial for all organizational models not to exclude valuable flexibility from the markets if it is not able to provide all the services from Option 2. That is, it is important to give FSPs a choice to provide their flexibility at the beginning of the process chain or submit a bid to any specific market alone—with or without the intermediation of the flexibility platform.

Finally, Option 3 refers to the possibility of offering pool solutions, where an FSP operates certain assets that they can combine in more than one way. It would be possible, dependent on the respective composition of the pool, for different technical requirements to be fulfilled. Such a solution would require an exclusive-linking concept to allow the FSP to offer more than one flexibility service. Using this approach, it would still be necessary to prequalify each pool for the respective product separately, unless the process is simplified, as proposed in Option 1.

Furthermore, it needs to be mentioned that congestion management does not necessarily compete with balancing market resources. Indeed, actions such as raising demand behind a constraint to absorb excess renewables do not impact the ability of resources behind the constraint to contribute to market balancing issues. However, it is important to note that due to the significant differences in technical and product requirements, most resources involved in RD are, for now, not prequalified to provide balancing services.

A crucial point for the combination of redispatch procurement with other markets is that for each analyzed organizational model, only those bids that contain locational information could be forwarded/substituted to be used for (ID) RD. As stated earlier, this would require bids to be submitted through the flexibility platform so that locational information is not lost.

Product standardization could be performed either on a product level or an attribute level. Option 1 would mean that the FSP “packages” flexibility to match the product requirements (current approach). Option 2 would need the FSP to provide parameters/attributes (location, profile, time, …), and the platform performs the “packaging” or matches the attributes to the TSO (or DSO) requirements, or the platform builds a flexibility catalog in which the those with specific needs can filter by relevant parameters (see, e.g., NODES markets) → ad hoc specific flexibility service. Currently, it is not intended to implement Option 2; we therefore focus on Option 1 in the following analysis and discussion.

3.4. Hybrid Approach

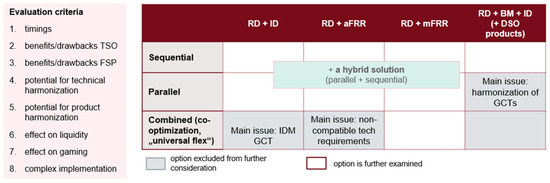

Considering the possible organizational models and market combinations, we analyzed twelve different combinations of organizational models (sequential, parallel and combined—see Figure 6), and flexibility products (ID + RD, RD + aFRR, RD + mFRR and RD + BE + ID) based on eight evaluation criteria, which are summarized in Figure 7. The lessons learned from the analyzed option space are summarized in Table 1.

Figure 6.

Analyzed organizational models.

Figure 7.

Analyzed option space. Based on eight evaluation criteria, three different organizational models and four different product combinations were analyzed.

Table 1.

Overview of analysis of eight evaluation criteria for the different organizational models proposed. As the hybrid approach is a combination of sequential and parallel approachs, no separate consideration is introduced.

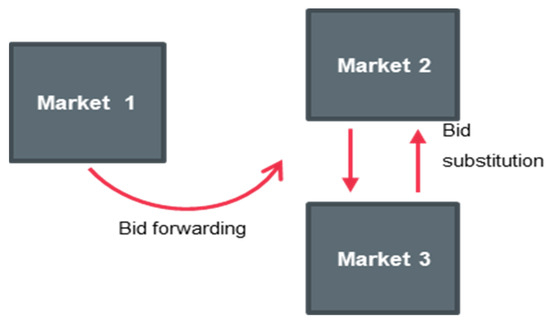

In the course of the analysis of the organizational models, a fourth possibility of market organization emerged. The hybrid model is composed of a combination of sequential and parallel markets (see Figure 8). Concerning GCTs, this means that the GCTs of the preceding market(s) can differ (sequential), whereas the GCTs of the final markets (which corresponds to closest ones to real time) are the same. There is no restriction on gate opening times (GOTs), but they may still differ.

Figure 8.

Schematic overview of hybrid market model.

The analysis showed that in the short to medium term, the sequential procurement of D-1 RD and BE with fixed GCTs would be most realistic since, due to the structure of the current processes, these timing structures are most easily reconciled with a sequential market model. From the FSP’s perspective, sequential markets allow at least for partial use of the same flexibility resources for several use cases. In addition, we expect an increase in liquidity in markets with a later GCT. Furthermore, the gaming potential is likely to be reduced, as the FSP would not know its activation purpose in advance and the forwarding increases demand fluctuation in the subsequent market(s), making gaming more risky. In addition to the sequential procurement of D-1 RD and balancing energy, the introduction of a parallel ID market and intraday RD (ID RD) could potentially provide an additional avenue for the TSO to procure (remaining) redispatch in a shorter timeframe. At the same time, this hybrid approach would allow the TSO to forward unused bids submitted through the flexibility platform to the ID market. This solution has the potential to increase liquidity for ID RD as well as in the ID market.

3.5. Hybrid Platform-Based Procurement of Flexibility

A possible practical application for the hybrid approach could be the sequential procurement of D-1 redispatch and balancing energy with fixed GCTs followed by parallel ID and ID RD markets. This approach would allow for using ID bids for ID RD needs as a complement to D-1 redispatch. In doing so, one would have to block flexibility bids on the IDM (cancel offers) and call them back for RD optimization. Contrarily, bids not needed for RD could be sent back to the ID market, which could be carried out in several optimization rounds. A central role in the process would be played by the flexibility platform. The platform functions as a data-exchange platform to which FSPs send their (flexibility) bids (depending on the operational model: redispatch, aFRR/mFRR markets(s), IDM) and receive market updates (as well as activation signals). Furthermore, it handles locational information, which is referenced to the original bid with a corresponding bid ID and is stored throughout the process chain.

In this process, three actors are represented:

- FSPs: a party that offers their flexibility in the form of bids.

- Flexibility platform: a data-exchange platform to which FSPs send their (flexibility) bids (depending on the operational model: redispatch, aFRR/mFRR markets(s), IDM) and receive market updates (as well as activation signals).

- Market/TSO process: the tasks conducted by the TSO, TSCNET and power exchanges are represented along the same process axis.

In order to ensure the possibility of multiple feedback loops between the platform and the TSO/power exchange, any bid submitted to the platform at any stage in the process would need to be assigned an immutable bid ID, including all bid properties that are stored on the platform throughout the process chain.

3.5.1. Assumptions

The following assumptions were made in order to ensure that the process is as realistic as possible and therefore immediately applicable in practice:

- The FSP prequalifies its assets for the respective service and aggregates them in such a way that the minimal bid requirements are met; the technical-unit level is left out.

- The platform serves as a communication platform between the FSPs, the TSOs (and potentially DSOs) and the markets.

- Optimization processes for the ancillary services are carried out at the TSO level and not on the platform.

- The main volume of redispatch is procured (D-1).

- It is possible for the FSP to add expiry dates depending on the filtering process.

- An ID RD product is considered to cover the remaining RD demand in the intraday timeframe and requires shorter optimization times as fewer options are available.

- FSPs that are prequalified for only one market are not excluded from the process but can submit bids in a regular fashion before the market’s GCT.

- Intermediation of the flexibility platform is voluntary; if an FSP is only prequalified for one flexibility service and does not have an interface to the platform, it is still possible to submit the bids directly to the TSO/the power exchange.

- The verification process remains at the TSO and not at the platform level.

- The procurement of balancing capacity (or any form of capacity reservation for redispatch) is not considered in the process diagrams.

- No activation of redispatch is foreseen after the GCT of balancing energy markets.

In order to implement a bid-forwarding concept in accordance with EU regulations, a capacity management mechanism would be required. Based on the requirements set out for the EBGL (e.g., EB GL Art 29(14): “Each TSO may declare the balancing energy bids submitted to the activation optimisation function unavailable for the activation by other TSOs because they are restricted due to internal congestion or due to operational security constraints within the connecting TSO scheduling area.”), the introduction of a capacity management mechanism4 would be necessary to allow for balancing bids to be used for RD. That is, a pre-filtering process is needed in order for the TSO to retain balancing energy bids and use them for congestion management. (A capacity management or a filtering process is necessary for the TSO to mitigate potential issues on the lower distribution grid level, where some of the flexible resources are expected to be connected. However, due to their highly complex nature, this process and TSO-DSO coordination are beyond the scope of this paper.) [26]. As pointed out, following the draft FG on DR, the TSO may recur to intraday or balancing bids for CM, subject to the NRA’s approval.

For sequential markets, it is assumed that explicit bid forwarding is used. This implies the following:

- FSPs can choose the markets in which they would like to participate at the beginning of the process chain.

- Once notified of the results of the preceding market, FSPs are given the option to update their bids for the subsequent markets at a later stage (updating bid information or removing them from the process chain altogether).

Furthermore, the following regulatory/market design constraints have been considered in the process diagrams:

- Cross-border balancing platforms, PICASSO and MARI:

- Timings of the platforms must be met [27].

- According to the Austrian terms and conditions for BSPs, the awarded volume in balancing energy (BE) auctions corresponds at least to the dimensioned and awarded volume of the balancing capacity. All awarded aFRR BE bids are forwarded to MARI or PICASSO. In accordance with Art. 29 of the EBGL, TSOs are mandated to forward all submitted BE bids to the platforms, unless they request an exception under Art. 29(10) in cases where the GCT of the local intraday (ID) market occurs after the GCT of the cross-border platforms. APG is currently applying this exception to facilitate the utilization of non-awarded bids in the subsequent IDM.

- Art. 29 of the EBGL further requires the TSOs to forward the cheapest BE bids to the platforms.

- Cross-border remedial action optimization (RAO): the timing of RAO, as is stipulated in the Core Regional Operational Security (ROSC) Methodology, must be observed:

- SoMa 3 specifies that schedule updates after D-1 GCT are to be carried out until 14:30.

- The TSO grid security analysis then starts after 14:30.

- The compilation of TSO data for grid security analysis starts at 16:00.

- The requirements from the System Operation (SO) Regulation and Core ROSC Methodology require the coordination of redispatch calculation among TSOs. Its implementation is expected by 2025 and currently requires the provision of redispatch potential by the TSOs shortly before 18:00.

- The joint security analysis at TSCNET starts no sooner than 18:30.

- The redispatch calculation results are expected no sooner than 22:00.

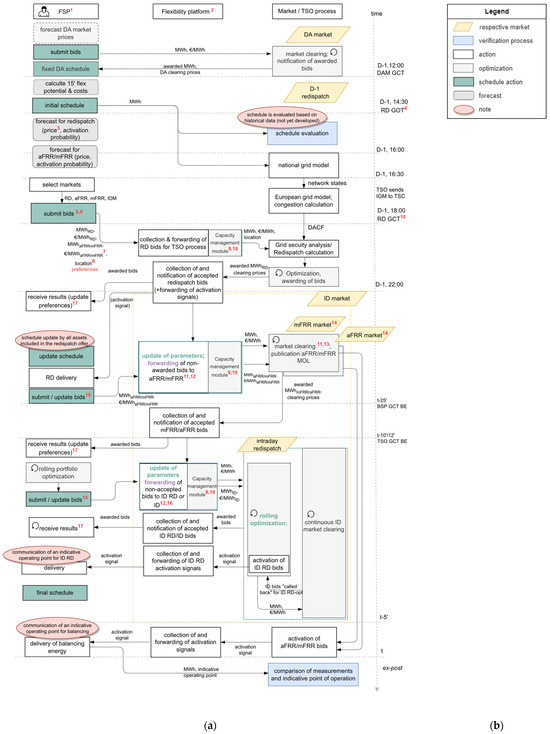

3.5.2. Process

The full process is depicted in Figure 9.

Figure 9.

(a) Detailed process overview (b) Legend.

DA market

Starting with the DA market, the FSPs submit their bids directly to the power exchange. There is no platform involvement foreseen in the DA market process.

D-1 redispatch

Then, starting from 14:30 D-1, based on a forecast of its 15′ flexibility potential and costs (unless the remuneration is cost-based), the FSP selects the market(s) (RD, aFRR, mFRR, IDM) in which it wishes to participate. For the selected markets, the FSP submits the bids (MWh, EUR/MWh, opt.: location) to the platform by 18:00 D-1. Note that there is no set GCT for RD in Austria at the moment. The GCT is therefore proposed based on the current TSO processes within the regional operational security coordination.

Depending on the prerequisites for the bid submission process, bid expiry dates may be considered. Assuming the forwarding of bids, it is necessary to submit RD and BE at the same time. At a later point, the FSP should still have the possibility to update the bids before each specific GCT. The results from the grid security analysis are expected no sooner than 22:00 D-1.

Balancing energy markets

For the balancing markets, starting from 09:30 D-1 (aFRR) and 10:00 D-1 (mFRR), additional aFRR/mFRR energy bids (MWh, EUR/MWh) can be submitted either through the platform or directly to the TSO (if there is no interface between the platform and the FSP). The FSP could technically update earlier submitted bids or remove them up until t-23′ (GCT BE). Bids would need to be submitted to the flexibility platform 1–2 min ahead of the GCT of MARI/PICASSO (t-25′) for data transmission purposes. At the platform level, the remaining non-accepted RD bids that are marked for forwarding to the respective balancing market are updated (the locational information is removed) and passed on to the TSO. The TSO then forwards the bids to the European balancing platforms, and the FSPs are notified about their awarded bids via the flexibility platform.

IDM and ID RD

The balancing market is then followed by the parallel ID and ID RD markets. Based on rolling portfolio optimization, the FSP can submit additional ID and ID RD bids (MWh, EUR/MWh, location) through the platform. On the platform level, non-accepted D-1 RD bids that are marked as usable for the ID market by the FSPs are forwarded to the ID market. For ID RD, rolling optimization is carried out on the TSO level. An ID bid can be “called back” for ID RD optimization and matched with the bid’s original locational information based on its universal bid ID. Another option for preserving locational information would be by introducing mutually exclusive bids. It is important to note that only those bids that contained locational information when they first entered the market can be used for ID RD purposes. The ID RD process ends at t-25′ (BE GCT). As soon as a bid is accepted, the respective FSP is notified about the change in the bid status.

Real time

At time t, the TSO activates the balancing bids by sending an activation signal via the platform to the FSP.

Notes

- The technical-unit level is intentionally left out.

- Bid forwarding is assumed in this model.

- A price forecast is performed unless remuneration is cost-based.

- The GOT and GCT of the redispatch procurement process are line with the Austrian research project Industry4Redispatch.

- Assuming the forwarding of bids, the redispatch and balancing energy bids need to be submitted to the platform at the same time.

- Only free balancing energy bids can be submitted (no reserved balancing capacity bids).

- Different prices are allowed.

- The level of granularity for locational information is to be defined.

- The exact location and design of the capacity management module is an open design question.

- The passive capacity management of aFRR bids and TSO-DSO capacity management processes are to be defined.

- It is assumed that flexibility from reserved balancing capacity bids and other short-term balancing energy bids are collected on the platform and forwarded to the MARI/PICASSO platforms by the TSO.

- Dependent on the prerequisites for the bid submission process, expiry dates may or may not be considered.

- Bids awarded in the balancing capacity market are included.

- The MARI/PICASSO platforms are not included in the processes as BSPs do not interact with the platforms, while bids are awarded by the TSO and not the platform.

- It is assumed that it is possible to submit additional bids to the market either through the platform or directly to the aFRR/mFRR market/IDM order book (if a participant does not have an interface with the platform).

- Parallelization without information loss could work via exclusively linked “twin” bids.

- Whenever the status of a bid changes (e.g., whether it is awarded in a market or is being forwarded), the FSP is informed.

4. Discussion

The increasing number of flexibility options on the supply and demand side, as well as the changing technology landscape, place increasing demands on system operation, including a growing need for flexibility. To meet this increased demand, this paper analyses different approaches to cross-product integration. Two basic approaches are available to achieve this integration: the linking and forwarding of product-specific bids as well as product harmonization. Our analysis shows that full product harmonization is not absolutely necessary for the multi-use-case logic, as would be required, for example, by the combined markets approach. Rather, our results show that the most promising option, both in terms of practicability and implementation effort, is a combination of sequential RD and BE, complemented by a parallel ID market and the procurement of remaining ID-RD.

Besides market organization and the choice of use cases, other aspects affect the efficiency of the selected process design. The question of whether an FSP is allowed to submit the same bid to different markets with different price information has an impact on their incentives, as would different pricing rules for different services (cost-based, pay-as-bid, marginal). In addition, the approach to linking bids is seen as an important design variable. A middle ground between the same and different resources for different use cases could be the possibility of overlapping flexibility pools. This would mean that some of the technical units in a pool could be used for more than one flexibility service. While this complex structure requires the development of new pre-qualification and verification approaches, it could facilitate the integration of technical and product requirements. The main advantage of such a solution would be more room to maneuver for the FSP when defining the pools and it would allow the TSO not to exclude valuable flexibility from one or the other market just because the pool in its entirety cannot provide a service. At the same time, such a setup would be highly complex in terms of the FSP’s decision-making and from the point of view of optimization on the TSO’s side.

In summary, it seems crucial for all organizational models not to exclude valuable flexibility from the markets if it is not able to provide all the services. This underlines the importance of giving FSPs a free choice to either make their flexibility available at the beginning of the process chain or to position offers on specific markets, in each case independently or with the involvement of the flexibility platform.

This study focuses on the FSP <> platform <> TSO perspective, but most of the proposed approaches could be also applied at the DSO level, including the use of the proposed flexibility platform. In order to consider the interdependencies between DSOs and TSOs, at least two iterations are necessary. In general, if DSOs were to procure flexibility through the platform, stronger locational limitations for the distribution grid would have to be considered in the process extension and a TSO-DSO capacity management approach would be required.

Future work should focus on substantiating the qualitative findings of this study using a quantitative method. For example, an agent-based model could be used to analyze the behavior of the various agents in the markets.

Author Contributions

S.F.: Conceptualization, Methodology, Investigation, Writing—Original Draft, Visualization, Project Administration. K.T.: Conceptualization, Methodology, Writing—Review and Editing, Supervision, Project Administration, Funding Acquisition. M.R.: Conceptualization, Writing—Review and Editing, Funding Acquisition. L.O. and C.W.: Conceptualization, Writing—Review and Editing. All authors have read and agreed to the published version of the manuscript.

Funding

The DigIPlat project received funding in the framework of the joint programming initiative ERA-Net Smart Energy Systems’ focus initiative Digital Transformation for the Energy Transition, with support from the European Union’s Horizon 2020 research and innovation program under grant agreement No 883973.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

Author Sarah Fanta was employed by the AIT Austrian Institute of Technology GmbH. Author Ksenia Tolstrup was employed by the Magnus Energy. Authors Markus Riegler, Lukas Obernosterer and Christina Wirrer were employed by the AIT Austrian Institute of Technology GmbH. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- Villar, J.; Bessa, R.; Matos, M. Flexibility products and markets: Literature review. Electr. Power Syst. Res. 2018, 154, 329–340. [Google Scholar] [CrossRef]

- Schittekatte, T.; Meeus, L. Flexibility markets: Q&A with project pioneers. Util. Policy 2020, 63, 101017. [Google Scholar] [CrossRef]

- Rebenaque, O.; Schmitt, C.; Schumann, K.; Dronne, T.; Roques, F. Success of local flexibility market implementation: A review of current projects. Util. Policy 2023, 80, 101491. [Google Scholar] [CrossRef]

- Poplavskaya, K.; Joos, M.; Krakowski, V.; Knorr, K.; de Vries, L. Redispatch and balancing: Same but different. Links, conflicts and solutions. In Proceedings of the 2020 17th International Conference on the European Energy Market (EEM), Stockholm, Sweden, 16–18 September 2020; pp. 1–6. [Google Scholar]

- Valarezo, O.; Gómez, T.; Chaves-Avila, J.P.; Lind, L.; Correa, M.; Ziegler, D.U.; Escobar, R. Analysis of New Flexibility Market Models in Europe. Energies 2021, 14, 3521. [Google Scholar] [CrossRef]

- Anaya, K.L.; Pollitt, M.G. A Review of International Experience in the Use of Smart Electricity Platforms for the Procurement of Flexibility Services,” University of Cambridge, 2020. Available online: https://project-merlin.co.uk/wp-content/uploads/2020/11/Cambridge-M2-Report.pdf (accessed on 24 May 2024).

- Anaya, K.L.; Pollitt, M.G. How to Procure Flexibility Services within the Electricity Distribution System: Lessons from an International Review of Innovation Projects. Energies 2021, 14, 4475. [Google Scholar] [CrossRef]

- Open Utility Ltd. Company, “Piclo Flex”. Available online: https://picloflex.com/ (accessed on 3 November 2023).

- InteGrid, “InteGrid—Smart Grid Solutions,” InteGrid—Smart Grid Solutions. Available online: https://integrid-h2020.eu/ (accessed on 3 November 2022).

- InterFlex, “Interflex—Home.”. Available online: https://interflex-h2020.com/ (accessed on 3 November 2022).

- Khomami, H.P.; Fonteijn, R.; Geelen, D. Flexibility Market Design for Congestion Management in Smart Distribution Grids: The Dutch Demonstration of the Interflex Project. In Proceedings of the 2020 IEEE PES Innovative Smart Grid Technologies Europe (ISGT-Europe), virtual, 26–28 October 2020; pp. 1191–1195. [Google Scholar]

- GOPACS.eu, “Home,” GOPACS. Available online: https://en.gopacs.eu/ (accessed on 3 November 2022).

- Energy & Meteo Systems GmbH, “Enera: Energy Supply of the Future|Energy & Meteo Systems,” Energy & Meteo Systems. Available online: https://www.energymeteo.com/customers/research_projects/enera.php (accessed on 9 November 2022).

- Madina, C.; Gomez-Arriola, I.; Santos-Mugica, M.; Jimeno, J.; Kessels, K.; Trakas, D.; Chaves, J.P.; Ruwaida, Y. Flexibility markets to procure system services. CoordiNet project. In Proceedings of the 2020 17th International Conference on the European Energy Market (EEM), Stockholm, Sweden, 16–18 September 2020; pp. 1–6. [Google Scholar]

- Mladenov, V.; Chobanov, V.; Seritan, G.C.; Porumb, R.F.; Enache, B.-A.; Vita, V.; Stănculescu, M.; Van, T.V.; Bargiotas, D. A Flexibility Market Platform for Electricity System Operators Using Blockchain Technology. Energies 2022, 15, 539. [Google Scholar] [CrossRef]

- Attar, M.; Repo, S.; Mann, P. Congestion management market design- Approach for the Nordics and Central Europe. Appl. Energy 2022, 313, 118905. [Google Scholar] [CrossRef]

- Heilmann, E.; Klempp, N.; Wetzel, H. Design of regional flexibility markets for electricity: A product classification framework for and application to German pilot projects. Util. Policy 2020, 67, 101133. [Google Scholar] [CrossRef]

- Council of European Energy Regulators asbl, “Redispatching Arrangements in Europe against the Back-Ground of the Clean Energy Package Requirements,” Bruessels. 2021. Available online: https://www.ceer.eu/documents/104400/-/-/7421d0f3-310b-f075-5200-347fb09ed83a (accessed on 3 November 2022).

- ACER, Decision no 16/2020 of the European Union Agency for the cooperation of energy regulators of 15 July 2020 on the Methodology for Classifying the Activation Purposes of Balancing Energy Bids. Available online: https://www.sprk.gov.lv/sites/default/files/editor/ACER%20Decision%2016-2020%20on%20the%20methodology%20for%20classifying%20the%20activation%20purposes%20of%20balancing%20energy%20bids%20(APP).pdf (accessed on 16 August 2022).

- Commission Regulation (EU) 2017/2195 of 23 November 2017 Establishing a Guideline on Electricity Balancing (Text with EEA relevance), Volume 312. 2017. Available online: http://data.europa.eu/eli/reg/2017/2195/oj/eng (accessed on 11 August 2022).

- Commission Regulation (EU) 2017/1485 of 2 August 2017 Establishing a Guideline on Electricity Transmission System Operation (Text with EEA Relevance), Volume 220. 2017. Available online: http://data.europa.eu/eli/reg/2017/1485/oj/eng (accessed on 25 January 2022).

- ACER, PC_2022_E_05—Public Consultation on the Draft Framework Guidelines on Demand Response. 22AD. Available online: https://extranet.acer.europa.eu/Official_documents/Public_consultations/Pages/PC_2022_E_05.aspx (accessed on 14 December 2022).

- NEFI, “Industry4Redispatch,” Industry4Redispatch—NEFI. Available online: https://www.nefi.at/en/project/industry4redispatch/ (accessed on 22 March 2024).

- Tolstrup, K.; Fanta, S.; Zobernig, V.; Riegler, M.; Kumm, J.; Bammert, J.; McCulloch, M.; Schürle, M. Deliverable 3.2. Standardized Flexibility Products and Attributes. 2022. Available online: https://www.digiplat.eu/fileadmin//NES/DigIPlat_D3.2-Standardized_flexibility_attributes_final.pdf (accessed on 13 March 2024).

- Dierenbach, J.; Baartar, M.; Graeber, D.; Zobernig, V.; McCulloch, M.; Schürle, M.; Hödl, M. Deliverable 3.3. Definition of Multifunctional Flexibility Use Cases. 2023. Available online: https://www.digiplat.eu/fileadmin//NES/DigIPlat_D3.3-UseCases_final.pdf (accessed on 13 March 2024).

- Poplavskaya, K.; Fanta, S. MODULE 1—MULTI-USE-CASE LOGIC of flexibility procurement with a focus on balancing and redispatch. Wien, 2022.

- Entsoe, “Picasso Mari-Stakeholderworkshop,” Webinar Session. 2020. Available online: https://eepublicdownloads.azureedge.net/webinars/200713_MARI-PICASSO_Stakeholder_Workshop%20slides.pdf (accessed on 7 September 2021).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).